UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the SEC Only (as permitted byRule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to§240.14a-12

LORILLARD, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

| þ | No fee required. |

| |

| o | Fee computed on table below per Exchange ActRules 14a-6(i)(4) and0-11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: |

| | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | (4) | Proposed maximum aggregate value of transaction: |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | |

| | (2) | Form, Schedule or Registration Statement No.: |

April 8, 2009

Dear Fellow Shareholder:

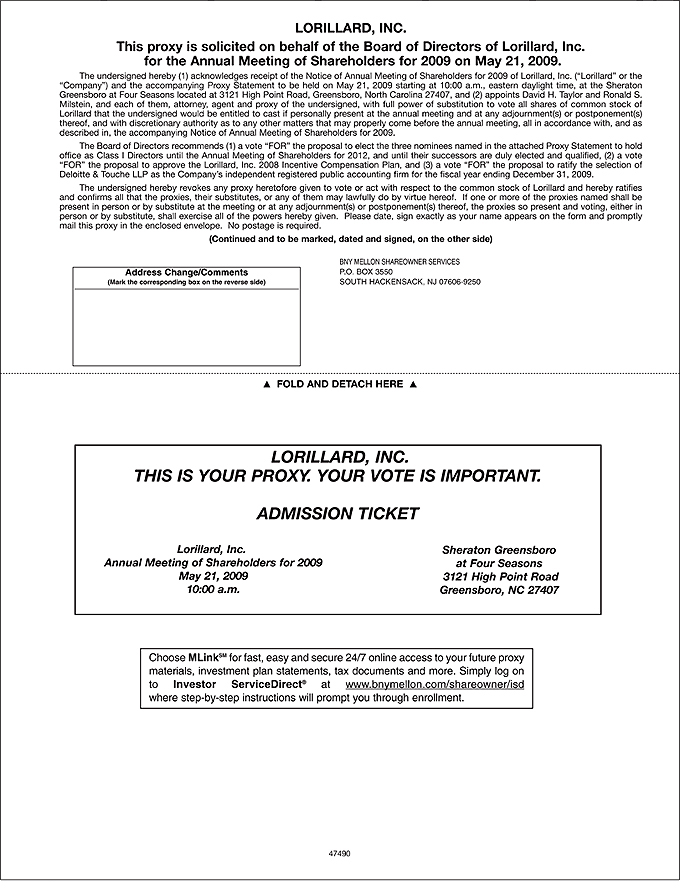

You are cordially invited to attend the Annual Meeting of Shareholders for 2009 (the “Annual Meeting”) of Lorillard, Inc. (the “Company”), which will be held at the Sheraton Greensboro at Four Seasons located at 3121 High Point Road, Greensboro, North Carolina 27407, on May 21, 2009 at 10:00 a.m., eastern daylight time.

At the Annual Meeting, shareholders will be asked to elect the three nominees named in the attached proxy statement to hold office as Class I Directors until the Annual Meeting of Shareholders for 2012, to approve the Lorillard, Inc. 2008 Incentive Compensation Plan, to ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2009 and to transact such other business as may properly come before the meeting. The accompanying Notice of Annual Meeting and Proxy Statement describe in more detail the business to be conducted at the Annual Meeting and provide other information concerning the Company of which you should be aware when you vote your shares. Also enclosed is a copy of the Company’s Annual Report onForm 10-K for the year ended December 31, 2008.

Admission to the Annual Meeting will be by ticket only. If you are a registered shareholder planning to attend the meeting, please check the appropriate box on the proxy card and retain the bottom portion of the card as your admission ticket. If your shares are held through an intermediary, such as a bank or broker, please follow the instructions under the “About the Annual Meeting of Shareholders” section of the Proxy Statement to obtain a ticket.

Your participation in the Company’s Annual Meeting is important, regardless of the number of shares you own. In order to ensure that your shares are represented at the Annual Meeting, whether you plan to attend or not, please vote in accordance with the enclosed instructions. As a shareholder of record, you can vote your shares by telephone, electronically via the Internet or by submitting the enclosed proxy card. If you vote using the proxy card, you must sign, date and mail the proxy card in the enclosed envelope. If you decide to attend the Annual Meeting and wish to modify your vote, you may revoke your proxy and vote in person at the meeting.

The Board of Directors appreciates your time and attention in reviewing the accompanying Proxy Statement. Thank you for your interest in Lorillard, Inc. We look forward to seeing you at the meeting.

Sincerely,

Martin L. Orlowsky

Chairman, President and CEO

[This Page Intentionally Left Blank]

LORILLARD, INC.

714 Green Valley Road

Greensboro, North Carolina 27408

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS FOR 2009

To Be Held on May 21, 2009

To Our Shareholders:

The Annual Meeting of Shareholders of Lorillard, Inc. (the “Company”) for 2009 will be held at the Sheraton Greensboro at Four Seasons located at 3121 High Point Road, Greensboro, North Carolina 27407, on May 21, 2009 at 10:00 a.m., eastern daylight time (the “Annual Meeting”), to consider and vote upon the following matters:

1. To elect the three nominees named in the attached proxy statement to hold office as Class I Directors until the Annual Meeting of Shareholders for 2012, and until their successors are duly elected and qualified;

2. To approve the Lorillard, Inc. 2008 Incentive Compensation Plan;

3. To ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2009; and

4. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The Board of Directors has fixed the close of business on March 30, 2009 as the record date for the Annual Meeting. Only shareholders of record as of the record date are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

By Order of the Board of Directors

Ronald S. Milstein

Senior Vice President, Legal and External Affairs,

General Counsel and Secretary

April 8, 2009

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS FOR 2009 TO BE HELD ON MAY 21, 2009. THE PROXY STATEMENT FOR THE ANNUAL MEETING AND THE COMPANY’S ANNUAL REPORT ONFORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2008, BOTH OF WHICH ARE PROVIDED HEREWITH, ARE ALSO AVAILABLE AThttp://investors.lorillard.com/phoenix.zhtml?c=134955&p=irol-proxy.

PLEASE VOTE YOUR SHARES IN ACCORDANCE WITH THE INSTRUCTIONS PROVIDED IN THE PROXY STATEMENT. IF VOTING USING THE ENCLOSED PROXY CARD, PLEASE MARK, SIGN, DATE AND PROMPTLY RETURN THE PROXY IN THE ADDRESSED REPLY ENVELOPE WHICH IS FURNISHED FOR YOUR CONVENIENCE. THE ENVELOPE NEEDS NO POSTAGE IF MAILED WITHIN THE UNITED STATES.

TABLE OF CONTENTS

| | | | | |

| | | 1 | |

| | | 5 | |

| | | 7 | |

| | | 7 | |

| | | 8 | |

| | | 8 | |

| | | 10 | |

| | | 12 | |

| | | 13 | |

| | | 14 | |

| | | 14 | |

| | | 38 | |

| | | 39 | |

| | | 45 | |

| | | 45 | |

| | | 46 | |

| | | 47 | |

| | | 47 | |

| | | 48 | |

| | | A-1 | |

| | | B-1 | |

LORILLARD, INC.

714 Green Valley Road

Greensboro, North Carolina 27408

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 21, 2009

ABOUT THE ANNUAL MEETING OF SHAREHOLDERS

Who is soliciting my vote?

The Board of Directors of Lorillard, Inc., a Delaware corporation (“we,” “our,” “us,” “Lorillard” or the “Company”), is soliciting your vote at our Annual Meeting of Shareholders for 2009, and any adjournment or postponement thereof (the “Annual Meeting”), to be held on the date at the time and place, and for the purposes set forth in the accompanying notice. This Proxy Statement and appendix, the accompanying notice of annual meeting, the enclosed proxy card and our Annual Report onForm 10-K for the year ended December 31, 2008 (the “2008 Annual Report”) filed with the Securities and Exchange Commission (“SEC”) on March 2, 2009 are being mailed to shareholders on or about April 8, 2009.

What is the purpose of the Annual Meeting?

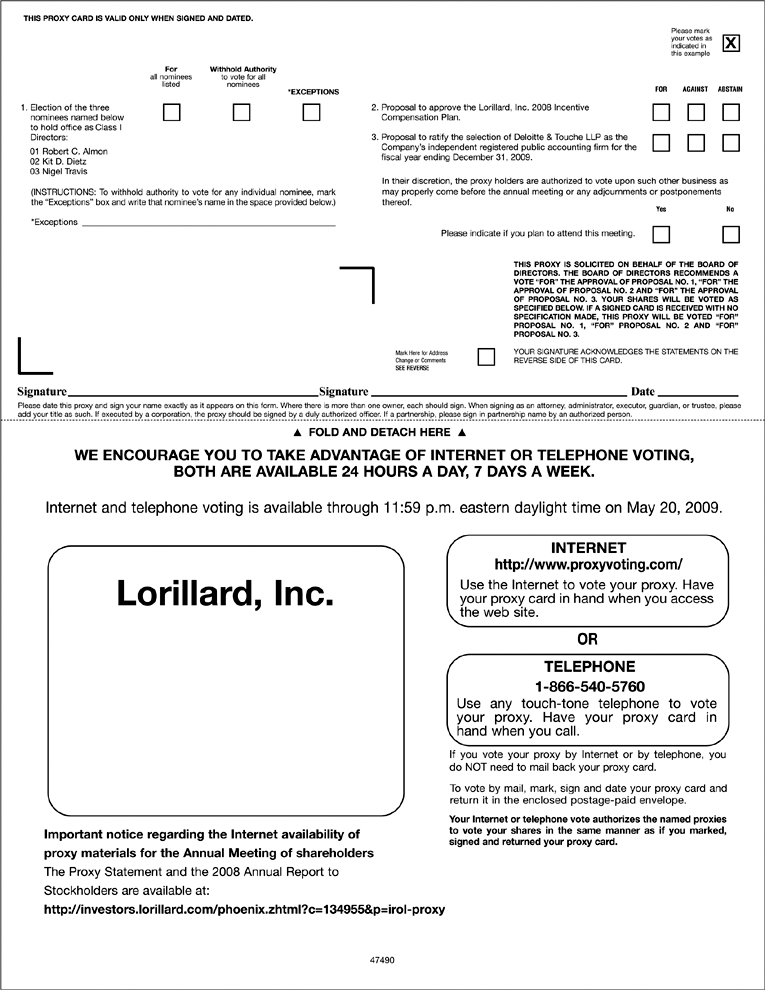

At the Annual Meeting, shareholders will act on the matters outlined in the accompanying notice. The only matters scheduled to be acted upon at the Annual Meeting are (1) the election of the three nominees named in this Proxy Statement to hold office as Class I Directors (see page 7 of this Proxy Statement), (2) the approval of the Lorillard, Inc. 2008 Incentive Compensation Plan (see page 39 of this Proxy Statement) and (3) the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2009 (see page 45 of this Proxy Statement).

Who can attend the Annual Meeting?

Only shareholders of record as of March 30, 2009 (the “Record Date”), or their duly appointed proxies, may attend the Annual Meeting. Registration and seating will begin at 9:00 a.m. Shareholders will be asked to present valid picture identification, such as a driver’s license or passport. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting.

Please note that if you hold your shares in “street name” (that is, through a broker or other nominee), you must bring either a copy of the voting instruction card provided by your broker or nominee or a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the Annual Meeting.

A list of shareholders entitled to vote at the Annual Meeting will be available for examination by any shareholder for any purpose germane to the Annual Meeting beginning ten days prior to the Annual Meeting during ordinary business hours at 714 Green Valley Road, Greensboro, North Carolina 27408, the Company’s principal place of business, and ending on the date of the Annual Meeting.

Do I need a ticket to attend the Annual Meeting?

Yes. Attendance at the Annual Meeting will be limited to shareholders as of the Record Date, their authorized representatives and our guests. Admission will be by ticket only. For registered shareholders, the bottom portion of the proxy card enclosed with the Proxy Statement is the Annual Meeting ticket. If you are a beneficial owner and hold your shares in “street name,” or through an intermediary, such as a bank or broker, you should request tickets in writing from Lorillard, Inc., Attention: Investor Relations, 714 Green Valley Road, Greensboro, North Carolina 27408, and include proof of ownership, such as a bank or brokerage firm account statement or letter from the broker, trustee, bank or nominee holding your stock, confirming your beneficial ownership. Shareholders who do not obtain tickets in advance may obtain them on the Annual Meeting date at the registration desk upon verifying their stock ownership as of the Record Date. In accordance with our security procedures, all persons attending the Annual

Meeting must present a picture identification along with their admission ticket or proof of beneficial ownership in order to gain admission. Admission to the Annual Meeting will be expedited if tickets are obtained in advance. Tickets may be issued to others at our discretion.

How many votes do I have?

You will have one vote for every share of our common stock, $0.01 par value, (“Common Stock”) you owned on the Record Date.

How many votes can be cast by all shareholders?

168,167,235 votes may be cast at the Annual Meeting, representing one vote for each share of our Common Stock that was outstanding on the Record Date. There is no cumulative voting, and the holders of our Common Stock vote together as a single class.

How many votes must be present to hold the Annual Meeting?

A majority of the outstanding shares of our Common Stock entitled to vote at the Annual Meeting must be present, in person or by proxy, to constitute a quorum at the Annual Meeting. Shareholders of record who are present at the Annual Meeting, in person or by proxy, and who abstain from voting, including brokers holding customers’ shares of record who cause abstentions to be recorded at the Annual Meeting, will be included in the number of shareholders present at the Annual Meeting for purposes of determining whether a quorum is present.

How many votes are required to elect Directors and adopt any other proposals?

Directors are elected by the affirmative vote of a plurality of the shares of our Common Stock cast at the Annual Meeting, in person or by proxy, and entitled to vote in the election of Directors. Under applicable Delaware law, in determining whether such nominees have received the requisite number of affirmative votes, abstentions and broker non-votes will not be counted and will have no effect on the outcome of the vote.

Approval of the Lorillard, Inc. 2008 Incentive Compensation Plan, ratification of the selection of our independent registered public accounting firm and generally all other matters that may come before the Annual Meeting require the affirmative vote of a majority of the shares of our Common Stock cast, in person or by proxy, and entitled to vote at the Annual Meeting. Under applicable Delaware law, in determining whether such proposals have received the requisite number of affirmative votes, abstentions will be counted and will have the same effect as a vote against each proposal. Broker non-votes will not be counted and will have no effect on the outcome of the voting for these matters.

What is a broker non-vote?

Generally, a broker non-vote occurs when shares held by a nominee for a beneficial owner are not voted with respect to a particular proposal because (i) the nominee has not received voting instructions from the beneficial owner and (ii) the nominee lacks discretionary voting power to vote such shares. Under the rules of the New York Stock Exchange, Inc. (the “NYSE”), a nominee does not have discretionary voting power with respect to“non-routine” matters.

How do I vote?

You can vote in person or by valid proxy received by telephone, via the Internet or by mail. If voting by mail, you must:

| | |

| | • | indicate your instructions on the proxy; |

| |

| | • | date and sign the proxy; |

| |

| | • | mail the proxy promptly in the enclosed envelope; and |

| |

| | • | allow sufficient time for the proxy to be received before the date of the Annual Meeting. |

2

Alternatively, in lieu of returning signed proxy cards, our shareholders of record can vote their shares by telephone or via the Internet. If you are a registered shareholder (that is, if you hold your stock in certificate form), you may vote by telephone or electronically through the Internet by following the instructions included with your proxy card. The deadline for voting by telephone or electronically through the Internet is 11:59 p.m., eastern daylight time, on May 20, 2009. If your shares are held in “street name” such as in a stock brokerage account or by a bank or other nominee, please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically through the Internet.

Can I change my vote?

Yes. A proxy may be revoked at any time prior to the voting at the Annual Meeting by submitting a later dated proxy (including a proxy by telephone or electronically through the Internet), by giving timely written notice of such revocation to our Corporate Secretary or by attending the Annual Meeting and voting in person. However, if you hold shares in “street name,” you may not vote these shares in person at the Annual Meeting unless you bring with you a legal proxy from the shareholder of record.

What if I do not vote for some of the matters listed on my proxy card?

Shares of our Common Stock represented by proxies received by us (whether through the return of the enclosed proxy card, by telephone or through the Internet), where the shareholder has specified his or her choice with respect to the proposals described in this Proxy Statement, including the election of Directors, approval of the adoption of the Lorillard, Inc. 2008 Incentive Compensation Plan and ratification of the selection of the independent registered public accounting firm, will be voted in accordance with the specification(s) so made.

If your proxy is properly executed but does not contain voting instructions, or if you vote by telephone or via the Internet without indicating how you want to vote, your shares will be voted:

| | |

| | • | “FOR”the election of the three nominees named in this Proxy Statement to hold office as Class I Directors. |

| |

| | • | “FOR”the approval of the Lorillard, Inc. 2008 Incentive Compensation Plan. |

| |

| | • | “FOR”the ratification of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2009. |

Could other matters be decided at the Annual Meeting?

The Board of Directors does not intend to bring any matter before the Annual Meeting other than those set forth above, and the Board is not aware of any matters that anyone else proposes to present for action at the Annual Meeting. However, if any other matters properly come before the Annual Meeting, the persons named in the enclosed proxy, or their duly constituted substitutes acting at the Annual Meeting, will be authorized to vote or otherwise act thereon in accordance with their judgment on such matters.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Our directors, officers and employees may solicit proxies on behalf of the Company in person or by telephone, facsimile or other electronic means. We have engaged Georgeson Shareholder Communications Inc. to assist us in the distribution and solicitation of proxies for a fee of $12,500 plus expenses. In accordance with the regulations of the SEC and the NYSE, we also reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to beneficial owners of our Common Stock as of the Record Date.

Has the Company adopted the newe-proxy rules for the delivery of the proxy materials?

No. We are delivering the proxy materials, including the 2008 Annual Report, the Proxy Statement and other materials, to all shareholders. We will evaluate whether to adopt the notice and access option under thee-proxy rules for delivery of proxy materials for future annual meetings.

3

How can I access the Company’s proxy materials and 2008 Annual Report electronically?

Copies of the 2008 Annual Report, the Proxy Statement and other materials filed by the Company with the SEC are available without charge to shareholders on our corporate website at www.lorillard.com or upon written request to Lorillard, Inc., Attention: Corporate Secretary, 714 Green Valley Road, Greensboro, North Carolina 27408. You can elect to receive future annual reports and proxy statements electronically by following the instructions provided if you vote via the Internet or by telephone.

What financial information is accompanying the Proxy Statement?

Accompanying the Proxy Statement is the 2008 Annual Report. The 2008 Annual Report includes our audited consolidated financial statements as of December 31, 2008 and 2007 and for the years ended December 31, 2008, 2007 and 2006. Based on the inherent uncertainties of our business, the historical financial information included in the 2008 Annual Report and selected financial data may not be indicative of what our results of operations and financial position will be in the future.

NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE OF THIS PROXY STATEMENT.

4

BOARD OF DIRECTORS

Our Board of Directors currently consists of eight members. Our charter divides our Board of Directors into three classes of directors having staggered terms, with one class being elected each year for a new three-year term and until their successors are elected and qualified. The term for Class I Directors expires at the annual meeting of our shareholders for 2009, the term for Class II Directors expires at the annual meeting of our shareholders for 2010 and the term for Class III Directors expires at the annual meeting of our shareholders for 2011. The following table sets forth certain information with respect to the members of our Board of Directors:

| | | | | | | | | | | |

| | | | | | | Term Expires

|

| | | | | | | at Annual

|

| | | | | | | Meeting Held

|

Name | | Age | | Position(s) | | for the Year |

| |

| Martin L. Orlowsky | | | 67 | | | Chairman of the Board of Directors, President and Chief Executive Officer | | | 2011 | |

| David H. Taylor | | | 53 | | | Director and Executive Vice President, Finance and Planning and Chief Financial Officer | | | 2010 | |

| Robert C. Almon | | | 57 | | | Director | | | 2009 | |

| Virgis W. Colbert | | | 69 | | | Director | | | 2010 | |

| David E.R. Dangoor | | | 59 | | | Director | | | 2011 | |

| Kit D. Dietz | | | 52 | | | Director | | | 2009 | |

| Richard W. Roedel | | | 59 | | | Director | | | 2010 | |

| Nigel Travis | | | 59 | | | Director | | | 2009 | |

Martin L. Orlowskyis a Director and the Chairman, President and Chief Executive Officer of Lorillard. He has served as President and Chief Executive Officer of Lorillard since January of 1999 and added the Chairman’s position in January 2001. Previously, he served as President and Chief Operating Officer and prior to this position he was Executive Vice President, Marketing and Sales. He has been with Lorillard since 1990.

David H. Tayloris a Director and the Executive Vice President, Finance and Planning and Chief Financial Officer of Lorillard. Mr. Taylor joined Lorillard and was elected to its Board of Directors in January 2008. Prior to joining Lorillard, Mr. Taylor was a Senior Managing Director with FTI Palladium Partners, a firm specializing in providing interim management services. In that capacity, he served as Interim Chief Financial Officer of Eddie Bauer Holdings, Inc. from January 2006 to November 2007. Prior to joining FTI Palladium Partners, from 2002 to 2005, Mr. Taylor served as Executive Vice President and Chief Financial Officer of Guilford Mills, Inc.

Robert C. Almonbecame a Director of Lorillard on November 4, 2008. Mr. Almon is a retired principal of Ernst & Young LLP. He joined Ernst & Young LLP in 1998 where he established and served as National Director of the Center for Strategic Transactions, a strategy consulting practice focused on enhancing shareholder value, and subsequently he served on Ernst & Young’s Partner Advisory Council. Prior to 1998, Mr. Almon was a Managing Director in Corporate Finance at Salomon Brothers (now Citigroup) and previously at Lehman Brothers. Before becoming an investment banker he held strategic and treasury positions with General Motors Corporation and General Motors Acceptance Corporation.

Virgis W. Colbertbecame a Director of Lorillard on July 8, 2008. Mr. Colbert is a Senior Advisor to the MillerCoors Brewing Company, where he worked from 1979 until December 2005, in a variety of roles, including Executive Vice President of worldwide operations. Mr. Colbert serves on the Board of Directors of Bank of America Corp., Sara Lee Corporation, The Stanley Works and The Manitowoc Company, Inc. During 2008, Mr. Colbert also served on the Board of Directors of Merrill Lynch & Co., Inc. prior to its acquisition by Bank of America Corporation. He is Chairman Emeritus of the Board for the Thurgood Marshall Scholarship Fund, former Chairman of the Board of Trustees for Fisk University, and a member of Omega Psi Phi Fraternity and the Boule’. He is a life member of the National Association for the Advancement of Colored People.

David E.R. Dangoorbecame a Director of Lorillard on July 8, 2008. Mr. Dangoor has been President of Innoventive Partners LLC, a firm providing consulting services in the fields of Marketing Strategy and Public Relations since 2003, and has served as a Managing Partner of the consulting firm Cato Dangoor & Associates, London, since 2002. Mr. Dangoor retired from Philip Morris in 2002 following more than 27 years in senior

5

executive positions, which included Head of Marketing, Philip Morris Germany; President, Philip Morris Canada; Senior Vice President of Marketing, Philip Morris USA, and Executive Vice President, Philip Morris International. Mr. Dangoor serves as a director of Lifetime Brands, Inc., ICP Solar Technologies, Inc.; Chairman of the Board of Directors of BioGaia AB; and a member of the Advisory Board of the Denihan Hospitality Group.

Kit D. Dietzbecame a Director of Lorillard on June 10, 2008. Mr. Dietz is the principal of Dietz Consulting LLC, a consulting firm founded in 2004 to provide consulting services for the convenience industry in the United States and Canada. In 2003, Mr. Dietz was a Senior Vice President with Willard Bishop Consulting LTD, which provides consulting services to companies in the food industry, including consumer packaged goods companies. In addition, Mr. Dietz has served on the Board of Directors of the American Wholesale Marketer’s Association, an international trade organization working on behalf of convenience distributors in the United States, and was the Chairman of its Industry Education Committee. Mr. Dietz continues to provide consulting services to the American Wholesale Marketer’s Association.

Richard W. Roedelbecame a Director of Lorillard on June 10, 2008. Mr. Roedel is currently a director and chairman of the audit committee for Sealy Corporation, Brightpoint, Inc., Luna Innovations Incorporated, and Broadview Networks, Inc. He is also a director and audit committee member for IHS, Inc. From 1985 through 2000, Mr. Roedel was employed by the accounting firm BDO Seidman LLP, the United States member firm of BDO International, as an Audit Partner, being promoted in 1990 to Managing Partner in Chicago, and then to Managing Partner in New York in 1994, and finally in 1999 to Chairman and Chief Executive. Mr. Roedel joined the Board of Directors of Take-Two Interactive Software, Inc., a publisher of video games, in November 2002 and served in various capacities with that company through June 2005 including Chairman and Chief Executive Officer. Mr. Roedel is a director of the Association of Audit Committee Members, Inc., a non-profit association of audit committee members dedicated to strengthening the audit committee by developing best practices. Mr. Roedel is a certified public accountant.

Nigel Travisbecame a Director of Lorillard on July 8, 2008. Mr. Travis is the Chief Executive Officer of Dunkin Brands, Inc., a position he has held since January 2009. Mr. Travis had been President and Chief Executive Officer of Papa John’s International, the world’s third largest pizza company since 2005, where he was responsible for running the company’s operations across 20 countries. Prior to this he was President and Chief Operating Officer of Blockbuster Inc. where he worked for ten years. He has also worked at Burger King Corporation as Managing Director of Europe, Middle East and Africa and held positions at Grand Metropolitan, Esso Petroleum, Kraft Foods and Rolls Royce.

Independence of the Board of Directors

Under the rules of the NYSE, our Board of Directors is required to affirmatively determine which directors are independent and to disclose such determination in the 2008 Annual Report and in the proxy statement for each annual meeting of shareholders going forward. On March 12, 2008, our Board of Directors reviewed each director’s relationships with us in conjunction with our Independence Standards for Directors (the “Independence Standards”), which were adopted at that time, and Section 303A of the NYSE’s Listed Company Manual (the “NYSE Listing Standards”). A copy of our Independence Standards is attached to this Proxy Statement as Appendix A and is available on our corporate website at www.lorillard.com under the heading “Investor Relations — Corporate Governance.” A copy of our Independence Standards is also available to shareholders upon request, addressed to the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408. At the meeting, the Board affirmatively determined that all non-executive directors — Messrs. Almon, Colbert, Dangoor, Dietz, Roedel and Travis — meet the categorical standards under the Independence Standards and are independent Directors under the NYSE Listing Standards.

In the course of its determination of the independence of each non-executive director, the Board of Directors considered Mr. Colbert’s service on the board of directors of Merrill Lynch & Co., Inc. during 2008. We entered into various investment arrangements, including repurchase agreements and money market funds, with Merrill Lynch during 2008. The interest rate and collateral requirements of these transactions were substantially the same as those prevailing at the time for comparable transactions, and the interest paid to the Company represented less than 0.1% of Merrill Lynch’s revenue for 2008. In addition, the Board of Directors considered Mr. Colbert’s service on the

6

board of directors of Bank of America Corporation following its acquisition of Merrill Lynch in January 2009. Pursuant to a Schedule 13G filing with the SEC, Bank of America held more than 5% of our Common Stock. Based on the nature of his position as a non-executive director of each company, our Board considered Mr. Colbert’s relationships with Merrill Lynch and Bank of America and determined that Mr. Colbert did not have a direct or indirect material interest in the relationships or transactions with these entities.

Our Board also determined that Messrs. Orlowsky and Taylor, who serve as executive officers of the Company, are not independent Directors. Accordingly, a majority of the members of our Board of Directors are independent as required by our Corporate Governance Guidelines.

PROPOSAL NO. 1 — ELECTION OF CLASS I DIRECTORS

The Board of Directors has nominated Messrs. Robert C. Almon, Kit D. Dietz and Nigel Travis to be elected at the Annual Meeting to serve as Class I directors for a three-year term ending at the annual meeting of shareholders for 2012 and until their successors are duly elected and qualified. Each of the nominees are currently incumbent directors of the Company. The terms of the remaining Class II and Class III directors expire at the annual meeting of shareholders for 2010 and 2011, respectively.

Each nominee has consented to being named in this Proxy Statement and to serve if elected. If, prior to the Annual Meeting, either nominee should become unavailable to serve, the shares of our Common Stock represented by a properly executed and returned proxy (whether through the return of the enclosed proxy card, by telephone or electronically through the Internet) will be voted for such additional person as shall be designated by the Board of Directors, unless the Board of Directors determines to reduce the number of directors in accordance with our amended and restated certificate of incorporation and amended and restated by-laws.

Directors shall be elected by the affirmative vote of a plurality of the shares of our Common Stock cast at the Annual Meeting, in person or by proxy, and entitled to vote in the election of directors; provided that a quorum is present. Pursuant to applicable Delaware law, in determining whether such nominees have received the requisite number of affirmative votes, abstentions and broker non-votes will have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH NOMINEE AS A CLASS I DIRECTOR. UNLESS MARKED TO THE CONTRARY, SIGNED PROXIES RECEIVED BY THE COMPANY WILL BE VOTED “FOR” THE ELECTION OF THE THREE NOMINEES LISTED ABOVE.

COMMITTEES OF THE BOARD

The Board of Directors has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee consisting of directors who have been affirmatively determined to be “independent” as defined in the NYSE Listing Standards. Each of these committees operates pursuant to a written charter approved by the Board of Directors and available on our corporate website at www.lorillard.com under the heading “Investor Relations — Corporate Governance.” A copy of each committee charter is also available to shareholders upon request, addressed to the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408.

Audit Committee

The Audit Committee assists our Board of Directors in the oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements, the qualifications and independence of our independent registered public accounting firm and the performance of our internal audit staff and our independent registered public accounting firm. In addition, the Audit Committee is responsible for oversight of our system of internal control over financial reporting and our enterprise risk management and has sole authority and responsibility to select, determine the compensation of, evaluate and, when appropriate, replace our independent registered public accounting firm. The Audit Committee is a separately-designated standing audit committee established in accordance with the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Audit Committee is comprised of Messrs. Roedel (Chair), Almon and Dangoor. At the time of our separation from Loews Corporation (“Loews”) on June 10, 2008 (the “Separation”), Messrs. Orlowsky and Taylor

7

were members of the Audit Committee as permitted by the transition period rules and regulations of the SEC and the NYSE and were replaced on July 8, 2008 and November 4, 2008 by Messrs. Dangoor and Almon, respectively. Each member of the Audit Committee is required to have the ability to read and understand fundamental financial statements. The Audit Committee is also required to have at least one member that qualifies as an “audit committee financial expert” as defined by the rules of the SEC. Our Board of Directors has determined that Mr. Roedel qualifies as an audit committee financial expert and that his simultaneous service on the audit committees of five public companies, in addition to us, does not impair his ability to effectively serve on our Audit Committee. Each member of the Audit Committee is a non-employee, independent director. During 2008, the Audit Committee met four times.

Compensation Committee

The Compensation Committee is responsible for annually reviewing and approving the corporate goals and objectives relevant to the compensation of the Chief Executive Officer and evaluating his or her performance in light of these goals; determining the compensation of our executive officers and other appropriate officers; reviewing and reporting to the Board of Directors on compensation of directors and board committee chairs; and administering our incentive and equity-based compensation plans. See “Executive Compensation” for additional information regarding the process for the determination and consideration of executive compensation. The Compensation Committee is comprised of Messrs. Colbert (Chair), Almon, Dietz and Travis. During 2008, the Compensation Committee met three times.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for identifying, evaluating and recommending nominees for our Board of Directors for each annual meeting (see “Nomination Process and Qualifications for Director Nominees” below); evaluating the composition, organization and governance of our Board of Directors and its committees and developing and recommending corporate governance principles and policies applicable to us. The Committee is comprised of Messrs. Dietz (Chair), Colbert and Roedel. At the time of the Separation, Messrs. Orlowsky and Taylor were members of the Nominating and Corporate Governance Committee as permitted by the transition period rules of the NYSE and were replaced on July 8, 2008 by Messrs. Roedel and Colbert, respectively. During 2008, the Nominating and Corporate Governance Committee met one time.

BOARD AND SHAREHOLDER MEETINGS

During 2008, our Board of Directors held four meetings and acted by unanimous written consent on one occasion. In addition, the standing committees of the Board of Directors held an aggregate of eight meetings in that period. In 2008, all incumbent directors attended at least 75% of the aggregate number of meetings of the Board of Directors and Committees of the Board of Directors on which they served. All directors are expected to attend each regularly scheduled Board of Directors meeting as well as each annual meeting of our shareholders (subject to limited exceptions). The Annual Meeting will be our first annual meeting of shareholders as a public company.

DIRECTOR COMPENSATION

The Compensation Committee is responsible for reviewing and recommending to the Board of Directors the compensation of our non-executive directors. Members of our Board of Directors who are also our officers or employees do not receive compensation for serving as a director (other than travel-related expenses for Board meetings held outside of our corporate offices). The following table sets forth the annual retainer and stipend compensation for non-executive directors:

| | | | | |

| | | Compensation |

| |

| Annual Non-Executive Director Cash Retainer | | $ | 100,000 | |

| Annual Non-Executive Director Equity Retainer | | | 100,000 | |

| Audit Committee Chair Stipend | | | 20,000 | |

| Compensation Committee Chair Stipend | | | 15,000 | |

| Nominating and Corporate Governance Committee Chair Stipend | | | 10,000 | |

8

The annual non-executive director cash retainer set forth in the table above is paid in $25,000 installments in the first week of each calendar quarter. The Audit, Compensation and Nominating and Corporate Governance Committees chair stipends are paid in full with the first quarterly installment of the annual non-executive director cash retainer for the calendar year. The annual non-executive director equity retainer is granted in the form of restricted stock annually on the date of the first regular meeting of the Board of Directors in each calendar year occurring after the public release of financial results for the prior year. The number of shares of restricted stock is determined by dividing the amount of the annual non-executive director equity retainer by the closing price of our Common Stock on the date of grant (rounding up to the nearest whole share). The restricted stock vests in full on the first anniversary of the date of grant if the director continues to serve as a director on such date (or on the earlier of the death or disability of such director). Messrs. Dietz and Roedel joined the Board on June 10, 2008; Messrs. Colbert, Dangoor and Travis joined the Board on July 8, 2008; and Mr. Almon joined the Board on November 4, 2008. During 2008, the directors received payment of the compensation described above on a pro rata basis to reflect the calendar quarter in which they joined the Board. These amounts were awarded by the Board of Directors at its meeting on or after each non-executive director joined the Board. We do not maintain a pension plan, incentive plan or deferred compensation arrangement for non-executive directors. Non-executive directors did not receive any other compensation for 2008.

Director Compensation Table

The following table sets forth the compensation paid to or earned by each non-executive director for 2008:

| | | | | | | | | | | | | |

| | | Fees

| | | | |

| | | Earned or

| | Stock

| | |

Non-Executive Director | | Paid in Cash(1) | | Awards(2) | | Total |

| |

| Robert C. Almon | | $ | 25,000 | | | $ | 25,007 | | | $ | 50,007 | |

| Virgis W. Colbert | | | 57,500 | | | | 50,028 | | | | 107,528 | |

| David E.R. Dangoor | | | 50,000 | | | | 50,028 | | | | 100,028 | |

| Kit D. Dietz | | | 55,000 | | | | 50,028 | | | | 105,028 | |

| Richard W. Roedel | | | 60,000 | | | | 50,028 | | | | 110,028 | |

| Nigel Travis | | | 50,000 | | | | 50,028 | | | | 100,028 | |

| | |

| (1) | | The fees include two quarterly retainer payments of $25,000 to Messrs. Colbert, Dangoor, Dietz, Roedel and Travis for the third and fourth quarters 2008. Mr. Almon received one quarterly retainer payment of $25,000 for the fourth quarter 2008. In addition, Messrs. Roedel, Colbert and Dietz received $10,000, $7,500 and $5,000, respectively, representing 50% of the annual committee chair stipends for their respective service as chairs of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee during 2008. |

| |

| (2) | | The amount shown reflects the accrued expense based on the grant date fair value of the restricted stock awarded to each non-executive director in 2008, calculated under FAS 123R using the closing price for our Common Stock on the date of grant. Messrs. Colbert, Dangoor, Dietz, Roedel and Travis each received a pro rated annual non-executive director equity retainer award of 728 shares of restricted stock on July 30, 2008. The closing price of our Common Stock was $68.72 on July 30, 2008. Mr. Almon received a pro rated annualnon-executive director equity retainer award of 417 shares of restricted stock on November 6, 2008. The closing price of our Common Stock was $59.97 on November 6, 2008. Each restricted stock grant vests in full on the first anniversary of the date of grant if the director continues to serve as a director on such date (or on the earlier of the death or disability of such director). As of December 31, 2008, the aggregate number of shares of restricted stock outstanding was 417 shares for Mr. Almon and 728 shares for each of Messrs. Colbert, Dangoor, Dietz, Roedel and Travis. Non-executive directors received payment of dividends on the restricted stock awarded for each dividend declared for all shareholders. During 2008, these dividend payments totaled $384 for Mr. Almon and $1,340 each for Messrs. Colbert, Dangoor, Dietz, Roedel and Travis. |

9

CORPORATE GOVERNANCE

Executive Sessions of Non-Executive Directors

Executive sessions of non-executive directors without management present are held regularly by the Board of Directors. In 2008, the non-executive directors met in executive session without management one time. Our Board of Directors has adopted a policy for the selection of the presiding director for such executive sessions, which provides that the chairs of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee each preside at the executive sessions of the non-executive directors of the Board of Directors on a rotating basis.

Corporate Governance Guidelines

The Board of Directors has adopted Corporate Governance Guidelines to assist the Board of Directors in monitoring the effectiveness of policy and decision making, both at the Board of Directors and management levels with a view to enhancing shareholder value over the long term. The Corporate Governance Guidelines outline, among other things, the following:

| | |

| | • | the composition of the Board of Directors, including director qualification standards; |

| |

| | • | the responsibilities of the Board of Directors, including access to management and independent advisors; |

| |

| | • | the process for interested parties to communicate with the Board of Directors; |

| |

| | • | the conduct of Board of Directors and committee meetings; |

| |

| | • | succession planning for our Chief Executive Officer; and |

| |

| | • | the process for evaluating the performance of and compensation for the Board of Directors and the Chief Executive Officer. |

Our Corporate Governance Guidelines are available on our corporate website at www.lorillard.com under the heading “Investor Relations — Corporate Governance.” A copy of our Corporate Governance Guidelines is also available to shareholders upon request, addressed to the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408.

Code of Business Conduct and Ethics

We are committed to maintaining high standards for honest and ethical conduct in all of our business dealings and complying with applicable laws, rules and regulations. In furtherance of this commitment, our Board of Directors promotes ethical behavior and has adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) that is applicable to all of our employees, including our directors and officers. The Code of Conduct provides, among other things:

| | |

| | • | guidelines with respect to ethical handling of possible conflicts of interest, corporate opportunities and protection of corporate assets; |

| |

| | • | standards for dealing with customers, suppliers, employees and competitors; |

| |

| | • | a requirement to comply with all applicable laws, rules and regulations, including but not limited to insider trading prohibitions; |

| |

| | • | standards for promoting full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by us; |

| |

| | • | reporting procedures promoting prompt internal communication of any suspected violations of the Code of Conduct to the appropriate person or persons; and |

| |

| | • | disciplinary measures for violations of the Code of Conduct. |

10

The Code of Conduct is available on our corporate website at www.lorillard.com under the heading “Investor Relations — Corporate Governance.” We will post any amendments to the Code of Conduct, or waivers of the provisions thereof, to our corporate website under the heading “Investor Relations — Corporate Governance.” A copy of the Code of Conduct is also available to shareholders upon request, addressed to the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408.

Nomination Process and Qualifications for Director Nominees

The Board of Directors has established certain procedures and criteria for the selection of nominees for election as a member of our Board of Directors. Pursuant to its charter, the Nominating and Corporate Governance Committee is responsible for screening candidates, for developing and recommending to the Board criteria for nominees and for recommending to the Board a slate of nominees for election to the Board at the annual meeting of shareholders. In recommending candidates, the committee may consider criteria it deems appropriate, including judgment, skill, diversity, experience with businesses and other organizations, the interplay of the candidate’s experience with the experience of the other directors and the extent to which the candidate would be a desirable addition to the Board of Directors.

Our amended and restated by-laws provide the procedure for shareholders to make director nominations either at any annual meeting of shareholders or at any special meeting of shareholders called for the purpose of electing directors. A shareholder who is both a shareholder of record on the date of notice as provided for in our amended and restated by-laws and on the record date for the determination of shareholders entitled to vote at such meeting and gives timely notice can nominate persons for election to our Board of Directors either at an annual meeting of shareholders or at any special meeting of shareholders called for the purpose of electing directors. The Nominating and Corporate Governance Committee considers all nominee candidates in its screening process. To be timely, the notice must be delivered to or mailed and received by the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408:

| | |

| | • | in the case of an annual meeting of shareholders, not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding annual meeting of shareholders; provided, however, that in the event that the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the shareholder must be so delivered not later than the close of business on the tenth day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure of the date of the annual meeting was made, whichever first occurs, and |

| |

| | • | in the case of a special meeting of shareholders called for the purpose of electing directors, not later than the close of business on the tenth day following the day on which notice of the date of the special meeting was mailed or public disclosure of the date of the special meeting was made, whichever first occurs. |

To be in proper written form, the shareholder’s notice to our Corporate Secretary must set forth (a) as to each person whom the shareholder proposes to nominate for election as a director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the person and (iv) any other information relating to the person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder; and (b) as to the shareholder giving the notice:

| | |

| | • | the name and record address of the shareholder; |

| |

| | • | the class or series and number of shares of our capital stock which are owned beneficially or of record by the shareholder; |

| |

| | • | a description of all arrangements or understandings between the shareholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by the shareholder; |

11

| | |

| | • | a representation that the shareholder intends to appear in person or by proxy at the meeting to nominate the person(s) named in its notice; and |

| |

| | • | any other information relating to the shareholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of Directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. |

In addition, the notice must be accompanied by a written consent of each proposed nominee to be named as a nominee and to serve as a director if elected.

Communication with Non-Executive Directors

In accordance with our Corporate Governance Guidelines, interested parties, including shareholders, may communicate with the Board of Directors, the non-executive directors as a group or any individual director by forwarding such communication to the attention of the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408. The Corporate Secretary shall forward all interested party communications to the appropriate members of the Board.

EXECUTIVE OFFICERS

Our executive officers are set forth in the table below. All executive officers are appointed by and serve at the pleasure of the Board of Directors. Messrs. Orlowsky, Taylor, Milstein, Hennighausen, Spell and Staab together are referred to as the “Named Executive Officers.”

| | | | | | | |

Name | | Age | | Position(s) |

| |

| Martin L. Orlowsky | | | 67 | | | Chairman, President and Chief Executive Officer |

| David H. Taylor | | | 53 | | | Executive Vice President, Finance and Planning and Chief Financial Officer |

| Randy B. Spell | | | 57 | | | Executive Vice President, Marketing and Sales |

| Ronald S. Milstein | | | 52 | | | Senior Vice President, Legal and External Affairs, General Counsel and Secretary |

| Charles E. Hennighausen | | | 54 | | | Executive Vice President, Production Operations |

| Thomas R. Staab | | | 66 | | | Senior Vice President, Finance and Chief Accounting Officer |

Randy B. Spellis the Executive Vice President, Marketing and Sales of Lorillard and has served in the same position with Lorillard since 1999. Previously, Mr. Spell served as Senior Vice President, Sales for four years and prior to that, as Vice President, Sales for one year. Mr. Spell has been with Lorillard since 1977.

Ronald S. Milsteinis the Senior Vice President, Legal and External Affairs, General Counsel and Secretary of Lorillard and has served in the same executive positions with Lorillard since 2005. Previously, Mr. Milstein served as Vice President, General Counsel, and Secretary for seven years. Mr. Milstein has been with Lorillard since 1996.

Charles E. Hennighausenis the Executive Vice President, Production Operations of Lorillard. Mr. Hennighausen has served in this position since he joined Lorillard in 2002.

Thomas R. Staabis the Senior Vice President, Finance and Chief Accounting Officer of Lorillard and has served in that position since 2008. Prior to 2008, he served as Senior Vice President and Chief Financial Officer since joining Lorillard in 1998.

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our outstanding Common Stock, as of March 30, 2009, by those persons who are known to us to be beneficial owners of 5% or more of our Common Stock, by each of our directors and Named Executive Officers and by our directors and executive officers as a group.

| | | | | | | |

| | | Shares

| | Percent of

|

| | | Beneficially

| | Common Stock

|

Name | | Owned(1) | | Outstanding(2) |

| |

| Principal Shareholders: | | | | | | |

| Bank of America Corporation(3) | | | 9,539,731 | | | 5.7% |

100 North Tryon Street, Floor 25

Bank of America Corporate Center

Charlotte, NC 28255 | | | | | | |

| Goldman Sachs Asset Management(4) | | | 8,599,385 | | | 5.1% |

32 Old Slip

New York, NY 10005 | | | | | | |

| Directors and Named Executive Officers: | | | | | | |

| Martin L. Orlowsky(5) | | | 105,393 | | | * |

| David H. Taylor(6) | | | 11,161 | | | * |

| Randy B. Spell(7) | | | 35,744 | | | * |

| Ronald S. Milstein(8) | | | 23,803 | | | * |

| Charles E. Hennighausen(9) | | | 23,828 | | | * |

| Thomas R. Staab(10) | | | 61,141 | | | * |

| Robert C. Almon(11) | | | 2,082 | | | * |

| Virgis W. Colbert(11) | | | 2,393 | | | * |

| David E.R. Dangoor(11) | | | 2,393 | | | * |

| Kit D. Dietz(11) | | | 2,393 | | | * |

| Richard W. Roedel(11) | | | 2,393 | | | * |

| Nigel Travis(11) | | | 2,393 | | | * |

| All Directors and Executive Officers as a Group (12 persons) | | | 275,117 | | | * |

| | |

| * | | Represents less than one percent. |

| |

| (1) | | Based upon information furnished to us by the respective shareholders or contained in filings made with the SEC. For purposes of this table, if a person has or shares voting or investment power with respect to any of our Common Stock, then such common stock is considered beneficially owned by that person under the SEC rules. Shares of our Common Stock beneficially owned include direct and indirect ownership of shares, restricted stock and stock options and stock appreciation rights which are vested or are expected to vest within 60 days of March 30, 2009. Unless otherwise indicated in the table, the address of all listed shareholders isc/o Lorillard, Inc., 714 Green Valley Road, Greensboro, North Carolina 27408. |

| |

| (2) | | Based upon 168,167,235 shares of our Common Stock outstanding as of March 30, 2009. Shares which vest or are expected to vest within 60 days of March 30, 2009 are deemed outstanding for the purpose of computing the percentage ownership for the named shareholder, director and executive officer. |

| |

| (3) | | Reflects beneficial ownership of shares of our Common Stock as reported in a Schedule 13G filed with the SEC by Bank of America Corporation on behalf of itself and its affiliates on February 12, 2009. |

| |

| (4) | | Reflects beneficial ownership of shares of our Common Stock as reported in a Schedule 13G filed with the SEC by Goldman Sachs Asset Management on behalf of itself and its affiliates on February 9, 2009. |

| |

| (5) | | Represents 6,564 shares of our Common Stock directly held by Mr. Orlowsky, 26,641 shares of restricted stock and exercisable options and/or stock appreciation rights to purchase 72,188 shares of our Common Stock. |

13

| | |

| (6) | | Represents 6,661 shares of restricted stock held by Mr. Taylor and exercisable options and/or stock appreciation rights to purchase 4,500 shares of our Common Stock. |

| |

| (7) | | Represents 1,500 shares of our Common Stock directly held by Mr. Spell, 4,996 shares of restricted stock and exercisable options and/or stock appreciation rights to purchase 29,248 shares of our Common Stock. |

| |

| (8) | | Represents 809 shares of our Common Stock directly held by Mr. Milstein, 4,996 shares of restricted stock and exercisable options and/or stock appreciation rights to purchase 17,998 shares of our Common Stock. |

| |

| (9) | | Represents 4,330 shares of restricted stock held by Mr. Hennighausen and exercisable options and/or stock appreciation rights to purchase 19,498 shares of our Common Stock. |

| |

| (10) | | Represents 5,000 shares of our Common Stock directly held by Mr. Staab, 3,331 shares of restricted stock and exercisable options and/or stock appreciation rights to purchase 52,810 shares of our Common Stock. |

| |

| (11) | | Represents restricted stock. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than ten percent of a registered class of our equity securities, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC and the NYSE. Executive officers, directors and greater than ten percent beneficial owners are required to furnish us with copies of all Forms 3, 4 and 5 they file. Based on our review of the copies of such forms we have received and written representations from such reporting persons, we believe that all of our executive officers and directors complied with all filing requirements applicable to them with respect to transactions during 2008.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

Prior to June 10, 2008, Lorillard was a wholly-owned subsidiary of Loews, a publicly traded company listed on the NYSE. From 2002 through June 2008, Loews had also issued a separate class of its common stock, referred to as the “Carolina Group Stock,” to track the economic performance of Loews’ 100% interest in us and certain liabilities, costs and expenses of Loews and us arising out of or related to tobacco or tobacco-related businesses. On June 10, 2008, we began operating as an independent, publicly traded company pursuant to the Separation with our Common Stock trading on the NYSE.

Prior to the Separation, our executive compensation program was administered by the Board of Directors of Lorillard Tobacco Company (the “LTC Board”), our wholly-owned subsidiary and the employer of our executive officers prior to the Separation, and the compensation committee of Loews with respect to equity awards of Carolina Group Stock. Following the Separation, our Compensation Committee was duly constituted and assumed responsibility for the administration of our executive compensation program, including equity awards of our Common Stock pursuant to the Lorillard, Inc. 2008 Incentive Compensation Plan (the “2008 Plan”). The Compensation Committee held its first meeting in July 2008.

Compensation Committee Oversight of Executive Compensation

The Compensation Committee of the Board of Directors is comprised of four independent, non-executive directors — Messrs. Colbert (Chair), Almon, Dietz and Travis — and is responsible for overseeing our executive compensation policies, including evaluating and approving the compensation of the Named Executive Officers as listed in the Summary Compensation Table below. The Board of Directors has adopted a Compensation Committee Charter that sets forth the purpose, composition, authority and responsibilities of the Compensation Committee. The Compensation Committee reviews and determines the base salary, annual and long-term incentive awards, equity awards and other compensation for each Named Executive Officer, including our Chief Executive Officer, and reviews our executive compensation policies. The Compensation Committee also has the authority to engage and retain executive compensation consultants to assist with such evaluations.

14

Executive Compensation Consultants

Towers Perrin, a nationally recognized executive compensation consulting firm, (“Towers Perrin” or the “Committee’s Compensation Consultant”) was retained during 2008 by the LTC Board prior to the Separation and the Compensation Committee after the Separation to assist with the evaluation of our executive compensation program. Towers Perrin analyzed and provided comparative executive compensation data and compensation program proposals to assist in evaluating and setting the compensation of the Named Executive Officers and the overall structure of our executive compensation policies. Towers Perrin also provided certain benefit plan services to the Company during 2008. The Compensation Committee reviewed the nature of the services provided and the fees paid and does not believe that these other services impaired Towers Perrin’s ability to provide the Compensation Committee with an independent perspective on executive compensation.

Role of Management in Executive Compensation Decisions

Generally, our Chief Executive Officer makes recommendations to the Compensation Committee relating to the compensation of the other Named Executive Officers. In addition, our Chief Executive Officer and Vice President of Human Resources provide input and make proposals regarding the design, operation, objectives and values of the various components of compensation in order to provide appropriate performance and retention incentives for key employees. These proposals may be initiated by the Chief Executive Officer or upon the request of the Compensation Committee and may reflect the advice and counsel of our executive compensation consultants.

Benchmarking

Our executive compensation program uses competitive peer group and survey information to assist in determining base salary, annual incentive compensation and stock-based award guidelines. The Compensation Committee considered this information on market practices, which was compiled by the Committee’s Compensation Consultant, along with factors such as internal equity, individual performance, promotion potential and retention risk in determining total direct compensation for our Named Executive Officers. Prior to the Separation in 2008, the LTC Board benchmarked our executive compensation against the compensation paid to executives at (i) a group of peer companies consisting of 24 food, beverage and tobacco companies (the “Peer Group”) and (ii) survey data for the food, beverage and tobacco industry (the “Survey Data”). The companies comprising the 2008 Peer Group are listed below.

| | | |

| • Altria Group, Inc. | | • H.J. Heinz Company |

| • Anheuser-Busch Companies Inc. | | • Hormel Foods Corp. |

| • Brown Forman Corp. | | • J.M. Smuckers Co. |

| • Campbell Soup Company | | • Kellogg Company |

| • Chiquita Brands International, Inc. | | • Kraft Foods, Inc. |

| • The Coca-Cola Company | | • Molson Coors Brewing Co. |

| • Coca-Cola Enterprises, Inc. | | • PepsiAmericas, Inc. |

| • ConAgra Foods, Inc. | | • PepsiCo, Inc. |

| • Constellation Brands, Inc. . | | • Reynolds American, Inc. |

| • Dean Foods Co. | | • Sara Lee Corp |

| • General Mills, Inc. . | | • Universal Corp. |

| • The Hershey Company | | • William Wrigley Jr. Co. |

Following the Separation, the Compensation Committee reviewed the Peer Group and Survey Data with the Committee’s Compensation Consultant and determined that it was appropriate. The Compensation Committee will periodically evaluate the appropriateness of the size and composition of the Peer Group with the assistance of the Committee’s Compensation Consultant. In 2008, the Committee’s Compensation Consultant provided executive pay practices information for the Peer Group and Survey Data in order to assist in the compensation evaluation. The Compensation Committee evaluated the base salary, annual incentive awards and stock-based awards and actual and target total compensation levels for the Peer Group and Survey Data, including the median and 75th percentile values for each compensation component, for comparison with that of our Named Executive Officers.

15

Executive Compensation Policy and Objectives

The objective of our executive compensation program is to attract and retain highly qualified senior executive officers and provide motivation to ensure a high level of performance in order to maximize shareholder value. To meet this objective, we established a compensation program for senior executive officers that combines base salary, cash incentives, stock-based awards and benefits. In establishing our executive compensation program, the Compensation Committee considered a number of factors, including:

| | |

| | • | the executive compensation programs and market practices of large, non-durable consumer goods companies; |

| |

| | • | Peer Group and Survey Data of executive compensation and other materials; |

| |

| | • | recommendations of external compensation and benefits consultants; and |

| |

| | • | our historical compensation practices. |

Our executive compensation program is designed to align executive compensation within the framework of the Company’s strategic objectives and is intended to motivate and reward executives, including the Named Executive Officers, for achieving the Company and individual performance objectives, which are established to further the Company’s short and long term goals. The Compensation Committee is responsible for reviewing and approving the compensation for our Named Executive Officers and stock equity awards for all eligible employees. The Compensation Committee does not rely upon a fixed formula or specific numerical criteria in determining each Named Executive Officer’s total compensation or the allocation of compensation among the various components of compensation described below. Moreover, we do not have a specific policy for the allocation of compensation between short-term and long-term compensation or cash and equity compensation. Rather, the Compensation Committee exercises its business judgment in determining total compensation based upon the following criteria:

| | |

| | • | our long-term strategic objectives, financial and other performance criteria and individual performance goals; |

| |

| | • | the competitive compensation levels for executive officers at companies in similar businessesand/or of similar size; |

| |

| | • | the overall economic environment and industry conditions; |

| |

| | • | unique circumstances impacting the industry, the Company and our executive officers; and |

| |

| | • | the advice of the Committee’s Compensation Consultant. |

Based upon its analysis of these criteria, the Compensation Committee determines each component of executive compensation — base salary, annual incentive awards and stock-based awards — for the Named Executive Officers, generally targeting total direct compensation at the 75th percentile of market practice for our Peer Group and Survey Data taking into consideration internal equity, individual performance, promotion potential, retention risk and other factors. Given the negative public opinion towards the tobacco industry, we believe that it is in the best interests of the Company and our shareholders to use this target level for total direct compensation in order to attract and retain talented executives. This target may be adjusted based upon the specific responsibilities, experience and performance of each Named Executive Officer as well as other factors in the Compensation Committee’s discretion.

Components of Executive Compensation

The principal components of compensation for our Named Executive Officers in the last fiscal year were:

| | |

| | • | base salary; |

| |

| | • | annual incentive awards; |

| |

| | • | stock-based awards; and |

| |

| | • | retirement, severance and other benefits. |

16

Base Salary. We pay base salaries in order to attract and retain leadership talent and to provide a competitive basis of compensation that recognizes the executive’s skills and experience relative to his or her responsibilities in the position. During 2008, the Peer Group and Survey Data were used to construct base salary ranges for all salaried employees, including the Named Executive Officers. The minimum and maximum of each range were set at 75% and 125% of the range midpoint, respectively. This standard grade range spread of 50 percentage points provided a market relevant base salary range for similar company positions with salary growth potential. Individual base pay may deviate from the range midpoint due to specific individual factors applicable to each executive, such as seniority, individual performance, experience level, scope of responsibility, or a unique combination of functional responsibilities. For 2008, the Chief Executive Officer’s base salary was set pursuant to the terms of his employment agreement and is described below in “Chief Executive Officer Compensation.”

The base salaries for the Named Executive Officers were primarily based upon a review of the following considerations:

| | |

| | • | comparative data provided by external data sources publicly available or received from nationally recognized executive compensation management and consulting firms; |

| |

| | • | individual performance of the executive; and |

| |

| | • | a review and analysis of the executive’s compensation, both on an absolute level and relative to other executive officers of the Company based on his or her responsibilities and strategic corporate achievement. |

Through 2008, base salary adjustments for the Named Executive Officers, excluding the Chief Executive Officer, were subject to a periodic performance appraisal process. The frequency of such reviews was determined by each executive’s position within the applicable salary range and occurred within a 13 to 18 month cycle. The review process sought to provide an assessment of each executive’s performance against the duties and responsibilities for the specific position and resulted in an overall performance rating in one of five rating categories. A specified base salary adjustment rate corresponded to each of the five rating categories. The lowest two ratings categories “fails to meet standards” and “needs improvement to meet standards” provided no base salary increase. The ratings categories “fully meets standards,” “exceeds standards” and “far exceeds standards” provided for increases in base salary, respectively, in 2008.

2008 Salary Adjustments. During 2008, base salaries for Messrs. Hennighausen, Milstein and Staab were reviewed in accordance with this performance appraisal process and each received a rating of “far exceeds standards.” A market adjustment was made to Mr. Spell’s base salary based on a review of salary data in the Peer Group and Survey data prior to the Separation. Mr. Orlowsky’s base salary of $2,200,000 for 2008 was set forth in his employment agreement. See “Chief Executive Officer Compensation” below for more information. Mr. Taylor was hired as our Executive Vice President, Finance and Planning on January 7, 2008 with a base salary of $800,000 and was not eligible for review in 2008 under the policy. The following table sets forth the base salary adjustments for Messrs. Spell, Milstein, Hennighausen and Staab for 2008.

| | | | | | | | | | | | | |

| | | | | Base Salary

| | Base Salary

| | Effective

|

| | | | | as of

| | as of

| | Date of

|

| | | | | January 1,

| | December 31,

| | Salary

|

Name | | Title | | 2008 | | 2008 | | Adjustment |

| |

| Randy B. Spell | | Executive Vice President, Marketing and Sales | | | $589,420 | | | | $630,000 | | | June 9, 2008 |

| Ronald S. Milstein | | Senior Vice President, Legal and External Affairs, General Counsel and Secretary | | | 582,023 | | | | 632,659 | | | December 8, 2008 |

| Charles E. Hennighausen | | Executive Vice President, Production Operations | | | 559,983 | | | | 608,702 | | | August 18, 2008 |

| Thomas R. Staab | | Senior Vice President and Chief Accounting Officer | | | 564,369 | | | | 613,469 | | | November 10, 2008 |

2009 Salary Adjustments. In November 2008, the Compensation Committee reviewed the Company’s process for base salary adjustments and determined that beginning in 2009, the base salary for the Named Executive Officers would be reviewed, and any adjustments thereto made, on an annual common date in order to facilitate the

17

administration of salaries and align incentive plan decisions with the base salary review process. In determining base salary adjustments for 2009 for the Named Executive Officers other than the Chief Executive Officer, the Compensation Committee considered the performance and contributions of each Named Executive Officer, the financial performance of the Company, the recommendations of the Chief Executive Officer and the competitiveness of the individual’s pay relative to compensation data for executives in comparable positions in the Peer Group and Survey Data provided by the Committee’s Compensation Consultant. Based on these considerations, the Compensation Committee determined that base salaries for the Named Executive Officers, except the Chief Executive Officer, be adjusted, as of January 5, 2009, based on their individual performance rating and the amount of time elapsed since their last salary review date during 2008 (and in Mr. Taylor’s case, his hire date). Mr. Orlowsky’s base salary was reduced to $1,200,000, effective as of January 1, 2009, pursuant to an amendment to his employment agreement to shift the distribution of his total cash compensation from base salary to performance based compensation. See “Chief Executive Officer Compensation” below for more information regarding Mr. Orlowsky’s compensation. The table below sets forth the 2009 base salaries for each Named Executive Officer as of January 5, 2009.

| | | | | | | |

| | | | | Base

|

| | | | | Salary as of

|

| | | | | January 5,

|

Name | | Title | | 2009 |

| |

| Martin L. Orlowsky | | Chairman, President and Chief Executive Officer | | | $1,200,000 | |

| David H. Taylor | | Executive Vice President, Finance and Planning and Chief Financial Officer | | | 869,409 | |

| Randy B. Spell | | Executive Vice President, Marketing and Sales | | | 661,535 | |

| Ronald S. Milstein | | Senior Vice President, Legal and External Affairs, General Counsel and Secretary | | | 636,881 | |

| Charles E. Hennighausen | | Executive Vice President, Production Operations | | | 629,014 | |

| Thomas R. Staab | | Senior Vice President and Chief Accounting Officer | | | 621,658 | |

Annual Incentive Awards. Our annual incentive plan (“AIP”) ensures that a significant portion of each Named Executive Officer’s annual compensation is at risk and dependent upon our overall performance and individual performance criteria intended to align the executive’s interests with shareholder interests. Prior to the Separation, the LTC Board had determined that 50% of each annual incentive award would be based on the Company’s overall performance based on achievement of a net income target and the remaining 50% would be based on individual performance criteria, as described below. At the beginning of each annual performance period, the LTC Board established, in consultation with the Chief Executive Officer, three individual performance criteria for each Named Executive Officer. These criteria were used because the LTC Board and Chief Executive Officer believed they reflected the performance criteria that were most directly correlated to increasing enterprise value.

The incentive payout target under the 2008 AIP for all Named Executive Officers, excluding the Chief Executive Officer, was set at 50% of base salary in 2008. The percentage was designed to establish a significant incentive and provide motivation toward achieving the Company’s short and long term goals. The Company’s and each individual’s performance against specific criteria could have resulted in payments at less than the target incentive levels, and no incentive payment would have been earned, if less than 80% of the combined (both Company and individual) performance criteria were not achieved. Mr. Orlowsky’s incentive payment target for 2008 was set at $1,500,000, 68% of his base salary, pursuant to the terms of his employment agreement. See “Chief Executive Officer Compensation” for more information regarding Mr. Orlowsky’s compensation.