Exhibit 99.2

Q1 2023 QUARTERLY SUPPLEMENTAL INFORMATION Broadstone Net Lease, Inc. (NYSE: BNL) is a Real Estate Investment Trust (REIT) that acquires, owns, and manages single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. www.broadstone.com

Table of Contents

| | |

Section | Page |

|

About the Data | 3 |

Company Overview | 4 |

Quarterly Financial Summary | 5 |

Balance Sheet | 6 |

Income Statement Summary | 7 |

Funds From Operations (FFO), Core Funds From Operations (Core FFO), and Adjusted Funds From Operations (AFFO) | 8 |

EBITDA, EBITDAre, and Other Non-GAAP Operating Measures | 9 |

Lease Revenues Detail | 10 |

Capital Structure | 11 |

Equity Rollforward | 12 |

Debt Outstanding | 13 |

Net Debt Metrics | 14 |

Covenants | 15 |

Debt Maturities | 16 |

Investment Activity | 17 |

Dispositions | 18 |

Portfolio at a Glance: Key Metrics | 19 |

Diversification: Tenants and Brands | 20-21 |

Diversification: Property Type | 22-23 |

Key Statistics by Property Type | 24 |

Diversification: Tenant Industry | 25 |

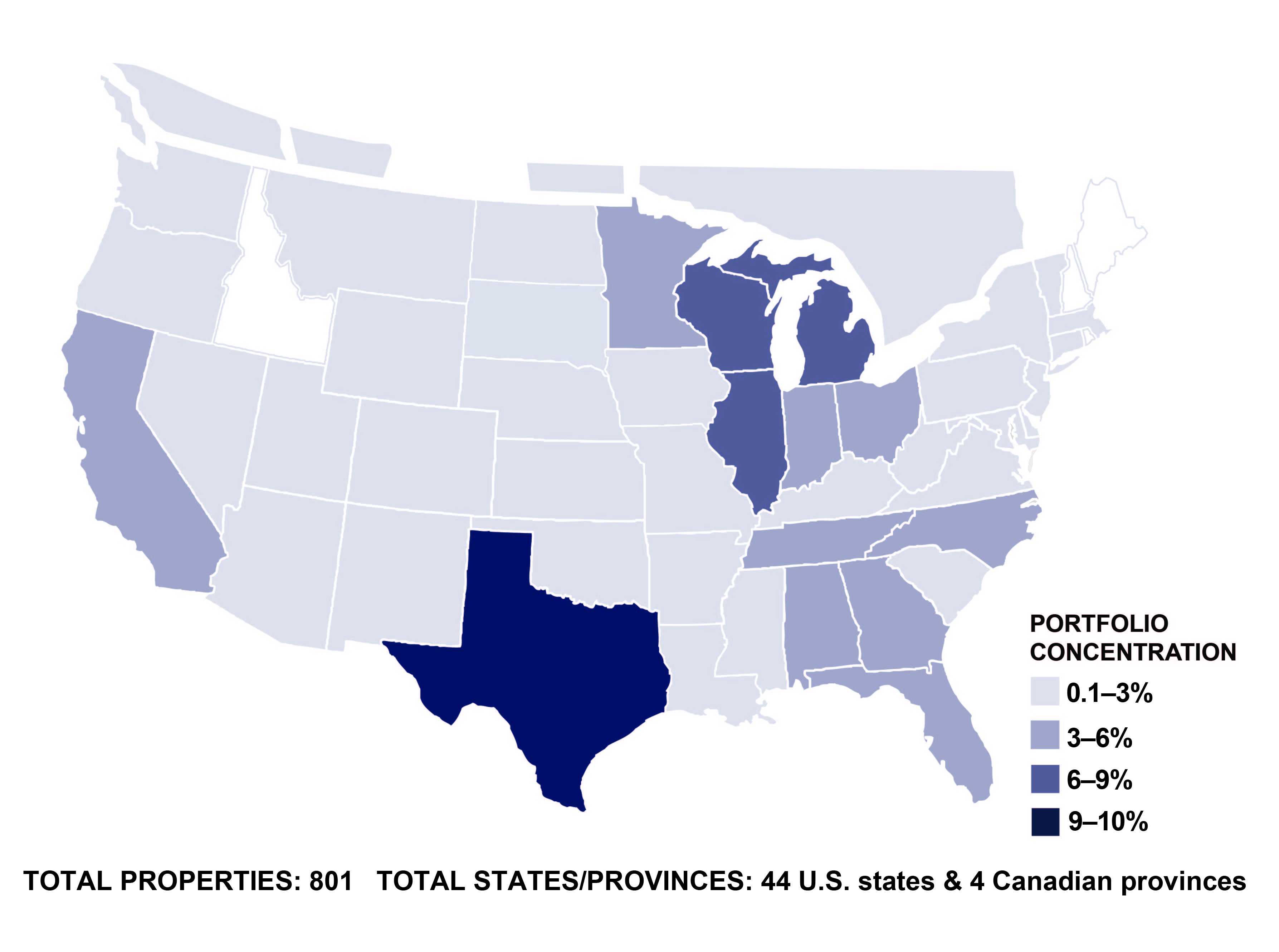

Diversification: Geography | 26 |

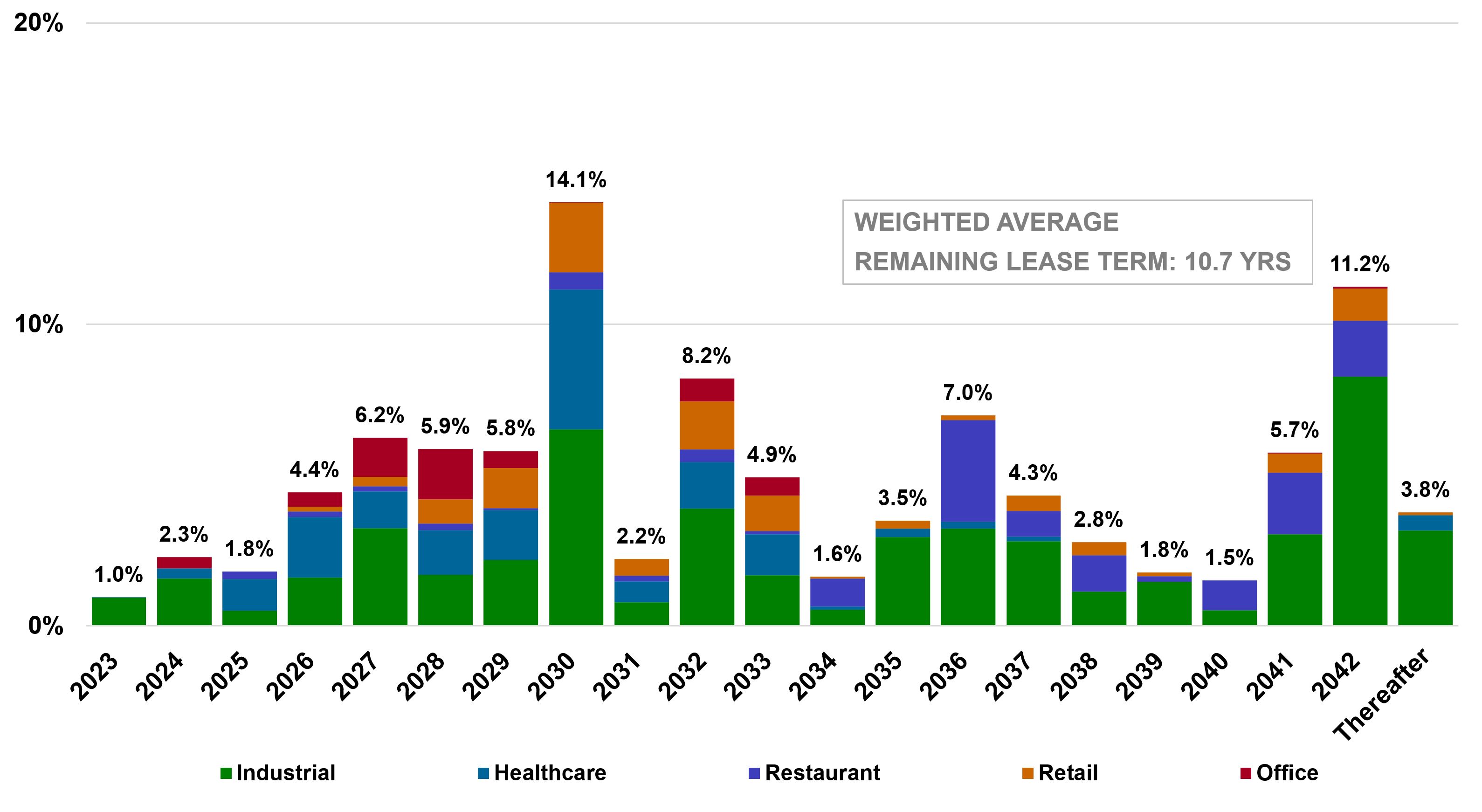

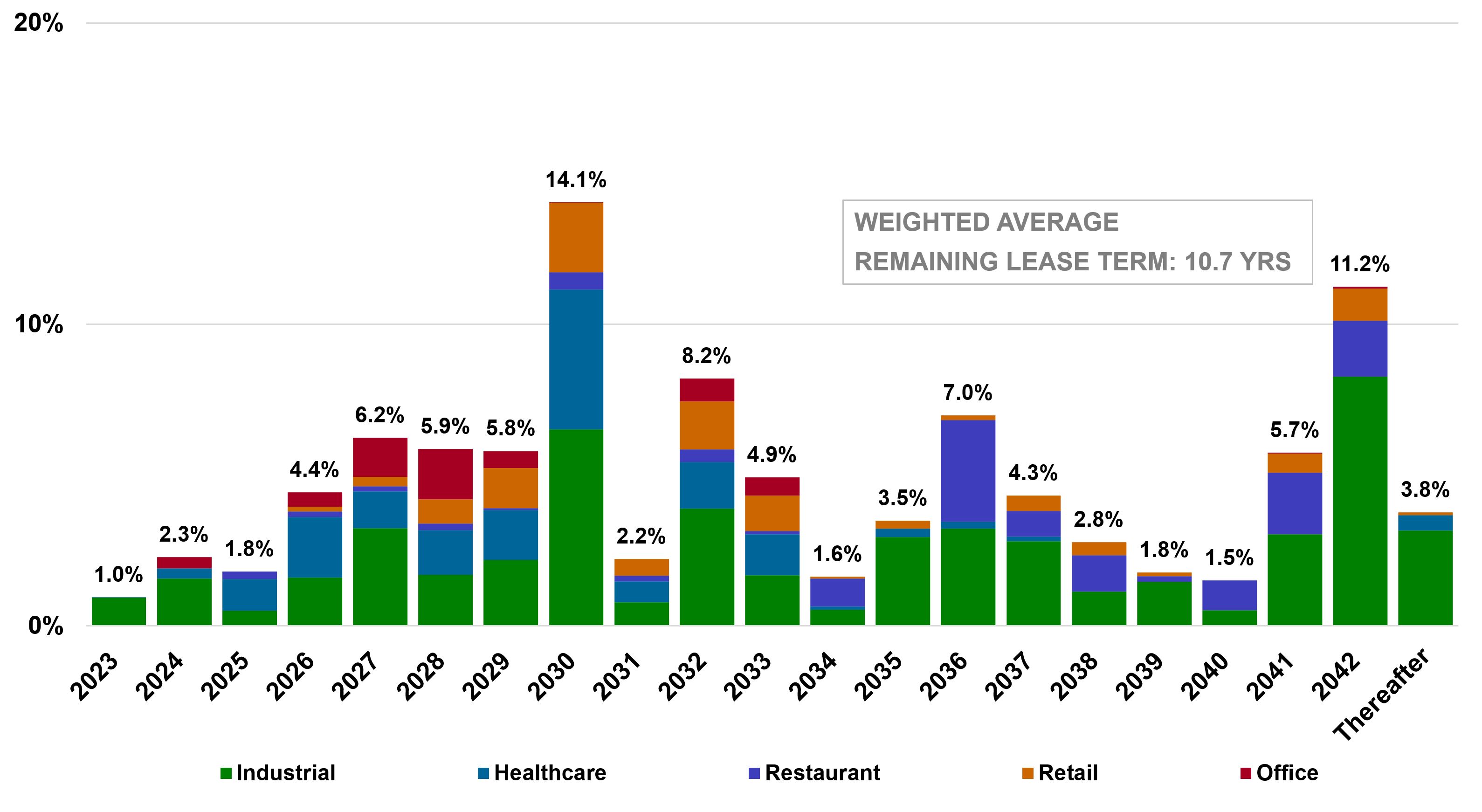

Lease Expirations | 27 |

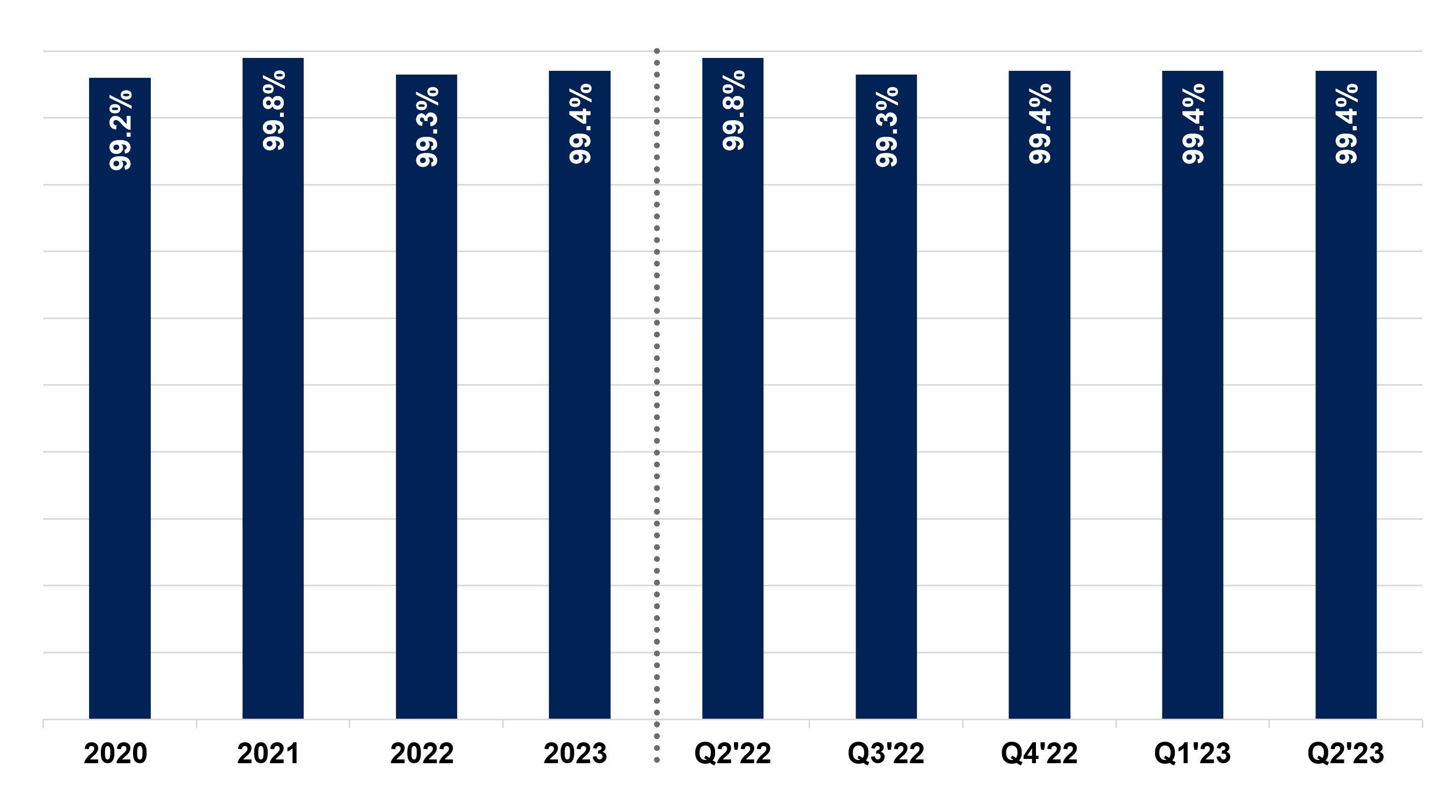

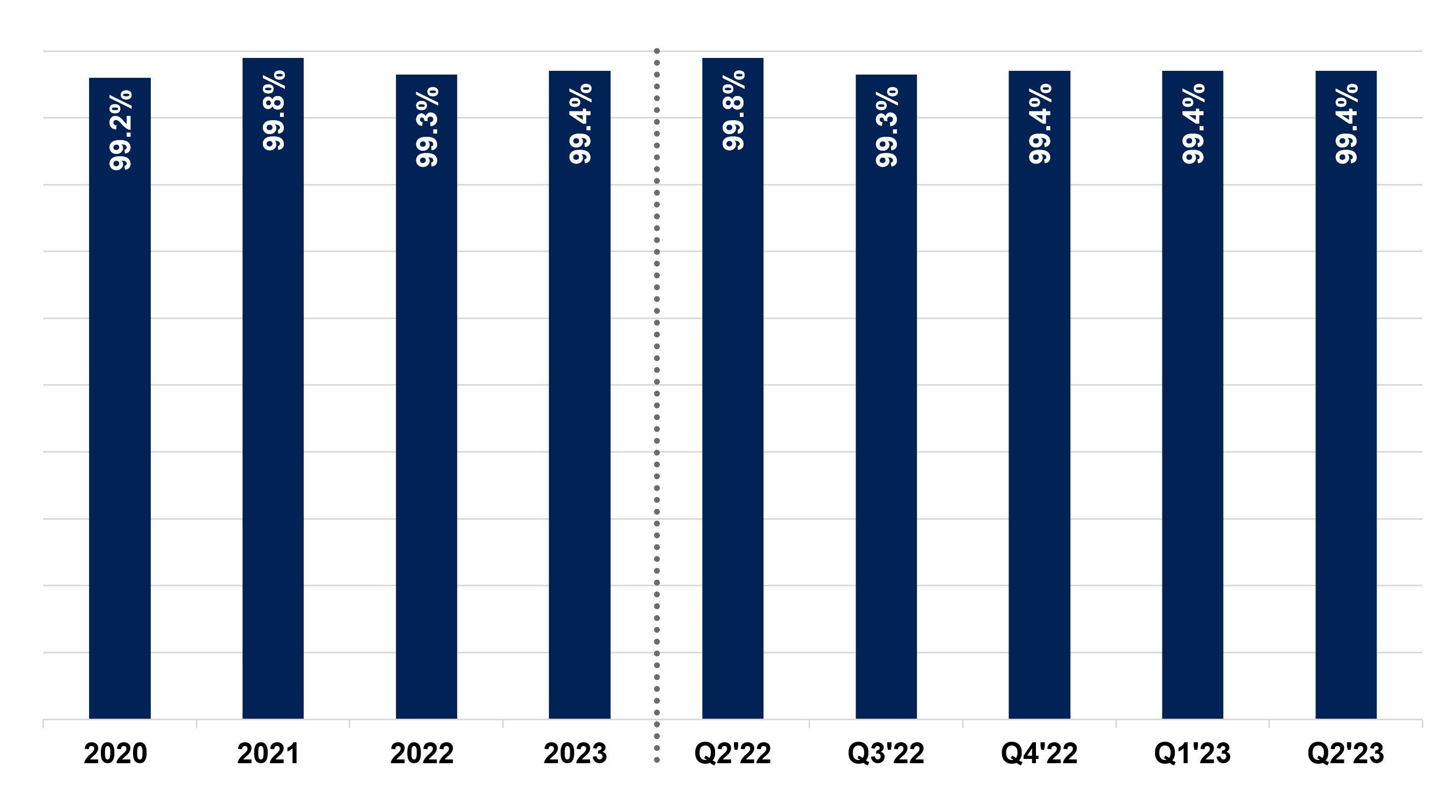

Portfolio Occupancy | 28 |

Definitions and Explanations | 29-30 |

| |

| |

| |

| |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 2

About the Data

This data and other information described herein are as of and for the three months ended June 30, 2023 unless otherwise indicated. Future performance may not be consistent with past performance and is subject to change and inherent risks and uncertainties. This information should be read in conjunction with Broadstone Net Lease, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2022, including the financial statements and the management's discussion and analysis of financial condition and results of operations sections.

Forward Looking Statements

Information set forth herein contains forward-looking statements, which reflect our current views regarding our business, financial performance, growth prospects and strategies, market opportunities, and market trends. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify these forward-looking statements by the use of words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "could," "seeks," "approximately," "projects," "predicts," "intends," "plans," "estimates," "anticipates," or the negative version of these words or other comparable words. All of the forward-looking statements herein are subject to various risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results, performance, and achievements could differ materially from those expressed in or by the forward-looking statements and may be affected by a variety of risks and other factors. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from such forward-looking statements. These factors include, but are not limited to, risks and uncertainties related to general economic conditions, including but not limited to increases in the rate of inflation and/or interest rates, local real estate conditions, tenant financial health, and property acquisitions and the timing of these investments and acquisitions. These and other risks, assumptions, and uncertainties are described in our filings with the SEC, which are available on the SEC's website at www.sec.gov.

You are cautioned not to place undue reliance on any forward-looking statements included herein. All forward-looking statements are made as of the date of this document and the risk that actual results, performance, and achievements will differ materially from the expectations expressed or referenced herein will increase with the passage of time. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 3

Company Overview

Broadstone Net Lease, Inc. (NYSE:BNL) (the "Company," "BNL," "us," "our" and "we") is an industrial-focused, diversified net lease real estate investment trust ("REIT") that acquires, owns, and manages primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. Since our inception, we have selectively invested in real estate across the industrial, healthcare, restaurant, retail, and office property types. We target properties with credit worthy tenants in industries characterized by positive business drivers and trends, where the properties are an integral part of the tenants' businesses and there are opportunities to secure long-term net leases. Through long-term net leases, our tenants are able to retain operational control of their strategically important locations, while allocating their debt and equity capital to fund core business operations rather than real estate ownership.

| | |

Executive Team John D. Moragne Chief Executive Officer and Member, Board of Directors Ryan M. Albano President and Chief Operating Officer Kevin M. Fennell Executive Vice President and Chief Financial Officer John D. Callan, Jr. Senior Vice President, General Counsel, and Secretary Michael B. Caruso Senior Vice President, Corporate Strategy & Investor Relations Timothy D. Dieffenbacher Senior Vice President, Chief Accounting Officer, and Treasurer Laurier James Lessard, Jr. Senior Vice President, Asset Management Jennie L. O'Brien Senior Vice President, Accounting, and Controller Roderick A. Pickney Senior Vice President, Acquisitions Molly Kelly Wiegel Senior Vice President, Human Resources & Administration Andrea T. Wright Senior Vice President, Property Management | | Board of Directors Laurie A. Hawkes Chairman of the Board John D. Moragne Chief Executive Officer Denise Brooks-Williams Michael A. Coke Jessica Duran Laura Felice David M. Jacobstein Shekar Narasimhan James H. Watters |

| |

Company Contact Information Michael Caruso

SVP, Corporate Strategy & Investor Relations michael.caruso@broadstone.com 585-402-7842 Transfer Agent Computershare Trust Company, N.A. 150 Royall Street Canton, Massachusetts 02021 800-736-3001 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 4

Quarterly Financial Summary

(unaudited, dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | Q2 2023 | | | Q1 2023 | | | Q4 2022 | | | Q3 2022 | | | Q2 2022 | |

Financial Summary | | | | | | | | | | | | | | | |

Investment in rental property | | $ | 4,981,430 | | | $ | 5,002,330 | | | $ | 5,035,846 | | | $ | 4,775,460 | | | $ | 4,594,776 | |

Less accumulated depreciation | | | (578,616 | ) | | | (558,410 | ) | | | (533,965 | ) | | | (505,456 | ) | | | (479,952 | ) |

Property under development | | | 37,449 | | | | — | | | | — | | | | — | | | | — | |

Investment in rental property, net | | | 4,440,263 | | | | 4,443,920 | | | | 4,501,881 | | | | 4,270,004 | | | | 4,114,824 | |

Cash and cash equivalents | | | 20,763 | | | | 15,412 | | | | 21,789 | | | | 75,912 | | | | 16,813 | |

Restricted cash | | | 15,502 | | | | 3,898 | | | | 38,251 | | | | 6,449 | | | | 12,163 | |

Total assets | | | 5,368,150 | | | | 5,335,868 | | | | 5,457,609 | | | | 5,239,192 | | | | 4,979,442 | |

Unsecured revolving credit facility | | | 122,912 | | | | 108,330 | | | | 197,322 | | | | 219,537 | | | | 320,657 | |

Mortgages, net | | | 80,141 | | | | 85,853 | | | | 86,602 | | | | 94,753 | | | | 95,453 | |

Unsecured term loans, net | | | 895,319 | | | | 895,006 | | | | 894,692 | | | | 894,378 | | | | 587,098 | |

Senior unsecured notes, net | | | 844,932 | | | | 844,744 | | | | 844,555 | | | | 844,367 | | | | 844,178 | |

Total liabilities | | | 2,106,553 | | | | 2,103,551 | | | | 2,195,104 | | | | 2,231,045 | | | | 2,012,800 | |

Total Broadstone Net Lease, Inc.

stockholders' equity | | | 3,107,536 | | | | 3,079,207 | | | | 3,092,918 | | | | 2,840,692 | | | | 2,798,690 | |

Total equity (book value) | | | 3,261,597 | | | | 3,232,317 | | | | 3,262,505 | | | | 3,008,147 | | | | 2,966,642 | |

| | | | | | | | | | | | | | | |

Revenues | | | 109,353 | | | | 118,992 | | | | 112,135 | | | | 103,524 | | | | 98,013 | |

General and administrative -

other | | | 7,944 | | | | 8,924 | | | | 7,814 | | | | 8,439 | | | | 7,907 | |

Stock based compensation | | | 1,539 | | | | 1,492 | | | | 1,503 | | | | 1,503 | | | | 1,381 | |

General and administrative | | | 9,483 | | | | 10,416 | | | | 9,317 | | | | 9,942 | | | | 9,288 | |

Total operating expenses | | | 53,502 | | | | 59,559 | | | | 61,320 | | | | 59,133 | | | | 50,875 | |

Interest expense | | | 20,277 | | | | 21,139 | | | | 23,773 | | | | 20,095 | | | | 17,888 | |

Net income | | | 62,996 | | | | 41,374 | | | | 36,773 | | | | 28,709 | | | | 35,552 | |

Net earnings per common share,

diluted | | $ | 0.32 | | | $ | 0.21 | | | $ | 0.20 | | | $ | 0.16 | | | $ | 0.20 | |

| | | | | | | | | | | | | | | |

FFO | | | 72,524 | | | | 81,177 | | | | 71,718 | | | | 72,169 | | | | 68,340 | |

FFO per share, diluted | | $ | 0.37 | | | $ | 0.41 | | | $ | 0.39 | | | $ | 0.39 | | | $ | 0.38 | |

Core FFO | | | 74,381 | | | | 74,473 | | | | 70,527 | | | | 66,677 | | | | 65,986 | |

Core FFO per share, diluted | | $ | 0.38 | | | $ | 0.38 | | | $ | 0.38 | | | $ | 0.36 | | | $ | 0.37 | |

AFFO | | | 69,004 | | | | 67,485 | | | | 65,584 | | | | 63,386 | | | | 62,804 | |

AFFO per share, diluted | | $ | 0.35 | | | $ | 0.34 | | | $ | 0.36 | | | $ | 0.35 | | | $ | 0.35 | |

| | | | | | | | | | | | | | | |

Net cash provided by operating

activities | | | 62,228 | | | | 74,376 | | | | 60,440 | | | | 77,515 | | | | 58,855 | |

Net cash provided by (used in)

investing activities | | | 1,713 | | | | 29,633 | | | | (274,485 | ) | | | (205,187 | ) | | | (172,293 | ) |

Net cash (used in) provided by

financing activities | | | (46,986 | ) | | | (144,739 | ) | | | 191,724 | | | | 181,057 | | | | 76,867 | |

Distributions declared | | | 55,419 | | | | 54,887 | | | | 45,824 | | | | 46,242 | | | | 49,507 | |

Distributions declared per diluted

share | | $ | 0.280 | | | $ | 0.275 | | | $ | 0.275 | | | $ | 0.270 | | | $ | 0.270 | |

| | | | | | | | | | | | | | | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 5

Balance Sheet

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | June 30,

2023 | | | March 31,

2023 | | | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | |

Assets | | | | | | | | | | | | | | | |

Accounted for using the operating method: | | | | | | | | | | | | | | | |

Land | | $ | 754,402 | | | $ | 760,142 | | | $ | 768,667 | | | $ | 755,206 | | | $ | 731,208 | |

Land improvements | | | 332,757 | | | | 337,296 | | | | 340,385 | | | | 331,858 | | | | 320,513 | |

Buildings and improvements | | | 3,857,236 | | | | 3,866,952 | | | | 3,888,756 | | | | 3,650,275 | | | | 3,503,478 | |

Equipment | | | 9,608 | | | | 10,422 | | | | 10,422 | | | | 10,422 | | | | 10,422 | |

Total accounted for using the

operating method | | | 4,954,003 | | | | 4,974,812 | | | | 5,008,230 | | | | 4,747,761 | | | | 4,565,621 | |

Less accumulated depreciation | | | (578,616 | ) | | | (558,410 | ) | | | (533,965 | ) | | | (505,456 | ) | | | (479,952 | ) |

Accounted for using the

operating method, net | | | 4,375,387 | | | | 4,416,402 | | | | 4,474,265 | | | | 4,242,305 | | | | 4,085,669 | |

Accounted for using the direct

financing method | | | 26,855 | | | | 26,947 | | | | 27,045 | | | | 27,128 | | | | 28,584 | |

Accounted for using the sales-type

method | | | 572 | | | | 571 | | | | 571 | | | | 571 | | | | 571 | |

Property under development | | | 37,449 | | | | — | | | | — | | | | — | | | | — | |

Investment in rental property, net | | | 4,440,263 | | | | 4,443,920 | | | | 4,501,881 | | | | 4,270,004 | | | | 4,114,824 | |

Cash and cash equivalents | | | 20,763 | | | | 15,412 | | | | 21,789 | | | | 75,912 | | | | 16,813 | |

Accrued rental income | | | 148,697 | | | | 142,031 | | | | 135,666 | | | | 129,579 | | | | 124,297 | |

Tenant and other receivables, net | | | 1,895 | | | | 2,004 | | | | 1,349 | | | | 791 | | | | 2,069 | |

Prepaid expenses and other assets | | | 42,322 | | | | 29,764 | | | | 64,180 | | | | 34,221 | | | | 38,989 | |

Interest rate swap, assets | | | 65,143 | | | | 45,490 | | | | 63,390 | | | | 66,602 | | | | 26,562 | |

Goodwill | | | 339,769 | | | | 339,769 | | | | 339,769 | | | | 339,769 | | | | 339,769 | |

Intangible lease assets, net | | | 309,298 | | | | 317,478 | | | | 329,585 | | | | 322,314 | | | | 316,119 | |

Total assets | | $ | 5,368,150 | | | $ | 5,335,868 | | | $ | 5,457,609 | | | $ | 5,239,192 | | | $ | 4,979,442 | |

Liabilities and equity | | | | | | | | | | | | | | | |

Unsecured revolving credit facility | | $ | 122,912 | | | $ | 108,330 | | | $ | 197,322 | | | $ | 219,537 | | | $ | 320,657 | |

Mortgages, net | | | 80,141 | | | | 85,853 | | | | 86,602 | | | | 94,753 | | | | 95,453 | |

Unsecured term loans, net | | | 895,319 | | | | 895,006 | | | | 894,692 | | | | 894,378 | | | | 587,098 | |

Senior unsecured notes, net | | | 844,932 | | | | 844,744 | | | | 844,555 | | | | 844,367 | | | | 844,178 | |

Accounts payable and other liabilities | | | 44,147 | | | | 46,090 | | | | 47,547 | | | | 52,594 | | | | 42,923 | |

Dividends payable | | | 55,640 | | | | 54,515 | | | | 54,460 | | | | 49,886 | | | | 49,541 | |

Accrued interest payable | | | 5,889 | | | | 9,654 | | | | 7,071 | | | | 10,559 | | | | 6,086 | |

Intangible lease liabilities, net | | | 57,573 | | | | 59,359 | | | | 62,855 | | | | 64,971 | | | | 66,864 | |

Total liabilities | | | 2,106,553 | | | | 2,103,551 | | | | 2,195,104 | | | | 2,231,045 | | | | 2,012,800 | |

Equity | | | | | | | | | | | | | | | |

Broadstone Net Lease, Inc.

stockholders' equity: | | | | | | | | | | | | | | | |

Preferred stock, $0.001 par value | | | — | | | | — | | | | — | | | | — | | | | — | |

Common stock, $0.00025 par value | | | 47 | | | | 47 | | | | 47 | | | | 43 | | | | 43 | |

Additional paid-in capital | | | 3,430,692 | | | | 3,434,534 | | | | 3,419,395 | | | | 3,148,075 | | | | 3,125,377 | |

Cumulative distributions in excess of

retained earnings | | | (391,631 | ) | | | (398,890 | ) | | | (386,049 | ) | | | (369,260 | ) | | | (350,127 | ) |

Accumulated other comprehensive

Income | | | 68,428 | | | | 43,516 | | | | 59,525 | | | | 61,834 | | | | 23,397 | |

Total Broadstone Net Lease, Inc.

stockholders’ equity | | | 3,107,536 | | | | 3,079,207 | | | | 3,092,918 | | | | 2,840,692 | | | | 2,798,690 | |

Non-controlling interests | | | 154,061 | | | | 153,110 | | | | 169,587 | | | | 167,455 | | | | 167,952 | |

Total equity | | | 3,261,597 | | | | 3,232,317 | | | | 3,262,505 | | | | 3,008,147 | | | | 2,966,642 | |

Total liabilities and equity | | $ | 5,368,150 | | | $ | 5,335,868 | | | $ | 5,457,609 | | | $ | 5,239,192 | | | $ | 4,979,442 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 6

Income Statement Summary

(unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | June 30,

2023 | | | March 31,

2023 | | | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | |

Revenues | | | | | | | | | | | | | | | |

Lease revenues, net | | $ | 109,353 | | | $ | 118,992 | | | $ | 112,135 | | | $ | 103,524 | | | $ | 98,013 | |

Operating expenses | | | | | | | | | | | | | | | |

Depreciation and amortization | | | 39,031 | | | | 41,784 | | | | 45,606 | | | | 39,400 | | | | 35,511 | |

Property and operating

expense | | | 4,988 | | | | 5,886 | | | | 6,397 | | | | 5,636 | | | | 4,696 | |

General and administrative | | | 9,483 | | | | 10,416 | | | | 9,317 | | | | 9,942 | | | | 9,288 | |

Provision for impairment of

investment in rental

properties | | | — | | | | 1,473 | | | | — | | | | 4,155 | | | | 1,380 | |

Total operating expenses | | | 53,502 | | | | 59,559 | | | | 61,320 | | | | 59,133 | | | | 50,875 | |

Other income (expenses) | | | | | | | | | | | | | | | |

Interest income | | | 82 | | | | 162 | | | | 40 | | | | 4 | | | | — | |

Interest expense | | | (20,277 | ) | | | (21,139 | ) | | | (23,773 | ) | | | (20,095 | ) | | | (17,888 | ) |

Gain on sale of real estate | | | 29,462 | | | | 3,415 | | | | 10,625 | | | | 61 | | | | 4,071 | |

Income taxes | | | (448 | ) | | | (479 | ) | | | (106 | ) | | | (356 | ) | | | (401 | ) |

Other (expenses) income | | | (1,674 | ) | | | (18 | ) | | | (828 | ) | | | 4,704 | | | | 2,632 | |

Net income | | | 62,996 | | | | 41,374 | | | | 36,773 | | | | 28,709 | | | | 35,552 | |

Net income attributable to

non-controlling interests | | | (2,982 | ) | | | (2,070 | ) | | | (2,041 | ) | | | (1,600 | ) | | | (2,036 | ) |

Net income attributable to

Broadstone Net Lease, Inc. | | $ | 60,014 | | | $ | 39,304 | | | $ | 34,732 | | | $ | 27,109 | | | $ | 33,516 | |

| | | | | | | | | | | | | | | |

Weighted average number of common shares outstanding | | | | | | | | | | | | | | | |

Basic1 | | | 186,733 | | | | 186,130 | | | | 173,283 | | | | 172,578 | | | | 169,555 | |

Diluted1 | | | 196,228 | | | | 196,176 | | | | 183,592 | | | | 182,971 | | | | 180,256 | |

Net earnings per common share2 | | | | | | | | | | | | | | | |

Basic and diluted | | $ | 0.32 | | | $ | 0.21 | | | $ | 0.20 | | | $ | 0.16 | | | $ | 0.20 | |

1 Excludes 504,161, 431,392, 396,924, 395,441, and 377,407, weighted average shares of unvested restricted common stock for the three months ended June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022, and June 30, 2022, respectively.

2 Excludes $0.2 million from the numerator for the three months ended June 30, 2023, and $0.1 million from the numerator for the three months ended March 31, 2023, December 31, 2022, September 30, 2022, and June 30, 2022, related to dividends declared on shares of unvested restricted stock.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 7

Funds From Operations (FFO), Core Funds From Operations (Core FFO), and Adjusted Funds From Operations (AFFO)

(unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | June 30,

2023 | | | March 31,

2023 | | | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | |

Net income | | $ | 62,996 | | | $ | 41,374 | | | $ | 36,773 | | | $ | 28,709 | | | $ | 35,552 | |

Real property depreciation and

amortization | | | 38,990 | | | | 41,745 | | | | 45,570 | | | | 39,366 | | | | 35,479 | |

Gain on sale of real estate | | | (29,462 | ) | | | (3,415 | ) | | | (10,625 | ) | | | (61 | ) | | | (4,071 | ) |

Provision for impairment of investment

in rental properties | | | — | | | | 1,473 | | | | — | | | | 4,155 | | | | 1,380 | |

FFO | | $ | 72,524 | | | $ | 81,177 | | | $ | 71,718 | | | $ | 72,169 | | | $ | 68,340 | |

Net write-offs of accrued rental income | | | — | | | | 297 | | | | — | | | | — | | | | — | |

Lease termination fees | | | — | | | | (7,500 | ) | | | (1,678 | ) | | | (791 | ) | | | — | |

Cost of debt extinguishment | | | 3 | | | | — | | | | 77 | | | | 231 | | | | — | |

Gain on insurance recoveries | | | — | | | | — | | | | (341 | ) | | | — | | | | — | |

Severance and executive transition costs1 | | | 183 | | | | 481 | | | | — | | | | 3 | | | | 278 | |

Other (income) expenses2 | | | 1,671 | | | | 18 | | | | 751 | | | | (4,935 | ) | | | (2,632 | ) |

Core FFO | | $ | 74,381 | | | $ | 74,473 | | | $ | 70,527 | | | $ | 66,677 | | | $ | 65,986 | |

Straight-line rent adjustment | | | (7,276 | ) | | | (7,271 | ) | | | (6,826 | ) | | | (5,175 | ) | | | (4,965 | ) |

Adjustment to provision for credit

losses | | | (10 | ) | | | — | | | | — | | | | (4 | ) | | | (1 | ) |

Amortization of debt issuance costs | | | 986 | | | | 986 | | | | 988 | | | | 948 | | | | 900 | |

Amortization of net mortgage

premiums | | | (52 | ) | | | (26 | ) | | | (26 | ) | | | (26 | ) | | | (25 | ) |

Loss on interest rate swaps and

other non-cash interest expense | | | 521 | | | | 522 | | | | 522 | | | | 639 | | | | 695 | |

Amortization of lease intangibles | | | (1,085 | ) | | | (2,691 | ) | | | (1,308 | ) | | | (1,176 | ) | | | (1,167 | ) |

Stock-based compensation | | | 1,539 | | | | 1,492 | | | | 1,503 | | | | 1,503 | | | | 1,381 | |

Deferred taxes | | | — | | | | — | | | | 204 | | | | — | | | | — | |

AFFO | | $ | 69,004 | | | $ | 67,485 | | | $ | 65,584 | | | $ | 63,386 | | | $ | 62,804 | |

| | | | | | | | | | | | | | | |

Diluted weighted average shares

outstanding3 | | | 196,228 | | | | 196,176 | | | | 183,592 | | | | 182,971 | | | | 180,256 | |

Net earnings per diluted share4 | | $ | 0.32 | | | $ | 0.21 | | | $ | 0.20 | | | $ | 0.16 | | | $ | 0.20 | |

FFO per diluted share4 | | | 0.37 | | | | 0.41 | | | | 0.39 | | | | 0.39 | | | | 0.38 | |

Core FFO per diluted share4 | | | 0.38 | | | | 0.38 | | | | 0.38 | | | | 0.36 | | | | 0.37 | |

AFFO per diluted share4 | | | 0.35 | | | | 0.34 | | | | 0.36 | | | | 0.35 | | | | 0.35 | |

1 Amount includes $0.2 million and $0.1 million of executive transition costs during the three months ended June 30, 2023 and March 31, 2023, respectively, and $0.4 million of accelerated stock-based compensation during the three months ended March 31, 2023, related to the departure of our previous chief executive officer.

2 Amount includes $1.7 million, $18 thousand, $0.8 million, ($4.9) million, and ($2.6) million of unrealized and realized foreign exchange loss (gain) for the three months ended June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, respectively, primarily associated with our Canadian dollar denominated revolver borrowings.

3 Excludes 504,161, 431,392, 396,924, 395,441, and 377,407, weighted average shares of unvested restricted common stock for the three months ended June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022, and June 30, 2022, respectively.

4 Excludes $0.2 million from the numerator for the three months ended June 30, 2023, and $0.1 million from the numerator for the three months ended March 31, 2023, December 31, 2022, September 30, 2022, and June 30, 2022, related to dividends declared on shares of unvested restricted stock.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 8

EBITDA, EBITDAre, and Other-Non GAAP Operating Measures

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | June 30,

2023 | | | March 31,

2023 | | | December 31,

2022 | | | September 30,

2022 | | | June 30,

2022 | |

Net income | | $ | 62,996 | | | $ | 41,374 | | | $ | 36,773 | | | $ | 28,709 | | | $ | 35,552 | |

Depreciation and amortization | | | 39,031 | | | | 41,784 | | | | 45,606 | | | | 39,400 | | | | 35,511 | |

Interest expense | | | 20,277 | | | | 21,139 | | | | 23,773 | | | | 20,095 | | | | 17,888 | |

Income taxes | | | 448 | | | | 479 | | | | 105 | | | | 356 | | | | 401 | |

EBITDA | | $ | 122,752 | | | $ | 104,776 | | | $ | 106,257 | | | $ | 88,560 | | | $ | 89,352 | |

Provision for impairment of investment in

rental properties | | | — | | | | 1,473 | | | | — | | | | 4,155 | | | | 1,380 | |

Gain on sale of real estate | | | (29,462 | ) | | | (3,415 | ) | | | (10,625 | ) | | | (61 | ) | | | (4,071 | ) |

EBITDAre | | $ | 93,290 | | | $ | 102,834 | | | $ | 95,632 | | | $ | 92,654 | | | $ | 86,661 | |

Adjustment for current quarter acquisition activity 1 | | | 342 | | | | 406 | | | | 1,283 | | | | 2,358 | | | | 2,780 | |

Adjustment for current quarter disposition activity 2 | | | (444 | ) | | | (365 | ) | | | (440 | ) | | | — | | | | (141 | ) |

Adjustment to exclude non-recurring and other expenses 3 | | | 183 | | | | (1,023 | ) | | | — | | | | — | | | | — | |

Adjustment to exclude gain on insurance recoveries | | | — | | | | — | | | | (341 | ) | | | — | | | | — | |

Adjustment to exclude net write-offs of accrued rental income | | | — | | | | 297 | | | | — | | | | — | | | | — | |

Adjustment to exclude realized / unrealized foreign exchange (gain) loss | | | 1,681 | | | | 18 | | | | 796 | | | | (4,934 | ) | | | (2,632 | ) |

Adjustment to exclude cost of debt extinguishments | | | 3 | | | | — | | | | 77 | | | | 231 | | | | — | |

Adjustment to exclude lease termination fees | | | — | | | | (7,500 | ) | | | (1,678 | ) | | | (791 | ) | | | — | |

Adjusted EBITDAre | | $ | 95,055 | | | $ | 94,667 | | | $ | 95,329 | | | $ | 89,518 | | | $ | 86,668 | |

General and administrative | | | 9,300 | | | | 9,935 | | | | 9,318 | | | | 9,942 | | | | 9,288 | |

Adjusted Net Operating Income ("NOI") | | $ | 104,355 | | | $ | 104,602 | | | $ | 104,647 | | | $ | 99,460 | | | $ | 95,956 | |

Straight-line rental revenue, net | | | (7,277 | ) | | | (7,425 | ) | | | (7,315 | ) | | | (5,750 | ) | | | (5,616 | ) |

Other amortization and non-cash charges | | | (1,095 | ) | | | (1,668 | ) | | | (1,353 | ) | | | (1,177 | ) | | | (1,167 | ) |

Adjusted Cash NOI | | $ | 95,983 | | | $ | 95,509 | | | $ | 95,979 | | | $ | 92,533 | | | $ | 89,173 | |

Annualized EBITDAre | | $ | 373,160 | | | $ | 411,336 | | | $ | 382,528 | | | $ | 370,616 | | | $ | 346,642 | |

Annualized Adjusted EBITDAre | | | 380,220 | | | | 378,668 | | | | 381,315 | | | | 358,072 | | | | 346,672 | |

Annualized Adjusted NOI | | | 417,420 | | | | 418,411 | | | | 418,585 | | | | 397,834 | | | | 383,830 | |

Annualized Adjusted Cash NOI | | | 383,932 | | | | 382,043 | | | | 383,914 | | | | 370,128 | | | | 356,701 | |

1 Reflects an adjustment to give effect to all investments during the quarter as if they had been acquired as of the beginning of the quarter.

2 Reflects an adjustment to give effect to all dispositions during the quarter as if they had been sold as of the beginning of the quarter.

3 Amounts include $0.2 million of executive transition costs and $0.5 million of executive transition costs and accelerated amortization of stock-based compensation for the three months ended June 30, 2023 and March 31, 2023, related to the departure of our previous chief executive officer, and $(1.5) million of accelerated amortization of lease intangibles during the three months ended March 31, 2023.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 9

Lease Revenues Detail

(unaudited, in thousands)

| | | | | | | | | | |

| | Three Months Ended |

| | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

Contractual rental amounts billed for

operating leases | | $96,456 | | $98,102 | | $96,208 | | $91,208 | | $87,505 |

Adjustment to recognize contractual

operating lease billings on a straight-

line basis | | 7,380 | | 7,370 | | 6,898 | | 5,344 | | 5,090 |

Net write-offs of accrued rental income | | — | | (105) | | — | | — | | — |

Variable rental amounts earned | | 452 | | 341 | | 721 | | 309 | | 291 |

Earned income from direct financing

leases | | 689 | | 691 | | 693 | | 719 | | 721 |

Interest income from sales-type

leases | | 15 | | 14 | | 15 | | 14 | | 15 |

Operating expenses billed to tenants | | 4,594 | | 5,075 | | 5,720 | | 5,061 | | 4,263 |

Other income from real estate

transactions | | 3 | | 7,392 | | 2,019 | | 874 | | 134 |

Adjustment to revenue recognized for

uncollectible rental amounts billed, net | | (236) | | 112 | | (139) | | (5) | | (6) |

Total Lease revenues, net | | $109,353 | | $118,992 | | $112,135 | | $103,524 | | $98,013 |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 10

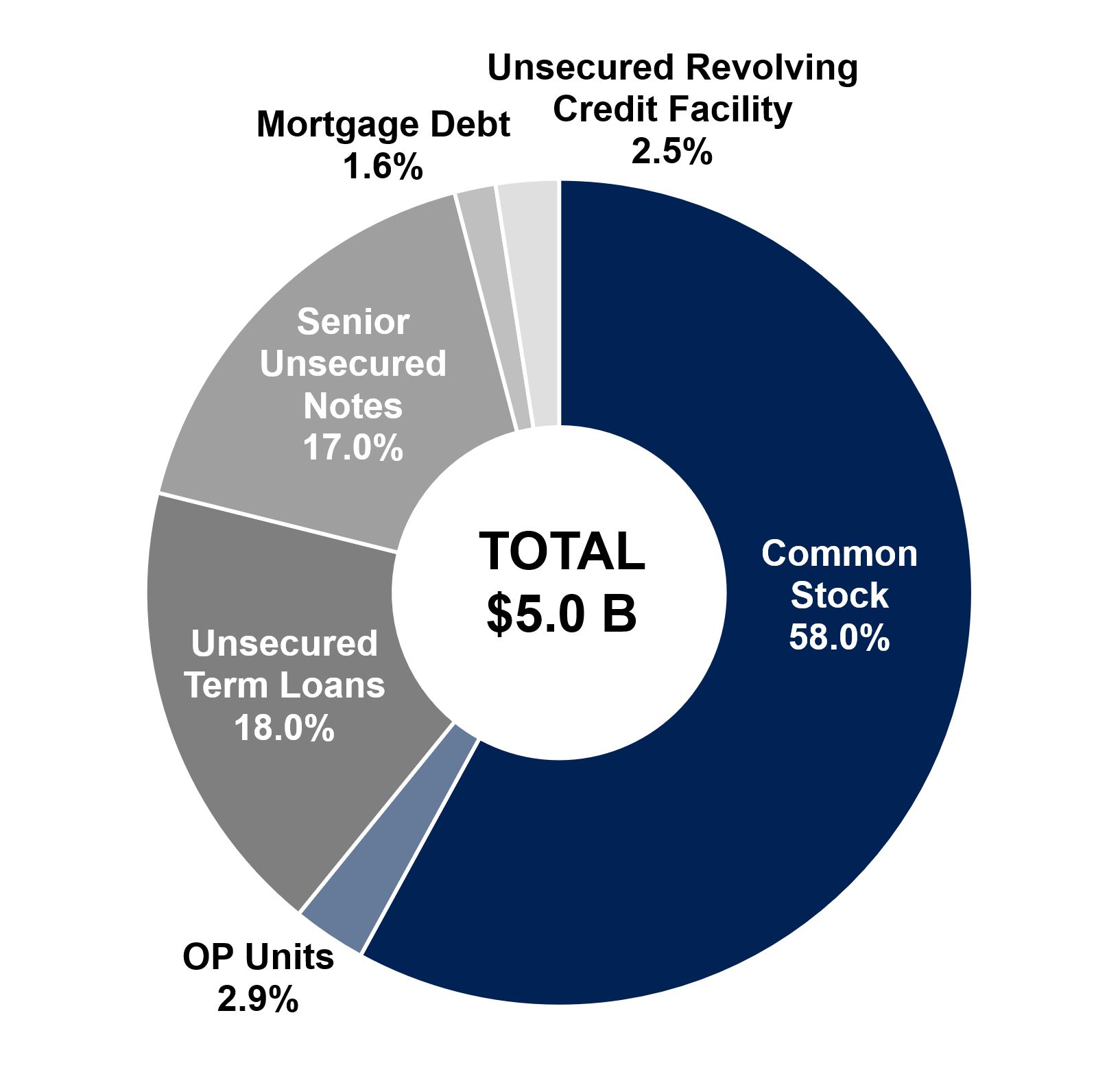

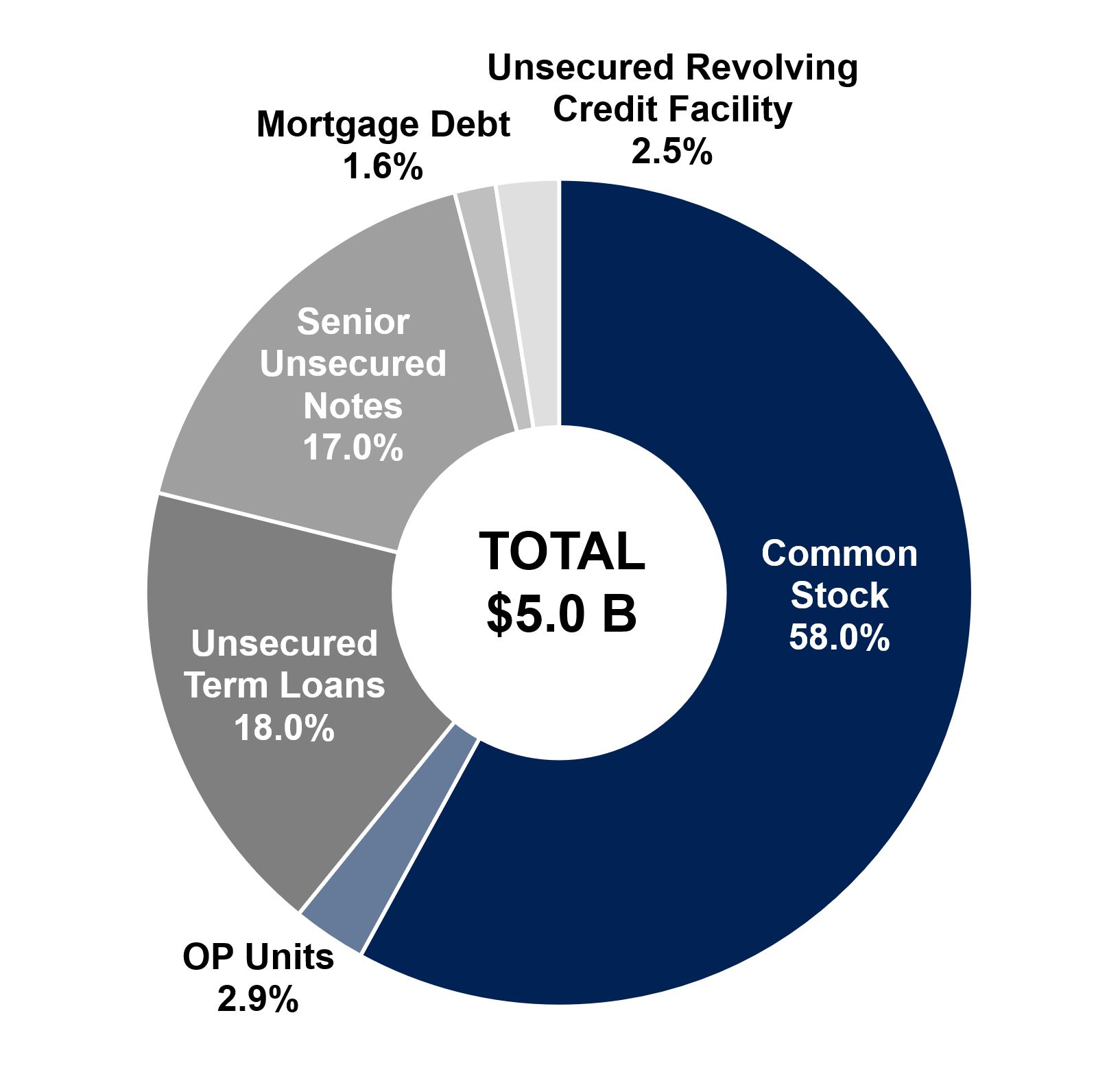

Capital Structure

(in thousands, except per share data)

| | | | |

EQUITY | | | |

Shares of Common Stock | | | 187,273 | |

OP Units | | | 9,283 | |

Common Stock & OP Units | | | 196,556 | |

Price Per Share / Unit at June 30, 2023 | | $ | 15.44 | |

IMPLIED EQUITY MARKET CAPITALIZATION | | $ | 3,034,828 | |

% of Total Capitalization | | | 60.8 | % |

DEBT | | | |

Unsecured Revolving Credit Facility - 2026 | | $ | 122,912 | |

Unsecured Term Loans | | | 900,000 | |

Unsecured Term Loan - 2026 | | | 400,000 | |

Unsecured Term Loan - 2027 | | | 200,000 | |

Unsecured Term Loan - 2029 | | | 300,000 | |

Senior Unsecured Notes | | | 850,000 | |

Senior Unsecured Notes - 2027 | | | 150,000 | |

Senior Unsecured Notes - 2028 | | | 225,000 | |

Senior Unsecured Notes - 2030 | | | 100,000 | |

Senior Unsecured Public Notes - 2031 | | | 375,000 | |

Mortgage Debt - Various | | | 80,264 | |

TOTAL DEBT | | $ | 1,953,176 | |

% of Total Capitalization | | | 39.2 | % |

Floating Rate Debt % | | | 2.4 | % |

Fixed Rate Debt % | | | 97.6 | % |

Secured Debt % | | | 4.1 | % |

Unsecured Debt % | | | 95.9 | % |

| | | |

Total Capitalization | | $ | 4,988,004 | |

Less: Cash and Cash Equivalents | | | (20,763 | ) |

Enterprise Value | | $ | 4,967,241 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 11

Equity Rollforward

(in thousands)

| | | | | | | | | | | | | |

| | | Shares of Common Stock | | | OP Units | | | Total Diluted Shares | |

Balance, January 1, 2023 | | | | 186,114 | | | | 10,205 | | | | 196,319 | |

Grants of restricted stock awards - Employees | | | | 259 | | | | — | | | | 259 | |

Retirement of common shares under equity incentive plan | | | | (66 | ) | | | — | | | | (66 | ) |

OP conversion | | | | 896 | | | | (896 | ) | | | — | |

Balance, March 31, 2023 | | | | 187,203 | | | | 9,309 | | | | 196,512 | |

Grants of restricted stock awards - Board of Directors | | | | 50 | | | | — | | | | 50 | |

Grants of restricted stock awards - Employees | | | | 1 | | | | — | | | | 1 | |

Forfeiture of restricted stock awards | | | | (6 | ) | | | — | | | | (6 | ) |

OP conversion | | | | 25 | | | | (25 | ) | | | — | |

Balance, June 30, 2023 | | | | 187,273 | | | | 9,284 | | | | 196,557 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 12

Debt Outstanding

(in thousands)

| | | | | | | | | | | | |

| | Outstanding Balance | | | | | |

| | June 30, | | | December 31, | | | | | |

| | 2023 | | | 2022 | | | Interest Rate | | Maturity Date |

Unsecured revolving credit facility | $ | 122,912 | | | $ | 197,322 | | | Applicable reference rate

+ 0.85%1 | | Mar. 2026 |

Unsecured term loans: | | | | | | | | | | |

2026 Unsecured Term Loan | | | 400,000 | | | | 400,000 | | | one-month adjusted SOFR + 1.00%2 | | Feb. 2026 |

2027 Unsecured Term Loan | | | 200,000 | | | | 200,000 | | | one-month adjusted SOFR + 0.95% | | Aug. 2027 |

2029 Unsecured Term Loan | | | 300,000 | | | | 300,000 | | | one-month adjusted SOFR + 1.25% | | Aug. 2029 |

Total unsecured term loans | | | 900,000 | | | | 900,000 | | | | | |

Unamortized debt issuance costs, net | | | (4,681 | ) | | | (5,308 | ) | | | | |

Total unsecured term loans, net | | | 895,319 | | | | 894,692 | | | | | |

Senior unsecured notes: | | | | | | | | | | |

2027 Senior Unsecured Notes - Series A | | 150,000 | | | | 150,000 | | | 4.84% | | Apr. 2027 |

2028 Senior Unsecured Notes - Series B | | 225,000 | | | | 225,000 | | | 5.09% | | Jul. 2028 |

2030 Senior Unsecured Notes - Series C | | 100,000 | | | | 100,000 | | | 5.19% | | Jul. 2030 |

2031 Senior Unsecured Public Notes | | | 375,000 | | | | 375,000 | | | 2.60% | | Sep. 2031 |

Total senior unsecured notes | | | 850,000 | | | | 850,000 | | | | | |

Unamortized debt issuance costs and

original issuance discount, net | | | (5,068 | ) | | | (5,445 | ) | | | | |

Total senior unsecured notes, net | | | 844,932 | | | | 844,555 | | | | | |

Total unsecured debt, net | | $ | 1,863,163 | | | $ | 1,936,569 | | | | | |

1 At June 30, 2023 and December 31, 2022, a balance of $16.0 million and $123.5 million was subject to the one-month adjusted SOFR of 5.14% and 4.36%, respectively. At June 30, 2023, a balance of $31.5 million was subject to the daily simple SOFR of 5.09%. The remaining balance includes $100 million CAD borrowings remeasured to $75.4 million USD and $73.8 million USD, at June 30, 2023 and December 31, 2022, respectively, and was subject to the one-month CDOR of 5.27% and 4.74%, respectively.

2 Effective June 30, 2023, the loan converted into a one-month SOFR borrowing concurrent with LIBOR's cessation.

| | | | | | | | | | | | | | |

| | Origination | | Maturity | | | | | | | | |

| | Date | | Date | | Interest | | June 30, | | | December 31, | |

Lender | | (Month/Year) | | (Month/Year) | | Rate | | 2023 | | | 2022 | |

Wilmington Trust National Association | | Apr-19 | | Feb-28 | | 4.92% | | $ | 44,866 | | | $ | 45,516 | |

Wilmington Trust National Association | | Jun-18 | | Aug-25 | | 4.36% | | | 18,939 | | | | 19,150 | |

PNC Bank | | Oct-16 | | Nov-26 | | 3.62% | | | 16,459 | | | | 16,675 | |

Aegon | | Apr-12 | | Oct-23 | | 6.38% | | | — | | | | 5,413 | |

Total mortgages | | | | | | | | | 80,264 | | | | 86,754 | |

Debt issuance costs, net | | | | | | | | | (123 | ) | | | (152 | ) |

Mortgages, net | | | | | | | | $ | 80,141 | | | $ | 86,602 | |

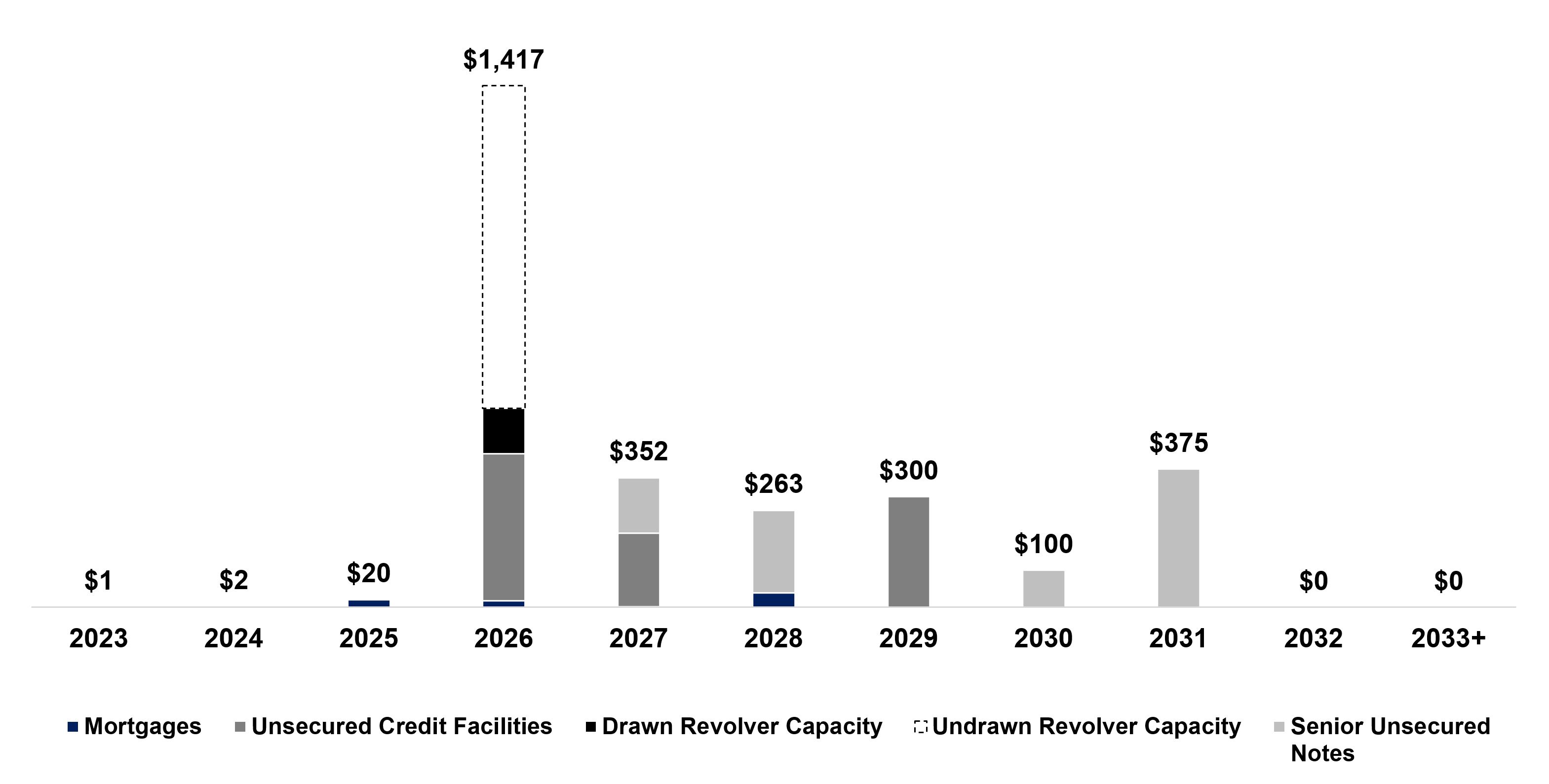

| | | | | | | | | | | | | | | | | | | | |

Year of Maturity | | Revolving

Credit Facility | | | Mortgages | | | Term Loans | | | Senior Notes | | | Total | |

2023 | | $ | — | | | $ | 1,092 | | | $ | — | | | $ | — | | | $ | 1,092 | |

2024 | | | — | | | | 2,260 | | | | — | | | | — | | | | 2,260 | |

2025 | | | — | | | | 20,195 | | | | — | | | | — | | | | 20,195 | |

2026 | | | 122,912 | | | | 16,843 | | | | 400,000 | | | | — | | | | 539,755 | |

2027 | | | — | | | | 1,597 | | | | 200,000 | | | | 150,000 | | | | 351,597 | |

Thereafter | | | — | | | | 38,277 | | | | 300,000 | | | | 700,000 | | | | 1,038,277 | |

Total | | $ | 122,912 | | | $ | 80,264 | | | $ | 900,000 | | | $ | 850,000 | | | $ | 1,953,176 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 13

Net Debt Metrics

(in thousands)

| | | | | | | | | | |

| | | | | | | | | | |

| | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

Debt | | | | | | | | | | |

Unsecured revolving credit facility | | $122,912 | | $108,330 | | $197,322 | | $219,537 | | $320,657 |

Unsecured term loans, net | | 895,319 | | 895,006 | | 894,692 | | 894,378 | | 587,098 |

Senior unsecured notes, net | | 844,932 | | 844,744 | | 844,555 | | 844,367 | | 844,178 |

Mortgages, net | | 80,141 | | 85,853 | | 86,602 | | 94,753 | | 95,453 |

Debt issuance costs | | 9,872 | | 10,390 | | 10,905 | | 11,498 | | 8,991 |

Gross Debt | | 1,953,176 | | 1,944,323 | | 2,034,076 | | 2,064,533 | | 1,856,377 |

Cash and cash equivalents | | (20,763) | | (15,412) | | (21,789) | | (75,912) | | (16,813) |

Restricted cash | | (15,502) | | (3,898) | | (38,251) | | (6,449) | | (12,163) |

Net Debt | | $1,916,911 | | $1,925,013 | | $1,974,036 | | $1,982,172 | | $1,827,401 |

Anticipated proceeds from forward equity agreement | | — | | — | | — | | (270,732) | | — |

Pro Forma Net Debt | | $1,916,911 | | $1,925,013 | | $1,974,036 | | $1,711,440 | | $1,827,401 |

| | | | | | | | | | |

Net Debt to Annualized EBITDAre | | 5.1x | | 4.7x | | 5.2x | | 5.3x | | 5.3x |

Net Debt to Annualized Adjusted

EBITDAre | | 5.0x | | 5.1x | | 5.2x | | 5.5x | | 5.3x |

Pro Forma Net Debt to Annualized

Adjusted EBITDAre | | 5.0x | | 5.1x | | 5.2x | | 4.8x | | 5.3x |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 14

Covenants

The following is a summary of key financial covenants for the Company's unsecured debt instruments. The covenants associated with the Revolving Credit Facility, Unsecured Term Loans with commercial banks, and the Series A-C Senior Unsecured Notes, are reported to the respective lenders via quarterly covenant reporting packages. The covenants associated with the 2031 Senior Unsecured Public Notes are not required to be reported externally to third parties, and are instead calculated in connection with borrowing activity and for financial reporting purposes only. These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show that as of June 30, 2023, the Company believes it is in compliance with the covenants.

| | | | | | | | | | | | | | |

Covenants | | Required | | Revolving Credit Facility and Unsecured Term Loans | | | Senior Unsecured

Notes Series

A, B, & C | | | 2031 Senior Unsecured Public Notes | |

Leverage ratio | | ≤ 0.60 to 1.00 | | | 0.33 | | | | 0.34 | | | Not Applicable | |

Secured indebtedness ratio | | ≤ 0.40 to 1.00 | | | 0.01 | | | | 0.01 | | | Not Applicable | |

Unencumbered coverage ratio | | ≥ 1.75 to 1.00 | | | 3.77 | | | Not Applicable | | | Not Applicable | |

Fixed charge coverage ratio | | ≥ 1.50 to 1.00 | | | 4.12 | | | | 4.12 | | | Not Applicable | |

Total unsecured indebtedness to

total unencumbered eligible

property value | | ≤ 0.60 to 1.00 | | | 0.34 | | | | 0.36 | | | Not Applicable | |

Dividends and other restricted

payments | | Only applicable

in case of default | | Not Applicable | | | Not Applicable | | | Not Applicable | |

Aggregate debt ratio | | ≤ 0.60 to 1.00 | | Not Applicable | | | Not Applicable | | | | 0.36 | |

Consolidated income available for

debt to annual debt service

charge | | ≥ 1.50 to 1.00 | | Not Applicable | | | Not Applicable | | | | 4.60 | |

Total unencumbered assets to

total unsecured debt | | ≥ 1.50 to 1.00 | | Not Applicable | | | Not Applicable | | | | 2.84 | |

Secured debt ratio | | ≤ 0.40 to 1.00 | | Not Applicable | | | Not Applicable | | | | 0.01 | |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 15

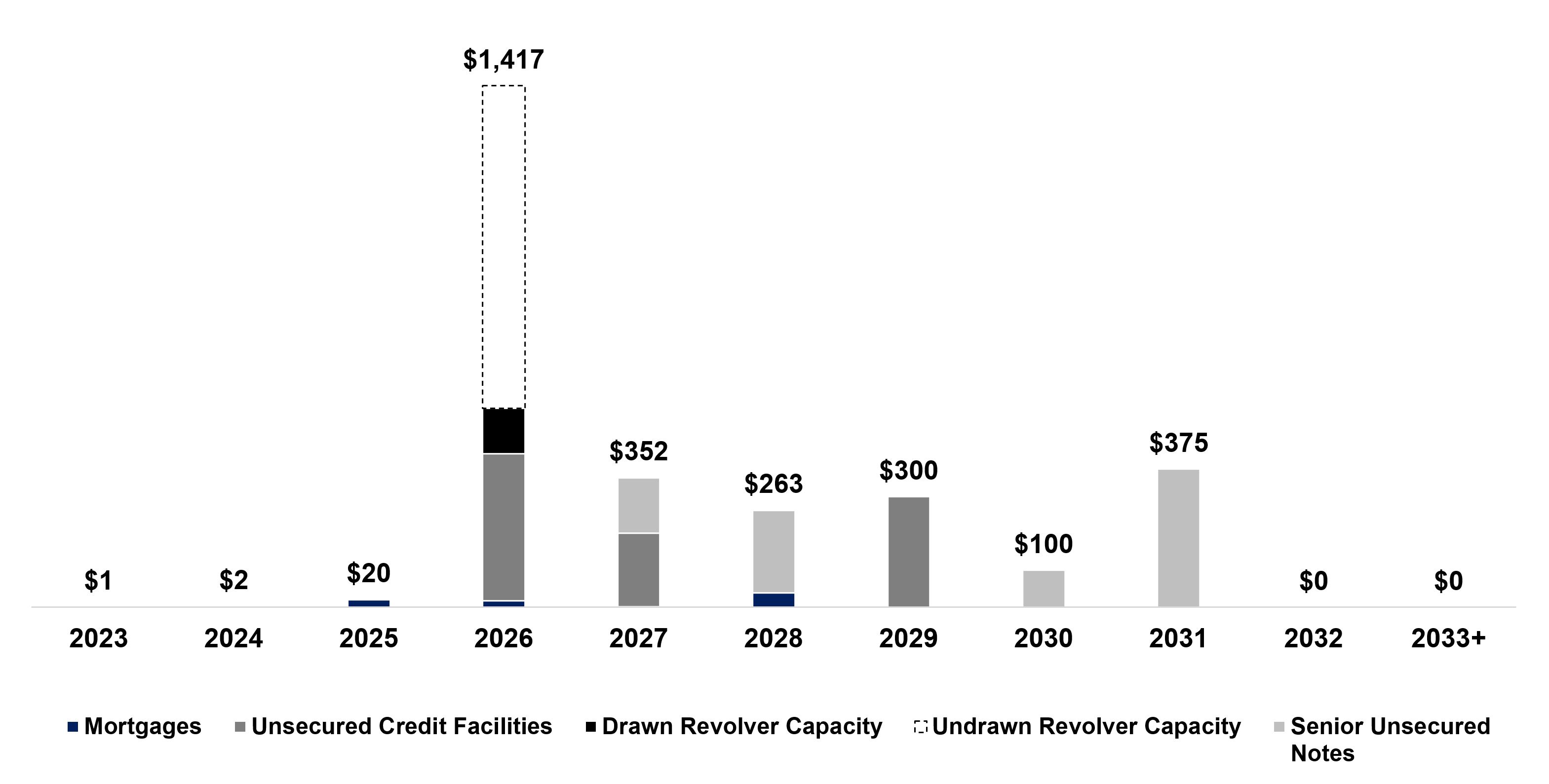

Debt Maturities

(dollars in millions)

The Company utilizes diversified sources of debt capital including unsecured bank debt, unsecured notes, and secured mortgages (where appropriate).

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 16

Investment Activity

(square feet and dollars in thousands)

The following tables summarize the Company's investment activity during 2023.

| | | | | | |

| | Q1 20231 | | Q2 2023 | | YTD 2023 |

Acquisitions: | | | | | | |

Number of transactions | | 1 | | 2 | | 3 |

Number of properties | | 1 | | 3 | | 4 |

Square feet | | 10 | | 144 | | 154 |

Acquisition price | | $5,221 | | $20,384 | | $25,605 |

Industrial | | — | | 20,384 | | 20,384 |

Retail | | 5,221 | | — | | 5,221 |

Restaurant | | — | | — | | — |

Healthcare | | — | | — | | — |

Initial cash capitalization rate | | 6.8% | | 7.4% | | 7.3% |

GAAP capitalization rate | | 8.0% | | 8.6% | | 8.5% |

Weighted avg. lease term (years) | | 20.1 | | 14.2 | | 15.3 |

Weighted average annual rent increase | | 1.8% | | 2.0% | | 2.0% |

| | | | | | |

Revenue generating capital expenditures: | | | | | | |

Number of existing properties | | 2 | | 1 | | 3 |

Investments2 | | $14,825 | | $7,000 | | $21,825 |

Industrial | | 14,825 | | 7,000 | | 21,825 |

Retail | | — | | — | | — |

Restaurant | | — | | — | | — |

Healthcare | | — | | — | | — |

Initial cash capitalization rate | | 7.0% | | 7.0% | | 7.0% |

Weighted avg. lease term (years) | | 18.2 | | 18.4 | | 18.3 |

Weighted average annual rent increase | | 1.8% | | 1.8% | | 1.8% |

| | | | | | |

Development funding opportunities: | | | | | | |

Number of properties | | — | | 1 | | 1 |

Investments2 | | — | | $37,549 | | $37,549 |

| | | | | | |

Total investments | | $20,046 | | $64,933 | | $84,979 |

Total initial cash capitalization rate3 | | 7.0% | | 7.3% | | 7.2% |

Total weighted average lease term (years)3 | | 18.7 | | 15.2 | | 16.7 |

Total weighted average annual rent increase3 | | 1.8% | | 1.9% | | 1.9% |

1 During the first quarter, we entered into an agreement under the terms of an existing lease to substitute two properties with a tenant in exchange for one new property of equal value. Property substitutions are not included in the acquisition/disposition activity, however will affect the total number of properties reported as of June 30, 2023.

2 Total unfunded investment commitments at June 30, 2023, include up to $167.3 million in development fundings and $13.5 million in revenue generating capital expenditures.

3 Due to the nature of development funding opportunities not generating revenue during construction, these developments are excluded from the calculation of total capitalization rates, weighted average lease terms, and rent increases.

Developments4

(square feet and dollars in thousands)

The following table summarizes the Company's current developments as of June 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | |

Property | | Property Type | | Projected Rentable Square Feet | | Start Date4 | | Target Completion Date4 | | Initial Purchase Price4 | | Estimated Project Development Costs4 | | Estimated Total Project Investment4 | | QTD Q2 2023 Investment | | Cumulative Investment at 6/30/23 | | Estimated Stabilized Yield4 | | Estimated GAAP Capitalization Rate |

UNFI (8380 21st Street) | | Industrial | | 1,016 | | 05/2023 | | 10/2024 | | $17,300 | | $187,500 | | $204,800 | | $37,549 | | $37,549 | | 7.3% | | 8.3% |

4 Refer to definitions and explanations appearing on page 30 of this supplemental document.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 17

Dispositions1

(square feet and dollars in thousands)

The following table summarizes the Company's property disposition activity during 2023.

| | | | | | | | | | |

Q1 2023 | | | | | | | | | | |

Property Type | | Number of Properties | | Square Feet | | Acquisition Price | | Disposition Price | | Net Book

Value |

Office2 | | 1 | | 282 | | $33,050 | | 32,000 | | $30,881 |

Industrial | | 1 | | 74 | | 16,240 | | 18,550 | | 15,015 |

Restaurant | | 1 | | 5 | | 1,186 | | 1,324 | | 1,099 |

Total Properties | | 3 | | 361 | | $50,476 | | $51,874 | | $46,995 |

Weighted average cash cap rate2 | | | | | | | | 6.0% |

| | | | | | | | | | |

Q2 2023 | | | | | | | | | | |

Property Type | | Number of Properties | | Square Feet | | Acquisition Price | | Disposition Price | | Net Book

Value |

Office | | 1 | | 58 | | $5,925 | | 3,000 | | $2,701 |

Industrial | | 2 | | 601 | | 43,000 | | 61,950 | | 32,961 |

Retail | | 1 | | 4 | | 3,454 | | 4,440 | | 2,719 |

Total Properties | | 4 | | 663 | | $52,379 | | $69,390 | | $38,381 |

Weighted average cash cap rate | | | | | | | | 5.6% |

| | | | | | | | | | |

2023 Dispositions | | | | | | | | | | |

Property Type | | Number of Properties | | Square Feet | | Acquisition Price | | Disposition Price | | Net Book

Value |

Office2 | | 2 | | 340 | | $38,975 | | $35,000 | | $33,582 |

Industrial | | 3 | | 675 | | $59,240 | | $80,500 | | $47,976 |

Retail | | 1 | | 4 | | $3,454 | | $4,440 | | $2,719 |

Restaurant | | 1 | | 5 | | $1,186 | | $1,324 | | $1,099 |

Total Properties | | 7 | | 1,024 | | $102,855 | | $121,264 | | $85,376 |

Weighted average cash cap rate2 | | | | | | | | 5.7% |

1 During the first quarter, we entered into an agreement under the terms of an existing lease to substitute two properties with a tenant in exchange for one new property of equal value. Property substitutions are not included in the acquisition/disposition activity, however will affect the total number of properties reported as of June 30, 2023.

2 Sale of office asset executed simultaneously with a $7.5 million lease buyout for total proceeds of $39.5 million, representing an all-in cash capitalization rate of 6.1%. Amounts have been excluded from the weighted average cash capitalization rate due to the nature of the separate transactions.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 18

Portfolio at a Glance: Key Metrics

| | | | | | | | | |

| June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 |

Properties1 | 801 | | 801 | | 804 | | 790 | | 764 |

U.S. States | 44 | | 44 | | 44 | | 44 | | 44 |

Canadian Provinces | 4 | | 4 | | 4 | | 4 | | 4 |

Total Annualized Base Rent | $391.0M | | $389.5M | | $389.1M | | $371.9M | | $360.0M |

Total Rentable Sq. Footage | 38.5M | | 39.1M | | 39.1M | | 36.8M | | 34.4M |

Tenants | 221 | | 221 | | 221 | | 218 | | 213 |

Brands | 209 | | 209 | | 211 | | 208 | | 203 |

Industries | 54 | | 54 | | 55 | | 56 | | 57 |

Occupancy (based on SF) | 99.4% | | 99.4% | | 99.4% | | 99.3% | | 99.8% |

Rent Collection | 99.9% | | 100.0% | | 99.9% | | 100.0% | | 100.0% |

Top 10 Tenant Concentration | 19.4% | | 19.2% | | 19.0% | | 17.1% | | 16.5% |

Top 20 Tenant Concentration | 32.1% | | 31.4% | | 31.4% | | 29.8% | | 29.4% |

Investment Grade (tenant/guarantor) | 15.3% | | 15.6% | | 15.4% | | 16.0% | | 16.4% |

Financial Reporting Coverage2 | 94.2% | | 94.3% | | 94.3% | | 94.1% | | 94.0% |

Rent Coverage Ratio (Restaurants Only) | 3.3x | | 3.2x | | 3.2x | | 3.1x | | 3.3x |

Weighted Average Annual Rent Increases | 2.0% | | 2.0% | | 2.0% | | 2.0% | | 2.0% |

Weighted Average Remaining Lease Term | 10.7 years | | 10.8 years | | 10.9 years | | 10.7 years | | 10.6 years |

Master Leases (based on ABR) | | | | | | | | | |

Total Portfolio | 41.5% | | 41.2% | | 40.8% | | 37.7% | | 36.1% |

Multi-site tenants | 69.3% | | 69.3% | | 67.7% | | 65.4% | | 63.9% |

1 During the first quarter, we entered into an agreement under the terms of an existing lease to substitute two properties with a tenant in exchange for one new property of equal value. Property substitutions are not included in the acquisition/disposition activity, however will affect the total number of properties reported as of June 30, 2023.

2 Includes 7.9%, 7.9%, 8.5%, 8.8%, and 9.0%, related to tenants not required to provide financial information under the terms of our lease, but whose financial statements are available publicly at June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022, and June 30, 2022.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 19

Diversification: Tenants & Brands

Top 20 Tenants

| | | | | | | | | | | | | | | | | | | | | | |

Tenant | | Property Type | | #

Properties | | | ABR

($'000s) | | | ABR as a

% of Total

Portfolio | | | Square

Feet

('000s) | | | SF as a

% of Total

Portfolio | |

Roskam Baking Company, LLC* | | Food Processing | | | 7 | | | $ | 15,605 | | | | 4.0 | % | | | 2,250 | | | | 5.8 | % |

AHF, LLC* | | Distribution & Warehouse/Manufacturing | | | 8 | | | | 9,378 | | | | 2.4 | % | | | 2,284 | | | | 5.9 | % |

Jack's Family Restaurants LP* | | Quick Service Restaurants | | | 43 | | | | 7,309 | | | | 1.9 | % | | | 147 | | | | 0.4 | % |

Joseph T. Ryerson & Son, Inc | | Distribution & Warehouse | | | 11 | | | | 6,491 | | | | 1.7 | % | | | 1,537 | | | | 4.0 | % |

Red Lobster Hospitality & Red Lobster Restaurants LLC* | | Casual Dining | | | 19 | | | | 6,178 | | | | 1.6 | % | | | 157 | | | | 0.4 | % |

Axcelis Technologies, Inc. | | Flex and R&D | | | 1 | | | | 6,126 | | | | 1.6 | % | | | 417 | | | | 1.1 | % |

J. Alexander's, LLC* | | Casual Dining | | | 16 | | | | 6,115 | | | | 1.6 | % | | | 131 | | | | 0.3 | % |

Salm Partners, LLC* | | Food Processing | | | 2 | | | | 6,062 | | | | 1.6 | % | | | 368 | | | | 1.0 | % |

Hensley & Company* | | Distribution & Warehouse | | | 3 | | | | 5,989 | | | | 1.5 | % | | | 577 | | | | 1.5 | % |

Dollar General Corporation | | General Merchandise | | | 60 | | | | 5,966 | | | | 1.5 | % | | | 562 | | | | 1.5 | % |

Total Top 10 Tenants | | | | | 170 | | | $ | 75,219 | | | | 19.4 | % | | | 8,430 | | | | 21.9 | % |

| | | | | | | | | | | | | | | | | |

BluePearl Holdings, LLC** | | Animal Health Services | | | 13 | | | $ | 5,599 | | | | 1.4 | % | | | 165 | | | | 0.4 | % |

Krispy Kreme Doughnut Corporation | | Quick Service Restaurants/

Food Processing | | | 27 | | | | 5,525 | | | | 1.4 | % | | | 156 | | | | 0.4 | % |

Outback Steakhouse of Florida LLC* | | Casual Dining | | | 22 | | | | 5,365 | | | | 1.4 | % | | | 140 | | | | 0.4 | % |

Tractor Supply Company | | General Merchandise | | | 21 | | | | 5,349 | | | | 1.4 | % | | | 417 | | | | 1.1 | % |

Big Tex Trailer Manufacturing Inc.* | | Automotive/Distribution & Warehouse/Manufacturing/ Corporate Headquarters | | | 17 | | | | 5,056 | | | | 1.3 | % | | | 1,302 | | | | 3.4 | % |

Nestle' Dreyer's Ice Cream Company1 | | Cold Storage | | | 1 | | | | 4,543 | | | | 1.2 | % | | | 309 | | | | 0.8 | % |

Carvana, LLC* | | Industrial Services | | | 2 | | | | 4,510 | | | | 1.2 | % | | | 230 | | | | 0.6 | % |

Klosterman Bakery* | | Food Processing | | | 11 | | | | 4,500 | | | | 1.2 | % | | | 549 | | | | 1.4 | % |

Arkansas Surgical Hospital | | Surgical | | | 1 | | | | 4,476 | | | | 1.1 | % | | | 129 | | | | 0.3 | % |

Chiquita Holdings Limited | | Food Processing | | | 1 | | | | 4,418 | | | | 1.1 | % | | | 335 | | | | 0.9 | % |

Total Top 20 Tenants | | | | | 286 | | | $ | 124,560 | | | | 32.1 | % | | | 12,162 | | | | 31.6 | % |

1Nestle's ABR excludes $1.6 million of rent paid under a sub-lease for an additional property, which will convert to a prime lease no later than August, 2024

*Subject to a master lease.

**Includes properties leased by multiple tenants, some, not all, of which are subject to master leases.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 20

Top 20 Brands

| | | | | | | | | | | | | | | | | | | | | | |

Brand | | Property Type | | #

Properties | | | ABR

($'000s) | | | ABR as a

% of Total

Portfolio | | | Square

Feet

('000s) | | | SF as a

% of Total

Portfolio | |

Roskam Baking Company, LLC* | | Food Processing | | | 7 | | | $ | 15,605 | | | | 4.0 | % | | | 2,250 | | | | 5.8 | % |

AHF Products* | | Distribution & Warehouse/

Manufacturing | | | 8 | | | | 9,378 | | | | 2.4 | % | | | 2,284 | | | | 5.9 | % |

Jack's Family Restaurants* | | Quick Service Restaurants | | | 43 | | | | 7,309 | | | | 1.9 | % | | | 147 | | | | 0.4 | % |

Ryerson | | Distribution & Warehouse | | | 11 | | | | 6,491 | | | | 1.7 | % | | | 1,537 | | | | 4.0 | % |

Red Lobster* | | Casual Dining | | | 19 | | | | 6,178 | | | | 1.6 | % | | | 157 | | | | 0.4 | % |

Axcelis | | Flex and R&D | | | 1 | | | | 6,126 | | | | 1.6 | % | | | 417 | | | | 1.1 | % |

Salm Partners, LLC* | | Food Processing | | | 2 | | | | 6,062 | | | | 1.6 | % | | | 368 | | | | 1.0 | % |

Hensley* | | Distribution & Warehouse | | | 3 | | | | 5,989 | | | | 1.5 | % | | | 577 | | | | 1.5 | % |

Dollar General | | General Merchandise | | | 60 | | | | 5,966 | | | | 1.5 | % | | | 562 | | | | 1.5 | % |

BluePearl Veterinary Partners** | | Animal Health Services | | | 13 | | | | 5,598 | | | | 1.4 | % | | | 165 | | | | 0.4 | % |

Total Top 10 Brands | | | | | 167 | | | $ | 74,702 | | | | 19.2 | % | | | 8,464 | | | | 22.0 | % |

| | | | | | | | | | | | | | | | | |

Krispy Kreme | | Quick Service Restaurants/

Food Processing | | | 27 | | | $ | 5,525 | | | | 1.4 | % | | | 156 | | | | 0.4 | % |

Bob Evans Farms* | | Casual Dining/Food Processing | | | 21 | | | | 5,459 | | | | 1.4 | % | | | 281 | | | | 0.7 | % |

Tractor Supply Company | | General Merchandise | | | 21 | | | | 5,349 | | | | 1.4 | % | | | 417 | | | | 1.1 | % |

Big Tex Trailers* | | Automotive/Distribution &

Warehouse/Manufacturing/

Corporate Headquarters | | | 17 | | | | 5,056 | | | | 1.3 | % | | | 1,302 | | | | 3.4 | % |

Outback Steakhouse* | | Casual Dining | | | 20 | | | | 4,641 | | | | 1.2 | % | | | 126 | | | | 0.3 | % |

Nestle'1 | | Cold Storage | | | 1 | | | | 4,543 | | | | 1.2 | % | | | 309 | | | | 0.8 | % |

Carvana* | | Industrial Services | | | 2 | | | | 4,510 | | | | 1.2 | % | | | 230 | | | | 0.6 | % |

Klosterman Bakery* | | Food Processing | | | 11 | | | | 4,500 | | | | 1.2 | % | | | 549 | | | | 1.4 | % |

Arkansas Surgical Hospital | | Surgical | | | 1 | | | | 4,476 | | | | 1.1 | % | | | 129 | | | | 0.3 | % |

Chiquita Holdings Limited | | Food Processing | | | 1 | | | | 4,419 | | | | 1.1 | % | | | 335 | | | | 0.9 | % |

Total Top 20 Brands | | | | | 289 | | | $ | 123,180 | | | | 31.7 | % | | | 12,298 | | | | 31.9 | % |

1Nestle's ABR excludes $1.6 million of rent paid under a sub-lease for an additional property, which will convert to a prime lease no later than August, 2024

*Subject to a master lease.

**Includes properties leased by multiple tenants, some, not all, of which are subject to master leases.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 21

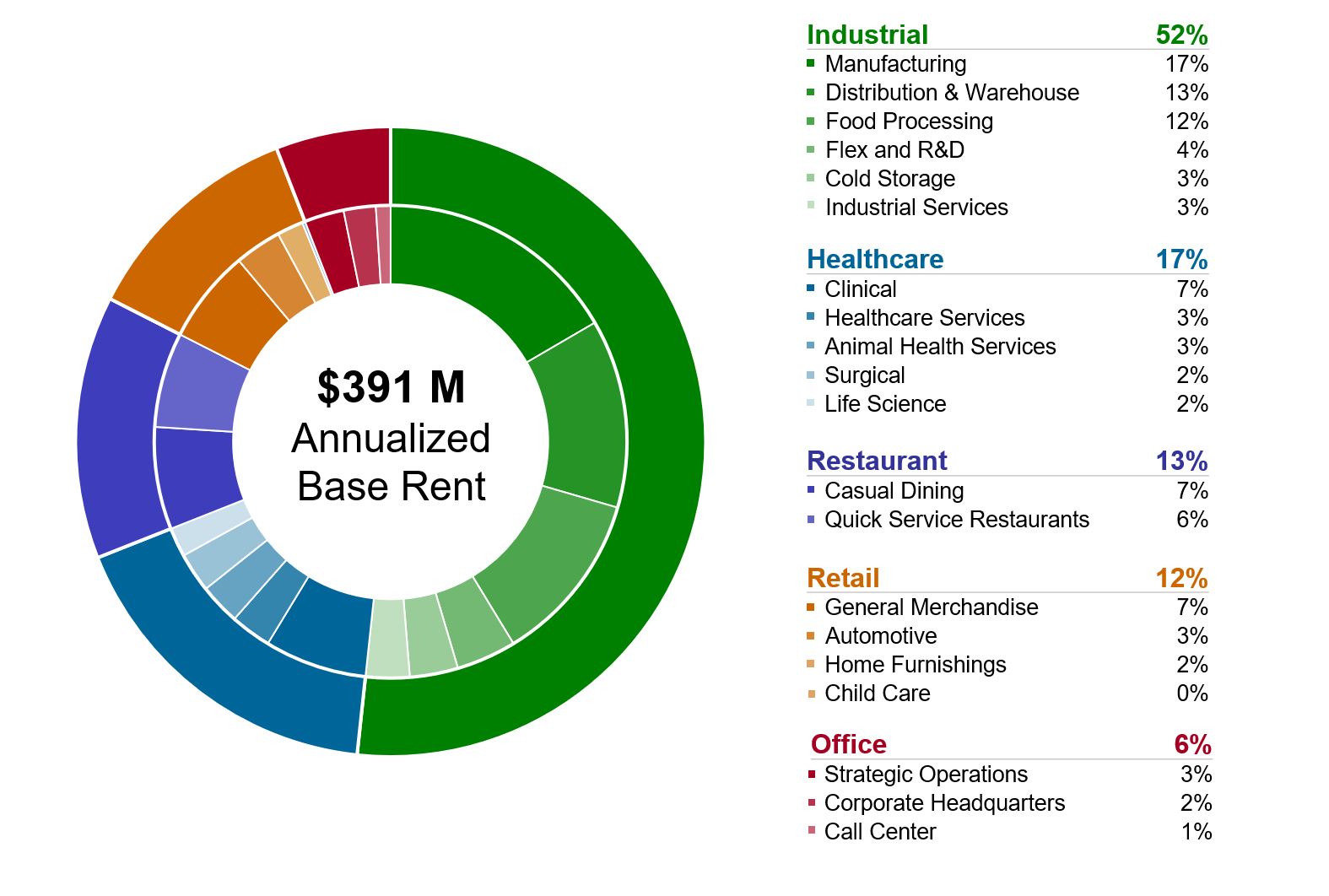

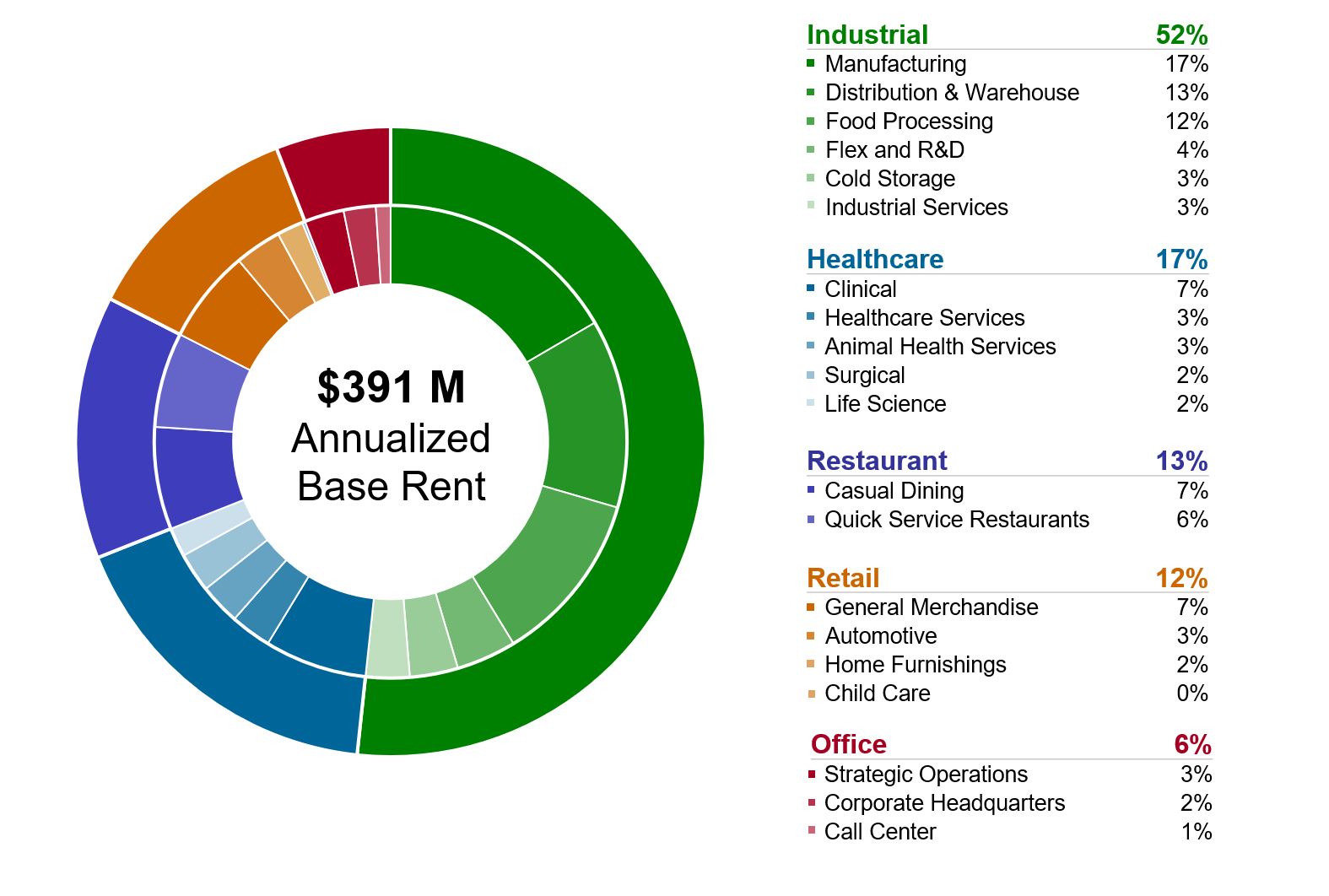

Diversification: Property Type

(rent percentages based on ABR)

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 22

Diversification: Property Type (continued)

| | | | | | | | | | | | | | | | | | | | |

Property Type | | # Properties | | | ABR

($'000s) | | | ABR as a % of

Total Portfolio | | | Square Feet

('000s) | | | SF as a % of

Total Portfolio | |

Industrial | | | | | | | | | | | | | | | |

Manufacturing | | | 81 | | | $ | 64,908 | | | | 16.6 | % | | | 12,266 | | | | 31.8 | % |

Distribution & Warehouse | | | 46 | | | | 50,121 | | | | 12.8 | % | | | 9,158 | | | | 23.8 | % |

Food Processing | | | 33 | | | | 46,072 | | | | 11.8 | % | | | 5,442 | | | | 14.1 | % |

Flex and R&D | | | 6 | | | | 15,977 | | | | 4.1 | % | | | 1,157 | | | | 3.0 | % |

Cold Storage | | | 5 | | | | 12,849 | | | | 3.3 | % | | | 933 | | | | 2.4 | % |

Industrial Services | | | 23 | | | | 11,698 | | | | 3.0 | % | | | 607 | | | | 1.6 | % |

Untenanted | | | 1 | | | | — | | | | — | | | | 123 | | | | 0.3 | % |

Industrial Total | | | 195 | | | | 201,625 | | | | 51.6 | % | | | 29,686 | | | | 77.0 | % |

Healthcare | | | | | | | | | | | | | | | |

Clinical | | | 52 | | | | 27,396 | | | | 7.0 | % | | | 1,090 | | | | 2.8 | % |

Healthcare Services | | | 29 | | | | 11,795 | | | | 3.0 | % | | | 478 | | | | 1.2 | % |

Animal Health Services | | | 27 | | | | 10,939 | | | | 2.8 | % | | | 405 | | | | 1.0 | % |

Surgical | | | 12 | | | | 10,528 | | | | 2.7 | % | | | 330 | | | | 0.9 | % |

Life Science | | | 9 | | | | 7,942 | | | | 2.0 | % | | | 549 | | | | 1.4 | % |

Healthcare Total | | | 129 | | | | 68,600 | | | | 17.5 | % | | | 2,852 | | | | 7.3 | % |

Restaurant | | | | | | | | | | | | | | | |

Casual Dining | | | 101 | | | | 27,410 | | | | 7.0 | % | | | 673 | | | | 1.7 | % |

Quick Service Restaurants | | | 146 | | | | 25,497 | | | | 6.5 | % | | | 499 | | | | 1.3 | % |

Restaurant Total | | | 247 | | | | 52,907 | | | | 13.5 | % | | | 1,172 | | | | 3.0 | % |

Retail | | | | | | | | | | | | | | | |

General Merchandise | | | 132 | | | | 24,800 | | | | 6.4 | % | | | 1,865 | | | | 4.8 | % |

Automotive | | | 67 | | | | 12,457 | | | | 3.2 | % | | | 773 | | | | 2.0 | % |

Home Furnishings | | | 13 | | | | 7,147 | | | | 1.8 | % | | | 797 | | | | 2.1 | % |

Child Care | | | 2 | | | | 730 | | | | 0.2 | % | | | 20 | | | | 0.2 | % |

Retail Total | | | 214 | | | | 45,134 | | | | 11.6 | % | | | 3,455 | | | | 9.1 | % |

Office | | | | | | | | | | | | | | | |

Strategic Operations | | | 6 | | | | 10,381 | | | | 2.7 | % | | | 632 | | | | 1.6 | % |

Corporate Headquarters | | | 7 | | | | 8,389 | | | | 2.1 | % | | | 409 | | | | 1.1 | % |

Call Center | | | 2 | | | | 3,938 | | | | 1.0 | % | | | 287 | | | | 0.7 | % |

Untenanted | | | 1 | | | | — | | | | — | | | | 46 | | | | 0.2 | % |

Office Total | | | 16 | | | | 22,708 | | | | 5.8 | % | | | 1,374 | | | | 3.6 | % |

Total | | | 801 | | | $ | 390,974 | | | | 100.0 | % | | | 38,539 | | | | 100.0 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 23

Key Statistics by Property Type

| | | | | | | | | | | | | | | | | | | | |

| | Q2 2023 | | | Q1 2023 | | | Q4 2022 | | | Q3 2022 | | | Q2 2022 | |

Industrial | | | | | | | | | | | | | | | |

Number of properties | | | 195 | | | | 193 | | | | 195 | | | | 185 | | | | 166 | |

Square feet (000s) | | | 29,686 | | | | 30,142 | | | | 29,947 | | | | 27,631 | | | | 25,279 | |

Weighted average lease term (years) | | | 11.8 | | | | 11.9 | | | | 11.2 | | | | 11.2 | | | | 10.8 | |

Weighted average annual rent escalation | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % |

Percentage of total ABR | | | 51.6 | % | | | 51.8 | % | | | 51.5 | % | | | 49.0 | % | | | 47.6 | % |

| | | | | | | | | | | | | | | |

Healthcare | | | | | | | | | | | | | | | |

Number of properties | | | 129 | | | | 130 | | | | 130 | | | | 130 | | | | 129 | |

Square feet (000s) | | | 2,852 | | | | 2,870 | | | | 2,870 | | | | 2,869 | | | | 2,855 | |

Weighted average lease term (years) | | | 6.8 | | | | 7.0 | | | | 8.2 | | | | 8.2 | | | | 8.4 | |

Weighted average annual rent escalation | | | 2.3 | % | | | 2.3 | % | | | 2.2 | % | | | 2.2 | % | | | 2.2 | % |

Percentage of total ABR | | | 17.5 | % | | | 17.4 | % | | | 17.1 | % | | | 18.5 | % | | | 18.8 | % |

| | | | | | | | | | | | | | | |

Restaurant | | | | | | | | | | | | | | | |

Number of properties | | | 247 | | | | 247 | | | | 248 | | | | 250 | | | | 247 | |

Square feet (000s) | | | 1,172 | | | | 1,172 | | | | 1,177 | | | | 1,191 | | | | 1,174 | |

Weighted average lease term (years) | | | 14.1 | | | | 14.3 | | | | 14.8 | | | | 14.8 | | | | 15.0 | |

Weighted average annual rent escalation | | | 1.8 | % | | | 1.8 | % | | | 1.8 | % | | | 1.8 | % | | | 1.8 | % |

Percentage of total ABR | | | 13.5 | % | | | 13.4 | % | | | 13.5 | % | | | 14.1 | % | | | 14.3 | % |

| | | | | | | | | | | | | | | |

Retail | | | | | | | | | | | | | | | |

Number of properties | | | 214 | | | | 215 | | | | 214 | | | | 209 | | | | 206 | |

Square feet (000s) | | | 3,455 | | | | 3,459 | | | | 3,448 | | | | 3,411 | | | | 3,404 | |

Weighted average lease term (years) | | | 10.0 | | | | 10.2 | | | | 10.5 | | | | 10.5 | | | | 10.9 | |

Weighted average annual rent escalation | | | 1.6 | % | | | 1.6 | % | | | 1.6 | % | | | 1.6 | % | | | 1.6 | % |

Percentage of total ABR | | | 11.6 | % | | | 11.6 | % | | | 11.5 | % | | | 11.7 | % | | | 12.0 | % |

| | | | | | | | | | | | | | | |

Office | | | | | | | | | | | | | | | |

Number of properties | | | 16 | | | | 16 | | | | 17 | | | | 16 | | | | 16 | |

Square feet (000s) | | | 1,374 | | | | 1,415 | | | | 1,697 | | | | 1,686 | | | | 1,685 | |

Weighted average lease term (years) | | | 5.9 | | | | 6.0 | | | | 6.1 | | | | 6.1 | | | | 6.0 | |

Weighted average annual rent escalation | | | 2.5 | % | | | 2.5 | % | | | 2.5 | % | | | 2.5 | % | | | 2.4 | % |

Percentage of total ABR | | | 5.8 | % | | | 5.8 | % | | | 6.4 | % | | | 6.7 | % | | | 7.3 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 24

Diversification: Tenant Industry

| | | | | | | | | | | | | | | | | | | | |

Industry | | # Properties | | | ABR

($'000s) | | | ABR as a %

of Total

Portfolio | | | Square Feet ('000s) | | | SF as a %

of Total

Portfolio | |

Healthcare Facilities | | | 104 | | | $ | 54,517 | | | | 13.9 | % | | | 2,062 | | | | 5.3 | % |

Restaurants | | | 250 | | | | 53,746 | | | | 13.7 | % | | | 1,214 | | | | 3.2 | % |

Packaged Foods & Meats | | | 29 | | | | 40,358 | | | | 10.3 | % | | | 4,713 | | | | 12.2 | % |

Auto Parts & Equipment | | | 45 | | | | 16,424 | | | | 4.2 | % | | | 2,799 | | | | 7.3 | % |

Distributors | | | 27 | | | | 16,042 | | | | 4.1 | % | | | 2,695 | | | | 7.0 | % |

Specialty Stores | | | 31 | | | | 14,350 | | | | 3.7 | % | | | 1,338 | | | | 3.5 | % |

Food Distributors | | | 8 | | | | 14,133 | | | | 3.6 | % | | | 1,712 | | | | 4.4 | % |

Home Furnishing Retail | | | 18 | | | | 12,684 | | | | 3.3 | % | | | 1,858 | | | | 4.8 | % |

Specialized Consumer Services | | | 48 | | | | 12,501 | | | | 3.2 | % | | | 724 | | | | 1.9 | % |

Metal & Glass Containers | | | 8 | | | | 10,114 | | | | 2.6 | % | | | 2,206 | | | | 5.7 | % |

General Merchandise Stores | | | 96 | | | | 9,644 | | | | 2.5 | % | | | 880 | | | | 2.3 | % |

Industrial Machinery | | | 20 | | | | 9,528 | | | | 2.4 | % | | | 1,949 | | | | 5.1 | % |

Forest Products | | | 8 | | | | 9,378 | | | | 2.4 | % | | | 2,284 | | | | 5.9 | % |

Healthcare Services | | | 18 | | | | 9,342 | | | | 2.4 | % | | | 515 | | | | 1.3 | % |

Electronic Components | | | 2 | | | | 6,957 | | | | 1.8 | % | | | 466 | | | | 1.2 | % |

Other (39 industries) | | | 87 | | | | 101,256 | | | | 25.9 | % | | | 10,900 | | | | 28.3 | % |

Untenanted properties | | | 2 | | | | - | | | | 0.0 | % | | | 224 | | | | 0.6 | % |

Total | | | 801 | | | $ | 390,974 | | | | 100.0 | % | | | 38,539 | | | | 100.0 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 25

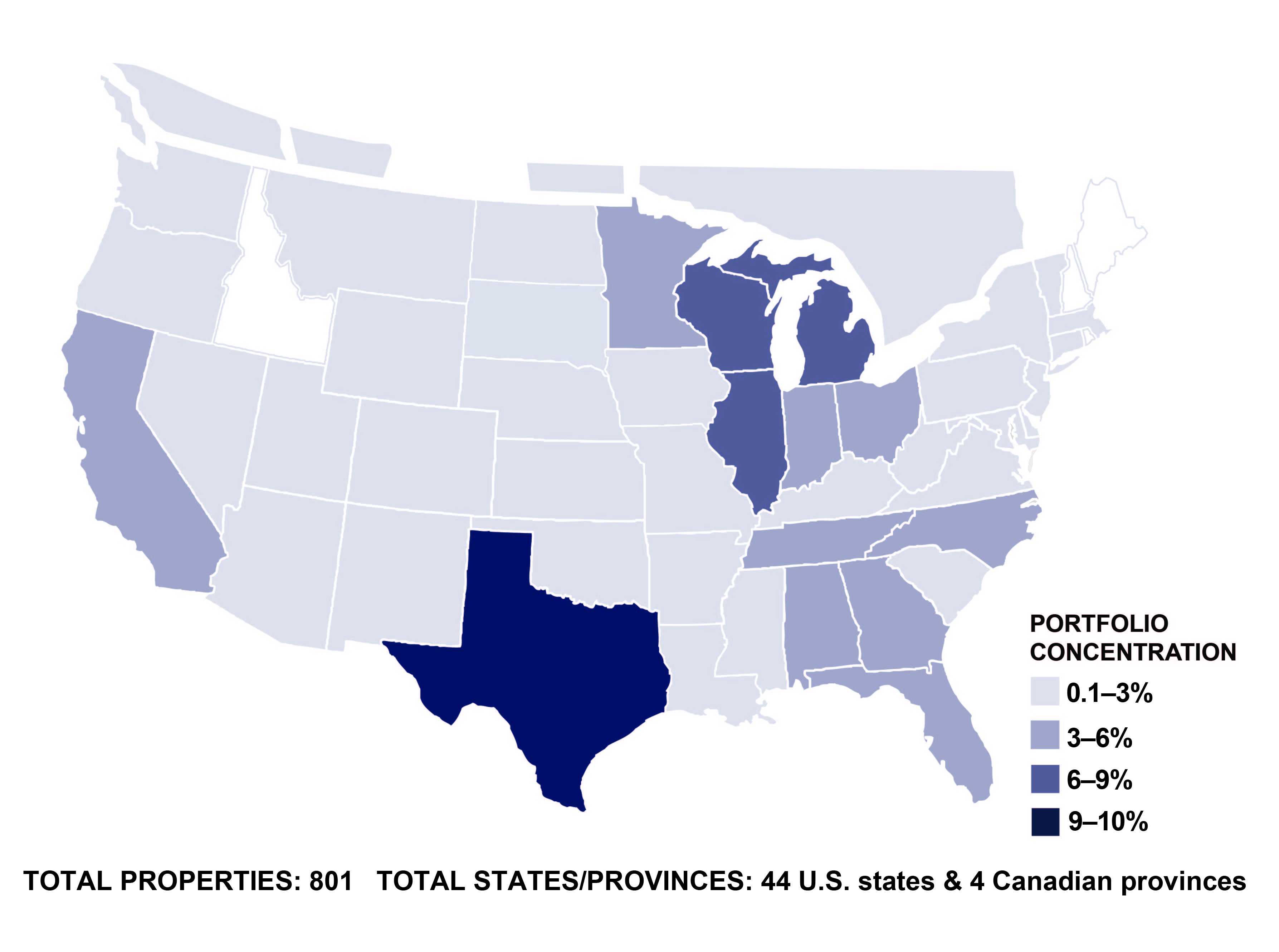

Diversification: Geography

(rent percentages based on ABR)

| | | | | | | | | | | | | | | | | | | | | | | |

State /

Province | | #

Properties | | ABR

($'000s) | | ABR as

a % of

Total

Portfolio | | Square

Feet

('000s) | | SF as a

% of

Total

Portfolio | | | State /

Province | | #

Properties | | ABR

($'000s) | | ABR as

a % of

Total

Portfolio | | Square

Feet

('000s) | | SF as a

% of

Total

Portfolio |

TX | | 72 | | $38,240 | | 9.8% | | 3,621 | | 9.4% | | | WA | | 15 | | $4,362 | | 1.1% | | 150 | | 0.4% |

MI | | 55 | | 32,573 | | 8.2% | | 3,811 | | 9.8% | | | LA | | 4 | | 3,407 | | 0.9% | | 194 | | 0.5% |

IL | | 32 | | 24,268 | | 6.1% | | 2,424 | | 6.2% | | | MS | | 11 | | 3,322 | | 0.9% | | 430 | | 1.1% |

WI | | 35 | | 23,242 | | 5.9% | | 2,163 | | 5.6% | | | NE | | 6 | | 3,183 | | 0.8% | | 509 | | 1.3% |

OH | | 48 | | 19,118 | | 4.9% | | 1,792 | | 4.7% | | | MD | | 4 | | 3,073 | | 0.8% | | 293 | | 0.8% |

CA | | 13 | | 18,838 | | 4.8% | | 1,718 | | 4.5% | | | SC | | 13 | | 2,964 | | 0.8% | | 308 | | 0.8% |

FL | | 42 | | 16,237 | | 4.2% | | 840 | | 2.2% | | | IA | | 4 | | 2,804 | | 0.7% | | 622 | | 1.6% |

IN | | 32 | | 15,997 | | 4.1% | | 1,906 | | 4.9% | | | NM | | 9 | | 2,767 | | 0.7% | | 107 | | 0.3% |

MN | | 21 | | 15,442 | | 3.9% | | 2,500 | | 6.5% | | | CO | | 4 | | 2,501 | | 0.6% | | 126 | | 0.3% |

TN | | 50 | | 15,273 | | 3.9% | | 1,103 | | 2.9% | | | UT | | 3 | | 2,432 | | 0.6% | | 280 | | 0.7% |

NC | | 36 | | 12,385 | | 3.2% | | 1,135 | | 2.9% | | | CT | | 2 | | 1,828 | | 0.5% | | 55 | | 0.1% |

AL | | 53 | | 12,197 | | 3.1% | | 873 | | 2.3% | | | ND | | 3 | | 1,700 | | 0.4% | | 48 | | 0.1% |

AZ | | 9 | | 11,876 | | 3.0% | | 909 | | 2.4% | | | MT | | 7 | | 1,582 | | 0.4% | | 43 | | 0.1% |

GA | | 33 | | 11,581 | | 3.0% | | 1,576 | | 4.1% | | | DE | | 4 | | 1,167 | | 0.3% | | 133 | | 0.3% |

PA | | 22 | | 9,700 | | 2.5% | | 1,836 | | 4.8% | | | VT | | 2 | | 426 | | 0.1% | | 24 | | 0.1% |

NY | | 26 | | 9,337 | | 2.4% | | 680 | | 1.8% | | | WY | | 1 | | 307 | | 0.1% | | 21 | | 0.1% |

KY | | 24 | | 8,548 | | 2.2% | | 900 | | 2.3% | | | NV | | 1 | | 268 | | 0.1% | | 6 | | 0.0% |

OK | | 22 | | 8,121 | | 2.1% | | 987 | | 2.6% | | | OR | | 1 | | 136 | | 0.0% | | 9 | | 0.0% |

AR | | 11 | | 7,728 | | 2.0% | | 283 | | 0.7% | | | SD | | 1 | | 81 | | 0.0% | | 9 | | 0.0% |

MA | | 3 | | 6,543 | | 1.7% | | 444 | | 1.2% | | | Total U.S. | | 794 | | $382,823 | | 97.8% | | 38,108 | | 98.8% |

MO | | 12 | | 6,175 | | 1.6% | | 1,138 | | 3.0% | | | BC | | 2 | | $4,596 | | 1.2% | | 253 | | 0.7% |

KS | | 11 | | 5,643 | | 1.4% | | 648 | | 1.7% | | | ON | | 3 | | 2,168 | | 0.6% | | 101 | | 0.3% |

VA | | 17 | | 5,561 | | 1.4% | | 204 | | 0.5% | | | AB | | 1 | | 1,019 | | 0.3% | | 51 | | 0.1% |

WV | | 17 | | 4,981 | | 1.3% | | 884 | | 2.3% | | | MB | | 1 | | 368 | | 0.1% | | 26 | | 0.1% |

NJ | | 3 | | 4,909 | | 1.3% | | 366 | | 0.9% | | | Total Canada | | 7 | | $8,151 | | 2.2% | | 431 | | 1.2% |

| | | | | | | | | | | | | Grand Total | | 801 | | $390,974 | | 100.0% | | 38,539 | | 100.0% |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 26

Lease Expirations

(rent percentages based on ABR)

| | | | | | | | | | | | | | | | | | | | | | | | |

Expiration Year | | # Properties | | | # Leases | | | ABR

($'000s) | | | ABR as a % of Total Portfolio | | | Square Feet ('000s) | | | SF as a % of Total Portfolio | |

2023 | | | 3 | | | | 4 | | | $ | 3,729 | | | | 1.0 | % | | | 467 | | | | 1.1 | % |

2024 | | | 8 | | | | 8 | | | | 8,884 | | | | 2.3 | % | | | 938 | | | | 2.4 | % |

2025 | | | 19 | | | | 21 | | | | 7,001 | | | | 1.8 | % | | | 394 | | | | 1.0 | % |

2026 | | | 34 | | | | 35 | | | | 17,278 | | | | 4.4 | % | | | 1,150 | | | | 3.0 | % |

2027 | | | 29 | | | | 30 | | | | 24,341 | | | | 6.2 | % | | | 2,079 | | | | 5.4 | % |

2028 | | | 36 | | | | 37 | | | | 22,876 | | | | 5.9 | % | | | 1,930 | | | | 5.0 | % |

2029 | | | 72 | | | | 73 | | | | 22,616 | | | | 5.8 | % | | | 2,724 | | | | 7.1 | % |

2030 | | | 101 | | | | 101 | | | | 54,800 | | | | 14.1 | % | | | 5,110 | | | | 13.3 | % |

2031 | | | 33 | | | | 33 | | | | 8,647 | | | | 2.2 | % | | | 805 | | | | 2.1 | % |

2032 | | | 62 | | | | 63 | | | | 32,001 | | | | 8.2 | % | | | 3,469 | | | | 9.0 | % |

2033 | | | 50 | | | | 50 | | | | 19,222 | | | | 4.9 | % | | | 1,593 | | | | 4.1 | % |

2034 | | | 33 | | | | 33 | | | | 6,345 | | | | 1.6 | % | | | 409 | | | | 1.1 | % |

2035 | | | 19 | | | | 19 | | | | 13,618 | | | | 3.5 | % | | | 2,021 | | | | 5.2 | % |

2036 | | | 88 | | | | 88 | | | | 27,244 | | | | 7.0 | % | | | 2,952 | | | | 7.7 | % |

2037 | | | 22 | | | | 22 | | | | 16,848 | | | | 4.3 | % | | | 1,120 | | | | 2.9 | % |

2038 | | | 38 | | | | 38 | | | | 10,819 | | | | 2.8 | % | | | 848 | | | | 2.2 | % |

2039 | | | 10 | | | | 10 | | | | 6,927 | | | | 1.8 | % | | | 798 | | | | 2.1 | % |

2040 | | | 31 | | | | 31 | | | | 5,864 | | | | 1.5 | % | | | 312 | | | | 0.8 | % |

2041 | | | 40 | | | | 40 | | | | 22,382 | | | | 5.7 | % | | | 1,731 | | | | 4.5 | % |

2042 | | | 59 | | | | 59 | | | | 43,859 | | | | 11.2 | % | | | 4,813 | | | | 12.5 | % |

Thereafter | | | 12 | | | | 11 | | | | 15,673 | | | | 3.8 | % | | | 2,652 | | | | 6.9 | % |

Untenanted properties | | | 2 | | | | — | | | | — | | | | — | | | | 224 | | | | 0.6 | % |

Total | | | 801 | | | | 806 | | | $ | 390,974 | | | | 100.0 | % | | | 38,539 | | | | 100.0 | % |

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 27

Occupancy

Occupancy by Rentable Square Footage

Change in Occupancy

| | | | | |

| | | Number of properties | |

Vacant properties at January 1, 2023 | | | | 3 | |

Lease expirations1 | | | | 2 | |

Leasing activities | | | | (3 | ) |

Vacant dispositions | | | | — | |

Vacant properties at March 31, 2023 | | | | 2 | |

Lease expirations1 | | | | 3 | |

Leasing activities | | | | (3 | ) |

Vacant dispositions | | | | — | |

Vacant properties at June 30, 2023 | | | | 2 | |

1 Includes scheduled and unscheduled expirations (including leases rejected in bankruptcy), as well as future expirations resolved in the periods indicated above.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 28

Definitions and Explanations

Adjusted NOI, Annualized Adjusted NOI, Adjusted Cash NOI and Annualized Adjusted Cash NOI: Our reported results and net earnings per diluted share are presented in accordance with accounting principles generally accepted in the United States of America (GAAP). Adjusted NOI and Adjusted Cash NOI are non-GAAP financial measures that we believe are useful to assess property-level performance. We compute Adjusted NOI by adjusting Adjusted EBITDAre (defined below) to exclude general and administrative expenses incurred at the corporate level. Given the net lease nature of our portfolio, we do not incur general and administrative expenses at the property level. To compute Adjusted Cash NOI, we adjust Adjusted NOI to exclude non-cash items included in total revenues and property expenses, such as straight-line rental revenue and other amortization and non-cash items, based on an estimate calculated as if all investment and disposition activity that took place during the quarter had occurred on the first day of the quarter. We then annualize quarterly Adjusted NOI and Adjusted Cash NOI by multiplying each amount by four to compute Annualized Adjusted NOI and Annualized Adjusted Cash NOI, respectively, which are also non-GAAP financial measures. We believe Adjusted NOI and Adjusted Cash NOI provide useful and relevant information because they reflect only those income and expense items that are incurred at the property level and present such items on an unlevered basis. We believe that the exclusion of certain non-cash revenues and expenses from Adjusted Cash NOI is a useful supplemental measure for investors to consider because it will help them to better assess our operating performance without the distortions created by non-cash revenues or expenses. You should not unduly rely on Annualized Adjusted NOI and Annualized Adjusted Cash NOI as they are based on assumptions and estimates that may prove to be inaccurate. Our actual reported Adjusted NOI and Adjusted Cash NOI for future periods may be significantly different from our Annualized Adjusted NOI and Annualized Adjusted Cash NOI. Additionally, our computation of Adjusted NOI and Adjusted Cash NOI may differ from the methodology for calculating these metrics used by companies in our industry, and, therefore, may not be comparable to similarly titled measures reported by other companies.

Adjusted Secured Overnight Financing Rate (SOFR): We define Adjusted SOFR as the current one month term SOFR plus an adjustment of 0.10% per the terms of our credit facilities.

Annualized Base Rent (ABR): We define ABR as the annualized contractual cash rent due for the last month of the reporting period, excluding the impacts of short-term rent deferrals, abatements, or free rent, and adjusted to remove rent from properties sold during the month and to include a full month of contractual cash rent for investments made during the month.

Cash Capitalization Rate: Cash Capitalization Rate represents either (1) for acquisitions and new developments, the estimated first year cash yield to be generated on a real estate investment, which was estimated at the time of investment based on the contractually specified cash base rent for the first full year after the date of the investment, divided by the purchase price for the property excluding capitalized acquisitions costs, or (2) for disposition properties, the estimated first year cash yield to be generated subsequent to disposition based on contractually specified cash base rent divided by the disposition price.

EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre: EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre are non-GAAP financial measures. We compute EBITDA as earnings before interest, income taxes and depreciation and amortization. EBITDA is a measure commonly used in our industry. We believe that this ratio provides investors and analysts with a measure of our performance that includes our operating results unaffected by the differences in capital structures, capital investment cycles and useful life of related assets compared to other companies in our industry. We compute EBITDAre in accordance with the definition adopted by Nareit. Nareit defines EBITDAre as EBITDA excluding gains (loss) from the sales of depreciable property and provisions for impairment on investment in real estate. We believe EBITDA and EBITDAre are useful to investors and analysts because they provide important supplemental information about our operating performance exclusive of certain non-cash and other costs. Adjusted EBITDAre represents EBITDAre, adjusted to reflect revenue producing acquisitions and dispositions for the quarter as if such acquisitions and dispositions had occurred at the beginning of the quarter, and to exclude certain GAAP income and expense amounts that are either non-cash, such as cost of debt extinguishments, realized or unrealized gains and losses on foreign currency transactions, or gains on insurance recoveries, or that we believe are one time, or unusual in nature because they relate to unique circumstances or transactions that had not previously occurred and which we do not anticipate occurring in the future, and to eliminate the impact of lease termination fees, and other items that are not a result of normal operations. We then annualize quarterly Adjusted EBITDAre by multiplying it by four to compute Annualized Adjusted EBITDAre. Our reported EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre may not be comparable to similarly titled measures of other companies. You should not consider these measures as alternatives to net income or cash flows from operating activities determined in accordance with GAAP.

Funds From Operations (FFO), Core Funds From Operations (Core FFO), and Adjusted Funds From Operations (AFFO): FFO, Core FFO, and AFFO are non-GAAP measures. We believe the use of FFO, Core FFO, and AFFO are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. FFO, Core FFO, and AFFO should not be considered alternatives to net income as a performance measure or to cash flows from operations, as reported on our statement of cash flows, or as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. We compute Core FFO by adjusting FFO to exclude certain GAAP income and expense amounts that we believe are infrequently recurring, unusual in nature, or not related to its core real estate operations, including write-offs or recoveries of accrued rental income, lease termination fees, the gain on insurance recoveries, cost of debt extinguishments, unrealized and realized gains or losses on foreign currency transactions, severance and executive transition costs, and other extraordinary items. We compute AFFO by adjusting Core FFO for certain non-cash revenues and expenses, including straight-line rents, amortization of lease intangibles, amortization of debt issuance costs, amortization of net mortgage premiums, (gain) loss on interest rate swaps and other non-cash interest expense, stock-based compensation, and other specified non-cash items.

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2023 Broadstone Net Lease, LLC. All rights reserved. 29

Definitions and Explanations (continued)