UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

For the fiscal year ended December 31, 2014

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

For the transition period from to

Commission File No. 001-36640

Travelport Worldwide Limited

(Exact name of registrant as specified in its charter)

| | |

| Bermuda | | 98-0505105 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

Axis One, Axis Park

Langley, Berkshire, United Kingdom SL3 8AG

(Address of principal executive offices, including zip code)

+44-1753-288-000

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Shares, Par Value $0.0025 | | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check whether the registrant has submitted electronically and posted on its corporate website, if any, every interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x | | Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

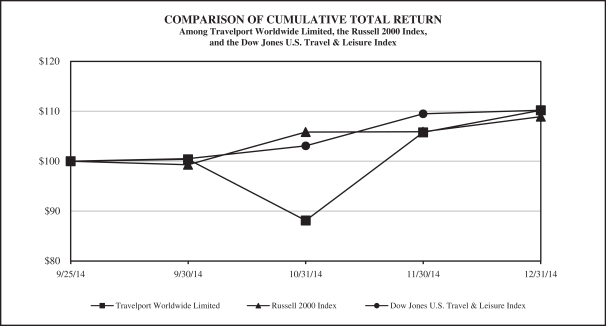

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price on the New York Stock Exchange as of the last business day of the Registrant’s most recently completed second fiscal quarter is not available because the Registrant’s common shares did not begin trading until September 25, 2014.

As of February 27, 2015, there were 121,411,360 common shares of the Registrant, par value $0.0025, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

The forward-looking statements contained herein involve risks and uncertainties. Many of the statements appear, in particular, in the sections entitled “Business”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Forward-looking statements identify prospective information. Important factors could cause actual results to differ, possibly materially, from those in the forward-looking statements. In some cases you can identify forward-looking statements by words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “potential”, “should”, “will” and “would” or other similar words. You should read statements that contain these words carefully because they discuss our future priorities, goals, strategies, actions to improve business performance, market growth assumptions and expectations, new products, product pricing, changes to our business processes, future business opportunities, capital expenditures, financing needs, financial position and other information that is not historical information. References within this Annual Report on Form 10-K to “we”, “our”, “us” or “Travelport” refer to Travelport Worldwide Limited, a Bermuda company, and its consolidated subsidiaries.

The following list represents some, but not necessarily all, of the factors that could cause actual results to differ from historical results of continuing operations or those anticipated or predicted by these forward-looking statements:

| | • | | factors affecting the level of travel activity, particularly air travel volume, including security concerns, pandemics, general economic conditions, natural disasters and other disruptions; |

| | • | | our ability to obtain travel provider inventory from travel providers, such as airlines, hotels, car rental companies, cruise lines and other travel providers; |

| | • | | our ability to maintain existing relationships with travel agencies and to enter into new relationships on acceptable financial and other terms; |

| | • | | our ability to develop and deliver products and services that are valuable to travel agencies and travel providers and generate new revenue streams; |

| | • | | the impact on travel provider capacity and inventory resulting from consolidation of the airline industry; |

| | • | | our ability to grow adjacencies, such as eNett, in which we own a majority interest; |

| | • | | general economic and business conditions in the markets in which we operate, including fluctuations in currencies, particularly in the U.S. dollar, and the economic conditions in the eurozone; |

| | • | | pricing, regulatory and other trends in the travel industry; |

| | • | | the impact our outstanding indebtedness may have on the way we operate our business; |

| | • | | our ability to achieve expected cost savings from our efforts to improve operational efficiency; and |

| | • | | maintenance and protection of our information technology and intellectual property. |

We caution you that the foregoing list of important factors may not contain all of the factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this report may not in fact occur.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. The factors listed in the section captioned “Risk Factors” in this Annual report on Form 10-K, provide examples of risks, uncertainties and events that may

1

cause actual results to differ materially from the expectations described in the forward-looking statements. You should be aware that the occurrence of the events described in these risk factors and elsewhere in this report could have an adverse effect on our business, results of operations, financial position and cash flows.

Forward-looking statements speak only as of the date the statements are made. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect thereto or with respect to other forward-looking statements. For any forward-looking statements contained in any document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

2

PART I

ITEM 1. BUSINESS

Overview

We are a leading travel commerce platform providing distribution, technology, payment and other solutions for the $7 trillion global travel and tourism industry. We facilitate travel commerce by connecting the world’s leading travel providers, such as airlines and hotel chains with online and offline travel agencies and other travel buyers in our proprietary business-to-business (“B2B”) travel commerce platform (our Travel Commerce Platform). We processed approximately $90 billion of travel spending in 2014. Our geographically dispersed footprint allows travel providers to generate high yielding and incremental global demand for their perishable and capital intensive travel inventory from customers living in non-domestic, or away, markets, in addition to serving their domestic, or home, markets. As travel industry needs evolve, we are utilizing our Travel Commerce Platform to redefine the electronic distribution and merchandising of airline core and ancillary products, as well as extending our reach into the growing world of travel commerce beyond air, including to hotel, car rental, rail, cruise-line and tour operators. In addition, we leveraged our domain expertise in the travel industry to design a unique and pioneering B2B payment solution that addresses the need of travel agencies to efficiently and securely make payments to travel providers globally. Through our global reach in over 170 countries, distinct merchandising platform with capabilities for value-added content and enhanced user experience, we offer a strong value proposition not only to travel providers, travel agencies and corporations, but also to end travelers. Our primarily transaction-based pricing model links our revenue to global travel passenger volume rather than travel spending, thus creating a stable and recurring business model with high revenue visibility.

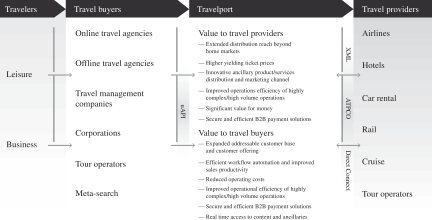

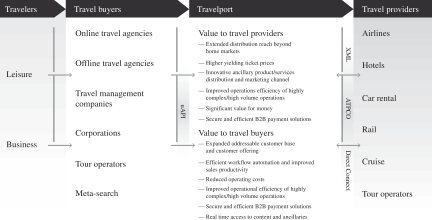

Our Travel Commerce Platform connects travel providers and travel buyers, the latter of which includes travel agencies, Travel Management Companies (“TMCs”) and corporations. The diagram below illustrates our central role in global travel commerce as a provider of high value, real-time distribution services:

We believe that our Travel Commerce Platform combines state-of-the-art technology with industry leading features, functionality and innovative solutions to address the high-volume and growing transaction processing requirements for the evolving needs of the travel industry. In 2014, our systems processed up to 3 billion travel related system messages per day on an average transaction speed of 240 millisecond and over 9 billion Application Programming Interface (“API”) calls per month. Our advanced search technology aggregates global travel content, filters it through sophisticated search algorithms and presents it in a transparent and efficient workflow for travel agencies, enabling them to create and modify multi-content, multi-modular complex itineraries, issue travel documents, process millions of booking transactions and invoices and transfer secure, cost-effective and automated payments, all on a graphically rich, single user interface.

3

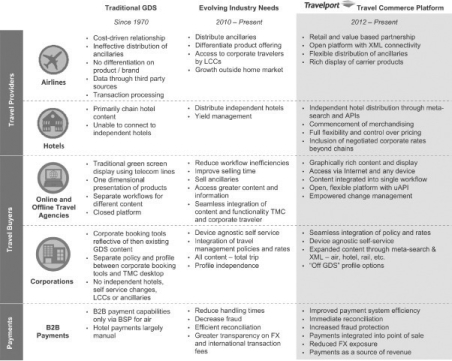

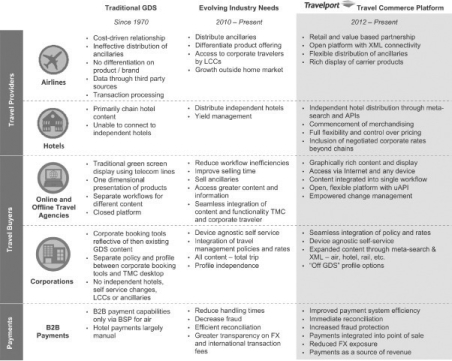

Since 2012, we have strategically invested approximately 580 million in products with a focus on redefining our Travel Commerce Platform to address the trends, inefficiencies and unmet needs of all components of the travel value chain: Air and Beyond Air, which include distribution and merchandising solutions for hotel, car rental, rail, cruise-line and tour operators, B2B travel payments, advertising and an array of additional platform services. For Air, we have transformed the traditional Global Distribution System (“GDS”) concept, which had very limited ancillary sales capabilities, into an open platform with eXtensible Markup Language (“XML”) connectivity and a graphically rich, single user interface to enable marketing and sales of not only full air content, but also full ancillary content. For Beyond Air, we have connected independent hotels, previously unable to reach corporate customers, to a global network of travel agencies through our meta-search technology, which combines search results from multiple sources and have given hotels the ability to display their full range of rates and packages in a one-stop booking portal. We have also pioneered a secure, cost-effective and automated B2B payment alternative to the traditional inefficient and costly methods for travel agencies to pay travel providers. Our Travel Commerce Platform creates synergies and network effects that facilitate revenue growth across the travel value chain. The chart below demonstrates the ways in which our Travel Commerce Platform has identified, addressed and redefined key elements of the travel value chain that are fully or partially unaddressed by traditional GDS providers:

Our Travel Commerce Platform Addresses the Evolving Needs of Our Industry

We provide air distribution services to approximately 400 airlines globally, including approximately 100 low cost carriers (“LCCs”). We distribute ancillaries for 25 airlines. In addition, we serve numerous Beyond Air travel providers, including over 650,000 hotel properties (of which over 550,000 are independent hotel properties), which, based on our internal estimates, is the largest inventory of hotel properties on any travel platform in the world, over 35,000 car rental locations and 61 cruise-line and tour operators. We aggregate travel content across over 67,000 travel agency locations representing 259,000 online and offline travel agency terminals worldwide, which in turn serve millions of end consumers globally. In 2014, we created over 170 million individual travel itineraries, handled over 355 million segments sold by travel agencies, issued 122 million airline tickets and sold over 63 million hotel room nights and 85 million car rental days. Our Travel

4

Commerce Platform provides real-time search, pricing, booking, change, payment and integrated itinerary creation for travelers who use the services of online and offline travel agencies for both leisure and business travel. Our access to business travelers, merchandising capabilities and ability to process complex itineraries have attracted and allowed for the full integration of several fast-growing LCCs such as AirAsia, easyJet, Ryanair and Spirit Airlines into our Travel Commerce Platform.

Through eNett International (Jersy) Limited (“eNett”), our majority-owned subsidiary and an early adopter in automated payments, we are redefining how travel agencies pay travel providers. When a consumer purchases an itinerary through a travel agency, the consumer pays using a variety of mechanisms, including cash, direct debit and credit card. Generally, the consumer makes one payment for the entire itinerary of flights, hotels and ground services, such as transfers. The travel agency then remits the individual payments to each travel provider. eNett’s core offering is a VAN payment solution that automatically generates unique MasterCard numbers used to process payments globally. Before eNett, travel payments were primarily settled in cash and exposed payers to risks of fraud, delays and costly reconciliations. The Virtual Account Number (“VAN”) solution is integrated into all of our point of sale systems and exclusively utilizes the MasterCard network pursuant to a long-term agreement. eNett’s operations currently focus on Asia Pacific and Europe, and we believe the model is highly scalable. We have expanded beyond the core hospitality sector into air travel, including LCCs, with further opportunities for growth in other sectors of the travel industry. eNett was formed in 2009, and eNett’s net revenue has grown from $2 million in 2011 to $67 million in 2014.

In addition to hospitality and payments, we utilize the broad connections and extensive data managed by our Travel Commerce Platform to provide advertising solutions to approximately 5,000 advertisers that allow our travel providers to easily and cost-effectively promote upgrades, ancillary products or services, package deals and other offers. We also offer other platform services, including subscription services, processing services, business intelligence data services and marketing-oriented analytical tools, to travel agencies, travel providers and other travel data users.

We provide IT solutions to airlines, such as pricing, shopping, ticketing, ground handling and other services, enabling them to focus on their core business competencies and reduce costs. We also host and manage reservations, inventory management and other related systems for Delta Air Lines Inc. (“Delta”) and in May 2014, we signed a new long-term agreement to continue to run the system infrastructure for the Delta Air Lines platform in our Atlanta data center. In addition, we own a 51% controlling interest in IGT Solutions Private Ltd. (“InterGlobe”), a Gurgaon, India-based company that provides application development services. We use InterGlobe to perform software development in support of our products and services. Using offshore and onshore human resources, InterGlobe augments our software development staff and manages project-specific development tasks. InterGlobe also provides application development services in the same service delivery model to other customers in the travel industry. We refer to these solutions and services as “Technology Services.”

As travel providers increase their focus on distribution and merchandising, we do not believe that a travel provider’s choice of distribution and merchandising services are affected in any meaningful way by their choice of hosting solutions. For example, based on our distribution capabilities, we believe we have the largest share of bookings in Australia and the United Kingdom even though we do not provide any hosting solutions in those countries.

We believe we are the most geographically balanced participant in the travel distribution industry. In 2014, we generated $2,031 million in Travel Commerce Platform revenue, of which 68% is international (with 20% from Asia Pacific, 30% from Europe, 4% from Latin America and Canada and 14% from the Middle East and Africa) and 32% is from the United States, closely mirroring the total GDS-processed air segments globally. Our geographically dispersed footprint helps insulate us from particular country or regional instability, allows for optimal IT efficiency and enhances our value proposition to travel providers. We are well positioned to capture higher value business from travel providers operating in away markets, which results in higher per transaction

5

revenue for both us and the travel providers we serve. As of December 31, 2014, we served over 170 countries through our extensive global network of approximately 60 sales and marketing offices, or SMOs, and a diverse workforce of approximately 3,400 full-time employees and an additional 1,100 employees at InterGlobe.

We have a recurring, primarily transaction-based, revenue model. As an asset-light company, we do not take airline, hotel or other inventory risk, and we are not directly exposed to fuel price volatility or labor unions like our travel providers. Our recurring, transaction-based revenue model is primarily driven by discrete travel events such as Air or Beyond Air segments booked rather than the price of the booking, meaning we benefit from an increase in total global travel without being exposed to price changes. However, our results, like others in our industry, are dependent upon various levels of travel activity, particularly air travel as well as our ability to obtain travel provider inventories, our ability to maintain existing relationships with travel agencies and our ability to deliver desired products and services.

Our ability to offer broad, high-quality and multi-product content on a single user interface encourages those booking travel to purchase additional products and services beyond the original Air or Beyond segment. For example, for every 100 air tickets sold in 2014, 43 hospitality segments were sold, which has grown from 34 hospitality segments sold for every 100 air tickets sold in 2010. The merchandising of additional products and services increases our revenue per transaction, and, consequently, we measure performance primarily on the basis of increases in both Reported Segments and RevPas. We place limited reliance and emphasis on traditional publicly reported air booking share metrics as they do not appropriately reflect the profitability of our expanded Travel Commerce Platform. Our recurring, transaction-based revenue model combined with high-quality content availability (which encourages incremental services booked with each transaction), our investment in our distribution and payment solutions technology and our multi-year contracts with travel providers and travel agents have enabled us to grow our RevPas in each of the last 12 quarters on a year-over-year basis. We increased our RevPas from $5.11 in the first quarter of 2011 to $5.78 in the fourth quarter of 2014. We grew Reported Segments from 347 million in 2012 to 356 million in 2014.

Our management team, led by industry veteran Gordon Wilson, our Chief Executive Officer since June 2011, spearheaded a shift in our corporate strategy to focus on the trends, inefficiencies and unmet needs of all components of the travel value chain and defined a new five-year strategy to transform our business from a traditional GDS to a next generation travel commerce platform. Our strategy is built on five pillars: unrivalled content, empowered selling, transforming payments, open platform and new business frontiers. Since refocusing our strategy in 2012, we have experienced revenue growth from airline fees, hospitality, advertising and payments and launched our air merchandising platform. We grew our Beyond Air revenue by 14% between 2012 and 2013 and 14% between 2013 and 2014. As a result, we delivered year-over-year quarterly improvements in key business metrics, such as RevPas, over the last 12 consecutive quarters and Reported Segments for the last 7 consecutive quarters (excluding the loss of segments relating to the hosting contract from United Airlines following its merger with Continental Airlines). We also addressed legacy contracts by stabilizing our business from the 2012 loss of a contract with United Airlines following its merger with Continental Airlines, entering into a new long-term contract in February 2014 with Orbitz Worldwide and restructuring and extending our Technology Services relationship with Delta Air Lines in May 2014.

We have historically generated strong cash flows on a consistent basis with Adjusted EBITDA margins of 25.1%, 24.9% and 24.7% for the years ended December 31, 2014, 2013 and 2012, respectively (See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a discussion of Adjusted EBITDA). Drivers of our cash flows benefit from relatively modest capital expenditure requirements and attractive working capital dynamics. Furthermore, the diversity of our business provides us with multiple independent revenue streams from various markets and channels that lessen the impact of potential strategic and geographic shifts within the industry. These characteristics, combined with the contractual nature of our revenue and costs, our leading industry position and our long-standing customer relationships provide for a strong and predictable stream of cash flows.

For the years ended December 31, 2014 and 2013, we recorded net revenue of $2,148 million and $2,076 million, respectively, net income (loss) of $91 million and $(203) million, respectively, and Adjusted EBITDA of

6

$540 million and $517 million, respectively, reflecting a 4.2% net income margin and a 9.8% net loss margin and a 25.1% and 24.9% Adjusted EBITDA margin, respectively. As of December 31, 2014 we had total indebtedness of approximately $2.4 billion.

Company History

In 2006, we were acquired by affiliates of The Blackstone Group (“Blackstone”), affiliates of Technology Crossover Ventures and certain existing and former members of our management. One Equity Partners acquired an economic interest in us in December 2006. In 2007, we expanded and diversified our geographic and commercial footprint by acquiring Worldspan.

In 2013, we completed a comprehensive refinancing plan that extended our debt maturities and simplified our capital structure.

During 2014, we completed several deleveraging transactions and a debt refinancing. Further, on September 30, 2014, we completed our initial public offering, and our common shares are currently traded on the New York Stock Exchange under the symbol “TVPT.”

We were incorporated in 2006 in Bermuda. Our principal executive offices are located at Axis One, Axis Park, Langley, Berkshire SL3 8AG, United Kingdom and our telephone number is +44-1753-288-000.

We continually explore, prepare for and evaluate possible transactions, including acquisitions, divestitures, joint ventures and other arrangements, to ensure we have the most efficient and effective capital structure and/or to maximize the value of the enterprise. No assurance can be given with respect to the timing, likelihood or effect of any possible transactions.

Our Competitive Strengths

We believe that several aspects of our strategy fundamentally differentiate us from our competitors, including our focus on redefining travel distribution and commerce instead of investing in more capital and labor intensive airline and hospitality related IT solutions, our fast growing Beyond Air portfolio, including our automated B2B payments solution with a large addressable market and our emphasis on a value-based partnership approach with travel providers that allows us to increase revenue and profitability per Reported Segment. The following attributes describe in further detail how we differentiate ourselves from our competitors.

Our Travel Commerce Platform Addresses the Evolving Needs of Travel Providers, Agencies, Corporations and Travelers

Travel providers need flexible systems to distribute and merchandise their increasingly sophisticated core products and broadening offerings of ancillary products and services. We offer them a portfolio of industry-leading, value-add tools to increase revenue, lower costs and efficiently reach travel buyers globally in every channel. Our global reach allows travel providers to display and sell products in over 170 countries and across over 67,000 travel agency locations representing 259,000 online and offline travel agency terminals worldwide. Our Travel Commerce Platform enables travel providers to (i) extend their distribution by broadening their geographic reach to away markets and connects them with higher value business travelers, (ii) access higher yielding ticket prices from long-haul segments, room rates, complex itineraries and business travelers and (iii) encourage travelers to purchase ancillary services and/or upgrade or upsell travelers through our highly-differentiated Travelport Merchandising Platform.

Our Travelport Merchandising Platform, consisting of three distinct solutions—Travelport Aggregated Shopping, Travelport Ancillary Services and Travelport Rich Content and Branding—offers a range of sophisticated travel sales and marketing capabilities in collaboration with airlines. These solutions allow airlines to promote their products and services to the right buyers, at the right time and in the right place. Travelport Aggregated Shopping allows travel agencies to efficiently and directly compare results from traditional carriers,

7

who deliver data through the traditional industry standard ATPCO, which regularly updates traditional GDSs, with those from LCCs and other carriers who use an API connection to deliver data directly and in real time to us. Travelport Ancillary Services allows travel agencies to sell airline ancillaries, such as checked baggage, premium seats and lounge passes, directly through their existing interface rather than needing to book separately on an airline’s website. Travelport Rich Content and Branding allows airlines to more effectively control how their flights and ancillaries are visually presented and described on travel agency screens, bringing the display more in line with the airlines’ own website. This is especially valuable to airlines given the increasing importance of ancillary revenue for profitability. Our ability to help travel providers and travel agencies increase their revenue reinforces the value proposition of our Travel Commerce Platform when compared to alternative distribution channels, and is a key part of our strategy to change our relationship with travel providers from cost-focused to value-focused.

Our leading access to global travel provider content helps attract more travel buyers onto our platform, which in turn drives greater value for the travel providers, increasing their addressable customer base. Our leading point of sale solutions, such Travelport Smartpoint, Universal Desktop and Travelport Mobile Agent, along with Travelport Rich Content and Branding, provide travel agencies with greater choice and detailed information on key differences between the products and services offered by travel providers, allowing them to provide more valuable insights to their customers, higher levels of customer service and improved sales productivity. Utilization of our Travel Commerce Platform simplifies highly complex, high volume operations, freeing up more time for travel agencies to focus on the selling process. In addition, our Travel Commerce Platform reduces operating costs for travel agencies by offering a single point of access to broad global travel content and by integrating critical data for back office, accounting and corporate customer reporting. Furthermore, our Travel Commerce Platform gives travelers a quick and easy way to compare a multitude of available travel options and obtain the true cost of a desired itinerary, buy ancillaries directly after the core booking has been made and provides greater control over itineraries through an option to add features at later stages in the travel process.

Fast Growing Portfolio of Beyond Air Initiatives

Our Travel Commerce Platform provides us with a foundation to offer a fast growing portfolio of additional products and services, which in turn results in additional revenue. Our Beyond Air portfolio includes distribution and merchandising solutions for hotel, car rental, rail, cruise-line and tour operators, payment solutions, advertising and other platform services.

We offer the largest inventory of hotel properties on any travel platform in the world via our innovative distribution and merchandising solutions for both chain and independent hotels. Independent hotels were largely unaddressed by the GDS industry, which we integrate on one platform by combining the content from chain hotels captured by the traditional GDSs with independent hotel content our system accesses through our meta-search technology. In particular, our B2B solution, Travelport Rooms and More, is a single user interface that combines detailed product insights with meta-search functionality to deliver a fully-integrated hotel booking platform to travel agencies. Travelport Rooms and More captures highly fragmented content in one interface (including over 650,000 hotel properties) by combining content from large global Online Travel Agents (“OTAs”) with that from aggregators specializing in a particular geographic area. This streamlined and efficient interface also enables travel agencies to more easily upsell hotel content in a single, consistent and efficient workflow and user experience.

We are an early adopter in automated B2B payments and are redefining payments from travel agencies to travel providers. We have pioneered a new class of payments for the unmet needs of the travel industry that is focused on replacing cash and other payment methods with secure virtual pre-funded payment cards. eNett’s innovative, cost-efficient and secure travel payment solutions offer a strong value proposition to travel agencies and travel providers, including full flexibility, elimination of credit or bankruptcy risk, lower administrative cost due to significantly reduced time spent on reconciliation, rewards to travel agencies with incentive payments

8

based on payment volumes and a lower spread for foreign currency payments. eNett exclusively utilizes MasterCard under a long-term agreement for card issuance, giving unparalleled access to the payment systems of virtually all the world’s travel providers who accept MasterCard as a form of payment. We believe the model is highly scalable as we expand beyond the core hospitality sector into air travel, including LCCs, as well as other sectors of the travel industry. We estimate that there is over $2 trillion of direct spending on travel annually, $810 billion of which is booked through the indirect channel, and payment is made from travel agencies to travel providers.

In addition to hospitality and payments, we utilize the broad connections and extensive data managed by our Travel Commerce Platform to provide advertising solutions to approximately 5,000 advertisers, which includes, among others, travel providers who use our advertising solutions to easily and cost-effectively promote upgrades, ancillary products or services, package deals and other offers and, as a result, more effectively merchandise their products and services to targeted customers. We give advertisers direct access to a captive professional audience across over 67,000 travel agency locations representing 259,000 online and offline travel agency terminals worldwide, with a full-time focus on global travel bookings and cover all main domestic and international travel flows. Our improved, graphically rich point of sale solutions provide increased capabilities and advertising space to display banner advertisements, add click through functionality and market ancillary products through our user interface.

Innovative, Flexible and Scalable Open Technology Platform Tailored to Meet Evolving Industry Needs

Through our industry-leading technology platform, we have been able to maintain our position at the forefront of innovation by meeting the global demands of our travel agents and travel providers for speed, flexibility and convergence. Our technology-enabled solutions offer rich content through accessible distribution channels, such as Travelport Smartpoint and Travelport Mobile Agent. To address unmet industry needs, we made significant strategic investments in innovative technology over the last three years, and we continue to invest in developing new technologies, platforms and ideas, all on an open and accessible platform that delivers expansive content and improves service. Our open connectivity approach allows for fully-flexible access to content and services across a range of delivery mechanisms, from XML protocols to more traditional industry sources such as ATPCO. Our open platform allows us to pull together content delivered from multiple sources into a cohesive display for the travel buyer, enabling search, comparison, reservation and payment across multiple providers. We deliver our content and functionality through state-of-the-art point of sale tools or via our own uAPI, which enables the flexibility for travel agencies and intermediaries to design customized user interfaces. A broad network of over 800 developers utilize our uAPI, create their own applications and increase the robustness of our systems. Our point of sale tools are device agnostic, allowing travel agents to access our platform via internet connection on a desktop or a variety of mobile devices, such as smartphones and tablets. In 2014, our systems processed up to 3 billion travel related system messages per day with 240 millisecond peak transaction frequency, over 9 billion API calls per month with 99.991% core system uptime using approximately 9,900 physical and virtual servers and had total storage capacity of over 13 petabytes. We operate our own in-house data center, which is another source of competitive advantage.

In recognition of the advantages provided by our open platform, we were the first among our competitors to offer Delta Air Lines’ full range of seating products. In addition, starting in 2013, we offered Travelport Aggregated Shopping through XML connectivity to airline content, which has enabled and encouraged leading LCCs such as AirAsia, EasyJet and Ryanair to join our fully integrated Travel Commerce Platform. In 2013, we launched an innovative Air Merchandising Platform to enhance user experience and focus on the sale of ancillary products and services, which are becoming increasingly important for airlines’ profitability. In the hospitality industry, we were the first GDS to our knowledge to offer a one-stop portal for hotel content distribution powered by “meta-search” technology.

9

Resilient, Recurring, Transaction-based Business Model with High Revenue Visibility

Our operations are primarily founded on a transaction-based business model that ties our revenue to travel providers’ transaction volumes rather than the price paid by a consumer for airfare, hotel rooms or other travel products and services booked through our systems. Travel related businesses with volume-based revenue models have generally shown strong visibility, predictability and resilience across economic cycles because travel providers have historically sought to maintain traveler volumes by reducing prices in an economic downturn.

In general, our business is characterized by multi-year travel provider and travel agency contracts. Our standard distribution agreements with travel providers are open-ended or rollover unless specifically terminated. In 2014, we had 38 planned airline contract renewals, and we successfully renewed all such contracts. We currently have 60 and 48 planned airline contract renewals in 2015 and 2016, respectively, including contracts which rollover on an annual basis. We also enter into contracts with travel buyers, such as travel agencies and corporate travel departments. A meaningful portion of our travel buyer agreements, representing approximately 17% of our revenue on average, are up for renewal in any given year. We did not lose any material travel buyer contract in the last three years. The length of our contracts, as well as the transaction-based and recurring nature of our revenue, provides high revenue visibility going forward.

Balanced Global Footprint with Long-standing Relationships

We believe we are the most geographically balanced participant in the travel distribution industry. In 2014, we generated $2,031 million in Travel Commerce Platform revenue, of which 68% is international (with 20% from Asia Pacific, 30% from Europe, 4% from Latin America and Canada and 14% from the Middle East and Africa), and 32% is from the United States, closely mirroring the total GDS-processed air segments globally. Our geographically dispersed footprint helps insulate us from particular country or regional instability, allows for optimal IT efficiency and enhances our value proposition to travel providers. We are well positioned to capture higher value business from travel providers operating in away markets, which results in higher per transaction revenue for both us and the travel providers we serve. This strategically diversified geographic footprint allows us to focus on higher value transactions in the international travel segment. Our balanced network positions us well to benefit from global industry growth, while lessening the impact of potential geographic shifts within the industry. Our footprint also positions us as the challenger to the industry leader for air segments processed in each geographic region and provides us opportunities to grow our share.

We also have highly diversified, strong, long-standing relationships with both our travel providers and travel buyers. None of our travel buyers or travel providers accounted for more than 10% of our revenue for the year ended December 31, 2014. Our top 15 travel providers (by 2014 revenue) have been with us for more than ten years on average.

Proven and Motivated Management Team with Deep Travel Industry Expertise

Our management team has over 100 years of combined travel industry experience and is committed to improving and maintaining operational excellence by utilizing their extensive knowledge of the travel and technology industries. Their dedication and excellence has been demonstrated by improving our key business metrics and our recent capital structure improvements. Our management team’s compensation structure directly incentivizes them to improve business performance and profitability. Members of management currently own approximately 2.75% of our outstanding common shares (approximately 6% on a fully diluted basis assuming the vesting of existing equity awards).

Our management team is supported by a skilled, diverse, motivated and global workforce, comprised of approximately 3,400 full-time employees and an additional 1,100 employees at InterGlobe as of December 31, 2014. By investing in training, skills development and rotation programs for our employees, we seek to develop leaders with broad knowledge of our company, the industry, technology and customer-specific needs. We also hire externally as needed to bring in new expertise. Our combination of deep industry and company experience combined with the fresh perspective and insight of new hires across our management team creates a solid foundation for driving our business to success, profitability and industry leadership.

10

Our Growth Strategies

We believe we are well positioned for future growth. Our balanced geographic footprint aligns us with anticipated industry growth across geographies, and we expect trends such as the increasing importance of ancillary revenue, the need by travel providers to personalize their offers to travelers, expansion by LCCs into the business travel industry, continued penetration by GDSs into hospitality distribution and growth of B2B travel advertising to further underpin our growth. We continue to leverage our domain expertise and relationships with travel providers to grow eNett. We will continue to evaluate and pursue strategic acquisition opportunities that enhance our Travel Commerce Platform. Our recent strategic capital investments, current product portfolio and strategic positioning enable us to benefit from industry trends, and we intend to capitalize further on these industry trends by focusing on the following initiatives:

Driving Beyond Air Innovation and Growth

Our Beyond Air portfolio includes fast growing hotel distribution, advertising and payment solutions. Given growth rates and the underpenetrated nature of these three areas, we believe we can grow our Beyond Air portfolio at a multiple to overall travel industry growth by continuing to strategically invest in the development of state-of-the-art capabilities in order to achieve a leading industry position.

Payments: Our strategy for eNett is to continue growing the scale of the business through further investment in operational capabilities, sales and marketing and targeted geographic expansion. We plan to capitalize on our early adopter advantage to capture “white space” given the travel industry’s previously unmet needs for a secure and efficient payment solution. Our Travel Commerce Platform allows us to leverage our extensive network of travel agencies to grow the penetration rate for eNett payments.

Hospitality: Through our leading meta-search capabilities, we are increasing our presence among independent hotels and have the largest inventory of hotel properties on any travel platform in the world. In addition, we provide superior chain hotel content to OTAs relative to our competitors by providing direct XML connectivity. Our strategy to grow in hospitality distribution is also focused on delivering corporate access to aggregated hotel content, including both chain and independent hotels through a single point of sale.

Advertising: Our strategy is to focus on the B2B advertising opportunity by targeting travel agencies. Hotel advertising will remain our core offering, but other advertising categories (especially air) also represent areas for growth, which we believe we are well positioned to capitalize on through our Travel Commerce Platform.

Expand Air Platform

We are well positioned in the high-value, complex segment of air travel distribution, which is characterized by its larger number of business travelers, complex itineraries and international bookings. Our strategy to grow our Air platform focuses on providing state-of-the-art solutions to address the changing manner in which airlines are positioning and selling their products and services.

To achieve these objectives, we developed, and in April 2013, we launched, our Air Merchandising Platform that offers Rich Content and Branding capabilities and integrates XML content with traditional content in a graphically rich, single user interface. This allows for more flexible and effective distribution and merchandising of both core travel content and ancillary products and services, results in a higher value proposition for both network carriers and LCCs and allows travel agencies to upsell more content efficiently. We are also able to offer eNett payment capabilities to our travel buyers.

We intend to focus on the following strategies to drive Air growth:

Growth through Retailing and Merchandising Capabilities: In order to address the growing importance for travel providers of flexible systems to distribute and merchandise their increasingly sophisticated core products and broadening offerings of ancillary products, we have heavily invested in our Travelport Merchandising

11

Platform to more effectively market and sell products and services. We have signed numerous airlines to our Rich Content and Branding solution and will continue to target additional airlines with this solution. In addition, increasing the sale of ancillaries through our platform not only results in additional transaction revenue, but also helps us attract new content from carriers. We intend to continuously invest in our retailing and ancillary merchandising capabilities and grow by partnering with both traditional carriers and LCCs.

LCC Participation Growth: As LCCs continue to evolve and look for further growth opportunities, they seek to expand their offering to higher yield customers, mainly business travelers. Our access to business travelers, merchandising capabilities and ability to process complex itineraries have attracted and allowed for the full integration of several fast-growing LCCs such as AirAsia, EasyJet and Ryanair into our Travel Commerce Platform. We view the expansion of LCCs into the business travel segment as a significant growth opportunity for us, and we will continue building our offering to win their business.

Targeted Geographic Expansion: Because the ability to increase away segments provides more revenue to airlines, away segments attract a premium to home segments, a dynamic that will benefit our performance as this trend continues. Furthermore, due to our balanced global footprint, we are well placed to benefit from global airline capacity shifts and increased LCC participation. We will continue to grow our international business and will focus on expanding into new emerging regions such as Africa, Latin America and Eastern Europe.

Business Travel Growth: Our strategy to grow in the business travel space is focused on investing in products that distribute travel technology solutions directly to corporations, allowing them to easily access and book travel content that incorporates their travel management policies directly through our platform.

Focus on Distribution Technology Leadership and Differentiated Products

Achieving growth in our Travel Commerce Platform is predicated on our continued investment in developing advanced technologies and differentiated products to maintain our competitive position. We intend to continue our strong commitment to product innovation and technological excellence to maintain our state-of-the-art product portfolio and preserve our early adopter advantage in several key growth areas, such as the sale of ancillaries, B2B travel payments, hospitality merchandising and advertising. We plan to continue offering rich travel content and empowered selling capabilities on an open platform with service oriented architecture and industry leading uAPI, and plan to continue to focus on developing a diverse application set to consistently increase the value of our Travel Commerce Platform to our customers. We are exploring new adjacencies, such as big data, which allow us to improve our products and data offerings to our customers and develop insights into travel behaviors. We have chosen not to focus our resources on more capital and labor intensive airline and hospitality related IT solutions. Instead, we focus on distribution products and payment related solutions. Our ability to offer differentiated, high value products and services allows us to shift the focus of our dialogue with travel providers from price to value, leading to higher RevPas.

Travel Providers

Our relationships with travel providers extend to airlines, hotels, car rental companies, rail networks, cruise-line and tour operators. Travel providers are offered varying levels of services and functionality at which they can participate in our Travel Commerce Platform. These levels of functionality generally depend upon the travel provider’s preference as well as the type of communications and real-time access allowed with respect to the particular travel provider’s host reservations and other systems.

We provide air distribution services to approximately 400 airlines globally, including approximately 100 LCCs. We distribute ancillaries for approximately 40 airlines. We have relationships with approximately 330 hotel chains, representing approximately 100,000 hotel properties, which provide us with live availability and instant confirmation for bookings, in addition to approximately 20 hotel aggregators resulting in an aggregate

12

of over 650,000 hotel properties bookable through Travelport Rooms and More, which, based on our internal estimates, is the largest inventory of hotel properties on any travel platform in the world. In addition, we serve over 35,000 car rental locations, 61 cruise-lines and tour operators and 12 major rail networks worldwide.

The table below lists alphabetically our largest airline providers in the regions presented for the year ended December 31, 2014, based on revenue:

| | | | | | | | |

Asia Pacific | | Europe | | Latin America and

Canada | | Middle East and

Africa | | United States |

Jet Airways | | Aeroflot Airlines | | Air Canada | | Emirates Airlines | | American Airlines |

Malaysian Airlines | | Alitalia Airlines | | American Airlines | | Ethiopian Airlines | | Delta Air Lines |

Qantas Airways | | British Airways/Iberia | | Avianca Airways | | Qatar Airways | | Frontier Airlines |

Singapore Airlines | | Emirates Airlines | | United Airlines | | South African Airways | | United Airlines |

Virgin Australia Airlines | | Lufthansa Airlines | | WestJet | | Turkish Airlines | | US Airways |

The majority of our agreements remain in effect each year, with exceptions usually linked to airline mergers or insolvencies. In 2014, we had 38 planned airline contract renewals, and we successfully renewed all such contracts. We currently have 60 and 48 planned airline contract renewals in 2015 and 2016, respectively, including contracts which roll on an annual basis. Our top fifteen travel providers as measured by revenue for the year ended December 31, 2014, all of which are airlines, have been customers on average for more than ten years. For the year ended December 31, 2014, our top ten travel providers represented approximately 30% of revenue and no single provider accounted for more than 10% of revenue.

We have entered into a number of specific-term agreements with airlines across the globe to secure all of the airline’s public content. These content agreements allow our travel agency customers to have access to the full range of our airline providers’ public content, including the ability to book the last available seat, as well as other functionalities. We have secured full-content or distribution parity agreements with approximately 110 airlines, including LCCs. Revenue attributable to these agreements comprised 64% of Air revenue in the year ended December 31, 2014. Certain full-content agreements expire, or may be terminated, during 2015. For example, though we have participation agreements with these airline providers in which they participate in our Travel Commerce Platform, full-content or distribution parity agreements with airlines representing approximately 27% of our Travel Commerce Platform revenue for the year ended December 31, 2014 are up for renewal or are potentially terminable by such carriers in 2015.

We have approximately 100 airlines that we classify as LCCs participating in our Travel Commerce Platform around the world, including Ryanair, easyJet and AirAsia. Our revenue from LCCs increased by 12% for the year ended December 31, 2014, in contrast to a 1% increase in revenue attributable to network carriers compared to the prior year.

Our top hotel providers for the year ended December 31, 2014 were Hilton, Intercontinental Hotels Group and Marriott Hotels.

Our top five car rental company providers by brand for the year ended December 31, 2014 were Avis, Dollar, Enterprise, Hertz and National. We provide electronic ticket distribution to 12 major international and national rail networks, including Société Nationale des Chemins de Fer France (SNCF) (France), Amtrak (United States), Eurostar Group (United Kingdom/France) and AccessRail (United States).

Travel Agencies

Over 67,000 travel agency locations representing 259,000 online and offline travel agency terminals worldwide use us for travel information, booking and ticketing capabilities, travel purchases, workflow automation and management tools for travel information and travel agency operations. Access to our Travel

13

Commerce Platform enables travel agencies to electronically search travel related data such as schedules, availability, services and prices offered by travel providers and to book travel for end customers.

Our Travel Commerce Platform also facilitates travel agencies’ internal business processes such as quality control, operations and financial information management. Increasingly, this includes the integration of products and services from independent parties that complement our core product and service offerings, including a wide array of mid- and back-office service providers. We also provide technical support, training and other assistance to travel agencies, including numerous customized access options, productivity tools, automation, training and customer support focusing on process automation, back-office efficiency, aggregation of content at the desktop and online booking solutions.

Our relationships with travel agencies typically are non-exclusive, meaning they subscribe to and have the ability to use more than one GDS but may require a substantial portion to be booked through our Travel Commerce Platform. We pay travel agencies a commission for segments booked on our Travel Commerce Platform and, in order to encourage greater use of our Travel Commerce Platform, we may pay an increased commissions based on negotiated segment volume thresholds. Travel agencies or other customers in some cases pay a fee for access to our GDS or to access specific services or travel content. Our travel agency customers comprise online, offline, corporate and leisure travel agencies. Our largest online travel agency customers, by revenue, in 2014 were Orbitz Worldwide (which includes orbitz.com and cheaptickets.com in the United States and ebookers.com in Europe), Priceline and Expedia. In the year ended December 31, 2014, approximately 20% of our revenue was derived from OTAs and management estimates that the remaining revenue is split evenly between leisure and business. Our largest business travel agency customers in 2014 were American Express, BCD Holdings, Carlson Wagonlit Travel, Flight Centre Limited and Hogg Robinson Group. Our largest leisure travel agency customers in 2014 include AAA Travel, Carlson Leisure Group and GTT Global/USA Gateway. For the year ended December 31, 2014, our top ten travel agency customers represented approximately 30% of revenue and no single travel agency customer accounted for more than 10% of revenue. Travel agency contracts representing approximately 22%, 12%, 22% and 44% of 2014 revenue are up for renewal in 2015, 2016, 2017 and beyond, respectively.

Competition

Travel Commerce Platform

The marketplace for travel distribution is large, multi-faceted and highly competitive. We compete with a number of travel distributors, including:

| | • | | traditional GDSs, such as Abacus, Amadeus and Sabre; |

| | • | | local distribution systems that are primarily owned by airlines or governmental entities and operated predominately in their home countries, including TravelSky in China, Axess and Infini in Japan, Topas in South Korea and Sirena Travel in Russia; |

| | • | | travel providers that use direct distribution, including through the use of travel provider websites and mobile applications; |

| | • | | corporate booking tools, including Concur Technologies, GetThere, Deem, KDS, eTravel and Egencia (although most corporate booking tools interface with a GDS to access the content and functionality offered by the GDS); and |

| | • | | other participants, including Kayak, TripAdvisor, Yahoo! and Google, which have launched business-to-consumer travel search tools (although bookings are often fulfilled through a GDS) that connect travelers with direct distribution channels and OTAs. |

14

While many of the products and services offered by non-GDSs offer some of the functionality and integration provided by our Travel Commerce Platform, we believe none of them offer the full functionality and integration we offer, including serving the end consumer who desires to explore all booking options. Among industry participants with a traditional GDS, we believe our Travel Commerce Platform differentiates us from our competitors. We believe that competition in the industry is based on the following criteria:

| | • | | the timeliness, reliability and scope of travel inventory and related content; |

| | • | | service, reliability and ease of use of the system; |

| | • | | the number and size of travel agencies and the fees charged by a GDS and incentives and loyalty payments made to travel agencies; |

| | • | | travel provider participation levels, inventory and the transaction fees charged to travel providers; |

| | • | | the range of products and services available to travel providers and travel agencies; and |

| | • | | geographical reach, consistency of data and content, cross border capabilities and end traveler and corporation servicing. |

According to Market Information Data Transfer (“MIDT”), for the years ended December 31, 2014 and 2013, we accounted for 26% of global GDS-sold air segments, with a distribution mirroring the global distribution of GDS air segments.

Payment Solutions

While we believe eNett is redefining payments from travel agencies to travel providers, there are currently multiple ways to settle travel payments from travel agencies to travel providers. Traditional methods of settling travel payments include:

| | • | | consumer cards, corporate cards, lodge cards and bank-issued VANs; and |

| | • | | wire transfers and Electronic Funds Transfer (“EFTs”). |

Technology Services

The technology services sector of the travel industry is highly fragmented by service offering, including hosting solutions, such as internal reservation system services, as well as flight operations technology services and software development services. For example, sector participants include Amadeus, HP Enterprise Services, Navitaire LLC, Sabre, SITA and Google, as well as airlines that provide the services and support for their own internal reservation system services and also host external airlines.

Sales and Marketing

Our Sales and Marketing Organizations (“SMOs”) and National Distribution Companies (“NDCs”) are organized by country or region and are typically divided between the new account teams, which seek to add new travel agencies to our Travel Commerce Platform, and account management teams, which service and expand existing business. In certain regions, smaller customers are managed by telemarketing teams. Our SMOs are wholly-owned and represented approximately 82% of our Travel Commerce Platform revenue in 2014. We continue to utilize NDCs in certain regions where our appointed distributor either provides specialized expertise in the technology or the countries in which they operate for us. These NDCs are typically located in regions where airlines continue to exert strong influence over travel agencies or where the NDC has specialized expertise in the local region or country. We also contract with new NDCs in countries and regions where doing so would be more cost-effective than establishing an SMO. Our top ten NDCs generated approximately 11% of revenue in 2014 and no single NDC accounted for more than 5% of revenue.

15

We have a dedicated organization for hospitality, which covers sales, marketing, product and application development. eNett operates independently, but works closely with the Travel Commerce Platform SMOs to realize cross-sale opportunities.

Technology

Achieving growth for our Travel Commerce Platform is predicated on our continued investment in developing advanced technologies and differentiated products to maintain our competitive position. We intend to continue our commitment to product innovation and technological excellence to maintain our product portfolio and preserve our early adopter advantage in several key growth areas, such as the sale of ancillaries, B2B travel payments, hospitality merchandising and advertising. We plan to continue offering rich travel content on an open platform with service oriented architecture and an industry leading uAPI, and are also focused on developing a diverse application set to consistently keep increasing value of our Travel Commerce Platform to our customers. We are exploring new adjacencies, such as big data, which allow us to improve our products and data offerings to our customers and develop insights into travel behaviors. We have chosen not to focus our resources on more capital and labor intensive airline and hospitality related IT solutions. Instead, we focus on distribution products, payment related solutions and technology services. For example, starting in 2013, we offered Travelport Aggregated Shopping through XML connectivity to airline content, which has enabled and encouraged leading LCCs such as AirAsia, easyJet, Ryanair and Spirit Airlines to join our fully integrated Travel Commerce Platform, and have focused on providing superior chain hotel content to OTAs relative to our competitors by directly connecting via XML to key hotel chains. Our ability to offer differentiated, high value products and services allows us to shift the focus of our dialogue with travel providers from price to value, leading to higher revenue per transaction. Our Travel Commerce Platform includes three GDS systems—Travelport, Galileo and Worldspan.

We support our operations from a single data center location in Atlanta, Georgia that we operate. We believe that our data center is a state-of-the-art facility, one that has completed comprehensive technology upgrades to current processing and storage platforms. The combined facility features a technology platform that we believe leads the industry in terms of functionality, performance, reliability and security. The existing systems are certified compliant with the Payment Card Industry Data Security Standard, offering a secure environment for operations and have historically operated at a 99.991% core systems uptime. In 2014, our systems processed approximately 1 trillion transactions, up to 3 billion travel related system messages per day on an average transaction speed of 240 milliseconds and over 9 billion API calls per month. Our data center uses approximately 9,900 physical and virtual servers and has total storage capacity of over 13 petabytes. In the data center environment, our customers benefit from access to one of the industry’s most powerful, reliable and responsive travel distribution and hosting platforms. Continued modernization of our technical environment is an integral part of our aim to support growth by efficiently delivering distribution systems to our customers.

Intellectual Property

We regard our technology and other intellectual property as critical components and assets of our business. We protect our intellectual property rights through a combination of copyright, trademark and patent laws, and trade secret and confidentiality laws and procedures, as well as database rights, where applicable. We own and seek protection of key technology and business processes and rely on trade secret and copyright laws to protect proprietary software and processes. We also use confidentiality procedures and non-disclosure and other contractual provisions to protect our intellectual property assets. We rely on appropriate laws to protect the ownership of our data and databases.

Where appropriate, we seek statutory and common law protection of our material trade and service marks. The laws of some foreign jurisdictions, however, vary and offer less protection than other jurisdictions for our proprietary rights. Unauthorized use of our intellectual property could have a material adverse effect on us, and there is no assurance that our legal remedies would adequately compensate us for the damages caused by such unauthorized use.

16

We rely on technology that we license or obtain from third parties to operate our business. Vendors that support our core GDS technology include IBM, CA, Inc., SAS Group, Inc., Cisco Systems, Inc., EMC Corporation and Red Hat, Inc. Certain agreements with these vendors are subject to renewal or negotiation within the next year. In 2010, we obtained licenses to our Transaction Processing Facility operating system from IBM. Associated maintenance, support and capacity are available through December 31, 2016 under an agreement with IBM, and we expect such services will continue to be available to us after December 31, 2016.

Employees

As of December 31, 2014, we had approximately 3,400 full-time employees and an additional 1,100 employees at InterGlobe. None of our employees in the United States are subject to collective bargaining agreements governing employment with us. In certain of the European countries in which we operate, we are subject to, and comply with, local law requirements in relation to the establishment of work councils. In addition, due to our presence across Europe and pursuant to an E.U. Directive, we have a Travelport European Works Council in which we address E.U. and enterprise-wide issues. We believe that our employee relations are good.

Seasonality

Our business experiences seasonal fluctuations, reflecting seasonal demand trends for the products and services we offer. These trends generally cause our revenue to be higher in the first and second quarters as compared to the third and fourth quarters of the calendar year. Revenue typically peaks during these times as travelers plan and book their upcoming spring and summer travel.

Government Regulation

In the countries in which we operate, we are subject to or affected by international, federal, state and local laws, regulations and policies, including anti-bribery rules, trade sanctions, data privacy requirements, labor laws and anti-competition regulations, which are constantly subject to change. In addition, certain government trade sanctions affect our ability to operate in Cuba, Iran, Sudan, Syria and Ukraine. The descriptions of the laws, regulations and policies that follow are summaries and should be read in conjunction with the texts of the laws and regulations. The descriptions do not purport to describe all present and proposed laws, regulations and policies that affect our businesses.

We believe that we are in material compliance with these laws, regulations and policies. Although we cannot predict the effect of changes to the existing laws, regulations and policies or of the proposed laws, regulations and policies that are described below, we are not aware of proposed changes or proposed new laws, regulations and policies that will have a material adverse effect on our business.

Industry Regulations

Our business is subject to GDS industry specific regulations, including in the E.U., Canada, India and China, and eNett operates in the highly regulated financial services industry.

Historically, regulations were adopted in the E.U. and Canada to guarantee consumers access to competitive information by Computer Reservation Systems (“CRSs”) (then owned by individual airlines) and to provide travel agencies with unbiased displays and rankings of flights. Under the current E.U. CRS Regulations, GDSs and airlines are free to negotiate booking fees charged by GDSs and the information content provided by the airlines. The E.U. CRS Regulations include provisions to ensure a neutral and non-discriminatory presentation of travel options in the GDS displays and to prohibit the identification of travel agencies in MIDT data without their consent. The E.U. CRS Regulations also require GDSs to display rail or rail/air alternatives to air travel on the first screen of their principal displays in certain circumstances. In addition, to prevent parent carriers of GDSs from hindering competition from other GDSs, parent carriers will continue to be required to provide other GDSs with the same information on their transport services and to accept bookings from another GDS.

17

There are also GDS regulations in Canada, under the regulatory authority of the Canadian Department of Transport. Under the present regulations, Air Canada, the principal Canadian airline, could choose distribution channels that it owns and controls or distribution through another GDS rather than through our Travel Commerce Platform.

Although all GDS regulations in the United States (which only covered airline distribution) expired as of July 2004, the U.S. Department of Transportation, or DOT, retains the jurisdiction to regulate GDSs if they engage in “unfair or deceptive” practices relating to airfare price listings. To date, the DOT has not intervened in relation to our Travel Commerce Platform activities in the United States, but has provided industry guidance regarding, among other things, any biasing of air carrier GDS displays. On May 21, 2014, the DOT proposed rules requiring airlines and ticket agents to disclose fees for basic ancillary information associated with airline tickets. The proposed rules contain two alternative proposals, one of which would require carriers to disclose fee information to all ticket agents, including GDSs, and another alternative that would exclude GDSs.

In 2010, new Civil Aviation Requirements were issued by the Government of India to regulate CRSs operating in India for the purpose of displaying or selling air services, to promote fair competition in the airline sector and to ensure that consumers do not receive inaccurate or misleading information on airline services.

On October 1, 2012, the Interim Regulations on Administering the Permit of Direct Access to and Use of Foreign Computer Reservation System by Foreign Airlines’ Agents in China were published by the Civil Aviation Administration of China, or CAAC, and became effective on that date. The key element of the new regulations is the introduction of a permit scheme whereby foreign airlines are able to apply to CAAC for approval to allow Chinese-based travel agencies to access their nominated foreign CRS provider’s system for the purpose of making international bookings.

Because eNett operates an innovative payment solution, the regulatory environment for eNett products and services is not clearly defined and varies from country to country. In November 2013, eNett was granted a financial services license in Australia by the Australian Securities and Investments Commission. eNett had previously provided its eNett VAN solution pursuant to a sub-license from an Australian payments processor. In the European Union, eNett partners with regulated entities to limit its obligation to be regulated as a financial services provider with regard to its management of client funds. In jurisdictions where eNett’s operations are regulated, the regulations generally require licensing, insurance, systems and controls, client identification checks, and/or compliance staffing. Any violation of these regulatory requirements could compromise licenses and lead to financial penalties, imposed changes to systems and controls, closer monitoring, and detailed regulatory reviews.

We are also subject to regulations affecting issues such as international trade.

Privacy and Data Protection Regulations

Privacy regulations continue to evolve and on occasion may be inconsistent from one jurisdiction to another. Many states in the United States have introduced legislation or enacted laws and regulations that provide for penalties for failure to notify customers when security is breached, even by third parties.

Many countries have enacted or are considering legislation to regulate the protection of private information of consumers. In the United States, significant legislation is pending at the state and federal level. We cannot predict whether any of the proposed privacy legislation currently pending will be enacted and what effect, if any, it would have on our business.

A primary source of privacy regulations to which our operations are subject is the E.U. Data Protection Directive 95/46/EC of the European Parliament and Council (October 24, 1995), or the E.U. Data Protection Directive. Pursuant to this Directive, individual countries within the E.U. have specific regulations related to the

18

trans-border dataflow of personal information (i.e., sending personal information from one country to another). The E.U. Data Protection Directive requires companies doing business in E.U. member states to comply with its standards. It provides for, among other things, specific regulations requiring all non-E.U. countries doing business with E.U. member states to provide adequate data privacy protection when processing personal data from any of the E.U. member states. The E.U. has enabled several means for U.S.-based companies to comply with the E.U. Data Protection Directive, including a voluntary safe-harbor arrangement and a set of standard form contractual clauses for the transfer of personal data outside of Europe. We most recently completed self-certification for our GDS data processing under this safe-harbor arrangement on February 12, 2014. In January 2012, the European Commission issued a draft data protection regulation intended to replace this Directive, and we are monitoring developments in this rulemaking.

We are also subject to the U.S.-E.U. Safe Harbor Framework, or the Safe-Harbor, which provides a method for U.S. companies to transfer personal data outside the E.U. in a way that is consistent with the E.U. Data Protection Directive. To join the Safe-Harbor, we were required to self-certify to the U.S. Department of Commerce that we comply with E.U. standards. The Federal Trade Commission has enforcement authority over entities participating in the Safe-Harbor.

The CRS Regulations in force in Europe also incorporate personal data protection provisions that, among other things, classify GDSs as data controllers under the E.U. Data Protection Directive. The data protection provisions contained in the CRS Regulations are complementary to E.U. national and international data protection and privacy laws.

Many other countries have adopted data protection regimes. An example is Canada’s Personal Information and Protection of Electronic Documents Act, or PIPEDA. PIPEDA provides Canadian residents with privacy protections with regard to transactions with businesses and organizations in the private sector. PIPEDA recognizes the need of organizations to collect, use and share personal information and establishes rules for handling personal information.

Russia has recently enacted a data localization law that will require all personal data of Russian citizens to be stored and processed in Russia, effective on September 1, 2015. This law conflicts with our operational practice of aggregating and processing data at a central site. We are coordinating our response with other affected businesses.

Iran Sanctions Disclosure

As part of our global business in the travel industry, we provide certain passenger travel related Travel Commerce Platform and Technology Services to Iran Air. We also provide certain Technology Services to Iran Air Tours. All of these services are either exempt from applicable sanctions prohibitions pursuant to a statutory exemption permitting transactions ordinarily incident to travel or, to the extent not otherwise exempt, specifically licensed by the U.S. Office of Foreign Assets Control. Subject to any changes in the exempt/licensed status of such activities, we intend to continue these business activities, which are directly related to and promote the arrangement of travel for individuals.