SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

Commission File Number 333-148987

_______________

_______________

(Exact name of registrant as specified in its charter)

| Florida | 20-35337265 | |

| State or other jurisdiction of incorporation or organization | I.R.S. Employer Identification Number | |

| 5601 W. Spring Parkway | ||

| Plano, TX | 75021 | |

| Address of principal executive offices | Zip Code |

(972) 378-6600

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

_______________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates (excluding voting shares held by officers and directors) as of April 13, 2011 was $14,001,459.00

70,007,296 common shares, $0.001 par value, were outstanding on April 13, 2011.

| Page | ||

| PART I | ||

| Item 1. | Business | 3 |

| Item 2. | Properties | 7 |

| Item 3. | Legal Proceedings | 7 |

| Item 4. | [Removed and Reserved] | 7 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 8 |

| Item 6. | Selected Financial Data | 8 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 9 |

| Item 8. | Financial Statements | 16 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 18 |

| Item 9A. | Controls and Procedures | 18 |

| Item 9B. | Other Information | 19 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 19 |

| Item 11. | Executive Compensation | 21 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 22 |

| Item 13. | Certain Relationships and Related Transactions and Director Independence | 23 |

| Item 14. | Principal Accountant Fees and Services | 23 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 24 |

1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This Annual Report on Form 10-K (“Annual Report”), the other reports, statements, and information that we have previously filed or that we may subsequently file with the Securities and Exchange Commission (“SEC”) and public announcements that we have previously made or may subsequently make include, may include, incorporate by reference or may incorporate by reference certain statements that may be deemed to be forward-looking statements. The forward-looking statements included or incorporated by reference in this Annual Report and those reports, statements, information and announcements address activities, events or developments that League Now Holdings Corporation (together with its subsidiaries hereinafter referred to as “we,” “us,” “our” or “League Now”) expects or anticipates will or may occur in the future. Any statements in this document about expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “will continue,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” and similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties, which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this document. All forward-looking statements concerning economic conditions, rates of growth, rates of income or values as may be included in this document are based on information available to us on the dates noted, and we assume no obligation to update any such forward-looking statements.

The risk factors referred to in this Annual Report could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us, and you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and we do not undertake any obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Management cautions that these statements are qualified by their terms and/or important factors, many of which are outside of our control, involve a number of risks, uncertainties and other factors that could cause actual results and events to differ materially from the statements made, including, but not limited to, the following risk factors.

| ● | Our ability to generate sufficient cash flow to support capital expansion plans and general operating activities, |

| ● | Our ability to penetrate new markets and maintain or expand existing markets, |

| ● | Maintaining existing relationships and expanding the distributor network of our products, |

| ● | The marketing efforts of distributors of our products, most of whom also distribute products that are competitive with our products, |

| ● | Economic and political changes, |

| ● | The availability and cost of capital to finance our working capital needs and growth plans, |

| ● | The effectiveness of our advertising, marketing and promotional programs, |

| ● | Competitive products and pricing pressures and our ability to gain or maintain its share of sales in the marketplace and |

| ● | The introduction of new products. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements.

2

PART I

Item 1. Business

Background

Our original business plan was designed to take advantage of existing web based service providers offering web-based services for the online video gaming industry. We had offered four (4) games, football, baseball, basketball, and hockey each identified by the market names Madden 2006, MLB 2006, NBA Live 2006, and NHL 2006 respectively. We have not been able to raise additional funds through either debt or equity offerings. Without this additional cash we have been unable to complete our plan of operations and generate sufficient revenue to complete our business plan.

On October 4, 2010, the Company's stockholders approved a 16 for 1 forward stock split for its common stock. As a result, stockholders of record at the close of business on October 21, 2010, received sixteen shares of common stock for every one share held.

On October 6, 2010, in accordance with a share exchange agreement, we acquired 100% of the issued and outstanding shares of Pure Motion, Inc. (“Pure Motion”), for 24,009,008 post split shares of our common stock. We agreed to repurchase and cancel 38,048,000 post split shares of common stock from our former CEO, James Pregiato, for an initial payment of $100,000 and an additional payment of $150,000 in increments of $50,000 on each of October 31, 2010, November 30, 2010 and December 31, 2010. The transaction will be accounted for as a purchase by the Company of Pure Motion. The 38,048,000 shares are being held in escrow until receipt of the Final Cash Payment. Upon closing of the transaction, Mr. Pregiato resigned as an officer and director of the Company. Mr. Pregiato agreed to extinguish all outstanding debt and liabilities of League Now outstanding as of the Closing Date upon receipt of the Final Cash Payment.

Pure Motion has spent the last two years developing and customizing its patented reflector based technology to provide specific solutions to various gaming and military training entities. TOMI’s application within the golf industry is one example of how the company has adapted its technology for specific use in the instructional sports industry, further applications in broad gaming and military training markets appear to be prevalent. Pure Motion has the ability to expand, develop and specialize its technology for wide-ranging applications that have the potential to reach several near term vertical markets. Pure Motion currently has two employees and two consultants.

The Company is in the process of raising sufficient capital to execute its business plan and to make its payments pursuant to the share exchange agreement. However, as of the date of this report, the Company has not made payment on any portion of the Final Cash Payment and is in breach of the share exchange agreement. If the Company fails to make the entire Final Cash Payment by December 31, 2010, James Pregiato will have the right to keep the 38,048,000 shares that are in escrow and will continue to hold the right to approve any issuances by the Company of its securities.

Pure Motion was incorporated in the State of Texas in June 2004.

Pure Motion is a Texas corporation formed to develop and introduce skill improvement products and systems for recreational sports, particularly those that require a high degree of fine motor skill and mental acuity. Based on management’s extensive research in cybernetics and human motor functions, the Company has developed a proprietary reflector measurement technology, which it calls TOMI (The Optimal Motion Instructor). TOMI is a software-based device that records every motion and angle of an object in three-dimensional space and groups the collected data into a graphical feedback system. The results are then displayed in a series of high resolution, easy-to-understand graphs and charts.

The company has spent the last two years developing and customizing its patented reflector based technology to provide specific solutions to various gaming and military training entities. TOMI’s application within the golf industry is one example of how the company has adapted its technology for specific use in the instructional sports industry, further applications in broad gaming and military training markets appear to be prevalent. Pure Motion has the ability to expand, develop and specialize its technology for wide-ranging applications that have the potential to reach several near term vertical markets. In the pages that follow we will enumerate several of those potential applications.

3

Overview

Pure Motion is a Texas corporation formed to develop and introduce skill improvement products and systems for recreational sports, particularly those that require a high degree of fine motor skill and mental acuity. Based on management’s extensive research in cybernetics and human motor functions, the Company has developed a proprietary reflector measurement technology, which it calls TOMI (The Optimal Motion Instructor). TOMI is a software-based device that records every motion and angle of an object in three-dimensional space and groups the collected data into a graphical feedback system. The results are then displayed in a series of high resolution, easy-to-understand graphs and charts.

Initially, the Company’s business plan focused on manufacturing and marketing versions of the TOMI product designed for the game of golf (specifically, the crucial challenges presented by putting and, subsequently, chipping). For this market, Pure Motion has developed two principal versions of the TOMI product, TOMI-Pro and TOMI-Consumer. TOMI-Pro is designed primarily to support professional instruction and consists of the following: (i) a transmitter clip that easily attaches to any putter shaft; (ii) a base unit that receives and digitizes the signals from the clip and relays them to the user’s laptop or personal computer (either, a “PC”); and (iii) stroke analysis software installed on the PC which provides real-time feedback in graphical form on the eight critical parameters that define a well or poorly executed putt. Pure Motion successfully introduced TOMI-Pro at the PGA Merchandise Show in Orlando, Florida on January 25-27, 2007 the company was awarded “Product of the Show”. Further, the company began shipping TOMI-Pro in August 2007; to date the company has shipped 2,700 TOMI systems into 22 different countries. The average SRP was $671.00 per unit. Retailers currently selling TOMI are; PGA Tour Superstores, Edwin Watts and Golf Galaxy. TOMI-Pro has been featured on a segment with the Golf Channel learning center hosted by Dave Marr. Pure Motion introduced a simplified, lower priced retail version of its TOMI-Pro product that will be essentially identical to TOMI-Pro but will display only four putting stroke parameters. Although based on the same technology as TOMI-Pro, TOMI-Consumer has a somewhat simplified version of the stroke analysis software and will display only four putting stroke parameters. The company successfully launched TOMI-Consumer at the PGA Merchandising show in Orlando Florida in January 2008 and it began making shipments in February of 2008 at an SRP of $199.99. Like its cousin TOMI-Pro TOMI Consumer was named “Product of the show” in 2008. Most recently Pure Motion was awarded Innovator of the Year award for 2009 by Golf Magazine.

In terms of intellectual property the Company has a patent issued for TOMI in the United States and has made the necessary filings to enable it to file patent applications for TOMI in all other developed countries.

The company has spent the last two years developing and customizing its patented reflector based technology to provide specific solutions to various gaming and military training entities. TOMI’s application within the golf industry is one example of how the company has adapted its technology for specific use in the instructional sports industry, further applications in broad gaming and military training markets appear to be prevalent. Pure Motion has the ability to expand, develop and specialize its technology for wide-ranging applications that have the potential to reach several near term vertical markets. In the pages that follow we will enumerate several of those potential applications.

Technology Overview

Augmented Reality

Augmented reality (AR) is a field of computer research which deals with the combination of real-world and computer-generated data (virtual reality), where computer graphics objects are blended into real footage in real time.

At present, most AR research is concerned with the use of live video imagery which is digitally processed and "augmented" by the addition of computer-generated graphics. Advanced research includes the use of motion-tracking data and fiducially marked recognition, using machine vision and the construction of controlled environments containing any number of sensors and actuators.

The Pure Motion technology is significantly advanced in the AR development sector in that it captures motion while measuring and rendering this motion in three-dimensions and “4th being real time”. Other motion capture software applications in the marketplace are surpassed by Pure Motion’s ability to concurrently record and render movement in real time and in 4D.

Although Sony and Nintendo have “gesture based recognition” software technology, the closest competitor to Pure Motion’s technology is Microsoft’s Project Natal. However, Pure Motion has a few competitive advantages against Microsoft and other competitors which include its ability to more accurately capture data in real time, its competitive pricing, but more importantly its flexible software platform, which provides a significantly broader customer base and diversified revenue stream for Pure Motion or a prospective acquirer of Pure Motion.

4

An online display of the XYZ Platform technology is readily available upon request.

Prospective Clients with Ability to Utilize Technology

There are multiple markets in which the XYZ platform could be utilized to improve gaming interaction and/or training simulation. The following are a couple of customer segments (explained in more detail in the Industry Overview Section):

| 1. | The XYZ Platform offers game developers across multiple gaming sectors the opportunity to integrate software that will attract an increased number of players based on the fact that the player will be immersed in “real time” into the gaming environment through LED technology, thus offering a more realistic player experience. |

| 2. | There is a primary gap in technology currently used to train soldiers and security company employees. The XYZ platform technology has the ability to bridge this gap by training soldiers within multiple virtual world simulations and virtual world warfare environments, all while capturing data analytics and customizing and or reporting that data in real time. |

Market Opportunity

Massive Multiplayer Market and Console Gaming (MMOG)

The global video gaming industry has grown rapidly to become a significant segment of the entertainment market. It represents the fastest growing component of the $1.3 trillion worldwide entertainment and media industry. The global video game market is expected to increase from $25.4 billion in 2005 to over $50 billion in 2009 (“PWC”).

Government and Military Training Companies

Government and military training companies can utilize the XYZ Platform to simulate or render 3D environments and record all motion within those environments in real-time. The XYZ Platform will be revolutionary in military training exercises and simulations. The platform technology can be utilized in a multitude of environments such as urban warfare, terrorist training simulation and logistical simulation analysis.

Abstract of Patent

Pure Motion has received a patent with four claims and is pursuing additional patent protection. The following summarizes two of those issued claims:

| (1) | A system for determining the relative displacement of a rigid object is described herein. In one embodiment, the system includes three data sources positioned on an object. The data sources are configured to transmit data relating to positional displacement of the object. Each data source has predefined movement parameters based on the position of each data source on the object. In one embodiment, the system further includes a receiver unit configured to display positional information relating to the object based on the data received from each data source. The positional information represents a single valid solution set generated in part by eliminating positional movements that exceed the predefined movement parameters. |

| (2) | The apparatus of claim 1, further comprising: three data sources positioned on an object, the data sources configured to transmit data relating to positional displacement of the object, each data sources having predefined movement parameters based on the position of each data source on the object, and a receiver unit for receiving the data relating to positional displacement from each data source, and a processing means for processing the data to provide positional information representing a single valid solution set generated in part by eliminating positional movements that exceed predefined movement parameters. |

Pure Motion has a pending continuation-in-part patent application. The Pure Motion technology Patent, describing in detail all additional claims is available upon request. The XYZ platform is patented with all claims issued with “no comments from examiner”, highly unusual.

Industry Overview

Massively Multiplayer Online Game Market Opportunity

Revenues in the online gaming industry have seen a meteoric rise, from $592 million (USD) in 2001 to $7.5 billion (USD) in 2007, and the market for MMOGs is anticipated to reach $9.0 billion 2009 year end.

The Tower Group forecasts that “real world” revenue generated from MMOGs will reach $11 billion (USD) annually by 2010; and that the market will grow to almost 400 million people spending over $13 billion (USD) annually by 2010.

5

Leading sources in the MMO gaming research space estimate a CAGR (compound annual growth rate) of close to 50% by 2010.

Virtual gaming markets include complete social and economic systems for players using specialized browsers to engage in online game playing environments.

Expenditures on PC online games are expected to increase rapidly and DFC Intelligence predicts revenues of $15.6 billion (USD) by 2013. This growth in part reflects not only the continued increase in broadband connections across the globe, but also the attractiveness of the multiplayer environment which is more social than traditional single player gaming.

Using the internet to enhance game-play and build loyal communities of players, gaming companies have successfully monetized the online space principally through the subscription based model. Pure Motion has identified that the market is shifting towards a more interactive game playing experience.

Pure Motion is positioned to benefit tremendously from this growth. The XYZ Platform technology allows for game developers to utilize a more realistic player environment experience within first-person shooter games (FPS’), athletic games involving applications of real time movement, and even social networking games involving dressing and shopping experiences, for instance. Finally, the XYZ Platform technology has multiple applications in any environment requiring real time rendering and motion image capturing. New games in this market are being developed which require the interactive application listed above.

Console Video Gaming

Through extensive research and documented case studies, Pure Motion has determined that there is a primary gap in the video game industry for controllers that offer the consumer a more realistic gaming or training experience. “Companies in the Gaming Console industry are experiencing challenging times with the rise in mobile phones and portable media players presenting them with the threat of substitutes. Products such as the Nintendo Wii and Sony PSP risk being overtaken by multifunctional media players that offer consumers more options. The use of both the games console and the handheld version at the same time, for different functions, is an area that is expected to grow as the interoperation provides opportunities for further innovation. The availability of attachments to consoles, such as cameras, should encourage the market to continue growing” (Datamonitor). The Pure Motion technology represents a significant opportunity for the company in the console gaming industry as well; it will resolve numerous inter-operation issues that currently face Nintendo and Microsoft Xbox 360.

Brand X Games Partnership

The company has already begun initial partnership discussions with Brand X games located in Redmond Washington (www.Brandxgames.com/about.html). Brand X Games was founded in 2006 by John Caporale and Charles Balas. Their vision is to create family friendly games that can bring all ages together. In 2007, the company was joined by long time industry guru Scott K. Tsumura. Brand X Games currently has several original titles under development.

Mr. Scott Tsumura, former founder and CEO of Nintendo Software, heads development. Mr. Tsumura and his team are highly regarded having successfully developed and licensed games as well as gaming platforms for Wonderword, Leapfrog, and Game Buddy, and most recently, developed the casual downloadable game, “Camelia's Locket: The Tale of Dead Jim Cane” for Big Fish.

Brand X has indicated that XYZ Motion should have a distinct advantage over other technology developers due to its intellectual property and the fact that the product has the ability to see and record X Y Z coordinates. Other manufacturers currently have the ability to see and record X and Y coordinates only. This includes Wii from Nintendo and Xbox 360 from Microsoft.

Continued Development

The Company plans to significantly enhance the functionality and appeal of its technology. The gaming platform has a wireless interface option coinciding with each of the popular game box system platforms (Nintendo, Xbox and Play station) offered in the marketplace. For example, the XYZ platform application of the technology has the flexibility to attach to any object hard or soft. Further, the platform can be attached to arms, hands or legs. It can also be attached to any fixed objects including golf clubs, tennis racket, baseball bat or hockey sticks.

The XYZ gaming platform application includes a proprietary servo system which allows a camera to “float” and track the users movement in real time. Unlike the current gaming controllers, this technology application can be used with many multiplayer virtual and shared playing scenarios (where multiple players – both real and virtual – can play simulated and real games across the internet). By using the “high performance XYZ gaming technology” the user is able to attain a far more accurate and realistic experience for performance on any fitness related games. The platform also has application in real time simulations related to robotics as well as educational and development tasks for honing fine motor skills. If you need to monitor it, analyze it and report it, the Pure Motion technology can do it.

6

Government and Military Training Companies

A number of computer gaming products have been repurposed for use in training systems or are integrated as part of larger simulations. Technologies that are associated with computer games are making instrumental improvements due to the popularity and financing that is available from customers. The technologies include 3D engines, graphical user interfaces, AI, physics modeling, network play and persistent worlds. Military training centers can utilize the XYZ platform within these interactive training environments. This is a very popular way to train the current generation of soldiers. Research indicates that more than 50% of young enlisted soldiers call themselves “gamers”, or are familiar with the mechanics of game play. The XYZ platform utilized in the first person shooter environment (FPS) further creates a more realistic scenario for soldiers and government/military employees to train in.

Applications of the XYZ platform within the military training realm are many and varied. The technology has promising applications in repetitive motion studies to determine the optimal design and layout for human-machine interactions. For instance, production work stations can be optimized using the technology to achieve the most efficient, cost-effective accomplishment of tasks. Using the technology in this manner, for instance, can assist in the design of airplane cockpits to ensure the most effective performance in high-stress situations requiring the execution of many tasks in a short period of time. The technology also has tactical applications for artillery and mortar crews in coordinating various missions, such as storming a strong point or building.

Military training applications of the Company’s technology are especially enhanced by the Company’s motion capture technology. Post-engagement review of militaristic activities such as climbing and rappelling, aircraft weapons loading and unloading, and hand to hand combat training are a few examples of how the technology can aid in outcome analysis as a means of modifying future missions to enhance the likelihood of desired results. The technology can also be applied in the real-time modeling and simulation environment for precise six-degree of freedom (location and orientation) control – specific use in this area includes inducing proper vibratory excitations (reflexes).

The technology is optimal for testing purposes as it proves especially useful in situations where wires cannot be directly attached to the item under study. Application of the motion capture device is also advantageous in situations where testing is desired for occurrences in an undisturbed environment; alternative measuring devices disturb dynamic environments, thereby altering test results. As such, the XYZ platform is optimal in testing scenarios including wind tunnel analysis for various test items, scale model testing for naval designs, and rotor blade testing for helicopters, to name a select few.

Summary of Competitive Technology

Although not currently in market, there is one software technology (3DV), that will compete with Pure Motions’ XYZ platform technology. However, there are many advantages the XYZ platform has against 3DV and other future competitors. Because 3DV is further along in development than some other companies and has been displayed at E3 in California, we have compiled an analysis of the two software platforms below as well as the current ownership structures.

● 3DV has been in development for 10 years and was recently acquired by Microsoft for $38 mm; The XYZ platform technology is currently exploring two potential paths, a minority preferred equity investment and various acquisition scenarios. | |

● The XYZ platform is currently being utilized within a golf product called TOMI, so the technology is proven; 3DV is not currently in market and is only being displayed at tech fairs. |

● The XYZ platform is easy to specialize / customize development for specific customer needs, while 3DV is very hard for people to develop around. | |

● XYZ can be used as a standalone system and console system in 2D, 3D and 4D platforms, while the 3DV technology can only be used in 3D environments. |

● The XYZ platform also works with cell phone cameras and has the ability to work with PSP and Nintendo DS systems and 3DV only has the capability to work with high end console systems limiting its user audience |

The XYZ platform is patented with all claims issues with “no comments from examiner”, highly unusual.

Employees

We have 2 full-time employee on our corporate staff, as follows. We employ additional people on a part-time basis as needed. We have never participated in a collective bargaining agreement. We believe that the relationship with our employees is good.

Item 2. Property

We lease an office of approximately 750 square feet, which serves as our principal executive offices located at 5601 W. Spring Creek Parkway Plano, TX 75021.

Item 3. Legal Proceedings

None.

7

PART II

Item 5.Market for Common Equity and Related Stockholder Matters

Our common stock has traded on the OTC Bulletin Board system under the symbol “LNWH” since May 7, 2008. However, to date there has been no trading market for our Common Stock.

The market price of our common stock will be subject to significant fluctuations in response to variations in our quarterly operating results, general trends in the market, and other factors, over many of which we have little or no control. In addition, broad market fluctuations, as well as general economic, business and political conditions, may adversely affect the market for our common stock, regardless of our actual or projected performance.

As of April 13, 2011 in accordance with our transfer agent records, we had 88 record holders of our Common Stock.

On October 4, 2010, the Company effectuated a 16 for 1 forward split of its common stock.

Unregistered Sales of Equity Securities

During the fiscal year ended December 31, 2010, all issuances of equity securities that were unregistered under the Securities Act were reported in our Exchange Act filings.

Dividend Policy

We have never declared or paid dividends on our common stock. We currently intend to retain future earnings, if any, for use in our business, and, therefore, we do not anticipate declaring or paying any dividends in the foreseeable future. Payments of future dividends, if any, will be at the discretion of our board of directors after taking into account various factors, including the terms of our credit facility and our financial condition, operating results, current and anticipated cash needs and plans for expansion.

To date, we do not have any equity compensation plans and have not granted any stock options.

Item 6. Selected Financial Data

As a smaller reporting company, League Now is not required to provide disclosure pursuant to this Item 6.

8

Item 7.Management’s Discussion and Analysis and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes appearing elsewhere in this Annual Report. This discussion and analysis may contain forward-looking statements based on assumptions about our future business. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including but not limited to those set forth under “Risk Factors” and elsewhere in this Annual Report.

Overview

We continued to make significant progress in narrowing our operating losses during 2010. Our net loss for 2010 was $(81,519) as compared to $(1,873,867) in 2009. The largest reduction was in interest expense and selling, general and administrative expenses. The Company has significantly reduced its overhead and operating expenses. Currently the Company has one employee which handles all office related matters including order entry and technical calls with our customer base. Management intends to hold expenses to a minimum and to obtain services on a contingency basis when possible.

The Company is focused in two areas; first, the Company generates revenue with its golf product and second, it has the opportunity to license or develop out its technology for application in areas such as; video gaming, medical, industrial-machine vision and early education applications. In October 2010 the Company acquired. Pure Motion, Inc. a Texas corporation that developed, manufactures and markets skill improvement products including systems for recreational sports, and performance related gaming applications. The Company developed and patented a proprietary reflector measurement technology (motion capturing algorithm), which it calls TOMI (The Optimal Motion Instructor). TOMI’s platform consists of hardware and software which records in “real time” every motion and angle of an object in three-dimensional space (X Y Z coordinates) with six degrees of freedom. The results are then displayed in a series of high resolution, easy-to-understand graphs and charts. The Company has generated revenue with the TOMI product since 2007 in the instructional golf space.

Over the next twelve months the Company has three product development initiatives planned for its TOMI technology. First, the Company intends to develop its TOMI consumer golf product utilizing the underlying technology in TOMI Pro. The Company anticipates that its TOMI consumer product will be released for market third quarter 2011. Second, the Company has executed a development agreement with RGE Enterprises, Inc. to create the Company’s API (tool kit) which will allow gaming publishers to utilize the Company’s patented motion capturing technology for video gaming applications. Third, utilizing the Company’s proven motion capturing and measuring algorithm the Company intends to develop a PC based imageless guidance system for hip surgery. The TOMI (The Optimal Motion Instrument) motion capturing system should enable improved accuracy to be achieved for alignment and orientation of instruments and hip implants.

Our plan of operations has been subject to attaining additional financing. We cannot assure investors that adequate funding will be available. In the absence of additional financing, we may be unable to proceed with our plan of operations. In the event that the Company does need to raise capital most likely the only method available to the Company would be the private sale of its securities. Because of the nature of the Company as a development stage Company, it is unlikely that it could make a public sale of securities or be able to borrow any significant sum from either a commercial or private lender.

9

Results of Operations

LEAGUE NOW HOLDINGS CORPORATION

STATEMENT OF OPERATIONS

For the years ended December 31,

| 2010 | 2009 | |||||||

| Sales | $ | 206,623.00 | $ | 297,779.00 | ||||

| Cost of Sales | $ | 57,448.00 | $ | 68,903.00 | ||||

| $ | 149,175.00 | $ | 228,876.00 | |||||

| Expenses: | ||||||||

| Selling, general and administrative | $ | 222,413.00 | $ | 856,294.00 | ||||

| Depreciation and amortization | $ | 2,475.00 | $ | 4,950.00 | ||||

| Total expenses | $ | 224,888.00 | $ | 861,244.00 | ||||

| Loss from operations | $ | (75,713.00 | ) | $ | (632,368.00 | ) | ||

| Interest Expense | $ | (5,806.00 | ) | $ | (1,241,499.00 | ) | ||

| Loss before provision of income taxes | $ | (81,519.00 | ) | $ | (1,873,867.00 | ) | ||

| Provision for income taxes | - | - | ||||||

| Net loss | $ | (81,519.00 | ) | $ | (1,873,867.00 | ) | ||

| BASIC EARNINGS (LOSS) PER SHARE | $ | 0.01 | $ | 0.01 | ||||

| WEIGHTED AVERAGE NUMBER OF COMMON | ||||||||

| SHARES OUTSTANDING | - | - | ||||||

10

Year ended December 31, 2010 Compared to Year ended December 31, 2009

Sales

Sales of Tomi Pro were $206,623 for the year ended December 31, 2010 this represents a decrease of $91,156 or 30%, as compared to the prior year same period. We currently sell Tomi Pro through a “grass roots” effort. All sales are made by word of mouth and referral. We do not have a sales organization rather we rely on web-based services for all sales activity. During the next twelve months providing we get the required financing the Company intends to launch an aggressive marketing program.

Cost of Goods Sold

Cost of goods sold consists primarily of the costs of our hardware, production and freight. Our cost of goods sold of $57,448 for the year ended December 31, 2010 represents a decrease of $68,903, or 16% as compared to 2009.

Gross Profit

Our gross profit decreased to $149,175 in the year ended December 31, 2010, from $ 228,876 in 2009, a decrease of $79,701 or 35%. The overall gross profit as a percentage of sales decreased to 72% in 2010, from 77% in 2009. The gross profit percentage decrease is primarily due to lower margins from selling our products at lower prices. Ongoing margins from Tomi sales are anticipated to improve with 2011 contracts.

11

Selling and marketing expenses

Selling and marketing expenses consist primarily of direct charges for staff compensation costs, advertising, sales promotion, marketing and trade shows. Selling and marketing costs decreased to $35,991 in the year ended December 31, 2010 from $159,609 in 2009. Our marketing efforts for Tomi consist of attending one trade show each year and web based marketing. We have recently increased our web-based marketing capabilities and have expanded our distribution agreements to include Asia and South America.

General and Administrative Expenses

General and administrative expenses consist primarily of the cost of executive, administrative, and finance personnel, as well as professional fees. General and administrative expenses decreased to $186,422 during the year ended December 31, 2010 from $696,685 in the same period of 2009. The overall decrease of $510,263 in 2010 is primarily due to a decrease in consulting costs, legal and professional and salary expense. We believe that our existing staffing levels are sufficient to allow for moderate growth without the need to add personnel and related costs for the foreseeable future.

Loss from Operations

Our loss from operations decreased to $81,519 in the year ended December 31, 2010 from $1,873,867 in the same period of 2009. The improvement is a direct result of reducing operating costs.

Interest Expense

Interest expense decreased to $5,806 in the year ended December 31, 2010, compared to interest expense of $1,241,499 in 2009. The decrease is due to the conversion of debt to equity in the Company.

Modified EBITDA

The Company defines modified EBITDA (a non-GAAP measurement) as net loss before interest, taxes, depreciation and amortization, and non-cash expense for securities. Other companies may calculate modified EBITDA differently. Management believes that the presentation of modified EBITDA provides a measure of performance that approximates cash flow before interest expense, and is meaningful to investors.

MODIFIED EBITDA SCHEDULE

| Year ended December 31, | ||||||||

| 2010 | 2009 | |||||||

| Net loss | $ | (81,519 | ) | $ | (1,873,867 | ) | ||

| Modified EBITDA adjustments: | ||||||||

| Depreciation and amortization | 2,475 | 4,950 | ||||||

| Interest expense | 5,806 | 1,241,499 | ||||||

| Other stock compensation for services | 400,000 | |||||||

| Total EBITDA adjustments | ||||||||

| Modified EBITDA income (loss) from operations | $ | (326,762) | $ | (627,418 | ) | |||

Liquidity and Capital Resources

As of December 31, 2010, we had stockholders equity of $356,910 and we had working capital of $6,436, compared to stockholders equity of $407,407 and working capital of $30,134 at December 31, 2009. Cash and cash equivalents were $331,841 as of December 31, 2010, as compared to $378,863 at December 31, 2009. The decrease in our working capital of $47,022 was primarily a result of losses from operations, before depreciation and other non-cash expenses.

Our Plan of operations has been subject to attaining additional financing. We cannot assure investors that adequate funding will be available. In the absence of additional financing, we may be unable to proceed with our plan of operations. In the event that the Company does need to raise capital most likely the only method available to the Company would be the private sale of its securities. Because of the nature of the Company as a development stage Company, it is unlikely that it could make a public sale of securities or be able to borrow any significant sum from either a commercial or private lender.

12

Net cash used in operations during 2010 was $(23,698) compared with $26,822 used in operations during the same period in 2009. Cash used in operations during 2010 was primarily due to the net loss in the period and to an increase in accounts receivable.

Net cash provided by financing activities of $21,900 during 2010 was primarily due to proceeds from the increase in shareholders notes and debentures.

We may not generate sufficient revenues from product sales in the future to achieve profitable operations. If we are not able to achieve profitable operations at some point in the future, we eventually may have insufficient working capital to maintain our operations as we presently intend to conduct them or to fund our expansion and marketing and product development plans. In addition, our losses may increase in the future as we expand our manufacturing capabilities and fund our marketing plans and product development. These losses, among other things, have had and may continue to have an adverse effect on our working capital, total assets and stockholders’ equity. If we are unable to achieve profitability, the market value of our common stock would decline and there would be a material adverse effect on our financial condition.

If we continue to suffer losses from operations, our working capital may be insufficient to support our ability to expand our business operations as rapidly as we would deem necessary at any time, unless we are able to obtain additional financing. There can be no assurance that we will be able to obtain such financing on acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to pursue our business objectives and would be required to reduce our level of operations, including reducing infrastructure, promotions, personnel and other operating expenses. These events could adversely affect our business, results of operations and financial condition. If adequate funds are not available or if they are not available on acceptable terms, our ability to fund the growth of our operations, take advantage of opportunities, develop products or services or otherwise respond to competitive pressures, could be significantly limited.

Critical Accounting Policies and Estimates

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP. GAAP requires us to make estimates and assumptions that affect the reported amounts in our financial statements including various allowances and reserves for accounts receivable and inventories, the estimated lives of long-lived assets and trademarks and trademark licenses, as well as claims and contingencies arising out of litigation or other transactions that occur in the normal course of business. The following summarize our most significant accounting and reporting policies and practices:

Revenue Recognition. Revenue is recognized on the sale of a product when the product is shipped, which is when the risk of loss transfers to our customers, and collection of the receivable is reasonably assured. A product is not shipped without an order from the customer and credit acceptance procedures performed. The allowance for returns is regularly reviewed and adjusted by management based on historical trends of returned items. Amounts paid by customers for shipping and handling costs are included in sales. The Company reimburses its wholesalers and retailers for promotional discounts, samples and certain advertising and promotional activities used in the promotion of the Company’s products. The accounting treatment for the reimbursements for samples and discounts to wholesalers results in a reduction in the net revenue line item. Reimbursements to wholesalers and retailers for certain advertising activities are included in selling and marketing expenses.

Trademark License and Trademarks. We own trademarks that we consider material to our business. Three of our material trademarks are registered trademarks in the U.S. Patent and Trademark Office: Tomi Pro ®, Putting with Perfection ® and Tomi ®. Registrations for trademarks in the United States will last indefinitely as long as we continue to use and police the trademarks and renew filings with the applicable governmental offices. We have not been challenged in our right to use any of our material trademarks in the United States. We intend to obtain international registration of certain trademarks in foreign jurisdictions.

We account for these items in accordance with FASB guidance; we do not amortize indefinite-lived trademark licenses and trademarks.

In accordance with FASB guidance, we evaluate our non-amortizing trademark license and trademarks quarterly for impairment. We measure impairment by the amount that the carrying value exceeds the

estimated fair value of the trademark license and trademarks. The fair value is calculated by reviewing net sales of the various beverages and applying industry multiples. Based on our quarterly impairment analysis the estimated fair values of trademark license and trademarks exceeded the carrying value and no impairments were identified during the year ended December 31, 2010.

13

Long-Lived Assets. Our management regularly reviews property, equipment and other long-lived assets, including identifiable amortizing intangibles, for possible impairment. This review occurs quarterly or more frequently if events or changes in circumstances indicate the carrying amount of the asset may not be recoverable. If there is indication of impairment of property and equipment or amortizable intangible assets, then management prepares an estimate of future cash flows (undiscounted and without interest charges) expected to result from the use of the asset and its eventual disposition. If these cash flows are less than the carrying amount of the asset, an impairment loss is recognized to write down the asset to its estimated fair value. The fair value is estimated at the present value of the future cash flows discounted at a rate commensurate with management’s estimates of the business risks. Quarterly, or earlier, if there is indication of impairment of identified intangible assets not subject to amortization, management compares the estimated fair value with the carrying amount of the asset. An impairment loss is recognized to write down the intangible asset to its fair value if it is less than the carrying amount. Preparation of estimated expected future cash flows is inherently subjective and is based on management’s best estimate of assumptions concerning expected future conditions. No impairments were identified during the year ended December 31, 2010.

Management believes that the accounting estimate related to impairment of our long lived assets, including our trademark license and trademarks, is a “critical accounting estimate” because: (1) it is highly susceptible to change from period to period because it requires management to estimate fair value, which is based on assumptions about cash flows and discount rates; and (2) the impact that recognizing an impairment would have on the assets reported on our balance sheet, as well as net income, could be material. Management’s assumptions about cash flows and discount rates require significant judgment because actual revenues and expenses have fluctuated in the past and we expect they will continue to do so.

In estimating future revenues, we use internal budgets. Internal budgets are developed based on recent revenue data for existing product lines and planned timing of future introductions of new products and their impact on our future cash flows.

Accounts Receivable. We evaluate the collectability of our trade accounts receivable based on a number of factors. In circumstances where we become aware of a specific customer’s inability to meet its financial obligations to us, a specific reserve for bad debts is estimated and recorded which reduces the recognized receivable to the estimated amount our management believes will ultimately be collected. In addition to specific customer identification of potential bad debts, bad debt charges are recorded based on our historical losses and an overall assessment of past due trade accounts receivable outstanding.

Inventories. Inventories are stated at the lower of cost to purchase and/or manufacture the inventory or the current estimated market value of the inventory. We regularly review our inventory quantities on hand and record a provision for excess and obsolete inventory based primarily on our estimated forecast of product demand and/or our ability to sell the product(s) concerned and production requirements. Demand for our products can fluctuate significantly. Factors that could affect demand for our products include unanticipated changes in consumer preferences, general market conditions or other factors, which may result in cancellations of advance orders or a reduction in the rate of reorders placed by customers. Additionally, our management’s estimates of future product demand may be inaccurate, which could result in an understated or overstated provision required for excess and obsolete inventory.

Stock-Based Compensation. We periodically issue stock options and warrants to employees and non-employees in non-capital raising transactions for services and for financing costs. The Company accounts for stock option and warrant grants issued and vesting to employees based on FASB ASC Topic 718, “Compensation – Stock Compensation”, whereas the award is measured at its fair value at the date of grant and is amortized ratably over the vesting period. We account for stock option and warrant grants issued and vesting to non-employees in accordance with ASC Topic 718 whereby the fair value of the stock compensation is based on the measurement date as determined at either (a) the date at which a performance commitment is reached, or (b) at the date at which the necessary performance to earn the equity instrument is complete.

We estimate the fair value of stock options using the Black-Scholes option-pricing model, which was developed for use in estimating the fair value of options that have no vesting restrictions and are fully transferable. This model requires the input of subjective assumptions, including the expected price volatility of the underlying stock and the expected life of stock options. Projected data related to the expected volatility of stock options is based on the historical volatility of the trading prices of the Company’s common stock and the expected life of stock options is based upon the average term and vesting schedules of the options. Changes in these subjective assumptions can materially affect the fair value of the estimate, and therefore the existing valuation models do not provide a precise measure of the fair value of our employee stock options.

We believe there have been no significant changes, during the year ended December 31, 2010, to the items disclosed as critical accounting policies and estimates in Management's Discussion and Analysis of Financial Condition and Results of Operations in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009.

14

Recent Accounting Pronouncements

In April 2010, the Financial Accounting Standards Board (FASB) issued new accounting guidance in applying the milestone method of revenue recognition to research or development arrangements. Under this guidance management may recognize revenue contingent upon the achievement of a milestone in its entirety, in the period in which the milestone is achieved, only if the milestone meets all the criteria within the guidance to be considered substantive. This standard is effective on a prospective basis for research and development milestones achieved in fiscal years, beginning on or after June 15, 2010. Early adoption is permitted; however, adoption of this guidance as of a date other than January 1, 2011 will require the Company to apply this guidance retrospectively effective as of January 1, 2010 and will require disclosure of the effect of this guidance as applied to all previously reported interim periods in the fiscal year of adoption. As the Company plans to implement this standard prospectively, the effect of this guidance will be limited to future transactions. The Company does not expect adoption of this standard to have a material impact on its financial position or results of operations as it has no material research and development arrangements which will be accounted for under the milestone method.

In January 2010, the FASB issued new accounting guidance which requires new disclosures regarding transfers in and out of Level 1 and Level 2 fair value measurements, as well as requiring presentation on a gross basis of information about purchases, sales, issuances and settlements in Level 3 fair value measurements. The guidance also clarifies existing disclosures regarding level of disaggregation, inputs and valuation techniques. The new guidance is effective for interim and annual reporting periods beginning after December 15, 2009. Disclosures about purchases, sales, issuances and settlements in the roll forward of activity in Level 3 fair value measurements are effective for fiscal years beginning after December 15, 2010. As this guidance requires only additional disclosure, there should be no impact on the financial statements of the Company upon adoption.

In October 2009, a new accounting consensus was issued for multiple-deliverable revenue arrangements. This consensus amends existing revenue recognition accounting standards. This consensus provides accounting principles and application guidance on whether multiple deliverables exist, how the arrangement should be separated and the consideration allocated. This guidance eliminates the requirement to establish the fair value of undelivered products and services and instead provides for separate revenue recognition based upon management’s estimate of the selling price for an undelivered item when there is no other means to determine the fair value of that undelivered item. Previously the existing accounting consensus required that the fair value of the undelivered item be the price of the item either sold in a separate transaction between unrelated third parties or the price charged for each item when the item is sold separately by the vendor. Under the existing accounting consensus, if the fair value of all of the elements in the arrangement was not determinable, then revenue was deferred until all of the items were delivered or fair value was determined. This new approach is effective prospectively for revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010. The Company is in the process of evaluating whether the adoption of this standard will have a material effect on its financial position, results of operations or cash flows.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force), the AICPA, and the Securities Exchange Commission (the "SEC") did not or are not believed by management to have a material impact on the Company's present or future financial statements.

Inflation

Although management expects that our operations will be influenced by general economic conditions, we do not believe that inflation has a material effect on our results of operations.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose entities” (SPEs).

15

| Report of Independent Registered Public Accounting Firm | F-1 |

| Financial Statements: | |

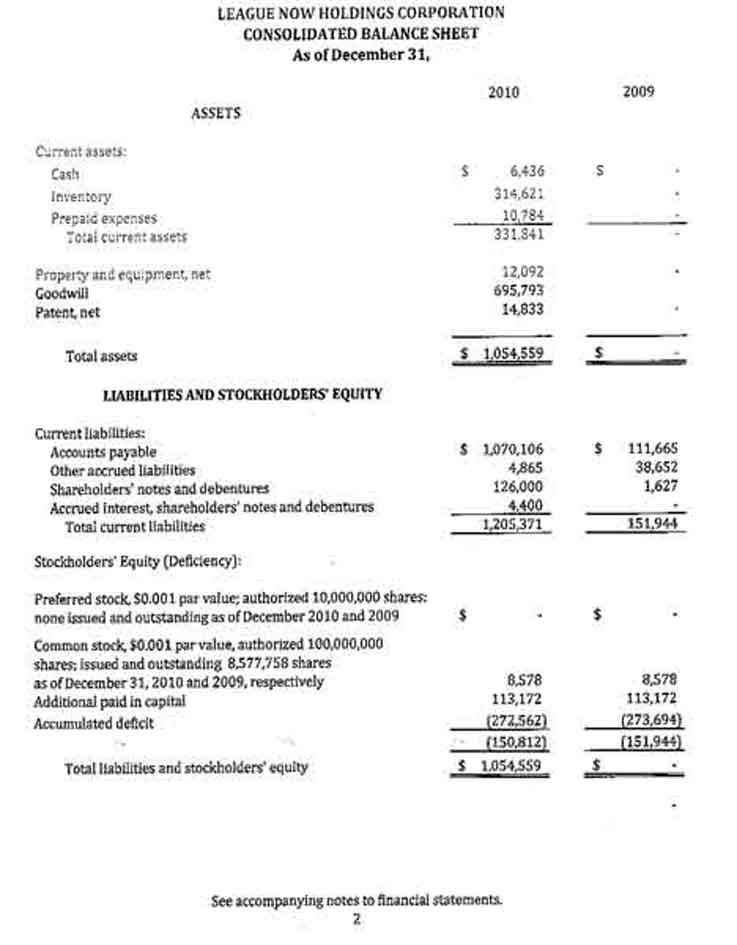

| Balance Sheets as of December 31, 2010 and December 31, 2009 | F-2 |

| Statements of Operations for the years ended December 31, 2010 and 2009 | F-3 |

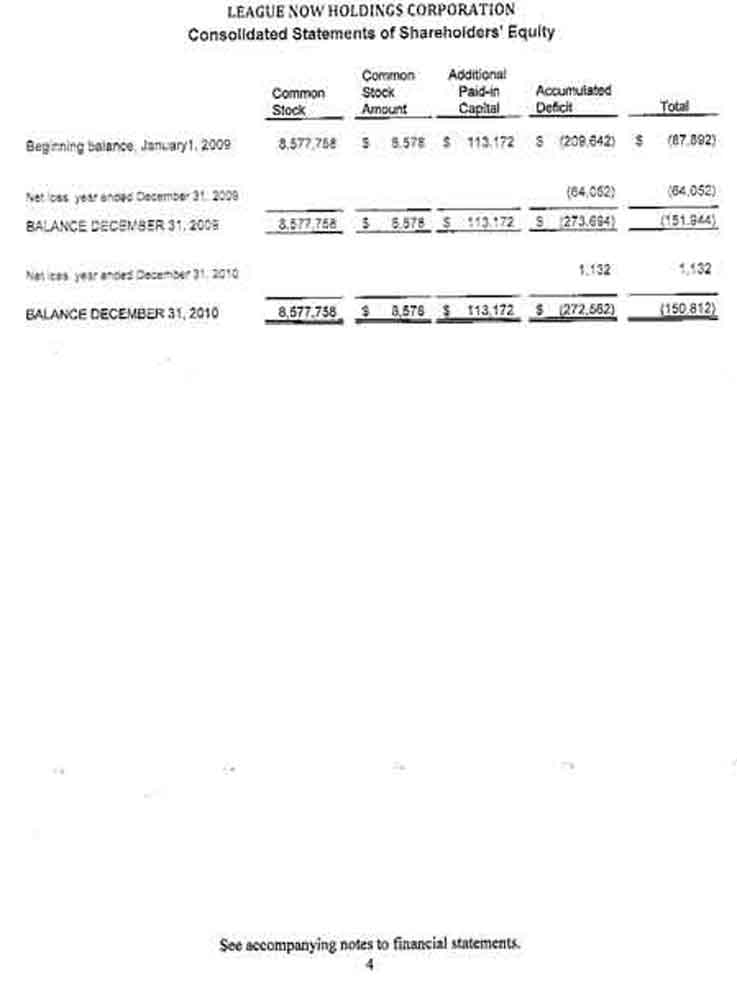

| Statements of Changes in Stockholders’ Equity for the years ended December 31, 2010 and 2009 | F-4 |

| Statements of Cash Flows for the years ended December 31, 2010 and 2009 | F-5 |

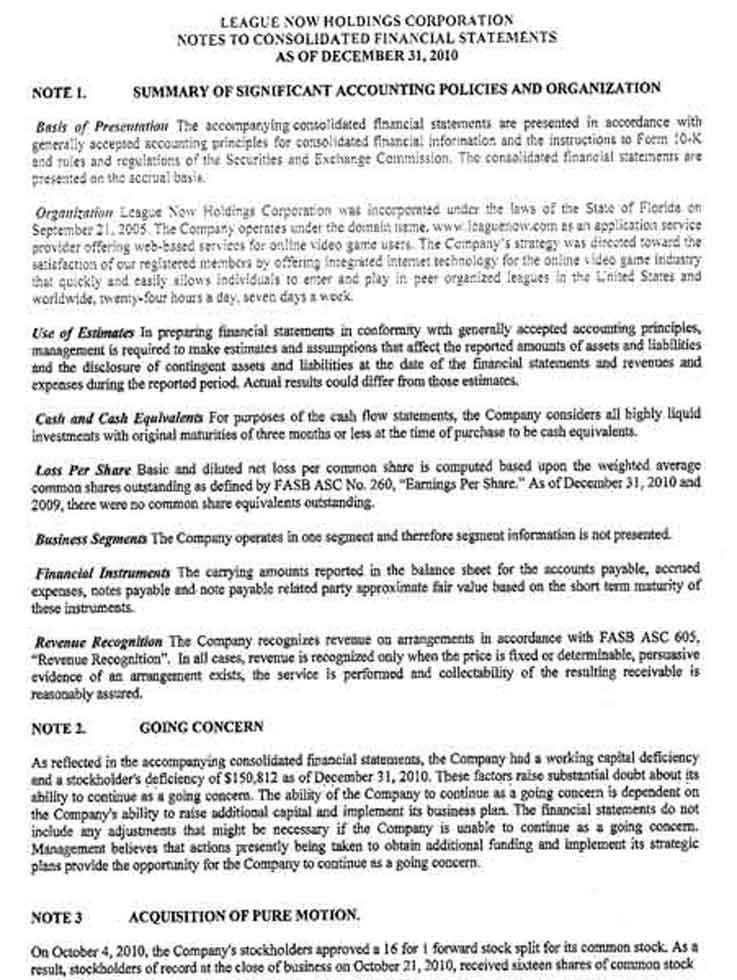

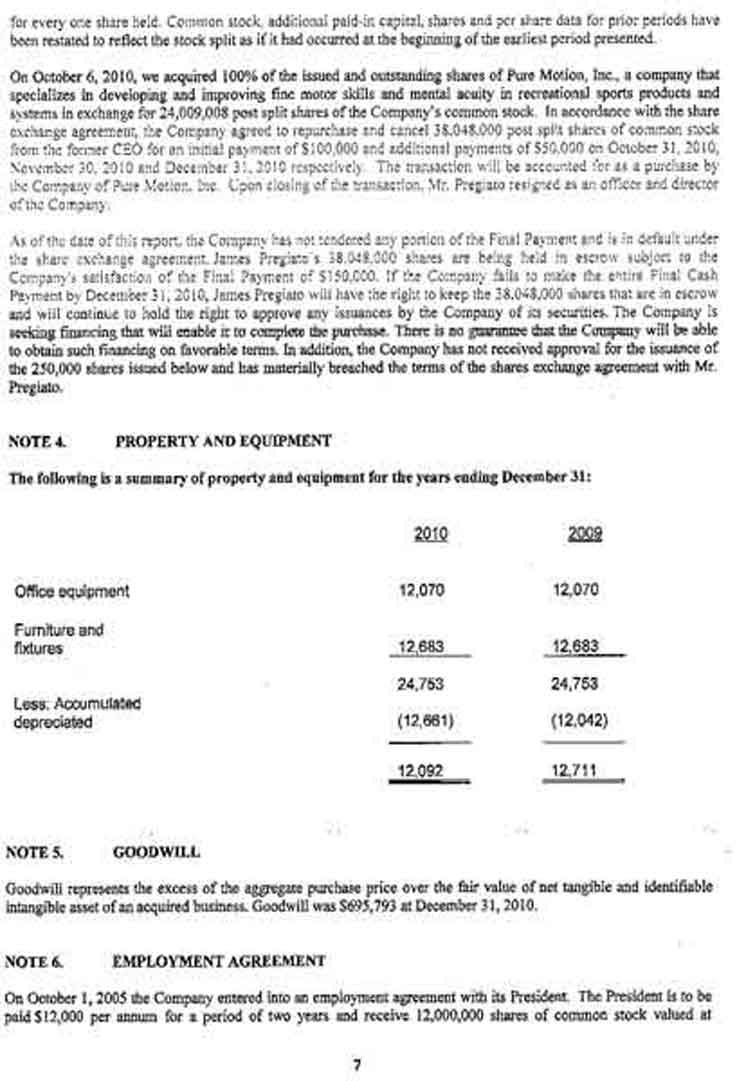

| Notes to Financial Statements | F-6 |

16

HARRIS F. RATTRAY CPA

1601 Palm Avenue #114

Pembroke Pines FL 33026

April 15, 2011

The Board of Directors

League Now Holdings Corporation

Plano, Texas

REPORT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTANT

I have audited the balance sheet of League Now Holdings Corporation and subsidiary (the "Company") as of December 31, 2010 and December 31, 2009, and the related statements of operations, stockholders' equity and cash flows for the years ended December 31, 2010 and December 31, 2009. These financial statements are the responsibility of the Company's management. My responsibility is to express an opinion on these financial statements based on the audit.

I conducted the audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit includes examining on test basis evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that the audit provides a reasonable basis for the opinion.

In my opinion, the financial statements referred to above present fairly in all material respects, the financial position of League Now Holdings Corporation. and subsidiary at December 31, 2010 and December 31, 2009 and the related statements of operations, stockholders' equity and cash flows for the years ended December 31, 2010 and December 31, 2009, in conformity with accounting principles generally accepted in the United States of America.

/s/ Harris F. Rattray CPA

Harris F. Rattray CPA

Pembroke Pines, Florida

Item 9.Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Effective March 17, 2011, Webb & Company, PA, Certified Public Accountants (“Webb”), resigned from their engagement with League Now. The principal accountant’s report on the financial statements for either of the Company’s past two fiscal years did not contain an adverse opinion or a disclaimer of opinion or qualification or modification as to uncertainty, audit scope or accounting principles.

During the Company’s two most recent fiscal years and any subsequent interim period preceding the date of dismissal of Webb, there were no disagreements with Webb on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which would have caused Webb to make reference to the subject matter of the disagreements in Webb’s report.

Effective March 28, 2011, the Company engaged Rattray & Associates, C.P.A., LLC (“Rattray”) as the Company’s principal accountant to audit financial statements. During the Company’s two most recent fiscal years and any subsequent period prior to engaging Rattray, the Company did not consult Rattray regarding either the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements.

The decision to engage Rattray was recommended by the board of directors of the Company.

Item 9A. Controls and Procedures

Management’s Annual Report on Internal Control over Financial Reporting

Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including our Chief Executive Officer and our Chief Financial Officer, we conducted an evaluation of our disclosure controls and procedures, as such term is defined under Securities and Exchange Act of 1934 Rules 13a-15(f). Based on this evaluation, our Chief Executive Officer and our Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective as of December 31, 2010.

Changes in Internal Control Over Financial Reporting

There have been no changes in the Company’s internal control over financial reporting during the year ended December 31, 2010 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2010. In making this assessment, we used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control — Integrated Framework. Based on our assessment we concluded that, as of December 31, 2010, the Company’s internal control over financial reporting was effective..

This annual report does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our independent registered public accounting firm, pursuant to provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act that permit us to provide only management’s report in this Annual Report on Form 10-K.

This report shall not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

18

| Item 9B. Other Information |

Engagement of Ryan W. Drutman

On April 13, 2011, the Board of Directors appointed Ryan W. Drutman as the Company’s Chief Operating Officer. Mr. Drutman does not and has not in the past held any positions or offices with the Company. Other than the terms of that certain Employment Agreement dated April 13, 52011 (“Employment Agreement”) between the Company and Mr. Drutman (described below), there are no arrangements or understandings between Mr. Drutman and any other person pursuant to which he was or is to be selected as an officer.

Mr. Drutman, during the Company’s last fiscal year, has not had a direct or indirect material interest in any transaction of the Company, nor is such a transaction proposed, other than the terms of the Employment Agreement (described in Item 11 below).

Resignation of Brooks Thiele

On February 1, 2011, Brooks Thiele resigned from his position as a director of the Company. Mr. Thiele resigned due to the fact that the Company does not currently carry liability insurance for its officers and directors. Mr. Thiele did not have a disagreement with the Company with regard to any of the Company’s other policies, operations or practices. The Company is providing Mr. Thiele with a copy of this disclosure and is advising Mr. Thiele that he may furnish the Company with a letter stating whether or not he agrees with this disclosure, and if not, stating the respects in which he does not agree. The Company will file any responsive letter received from Mr. Thiele in a Current Report of Form 8K within two days of receipt of the letter.

PART III

Item 10. Directors, Executive Officers, Promoters, Control Persons and Corporate Governance; Compliance with Section 16(a) of the Exchange Act |

General

Our directors currently have terms which will end at our next annual meeting of the stockholders or until their successors are elected and qualify, subject to their death, resignation or removal. Officers serve at the discretion of the board of directors. Our board members are encouraged to attend meetings of the board of directors and the annual meeting of stockholders. The board of directors held _5___ meetings in 2010. The following table sets forth certain information with respect to our current directors and executive officers:

| NAME | AGE | POSITION | ||

| Mario Barton | 62 | Chairman of the Board of Directors, Chief Executive Officer and Chief Financial Officer | ||

| Doug Anderson | 57 | Director | ||

| Ryan W. Drutman | 28 | Chief Operations Officer, President |

The business background descriptions of the newly appointed director and officer are as follows:

Mario Barton, Chairman of the Board and Chief Executive Officer

For the past five years, prior to the Corporation’s acquisition of Pure Motion, Inc., Mr. Barton served as Chief Executive Officer of Pure Motion, Inc. Mr. Barton attended the University of California at Los Angeles from 1969 to 1974.

Doug Anderson, Director

Douglas A. Anderson M.D.

Dr. Anderson graduated from Augustana College, Sioux Falls, South Dakota in 1974 and Tufts University School of Medicine, Boston, Massachusetts in 1981. He completed his post-graduate training in Nephrology at Beth Israel Hospital and Harvard University in 1986. He started a private practice in Nephrology in Phoenix, Arizona and practiced there until his retirement in 2004. Dr. Anderson was instrumental in the formation of Renal West, a dialysis provider with 20 locations throughout Arizona with 2000 patients. Renal West merged with several other providers throughout the United States in 1996 and formed Renal Care Group Inc. Dr. Anderson served on the national Medical Advisory Board of Renal Care Group until his retirement.

Since retirement from medicine, Dr. Anderson has been involved with Pure Motion Inc. from the inception as a co-founder.

19

Ryan W. Drutman, Chief Operating Officer and President

Mr. Drutman served as the Vice President of Corporate Relations for Capital Group Communications, Inc., a company specializing in investor relations, from March 2005 to March 2011.

Family Relationships

None of our directors or executive officers are related to one another.

Legal Proceedings

To the best of our knowledge, none of our executive officers or directors are parties to any material proceedings adverse to the Company, have any material interest adverse to the Company or have, during the past ten years:

| ● | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| ● | had any bankruptcy petition filed by or against him/her or any business of which he/she was a general partner or executive officer, either at the time of the bankruptcy or within two years prior to that time; |

| ● | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his/her involvement in any type of business, securities, futures, commodities or banking activities; |

| ● | been found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

Corporate Governance

We are committed to having sound corporate governance principles. We believe that such principles are essential to running our business efficiently and to maintaining our integrity in the marketplace. There have been no changes to the procedures by which stockholders may recommend nominees to our board of directors.

We do not have an audit committee, although we are in the process of setting up an Audit Committee. Our entire Board of Directors currently functions as our Audit Committee and pre-approves all services provided by our independent auditors. We are in the process of determining whether or not we have a director that qualifies as an Audit Committee financial expert.

Director Qualifications

We believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy-making level in business or banking. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties for us. Each director must represent the interests of all stockholders. When considering potential director candidates, the board of directors also considers the candidate’s character, judgment, diversity, age and skills, including financial literacy and experience in the context of our needs and the needs of the board of directors.

20

Director Independence

The Board of Directors is in the process of restructuring to include two directors that are independent under the revised listing standards of The Nasdaq Stock Market, Inc. We intend to maintain at least two independent directors on our board of directors in the future.

Code of Ethics

Our Chief Executive Officer and all senior financial officers, including the Chief Financial Officer, are bound by a Code of Ethics that complies with Item 406 of Regulation S-B of the Exchange Act. Our Code of Ethics is attached hereto as Exhibit 14.1.

Section 16(a) Beneficial Ownership Reporting Compliance

The Company’s securities are not registered under Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Therefore our directors and executive officers and beneficial holders of more than 10% of our securities are not subject to the reporting requirements of Section 16(a).

The following table summarizes all compensation for fiscal years 2010 and 2009 received by our principal executive officer and principal financial officer, our “Named Executive Officers”.

Name and Principal Position | Year | Salary | Bonus | Stock Awards | Option Awards ($)(1) | Non- Equity Incentive Plan Compensation | Non- Qualified Deferred Compensation Earnings | All Other Compensation | Total | ||||||||||||||||||||||||

James Pregiato (1), Former President, Chief Executive Officer, Secretary, Treasurer | 2010 | $ | 12,000 | - | - | - | - | - | $ | 12,000 | |||||||||||||||||||||||

| (Principal Executive Officer and Principal Financial Officer) | 2009 | $ | 12,000 | - | - | - | - | - | $ | 12,000 | |||||||||||||||||||||||

Mario Barton (2), Chief Executive Officer, Treasurer, Secretary | 2010 | $ | - | - | - | - | - | - | - | $ | 0 | ||||||||||||||||||||||

| (Principal Executive Officer and Principal Financial Officer) | 2009 | - | - | - | - | - | - | - | $ | - | |||||||||||||||||||||||

| (1) | James Pregiato served in these offices through October 6, 2010. | ||||||||||||||||||||||||||||||||

| (2) | Mario Barton was appointed to these offices on October 6, 2010. | ||||||||||||||||||||||||||||||||

21

Employment Agreements

On April 13, 2011, our Board of Directors approved an Employment Agreement between the Company and Ryan W. Drutman. We engaged Mr. Drutman to serve as Chief Operating Officer and President of the Company for a term of one year.

Pursuant to the Employment Agreement, we have agreed to pay Mr. Drutman a monthly salary of one thousand two hundred and eighty dollars ($1,280), which will accrue without interest until we complete a Qualified Financing (defined below) in the minimum amount of two hundred and fifty thousand dollars ($250,000). “Qualified Financing” means a financing transaction or series of transactions completed without the assistance of a FINRA registered broker-dealer or third party finder.