Earnings Results 3Q24 October 24, 2024 PCB BANCORP

2 Forward-Looking Statement & Non-GAAP Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections and statements of our beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include without limitation any statement that may predict, forecast, indicate or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. We caution that the forward-looking statements are based largely on our expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond our control, including but not limited to the health of the national and local economies including the impact to the Company and its customers resulting from changes to, and the level of, inflation and interest rates; the Company’s ability to maintain and grow its deposit base; loan demand and continued portfolio performance; the impact of adverse developments at other banks, including bank failures, that impact general sentiment regarding the stability and liquidity of banks that could affect our financial performance and our stock price; changes to valuations of the Company’s assets and liabilities including the allowance for credit losses, earning assets, and intangible assets; changes to the availability of liquidity sources including borrowing lines and the ability to pledge or sell certain assets; the Company's ability to attract and retain skilled employees; customers' service expectations; cyber security risks; the Company's ability to successfully deploy new technology; the success of acquisitions and branch expansion; operational risks including the ability to detect and prevent errors and fraud; the effectiveness of the Company’s enterprise risk management framework; costs related to litigation; changes in laws, rules, regulations, or interpretations to which the Company is subject; the effects of severe weather events, pandemics, other public health crises, acts of war or terrorism, and other external events on our business. These and other important factors are detailed in various securities law filings made periodically by the Company, copies of which are available without charge on the SEC’s website at www.sec.gov and the on the investor relations section of the Company’s website at www.mypcbbank.com. Actual results, performance or achievements could differ materially from those contemplated, expressed, or implied by the forward-looking statements. Any forward- looking statements presented herein are made only as of the date of this presentation, and we do not undertake any obligation to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise, except as required by law. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of historical or future financial performance, financial position or cash flows that excludes amounts or is subject to adjustments that have the effect of excluding amounts that are included in the most directly comparable measure calculated and presented in accordance with GAAP. Reconciliations of non-GAAP measures to the most directly comparable GAAP measures are provided in the Non-GAAP Measures section of this presentation. References to the “Company,” “we,” or “us” refer to PCB Bancorp and references to the “Bank” refer to the Company’s subsidiary, PCB Bank.

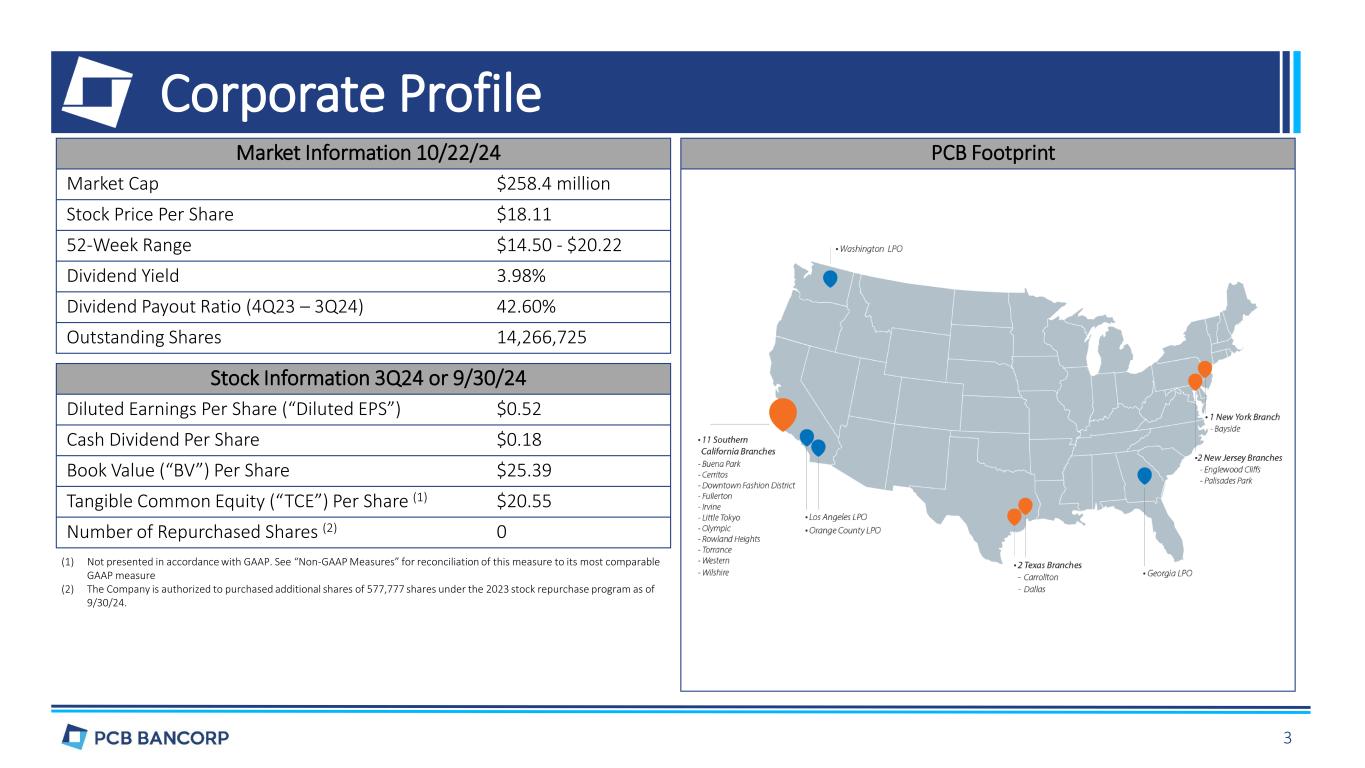

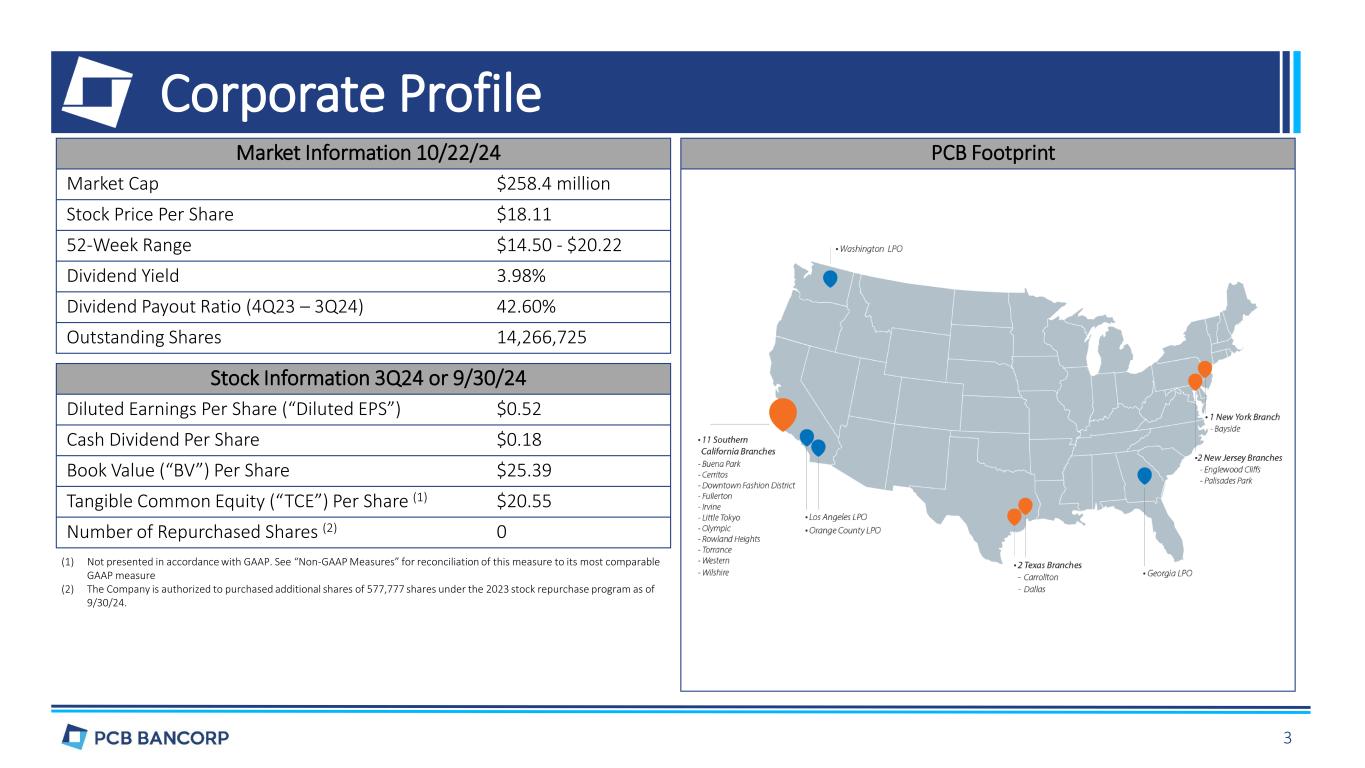

Market Information 10/22/24 Market Cap $258.4 million Stock Price Per Share $18.11 52-Week Range $14.50 - $20.22 Dividend Yield 3.98% Dividend Payout Ratio (4Q23 – 3Q24) 42.60% Outstanding Shares 14,266,725 Stock Information 3Q24 or 9/30/24 Diluted Earnings Per Share (“Diluted EPS”) $0.52 Cash Dividend Per Share $0.18 Book Value (“BV”) Per Share $25.39 Tangible Common Equity (“TCE”) Per Share (1) $20.55 Number of Repurchased Shares (2) 0 (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of this measure to its most comparable GAAP measure (2) The Company is authorized to purchased additional shares of 577,777 shares under the 2023 stock repurchase program as of 9/30/24. PCB Footprint Corporate Profile 3

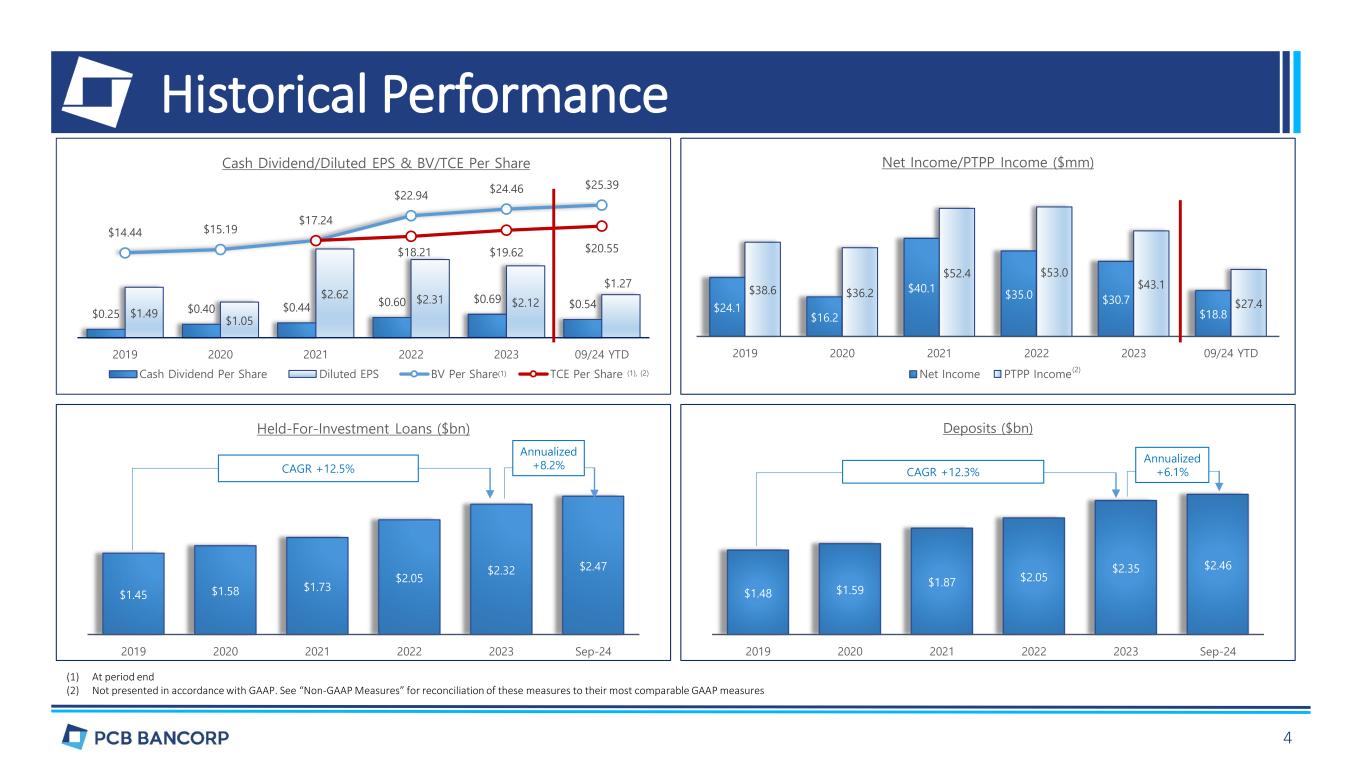

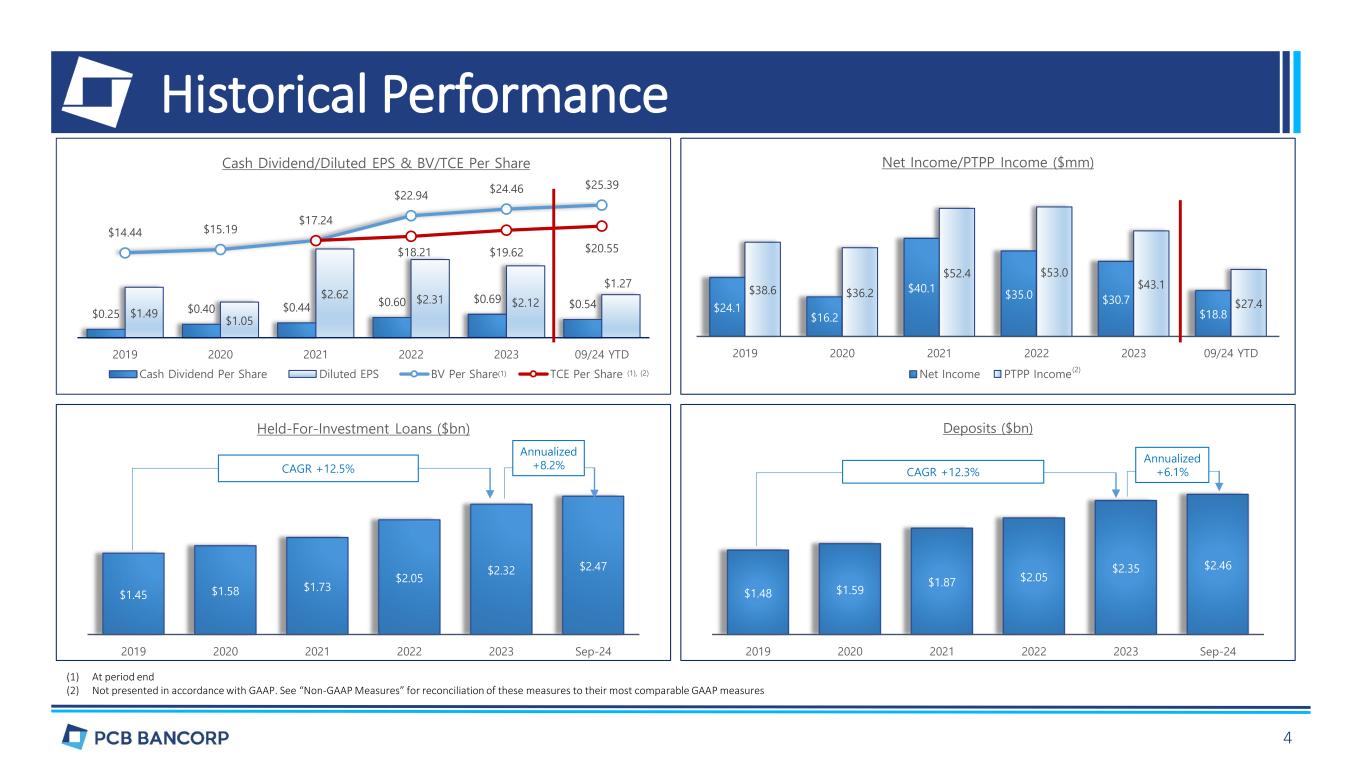

Historical Performance $1.45 $1.58 $1.73 $2.05 $2.32 $2.47 0.000 0.500 1.000 1.500 2.000 2.500 3.000 2019 2020 2021 2022 2023 Sep-24 Held-For-Investment Loans ($bn) $1.48 $1.59 $1.87 $2.05 $2.35 $2.46 0.000 0.500 1.000 1.500 2.000 2.500 3.000 2019 2020 2021 2022 2023 Sep-24 Deposits ($bn) $24.1 $16.2 $40.1 $35.0 $30.7 $18.8 $38.6 $36.2 $52.4 $53.0 $43.1 $27.4 0.000 10.000 20.000 30.000 40.000 50.000 60.000 2019 2020 2021 2022 2023 09/24 YTD Net Income/PTPP Income ($mm) Net Income PTPP Income CAGR +12.5% CAGR +12.3% $0.25 $0.40 $0.44 $0.60 $0.69 $0.54 $1.49 $1.05 $2.62 $2.31 $2.12 $1.27 $14.44 $15.19 $17.24 $22.94 $24.46 $25.39 $18.21 $19.62 $20.55 -$5.00 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 2019 2020 2021 2022 2023 09/24 YTD Cash Dividend/Diluted EPS & BV/TCE Per Share Cash Dividend Per Share Diluted EPS BV Per Share TCE Per Share (1) At period end (2) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of these measures to their most comparable GAAP measures (1), (2)(1) (2) Annualized +8.2% Annualized +6.1% 4

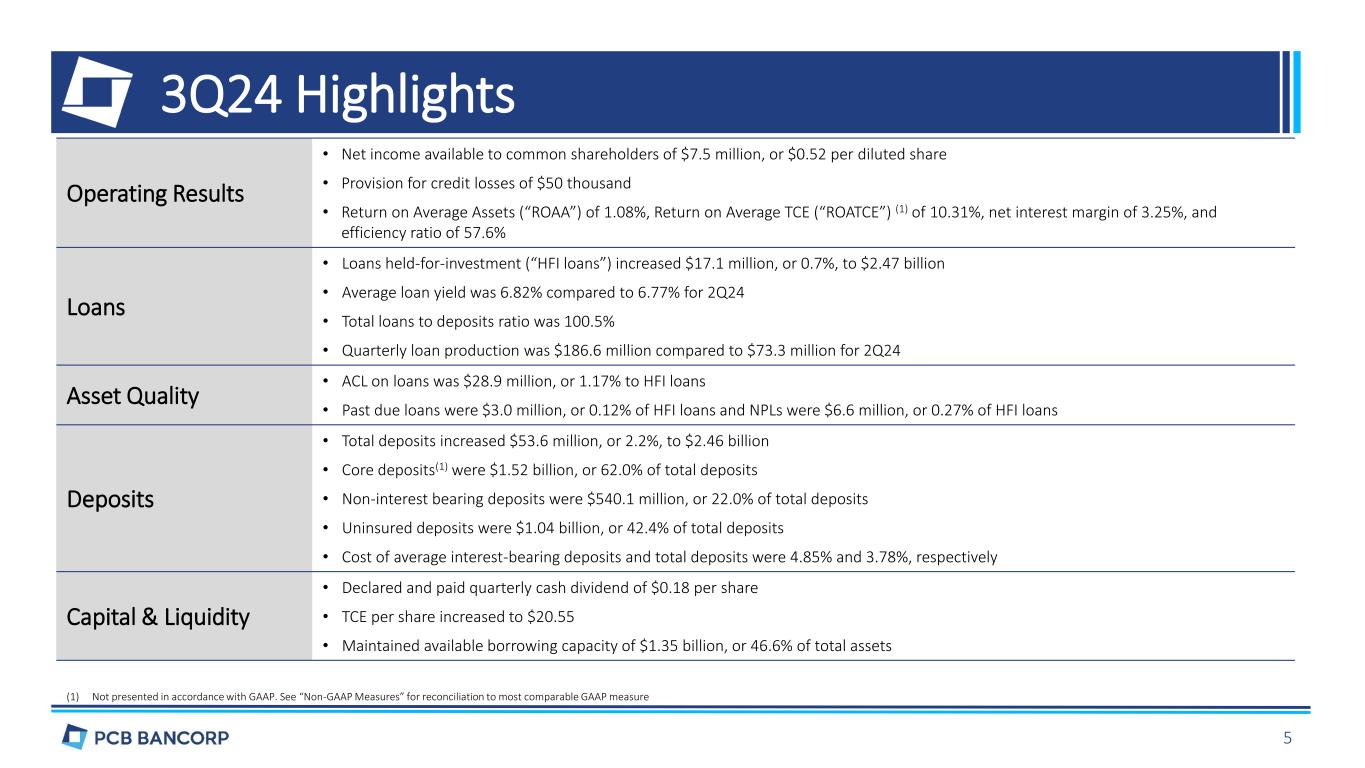

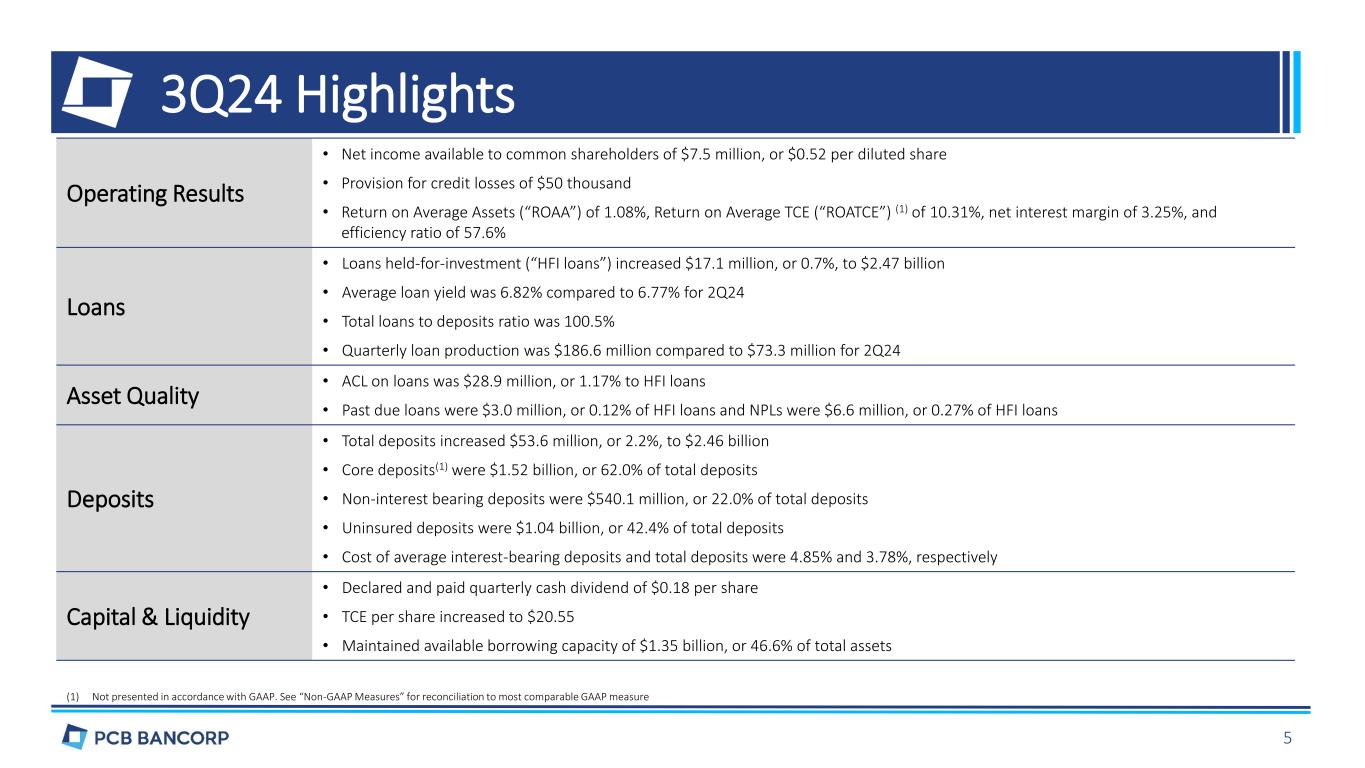

3Q24 Highlights Operating Results • Net income available to common shareholders of $7.5 million, or $0.52 per diluted share • Provision for credit losses of $50 thousand • Return on Average Assets (“ROAA”) of 1.08%, Return on Average TCE (“ROATCE”) (1) of 10.31%, net interest margin of 3.25%, and efficiency ratio of 57.6% Loans • Loans held-for-investment (“HFI loans”) increased $17.1 million, or 0.7%, to $2.47 billion • Average loan yield was 6.82% compared to 6.77% for 2Q24 • Total loans to deposits ratio was 100.5% • Quarterly loan production was $186.6 million compared to $73.3 million for 2Q24 Asset Quality • ACL on loans was $28.9 million, or 1.17% to HFI loans • Past due loans were $3.0 million, or 0.12% of HFI loans and NPLs were $6.6 million, or 0.27% of HFI loans Deposits • Total deposits increased $53.6 million, or 2.2%, to $2.46 billion • Core deposits(1) were $1.52 billion, or 62.0% of total deposits • Non-interest bearing deposits were $540.1 million, or 22.0% of total deposits • Uninsured deposits were $1.04 billion, or 42.4% of total deposits • Cost of average interest-bearing deposits and total deposits were 4.85% and 3.78%, respectively Capital & Liquidity • Declared and paid quarterly cash dividend of $0.18 per share • TCE per share increased to $20.55 • Maintained available borrowing capacity of $1.35 billion, or 46.6% of total assets (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation to most comparable GAAP measure 5

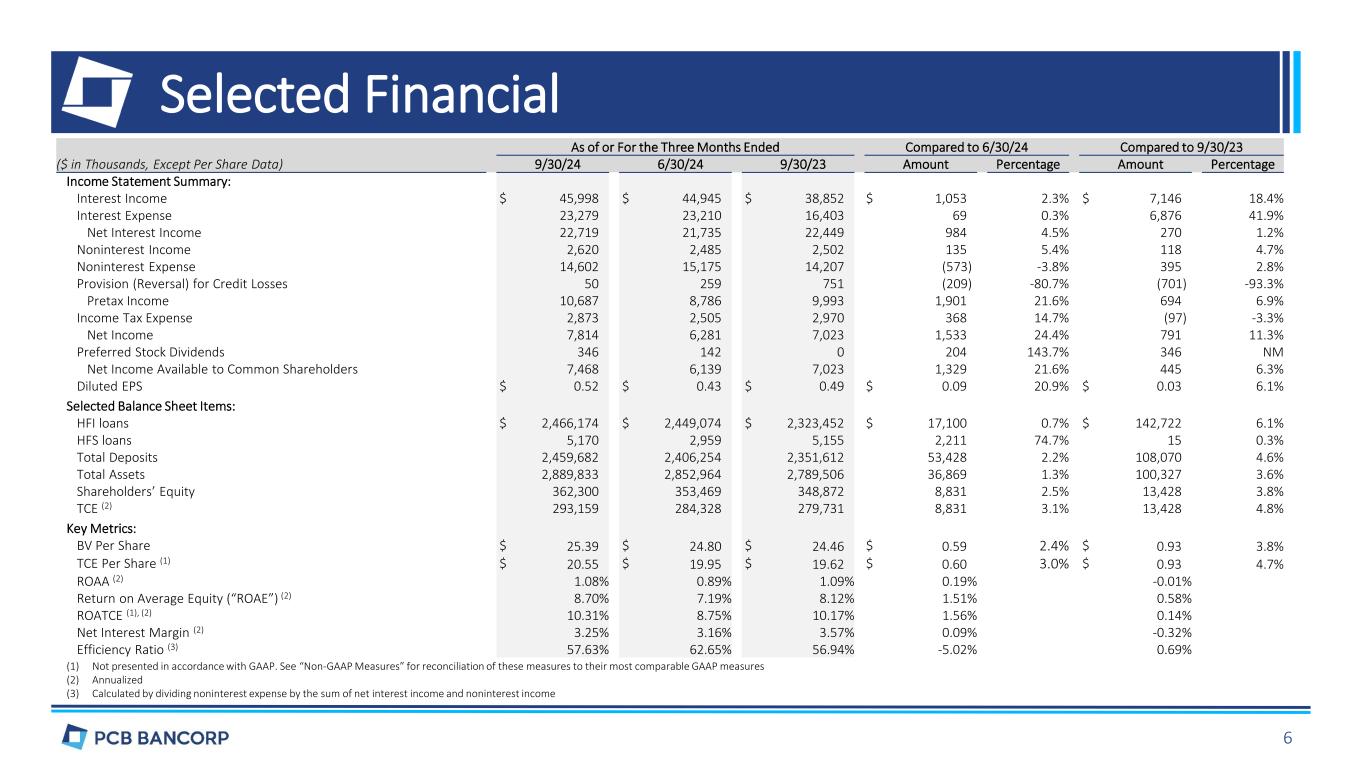

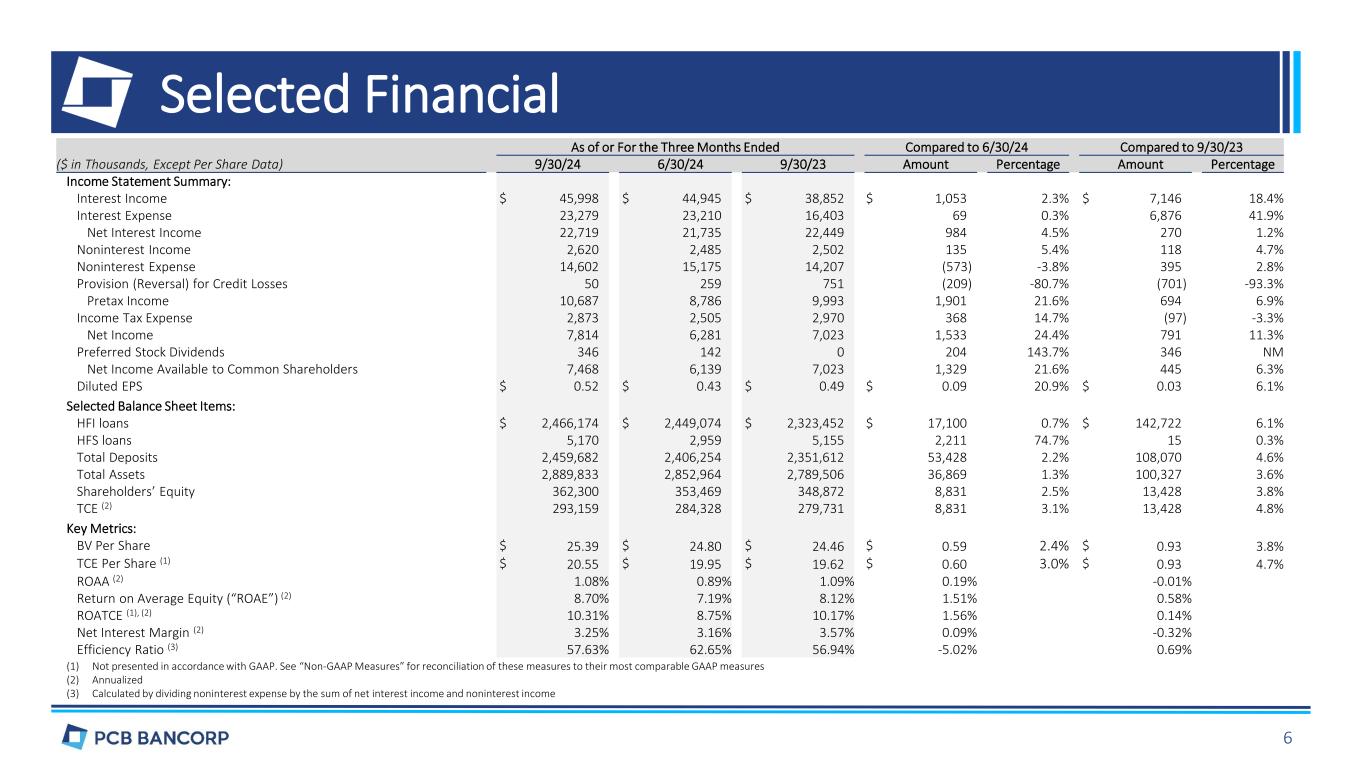

Selected Financial As of or For the Three Months Ended Compared to 6/30/24 Compared to 9/30/23 ($ in Thousands, Except Per Share Data) 9/30/24 6/30/24 9/30/23 Amount Percentage Amount Percentage Income Statement Summary: Interest Income $ 45,998 $ 44,945 $ 38,852 $ 1,053 2.3% $ 7,146 18.4% Interest Expense 23,279 23,210 16,403 69 0.3% 6,876 41.9% Net Interest Income 22,719 21,735 22,449 984 4.5% 270 1.2% Noninterest Income 2,620 2,485 2,502 135 5.4% 118 4.7% Noninterest Expense 14,602 15,175 14,207 (573) -3.8% 395 2.8% Provision (Reversal) for Credit Losses 50 259 751 (209) -80.7% (701) -93.3% Pretax Income 10,687 8,786 9,993 1,901 21.6% 694 6.9% Income Tax Expense 2,873 2,505 2,970 368 14.7% (97) -3.3% Net Income 7,814 6,281 7,023 1,533 24.4% 791 11.3% Preferred Stock Dividends 346 142 0 204 143.7% 346 NM Net Income Available to Common Shareholders 7,468 6,139 7,023 1,329 21.6% 445 6.3% Diluted EPS $ 0.52 $ 0.43 $ 0.49 $ 0.09 20.9% $ 0.03 6.1% Selected Balance Sheet Items: HFI loans $ 2,466,174 $ 2,449,074 $ 2,323,452 $ 17,100 0.7% $ 142,722 6.1% HFS loans 5,170 2,959 5,155 2,211 74.7% 15 0.3% Total Deposits 2,459,682 2,406,254 2,351,612 53,428 2.2% 108,070 4.6% Total Assets 2,889,833 2,852,964 2,789,506 36,869 1.3% 100,327 3.6% Shareholders’ Equity 362,300 353,469 348,872 8,831 2.5% 13,428 3.8% TCE (2) 293,159 284,328 279,731 8,831 3.1% 13,428 4.8% Key Metrics: BV Per Share $ 25.39 $ 24.80 $ 24.46 $ 0.59 2.4% $ 0.93 3.8% TCE Per Share (1) $ 20.55 $ 19.95 $ 19.62 $ 0.60 3.0% $ 0.93 4.7% ROAA (2) 1.08% 0.89% 1.09% 0.19% -0.01% Return on Average Equity (“ROAE”) (2) 8.70% 7.19% 8.12% 1.51% 0.58% ROATCE (1), (2) 10.31% 8.75% 10.17% 1.56% 0.14% Net Interest Margin (2) 3.25% 3.16% 3.57% 0.09% -0.32% Efficiency Ratio (3) 57.63% 62.65% 56.94% -5.02% 0.69% (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of these measures to their most comparable GAAP measures (2) Annualized (3) Calculated by dividing noninterest expense by the sum of net interest income and noninterest income 6

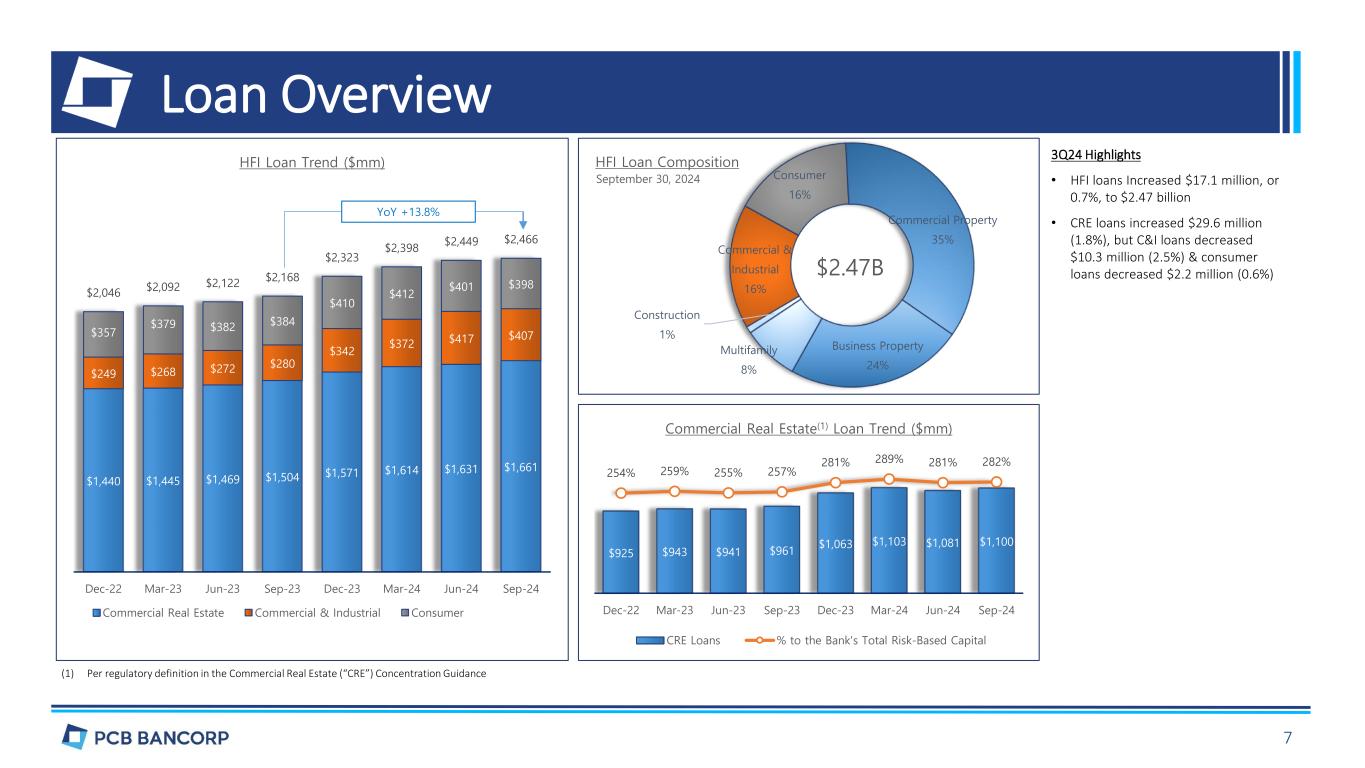

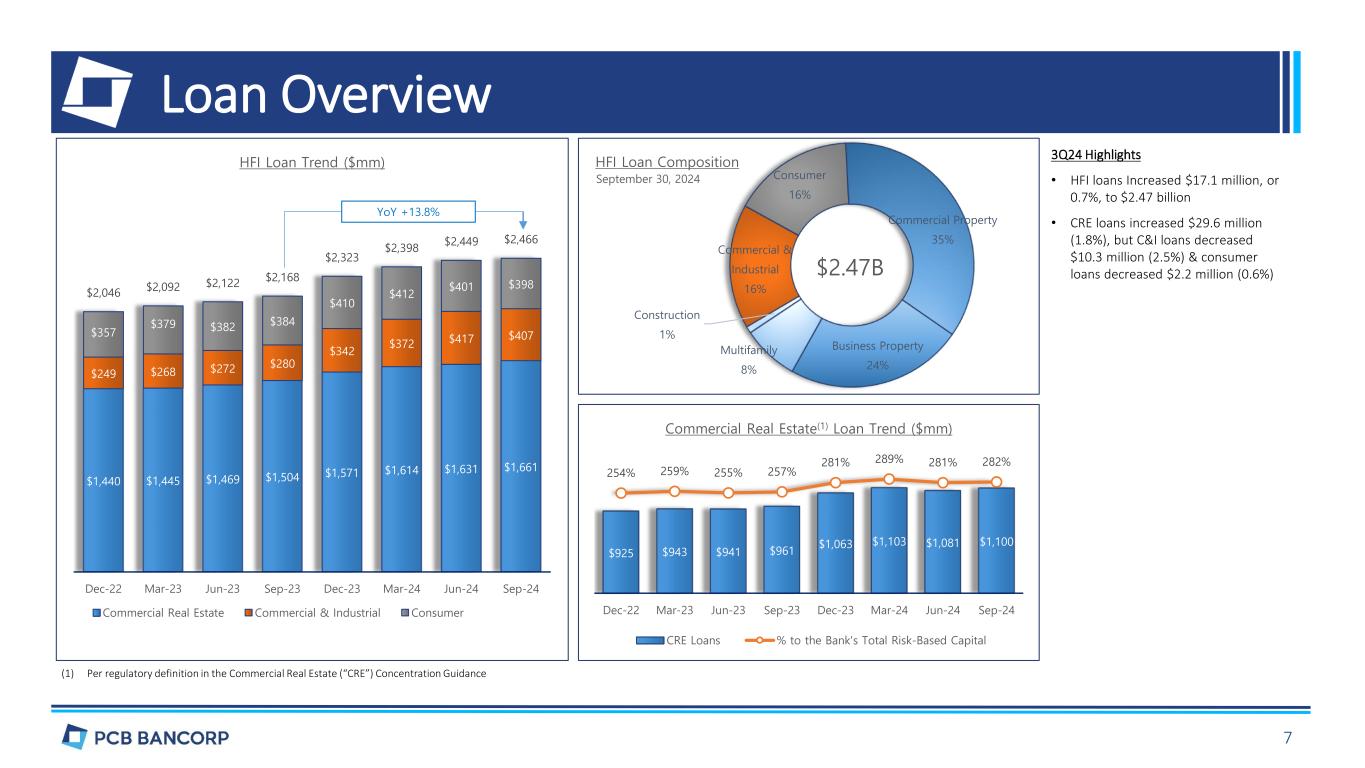

$1,440 $1,445 $1,469 $1,504 $1,571 $1,614 $1,631 $1,661 $249 $268 $272 $280 $342 $372 $417 $407$357 $379 $382 $384 $410 $412 $401 $398 $2,046 $2,092 $2,122 $2,168 $2,323 $2,398 $2,449 $2,466 - 500 1,000 1,500 2,000 2,500 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 HFI Loan Trend ($mm) Commercial Real Estate Commercial & Industrial Consumer 7 Loan Overview YoY +13.8% (1) Per regulatory definition in the Commercial Real Estate (“CRE”) Concentration Guidance $925 $943 $941 $961 $1,063 $1,103 $1,081 $1,100 254% 259% 255% 257% 281% 289% 281% 282% 0% 50% 100% 150% 200% 250% 300% 300.0 400.0 500.0 600.0 700.0 800.0 900.0 1,000.0 1,100.0 1,200.0 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Commercial Real Estate(1) Loan Trend ($mm) CRE Loans % to the Bank's Total Risk-Based Capital Commercial Property 35% Business Property 24% Multifamily 8% Construction 1% Commercial & Industrial 16% Consumer 16% HFI Loan Composition September 30, 2024 $2.47B 3Q24 Highlights • HFI loans Increased $17.1 million, or 0.7%, to $2.47 billion • CRE loans increased $29.6 million (1.8%), but C&I loans decreased $10.3 million (2.5%) & consumer loans decreased $2.2 million (0.6%)

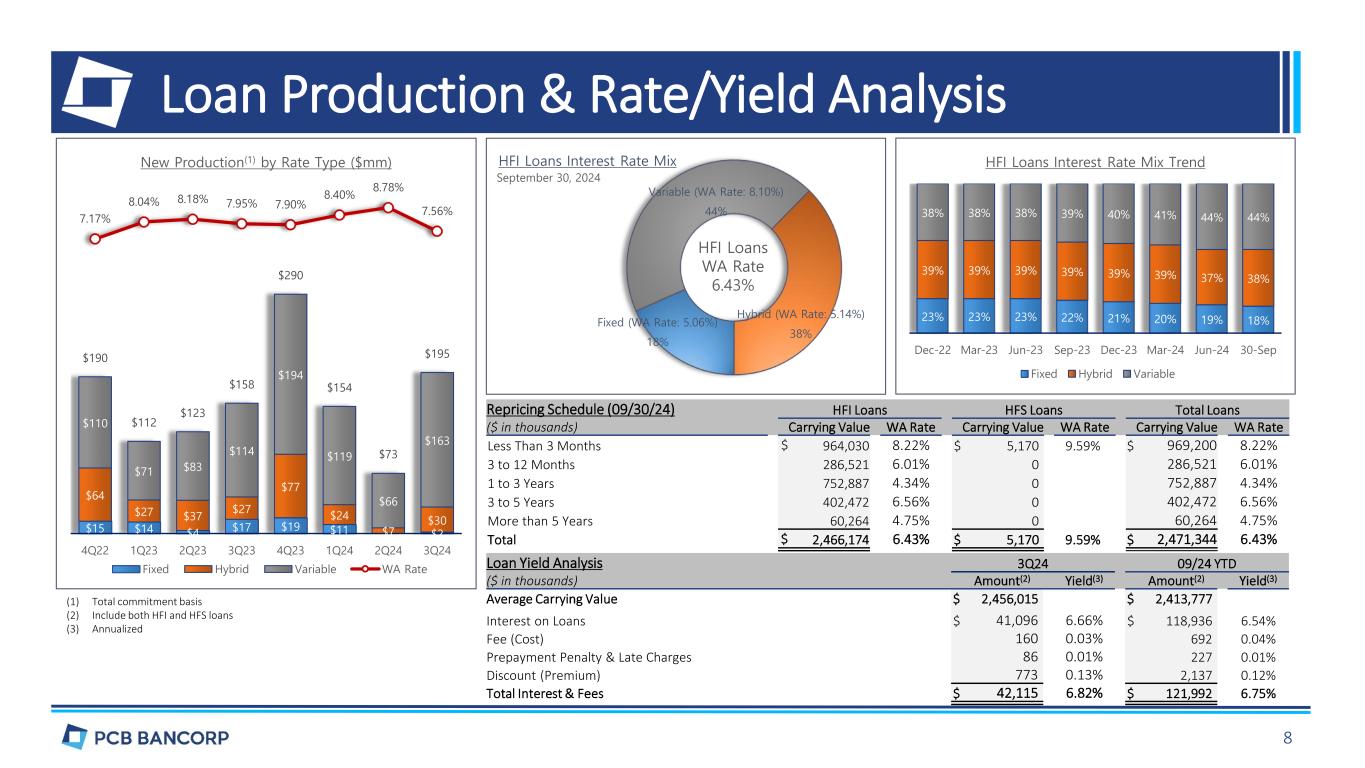

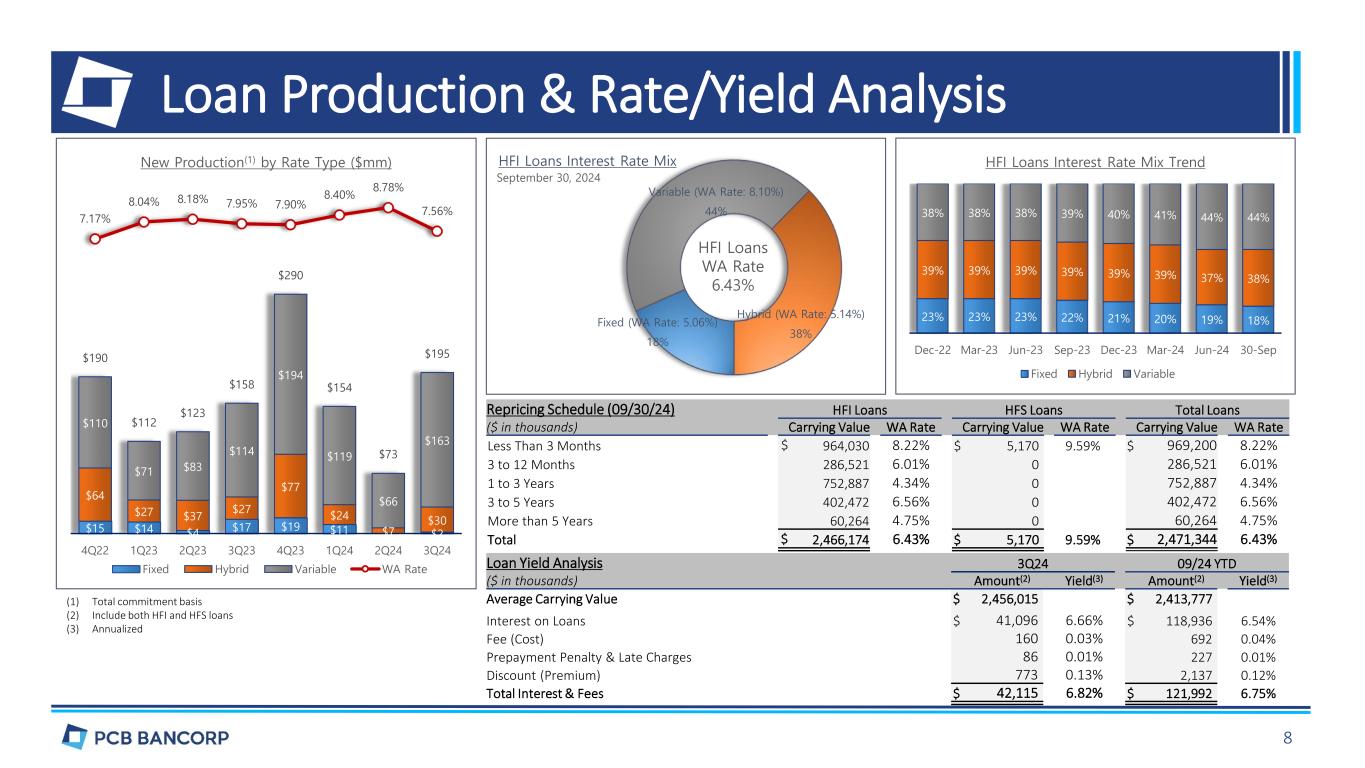

8 Loan Production & Rate/Yield Analysis (1) Total commitment basis (2) Include both HFI and HFS loans (3) Annualized $15 $14 $4 $17 $19 $11 $2 $64 $27 $37 $27 $77 $24 $7 $30 $110 $71 $83 $114 $194 $119 $66 $163 $190 $112 $123 $158 $290 $154 $73 $195 7.17% 8.04% 8.18% 7.95% 7.90% 8.40% 8.78% 7.56% -8% -6% -4% -2% 0% 2% 4% 6% 8% 0 50 100 150 200 250 300 350 400 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 New Production(1) by Rate Type ($mm) Fixed Hybrid Variable WA Rate Fixed (WA Rate: 5.06%) 18% Variable (WA Rate: 8.10%) 44% Hybrid (WA Rate: 5.14%) 38% HFI Loans Interest Rate Mix 23% 23% 23% 22% 21% 20% 19% 18% 39% 39% 39% 39% 39% 39% 37% 38% 38% 38% 38% 39% 40% 41% 44% 44% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 30-Sep HFI Loans Interest Rate Mix Trend Fixed Hybrid Variable September 30, 2024 HFI Loans WA Rate 6.43% Repricing Schedule (09/30/24) HFI Loans HFS Loans Total Loans ($ in thousands) Carrying Value WA Rate Carrying Value WA Rate Carrying Value WA Rate Less Than 3 Months $ 964,030 8.22% $ 5,170 9.59% $ 969,200 8.22% 3 to 12 Months 286,521 6.01% 0 286,521 6.01% 1 to 3 Years 752,887 4.34% 0 752,887 4.34% 3 to 5 Years 402,472 6.56% 0 402,472 6.56% More than 5 Years 60,264 4.75% 0 60,264 4.75% Total $ 2,466,174 6.43% $ 5,170 9.59% $ 2,471,344 6.43% Loan Yield Analysis 3Q24 09/24 YTD ($ in thousands) Amount(2) Yield(3) Amount(2) Yield(3) Average Carrying Value $ 2,456,015 $ 2,413,777 Interest on Loans $ 41,096 6.66% $ 118,936 6.54% Fee (Cost) 160 0.03% 692 0.04% Prepayment Penalty & Late Charges 86 0.01% 227 0.01% Discount (Premium) 773 0.13% 2,137 0.12% Total Interest & Fees $ 42,115 6.82% $ 121,992 6.75%

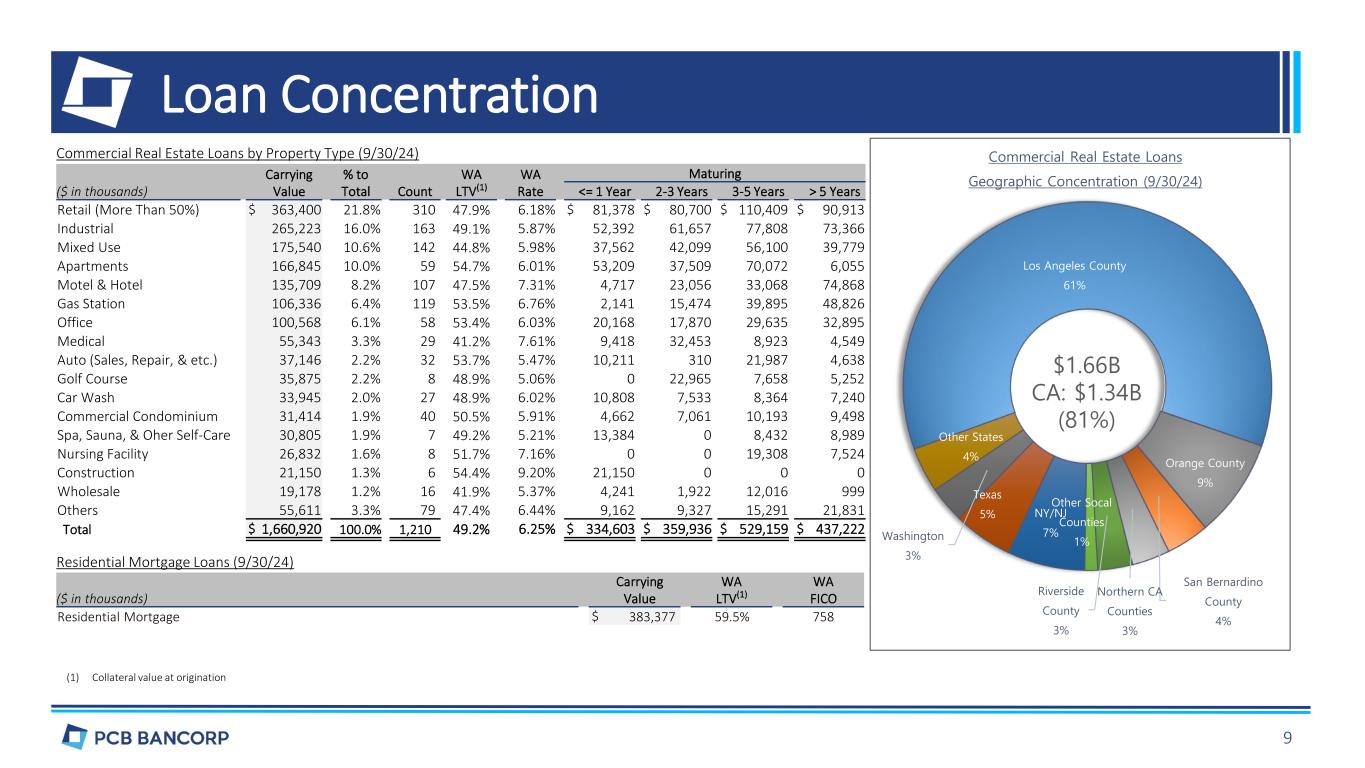

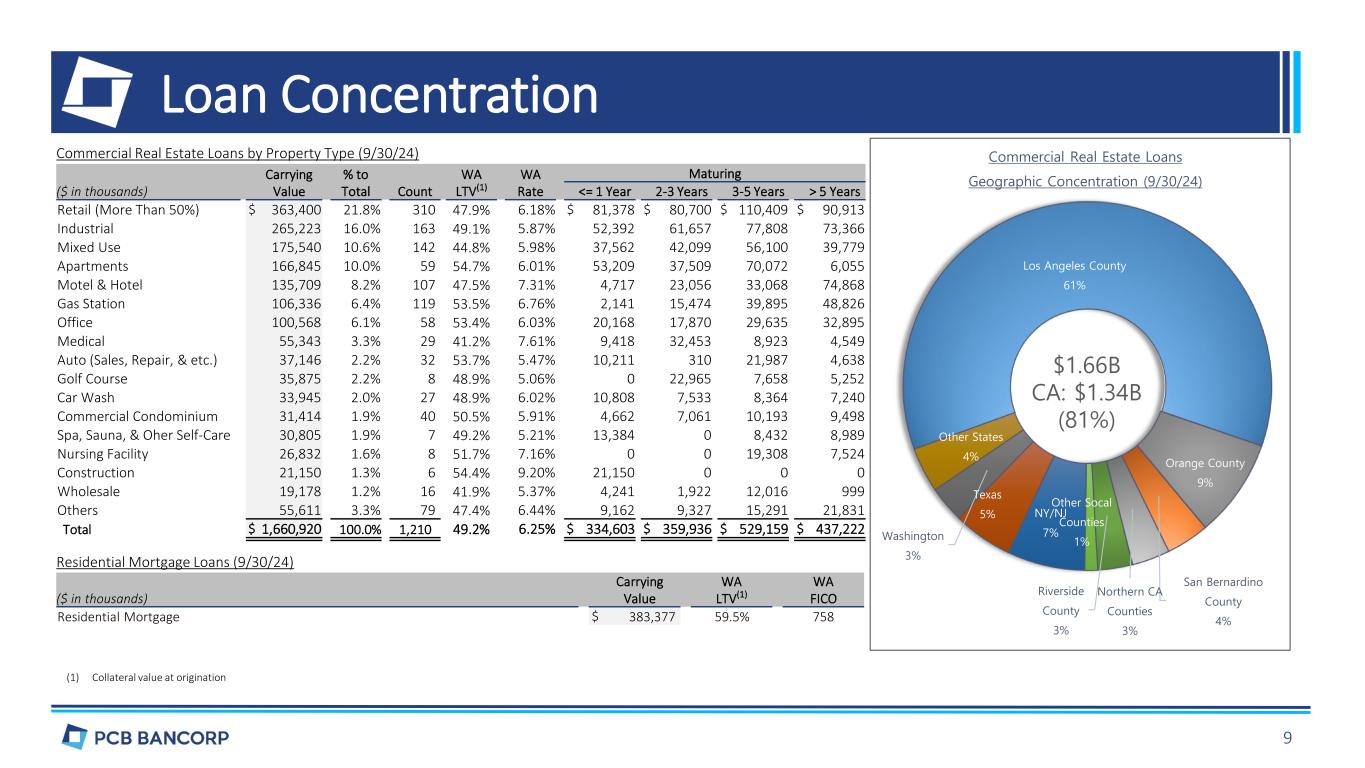

Carrying Value % to Total Count WA LTV(1) WA Rate Maturing ($ in thousands) <= 1 Year 2-3 Years 3-5 Years > 5 Years Retail (More Than 50%) $ 363,400 21.8% 310 47.9% 6.18% $ 81,378 $ 80,700 $ 110,409 $ 90,913 Industrial 265,223 16.0% 163 49.1% 5.87% 52,392 61,657 77,808 73,366 Mixed Use 175,540 10.6% 142 44.8% 5.98% 37,562 42,099 56,100 39,779 Apartments 166,845 10.0% 59 54.7% 6.01% 53,209 37,509 70,072 6,055 Motel & Hotel 135,709 8.2% 107 47.5% 7.31% 4,717 23,056 33,068 74,868 Gas Station 106,336 6.4% 119 53.5% 6.76% 2,141 15,474 39,895 48,826 Office 100,568 6.1% 58 53.4% 6.03% 20,168 17,870 29,635 32,895 Medical 55,343 3.3% 29 41.2% 7.61% 9,418 32,453 8,923 4,549 Auto (Sales, Repair, & etc.) 37,146 2.2% 32 53.7% 5.47% 10,211 310 21,987 4,638 Golf Course 35,875 2.2% 8 48.9% 5.06% 0 22,965 7,658 5,252 Car Wash 33,945 2.0% 27 48.9% 6.02% 10,808 7,533 8,364 7,240 Commercial Condominium 31,414 1.9% 40 50.5% 5.91% 4,662 7,061 10,193 9,498 Spa, Sauna, & Oher Self-Care 30,805 1.9% 7 49.2% 5.21% 13,384 0 8,432 8,989 Nursing Facility 26,832 1.6% 8 51.7% 7.16% 0 0 19,308 7,524 Construction 21,150 1.3% 6 54.4% 9.20% 21,150 0 0 0 Wholesale 19,178 1.2% 16 41.9% 5.37% 4,241 1,922 12,016 999 Others 55,611 3.3% 79 47.4% 6.44% 9,162 9,327 15,291 21,831 Total $ 1,660,920 100.0% 1,210 49.2% 6.25% $ 334,603 $ 359,936 $ 529,159 $ 437,222 Loan Concentration (1) Collateral value at origination Los Angeles County 61% Orange County 9% San Bernardino County 4% Northern CA Counties 3% Riverside County 3% Other Socal Counties 1% NY/NJ 7% Texas 5% Washington 3% Other States 4% Commercial Real Estate Loans Geographic Concentration (9/30/24) $1.66B CA: $1.34B (81%) Commercial Real Estate Loans by Property Type (9/30/24) ($ in thousands) Carrying Value WA LTV(1) WA FICO Residential Mortgage $ 383,377 59.5% 758 Residential Mortgage Loans (9/30/24) 9

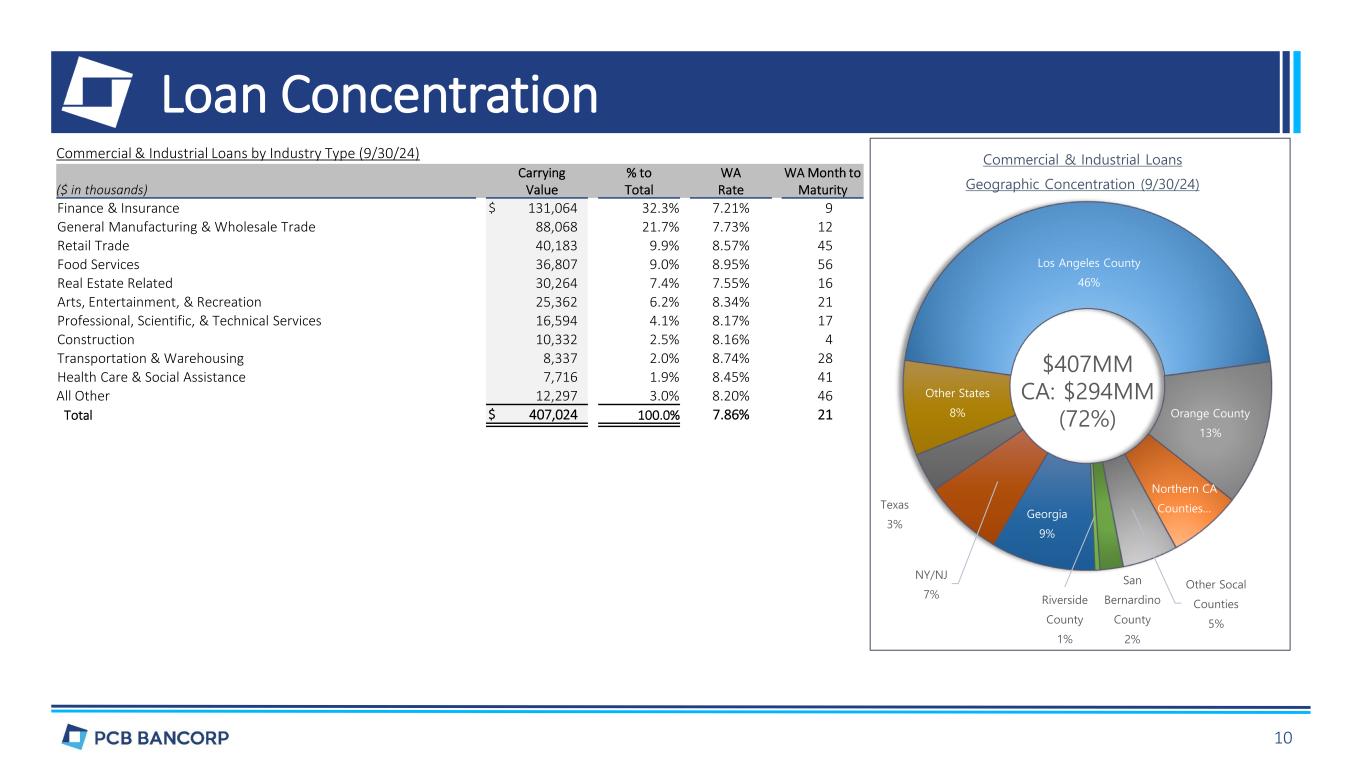

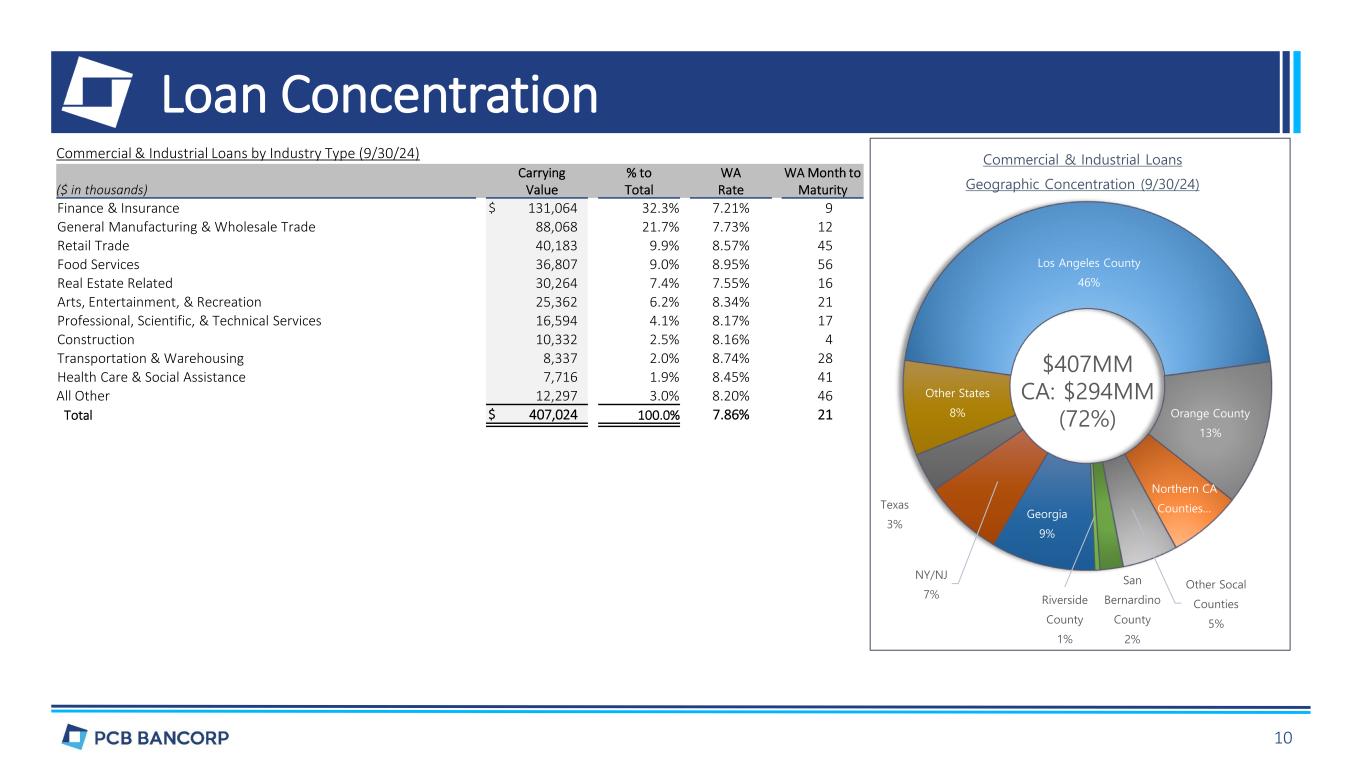

Loan Concentration Carrying Value % to Total WA Rate WA Month to Maturity($ in thousands) Finance & Insurance $ 131,064 32.3% 7.21% 9 General Manufacturing & Wholesale Trade 88,068 21.7% 7.73% 12 Retail Trade 40,183 9.9% 8.57% 45 Food Services 36,807 9.0% 8.95% 56 Real Estate Related 30,264 7.4% 7.55% 16 Arts, Entertainment, & Recreation 25,362 6.2% 8.34% 21 Professional, Scientific, & Technical Services 16,594 4.1% 8.17% 17 Construction 10,332 2.5% 8.16% 4 Transportation & Warehousing 8,337 2.0% 8.74% 28 Health Care & Social Assistance 7,716 1.9% 8.45% 41 All Other 12,297 3.0% 8.20% 46 Total $ 407,024 100.0% 7.86% 21 Los Angeles County 46% Orange County 13% Northern CA Counties… Other Socal Counties 5% San Bernardino County 2% Riverside County 1% Georgia 9% NY/NJ 7% Texas 3% Other States 8% Commercial & Industrial Loans Geographic Concentration (9/30/24) Commercial & Industrial Loans by Industry Type (9/30/24) $407MM CA: $294MM (72%) 10

Credit Quality & Peer(1) Comparison $7.4 $3.0 $3.8 $3.7 $6.5 $4.9 $7.5 $7.1 0 1 2 3 4 5 6 7 8 9 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Non-Performing Assets (“NPAs”) ($mm) 0.30% 0.12% 0.15% 0.15% 0.23% 0.17% 0.26% 0.24% 0% 0% 0% 0% 0% 0% 0% 0% Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 NPAs to Total Assets 1.22% 1.18% 1.17% 1.18% 1.19% 1.18% 1.17% 1.17% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 ACL on Loans to HFI Loans 742% 834% 647% 686% 703% 574% 383% 437% -0.5 0.5 1.5 2.5 3.5 4.5 5.5 6.5 7.5 8.5 9.5 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 ACL on Loans to Non-Performing HFI Loans 0.77% 0.57% 0.55% 0.54% 0.54% 0.32% 0.32% 0.29% 0.23% 0% 0% 0% 0% 0% 1% 1% 1% 1% 1% Hope Open CBB Peer Shinhan Hanmi USM PCB Woori NPAs / (Total Loans + OREO)(2) September 30, 2024 Peer Information: June 30, 2024 1.40% 0.77% 0.63% 0.46% 0.32% 0% 0% 0% 1% 1% 1% 1% 1% 2% Hope CBB Open Hanmi PCB Classified Assets to Total Assets(4) September 30, 2024 Peer Information: June 30, 2024 (1) Korean-American banks operating in Southern California (2) Source: UBPR (3) PCB Bank’s Peer Group per UBPR (4) Source: press releases concerning financial performance (3) 11

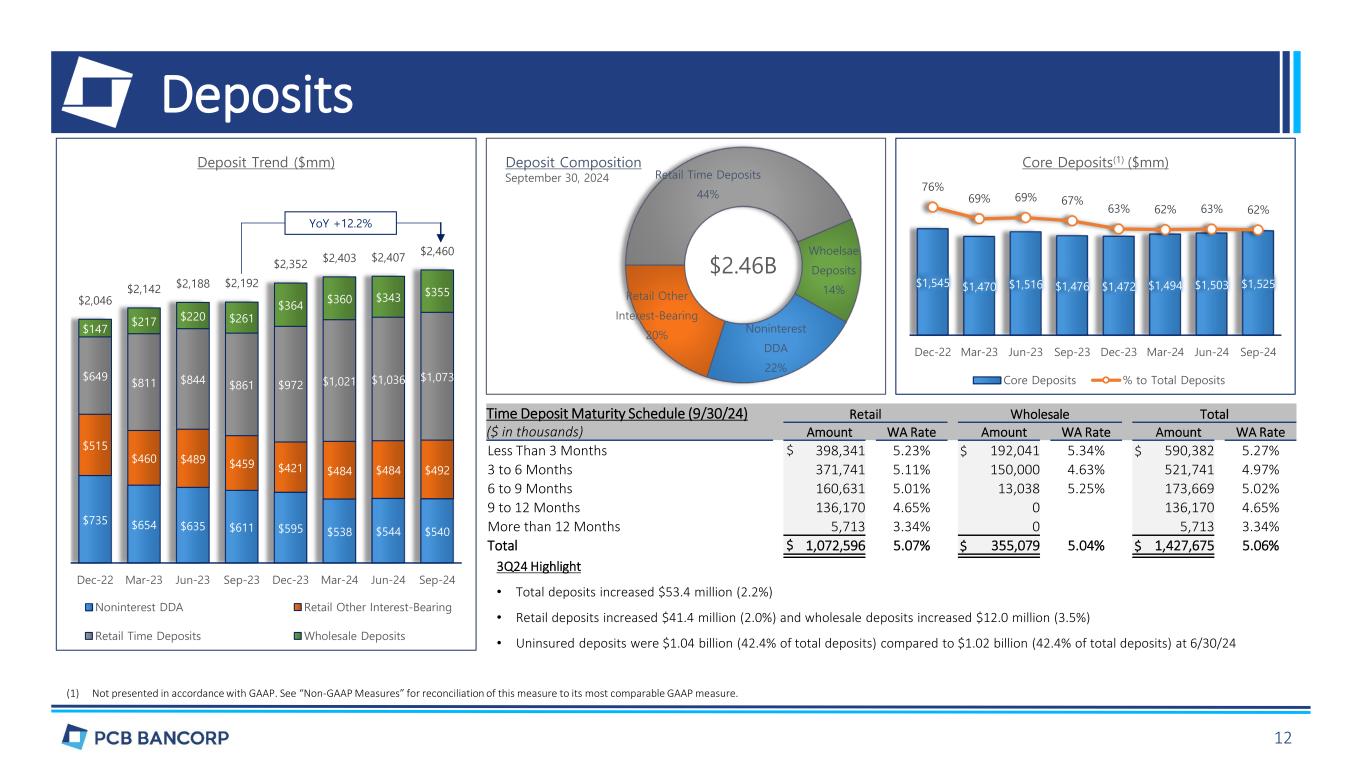

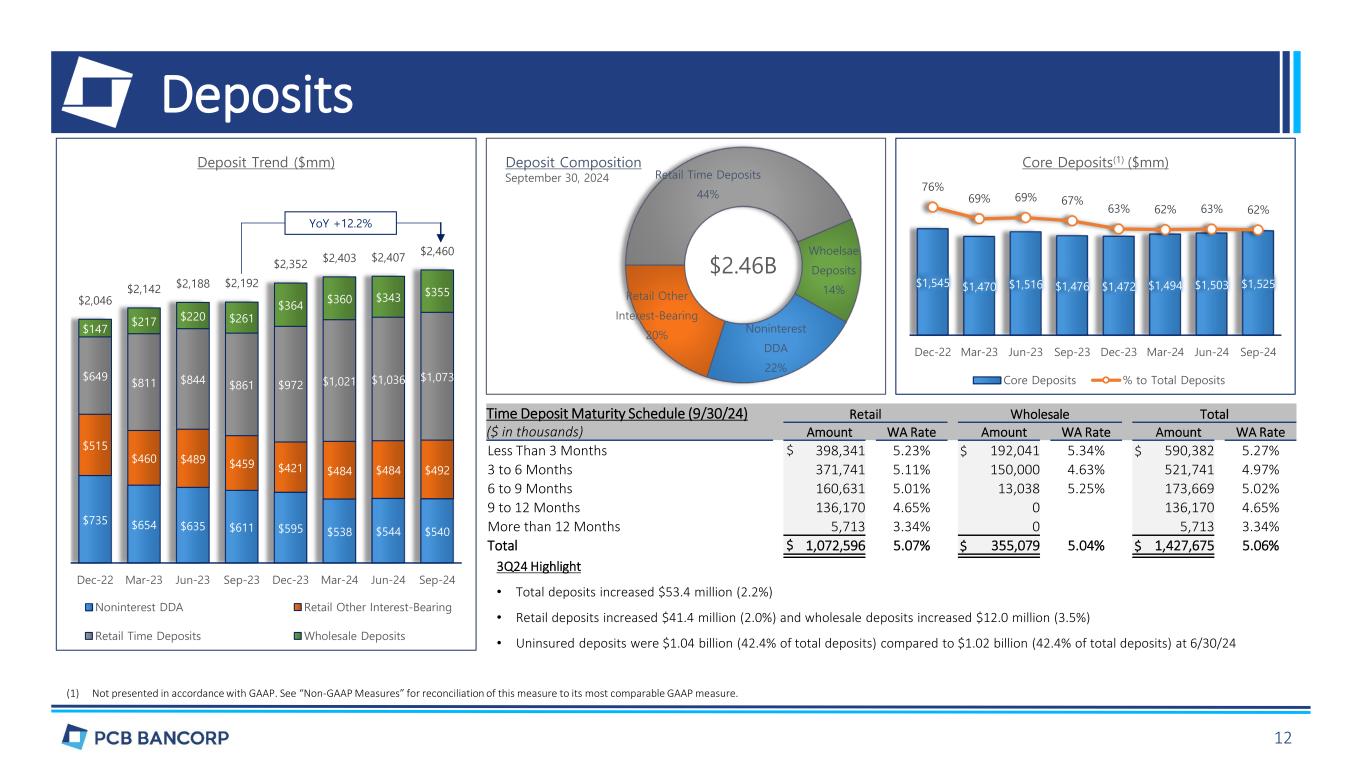

Deposits (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of this measure to its most comparable GAAP measure. $735 $654 $635 $611 $595 $538 $544 $540 $515 $460 $489 $459 $421 $484 $484 $492 $649 $811 $844 $861 $972 $1,021 $1,036 $1,073 $147 $217 $220 $261 $364 $360 $343 $355 $2,046 $2,142 $2,188 $2,192 $2,352 $2,403 $2,407 $2,460 0 500 1,000 1,500 2,000 2,500 3,000 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Deposit Trend ($mm) Noninterest DDA Retail Other Interest-Bearing Retail Time Deposits Wholesale Deposits Noninterest DDA 22% Retail Other Interest-Bearing 20% Retail Time Deposits 44% Whoelsae Deposits 14% Deposit Composition $2.46B $1,545 $1,470 $1,516 $1,476 $1,472 $1,494 $1,503 $1,525 76% 69% 69% 67% 63% 62% 63% 62% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% $500 $700 $900 $1,100 $1,300 $1,500 $1,700 $1,900 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Core Deposits(1) ($mm) Core Deposits % to Total Deposits Time Deposit Maturity Schedule (9/30/24) Retail Wholesale Total ($ in thousands) Amount WA Rate Amount WA Rate Amount WA Rate Less Than 3 Months $ 398,341 5.23% $ 192,041 5.34% $ 590,382 5.27% 3 to 6 Months 371,741 5.11% 150,000 4.63% 521,741 4.97% 6 to 9 Months 160,631 5.01% 13,038 5.25% 173,669 5.02% 9 to 12 Months 136,170 4.65% 0 136,170 4.65% More than 12 Months 5,713 3.34% 0 5,713 3.34% Total $ 1,072,596 5.07% $ 355,079 5.04% $ 1,427,675 5.06% YoY +12.2% 3Q24 Highlight • Total deposits increased $53.4 million (2.2%) • Retail deposits increased $41.4 million (2.0%) and wholesale deposits increased $12.0 million (3.5%) • Uninsured deposits were $1.04 billion (42.4% of total deposits) compared to $1.02 billion (42.4% of total deposits) at 6/30/24 September 30, 2024 12

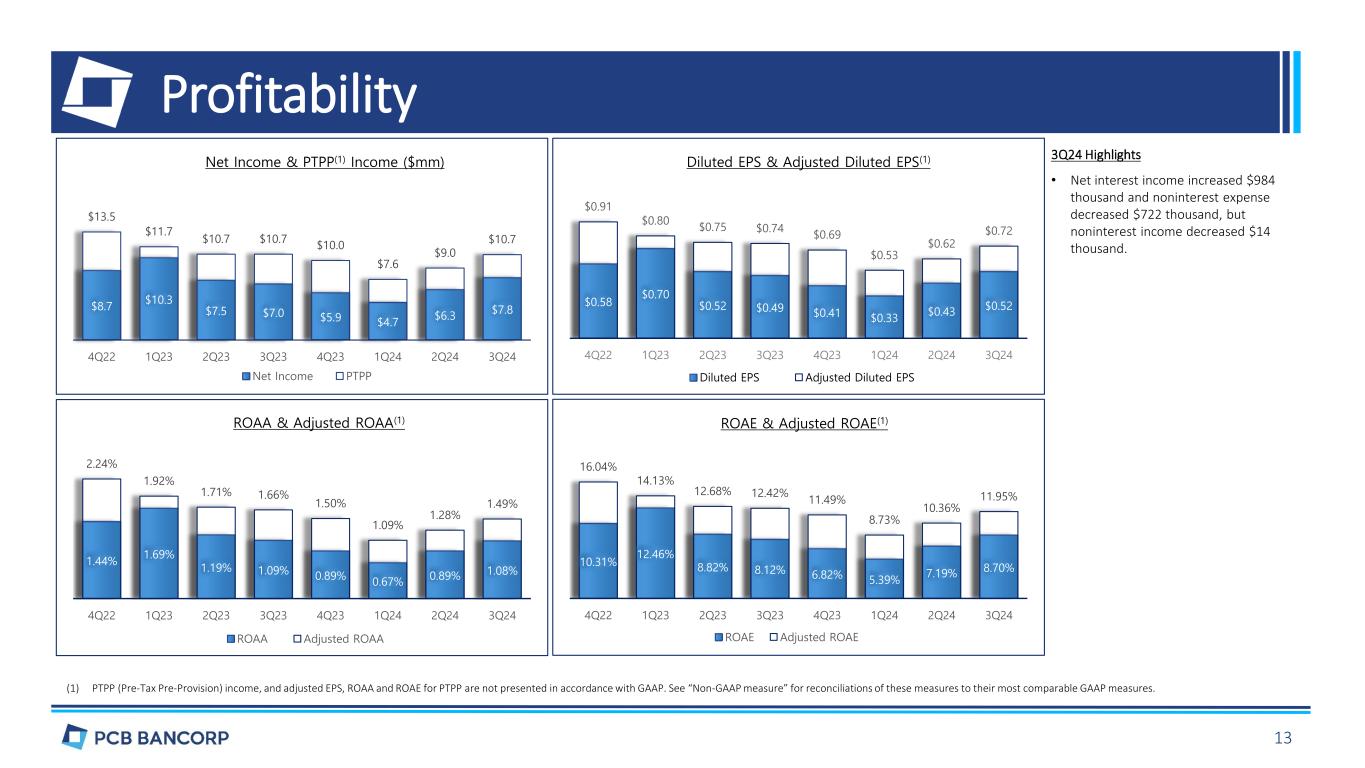

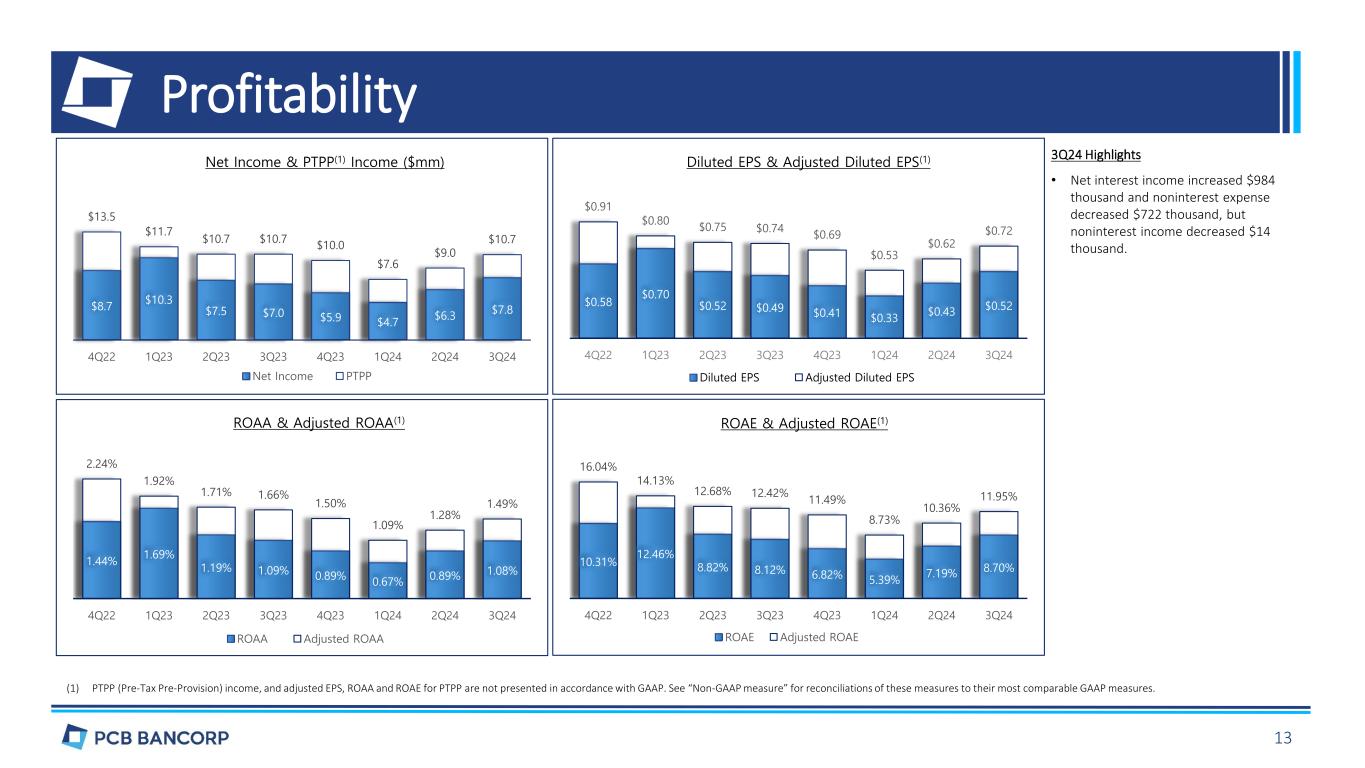

Profitability (1) PTPP (Pre-Tax Pre-Provision) income, and adjusted EPS, ROAA and ROAE for PTPP are not presented in accordance with GAAP. See “Non-GAAP measure” for reconciliations of these measures to their most comparable GAAP measures. $8.7 $10.3 $7.5 $7.0 $5.9 $4.7 $6.3 $7.8 $13.5 $11.7 $10.7 $10.7 $10.0 $7.6 $9.0 $10.7 -1 1 3 5 7 9 11 13 15 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Net Income PTPP Net Income & PTPP(1) Income ($mm) $0.58 $0.70 $0.52 $0.49 $0.41 $0.33 $0.43 $0.52 $0.91 $0.80 $0.75 $0.74 $0.69 $0.53 $0.62 $0.72 0.00 0.20 0.40 0.60 0.80 1.00 1.20 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Diluted EPS Adjusted Diluted EPS Diluted EPS & Adjusted Diluted EPS(1) 1.44% 1.69% 1.19% 1.09% 0.89% 0.67% 0.89% 1.08% 2.24% 1.92% 1.71% 1.66% 1.50% 1.09% 1.28% 1.49% 0% 1% 1% 2% 2% 3% 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 ROAA Adjusted ROAA ROAA & Adjusted ROAA(1) 10.31% 12.46% 8.82% 8.12% 6.82% 5.39% 7.19% 8.70% 16.04% 14.13% 12.68% 12.42% 11.49% 8.73% 10.36% 11.95% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 ROAE Adjusted ROAE ROAE & Adjusted ROAE(1) 3Q24 Highlights • Net interest income increased $984 thousand and noninterest expense decreased $722 thousand, but noninterest income decreased $14 thousand. 13

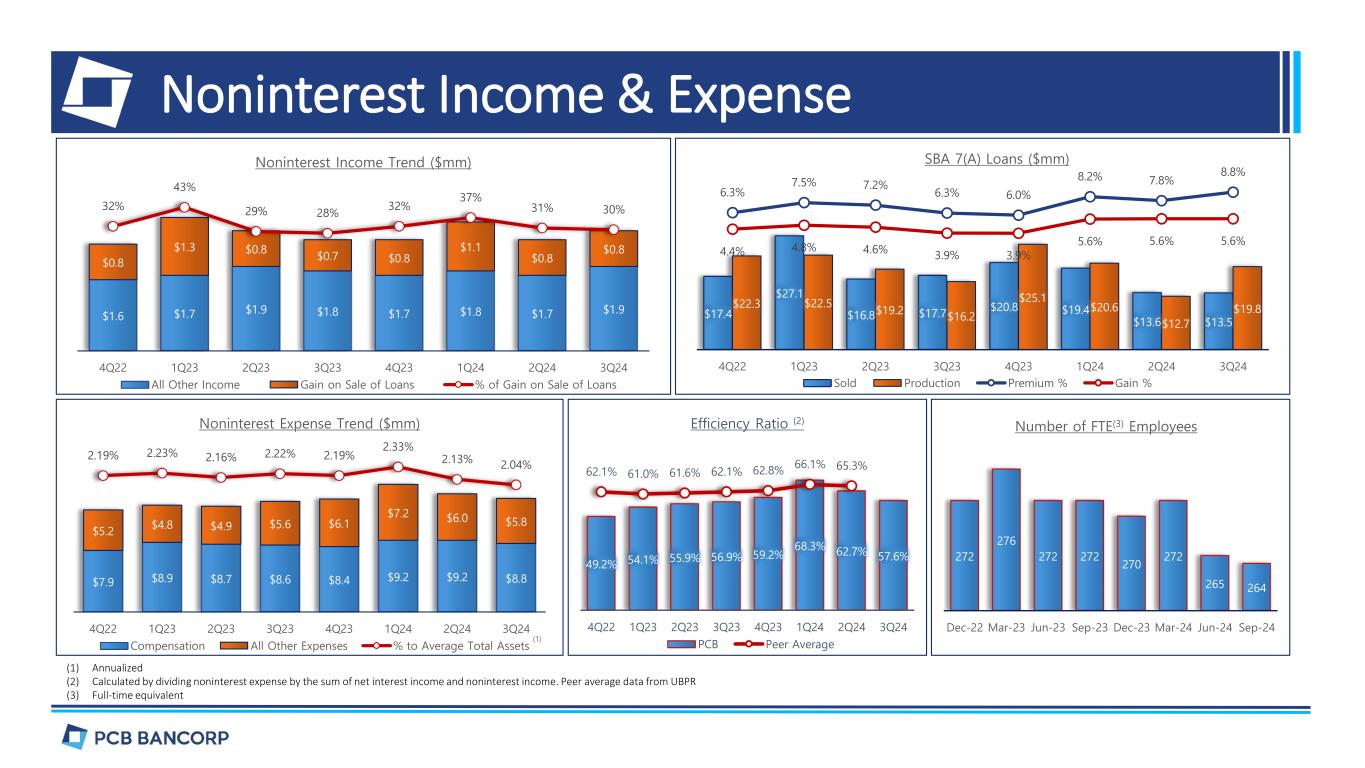

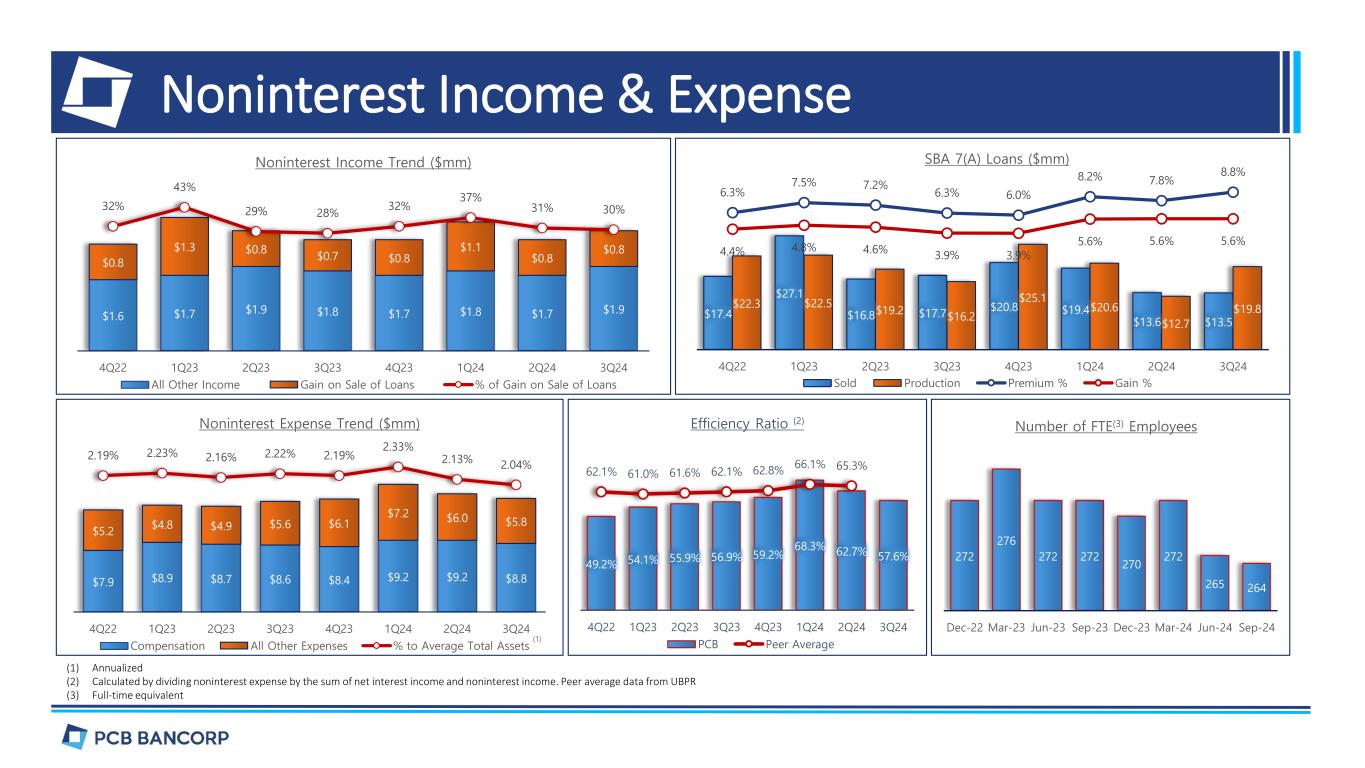

Noninterest Income & Expense $17.4 $27.1 $16.8 $17.7 $20.8 $19.4 $13.6 $13.5 $22.3 $22.5 $19.2 $16.2 $25.1 $20.6 $12.7 $19.8 6.3% 7.5% 7.2% 6.3% 6.0% 8.2% 7.8% 8.8% 4.4% 4.8% 4.6% 3.9% 3.9% 5.6% 5.6% 5.6% -10% -8% -6% -4% -2% 0% 2% 4% 6% 8% 10% 0 5 10 15 20 25 30 35 40 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 SBA 7(A) Loans ($mm) Sold Production Premium % Gain % $7.9 $8.9 $8.7 $8.6 $8.4 $9.2 $9.2 $8.8 $5.2 $4.8 $4.9 $5.6 $6.1 $7.2 $6.0 $5.8 2.19% 2.23% 2.16% 2.22% 2.19% 2.33% 2.13% 2.04% 0% 1% 1% 2% 2% 3% 0 2 4 6 8 10 12 14 16 18 20 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Noninterest Expense Trend ($mm) Compensation All Other Expenses % to Average Total Assets 49.2% 54.1% 55.9% 56.9% 59.2% 68.3% 62.7% 57.6% 62.1% 61.0% 61.6% 62.1% 62.8% 66.1% 65.3% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Efficiency Ratio (2) PCB Peer Average 272 276 272 272 270 272 265 264 258 260 262 264 266 268 270 272 274 276 278 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Number of FTE(3) Employees (1) Annualized (2) Calculated by dividing noninterest expense by the sum of net interest income and noninterest income. Peer average data from UBPR (3) Full-time equivalent (1) $1.6 $1.7 $1.9 $1.8 $1.7 $1.8 $1.7 $1.9 $0.8 $1.3 $0.8 $0.7 $0.8 $1.1 $0.8 $0.8 32% 43% 29% 28% 32% 37% 31% 30% -40% -30% -20% -10% 0% 10% 20% 30% 40% 50% 0 1 1 2 2 3 3 4 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Noninterest Income Trend ($mm) All Other Income Gain on Sale of Loans % of Gain on Sale of Loans

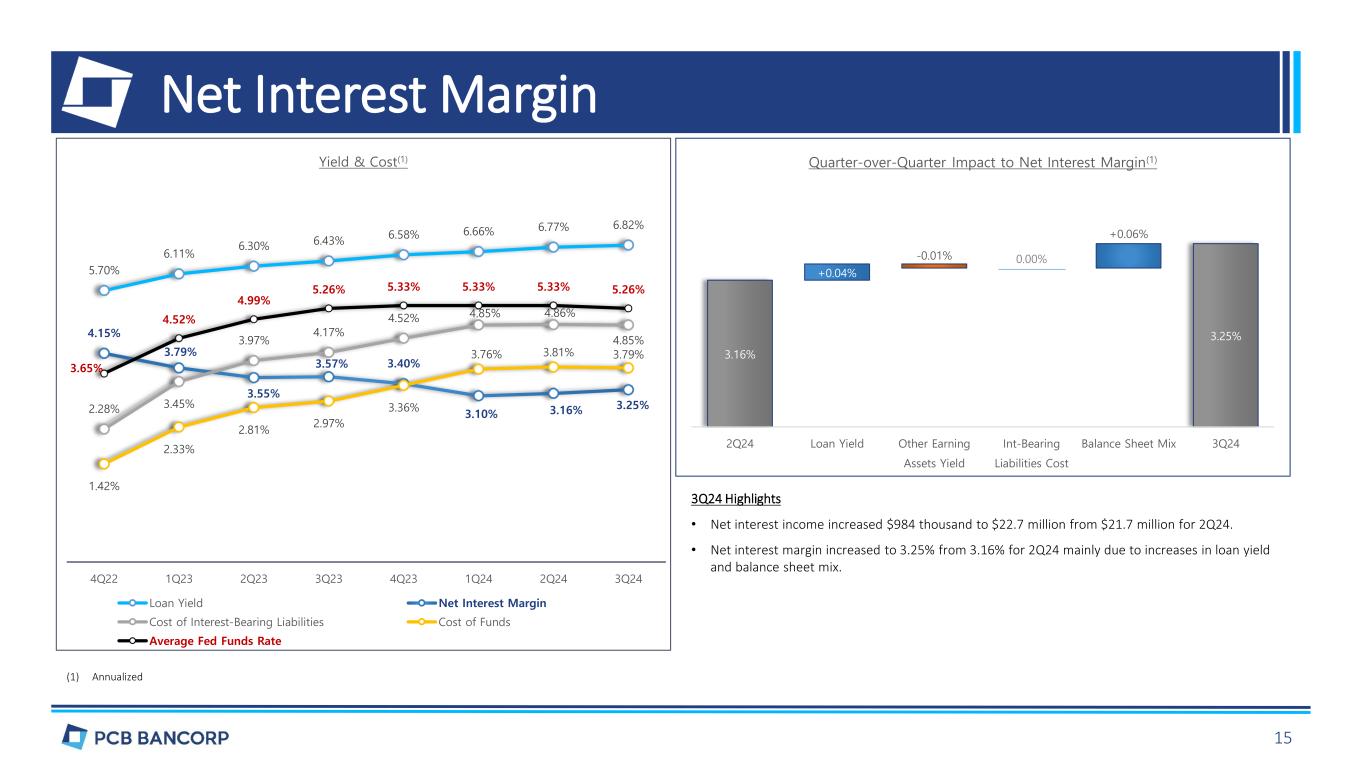

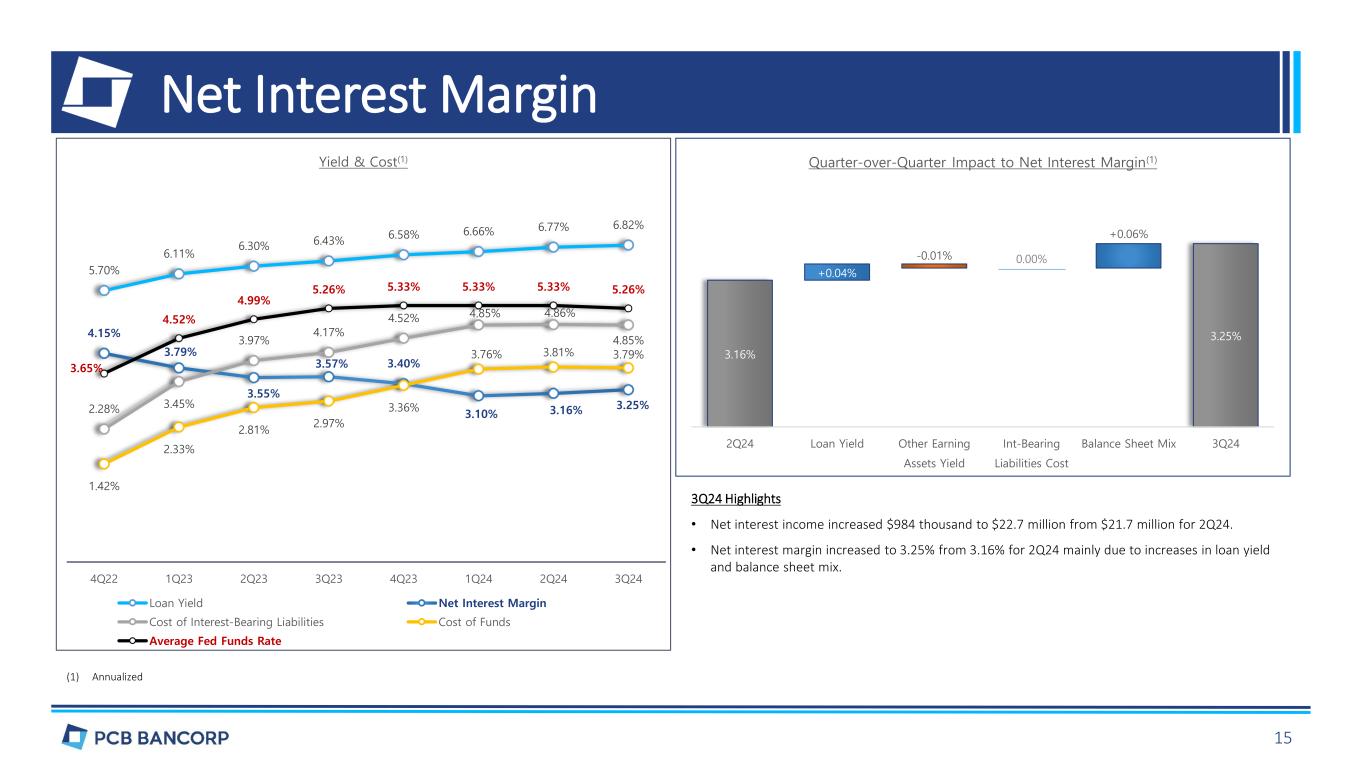

Net Interest Margin (1) Annualized 5.70% 6.11% 6.30% 6.43% 6.58% 6.66% 6.77% 6.82% 4.15% 3.79% 3.55% 3.57% 3.40% 3.10% 3.16% 3.25%2.28% 3.45% 3.97% 4.17% 4.52% 4.85% 4.86% 4.85% 1.42% 2.33% 2.81% 2.97% 3.36% 3.76% 3.81% 3.79% 3.65% 4.52% 4.99% 5.26% 5.33% 5.33% 5.33% 5.26% -1% 0% 1% 2% 3% 4% 5% 6% 7% 8% 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Yield & Cost(1) Loan Yield Net Interest Margin Cost of Interest-Bearing Liabilities Cost of Funds Average Fed Funds Rate 3.16% 3.25% +0.04% -0.01% 0.00% +0.06% 2.80% 2.90% 3.00% 3.10% 3.20% 3.30% 3.40% 2Q24 Loan Yield Other Earning Assets Yield Int-Bearing Liabilities Cost Balance Sheet Mix 3Q24 Quarter-over-Quarter Impact to Net Interest Margin(1) 3Q24 Highlights • Net interest income increased $984 thousand to $22.7 million from $21.7 million for 2Q24. • Net interest margin increased to 3.25% from 3.16% for 2Q24 mainly due to increases in loan yield and balance sheet mix. 15

Capital 12.49% 14.33% 15.54% 14.33% 5.00% 6.50% 8.00% 10.00% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% Tier 1 Leverage CET 1 Capital Tier 1 Capital Total Capital Bank-Level Regulatory Capital Ratios Actual Minimum Requirement For Well-Capitalized $22.94 $23.56 $23.77 $23.87 $24.46 $24.54 $24.80 $25.39 $18.21 $18.72 $18.94 $19.05 $19.62 $19.69 $19.95 $20.55 $12 $14 $16 $18 $20 $22 $24 $26 $28 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Book Value/TCE(1) Per Share BV Per Share TCE Per Share September 30, 2024 13.86% 13.47% 13.32% 13.31% 12.51% 12.26% 12.39% 12.54% 11.00% 10.71% 10.61% 10.62% 10.03% 9.84% 9.97% 10.14% 8% 9% 10% 11% 12% 13% 14% 15% Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Total Equity/TCE(1) to Total Assets Total Equity to Total Assets TCE to Total Assets (1) Not presented in accordance with GAAP. See “Non-GAAP Measures” for reconciliation of this measure to its most comparable GAAP measure. 16

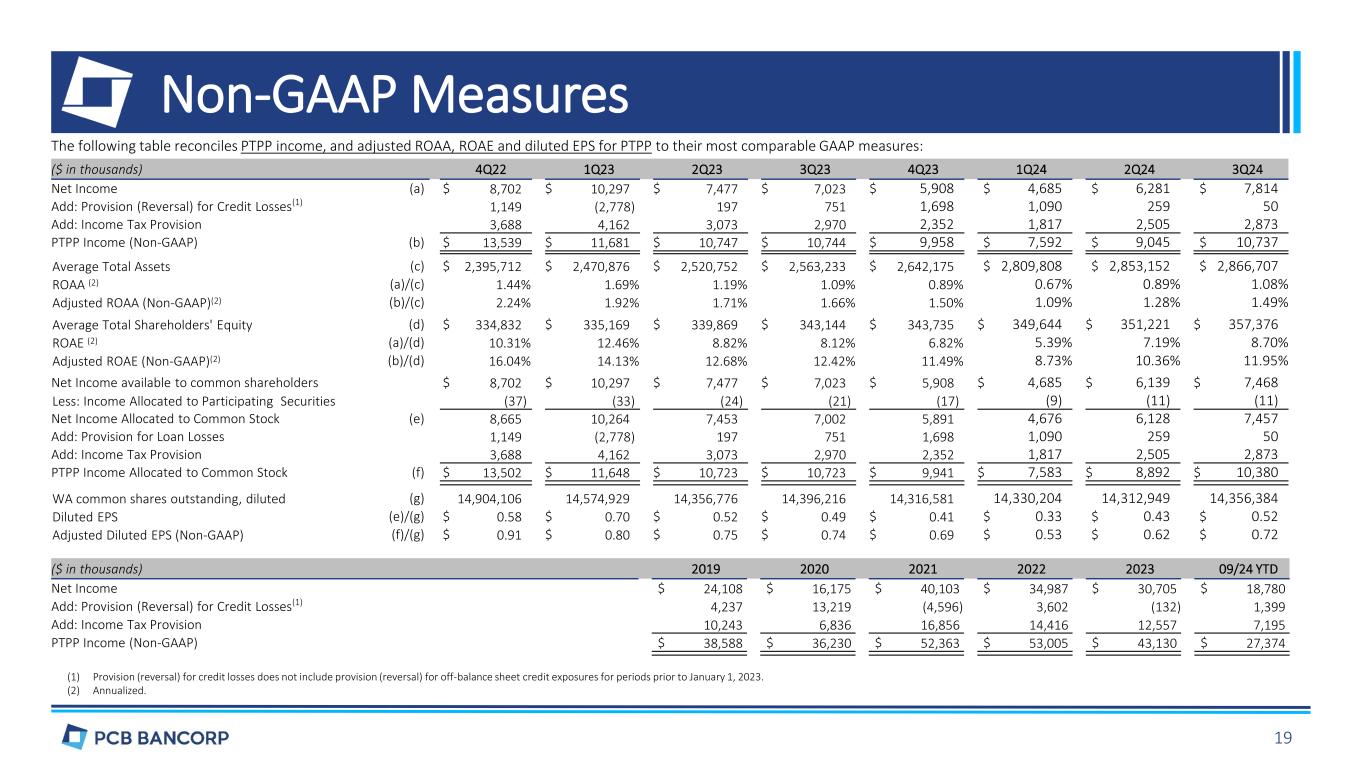

Non-GAAP Measures To supplement the financial information presented in accordance with GAAP, we use certain non-GAAP financial measures. Management believes the non-GAAP measures enhance investors’ understanding of the Company’s business and performance. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. Risks associated with non-GAAP measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. In the information below, we provide reconciliations of the non-GAAP financial measures used in this presentation to the most direct comparable GAAP measures. Core Deposits Core Deposits are a non-GAAP measure that we use to measure the portion of our total deposits that are thought to be more stable, lower cost and reprice less frequently on average in a rising rate environment. We calculate core deposits as total deposits less time deposits greater than $250,000 and brokered deposits. Management tracks its core deposits because management believes it is a useful measure to help assess the Company’s deposit base and, among other things, potential volatility therein. ROATCE, TCE Per Share and TCE to Total Assets ROATCE, TCE per share and TCE to total assets measures that we use to measure the Company’s performance. We calculated TCE as total shareholders’ equity excluding preferred stock. Management believes the non-GAAP measures provide useful supplemental information, and a clearer understanding of the Company’s performance. PTPP Income, and Adjusted ROAA, ROAE and Diluted EPS for PTPP PTPP income, and adjusted ROAA, ROAE and Diluted EPS are non-GAAP measures that we use to measure the Company’s performance and believe these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. We calculated PTPP income as net income excluding income tax provision and provision for loan losses. 17

Non-GAAP Measures The following table reconciles core deposits to its most comparable GAAP measure: ($ in thousands) Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Total Deposits (d) $ 2,045,983 $ 2,141,689 $ 2,188,231 $ 2,192,129 $ 2,351,612 $ 2,402,840 $ 2,406,254 $ 2,459,682 Less: Time Deposits Greater Than $250K (413,876) (514,464) (511,590) (514,406) (575,702) (609,550) (619,832) (640,166) Less: Brokered Deposits (87,031) (157,020) (160,149) (201,258) (303,742) (299,776) (283,033) (295,080) Core Deposits (e) $ 1,545,076 $ 1,470,205 $ 1,516,492 $ 1,476,465 $ 1,472,168 $ 1,493,514 $ 1,503,389 $ 1,524,436 Core Deposits to Total Deposits (e)/(d) 75.5% 68.6% 69.3% 67.4% 62.6% 62.2% 62.5% 62.0% The following table reconciles ROATCE to its most comparable GAAP measure: ($ in thousands) 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Average Total Shareholders' Equity (a) $ 334,832 $ 335,169 $ 339,869 $ 343,144 $ 343,735 $ 349,644 $ 351,221 $ 357,376 Less: Average Preferred Stock 69,141 69,141 69,141 69,141 69,141 69,141 69,141 69,141 Average TCE (Non-GAAP) (b) $ 265,691 $ 266,028 $ 270,728 $ 274,003 $ 274,594 $ 280,503 $ 282,080 $ 288,235 Net Income (c) $ 8,702 $ 10,297 $ 7,477 $ 7,023 $ 5,908 $ 4,685 $ 6,281 $ 7,814 ROAE (1) (c)/(a) 10.31% 12.46% 8.82% 8.12% 6.82% 5.32% 7.19% 8.70% Net Income Available to Common Shareholders (d) $ 8,702 $ 10,297 $ 7,477 $ 7,023 $ 5,908 $ 4,685 $ 6,139 $ 7,468 ROATCE (Non-GAAP)(1) (d)/(b) 12.99% 15.70% 11.08% 10.17% 8.54% 6.63% 8.75% 10.31% The following table reconciles TCE per share and TCE to total assets to their most comparable GAAP measures: ($ in thousands, except per share data) Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Total Shareholders' Equity (a) $ 335,442 $ 336,830 $ 340,411 $ 341,852 $ 348,872 $ 350,005 $ 353,469 $ 362,300 Less: Preferred Stock 69,141 69,141 69,141 69,141 69,141 69,141 69,141 69,141 TCE (Non-GAAP) (b) $ 266,301 $ 267,689 $ 271,270 $ 272,711 $ 279,731 $ 280,864 $ 284,328 $ 293,159 Outstanding Shares (c) 14,625,474 14,297,870 14,318,890 14,319,014 14,260,440 14,263,791 14,254,024 14,266,725 Book Value Per Share (a)/(c) $ 22.94 $ 23.56 $ 23.77 $ 23.87 $ 24.46 $ 24.54 $ 24.80 $ 25.39 TCE Per Share (Non-GAAP) (b)/(c) $ 18.21 $ 18.72 $ 18.94 $ 19.05 $ 19.62 $ 19.69 $ 19.95 $ 20.55 Total Assets (d) $ 2,420,036 $ 2,500,524 $ 2,556,345 $ 2,567,974 $ 2,789,506 $ 2,854,292 $ 2,852,964 $ 2,889,833 Total Shareholders’ Equity to Total Assets (a)/(d) 13.86% 13.47% 13.32% 13.31% 12.51% 12.26% 12.39% 12.54% TCE to Total Assets (Non-GAAP) (b)/(d) 11.00% 10.71% 10.61% 10.62% 10.03% 9.84% 9.97% 10.14% (1) Annualized 18

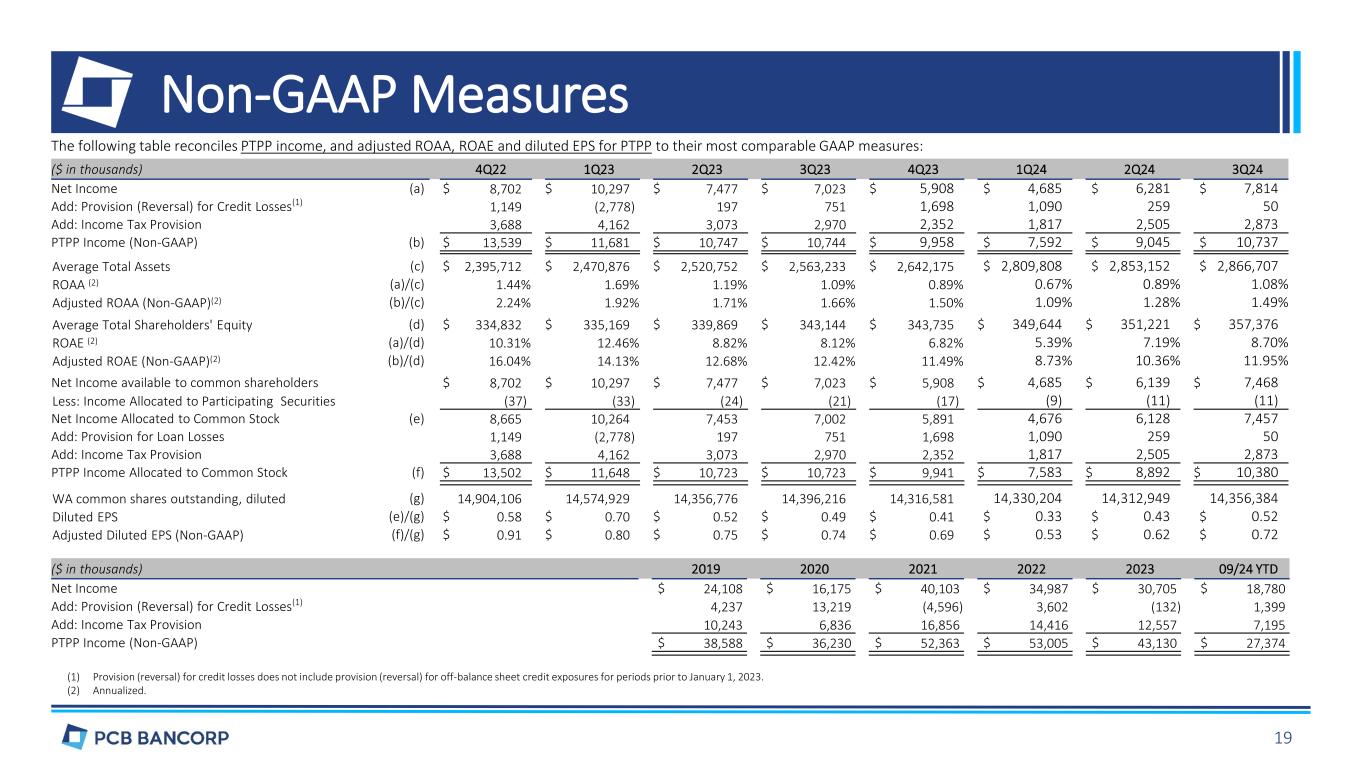

Non-GAAP Measures (1) Provision (reversal) for credit losses does not include provision (reversal) for off-balance sheet credit exposures for periods prior to January 1, 2023. (2) Annualized. The following table reconciles PTPP income, and adjusted ROAA, ROAE and diluted EPS for PTPP to their most comparable GAAP measures: ($ in thousands) 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Net Income (a) $ 8,702 $ 10,297 $ 7,477 $ 7,023 $ 5,908 $ 4,685 $ 6,281 $ 7,814 Add: Provision (Reversal) for Credit Losses(1) 1,149 (2,778) 197 751 1,698 1,090 259 50 Add: Income Tax Provision 3,688 4,162 3,073 2,970 2,352 1,817 2,505 2,873 PTPP Income (Non-GAAP) (b) $ 13,539 $ 11,681 $ 10,747 $ 10,744 $ 9,958 $ 7,592 $ 9,045 $ 10,737 Average Total Assets (c) $ 2,395,712 $ 2,470,876 $ 2,520,752 $ 2,563,233 $ 2,642,175 $ 2,809,808 $ 2,853,152 $ 2,866,707 ROAA (2) (a)/(c) 1.44% 1.69% 1.19% 1.09% 0.89% 0.67% 0.89% 1.08% Adjusted ROAA (Non-GAAP)(2) (b)/(c) 2.24% 1.92% 1.71% 1.66% 1.50% 1.09% 1.28% 1.49% Average Total Shareholders' Equity (d) $ 334,832 $ 335,169 $ 339,869 $ 343,144 $ 343,735 $ 349,644 $ 351,221 $ 357,376 ROAE (2) (a)/(d) 10.31% 12.46% 8.82% 8.12% 6.82% 5.39% 7.19% 8.70% Adjusted ROAE (Non-GAAP)(2) (b)/(d) 16.04% 14.13% 12.68% 12.42% 11.49% 8.73% 10.36% 11.95% Net Income available to common shareholders $ 8,702 $ 10,297 $ 7,477 $ 7,023 $ 5,908 $ 4,685 $ 6,139 $ 7,468 Less: Income Allocated to Participating Securities (37) (33) (24) (21) (17) (9) (11) (11) Net Income Allocated to Common Stock (e) 8,665 10,264 7,453 7,002 5,891 4,676 6,128 7,457 Add: Provision for Loan Losses 1,149 (2,778) 197 751 1,698 1,090 259 50 Add: Income Tax Provision 3,688 4,162 3,073 2,970 2,352 1,817 2,505 2,873 PTPP Income Allocated to Common Stock (f) $ 13,502 $ 11,648 $ 10,723 $ 10,723 $ 9,941 $ 7,583 $ 8,892 $ 10,380 WA common shares outstanding, diluted (g) 14,904,106 14,574,929 14,356,776 14,396,216 14,316,581 14,330,204 14,312,949 14,356,384 Diluted EPS (e)/(g) $ 0.58 $ 0.70 $ 0.52 $ 0.49 $ 0.41 $ 0.33 $ 0.43 $ 0.52 Adjusted Diluted EPS (Non-GAAP) (f)/(g) $ 0.91 $ 0.80 $ 0.75 $ 0.74 $ 0.69 $ 0.53 $ 0.62 $ 0.72 ($ in thousands) 2019 2020 2021 2022 2023 09/24 YTD Net Income $ 24,108 $ 16,175 $ 40,103 $ 34,987 $ 30,705 $ 18,780 Add: Provision (Reversal) for Credit Losses(1) 4,237 13,219 (4,596) 3,602 (132) 1,399 Add: Income Tax Provision 10,243 6,836 16,856 14,416 12,557 7,195 PTPP Income (Non-GAAP) $ 38,588 $ 36,230 $ 52,363 $ 53,005 $ 43,130 $ 27,374 19