PROSPECTUS Filed pursuant to Rule 424 (b) (i)

SEC File #333-148984

You should read this summary in conjunction with the more detailed information and financial statements appearing elsewhere in this prospectus.

PLATA RESOURCES, INC.

Shares of Common Stock

1,390,000 shares

There is no public market for the common shock Plata Resources, Inc (“Plata” or the “Company”). We intend to have our shares of common stock quoted on the Over-the-Counter Bulletin Board (the “OTCBB”) operated by the Financial Industry Regulatory Authority. There is, however, no assurance that the shares will ever be quoted on the OTCBB.

Our selling shareholders, including our directors and officers, are offering for sale a total of 1,390,000 of common shares at a price of $0.05 per share or whatever the market value of the shares are, if and when, we are quoted on the OTCBB. The selling shareholder may sell all or any portion of their shares of common stock in one or more transactions on the OTCBB or in private, negotiated transactions. Each selling shareholder will determine the prices at which he or she sells shares. Although Plata will incur expenses in connection with the registration of common shares, we will not receive any of the proceeds from the sale of the common shares by the selling shareholders.

Plata is a pre-exploration stage company and currently has no operations. Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares in our Company if you can afford a loss of your entire investment.

The shares of common stock offered under this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 5.

Neither the U.S. Securities and Exchange Commission nor any state securities division has approved or disapproved these securities, or determined if this prospectus is truthful, accurate, current or complete. Any representation to the contrary is a criminal offense.

DEALER PROSPECTUS DELIVERY INSTRUCTIONS

Until July 30, 2008, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The date of this prospectus in April 30, 2008

TABLE OF CONTENT

| Item | Information Required | Page |

| | | |

| Item 3 | Summary Information and Risk Factors | 3 |

| | | |

| Item 4 | Use of Proceeds | 11 |

| | | |

| Item 5 | Determination of Offering Price | 11 |

| | | |

| Item 6 | Dilution | 12 |

| | | |

| Item 7 | Selling Security Holders | 12 |

| | | |

| Item 8 | Plan of Distribution | 13 |

| | | |

| Item 9 | Legal Proceedings | 14 |

| | | |

| Item 10 | Directors, Executive Officers, Promoters and Control Persons | 14 |

| | | |

| Item 11 | Security Ownership of Certain Beneficial Owners and Management | 17 |

| | | |

| Item 12 | Description of Securities | 18 |

| | | |

| Item 13 | Interest of Named Experts and Counsel | 20 |

| | | |

| Item 14 | Disclosure of Commission Position of Indemnification for Securities Act Legislation | 21 |

| | | |

| Item 15 | Organization Within the Last Five Years | 21 |

| | | |

| Item 16 | Description of Business | 21 |

| | | |

| Item 17 | Management’s Discussion and Analysis or Plan of Operations | 28 |

| | | |

| Item 18 | Description of Property | 33 |

| | | |

| Item 19 | Certain Relationships and Related Transactions | 33 |

| | | |

| Item 20 | Market for Common Equity and Related Stockholder Matters | 34 |

| | | |

| Item 21 | Executive Compensation | 35 |

| | | |

| Item 22 | Financial Statements | 36 |

| | | |

| Item 23 | Changes In and Disagreement with Accountants on Accounting and Financial Disclosure | 45 |

We have not authorized any person to give you any supplemental information or to make any representations for us. You should not rely upon any information about Plata that is not contained in this prospectus. Information contained in this prospectus may become stale. You should not assume that the information contained in this prospectus, any prospectus supplement or the documents incorporated by reference are accurate as of any date other than their respective dates, regardless of the time of delivery of this prospectus or any sale of the shares. Our business, financial condition, results of operations and prospectus may have changed since those dates. The selling shareholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

ITEM 3. SUMMARY INFORMATION AND RISK FACTORS

Our Company

We were incorporated on July 17, 2007 under the laws of the State of Nevada. We are a pre-exploration stage company. A pre-exploration stage company is one engaged in the search of mineral deposits or reserves but is not in either the development or production stage. It might take us years before we are able to be in either the development or production stage and the chances are that we might never be in either of these two stages. Our mineral property is called the Bontoc Gold Claim (the “Bontoc Claim”) and is located in the Philippines. We own 100% of the Bontoc Claim. It consists of one – 9 unit claim block containing 102.5 hectares which have been staked and recorded with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of Philippines.

We have no revenue, have achieved losses since inception, have no operations and have relied upon the sale of our securities and loans from our officers and directors to fund our operations.

Our administrative office is located at 2911 Park Avenue, Pasay City, Metro Manila, Philippines (Tel: 632-886-788) and our registered statutory office is located at 2050 Russett Way, Carson City, Nevada, 89703.

There is no current public market for our securities of our selling shareholders. As our stock is not publicly traded, investors purchasing shares from our selling shareholders in a private transaction should be aware they probably will be unable to sell their shares and their investment in our securities is not liquid.

The Offering

This offering relates to the offer and sale of our common stock by the selling shareholders identified in this prospectus. The selling shareholders will determine when they will sell their shares, and in all cases, will sell their shares at the current market price or at negotiated prices at the time of the sale. Although we have agreed to pay the expenses related to the registration of the shares being offered, we will not receive any proceeds from the sale of the shares by the selling shareholders.

Summary Financial Information

The following summary financial data was derived from our financial statements. This information is only a summary and does not provide all the information contained in our financial statements and related notes thereto. You should read the “Management’s Discussion and Analysis or Plan of Operations” beginning on page 28 of this prospectus and our financial statements and related noted included elsewhere in this prospectus.

Operation Statement Data

| | July 17, 2007 (date of incorporation) to December 31, 2007 |

| | |

| Revenue | $ - |

| Exploration expenses | 5,000 |

| General and Administration | 10,120 |

| Net loss | 15,120 |

| Weighted average shares outstanding (basic) | 2,441,796 |

| Weighted average shares outstanding (diluted) | 2,441,796 |

| Net loss per share (basic) | $ (0.00) |

| Net loss per share (diluted) | $ (0.00) |

Balance Sheet Data

| Cash and cash equivalent | $ 52,490 |

| Total assets | 52,490 |

| Total liabilities | 4,810 |

| Total Shareholders’ equity | 47,680 |

Our historical results do not necessary indicate results expected for any future periods.

Cautionary Statement Concerning Forward-Looking Statements

This prospectus contains written statements regarding our business and prospectus, such as projections of future performance, statements of management’s plans and objectives, forecasts of market trends, and other matters that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933. Statements containing the words or phases such as “is anticipated”, “estimates”, “believes”, “expects”, “anticipates”, “plans”, “objective”, “should” or similar expressions identify forward-looking statements, which may appear in this prospectus.

Our future results, including results related to forward-looking statements, involve a number of risks and uncertainties. No assurance can be given that the results reflected in any forward-looking statements will be achieved. Any forward-looking statement speaks only as of the date on which such statement is made. Our forward-looking statements are based upon assumptions that are sometimes based upon estimates, data, communication and other information from government agencies and other sources that may be subject to revision. Except as required by law, we do not undertake any obligation to update or keep current either (i) any forward-looking statement to reflect events or circumstances arising after the date of such statement, or (ii) the important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or which are reflected from time to time in any forward-looking statement.

In addition to other matters identified or described by us from time to time in filings with the SEC, there are several important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or results that are reflected from time to time in any forward-looking statement. Some of these important factors, but not necessarily all important factors, include the following:

Risk Factors

An investment in our common stock is speculative and involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before purchasing any shares of our common stock from our selling shareholders. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties may also adversely impair our business operations. If any of the events described in the risk factors below actually occur, our business, financial condition or results of operations could suffer significantly. In such case, the value of your investment could decline and you may lose all or part of the money you paid to buy the shares of common stock.

We are a pre-exploration stage company but have not yet commenced exploration activities on the Bontoc Claim. We expect to incur operating losses for the foreseeable future.

We have not yet commenced exploration on the Bontoc Claim located in the Philippines. Accordingly, we have no way to evaluate the likelihood that our exploration activities and our business endeavors will be successful. We were incorporated on July 17, 2007 and to date have been involved primarily in organizational activities and the acquisition of our mineral claim. We have not earned any revenues as of the date of this prospectus and have loss to date of $15,120. Potential investors, who wish to acquire shares from our selling shareholders, should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the Bontoc that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development and production of minerals from the Bontoc Claim, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

There is the likelihood of the Bontoc Claim containing little or no economic mineralization or reserves of gold or any other minerals. We have a geological report detailing previous exploration in the area, and the claim has been staked per Philippines regulations. Even though the area around the Bontoc Claim is rich in mineralization there is no assurance that the Bontoc Claim itself will have any minerals on it. This, being the case, the funds spent on exploration of the Bontoc Claim might be spent without any meaningful results being obtained.

Because we have not surveyed the Bontoc Claim, we may discover mineralization which might not be within our actual claim boundaries.

While we have a 100% ownership in the mineral on the Bontoc Claim, this should not be construed as a guarantee of the Bontoc’s boundaries. Until the claim is surveyed, the precise location of the boundaries of Bontoc Claim may be in doubt. If we discover mineralization that is close to the Bontoc’s boundaries, it is possible that some or all of the mineralization may occur outside its boundaries. In such a case, we would not have the right to extract those minerals.

Because the probability of an individual mineral claim ever having reserves is extremely remote, in all probability our Bontoc Claim might not contain any reserves.

Because the probability of an individual mineral claim ever having reserves is extremely remote, in all probability our Bontoc Claim does not contain any reserves, and any funds spent on exploration will be lost. If we cannot raise further funds as a result, we may have to suspend or cease operations entirely which would result in the loss of your investment.

If access to the Bontoc Claim is restricted by inclement weather, we may delay our exploration program.

It is possible that rain, during the wet season in the Philippines, could cause the access roads to the Bontoc Claim by making it impossible to reach the claim itself. If the roads are impassable we would be delayed in our exploration timetable.

There has been relatively little if any exploration work on the Bontoc Claim to date and no recorded drilling activity.

As indicated in the geological report prepared by Geraldo Peralta, Professional Geologist, dated August 16, 2007, there has been no detailed exploration work undertaken on the Bontoc Claim and no recorded drilling activity. Therefore, the Bontoc Claim is a grass root exploration program which might result in no mineralization being discovered at all. If this is the case, the money you have spend to acquire our selling shareholders’ shares might be lost.

Our two directors and officers are not professional geologist and therefore will have to rely upon professional geologists in the exploration of the Bontoc Claim.

Even though our President, Dexter Caliso, has a Certificate in aerial mapping and surveying from the Bureau of Mines and Geoscience in the Philippines, he does not possess the exploration skills to supervise Phase I of the exploration program on the Bontoc Claim. Our other director and officer, Presentacion Coranes has no back ground in mineral exploration. Therefore, the directors will have to rely upon professional geologists to undertake the exploration program on the Bontoc. If a geologist cannot be found at the time the directors wish to commence Phase I then it will have to be delayed. This might result in a lack of money in the future.

If we are fortunate in the future to recover ore from the Bontoc Claim, the demand for our ore many be slow due to economic situations in world mineral prices resulting in reduced revenues, if any, to Plata.

Our continued success in the future, when and if we go into the production stage, will be dependent on the growth in demand for ore. World prices of metals will have an impact on our revenues; for example, if the prices are low for gold and our production costs are high it will result in us either losing money or discontinuing production. This will limit our ability to generate revenues and our financial condition and operating results will be harmed.

Our officers and directors have other business besides Plata which will mean they will not be able or willing to devote a sufficient amount of time to our business operations which might result in our Company failing.

Messrs. Dexter Caliso and Presentacion Coranes are our officers and directors, currently devote approximately 4-5 hours per week each in providing management services to Plata. While they presently possess adequate time to attend to the Company’s interests, it is possible that the demands from other obligations could increase, with the result that they would no longer be able to devote sufficient time to the management of our business. This could negatively impact our business development.

RISKS ASSOCIATED WITH THIS OFFERING:

The trading in our shares will be regulated by the SEC’s Rule 15G-9 which established the definition of a “Penny Stock”.

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 ($300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser's written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase from our selling shareholders, if at all.

Due to the lack of a trading market for our securities, you may have difficulty selling any shares you purchase from our selling shareholders.

We are not registered on any public stock exchange. There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the effectiveness of this registration statement and apply to have our shares quoted on the OTCBB. The OTCBB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter securities. The OTCBB is not an issuer listing service, market or exchange. Although the OTCBB does not have any listing requirements per se, to be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC or applicable regulatory authority. Market makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time. We cannot guarantee that our application will be accepted or approved and our stock listed and quoted for sale. As of the date of this filing, there have been no discussions or understandings between Plata, or anyone acting on our behalf, with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase from our selling shareholders. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

You will incur immediate and substantial dilution of the price of your shares if we have to issue additional share capital to meet our ongoing commitments.

Other than our directors, who purchased their shares at $0.001 per share, our other selling shareholders acquired their shares at $0.05 per share. Any price you acquire your shares above the $0.05 per share price will result in your having paid considerable more than what we issued shares for. In the event we wish to issue more shares from Treasury to meet our current demands for funds it might result in our price per share being either at $0.05 per share or below this amount. If this were the case, you would have acquired shares at a higher price and with the additional shares being issued you would suffer a dilution in the percentage of ownership you have in Plata.

We will incur ongoing costs and expenses for SEC reporting and compliance without any revenue; hence, without any additional funds, we may not be able to remain in compliance which will result in you not being able to sell your shares.

Our directors and officers, collectively own 2,000,000 common shares or 63% of the issued and outstanding share capital of Plata. In the future, if they wished to sell either all or part their shares, they could adversely affect the market price of the trading shares.

Due to the amount of shares held by Messrs. Calico and Coranes, if they were able to sell even a small percentage of their shares it could have an adverse effect on the market price and might restrict you from selling your shares at the price you had hoped for. Other than the shares owned by our two directors which have been qualified under this registration statement, the balance of their shares are subject to Rule 144 under the Securities Act of 1933 which restricts the ability of our directors or officers to sell their shares. Nevertheless, even a small number of shares sold by them could affect the market value of the shares considerable.

When and if our common stock is quoted on the OTCBB the market price per share could be volatile.

When and if our common stock is quoted on the OTCBB there is a strong possibility that the price could be highly volatile and subject to wide fluctuations in response to the following:

| ● | | Changes in the way the business community, especially the investment community, views our share price; |

| ● | | Departures of key personnel; |

| ● | | Results obtained on exploration work on the Bontoc Claim; |

| ● | | Increases or decreases in the price of gold or other precious metals; and |

| ● | | Any potential litigation. |

We have no plans in the immediate future to pay dividends.

We will not be paying any dividends in the immediate future and will use whatever funds we have, and especially those obtained from any revenues derived from our Bontoc Claim, to re-invest into further exploration work.

Glossary of Geological and Technical Terms

The following represents various geological and technical terms used in this prospectus relating to the geological information pertaining to the Bontoc Claim which you may not be familiar with.

| Geological Term | Definition |

| | |

| Amphibolites | A crystallized rock with little quartz in it. |

| | |

| Anorthosites | A plutonic rock composed entirely of plagioclase, usually labradorite |

| | |

| Aplites | A light-colored igneous rock characterized by a fine-grained texture |

| | |

| Auriferous | Gold bearing ore. |

| | |

| Bauxites | Chief ore of aluminum |

| | |

| Caldera | A large circular volcanic depression, often originating due to collapse. |

| | |

| Clinopyroxenites | Mineral of the zeolite group; a rock used mainly in kitten litter. |

| | |

| Deposit | Mineral deposit or ore deposit is used to designate a natural occurrence of a useful mineral, or an ore, in sufficient extent and degree of concentration to invite exploration. |

| | |

| Dolerite | Fine-grained character of rock that makes it difficult to precisely identify |

| | |

| Dynamothermal | Type of situation where extreme pressure is applied to make the type of rock underneath. |

| | |

| Feldspar | Any group of crystalline minerals, aluminum silicates with either potassium, sodium, calcium, etc. |

| | |

| Granite Gneiss | Granite rock in a parallel orientation. |

| | |

| Granulities | A metamorphic rock consisting of even-sized, interlocking mineral grains less than 10%of which have any obvious preferred orientation |

| | |

| Gypsum | Made of calcium and is known for use in Plaster of Paris. |

| | |

| Laterites | Red residual soil developed in humid, tropical, and subtropical regions of good drainage. |

| | |

| Leptynites | A hard rock containing mica, quartz and feldspar. |

| | |

| Lignite | A noncaking, usually brownish-black variety of coal – a cross between peat and coal |

| | |

| Mineralization | Potential economic concentration of commercial metals occurring in nature. |

| | |

| Metamorphic gneisses | Rock structurally adjusted from it original composition by pressure or the flow of water. |

| | |

| Nodules | A rock structure having the look of a group of nodules. |

| | |

| Ore | The natural occurring mineral from which a mineral or minerals of economic value can be extracted profitable or to satisfy social or political objectives. |

| | |

| Paragneisses | A characteristic association or occurrence of minerals or minerals assemblages in ore deposits |

| | |

| Pegmatites | An exceptionally course-grained igneous rock with interlocking crystals. |

| | |

| Quartzites | A very hard sandstone rock comprising silica grains |

| | |

| Reserve | (1) That part of a mineral deposit which could be economically and legally extracted or produced at the time the reserve is determined. (2) Proven: Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the site for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. (3) Probable: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| | |

| Wollastonite | Usually is found in limestone and occurs usually in cleavable masses or sometimes in tabular twinned crystals. It may be white, gray, brown, red or yellow in color. |

| | |

| Zone | A belt, band, or strip of earth materials, however disposed; characterized as distinct from surrounding parts by some particular secondary enrichment. |

Foreign Currency and Exchange Rates

Our mineral property is located in the Philippine, and costs expressed in the geological report on the Bontoc Claim are expressed in Philippine Peso (“PHP”). For purposes of consistency and to express United States Dollars throughout this prospectus, PHP have been converted into United States currency at the rate of US $1.00 being approximately equal to PHP $40.626 or PHP $1.00 being approximately equal US $0.02461 which is the approximate average exchange rate during recent months and which is consistent with the incorporated financial statements.

ITEM 4. USE OF PROCEEDS

We will not receive any proceeds from the sale of the selling shareholders of the shares of common stock covered under this prospectus.

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling security holders. Plata will pay all expenses of this offering. The estimated cost of $ 16,957 is summarized below:

| Description of Expenses | Paid to date | Future payments | Total amount |

| | | | |

| Accountant – preparation of financial statements as required (1) | $ - | $ 3,250 | $ 3,250 |

| Auditors’ examination of financial statements (2) | 2,500 | 1,000 | 3,500 |

| Consulting and legal fees & preparation of Registration Statement | - | 10,000 | 10,000 |

| Photocopying and delivery expenses | - | 200 | 200 |

| SEC filing fees | - | 7 | 7 |

Estimated offering costs | $ 2,500 | $ 14,457 | $ 16,957 |

| (1) | The accountant has prepared the working papers for the December 31, 2007 financial statements and the cost of interim financial statements preparation. |

| | (2) | The auditors have given an opinion of the December 31, 2007 financial statements included herein and the review of subsequent financial statements. |

ITEM 5. DETERMINATION OF THE OFFERING PRICE

Plata is not offering for sale any shares under this prospectus. The only shares which are being offered are the shares held by our selling shareholders which might be sold in one or more transactions on the over the counter market or in private, negotiated transactions. Each selling shareholder will determine the price at which he or she wishes to sell their shares.

ITEM 6. DILUTION

Since Plata is not selling any share from treasury under this prospectus there will be no dilution to its shareholders.

ITEM 7. SELLING SECURITY HOLDERS

The securities being offered hereunder are being offered by our selling shareholders. The selling shareholders may from time to time offer and sell pursuant to this prospectus up to an aggregate 1,390,000 of shares of our common stock. Because the selling shareholders are obligated to sell his or her shares, and because the selling shareholders may also acquire publicly traded shares of our common stock, we cannot estimate how many shares the selling shareholders will own after the offering.

All expenses incurred with respect to the registration of the common stock covered by this prospectus will be borne by us, but we will not be obligated to pay any underwriting fees, discounts, commissions or other expenses incurred by the selling shareholders in connection with the sale of their shares.

The following table sets forth, with respect to each selling shareholder:

| (i) | | the number of shares of commons stock beneficially owned prior to this offering contemplated hereby; |

| (ii) | | the maximum number of share of commons stock which may be sold by the selling shareholders under this registration statement; and |

| (iii) | | the number of shares of common stock which will be owned after this offering by the selling shareholders. |

Name of Beneficial owner | Shares beneficially owned prior to this offering | Maximum number of shares which may be sold | Shares beneficially owned after this offering |

| | Number Percentage | | Number Percentage |

| Alberto Araneta | 25,000 | .008 | 25,000 | - | - |

| Eduardo Asuncion | 20,000 | .006 | 20,000 | - | - |

| Mary Rose Breis | 55,000 | .018 | 55,000 | - | - |

| Avery G. Buenaventura | 25,000 | .008 | 25,000 | - | - |

| Amelita H. Castro | 30,000 | .009 | 30,000 | - | - |

| Caven H. Castro | 45,000 | .014 | 45,000 | - | - |

| Lolito T. Castro | 40,000 | .013 | 40,000 | - | - |

| Henry Caylas | 55,000 | .018 | 55,000 | - | - |

| Ricky Cebrero | 30,000 | .009 | 30,000 | - | - |

| Domingo D. Cosip | 20,000 | .006 | 20,000 | - | - |

| Joseph T. Cuenco | 50,000 | .016 | 50,000 | - | - |

| Alfredo Furio | 45,000 | .014 | 45,000 | - | - |

| Marlon Fenid Fuyoc | 50,000 | .016 | 50,000 | - | - |

| Bernardo C. Gomez | 55,000 | .018 | 55,000 | - | - |

| Rafael A. Gomeza | 50,000 | .016 | 50,000 | - | - |

| Gloria P. Gonzaga | 55,000 | .018 | 55,000 | - | - |

| Rodolfo V. Guervarra | 55,000 | .018 | 55,000 | - | - |

| Raquel A. Hapin | 15,000 | .004 | 15,000 | - | - |

| Lucia N. Hernandez | 50,000 | .016 | 50,000 | - | - |

| Venice M. Jadloc | 35,000 | .011 | 35,000 | - | - |

| Emmanuel H. Jimenez Jr. | 25,000 | .008 | 25,000 | - | - |

| Emily A. Lagarde | 15,000 | .004 | 15,000 | - | - |

| Veneranda G. Magbanua | 25,000 | .008 | 25,000 | - | - |

| Raul C. Mangalindan Jr. | 50,000 | .016 | 50,000 | - | - |

| Estelita T. Noderama | 20,000 | .006 | 20,000 | - | - |

| Angelito Palad | 40,000 | .013 | 40,000 | - | - |

| Hernando I. Peralta | 35,000 | .004 | 35,000 | - | - |

| Jerry N. Peralta | 30,000 | .009 | 30,000 | - | - |

| Locita N. Perlata | 30,000 | .009 | 30,000 | - | - |

| Leonora V. Porsueto | 35,000 | .011 | 35,000 | - | - |

| Jonell N. Ramin | 25,000 | .008 | 25,000 | - | - |

| Joaquino Orlando Savandal | 15,000 | .004 | 15,000 | - | - |

| Ronnie E. Tejida | 40,000 | .013 | 40,000 | - | - |

| Dexter R. Caliso | 1,200,000 | .378 | 120,000 | 1,080,000 | .339 |

| Presentaction A. Coranes | 800,000 | .253 | 80,000 | 720,000 | .225 |

| | | | | | |

Total | 3,190,000 | 1.000 | 1,390,000 | 1,800,000 | .564 |

(1) These figures assume all shares offered by selling security holders are in fact sold.

(2) Dexter Caliso is our President, Principal Executive Officer and a Director.

(3) Presentacion Coranes is our Secretary Treasurer, Principal Financial Officer and a Director.

Other than Dexter Caliso and Presentacion, the selling shareholders have not held any position or office or had any material relationship with Plata within the time since its inception. The selling shareholders possess sole voting and investment power with respect to the shares shown above, and except as provided above, no selling shareholder is a broker-dealer, or an affiliate of a broker-dealer.

UNIT 8. PLAN OF DISTRIBUTION

Each of our selling shareholders may, from time to time, sell any or all of their shares of common stock on the OTCBB, if and when Plata’s shares are quoted thereon, or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling shareholder may use any one or more of the following methods when selling shares:

| ▪ | | Ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ▪ | | Block trades in which the broker-dealer will attempt to sell shares as agent but may position and resell blocks as principal to facilitate the transaction; |

| ▪ | | Purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ▪ | | An exchange distribution in accordance with the rules of applicable exchange; |

| ▪ | | Privately negotiated transactions; |

| ▪ | | A combination of any such method of sale; or |

| ▪ | | Any other method permitted pursuant to applicable law. |

We have advised the selling shareholders that while they are engaged in a distribution of the shares included in this registration statement they are required to comply with Regulation M promulgated under the Securities Exchange Act of 1934, as amended. With certain exceptions, Regulation M precludes the selling shareholders, any affiliated purchasers, and any broker-dealer or other person who participates in such distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered in this prospectus.

Selling shareholders may also elect to sell their common shares in accordance with Rule 144 under the Securities Act of 1933, rather than pursuant to this prospectus if permitted. After the sale of the shares offered by this registration statement our two senior officer and directors, Dexter Caliso and Presentacion Coranes, will hold directly an aggregate total of 1,800,000 shares. The sale of these shares could have an adverse impact on the price of our shares or on any trading market that may develop.

We have not registered or qualified offers and sales of shares of common stock under the laws of any country, other than the United States. To comply with certain states’ securities laws, if applicable, the selling shareholders will offer and sell their shares of common stock in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the selling may not offer or sell shares of common stock unless we have registered or qualified such shares for sale in such states or we have complied with an available exemption from registration or qualification.

All expenses of this registration statement, estimated to be $16,957. (See “Use of Proceeds” page 11), including but not limited to legal, accounting, printing and mailing fees will, be paid by Plata. However, any selling costs or brokerage commissions incurred by each selling shareholders relating to the sale of his/her shares will be paid by them.

ITEM 9. LEGAL PROCEEDINGS

Plata is not a party to any pending litigation and none is contemplated or threatened; nor is the Bontoc Claim subject to any pending litigation or liens.

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS |

Each of our directors serves until his or her successor is elected and qualified. Each of our officers is elected by the Board of Directors to a term of one (1) year and serves until his or her successor is duly elected and qualified, or until he or she is removed from office. The Board of Director has no nominating or compensation committees.

The name, address, age and position of our present officers and directors are set forth below:

| Name and Address | Age | Positions |

| | | |

Dexter R. Caliso 658 Pasay Blvd. Pasig City 1300, Philippines | 33 | Chief Executive Officer and President |

| | | |

Presentaction A. Coranes 2432 M. Dela Cruz Street, Pasay City, Philippines | 29 | Chief Financial Officer, Chief Accounting Officer, Secretary Treasurer |

Both Dexter Caliso and Presentaction Coranes have held their offices/positions since inception of Plata and are expected to hold their offices/positions until the first annual meeting of our shareholders.

Background of Officers and Directors

Dexter Caliso

Dexter Caliso attended and attained a High School Diploma from Our Lady of Sorrows Secondary School in 1991. Between 1991 and 1995 he attended PATT College Aeronautics and obtained a Bachelor of Science degree in Aircraft Technology. After graduation in 1995 and until 1999, he was employed by Philippines Airlines in Manila where he supervised night crews for maintenance of all Beoing 747-400 aircrift owned by Philippine Airlines. From 1999 to 2001 he was employed by Singapore Airlines in Manila as 2nd Aircraft Mechanic and was responsible for instruction of junior mechanics as to the repair and maintenance of aircraft. Between 2001 and 2004 he was employed by Emirates Airlines in Manila as Supervising Aircraft Mechanic and was the supervisor of all maintenance personal in his department which resulted in Dexter being promoted to Chief Supervising Aircraft Mechanic. After 2004, until the present time, he was employed with Cathy Pacific Airline in Manila as Department Head of Maintenance Operations and was responsible for managing a staff of 30 aircraft mechanics. During this time he was responsible for implementing all new security and safety measures for all incoming Cathy Pacific Aircraft in Manila. While working for Cathy Pacific he attended and obtained a Certificate of Completion from the Bureau of Mines and Geoscience in Aerial Mapping and Surveying.

Presentacion Coranes

Presentacion Coranes graduated and received a diploma from Pedro Diaz High School in 1995 before attending AMA Computer College where she graduated with diplomas in bookkeeping and accounting. In 2000 Presentacion attended the University of the Far East and earned a diploma in Advanced Audit Procedures qualifying her to do full audit procedures of both private and public companies in the Philippines. While attending AMA Computer College, she worked for Zamperla Asia Pacific in Manila, Philippines and was responsible for handling the payroll for the entire company. In 1999, while attending the University of the Far East, Presentacion was employed by Philippines Long Distance Telecommunication Co. and was responsible for accounts receivable, collections and worked part time in the internal audit department where she assisted with filing with the Securities Exchange Commission of the Philippines. After graduating from the University of the Far East, she became employed with UCPB Insurance where she was solely responsible for auditing the accounts receivable department and assisting in the filings with the Securities Exchange Commission of the Philippines. In 2004 she joined the firm of JV & Sons Corp. as Audit Co-ordinator and was responsible for compiling audit reports for management and preparing filing documents for submission to the Securities Exchange Commission of the Philippines. Since 2005 she has been employed with Mary Kel Company as Department Head of the Collections Department where Presentacion is responsible of conducting the audits of the company and overseeing a staff of 10 people. In addition, she is the signing officer on the full and final version of the audit that is filed with the relevant tax authorities and the Securities Exchange Commission of the Philippines.

None of our officers and directors work full time for our company. Dexter Caliso spends approximately 4 to 5 hours a week on administrative and accounting matters. With recent preparation of this registration statement and because the Company intends to seek a quotation on the OTCBB in the near future Dexter Caliso’s time on Plata’s affairs is expected to continue at this pace for the foreseeable future. As Secretary Treasurer, Presentacion Coranes spends approximately 4 to 5 week per month on corporate matters.

None of our directors is an officer or director of a company registered under the Securities and Exchange Act of 1934.

Board of Directors Audit Committee

Below is a description of the Audit Committee of the Board of Directors. The Audit Committee Charter of Plata sets forth the responsibilities of the Audit Committee. The primary function of the Audit Committee is to oversee and monitor the Company’s accounting and reporting processes and the audits of the Company’s financial statements.

Our Audit Committee is comprised of Dexter Caliso, our President and Chairman of the audit committee, and Presentaction Coranes our Chief Financial Officer and Secretary Treasurer neither of whom are independent. Only Presentacion Coranes can be considered an “audit committee financial expert” as defined in Item 401 of Regulation S-B based on her prior training and present occupation.

Apart from the Audit Committee, the Company has no other Board committees.

Since inception on July 17, 2007, our Board has conducted its business entirely by consent resolutions and has not met, as such. Our Audit Committee has held one meeting.

Conflicts of Interest

None of our officers and directors is a director or officer of any other company involved in the mining industry. However there can be no assurance such involvement in other companies in the mining industry will not occur in the future. Such potential future involvement could create a conflict of interest.

To ensure that potential conflicts of interest are avoided or declared, the Board of Directors adopted, on July 20, 2007, a Code of Business Ethics and Control for the Board of Directors (the “Code”). Plata’s Code embodies our commitment to such ethical principles and sets forth the responsibilities of Plata and its officers and directors to its shareholders, employees, customers, lenders and other organizations. Our Code addresses general business ethical principles and other relevant issues.

Significant Employees

We have no paid employees as such. Our Officers and Directors fulfill many functions that would otherwise require Plata to hire employees or outside consultants. We anticipate engaging the services of workers to assist in the exploration of the Bontoc Claim. Due to neither of our directors being a trained geologist, other than Dexter Caliso having a diploma in aerial mapping and surveying, Plata will use the services of Geraldo Peralta if he is available when needed. We expect to engage a field worker(s) later this year to assist in conduct the Phase I exploration work to undertaken on the Bontoc claim by the end of 2008. Any field workers we engage will not be considered employees either on a full time or part time basis. This is because our exploration programs will not last more than a few weeks and once completed these individuals will no longer be required to fulfill such functions.

Family Relationships

Our President and our Chief Financial Officer and Secretary Treasurer are unrelated.

Involvement in Certain Legal Proceedings

To the knowledge of the Plata, during the past five years, none of our directors or executive officers:

| (1) | has filed a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent or similar officer appointed by the court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filings; |

| (2) | was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| (3) | was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting, the following activities: |

(i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliate person, director or employee of any investment company, or engaging in or continuing any conduct or practice in connection with such activity;

(ii) engaging in any type of business practice; or

(iii) engaging in any activities in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodities laws;

| (4) | was the subject of any order, judgment, or decree, not subsequently reversed, suspended, or vacated, of any federal or state authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described above under this Item, or to be associated with persons engaged in any such activities; |

| (5) | was found by a court of competent jurisdiction in a civil action or by the SEC to have violated any federal or state securities law, and the judgment in such civil action or finding by the SEC has not been subsequently reversed, suspended, or vacated. |

| (6) | was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated. |

| ITEM 11. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

The following table sets forth information regarding the beneficial ownership of shares of Plata's common stock as of March 26, 2008 (3,190,000 shares issued and outstanding) by (1) all shareholders known to Plata to be beneficial owners of more than 5 percent of the outstanding common stock; and (2) all directors and executive officers of the Company, individually and collectively as a group. The table also reflects such ownership assuming the maximum shares qualified under this registration statement is sold by them.

Title or Class of Share | Name and address of Beneficial Owner (1) | Beneficially Owed Before Selling (2) | % | Beneficially Owned After Selling (3) | % |

| | | | | | |

| Common | Dexter R. Caliso 658 Pasay Blvd., Pasig City, 1300, Philippines | 1,200,000 | 37.8 | 1,080,000 | 33.9 |

| | | | | | |

| Common | Presentacion A. Coranes 2432 M. Dela Cruz Street, Pasay City, Philippines | 800,000 | 25.3 | 720,000 | 22.5 |

| | | | | | |

| Common | Ownership of all directors and officers | 2,000,000 | 63.1 | 1,800,000 | 56.4 |

| (1) | | As of March 26, 2007, there were 3,910,000 common shares issued and outstanding. Unless otherwise noted, the security ownership disclosed in this table is of record and beneficial. |

| | | |

| (2) | | Under Rule 13-d under the Exchange Act, shares not outstanding but subject to options, warrants, rights, conversion privileges pursuant to which such shares may be acquired in the next 60 days are deemed to be outstanding for the purpose of computing the percentage of outstanding shares owned by the persons having such rights, but are not deemed outstanding for the purpose of computing the percentage for such other persons. |

| | | |

| (3) | | These shares are restricted since they were issued in compliance with exemptions from registration provided by Section 4(2) of the Securities Act of 1933, as amended. After these shares have been held for one year the Dexter Caliso and Presentacion Coranes could sell 1% of the outstanding shares in Plata every three months. Therefore, these shares can be sold after the expiration of one year in compliance with provisions of Rule 144. The share certificates bear “stock transfer” instructions imprinted on the stock certificates themselves which restricts their sale other than in compliance with Rule 144. |

Other than Dexter Caliso and Presentacion Coranes, Plata does not know of any other shareholder who has more than 5 percent of the issued shares.

This number of shares that could presently be sold under Rule 144 is 31,900; being the above noted shares held by Dexter Caliso and Presentacion Coranes.

Even with the sale of the shares held by Dexter Caliso and Presentacion Coranes are qualified under registration statement they will retain voting control over the number of shares issued and outstanding.

There are no voting trusts or similar arrangements known to Plata whereby voting power is held by another party not named herein. Plata knows of no trusts, proxies, power of attorney, pooling arrangements, direct or indirect, or any other contract arrangement or device with the purpose or effect of divesting such person or persons of beneficial ownership of Plata's common shares or preventing the vesting of such beneficial ownership.

Plata does not know of any arrangements, which might result in a change in control.

ITEM 12. DESCRIPTION OF SECURITIES

Our authorized capital consists of 750,000,000 shares of common stock, par value $0.001 per share, of which 3,190,000 shares are issued and outstanding.

The holders of our common stock are entitled to receive dividends as may be declared by our Board of Directors; are entitled to share ratably in all of our assets available for distribution upon winding up of the affairs of Plata; and are entitled to one non-cumulative vote per share on all matters on which shareholders may vote at all meetings of the shareholders.

The shareholders are not entitled to preference as to dividends or interest; preemptive rights to purchase in new issues of shares; preference upon liquidation; or any other special rights or preferences.

Non-cumulative Voting

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event the holders of the remaining shares will not be able to elect any of our directors. After this offering is completed assuming all the shares offered by our selling shareholders are sold, the shareholders, not including our officers and directors, will own 37 % of our outstanding shares.

Anti-Takeover Provisions

There are no Nevada anti-takeover provisions that may have the affect of delaying or preventing a change in control. Sections 78.378 through 78.3793 of the Nevada Revised Statutes relates to control share

acquisitions that may delay to make more difficult acquisitions or changes in our control, however, they only apply when we have 200 or more stockholders of record, at least 100 of whom have addresses in the state of Nevada appearing on our stock ledger and we do business in this state directly or through an affiliated corporation. Neither of the foregoing events seems likely to occur. Currently, we have no Nevada shareholders and since this offering will not be made in the state of Nevada, no shares will be sold to Nevada residents. Further, we do not do business in Nevada directly or through an affiliate corporation and we do not intend to do business in the state of Nevada in the future. Accordingly there are no anti-takeover provisions that have the affect of delaying or preventing a change in our control.

Dividend Policy

As of the date of this prospectus, Plata has not paid any cash dividends to stockholders. The declaration of any future cash dividends, if any, will be at the discretion of the Board of Directors and will depend on our earnings, if any, capital requirements and financial position, general economic conditions and other pertinent conditions. It is Plata’s present intention not to pay any cash dividends in the near future.

Transfer Agent

We have engaged the services of Action Stock Transfer Corporation, 7069 S. Highland Drive, Suite 300, Salt Lake City, UT., 84121 to act as transfer and registrar.

Market Information

At the present time, there is no established market price for our shares.

There are no shares that have been offered pursuant to or underlying an employee benefit plan. There are no shares of common stock that are subject to outstanding options, warrants or securities convertible into common stock of Plata.

Holders

Including its two officers and directors, Plata has 35 shareholders as at the date of this prospectus.

Certain Transactions

There have been no transactions, or proposed transactions, which have materially affected or will materially affect us in which any director, executive officer, or beneficial holder of more than 10% of the outstanding common stock, or any of their respective relatives, spouses, associates or affiliates has had or will have any direct or material indirect interest, except as follows:

On September 18, 2007 Plata issued to (i) our President, Chief Executive Officer and Director, Dexter Caliso, 1,200,000 shares at the price of $0.001 per share for total consideration of $1,200; and (ii) our Chief Financial Officer, Secretary-Treasurer and a Director, Presentacion Coranes, 800,000 shares at the price of $0.001 per share for total consideration of $800.

The shares issued to Mr. Caliso and Ms. Coranes were in consideration of their agreeing to take the initiative in developing and implementing the business plan of Plata, including, among other things, incorporated Plata, providing the initial capital to allow Plata to identify the Bontoc Claim in the Philippines and arrange for Geraldo Peralta to prepare a geological report thereon, identifying potential investors and arranging for the initial private placement to enable Plata to implement its business plan.

Available Information

We are subject to the informational requirements of the Securities Exchange Act of 1934 and, in accordance therewith, will be responsible upon the effectiveness of this registration statement to file reports, proxy statements and other information with the SEC. Our reports, proxy statements and other information filed pursuant to the Securities Exchange Act of 1934 may be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street N.W., Washington, DC, 20549, at prescribed rates. The public may obtain information on the operations of the Public Reference Room by calling SEC at 1-800-SEC-0330. In addition, the SEC maintains a Web site that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. The address of the SEC’s Web sit is http://www.sec.gov.

Plata has filed with the Commission a registration statement on Form S-1 under the Securities Act of 1933 with respect to the common stock being offered hereby. As permitted by the rules and regulations of the Commission, this prospectus does not contain all the information set forth in the registration statement and the exhibits and schedules thereto. For further information with respect to Plata and the common stock offered hereby, reference is made to the registration statement, and such exhibits and schedules. A copy of the registration statement, and the exhibits and schedules thereto, may be inspected without charge at the public reference facilities maintained by the Commission at the addresses set forth above, and copies of all or any part of the registration statement may be obtained from such offices upon payment of the fees prescribed by the Commission. In addition, the registration statement may be accessed at the Commission’s web site. Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete and, in each instance, reference is made to the copy of such contract or document filed as an exhibit to the registration statement, each such statement being qualified in all respects by such reference.

ITEM 13. INTEREST OF NAMED EXPERTS AND COUNSEL

No named expert or counsel referred to in this registration statement has any interest in our Company. No expert or counsel was hired on a contingent basis, will receive a direct or indirect interest in Plata or was a promoter, underwriter, voting trustee, director, officer or employee of, or for, our Company. An “expert” is a person who is named as preparing or certifying all or part of our registration statement or a report or valuation for use in connection with the registration statement. “Counsel” is any counsel named in this prospectus as having given an opinion on the validity of securities being registered or upon other legal matters concerning the registration or offering of securities.

Our financial statements of the period from inception to December 31, 2007 included in this prospectus have been audited by Madsen & Associates CPA’s Inc., Unit #3 – 684 East Vine Street, Murray, Utah, 84107 as set forth in their report included in this prospectus. Their report is given upon their authority as experts in accounting and legal.

Our geological report was prepared by Geraldo Peralta, Professional Engineer,101 Boni Serrano Avenue, Quezon City, Philippines, who is independent of Plata and his report is used in this prospectus upon his authority as an expert in geology.

The legal opinion rendered by Lawler & Associates, Attorney at Law, 29377 Rancho California road, Suite 204, Temecula, California, 92591 regarding the Common Stock of Plata registered on prospectus is as set forth in his opinion letter dated January 28, 2008.

| ITEM 14. | DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LEGISLATION |

Under our Articles of Incorporation and Bylaws of Plata, we may indemnify an officer or director who is made a party to any proceeding, including a law suit, because of his or her position, if he or she acts in good faith and in a manner he reasonably believed to be in Plata’s best interest. We may advance expense incurred in defending a proceeding. To the extent that the officer or director is successful on the merits in a proceeding as to which he or she is to be indemnified, Plata must indemnify him against all expenses incurred, including attorney’s fees. With respect to a derivation action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceedings, and if the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors and officers under Nevada law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

ITEM 15. ORGANIZATION WITHIN THE LAST FIVE YEARS

Plata was incorporated on July 17, 2007 under the laws of the State of Nevada. The Company was incorporated upon the instructions of Dexter Caliso who became a Director along with Presentacion Coranes on July 18, 2007. On the same day, the Board of Directors appointed Dexter Caliso as Chief Executive Officer and President and Presentacion Coranes as Chief Financial Officer, Chief Executive Officer and Secretary Treasurer of Plata. The above noted directors and officers of Plata own shares of common stock of the Company pursuant to the transaction described in Item 19 - Certain Relationships and Related Transactions.

ITEM 16. DESCRIPTION OF BUSINESS

Plata was incorporated under the laws of the State of Nevada on July 17, 2007 under the name of Plata Resources, Inc. We are a pre-exploration company since we have not yet, and may never, reach the development or production stage. We have not undertaken any exploration work on our sole property, the Bontoc Claim located in the Philippines. Our Company intends to engage in the exploratory search for mineral deposits or reserves and there is no assurance that mineralized material with any commercial value exits on our Bontoc Claim.

We do not have any ore body and have not generated any revenues from our operations.

We maintain our statutory registered agent's office at 2050 Russett Way, Carson City, Nevada, 89703 and our business office is located at 2911 Park Avenue, Pasay City, Metro Manila, Philippines. Our telephone number is (632) 886-788.

.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause our plans to change.

On August 1, 2007, we purchased the Bontoc Claim for $5,000 from Castillo Explorations LLC, an unrelated company incorporate in the Republic of the Philippines, whereby we obtained a 100% interest in the Bontoc Claim. The Bontoc Claim upon purchase was free and clear of any and all charges, encumbrances, or liens of any nature of kind whatsoever. There is no requirement under Philippine mineral law to spend any money on the Bontoc Claim to maintain our interest therein. Nevertheless, it is the intention of Plata to undertake an exploration program during 2008 as set forth by Geraldo Peralta in his geological report dated August 16, 2007 as more fully mentioned below.

We have no revenues, have achieved losses since inception, have no operations and rely upon the sale of our securities and loans from our officers and directors to fund operations.

As mentioned above the Bontoc Claim is unencumbered and there are no competitive conditions which affect the property. Further, there is no insurance covering the Bontoc Claim and we believe that no insurance is necessary since it is unimproved and contains no buildings or improvements.

To date we have not performed any work on the property. We are presently in the pre-exploration stage and we cannot guarantee that a commercially viable mineral deposit, a reserve, exists on Bontoc Claim until further exploration is done and a comprehensive evaluation concludes economic and legal feasibility.

There are no known environmental concerns or parks designated for any area contained within the Bontoc Claim. We have no plans to try and interest other companies in the Bontoc Claim if mineralization is found. If mineralization is found, we will try to develop it ourselves.

Bontoc Gold Claim

Upon acquiring the Bontoc Claim, Plata commissioned Geraldo Peralta, Professional Geolgoist, 101 Boni Serrano Avenue, Quezon City, Philippines to prepare a geological report on the Bontoc Claim and recommend an exploration program thereon. Mr. Peralta is a graduate of the University of Western Australia with a Bachelor of Science degree in Geology (1984) and a Masters of Science (1979) from the same University. He is a member of the Geological Society of the Philippines. He has worked for over 30 years as a Geologist. He has worked as a Geological Consultant for companies such as Altai Resources Inc., Mindanao Mining and Abralti Mining Ltd. and has consulted for several other companies around the world writing reports for their use and is therefore qualified to write our report and recommend the proposed exploration program and budget. In preparing the “Summary of Exploration on the Bontoc Property, Philippines” (“Summary”) dated August 16, 2007 Mr. Peralta visited the Bontoc on August 6 and 8 of 2007. At that time, he was able to interview field party personnel who were working near the Bontoc Claim. He has had no prior involvement with the Bontoc Claim and has read Instrument and Form 43-101 F1 prior to preparing the Summary so that it is in compliance with the requirements of Form 43-101 F1 as required by Philippine mining law.

The Summary recommends a two phased mineral exploration program consisting of air photo interpretation, geological mapping, geochemical soil sampling and geophysical surveying will enhance the targets for diamond drilling. This exploration program to evaluate the prospects of the Bontoc Claim, at a cost of $43,964 - PHP 1,786,500 is fully warranted to be spent.

Property

Plata has purchased a 100% interest in Bontoc Claim. Our claim consists of one – 9 unit claim block containing 102.5 hectares which have been staked and recorded with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of Philippines.

The Bontoc Claim was staked to cover gold zones within the claim boundaries, and we hope the mineralization is similar to the Ramos Gold Claim, which is located approximately 22 kilometers to the west of the Bontoc Claim, which produced in excess of 32 million ounces of gold and is currently being reactivated on a limited basis. Previous exploration work to investigate the mineral potential of the Bontoc Claim has outlined some favorable areas for continued exploration and development.

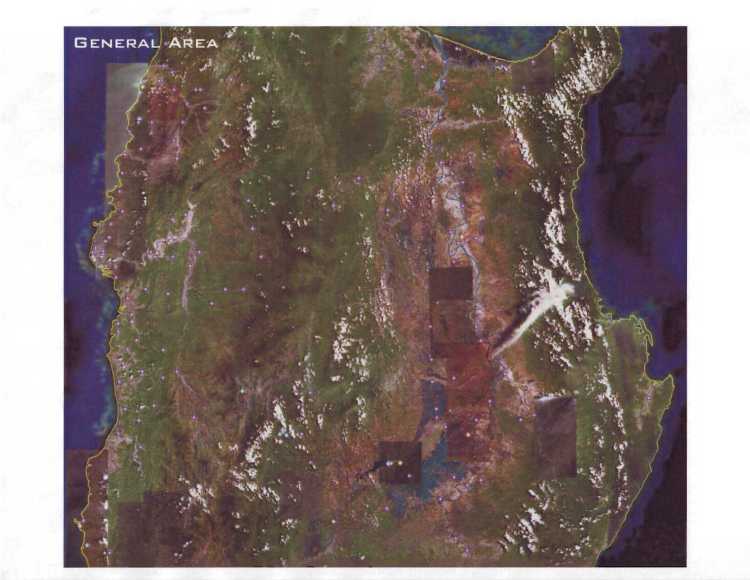

Description and Location

Bontoc Claim consists of 1 unpatented mineral claim, located 23 kilometers Southeast of the city of Bontoc at UTM co-ordinates Latitude 17°07’00”N and Longitude 120°58’00”E. The mineral claim was assigned to Plata by Castillo Explorations LLC and the said assignment was filed with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of the Philippines.

Plata has purchased a 100% interest in the property.

Accessibility, Climate, Local Resources, Infrastructure and Topography

Bontoc Gold Claim is accessible from city of Bontoc by traveling on the country’s only highway system which for the most part consists of one lane in each direction and by taking an all weather gravel road. The province is nestled deep in the Cordillera mountain range. Landlocked, it is bounded by the mountains of Benguet on the west and those of the Mountain Province in the north. The terrain is mountainous, sloping into gently rolling hills and plateaus. Its mountain ranges reach an elevation of 2,523 meter above sea level. V-shaped gullies, creeks, streams and U-shaped rivers drain through the valleys. It is the premier mining district. Some 80% of the total Philippine gold production comes from the Cordillera.

The Philippines is situated between 5 and 22 degrees North latitude. This means the country falls within the so-called tropical climate zone, a zone characterized by high temperatures the whole year round, relatively high rainfall and lush vegetation. Rainfall on the city can occur in every month, but the wettest months are October, November and December. Annual rainfall is approximately 1.5 meters. Due to the steep, deforested, mountains on average 60 percent of the rainwater runs off fast to the sea. The remaining 40 percent partly evaporates partly seeps through to the island’s underground water aquifier.

Bontoc has an experienced work force and will provide all the necessary services needed for an exploration and development operation, including police, hospitals, groceries, fuel, helicopter services, hardware and other necessary items. Drilling companies and assay facilities are present in Bontoc.

History

Deposits of shell and eroded sand formed the basis for the limestone, which makes up most of Philippines. This limestone was, over the ages, pushed upwards, making it possible to find today sea fossils high in the country’s mountains. This pushing up continues today. It is caused by the fact that the Philippine Plate, on which most of the country lies, is slowly diving under the Eurasian Plate of the mainland of Asia.

The Philippines is characterized by steep mountains without any substantial forest cover. Highest peaks reach over 1,000 meters. The island is 300 km long and 35 km wide. High, steep mountains, short distances and lack of forest cover mean that rainwater runs fast to the sea, causing substantial erosion.

The island has vast copper, gold and coal reserves which are mined mainly in the central part.

Numerous showings of mineralization have been discovered in the area and six prospects have achieved significant production, with the nearby Ramos Gold Mine (22 kilometers away) producing 185,000 ounces of Gold annually.

During the 1990’s several properties west of Bontoc Claim were drilled by junior mineral exploration companies.

Plata is preparing to conduct preliminary exploration work on its claim.

Regional Geology of the Area

The hilly terrains and the middle level plain contain crystalline hard rocks such as charnockites, granite gneiss, khondalites, leptynites, metamorphic gneisses with detached occurrences of crystalline limestone, iron ore, quartzo-feldspathic veins and basic intrusives such as dolerites and anorthosites. Coastal zones contain sedimentary limestones, clay, laterites, heavy mineral sands and silica sands. The hill ranges are sporadically capped with laterites and bauxites of residual nature. Gypsum and phosphatic nodules occur as sedimentary veins in rocks of the cretaceous age. Gypsum of secondary replacement occurs in some of the areas adjoining the foot hills of the Western Ghats. Lignite occurs as sedimentary beds of tertiary age. The Black Granite and other hard rocks are amenable for high polish. These granites occur in most of the districts except the coastal area.

Stratigraphy

The principal bedded rocks for the area of Bontoc Claim (and for most of the Philippines for that matter) are Precambrian rocks which are exposed along a wide axial zone of a broad complex.

Gold at the Ramos Gold Mine (which, as stated above, is in close proximity to the Bontoc claim) is generally concentrated within extrusive volcanic rocks in the walls of large volcanic caldera.

Intrusive

In general the volcanoes culminate with effluents of hydrothermal solutions that carry precious metals in the form of naked elements, oxides or sulphides.

These hydrothermal solutions intrude into the older rocks as quartz veins. These rocks may be broken due to mechanical and chemical weathering into sand size particles and carried by streams and channels. Gold occurs also in these sands as placers.

Recent exploration result for gold occurrence in Bontoc, Mountain Province is highly encouraging. Gold belt in sheared gneissic rocks is found in three subparallel auriferous load zones where some blocks having 250 to 500 metre length and 1.5 to 2 metre width could be identified as most promising ones.

Structure

(a) Depositional Environment/Geological Settings:

Veins form in high-grade, dynamothermal metamorphic environment where metasedimentary belts are invaded by igneous rocks.

(b) Host/Associated Rock Types:

Hosted by paragneisses, quartzites, clinopyroxenites, wollastonite-rich rocks, pegmatites. Other associated rocks are charnockites, granitic and intermediate intrusive rocks, quartz-mica schists, granulites, aplites, marbles, amphibolites, magnetite-graphite iron formations and anorthosites.

(c) Tectonic Setting(s):

Katazone (relatively deep, high-grade metamorphic environments associated with igneous activity; conditions that are common in the shield areas).

Deposit Types

Deposits are from a few millimetres to over a metre thick in places. Individual veins display a variety of forms, including saddle-, pod- or lens-shaped, tabular or irregular bodies; frequently forming anastomosing or stockwork patterns

Mineralization is located within a large fractured block created where prominent northwest-striking shears intersect the north striking caldera fault zone. The major lodes cover an area of 2 km and are mostly within 400m of the surface. Lodes occur in three main structural settings:

(i) steeply dipping northweststriking shears;

(ii) flatdipping (1040) fractures (flatmakes); and

(iii) shatter blocks between shears.

Most of the gold occurs in tellurides and there are also significant quantities of gold in pyrite.

Mineralization

No mineralization has been reported for the area of the property but structures and shear zones affiliated with mineralization on adjacent properties pass through it.

Exploration

Previous exploration work on the Bontoc Claim has not been recorded if it was ever done. Governmental records indicate that no detailed exploration has been completed on the property.

Property Geology

To the east of the property is intrusives consisting of rocks such as tonalite, monzonite, and gabbro while the property itself is underlain by sediments and volcanics. The intrusives also consist of a large mass of granodiorite towards the western most point of the property.

The area consists of interlayered chert, argillite and massive andesitic to basaltic volcanics. The volcanics are hornfelsed, commonly contain minor pyrite, pyrrhotite.

Drilling Summary

No drilling is reported on the Bontoc Claim.

Sample Method, Sample Preparation, Data Verification

All the exploration conducted to date has been conducted according to generally accepted exploration procedures with methods and preparation that are consistent with generally accepted exploration practices. No opinion as to the quality of the samples taken can be presented. No other procedures of quality control were employed.

Interpretation and Conclusions

The area is well known for numerous productive mineral occurrences including the Ramos Gold Claim.

The locale of the Bontoc Claim is underlain by the units of the Precambrian rocks that are found at those mineral occurrence sites.

These rocks consisting of cherts and argillites (sediments) and andesitic to basaltic volcanic have been intruded by granodiorite. Structures and mineralization probably related to this intrusion are found throughout the region and occur on the claim. They are associated with all the major mineral occurrences and deposits in the area.

Mineralization found on the claim is consistent with that found associated with zones of extensive mineralization. Past work however has been limited and sporadic and has not tested the potential of the property.

Potential for significant amounts of mineralization to be found exists on the property and it merits intensive exploration.

Recommendations

A two phased exploration program to further delineate the mineralized system currently recognized on Bontoc Claim is recommended.