Filed Pursuant to Rule 424(b)(3)

Registration No. 333-148847

PROSPECTUS

KAR HOLDINGS, INC.

OFFERS TO EXCHANGE

$150,000,000 aggregate principal amount of its Floating Rate Senior Notes due 2014, $450,000,000 aggregate principal amount of its 8 3/4% Senior Notes due 2014, and $425,000,000 aggregate principal amount of its 10% Senior Subordinated Notes due 2015, the issuance of each of which has been registered under the Securities Act of 1933 (collectively, the “Exchange Notes”),

for

any and all of its outstanding Floating Rate Senior Notes due 2014; 8 3/4% Senior Notes due 2014; and 10% Senior Subordinated Notes due 2015 (collectively, the “Restricted Notes” and, together with the Exchange Notes, the “notes”). We refer herein to the foregoing offers to exchange collectively as the “exchange offer.”

The exchange offer will expire at 5:00 p.m., New York City time, on March 18, 2008, unless we extend

the exchange offer in our sole and absolute discretion.

Terms of the Exchange Offer:

| | • | | We will exchange all outstanding Restricted Notes that are validly tendered and not withdrawn prior to the expiration or termination of the exchange offer for an equal principal amount of the applicable Exchange Notes. |

| | • | | You may withdraw tenders of Restricted Notes at any time prior to the expiration or termination of the exchange offer. |

| | • | | The terms of the Exchange Notes are substantially identical in all material respects to those of the applicable outstanding Restricted Notes, except that the transfer restrictions, registration rights and additional interest provisions relating to the Restricted Notes do not apply to the Exchange Notes. |

| | • | | The exchange of Restricted Notes for Exchange Notes will not be a taxable transaction for United States federal income tax purposes, but you should see the discussion under the caption “Material United States Federal Income Tax Considerations” for more information. |

| | • | | We will not receive any proceeds from the exchange offer. |

| | • | | We issued the Restricted Notes in transactions not requiring registration under the Securities Act of 1933 and, as a result, their transfer is restricted. We are making the exchange offer to satisfy your registration rights, as a holder of the Restricted Notes. |

Results of the Exchange Offer:

| | • | | The Exchange Notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the Exchange Notes or the Restricted Notes on any national securities exchange. |

All outstanding Restricted Notes not tendered will continue to be subject to the restrictions on transfer set forth in the outstanding Restricted Notes and in the applicable indenture. In general, the outstanding Restricted Notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding Restricted Notes under the Securities Act.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. By so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for Restricted Notes where such Restricted Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 90 days after the closing of this exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

There is no established trading market for the Exchange Notes or the Restricted Notes.

See “Risk Factors” beginning on page 23 for a discussion of risks you should consider prior to tendering your outstanding Restricted Notes for exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 14, 2008.

TABLE OF CONTENTS

This prospectus incorporates by reference important business and financial information about us that is not included in or delivered in this document. Copies of this information are available, without charge, to any person to whom this prospectus is delivered, upon written or oral request. Written requests should be sent to:

KAR Holdings, Inc.

13085 Hamilton Crossing Boulevard

Carmel, Indiana 46032

Oral requests should be made by telephoning (800) 923-3725.

In order to obtain timely delivery, you must request the information no later than March 11, 2008, which is five business days before the expiration date of the exchange offer.

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

i

USE OF NON-GAAP MEASURES

EBITDA and Adjusted EBITDA, as presented in this prospectus, are supplemental measures of our performance that are not required by, or presented in accordance with, generally accepted accounting principles in the United States, or GAAP. They are not a measurement of our financial performance under GAAP and should not be considered as an alternative to revenues, net earnings (loss) or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as measures of our liquidity.

EBITDA is defined as net earnings (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization, as set out in our Unaudited Pro Forma Consolidated Statement of Operations included elsewhere in this prospectus. We believe that EBITDA is a useful financial metric to assess our operating performance from period to period by excluding certain items that we believe are not representative of our core business. We also believe EBITDA is useful to assess our ability to generate cash from operations sufficient to pay taxes, to service debt and to undertake capital expenditures. We use EBITDA for business planning purposes, including to establish budgets and operational goals and manage our business. We believe EBITDA is a measure commonly used by investors to evaluate our performance as well as the performance of our competition.

Adjusted EBITDA is calculated by adjusting EBITDA for the items of income and expense and cost saving as follows: (a) gain and losses from asset sales; (b) unrealized foreign currency translation gains and losses in respect of indebtedness; (c) certain non-recurring gains and losses; (d) stock option expense; (e) certain other noncash amounts included in the determination of net income; (f) management, monitoring, consulting and advisory fees paid to the equity sponsors; (g) charges and revenue reductions resulting from purchase accounting; (h) unrealized gains and losses on hedge agreements; (i) minority expenses; (j) expenses associated with the consolidation of salvage operations; (k) consulting expenses incurred for cost reduction, operating restructuring and business improvement efforts; (l) expenses realized upon the termination of employees and the termination or cancellation of leases, software licenses or other contracts in connection with the operational restructuring and business improvement efforts; and (m) expenses incurred in connection with permitted acquisitions. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about certain covenants required pursuant to our senior credit facilities and the notes.

The EBITDA measure has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| | • | | it does not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments; |

| | • | | it does not reflect changes in, or cash requirements for, our working capital needs; |

| | • | | it does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| | • | | it does not reflect any cash income taxes that we may be required to pay; |

| | • | | assets are depreciated or amortized over differing estimated useful lives and often have to be replaced in the future, and this measure does not reflect any cash requirements for such replacements; |

| | • | | it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; |

| | • | | it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations; |

ii

| | • | | it does not reflect limitations on, or costs related to, transferring earnings from our subsidiaries to us; and |

| | • | | other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure. |

Because of these limitations, our EBITDA measure should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as a measure of cash that will be available to us to meet our obligations. You should compensate for these limitations by relying primarily on our GAAP results and using this measure supplementally. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and the related notes included elsewhere in this prospectus.

Unless the context other requires, in this prospectus, (i) “we,” “us,” “our,” “the Company” and “KAR Holdings” refer collectively to KAR Holdings, Inc., a Delaware corporation, and all its subsidiaries, including ADESA and IAAI; (ii) “ADESA” refers to ADESA, Inc. and its subsidiaries; (iii) “IAAI” refers to Insurance Auto Auctions, Inc. and its subsidiaries; and (iv) the “Equity Sponsors” refers, collectively, to GS Capital Partners VI Fund, L.P., Kelso Investment Associates VII, L.P., Parthenon Investors II, L.P. and ValueAct Capital Master Fund, L.P., which own through their respective affiliates, including, in respect of Kelso, Axle Holdings II, LLC, substantially all of our equity.

iii

SUMMARY

This summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information that you should consider before participating in this exchange offer. You should read the entire prospectus carefully, including the matters discussed under the caption “Risk Factors” and “Unaudited Pro Forma Consolidated Financial Data” and in the financial statements and related notes included elsewhere in this prospectus, as well as information incorporated by reference. On April 20, 2007, KAR Acquisition, Inc. merged with and into ADESA, with ADESA continuing as the surviving corporation (the “Merger”). The Restricted Notes were issued in connection with the Merger and the related transactions described below. After consummation of the Merger and the related transactions, ADESA and IAAI became wholly owned subsidiaries of KAR Holdings, Inc.

Our Company

Overview

We are the second largest provider of whole car auctions, the second largest provider of salvage vehicle auctions and have the largest network of automobile auction locations in North America. Our network of whole car and salvage vehicle auctions facilitates the sale of used and salvage vehicles through physical, online and hybrid auctions, which permit Internet buyers to participate in physical auctions. We earn auction fees from both vehicle buyers and sellers for completed transactions. We also generate revenues by providing our customers with value-added ancillary services, including reconditioning, inspection and certification, titling, transportation and administrative and salvage recovery services. We facilitate the transfer of ownership directly from seller to buyer and, in almost all cases, we do not take title or ownership to vehicles sold at our auctions.

We are also a leading provider of short-term inventory-secured financing, known as floorplan financing, primarily to independent used vehicle dealers. Floorplan financing typically involves the financing of dealer vehicle purchases at auction in exchange for a security interest in those vehicles. Loans are generally short-term in nature and typically repaid when the vehicle is sold by the dealer. We generate revenues from both fees and interest on these loans.

Our key competitive advantages include our leading North American market positions, broad distribution network, established relationships with a diversified customer base, comprehensive range of innovative value-added services and strong management team with significant industry experience. As of January 21, 2008, we have a network of 58 whole car auction locations, 134 salvage auction locations and 91 loan production offices in North America. Our auction locations are primarily stand-alone facilities dedicated to either whole car or salvage auctions. Eight of these locations are combination sites, which offer separate whole car and salvage auctions. We believe our extensive network and product offerings enables us to drive revenues by leveraging relationships with North American institutional vehicle providers and over 85,000 registered buyers of used and salvage vehicles.

Business Segments

We operate through three business segments: ADESA Auctions, IAAI Salvage and Automotive Finance Corporation, or AFC.

ADESA Auctions

We are the second largest provider of whole car auctions and related services in North America. We serve our customer base through 58 whole car auction sites located throughout North America. Our whole car auction facilities are strategically located to draw professional sellers and buyers together and allow our buyers to physically inspect and compare vehicles, which we believe many customers in the industry demand. Our

1

complementary online auction capabilities provide the convenience of viewing, comparing and bidding on vehicles remotely and the advantage of a potentially larger group of buyers.

Vehicles available at our auctions include vehicles from institutional customers, such as off-lease vehicles, repossessed vehicles, rental vehicles and other program fleet vehicles that have reached a predetermined age or mileage and have been repurchased by the manufacturers, as well as vehicles from dealers turning their inventory. Sellers include large institutions, such as vehicle manufacturers and their captive finance arms, vehicle rental companies, financial institutions, commercial fleets and fleet management companies and independent and franchised used vehicle dealers. Buyers are primarily franchised or independent used vehicle dealers. We currently maintain relationships with over 50,000 such registered buyers.

ADESA Auctions generates revenue primarily from auction fees paid by vehicle buyers and sellers. In almost all cases, ADESA Auctions does not take ownership or title to vehicles sold at our auctions. Our buyer fees and dealer seller fees are typically based on a tiered structure with fees increasing with the sale price of the vehicle, while institutional seller fees are typically fixed. We also generate revenues from ancillary services, such as vehicle reconditioning and preparation, transportation and professional field information services.

IAAI Salvage

We are the second largest provider of salvage vehicle auctions and related services in North America. We serve our customer base through 134 salvage auction locations throughout North America. Our salvage auctions facilitate the redistribution of damaged vehicles that are designated as total-losses by insurance companies, recovered stolen vehicles for which an insurance settlement with the vehicle owner has already been made and older model vehicles donated to charity or sold by dealers in salvage auctions.

Salvage vehicles are primarily supplied by property and casualty insurance companies, as well as non-profit organizations, automobile dealers and vehicle leasing and rental car companies. We enjoy long-term relationships with all the major automobile insurance companies in North America. Buyers of salvage vehicles include licensed vehicle dismantlers, rebuilders, repair shop operators and used vehicle dealers. We currently maintain relationships with over 41,000 such registered buyers.

We process salvage vehicles primarily under two consignment methods: fixed fee and percentage of sale. Under these methods, in return for agreed upon fees, we sell vehicles on behalf of insurance companies, which continue to own the vehicles until they are sold to buyers at auction. In addition to auction fees, we generally charge fees to vehicle suppliers for various services, including towing, title processing and other administrative services. Under all methods of sale, we also charge vehicle buyers fees based on a tiered structure that increases with the sale price of the vehicle, as well as fixed fees for other services.

AFC

We are a leading provider of floorplan financing to independent used vehicle dealers. We provide, directly or indirectly through an intermediary, floorplan financing to independent used vehicle dealers through 91 loan production offices located throughout North America. Typical loan terms are 30 to 60 days with an option to extend the original term of the loan. In 2007, AFC arranged approximately 1.2 million loan transactions, which number includes extensions or “curtailments” of loans. We sell the majority of our U.S. dollar denominated finance receivables without recourse to a wholly owned bankruptcy remote special purpose entity, which sells an undivided participation interest in such finance receivables to a bank conduit facility on a revolving basis.

Floorplan financing supports independent used vehicle dealers in North America which purchase vehicles from our auctions, independent auctions, auctions affiliated with other auction networks and non-auction purchases. Our ability to provide floorplan financing facilitates the growth of vehicle sales at auction.

2

AFC generates a significant portion of its revenue from fees. These fees include origination, curtailment and other related program fees. We collect accrued fees and interest when the loan is extended or paid in full. To secure our obligations, we typically retain possession of the title document to the vehicle, file UCC filings and receive personal guarantees from the dealer. We also maintain a close relationship with customers to assess their financial health and conduct regular inventory checks on the dealers’ lots through our AutoVIN subsidiary.

Competitive Strengths

Leading North American Market Positions

We are the second largest provider of whole car auctions and salvage vehicle auctions and related services in North America. In 2006, the most recent date available, we had estimated market shares of approximately 18% and 33% in the whole car auction and salvage auction markets, respectively. We leverage our significant market presence to attract a high volume of vehicles, thereby ensuring sufficient supply to create the successful marketplaces that buyers and sellers demand. We also have a leading market position in the floorplan financing industry. AFC’s broad coverage, strong brand name and longstanding customer relationships have established it as a leading provider of floorplan financing for independent used car dealers.

Broad North American Distribution Network

Our 58 whole car and 134 salvage auction locations enable us to provide a single source solution for our customers’ needs throughout North America. In addition, AFC has 91 loan production offices supporting independent dealers across North America who purchase vehicles from auctions held by ADESA Auctions, independent auctions, auctions affiliated with other auction networks and non-auction sources. Of these offices, 46 are located at ADESA Auctions sites, 34 are located strategically near auctions and 11 are located at third-party auctions. Our network enables us to maintain and develop our relationships with local sellers and buyers, while our North American presence allows institutional customers to access buyers and to redistribute vehicles to markets where demand best matches supply. Our presence in 70 of the top 75 metropolitan markets in the United States gives us an advantage over our smaller competitors, the large majority of which operate in a single market and lack scale. As our customers increasingly demand single source solutions, we believe that our scale and network will become an even more distinct advantage over our competitors. In addition, we believe our broad, established network positions us well because of the large tracts of land required to build new auction sites (our average whole car site is 75 acres and our average salvage site is 20 acres) and the need to comply with regulatory requirements, including zoning and use permits.

Established Relationships with a Diversified Customer Base

We have established strong business relationships with dealers and institutional customers, such as vehicle manufacturers, insurers, financial institutions, rental agencies and fleet companies. We have a diverse customer base and do not have a major concentration of business with any one customer. We believe this diversity allows us to better withstand changes in the economy and market conditions. In our whole car business, we enjoy long-term relationships with all of the major vehicle manufacturers, vehicle finance companies and rental car companies in North America, including Chrysler Motors, LLC, Ford Motor Company, General Motors Corporation, American Honda Finance Corporation, Toyota Motor Credit Corporation, AmeriCredit Financial Services, Inc., Capital One Auto Finance, Chase Auto Finance Corp., Enterprise Rent-A-Car, The Hertz Corporation, Mercedes-Benz Credit Corporation, Nissan North America, Inc., VW Credit, Inc., WFS Financial and World Omni Financial Corp. In our salvage vehicle auction business, we enjoy long-term relationships with The Allstate Corporation, American Family Insurance, American International Group, The Farmers Insurance Group of Companies, GEICO (Government Employees Insurance Company), Nationwide Financial Services, Inc., The Progressive Corporation, State Farm and USAA (United Services Automobile Association). As of

3

January 1, 2008, no single supplier represented more than 7.5% of our unit sales and no single buyer represented more than 1% of our unit sales. ADESA Auctions has over 50,000 registered buyers, while IAAI Salvage has over 41,000 registered buyers.

Single-Source Service Provider of Value-Added Services

We are able to serve as a “one-stop shop” for our customers by offering a comprehensive range of innovative and value-added services. We offer physical auctions with Internet-bidding capabilities that enable buyers to pre-bid over the Internet, participate in person at a physical auction and bid over the Internet in real time. Through ADESA Auctions, we offer reconditioning and preparation services and customized reporting and analytical services. Through IAAI Salvage, we provide on-site facilities for insurance providers and online tools for salvage vehicle suppliers that include inventory management, salvage returns analysis and electronic data interchange of titling information. We also provide our insurance company suppliers with the capability to electronically assign and manage their salvage vehicle inventory.

Strong Management Team with Significant Industry Experience

Our senior management team has extensive experience in the automotive services industry.

Brian Clingen, our Chairman and Chief Executive Officer, has significant operational and investment experience in the automotive services industry. Mr. Clingen has served as a managing partner of BP Capital Management since 1998.

Jim Hallett, President and Chief Executive Officer of ADESA Auctions, has significant experience in the automotive auctions industry. Mr. Hallett previously served as an executive officer of ADESA from August 1996 until May 2005.

Tom O’Brien, President and Chief Executive Officer of IAAI Salvage, has over 30 years experience in general management of various businesses, with 15 years in businesses that provide services to the automotive insurance industry. Mr. O’Brien has led IAAI since 2000.

Curt Phillips, President and Chief Executive Officer of AFC, has significant experience in overseeing accounting, cash management, and the credit and contract functions. Mr. Phillips previously served as Chief Financial Officer of AFC from April 1998 until January 2004.

Eric Loughmiller, our Chief Financial Officer, has over 25 years experience in finance and accounting and over 10 years as Chief Financial Officer of public and private companies.

John Nordin, our Chief Information Officer, has over 26 years of experience in IT and over 13 years as Chief Information Officer of public and private companies.

Rebecca Polak, our Executive Vice President, General Counsel and Secretary, has significant experience in corporate and securities law. Ms. Polak served as Associate General Counsel of ADESA from February 2005 to April 2007.

4

Business Strategy

We continue to focus on growing our revenues and profitability through the execution of the following key operating strategies:

Increase Whole Car Volume

Institutional. We continue to focus on growing our whole car auction business by building stronger and more interactive relationships with our institutional customers. Jim Hallett is highly regarded in the industry, and has extensive customer relationships that he has developed over 17 years in the North American used vehicle redistribution industry. In addition, we have staffed, and will continue to staff, our sales organization with relationship managers focused on the various categories of institutional customers that we serve. To the extent possible, we have aligned our managers with the types of customers that they have the most relevant experience with: vehicle manufacturers, finance companies, rental car companies, leasing companies and fleet management companies. This allows our managers to focus on the current trends for their respective institutional customer group in order to better coordinate our sales efforts and service offerings tailored to our customers’ needs. In addition to our team of relationship managers, we utilize ADESA Analytical Services to provide our institutional customers with customized studies and data analysis tools to enhance their remarketing decisions, target potential buyers and determine the best market and forum for their vehicles.

Dealers. We have a decentralized sales and marketing approach for our dealer business with primary coverage responsibilities managed by the individual auction locations. We believe this decentralized approach enhances relationships with the dealer community and increases dealer volumes at our auctions. Dealer business is a highly market specific business and we have local relationship managers who have experience in the used car business and possess an intimate knowledge of their local market.

Realize Cost Savings and Enhance Revenues in Salvage Operations

We continue to focus on cost savings and revenue synergies from the combination of ADESA’s and IAAI’s salvage operations by reducing corporate overhead of the combined salvage operations. We strive to increase performance of our salvage operations through enhancement opportunities, including reducing corporate overhead of the combined salvaged operations, consolidating existing salvage sites onto existing whole car sites, opening new salvage sites on existing whole car sites, easing volume constraints through a larger branch network and implementing IAAI standard processes and information technology systems to streamline operations and improve operating efficiencies at existing ADESA salvage branches.

Over the past few years, IAAI has successfully implemented an operating model for its auction sites that streamlines numerous operating and administrative activities and standardizes processes, resulting in cost savings and improved customer service levels. We have implemented this scaleable operating model at 28 of ADESA salvage facilities located in the United States, which we believe will result in additional cost savings, primarily by reducing headcount and personnel costs. We intend to implement the IAAI operating model at 13 of ADESA’s salvage locations in Canada in 2008.

5

Reduce Costs and Enhance Revenues at ADESA Auctions

We continue to focus on reducing costs and enhancing revenues at ADESA Auctions by implementing the following initiatives:

| | • | | Optimize management and staffing levels for each auction |

| | • | | Establish standardized operating procedures and utilize technology to automate process controls for key operational areas and to improve labor efficiency |

| | • | | Centralize certain common functions currently performed at individual auction locations such as payables processing and general ledger entry to reduce costs and improve working capital turns |

| | • | | Centralize and consolidate certain procurement functions to leverage global volumes of commodities and services to gain more favorable pricing |

| | • | | Standardize fee structures for ancillary services |

Expand through Selective Relocations, Greenfields and Acquisitions

We continue our efforts on relocating several of our existing whole car auction facilities to new, larger facilities in markets where our existing facilities are capacity-constrained. In addition, increased demand for single source solutions by our customers may enable us to acquire smaller, less geographically diversified competitors at attractive prices. Both ADESA and IAAI have been successful in acquiring independent auction operations over the past few years. We will continue to evaluate opportunities to open new greenfield sites in markets adjacent to those in which we already have a presence, in order to effectively leverage our sales and marketing capabilities. We expect to expand our salvage operations by selectively locating new salvage auction sites at ADESA Auctions’ existing auction facilities.

Expand AFC

We will continue to focus on expanding AFC’s geographic coverage and gaining market share by adding loan production offices in selected markets and improving coordination with ADESA Auctions to capitalize on cross-selling opportunities. By encouraging a collaborative marketing effort between AFC and ADESA Auctions, we believe we can market more effectively to dealers and tailor AFC’s financing products to individual dealer needs. We will continue to focus on generating additional revenues by expanding our floorplan financing business to certain IAAI Salvage buyers and by cross-selling our whole car auction services to our AFC customers that do not currently use ADESA Auctions.

Continue to Invest in Information Technology

We will continue to invest in and improve our technology infrastructure to expand service offerings and improve operating efficiencies and customer service. We are utilizing the experience gained through the recent development of IAAI’s proprietary IT systems (completed in 2005) as we continue to upgrade the ADESA Auctions IT systems. John Nordin, our Chief Information Officer, who was instrumental in the implementation of IAAI’s IT upgrade, is leading the systems upgrade effort for ADESA Auctions. We are utilizing technology to provide additional service offerings across our whole car and salvage businesses to improve customers’ returns, shorten the claims processing cycle on the salvage side and lower overall transaction costs. In addition, we are enhancing our e-commerce products and services portfolio in order to better serve our whole car buyers and sellers. These information technology improvements should also allow us to reduce field staff through more efficient and reliable systems, while providing our institutional customers with quicker and better data analysis.

6

The Transactions

On April 20, 2007, KAR Acquisition, Inc., a Delaware corporation that was a wholly owned subsidiary of KAR Holdings, merged with and into ADESA, with ADESA continuing as the surviving corporation. After completion of the Merger and related transactions described below, ADESA and IAAI became wholly owned subsidiaries of KAR Holdings.

The following transactions occurred in connection with the Merger: (i) all of ADESA’s outstanding equity interests were cancelled in exchange for aggregate cash payments of approximately $2,541.5 million; (ii) affiliates of the Equity Sponsors and management contributed to KAR Holdings approximately $1.1 billion in equity, consisting of approximately $790.0 million in cash and approximately $272.4 million in equity interest in IAAI; (iii) we entered into senior secured credit facilities, comprised of a $1,565.0 million term loan facility and a $300.0 million revolving credit facility and, each of our existing and certain future domestic subsidiaries, subject to certain exceptions, guaranteed such credit facilities; and (iv) we issued the Restricted Notes and, after the Merger, each of our restricted subsidiaries that guaranteed our senior secured credit facilities also guaranteed the Floating Rate Senior Notes and Fixed Rate Senior Notes on an unsecured senior basis and the Senior Subordinated Notes on a senior subordinated basis.

In addition, in connection with the Merger, ADESA completed a tender offer to purchase for cash any and all of its outstanding 7 5/8% senior subordinated notes due June 15, 2012, or the 2012 Notes, and a consent solicitation to amend the indenture governing the 2012 Notes to eliminate substantially all of the restrictive covenants and certain events of default and modify other provisions contained in such indenture. Also, IAAI completed a tender offer to purchase for cash any and all of its outstanding 11% senior notes due April 1, 2013, or the 2013 Notes, and a consent solicitation to amend the indenture governing the 2013 Notes to eliminate substantially all of the restrictive covenants and certain events of default and modify other provisions contained in such indenture.

The equity contributions, borrowings under our senior credit facilities, our cash on hand and the net proceeds from the offering of the Restricted Notes were used to pay the Merger consideration, consummate the tender offers and pay the related fees and expenses. In this prospectus, we refer to the Merger and the above related transactions as the “Transactions.”

Upon consummation of the Transactions, we also entered into agreements with the Equity Sponsors and their affiliates, pursuant to which such entities or their affiliates will provide financial and advisory services to us. See “Certain Relationships and Related Party Transactions” for more information regarding these agreements.

7

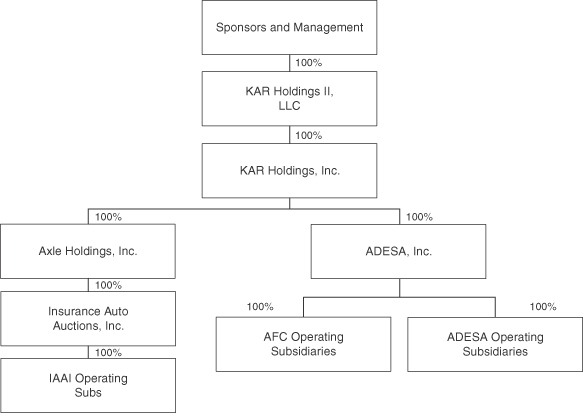

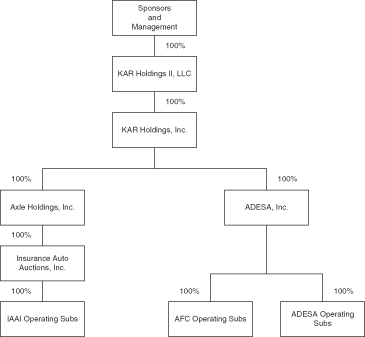

Our Corporate Structure

The following chart presents our corporate structure:

8

The Equity Sponsors

Kelso & Company

Kelso & Company, one of the oldest and most established firms specializing in private equity investing, has been involved in leveraged acquisitions both as principal and as financial advisor since 1971. Kelso makes equity investments on behalf of investment partnerships, which it manages. Since 1980, Kelso has completed over 95 transactions with an aggregate initial capitalization at closing of approximately $50 billion.

GS Capital Partners

Founded in 1869, Goldman Sachs is one of the oldest and largest investment banking firms. Goldman Sachs is also a global leader in private equity and mezzanine investing. Established in 1992, the GS Capital Partners family of funds is part of the firm’s Principal Investment Area in the Merchant Banking Division. Goldman Sachs’ Principal Investment Area has formed 13 investment vehicles aggregating $56 billion of capital to date.

ValueAct Capital

ValueAct, with offices in San Francisco and Boston and more than $6 billion in investments, seeks to make strategic-block value investments in a limited number of companies. ValueAct concentrates primarily on acquiring significant ownership stakes in publicly traded companies, and a select number of control investments, through both open-market purchases and negotiated transactions.

Parthenon Capital

Parthenon Capital is a private equity firm with offices in Boston and San Francisco. The firm provides capital and strategic resources to growing middle market companies for acquisitions, internal growth strategies and shareholder liquidity. The firm invests in a wide variety of industries with particular expertise in Business Services, Financial Services and Healthcare.

9

Summary Description of the Exchange Offer

On April 20, 2007, in connection with the Merger, we completed the private offering of $150 million aggregate principal amount of Floating Rate Senior Notes due 2014 (the “Floating Rate Senior Restricted Notes”), $450 million aggregate principal amount of 8 3/4% Senior Notes due 2014 (the “Fixed Rate Senior Restricted Notes”) and $425 million aggregate principal amount of 10% Senior Subordinated Notes due 2015 (the “Senior Subordinated Restricted Notes”), which we refer to collectively as the “Restricted Notes.” As part of that offering, we entered into a registration rights agreement with the initial purchasers of the Restricted Notes in which we agreed, among other things, to complete an exchange offer for the Restricted Notes. We refer to the Floating Rate Senior Exchange Notes and the Fixed Rate Senior Exchange Notes (each as defined below) as the “Senior Exchange Notes.” Below is a summary of each exchange offer. We refer herein to the exchange offers collectively as the “exchange offer.”

Restricted Notes | (i) $150 million aggregate principal amount of Floating Rate Senior Notes due 2014, (ii) $450 million aggregate principal amount of 8 3/4% Senior Notes due 2014 and (iii) $425 million aggregate principal amount of 10% Senior Subordinated Notes due 2015. |

Exchange Notes | (i) $150 million aggregate principal amount of Floating Rate Senior Notes due 2014 (the “Floating Rate Senior Exchange Notes”), (ii) $450 million aggregate principal amount of 8 3/4% Senior Notes due 2014 (the “Fixed Rate Senior Exchange Notes”) and (iii) $425 million aggregate principal amount of 10% Senior Subordinated Notes due 2014 (the “Senior Subordinated Exchange Notes”), the issuance of each of which has been registered under the Securities Act. The form and terms of each series of Exchange Notes are substantially identical in all material respects to those of the applicable series of Restricted Notes, except that the transfer restrictions, registration rights and additional interest provisions relating to the Restricted Notes do not apply to the Exchange Notes. |

Exchange Offer | We are offering to issue up to: |

(i) $150 million aggregate principal amount of Floating Rate Senior Exchange Notes,

(ii) $450 million aggregate principal amount of Fixed Rate Senior Exchange Notes, and

(iii) $425 million aggregate principal amount of Senior Subordinated Exchange Notes,

| | in exchange for a like principal amount of the respective Restricted Notes to satisfy our obligations under the registration rights agreement that we entered into when the Restricted Notes were issued in reliance upon the exemption from registration provided by Rule 144A and Regulation S of the Securities Act. |

10

Expiration Date; Tenders | The exchange offer will expire at 5:00 p.m., New York City time, on March 18, 2008, unless extended in our sole and absolute discretion. By tendering your Restricted Notes, you represent to us that: |

| | • | | you are not our “affiliate,” as defined in Rule 405 under the Securities Act; |

| | • | | you are not engaged in, and do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the Exchange Notes; |

| | • | | you are acquiring the Exchange Notes in your ordinary course of business; and |

| | • | | if you are a broker-dealer, you will receive the Exchange Notes for your own account in exchange for Restricted Notes that were acquired by you as a result of your market-making or other trading activities and that you will deliver a prospectus in connection with any resale of the Exchange Notes you receive. For further information regarding resales of the Exchange Notes by participating broker-dealers, see the discussion under the caption “Plan of Distribution.” |

Withdrawal | You may withdraw any Restricted Notes tendered in the exchange offer at any time prior to 5:00 p.m., New York City time, on March 18, 2008. |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, which we may waive. See the discussion below under the caption “The Exchange Offer—Conditions to the Exchange Offer” for more information regarding the conditions to the exchange offer. |

Procedures for Tendering the Restricted Notes | Except as described in the section titled “The Exchange Offer—Procedures for Tendering Restricted Notes,” a tendering holder must, on or prior to the expiration date, transmit an agent’s message to the exchange agent at the address listed in this prospectus. In order for your tender to be considered valid, the exchange agent must receive a confirmation of book entry transfer of your Restricted Notes into the exchange agent’s account at The Depository Trust Company, or DTC, prior to the expiration or termination of the exchange offer. |

Special Procedures for Beneficial Owners | If you are a beneficial owner whose Restricted Notes are registered in the name of the broker, dealer, commercial bank, trust company or other nominee, and you wish to tender your Restricted Notes in the exchange offer, you should promptly contact the person in whose name the Restricted Notes are registered and instruct that person to tender on your behalf. Any registered holder that is a participant in DTC’s book-entry transfer facility system may make book-entry delivery of the Restricted Notes by causing DTC to transfer the Restricted Notes into the exchange agent’s account. |

11

Use of Proceeds | We will not receive any proceeds from the exchange offer. |

Exchange Agent | Wells Fargo Bank, National Association is the exchange agent for the exchange offer. You can find the address and telephone number of the exchange agent below under the caption “The Exchange Offer—Exchange Agent.” |

Resales | Based on interpretations by the staff of the SEC, as detailed in a series of no-action letters issued to third parties, we believe that the Exchange Notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act as long as: |

| | • | | you are acquiring the Exchange Notes in the ordinary course of your business; |

| | • | | you are not participating, do not intend to participate and have no arrangements or understanding with any person to participate in a distribution of the Exchange Notes; |

| | • | | you are not an affiliate of ours. |

| | If you are an affiliate of ours, are engaged in or intend to engage in or have any arrangement or understanding with any person to participate in the distribution of the Exchange Notes: |

| | • | | you cannot rely on the applicable interpretations of the staff of the SEC; |

| | • | | you will not be entitled to participate in the exchange offer; and |

| | • | | you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. |

| | See the discussion below under the caption “The Exchange Offer—Consequences of Exchanging or Failing to Exchange Restricted Notes” for more information. |

Broker-Dealer | Each broker or dealer that receives Exchange Notes for its own account in exchange for Restricted Notes that were acquired as a result of market-making or other trading activities must acknowledge that it will comply with the registration and prospectus delivery requirements of the Securities Act in connection with any offer to resell or other transfer of the Exchange Notes issued in the exchange offer, including the delivery of a prospectus that contains information with respect to any selling holder required by the Securities Act in connection with any resale of the Exchange Notes. |

12

| | Furthermore, any broker-dealer that acquired any of its Restricted Notes directly from us: |

| | • | | may not rely on the applicable interpretation of the staff of the SEC’s position contained in Exxon Capital Holdings Corp., SEC no-action letter (April 13, 1988), Morgan, Stanley & Co. Inc., SEC no-action letter (June 5, 1991) and Shearman & Sterling, SEC no-action letter (July 2, 1993); and |

| | • | | must also be named as a selling bondholder in connection with the registration and prospectus delivery requirements of the Securities Act relating to any resale transaction. |

| | This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for Restricted Notes which were received by such broker-dealer as a result of market making activities or other trading activities. We have agreed that for a period of not less than 90 days after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution” for more information. |

Registration Rights Agreement | When we issued the Restricted Notes, we entered into a registration rights agreement with the initial purchasers of the Restricted Notes. Under the terms of the registration rights agreement, we agreed to use our commercially reasonable efforts to: |

| | • | | prepare and file with the SEC and cause to become effective a registration statement relating to an offer to exchange the Restricted Notes for the Exchange Notes; |

| | • | | keep the exchange offer open for not less than 20 business days (or longer if required by applicable law) after the date of notice thereof is mailed to the holders of the Restricted Notes; and |

| | • | | complete the exchange offer within 360 days of the issue date of the Restricted Notes. |

| | If we do not complete the exchange offer within 360 days of the date that we sold the Restricted Notes, or if after a shelf registration statement with respect to the Restricted Notes is declared (or becomes automatically) effective and such registration statement thereafter ceases to be effective, additional interest will be paid in an amount equal to $0.05 per week per $1,000 principal amount of the applicable Restricted Notes. The amount of additional interest will increase by an additional $0.05 per week per $1,000 principal amount of the applicable Restricted Notes for each subsequent 90-day period until the registration default has been cured, up to a maximum amount of $0.50 per week per $1,000 principal amount of the applicable Restricted Notes. |

| | Under some circumstances set forth in the registration rights agreement, holders of Restricted Notes, including holders who are not permitted to participate in the exchange offer or who may not freely |

13

| | sell Exchange Notes received in the exchange offer, may require us to file and cause to become effective, a shelf registration statement covering resales of the Restricted Notes by these holders. |

| | A copy of the registration rights agreement is incorporated by reference as an exhibit to the registration statement of which this prospectus is a part. See “Book-Entry, Delivery and Form.” |

Material United States Federal Income Tax Considerations | Your exchange of restricted notes for exchange notes pursuant to the exchange offer generally will not be a taxable event for U.S. federal income tax purposes. |

Summary of Consequences of Not Exchanging Restricted Notes

If you do not exchange your Restricted Notes in the exchange offer, your Restricted Notes will continue to be subject to the restrictions on transfer currently applicable to the Restricted Notes. In general, you may offer or sell your Restricted Notes only:

| | • | | if the offer or sale is registered under the Securities Act and applicable state securities laws; |

| | • | | if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities laws; or |

| | • | | if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

If you do not exchange your Restricted Notes in the exchange offer, you will continue to be entitled to all the rights and limitations applicable to the Restricted Notes as set forth in the applicable indenture, but we will not have any further obligation to you to provide for the exchange and registration of the Restricted Notes under the applicable registration rights agreement. Accordingly, there will be no increase in the interest rate on the Restricted Notes under the applicable circumstances described in the registration rights agreements.

We do not currently intend to register sales of the Restricted Notes under the Securities Act. Under some circumstances, however, holders of the Restricted Notes, including holders who are not permitted to participate in the exchange offer or who may not freely resell Exchange Notes received in the exchange offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of Restricted Notes by these holders. For more information regarding the consequences of not tendering your Restricted Notes and our obligation to file a shelf registration statement, see “The Exchange Offer—Consequences of Exchanging or Failing to Exchange Restricted Notes.”

14

Summary Description of the Exchange Notes

The summary below describes the principal terms of the Exchange Notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Senior Exchange Notes” section of this prospectus contains a more detailed description of the terms and conditions of the Senior Exchange Notes and the “Description of Senior Subordinated Exchange Notes” section of this prospectus contains a more detailed description of the terms and conditions of Senior Subordinated Exchange Notes.

Exchange Notes Offered | Up to $150.0 million in aggregate principal amount of Floating Rate Senior Notes due 2014. |

| | Up to $450.0 million in aggregate principal amount of 8 3/4% Senior Notes due 2014. |

| | Up to $425.0 million aggregate principal amount of 10% Senior Subordinated Notes due 2015. |

Maturity Dates | The Floating Rate and Fixed Rate Senior Exchange Notes will mature on May 1, 2014 respectively. |

| | The Senior Subordinated Exchange Notes will mature on May 1, 2015. |

Interest Payment Dates | With respect to the Floating Rate Senior Exchange Notes, May 1, August 1, November 1 and February 1 of each year, commencing August 1, 2007. |

| | With respect to the Fixed Rate Senior Exchange Notes and the Senior Subordinated Exchange Notes, May 1 and November 1 of each year, commencing November 1, 2007. |

Guarantees | The Floating Rate and Fixed Rate Senior Exchange Notes will be guaranteed, jointly and severally and fully and unconditionally, on an unsecured unsubordinated basis by each of our subsidiaries that guarantees debt under our senior credit facility. |

| | The Senior Subordinated Exchange Notes will be guaranteed, jointly and severally and fully and unconditionally, on an unsecured subordinated basis by each of our subsidiaries that guarantees debt under our senior credit facility. |

Ranking | The Floating Rate and Fixed Rate Senior Exchange Notes and the respective guarantees thereof are our and the guarantors’ unsecured, senior obligations and will rank in right of payment: |

| | • | | pari passu with all of our and the guarantors’ existing and future senior indebtedness, including any borrowings under our senior secured credit facilities and the guarantees thereof; |

15

| | • | | senior to all of our and our guarantors’ existing and future subordinated indebtedness, including the Senior Subordinated Notes and the guarantees thereof; and |

| | • | | structurally subordinated to all existing and future liabilities, including trade and other payables, of our non-guarantor subsidiaries. |

| | As of September 30, 2007, the aggregate amount of liabilities of our non-guarantor subsidiaries, including trade and other payables, was $336.1 million. |

| | Because the Exchange Notes are unsecured, in the event of bankruptcy, liquidation, reorganization or other winding up of our company or the guarantors or upon default in payment with respect to, or the acceleration of, any indebtedness under our senior secured credit facility or other secured indebtedness, the assets of our company and the guarantors that secure other secured indebtedness will be available to pay obligations on the Exchange Notes and the guarantees only after all indebtedness under such other secured indebtedness has been repaid in full from such assets. See “Description of Other Indebtedness.” |

| | As of September 30, 2007, the Senior Exchange Notes would have been effectively subordinated to approximately $1,595.6 million of our and the guarantors’ secured debt and there would have been $300.0 million of additional availability under our senior secured credit facilities. |

| | The Senior Subordinated Exchange Notes and the guarantees thereof are our and the guarantors’ unsecured, senior subordinated obligations and rank in right of payment: |

| | • | | junior to all of our and the guarantors’ existing and future senior indebtedness, including the Senior Exchange Notes and the guarantees thereof and any borrowings under our senior secured credit facilities and the guarantees thereof; |

| | • | | pari passu with all of our and our guarantors’ existing and future unsecured senior subordinated indebtedness; and |

| | • | | structurally subordinated to all existing and future liabilities, including trade and other payables, of our non-guarantor subsidiaries. |

| | As of September 30, 2007, the Senior Subordinated Exchange Notes would have been (i) subordinated to $2,195.6 million of our and the guarantors’ senior debt, including the Senior Exchange Notes, and there would have been $300.0 million of additional availability under our senior secured credit facilities and (ii) structurally subordinated to $336.1 million of liabilities of our non-guarantor subsidiaries, including trade and other payables. |

16

Optional Redemption | We may, at our option, redeem some or all of the Floating Rate Senior Exchange Notes at the redemption prices listed under “Description of Senior Exchange Notes—Optional Redemption—Floating Rate Senior Notes.” |

| | We may, at our option, redeem some or all of the Fixed Rate Senior Exchange Notes at the redemption prices listed under “Description of Senior Exchange Notes—Optional Redemption—Fixed Rate Senior Notes.” |

| | We may, at our option, redeem some or all of the Senior Subordinated Exchange Notes at the redemption prices listed under “Description of Senior Subordinated Exchange Notes—Optional Redemption.” |

| | In addition, on or prior to May 1, 2010, we may, at our option, redeem up to 35% of each series of the Exchange Notes with the proceeds of equity offerings at the redemption price listed under “Description of Senior Exchange Notes—Optional Redemption” and “Description of Senior Subordinated Notes—Optional Redemption.” |

Mandatory Repurchase Offer | If we experience specific types of changes in control, we must offer to repurchase the Exchange Notes at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest to the date of purchase, subject to the rights of holders of Exchange Notes on the relevant record date to receive interest due on the relevant payment date. See “Description of Senior Exchange Notes—Repurchase at the Option of Holders” and “Description of Senior Subordinated Exchange Notes—Repurchase at the Option of Holders.” |

Certain Covenants | We will issue the Exchange Notes under indentures with Wells Fargo, National Association, which will initially act as trustee on your behalf. The indentures will, among other things, restrict our ability and the ability of our restricted subsidiaries to: |

| | • | | pay dividends and make distributions; |

| | • | | make certain investments; |

| | • | | enter into transactions with affiliates; |

| | • | | merge or consolidate; and |

| | • | | transfer or sell assets. |

| | These covenants are subject to important exceptions and qualifications. For more details, see “Description of Senior Exchange Notes—Certain Covenants” and “Description of Senior Subordinated Exchange Notes—Certain Covenants.” |

17

Risk Factors

You should carefully consider the information set forth under “Risk Factors” beginning on page 23 before deciding to invest in the Exchange Notes.

Information About KAR Holdings

We were incorporated in Delaware on November 9, 2006. Our principal executive offices are located at 13085 Hamilton Crossing Boulevard, Carmel, Indiana 46032, and our telephone number is (800) 923-3725. Our websites are located at www.adesainc.com and www.iaai.com. The information on, or accessible through, the websites is not a part of, or incorporated by reference in, this prospectus.

18

Summary Historical and Pro Forma Consolidated Financial Data

The following table sets forth our summary historical consolidated financial data and summary unaudited pro forma consolidated income statement data, at the dates and for the periods indicated. The summary historical consolidated financial data as of September 30, 2007 and for the nine months ended September 30, 2007 have been derived from our unaudited consolidated financial statements and the related notes included elsewhere in this prospectus. We were incorporated on November 9, 2006; however, we had no operations until the consummation of the Transactions on April 20, 2007.

The summary unaudited pro forma consolidated statement of operations data and other financial data for the year ended December 31, 2006 and the nine months ended September 30, 2007 have been prepared to give effect to (i) the Transactions as if they had occurred on the first day of the fiscal year 2006 (December 26, 2005 for IAAI and January 1, 2006 for ADESA) and (ii) IAAI’s acquisition of branches in Erie, Pennsylvania; Indianapolis and South Bend, Indiana; Cincinnati, Cleveland, Columbus, Dayton and Lima, Ohio; Ashland, Kentucky; Buckhannon, West Virginia; Missoula, Montana; Des Moines, Cedar Falls and Sioux City, Iowa; Cicero, New York; and Pulaski, Virginia (the “IAAI 2006 Acquisitions”), which all occurred during IAAI’s 2006 fiscal year, as if each of these acquisitions had been consummated on December 26, 2005. The summary unaudited pro forma consolidated financial data does not purport to represent what our results of operations, balance sheet data or financial information would have been if the Transactions had occurred as of the dates indicated, or what such results will be for any future period.

The following selected financial data should be read in conjunction with “Use of Non-GAAP Measures,” “Selected Historical Consolidated Financial Data,” “Unaudited Pro Forma Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the unaudited consolidated financial statements of KAR Holdings and related notes, the audited consolidated financial statements of ADESA and related notes, the audited consolidated financial statements of IAAI and related notes, and other financial information included elsewhere in this prospectus.

| | | | | | | | | | | | |

| (Dollars in millions) | | Pro forma

year ended

December 31,

2006 | | | Nine months

ended

September 30,

2007(1) | | | Pro forma

nine months

ended

September 30,

2007(2) | |

| | | (unaudited) | | | (unaudited) | | | (unaudited) | |

Statement of Operations Data: | | | | | | | | | | | | |

Net revenues | | $ | 1,452.9 | | | $ | 704.4 | | | $ | 1,192.5 | |

Cost of sales (excludes depreciation and amortization) | | | 800.1 | | | | 391.1 | | | | 654.9 | |

| | | | | | | | | | | | |

Gross profit | | | 652.8 | | | | 313.3 | | | | 537.6 | |

Operating expense: | | | | | | | | | | | | |

Selling, general and administrative | | | 327.9 | | | | 146.3 | | | | 252.1 | |

Depreciation and amortization | | | 158.4 | | | | 66.8 | | | | 118.8 | |

| | | | | | | | | | | | |

Operating income | | | 166.5 | | | | 100.2 | | | | 166.7 | |

| | | | | | | | | | | | |

Other (income) expense: | | | | | | | | | | | | |

Interest expense | | | 229.8 | | | | 104.4 | | | | 168.8 | |

Other expense (income) | | | (4.2 | ) | | | (6.7 | ) | | | (8.8 | ) |

Early extinguishment of debt | | | 1.3 | | | | — | | | | — | |

| | | | | | | | | | | | |

Income (loss) before income taxes | | | (60.4 | ) | | | 2.5 | | | | 6.7 | |

Income taxes | | | (22.2 | ) | | | 6.5 | | | | 11.7 | |

| | | | | | | | | | | | |

Net (loss) income from continuing operations | | $ | (38.2 | ) | | $ | (4.0 | ) | | $ | (5.0 | ) |

| | | | | | | | | | | | |

19

| | | | | | | |

| | | Pro forma

year ended

December 31,

2006 | | | Nine months

ended

September 30,

2007(1) |

| | | (unaudited) | | | (unaudited) |

Other Financial Data: | | | | | | | |

Pro forma EBITDA(8) | | $ | 327.3 | | | | 262.4 |

Pro forma Adjusted EBITDA(8) | | | 381.3 | | | | 317.6 |

Capital expenditures | | | 54.6 | (3) | | | 31.1 |

Ratio of earnings to fixed charges(4) | | | — | | | | 1.0x |

| | |

Balance Sheet Data (at end of period): | | | | | | | |

Available cash and cash equivalents(5) | | | | | | $ | 154.4 |

Working capital(6) | | | | | | | 485.6 |

Total assets | | | | | | | 5,030.1 |

Total debt | | | | | | | 2,620.6 |

Total net debt(7) | | | | | | | 2,466.2 |

Total stockholders’ equity | | | | | | | 1,081.2 |

| (1) | We were incorporated on November 9, 2006, but had no operations until the consummation of the Transactions on April 20, 2007. |

| (2) | The amount for pro forma nine months ended September 30, 2007 is based on the historical financial data of ADESA for the period from January 1, 2007 to April 19, 2007, the historical financial data of IAAI for the period from January 1, 2007 to April 19, 2007 and the historical financial data of KAR Holdings for the period from January 1, 2007 to September 30, 2007, as adjusted to combine the financial statements of ADESA and IAAI on a historical basis and to illustrate the pro forma effects of the Transactions as if they had occurred on January 1, 2006. KAR Holdings was incorporated on November 9, 2006, but had no operations until the consummation of the Transactions on April 20, 2007. |

| (3) | The 2006 pro forma amount excludes amounts related to the IAAI 2006 Acquisitions prior to the respective acquisition date. |

| (4) | For purposes of determining the ratio of earnings to fixed charges, earnings consist of income before income taxes and fixed charges. Fixed charges consist of interest on indebtedness, amortization of debt issuance costs which are charged to interest expense and a reasonable approximation of the interest factor related to operating leases. The amount of deficiency for the pro forma year ended December 31, 2006 was $60.4 million. |

| (5) | Available cash and cash equivalents excludes cash in transit, restricted cash balances and foreign cash not repatriated at ADESA. |

| (6) | Working capital is defined as current assets less current liabilities. |

| (7) | Represents total debt less available cash and cash equivalents, which excludes cash in transit, restricted cash balances and foreign cash not repatriated at ADESA. |

| (8) | EBITDA is defined as net income (loss), plus interest expense net of interest income, income taxes and depreciation and amortization, as set out in detail below. Adjusted EBITDA consists of EBITDA as further adjusted to exclude (i) certain items and expenses that are permitted to be excluded from the calculation of “Consolidated EBITDA,” as that term is defined under our senior secured credit facilities and (ii) the expected incremental revenue and cost savings specified below. |

We believe that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA are appropriate to provide additional information to investors about certain covenants that we are required to satisfy under our senior secured credit facilities and notes and about our incremental revenue and cost savings. However, we cannot assure you that we will be able to realize these incremental revenues or cost savings or the timing thereof. See “Risk Factors—Risks Relating to Our Business—We may not

20

successfully implement our business strategies or realize our expected cost savings and revenue enhancements.” EBITDA is also one of the measures management uses to assess our financial performance and is a metric used in certain of our management incentive programs.

Under our credit agreement and notes, we are required to maintain a “Maximum Consolidated Senior Secured Leverage Ratio” which is based on Adjusted EBITDA. Failure to comply with the ratio covenant would result in a default under the credit agreement for our credit facility and, absent a waiver or an amendment from the lenders, permit the acceleration of all outstanding borrowings under the credit facility.

EBITDA and Adjusted EBITDA are not recognized terms under GAAP and do not purport to be alternatives to net income as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for management’s discretionary use, as they do not reflect certain cash requirements such as interest payments, tax payments and debt service requirements. Furthermore, we cannot assure you that charges and expenses categorized as “non-recurring” below will not recur in the future. Because not all companies use identical calculations, these presentations of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

21

EBITDA and Adjusted EBITDA are reconciled to net income as follows

(unaudited):

| | | | |

| (In millions) | | Pro forma year ended

December 31,

2006 | |

Net loss | | $ | (38.2 | ) |

Add back: discontinued operations | | | — | |

| | | | |

Income from continuing operations | | | (38.2 | ) |

Add back: | | | | |

Income taxes | | | (22.2 | ) |

Interest expense, net of interest income | | | 229.3 | |

Depreciation and amortization | | | 158.4 | |

| | | | |

EBITDA | | | 327.3 | |

Nonrecurring charges | | | 16.3 | |

Noncash and related non-recurring charges | | | 18.0 | |

Acquisition adjustments | | | 4.4 | |

Other considerations, net | | | 2.8 | |

Incremental cost savings | | | 12.5 | |

| | | | |

Adjusted EBITDA | | $ | 381.3 | |

| | | | |

| | | |

| (In millions) | | Nine months ended

September 30,

2007(a) |

Net income | | $ | 22.5 |

Add back: discontinued operations | | | — |

| | | |

Income from continuing operations | | | 22.5 |

Add back: | | | |

Income taxes | | | 32.9 |

Interest expense, net of interest income | | | 116.5 |

Depreciation and amortization | | | 90.5 |

| | | |

EBITDA | | | 262.4 |

Nonrecurring charges | | | 11.7 |

Nonrecurring transaction charges | | | 24.8 |

Noncash charges | | | 7.1 |

Advisory services | | | 1.8 |

| | | |

| | | 307.8 |

Pro forma impact of recent acquisitions | | | 2.6 |

Pro forma cost savings per the credit agreement | | | 7.2 |

| | | |

Adjusted EBITDA | | $ | 317.6 |

| | | |

| | (a) | The results of ADESA and IAAI have been combined for the period of time prior to the Transactions. |

22

RISK FACTORS

Participating in the exchange offer involves a number of risks. You should consider carefully the following information about these risks, together with the other information included in this prospectus before tendering your Restricted Notes in the exchange offer. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations. We cannot assure you that any of the events discussed in the risk factors below will not occur. If they do, our business, financial condition or results of operations could be materially and adversely affected.

Risks Related to Our Business

Fluctuations in consumer demand for and in the supply of used, leased and salvage vehicles impact auction sales volume, conversion rates and the demand for floorplan financing by independent used vehicle dealers, which may adversely affect our revenues and profitability.

In the normal course of business, we are subject to changes in general U.S. economic conditions, including but not limited to, availability and affordability of consumer credit, interest rates, fuel prices, inflation, discretionary spending levels, unemployment rates and consumer confidence about the economy in general. Significant changes in economic conditions could adversely impact consumer demand for used vehicles.

As consumer demand fluctuates, the volume and prices of used vehicles may be affected and the demand for used vehicles at auction by dealers may likewise be affected. The demand for used vehicles at auction by dealers may therefore affect the wholesale price of used vehicles and the conversion percentage of vehicles sold at auction. In addition, changes in demand for used vehicles may affect the demand for floorplan financing as well as our ability to collect existing floorplan loans.

The number of new and used vehicles that are leased by consumers affects the supply of vehicles coming to auction. As manufacturers and other lenders have decreased the number of leases in the last few years and extended the lease terms of some of the leases that were written, the number of off-lease vehicles available at auction declined in 2003, 2004, 2005 and 2006. We are not able to predict manufacturers’ and lenders’ approaches to leasing and thus future volumes of off-lease vehicles may be affected based upon leasing terms and trends. The supply of off-lease vehicles coming to auction is also affected by the market value of used vehicles compared to the residual value of those vehicles per the lease terms. In most cases, the lessee and the dealer have the ability to purchase the vehicle at the residual price at the end of the lease term. Generally, as market values of used vehicles rise, the number of vehicles purchased at residual value by the lessees and dealers increases, thus decreasing the number of off-lease vehicles available at auction.

We are also dependent upon receiving a sufficient number of total-loss vehicles as well as recovered theft vehicles to sustain our profit margins in our salvage auction business. Factors that can affect the number of vehicles received include, but are not limited to, driving patterns, mild weather conditions that cause fewer traffic accidents, reduction of policy writing by insurance providers that would affect the number of claims over a period of time, delays or changes in state title processing, and changes in direct repair procedures that would reduce the number of newer, less damaged total-loss vehicles, which tend to have higher salvage values. In addition, our salvage auction business depends on a limited number of key insurance companies to supply the salvage vehicles we sell at auction. Our agreements with our insurance company suppliers are generally subject to cancellation by either party upon 30 to 90 days notice. There can be no assurance that our existing agreements will not be cancelled or that we will be able to enter into future agreements with these suppliers. Future decreases in the quality and quantity of vehicle inventory, and in particular the availability of newer and less damaged vehicles, could have a material adverse effect on our operating results and financial condition. In addition, in the last few years there has been a declining trend in theft occurrences which reduces the number of stolen vehicles covered by insurance companies for which a claim settlement has been made.

23

Our operating results may fluctuate significantly.

Our operating results have in the past and may in the future fluctuate significantly depending on a number of factors, many of which are beyond our control. These factors include, but are not limited to:

| | • | | general business conditions, including the availability and quality of used, leased and salvage vehicles and buyer attendance at our vehicle auctions; |

| | • | | trends in new and used vehicle sales and incentives, including wholesale used vehicle pricing; |

| | • | | economic conditions including fuel prices and Canadian exchange rate and interest rate fluctuations; |

| | • | | trends in the vehicle remarketing industry; |

| | • | | the introduction of new competitors; |

| | • | | laws, regulations and industry standards, including changes in regulations governing the sale of used vehicles, the processing of salvage vehicles and commercial lending activities; |

| | • | | changes in the market value of vehicles we auction, including changes in the actual cash value of salvage vehicles; |

| | • | | competitive pricing pressures; and |

| | • | | costs associated with the acquisition of businesses or technologies. |

As a result of the above factors, we believe that period-to-period comparisons of our results of operations are not necessarily meaningful and should not be relied upon as any indication of future performance. Furthermore, revenues for any future quarter are not predictable with any significant degree of accuracy, and our operating results may vary significantly due to our relatively fixed expense levels. Due to these factors, it is possible that in some future quarters our operating results may fall below the expectations of public market analysts and investors.

Changes in interest rates or market conditions could adversely impact the profitability and business of AFC.

Rising interest rates may have the effect of depressing the sales of used vehicles because many consumers finance their vehicle purchases. In addition, AFC sells the majority of its finance receivable to a special purpose entity, which sells an undivided interest in its finance receivables to a bank conduit facility on a revolving basis. Volatility and/or market disruption in the asset-backed securities market in the U.S. can impact AFC’s cost of financing related to; or its ability to arrange financing on acceptable terms through, its securitization conduit, which could negatively affect AFC’s business and our financial condition and operations.

AFC generally charges interest on its floorplan loans based on the prime rate plus a spread. Declining interest rates decrease the interest income earned on AFC’s loan portfolio.

We may not be able to grow if we are unable to successfully acquire and integrate other auction businesses and facilities.

The used vehicle redistribution industry is considered a mature industry in which low single-digit growth is expected in industry unit sales. Acquisitions have been a significant part of our historical growth and have enabled us to further broaden and diversify our service offerings. Our strategy involves the acquisition and integration of additional physical auction sites, technologies and personnel. Acquisition of businesses requires substantial time and attention of management personnel and may also require additional equity or debt financings. Further, integration of newly established or acquired businesses is often disruptive. Since we have acquired or in the future may acquire one or more businesses, there can be no assurance that we will identify appropriate targets, will acquire such businesses on favorable terms, or will be able to successfully integrate such organizations into our business. Failure to do so could materially adversely affect our business, financial condition and results of operations. In addition, we expect to compete against other auction groups or new industry consolidators for suitable acquisitions. If we are able to consummate acquisitions, such acquisitions could be dilutive to earnings, and we could overpay for such acquisitions.

24

In pursuing a strategy of acquiring other auctions, we face other risks commonly encountered with growth through acquisitions. These risks include, but are not limited to: