Exhibit 99.2

Q4 2022 QUARTERLY SUPPLEMENTAL INFORMATION Broadstone Net Lease, Inc. (NYSE: BNL) is a Real Estate Investment Trust (REIT) that acquires, owns, and manages single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. www.broadstone.com

Table of Contents

| | |

Section | Page |

|

About the Data | 3 |

Company Overview | 4 |

Quarterly Financial Summary | 5 |

Balance Sheet | 6 |

Income Statement Summary | 7 |

Funds From Operations (FFO), Core Funds From Operations (Core FFO), and Adjusted Funds From Operations (AFFO) | 8 |

EBITDA, EBITDAre, and Other Non-GAAP Operating Measures | 9 |

Lease Revenues Detail | 10 |

Capital Structure | 11 |

Equity Rollforward | 12 |

Debt Outstanding | 13 |

Net Debt Metrics | 14 |

Covenants | 15 |

Debt Maturities | 16 |

Investment Activity | 17 |

Dispositions | 18 |

Portfolio at a Glance: Key Metrics | 19 |

Diversification: Tenants and Brands | 20-21 |

Diversification: Property Type | 22-23 |

Key Statistics by Property Type | 24 |

Diversification: Tenant Industry | 25 |

Diversification: Geography | 26 |

Lease Expirations | 27 |

Portfolio Occupancy | 28 |

Definitions and Explanations | 29-30 |

| |

| |

| |

| |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 2

About the Data

This data and other information described herein are as of and for the three months ended December 31, 2022 unless otherwise indicated. Future performance may not be consistent with past performance and is subject to change and inherent risks and uncertainties. This information should be read in conjunction with Broadstone Net Lease, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2022, including the financial statements and the management's discussion and analysis of financial condition and results of operations sections.

Forward Looking Statements

Information set forth herein contains forward-looking statements, which reflect our current views regarding our business, financial performance, growth prospects and strategies, market opportunities, and market trends. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify these forward-looking statements by the use of words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "could," "seeks," "approximately," "projects," "predicts," "intends," "plans," "estimates," "anticipates," or the negative version of these words or other comparable words. All of the forward-looking statements herein are subject to various risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results, performance, and achievements could differ materially from those expressed in or by the forward-looking statements and may be affected by a variety of risks and other factors. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from such forward-looking statements. These factors include, but are not limited to, risks and uncertainties related to general economic conditions, including but not limited to increases in the rate of inflation and/or interest rates, local real estate conditions, tenant financial health, and property acquisitions and the timing of these investments and acquisitions. These and other risks, assumptions, and uncertainties are described in our filings with the SEC, which are available on the SEC's website at www.sec.gov.

You are cautioned not to place undue reliance on any forward-looking statements included herein. All forward-looking statements are made as of the date of this document and the risk that actual results, performance, and achievements will differ materially from the expectations expressed or referenced herein will increase with the passage of time. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 3

Company Overview

As of February 22, 2023

Broadstone Net Lease, Inc. (NYSE:BNL) (the "Company," "BNL," "us," "our" and "we") is a real estate investment trust ("REIT") that acquires, owns, and manages primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. Since our inception, we have selectively invested in real estate across the industrial, healthcare, restaurant, retail, and office property types. We target properties with credit worthy tenants in industries characterized by positive business drivers and trends, where the properties are an integral part of the tenants' businesses and there are opportunities to secure long-term net leases. Through long-term net leases, our tenants are able to retain operational control of their strategically important locations, while allocating their debt and equity capital to fund core business operations rather than real estate ownership.

| | |

Executive Team Christopher J. Czarnecki Chief Executive Officer, President, and Director Ryan M. Albano Executive Vice President and Chief Financial Officer John D. Moragne Executive Vice President and Chief Operating Officer John D. Callan, Jr. Senior Vice President, General Counsel, and Secretary Michael B. Caruso Senior Vice President, Corporate Finance & Investor Relations Timothy D. Dieffenbacher Senior Vice President, Chief Accounting Officer, and Treasurer Kevin M. Fennell Senior Vice President, Capital Markets & Credit Risk Laurier James Lessard, Jr. Senior Vice President, Asset Management Jennie L. O'Brien Senior Vice President, Accounting & Controller Roderick A. Pickney Senior Vice President, Acquisitions Molly Kelly Wiegel Senior Vice President, Human Resources Andrea T. Wright Senior Vice President, Property Management | | Board of Directors Laurie A. Hawkes Chairman of the Board Christopher J. Czarnecki Chief Executive Officer and President Denise Brooks-Williams Michael A. Coke Jessica Duran Laura Felice David M. Jacobstein Shekar Narasimhan Geoffrey H. Rosenberger James H. Waters |

| |

Company Contact Information Michael Caruso

SVP, Corporate Finance & Investor Relations michael.caruso@broadstone.com 585-402-7842 Transfer Agent Computershare Trust Company, N.A. 150 Royall Street Canton, Massachusetts 02021 800-736-3001 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 4

Quarterly Financial Summary

(unaudited, dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | Q4 2022 | | | Q3 2022 | | | Q2 2022 | | | Q1 2022 | | | Q4 2021 | |

Financial Summary | | | | | | | | | | | | | | | |

Investment in rental property | | $ | 5,035,846 | | | $ | 4,775,460 | | | $ | 4,594,776 | | | $ | 4,431,929 | | | $ | 4,234,544 | |

Less accumulated depreciation | | | (533,965 | ) | | | (505,456 | ) | | | (479,952 | ) | | | (454,122 | ) | | | (430,141 | ) |

Investment in rental property, net | | | 4,501,881 | | | | 4,270,004 | | | | 4,114,824 | | | | 3,977,807 | | | | 3,804,403 | |

Cash and cash equivalents | | | 21,789 | | | | 75,912 | | | | 16,813 | | | | 54,103 | | | | 21,669 | |

Restricted cash | | | 38,251 | | | | 6,449 | | | | 12,163 | | | | 11,444 | | | | 6,100 | |

Total assets | | | 5,457,609 | | | | 5,239,192 | | | | 4,979,442 | | | | 4,852,520 | | | | 4,618,648 | |

Unsecured revolving credit facility | | | 197,322 | | | | 219,537 | | | | 320,657 | | | | 266,118 | | | | 102,000 | |

Mortgages, net | | | 86,602 | | | | 94,753 | | | | 95,453 | | | | 96,141 | | | | 96,846 | |

Unsecured term loans, net | | | 894,692 | | | | 894,378 | | | | 587,098 | | | | 586,884 | | | | 646,671 | |

Senior unsecured notes, net | | | 844,555 | | | | 844,367 | | | | 844,178 | | | | 843,990 | | | | 843,801 | |

Total liabilities | | | 2,195,104 | | | | 2,231,045 | | | | 2,012,800 | | | | 1,961,200 | | | | 1,877,510 | |

Total Broadstone Net Lease, Inc.

stockholders' equity | | | 3,092,918 | | | | 2,840,692 | | | | 2,798,690 | | | | 2,724,641 | | | | 2,577,292 | |

Total equity (book value) | | | 3,262,505 | | | | 3,008,147 | | | | 2,966,642 | | | | 2,891,320 | | | | 2,741,138 | |

| | | | | | | | | | | | | | | |

Revenues | | | 112,135 | | | | 103,524 | | | | 98,013 | | | | 93,841 | | | | 92,642 | |

General and administrative -

other | | | 7,814 | | | | 8,439 | | | | 7,907 | | | | 7,899 | | | | 7,501 | |

Stock based compensation | | | 1,503 | | | | 1,503 | | | | 1,381 | | | | 929 | | | | 1,025 | |

General and administrative | | | 9,317 | | | | 9,942 | | | | 9,288 | | | | 8,828 | | | | 8,526 | |

Total operating expenses | | | 61,320 | | | | 59,133 | | | | 50,875 | | | | 48,162 | | | | 46,649 | |

Interest expense | | | 23,773 | | | | 20,095 | | | | 17,888 | | | | 16,896 | | | | 16,997 | |

Net income | | | 36,773 | | | | 28,709 | | | | 35,552 | | | | 28,441 | | | | 32,226 | |

Net earnings per common share,

diluted | | $ | 0.20 | | | $ | 0.16 | | | $ | 0.20 | | | $ | 0.16 | | | $ | 0.19 | |

| | | | | | | | | | | | | | | |

FFO | | | 71,718 | | | | 72,169 | | | | 68,340 | | | | 61,504 | | | | 62,152 | |

FFO per share, diluted | | $ | 0.39 | | | $ | 0.39 | | | $ | 0.38 | | | $ | 0.35 | | | $ | 0.36 | |

Core FFO | | | 70,527 | | | | 66,677 | | | | 65,986 | | | | 64,076 | | | | 62,232 | |

Core FFO per share, diluted | | $ | 0.38 | | | $ | 0.36 | | | $ | 0.37 | | | $ | 0.37 | | | $ | 0.36 | |

AFFO | | | 65,585 | | | | 63,386 | | | | 62,804 | | | | 60,401 | | | | 58,692 | |

AFFO per share, diluted | | $ | 0.36 | | | $ | 0.35 | | | $ | 0.35 | | | $ | 0.35 | | | $ | 0.34 | |

| | | | | | | | | | | | | | | |

Net cash provided by operating

activities | | | 60,440 | | | | 77,515 | | | | 58,855 | | | | 59,104 | | | | 57,619 | |

Net cash used in investing

activities | | | (274,485 | ) | | | (205,187 | ) | | | (172,293 | ) | | | (207,678 | ) | | | (133,925 | ) |

Net cash provided by financing

activities | | | 191,724 | | | | 181,057 | | | | 76,867 | | | | 186,352 | | | | 83,998 | |

Distributions declared | | | 45,824 | | | | 46,242 | | | | 49,507 | | | | 48,115 | | | | 45,857 | |

Distributions declared per diluted

share | | $ | 0.275 | | | $ | 0.270 | | | $ | 0.270 | | | $ | 0.265 | | | $ | 0.265 | |

| | | | | | | | | | | | | | | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 5

Balance Sheet

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | | | March 31,

2022 | | | December 31,

2021 | |

Assets | | | | | | | | | | | | | | | |

Accounted for using the operating method: | | | | | | | | | | | | | | | |

Land | | $ | 768,667 | | | $ | 755,206 | | | $ | 731,208 | | | $ | 709,962 | | | $ | 655,374 | |

Land improvements | | | 340,385 | | | | 331,858 | | | | 320,513 | | | | 300,300 | | | | 295,329 | |

Buildings and improvements | | | 3,888,756 | | | | 3,650,275 | | | | 3,503,478 | | | | 3,381,990 | | | | 3,242,618 | |

Equipment | | | 10,422 | | | | 10,422 | | | | 10,422 | | | | 10,422 | | | | 11,870 | |

Total accounted for using the

operating method | | | 5,008,230 | | | | 4,747,761 | | | | 4,565,621 | | | | 4,402,674 | | | | 4,205,191 | |

Less accumulated depreciation | | | (533,965 | ) | | | (505,456 | ) | | | (479,952 | ) | | | (454,122 | ) | | | (430,141 | ) |

Accounted for using the

operating method, net | | | 4,474,265 | | | | 4,242,305 | | | | 4,085,669 | | | | 3,948,552 | | | | 3,775,050 | |

Accounted for using the direct

financing method | | | 27,045 | | | | 27,128 | | | | 28,584 | | | | 28,684 | | | | 28,782 | |

Accounted for using the sales-type

method | | | 571 | | | | 571 | | | | 571 | | | | 571 | | | | 571 | |

Investment in rental property, net | | | 4,501,881 | | | | 4,270,004 | | | | 4,114,824 | | | | 3,977,807 | | | | 3,804,403 | |

Cash and cash equivalents | | | 21,789 | | | | 75,912 | | | | 16,813 | | | | 54,103 | | | | 21,669 | |

Accrued rental income | | | 135,666 | | | | 129,579 | | | | 124,297 | | | | 120,117 | | | | 116,874 | |

Tenant and other receivables, net | | | 1,349 | | | | 791 | | | | 2,069 | | | | 1,160 | | | | 1,310 | |

Prepaid expenses and other assets | | | 49,661 | | | | 18,984 | | | | 22,916 | | | | 22,525 | | | | 17,275 | |

Interest rate swap, assets | | | 63,390 | | | | 66,602 | | | | 26,562 | | | | 8,944 | | | | — | |

Goodwill | | | 339,769 | | | | 339,769 | | | | 339,769 | | | | 339,769 | | | | 339,769 | |

Intangible lease assets, net | | | 329,585 | | | | 322,314 | | | | 316,119 | | | | 311,277 | | | | 303,642 | |

Debt issuance costs – unsecured

revolving credit facility, net | | | 6,013 | | | | 6,485 | | | | 6,956 | | | | 7,427 | | | | 4,065 | |

Leasing fees, net | | | 8,506 | | | | 8,752 | | | | 9,117 | | | | 9,391 | | | | 9,641 | |

Total assets | | $ | 5,457,609 | | | $ | 5,239,192 | | | $ | 4,979,442 | | | $ | 4,852,520 | | | $ | 4,618,648 | |

Liabilities and equity | | | | | | | | | | | | | | | |

Unsecured revolving credit facility | | $ | 197,322 | | | $ | 219,537 | | | $ | 320,657 | | | $ | 266,118 | | | $ | 102,000 | |

Mortgages, net | | | 86,602 | | | | 94,753 | | | | 95,453 | | | | 96,141 | | | | 96,846 | |

Unsecured term loans, net | | | 894,692 | | | | 894,378 | | | | 587,098 | | | | 586,884 | | | | 646,671 | |

Senior unsecured notes, net | | | 844,555 | | | | 844,367 | | | | 844,178 | | | | 843,990 | | | | 843,801 | |

Interest rate swap, liabilities | | | — | | | | — | | | | — | | | | 1,154 | | | | 27,171 | |

Accounts payable and other liabilities | | | 47,547 | | | | 52,594 | | | | 42,923 | | | | 40,611 | | | | 38,038 | |

Dividends payable | | | 54,460 | | | | 49,886 | | | | 49,541 | | | | 47,682 | | | | 45,914 | |

Accrued interest payable | | | 7,071 | | | | 10,559 | | | | 6,086 | | | | 9,845 | | | | 6,473 | |

Intangible lease liabilities, net | | | 62,855 | | | | 64,971 | | | | 66,864 | | | | 68,775 | | | | 70,596 | |

Total liabilities | | | 2,195,104 | | | | 2,231,045 | | | | 2,012,800 | | | | 1,961,200 | | | | 1,877,510 | |

Equity | | | | | | | | | | | | | | | |

Broadstone Net Lease, Inc.

stockholders' equity: | | | | | | | | | | | | | | | |

Preferred stock, $0.001 par value | | | — | | | | — | | | | — | | | | — | | | | — | |

Common stock, $0.00025 par value | | | 47 | | | | 43 | | | | 43 | | | | 42 | | | | 41 | |

Additional paid-in capital | | | 3,419,395 | | | | 3,148,075 | | | | 3,125,377 | | | | 3,056,560 | | | | 2,924,168 | |

Cumulative distributions in excess of

retained earnings | | | (386,049 | ) | | | (369,260 | ) | | | (350,127 | ) | | | (336,988 | ) | | | (318,476 | ) |

Accumulated other comprehensive

loss | | | 59,525 | | | | 61,834 | | | | 23,397 | | | | 5,027 | | | | (28,441 | ) |

Total Broadstone Net Lease, Inc.

stockholders’ equity | | | 3,092,918 | | | | 2,840,692 | | | | 2,798,690 | | | | 2,724,641 | | | | 2,577,292 | |

Non-controlling interests | | | 169,587 | | | | 167,455 | | | | 167,952 | | | | 166,679 | | | | 163,846 | |

Total equity | | | 3,262,505 | | | | 3,008,147 | | | | 2,966,642 | | | | 2,891,320 | | | | 2,741,138 | |

Total liabilities and equity | | $ | 5,457,609 | | | $ | 5,239,192 | | | $ | 4,979,442 | | | $ | 4,852,520 | | | $ | 4,618,648 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 6

Income Statement Summary

(unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | | | March 31,

2022 | | | December 31,

2021 | |

Revenues | | | | | | | | | | | | | | | |

Lease revenues, net | | $ | 112,135 | | | $ | 103,524 | | | $ | 98,013 | | | $ | 93,841 | | | $ | 92,642 | |

Operating expenses | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 45,606 | | | | 39,400 | | | | 35,511 | | | | 34,290 | | | | 33,476 | |

Property and operating

expense | | | 6,397 | | | | 5,636 | | | | 4,696 | | | | 5,044 | | | | 4,440 | |

General and administrative | | | 9,317 | | | | 9,942 | | | | 9,288 | | | | 8,828 | | | | 8,526 | |

Provision for impairment of

investment in rental

properties | | | — | | | | 4,155 | | | | 1,380 | | | | — | | | | 207 | |

Total operating expenses | | | 61,320 | | | | 59,133 | | | | 50,875 | | | | 48,162 | | | | 46,649 | |

Other (expenses) income | | | | | | | | | | | | | | | |

Interest income | | | 40 | | | | 4 | | | | — | | | | — | | | | 6 | |

Interest expense | | | (23,773 | ) | | | (20,095 | ) | | | (17,888 | ) | | | (16,896 | ) | | | (16,997 | ) |

Cost of debt extinguishment | | | (77 | ) | | | (231 | ) | | | — | | | | — | | | | — | |

Gain on sale of real estate | | | 10,625 | | | | 61 | | | | 4,071 | | | | 1,196 | | | | 3,732 | |

Income taxes | | | (106 | ) | | | (356 | ) | | | (401 | ) | | | (412 | ) | | | (457 | ) |

Other (expenses) income | | | (751 | ) | | | 4,935 | | | | 2,632 | | | | (1,126 | ) | | | (51 | ) |

Net income | | | 36,773 | | | | 28,709 | | | | 35,552 | | | | 28,441 | | | | 32,226 | |

Net income attributable to

non-controlling interests | | | (2,041 | ) | | | (1,600 | ) | | | (2,036 | ) | | | (1,683 | ) | | | (1,935 | ) |

Net income attributable to

Broadstone Net Lease, Inc. | | $ | 34,732 | | | $ | 27,109 | | | $ | 33,516 | | | $ | 26,758 | | | $ | 30,291 | |

| | | | | | | | | | | | | | | |

Weighted average number of common shares outstanding | |

Basic1 | | | 173,283 | | | | 172,578 | | | | 169,555 | | | | 163,809 | | | | 161,545 | |

Diluted1 | | | 183,592 | | | | 182,971 | | | | 180,256 | | | | 174,288 | | | | 172,094 | |

Net earnings per common share2 | | | | | | | |

Basic and diluted | | $ | 0.20 | | | $ | 0.16 | | | $ | 0.20 | | | $ | 0.16 | | | $ | 0.19 | |

1 Excludes 396,924, 395,441, 377,407, 370,539, and 373,678, weighted average shares of unvested restricted common stock for the three months ended December 31, 2022, September 30, 2022, June 30, 2022, March 31, 2022 and December 31, 2021.

2 Excludes $0.1 million from the numerator for the three months ended December 31, 2022, September 30, 2022, June 30, 2022, March 31, 2022, and December 31, 2021, related to dividends declared on shares of unvested restricted common stock.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 7

Funds From Operations (FFO), Core Funds From Operations (Core FFO), and Adjusted Funds From Operations (AFFO)

(unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | | | March 31,

2022 | | | December 31,

2021 | |

Net income | | $ | 36,773 | | | $ | 28,709 | | | $ | 35,552 | | | $ | 28,441 | | | $ | 32,226 | |

Real property depreciation and

amortization | | | 45,570 | | | | 39,366 | | | | 35,479 | | | | 34,259 | | | | 33,451 | |

Gain on sale of real estate | | | (10,625 | ) | | | (61 | ) | | | (4,071 | ) | | | (1,196 | ) | | | (3,732 | ) |

Provision for impairment of investment

in rental properties | | | — | | | | 4,155 | | | | 1,380 | | | | — | | | | 207 | |

FFO | | $ | 71,718 | | | $ | 72,169 | | | $ | 68,340 | | | $ | 61,504 | | | $ | 62,152 | |

Net write-offs of accrued rental income | | | — | | | | — | | | | — | | | | 1,326 | | | | — | |

Lease termination fee | | | (1,678 | ) | | | (791 | ) | | | — | | | | — | | | | — | |

Cost of debt extinguishment | | | 77 | | | | 231 | | | | — | | | | — | | | | — | |

Gain on insurance recoveries | | | (341 | ) | | | | | | | | | | | | |

Severance | | | — | | | | 3 | | | | 278 | | | | 120 | | | | 29 | |

Other expenses (income)1 | | | 751 | | | | (4,935 | ) | | | (2,632 | ) | | | 1,126 | | | | 51 | |

Core FFO | | $ | 70,527 | | | $ | 66,677 | | | $ | 65,986 | | | $ | 64,076 | | | $ | 62,232 | |

Straight-line rent adjustment | | | (6,825 | ) | | | (5,175 | ) | | | (4,965 | ) | | | (4,934 | ) | | | (5,321 | ) |

Adjustment to provision for credit

losses | | | — | | | | (4 | ) | | | (1 | ) | | | — | | | | (37 | ) |

Amortization of debt issuance costs | | | 988 | | | | 948 | | | | 900 | | | | 856 | | | | 1,022 | |

Amortization of net mortgage

premiums | | | (26 | ) | | | (26 | ) | | | (25 | ) | | | (27 | ) | | | (26 | ) |

Loss on interest rate swaps and

other non-cash interest expense | | | 522 | | | | 639 | | | | 695 | | | | 659 | | | | 696 | |

Amortization of lease intangibles | | | (1,308 | ) | | | (1,176 | ) | | | (1,167 | ) | | | (1,158 | ) | | | (899 | ) |

Stock-based compensation | | | 1,503 | | | | 1,503 | | | | 1,381 | | | | 929 | | | | 1,025 | |

Deferred taxes | | | 204 | | | | — | | | | — | | | | — | | | | — | |

AFFO | | $ | 65,585 | | | $ | 63,386 | | | $ | 62,804 | | | $ | 60,401 | | | $ | 58,692 | |

| | | | | | | | | | | | | | | |

Diluted weighted average shares

outstanding2 | | | 183,592 | | | | 182,971 | | | | 180,256 | | | | 174,288 | | | | 172,094 | |

Net earnings per diluted share3 | | $ | 0.20 | | | $ | 0.16 | | | $ | 0.20 | | | $ | 0.16 | | | $ | 0.19 | |

FFO per diluted share3 | | | 0.39 | | | | 0.39 | | | | 0.38 | | | | 0.35 | | | | 0.36 | |

Core FFO per diluted share3 | | | 0.38 | | | | 0.36 | | | | 0.37 | | | | 0.37 | | | | 0.36 | |

AFFO per diluted share3 | | | 0.36 | | | | 0.35 | | | | 0.35 | | | | 0.35 | | | | 0.34 | |

1 Amount includes $0.8 million, ($4.9) million, ($2.6) million and $1.1 million of unrealized and realized foreign exchange (gain) loss for the three months ended December 31,2022, September 30, 2022, June 30, 2022 and March 31, 2022, respectively, primarily associated with our Canadian dollar denominated revolver borrowings.

2 Excludes 396,924, 395,441, 377,407, 370,539, and 373,678, weighted average shares of unvested restricted common stock for the three months ended December 31, 2022, September 30, 2022, June 30, 2022, March 31, 2022,and December 31, 2021, respectively.

3 Excludes $0.1 million from the numerator for the three months ended December 31, 2022, September 30, 2022, June 30, 2022, March 31, 2022, and December 31, 2021, related to dividends declared on shares of unvested restricted common stock.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 8

EBITDA, EBITDAre, and Other-Non GAAP Operating Measures

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | | | March 31,

2022 | | | December 31,

2021 | |

Net income | | $ | 36,773 | | | $ | 28,709 | | | $ | 35,552 | | | $ | 28,441 | | | $ | 32,226 | |

Depreciation and amortization | | | 45,606 | | | | 39,400 | | | | 35,511 | | | | 34,290 | | | | 33,476 | |

Interest expense | | | 23,773 | | | | 20,095 | | | | 17,888 | | | | 16,896 | | | | 16,997 | |

Income taxes | | | 105 | | | | 356 | | | | 401 | | | | 412 | | | | 457 | |

EBITDA | | $ | 106,257 | | | $ | 88,560 | | | $ | 89,352 | | | $ | 80,039 | | | $ | 83,156 | |

Provision for impairment of investment in

rental properties | | | — | | | | 4,155 | | | | 1,380 | | | | — | | | | 207 | |

Gain on sale of real estate | | | (10,625 | ) | | | (61 | ) | | | (4,071 | ) | | | (1,196 | ) | | | (3,732 | ) |

EBITDAre | | $ | 95,632 | | | $ | 92,654 | | | $ | 86,661 | | | $ | 78,843 | | | $ | 79,631 | |

Adjustment for current quarter acquisition

activity 1 | | | 1,283 | | | | 2,358 | | | | 2,780 | | | | 3,225 | | | | 2,002 | |

Adjustment for current quarter disposition

activity 2 | | | (440 | ) | | | — | | | | (141 | ) | | | (79 | ) | | | (180 | ) |

Adjustment to exclude net write-offs of accrued

rental income | | | — | | | | — | | | | — | | | | 1,326 | | | | — | |

Adjustment to exclude gain on insurance recoveries | | | (341 | ) | | | — | | | | — | | | | — | | | | — | |

Adjustment to exclude realized / unrealized

foreign exchange (gain) loss | | | 796 | | | | (4,934 | ) | | | (2,632 | ) | | | 1,125 | | | | — | |

Adjustment to exclude cost of debt

extinguishments | | | 77 | | | | 231 | | | | — | | | | — | | | | — | |

Adjustment to exclude lease termination

fees | | | (1,678 | ) | | | (791 | ) | | | — | | | | — | | | | — | |

Adjusted EBITDAre | | $ | 95,329 | | | $ | 89,518 | �� | | $ | 86,668 | | | $ | 84,440 | | | $ | 81,453 | |

General and administrative | | | 9,318 | | | | 9,942 | | | | 9,288 | | | | 8,825 | | | | 8,523 | |

Adjusted Net Operating Income ("NOI") | | $ | 104,647 | | | $ | 99,460 | | | $ | 95,956 | | | $ | 93,265 | | | $ | 89,976 | |

Straight-line rental revenue, net | | | (7,315 | ) | | | (5,750 | ) | | | (5,616 | ) | | | (5,456 | ) | | | (5,611 | ) |

Other amortization and non-cash charges | | | (1,353 | ) | | | (1,177 | ) | | | (1,167 | ) | | | (1,157 | ) | | | (847 | ) |

Adjusted Cash NOI | | $ | 95,979 | | | $ | 92,533 | | | $ | 89,173 | | | $ | 86,652 | | | $ | 83,518 | |

Annualized EBITDAre | | $ | 382,528 | | | $ | 370,616 | | | $ | 346,642 | | | $ | 315,375 | | | $ | 318,526 | |

Annualized Adjusted EBITDAre | | | 381,315 | | | | 358,072 | | | | 346,672 | | | | 337,759 | | | | 325,812 | |

Annualized Adjusted NOI | | | 418,585 | | | | 397,834 | | | | 383,830 | | | | 373,060 | | | | 359,904 | |

Annualized Adjusted Cash NOI | | | 383,914 | | | | 370,128 | | | | 356,701 | | | | 346,606 | | | | 334,072 | |

1 Reflects an adjustment to give effect to all acquisition during the quarter as if they had been acquired as of the beginning of the quarter.

2 Reflects an adjustment to give effect to all dispositions during the quarter as if they had been sold as of the beginning of the quarter.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 9

Lease Revenues Detail

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | | | March 31,

2022 | | | December 31,

2021 | |

Contractual rental amounts billed for

operating leases | | $ | 96,208 | | | $ | 91,208 | | | $ | 87,505 | | | $ | 84,396 | | | $ | 81,482 | |

Adjustment to recognize contractual

operating lease billings on a straight-

line basis | | | 6,898 | | | | 5,344 | | | | 5,090 | | | | 5,021 | | | | 5,372 | |

Net write-offs of accrued rental income | | | — | | | | — | | | | — | | | | (1,326 | ) | | | — | |

Variable rental amounts earned | | | 721 | | | | 309 | | | | 291 | | | | 186 | | | | 433 | |

Earned income from direct financing

leases | | | 693 | | | | 719 | | | | 721 | | | | 723 | | | | 725 | |

Interest income from sales-type

leases | | | 15 | | | | 14 | | | | 15 | | | | 14 | | | | 15 | |

Operating expenses billed to tenants | | | 5,720 | | | | 5,061 | | | | 4,263 | | | | 4,735 | | | | 4,464 | |

Other income from real estate

transactions | | | 2,019 | | | | 874 | | | | 134 | | | | 42 | | | | 1 | |

Adjustment to revenue recognized for

uncollectible rental amounts billed, net | | | (139 | ) | | | (5 | ) | | | (6 | ) | | | 50 | | | | 150 | |

Total Lease revenues, net | | $ | 112,135 | | | $ | 103,524 | | | $ | 98,013 | | | $ | 93,841 | | | $ | 92,642 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 10

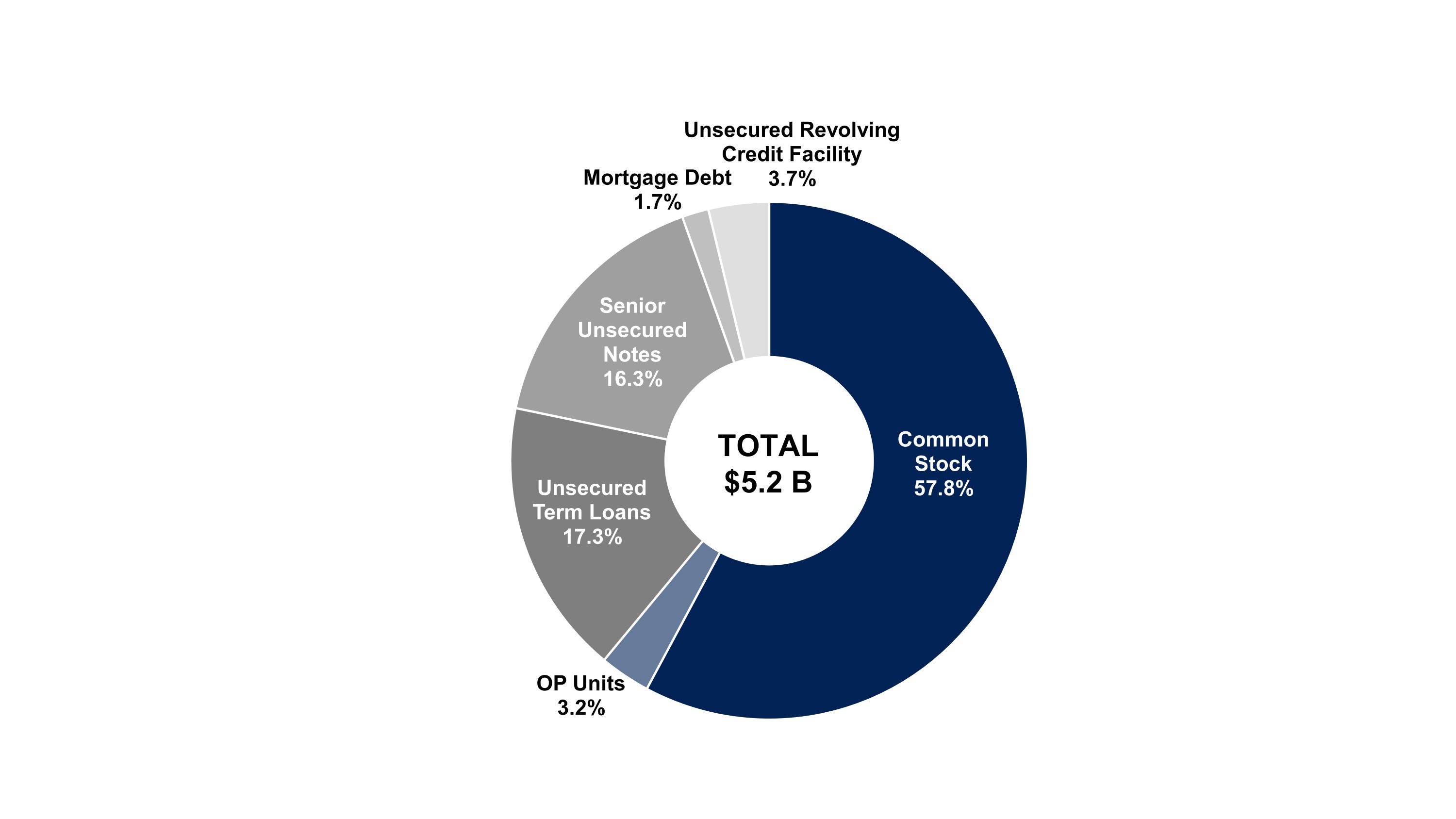

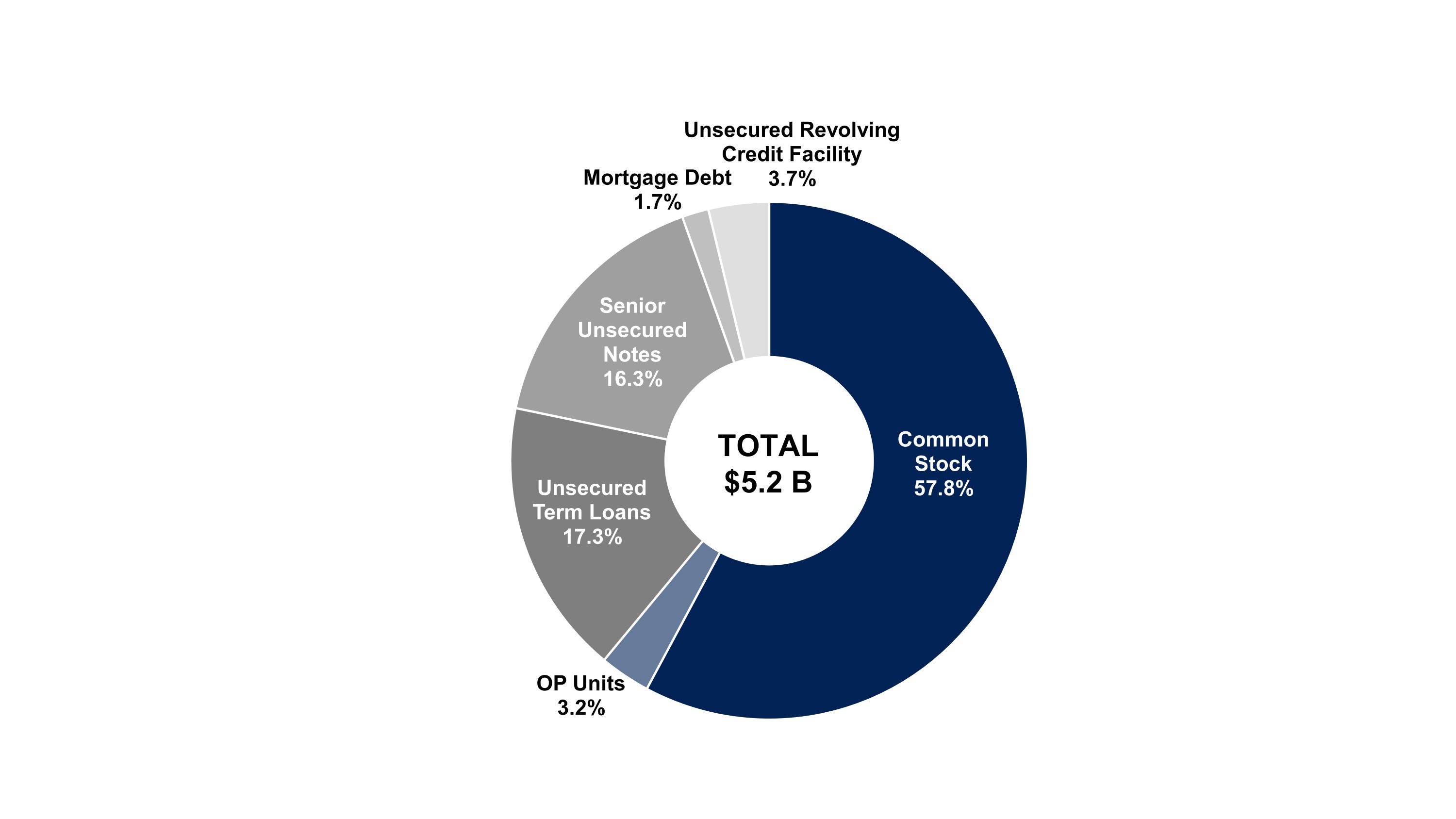

Capital Structure

(in thousands, except per share data)

| | | | |

EQUITY | | | |

Shares of Common Stock | | | 186,114 | |

OP Units | | | 10,205 | |

Common Stock & OP Units | | | 196,319 | |

Price Per Share / Unit at December 31, 2022 | | $ | 16.21 | |

IMPLIED EQUITY MARKET CAPITALIZATION | | $ | 3,182,331 | |

% of Total Capitalization | | | 61.0 | % |

DEBT | | | |

Unsecured Revolving Credit Facility - 2026 | | $ | 197,322 | |

Unsecured Term Loans | | | 900,000 | |

Unsecured Term Loan - 2026 | | | 400,000 | |

Unsecured Term Loan - 2027 | | | 200,000 | |

Unsecured Term Loan - 2029 | | | 300,000 | |

Senior Unsecured Notes | | | 850,000 | |

Senior Unsecured Notes - 2027 | | | 150,000 | |

Senior Unsecured Notes - 2028 | | | 225,000 | |

Senior Unsecured Notes - 2030 | | | 100,000 | |

Senior Unsecured Public Notes - 2031 | | | 375,000 | |

Mortgage Debt - Various | | | 86,754 | |

TOTAL DEBT | | $ | 2,034,076 | |

% of Total Capitalization | | | 39.0 | % |

% of Total Debt / Floating Rate Debt | | | 6.5 | % |

% of Total Debt / Fixed Rate Debt | | | 93.5 | % |

% of Total Debt / Secured Debt | | | 4.3 | % |

% of Total Debt / Unsecured Debt | | | 95.7 | % |

| | | |

Total Capitalization | | $ | 5,216,407 | |

Less: Cash and Cash Equivalents | | | (21,789 | ) |

Enterprise Value | | $ | 5,194,618 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 11

Equity Rollforward

(in thousands)

| | | | | | | | | | | | | | | | | |

| | | Shares of Common Stock | | | | OP Units | | | | Total Diluted Shares | |

Balance, January 1, 2022 | | | | 162,383 | | | | | 10,323 | | | | | 172,706 | |

ATM offerings | | | | 6,273 | | | | | — | | | | | 6,273 | |

Board of directors fees | | | | 12 | | | | | — | | | | | 12 | |

Grants of restricted stock awards | | | | 142 | | | | | — | | | | | 142 | |

Retirement of common shares | | | | (59 | ) | | | | — | | | | | (59 | ) |

Forfeiture of restricted stock awards | | | | (1 | ) | | | | — | | | | | (1 | ) |

Balance, March 31, 2022 | | | | 168,750 | | | | | 10,323 | | | | | 179,073 | |

ATM offerings | | | | 3,236 | | | | | — | | | | | 3,236 | |

Board of directors fees | | | | 13 | | | | | — | | | | | 13 | |

Grants of restricted stock awards | | | | 32 | | | | | — | | | | | 32 | |

Forfeiture of restricted stock awards | | | | (8 | ) | | | | — | | | | | (8 | ) |

Balance, June 30, 2022 | | | | 172,023 | | | | | 10,323 | | | | | 182,346 | |

ATM offerings | | | | 962 | | | | | — | | | | | 962 | |

OP Unit conversions | | | | 118 | | | | | (118 | ) | | | | — | |

Board of directors fees | | | | 7 | | | | | — | | | | | 7 | |

Grants of restricted stock awards | | | | 6 | | | | | — | | | | | 6 | |

Forfeiture of restricted stock awards | | | | (1 | ) | | | | — | | | | | (1 | ) |

Balance, September 30, 2022 | | | | 173,115 | | | | | 10,205 | | | | | 183,320 | |

Forfeiture of restricted stock awards | | | | (1 | ) | | | | — | | | | | (1 | ) |

Settlement of August 2022 forward equity offering | | | | 13,000 | | | | | — | | | | | 13,000 | |

Balance, December 31, 2022 | | | | 186,114 | | | — | | | 10,205 | | | — | | | 196,319 | |

Percentage ownership of OP at December 31, 2022 | | | 94.8 | % | | | | 5.2 | % | | | | 100 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 12

Debt Outstanding

(in thousands)

| | | | | | | | | | | | |

| | Outstanding Balance | | | | | |

| | December 31, | | | December 31, | | | | | |

| | 2022 | | | 2021 | | | Interest Rate | | Maturity Date |

Unsecured revolving credit facility | $ | 197,322 | | | $ | 102,000 | | | Applicable reference rate

+ 0.85%1 | | Mar. 2026 |

Unsecured term loans: | | | | | | | | | | |

2022 Unsecured Term Loan | | | — | | | | 60,000 | | | one-month LIBOR + 1.00% | | Feb. 2022 |

2024 Unsecured Term Loan | | — | | | | 190,000 | | | one-month LIBOR + 1.00% | | Jun. 2024 |

2026 Unsecured Term Loan | | | 400,000 | | | | 400,000 | | | one-month LIBOR + 1.00% | | Feb. 2026 |

2027 Unsecured Term Loan | | | 200,000 | | | | — | | | one-month adjusted SOFR + 0.95% | | Aug. 2027 |

2029 Unsecured Term Loan | | | 300,000 | | | | — | | | one-month adjusted SOFR + 1.25% | | Aug. 2029 |

Total unsecured term loans | | | 900,000 | | | | 650,000 | | | | | |

Unamortized debt issuance costs, net | | | (5,308 | ) | | | (3,329 | ) | | | | |

Total unsecured term loans, net | | | 894,692 | | | | 646,671 | | | | | |

Senior unsecured notes: | | | | | | | | | | |

2027 Senior Unsecured Notes - Series A | | 150,000 | | | | 150,000 | | | 4.84% | | Apr. 2027 |

2028 Senior Unsecured Notes - Series B | | 225,000 | | | | 225,000 | | | 5.09% | | Jul. 2028 |

2030 Senior Unsecured Notes - Series C | | 100,000 | | | | 100,000 | | | 5.19% | | Jul. 2030 |

2031 Senior Unsecured Public Notes | | | 375,000 | | | | 375,000 | | | 2.60% | | Sep. 2031 |

Total senior unsecured notes | | | 850,000 | | | | 850,000 | | | | | |

Unamortized debt issuance costs and

original issuance discount, net | | | (5,445 | ) | | | (6,199 | ) | | | | |

Total senior unsecured notes, net | | | 844,555 | | | | 843,801 | | | | | |

Total unsecured debt, net | | $ | 1,936,569 | | | $ | 1,592,472 | | | | | |

1 At December 31, 2022 a balance of $123.5 million was subject to the one-month SOFR. The remaining balance includes $100 million CAD borrowings remeasured to $73.8 million USD, which was subject to the one-month Canadian Dollar Offered Rate.

| | | | | | | | | | | | | | |

| | Origination | | Maturity | | | | | | | | |

| | Date | | Date | | Interest | | December 31, | | | December 31, | |

Lender | | (Month/Year) | | (Month/Year) | | Rate | | 2022 | | | 2021 | |

Wilmington Trust National Association | | Apr-19 | | Feb-28 | | 4.92% | | $ | 45,516 | | | $ | 46,760 | |

Wilmington Trust National Association | | Jun-18 | | Aug-25 | | 4.36% | | | 19,150 | | | | 19,557 | |

PNC Bank | | Oct-16 | | Nov-26 | | 3.62% | | | 16,675 | | | | 17,094 | |

Aegon | | Apr-12 | | Oct-23 | | 6.38% | | | 5,413 | | | | 6,249 | |

T2 Durham I, LLC | | Jul - 21 | | Jul -24 | | Greater of Prime + 1.25% or 5.00% | | | — | | | | 7,500 | |

Total mortgages | | | | | | | | | 86,754 | | | | 97,160 | |

Debt issuance costs, net | | | | | | | | | (152 | ) | | | (314 | ) |

Mortgages, net | | | | | | | | $ | 86,602 | | | $ | 96,846 | |

| | | | | | | | | | | | | | | | | | | | | | |

Year of Maturity | | Term Loans | | | Revolving Credit Facility | | | Senior Notes | | | Mortgages | | Interest

Expense | | Total | |

2023 | | $ | — | | | $ | — | | | $ | — | | | $ | 7,582 | | $ | 79,171 | | $ | 86,753 | |

2024 | | | — | | | | — | | | | — | | | | 2,260 | | | 78,906 | | | 81,166 | |

2025 | | | — | | | | — | | | | — | | | | 20,195 | | | 80,686 | | | 100,881 | |

2026 | | | 400,000 | | | | 197,322 | | | | — | | | | 16,843 | | | 57,180 | | | 671,345 | |

2027 | | | 200,000 | | | | — | | | | 150,000 | | | | 1,596 | | | 42,401 | | | 393,997 | |

Thereafter | | | 300,000 | | | | — | | | | 700,000 | | | | 38,278 | | | 64,255 | | | 1,102,533 | |

Total | | $ | 900,000 | | | $ | 197,322 | | | $ | 850,000 | | | $ | 86,754 | | $ | 402,599 | | $ | 2,436,675 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 13

Net Debt Metrics

(in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | | | March 31,

2022 | | | December 31,

2021 | |

Debt | | | | | | | | | | | | | | | |

Unsecured revolving credit facility | | $ | 197,322 | | | $ | 219,537 | | | $ | 320,657 | | | $ | 266,118 | | | $ | 102,000 | |

Unsecured term loans, net | | | 894,692 | | | | 894,378 | | | | 587,098 | | | | 586,884 | | | | 646,671 | |

Senior unsecured notes, net | | | 844,555 | | | | 844,367 | | | | 844,178 | | | | 843,990 | | | | 843,801 | |

Mortgages, net | | | 86,602 | | | | 94,753 | | | | 95,453 | | | | 96,141 | | | | 96,846 | |

Debt issuance costs | | | 10,905 | | | | 11,498 | | | | 8,991 | | | | 9,419 | | | | 9,842 | |

Gross Debt | | | 2,034,076 | | | | 2,064,533 | | | | 1,856,377 | | | | 1,802,552 | | | | 1,699,160 | |

Cash and cash equivalents | | | (21,789 | ) | | | (75,912 | ) | | | (16,813 | ) | | | (54,103 | ) | | | (21,669 | ) |

Restricted cash | | | (38,251 | ) | | | (6,449 | ) | | | (12,163 | ) | | | (11,444 | ) | | | (6,100 | ) |

Net Debt | | $ | 1,974,036 | | | $ | 1,982,172 | | | $ | 1,827,401 | | | $ | 1,737,005 | | | $ | 1,671,391 | |

Anticipated proceeds from forward

equity agreement | | | — | | | | (270,732 | ) | | | — | | | | — | | | | — | |

Pro Forma Net Debt | | $ | 1,974,036 | | | $ | 1,711,440 | | | $ | 1,827,401 | | | $ | 1,737,005 | | | $ | 1,671,391 | |

| | | | | | | | | | | | | | | |

Net Debt to Annualized EBITDAre | | 5.2x | | | 5.3x | | | 5.3x | | | 5.5x | | | 5.3x | |

Net Debt to Annualized Adjusted

EBITDAre | | 5.2x | | | 5.5x | | | 5.3x | | | 5.1x | | | 5.1x | |

Pro Forma Net Debt to Annualized

Adjusted EBITDAre | | 5.2x | | | 4.8x | | | 5.3x | | | 5.1x | | | 5.1x | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 14

Covenants

The following is a summary of key financial covenants for the Company's revolving credit facility and unsecured term loans and senior unsecured notes. The covenants associated with the Revolving Credit Facility, Unsecured Term Loans with commercial banks, and the Series A-C Senior Unsecured Notes, are reported to the lenders via quarterly covenant reporting packages. The covenants associated with the 2031 Senior Unsecured Public Notes are not required to be reported externally to third parties, and are instead calculated in connection with borrowing activity and for financial reporting purposes only. These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show that as of December 31, 2022, the Company believes it is in compliance with the covenants.

| | | | | | | | | | | | | | |

Covenants | | Required | | Revolving Credit Facility and Unsecured Term Loans | | | Senior Unsecured

Notes Series

A, B, & C | | | 2031 Senior Unsecured Public Notes | |

Leverage ratio | | ≤ 0.60 to 1.00 | | | 0.34 | | | | 0.35 | | | Not Applicable | |

Secured indebtedness ratio | | ≤ 0.40 to 1.00 | | | 0.02 | | | | 0.01 | | | Not Applicable | |

Unencumbered coverage ratio | | ≥ 1.75 to 1.00 | | | 3.72 | | | Not Applicable | | | Not Applicable | |

Fixed charge coverage ratio | | ≥ 1.50 to 1.00 | | | 3.52 | | | | 3.52 | | | Not Applicable | |

Total unsecured indebtedness to

total unencumbered eligible

property value | | ≤ 0.60 to 1.00 | | | 0.36 | | | | 0.37 | | | Not Applicable | |

Dividends and other restricted

payments | | Only applicable

in case of default | | Not Applicable | | | Not Applicable | | | Not Applicable | |

Aggregate debt ratio | | ≤ 0.60 to 1.00 | | Not Applicable | | | Not Applicable | | | | 0.37 | |

Consolidated income available for

debt to annual debt service

charge | | ≥ 1.50 to 1.00 | | Not Applicable | | | Not Applicable | | | | 4.65 | |

Total unencumbered assets to

total unsecured debt | | ≥ 1.50 to 1.00 | | Not Applicable | | | Not Applicable | | | | 2.73 | |

Secured debt ratio | | ≤ 0.40 to 1.00 | | Not Applicable | | | Not Applicable | | | | 0.02 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 15

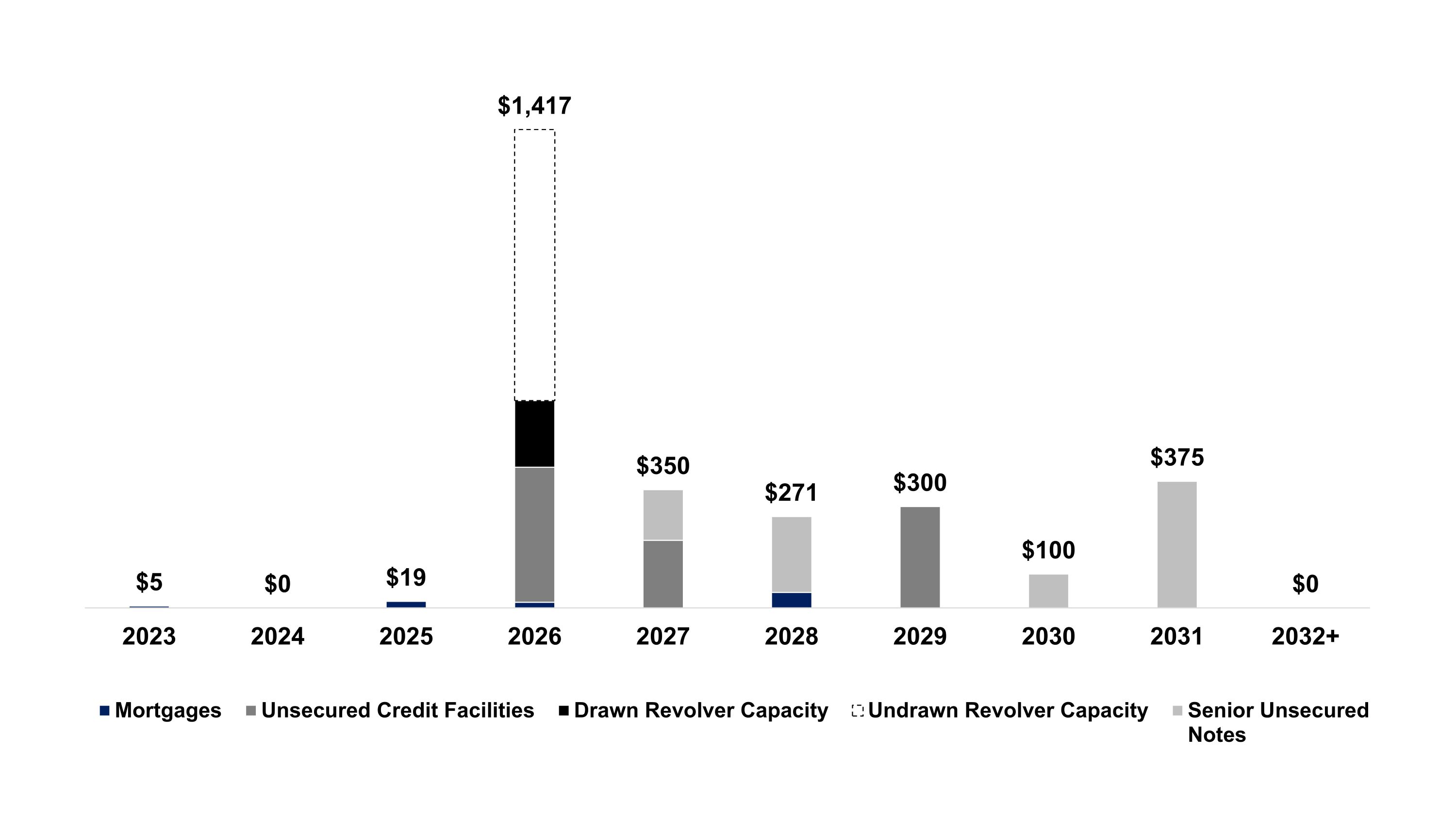

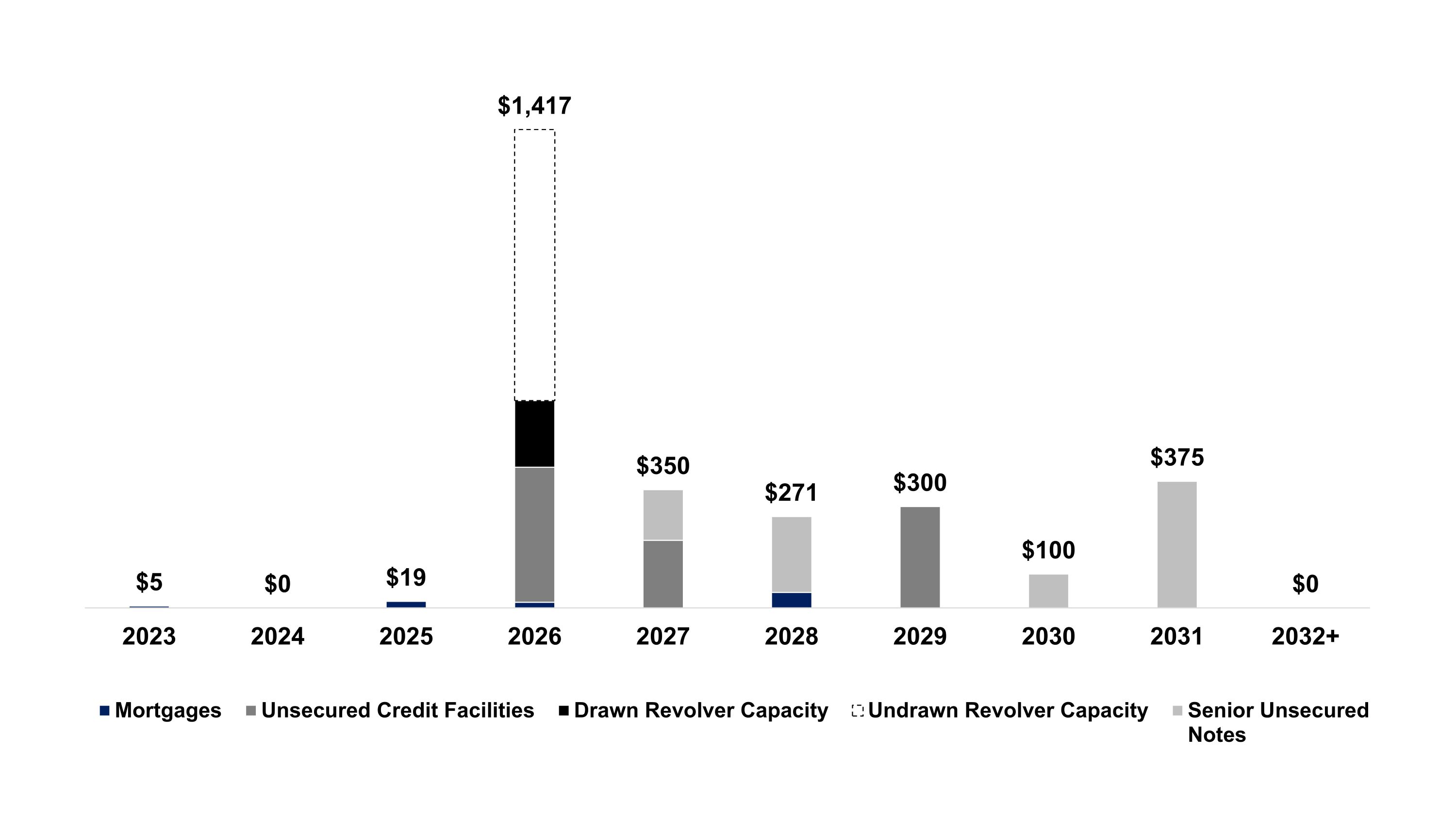

Debt Maturities

(dollars in millions)

The Company utilizes diversified sources of debt capital including unsecured bank debt, unsecured notes, and secured mortgages (where appropriate).

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 16

Investment Activity

(square feet and dollars in thousands)

The following tables summarize the Company's investment activity during 2022.

| | | | | | | | | | | | | | | | | | | | |

| | Q1 2022 | | | Q2 2022 | | | Q3 2022 | | | Q4 2022 | | | 2022 | |

Acquisitions: | | | | | | | | | | | | | | | |

Number of transactions | | | 6 | | | | 11 | | | | 8 | | | | 7 | | | | 32 | |

Number of properties | | | 27 | | | | 15 | | | | 27 | | | | 17 | | | | 86 | |

Square feet | | | 619 | | | | 1,514 | | | | 2,414 | | | | 2,678 | | | | 7,225 | |

Acquisition price | | $ | 209,973 | | | $ | 164,995 | | | $ | 203,926 | | | $ | 299,539 | | | $ | 878,433 | |

Initial cash cap rate | | | 5.7 | % | | | 6.5 | % | | | 6.5 | % | | | 6.7 | % | | | 6.4 | % |

Initial GAAP cap rate | | | 6.4 | % | | | 8.2 | % | | | 7.9 | % | | | 8.0 | % | | | 7.6 | % |

Weighted avg. lease term (years) | | | 19.3 | | | | 20.0 | | | | 20.9 | | | | 19.7 | | | | 20.3 | |

Weighted average annual rent increase | | | 1.5 | % | | | 2.2 | % | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % |

| | | | | | | | | | | | | | | |

Revenue generating capital expenditures: | | | | | | | | | | | | | | | |

Number of properties1 | | | - | | | | 1 | | | | 1 | | | | 1 | | | | 3 | |

Investments2 | | | - | | | $ | 17,387 | | | $ | 600 | | | $ | 10,754 | | | $ | 28,741 | |

Initial cash cap rate | | | - | | | | 5.8 | % | | | 8.1 | % | | | 6.8 | % | | | 5.9 | % |

Weighted avg. lease term (years) | | | - | | | | 19.3 | | | | 14.0 | | | | 18.8 | | | | 19.0 | |

Weighted average annual rent increase | | | - | | | | 1.8 | % | | | 3.5 | % | | | 1.8 | % | | | 1.8 | % |

| | | | | | | | | | | | | | | |

Total investments | | $ | 209,973 | | | $ | 182,382 | | | $ | 204,526 | | | $ | 310,293 | | | $ | 907,174 | |

Total initial cash cap rate | | | 5.7 | % | | | 6.4 | % | | | 6.5 | % | | | 6.7 | % | | | 6.4 | % |

Total weighted average lease term (years) | | | 19.3 | | | | 19.9 | | | | 20.8 | | | | 19.7 | | | | 20.3 | |

Total weighted average annual rent increase | | | 1.5 | % | | | 2.1 | % | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % |

1 Number of properties includes revenue generating capital expenditures on existing properties.

2 Total unfunded investment commitments at December 31, 2022 were $30.6 million

| | | | | | | | | | | | | | | | | | | | |

Q4 Acquisitions | | | | | | | | | | | | | | | |

Property Type | | Number of Properties | | | Square Feet | | | Weighted Average Lease Term (years) | | | Weighted Average Annual Rent Increase | | | Acquisition

Price | |

Industrial | | | 11 | | | | 2,629 | | | | 19.2 | | | | 2.0 | % | | $ | 281,389 | |

Retail | | | 5 | | | | 37 | | | | 16.0 | | | | 1.2 | % | | | 15,131 | |

Office | | | 1 | | | | 12 | | | | 20.1 | | | | 2.0 | % | | | 3,019 | |

Total Properties | | | 17 | | | | 2,678 | | | | 19.7 | | | | 2.0 | % | | $ | 299,539 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

2022 Acquisitions: | | | | | | | | | | | | | | | |

Property Type | | Number of Properties | | | Square Feet | | | Weighted Average Lease Term (years) | | | Weighted Average Annual Rent Increase | | | Acquisition

Price | |

Industrial | | | 40 | | | | 6,537 | | | | 21.4 | | | | 2.2 | % | | $ | 615,823 | |

Retail | | | 24 | | | | 472 | | | | 16.5 | | | | 1.5 | % | | | 125,495 | |

Restaurant | | | 19 | | | | 148 | | | | 19.6 | | | | 1.1 | % | | | 112,410 | |

Healthcare | | | 2 | | | | 56 | | | | 11.9 | | | | 2.6 | % | | | 21,686 | |

Office | | | 1 | | | | 12 | | | | 20.1 | | | | 2.0 | % | | | 3,019 | |

Total Properties | | | 86 | | | | 7,225 | | | | 20.3 | | | | 2.0 | % | | $ | 878,433 | |

| | | | | | | | | | | | | | | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 17

Dispositions

(square feet and dollars in thousands)

The following table summarizes the Company's property disposition activity during 2022.

| | | | | | | | | | | | | | | | | | | | |

Q1 2022 | | | | | | | | | | | | | | | |

Property Type | | Number of Properties | | | Square Feet | | | Acquisition Price | | | Disposition Price | | | Net Book

Value | |

Restaurant | | | 1 | | | | 8 | | | $ | 3,891 | | | | 5,212 | | | $ | 3,824 | |

Total Properties | | | 1 | | | | 8 | | | $ | 3,891 | | | $ | 5,212 | | | $ | 3,824 | |

Weighted average cash cap rate | | | | | | | | | | | | | 5.7 | % |

| | | | | | | | | | | | | | | |

Q2 2022 | | | | | | | | | | | | | | | |

Property Type | | Number of Properties | | | Square Feet | | | Acquisition Price | | | Disposition Price | | | Net Book

Value | |

Restaurant | | | 3 | | | | 13 | | | $ | 7,792 | | | $ | 11,889 | | | $ | 7,311 | |

Total Properties | | | 3 | | | | 13 | | | $ | 7,792 | | | $ | 11,889 | | | $ | 7,311 | |

Weighted average cash cap rate | | | | | | | | | | | | | 5.1 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Q3 2022 | | | | | | | | | | | | | | | |

Property Type | | Number of Properties | | | Square Feet | | | Acquisition Price | | | Disposition Price | | | Net Book

Value | |

Retail | | | 1 | | | | 34 | | | $ | 6,901 | | | $ | 1,650 | | | $ | 1,557 | |

Total Properties | | | 1 | | | | 34 | | | $ | 6,901 | | | $ | 1,650 | | | $ | 1,557 | |

Weighted average cash cap rate | | | | | | | | | | | | N/A1 | |

1 Property was vacant at the time of disposition. | |

| | | | | | | | | | | | | | | |

Q4 2022 | | | | | | | | | | | | | | | |

Property Type | | Number of Properties | | | Square Feet | | | Acquisition Price | | | Disposition Price | | | Net Book

Value | |

Industrial | | | 1 | | | | 314 | | | $ | 23,289 | | | $ | 30,565 | | | $ | 21,970 | |

Restaurant | | | 2 | | | | 13 | | | $ | 6,447 | | | $ | 8,631 | | | $ | 5,823 | |

Total Properties | | | 3 | | | | 327 | | | $ | 29,736 | | | $ | 39,196 | | | $ | 27,793 | |

Weighted average cash cap rate | | | | | | | | | | | | | 5.7 | % |

| |

| | | | | | | | | | | | | | | |

2022 | | | | | | | | | | | | | | | |

Property Type | | Number of Properties | | | Square Feet | | | Acquisition Price | | | Disposition Price | | | Net Book

Value | |

Industrial | | | 1 | | | | 314 | | | $ | 23,289 | | | $ | 30,565 | | | $ | 21,970 | |

Restaurant | | | 6 | | | | 34 | | | $ | 18,130 | | | $ | 25,732 | | | $ | 16,958 | |

Retail | | | 1 | | | | 34 | | | $ | 6,901 | | | $ | 1,650 | | | $ | 1,557 | |

Total Properties | | | 8 | | | | 382 | | | $ | 48,320 | | | $ | 57,947 | | | $ | 40,485 | |

Weighted average cash cap rate | | | | | | | | | | | | | 5.6 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 18

Portfolio at a Glance: Key Metrics

| | | | | | | | | | | | | | | | | | | |

| December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | | | March 31,

2022 | | | December 31,

2021 | |

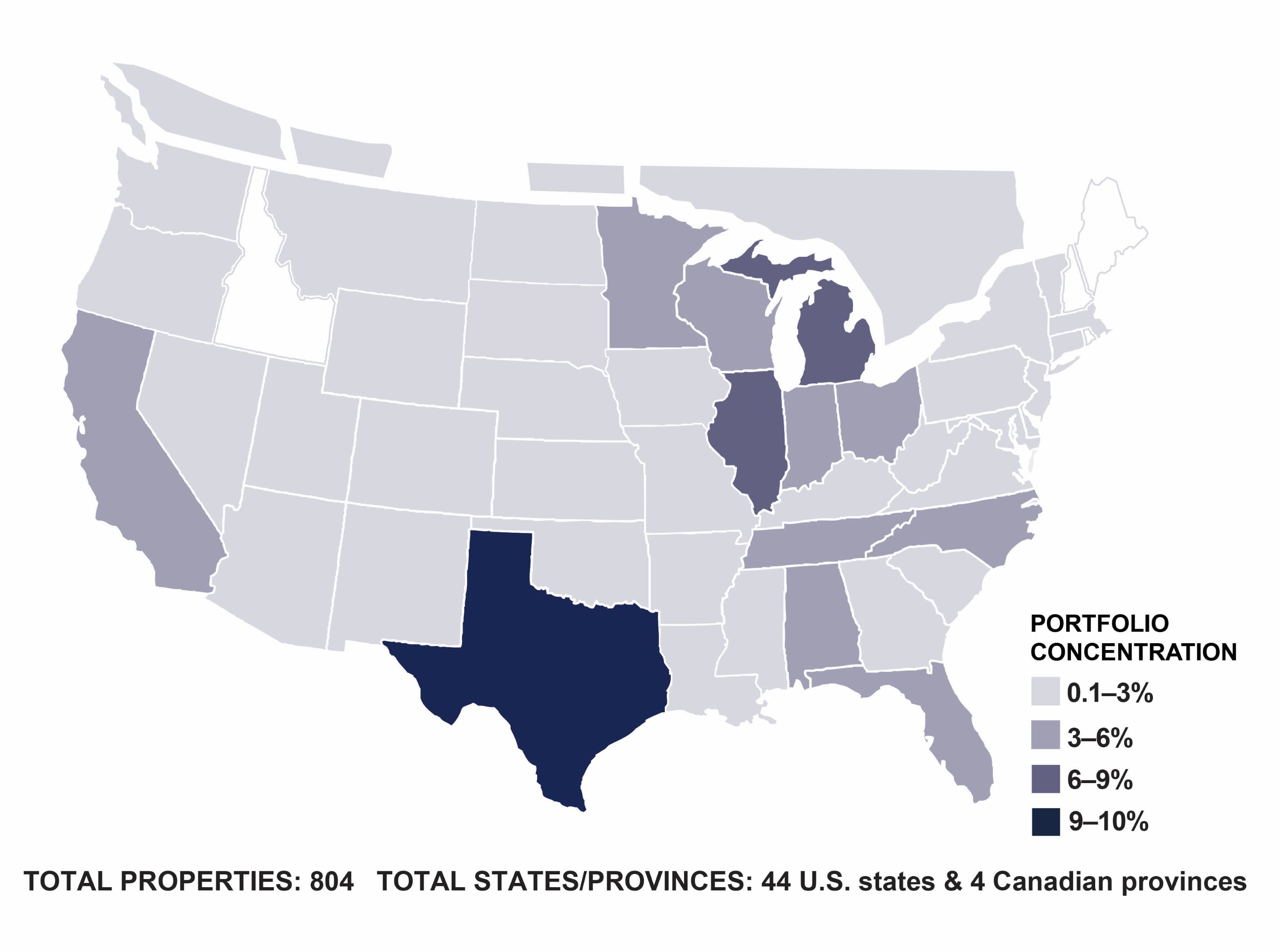

Properties | | 804 | | | | 790 | | | | 764 | | | | 752 | | | | 726 | |

U.S. States | | 44 | | | | 44 | | | | 44 | | | | 43 | | | | 42 | |

Canadian Provinces | | 4 | | | | 4 | | | | 4 | | | | 4 | | | | 1 | |

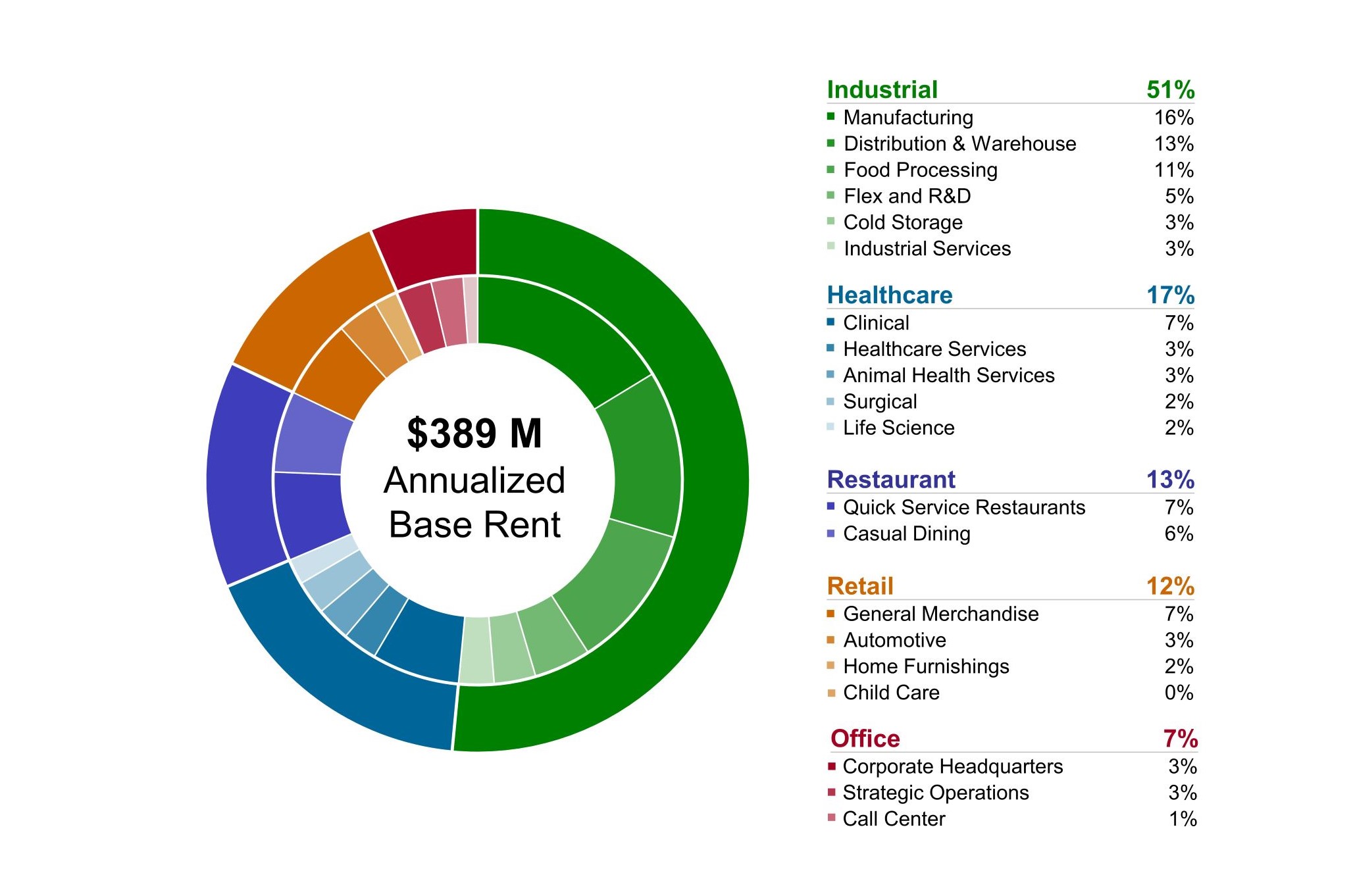

Total Annualized Base Rent | $389.1M | | | $371.9M | | | $360.0M | | | $347.7M | | | $334.1M | |

Total Rentable Sq. Footage | 39.1M | | | 36.8M | | | 34.4M | | | 32.8M | | | 32.2M | |

Tenants | | 221 | | | | 218 | | | | 213 | | | | 210 | | | | 204 | |

Brands | | 211 | | | | 208 | | | | 203 | | | | 198 | | | | 189 | |

Industries | | 55 | | | | 56 | | | | 57 | | | | 56 | | | | 56 | |

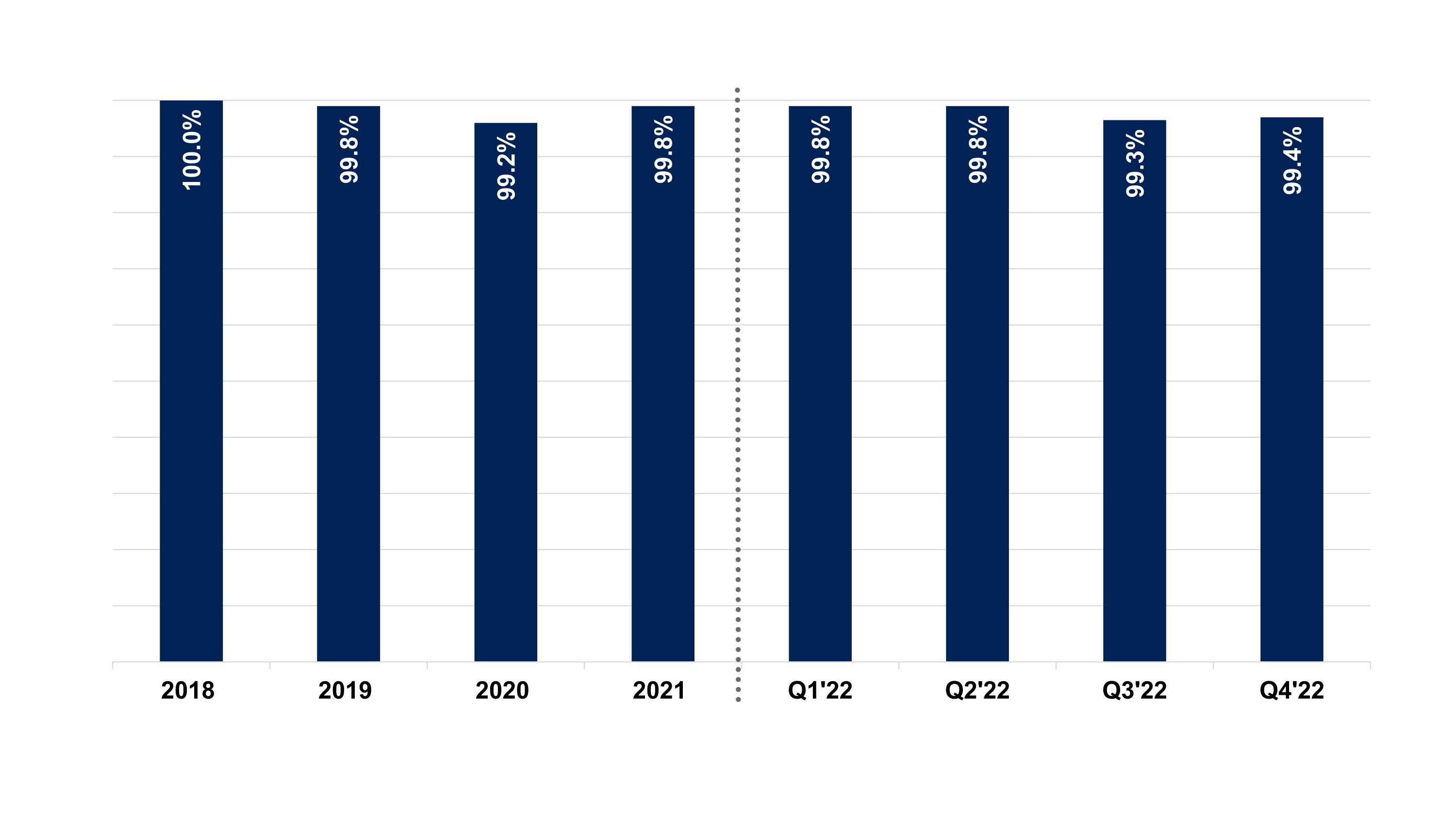

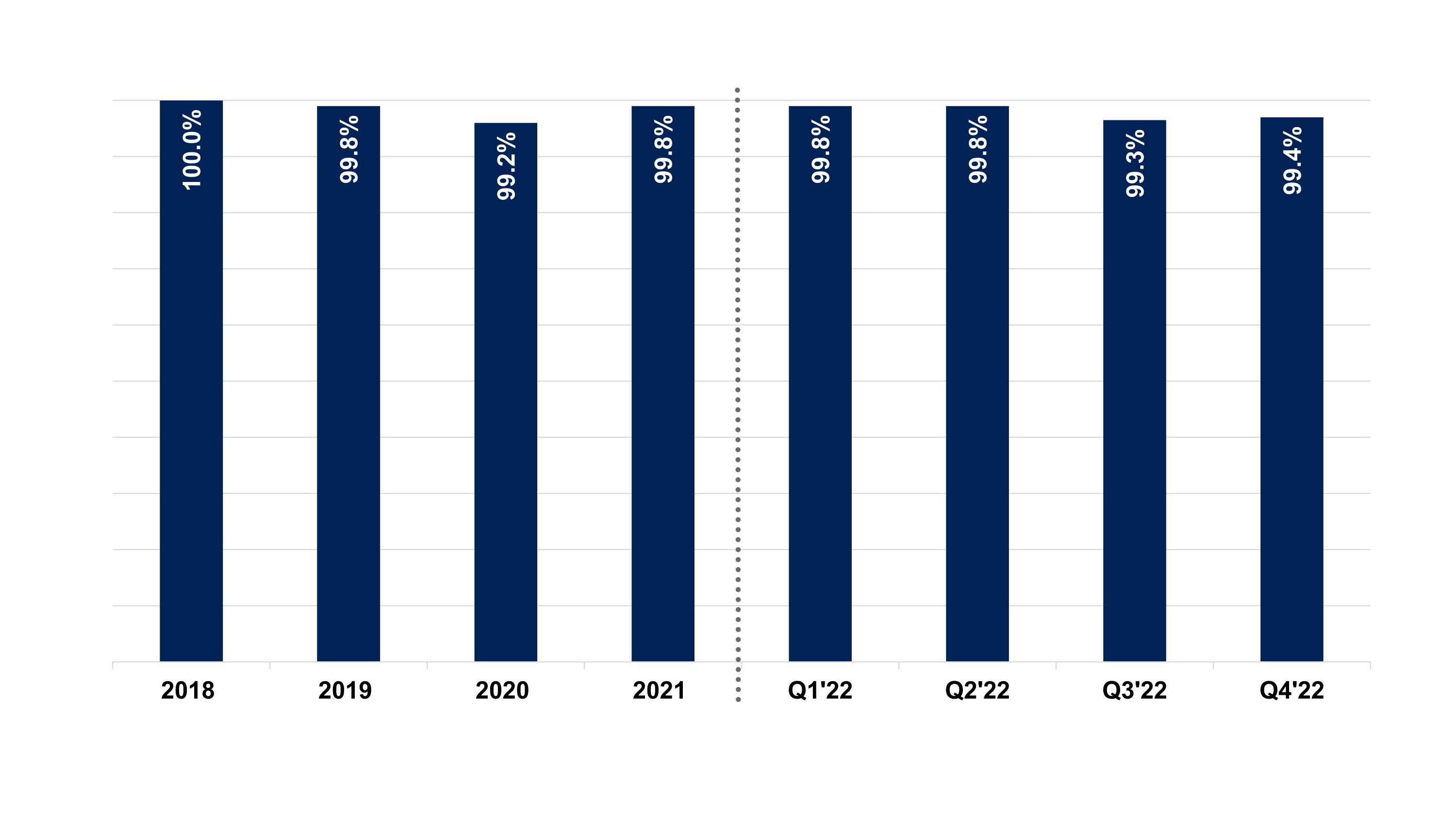

Occupancy (based on SF) | | 99.4 | % | | | 99.3 | % | | | 99.8 | % | | | 99.8 | % | | | 99.8 | % |

Rent Collection | | 99.9 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

Top Ten Tenant Concentration | | 19.0 | % | | | 17.1 | % | | | 16.5 | % | | | 17.1 | % | | | 17.5 | % |

Top Twenty Tenant Concentration | | 31.4 | % | | | 29.8 | % | | | 29.4 | % | | | 30.0 | % | | | 30.3 | % |

Investment Grade (tenant/guarantor) | | 15.4 | % | | | 16.0 | % | | | 16.4 | % | | | 15.3 | % | | | 15.7 | % |

Financial Reporting Coverage1 | | 94.3 | % | | | 94.1 | % | | | 94.0 | % | | | 94.2 | % | | | 94.0 | % |

Rent Coverage Ratio (Restaurants Only) | 3.2x | | | 3.1x | | | 3.3x | | | 3.2x | | | 3.2x | |

Weighted Average Annual Rent Increases | | 2.0 | % | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % |

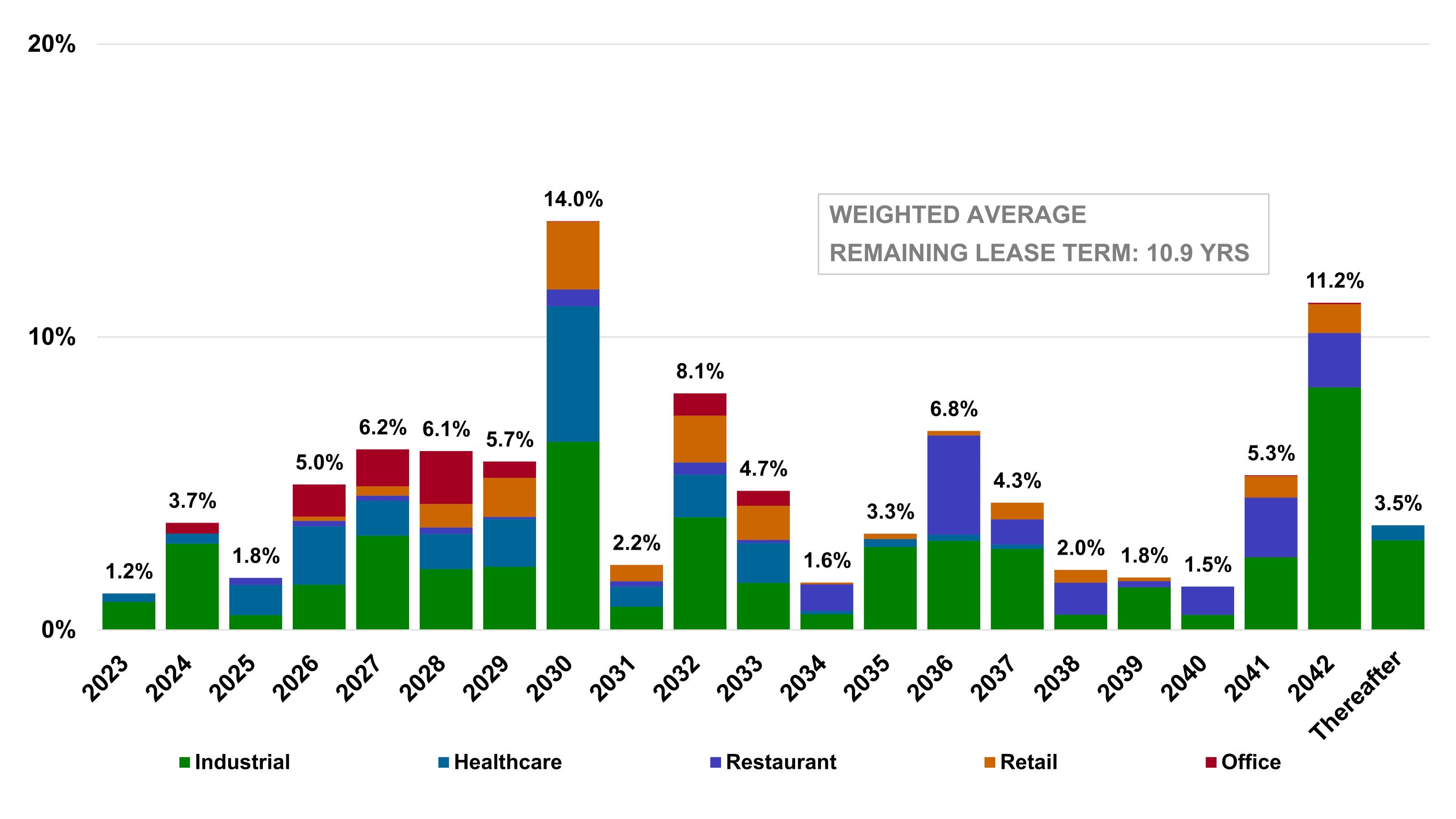

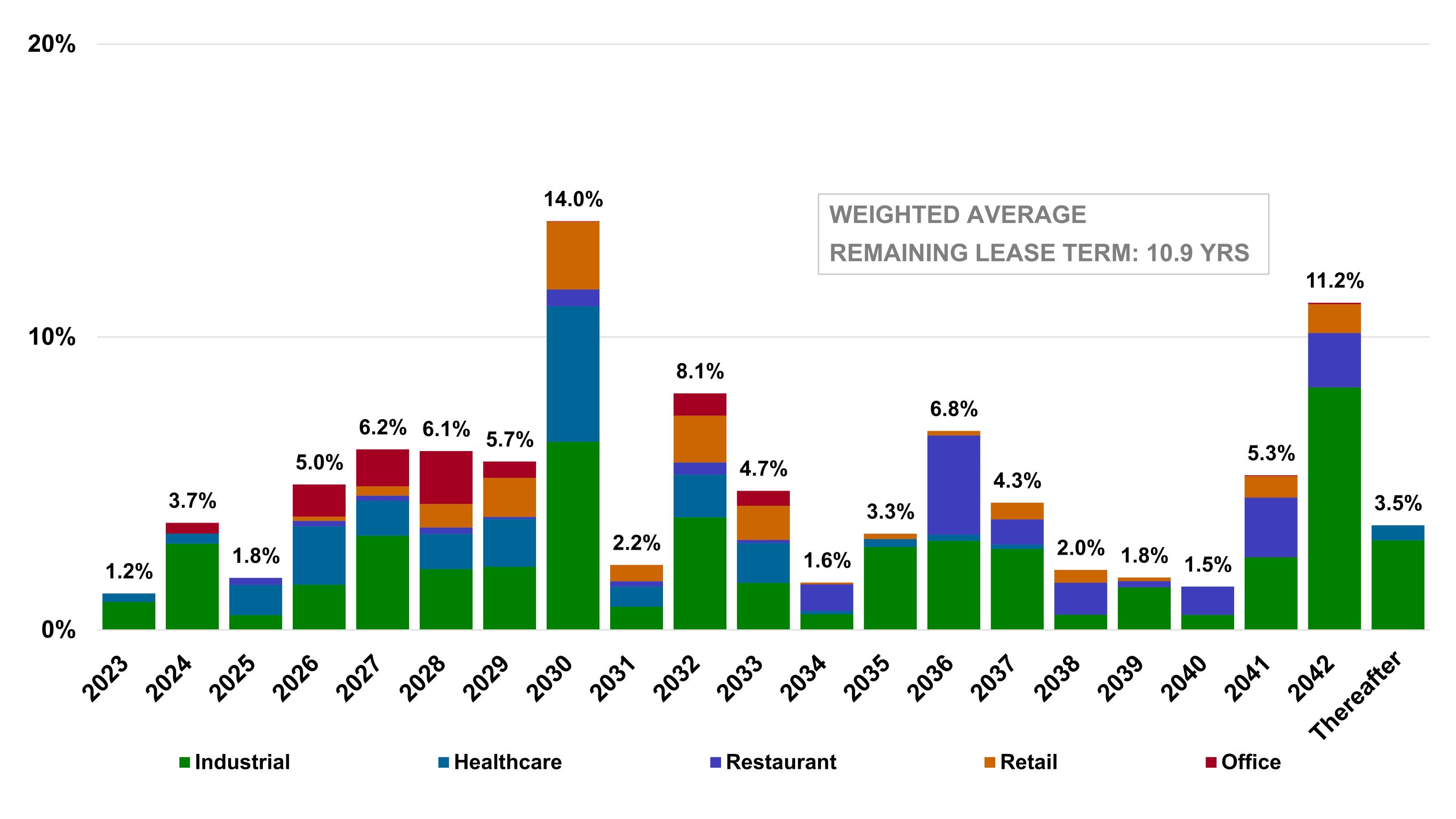

Weighted Average Remaining Lease Term | 10.9 years | | | 10.7 years | | | 10.6 years | | | 10.5 years | | | 10.5 years | |

Master Leases (based on ABR) | | | | | | | | | | | | | | |

Total Portfolio | | 40.8 | % | | | 37.7 | % | | | 36.1 | % | | | 34.5 | % | | | 32.7 | % |

Multi-site Tenants | | 67.7 | % | | | 65.4 | % | | | 63.9 | % | | | 61.6 | % | | | 59.2 | % |

1 Includes 8.5%, 8.8%, 9.0%, 9.1%, and 9.4%, related to tenants not required to provide financial information under the terms of our lease, but whose financial statements are available publicly at December 31, 2022, September 30, 2022, June 30, 2022, March 31, 2022, and December 31, 2021.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 19

Diversification: Tenants & Brands

Top 20 Tenants

| | | | | | | | | | | | | | | | | | | | | | |

Tenant | | Property Type | | #

Properties | | | ABR

($'000s) | | | ABR as a

% of Total

Portfolio | | | Square

Feet

('000s) | | | SF as a

% of Total

Portfolio | |

Roskam Baking Company * | | Food Processing | | | 7 | | | $ | 15,605 | | | | 4.0 | % | | | 2,250 | | | | 5.7 | % |

AHF, LLC* | | Distribution & Warehouse/Manufacturing | | | 9 | | | | 8,995 | | | | 2.3 | % | | | 2,014 | | | | 5.1 | % |

Jack's Family Restaurants * | | Quick Service Restaurants | | | 43 | | | | 7,310 | | | | 1.9 | % | | | 147 | | | | 0.4 | % |

Joseph T. Ryerson & Son, Inc | | Distribution & Warehouse | | | 11 | | | $ | 6,491 | | | | 1.7 | % | | | 1,537 | | | | 3.9 | % |

Red Lobster Hospitality & Red Lobster

Restaurants LLC* | | Casual Dining | | | 19 | | | | 6,178 | | | | 1.6 | % | | | 158 | | | | 0.4 | % |

J. Alexander's, LLC* | | Casual Dining | | | 16 | | | | 6,115 | | | | 1.6 | % | | | 131 | | | | 0.4 | % |

Axcelis Technologies, Inc. | | Flex and R&D | | | 1 | | | $ | 5,991 | | | | 1.5 | % | | | 417 | | | | 1.1 | % |

Dollar General Corporation | | General Merchandise | | | 60 | | | | 5,956 | | | | 1.5 | % | | | 562 | | | | 1.4 | % |

Hensley & Company* | | Distribution & Warehouse | | | 3 | | | | 5,871 | | | | 1.5 | % | | | 577 | | | | 1.5 | % |

BluePearl Holdings, LLC** | | Animal Health Services | | | 13 | | | $ | 5,543 | | | | 1.4 | % | | | 165 | | | | 0.4 | % |

Total Top 10 Tenants | | | | | 182 | | | $ | 74,055 | | | | 19.0 | % | | | 7,958 | | | | 20.3 | % |

| | | | | | | | | | | | | | | | | |

Outback Steakhouse of Florida LLC* | | Casual Dining | | | 22 | | | $ | 5,365 | | | | 1.4 | % | | | 140 | | | | 0.4 | % |

Tractor Supply Company | | General Merchandise | | | 21 | | | | 5,349 | | | | 1.4 | % | | | 417 | | | | 1.1 | % |

Krispy Kreme Doughnut Corporation | | Quick Service Restaurants/

Food Processing | | | 27 | | | | 5,034 | | | | 1.3 | % | | | 156 | | | | 0.4 | % |

Siemens Medical Solutions USA, Inc. &

Siemens Corporation | | Manufacturing/Flex

and R&D | | | 2 | | | | 5,012 | | | | 1.2 | % | | | 545 | | | | 1.4 | % |

Big Tex Trailer Manufacturing, Inc.* | | Automotive/Distribution &

Warehouse/Manufacturing/ Corporate Headquarters | | | 17 | | | | 4,957 | | | | 1.2 | % | | | 1,302 | | | | 3.3 | % |

Nestle' Dreyer's Ice Cream Company1 | | Cold Storage | | | 1 | | | | 4,543 | | | | 1.2 | % | | | 309 | | | | 0.8 | % |

Carvana, LLC* | | Industrial Services | | | 2 | | | | 4,509 | | | | 1.2 | % | | | 230 | | | | 0.6 | % |

Klosterman Bakery* | | Food Processing | | | 11 | | | | 4,500 | | | | 1.2 | % | | | 549 | | | | 1.4 | % |

Arkansas Surgical Hospital | | Surgical | | | 1 | | | | 4,475 | | | | 1.2 | % | | | 129 | | | | 0.3 | % |

American Signature, Inc. | | Home Furnishings | | | 6 | | | | 4,309 | | | | 1.1 | % | | | 474 | | | | 1.2 | % |

Total Top 20 Tenants | | | | | 292 | | | $ | 122,108 | | | | 31.4 | % | | | 12,209 | | | | 31.2 | % |

1Nestle's ABR excludes $1.6 million of rent paid under a sub-lease for an additional property, which will convert to a prime lease no later than August, 2024

*Subject to a master lease.

**Includes properties leased by multiple tenants, some, not all, of which are subject to master leases.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 20

Top 20 Brands

| | | | | | | | | | | | | | | | | | | | | | |

Brand | | Property Type | | #

Properties | | | ABR

($'000s) | | | ABR as a

% of Total

Portfolio | | | Square

Feet

('000s) | | | SF as a

% of Total

Portfolio | |

Roskam Baking Company* | | Food Processing | | | 7 | | | | 15,605 | | | | 4.0 | % | | | 2,250 | | | | 5.7 | % |

AHF, LLC* | | Distribution & Warehouse/Manufacturing | | | 9 | | | | 8,995 | | | | 2.3 | % | | | 2,014 | | | | 5.1 | % |

Jack's Family Restaurants * | | Quick Service Restaurants | | | 43 | | | | 7,309 | | | | 1.9 | % | | | 147 | | | | 0.4 | % |

Ryerson | | Distribution & Warehouse | | | 11 | | | | 6,491 | | | | 1.7 | % | | | 1,537 | | | | 3.9 | % |

Red Lobster* | | Casual Dining | | | 19 | | | | 6,178 | | | | 1.6 | % | | | 157 | | | | 0.4 | % |

Axcelis | | Flex and R&D | | | 1 | | | | 5,991 | | | | 1.5 | % | | | 417 | | | | 1.1 | % |

Dollar General Corporation | | General Merchandise | | | 60 | | | | 5,956 | | | | 1.5 | % | | | 562 | | | | 1.4 | % |

Hensley* | | Distribution & Warehouse | | | 3 | | | | 5,871 | | | | 1.5 | % | | | 577 | | | | 1.5 | % |

BluePearl Veterinary Partners** | | Animal Health Services | | | 13 | | | | 5,543 | | | | 1.4 | % | | | 165 | | | | 0.4 | % |

Bob Evans Farms* | | Casual Dining/Food

Processing | | | 21 | | | | 5,391 | | | | 1.4 | % | | | 281 | | | | 0.8 | % |

Total Top 10 Brands | | | | | 187 | | | $ | 73,330 | | | | 18.8 | % | | | 8,107 | | | | 20.7 | % |

| | | | | | | | | | | | | | | | | |

Tractor Supply Co. | | General Merchandise | | | 21 | | | | 5,349 | | | | 1.4 | % | | | 417 | | | | 1.1 | % |

Krispy Kreme | | Quick Service Restaurants/

Food Processing | | | 27 | | | | 5,034 | | | | 1.3 | % | | | 156 | | | | 0.4 | % |

Siemens | | Manufacturing/Flex

and R&D | | | 2 | | | | 5,012 | | | | 1.2 | % | | | 545 | | | | 1.4 | % |

Big Tex Trailers* | | Automotive/Distribution &

Warehouse/Manufacturing/

Corporate Headquarters | | | 17 | | | | 4,957 | | | | 1.2 | % | | | 1,302 | | | | 3.3 | % |

Outback Steakhouse* | | Casual Dining | | | 20 | | | | 4,641 | | | | 1.2 | % | | | 126 | | | | 0.3 | % |

Nestle' | | Cold Storage | | | 1 | | | | 4,543 | | | | 1.2 | % | | | 310 | | | | 0.8 | % |

Carvana, LLC* | | Industrial Services | | | 2 | | | | 4,509 | | | | 1.2 | % | | | 230 | | | | 0.6 | % |

Klosterman Bakery* | | Food Processing | | | 11 | | | | 4,500 | | | | 1.2 | % | | | 549 | | | | 1.4 | % |

Arkansas Surgical Hospital | | Surgical | | | 1 | | | | 4,476 | | | | 1.2 | % | | | 129 | | | | 0.3 | % |

Wendy's** | | Quick Service Restaurants | | | 29 | | | | 4,319 | | | | 1.1 | % | | | 84 | | | | 0.2 | % |

Total Top 20 Brands | | | | | 318 | | | $ | 120,670 | | | | 31.0 | % | | | 11,955 | | | | 30.5 | % |

1Nestle's ABR excludes $1.6 million of rent paid under a sub-lease for an additional property, which will convert to a prime lease no later than August, 2024

*Subject to a master lease.

**Includes properties leased by multiple tenants, some, not all, of which are subject to master leases.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 21

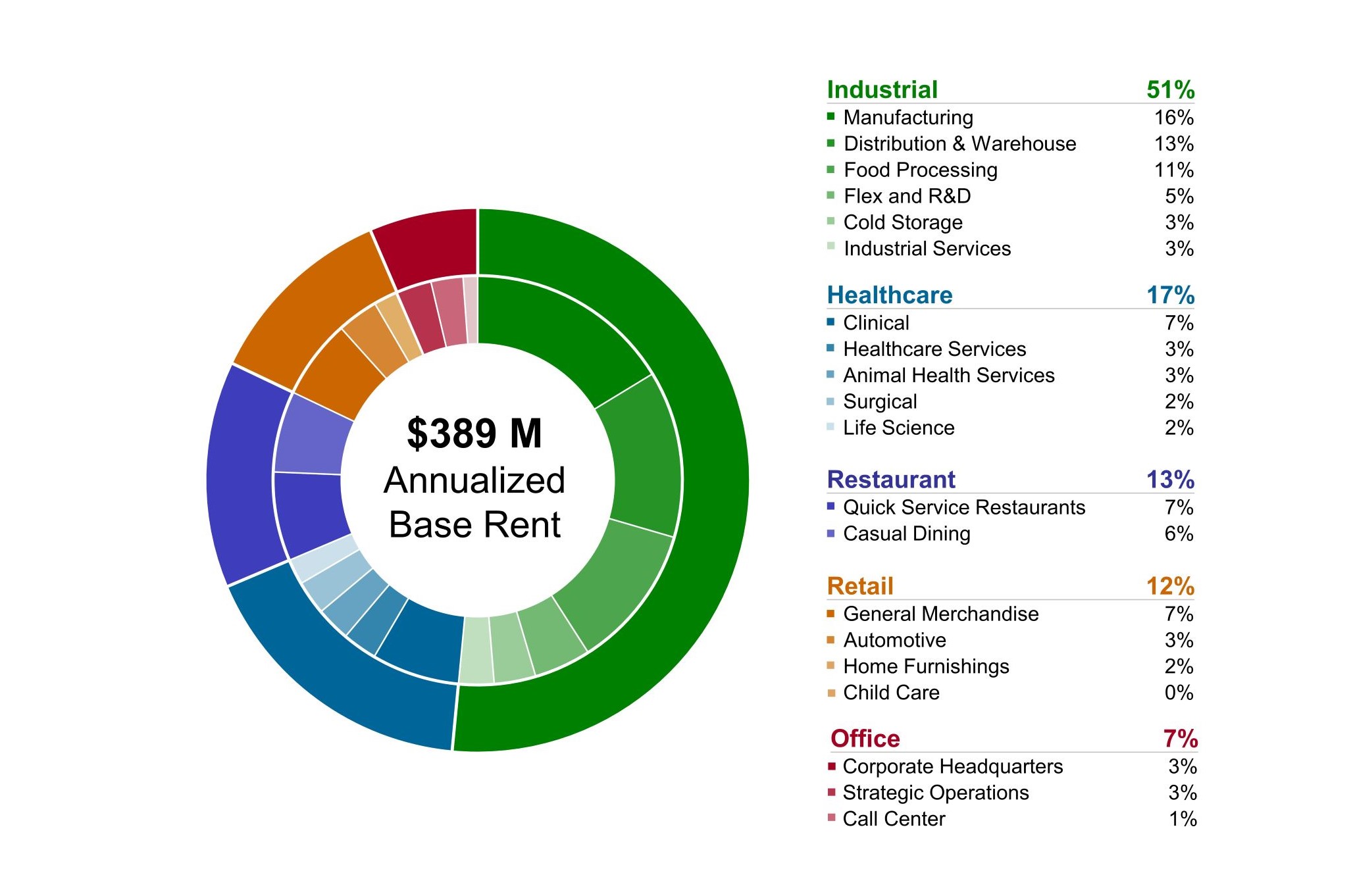

Diversification: Property Type

(rent percentages based on ABR)

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 22

Diversification: Property Type (continued)

| | | | | | | | | | | | | | | | | | | | |

Property Type | | # Properties | | | ABR

($'000s) | | | ABR as a %

of Total

Portfolio | | | Square Feet ('000s) | | | SF as a %

of Total

Portfolio | |

Industrial | | | | | | | | | | | | | | | |

Manufacturing | | | 80 | | | $ | 63,406 | | | | 16.3 | % | | | 11,873 | | | | 30.3 | % |

Distribution & Warehouse | | | 47 | | | | 51,406 | | | | 13.2 | % | | | 9,459 | | | | 24.2 | % |

Food Processing | | | 34 | | | | 44,427 | | | | 11.4 | % | | | 5,516 | | | | 14.1 | % |

Flex and R&D | | | 7 | | | | 17,498 | | | | 4.5 | % | | | 1,457 | | | | 3.7 | % |

Cold Storage | | | 4 | | | | 12,810 | | | | 3.3 | % | | | 933 | | | | 2.4 | % |

Industrial Services | | | 22 | | | | 10,851 | | | | 2.8 | % | | | 587 | | | | 1.5 | % |

Untenanted | | | 1 | | | | — | | | | 0.0 | % | | | 122 | | | | 0.3 | % |

Industrial Total | | | 195 | | | | 200,398 | | | | 51.5 | % | | | 29,947 | | | | 76.5 | % |

Healthcare | | | | | | | | | | | | | | | |

Clinical | | | 52 | | | | 27,020 | | | | 6.9 | % | | | 1,091 | | | | 2.8 | % |

Healthcare Services | | | 29 | | | | 10,679 | | | | 2.7 | % | | | 478 | | | | 1.2 | % |

Animal Health Services | | | 27 | | | | 10,549 | | | | 2.7 | % | | | 405 | | | | 1.0 | % |

Surgical | | | 12 | | | | 10,463 | | | | 2.7 | % | | | 329 | | | | 0.9 | % |

Life Science | | | 9 | | | | 7,867 | | | | 2.1 | % | | | 549 | | | | 1.4 | % |

Untenanted | | | 1 | | | | — | | | | — | | | | 18 | | | | 0.0 | % |

Healthcare Total | | | 130 | | | | 66,578 | | | | 17.1 | % | | | 2,870 | | | | 7.3 | % |

Restaurant | | | | | | | | | | | | | | | |

Casual Dining | | | 102 | | | | 27,387 | | | | 7.0 | % | | | 678 | | | | 1.7 | % |

Quick Service Restaurants | | | 146 | | | | 24,993 | | | | 6.5 | % | | | 499 | | | | 1.3 | % |

Restaurant Total | | | 248 | | | | 52,380 | | | | 13.5 | % | | | 1,177 | | | | 3.0 | % |

Retail | | | | | | | | | | | | | | | |

General Merchandise | | | 132 | | | | 24,435 | | | | 6.3 | % | | | 1,865 | | | | 4.8 | % |

Automotive | | | 68 | | | | 12,667 | | | | 3.3 | % | | | 776 | | | | 2.0 | % |

Home Furnishings | | | 13 | | | | 7,147 | | | | 1.8 | % | | | 797 | | | | 2.0 | % |

Child Care | | | 1 | | | | 375 | | | | 0.1 | % | | | 10 | | | | 0.0 | % |

Retail Total | | | 214 | | | | 44,624 | | | | 11.5 | % | | | 3,448 | | | | 8.8 | % |

Office | | | | | | | | | | | | | | | |

Corporate Headquarters | | | 8 | | | | 10,761 | | | | 2.8 | % | | | 691 | | | | 1.8 | % |

Strategic Operations | | | 5 | | | | 9,875 | | | | 2.5 | % | | | 615 | | | | 1.6 | % |

Call Center | | | 3 | | | | 4,478 | | | | 1.1 | % | | | 345 | | | | 0.9 | % |

Untenanted | | | 1 | | | | — | | | | — | | | | 46 | | | | 0.1 | % |

Office Total | | | 17 | | | | 25,114 | | | | 6.4 | % | | | 1,697 | | | | 4.4 | % |

Total | | | 804 | | | $ | 389,094 | | | | 100.0 | % | | | 39,139 | | | | 100.0 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 23

Key Statistics by Property Type

| | | | | | | | | | | | | | | | | | | | |

| | Q4 2022 | | | Q3 2022 | | | Q2 2022 | | | Q1 2022 | | | Q4 2021 | |

Industrial | | | | | | | | | | | | | | | |

Number of properties | | | 195 | | | | 185 | | | | 166 | | | | 158 | | | | 156 | |

Square feet (000s) | | | 29,947 | | | | 27,631 | | | | 25,279 | | | | 23,881 | | | | 23,617 | |

Weighted average lease term (years) | | | 11.2 | | | | 11.2 | | | | 10.8 | | | | 10.3 | | | | 10.5 | |

Weighted average annual rent escalation | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % |

| | | | | | | | | | | | | | | |

Healthcare | | | | | | | | | | | | | | | |

Number of properties | | | 130 | | | | 130 | | | | 129 | | | | 128 | | | | 128 | |

Square feet (000s) | | | 2,870 | | | | 2,869 | | | | 2,855 | | | | 2,813 | | | | 2,813 | |

Weighted average lease term (years) | | | 8.2 | | | | 8.2 | | | | 8.4 | | | | 8.6 | | | | 8.9 | |

Weighted average annual rent escalation | | | 2.2 | % | | | 2.2 | % | | | 2.2 | % | | | 2.2 | % | | | 2.2 | % |

| | | | | | | | | | | | | | | |

Restaurant | | | | | | | | | | | | | | | |

Number of properties | | | 248 | | | | 250 | | | | 247 | | | | 250 | | | | 235 | |

Square feet (000s) | | | 1,177 | | | | 1,191 | | | | 1,174 | | | | 1,188 | | | | 1,064 | |

Weighted average lease term (years) | | | 14.8 | | | | 14.8 | | | | 15.0 | | | | 15.3 | | | | 15.0 | |

Weighted average annual rent escalation | | | 1.8 | % | | | 1.8 | % | | | 1.8 | % | | | 1.9 | % | | | 2.0 | % |

| | | | | | | | | | | | | | | |

Retail | | | | | | | | | | | | | | | |

Number of properties | | | 214 | | | | 209 | | | | 206 | | | | 200 | | | | 191 | |

Square feet (000s) | | | 3,448 | | | | 3,411 | | | | 3,404 | | | | 3,235 | | | | 3,009 | |

Weighted average lease term (years) | | | 10.5 | | | | 10.5 | | | | 10.9 | | | | 11.2 | | | | 10.5 | |

Weighted average annual rent escalation | | | 1.6 | % | | | 1.6 | % | | | 1.6 | % | | | 1.6 | % | | | 1.5 | % |

| | | | | | | | | | | | | | | |

Office | | | | | | | | | | | | | | | |

Number of properties | | | 17 | | | | 16 | | | | 16 | | | | 16 | | | | 16 | |

Square feet (000s) | | | 1,697 | | | | 1,686 | | | | 1,685 | | | | 1,685 | | | | 1,685 | |

Weighted average lease term (years) | | | 6.1 | | | | 6.1 | | | | 6.0 | | | | 6.3 | | | | 6.5 | |

Weighted average annual rent escalation | | | 2.5 | % | | | 2.5 | % | | | 2.4 | % | | | 2.5 | % | | | 2.4 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 24

Diversification: Tenant Industry

| | | | | | | | | | | | | | | | | | | | |

Industry | | # Properties | | | ABR

($'000s) | | | ABR as a %

of Total

Portfolio | | | Square Feet ('000s) | | | SF as a %

of Total

Portfolio | |

Restaurants | | | 251 | | | $ | 53,151 | | | | 13.7 | % | | | 1,220 | | | | 3.1 | % |

Health Care Facilities | | | 103 | | | | 52,306 | | | | 13.4 | % | | | 2,044 | | | | 5.2 | % |

Packaged Foods & Meats | | | 29 | | | | 37,998 | | | | 9.8 | % | | | 4,713 | | | | 12.0 | % |

Distributors | | | 27 | | | | 15,922 | | | | 4.1 | % | | | 2,695 | | | | 6.9 | % |

Auto Parts & Equipment | | | 43 | | | | 15,348 | | | | 3.9 | % | | | 2,668 | | | | 6.8 | % |

Food Distributors | | | 8 | | | | 14,699 | | | | 3.8 | % | | | 1,786 | | | | 4.6 | % |

Specialty Stores | | | 31 | | | | 13,805 | | | | 3.5 | % | | | 1,338 | | | | 3.4 | % |

Specialized Consumer Services | | | 49 | | | | 12,725 | | | | 3.3 | % | | | 728 | | | | 1.9 | % |

Home Furnishing Retail | | | 18 | | | | 12,684 | | | | 3.3 | % | | | 1,858 | | | | 4.7 | % |

Metal & Glass Containers | | | 8 | | | | 10,010 | | | | 2.6 | % | | | 2,206 | | | | 5.6 | % |

General Merchandise Stores | | | 96 | | | | 9,634 | | | | 2.5 | % | | | 880 | | | | 2.2 | % |

Industrial Machinery | | | 20 | | | | 9,317 | | | | 2.4 | % | | | 1,949 | | | | 5.0 | % |

Healthcare Services | | | 18 | | | | 9,231 | | | | 2.4 | % | | | 515 | | | | 1.3 | % |

Forest Products | | | 9 | | | | 8,995 | | | | 2.3 | % | | | 2,014 | | | | 5.1 | % |

Aerospace & Defense | | | 6 | | | | 7,419 | | | | 1.9 | % | | | 776 | | | | 2.0 | % |

Other (40 industries) | | | 85 | | | | 105,850 | | | | 27.1 | % | | | 11,530 | | | | 29.6 | % |

Untenanted properties | | | 3 | | | | — | | | | — | | | | 219 | | | | 0.6 | % |

Total | | | 804 | | | $ | 389,094 | | | | 100.0 | % | | | 39,139 | | | | 100.0 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 25

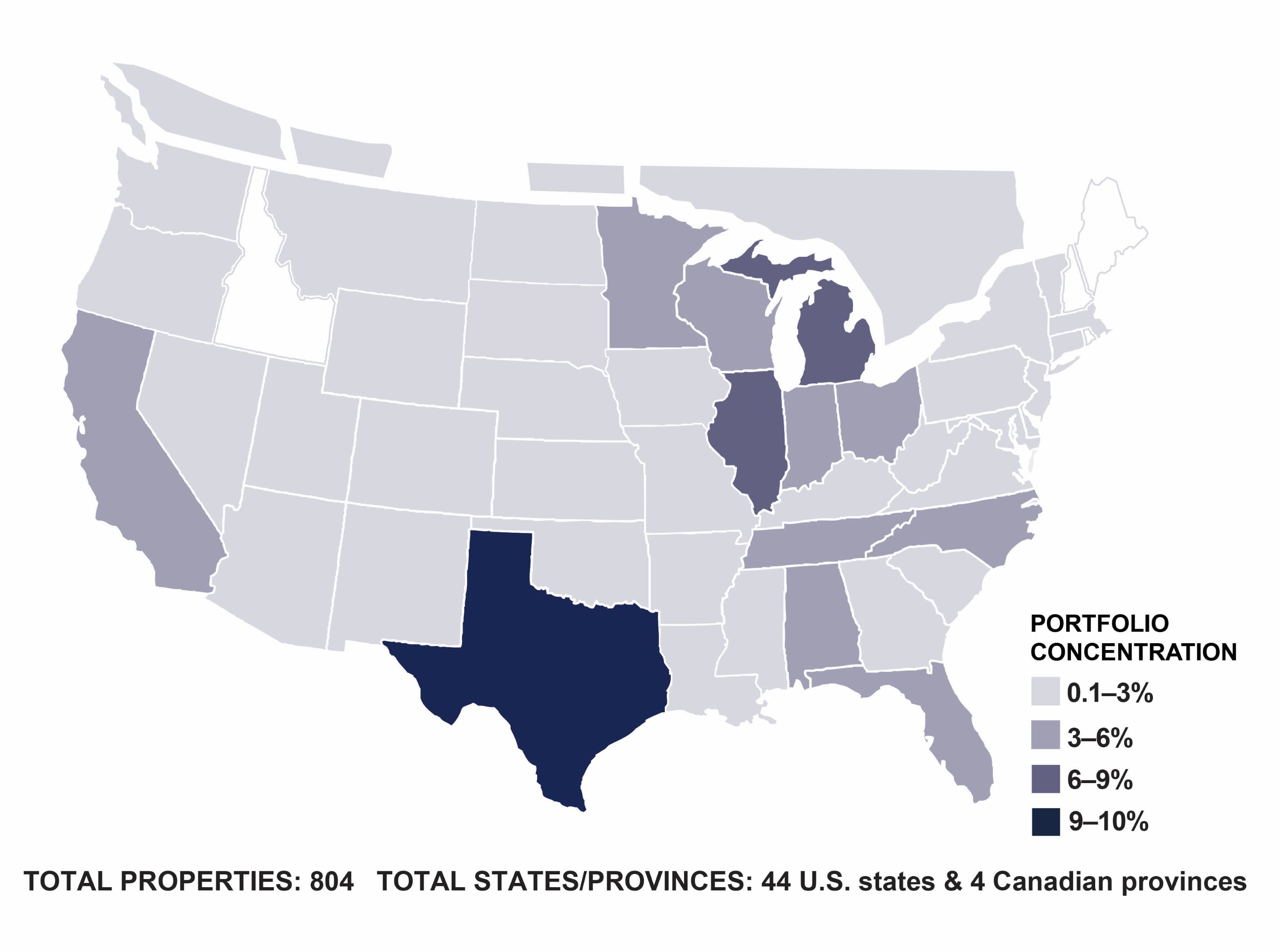

Diversification: Geography

(rent percentages based on ABR)

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 26

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

State /

Province | | #

Properties | | | ABR

($'000s) | | | ABR as

a % of

Total

Portfolio | | | Square

Feet

('000s) | | | SF as a

% of

Total

Portfolio | | | | State /

Province | | #

Properties | | ABR

($'000s) | | | ABR as

a % of

Total

Portfolio | | | Square

Feet

('000s) | | | SF as a

% of

Total

Portfolio | |

TX | | | 72 | | | $ | 37,883 | | | | 9.7 | % | | | 3,621 | | | | 9.3 | % | | | LA | | | 4 | | | 3,400 | | | | 0.9 | % | | | 194 | | | | 0.5 | % |

MI | | | 55 | | | | 32,545 | | | | 8.4 | % | | | 3,811 | | | | 9.7 | % | | | MS | | | 11 | | | 3,320 | | | | 0.9 | % | | | 430 | | | | 1.1 | % |

IL | | | 32 | | | | 24,148 | | | | 6.2 | % | | | 2,424 | | | | 6.2 | % | | | NE | | | 6 | | | 3,173 | | | | 0.8 | % | | | 509 | | | | 1.3 | % |

WI | | | 35 | | | | 21,087 | | | | 5.4 | % | | | 2,163 | | | | 5.5 | % | | | MD | | | 4 | | | 3,002 | | | | 0.8 | % | | | 293 | | | | 0.7 | % |

CA | | | 13 | | | | 18,773 | | | | 4.8 | % | | | 1,718 | | | | 4.4 | % | | | IA | | | 4 | | | 2,768 | | | | 0.7 | % | | | 622 | | | | 1.6 | % |

OH | | | 47 | | | | 18,667 | | | | 4.8 | % | | | 1,728 | | | | 4.4 | % | | | NM | | | 9 | | | 2,733 | | | | 0.7 | % | | | 107 | | | | 0.3 | % |

FL | | | 42 | | | | 16,197 | | | | 4.2 | % | | | 844 | | | | 2.2 | % | | | SC | | | 13 | | | 2,556 | | | | 0.7 | % | | | 308 | | | | 0.8 | % |

IN | | | 32 | | | | 15,552 | | | | 4.0 | % | | | 1,906 | | | | 4.9 | % | | | CO | | | 4 | | | 2,501 | | | | 0.6 | % | | | 126 | | | | 0.3 | % |

MN | | | 21 | | | | 15,341 | | | | 3.9 | % | | | 2,500 | | | | 6.4 | % | | | WV | | | 16 | | | 2,490 | | | | 0.6 | % | | | 109 | | | | 0.3 | % |

TN | | | 50 | | | | 15,117 | | | | 3.9 | % | | | 1,103 | | | | 2.8 | % | | | UT | | | 3 | | | 2,432 | | | | 0.6 | % | | | 280 | | | | 0.7 | % |

NC | | | 37 | | | | 13,935 | | | | 3.6 | % | | | 1,435 | | | | 3.7 | % | | | CT | | | 2 | | | 1,767 | | | | 0.5 | % | | | 55 | | | | 0.1 | % |

AL | | | 53 | | | | 12,151 | | | | 3.1 | % | | | 873 | | | | 2.2 | % | | | MT | | | 7 | | | 1,563 | | | | 0.4 | % | | | 43 | | | | 0.1 | % |

GA | | | 33 | | | | 11,473 | | | | 2.9 | % | | | 1,576 | | | | 4.0 | % | | | NV | | | 2 | | | 1,361 | | | | 0.3 | % | | | 81 | | | | 0.2 | % |

AZ | | | 9 | | | | 10,759 | | | | 2.8 | % | | | 909 | | | | 2.3 | % | | | DE | | | 4 | | | 1,167 | | | | 0.3 | % | | | 133 | | | | 0.3 | % |

MA | | | 5 | | | | 10,461 | | | | 2.7 | % | | | 1,026 | | | | 2.6 | % | | | ND | | | 2 | | | 954 | | | | 0.2 | % | | | 28 | | | | 0.1 | % |

PA | | | 22 | | | | 9,595 | | | | 2.5 | % | | | 1,836 | | | | 4.7 | % | | | VT | | | 2 | | | 420 | | | | 0.1 | % | | | 24 | | | | 0.1 | % |

KY | | | 26 | | | | 9,424 | | | | 2.4 | % | | | 1,148 | | | | 2.9 | % | | | WY | | | 1 | | | 307 | | | | 0.1 | % | | | 21 | | | | 0.1 | % |

NY | | | 26 | | | | 9,265 | | | | 2.4 | % | | | 680 | | | | 1.7 | % | | | OR | | | 1 | | | 136 | | | | 0.0 | % | | | 9 | | | | 0.0 | % |

AR | | | 12 | | | | 8,891 | | | | 2.3 | % | | | 544 | | | | 1.4 | % | | | SD | | | 1 | | | 81 | | | | 0.0 | % | | | 9 | | | | 0.0 | % |

OK | | | 21 | | | | 7,633 | | | | 2.0 | % | | | 977 | | | | 2.5 | % | | | Total U.S. | | | 797 | | | 381,436 | | | | 98.0 | % | | | 38,709 | | | | 98.9 | % |

MO | | | 12 | | | | 6,119 | | | | 1.6 | % | | | 1,138 | | | | 2.9 | % | | | BC | | | 2 | | | 4,408 | | | | 1.1 | % | | | 253 | | | | 0.6 | % |

KS | | | 11 | | | | 5,590 | | | | 1.4 | % | | | 648 | | | | 1.7 | % | | | ON | | | 3 | | | 1,984 | | | | 0.5 | % | | | 101 | | | | 0.3 | % |

VA | | | 17 | | | | 5,479 | | | | 1.4 | % | | | 204 | | | | 0.5 | % | | | AB | | | 1 | | | 933 | | | | 0.2 | % | | | 51 | | | | 0.1 | % |

NJ | | | 3 | | | | 4,909 | | | | 1.3 | % | | | 366 | | | | 0.9 | % | | | MB | | | 1 | | | 333 | | | | 0.2 | % | | | 25 | | | | 0.1 | % |

WA | | | 15 | | | | 4,311 | | | | 1.1 | % | | | 150 | | | | 0.4 | % | | | Total

Canada | | | 7 | | | 7,658 | | | | 2.0 | % | | | 430 | | | | 1.1 | % |

| | | | | | | | | | | | | | | | | | Grand

Total | | | 804 | | $ | 389,094 | | | | 100.0 | % | | | 39,139 | | | | 100.0 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 27

Lease Expirations

(rent percentages based on ABR)

| | | | | | | | | | | | | | | | | | | | | | | | |

Expiration Year | | # Properties | | | # Leases | | | ABR

($'000s) | | | ABR as a % of Total Portfolio | | | Square Feet ('000s) | | | SF as a % of Total Portfolio | |

2023 | | | 6 | | | | 9 | | | | 4,865 | | | | 1.2 | % | | | 559 | | | | 1.4 | % |

2024 | | | 11 | | | | 11 | | | | 14,224 | | | | 3.7 | % | | | 1,689 | | | | 4.3 | % |

2025 | | | 19 | | | | 22 | | | | 6,904 | | | | 1.8 | % | | | 385 | | | | 1.0 | % |

2026 | | | 35 | | | | 35 | | | | 19,317 | | | | 5.0 | % | | | 1,413 | | | | 3.6 | % |

2027 | | | 29 | | | | 31 | | | | 23,974 | | | | 6.2 | % | | | 2,079 | | | | 5.3 | % |

2028 | | | 35 | | | | 35 | | | | 23,742 | | | | 6.1 | % | | | 2,248 | | | | 5.7 | % |

2029 | | | 72 | | | | 73 | | | | 22,356 | | | | 5.7 | % | | | 2,724 | | | | 7.0 | % |

2030 | | | 101 | | | | 101 | | | | 54,280 | | | | 14.0 | % | | | 5,110 | | | | 13.1 | % |

2031 | | | 33 | | | | 33 | | | | 8,622 | | | | 2.2 | % | | | 804 | | | | 2.1 | % |

2032 | | | 62 | | | | 63 | | | | 31,420 | | | | 8.1 | % | | | 3,469 | | | | 8.9 | % |

2033 | | | 49 | | | | 49 | | | | 18,479 | | | | 4.7 | % | | | 1,575 | | | | 4.0 | % |

2034 | | | 33 | | | | 33 | | | | 6,295 | | | | 1.6 | % | | | 409 | | | | 1.0 | % |

2035 | | | 17 | | | | 17 | | | | 12,774 | | | | 3.3 | % | | | 1,927 | | | | 4.9 | % |

2036 | | | 87 | | | | 87 | | | | 26,414 | | | | 6.8 | % | | | 2,931 | | | | 7.5 | % |

2037 | | | 23 | | | | 23 | | | | 16,892 | | | | 4.3 | % | | | 1,124 | | | | 2.9 | % |

2038 | | | 35 | | | | 35 | | | | 7,962 | | | | 2.0 | % | | | 437 | | | | 1.1 | % |

2039 | | | 11 | | | | 11 | | | | 6,940 | | | | 1.8 | % | | | 803 | | | | 2.1 | % |

2040 | | | 31 | | | | 31 | | | | 5,744 | | | | 1.5 | % | | | 312 | | | | 0.8 | % |

2041 | | | 42 | | | | 42 | | | | 20,534 | | | | 5.3 | % | | | 1,737 | | | | 4.4 | % |

2042 | | | 59 | | | | 59 | | | | 43,460 | | | | 11.2 | % | | | 4,813 | | | | 12.3 | % |

Thereafter | | | 11 | | | | 11 | | | | 13,896 | | | | 3.5 | % | | | 2,372 | | | | 6.0 | % |

Untenanted

properties | | | 3 | | | | — | | | | - | | | | 0.0 | % | | | 219 | | | | 0.6 | % |

Total | | | 804 | | | | 811 | | | | 389,094 | | | | 100.0 | % | | | 39,139 | | | | 100.0 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 28

Occupancy

Occupancy by Rentable Square Footage

Change in Occupancy

| | | | | |

| | | Number of properties | |

Vacant properties at January 1, 2022 | | | | 2 | |

Lease expirations1 | | | | 1 | |

Leasing activities | | | | (1 | ) |

Vacant dispositions | | | | — | |

Vacant properties at March 31, 2022 | | | | 2 | |

Lease expirations1 | | | | 2 | |

Leasing activities | | | | (2 | ) |

Vacant dispositions | | | | — | |

Vacant properties at June 30, 2022 | | | | 2 | |

Lease expirations1 | | | | 4 | |

Leasing activities | | | | (2 | ) |

Vacant dispositions | | | | (1 | ) |

Vacant properties at September 30, 2022 | | | | 3 | |

Lease expirations1 | | | - | |

Leasing activities | | | - | |

Vacant dispositions | | | - | |

Vacant properties at December 31, 2022 | | | | 3 | |

| | | | |

1 Includes scheduled and unscheduled expirations (including leases rejected in bankruptcy), as well as future expirations resolved in the periods indicated above.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 29

Definitions and Explanations

Adjusted NOI, Annualized Adjusted NOI, Adjusted Cash NOI and Annualized Adjusted Cash NOI: Our reported results and net earnings per diluted share are presented in accordance with accounting principles generally accepted in the United States of America (GAAP). Adjusted NOI and Adjusted Cash NOI are non-GAAP financial measures that we believe are useful to assess property-level performance. We compute Adjusted NOI by adjusting Adjusted EBITDAre (defined below) to exclude general and administrative expenses incurred at the corporate level. Given the net lease nature of our portfolio, we do not incur general and administrative expenses at the property level. To compute Adjusted Cash NOI, we adjust Adjusted NOI to exclude non-cash items included in total revenues and property expenses, such as straight-line rental revenue and other amortization and non-cash items, based on an estimate calculated as if all investment and disposition activity that took place during the quarter had occurred on the first day of the quarter. We then annualize quarterly Adjusted NOI and Adjusted Cash NOI by multiplying each amount by four to compute Annualized Adjusted NOI and Annualized Adjusted Cash NOI, respectively, which are also non-GAAP financial measures. We believe Adjusted NOI and Adjusted Cash NOI provide useful and relevant information because they reflect only those income and expense items that are incurred at the property level and present such items on an unlevered basis. We believe that the exclusion of certain non-cash revenues and expenses from Adjusted Cash NOI is a useful supplemental measure for investors to consider because it will help them to better assess our operating performance without the distortions created by non-cash revenues or expenses. You should not unduly rely on Annualized Adjusted NOI and Annualized Adjusted Cash NOI as they are based on assumptions and estimates that may prove to be inaccurate. Our actual reported Adjusted NOI and Adjusted Cash NOI for future periods may be significantly different from our Annualized Adjusted NOI and Annualized Adjusted Cash NOI. Additionally, our computation of Adjusted NOI and Adjusted Cash NOI may differ from the methodology for calculating these metrics used by companies in our industry, and, therefore, may not be comparable to similarly titled measures reported by other companies.

Annualized Base Rent (ABR): We define ABR as the annualized contractual cash rent due for the last month of the reporting period, excluding the impacts of short-term rent deferrals, abatements or free rent, and adjusted to remove rent from properties sold during the month and to include a full month of contractual cash rent for investments made during the month.

Cash Cap Rate: Cash Cap Rate represents the estimated first year cash yield to be generated on a real estate investment, which was estimated at the time of investment based on the contractually specified cash base rent for the first full year after the date of the investment, divided by the purchase price for the property excluding capitalized acquisitions costs.