Wolverine Exploration Inc.

4055 McLean Road

Quesnel, British Columbia

V2J 6V5 Canada

VIA EDGAR

September 16, 2008

Mail Stop 7010

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, DC

20549

Attention: H. Roger Schwall

Dear Mr. Schwall:

| Re: | Wolverine Exploration Inc. (the “Company”) |

| | Registration Statement on Form S-1 |

File No. 333-152343

Further to your comment letter dated August 5, 2008, enclosed for filing are copies each of the following documents:

| 1. | Form SB-2/A – 1st Amendment (in triplicate); |

| 2. | redlined Form SB-2/A (in triplicate); |

| 3. | this comment letter (in duplicate). |

Also, I confirm that these documents have been filed via EDGAR.

The following are the responses to those comments. For convenience, the number of each response refers to the number of the comment in your letter.

General

| 1. | The required audited financial statements have been provided for the period ended May 31, 2008. Also, I confirm that the required revisions and updates for all of the related disclosure have been made throughout the registration statement. |

| 2. | The requested statement has been added to the cover page and elsewhere in registration statement as required. |

Determination of Offering Price, page 10

| 3. | The requested revision has been added to the registration statement regarding how the Company determined the offering price. See “Determination of Offering Price” on page 10 (page 10 of the EDGAR file). |

Selling Shareholders, page 11

| 4. | I confirm that Thian Yew Ng is the same person as Ng Thian Yew and that the names in the registration statement have been changed to make them consistent. See “Selling Shareholders” on page 14 (page 14 of the EDGAR file) and “Security Ownership of Certain Beneficial Owners and Management” on page 41 (page 56 of the EDGAR file). |

Exhibits

Exhibit 5.1

| 5. | I confirm that the requested revised opinion of counsel has been included and filed with the registration statement as a new Exhibit 5.1. |

I trust the above to be satisfactory. If you have any questions or require anything further please give me a call.

Sincerely,

Wolverine Exploration Inc.

Per: /s/ Lee Costerd

Director, President (Chief Executive Officer),

Principal Financial Officer, and

Principal Accounting Officer

SEC File # 333-152343

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Initial Filing

FORM S-1 /A

Amendment #1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

WOLVERINE EXPLORATION INC.

(Exact name of registrant as specified in its charter)

| Nevada | 1000 | 98-0569013 |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification Number) |

| | | |

4055 McLean Road

Quesnel, British Columbia

Canada, V2J 6V5

Telephone: (250) 992-6972

Facsimile: (250) 992-6972

(Address, including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

Agent for Service: Lee Costerd Wolverine Exploration Inc. 4055 McLean Road Quesnel, British Columbia Canada, V2J 6V5 Telephone: (250) 992-6972 Facsimile: (250) 992-6972 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

| If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: | [X] |

| If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | [ ] |

| If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | [ ] |

| If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | [ ] |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company in Rule 12b-2 of the Exchange Act. Larger accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] (Do not check if a smaller reporting company) Smaller reporting company [ X ] |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities To Be Registered | Amount to be registered | Proposed Maximum Offering Price per Unit [1] | Proposed Maximum Aggregate Offering Price [1] | Amount of Registration Fee |

Units, each consisting of one share of Common Stock, $0.001 par value, and one Warrant, to be registered by issuer | 15,000,000 Units | $0.10 | $1,500,000 | $58.95 |

Shares of Common Stock included as part of the Units, to be registered by issuer | 15,000,000 shares | - | - | - [3] |

| Warrants included as part of the Units, to be registered by issuer | 15,000,000 Warrants | - | - | - [3] |

Shares of Common Stock underlying the Warrants included in the Units, to be registered by issuer [2] | 15,000,000 shares | $0.15 | $2,250,000 | $88.43 |

Shares of Common Stock: $0.001 par value, to be registered by selling shareholders | 64,630,000 shares | $0.10 | $6,463,000 | $254.00 |

| Total | - | - | $10,213,000 | $401.38 |

| | [1] Estimated in accordance with Rule 457(c) solely for the purpose of calculating the registration fee based on a bona fide estimate of the maximum offering price. |

| | [2] These are the maximum number of shares of common stock that can be issued if all of the share purchase warrants underlying the unit offering are exercised. The maximum offering price is based upon the exercise price of the warrants. |

| | [3] No fee pursuant to Rule 457(g). |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. Wolverine and the selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Dated *, 2008

Prospectus

WOLVERINE EXPLORATION INC.

15,000,000 Units

and

64,630,000 Shares Common Stock

Wolverine Exploration Inc. (“Wolverine”) is offering up to 15 million units which as of this date have not been issued. Each unit consists of one share of common stock in the capital of Wolverine and one non-transferable share purchase warrant. Each warrant enables the subscriber to purchase one additional share of common stock at a price of US$0.15 per warrant for a period of two years from the date the units are issued.

Additionally, the selling shareholders named in this prospectus are offering to sell up to 64,630,000 shares of Wolverine’s common stock held by them. Wolverine will not receive any proceeds from the sale of the shares of common stock being offered by the selling shareholders. However, Wolverine will pay for the expenses of this offering and the selling stockholders’ offering, except for any selling shareholder’s legal or accounting costs or commissions.

Wolverine is offering a maximum 15 million units on a self underwritten basis. The offering price is $0.10 per unit. There is no minimum number of units that Wolverine will sell. All proceeds will be deposited to Wolverine’s operating account and there will be no refunds. The offering will be open until (Effective Date + 180 days). There are no minimum unit purchase requirements for individual investors.

Wolverine is a startup exploration stage company with no operations.

Wolverine’s shares of common stock are not quoted on any national securities exchange. The selling shareholders are required to sell Wolverine’s shares at $0.10 per share until Wolverine’s shares are quoted on the Over-the-Counter Bulletin Board (OTCBB), and thereafter at prevailing market prices or privately negotiated prices.

The offering made by Wolverine is comprised of shares plus additional warrants for the same offering price that the named selling shareholders are offering their shares, but without the additional warrants.

This investment involves a high degree of risk. See “Risk Factors” beginning on page 7 for a discussion of certain risk factors and uncertainties you should carefully consider before making a decision to purchase any shares of Wolverine’s common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Table of Contents

| | Page |

| Prospectus Summary | 5 |

| Risk Factors | 7 |

| Use of Proceeds | 9 |

| Determination of Offering Price | 10 |

| Dilution | 11 |

| Selling Shareholders | 12 |

| Plan of Distribution | 16 |

| Description of Securities to be Registered | 18 |

| Interests of Named Experts and Counsel | 19 |

| Description of Business | 20 |

| Description of Property | 27 |

| Legal Proceedings | 27 |

| SEC Filings | 27 |

| Market for Common Equity and Related Stock Matters | 28 |

Financial Statements May 31, 2008 audited financial statements | 30 31 |

| Management Discussion and Analysis of Financial Condition | 33 |

| Changes in Disagreements With Accountants on Accounting and Financial Disclosure | 38 |

| Directors, Officers, Promoters, and Control Persons | 38 |

| Executive Compensation | 40 |

| Security Ownership of Certain Beneficial Owners and Management | 41 |

| Transactions with Related Persons, Promoters, and Certain Control Persons | 42 |

| Disclosure of Commission Position of Indemnification for Securities Act Liabilities | 43 |

You should rely only on the information contained in this prospectus. Wolverine has not authorized anyone to provide you with information different from that contained in this prospectus. Wolverine and the selling stockholders are offering to sell shares of Wolverine’s common stock and seeking offers to buy shares of Wolverine’s common stock only in jurisdictions where such offers and sales are permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Wolverine’s business, financial condition, results of operations and prospects may have changed since that date.

The following summary is a shortened version of more detailed information, exhibits and financial statements appearing elsewhere in this prospectus. Prospective investors are urged to read this prospectus in its entirety.

Wolverine is a startup company in the business of base and precious metal exploration. There is no assurance that a commercially viable deposit exists on Wolverine’s mineral claims. Exploration will be required before a final evaluation as to the economic and legal feasibility of Wolverine’s mineral claims is determined.

On February 28, 2007 Wolverine acquired a 90% interest in 516 mineral claims from Shenin Resources Inc. for the aggregate cost of $374,000.

On May 17, 2007, Wolverine acquired an additional six mineral claims from Richard Haderer for the cost of $321 (CDN$360).

All 522 mineral claims are in the Province of Newfoundland and Labrador in Canada (the “Labrador Claims”). The Labrador Claims are located about 120 kilometres (76 miles) west of Goose Bay, Labrador, which is near the Atlantic Coast in northern Canada. Infrastructure required for exploration, advanced exploration and even mining are excellent given the proximity of the property to Goose Bay, Labrador, which has an international airport and a number of exploration outfitters.

Wolverine’s consulting geophysicist has written a report dated May 25, 2007, providing management with recommendations of how Wolverine should explore the Labrador Claims. From the work conducted on the Labrador Claims to date, there is indication of possible gold and copper mineralization, but additional work needs to be conducted on the Labrador Claims to prove such mineralization.

Wolverine’s objective is to conduct exploration activities on the Labrador Claims to assess whether the property possesses any commercially viable deposits. Until Wolverine can validate otherwise, the Labrador Claims are without known reserves. Management is planning a five phase exploration program to explore the Labrador Claims. Access to the Labrador Claims is restricted to the period of May to November of each year due to snow in the area. This means that Wolverine’s exploration activities are limited to a period of about six to seven months per year. Wolverine completed Phase One and Phase Two of its exploration program in October of 2007 and completed Phase 3 of its exploration program in August 2008. The following table summarizes the next three phases of Wolverine’s proposed exploration program:

Phase Number | Planned Exploration Activities | Time Table |

Four Three | Ground ReviewExcavating, Surface Trenching and an induced Polarization Survey | SummerFall 2008 |

| Five | Drill Program | Fall 2008 |

To date Wolverine has raised $759,400 via offerings completed between April 2006 and June 2008. The following table summarizes the date of offering, the price per share paid, the number of shares sold, and the amount raised for these three offerings.

| Closing Date of Offering | Price Per Share Paid | Number of Shares Sold | Amount Raised |

| April 3, 2006 | $0.001 | 4,000,000 | $4,000 |

| June 2006-September 2007 | $0.01 | 25,640,000 | $256,400 |

| September 2007-October 2007 | $0.10 | 3,890,000 | $389,000 |

| June 25 2008 | $0.10 | 1,100,000 | $110,000 |

Wolverine has no revenues, has achieved losses since inception, has no operations, has been issued a going concern opinion by its auditor and relies upon the sale of its shares of common stock to fund its operations.

Name, Address, and Telephone Number of Registrant

Wolverine Exploration Inc.

4055 McLean Road

Quesnel, British Columbia

Canada, V2J 6V5

Tel: (250) 992-6972

The Offering

The following is a brief summary of this offering.

| Securities being offered to new and current investors: | | Up to a maximum of 15 million units with no minimum purchase. Each unit consists of one share of common stock and one warrant exercisable at $0.15 per warrant for a period of two years. |

| Securities being offered by selling shareholders: | | 64,630,000 shares of common stock (These shares are being registered by Wolverine for resale on behalf of existing shareholders.) |

| Offering price: | | $0.10 (The offering price for Wolverine’s offering includes a share and an additional warrant whereas the same offering price for the named selling shareholders only includes a share and not an additional warrant.) |

| Offering period: | | The shares are being offered for a period not to exceed 180 days following the effective date of this registration statement. |

Net proceeds to Wolverine (assuming that all units are sold and no warrants exercised): | | Up to a maximum of $1,432,000. |

| Use of proceeds: | | To fund exploration work, fund ongoing operations, pay accounts payable, and to pay for offering expenses. |

| Number of shares outstanding before the offering: | | 68,630,000 |

Number of shares outstanding after the offering (assuming that all units are sold and no warrants exercised): | | 83,630,000 |

The tables and information below are derived from Wolverine’s audited financial statements for the years-ended May 31, 2007 and 2008 , and the period ended May 31, 2006. and from Wolverines unaudited financial statements for the nine months ended February 29, 2008 Wolverine had a working capital deficit of $116.568 92,277 and $105,874 as at May 31, February 29 2008 and May 31, 2007 respectively.

| Financial Summary | May 31,February 29 2008 $ | May 31, 2007 | May 31, 2007 $ |

| Cash | 18,990 | 10,366 | 10,36636,836 |

| Total Assets | 373,639 | 386,261 | 386,26136,961 |

| Total Liabilities | 141,986 | 143,914 | 143,91419,188 |

| Total Liabilities and Stockholder’s Equity | 373,639 | 386,261 | 386,26136,961 |

| Statement of Operations | Accumulated From February 23, 2006 (Date of Inception) to February 29,May 31, 2008 $ | For the Year Ended May 31, 20082007 $ | From February 23, 2006 (Date of Inception) to For the Year Ended May 31, 2007 2006 $ |

| Revenue | − | − | − |

| Net Loss For the Period | 868,421763,456 | 623,768224,926 | 224,92619,727 |

| Net Loss per Share | 0.02.01 | 0.01 | 0.01 |

The book value of Wolverine’s outstanding common stock is $0.01 per share as at May 31, 2008.2007

An investment in the common stock of Wolverine involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating Wolverine and its business before purchasing shares of Wolverine‘s common stock. Wolverine’s business, operating results and financial condition could be seriously harmed due to any of the following known material risks. The risks described below are not the only ones facing Wolverine. Additional risks not presently known to Wolverine may also impair its business operations. You could lose all or part of your investment due to any of these risks.

If Wolverine does not obtain additional financing, the business plan will fail.

Wolverine’s current operating funds are insufficient to complete the next phases of its proposed exploration program on its Labrador mineral claims. Wolverine will need to obtain additional financing in order to complete its business plan and its proposed exploration program. Wolverine’s business plan calls for significant expenses in connection with the exploration of the Labrador Claims. Wolverine has not made arrangements to secure any additional financing.

Wolverine’s failure to make required expenditures could cause us to lose title to the mineral claim.

Under the terms of the Vend-In Agreement with Shenin Resources Inc., Wolverine is required to incur the following expenditures on the claims (i) CDN $150,000 on or before March 1, 2008; (ii) CDN $200,000 on or before March 1, 2009, and (iii) CDN $250,000 on or before March 1, 2010; provided that (iv) any excess amount spent in one year may be carried forward and applied towards fulfillment of the expenditure required in the later year. As a result of its completion of Phase One and Phase Two of the proposed exploration program, Wolverine has met its March 1, 2008 expenditure requirements. However, there is no assurance that Wolverine can fulfill the other expenditure requirements and may lose title to the Labrador Claims.

Because Wolverine has only recently commenced business operations, Wolverine faces a high risk of business failure and this could result in a total loss of your investment.

Wolverine has recently begun the initial stages of exploration of the Labrador Claims, and thus has no way to evaluate the likelihood whether Wolverine will be able to operate its business successfully. Wolverine was incorporated on February 23, 2006 and to date has been involved primarily in organizational activities, obtaining financing and preliminary exploration of the Labrador Claims. Wolverine has not earned any revenues and Wolverine has never achieved profitability as of the date of this prospectus. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in the light of problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that Wolverine plans to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. Wolverine has no history upon which to base any assumption as to the likelihood that its business will prove successful, and Wolverine can provide no assurance to investors that Wolverine will generate any operating revenues or ever achieve profitable operations. If Wolverine is unsuccessful in addressing these risks its business will likely fail and you will lose your entire investment in this offering.

Because Wolverine has only recently commenced business operations, Wolverine expects to incur operating losses for the foreseeable future.

Wolverine has never earned any revenue and Wolverine has never been profitable. Prior to completing exploration on the Labrador Claims, Wolverine may incur increased operating expenses without realizing any revenues from the Labrador Claims, this could cause Wolverine to fail and you will lose your entire investment in this offering.

If Wolverine does not find a joint venture partner for the continued development of its mineral claims, Wolverine may not be able to advance exploration work.

If the results of the exploration program are successful, Wolverine may try to enter into a joint venture agreement with a partner for the further exploration and possible production of the Labrador Claims. Wolverine would face competition from other junior mineral resource exploration companies who have properties that they deem to be attractive in terms of potential return and investment cost. In addition, if Wolverine entered into a joint venture agreement, Wolverine would likely assign a percentage of its interest in the Labrador Claims to the joint venture partner. If Wolverine is unable to enter into a joint venture agreement with a partner, Wolverine may fail and you may lose your entire investment in this offering.

Because of the speculative nature of mineral property exploration, there is substantial risk that no commercially viable deposits will be found and the business of Wolverine will fail.

Exploration for base and precious metals is a speculative venture involving substantial risk. Wolverine can provide investors with no assurance that the Labrador Claims contain commercially viable mineral deposits. The exploration program that Wolverine will conduct on the Labrador Claims may not result in the discovery of commercial viable mineral deposits. Problems such as unusual and unexpected rock formations and other conditions are involved in base and precious metal exploration and often result in unsuccessful exploration efforts. In such a case, Wolverine may be unable to complete its business plan and you could lose your entire investment in this offering.

Because of the inherent dangers involved in base and precious metal exploration, there is a risk that Wolverine may incur liability or damages as Wolverine conducts its business.

The search for base and precious metals involves numerous hazards. As a result, Wolverine may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which Wolverine cannot insure or against which Wolverine may elect not to insure. Wolverine currently has no such insurance nor does Wolverine expect to get such insurance in the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed Wolverine’s asset value and cause Wolverine to liquidate all of its assets resulting in the loss of your entire investment in this offering.

Because access to Wolverine’s mineral claims is often restricted by inclement weather, Wolverine will be delayed in exploration and any future mining efforts.

Access to the Labrador mineral claims is restricted to the period between May and November of each year due to snow in the area. As a result, any attempts to visit, test, or explore the property are largely limited to these few months of the year when weather permits such activities. These limitations can result in significant delays in exploration efforts, as well as mining and production in the event that commercial amounts of minerals are found. Such delays can result in Wolverine’s inability to meet deadlines for exploration expenditures as defined by the Province of Newfoundland and Labrador or by the Vend-In Agreement with Shenin Resources Inc. This could cause the business venture to fail and the loss of your entire investment in this offering unless Wolverine can meet the deadlines.

As Wolverine undertakes exploration of the Labrador Claims, Wolverine will be subject to compliance with government regulation that may increase the anticipated time and cost of its exploration program.

There are several governmental regulations that materially restrict the exploration of minerals. Wolverine will be subject to the mining laws and regulations as contained in the Mineral Act of the Province of Newfoundland and Labrador as Wolverine carries out its exploration program. Wolverine may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. While Wolverine’s planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase Wolverine’s time and costs of doing business and prevent Wolverine from carrying out its exploration program.

Because market factors in the mining business are out of Wolverine’s control, Wolverine may not be able to market any minerals that may be found.

The mining industry, in general, is intensely competitive and we can provide no assurance to investors even if minerals are discovered that a ready market will exist from the sale of any base or precious metals found. Numerous factors beyond Wolverine’s control may affect the marketability of base or precious metals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Wolverine not receiving an adequate return on invested capital and you may lose your entire investment in this offering.

Because Wolverine holds a significant portion of its cash reserves in United States dollars, Wolverine may experience weakened purchasing power in Canadian dollar terms.

Wolverine holds a significant portion of its cash reserves in United States dollars. Due to foreign exchange rate fluctuations, the value of these United States dollar reserves can result in both translation gains or losses in Canadian dollar terms. If there was to be a significant decline in the United States dollar versus the Canadian Dollar, Wolverine’s US dollar purchasing power in Canadian dollars would also significantly decline. Wolverine has not entered into derivative instruments to offset the impact of foreign exchange fluctuations.

Wolverine’s auditors have expressed substantial doubt about Wolverine’s ability to continue as a going concern.

The accompanying financial statements have been prepared assuming that Wolverine will continue as a going concern. As discussed in Note 3 1 to the financial statements, Wolverine was recently incorporated on February 23, 2006, and does not have a history of earnings, and as a result, Wolverine’s auditor has expressed substantial doubt about the ability of Wolverine to continue as a going concern. Continued operations are dependent on Wolverine’s ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Wolverine’s financial statements do not include any adjustments that may result from the outcome of this uncertainty.

There is no liquidity and no established public market for Wolverine’s common stock and it may prove impossible to sell your shares.

There is presently no public market in Wolverine’s shares. While Wolverine intends to contact an authorized OTC Bulletin Board market maker for sponsorship of its common stock, Wolverine cannot guarantee that such sponsorship will be approved nor that Wolverine’s common stock will be listed and quoted for sale. Even if Wolverine’s shares are quoted for sale, buyers may be insufficient in numbers to allow for a robust market, and it may prove impossible to sell your shares.

If the selling shareholders sell a large number of shares all at once or in blocks, the value of Wolverine’s shares would most likely decline.

The selling shareholders are offering 64,630,000 shares of Wolverine’s common stock through this prospectus. They must sell these shares at a fixed price of $0.10 until such time as they are quoted on the OTC Bulletin Board or other quotation system or stock exchange. Wolverine’s common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of large numbers of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent approximately 94.2% of the common shares currently outstanding.

Wolverine’s common stock is subject to the “penny stock” rules of the SEC and the trading market in Wolverine’s securities is limited, which makes transactions in Wolverine’s stock cumbersome and may reduce the value of an investment in Wolverine’s stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to Wolverine, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| · | that a broker or dealer approve a person’s account for transactions in penny stocks; and |

| · | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| · | obtain financial information and investment experience objectives of the person; and |

| · | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form:

| · | sets forth the basis on which the broker or dealer made the suitability determination; and |

| · | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of Wolverine’s common stock and cause a decline in the market value of Wolverine’s common stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

| | | Sale Of 100% | Sale of 75% | Sale of 50% | Sale Of 25% |

| Gross Proceeds | | $1,500,000 | $1,125,000 | $750,000 | $375,000 |

| Number of Shares Sold | | 15,000,000 | 11,250,000 | 7,500,000 | 3,750,000 |

| | | | | | |

| Less expenses of offering: | | | | | |

| Legal and Registration Fees | | $30,500 | $30,500 | $30,500 | $30,500 |

| Accounting and Auditing | | 31,500 | 31,500 | 31,500 | 31,500 |

| Electronic Filing and Printing | | 3,000 | 3,000 | 3,000 | 3,000 |

| Transfer Agent | | 3,000 | 3,000 | 3,000 | 3,000 |

| Net Proceeds | | $1,432,000 | $1,057,000 | $682,000 | $307,000 |

| | | | | | |

| Use of net proceeds | | | | | |

| Exploration of Labrador Claims | | $744,050824,849 | $744,050824,849 | $214,500292,974 | $97,50026,174 |

| Payment of Accounts Payable | | $125,000 | $125,000 | $125,000 | $125,000 |

| Working Capital | | $562,950482,151 | $187,950107,151 | $342,500264,026 | $ 84,500155,826 |

| | | | | | |

Analysis of Financing Scenarios

After deduction $68,000 for estimated offering expenses including legal and registration fees, accounting and auditing, electronic filing and printing, and transfer agent, the net proceeds from this offering may be as much as $1,432,000, assuming all 15 million units are sold. However, there can be no assurance that any of these shares will be sold. Wolverine will use the proceeds to fund its next three phases of its proposed exploration program.

In all four scenarios Wolverine will complete exploration on its Labrador Claims. Wolverine will increase its exploration efforts if it is able to sell a higher percentage of this offering as described in the above table. The proposed exploration program on the Labrador Claims will consist of a ground review excavating, surface trenching, an induced polarization survey, and a drill program. See “Description of Business – Plan of Operation” below for more details. If Wolverine does not sell at least 127 % of this offering Wolverine will not be able to fund the excavation and surface trenching of Phase FourThree of its proposed exploration program. If Wolverine does not sell at least 1525 % of this offering Wolverine will be not be able to fund Phase Four of its proposed exploration program.

Determination of Offering Price

The offering price has been determined by Wolverine’s board of directors. The board of directors selected the $0.10 offering price for both the sale of the shares by the selling shareholders and for the sale of the units by Wolverine. The offering price was determined by using a number of factors. Management considered the price of the most recent financings. Additionally, management estimated the cost of this offering plus the amount Wolverine needs to operate its business for the next 12 months. Management determined the offering price by assessing Wolverine’s capital requirements against the price management thinks investors are willing to pay for Wolverine’s common stock.

The offering price for the shares to be sold by the selling shareholders was the last price that the selling shareholders paid for their shares. Currently there is no market for Wolverine’s common stock and Wolverine wanted to give its shareholders the ability to sell their shares for a price equal or greater to the price they paid for their shares. If Wolverine’s common stock is listed for trading on the OTC Bulletin Board, the price of the common stock will then be established by the market.

At the same time, the offering price for the units to be sold by Wolverine was arbitrarily determined based on Wolverine’s internal assessment of what the market would support in order for Wolverine to raise $1,500,000 in this offering. In determining the number of shares to be offered and the offering price, management took into consideration Wolverine’s cash on hand and the amount of money Wolverine would need to implement its plan of operation. Among the factors considered in determining the offering price were:

| · | Wolverine’s lack of business history; |

| · | the proceeds to be raised by the offering; |

| · | the amount of capital to be contributed by investors in this offering in proportion to the amount of stock to be retained by Wolverine’s existing shareholders, and; |

| · | Wolverine’s relative cash requirements; see “Plan of Distribution” beginning on page 16. |

The offering price for both the shares offered by the selling shareholders and the units offered by Wolverine does not bear any relationship to Wolverine’s assets, book value, earnings, or other established criteria for valuing a privately held company. Accordingly, the offering price should not be considered an indication of the actual value of the Wolverine’s common stock nor should the offering price be regarded as an indicator of the future market price of Wolverine’s common stock.

The offering made by Wolverine is comprised of shares plus additional warrants for the same offering price that the named selling shareholders are offering their shares, but without the additional warrants.

Dilution

Prior to this offering, Wolverine had 68,630,67,530000 shares of common stock issued and outstanding as at May 31February 29,, 2008. The net tangible book value of Wolverine as at May 31February 29,, 2008 was $231,653255,944 or $0.003004 per share. Net tangible book value per share is determined by dividing Wolverine’s tangible net worth, consisting of tangible assets less total liabilities, by the number of shares outstanding. The average price paid by the present shareholders is $0.016. The following tables summarize the difference between the average price paid by present shareholders and the price to be paid by subscribers to this offering for 25%, 50%, 75% and 100% subscription rates.

Analysis for 25% Subscription |

Shareholder Type | Price Paid $ | Number of Shares Held | Amount of Consideration Paid | Percentage of Consideration | Percentage of Shares Held |

Present Shareholders | $0.016 | 68,630,000 | $1,099,400 | 74.6% | 94.8% |

Investors in this Offering | $0.10 | 3,750,000 | $375,000 | 25.4% | 5.2% |

Analysis for 50% Subscription |

Shareholder Type | Price Paid $ | Number of Shares Held | Amount of Consideration Paid | Percentage of Consideration | Percentage of Shares Held |

Present Shareholders | $0.016 | 68,630,000 | $1,099,400 | 59.4% | 90.1% |

Investors in this Offering | $0.10 | 7,500,000 | $750,000 | 40.6% | 9.9% |

Analysis for 75% Subscription |

Shareholder Type | Price Paid $ | Number of Shares Held | Amount of Consideration Paid | Percentage of Consideration | Percentage of Shares Held |

Present Shareholders | $0.016 | 68,630,000 | $1,099,400 | 49.4% | 85.9% |

Investors in this Offering | $0.10 | 11,250,000 | $1,125,000 | 50.6% | 14.1% |

Analysis for 100% Subscription |

Shareholder Type | Price Paid $ | Number of Shares Held | Amount of Consideration Paid | Percentage of Consideration | Percentage of Shares Held |

Present Shareholders | $0.016 | 68,630,000 | $1,099,400 | 42.3% | 82.1% |

Investors in this Offering | $0.10 | 15,000,000 | $1,500,000 | 57.7% | 17.9% |

“Dilution” means the difference between Wolverine’s public offering price ($0.10 per unit) and its proforma net tangible book value per share after implementing this offering and accounting for the cost of the offering. Net tangible book value per share is determined by dividing Wolverine’s tangible net worth, consisting of tangible assets less total liabilities, by the number of shares outstanding. The following table will show the net tangible book value of Wolverine’s shares both before and after the completion of this offering for 25%, 50%, 75% and 100% subscription rates.

| | 25% | 50% | 75% | 100% |

| Public offering price per unit | $0.10 | $0.10 | $0.10 | $0.10 |

| Net tangible book value per share before offering | $0.003004 | $0.003004 | $0.003004 | $0.003004 |

| Proforma net tangible book value per share after offering | $0.007008 | $0.012 | $0.016 | $0.020 |

| Increase per share attributable to public investors | $0.004 | $0.009008 | $0.013012 | $0.017016 |

| Dilution per share to public investors | $0.093092 | $0.088 | $0.084 | $0.080 |

Selling Shareholders

The selling shareholders named in this prospectus are offering all of their 64,630,000 shares of the common stock offered through this prospectus. These shares were acquired from Wolverine in the following private placements and acquisition of mineral claims:

| 1. | 27,480,000 shares of Wolverine common stock that the selling shareholders acquired from Wolverine in offerings that were exempt from registration under Regulation S of the Securities Act of 1933 and were completed between June 13, 2006 and June 25, 2008. |

| 2. | 34,000,000 shares of common stock issued on February 28, 2007 to seven non-affiliate Canadian residents pursuant to a Vend-In Agreement dated February 28, 2007 with Shenin Resources Inc., a non-affiliate Canadian company, at a deemed price of $0.01 per share for the acquisition of the Labrador mineral claims. |

| 3. | 3,150,000 shares of Wolverine common stock that the selling shareholders acquired from Wolverine in offerings that were exempt from registration under Regulation D of the Securities Act of 1933 and were completed between April 30, 2007 and June 25, 2008. |

The shares of common stock were sold to investors under exemptions provided in Canada and Regulation S and accredited investors under exemptions provided in the United States and Regulation D.

Until a public market is established for Wolverine’s common stock, the selling shareholders will be offering their shares, which do not include an additional warrant, at the same offering price as the offering made by Wolverine, which includes both a share and an additional warrant.

The following table provides as of the date of this prospectus information regarding the beneficial ownership of Wolverine’s common stock held by each of the selling shareholders, including:

| 1. | the number of shares owned by each before the offering; |

| 2. | the total number of shares that are to be offered for each; |

| 3. | the total number of shares that will be owned by each upon completion of the offering; and |

| 4. | the percentage owned by each upon completion of the offering. |

| Name of Selling Shareholder | Shares Owned Before the Offering | Total Number of Shares to be Offered for the Security Holder’s Account | Total Shares Owned After the Offering is Complete | Percentage of Shares Owned After the Offering is Complete |

| Mitchell Adam | 300,000 | 300,000 | Nil | Nil |

Anchor Equipment (2005) Ltd. (1) | 100,000 | 100,000 | Nil | Nil |

| H. Roderick Anderson | 1,300,000 | 1,300,000 | Nil | Nil |

| Margaret Archibald | 100,000 | 100,000 | Nil | Nil |

| Daryl M. Auwai | 50,000 | 50,000 | Nil | Nil |

Balch Research Corp. (2) | 1,850,000 | 1,850,000 | Nil | Nil |

| Salvatore Basile | 50,000 | 50,000 | Nil | Nil |

| John Bevilacqua | 200,000 | 200,000 | Nil | Nil |

| Ralph Biggar | 5,000,000 | 5,000,000 | Nil | Nil |

| Dr. J. Andrew Birch | 400,000 | 400,000 | Nil | Nil |

| Mike Birch | 100,000 | 100,000 | Nil | Nil |

Birch Living Trust (3) | 2,150,000 | 2,150,000 | Nil | Nil |

| Tim Bokenfohr | 100,000 | 100,000 | Nil | Nil |

| Don Bossert | 50,000 | 50,000 | Nil | Nil |

| Don Bowins | 100,000 | 100,000 | Nil | Nil |

| Paulo Branco | 300,000 | 300,000 | Nil | Nil |

Donald & Pamela Brewer, joint tenants | 100,000 | 100,000 | Nil | Nil |

| Art Brown | 100,000 | 100,000 | Nil | Nil |

| Name of Selling Shareholder | Shares Owned Before the Offering | Total Number of Shares to be Offered for the Security Holder’s Account | Total Shares Owned After the Offering is Complete | Percentage of Shares Owned After the Offering is Complete |

| J. Frank Callaghan | 100,000 | 100,000 | Nil | Nil |

| Don J. Carroll | 100,000 | 100,000 | Nil | Nil |

| Alan Carter | 400,000 | 400,000 | Nil | Nil |

| Robin Chandler | 250,000 | 250,000 | Nil | Nil |

| Steve Chios | 100,000 | 100,000 | Nil | Nil |

| Chuch Choo | 200,000 | 200,000 | Nil | Nil |

| Clark David Chul Christie | 100,000 | 100,000 | Nil | Nil |

| David Christie | 100,000 | 100,000 | Nil | Nil |

| James Douglas Christie | 100,000 | 100,000 | Nil | Nil |

| Song Sook Byun Christie | 100,000 | 100,000 | Nil | Nil |

| Randy Contoli | 200,000 | 200,000 | Nil | Nil |

| Greg Corcoran | 200,000 | 200,000 | Nil | Nil |

| Angeline Wong Cordero | 100,000 | 100,000 | Nil | Nil |

| Anriza Wong Cordero | 1,000,000 | 1,000,000 | Nil | Nil |

| Debbie Coventry | 50,000 | 50,000 | Nil | Nil |

| Melvin Crocker | 50,000 | 50,000 | Nil | Nil |

Crystalwood Holdings Ltd. (4) | 200,000 | 200,000 | Nil | Nil |

| Joao DaCosta | 300,000 | 300,000 | Nil | Nil |

DaCosta Management Corp. (5) | 700,000 | 700,000 | Nil | Nil |

| Maria Da Silva | 1,000,000 | 1,000,000 | Nil | Nil |

| Marilyn Dilgenti-Smith | 50,000 | 50,000 | Nil | Nil |

| James F. Dixon | 100,000 | 100,000 | Nil | Nil |

| Eva Dudas | 50,000 | 50,000 | Nil | Nil |

| Art Den Duyf | 5,375,000 | 5,375,000 | Nil | Nil |

| John Dyck | 100,000 | 100,000 | Nil | Nil |

| Slade Dyer | 200,000 | 200,000 | Nil | Nil |

| Keith Elliot | 50,000 | 50,000 | Nil | Nil |

| Cherie Federau | 450,000 | 450,000 | Nil | Nil |

Dennis & Cindy Federighi, joint tenants | 100,000 | 100,000 | Nil | Nil |

| Rick Finlayson | 100,000 | 100,000 | Nil | Nil |

| Paul Fong | 50,000 | 50,000 | Nil | Nil |

| Peter Gommerud | 50,000 | 50,000 | Nil | Nil |

| David Grandy | 300,000 | 300,000 | Nil | Nil |

| Vincent Grant Gough | 300,000 | 300,000 | Nil | Nil |

| Feliberto Gurat | 300,000 | 300,000 | Nil | Nil |

| Allan Haderer | 50,000 | 50,000 | Nil | Nil |

| Richard Haderer | 5,250,000 | 5,250,000 | Nil | Nil |

| Hunter Henley | 50,000 | 50,000 | Nil | Nil |

| Peter J. Hoyle | 100,000 | 100,000 | Nil | Nil |

| Stanlie Hunt | 100,000 | 100,000 | Nil | Nil |

| Peter Keegan | 100,000 | 100,000 | Nil | Nil |

| Name of Selling Shareholder | Shares Owned Before the Offering | Total Number of Shares to be Offered for the Security Holder’s Account | Total Shares Owned After the Offering is Complete | Percentage of Shares Owned After the Offering is Complete |

| Ron Keegan | 50,000 | 50,000 | Nil | Nil |

| Jack A. Kleman | 100,000 | 100,000 | Nil | Nil |

| Amin Ladha | 100,000 | 100,000 | Nil | Nil |

| Laurel Lee | 50,000 | 50,000 | Nil | Nil |

| Ng Liang | 100,000 | 100,000 | Nil | Nil |

| Gary Liu | 100,000 | 100,000 | Nil | Nil |

| Deirdre Lynch | 5,250,000 | 5,250,000 | Nil | Nil |

| R. Hector MacKay-Dunn | 200,000 | 200,000 | Nil | Nil |

| Alastair MacLennan | 100,000 | 100,000 | Nil | Nil |

| Teresa Mallam | 50,000 | 50,000 | Nil | Nil |

| Joseph R. Martin | 250,000 | 250,000 | Nil | Nil |

| Terry Mathers | 50,000 | 50,000 | Nil | Nil |

| Kyle Stanley McClay | 100,000 | 100,000 | Nil | Nil |

| Stanley McClay | 200,000 | 200,000 | Nil | Nil |

| Stan McDonald | 100,000 | 100,000 | Nil | Nil |

| Patrick McGrath | 50,000 | 50,000 | Nil | Nil |

| Gerald T. McGuire | 100,000 | 100,000 | Nil | Nil |

| Derrick McKinnon | 100,000 | 100,000 | Nil | Nil |

| John McLachlan | 100,000 | 100,000 | Nil | Nil |

| Cindy Mitchell | 250,000 | 250,000 | Nil | Nil |

| Mario Morrison | 300,000 | 300,000 | Nil | Nil |

| Robert R. Morrison | 100,000 | 100,000 | Nil | Nil |

| Dave Neale | 200,000 | 200,000 | Nil | Nil |

| Deanna Neale | 200,000 | 200,000 | Nil | Nil |

| Greg Neale | 500,000 | 500,000 | Nil | Nil |

| Jill Neale | 750,000 | 750,000 | Nil | Nil |

| Thian Yew Ng | 5,225,000 | 5,225,000 | Nil | Nil |

| Linda Nichols | 500,000 | 500,000 | Nil | Nil |

| Neil Nichols | 5,000,000 | 5,000,000 | Nil | Nil |

| Byron L. Novosad | 400,000 | 400,000 | Nil | Nil |

| George Shigeru Okamoto | 400,000 | 400,000 | Nil | Nil |

| Christopher Thomas Oliver | 50,000 | 50,000 | Nil | Nil |

Otter Crique Ventures Limitee (6) | 1,000,000 | 1,000,000 | Nil | Nil |

| Angelo S. Paris | 100,000 | 100,000 | Nil | Nil |

| Enrica Paris | 250,000 | 250,000 | Nil | Nil |

| Franco Pederzini | 100,000 | 100,000 | Nil | Nil |

| Don Peterson | 400,000 | 400,000 | Nil | Nil |

| Lawrence Leroy Pickens and Mary Annette Pickens, joint tenants | 50,000 | 50,000 | Nil | Nil |

| Prote Poker | 5,000,000 | 5,000,000 | Nil | Nil |

| Dale B. Pope | 200,000 | 200,000 | Nil | Nil |

Vincent and Miriam Puccio 2007 Trust (7) | 300,000 | 300,000 | Nil | Nil |

| Name of Selling Shareholder | Shares Owned Before the Offering | Total Number of Shares to be Offered for the Security Holder’s Account | Total Shares Owned After the Offering is Complete | Percentage of Shares Owned After the Offering is Complete |

| Wade Pugh | 200,000 | 200,000 | Nil | Nil |

| Carla Radiuk | 50,000 | 50,000 | Nil | Nil |

| Russel Renneberg | 100,000 | 100,000 | Nil | Nil |

| Anthony Ricci | 1,000,000 | 1,000,000 | Nil | Nil |

| Patricia N. Ritchie | 100,000 | 100,000 | Nil | Nil |

| Robert Ruff | 100,000 | 100,000 | Nil | Nil |

| Bruce E. Rutherford | 50,000 | 50,000 | Nil | Nil |

| Brent Shaw | 100,000 | 100,000 | Nil | Nil |

| Chris Sherry | 300,000 | 300,000 | Nil | Nil |

| Lambros Siamos | 100,000 | 100,000 | Nil | Nil |

Signature Holdings L.L.C. (8) | 50,000 | 50,000 | Nil | Nil |

| Terry Sklavenitis | 200,000 | 200,000 | Nil | Nil |

| Adam Strauts | 50,000 | 50,000 | Nil | Nil |

| Daniel Strauts | 50,000 | 50,000 | Nil | Nil |

| Katherine Strauts | 50,000 | 50,000 | Nil | Nil |

| Matthew Strauts | 50,000 | 50,000 | Nil | Nil |

Dr. Z. Strauts Inc. (9) | 100,000 | 100,000 | Nil | Nil |

| Douglas H. Stroyhan | 100,000 | 100,000 | Nil | Nil |

| Michael Sweeney | 100,000 | 100,000 | Nil | Nil |

Tequila Sunset Ltd. (10) | 250,000 | 250,000 | Nil | Nil |

| Derrick Townsend | 200,000 | 200,000 | Nil | Nil |

| Anreas Tsonis | 100,000 | 100,000 | Nil | Nil |

| Steve Van Dalen | 300,000 | 300,000 | Nil | Nil |

VP Bank (Switzerland) Ltd. (11) | 100,000 | 100,000 | Nil | Nil |

| Dale Weeres | 180,000 | 180,000 | Nil | Nil |

| Kelvin Williams | 50,000 | 50,000 | Nil | Nil |

| Christian Wirth | 500,000 | 500,000 | Nil | Nil |

| David Wolfin | 100,000 | 100,000 | Nil | Nil |

| Anthony Wttewaall | 250,000 | 250,000 | Nil | Nil |

1628240 Ontario Inc. (12) | 400,000 | 400,000 | Nil | Nil |

| Total | 64,630,000 | 64,630,000 | 0 | 0 |

| (1) | John Dyck is the beneficial owner of Anchor Equipment (2005) Ltd. |

| (2) | Steve Balch is the beneficial owner of Balch Research Corp. |

| (3) | Dennis Birch is the beneficial owner of Birch Living Trust. |

| (4) | Leon Nowek is the beneficial owner of Crystalwood Holdings Ltd. |

| (5) | John daCosta is the beneficial owner of DaCosta Management Corp. |

| (6) | Verlee Webb is the beneficial owner of Otter Crique Ventures Limitée. |

| (7) | Vincent Puccio and Miriam Puccio are the beneficial owners of the Vincent and Miriam Puccio 2007 Trust. |

| (8) | Fred Avery is the beneficial owner of Signature Holdings L.L.C. |

| (9) | Zigart Strauts is the beneficial owner of Dr. Z. Strauts Inc. |

| (10) | Neil Nichols is the beneficial owner of Tequila Sunset Ltd. |

| (11) | Maria Salviti is the beneficial owner of VP Bank (Switzerland) Ltd. |

| (12) | Wally Boyko is the beneficial owner of 1628240 Ontario Inc. |

This is a self-underwritten offering. In general Wolverine will have two types of shares that will be available for distribution:

| 1. | New shares related to its Initial Public Offering. |

| 2. | Non-affiliate shares owned by selling shareholders. |

New Shares Related to Wolverine’s Initial Public Offering

Wolverine will attempt to sell a maximum of 15 million units to the public on a self underwritten basis. There can be no assurance that any of these units will be sold. Wolverine’s gross proceeds will be $1,500,000 if all the units offered are sold. Neither Wolverine nor its President, nor any other person, will pay commissions or other fees, directly or indirectly, to any person or firm in connection with solicitation of the sales of the shares.

The offering made by Wolverine is comprised of shares plus additional warrants for the same offering price that the named selling shareholders are offering their shares, but without the additional warrants.

The following discussion addresses the material terms of the plan of distribution.

Wolverine is offering up to 15 million units at a price of $0.10 per unit. Since this offering is conducted as a self-underwritten offering, there can be no assurance that any of the units will be sold. If Wolverine fails to sell all the units it is trying to sell, Wolverine’s ability to implement its business plan will be materially affected, and you may lose all or substantially all of your investment.

There is currently no market for any of Wolverine’s shares of common stock and little likelihood that a public market for such securities will develop after the closing of this offering or be sustained if developed. As such, investors may not be able to readily dispose of any shares purchased in this offering.

The legal opinion with respect to Wolverine’s stock is included as an exhibit to this registration statement.

Lee Costerd, Wolverine’s President and sole director, and current shareholders may purchase securities in this offering upon the same terms and conditions as public investors. If any purchase by a current shareholder triggered a material change, Wolverine would promptly file a post effective amendment to this registration statement. Any of these purchasers would be purchasing Wolverine’s common stock for investment and not for resale.

No broker or dealer is participating in this offering. If, for some reason, Wolverine’s sole director or shareholders were to determine that the participation of a broker or dealer is necessary, this offering will be promptly amended by a post effective amendment to disclose the details of this arrangement, including the fact that the broker or dealer is acting as an underwriter of this offering. This amendment would also detail the proposed compensation to be paid to any such broker or dealer. The post effective amendment would also extend an offer of rescission to any investors who subscribed to this offering before the broker or dealer was named. In addition to the foregoing requirements; Wolverine would be required to file any such amendment with the Corporate Finance Department of the National Association of Securities Dealers, Inc. and to obtain from them a “no objection” position from that organization on the fairness of the underwriting compensation.

The offering will remain open for a period 180 days from the date Wolverine is legally allowed to commence selling shares based on this prospectus, unless the entire gross proceeds are earlier received or Wolverine decides, in its sole discretion, to cease selling efforts.

Non-Affiliate Shares Owned by Selling Shareholders

The selling shareholders who currently own 64,630,000 shares of common stock in the capital of Wolverine may sell some or all of their common stock in one or more transactions, including block transactions.

The selling shareholders will sell the shares at $0.10 per share until Wolverine’s shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. The offering made by Wolverine is comprised of shares plus additional warrants for the same offering price that the named selling shareholders are offering their shares, but without the additional warrants.

The shares may also be sold in compliance with the Securities and Exchange Commission’s Rule 144. A description of the selling limitations defined by Rule 144 can be located on page 2627 of this prospectus.

The selling shareholders may also sell their shares directly to market makers acting as principals or brokers or dealers, who may act as agent or acquire the common stock as a principal. Any broker or dealer participating in such transactions as agent may receive a commission from the selling shareholders, or, if they act as agent for the purchaser of such common stock, from such purchaser. The selling shareholders will likely pay the usual and customary brokerage fees for such services. Brokers or dealers may agree with the selling shareholders to sell a specified number of shares at a stipulated price per share and, to the extent such broker or dealer is unable to do so acting as agent for the selling shareholders, to purchase, as principal, any unsold shares at the price required to fulfill the respective broker’s or dealer’s commitment to the selling shareholders.

Brokers or dealers who acquire shares as principals may thereafter resell such shares from time to time in transactions in a market or on an exchange, in negotiated transactions or otherwise, at market prices prevailing at the time of sale or at negotiated prices, and in connection with such re-sales may pay or receive commissions to or from the purchasers of such shares. These transactions may involve cross and block transactions that may involve sales to and through other brokers or dealers. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with Wolverine. Such partners may, in turn, distribute such shares as described above. Wolverine can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders.

Wolverine is bearing all costs relating to the registration of the common stock owned by the selling shareholders. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

| · | Not engage in any stabilization activities in connection with Wolverine’s common stock; |

| · | Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and |

| · | Not bid for or purchase any of Wolverine’s securities or attempt to induce any person to purchase any of Wolverine’s securities other than as permitted under the Securities Exchange Act. |

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which:

| · | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| · | contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties; |

| · | contains a brief, clear, narrative description of a dealer market, including “bid” and “ask” prices for penny stocks and the significance of the spread between the bid and ask price; |

| · | contains a toll-free telephone number for inquiries on disciplinary actions; |

| · | defines significant terms in the disclosure document or in the conduct of trading penny stocks; and |

| · | contains such other information and is in such form (including language, type, size, and format) as the Commission shall require by rule or regulation; |

The broker-dealer also must provide, prior to proceeding with any transaction in a penny stock, the customer:

| 1. | with bid and offer quotations for the penny stock; |

| 2. | details of the compensation of the broker-dealer and its salesperson in the transaction; |

| 3. | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and |

| 4. | monthly account statements showing the market value of each penny stock held in the customer’s account. |

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for Wolverine’s stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

Regulation M

During such time as Wolverine may be engaged in a distribution of any of the shares Wolverine is registering by this registration statement, Wolverine is required to comply with Regulation M. In general, Regulation M precludes any selling security holder, any affiliated purchasers, and any broker-dealer or other person who participates in a distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete. Regulation M defines a “distribution” as an offering of securities that is distinguished from ordinary trading activities by the magnitude of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a “distribution participant” as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a distribution.

Regulation M under the Exchange Act prohibits, with certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. Wolverine has informed the selling shareholders that the anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this prospectus, and Wolverine has also advised the selling shareholders of the requirements for delivery of this prospectus in connection with any sales of the common stock offered by this prospectus.

General

Wolverine’s authorized capital stock consists of 200,000,000 shares of common stock at a par value of $0.001 per share. On February 26, 2007, the authorized capital was increased from 75 million shares of common stock.

Common Stock

As at the date of this prospectus, 68,630,000 shares of common stock are issued and outstanding and held by 132 shareholders of record. All of this common stock has been validly issued, is fully paid and is non-assessable.

Holders of Wolverine’s common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of one-third of shares of common stock issued and outstanding, represented in person or by proxy, are necessary to constitute a quorum at any meeting of Wolverine’s stockholders. A vote by the holders of a majority of Wolverine’s outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to Wolverine’s Articles of Incorporation.

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. Holders of Wolverine’s common stock have no preemptive rights, no conversion rights and there are no redemption provisions applicable to Wolverine’s common stock.

Dividend Policy

Wolverine has never declared or paid any cash dividends on its common stock. Wolverine currently intends to retain future earnings, if any, to finance the expansion of its business. As a result, Wolverine does not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

As of the date of this prospectus, there are no outstanding warrants to purchase Wolverine’s securities. Wolverine may, however, in addition to the warrants to be issued in this unit offering, issue warrants to purchase its securities in the future.

Options

As of the date of this prospectus, there are no options to purchase Wolverine’s securities. Wolverine may, however, in the future grant such options and/or establish an incentive stock option plan for its directors, employees and consultants.

Convertible Securities

As of the date of this prospectus, Wolverine has not issued and does not have outstanding any securities convertible into shares of Wolverine’s common stock or any rights convertible or exchangeable into shares of Wolverine’s common stock. Wolverine may, however, issue such convertible or exchangeable securities in the future.

Nevada Anti-Takeover Laws

The provisions of the Nevada Revised Statutes (NRS) sections 78.378 to 78.3793 apply to any acquisition of a controlling interest in an certain type of Nevada corporation known as an “Issuing Corporation”, unless the articles of incorporation or bylaws of the corporation in effect on the 10th day following the acquisition of a controlling interest by an acquiring person provide that the provisions of those sections do not apply to the corporation, or to an acquisition of a controlling interest specifically by types of existing or future stockholders, whether or not identified.

The provisions of NRS 78.378 to NRS 78.3793 do not restrict the directors of an “Issuing Corporation” from taking action to protect the interests of the corporation and its stockholders, including, but not limited to, adopting or signing plans, arrangements or instruments that deny rights, privileges, power or authority to a holders of a specified number of shares or percentage of share ownership or voting power.

An “Issuing Corporation” is a corporation organized in the State of Nevada and which has 200 or more stockholders of record, with at least 100 of who have addresses in the State of Nevada appearing on the stock ledger of the corporation and does business in the state of Nevada directly. As Wolverine currently has less than 200 stockholders and no shareholders in the State of Nevada the statute does not currently apply to Wolverine.

If Wolverine does become an “Issuing Corporation” in the future, and the statute does apply to Wolverine, its sole director Mr. Costerd on his own will have the ability to adopt any of the above mentioned protection techniques whether or not he owns a majority of Wolverine’s outstanding common stock, provided he does so by the specified 10th day after any acquisition of a controlling interest.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest exceeding $50,000, directly or indirectly, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Conrad C. Lysiak, Attorney at Law of Spokane, Washington has provided the legal opinion regarding the legality of the shares being registered.

The financial statements included in this prospectus have been audited by Mendoza Berger and Company, L.L.P., Certified Public Accountants, of Irvine, California to the extent and for the periods set forth in their report appearing elsewhere herein, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

The geological report for the Labrador Claims was prepared by Stephen Balch, B.Sc., and the summary information from the geological report disclosed in this prospectus is in reliance upon the authority and capability of Mr. Balch as a Professional Geophysicist.

Wolverine is a mineral exploration company and was incorporated on February 23, 2006. Wolverine is a startup company in the business of base and precious metal exploration.

On February 28, 2007 Wolverine entered into a Vend-In Agreement with Shenin Resources Inc. (“Shenin”), a private Canadian corporation, for the purchase of a 90% interest 516 mineral claims located in Labrador Canada (the “Shenin Claims”). The purchase price paid to Shenin was $374,000 satisfied by the issuance of 34,000,000 shares of Wolverine’s common stock at a deemed price of $0.01 per share and a note payable of $34,000. Under the terms of the Vend-In Agreement Wolverine is required to incur the following expenditures on the claims: (i) CDN $150,000 on or before March 1, 2008; (ii) CDN $200,000 on or before March 1, 2009, and (iii) CDN $250,000 on or before March 1, 2010; provided that (iv) any excess amount spent in one year may be carried forward and applied towards fulfillment of the expenditure required in the later year. Shenin has also granted Wolverine a first right of refusal to purchase a 90% interest in all further property in Labrador Canada that Shenin may obtain an interest in from time to time. See Exhibit 10.1 – Vend-In Agreement for more details.

Also, on May 17, 2007 Wolverine acquired six mineral claims from Richard Haderer for $321 (CDN$ 360 ) (the “Haderer Claims”), which are contiguous to the Shenin Claims. See Exhibit 10.3 – Additional Property Agreement for more details.

On August 15, 2007, Wolverine extra-provincially registered in the Province of Newfoundland and Labrador for the purpose of being able to register the Shenin Claims and the Haderer Claims in the name of Wolverine and for the purpose of being able to conduct its business in the Province of Newfoundland and Labrador. See Exhibit 3.4 – Certificate of Registration for more details.

Location and Means of Access to the Claims

The Shenin Claims and the Haderer Claims (collectively, the “Labrador Claims”) are located about 120 kilometres (75 miles) west of Goose Bay, Labrador, a small town of 9,000 people on the Atlantic Coast of northern Canada. It takes approximately one and a half to two hours to drive to the Labrador Claims from Goose Bay.

The Labrador Claims lie within NTS map sheets 13E/01 and 13F/04 and extends approximately from 53o 11’ 08’’ N latitude and 62o 11’ 56’’ W longitude to 53o 06’ 34’’ N latitude and 61o 57’ 02’’ W longitude.

Goose Bay features an international airport. From there, the Labrador Claims can be accessed directly from the Trans-Labrador Highway. The Labrador Claims are easily accessible by the Trans-Labrador Highway, which runs through the central portion of the Labrador Claims. The Trans-Labrador Highway is a well maintained Provincial Highway with a gravel surface. There are no gas stations between Goose Bay and Churchill Falls, the next major community located 290 kilometres (180 miles) to the west of Goose Bay and 160 kilometres (105 miles) to the west of the Labrador Claims.

Access to the Labrador Claims is possible for most of the year given the proximity to Goose Bay and the fact that the highway is well maintained. Airborne geophysical surveys are best performed either in late winter (March-April) or during the summer (June-August). Ground geophysical surveys should be scheduled to avoid freeze-up (November-December) and breakup (late April to early June). Ground geological surveys are best conducted with no snow cover (mid June to mid November).

Figure 1. The Claims are located approximately 120 kilometres (75 miles) west of Goose Bay, Labrador.

Description of Labrador Claims

The Labrador Claims are unencumbered and in good standing and there are no third party conditions which affect the Labrador Claims other than conditions defined by the Province of Newfoundland and Labrador described below. The Labrador Claims together make up an aggregate area of 33,482 acres. Wolverine has no insurance covering the Labrador Claims. Management believes that no insurance is necessary since the Labrador Claims are unimproved and contain no buildings or improvements. The Labrador Claims cover an area with approximate dimensions of 20 kilometers east-west (12.5 miles) and 10 kilometers north-south (6.25 miles).

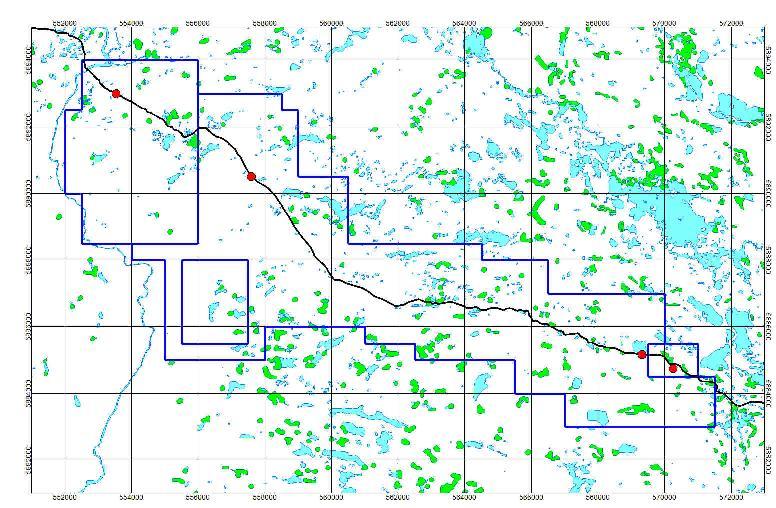

The Labrador Claims consist of a total of 522 mineral claims covering five separate licenses as described in Table 1 below. A layout of the Labrador Claims is shown in Figure 2 below.

| Number | # of Claims | NTS | Area (acres) | Good to Date |

| 013472M | 6 | 13F/04 | 371 | 17-05-2012 |

| 012427M | 20 | 13E/01 | 1,235 | 18-08-2011 |

| 012425M | 82 | 13E/01 | 5,065 | 18-08-2011 |

| 013039M | 254 | 13E/01 & 13F/04 | 16,927 | 05-02-2012 |

| 013187M | 160 | 13E/01 & 13F/04 | 9,884 | 14-03-2012 |

Table 1. Summary of the Claims.

Figure 2. The Claims extend for a distance of approximately 20 kilometers (12.5 miles) along the Trans-Labrador Highway.

There is no assurance that a commercially viable mineral deposit exists on the Labrador Claims. Further exploration will be required before an evaluation as to the economic feasibility of the Labrador Claims is determined. Wolverine’s consulting geophysicist has written a report and provided Wolverine with recommendations of how Wolverine should explore the Labrador Claims. Until management can validate otherwise, the Labrador Claims are without known reserves. Management is planning a five phase exploration program as recommended by its consulting geophysicist. Wolverine has completed the first two phases of the exploration program on the Labrador Claims.

Conditions to Retain Title to the Labrador Claims

The Labrador Claims have varying expiry dates. In order to maintain the Labrador Claims in good standing it will be necessary for Wolverine to coordinate an agent to perform and record valid exploration work with value of CDN$200 per claim in anniversary year 1, CDN$250 per claim in anniversary year 2, CDN$300 per claim in anniversary year 3, CDN$350 per claim in anniversary year 4, CDN$400 per claim in anniversary year 5, CDN$600 per claim in anniversary years six to ten inclusive, CDN$900 per claim in anniversary years 11 to 15 inclusive and CDN$1,200 per claim in anniversary years 16 to 20 inclusive. Failure to perform and record valid exploration work on the anniversary dates will result in forfeiture of title to the Labrador Claims.

History of Labrador and the Labrador Claims

According to the report prepared by Wolverine’s consulting geophysicist, the geologic setting is based on information available from the Geological Survey of Canada (DNR Open File 013F/0055) and the Government of Newfoundland and Labrador (Open File 013F/0061). The regional geology as described by both Government Reports contains very little detail because the Trans-Labrador Highway was under construction during much of the mapping initiative, opening in 1992.