Broadstone Net Lease, Inc.Internalization Presentation Exhibit 99.1

Forward Looking Statements Cautionary Statement Regarding Forward Looking Statements This presentation contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, our plans, strategies, and prospects, both business and financial. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," "will," “should,” "expect," "intend," "anticipate," "estimate," “would be,“ "believe," "continue," or other similar words. Forward-looking statements involve known and unknown risks, which may cause our actual future results to differ materially from expected results, including, without limitation, risks related to general economic conditions, local real estate conditions, tenant financial health, property acquisitions and the timing of these acquisitions, the availability of capital to finance planned growth, our success in our deleveraging efforts, the risk that the Internalization (as defined in our Quarterly Report on Form 10-Q for the period ended September 30, 2019) will not be consummated within the anticipated time period or at all, and our ability to effectively and efficiently manage the Internalization, if consummated. These and other risks, assumptions and uncertainties are described in Item 1A “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, which we filed with the SEC on March 14, 2019, and our Quarterly Report on Form 10-Q for the period ended September 30, 2019, which we filed on November 12, 2019. These documents, which you are encouraged to read, are available on the SEC’s website at www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. We expressly disclaim any current intention to update publicly any forward-looking statement after the distribution of this release, whether as a result of new information, future events, changes in assumptions or otherwise.

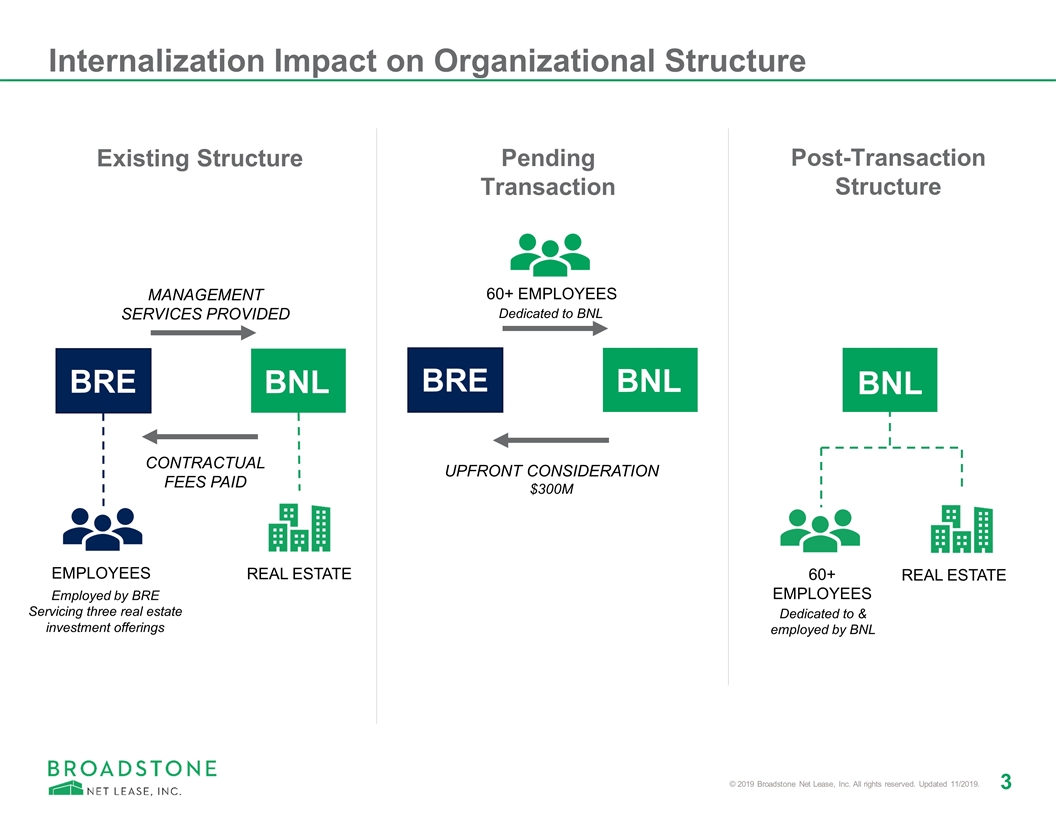

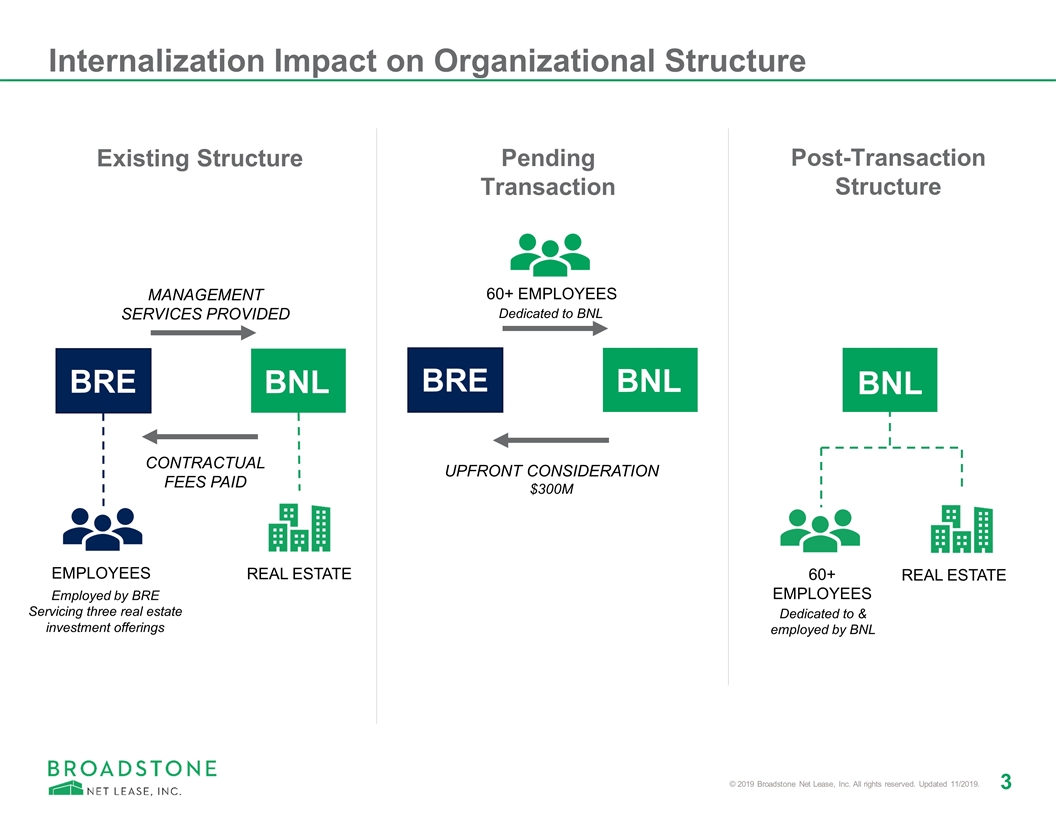

Existing Structure Pending Transaction Post-Transaction Structure BRE BRE BNL BRE BNL PROPERTIES EMPLOYEES CONTRACTUALFEES PAID MANAGEMENT SERVICES PROVIDED Internalization Impact on Organizational Structure EMPLOYEES REAL ESTATE 60+ EMPLOYEES REAL ESTATE 60+ EMPLOYEES Employed by BRE Servicing three real estate investment offerings Dedicated to BNL BRE BNL Dedicated to & employed by BNL UPFRONT CONSIDERATION $300M

Sean Cutt | Chief Investment Officer Joined BRE in 2012 Responsible for managing acquisitions, dispositions, asset management, credit analysis, investment policy, and real estate underwriting Chris Czarnecki | Chief Executive Officer Joined BRE in 2009 Responsible for leading the overall organization and executive team, directing strategic planning, and corporate initiatives Ryan Albano | Chief Financial Officer Joined BRE in 2013 Responsible for leading finance & capital markets, strategic & financial planning, monitoring key performance metrics, financial reporting, accounting, tax, and corporate development John Moragne | Chief Operating Officer Joined BRE in 2016 Responsible for oversight of portfolio management as well as all operational aspects of the organization, including corporate governance, administration, human resources, IT, legal, compliance, and risk management. 60+ Employees to be internalized, including the executive team to provide dedicated support to Broadstone Net Lease Accounting Finance & Capital Markets Acquisitions Asset Management & Credit Tax Portfolio Management Operations Systems & Technology Internal Management Comprehensive & Committed Team With A Proven Track Record of Success All Management functions covered by the internalized team

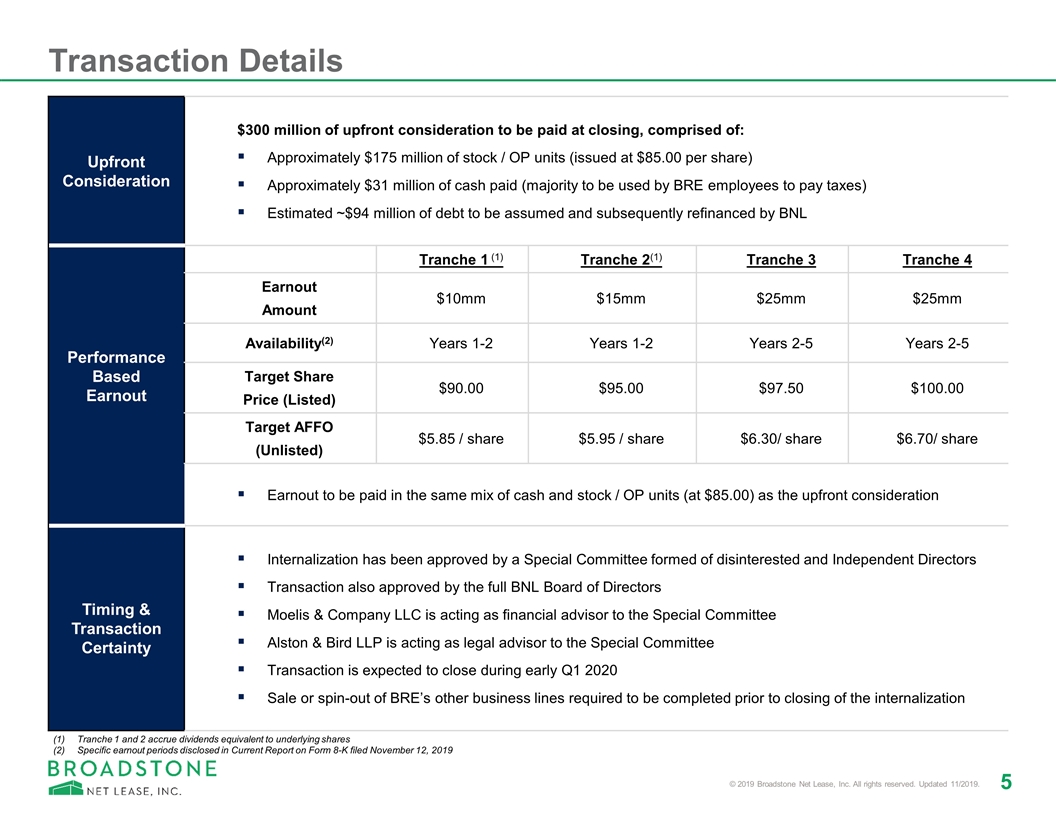

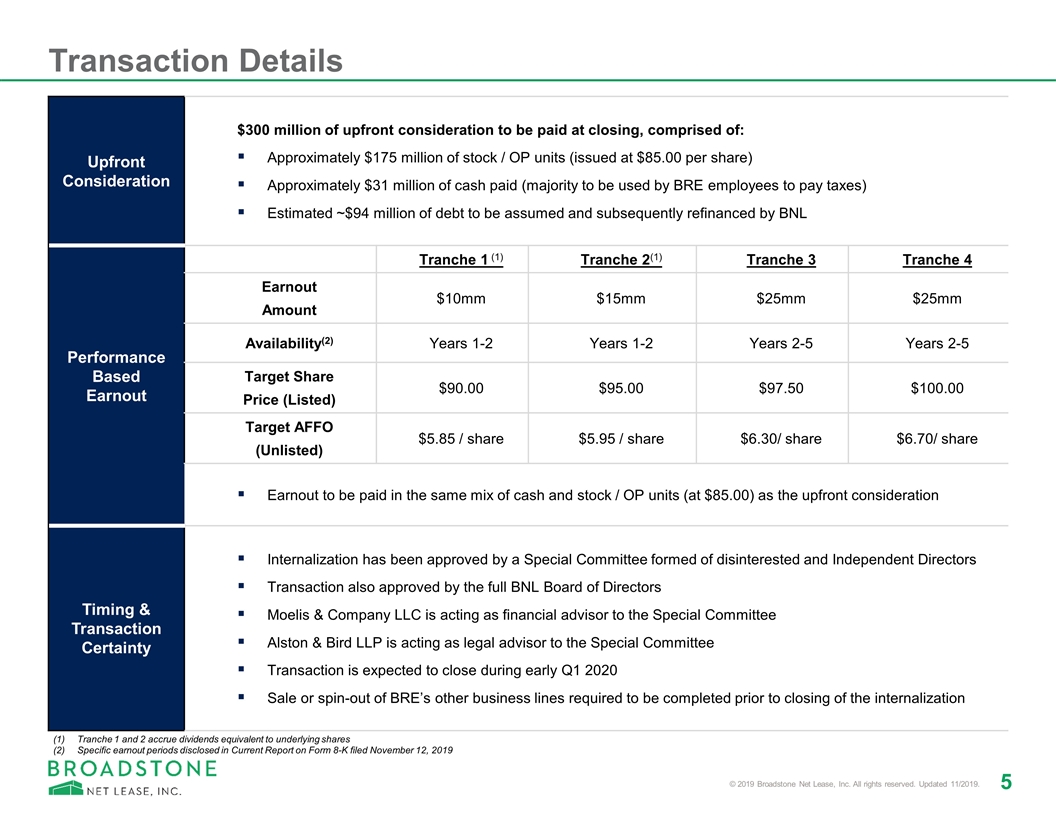

Transaction Details Upfront Consideration $300 million of upfront consideration to be paid at closing, comprised of: Approximately $175 million of stock / OP units (issued at $85.00 per share) Approximately $31 million of cash paid (majority to be used by BRE employees to pay taxes) Estimated ~$94 million of debt to be assumed and subsequently refinanced by BNL Performance Based Earnout Tranche 1 (1) Tranche 2(1) Tranche 3 Tranche 4 Earnout Amount $10mm $15mm $25mm $25mm Availability(2) Years 1-2 Years 1-2 Years 2-5 Years 2-5 Target Share Price (Listed) $90.00 $95.00 $97.50 $100.00 Target AFFO (Unlisted) $5.85 / share $5.95 / share $6.30/ share $6.70/ share Earnout to be paid in the same mix of cash and stock / OP units (at $85.00) as the upfront consideration Timing & Transaction Certainty Internalization has been approved by a Special Committee formed of disinterested and Independent Directors Transaction also approved by the full BNL Board of Directors Moelis & Company LLC is acting as financial advisor to the Special Committee Alston & Bird LLP is acting as legal advisor to the Special Committee Transaction is expected to close during early Q1 2020 Sale or spin-out of BRE’s other business lines required to be completed prior to closing of the internalization Tranche 1 and 2 accrue dividends equivalent to underlying shares Specific earnout periods disclosed in Current Report on Form 8-K filed November 12, 2019

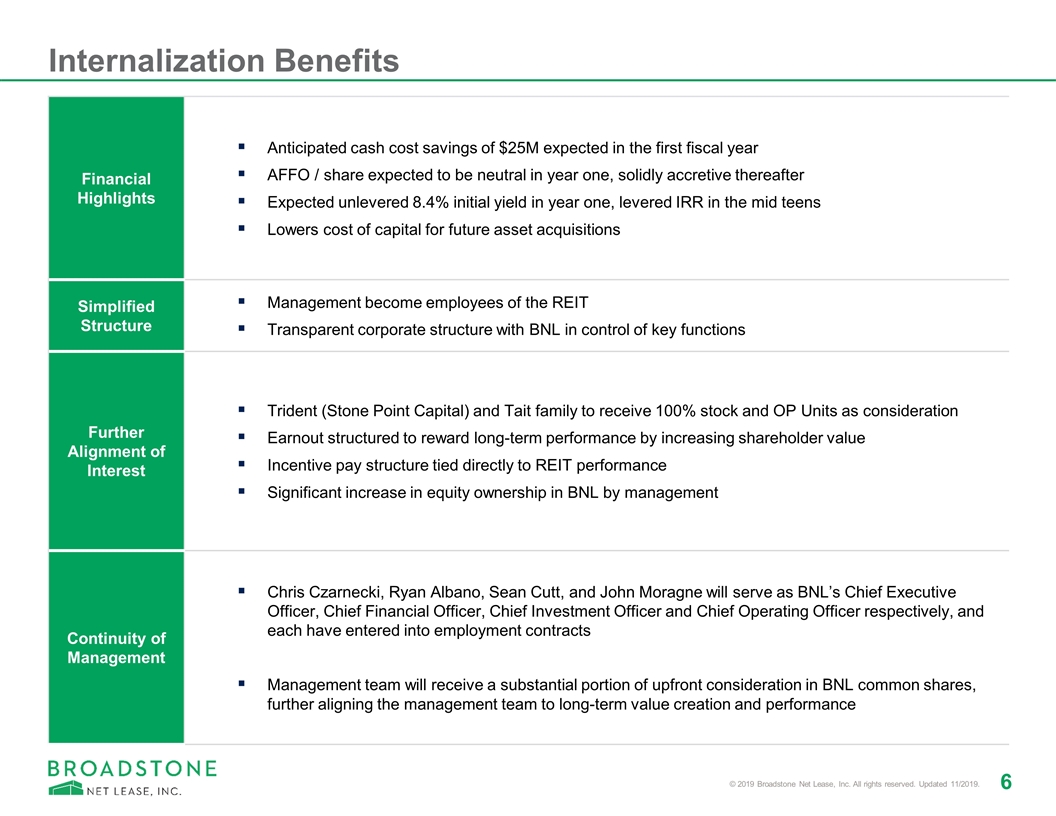

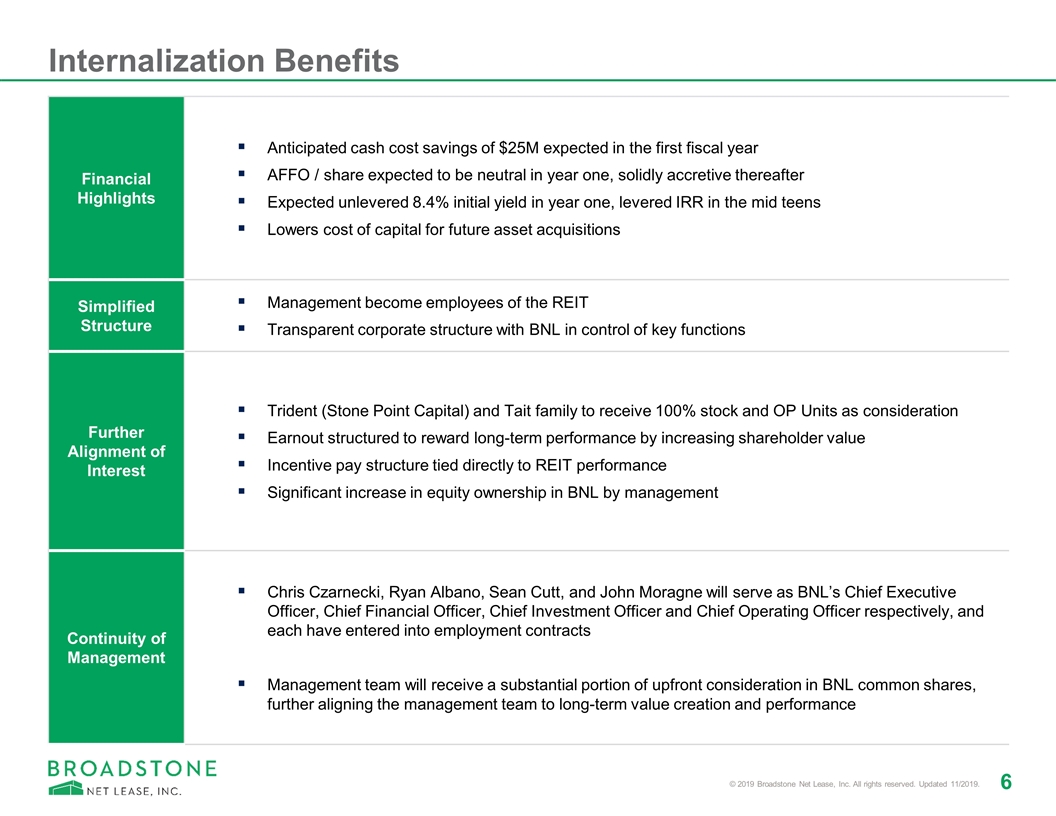

Internalization Benefits Financial Highlights Anticipated cash cost savings of $25M expected in the first fiscal year AFFO / share expected to be neutral in year one, solidly accretive thereafter Expected unlevered 8.4% initial yield in year one, levered IRR in the mid teens Lowers cost of capital for future asset acquisitions Simplified Structure Management become employees of the REIT Transparent corporate structure with BNL in control of key functions Further Alignment of Interest Trident (Stone Point Capital) and Tait family to receive 100% stock and OP Units as consideration Earnout structured to reward long-term performance by increasing shareholder value Incentive pay structure tied directly to REIT performance Significant increase in equity ownership in BNL by management Continuity of Management Chris Czarnecki, Ryan Albano, Sean Cutt, and John Moragne will serve as BNL’s Chief Executive Officer, Chief Financial Officer, Chief Investment Officer and Chief Operating Officer respectively, and each have entered into employment contracts Management team will receive a substantial portion of upfront consideration in BNL common shares, further aligning the management team to long-term value creation and performance

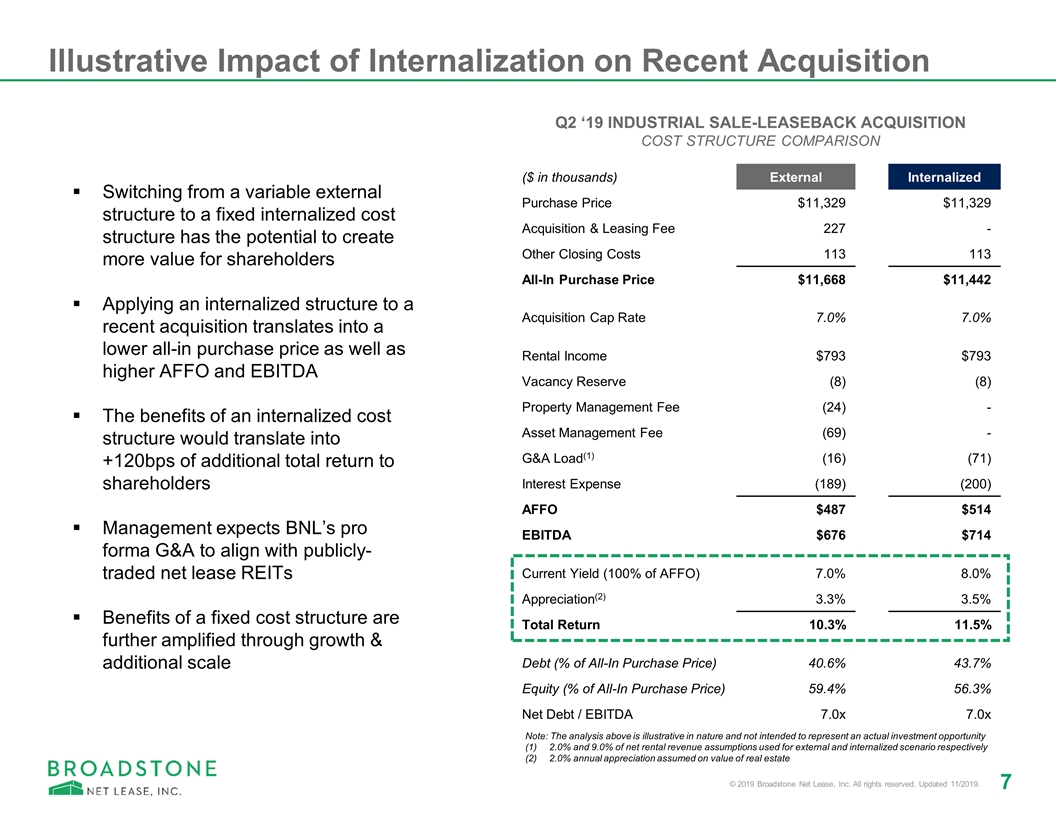

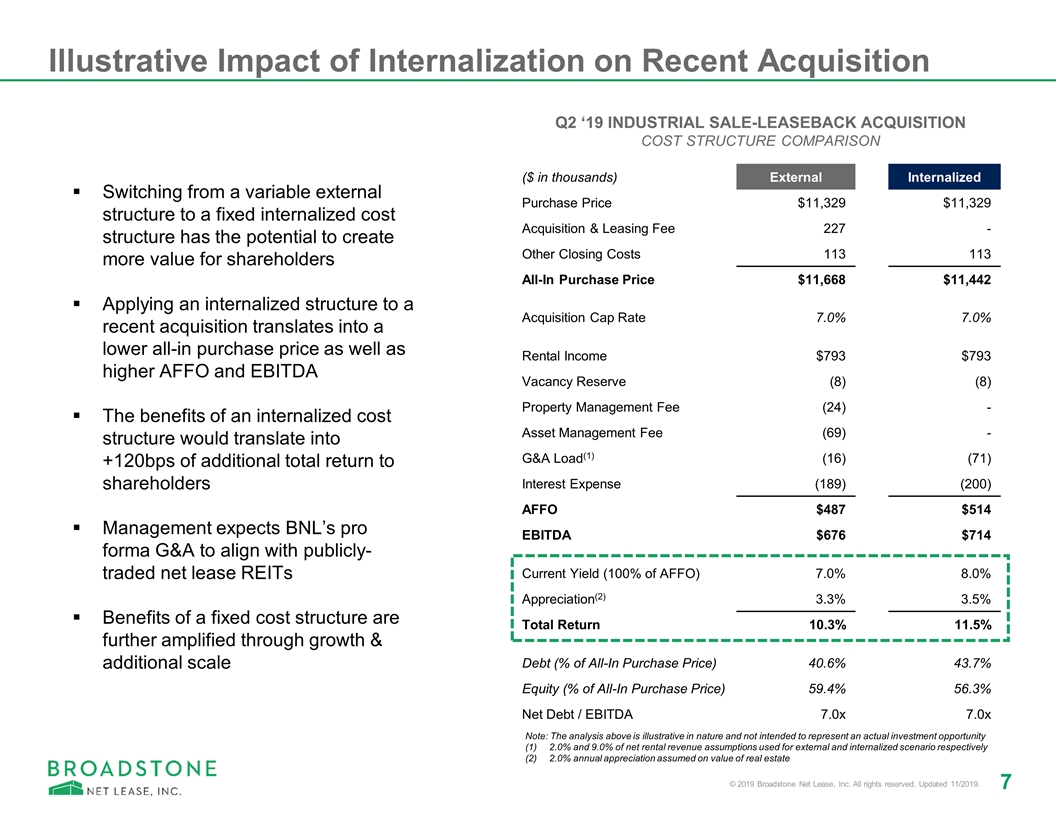

Illustrative Impact of Internalization on Recent Acquisition ($ in thousands) External Internalized Purchase Price $11,329 $11,329 Acquisition & Leasing Fee 227 - Other Closing Costs 113 113 All-In Purchase Price $11,668 $11,442 Acquisition Cap Rate 7.0% 7.0% Rental Income $793 $793 Vacancy Reserve (8) (8) Property Management Fee (24) - Asset Management Fee (69) - G&A Load(1) (16) (71) Interest Expense (189) (200) AFFO $487 $514 EBITDA $676 $714 Current Yield (100% of AFFO) 7.0% 8.0% Appreciation(2) 3.3% 3.5% Total Return 10.3% 11.5% Debt (% of All-In Purchase Price) 40.6% 43.7% Equity (% of All-In Purchase Price) 59.4% 56.3% Net Debt / EBITDA 7.0x 7.0x Note: The analysis above is illustrative in nature and not intended to represent an actual investment opportunity 2.0% and 9.0% of net rental revenue assumptions used for external and internalized scenario respectively 2.0% annual appreciation assumed on value of real estate Switching from a variable external structure to a fixed internalized cost structure has the potential to create more value for shareholders Applying an internalized structure to a recent acquisition translates into a lower all-in purchase price as well as higher AFFO and EBITDA The benefits of an internalized cost structure would translate into +120bps of additional total return to shareholders Management expects BNL’s pro forma G&A to align with publicly-traded net lease REITs Benefits of a fixed cost structure are further amplified through growth & additional scale Q2 ‘19 INDUSTRIAL SALE-LEASEBACK ACQUISITION COST STRUCTURE COMPARISON

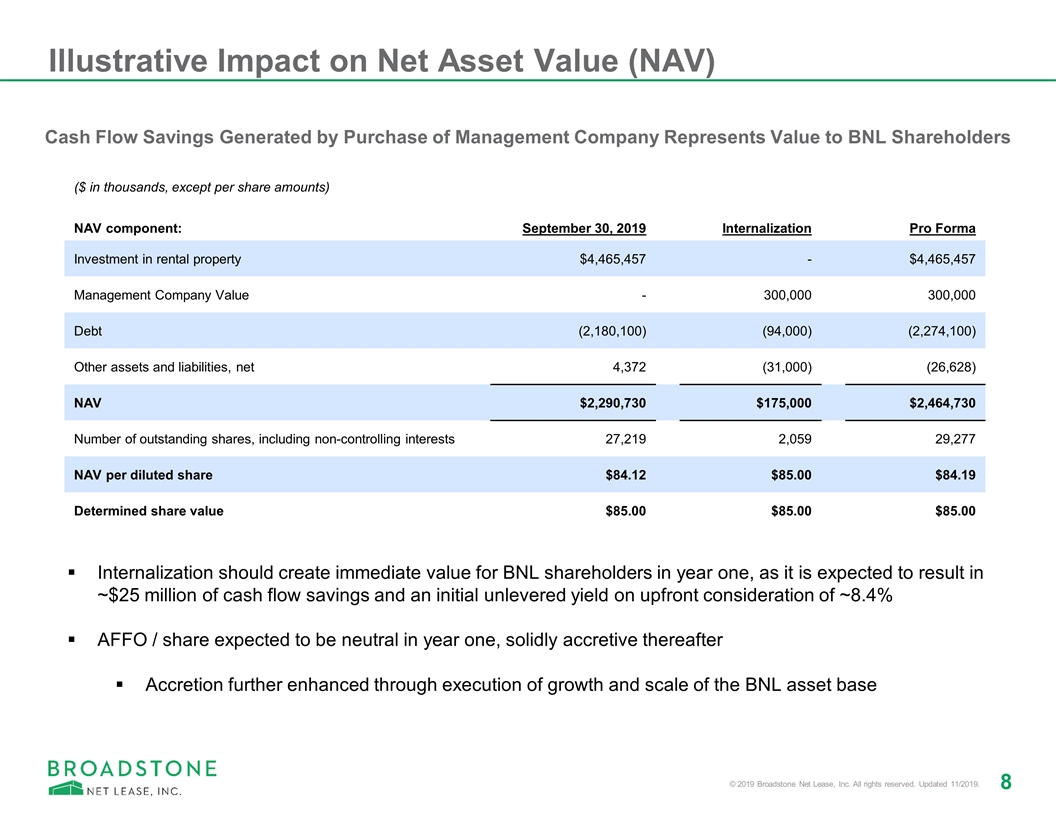

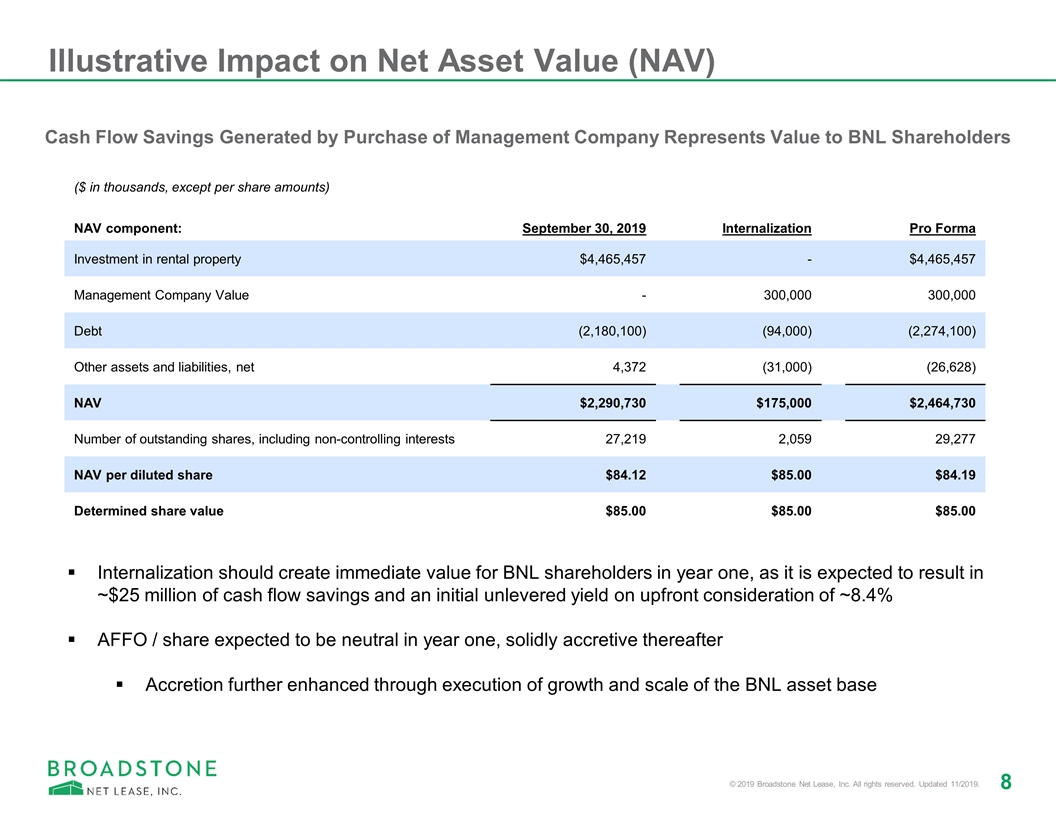

($ in thousands, except per share amounts) NAV component: September 30, 2019 Internalization Pro Forma Investment in rental property $4,465,457 - $4,465,457 Management Company Value - 300,000 300,000 Debt (2,180,100) (94,000) (2,274,100) Other assets and liabilities, net 4,372 (31,000) (26,628) NAV $2,290,730 $175,000 $2,464,730 Number of outstanding shares, including non-controlling interests 27,219 2,059 29,277 NAV per diluted share $84.12 $85.00 $84.19 Determined share value $85.00 $85.00 $85.00 Illustrative Impact on Net Asset Value (NAV) Internalization should create immediate value for BNL shareholders in year one, as it is expected to result in ~$25 million of cash flow savings and an initial unlevered yield on upfront consideration of ~8.4% AFFO / share expected to be neutral in year one, solidly accretive thereafter Accretion further enhanced through execution of growth and scale of the BNL asset base Cash Flow Savings Generated by Purchase of Management Company Represents Value to BNL Shareholders

FREQUENTLY ASKED QUESTIONS

In Summary IMMEDIATE COST SAVINGS of over $25 million in the first year, equating to an expected initial unlevered yield on upfront consideration of 8.4% and a levered IRR in the mid teens 1 2 3 4 ECONOMIES OF SCALE with significant growth potential through elimination of variable rate cost structure and corresponding asset, property and transaction-based fees SIMPLIFIED STRUCTURE through unification of all BNL’s investment activity, corporate operations, and resources under a single transparent corporate structure CONTINUITY OF MANAGEMENT TEAM with proven track record and further alignment of interests as compared to the existing external management structure