UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant þ | Filed by a Party other than the Registrant ¨ |

Check the appropriate box:

¨ Preliminary proxy statement

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

þ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

Rovi Corporation

(Exact name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if Other Than Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

ROVI CORPORATION ISSUES LETTER TO STOCKHOLDERS URGING THEM TO VOTE

THE BLUE PROXY CARD

| ● | ROVI IS EXECUTING ON A PLAN TO CREATE VALUE FOR STOCKHOLDERS |

| ● | ENGAGED CAPITAL DOES NOT EVEN HAVE A PLAN |

| ● | ROVI’S BOARD IS COMMITTED TO AUGMENTING WITH THE RIGHT EXPERTISE |

| ● | ENGAGED CAPITAL’S NOMINEES ARE NOT RIGHT FOR ROVI OR ITS STOCKHOLDERS |

SANTA CLARA, Calif.– (BUSINESS WIRE) –May 5, 2015 – Rovi Corporation (NASDAQ:ROVI) today issued the following letter to all Rovi stockholders in connection with its 2015 Annual Meeting of Stockholders, which will be held on May 13, 2015:

Dear Fellow Stockholders,

THIS IS A CRITICAL YEAR FOR EXECUTION: DON’T LET COLORFUL COMMENTARY

ABOUT THE PAST PUT AT RISK THE VALUE CREATION CURRENTLY UNDERWAY

ROVI URGES STOCKHOLDERS TOREJECT ALL ENGAGED CAPITAL NOMINEES

VOTE “FOR ALL” ROVI DIRECTORS ON THEBLUE PROXY CARD TODAY

Rovi’s Annual Meeting is quickly approaching, and you face an important decision. Engaged Capital claims that Rovi needs change. The critical question for our stockholders is whether nominees selected by a hedge fund manager with no substantial experience in our fast-moving industry can change Rovi for the better. Rovi’s Board of Directors has architected a strategic plan to deliver significant value to our stockholders, and that plan is beginning to bear fruit.DO NOT RISK DISRUPTING THE VALUABLE OPPORTUNITIES AHEAD BY VOTING FOR ENGAGED CAPITAL’S NOMINEES SIMPLY FOR THE SAKE OF CHANGE.

Rovi’s Board is continuing to enact change for the benefit of all stockholders – and you deserve theRIGHT changes that will create value on your investment. We arestill in the process of augmenting our Board, adding new perspectives and valuable experience. We want to add theRIGHT directors with the RIGHT experience, selected with stockholders’ best interests in mind through a genuine process. We firmly believe that Engaged Capital’s nomineesdo not possess the qualifications or offer the value our stockholders deserve.

We strongly believethat Engaged Capital is theWRONG change for Rovi today. All three Engaged Capital nominees have clear track records of value destruction at other public companies, and not one of them has presented a semblance of a future plan for Rovi or ideas to create value for you. In contrast, our Board has set in motion a long list of positive changes to put Rovi on a path for sustainable value creation.

1

ENGAGED CAPITAL’S NOMINEES AREWRONG FOR ROVI

| ● | Glenn Welling is a hedge fund manager with no known intellectual property (IP) experience or demonstrated operational ability, much less in the technology field. |

| ● | David Lockwood’s qualifications are inferior and unneeded, as ISS and Glass Lewis have agreed. |

| ● | Raghavendra Rau and Engaged Capital’s other nominees have clear records of value destruction at other public companies, as you can seehere [http://www.rovicorp.com/content/dam/rovicorp-ancillary/dm3/corp/proxy_apr15/050415b.pdf] (Link to Rovi’s Perspectives on Engaged Capital Nominees’ Prior Board Performance. Please see Exhibit 1 included herewith).1 |

Over the past 2 years, Mr. Welling has publicly offered his “ideas” – generic capital allocation strategies, for the most part – to a number of companies, while deliberately raising his hedge fund’s profile as a “shareholder activist.” The results are very concerning:

| ● | At Abercrombie & Fitch – which has been operating with four Engaged Capital-approved directors for over a year – alpha has beennegative (56%). |

| ● | At TriMas (TRS) and Jamba Inc. (JMBA) – the only other two companies where Engaged Capital has board representation or influence – alpha has beennegative (4%) for TRS and a meager 3% for JMBA, and Mr. Welling has been on the Board for less than four months at JMBA. |

Do not be fooled by materials Engaged Capital has filed during this campaign. The hedge fund appears to claim credit for the returns of companies in its portfolio despite a lack of Board involvement in achieving those returns at any one of them.Glenn Welling’s record on corporate boards is clear and it is troubling.

One of his nominees, David Lockwood, is in our opinion, unqualified.BothISS and Glass Lewis recommendedagainst him, despite their tendency to recommend in favor of dissident candidates for no reason other than change for change’s sake. Independent third parties have warned Rovi and its stockholders of Lockwood’s value-destroying missteps while running IP negotiations for Unwired Planet. In fact, he presided over negative alpha at Unwired Planet(negative 64%), Liberate Technologies(negative 44%), InterTrust Technologies(negative 2%), BigBand Networks(negative 38%) and EnergySolutions2 (negative 57%). Despite the value destruction at EnergySolutions, Lockwood received substantial payments during his tenure, including $16.8 million in cash “to settle existing obligations owed to” him. Also, while serving on the Liberate Board, Lockwood received severance payments based on a partial asset sale, a continued employment arrangement and a $325,000 cash bonus. We believe there is legitimate reason to conclude, based on his prior board and management experience, that David Lockwood could put Rovi’s IP business at unnecessary and substantial risk.

Raghavendra Rau also has a poor track record when it comes to value creation. Alpha at Aviat Networks wasnegative 152% during Rau’s Board tenure, and it wasnegative 110% during his Board tenure at SeaChange International. In fact, after being brought to SeaChange as CEO and a member of the Board of Directors by activist investor Starboard Value, he was replaced less than three years later.

ENGAGED CAPITAL HAS NO PLAN FOR ROVI

| ● | Rovi’s Board listens to Rovi’s stockholders and is making the changes that make sense for Rovi, with a transparent plan to create stockholder value. |

1 All references in this section use Alpha calculated as return on stock (including reinvested dividends and adjusted for spin-offs, splits and other corporate events) against the S&P 500 Total Return Index during Board tenure. Start dates based upon disclosed effective dates. Source: FactSet as of May 1, 2015.

2 Remains on the Board of EnergySolutions following take-private.

2

| ● | Rovi stockholders deserve to know what Engaged Capital nominees will do differently if elected. |

| ● | The vague ideas Engaged Capital has advanced suggest Engaged Capital does not understand the dynamics that drive Rovi’s revenues. |

| ● | Do not trust your investment to Board members that will still be learning Rovi’s business during critical near-term events such as the Big-4 renewals and next-generation product launches – the risk of disruption is too high. |

We believe it is crucial that Rovi stockholders understand what Engaged Capital’s nominees intend to do if elected to the Board. It is highly troubling to Rovi that even after an extensive proxy campaign and several letters and presentations to you,Engaged Capital and its nominees have outlinedNO PLAN for Rovi. There are no new ideas, not even a broad high-level vision to create the value that Rovi stockholders deserve.

The vague steps Engaged Capital has hinted at are generic capital allocation and cost cutting strategies that Engaged Capital has advanced at a broad array of other companies – apparel companies, beverage companies and the like – which have very different business models than Rovi. Importantly, Rovi’s Board and management have been open to these ideas, and discussed them with Engaged Capital, thoughtfully considered them along with suggestions from other stockholders, and taken action with respect to changes that the Board believes are in Rovi’s best interest.

We believeEngaged Capital poses significant risk to the future value of your investment. Without any plan beyond cost-cutting, Engaged Capital appears poised to push for unnecessary and dangerous changes to Rovi’s product strategy, which could destroy our next-generation product business, and in turn threaten our IP business by disrupting synergies between our IP and product businesses that are so important to stockholder value.

Importantly, we think stockholders should ask: Why now? Why not wait another year and judge the Company on the merits of the Big-4 renewals, or the success of our new product launches?Rovi has already conducted a comprehensive strategic review of its business and spent the last three years rebuilding the Company into what it is today. Rovi is experiencing momentum and traction with our next-generation products, well-positioned to enter into a very critical year of renewing major licenses, and on track to achieve double-digit revenue growth in 2016 and 2017.The start of yet another review period at this juncture would essentially set Rovi back in time, risk disrupting the significant progress we have made, and cost us present-day opportunities. We question Engaged Capital’s intentions and motivations in starting this process to gain representation on the Board – and think our stockholders should too. Is Engaged Capital acting in stockholders’ best interest or are they more interested in building a name for themselves as a “shareholder activist?”

Rovi’s Board has been listening to the Company’s stockholders. For example, the Board recently reduced its own compensation reflecting recent conversations with a number of Rovi stockholders, and Rovi received affirmative support from both proxy rating agencies this year for its executive compensation program.

We believe Engaged Capital has given Rovi stockholdersno good reason to trust that its candidates would provide more thought, generate better ideas or deliver more value than Rovi’s current directors, who have carefully repositioned the Company over the past three years. It is imperative that Rovi stockholders protect themselves against a hedge fund manager who could dismantle the very strategy that Rovi’s Board and management thoughtfully put in place –a strategy that is working.

3

ADDITIONAL PERSPECTIVES ON ISS AND GLASS LEWIS’ RECOMMENDATIONS

Rovi strongly disagrees with ISS’ and Glass Lewis’ recommendations that stockholders vote for Engaged Capital nominees Raghavendra Rau and Glenn Welling. Respectfully, we believe these recommendations demonstrate a lack of understanding of Rovi’s business and growth trajectory.

ISS has stated that when dissidents seek a minority position on a Board, they do “not require a detailed plan of action, nor that the dissidents prove their plan preferable to the incumbent plan” from the dissidents. Rovi strongly disagrees with this point of view and believes this “hall pass” for minority-seeking dissidents represents a naïve view of boardroom dynamics and the impact of each Director on a company’s strategy – particularly for companies like Rovi that have undergone a transformation and face critical execution milestones in the year ahead.

We recommend that all Rovi stockholders review the Company’s response to the recommendations issued by ISS and Glass Lewis, which can be viewedhere [http://www.rovicorp.com/content/dam/rovicorp-ancillary/dm3/corp/proxy_apr15/iss_gl_reco.pdf] (Link to Perspective on the ISS & Glass Lewis Recommendations. Please see Exhibit 2 included herewith).

ALLOW ROVI TO CONTINUE EXECUTING THE PLAN THAT IS WORKING FOR YOU

| ● | Rovi operates in a fast-moving technology environment. |

| ● | Rovi stockholders deserve qualified Board members with the RIGHT areas of expertise to guide Rovi’s strategy. |

As our stockholders and equity analysts are well aware, Rovi operates in a rapidly changing industry. Rovi needs a Board that can identify the opportunities ahead and has an acute understanding of the market environment and the customers Rovi serves. The Board has acknowledged and taken responsibility for its past decisions that have not proven successful – and most importantly – learned from them. The actions taken over the past three years to transform the Company were effected by Rovi’s current Board of Directors, and reflect the Board’s understanding of our dynamic market. As a stockholder, if you want to see additional expertise on the Board, make sure it is theRIGHT expertise.A hedge fund manager and failed technology executive are, in our opinion,NOT the right choices.

The bottom line is: Rovi is prepared to make theRIGHT changes with qualified nominees like recent addition Steven Lucas. We continue to actively augment our Board and management team with the relevant expertise to continue executing our plan to achieve double-digit revenue growth with expanding margins in 2016 and 2017. We trust that Rovi stockholders will see Engaged Capital’s distracting tactics, and allow our Board to rightfully focus on the path ahead.

We look forward to your support at the upcoming Annual Meeting by voting“FOR ALL” nominees on theBLUE proxy card and protecting your investment.

Thank you.

FORWARD LOOKING STATEMENTS

This communication contains “forward-looking” statements, including, without limitation, all statements related to Rovi’s ability to achieve its goal of enhancing stockholder value through the execution of its strategic plan, including all statements related to upcoming significant intellectual property license renewals, expected revenue growth, margin expansion and cash flow, new product and IP business opportunities, and the timing thereof, customer growth, expected return on the investments in core areas of the business; the statements related to Engaged Capital’s proposed reduction of product investment and

4

its negative effect on the stockholder value; and other statements that are not historical facts. Any statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Words such as “anticipate,” “believe,” “could,” “expect,” “may,” “plan,” “will,” “would” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon Rovi’s current expectations. Forward-looking statements involve risks and uncertainties. Rovi’s actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation: risks related to Rovi’s ability to successfully execute on its strategic plan and customer demand for and industry acceptance of Rovi’s technologies and integrated solutions; Rovi’s ability to successfully renew its major intellectual property license agreements; and risks related to future opportunities and plans, including the uncertainty of future operating results. These and other risk factors are discussed under the heading “Risk Factors” in Rovi’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the Securities and Exchange Commission on February 19, 2015. Rovi expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

If you have any questions, require assistance with voting your BLUE proxy card

or need additional copies of the proxy materials, please contact:

MacKenzie Partners, Inc.

105 Madison Avenue

New York, NY 10016

proxy@mackenziepartners.com

(212) 929-5500 (Call Collect)

Or

TOLL-FREE (800) 322-2885

ADDITIONAL INFORMATION AND WHERE TO FIND IT

Rovi Corporation, its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with Rovi’s 2015 Annual Meeting of Stockholders. Rovi has filed with the SEC and has provided to its stockholders a definitive proxy statement and aBLUE proxy card in connection with such solicitation. ROVI STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS) AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Information regarding the names of Rovi’s directors and executive officers and their respective interests in Rovi by security holdings or otherwise is set forth in Rovi’s definitive proxy statement for the 2015 Annual Meeting of Stockholders, filed with the SEC on April 13, 2015, and in Rovi’s annual report on Form 10-K for the year ended December 31, 2014, filed with the SEC on February 19, 2015, which documents are available at the investor relations portion of Rovi’s website at http://ir.rovicorp.com/CorporateProfile.aspx?iid=4206196. To the extent holdings of such participants in Rovi’s securities have changed since the amounts described in the 2015 proxy statement, or if a particular

5

participant’s holdings are not set forth in the 2015 proxy statement, such holdings (or changes thereto) have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the special interests of such participants, if any, in the matters to be voted on at Rovi’s 2015 Annual Meeting of Stockholders is included in the definitive proxy statement referred to above. You can obtain free copies of these referenced documents as described below.

These documents, including the definitive proxy statement (and amendments or supplements thereto) and the accompanyingBLUE proxy card, and any other relevant documents and other material filed by Rovi with the SEC, are or will be available for no charge at the SEC’s website atwww.sec.gov and at the investor relations portion of Rovi’s website at http://ir.rovicorp.com/CorporateProfile.aspx?iid=4206196. Copies may also be obtained free of charge by contacting Rovi Investor Relations by mail at 2830 De La Cruz Boulevard, Santa Clara, California 95050 or by telephone at (408) 562-8400.

About Rovi Corporation

Rovi is leading the way to a more personalized entertainment experience. The Company’s pioneering guides, data, and recommendations continue to drive program search and navigation on millions of devices on a global basis. With a new generation of cloud-based discovery capabilities and emerging solutions for interactive advertising and audience analytics, Rovi is enabling premier brands worldwide to increase their reach, drive consumer satisfaction and create a better entertainment experience across multiple screens. The Company holds over 5,000 issued or pending patents worldwide and is headquartered in Santa Clara, California. Discover more about Rovi at Rovicorp.com.

Contacts:

Investors

Peter Halt / Peter Ausnit

Rovi Corporation

(818) 295-6800 / (818) 565-5200

Dan Burch

MacKenzie Partners, Inc.

(212) 929-5500

Media

John Christiansen / Megan Bouchier

Sard Verbinnen & Co

(415) 618-8750

# # #

6

Exhibit 1

Rovi’s Perspectives on Engaged Capital Nominees’ Prior Board Performance

Rovi’s Perspectives on Engaged Capital Nominees’ Prior Board Performance |

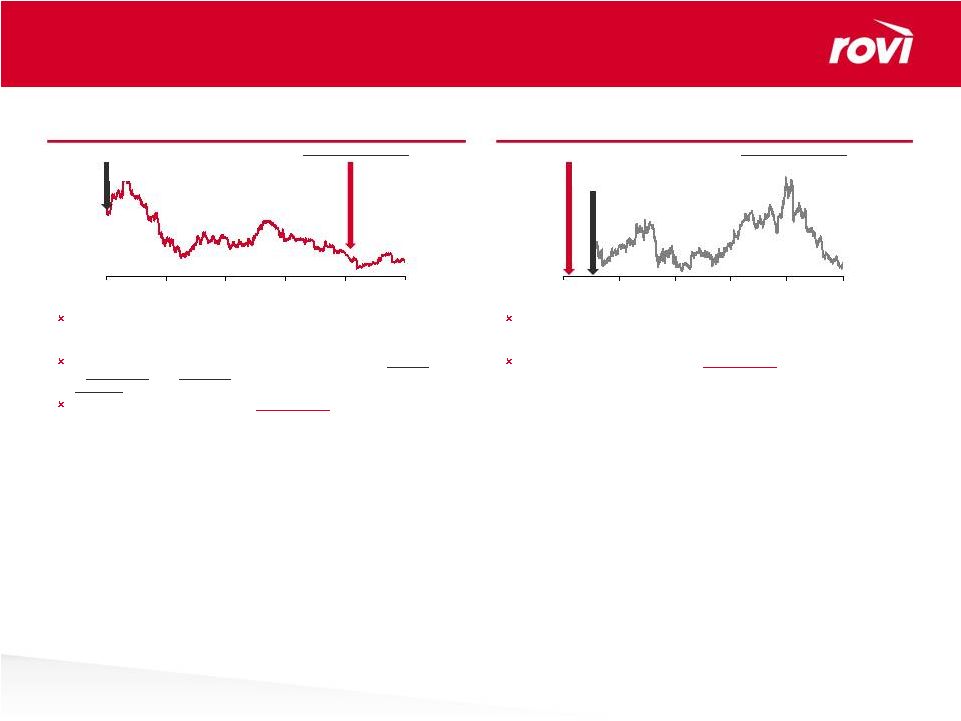

1 EnergySolutions Unwired Planet Liberate Technologies BigBand Networks InterTrust Technologies (12%) (22%) (8%) (27%) (35%) Engaged Capital conveniently presents data as of the date Mr. Lockwood announces his resignation from UPIP’s board, as opposed to the date he actually resigns – the stock price drops 14% between those two dates We believe our business is significantly more complex than that of a pure IP licensing business / patent troll like Unwired Planet Alpha (vs. TSR adjusted S&P 500) of negative 64% David Lockwood was appointed to the Board on 11/03/10 Engaged Capital cites 6/11/12 as the relevant start date after the stock had lost (65%) since his actual start date on the Board We believe that by focusing on Lockwood’s actions as CEO rather than as a Director, Engaged Capital is misrepresenting his track record Alpha (vs. TSR adjusted S&P 500) of negative 57% The Liberate stock price chart shown by Engaged Capital starts neither from when Mr. Lockwood becomes CEO nor from when he joins as a director We believe that Mr. Lockwood’s role at Liberate was largely to run a process to sell the company’s business units Alpha (vs. TSR adjusted S&P 500) of negative 44% Engaged Capital’s InterTrust stock price chart is shown for during Mr. Lockwood’s time as CEO – again, this is misleading in our opinion as it focuses on executive rather than directorial decisions Highlighting Mr. Lockwood’s dividend strategy suggests a bias towards corporate finance measures as opposed to a long-term strategy that truly addresses the dominant and changing themes in media and consumption Alpha (vs. TSR adjusted S&P 500) of negative 2% Mr. Lockwood’s performance as a director at BigBand Networks is completely omitted from Engaged Capital’s materials – Picking a few experiences while excluding others, especially those that were failures, presents a highly skewed picture of Mr. Lockwood’s track record, in our opinion Alpha (vs. TSR adjusted S&P 500) of negative 38% Actual start date: Jun 1, 2003 Start date cherry- picked by Engaged Capital Start date cherry- picked by Engaged Capital Start date cherry-picked by Engaged Capital Actual start date: Nov 3, 2010 Actual start date: Oct 9, 2000 $4.00 $3.50 $3.00 $2.50 3 $2.00 $4.50 3-Nov-10 24-Jun-11 10-Feb-12 2-Oct-12 24-May-13 $1.25 $2.50 $3.75 $5.00 $6.25 $7.50 15-Jan-13 28-Jun-13 9-Dec-13 22-May-14 3-Nov-14 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 1-Jan-03 26-Sep-03 25-Jun-04 23-Mar-05 19-Dec-05 29-Jul-10 26-Nov-10 25-Mar-11 22-Jul-11 21-Nov-11 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 9-Oct-00 1-May-01 21-Nov-01 13-Jun-02 3-Jan-03 $0.75 $3.00 $5.25 $7.50 $9.75 $12.00 Total return performance during actual Board tenure¹ Total return performance during actual Board tenure Total return performance during actual Board tenure² Total return performance during actual Board tenure Total return performance during actual Board tenure Source: FactSet as of 4/24/15. Note: Alpha calculated as return on stock (including reinvested dividends and adjusted for spin-offs, splits and other corporate events) against the S&P 500 Total Return Index during Board tenure. Start dates based upon disclosed effective dates. For companies that were acquired, end date based upon the disclosed transaction closing date. Remains on board following take-private. Price returns as of June 2, 2003, to account for the holiday on June 1, 2003. Assumes any dividends resulting from the liquidation of the company are not reinvested. End date for David Lockwood’s board tenure at Liberate Technologies based on the effective date of the stock split conducted as part of a “going private” transaction, per company filings. 1 2 3 David Lockwood – Total Return Performance as a Director |

2 Aviat Networks Raghu Rau – Total Return Performance as a Director SeaChange International (68%) (20%) Engaged Capital uses an arbitrary start date for its Aviat Networks stock price chart – one from when the stock outperforms peers, as opposed the actual dates of Mr. Rau’s board tenure Engaged Capital states that Mr. Rau resigned from the Board on 1/1/2015 – this is INCORRECT – the CORRECT exit date for Mr. Rau, per company filings, is 1/11/2015 (the stock declined 10% between those two dates) Alpha (vs. TSR adjusted S&P 500) of negative 152% Engaged Capital lists Mr. Rau’s actions as CEO and Board member at SeaChange; however, the time period selected for the stock price chart does not tie to either of those two tenures Alpha (vs. TSR adjusted S&P 500) of negative 110% Source: FactSet as of 4/24/15. Note: Alpha calculated as return on stock (including reinvested dividends and adjusted for spin-offs, splits and other corporate events) against the S&P 500 Total Return Index during Board tenure. Start dates based upon disclosed effective dates. 11-Jan-15 Start date cherry- picked by Engaged Capital Total return performance during actual Board tenure Total return performance during actual Board tenure Actual start date: Jul 15, 2010 Start date per Engaged Capital’s price chart Actual start date: Nov 9, 2010 9-Nov-10 9-Sep-11 10-Jul-12 10-May-13 12-Mar-14 $0.50 $1.75 $3.00 $4.25 $5.50 $6.75 1-Jan-10 17-Dec-10 2-Dec-11 16-Nov-12 1-Nov-13 20-Oct-14 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 |

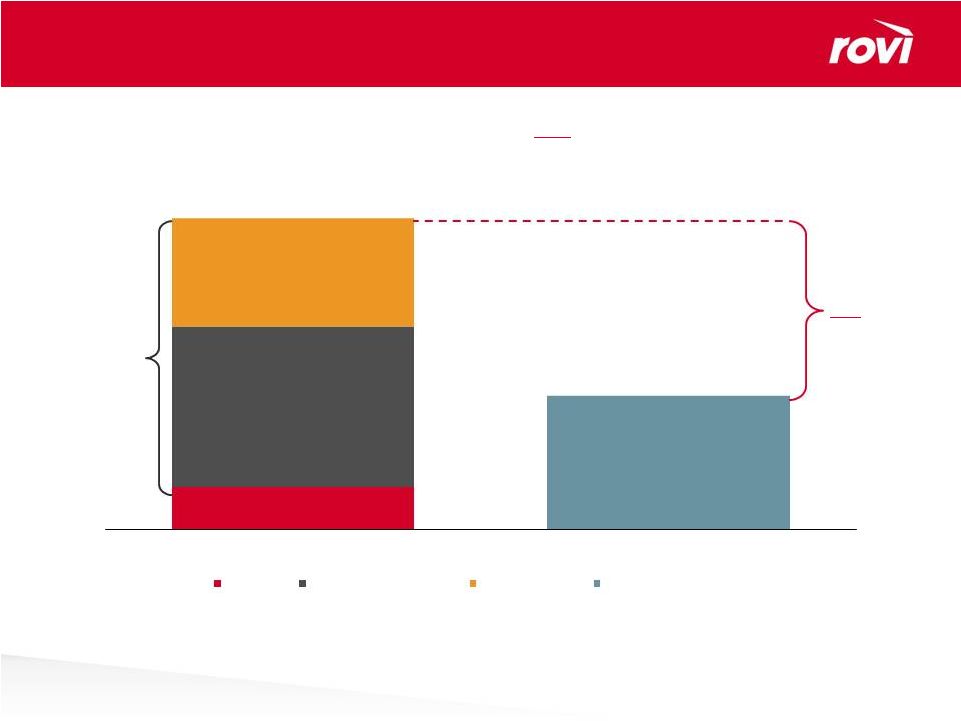

3 We Believe Engaged Capital Has No Real Technology Expertise and Its Board Influence Has Created Little to No Value The Only Three Boards Engaged Capital Nominees Joined • Engaged Capital gained no board seats to exert influence at any of these companies • Merely absolute return – does not represent additional value added (alpha) • Only one of nine positions is in technology • None are in technology • Engaged Capital either destroyed or created nominal additional value after its nominees got on the Board Returns claimed by Engaged Capital 1 Alpha generated since Engaged Capital took Board seats 2 None with Board influence The directors Engaged Capital approved, per its settlement agreement with ANF, one of whom was their specific nominee, have overseen considerable destruction of value 44% 44% 42% 38% 37% 35% 33% 15% (4%) (60%) (50%) (40%) (20%) (10%) 0% 10% 20% 30% 40% 50% OPLK TKR AVAV HAR SIMG PRXL ESL DST VOLC (30%) 1% 2% (55%) TRS JMBA ANF Source: Engaged Capital’s DFAN14A filed April 22, 2015. Source: FactSet as of April 24, 2015. Note: Alpha calculated as return on stock (including reinvested dividends and adjusted for spin-offs, splits and other corporate events) against the S&P 500 Total Return Index during Board tenure. Start dates based upon disclosed effective dates. 1 2 |

ROVI Stock 4 Our Board Has a Meaningful Economic Stake in Rovi’s Future Excluded from Engaged Capital’s analysis 3 4 2.3x Including exercisable options, the Board’s stake exceeds Engaged Capital – including restricted stock awards and units, the Board’s stake is 2.3x that of Engaged Capital 1 2 178,557 655,819 443,180 1,277,556 550,000 Engaged Capital Stock Exercisable Options RSAs/RSUs Engaged Capital's Shares 1 RSAs vesting through July 1, 2015, for all non-executive directors and RSAs/RSUs vesting through 2018 for President, CEO & Director Tom Carson. Certain of Mr. Carson’s RSAs/RSUs are also subject to performance-based vesting. 2 Are currently exercisable or exercisable within 60 days of March 16, 2015. 3 Source: Rovi’s 2015 proxy statement. 4 Source: Engaged Capital’s 2015 proxy statement. Rovi Directors |

Exhibit 2

Perspective on the ISS & Glass Lewis Recommendations

Perspective on the ISS & Glass Lewis Recommendations Rovi’s Board of Directors respectfully disagrees with the recommendation made by Institutional Shareholder Services (ISS) and Glass Lewis & Co. (GL) in connection with Rovi’s 2015 Annual Meeting of Stockholders, to be held on May 13, 2015 We believe the analysis used is flawed, in large part because we do not believe it is appropriate to evaluate a company like Rovi – which has undergone broad repositioning over the past several years – as if it has been operating under ordinary circumstances ISS and Glass Lewis are generalists by nature – we believe their analysis displays a serious lack of understanding of the highly complex nature of our business, the rapidly-evolving secular changes and challenges affecting our end markets, as well as our accomplishments through the transformation as a result Rovi stockholders need to review the facts carefully because our investors face a fundamental decision with respect to the Company's strategic direction and the qualifications of our Board of Directors to lead the Company. That decision requires greater attention to detail than ISS and Glass Lewis have provided Fundamentally, recommending new directors without any idea of what direction they will take the company is risky and irresponsible Rovi’s additional responses to some of the specific findings made by ISS and Glass Lewis are included in this presentation 0 |

1 Lack of Strategic Plan ISS / Glass Lewis view Rovi view A dissident slate not seeking majority control does not need a plan (ISS) Engaged’s plan recommends a strategic review and improved corporate governance and executive compensation standards (GL) This is a dangerous and naive view that does not accurately reflect the true dynamics of a Board room that we strongly disagree with Adding new directors with no plan while Rovi is in the midst of executing upon a strategic plan to deliver strong shareholder growth would be very disruptive during a crucial period of execution for the Company Engaged Capital has not offered a plan for Rovi Engaged Capital has had access to Rovi’s management team for nearly two years – more than enough time to formulate at least a few ideas or a basic strategic vision for the Company. Yet Engaged Capital has not articulated a vision or any meaningful steps other than generic corporate finance strategies Engaged Capital has not offered any ideas for how to drive growth, either through licensing, product delivery or otherwise, nor have they stated what costs they would be able to remove from the business |

Quality of Nominees ISS / Glass Lewis view Rovi view Rovi’s Board could benefit from having “stockholder friendly nominees” We agree that there is value in a slate of stockholder friendly nominees. However, we strongly believe that any slate of candidates should be compromised of stockholder friendly QUALIFIED nominees. As part of our search process with the assistance of a leading executive search firm, we are committed to adding a stockholder friendly QUALIFIED nominee to augment our Board We have taken nearly a half dozen highly qualified board candidates suggested by existing stockholders and added them to our search process We believe potential new directors should add value, as opposed to simply not doing harm. Rovi is a complex business at a critical time in its history, and the addition of an unqualified director would in fact be harmful We believe Engaged Capital’s nominees are NOT qualified to serve our stockholders Glenn Welling is a hedge fund manager with no known intellectual property (IP) experience or demonstrated operational ability, much less in the technology field David Lockwood’s qualifications are inferior and unneeded, as ISS and Glass Lewis have agreed Raghavendra Rau and Engaged Capital’s other nominees have clear records of value destruction at other public companies, as you can see at http://www.rovicorp.com/content/dam/rovicorp- ancillary/dm3/corp/proxy_apr15/050415b.pdf 2 |

3 ISS / Glass Lewis view Rovi view Rovi is perpetually in a “transition period” and growth products have not demonstrated results Arguments about Rovi’s purported lack of return on investment, including assertions that we continue to ask for more time without giving investors a good reason to provide that time, ignore the empirical reality that we are delivering new revenue today with a clear path to significant growth acceleration. ISS and Glass Lewis ignore the specific¸ customer-validated traction we are seeing, both in new product uptake and our increasing ability to deliver multiple classes of product under a comprehensive platform (e.g., Charter, DISH). ISS and Glass Lewis ignore these points because they undercut their conclusion We have pointed to numerous, proven examples of our traction in core product areas and licensing – all of which Engaged Capital has ignored as if they simply did not exist. Just some of these examples include our successes with Charter, Dish, Time Warner Cable, and America Movil We are perplexed by the observation that “it is possible to invest oneself into bankruptcy if the answer is always ‘the cycle is going to take longer’.” This concern does not apply to Rovi With EBITDA margins of 40+%, there is no relevant discussion in this situation about “investing oneself into bankruptcy” In this public contest, there has been a lot of noise from Engaged Capital about our purported lack of return on investment in the form of revenue, including repeated assertions that we continue to ask for more time without giving our investors a good reason to provide that time These arguments – and almost all of those that address our levels of spend in the context of our growth – conveniently ignore the empirical reality that we are delivering new revenue today with a clear path to significant growth acceleration Capital Allocation |

4 ISS / Glass Lewis view Rovi view Capital Allocation (continued) To the extent that “change” in Rovi’s strategy is appropriate, Rovi’s Board and management have discussed Engaged Capital’s ideas with Engaged, thoughtfully considered them along with suggestions from other stockholders, and taken action with respect to the changes that we believe are in Rovi’s best interest We would never seek to shut-out credible opinions about how we can improve our trajectory; however, we will continue to strongly resist any transfer of power from those who understand our markets and customers to those who simply do not We welcome feedback from all of our stockholders, and have participated in what we believe has been constructive dialogue with Engaged from the onset. In fact, we’ve made changes to capital allocation, share buybacks and executive compensation following suggestions from our stockholders Rovi has been unreceptive to stockholder suggestions on capital allocation strategy |

5 Capital Allocation (continued) Source: FactSet. 1 High based on closing price as of 01/18/2011. Rovi's product investments have not yielded the desired return for stockholders Some of the failed projects may be legacy issues from the prior management team – but they are the legacy of this same board ISS / Glass Lewis draws conclusions about Rovi’s performance based on calendar year time periods that disregard the substantial changes Rovi made to its capital allocation strategies following the Sonic acquisition. The fact is that Rovi coming out of 2014 was a completely different company than the Rovi that entered 2010, 2011 or 2012 The “failed projects“ ISS and Glass Lewis cite primarily relate to the single Sonic acquisition failure. Rovi’s Board has acknowledged that Sonic was a mistake and the Board has dramatically changed the company’s strategy, structure and product approach as a result If it is appropriate to evaluate our Board on the basis of the Sonic period, equal weight must be given to the latter period reflecting the Board’s revised strategy our Board has implemented It is common knowledge that acquisitions are difficult and very challenging. Holding a Board of Directors to a zero defect policy, and recommending their replacement based on a single failed transaction, is insanity based on a complete void of understanding of the real-world risks in acquisitions and the challenges inherent in them. The Rovi Board members that Engaged Capital seeks to replace (and that ISS and Glass Lewis have effectively recommended for the replacement of) are the same directors that saw the merits of combining Macrovision Corporation and Gemstar TV-Guide International in 2007. Rovi’s stock moved from a low of $16.65 at deal close to a high of $68.85 following that transaction¹ ISS / Glass Lewis view Rovi view |

6 Operating Performance Rovi’s overall revenue and core revenue growth has lagged despite substantial investment Criticizing Rovi’s recent revenue growth disregards key aspects of our business Our product business is an increasingly important part of our connected platform Engaged Capital’s failure to understand our product cycle’s should be concerning to stockholders as it demonstrates a lack of understanding of the industry in which we operate. ISS and Glass Lewis should also be held to a higher standard of that understanding in their “analysis” ISS / Glass Lewis view Rovi view As many of our stockholders and Wall Street Analysts understand, we expect our Big 4 license renewals to be a significant driver of revenue growth, and they are all tied to renewal dates later this year and next Product cycles in our industry are 18-24 months, and even longer when considering deployment to scale timelines. – As a result, it is patently unreasonable to rely upon the simplistic view that “despite the company’s heavy investments, the product segment has not seen the kind of ramp-up that shareholders may have expected” Both the absolute revenue and share of revenue from our product business has been increasing, and its strong profitability provides incremental margin to our IP business Our product revenues are an increasingly important piece of our business; with product revenues increasing to 51% of revenues in Q1’15 from 45% in 2013. This is clear evidence of our past investments in both IP and products producing results despite the decline in our analog business revenues from $129 million in 2010 to $30 million in 2014. Our product investment has supported core revenue that is up ~$100 million since 2010, to offset the decline from our analog business The significant synergies that exist between our product and licensing businesses that we have highlighted before, as well as the continued validation from marquee customers who utilize both our products and IP, we believe, contradicts ISS and Glass Lewis' assertion of a "failed" product investment strategy |

7 Operating Performance (continued) Rovi’s high margins are due to its IP business Rather, Rovi’s margin outperformance was driven by: Rovi’s superior margin profile cannot be “explained away” by virtue of our IP business ISS / Glass Lewis view Rovi view Rovi’s margins are high even compared to pure IP companies, or companies for whom a vast majority of revenue is comprised by IP Some of the benchmarking peers included pure IP companies, which have an average CY2014 EBITDA margin of 40%, lower than Rovi’s 43% margin Importantly, Rovi’s margin performance has exceeded that of these peers despite both (i) our transformation and the reinvestment it has required, and (ii) the existence of our large and growing product business Synergies among our various businesses that allow us to achieve revenue across various Rovi properties with the same dollar of spend Continued reduction in our cost base, including rationalization of non-strategic assets, aligning our resources more carefully against our opportunities, and revised executive compensation practices |

8 Operating Performance (continued) The company underperformed selected peers and the S&P 500 in ROA, ROE, revenue growth, and earnings per share growth measures Rovi has experienced a high degree of volatility in its earnings The ISS / Glass Lewis analysis disregards our stated strategy of reinvestment for growth and results in a misleading view of Rovi’s performance Since 2012, and despite the comprehensive rebuilding of the business, our cumulative net loss before extraordinary items was only $12.3 million or 0.8% of cumulative revenue over the same period In 2014 our Non-GAAP profit margin was 30%, far above those of IP and DaaS peers of 19% and 2015 proxy peers of 9% Our net income (excluding extraordinary items) has NOT displayed “remarkable volatility” ISS / Glass Lewis view Rovi view Rovi’s net income margin, on a non-GAAP basis, changed from 30% in 2012 to 31% in 2013 and 30% in 2014, all while the Company was investing in strategic growth areas. These movements are NOT “remarkable volatility” Companies like Rovi that serve highly fluid end-markets are less likely to exhibit highly consistent net income from one year to the next than companies in less dynamic sectors with established, long-term margin expansion structures and more end-market stability may be expected to have Companies that have recently undergone (or that are in the midst of) a transformation on the scale of Rovi’s are, we believe, very unlikely to demonstrate linear net income performance. Transformations are focused on repositioning for the longer-term rather than managing to immediate-term net income results We have spent the last several years investing in strategic growth areas and preparing for our Big 4 licensing renewals which have required considerable effort We expect the Big 4 renewals to contribute significantly – and positively – to all of these metrics As a result of our investments, we have a clear line of sight to achieving sustainable, profitable growth provided that our strategy is not derailed by outsiders who have not owned our shares until recently We believe it is inappropriate to focus on year-on-year EPS growth due to the outsized and misleading impact of “small numbers” on that calculation |

9 The “Big 4” Renewals ISS / Glass Lewis view Rovi view Investors were “surprised” at the success of the contract renewal with Charter and this signifies that investors are not confident in Rovi’s ability to renew the other “big” contracts (ISS) We were perplexed that ISS would attribute our stock gain following the Charter announcement to “surprise” and believe this betrays a lack of understanding regarding our business Rovi stock regularly moves upon perceived indicators with respect to our IP licensing business, and it was no surprise to us that investors would recognize the significance of an agreement with a sophisticated service provider validating the value of our IP and products. Simply, we view the 8.6% increase in our stock price on April 20 to be clear evidence that our stockholders have material upside potential before them if we continue to execute This position is nonsensical. The ISS “logic” would have you believe that any stock price increase on good news signifies lack of investor confidence in the future prior to the increase, because the stock price prior to the increase is “depressed”. As opposed to investors seeing positive proof points of strategy and an increased valuation of the Company associated with those proof points. We believe this is another example of ISS and Glass Lewis reaching a conclusion before writing their report, and then manufacturing reasons to support their conclusion. DON’T VOTE BASED ON THESE FLAWED CONCLUSIONS |

10 Corporate Governance Rovi adjusted its executive compensation structure only after facing proxy contests from dissidents Rovi view Our historical executive compensation plan was designed to attract and retain talent during a critical time in our business’ transformation. We sought our stockholders’ input and made fundamental changes to our plan before Engaged Capital’s campaign Overall Rovi has a shareholder friendly governance profile with low risk scores on Board and Shareholder Rights under ISS’s Governance QuickScore Our 2012 and 2013 compensation plans were designed to attract and retain talent during a period of transition for the Company, and thus our performance based awards lacked a long-term element During 2013 and 2014 and before Engaged Capital’s campaign, we sought input from our stockholders, including Engaged Capital, and made significant changes to our executive compensation plan. Now with our strategy set, we have introduced real long-term elements to our compensation plan. ln its report last year dated April 11, 2014, ISS noted: “The company demonstrated responsiveness by engaging with shareholders and making a number of changes to its compensation programs.” Rovi proactively changed its peer group well before Engaged Capital launched this proxy fight. Notably, ISS and Glass Lewis both support our current say on pay proposal, citing the positive changes Rovi has made in addressing concerns of stockholders and proxy advisors in recent years, with ISS noting “The company made a number of improvements to its pay program, including improving disclosure of performance- target setting, eliminating discretionary bonuses, making positive modifications to future performance awards, removing several outsized peers from its peer group and discontinuing benchmarking elements of pay above the market median. These actions mitigate several concerns raised by both the dissident and other shareholders.” ISS / Glass Lewis view |

11 Total Stockholder Return (TSR) Rovi has underperformed its selected peers and indexes for 1-, 3- and 5-year periods and since the Sonic acquisition through March 11, 2015 Note: Market data as of 3/11/2015, consistent with ISS and GL analysis. These time periods present a distorted view in this case. Investors should assess Rovi’s performance following the implementation of the Company’s strategy shift The calendar period do not account for the dramatic and decisive changes Rovi’s Board and leadership have implemented Since these changes were implemented beginning in July 2012, our stock price and trading multiple have improved markedly and well in excess of the indices and peer groups used by ISS and Glass Lewis. Specifically, Rovi’s Total Shareholder Return (TSR) has outperformed peers and indices referenced by ISS and Glass Lewis by an average of 68%, while Rovi’s earnings multiple has expanded by nearly 200% more than that of the 2015 proxy peers as well as the IP and DaaS peers. ISS and Glass Lewis ignore those points because they undercut their conclusion Wall Street analyst price targets, based upon our articulated strategy before Engaged Capital began its campaign, validate a belief in further stock price appreciation Peer group and market indices comparisons do not tell the whole story here Rovi’s peer groups include a broad variety of companies that face dramatically different circumstances from one another and from Rovi The broad market averages relied on by ISS and Glass Lewis may be valuable in assessing large sets of data and industries, but they ignore unique characteristics of individual companies and can be particularly misleading for assessing the performance of a company like Rovi that has undergone significant changes in a relatively short time period These factors are especially true in the technology sector, an industry in which companies and public markets change rapidly and unpredictably, and companies’ financial profiles vary widely Rovi’s Board has taken responsibility for the Sonic acquisition and readily acknowledges that the acquisition of Sonic Solutions was not a good deal for Rovi and the Board has subsequently rebuilt Rovi from the ground up ISS / Glass Lewis view Rovi view |