|

Copyright ® 2010 Rovi Corporation. Company Confidential. Rovi Corporate Overview An Introduction for Sonic Employees Corey Ferengul EVP Product Management & Marketing January 2011 Filed by: Rovi Corporation pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14d-2 under the Securities Exchange Act of 1934, as amended Subject Company: Sonic Solutions Commission File No. 000-23190 |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Safe Harbor Statement All statements contained herein, as well as oral statements that may be made by Rovi Corporation (the “Company”) or by officers, directors or employees of the Company acting on the Company’s behalf, that are not statements of historical fact, including but not limited to any description of the Company’s or its management’s future plans, objectives, or goals, constitute “forward-looking statements” and are made pursuant to the Safe-Harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to be materially different from the historical results and/or from any future results or outcomes expressed or implied by such forward-looking statements. Such factors include, among others, the Company’s estimates of future revenues, earnings and growth rates, business strategies, the Company’s assumptions and estimates relating to guide advertising, the Company’ ability to pay down its debt, whether markets materialize as anticipated and customer demand for the Company’s technologies and integrated offerings. Such factors also include the expected timetable and structure of the transaction between the Company and Sonic Solutions, the transaction’s anticipated strategic and financial benefits; and the potential impacts of the transaction on both the Company’s and Sonic’s organizations. The statements made by the Company in this document are based upon current expectations and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include the satisfaction of closing conditions for the acquisition, including the tender of a majority of the outstanding shares of common stock of Sonic Solutions; market conditions; the effect of the announcement of the transaction on the Company’s and Sonic’s respective businesses; the impact of any failure to complete the exchange offer and the merger; the risk that the Company will not realize the anticipated benefits of the acquisition; the potential inability to successfully operate or integrate Sonic’s business and expand product offerings as a result thereof; general industry and economic conditions; and other factors beyond the companies’ control. Such factors are further addressed in the Company’s Report on Form 10-Q for the period ended September 30, 2010 and other documents as are filed with the Securities and Exchange Commission from time to time (available at www.sec.gov). The Company assumes no obligation, except as required by law, to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this presentation. Page 2 |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 3 Page 3 Additional Information and Where to Find It This presentation is neither an offer to purchase nor a solicitation of an offer to sell shares of Sonic Solutions. Rovi has filed a registration statement on Form S-4 (containing a prospectus/offer to purchase and certain other offer documents) and a tender offer statement on Schedule TO with the SEC and Sonic Solutions has filed a solicitation/recommendation statement on Schedule 14D-9, all with respect to the Offer and the Merger (as defined in those documents). Sonic Solutions shareholders are urged to read Rovi’s prospectus/offer to purchase and the other offer documents contained in the registration statement, and Sonic Solutions's solicitation/recommendation statement, because they contain important information that shareholders should consider before making any decision regarding tendering their shares. The registration statement (including the prospectus/offer to purchase and the other offer documents contained therein), the tender offer statement and the solicitation/recommendation statement contain important information, which should be read carefully before any decision is made with respect to the Offer. The registration statement (including the prospectus/offer to purchase and certain other offer documents contained therein), as well as the tender offer statement and the solicitation/recommendation statement, are available to all shareholders of Sonic Solutions at no expense to them. The registration statement (including the prospectus/offer to purchase and other offer documents), the tender offer statement and the solicitation/recommendation statement are available for free at the SEC's web site at www.sec.gov. Free copies of the prospectus/offer to purchase (and other offer documents) are also available from Rovi by mail to Rovi Corporation, 2830 De La Cruz Blvd, Santa Clara, CA 95050, attention: Investor Relations, and free copies of the solicitation/recommendation statement are available from Sonic Solutions by mail to Sonic Solutions, 7250 Redwood Blvd., Suite 300 Novato, CA 94945 , attention: Investor Relations. In addition, the prospectus/offer to purchase (and other offer documents) may also be obtained free of charge by directing a request to the Information Agent for the offer, Phoenix Advisory Partners, 110 Wall Street, 27th floor, New York, NY 10005 (banks and brokers call (212) 493-3910; all others call toll free: (800) 576-4314). American Stock Transfer & Trust Company, LLC is acting as depositary for the tender offer. In addition to the foregoing materials filed with the SEC, Rovi and Sonic Solutions file annual, quarterly and special reports, proxy statements and other information with the SEC. Investors may read and copy any reports, statements or other information filed by Rovi or Sonic Solutions at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Rovi’s and Sonic Solutions’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at www.sec.gov. |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 4 Page 4 Interests of Certain Persons in the Offer and the Merger Rovi will be, and certain other persons may be, soliciting Sonic Solutions shareholders to tender their shares into the exchange offer. The directors and executive officers of Rovi and the directors and executive officers of Sonic Solutions may be deemed to be participants in Rovi’s solicitation of Sonic Solutions’s shareholders to tender their shares into the exchange offer. Investors and shareholders may obtain more detailed information regarding the names, affiliations and interests of the directors and officers of Rovi and Sonic Solutions in the exchange offer by reading the prospectus/offer to purchase and certain other offer documents, as well as the solicitation/recommendation statement. |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 5 About Rovi Stock Ticker: ROVI 2010 Revenue: Estimated $538-542M* Global Issued and Pending Patents: 4,700 Employees Worldwide: 1,200+ Headquarters: Santa Clara, CA Offices: San Francisco, Burbank, Tulsa, Radnor, Ann Arbor, New York, Bedford, London, Maidenhead, Luxembourg, Tokyo, Seoul, Hong Kong, Hsinchu Acquisitions: MediaUnbound, Muze, Gemstar-TV Guide, All Media Guide, BD+ Target key verticals Consumer Electronics, Service Providers, Advertising, Portals and Studios/Entertainment *Per Rovi press release issued 12/22/2010 |

|

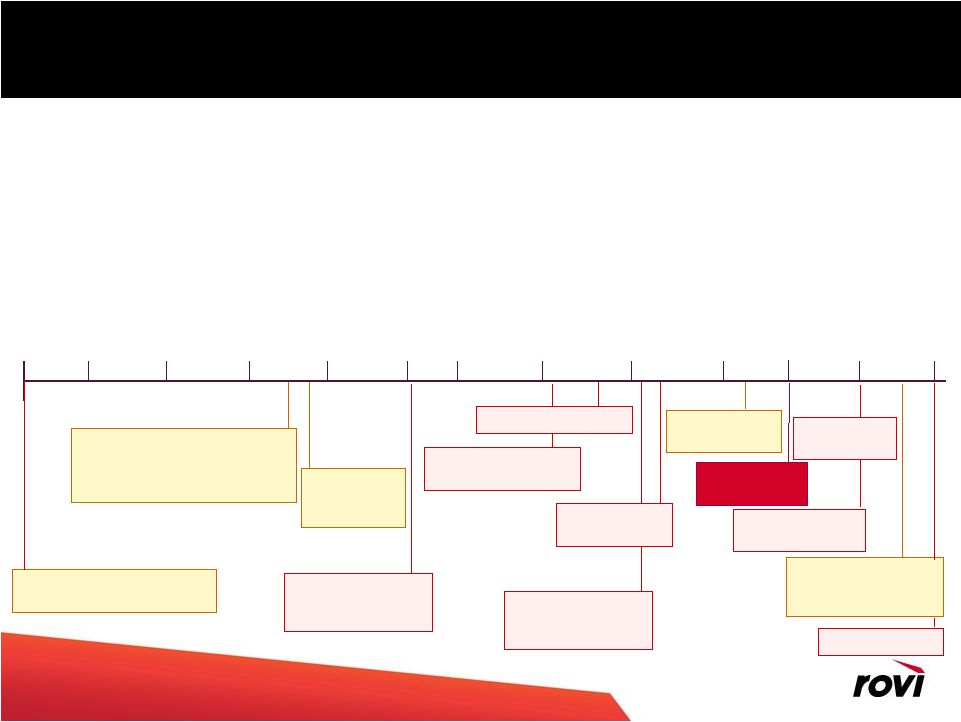

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 6 • Who we were - Copy protection licensed to studios, games publishers & hardware vendors - License management and installation software sold to ISV’s and enterprises • Who we have become - A leading digital media technology solutions provider: Products, services, metadata & patent • Major activities on our transformation - Acquired key digital media technology assets - Completed divestitures of non-core assets - Fully integrated all companies Our Transformation Mediabolic acquisition; yields Connected Platform AMG acquisition; yields Music, Movies and Games metadata plus Media Recognition technology Gemstar- TV Guide acquisition Sale of Software & Games Protection businesses Sale of TV Guide Magazine Sale of TV Guide Network & TV Guide Online Sale of TVG Network 1/1/07 12/31/08 9/30/08 6/30/08 3/31/08 12/31/07 9/30/07 6/30/07 3/31/07 Sale of eMeta Muze acquisition 3/31/09 Rovi Rebranding 6/30/09 Exit Guideworks JV Sale of Norpak MediaUnbound Acquisition recommendations 9/15/10 2/1/10 Restructure IPG JV |

|

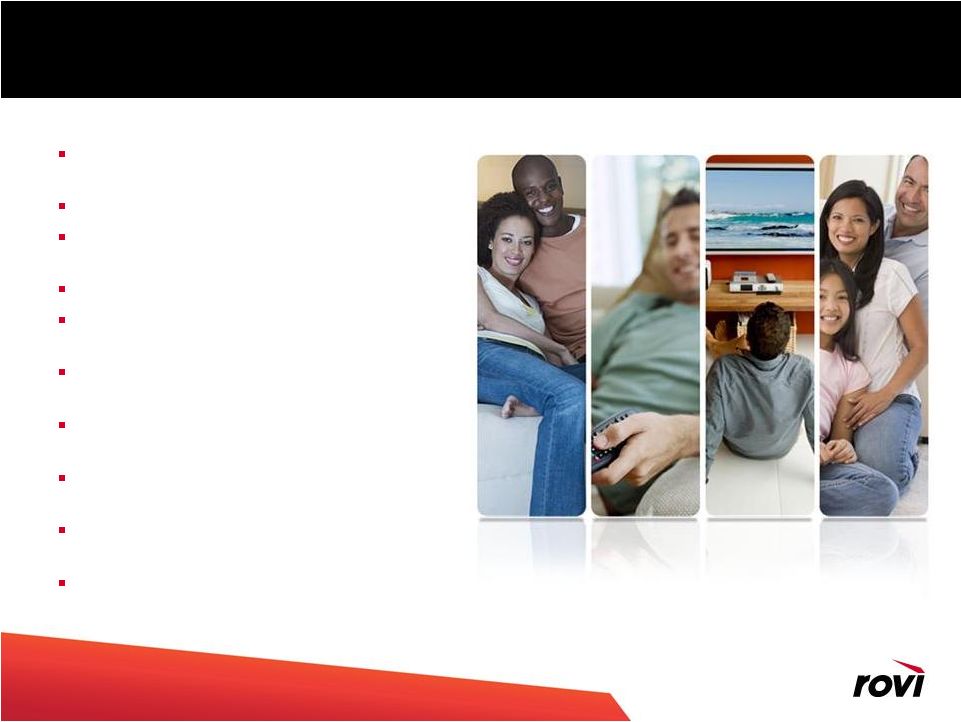

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 7 Powering Digital Entertainment Approximately 124 million viewers use our guide technologies Data on 3 million+ programs since 1954 Data on 2 million album releases and 20 million tracks Data on 460,000+ movie titles Protection on 9 billion+ DVDs and Blu-ray discs 500 million+ devices enabled with protection technologies 163 million+ CE devices with CE-IPG technologies. 7 million+ CE devices using content networking technologies IPG advertising technology active in over 70 million homes worldwide Rovi represents advertising in up to 15.8M US homes |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 8 Entertainment 8 Rovi Markets and Customer Highlights Consumer Electronics Service Providers Advertising Retailers/ Portals |

|

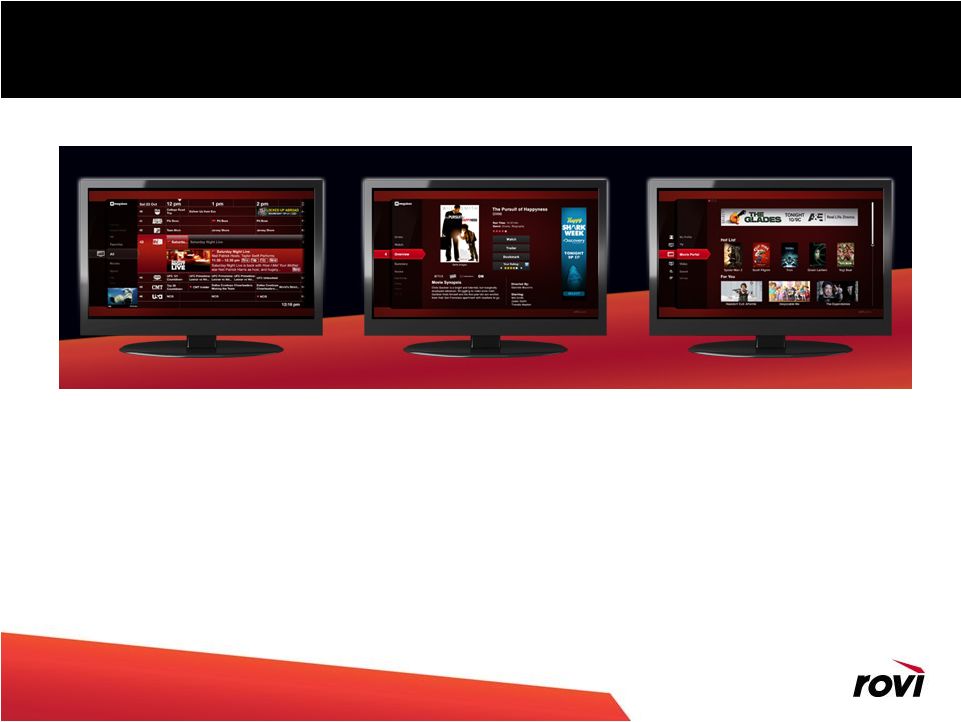

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 9 Page 9 The Rovi Vision Connecting customers to ‘entertainment moments’ Enriching the experience with insight and information Powering the discovery and enjoyment of digital entertainment Enabling consumers to share content Empowering our customers to connect with their customers To power the discovery and enjoyment of digital entertainment |

|

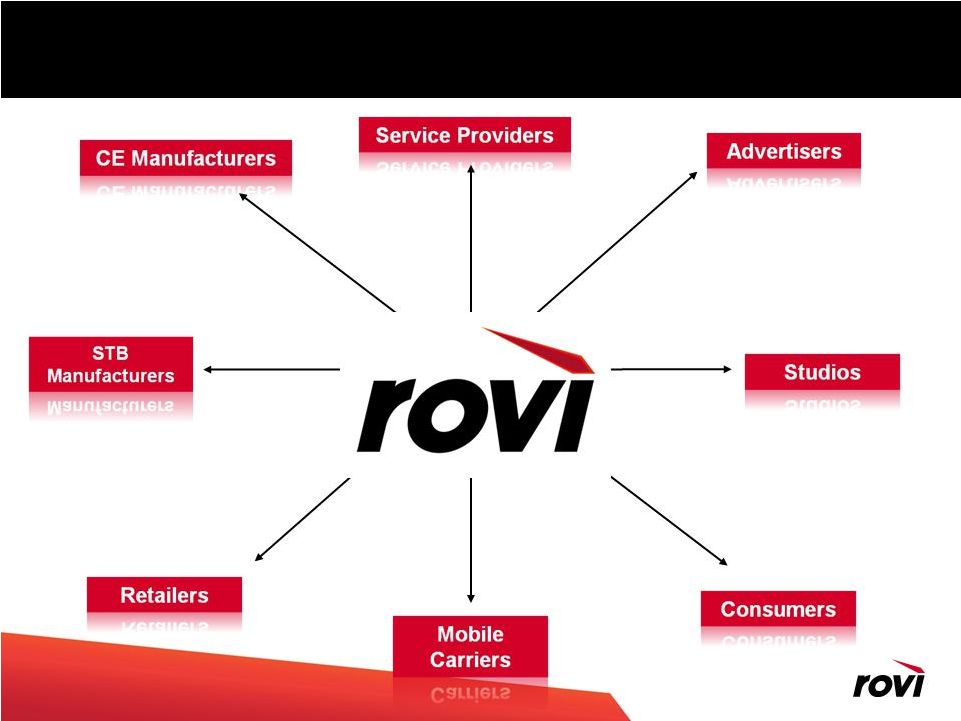

Copyright ® 2009 Rovi Corporation. Company Confidential. Rovi Key to The Ecosystem Page 10 |

|

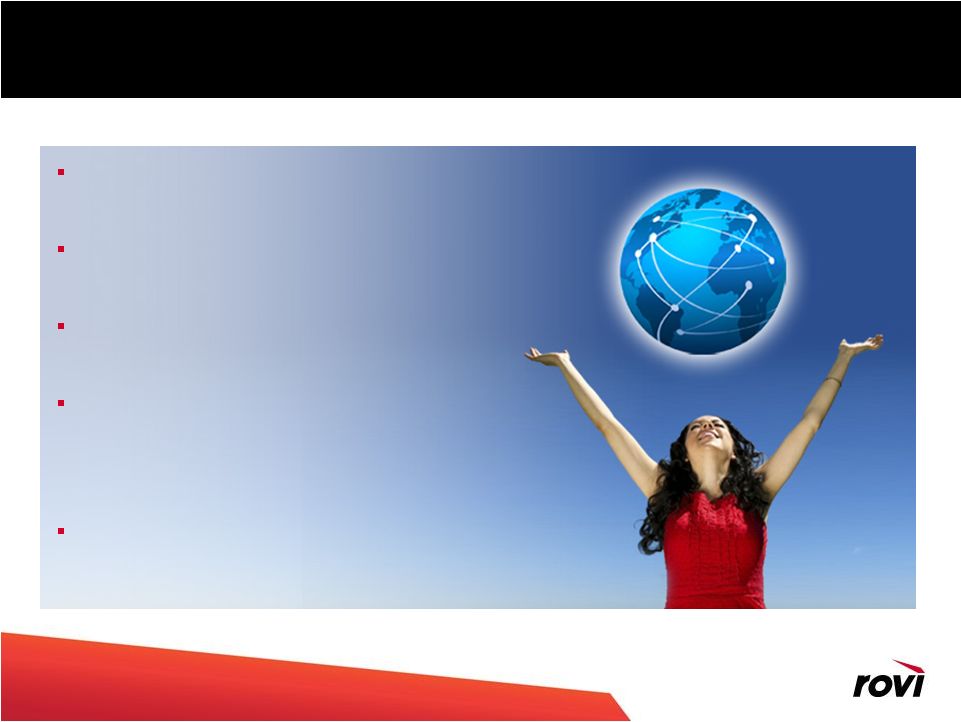

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 11 Rovi Leading The Way Substantial user interface development team targeting next generation user experiences Active research program to identify consumer behavior with digital media Local, geographic-based data operations generate metadata for TV, music and movies Operating geographically distributed infrastructure to support metadata, media search and recommendations as web services Innovative advertising network and platform on connected and non-connected CE devices |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Rovi Offerings Protect Content protection solutions for digital content: BD+, RipGuard, CopyBlock ACP Promote Targeted, in- guide ad platform – engages with a Targeted audience that’s ready to interact with your ad Guide Customized guidance and interfaces: TotalGuide, Guide+, G-Guide, Passport Guide and more Connect Products and services to connect devices throughout the home: Connected Platform, Software Update Service Insight World-class entertainment metadata, including: Music Data, Movie Data, Games Data, Books Data, Lasso Media Recognition Advertising Rovi IPG advertising technology is active in over 67 million homes worldwide, including 31 million homes in North America Page 12 |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 13 Connect •Connected Platform •Software Update Service Rovi Products & Solutions Rovi products connect devices and connect consumers to the entertainment they love. Guide •TotalGuide for CE •TotalGuide for SP •TV Guide OnScreen •Guide + Protect •BD+ Blu Ray protection •RipGuard •CopyBlock •ACP (VOD & DVD) Enhance •Data Access •Search •Recommendations •Profile •Media Recognition •Advertising •Passport Guide •Passport Guide DVR •G-Guide •i-Guide Insight •TV Data •Movie Data •Music Data •Games Data •Book Data |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 14 Rovi metadata around the world North America Latin America EMEA APAC 16,000 sources of video content in North America, 660 European TV channels, 450 Latin American TV channels, and 500 Asian TV channels Movies from 160 countries Music from 180 countries |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 15 Front-and-center ad placement enables advertisers to instantly engage millions of TV viewers • 57% of TV viewers are exposed to ads in the guide daily* • Flexible and interactive ad platform accommodates video, graphics and/or text-based campaigns Benefits for advertisers: Broad reach and high frequency vehicle; influences tune-in and increases brand awareness while reaching highly engaged audiences Benefits for consumers: Unique and interactive ad platform lets consumers select and enjoy content that’s most relevant to them Rovi Solutions for Advertisers *Source: Rovi Proprietary Data, May 2009 Advertising with Rovi Deliver your ad to the right audience in the right environment at the right time. |

|

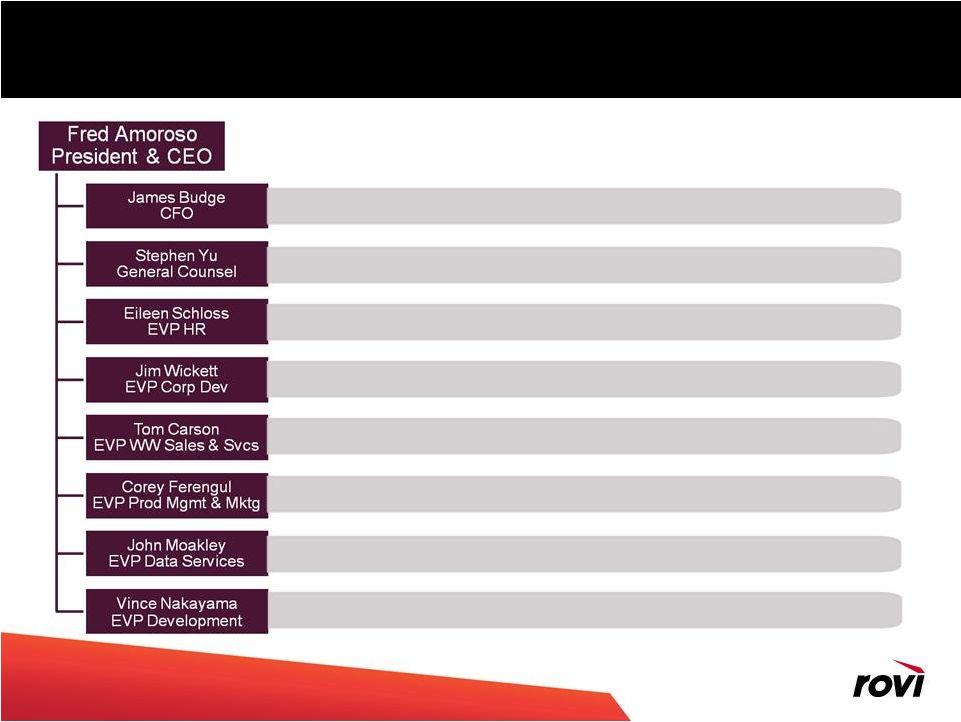

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 17 Rovi Executive Team Rovi has a functional organization structure • Accounting, Finance, Tax, Treasury, Investor Relations, IT, Facilities • Corporate Legal, Commercial Legal, Litigation • Employees, Benefits, Compensation, Recruiting, Community Relations • Corporate Development, Mergers & Acquisitions • Sales, Prof Svcs, Support, Ops, Intellectual Property (Patent Prosecution, Licensing, Litigation) • Prod Mgmt, Pricing, Product Mktg, Corporate Marketing/Brand, PR, Web, Biz Dev • Development/Matching/Delivery of all Rovi Data (TV, Movie, Music, etc.) • Engineering, Program Management |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 18 Rovi Verticals Consumer Electronics (CE) Service Provider (SP) Entertainment Advertising Portals Sales, Product Mgmt, Product Mktg & Development teams are generally organized by the following verticals: |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 19 One Final Reminder… While Rovi & Sonic continue actively planning for the integration of the companies during this pre-closing period, it is important that: The companies operate as two separate and independent companies until the close of the transaction The transfer of competitively sensitive information must take place only in the context of integration planning, with access given to only a limited number of cleared employees |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Page 20 We understand the dynamic changes in the industry We can help our customers put all the pieces in place We listen to our customers and provide solutions with a flexible approach We make it easier for our customers to connect with end consumers and to help them discover an exciting world of digital entertainment • With our solutions, our customers can deliver more of what consumers want, in the way they want it • The easier our customers make it for consumers, the more they’ll want to buy their devices and services Summary Rovi has the technologies, professional services and forward- thinking vision to solve the digital media conundrum |

|

Copyright ® 2009 Rovi Corporation. Company Confidential. Thank you. |

Additional Information and Where to Find It

This communication is neither an offer to purchase nor a solicitation of an offer to sell shares of Sonic Solutions. Rovi has filed a registration statement on Form S-4 (containing a prospectus/offer to purchase and certain other offer documents) and a tender offer statement on Schedule TO with the SEC and Sonic Solutions has filed a solicitation/recommendation statement on Schedule 14D-9, all with respect to the Offer and the Mergers (as defined in those documents). Sonic Solutions shareholders are urged to read Rovi’s prospectus/offer to purchase and the other offer documents contained in the registration statement, and Sonic Solutions’ solicitation/recommendation statement, because they contain important information that shareholders should consider before making any decision regarding tendering their shares. The registration statement (including the prospectus/offer to purchase and the other offer documents contained therein), the tender offer statement and the solicitation/recommendation statement contain important information, which should be read carefully before any decision is made with respect to the Offer. The registration statement (including the prospectus/offer to purchase and certain other offer documents contained therein), as well as the tender offer statement and the solicitation/recommendation statement, are available to all shareholders of Sonic Solutions at no expense to them. The registration statement (including the prospectus/offer to purchase and other offer documents), the tender offer statement and the solicitation/recommendation statement are available for free at the SEC’s web site atwww.sec.gov. Free copies of the prospectus/offer to purchase (and other offer documents) are also available from Rovi by mail to Rovi Corporation, 2830 De La Cruz Blvd, Santa Clara, CA 95050, attention: Investor Relations, and free copies of the solicitation/recommendation statement are available from Sonic Solutions by mail to Sonic Solutions, 7250 Redwood Blvd., Suite 300 Novato, CA 94945, attention: Investor Relations. In addition, the prospectus/offer to purchase (and other offer documents) may also be obtained free of charge by directing a request to the Information Agent for the offer, Phoenix Advisory Partners, 110 Wall Street, 27th floor, New York, NY 10005 (banks and brokers call (212) 493-3910; all others call toll free: (800) 576-4314). American Stock Transfer & Trust Company, LLC is acting as depositary for the tender offer.

In addition to the foregoing materials filed with the SEC, Rovi and Sonic Solutions file annual, quarterly and special reports, proxy statements and other information with the SEC. Investors may read and copy any reports, statements or other information filed by Rovi or Sonic Solutions at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330 for further information on the public reference room. Rovi’s and Sonic Solutions’ filings with the

SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC atwww.sec.gov.

Interests of Certain Persons in the Offer and the Merger

Rovi will be, and certain other persons may be, soliciting Sonic Solutions shareholders to tender their shares into the exchange offer. The directors and executive officers of Rovi and the directors and executive officers of Sonic Solutions may be deemed to be participants in Rovi’s solicitation of Sonic Solutions’ shareholders to tender their shares into the exchange offer.

Investors and shareholders may obtain more detailed information regarding the names, affiliations and interests of the directors and officers of Rovi and Sonic Solutions in the exchange offer by reading the prospectus/offer to purchase and certain other offer documents, as well as the solicitation/recommendation statement.

Forward Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. Such forward-looking statements include the expected timetable of the transaction between Rovi and Sonic Solutions, the transaction’s anticipated strategic and financial benefits; and the potential impacts of the transaction on both Rovi’s and Sonic Solutions’ organizations. The statements made by Rovi and Sonic Solutions in this document are based upon current expectations and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include the satisfaction of closing conditions for the acquisition, including the tender of a majority of the outstanding shares of common stock of Sonic Solutions; market conditions; the effect of the announcement of the transaction on Rovi’s and Sonic Solutions’ respective businesses; the impact of any failure to complete the exchange offer and the merger; the risk that Rovi will not realize the anticipated benefits of the acquisition; the potential inability to successfully operate or integrate Sonic Solutions’ business and expand product offerings as a result thereof; general industry and economic conditions; and other factors beyond the companies’ control and the risk factors and other cautionary statements described in Rovi’s and Sonic Solutions’ filings with the SEC. Such factors are further addressed in Rovi’s and Sonic Solutions’ most recent reports on Form 10-Q for the period ended September 30, 2010 and such other documents as are filed by Rovi or Sonic Solutions with the Securities and Exchange Commission from time to time (available at www.sec.gov). Neither Rovi nor Sonic Solutions assume any obligation to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this document, except as required by law.