UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(RULE 14c-101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

☐ Preliminary Information Statement

☐ Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

☒ Definitive Information Statement

Western Midstream Partners, LP

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Western Midstream Partners, LP

9950 Woodloch Forest Drive, Suite 2800

The Woodlands, TX 77380

NOTICE OF ACTION BY WRITTEN CONSENT

We are Not Asking You for a Proxy and

You are Requested Not to Send Us a Proxy

To the Unitholders of Western Midstream Partners, LP:

The purpose of this notice of action by written consent and information statement is to advise the unitholders of Western Midstream Partners, LP (the “Partnership”) of the approval, by written consent, of the Western Midstream Partners, LP 2021 Long-Term Incentive Plan (the “LTIP”). The LTIP provides for the grant of unit options, unit appreciation rights, restricted units, phantom units, other unit-based awards, cash awards, a unit award or a substitute award, to employees and directors of the Partnership, Western Midstream Holdings, LLC, the Partnership’s general partner (the “General Partner”), or a subsidiary of the Partnership. This notice and information statement is being mailed on or about April 7, 2021 to unitholders of record of the Partnership as of March 22, 2021.

We are not asking you to approve the LTIP. The LTIP was unanimously approved by the board of directors of our General Partner on March 22, 2021. Although approval by unitholders of the LTIP is also required by rules of The New York Stock Exchange (the “NYSE”), we are not soliciting your vote because, on March 22, 2021, affiliates of Occidental Petroleum Corporation (collectively, the “Consenting Majority Unitholder”), which held a majority of our outstanding total common units as of that date, also approved the LTIP by a written consent in lieu of a special meeting of the unitholders to be effective 20 calendar days after the date this information statement is sent or given to our unitholders. Such action by written consent is sufficient to adopt the LTIP without the affirmative vote of any other unitholders. Accordingly, no other votes are necessary to adopt the LTIP and your approval is neither required nor requested.

Notwithstanding the execution and delivery of the written consent by the Consenting Majority Unitholder as described above, under applicable securities regulations, the LTIP may not become effective until at least 20 calendar days after the date this information statement is sent or given to our unitholders. Therefore, the earliest possible date on which the LTIP can become effective is April 27, 2021. A copy of the LTIP is attached to the accompanying information statement as Annex A. Under the rules of the Securities and Exchange Commission (the “SEC”) and Delaware law, we are required to furnish you with certain information concerning the LTIP and this action by the Consenting Majority Unitholder. This notice and the accompanying information statement shall constitute notice to you as required by the rules of the SEC, our Second Amended and Restated Agreement of Limited Partnership and Delaware law.

If you have any questions, please contact our Investor Relations Department at (832) 636-6000.

Sincerely,

Christopher B. Dial

Senior Vice President, General Counsel and

Secretary

This notice and the accompanying information statement are dated and are first being mailed to our unitholders on or about April 7, 2021.

Western Midstream Partners, LP

9950 Woodloch Forest Drive, Suite 2800

The Woodlands, TX 77380

INFORMATION STATEMENT

We are Not Asking You for a Proxy and

You are Requested Not to Send Us a Proxy

To the Unitholders of Western Midstream Partners, LP:

This information statement is being furnished to the unitholders of Western Midstream Partners, LP (the “Partnership”) of record as of March 22, 2021 to provide information about the Western Midstream Partners, LP 2021 Long-Term Incentive Plan (the “LTIP”). The LTIP provides for the grant of unit options, unit appreciation rights, restricted units, phantom units, other unit-based awards, cash awards, a unit award or a substitute award, to employees and directors of the Partnership, Western Midstream Holdings, LLC, the Partnership’s general partner (the “General Partner”), or a subsidiary of the Partnership.

We are not asking you to approve the LTIP. The LTIP was unanimously approved by the board of directors of our General Partner on March 22, 2021. Although approval by unitholders of the LTIP is also required by rules of The New York Stock Exchange (the “NYSE”), we are not soliciting your vote because, on March 22, 2021, affiliates of Occidental Petroleum Corporation (collectively, the “Consenting Majority Unitholder”), which held a majority of our outstanding total common units as of that date, also approved the LTIP by a written consent in lieu of a special meeting of the unitholders to be effective 20 calendar days after the date this information statement is sent or given to our unitholders. This action by written consent was sufficient to adopt the LTIP without the affirmative vote of any other unitholders. Accordingly, no other votes are necessary to adopt the LTIP and your approval is neither required nor requested.

Notwithstanding the execution and delivery of the written consent by the Consenting Majority Unitholder as described above, under applicable securities regulations, the LTIP may not become effective until at least 20 calendar days after the date this information statement is sent or given to our unitholders. Therefore, the earliest possible date on which the LTIP can become effective is April 27, 2021. A copy of the LTIP is attached to this information statement as Annex A. Please read this information statement carefully and in its entirety as it contains important information.

Neither the SEC nor any state securities commission has approved or disapproved of the LTIP, passed upon the merits or fairness of the LTIP or determined if this information statement is accurate or complete. Any representation to the contrary is a criminal offense.

Sincerely,

Christopher B. Dial

Senior Vice President, General Counsel and

Secretary

This information statement is dated and is first being mailed to our unitholders on or about April 7, 2021.

ACTION BY THE BOARD OF DIRECTORS OF THE GENERAL PARTNER

AND CONSENTING MAJORITY UNITHOLDER

On March 22, 2021, the board of directors of Western Midstream Holdings, LLC (our “General Partner”), the general partner of Western Midstream Partners, LP (together with its consolidated subsidiaries, the “Partnership,” “WES,” “we,” “our” or “us”), unanimously approved resolutions adopting the Western Midstream Partners, LP 2021 Long-Term Incentive Plan (the “LTIP”), subject to the requisite unitholder approval as required by the rules of the New York Stock Exchange (“NYSE”). The LTIP provides for the grant of unit options, unit appreciation rights, restricted units, phantom units, other unit-based awards, cash awards, a unit award or a substitute award, to employees and directors of the Partnership, the General Partner or a subsidiary of the Partnership. The LTIP will authorize the issuance of up to 9.5 million common units representing limited partner interests of the Partnership (“Common Units”). Under Delaware law and under our Second Amended and Restated Agreement of Limited Partnership, dated as of December 31, 2019 (the “Partnership Agreement”), any action that may be taken at a meeting of unitholders may be taken without a meeting if approval in writing setting forth the action so taken is signed by the holders of outstanding limited partner interests having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all limited partner interests were present and voted. The action taken by the board of directors of the General Partner (the “Board”) on March 22, 2021 regarding the LTIP was approved by the written consent of affiliates of Occidental Petroleum Corporation (the “Consenting Majority Unitholder” or “Occidental”) on March 22, 2021, which held a majority of our outstanding total common units as of that date, to be effective 20 calendar days after the date this information statement is sent or given to our unitholders. Consequently, no meeting of our common unitholders is required to be or will be held to approve the LTIP.

DISSENTER’S RIGHT OF APPRAISAL

Under Delaware law, unitholders are not entitled to any dissenter’s right of appraisal with respect to the above action.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As of March 22, 2021, there were a total of 413,062,133 common units issued and outstanding. Each holder of common units is entitled to one vote for each such common unit held by such holder. As of March 22, 2021, the Consenting Majority Unitholder was the owner of 214,281,578 common units, representing a majority of the issued and outstanding common units of the Partnership. The Consenting Majority Unitholder, as the holder of a majority of our outstanding common units, has approved the LTIP as described above.

Preemptive Rights. Pursuant to our Partnership Agreement, no person, other than our General Partner, has any preemptive, preferential or other similar rights with respect to the issuance of our equity securities, including our common units. Our General Partner has the right, which it may assign to any of its affiliates, to purchase equity securities from us whenever, and on the same terms that, we issue equity securities to persons other than our General Partner and its affiliates, to the extent necessary for the General Partner and its affiliates to maintain their percentage ownership equal to any or all of the percentage ownership that existed immediately prior to the issuance of such equity securities.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of our units as of March 22, 2021 (the “Ownership Reference Date”) by:

•each person known to us to beneficially own 5% or more of any class of our outstanding units (including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934 (the “Exchange Act”);

•each of the directors and named executive officers (as named in our Annual Report on Form 10-K for the year ended December 31, 2020) of our General Partner; and

•all of the current directors and current executive officers of our General Partner as a group.

All information with respect to beneficial ownership has been furnished by the respective directors, officers or 5% or more unitholders, as the case may be, or based on a review of the copies of reports furnished to us.

Our General Partner is an indirect, wholly owned subsidiary of Occidental Petroleum Corporation. Our General Partner owns all of the general partner interests in us.

The amounts and percentage of units beneficially owned are reported on the basis of SEC regulations governing the determination of beneficial ownership of securities. Under the SEC regulations, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote, or to direct the voting, of such security, and/or “investment power,” which includes the power to dispose, or to direct the disposition of, such security. In computing the number of common units beneficially owned by a person and the percentage ownership of that person, a right to acquire beneficial ownership of a security within 60 days of the Ownership Reference Date by a person, if any, are deemed to be outstanding for computing the percentage of outstanding securities of the class by such person, but are not deemed to be outstanding for computing the percentage ownership of any other person. Except as indicated by footnote, the persons named in the table below have sole voting power and sole investment power with respect to all units shown as beneficially owned by them, subject to community property laws where applicable.

The percentages of units beneficially owned are based on total common units outstanding as of the Ownership Reference Date.

| | | | | | | | | | | | | | |

Name and Address of Beneficial Owner (1) | | Common Units Beneficially Owned (2) | | Percentage of

Common Units

Beneficially

Owned |

Occidental Petroleum Corporation (3) | | 214,281,578 | | | 51.88% |

| 5% Owners Not Listed Above or Below: | | | | |

ALPS Advisors, Inc. (4) | | 24,153,629 | | | 5.84% |

Invesco Ltd. (5) | | 21,340,971 | | | 5.16% |

| Current Directors and Named Executive Officers of Our General Partner: | | | | |

| Glenn Vangolen | | — | | | * |

Michael P. Ure (6) | | 69,498 | | | * |

| Robert W. Bourne | | 14,628 | | | * |

| Craig W. Collins | | 32,760 | | | * |

| Christopher B. Dial | | 12,879 | | | * |

| Catherine A. Green | | 5,389 | | | * |

| Charles G. Griffie | | 16,953 | | | * |

| Peter J. Bennett | | — | | * |

| Oscar K. Brown | | 1,440 | | | * |

| Kenneth F. Owen | | 7,182 | | | * |

| David J. Schulte | | 11,682 | | | * |

| Lisa A. Stewart | | 7,182 | | | * |

| Nicole E. Clark | | — | | | * |

| All current directors and current executive officers of our General Partner as a group (consisting of 13 persons) | | 179,593 | | | * |

_________________________________________________________________________________________

* An asterisk indicates that the person or entity owns less than one percent.

(1)The address for Occidental and its representatives on the Board of Directors of our general partner is 5 Greenway Plaza, Suite 110, Houston, Texas 77046.

(2)Does not include unvested WES phantom unit awards.

(3)Based on a Schedule 13D/A filed with the SEC on September 17, 2020. The filing was made jointly by Occidental Petroleum Corporation, Oxy USA Inc., Occidental Permian Manager LLC, OXY Oil Partners, Inc., New OPL, LLC, Baseball Merger Sub 2, Inc., Anadarko Petroleum Corporation, Western Gas Resources, Inc., APC Midstream Holdings, LLC, WGR Asset Holding Company LLC, Kerr-McGee Worldwide Corporation, Anadarko E&P Onshore LLC and Anadarko USH1 Corporation. Each party to the Schedule 13D, as amended, shares voting and dispositive power. The address for each party to the Schedule 13D, as amended, is 5 Greenway Plaza, Suite 110, Houston, Texas 77046.

(4)Based upon a Schedule 13G/A filed with the SEC on February 9, 2021. The address for ALPS Advisors, Inc. is 1290 Broadway, Suite 1100, Denver, Colorado 80203.

(5)Based upon a Schedule 13G filed with the SEC on February 16, 2021. The address for Invesco Ltd. is 1555 Peachtree Street NE, Suite 1800, Atlanta, Georgia 30309.

(6)Includes 10,000 common units held in a margin account. However, there are currently no margin borrowings associated with this account.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) describes the material elements, objectives, and principles of WES’s 2020 executive compensation program for its named executive officers (“NEOs”), recent compensation decisions, and the factors the Board considered in making those decisions. The NEOs for 2020 were:

| | | | | | | | |

| Name | | Position |

| Michael P. Ure | | President, Chief Executive Officer and Chief Financial Officer |

Michael C. Pearl (1) | | Former Senior Vice President and Chief Financial Officer |

| Craig W. Collins | | Senior Vice President and Chief Operating Officer |

| Charles G. Griffie | | Senior Vice President, Operations and Engineering |

| Robert W. Bourne | | Senior Vice President and Chief Commercial Officer |

| | |

| | |

| | |

| | |

________________________________________________________________________________

(1)Mr. Pearl left WES on September 11, 2020.

Executive Summary

Prior to December 31, 2019, we did not directly employ any of the persons responsible for managing our business. Our employees, including executive officers, who managed our business, were employed by Occidental (or, prior to the Occidental Merger, by Anadarko) and their respective subsidiaries other than us. During this period, compensation decisions for our executive officers were made by Occidental or Anadarko, and we reimbursed them for a portion of compensation expense that was allocated to us pursuant to the terms of our omnibus agreement.

Subsequent to the Occidental Merger, WES undertook a strategic shift toward becoming a functionally-independent company based on the recognition that operating our business under a midstream-focused organizational infrastructure, with an independent management team solely dedicated to WES, would position WES to achieve long-term cost efficiencies, increase the quality, safety, and reliability of WES’s service offerings and operate more competitively, thereby promoting the creation of long-term value for WES unitholders. Our executive management team, none of whom have any remaining role or responsibilities at Anadarko or Occidental, was brought into WES between August of 2019 and year-end 2019 to execute this transition. This change in organizational structure was and is a significant undertaking that informed all of our compensation decisions, including pay levels, the design of short-and long-term incentive programs, the determination of WES specific metrics used in these programs, and the benefit programs we provide.

In December 2019, we executed several agreements with Occidental designed to provide the legal and organizational framework for this transition. Among these agreements was the Amended and Restated Services, Secondment, and Employee Transfer Agreement (“Services Agreement”), which transferred employment of WES’s management team from Occidental to WES at year-end 2019 and provided for the secondment of all remaining WES-dedicated employees through the date of their formal transfer to WES—which occurred in the first quarter of 2020. Following the execution of the Services Agreement, the Board of Directors of our general partner (the “Board”) was vested with responsibility for all decisions relating to WES’s compensation programs, including the compensation of our NEOs.

The compensation actions taken by the Board in 2020 were designed to promote and align with this strategic and operational transition, but were also—in certain respects—limited or influenced by structural considerations relating to this transition and/or the Occidental Merger. For example:

•Under the Anadarko Change of Control Plan, any material diminution in compensation or benefits in connection with the transfer to WES of legacy Anadarko employees—who compromise the majority of our workforce—could have given rise to constructive termination claims and severance obligations.

•Although WES was deconsolidated from Occidental at year-end 2019, there were significant transition considerations in establishing standalone compensation program structures and administrative functions applicable to the newly-formed WES workforce. The WES organization therefore relied upon and remained influenced to some degree by the established infrastructure and programs that existed at Occidental during 2020.

•Because WES did not have any employees prior to 2020, and all members of our executive management team were new to the organization, WES management did not have years of accumulated equity grants tending to establish unitholder alignment and retention incentives.

During this transition period, our Board took several key actions—both in furtherance of WES’s strategic objectives and in reaction to external factors—which directly or indirectly impacted executive compensation:

•Approved the Services Agreement with Occidental that outlined the terms of transferring employees, including our NEOs, to WES; this agreement specified that the terms and conditions of employment, including employee aggregate benefit values, be substantially the same as those provided to employees immediately prior to the transfer;

•Hired an independent compensation consultant;

•Established an annual cash incentive program with performance measures aligned solely with WES’s performance;

•Established an annual equity-based long-term incentive program that rewards executives based on WES’s absolute unit price performance, relative unit price performance compared to industry peers, and return on assets over a three-year performance period;

•Reviewed and made compensation changes to our executive officer base salaries, target bonus opportunities, and long-term incentive awards;

•Approved a 50% cut to our quarterly distributions to secure the Partnership’s long-term financial health; executives participated in the distribution reductions on their own unit holdings, and through tandem distribution rights on their outstanding unvested unit awards.

As our transition to a standalone midstream company evolves, we will continue to review our compensation and benefit programs in order to ensure they align with WES’s overall strategy, provide for the attraction and retention of executive talent, and align executive officers’ interests with those of our long-term unitholders.

2020 Business and Performance Highlights

2020 was a transformative year for WES as it embarked on a business transition predicated on the idea that WES could drive and sustain greater unitholder value by functioning as an independent enterprise and simultaneously shifting its financial strategy toward optimizing its balance sheet and ability to self-fund future growth. While executing this transition, and despite the challenges occasioned by a world-wide pandemic, during the 2020 fiscal year WES:

•Maintained 99.1% system availability.

•Achieved year-over-year increases in throughput for natural gas, crude oil and NGLs, and produced water despite a significantly challenged commodity price environment.

•Generated $1.23 billion in Free Cash Flow, more than thirty times that generated during 2019 and representing a roughly $1.93 billion improvement to the negative $704.5 million generated by the business in 2018.

•Achieved its 2021 target of below 4.0X consolidated total leverage a full year ahead of schedule.

•Worked to reduce future cash obligations and leverage by retiring 30.2 million units, via repurchases and redemptions, and $218.0 million of senior notes.

•Refinanced $3.0 billion in debt coming due in 2020 at highly attractive rates.

•Generated record, above-forecast, 2020 EBITDA primarily through cost-saving initiatives.

•Published our first ESG report.

How We Make Compensation Decisions

Our Board has responsibility for evaluating and approving the officer and director compensation plans, policies, and programs of the Partnership. The Board uses several resources in reviewing elements of executive compensation and making compensation decisions. These decisions are not purely formulaic, and the Board exercises judgement and discretion as appropriate.

Compensation Philosophy. Our compensation programs are designed to attract, retain, and motivate our executive team to successfully manage the operations of a standalone midstream company. Specifically, our compensation programs are designed to:

•Align with unitholder interests;

•Emphasize performance-based compensation, balancing short-term and long-term results;

•Reward absolute and relative performance; and

•Provide total compensation opportunities competitive with those offered to other executives across our industry.

Compensation Consultant. In 2020, the Board engaged Meridian Compensation Partners, LLC (Meridian) as its independent compensation consultant to provide advice on various executive compensation matters. Because 2020 was the first year our Board became fully responsible for making pay decisions related to our NEOs, this was our first year to use an independent compensation consultant. In 2020, Meridian provided guidance on our benchmarking peer group, pay levels, pay mix, severance benefits, and overall executive compensation program design.

Benchmarking Peers. With assistance from Meridian, the Board looked at several factors when determining an appropriate peer group of companies to use for benchmarking compensation opportunities. These factors included: similar midstream businesses of comparable size and scope, comparable executive roles and responsibilities, similar structure (largely independent strategy and governance (whether MLP or C-Corp)), and companies that are in competition for the same senior executive talent.

The Partnership’s peer group used for conducting the 2020 executive benchmarking assessment is listed below:

| | | | | | | | |

•Crestwood Equity Partners LP | | •Magellan Midstream Partners LP |

•DCP Midstream LP | | •ONEOK, Inc. |

•Enable Midstream Partners LP | | •Plains All American Pipeline LP |

•EnLink Midstream, LLC | | •Targa Resources Corp. |

•Equitrans Midstream Corporation | | •Williams Companies, Inc. |

Benchmarking Data. To assist in reviewing the design and structure of our executive compensation program, Meridian provided the Board with an independent assessment of the compensation programs and practices in our industry peer group. This assessment included compensation data and program design information that was obtained from the most recent public filings for each company. When reviewing benchmarking data, the Board reviewed 25th, 50th, and 75th percentile data, however, the Board does not target a specific percentile of the benchmark data, and in making officer compensation decisions, they take into account other considerations as noted below.

Role of Executive Officers in Executive Compensation. The Board, after reviewing the information provided by Meridian and considering other factors and with input from Meridian, determines each element of compensation for our CEO. When making determinations about each element of compensation for our other executive officers, the Board also considers recommendations from our CEO. Additionally, at the Board’s request, our executive officers may assess

the design of, and make recommendations related to, our compensation and benefit programs, including recommendations related to the performance measures used in our incentive programs. The Board is under no obligation to implement these recommendations. Executive officers and others may also attend Board meetings when invited to do so, but the executive officers do not attend when their individual compensation is being discussed.

Other Considerations. In addition to the above resources, the Board considers other factors when making compensation decisions, such as individual experience, individual performance, internal pay equity, development and succession status, and other individual or organizational circumstances, including the current market and business environment. With respect to equity-based awards, the Board also considers the expense of such awards, the impact on dilution, and the relative value of each element comprising the executive officers’ target total compensation opportunity.

2020 Annual Compensation Program

Our executive compensation program includes direct and indirect compensation elements. We believe that a majority of an executive officer’s total compensation opportunity should be performance-based; however, we do not have a specified formula that dictates the overall weighting of each element. Beginning in 2020, as part of our transition to a standalone company, the Board established an annual target total compensation program that supports WES’s long-term strategic objectives and is competitive with industry practices.

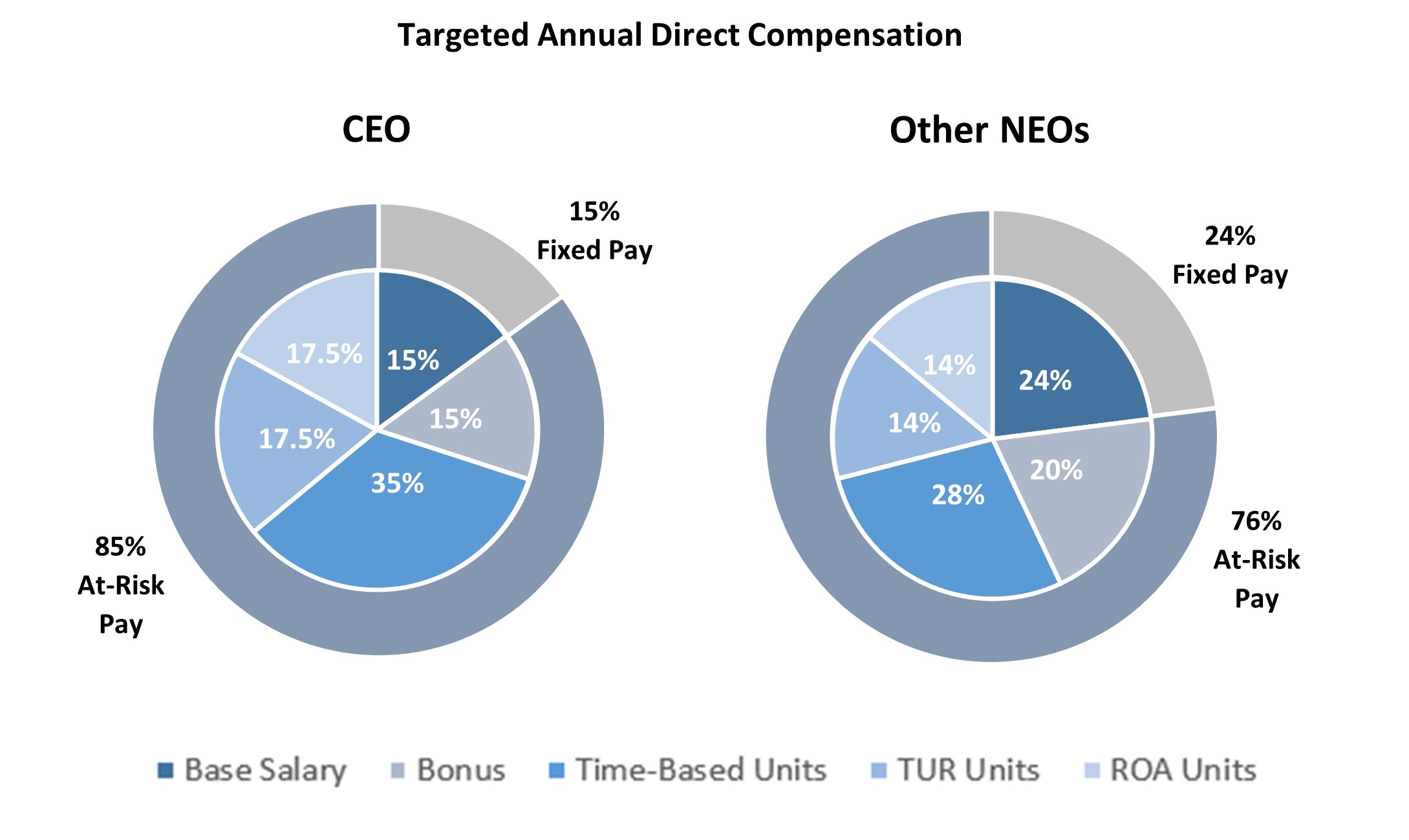

As illustrated in the charts below, a majority of our NEO targeted annual direct compensation is at-risk; 85% for our CEO and 76%, on average, for our other NEOs. Specifically, 70% of our CEO’s compensation and 56%, on average, for our other NEOs’ compensation is tied directly to WES’s unit performance through their annual long-term incentive awards.

The charts above are based on the following compensation elements, as discussed under Analysis of 2020 Compensation Actions: base salaries approved in 2020; target bonus opportunities approved by the Board in 2020; and the target value of the 2020 annual long-term incentive awards.

Direct Compensation Elements. The direct compensation elements for our 2020 annual compensation program are outlined in the table below. The indirect compensation elements are outlined in the Indirect Compensation Elements section below.

| | | | | | | | | | | | | | | | | | | | |

| Element | | Award | | Performance Metrics | | Purpose |

| Base Salary | | Cash | | N/A | | Provides a fixed level of competitive compensation to attract and retain executive talent. |

| Equity-Based Awards | | Time-Based Units

(50% of award) | | Absolute Unit Price | | Time-based Units align with absolute unit price and provide retentive value, especially in a volatile industry. |

| | ROA Units

(25% of award) | | 3-Year Return on Assets (“ROA”)

Absolute Unit Price | | ROA Units provide an incentive for NEOs to focus on efficiently managing the Partnership’s assets to generate earnings. |

| | TUR Units

(25% of award) | | 3-Year Relative Total Unitholder Return (“TUR”)

Absolute Unit Price | | TUR Units provide an effective comparison of our unit price performance against an industry peer group. |

| Annual Cash Incentives | | Cash | | Controllable Cash Costs

System Availability

Discretionary Capital Spend

Leverage

TRIR

Overall Performance | | Provides incentives for NEOs to focus and excel in areas aligned with WES’s business objectives by providing rewards for short-term financial and operational results. |

Analysis of 2020 Compensation Actions

The following is a discussion of the specific actions taken by the Board in 2020 related to each of our direct compensation elements. Each element is reviewed annually, unless circumstances, such as a promotion, other change in responsibilities, significant corporate event or a material change in market conditions require a more frequent review.

Base Salary. In setting base salary levels for each of the NEOs, the Board considered a number of factors, including each executive’s experience, individual performance, internal pay equity, development, and other individual or organizational circumstances, including the current market and business environment.

Prior to 2020, the compensation of WES’s executive officers, who became WES employees at year-end 2019, was based on decisions made by Anadarko and/or Occidental based on their roles in 2019. The table below reflects the base salaries for the NEOs established in 2020 at the commencement of the WES Board’s role in determining executive compensation at levels the Board believed were consistent with the transition and changes in their WES-dedicated roles and responsibilities.

| | | | | | | | |

| Name | | Salary as of

February 23, 2020 ($) |

| Mr. Ure | | 650,000 | |

| Mr. Pearl | | 455,000 | |

| Mr. Collins | | 455,000 | |

| Mr. Griffie | | 405,000 | |

| Mr. Bourne | | 405,000 | |

Mr. Ure’s salary reflects his responsibilities leading WES as a standalone company, based—in part— on our peer benchmark data. The establishment of salaries for the other NEOs was also informed by peer benchmark data with a view toward promoting internal compensation alignment.

Equity-Based Long-term Incentive Awards. Prior to the Occidental Merger, Anadarko periodically granted equity-based awards under their Omnibus Incentive Plan and, likewise, Occidental granted equity-based awards under the

Occidental LTIP Plan. As part of our transition to a standalone company, in February 2020, our Board established an annual long-term incentive program that consists of a combination of time-based units and performance-based units.

This use of both time-based and performance-based awards was intended to provide a combination of equity-based vehicles that are performance-based in absolute and relative terms while also encouraging retention. Our equity-based long-term incentive program is designed to reward our executive officers for sustained long-term unit performance. This program represents 70% of targeted annual direct compensation for our CEO and an average of 56% for our other NEOs.

Time-Based Units. These units, reflecting 50% of the overall 2020 annual long-term incentive awards, vest annually over a three-year period. Upon vesting, the awards are settled in WES common units. Distribution equivalent rights for time-based awards made during 2020 are paid during the vesting period in the form of WES common units.

Return on Asset Performance Units (“ROA Units”). The Board established ROA as a performance criterion for 25% of the 2020 annual long-term incentive awards. ROA is calculated each year during a three-year performance period as follows:

| | | | | | | | | | | | | | |

Adjusted

EBITDA | | divided by | | Average

Consolidated Total

Assets |

The actual number of units earned for the three-year performance period will be based on WES’s average annual ROA during this period. The following table reflects the payout scale used to determine the number of units earned. In the event performance falls between a whole percentage, the payout will be interpolated linearly.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| WES 3 Year Average ROA | 19% | 18% | 17% | 16% | 15% | 14% | 13% | 12% | 11% |

| Payout as a % of Target | 200% | 175% | 150% | 125% | 100% | 75% | 50% | 25% | 0% |

The number of units earned will be paid in the form of WES common units after the end of the performance period and after the Board has certified the attainment of ROA. Distribution equivalent rights for ROA Unit awards made during 2020 are paid during the performance period in the form of WES common units, assuming target performance.

Total Unit Return Performance Units (“TUR Units”). The Board established relative TUR as a performance criterion for 25% of the 2020 annual long-term incentive awards. The units are subject to relative TUR over a three-year performance period, with TUR calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Closing Common Unit Price for the last 30 trading days of the performance period | | minus | | Average Closing Common Unit Price for the 30 trading days preceding the beginning of the performance period | | plus | | Distributions paid per Common Unit over the performance period (based on ex-dividend date) |

| | | | | | | | |

| divided by |

| | | | | | | | |

| Average Closing Common Unit Price for the 30 trading days preceding the beginning of the performance period |

The industry peer group for our 2020 TUR awards is listed below. The TUR peer group differs from our compensation benchmarking peer group due primarily to the exclusion of C-Corp peers, whose securities have a different trading profile than that of master limited partnerships.

| | | | | | | | |

•Crestwood Equity Partners LP | | •EQM Midstream Partners LP |

•DCP Midstream LP | | •Magellan Midstream Partners LP |

•Enable Midstream Partners LP | | •Noble Midstream Partners LP |

•EnLink Midstream, LLC | | •Plains All American Pipeline LP |

If during the performance period, a peer company is acquired, ceases to exist, ceases to be a publicly-traded partnership, files for bankruptcy, spins off 25% or more of its assets, or sells all or substantially all of its assets, then such partnership shall be deemed to fall to the bottom of the relative TUR ranking for the performance period.

The actual number of units earned for the three-year performance period will be based on WES’s relative TUR during this period. The following table reflects the payout scale used to determine the number of units earned.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Final Relative Ranking | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Payout as a % of Target | 200% | 175% | 150% | 125% | 100% | 75% | 50% | 25% | 0% |

| | | | | | | | | |

The number of units earned will be paid in the form of WES common units after the end of the performance period and after the Board has certified the attainment of relative TUR. Distribution equivalent rights for TUR Unit awards made during 2020 are paid during the performance period in the form of WES common units, assuming target performance.

2020 Equity Awards. Effective February 12, 2020, the Board approved the following annual long-term incentive awards under the Western Gas Equity Partners, LP 2012 Long-Term Incentive Plan. These awards are included in the Grants of Plan-Based Awards Table. In determining the annual equity awards, the Board took into consideration our peer benchmarking data, internal pay equity, retention concerns, and current NEO unit ownership levels. Because each of our executive officers was newly-appointed to WES, each of them generally had minimal or no equity interest in WES prior to the 2020 LTI award cycle.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Target LTI Value ($) (1) | | Time-Based Units | | TUR Units | | ROA Units |

| Name | | | Number of Units (#) | | Target Value ($) | | Number of Units (#) | | Target Value ($) | | Number of Units (#) | | Target Value ($) |

| Mr. Ure | | 3,000,000 | | | 93,633 | | 1,500,000 | | | 46,817 | | 750,000 | | | 46,817 | | 750,000 | |

| Mr. Pearl | | 1,300,000 | | | 40,575 | | 650,000 | | | 20,288 | | 325,000 | | | 20,288 | | 325,000 | |

| Mr. Collins | | 1,300,000 | | | 40,575 | | 650,000 | | | 20,288 | | 325,000 | | | 20,288 | | 325,000 | |

| Mr. Griffie | | 800,000 | | | 24,969 | | 400,000 | | | 12,485 | | 200,000 | | | 12,485 | | 200,000 | |

| Mr. Bourne | | 700,000 | | | 21,848 | | 350,000 | | | 10,924 | | 175,000 | | | 10,924 | | 175,000 | |

_______________________________________________________________________________

(1)Target LTI values vary slightly from those reported in the Summary Compensation Table and Grants of Plan-Based Awards Table, which are calculated in accordance with FASB ASC Topic 718.

Special Equity Awards. In addition to the annual awards, in February 2020, the Board approved special equity awards in the form of time-based units to each of the NEOs. Because our NEOs were new to the Partnership in 2019 and had minimal WES equity, these grants were made to increase their equity holdings to a level adequate to instill an ownership culture more closely aligning their interests with those of our unitholders and to provide additional retentive value. These units vest annually over a three-year period, and upon vesting, the awards are settled in WES common units. Distribution equivalent rights are paid during the vesting period in the form of WES common units. The table below shows the special equity awards granted to each NEO.

| | | | | | | | | | | | | | |

| Name | | Number of

Time-Based Units (#) | | Target Value ($) (1) |

| Mr. Ure | | 62,422 | | 1,000,000 |

| Mr. Pearl | | 24,969 | | 400,000 |

| Mr. Collins | | 24,969 | | 400,000 |

| Mr. Griffie | | 15,606 | | 250,000 |

| Mr. Bourne | | 15,606 | | 250,000 |

_______________________________________________________________________________

(1)Target LTI values vary slightly from those reported in the Summary Compensation Table and Grants of Plan-Based Awards Table, which are calculated in accordance with FASB ASC Topic 718.

Performance-Based Annual Cash Incentives—WES Cash Bonus Program. During 2020, as part of our transition to a standalone business, the Board approved the WES Cash Bonus Program (“WCB Program”) under the US Incentive Compensation Program. Under this program, annual cash bonus awards are earned by eligible employees, including our NEOs, based on the board’s discretion, taking into account the achievement of specified business objectives and individual performance objectives.

In February 2020, individual target bonus opportunities were approved by the Board for each of our NEOs as noted in the table below.

| | | | | | | | | | | | | | |

| | 2020 Target Bonus |

| Name | | $ | | % of Salary |

| Mr. Ure | | 650,000 | | 100% |

| Mr. Pearl | | 390,000 | | 86% |

| Mr. Collins | | 390,000 | | 86% |

| Mr. Griffie | | 345,000 | | 85% |

| Mr. Bourne | | 330,000 | | 81% |

The NEO target bonuses were determined based on a review of our peer benchmarking data and internal pay equity considerations.

Performance Metrics. In February 2020, the Board approved performance measures and targets to be used as an aid in determining annual cash awards under the WCB Program for the one-year performance period that ended December 31, 2020. Our annual incentive program was designed to include measures that support our primary business strategy of creating long-term value for our unitholders by safely delivering above-average customer service and system availability, and obtaining new business over time, while achieving costs efficiencies and optimizing our financial profile.

The table below reflects the Partnership’s original 2020 performance metrics, performance targets and actual performance under these metrics.

| | | | | | | | | | | | | | | | | | | | | |

| Performance Metric | | Relative Weighting Factor | | WCB Program

Performance

Targets | | WCB Program Performance

Results | |

Controllable Cash Costs (1) | | 20% | | < $860MM | | $687MM | |

System Availability (2) | | 20% | | > 97% | | 99.1% | |

Discretionary Capital Spend (3) | | 20% | | < $780MM | | $269MM | |

Leverage (4) | | 15% | | < 4.3x (Debt/Adjusted EBITDA) | | 3.91x | |

TRIR (Total Recordable Incident Rate) (5) | | 10% | | < 0.35 | | 0.38 | |

Overall Performance (6) | | 15% | | Description Below | | Discussed Below | |

_________________________________________________________________________________________

(1)Controllable Cash includes operating expenses and general and administrative expenses, excluding non-cash restricted stock unit, bonus and benefits expense.

(2)System Availability is a measure of the “real” average availability experienced by WES’s customers related to its gas systems, oil systems, and water-disposal wells. It considers the ratio of average actual daily volumes to expected daily volumes and includes all experienced sources of downtime, such as scheduled and unscheduled downtime, logistic downtime, etc. The total availability score is a weighted average with more weight given to higher gross-margin-producing assets.

(3)Discretionary Capital Spend (Discretionary Capital Expenditures plus Equity Investments) includes expansion capital expenditures and expenditures related to equity investments. This metric does not include maintenance capital expenditures, as defined in WES’s financial statements.

(4)Leverage is calculated as the December 31, 2020 total debt balance divided by the trailing 12-months adjusted EBITDA.

(5)TRIR includes injuries or illnesses that result in any of the following: days away from work, restricted work or transfer to another job, medical treatment beyond first aid, loss of consciousness, or death.

(6)Overall Performance is assessed based upon WES’s year-over-year performance, including the ability to generate accretive third-party business and distributable cash flow.

COVID 19 and Our Board’s Approach to 2020 Bonuses. Shortly after the approval of the 2020 executive compensation programs described above, including the WCB Program, the energy industry found itself confronted with unprecedented challenges spurred by the COVID 19 global pandemic. Commodity prices fell and many producers forecasted significant production curtailments. In response to these challenges, WES cut its distribution to unitholders by 50%, eliminated geographical bonuses to certain employees, suspended promotions and pay raises for all of its personnel and required many of its personnel to work remotely. In March 2020, Mr. Ure informed the Board that he intended to forego cash bonus eligibility in order to reduce his cash compensation for the 2020 fiscal year.

This rapid change in the global economy prompted WES’s management team and Board to quickly recognize that the WCB Program performance targets described above, while valid leading indicators of WES’s performance in delivering long-term, sustainable value for unitholders, were not necessarily the most appropriate near-term measures of WES’s ability to withstand the immediate challenges brought by COVID 19. Accordingly, the Board utilized greater discretion in approaching 2020 bonuses than might ordinarily be expected and considered many factors, including not just WES’s attainment of previously enunciated goals, but also the recognition that the industry as a whole experienced significant challenges in 2020, which were shared by WES unitholders and employees alike, and that ongoing economic uncertainty is likely to persist into 2021. As a result, despite the fact that management’s overall performance exceeded the quantitative metrics established by the Board, it was determined that a 95% payout under the 2020 WCB Program was appropriate. This bonus level recognized WES’s meaningful financial and operational performance while also attempting to strike an appropriate balance with the hardships occasioned by—and remaining challenges coming out of—the COVID 19 pandemic and associated disruptions to the energy sector as a whole. The payout level was derived with particular importance placed on and potential improvement opportunities related to operating safely. Further, while recognizing that Mr. Ure previously informed the WES Board of his intent to forego a cash bonus as part of WES’s initial response to COVID 19, the Board determined that he should nevertheless be rewarded in light of WES’s performance during the particular challenges brought by 2020.

Actual Bonuses Earned for 2020. The cash bonus awards for 2020 for our NEOs are shown in the table below and are reflected in the “Bonus” column of the Summary Compensation Table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name (1) | | Target

Bonus ($) | | | | Board Discretionary Assessment of 2020 WCB Program | | | | Cash Bonus

Awards ($) |

| Mr. Ure | | 650,000 | | x | | 95% | | = | | 617,500 |

| Mr. Collins | | 390,000 | | x | | 95% | | = | | 370,500 |

| Mr. Griffie | | 345,000 | | x | | 95% | | = | | 327,750 |

| Mr. Bourne | | 330,000 | | x | | 95% | | = | | 313,500 |

_________________________________________________________________________________________

(1)Mr. Pearl is excluded from this table as he had left WES prior to the determination of awards and did not receive a 2020 bonus award.

Indirect Compensation Elements

As identified in the table below, the Partnership provides certain benefits and perquisites (considered indirect compensation elements) that are considered typical within our industry and necessary to attract and retain executive talent. The value of each element of indirect compensation is generally structured to be competitive within our industry.

| | | | | | | | |

| Indirect Compensation Element | | Primary Purpose |

| Retirement Benefits | | •Attracts talented executive officers and rewards them for extended service •Offers secure and tax-advantaged vehicles for executive officers to save effectively for retirement |

| Other Benefits (for example, health care, paid time off, disability, and life insurance) and Perquisites | | •Enhances executive welfare and financial security •Provides a competitive package to attract and retain executive talent, but does not constitute a significant part of an executive officer’s compensation |

| Severance Benefits | | •Attracts and helps retain executives in a volatile and consolidating industry •Provides transitional income following an executive’s involuntary termination of employment |

Retirement Benefits. Beginning in 2020, all our regular employees, including our NEOs, are eligible to participate in the Western Midstream Savings Plan, a defined-contribution benefit plan maintained by WES. We do not have a non-qualified savings restoration plan that provides for the accrual and deferral of employer contributions that the participant would have otherwise been eligible for absent the Internal Revenue Code (“IRC”) limitations that restrict the amount of benefits payable under the tax-qualified savings plan. However, in 2020, the Board approved a cash restoration payment program that provides a direct cash payment to participants in the amount of employer contributions that would have been allocated to the participant’s savings plan account each year, without regard to the IRC limitations. Prior to 2020, our NEOs participated in retirement plans provided by their legacy employer (Occidental or Anadarko). Their participation in these plans ceased when their employment was transferred to the Partnership on December 31, 2019 and we are not responsible for any expense related to these prior benefits.

Other Benefits. We provide other benefits such as medical, dental, vision, flexible spending and health savings accounts, paid time off, life insurance, and disability coverage to our executive officers. These benefits are also provided to all other eligible U.S. based employees. As legacy Anadarko management employees, Messrs. Pearl and Griffie were eligible for participation in a Management Life Insurance Plan, which provides an additional life insurance benefit of up to two times base salary. This plan was eliminated for 2021.

Perquisites. We provide a limited number of perquisites, including reimbursement of financial counseling, tax preparation, and estate planning services expense up to $4,000 annually, and reimbursement for the cost of personal excess liability insurance. The expenses related to the perquisites are imputed and considered taxable income to the executive officers, as applicable. We do not provide tax gross-ups on these perquisites. The incremental costs of the perquisites provided are included in the “All Other Compensation” column and supporting footnotes of the Summary Compensation Table.

Severance Benefits. In connection with the transfer of employment of our employees to WES on December 31, 2019, and per the terms of our Services Agreement, we assumed certain severance and termination pay obligations under existing Anadarko and Occidental plans and agreements for all employees, including officers, who were employed with Anadarko prior to the Occidental Merger. While employees maintain their eligibility and participation under these arrangements, our obligations are limited to no greater than:

•Six months of employee’s base salary or

•An amount the officer would be entitled to receive under the formulas set forth in Anadarko’s non-change in control Officer Severance Plan

•The Anadarko Entities, not our General Partner, are responsible for any payments that exceed these amounts.

Because Messrs. Pearl and Griffie were employees with Anadarko prior to the Occidental Merger, per the terms of our Services Agreement they were eligible for the benefits noted above. However, in connection with their acceptance of special retention awards granted to them in 2019, Messrs. Pearl and Griffie waved their right to receive severance pay or benefits upon resignation of employment for good reason or involuntary termination without cause.

In order to provide for uniformity in severance entitlements, on December 31, 2019, our Board extended the benefits under the Anadarko Change of Control Plan to all WES employees who were not employed with Anadarko prior to the Occidental Merger (this includes Messrs. Ure, Collins, and Bourne). These benefits will apply for so long as the Anadarko Change of Control Plan continues to apply for the former Anadarko employees who are now employed with us. For these NEOs, we will be responsible for 100% of these broad-based severance payments and benefits available under the plan.

A detailed discussion of the benefits under these programs is included in the Potential Payments Upon Termination or Change of Control section below.

Additional Compensation Policies and Provisions

The following provides a discussion of additional policies and provisions we have in place related to our overall executive compensation program.

Equity Grant Practices. WES maintains the Western Gas Equity Partners, LP 2012 Long-Term Incentive Plan and the Western Gas Partners, LP 2017 Long-Term Incentive Plan, which govern the issuance of equity and equity-based awards. Under the provisions of these Plans, the Board has the authority to grant equity awards to our Section 16 officers. The grant date fair value of each award is based on the closing unit price of WES’s common units on the NYSE on the grant date as designated by the Board. The grant date fair value of the TUR and ROA awards also incorporates the estimated payout percentage of the award on the grant date. As authorized by the terms of the Plans, the Board has delegated to Mr. Ure the authority to grant equity awards in certain circumstances to new employees and to grant equity awards to WES’s employees who are not Section 16 officers.

Clawback Provisions. Per the terms of our 2020 long-term incentive awards which were granted under the Western Gas Equity Partners, LP 2012 Long-Term Incentive Plan, if WES is required to prepare an accounting restatement due to the material noncompliance of the Partnership, as a result of misconduct, with any financial reporting requirement under the securities laws, and if the recipient knowingly engaged in the misconduct (whether or not they are an individual subject to automatic forfeiture under Section 304 of the Sarbanes-Oxley Act of 2002), the Board (or delegated Plan Administrator) may determine that the recipient must reimburse WES the amount of any payment in settlement of an award earned or accrued during the twelve-month period following the first public issuance or filing with the United States Securities and Exchange Commission (whichever first occurred) of the financial document embodying such financial reporting requirement.

Prohibition Against Derivative Transactions and Hedging. Our Insider Trading Policy expressly prohibits directors, officers and designated employees from directly or indirectly entering into equity derivative or other financial instruments (including, but not limited to, options, puts, calls, swaps, collars, forward contracts, hedges, exchange funds or short sales) tied to WES securities (including equity securities received as part of a compensation program as well as WES equity securities acquired personally).

Tax Law Considerations. We are a limited partnership for United States federal income tax purposes. Therefore, the compensation paid to our NEOs is not subject to the deduction limitations under Section 162(m) of the IRC. We have structured our compensation programs in a manner intended to be exempt from, or to comply with Section 409A of the IRC.

Compensation Committee Report

Neither we nor our general partner has a compensation committee. The Board of Directors has reviewed and discussed the Compensation Discussion and Analysis set forth above and based on this review and discussion has approved it for inclusion in this Form 10-K.

The Board of Directors of Western Midstream Holdings, LLC:

Glenn Vangolen

Michael P. Ure

Peter J. Bennett

Oscar K. Brown

Nicole E. Clark

Kenneth F. Owen

David J. Schulte

Lisa A. Stewart

EXECUTIVE COMPENSATION

As noted above, prior to 2020, we did not directly employ any of the persons responsible for managing or operating our business. Instead, we were managed by our general partner, and our executive officers were employees of Anadarko and Occidental. During this period, our reimbursement for the compensation of our executive officers was governed by the omnibus agreement. In December 2019, we executed several agreements with Occidental that enabled us to operate as a standalone business. Among these agreements was the Services Agreement, which transferred employment of WES’s management team from Occidental to WES.

Summary Compensation Table

The following table summarizes the compensation amounts expensed by us for our NEOs for the years ended December 31, 2020, 2019, and 2018. For 2020, the amounts include the full expense of our officers. For 2019, the amounts reflect the portion of the expense allocated to us by Anadarko and Occidental. None of these officers were considered NEOs in 2018, so there was no allocated expense to disclose for this year.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($) (1) | | | | Bonus ($) (2) | | Stock

Awards ($) (3) | | Non-Equity

Incentive Plan

Compensation ($) (4) | | All Other

Compensation ($) (5) | | Total

($) |

| Michael P. Ure | | 2020 | | 641,346 | | | | | 617,500 | | | 4,133,602 | | | — | | | 42,439 | | | 5,434,887 | |

| President, Chief Executive Officer | | 2019 | | 147,981 | | | | | — | | | 1,080,029 | | | 162,000 | | | 43,252 | | | 1,433,262 | |

| and Chief Financial Officer | | 2018 | | — | | | | | — | | | — | | | — | | | — | | | — | |

| Michael C. Pearl | | 2020 | | 320,673 | | | | | — | | | 1,757,410 | | | — | | | 237,803 | | | 2,315,886 | |

| Former Senior Vice President and | | 2019 | | 167,308 | | | | | — | | | — | | | 160,615 | | | 41,909 | | | 369,832 | |

| Chief Financial Officer | | 2018 | | — | | | | | — | | | — | | | — | | | — | | | — | |

| Craig W. Collins | | 2020 | | 461,923 | | | | | 370,500 | | | 1,757,410 | | | — | | | 41,500 | | | 2,631,333 | |

| Senior Vice President and | | 2019 | | 138,462 | | | | | — | | | 500,049 | | | 168,000 | | | 25,826 | | | 832,337 | |

| Chief Operating Officer | | 2018 | | — | | | | | — | | | — | | | — | | | — | | | — | |

| Charles G. Griffie | | 2020 | | 401,154 | | | | | 327,750 | | | 1,085,394 | | | — | | | 38,231 | | | 1,852,529 | |

| Senior Vice President, Operations | | 2019 | | 73,077 | | | | | — | | | 208,008 | | | 70,154 | | | 18,360 | | | 369,599 | |

| and Engineering | | 2018 | | — | | | | | — | | | — | | | — | | | — | | | — | |

| Robert W. Bourne | | 2020 | | 417,692 | | | | | 313,500 | | | 981,448 | | | — | | | 41,725 | | | 1,754,365 | |

| Senior Vice President and | | 2019 | | 136,500 | | | | | — | | | 1,250,029 | | | 154,932 | | | 10,680 | | | 1,552,141 | |

| Chief Commercial Officer | | 2018 | | — | | | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

________________________________________________________________

(1)For 2020, the amounts reflect each officer’s full base salary expense. For Messers. Ure, Collins and Bourne their 2020 amounts reflect one additional pay period that occurred during the year because of the administrative timing of transferring from the Occidental payroll to WES’s payroll. The 2019 amounts reflect the base salary expense allocated to us by Anadarko and Occidental.

(2)This column reflects annual cash bonus awards under the WCB Program for the year ended December 31, 2020.

(3)This column reflects the aggregate grant date fair value of stock awards, computed in accordance with FASB ASC Topic 718 (without respect to the risk of forfeitures). The value ultimately realized upon the actual vesting of the award(s) may or may not be equal to this determined value. The 2020 amounts reflect the full grant date fair value of awards granted during the year. The 2019 amounts reflect the allocated grant date fair value of awards granted in 2019. For information regarding the awards granted in 2020, see the Grants of Plan-Based Awards in 2020 table. Upon Mr. Pearl’s termination from the Partnership on September 11, 2020, he received a prorated portion of the disclosed 2020 awards based on the number of days he was employed during the vesting period and applicable performance period.

(4)This column reflects annual cash bonus compensation amounts allocated to us for the year ended December 31, 2019 under the Anadarko and Occidental plans.

(5)For 2019, the amounts in this column reflect the compensation expenses related to Anadarko’s and Occidental’s retirement and savings plans that were allocated to us for the year. For 2020, the amounts reflect the expenses detailed in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Payments by the Partnership to Employee 401(k) Plan ($) | | Financial/Tax/Estate Planning ($) | | Other ($) (1) | | Total ($) |

| Michael P. Ure | | 39,327 | | | 3,112 | | | — | | | 42,439 | |

| Michael C. Pearl | | 2,844 | | | — | | | 234,959 | | | 237,803 | |

| Craig W. Collins | | 37,500 | | | 4,000 | | | — | | | 41,500 | |

| Charles G. Griffie | | 38,231 | | | — | | | — | | | 38,231 | |

| Robert W. Bourne | | 41,725 | | | — | | | — | | | 41,725 | |

_________________________________________________________

(1)In conjunction with Mr. Pearl’s termination from the Partnership on September 11, 2020, he received a payout of his accrued but unused paid time off balance of $67,813 and also received a cash payment of $167,146 to restore the employer contributions under the employee 401(k) plan he would have otherwise been entitled to absent the IRS compensation limits.

Grants of Plan-Based Awards in 2020

The following table sets forth information concerning annual cash incentive awards, equity incentive plan awards, and unit awards. The equity incentive plan and unit awards were granted pursuant to the Western Gas Equity Partners, LP 2012 Long-Term Incentive Plan during 2020 to each of the NEOs as described below.

Non-Equity Incentive Plan Awards (WCB Program). Values disclosed reflect the estimated cash payouts under the WES WCB Program, as discussed in the Compensation Discussion and Analysis. If threshold levels of performance are not met, the payout can be zero. If maximum levels of performance are achieved, the plan funding is capped at 200% of target payout. Because of the significant amount of discretion exercised by the Board in determining this year’s bonus amounts under the WCB Program, the amounts actually paid to the NEOs for 2020 are disclosed in the Summary Compensation Table in the “Bonus” column.

Equity Incentive Plan Awards (ROA Units and TUR Units). Values disclosed reflect grant date fair values for ROA Units and relative TUR Units, as discussed in the Compensation Discussion and Analysis. Officers may earn between 0% and 200% of the target awards based on WES’s performance over a three-year performance period. Performance units earned are settled in the form of common units. The awards include tandem distribution equivalent rights in the form of common units paid on the applicable distribution payment date.

Time-Based Unit Awards. Values disclosed reflect grant date fair values for time-based unit awards that vest ratably over three years, beginning with the first anniversary of the grant date. The awards include tandem distribution equivalent rights in the form of common units paid on the applicable distribution payment date.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | All

Other

Unit

Awards:

Number of

Units

(#) | | Grant Date Fair Value of Unit Awards ($) (2) |

| | | | | | Estimated Future Payouts

Under Non-Equity

Incentive Plan Awards | | Estimated Future Payouts Under Equity Incentive Plan Awards | | |

Name and

Award Type | | Grant Date | | Board Approval Date | | Threshold

($) | | Target

($) | | Maximum ($) (1) | | Threshold

(#) | | Target

(#) | | Maximum

(#) | | |

| Michael P. Ure | | — | | | — | | | — | | | 650,000 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Time-Based Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | — | | | — | | | — | | | 156,055 | | | 2,539,015 | |

| ROA Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 11,704 | | | 46,817 | | | 93,634 | | | — | | | 761,713 | |

| TUR Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 11,704 | | | 46,817 | | | 93,634 | | | — | | | 832,874 | |

Michael C. Pearl (3) | | — | | | — | | | — | | | 390,000 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Time-Based Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | — | | | — | | | — | | | 65,544 | | | 1,066,401 | |

| ROA Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 5,072 | | | 20,288 | | | 40,576 | | | — | | | 330,086 | |

| TUR Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 5,072 | | | 20,288 | | | 40,576 | | | — | | | 360,924 | |

| Craig W. Collins | | — | | | — | | | — | | | 390,000 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Time-Based Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | — | | | — | | | — | | | 65,544 | | | 1,066,401 | |

| ROA Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 5,072 | | | 20,288 | | | 40,576 | | | — | | | 330,086 | |

| TUR Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 5,072 | | | 20,288 | | | 40,576 | | | — | | | 360,924 | |

| Charles G. Griffie | | — | | | — | | | — | | | 345,000 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Time-Based Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | — | | | — | | | — | | | 40,575 | | | 660,155 | |

| ROA Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 3,121 | | | 12,485 | | | 24,970 | | | — | | | 203,131 | |

| TUR Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 3,121 | | | 12,485 | | | 24,970 | | | — | | | 222,108 | |

| Robert W. Bourne | | — | | | — | | | — | | | 330,000 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Time-Based Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | — | | | — | | | — | | | 37,454 | | | 609,377 | |

| ROA Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 2,731 | | | 10,924 | | | 21,848 | | | — | | | 177,733 | |

| TUR Units | | 02/12/2020 | | 02/10/2020 | | — | | | — | | | — | | | 2,731 | | | 10,924 | | | 21,848 | | | — | | | 194,338 | |

_________________________________________________________________________________________(1)The non-equity incentive plan has a maximum overall funding of 200%, but there are no individual maximums established.

(2)The amounts reflect the fair value on the grant date of the awards made to the NEOs in 2020 computed in accordance with FASB ASC Topic 718. The value ultimately realized by the executive upon the actual vesting of the award(s) may or may not be equal to the determined value. For a discussion of valuation assumptions for the awards, see Note 15—Equity-Based Compensation in the Notes to Consolidated Financial Statements under Part II, Item 8 of this Form 10-K.

(3)Mr. Pearl’s employment with the Partnership ended on September 11, 2020 and he did not receive a payout under the non-equity incentive plan and also forfeited a prorated portion of his equity incentive awards and stock awards upon his resignation. The values disclosed reflect the full awards granted to him in 2020.

Outstanding Equity Awards at Year-End 2020

The following table reflects outstanding equity awards for each NEO as of December 31, 2020. The market values shown are based on WES’s closing unit price of $13.82 on December 31, 2020. The table excludes any prior outstanding awards granted under the Occidental LTIP Plan, as per the terms of the December 2019 Services Agreement, the Partnership no longer reimburses Occidental for the expense of these awards that were granted prior to 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Unit Awards |

| | | | | | Equity Incentive Plan Awards |

| | Restricted Units (1) | | Performance Units (2) |

| | | Number of

Units That Have

Not Vested

(#) | | Market Value of Units That Have

Not Vested

($) | | Number of Unearned Units

That Have Not Vested

(#) | | Market or Payout

Value of Unearned Units That Have Not Vested

($) |

| Name | | | | |

| Michael P. Ure | | | | | | | | |

| Time-Based Units | | 156,055 | | | 2,156,680 | | | — | | | — | |

| ROA Units | | — | | | — | | | 67,885 | | | 938,171 | |

| TUR Units | | — | | | — | | | 81,930 | | | 1,132,273 | |

| Michael C. Pearl | | | | | | | | |

| ROA Units | | — | | | — | | | 6,818 | | | 94,225 | |

| TUR Units | | — | | | — | | | 8,229 | | | 113,725 | |

| Craig W. Collins | | | | | | | | |

| Time-Based Units | | 65,544 | | | 905,818 | | | — | | | — | |

| ROA Units | | — | | | — | | | 29,418 | | | 406,557 | |

| TUR Units | | — | | | — | | | 35,504 | | | 490,665 | |

| Charles G. Griffie | | | | | | | | |

| Time-Based Units | | 40,575 | | | 560,747 | | | — | | | — | |

| ROA Units | | — | | | — | | | 18,104 | | | 250,197 | |

| TUR Units | | — | | | — | | | 21,849 | | | 301,953 | |

| Robert W. Bourne | | | | | | | | |

| Time-Based Units | | 37,454 | | | 517,614 | | | — | | | — | |

| ROA Units | | — | | | — | | | 15,840 | | | 218,909 | |

| TUR Units | | — | | | — | | | 19,117 | | | 264,197 | |

________________________________________________________________________________

(1)The time-based units vest ratably over three years in installments on the first, second, and third anniversaries of the grant date. One-third of the outstanding units vested on February 12, 2021, and the remaining unvested portion will vest one-third on February 12, 2022 and one-third on February 12, 2023. At the end of each vesting period, the number of units that vest are settled in unrestricted WES common units, less any units withheld for taxes.

(2)The number of outstanding performance units (including ROA units and TUR units) and the estimated payout values disclosed for each award, are calculated based on WES’s return on assets performance and relative total unit return performance ranking as of December 31, 2020, and are not necessarily indicative of what the payout earned will be at the end of each three-year performance period. Mr. Pearl’s outstanding units are based on his awards that were prorated upon his termination and continue to be subject to the original performance criteria. The three-year performance period for these awards is January 1, 2020 to December 31, 2022. WES’s performance to date as of December 31, 2020 under the ROA awards was 145% and 175% under the TUR awards.

Option Exercises and Units Vested in 2020

The following table reflects information about the aggregate dollar value realized during 2020 by our NEOs for WES awards that vested in 2020. The table below excludes the vesting of any prior awards granted under the Occidental LTIP, as per the terms of the December 2019 Services Agreement, the Partnership no longer reimburses Occidental for the expense of awards that were granted prior to 2020.

| | | | | | | | | | | | | | |

| | | Unit Awards |

| Name | | Number of Units Acquired on Vesting (#) (1) | | Value Realized on Vesting ($) (2) |

| Michael P. Ure | | 25,779 | | | 232,975 | |

| Michael C. Pearl | | 20,950 | | | 163,723 | |

| Craig W. Collins | | 10,957 | | | 99,018 | |

| Charles G. Griffie | | 6,767 | | | 61,159 | |

| Robert W. Bourne | | 6,123 | | | 55,339 | |

_______________________________________________________________________________(1)The number of units acquired on vesting include the vesting of distribution equivalent rights that, per the terms of the underlying award agreements, were settled in common units on the date of the distribution payment. Mr. Pearl’s value also includes the prorated number of WES time-based units that vested upon his termination of employment on September 11, 2020.

(2)The value realized on vesting represents the aggregate number of units that vested multiplied by the common unit price on the vesting date. The actual value ultimately realized by the officer, may be more or less than the valued disclosed in the above table, depending upon the timing in which he held or sold the units associated with the vesting occurrence.

Pension Benefits for 2020

WES does not have a defined benefit pension plan that provides NEOs a fixed monthly retirement payment. Instead, all salaried employees on the U.S. dollar payroll, including the NEOs, are eligible to participate in a tax-qualified defined contribution plan.

Nonqualified Deferred Compensation for 2020

WES does not have a nonqualified deferred compensation plan that allows employees the ability to accumulate additional retirement through deferrals of compensation.

Potential Payments Upon Termination or Change of Control

In connection with the transfer of employment of our NEOs to a subsidiary of WES on December 31, 2019, and per the terms of our Services Agreement, we assumed severance and termination pay obligations under plans and programs maintained by Anadarko and Occidental. The severance and termination pay arrangements of Anadarko included, for Messrs. Pearl and Griffie, a key employee change of control contract, pursuant to which the executive would be entitled to enhanced severance benefits in the event of an involuntary termination of employment without cause or resignation for good reason following a change of control of Anadarko. The Occidental Merger constituted a change of control of Anadarko for purposes of these agreements. In 2019, to encourage retention and dedication, Messrs. Pearl and Griffie were granted retention awards by Occidental in exchange for waiving their right to receive severance pay or benefits upon a resignation of employment for good reason or involuntary termination without cause under these agreements. Pursuant to the Services Agreement, we are not responsible for the cost of these retention awards.

The severance and termination pay arrangements of Anadarko also included the Anadarko Petroleum Corporation Amended and Restated Change of Control Severance Plan, which was a broad-based plan covering substantially all of Anadarko’s employees who provided services to us and provided for enhanced severance benefits following a change of control of Anadarko (the “Anadarko COC Plan”). The Anadarko COC Plan provided that eligible participants are entitled to certain severance benefits if (i)(A) the participant’s employment is terminated without cause by the participant’s employer or (B) if the participant terminates his or her employment within ninety days following the sale or disposition of the participant’s employer in which the participant was not offered substantially similar employment and compensation terms with the purchaser, in each case, within three years of a change of control or (ii) the participant resigns for good reason within one year following a change of control (all such terminations, a “Qualifying Termination”). Assuming there is a Qualifying Termination, the severance benefits upon termination under the Anadarko COC Plan include the following:

•A cash lump sum equal to (A) 50% of the sum of (i) the participant’s monthly base salary plus (ii) the highest annual bonus received by the participant over the previous three years, divided by twelve, multiplied by the number of years of service by the participant (clauses (i) and (ii), “Monthly Compensation”) and (B) one month of Monthly Compensation for each $10,000 of annual compensation (base salary plus highest annual bonus), rounding up to the next highest whole multiple of $10,000 if the participant’s annual compensation is not a multiple of $10,000 (the “Severance Benefit”);

•A cash lump sum equal to the pro-rata annual bonus based on the participant’s target bonus percentage; and

•Continuation of medical and dental insurance coverage for up to six months following termination of employment.