|

Exhibit 99.1

|

Investor Day

June 27, 2013

Agenda

Introduction

Strategic Plan Update

Regulatory Update

Legal Update

Financial Guidance (Lorillard-Style)

Additional Q&A

Bob Bannon – Investor Relations

Murray Kessler – Chairman, President & CEO

Neil Wilcox– SVP, Chief Compliance Officer

Bill True – SVP, R&D

Ron Milstein – EVP, Legal & General Counsel

David Taylor – EVP, Finance & CFO

All

Safe Harbor Disclaimer

of You the are Private cautioned Securities that certain Litigation statements Reform Act made of 1995. in this Forward-looking presentation are statements “forward-looking” include, statements without limitation, within the any meaning words statement “expect”, that may “intend”, project, “plan”, indicate “anticipate”, or imply future “estimate”, results, “believe”, events, performance “will be”, “will or continue”, achievements, “will and likely may result”, contain and the similar performance expressions. (including In addition, future revenues, any statement earnings that or may growth be provided rates), ongoing by management business strategies concerning or future prospects, financial and possible actions by Lorillard, Inc. are also forward-looking statements as defined by the Act. subject Forward-looking to a variety statements of risks and are uncertainties, based on current many expectations of which are and beyond projections the control about of future Lorillard, events Inc. and , and are could inherently cause actual results to differ materially from those anticipated or projected. is Information available in describing Lorillard, factors Inc.’s various that could filings cause with actual the Securities results to and differ Exchange materially Commission from those (“SEC”) in forward-looking . These filings are statements available from the SEC over the Internet or on hard copy, and are, in some cases, available from Lorillard, Inc. as well. undertaking Forward-looking to update statements these speak statements only as to of reflect the time any they change are in made, expectations and Lorillard, or beliefs Inc. expressly or any change disclaims in events, any obligation conditions or or circumstances on which any forward-looking statement is based.

This disclaimer. forward-looking You are urged statements to read disclaimer that disclaimer, is only which a brief is summary included of in Lorillard, Lorillard Inc. Inc.’s ’s Form statutory 10-K forward and Form -looking-statements 10-Q filings with the SEC.

Murray S. Kessler

Chairman, President and Chief Executive Officer

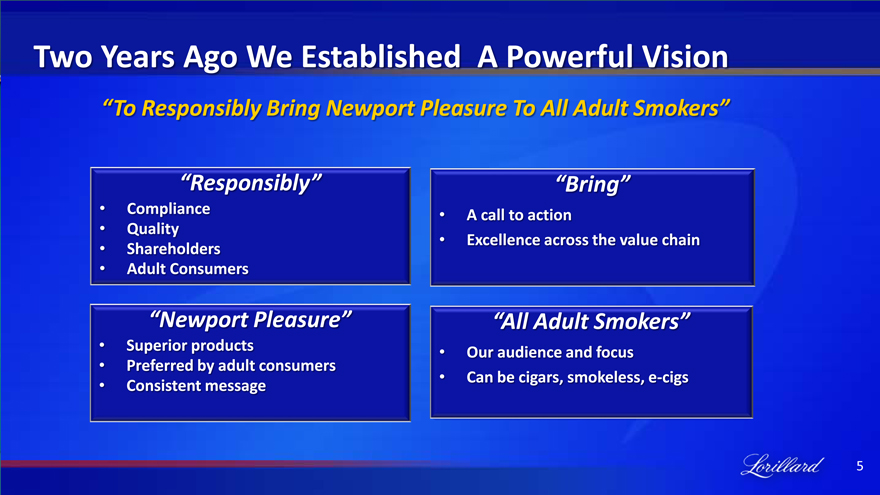

Two Years Ago We Established A Powerful Vision

“To Responsibly Bring Newport Pleasure To All Adult Smokers”

“Responsibly”

• Compliance

• Quality

• Shareholders

• Adult Consumers

“Bring”

A call to action

Excellence across the value chain

Superior products

Preferred by adult consumers Consistent message

“All Adult Smokers”

• Our audience and focus

• Can be cigars, smokeless, e-cigs

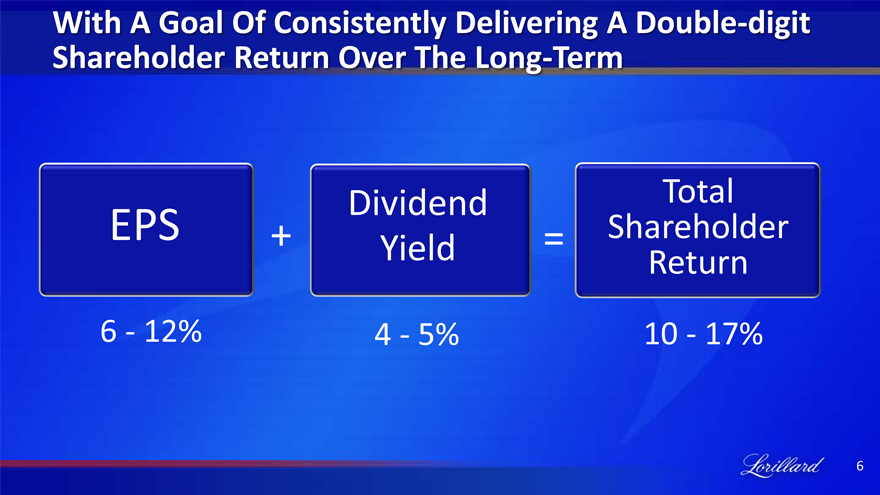

With A Goal Of Consistently Delivering A Double-digit Shareholder Return Over The Long-Term

EPS

+

Dividend Yield

Shareholder Total Return

10—17%

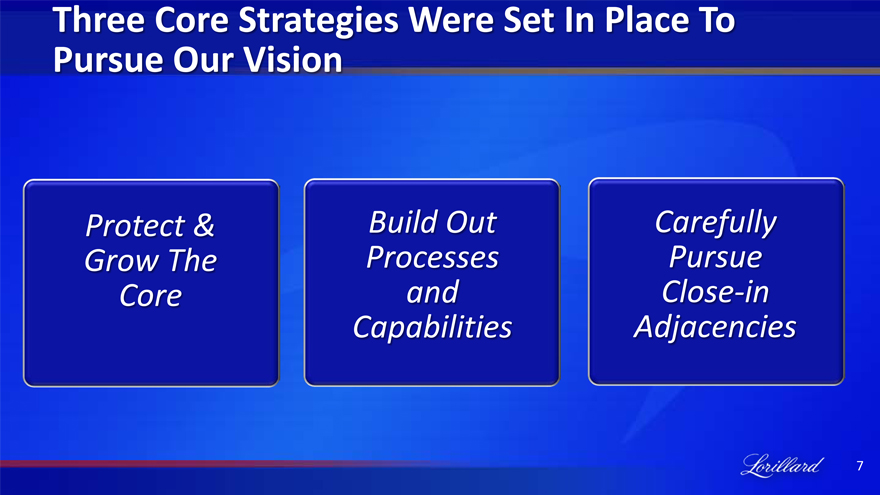

Three Core Strategies Were Set In Place To Pursue Our Vision

Grow Protect The & Core

Processes Build Out Capabilities and

Carefully Pursue Adjacencies Close-in

Source: MSA, Inc. Excel retail database.

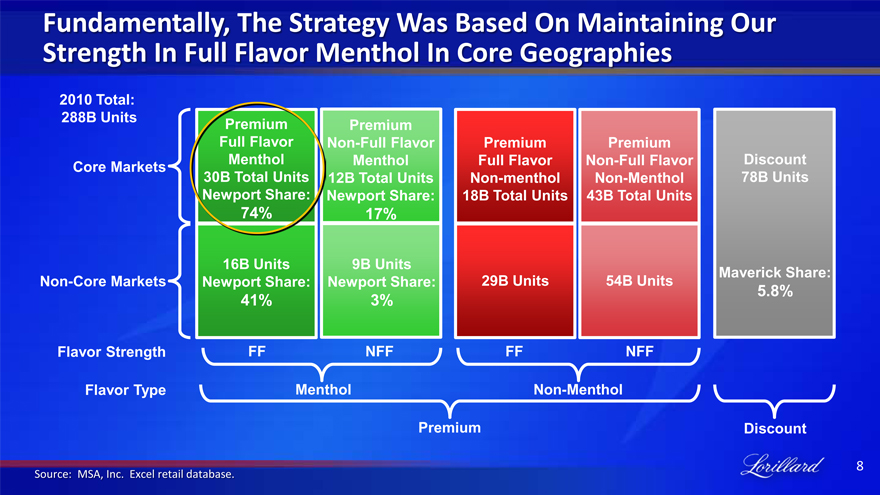

Fundamentally, The Strategy Was Based On Maintaining Our Strength In Full Flavor Menthol In Core Geographies

2010 Total: 288B Units

Core Markets

Non-Core Markets

Flavor Strength

Flavor Type

Premium Full Flavor Menthol 30B Total Units Newport Share: 74%

Premium Non-Full Flavor Menthol 12B Total Units Newport Share: 17%

Premium Full Flavor Non-menthol 18B Total Units

Premium Non-Full Flavor Non-Menthol 43B Total Units

16B Units Newport Share: 41%

9B Units Newport Share: 3%

29B Units

54B Units

Discount 78B Units

Maverick Share: 5.8%

FF NFF FF NFF

Menthol Non-Menthol

Premium

Discount

9

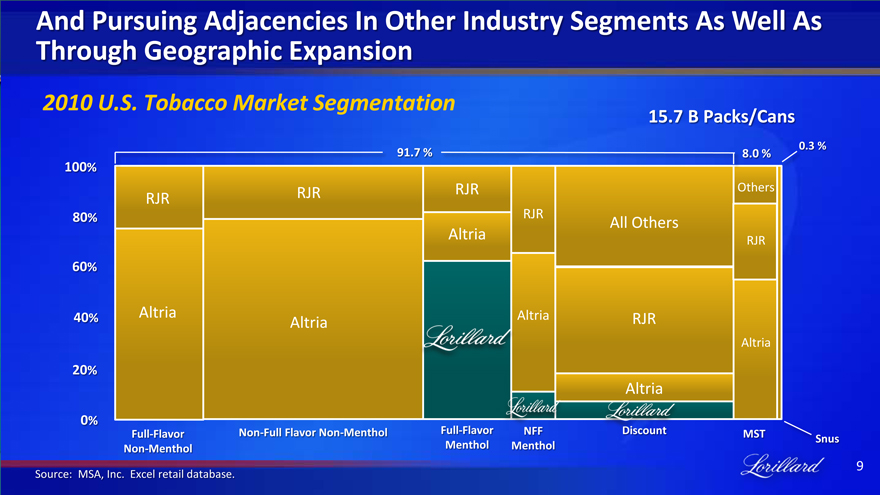

And Pursuing Adjacencies In Other Industry Segments As Well As Through Geographic Expansion

2010 U.S. Tobacco Market Segmentation

15.7 B Packs/Cans

100% 80% 60% 40% 20% 0%

RJR

Altria

RJR

Altria

91.7 %

RJR

Altria

RJR

Altria

All Others

RJR

Altria

Altria

RJR

Others

0.3 % 8.0 %

[Graphic Appears Here]

Source: MSA, Inc. Excel retail database.

10

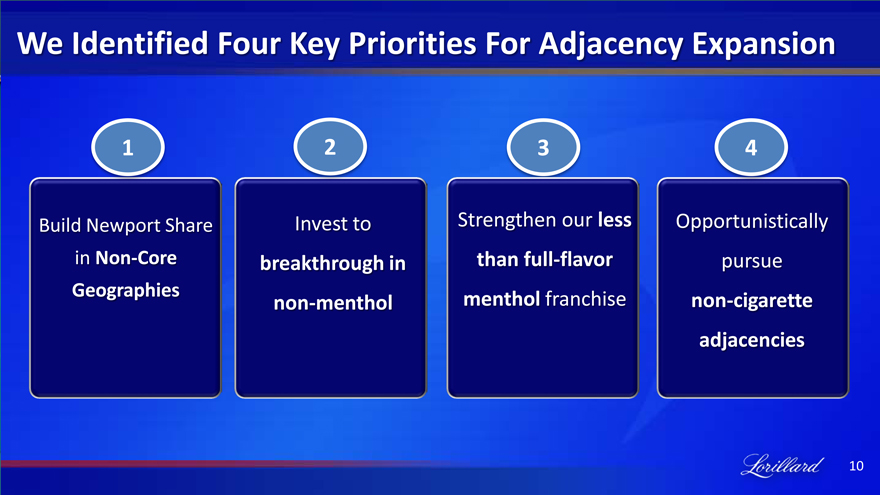

We Identified Four Key Priorities For Adjacency Expansion

Build Newport Share in Non-Core Geographies

Invest to breakthrough in non-menthol

Strengthen our less than full-flavor menthol franchise

Opportunistically pursue non-cigarette adjacencies

Source: Lorillard filings. * Earnings per share data adjusted to reflect 3-for-1 stock split effected January 15, 2013. See Appendix A for further discussion of adjustments

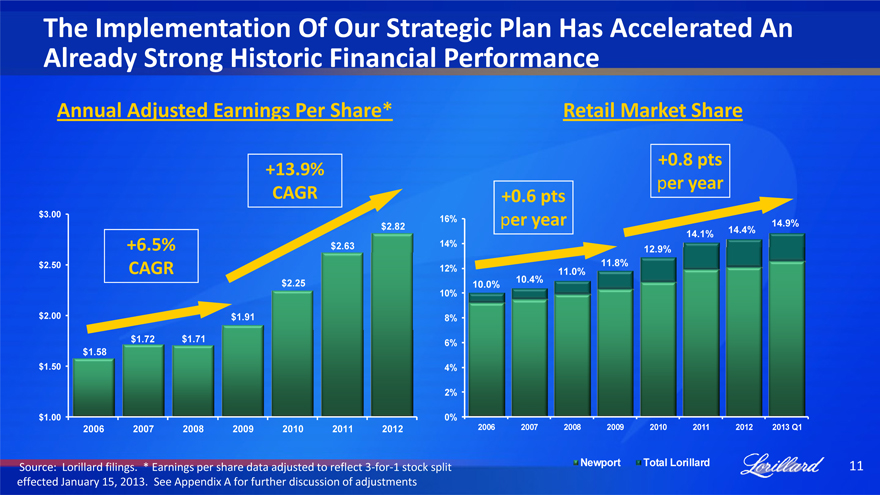

The Implementation Of Our Strategic Plan Has Accelerated An Already Strong Historic Financial Performance

Annual Adjusted Earnings Per Share*

Retail Market Share

+13.9% CAGR

+6.5% CAGR

+0.6 pts per year

+0.8 pts per year

$3.00 $2.50 $2.00 $1.50 $1.00

2006 2007 2008 2009 2010 2011 2012 2006 2007 2008 2009 2010 2011 2012 2013 YTD

16% 14% 12% 10% 8% 6% 4% 2% 0%

$1.72 $1.58

$1.71

$1.91

$2.25

$2.63

$2.82

10.0%

10.4%

11.0%

11.8%

12.9%

14.1%

14.4%

14.9%

Newport Total Lorillard

12

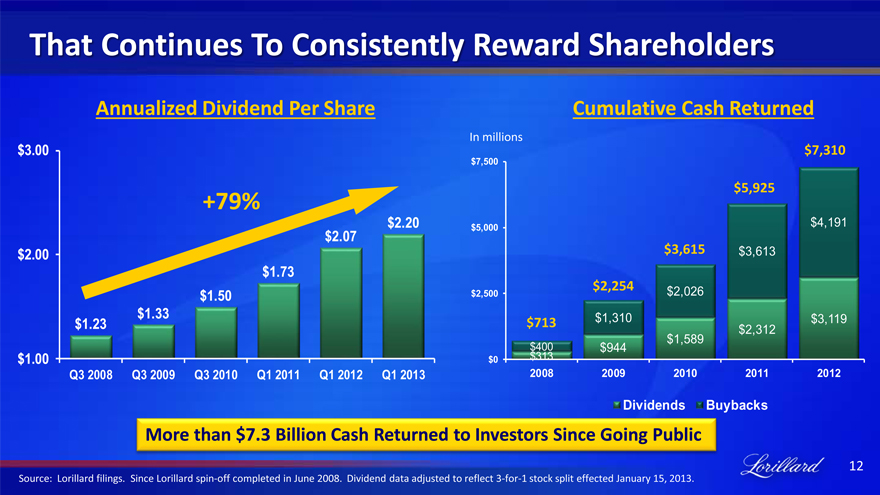

That Continues To Consistently Reward Shareholders

Annualized Dividend Per Share Cumulative Cash Returned

$3.00

+79%

$2.20 $2.07 $2.00 $1.73 $1.50 $1.33 $1.23

$1.00

Q3 2008 Q3 2009 Q3 2010 Q1 2011 Q1 2012 Q1 2013

In millions $7,310

$7,500

$5,925

$5,000 $4,191

$3,615 $3,613

$2,254 $2,026

$2,500

$713 $1,310 $3,119 $2,312 $1,589 $400 $944 $0 $313

2008 2009 2010 2011 2012

More than $7.3 Billion Cash Returned to Investors Since Going Public

Dividends Buybacks

Source: Lorillard filings. Since Lorillard spin-off completed in June 2008. Dividend data adjusted to reflect 3-for-1 stock split effected January 15, 2013.

13

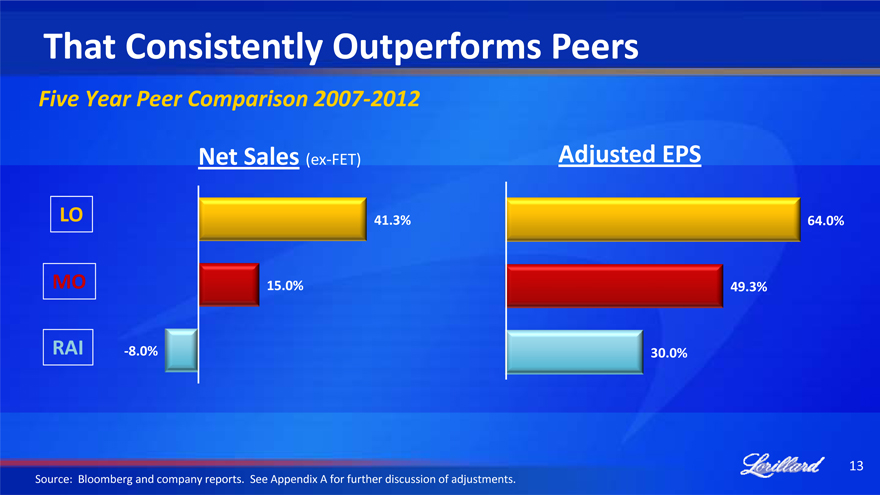

That Consistently Outperforms Peers

Five Year Peer Comparison 2007-2012

Net Sales (ex-FET) Adj. Operating Income Adjusted EPS

41.3%

15.0%

47.8%

49.8%

21.7%

64.0% 49.3% 30.0%

LO

MO

RAI -8.0%

Source: Bloomberg and company reports. See Appendix A for further discussion of adjustments.

14

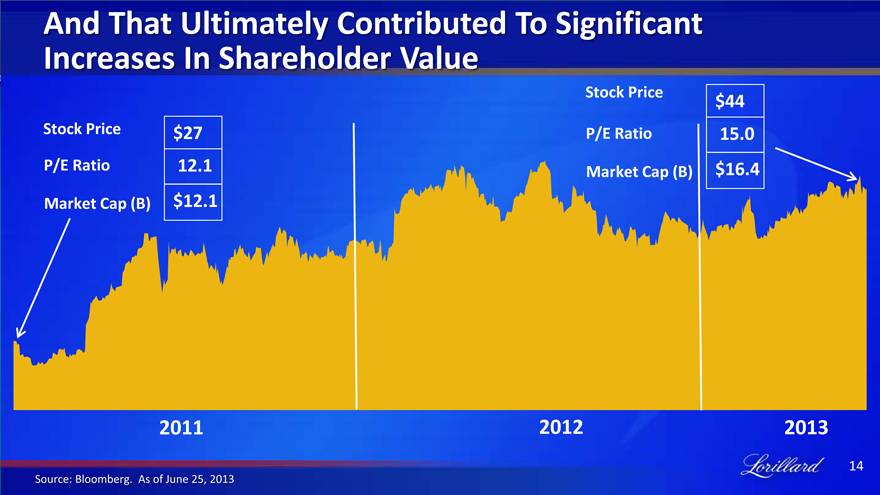

And That Ultimately Contributed To Significant Increases In Shareholder Value

Stock Price P/E Ratio

Market Cap (B)

$27 12.1 $12.1

P/E Ratio

Market Cap (B)

$44 15.0 $16.4

2011 2012 2013

Source: Bloomberg. As of June 25, 2013

15

Because Lorillard’s Strategic Plan Is Working

Newport full-flavor menthol in the core continues to remain stable despite increased menthol competition

Lorillard’s geographic expansion strategy has been successful

Newport’s launch into non-menthol has worked well

The blu eCigs acquisition has exceeded expectations and positions Lorillard as the clear leader in the rapidly growing e-cig category

In combination, New Initiatives have profitably contributed to Lorillard’s continued growth

Significant enhancements to processes and capabilities have been made with much of the investment behind us

Lorillard continues to successfully defend its Freedom to Operate

Lorillard’s capital structure continues to improve for the benefit of shareholders

16

Because Lorillard’s Strategic Plan Is Working

Newport full-flavor menthol in the core continues to remain stable despite increased menthol competition

Lorillard’s geographic expansion strategy has been successful

Newport’s launch into non-menthol has worked well

The blu eCigs acquisition has exceeded expectations and positions Lorillard as the clear leader in the rapidly growing e-cig category

In combination, New Initiatives have profitably contributed to Lorillard’s continued growth

Significant enhancements to processes and capabilities have been made with much of the investment behind us

Lorillard continues to successfully defend its Freedom to Operate

Lorillard’s capital structure continues to improve for the benefit of shareholders

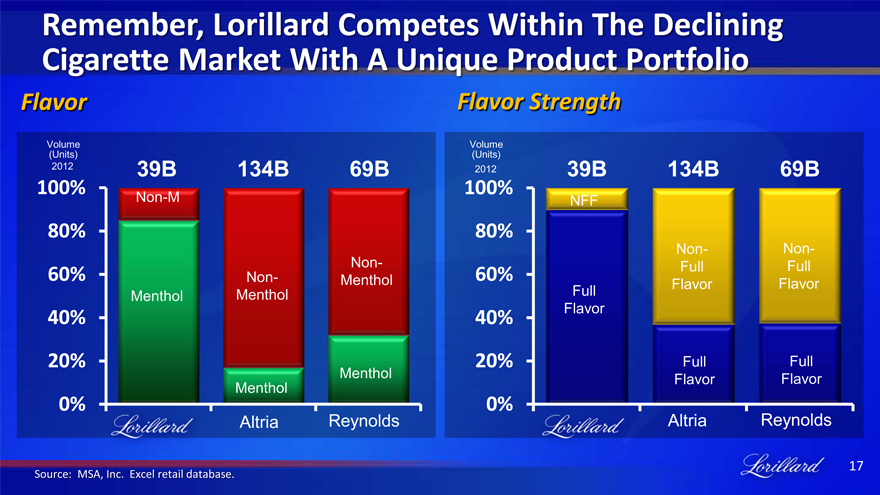

Remember, Lorillard Competes Within The Declining Cigarette Market With A Unique Product Portfolio

Flavor Strength

Volume (Units) 2012

100% 80% 60% 40% 20% 0%

39B 134B 69B

Non-M

Non- Non- Menthol Menthol Menthol

Menthol Menthol

Altria Reynolds

Volume (Units) 100% 2012

80% 60% 40% 20% 0%

39B 134B 69B

NFF

Non- Non- Full Full Full Flavor Flavor Flavor

Full Full Flavor Flavor

Altria Reynolds

Source: MSA, Inc. Excel retail database.

17

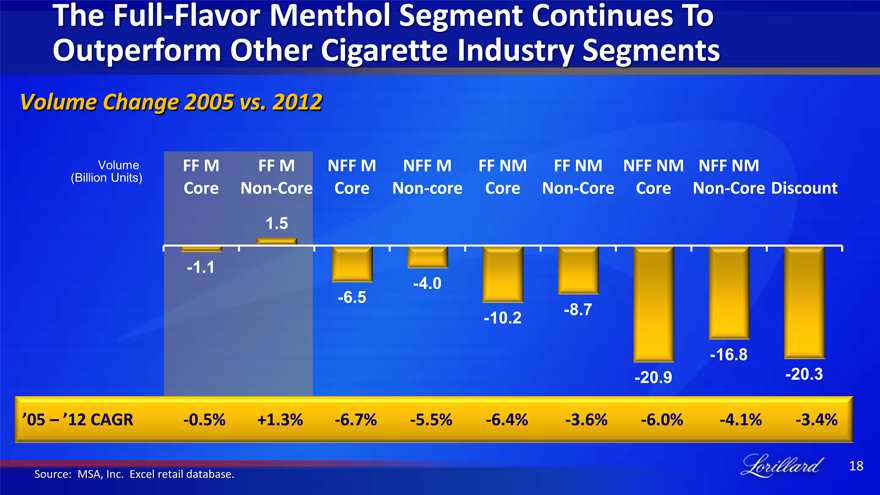

The Full-Flavor Menthol Segment Continues To Outperform Other Cigarette Industry Segments

Volume Change 2005 vs. 2012

(Billion Volume Units)

FF M FF M NFF M NFF M FF NM FF NM NFF NM NFF NM

Core Non-Core Core Non-core Core Non-Core Core Non-Core Discount

1.5

-1.1

-4.0 -6.5

-10.2 -8.7

-16.8

-20.9 -20.3

’05 – ’12 CAGR -0.5% +1.3% -6.7% -5.5% -6.4% -3.6% -6.0% -4.1% -3.4%

Source: MSA, Inc. Excel retail database.

18

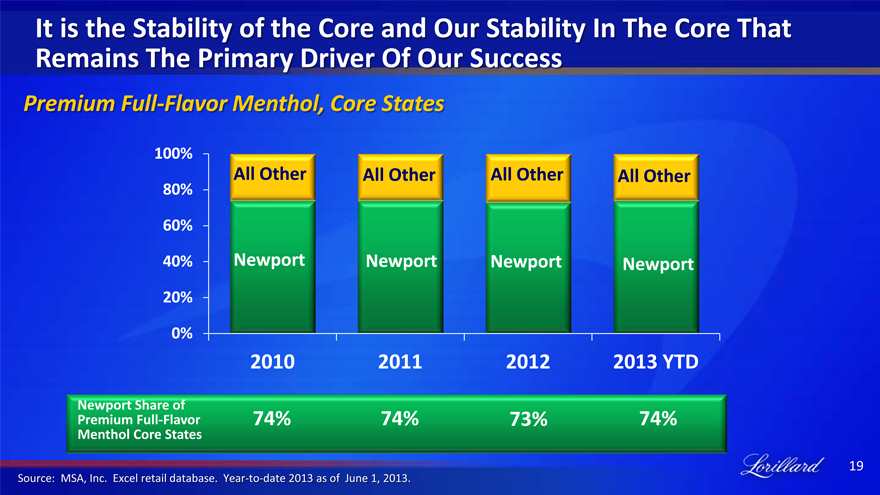

It is the Stability of the Core and Our Stability In The Core That Remains The Primary Driver Of Our Success

Premium Full-Flavor Menthol, Core States

100%

All Other All Other All Other All Other 80% 60% 40% Newport Newport Newport Newport 20% 0%

2010 2011 2012 2013 YTD

Newport Premium Share Full-Flavor of Menthol Core States

74% 74% 73% 74%

Source: MSA, Inc. Excel retail database. Year-to-date 2013 as of June 1, 2013.

19

20

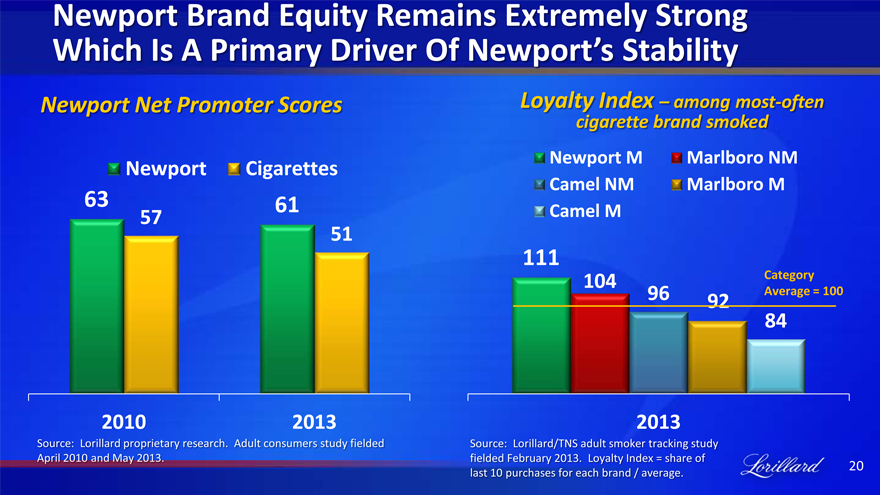

Which Is A Primary Driver Of Newport’s Stability

Newport Net Promoter Scores

Newport Cigarettes

63 61

57

51

Loyalty Index – among most-often cigarette brand smoked

Newport M Marlboro NM Camel NM Marlboro M Camel M

111

104 Category

96 92 Average = 100

84

2010 2013

2013

Source: Lorillard proprietary research. Adult consumers study fielded April 2010 and May 2013.

Source: Lorillard/TNS adult smoker tracking study fielded February 2013. Loyalty Index = share of last 10 purchases for each brand / average.

21

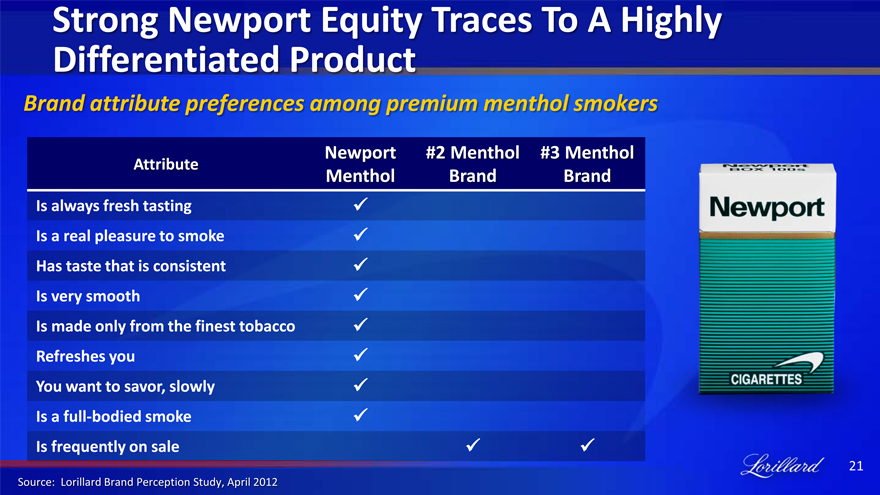

Strong Newport Equity Traces To A Highly Differentiated Product

Brand attribute preferences among premium menthol smokers

Attribute

Newport Menthol

#2 Menthol Brand

#3 Menthol Brand

Is always fresh tasting Is a real pleasure to smoke Has taste that is consistent Is very smooth

Is made only from the finest tobacco Refreshes you You want to savor, slowly Is a full-bodied smoke Is frequently on sale

Source: Lorillard Brand Perception Study, April 2012

22

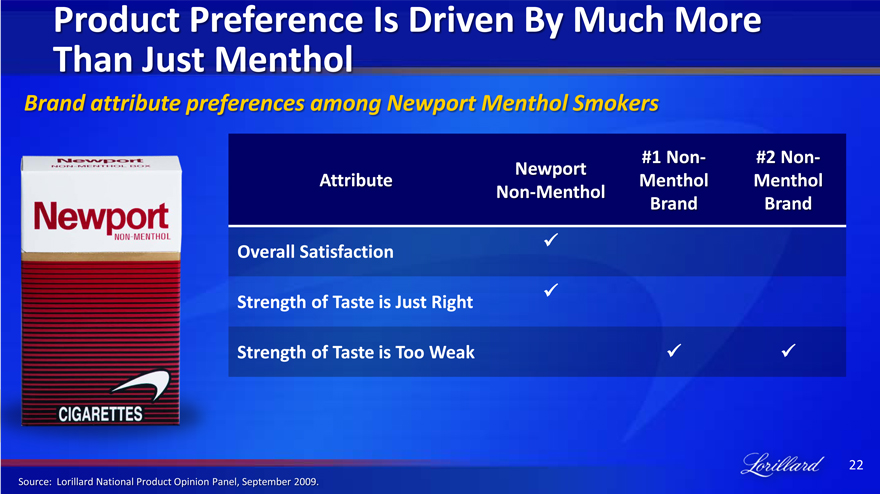

Than Just Menthol

Brand attribute preferences among Newport Menthol Smokers

Attribute

Newport Non-Menthol

#1 Non-Menthol Brand

#2 Non-Menthol Brand

OverallSatisfaction

Strength of Taste is Just Right

Strength of Taste is Too Weak

Source: Lorillard National Product Opinion Panel, September 2009.

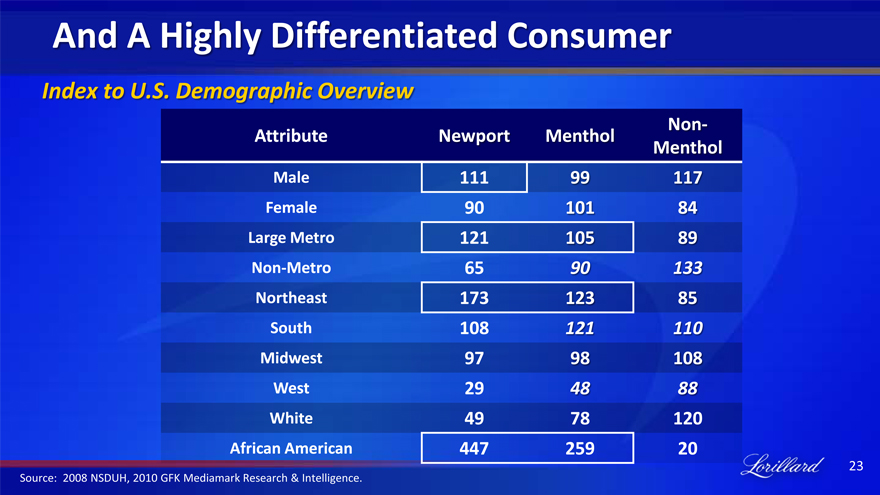

Attribute Newport Menthol Non-

Menthol

Male 111 99 117

Female 90 101 84

Large Metro 121 105 89

Non-Metro 65 90 133

Northeast 173 123 85

South 108 121 110

Midwest 97 98 108

West 29 48 88

White 49 78 120

African American 447 259 20

And A Highly Differentiated Consumer

Index to U.S. Demographic Overview

Source: 2008 NSDUH, 2010 GFK Mediamark Research & Intelligence.

23

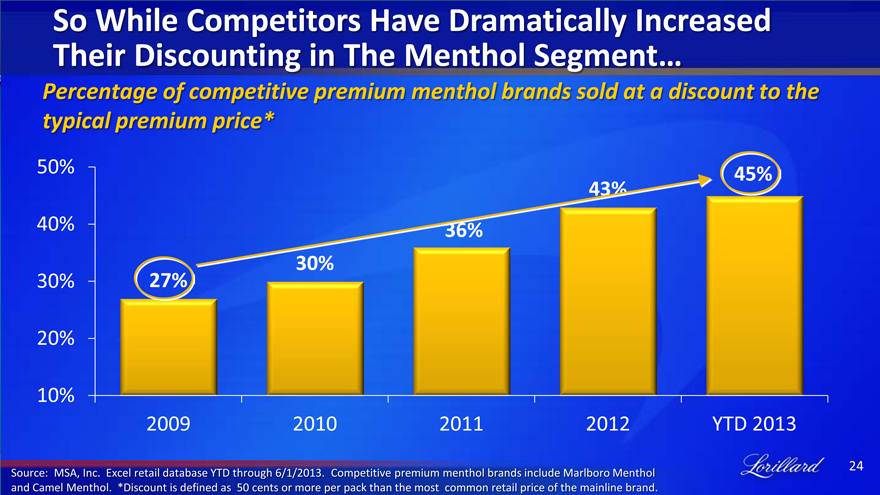

So While Competitors Have Dramatically Increased Their Discounting in The Menthol Segment…

Percentage of competitive premium menthol brands sold at a discount to the typical premium price*

50% 40% 30% 20% 10%

2009 2010 2011 2012 YTD 2013

Source: MSA, Inc. Excel retail database YTD through 6/1/2013. Competitive premium menthol brands include Marlboro Menthol and Camel Menthol. *Discount is defined as 50 cents or more per pack than the most common retail price of the mainline brand.

24

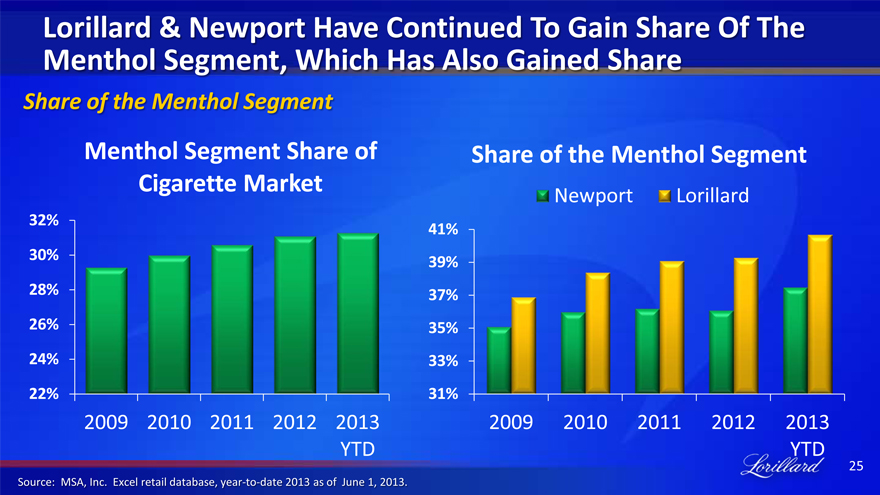

Source: MSA, Inc. Excel retail database, year-to-date 2013 as of June 1, 2013.

Lorillard & Newport Have Continued To Gain Share Of The Menthol Segment, Which Has Also Gained Share

Share of the Menthol Segment

Menthol Segment Share of Cigarette Market

Share of the Menthol Segment

Newport Lorillard

32% 30% 28% 26% 24% 22%

2009 2010 2011 2012 2013

YTD

41% 39% 37% 35% 33% 31%

2009 2010 2011 2012 2013

25

26

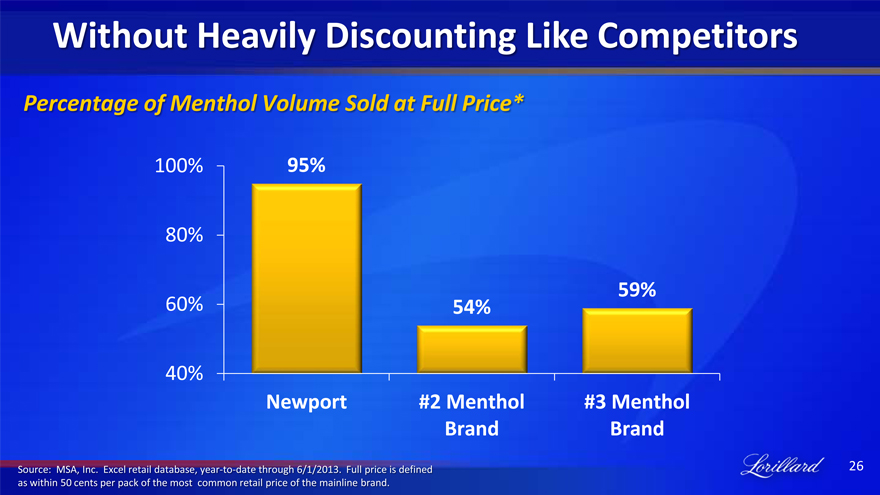

Without Heavily Discounting Like Competitors

Percentage of Menthol Volume Sold at Full Price*

100% 95%

80%

59% 60% 54%

40%

Newport #2 Menthol #3 Menthol Brand Brand

Source: MSA, Inc. Excel retail database, year-to-date through 6/1/2013. Full price is defined as within 50 cents per pack of the most common retail price of the mainline brand.

27

Going Forward, Lorillard Will Continue To Emphasize Brand-Building Over Discounting

Refreshed Print Advertising Program

More Aggressive Direct Mail Campaigns

Expanded Product Offerings

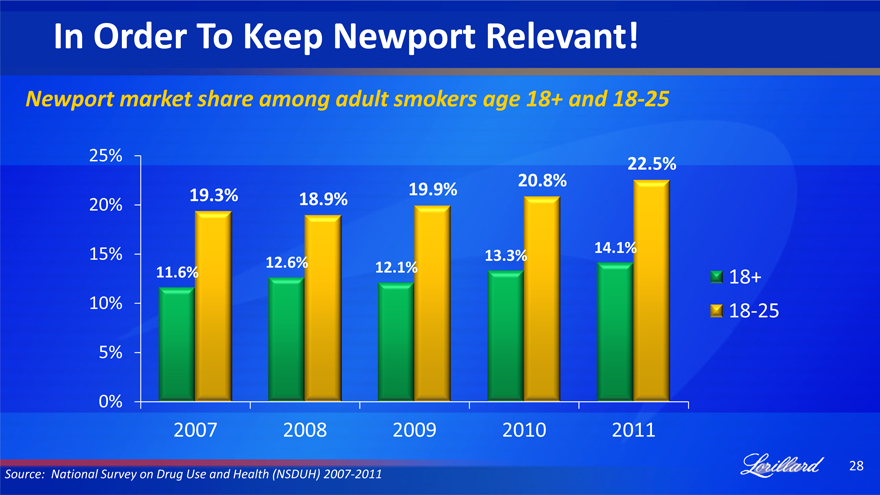

In Order To Keep Newport Relevant!

Newport market share among adult smokers age 18+ and 18-25

25% 22.5%

20% 19.3% 18.9% 19.9% 20.8%

15% 13.3% 14.1%

11.6% 12.6% 12.1%

10%

5%

0%

2007 2008 2009 2010 2011

18+ 18-25

Source: National Survey on Drug Use and Health (NSDUH) 2007-2011

28

29

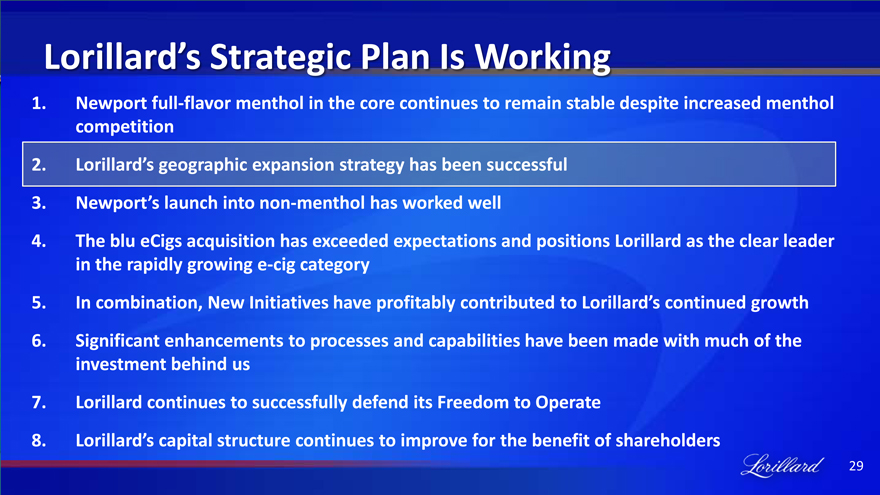

Lorillard’s Strategic Plan Is Working

Newport full-flavor menthol in the core continues to remain stable despite increased menthol competition

Lorillard’s geographic expansion strategy has been successful

Newport’s launch into non-menthol has worked well

The blu eCigs acquisition has exceeded expectations and positions Lorillard as the clear leader in the rapidly growing e-cig category

In combination, New Initiatives have profitably contributed to Lorillard’s continued growth

Significant enhancements to processes and capabilities have been made with much of the investment behind us

Lorillard continues to successfully defend its Freedom to Operate

Lorillard’s capital structure continues to improve for the benefit of shareholders

30

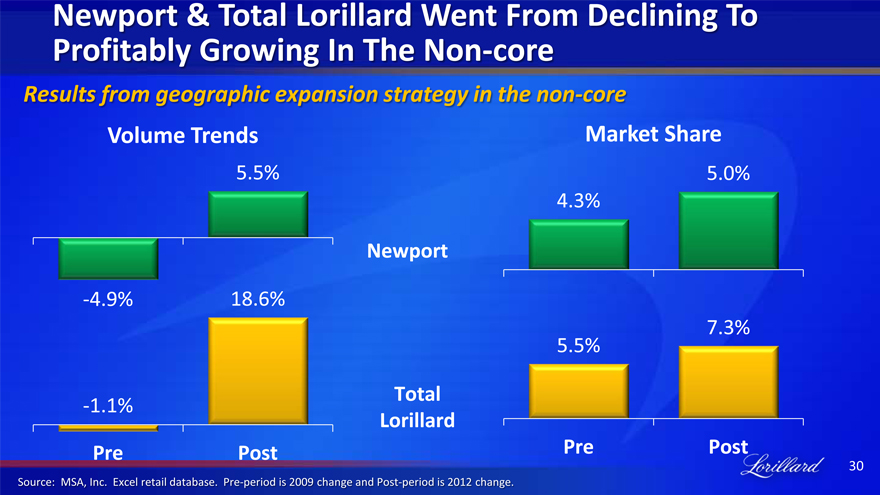

Newport & Total Lorillard Went From Declining To Profitably Growing In The Non-core

Results from geographic expansion strategy in the non-core

Volume Trends

Market Share

5.5% 5.0%

4.3%

Newport

-4.9% 18.6%

7.3%

5.5%

Total

-1.1%

Lorillard

Pre Post Pre Post

Source: MSA, Inc. Excel retail database. Pre-period is 2009 change and Post-period is 2012 change.

Driven By A Total Company Approach Outside The Core

• 32,000 new retail plans nce 2009 in the non-core

• Eliminating Newport’s price disadvantage in non-core

• Launching Newport Red

31

Lorillard’s Strategic Plan Is Working

pite increased menthol competition

2. Lorillard’s geographic expansion strategy has been successful

3. Newport’s launch into non-menthol has worked well

4. The blu eCigs acquisition has exceeded expectations and positions Lorillard as the clear leader in the rapidly growing e-cig category

5. In combination, New Initiatives have profitably contributed to Lorillard’s continued growth

6. Significant enhancements to processes and capabilities have been made with much of the investment behind us

7. Lorillard continues to successfully defend its Freedom to Operate

8. Lorillard’s capital structure continues to improve for the benefit of shareholders

32

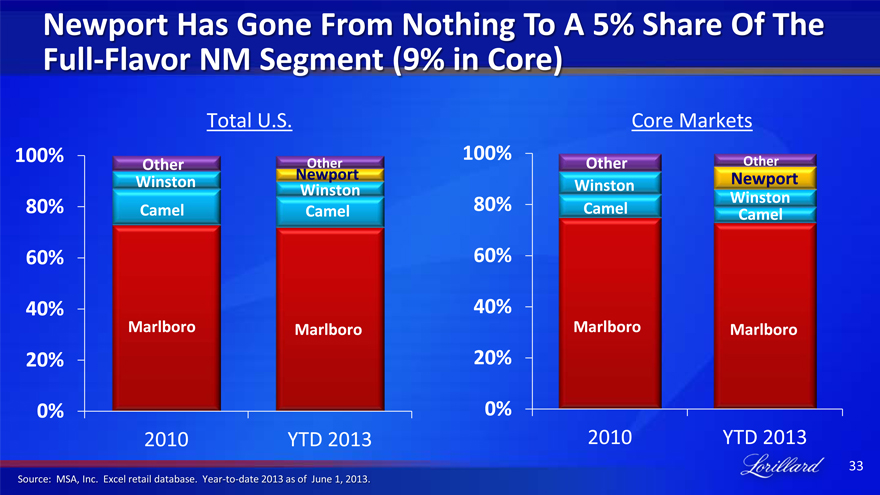

Newport Has Gone From Nothing To A 5% Share Of The Full-Flavor NM Segment (9% in Core)

Total U.S.

100% Other Other Winston Newport Winston 80% Camel Camel

60%

40% Marlboro

Marlboro

20%

0%

2010 YTD 2013

Core Markets

100% Other

Other

Winston Newport 80% Winston Camel Camel

60%

40%

Marlboro Marlboro

20%

0%

2010 YTD 2013

Source: MSA, Inc. Excel retail database. Year-to-date 2013 as of June 1, 2013.

33

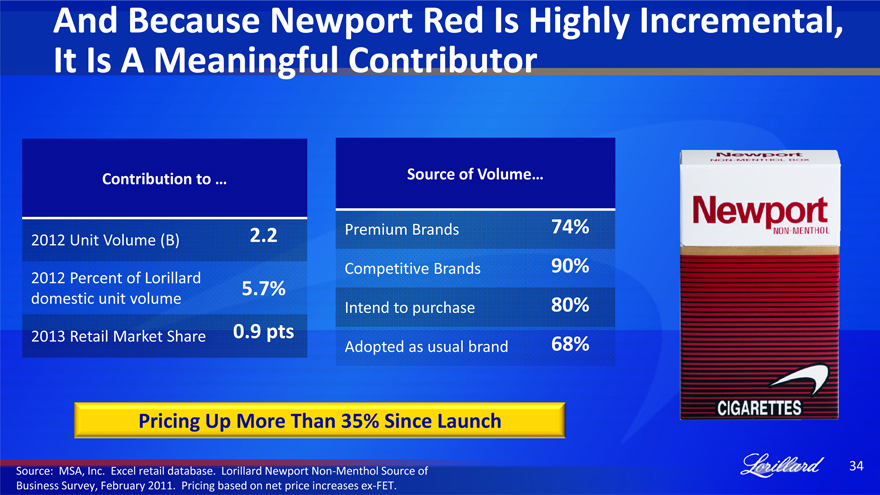

And Because Newport Red Is Highly It Is A Meaningful Contributor

Contribution to …

2012 Unit Volume (B) 2.2 2012 Percent of Lorillard 5.7% domestic unit volume 2013 Retail Market Share 0.9 pts

Source of Volume…

Premium Brands 74%

Competitive Brands 90%

Intend to purchase 80%

Adopted as usual brand 68%

Pricing Up More Than 35% Since Launch

Source: MSA, Inc. Excel retail database. Lorillard Newport Non-Menthol Source of Business Survey, February 2011. Pricing based on net price increases ex-FET.

34

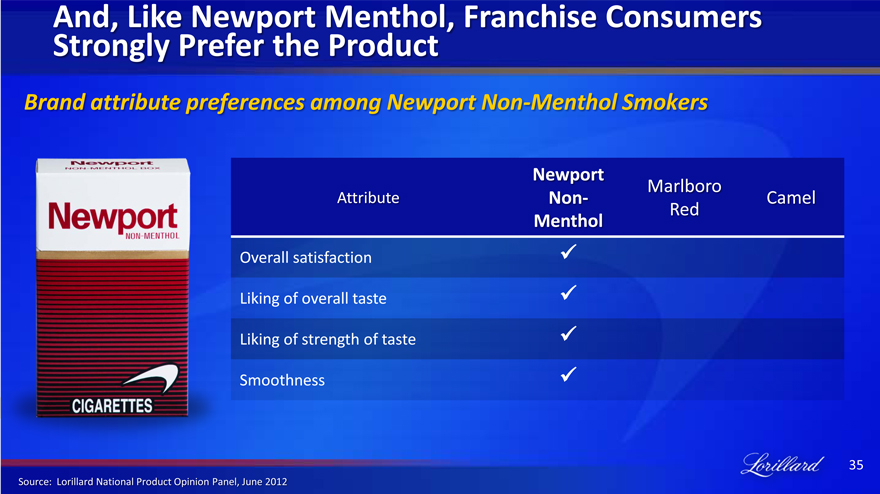

And, Like Newport Menthol, Franchise Consumers Strongly Prefer the Product

Brand attribute preferences among Newport Non-Menthol Smokers

Marlboro

Attribute Non- Camel

Red

Menthol

OVerall satisfaction ?

Liking of overall taste ?

Liking of strength of taste ?

smoothness ?

35

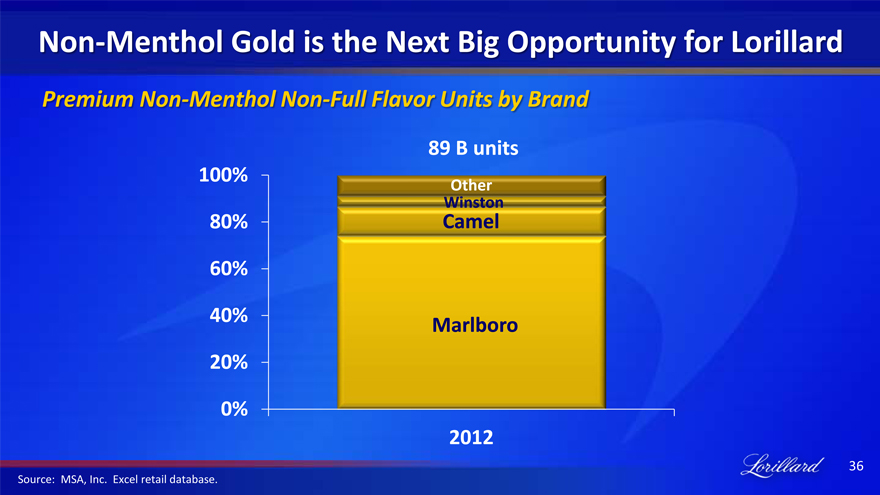

Non-Menthol Gold is the Next Big Opportunity for Lorillard

Premium Non-Menthol Non-Full Flavor Units by Brand

89 B units 100%

Winston Other

80% Camel 60% 40% Marlboro 20% 0% 2012

36

|

] |

Newport Non-Menthol Gold Has Been Deemed Substantially Equivalent by the FDA and Authorized for Marketing

37

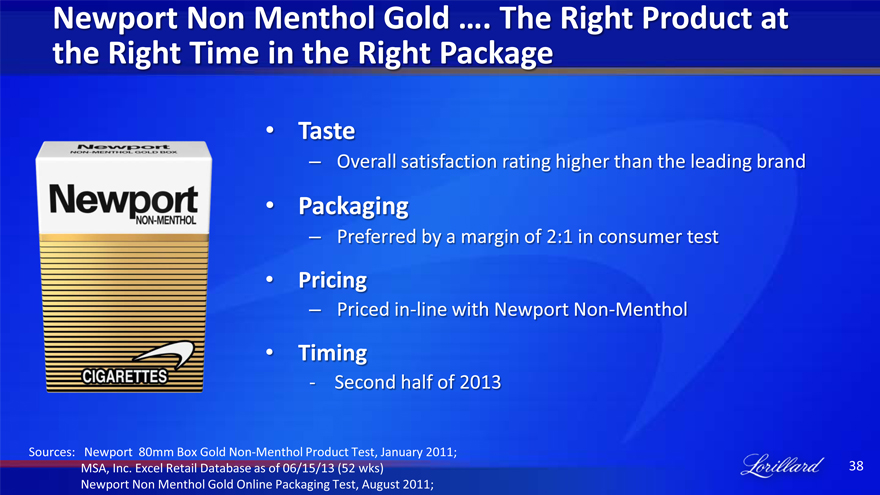

Newport Non Menthol Gold …. The Right Product at the Right Time in the Right Package

Taste

– Overall satisfaction rating higher than the leading brand

Packaging

– Preferred by a margin of 2:1 in consumer test

Pricing

– Priced in-line with Newport Non-Menthol

Timing

- Second half of 2013

hol Product Test, January 2011; MSA, Inc. Excel Retail Database as of 06/15/13 (52 wks) Newport Non Menthol Gold Online Packaging Test, August 2011;

38

Lorillard’s Strategic Plan Is Working

pite increased menthol competition

2. Lorillard’s geographic expansion strategy has been successful

3. Newport’s launch into non-menthol has worked well

4. The blu eCigs acquisition has exceeded expectations and positions Lorillard as the clear leader in the rapidly growing e-cig category

5. In combination, New Initiatives have profitably contributed to Lorillard’s continued growth

6. Significant enhancements to processes and capabilities have been made with much of the investment behind us

7. Lorillard continues to successfully defend its Freedom to Operate

8. Lorillard’s capital structure continues to improve for the benefit of shareholders

39

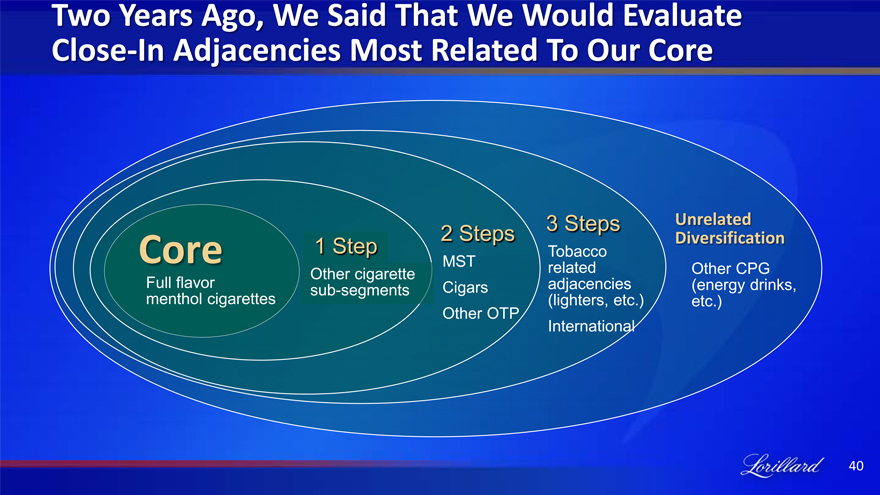

Two Years Ago, We Said That We Would Evaluate Close-In Adjacencies Most Related To Our Core

Core

menthol Full flavor cigarettes

3 Steps Unrelated

2 Steps Diversification

1 Step Tobacco

MST related Other CPG Other cigarette sub-segments Cigars (lighters, adjacencies etc. ) (energy drinks, etc.) Other OTP

International

40

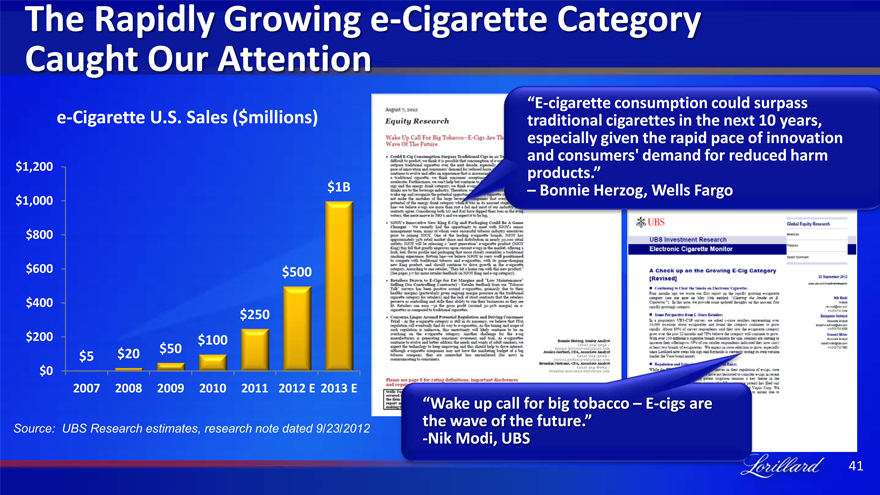

The Rapidly Growing e-Cigarette Category Caught Our Attention

e-Cigarette U.S. Sales ($millions)

$1,200 $1,000 $1B $800

$600 $500 $400 $250 $200 $100

$20 $50 $5 $0

2007 2008 2009 2010 2011 2012 E 2013 E

Source: UBS Research estimates, research note dated 9/23/2012

“E-cigarette consumption could surpass traditional cigarettes in the next 10 years, especially given the rapid pace of innovation and consumers’ demand for reduced harm products.”

– Bonnie Herzog, Wells Fargo

“Wake up call for big tobacc cigs are the wave of the future.

Ni Mo , UB

41

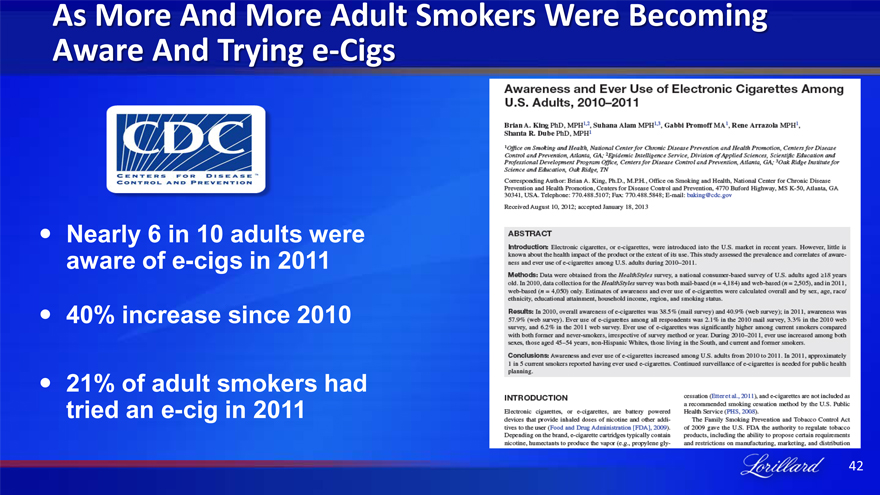

As More And More Adult Smokers Were Becoming Aware And Trying e-Cigs

Nearly 6 in 10 adults were aware of e-cigs in 2011

40% increase since 2010

21% of adult smokers had tried an e-cig in 2011

42

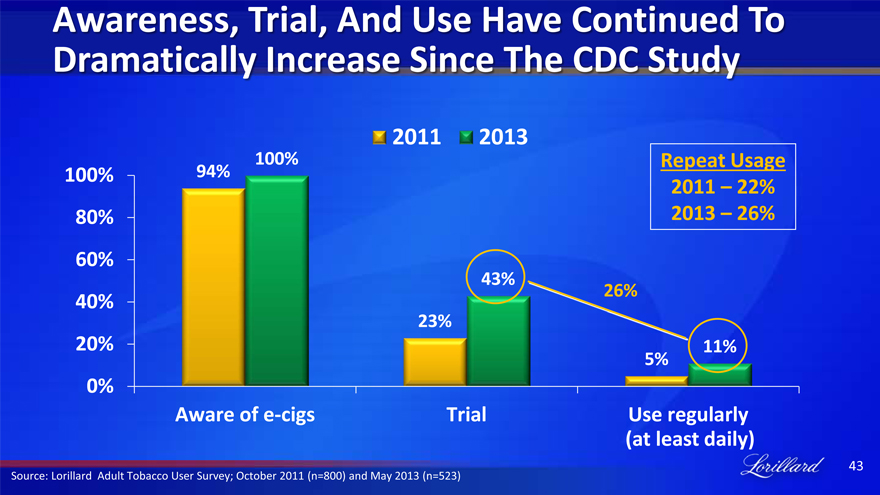

Awareness, Trial, And Use Have Continued To Dramatically Increase Since The CDC Study

2011 2013

100% Repeat Usage

100% 94% 2011 – 22%

80% 2013 – 26%

60%

43%

40% 26%

23%

20% 11%

5%

0%

Aware of e-cigs Trial Use regularly

(at least daily)

Source: Lorillard Adult Tobacco User Survey; October 2011 (n=800) and May 2013 (n=523)

43

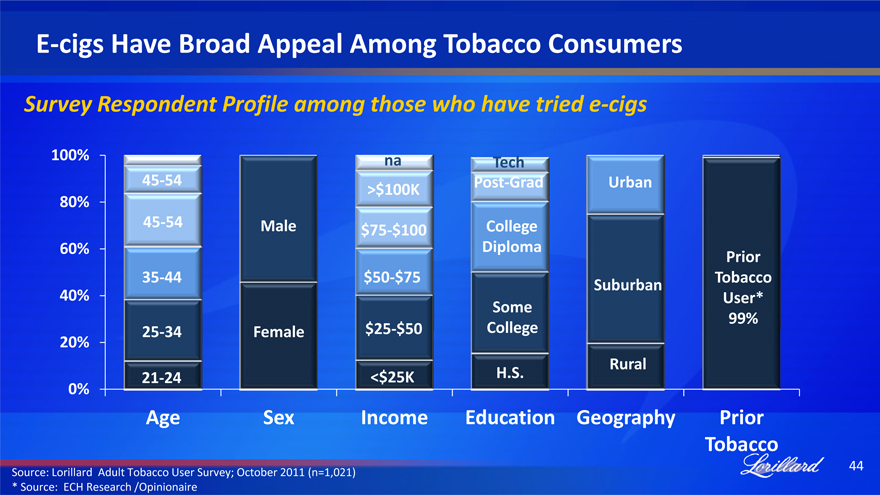

E-cigs Have Broad Appeal Among Tobacco Consumers

Survey Respondent Profile among those who have tried e-cigs

100% 80% 60% 40% 20% 0%

45-54

45-54

35-44

25-34

21-24

Male

Female

na

$100K

$75-$100

$50-$75

$25-$50

$25K

Tech Post-Grad

College Diploma

Some College

H.S.

Urban Suburban Rural

Prior Tobacco User* 99%

Age Sex Income Education Geography Prior

Tobacco

Source: Lorillard Adult Tobacco User Survey; October 2011 (n=1,021)

* Source: ECH Research /Opinionaire

44

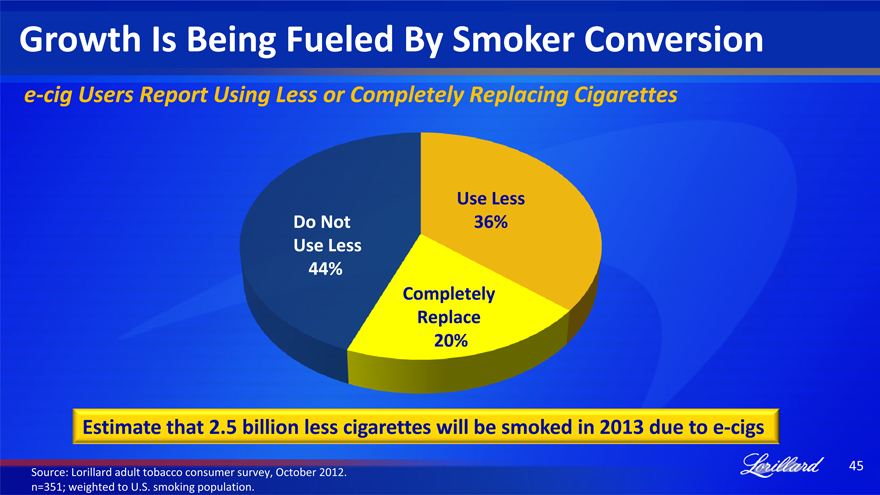

Growth Is Being Fueled By Smoker Conversion

e-cig Users Report Using Less or Completely Replacing Cigarettes

Use Less Do Not 36% Use Less 44% Completely Replace 20%

Estimate that 2.5 billion less cigarettes will be smoked in 2013 due to e-cigs

Source: Lorillard adult tobacco consumer survey, October 2012. n=351; weighted to U.S. smoking population.

45

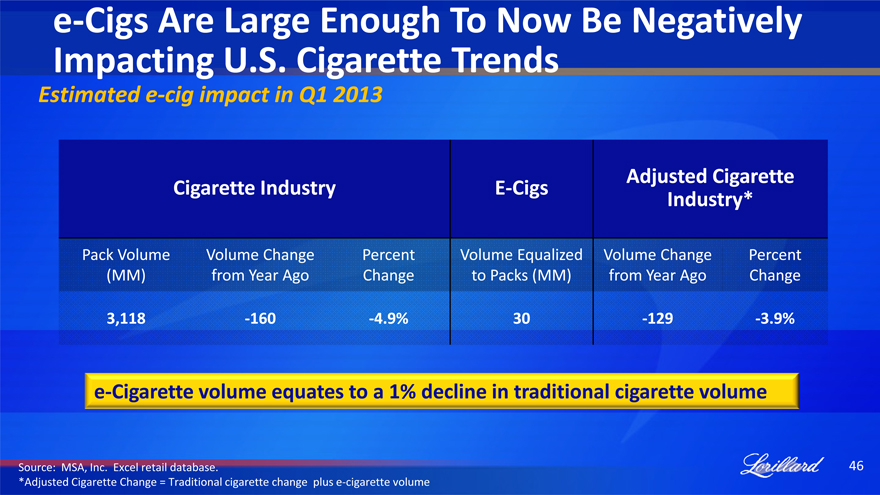

e-Cigs Are Large Enough To Now Be Negatively Impacting U.S. Cigarette Trends

Estimated e-cig impact in Q1 2013

Adjusted Cigarette Cigarette Industry E-Cigs Industry*

Pack Volume Volume Change Percent Volume Equalized Volume Change Percent (MM) from Year Ago Change to Packs (MM) from Year Ago Change

3,118 -160 -4.9% 30 -129 -3.9%

e-Cigarette volume equates to a 1% decline in traditional cigarette volume

Source: MSA, Inc. Excel retail database.

*Adjusted Cigarette Change = Traditional cigarette change plus e-cigarette volume

46

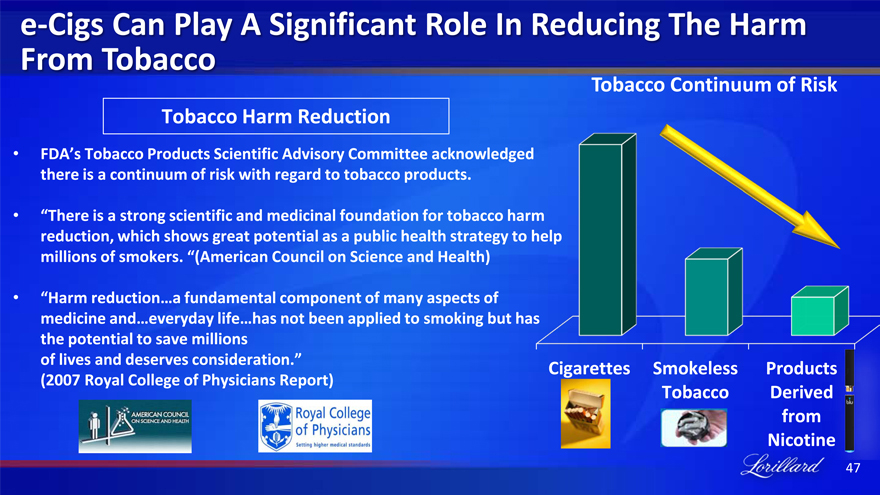

e-Cigs Can Play A Significant Role In Reducing The Harm From Tobacco

Tobacco Continuum of Risk

Tobacco Harm Reduction

• FDA’s Tobacco Products Scientific Advisory Committee acknowledged there is a continuum of risk with regard to tobacco products.

• “There is a strong scientific and medicinal foundation for tobacco har reduction, which shows great potential as a public health strategy to millions of smokers. “(American Council on Science and Health)

• “Harm reduction…a fundamental component of many aspects of medicine and…everyday life…has not been applied to smoking but has the potential to save millions of lives and deserves consideration.” (2007 Royal College of Physicians Report)

Cigarettes Smokeless Produc Tobacco Derive from Nicoti

47

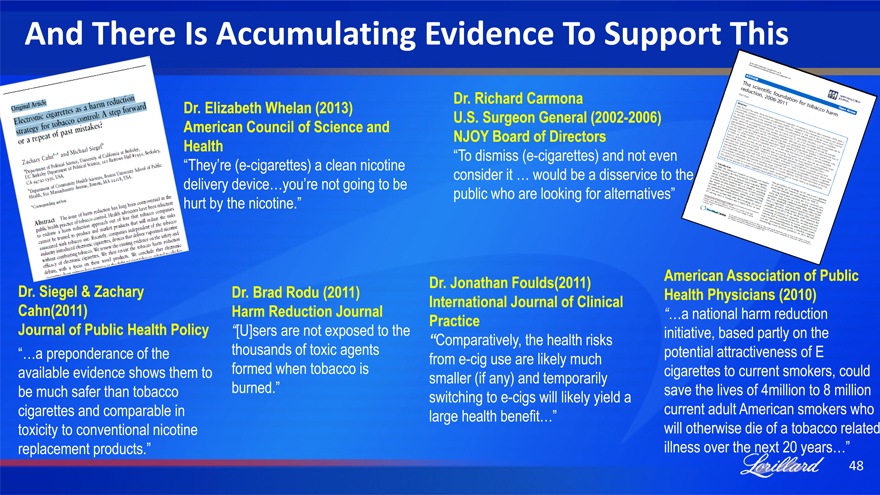

And There Is Accumulating Evidence To Support This

Dr. Richard Carmona

Dr. Elizabeth Whelan (2013) U.S. Surgeon General (2002-2006)

American Council of Science and NJOY Board of Directors

Health “To dismiss (e-cigarettes) and not even

“They’re (e-cigarettes) a clean nicotine consider it … would be a disservice to the

delivery device…you’re not going to be public who are looking for alternatives”

hurt by the nicotine.”

Dr. Jonathan Foulds(2011) American Association of Public

Dr. Siegel & Zachary Dr. Brad Rodu (2011) International Journal of Clinical Health Physicians (2010)

Cahn(2011) Harm Reduction Journal Practice “…a national harm reduction

Journal of Public Health Policy “[U]sers are not exposed to the “Comparatively, the health risks initiative, based partly on the

“…a preponderance of the thousands of toxic agents from e-cig use are likely much potential attractiveness of E

available evidence shows them to formed when tobacco is smaller (if any) and temporarily cigarettes to current smokers, could

be much safer than tobacco burned.” switching to e-cigs will likely yield a save the lives of 4million to 8 million

cigarettes and comparable in large health benefit…” current adult American smokers who

toxicity to conventional nicotine will otherwise die of a tobacco related

replacement products.” illness over the next 20 years…”

48

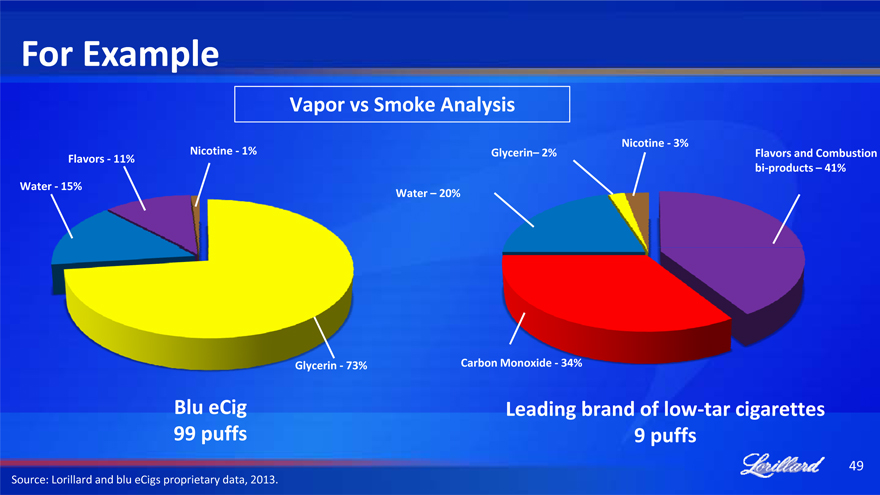

For Example

Vapor vs Smoke Analysis

Nicotine—3%

Nicotine—1% Glycerin– 2% Flavors and Combustion Flavors—11% bi-products – 41% Water—15% Water – 20%

Glycerin—73% Carbon Monoxide—34%

Blu eCig Leading brand of low-tar cigarettes 99 puffs 9 puffs

Source: Lorillard and blu eCigs proprietary data, 2013.

49

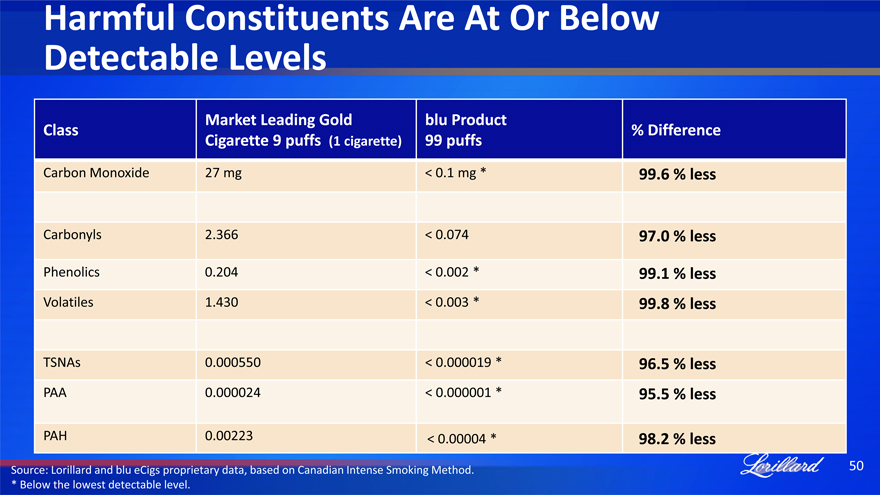

Harmful Constituents Are At Or Below Detectable Levels

Market Leading Gold blu Product

Class % Difference

Cigarette 9 puffs (1 cigarette) 99 puffs

Carbon Monoxide 27 mg < 0.1 mg * 99.6 % less

Carbonyls 2.366 < 0.074 97.0 % less

Phenolics 0.204 < 0.002 * 99.1 % less

Volatiles 1.430 < 0.003 * 99.8 % less

TSNAs 0.000550 < 0.000019 * 96.5 % less

PAA 0.000024 < 0.000001 * 95.5 % less

PAH 0.00223 < 0.00004 * 98.2 % less

Source: Lorillard and blu eCigs proprietary data, based on Canadian Intense Smoking Method.

* Below the lowest detectable level.

50

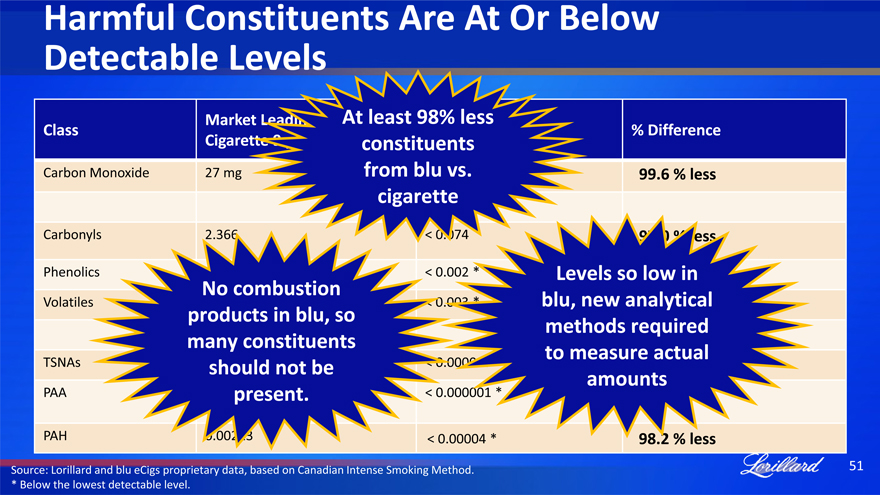

Harmful Constituents Are At Or Below Detectable Levels

Market Leading GoldAt least 98%blu Productless

Class % Difference

Cigarette 9 puffs (1 cigarette)constituents99 puffs

Carbon Monoxide 27 mg from blu< 0.1vs.mg * 99.6 % less

cigarette

Carbonyls 2.366 < 0.074 97.0 % less

Phenolics 0.204 < 0.002 * Levels so 99.low1 %inless

No combustion

Volatiles 1.430 < 0.003 * blu, new analytical99.8 % less

products in blu, so methods required

many constituents to measure actual

TSNAs 0.should000550 not be < 0.000019 * 96.5 % less

amounts

PAA 0.000024present. < 0.000001 * 95.5 % less

PAH 0.00223 < 0.00004 * 98.2 % less

Source: Lorillard and blu eCigs proprietary data, based on Canadian Intense Smoking Method.

* Below the lowest detectable level.

51

After Careful Evaluation, Lorillard Purchased blu e-Cigs

Superior Product

Highest brand awareness

Unique & proprietary positioning

Well-rounded portfolio

Disposables & rechargeables

All retail channels

Potential for Lorillard to be the category leader

52

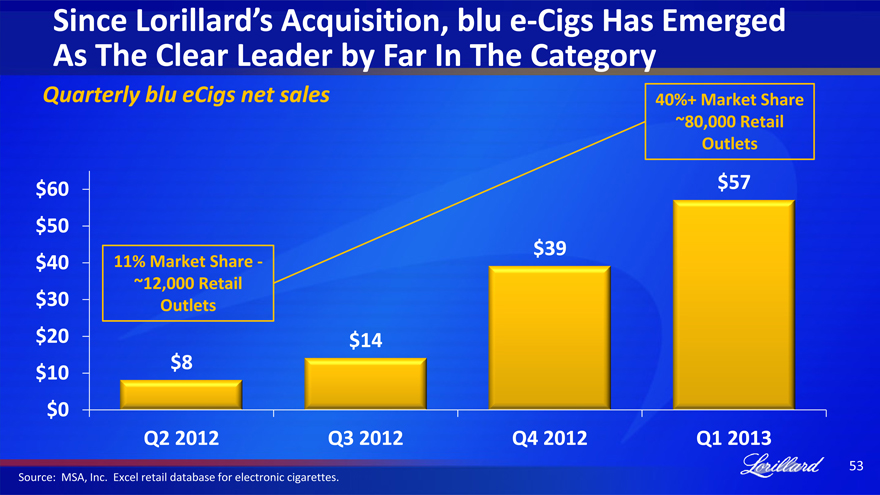

Since Lorillard’s Acquisition, blu e-Cigs Has Emerged As The Clear Leader by Far In The Category

Quarterly blu eCigs net sales

40%+ Market Share ~80,000 Retail Outlets

$60 $57 $50 $39

$40 11% Market Share—~12,000 Retail

$30 Outlets

$20 $14

$10 $8 $0

Q2 2012 Q3 2012 Q4 2012 Q1 2013

Source: MSA, Inc. Excel retail database for electronic cigarettes.

53

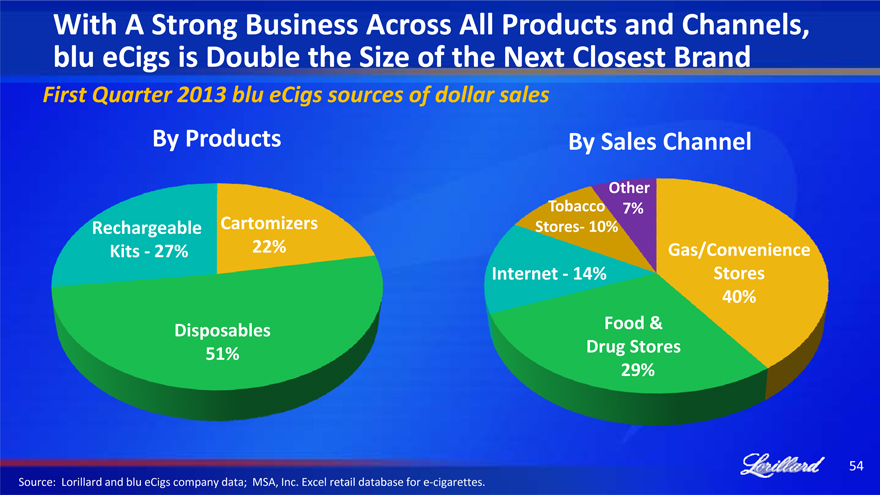

With A Strong Business Across All Products and Channels, blu eCigs is Double the Size of the Next Closest Brand

First Quarter 2013 blu eCigs sources of dollar sales

By Products

Rechargeable Cartomizers

Kits—27% 22%

Disposables

51%

By Sales Channel

Other

Tobacco 7%

Stores- 10%

Gas/Convenience

Internet—14% Stores

40%

Food &

Drug Stores

29%

Source: Lorillard and blu eCigs company data; MSA, Inc. Excel retail database for e-cigarettes.

54

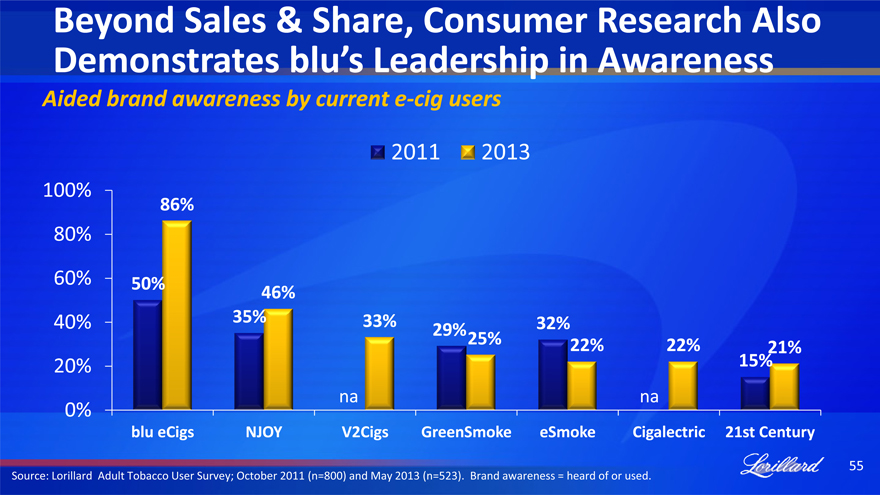

Beyond Sales & Share, Consumer Research Also Demonstrates blu’s Leadership in Awareness

Aided brand awareness by current e-cig users

2011 2013

100% 86%

80%

60% 50% 46%

40% 35% 33% 29% 32%

25% 22% 22% 21%

20% 15%

0% na na

blu eCigs NJOY V2Cigs GreenSmoke eSmoke Cigalectric 21st Century

Source: Lorillard Adult Tobacco User Survey; October 2011 (n=800) and May 2013 (n=523). Brand awareness = heard of or used.

55

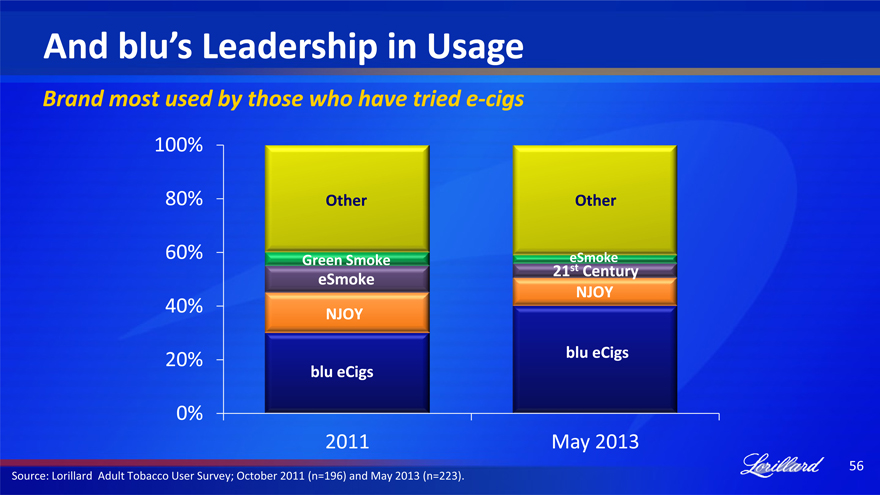

And blu’s Leadership in Usage

Brand most used by those who have tried e-cigs

100% 80% 60% 40% 20% 0%

Other Other

Green Smoke eSmoke

21st Century eSmoke NJOY NJOY

blu eCigs blu eCigs

2011 May 2013

Source: Lorillard Adult Tobacco User Survey; October 2011 (n=196) and May 2013 (n=223).

56

Why Because blu Is A Brand-Builder

57

blu Is A Brand-Builder

58

blu Is A Brand-Builder

59

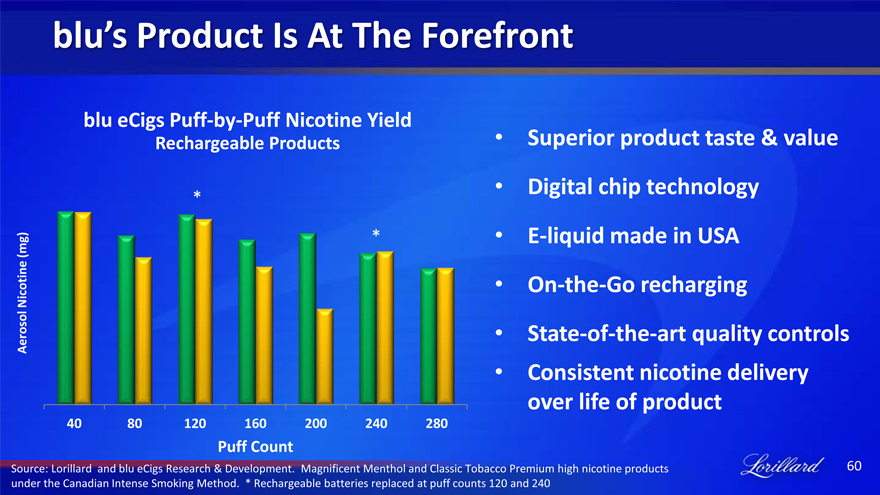

blu’s

Product

Is

At

The

Forefront

blu eCigs Puff-by-Puff Nicotine Yield

Rechargeable Products

Superior product taste & value

Digital chip technology

E-liquid made in USA

On-the-Go recharging

State-of-the-art quality controls

Consistent nicotine delivery over life of product

*

(mg) * Nicotine Aerosol

40 80 120 160 200 240 280

Puff Count

Source: Lorillard and blu eCigs Research & Development. Magnificent Menthol and Classic Tobacco Premium high nicotine products under the Canadian Intense Smoking Method. * Rechargeable batteries replaced at puff counts 120 and 240

60

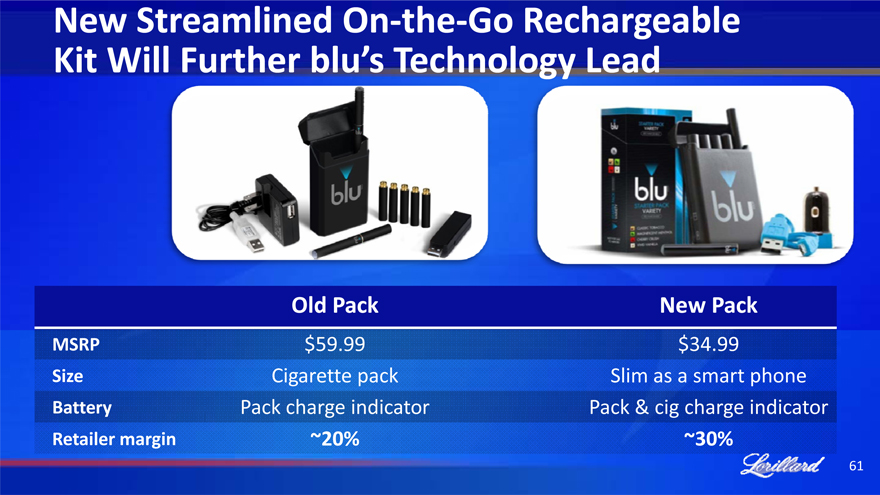

New Streamlined On-the-Go Rechargeable Kit Will Further blu’s Technology Lead

Old Pack New Pack

MSRP $59.99 $34.99

Size Cigarette pack Slim as a smart phone

Battery Pack charge indicator Pack & cig charge indicator

Retailer margin ~20% ~30%

61

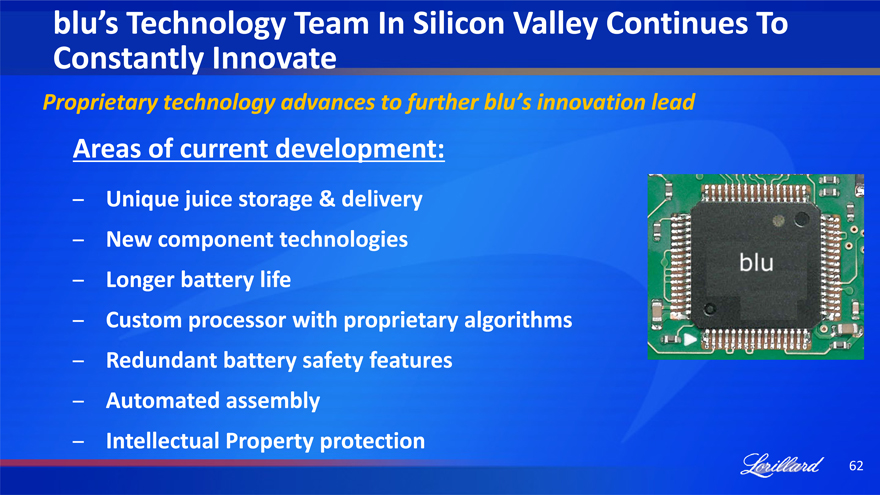

blu’s Technology Team In Silicon Valley Continues To Constantly Innovate

Proprietary technology advances to further blu’s innovation lead

Areas of current development:

Unique juice storage & delivery

New component technologies

Longer battery life

Custom processor with proprietary algorithms

Redundant battery safety features

Automated assembly

Intellectual Property protection

62

The

Acquisition Has Already Been Accretive

Electronic Cigarette Segment Results FY 2012 2013-Q1

(in millions)

Net Sales $ 61 $ 57

Gross Profit $ 21 $ 21

Adjusted Operating Income $ 7 $ 7

Source: Lorillard filings. See Appendix A for further discussion of adjustments

63

Lorillard’s Strategic Plan Is Working

Newport full-flavor menthol in the core continues to remain stable despite increased menthol competition

Lorillard’s geographic expansion strategy has been successful

Newport’s launch into non-menthol has worked well

The blu eCigs acquisition has exceeded expectations and positions Lorillard as the clear leader in the rapidly growing e-cig category

In combination, New Initiatives have profitably contributed to Lorillard’s continued growth

Significant enhancements to processes and capabilities have been made with much of the investment behind us

Lorillard continues to successfully defend its Freedom to Operate

Lorillard’s capital structure continues to improve for the benefit of shareholders

64

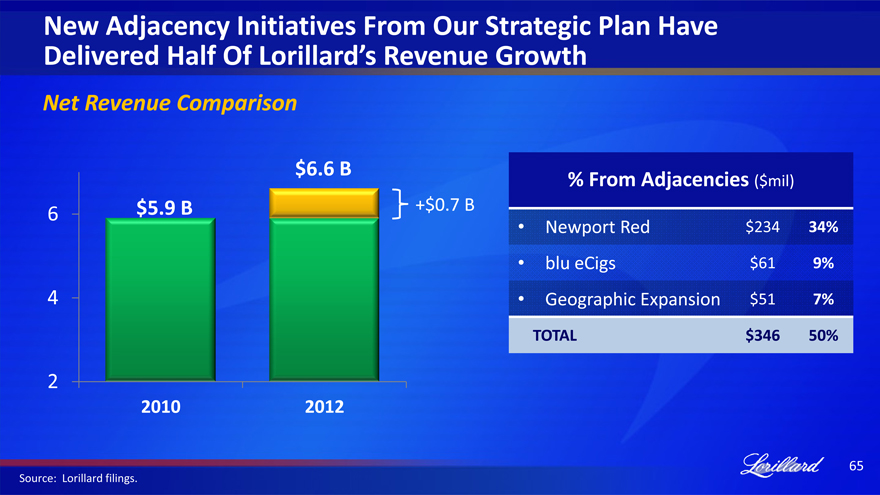

New Adjacency Initiatives From Our Strategic Plan Have

Delivered Half Of Lorillard’s Revenue Growth

Net Revenue Comparison

$6.6 B

2010 2012

% From Adjacencies ($mil)

• Newport Red $234 34%

• blu eCigs $61 9%

• Geographic Expansion $51 7%

TOTAL $346 50%

Source: Lorillard filings.

65

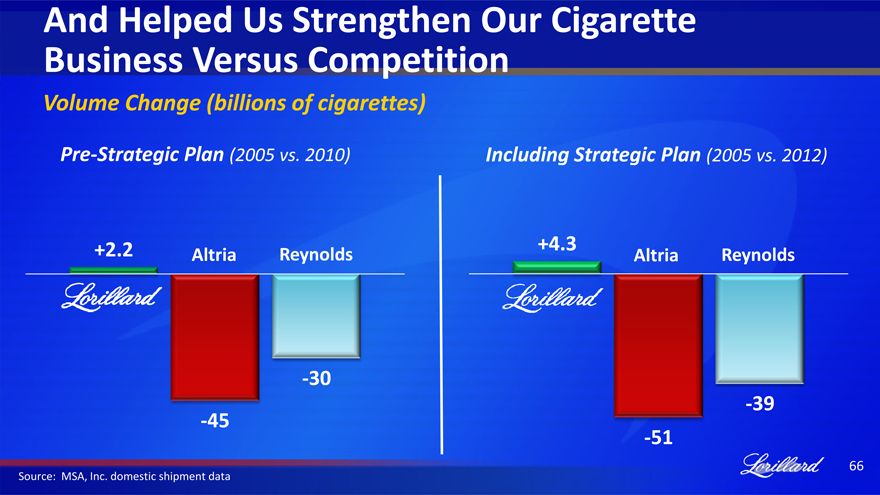

And Helped Us Strengthen Our Cigarette Business Versus Competition

Volume Change (billions of cigarettes)

Pre-Strategic Plan (2005 vs. 2010)

+2.2 Altria Reynolds

-30

-45

Including Strategic Plan (2005 vs. 2012)

+4.3 Altria Reynolds

-39

-51

Source: MSA, Inc. domestic shipment data

66

Lorillard’s Strategic Plan Is Working

Newport full-flavor menthol in the core continues to remain stable despite increased menthol competition

Lorillard’s geographic expansion strategy has been successful

Newport’s launch into non-menthol has worked well

The blu eCigs acquisition has exceeded expectations and positions Lorillard as the clear leader in the rapidly growing e-cig category

In combination, New Initiatives have profitably contributed to Lorillard’s continued growth

Significant enhancements to processes and capabilities have been made with much of the investment behind us

Lorillard continues to successfully defend its Freedom to Operate

Lorillard’s capital structure continues to improve for the benefit of shareholders

67

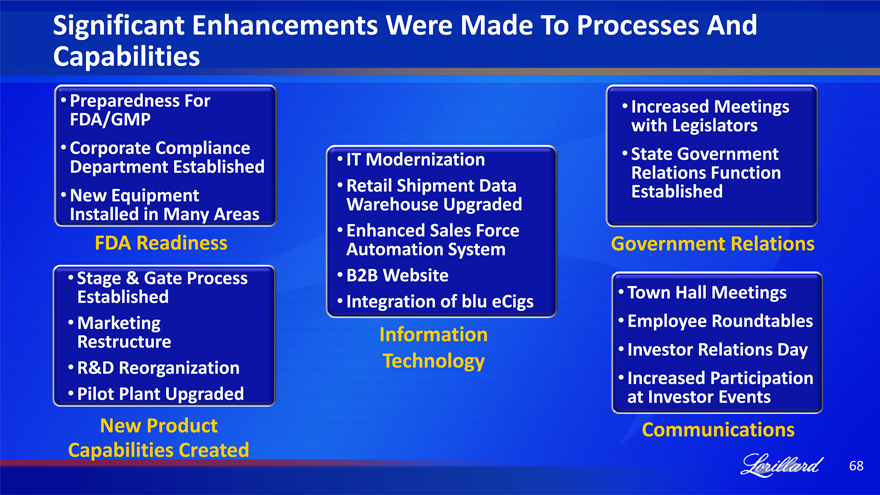

Significant Enhancements Were Made To Processes And Capabilities

Preparedness For FDA/GMP

Corporate Compliance Department Established

New Equipment Installed in Many Areas

FDA Readiness

Stage & Gate Process Established

Marketing Restructure

R&D Reorganization

Pilot Plant Upgraded

New Product Capabilities Created

IT Modernization

Retail Shipment Data Warehouse Upgraded

Enhanced Sales Force Automation System

B2B Website

Integration of blu eCigs

Information Technology

Increased Meetings with Legislators

State Government Relations Function Established

Government Relations

Town Hall Meetings

Employee Roundtables

Investor Relations Day

Increased Participation at Investor Events

Communications

68

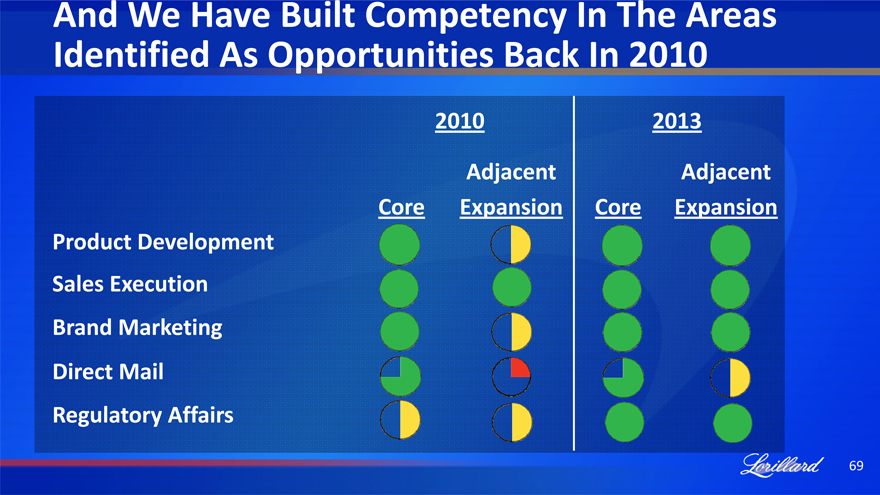

Identified As Opportunities Back In 2010

2010 2013

Adjacent Adjacent

Core Expansion Core Expansion

Product Development

Sales Execution

Brand Marketing

Direct Mail

Regulatory Affairs

69

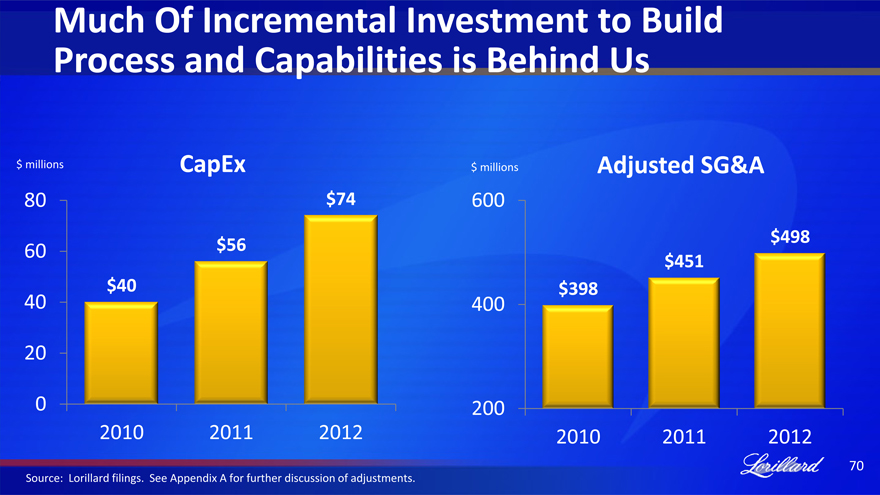

Much Of Incremental Investment to Build Process and Capabilities is Behind Us

$ millions CapEx

80 $74

60 $56

$40

40

20

0

2010 2011 2012

$ millions Adjusted SG&A

600

$498

$451

$398

400

200

2010 2011 2012

Source: Lorillard filings. See Appendix A for further discussion of adjustments.

70

Lorillard’s Strategic Plan Is Working

Newport full-flavor menthol in the core continues to remain stable despite increased menthol competition

Lorillard’s geographic expansion strategy has been successful

Newport’s launch into non-menthol has worked well

The blu eCigs acquisition has exceeded expectations and positions Lorillard as the clear leader in the rapidly growing e-cig category

In combination, New Initiatives have profitably contributed to Lorillard’s continued growth

Significant enhancements to processes and capabilities have been made with much of the investment behind us

Lorillard continues to successfully defend its Freedom to Operate

Lorillard’s capital structure continues to improve for the benefit of shareholders

71

Lorillard’s Freedom To Operate Successfully Defended But An Ongoing Challenge

Menthol Debate

NPM

Settlement

Leading the Way is Reasonable e-cig Regulation

Won Graphic Warnings Case

TPSAC Lawsuit

Successful FDA Inspections

72

Lorillard’s Strategic Plan Is Working

Newport full-flavor menthol in the core continues to remain stable despite increased menthol competition

Lorillard’s geographic expansion strategy has been successful

Newport’s launch into non-menthol has worked well

The blu eCigs acquisition has exceeded expectations and positions Lorillard as the clear leader in the rapidly growing e-cig category

In combination, New Initiatives have profitably contributed to Lorillard’s continued growth

Significant enhancements to processes and capabilities have been made with much of the investment behind us

Lorillard continues to successfully defend its Freedom to Operate

Lorillard’s capital structure continues to improve for the benefit of shareholders

73

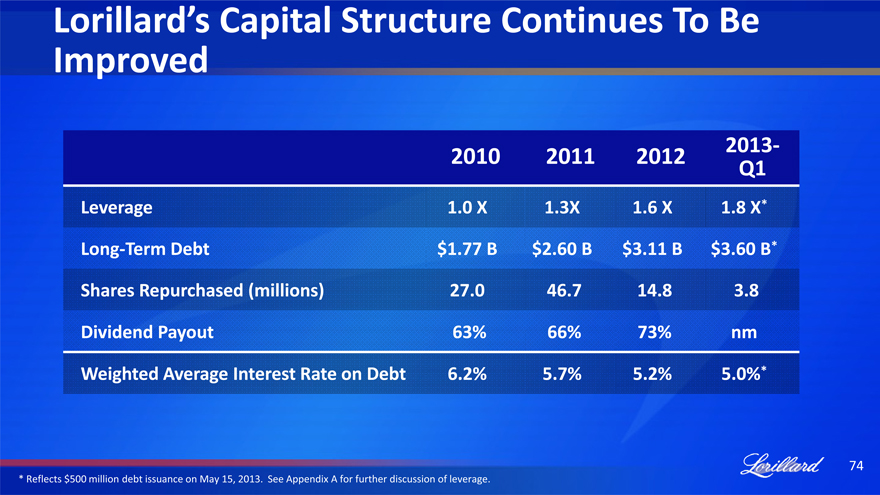

Lorillard’s Capital Structure Continues To Be Improved

2010 2011 2012 2013-

Q1

Leverage 1.0 X 1.3X 1.6 X 1.8 X*

Long-Term Debt $1.77 B $2.60 B $3.11 B $3.60 B*

Shares Repurchased (millions) 27.0 46.7 14.8 3.8

Dividend Payout 63% 66% 73% nm

Weighted Average Interest Rate on Debt 6.2% 5.7% 5.2% 5.0%*

* | | Reflects $500 million debt issuance on May 15, 2013. See Appendix A for further discussion of leverage. |

74

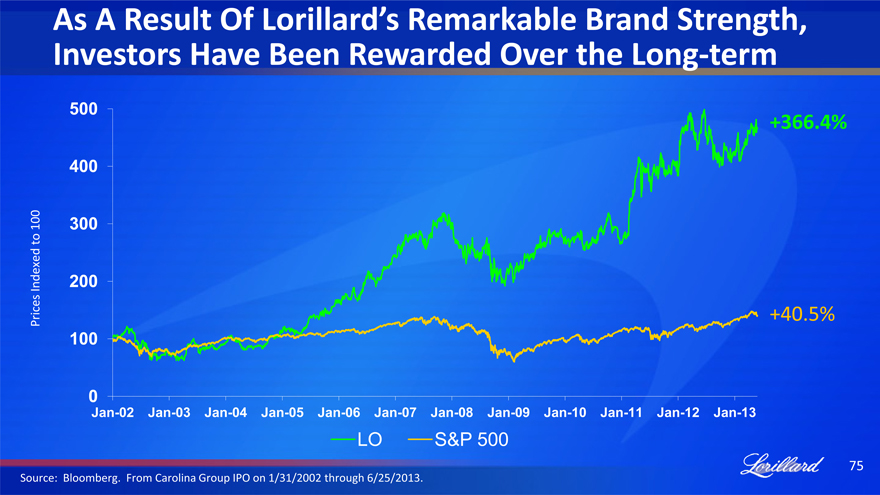

As A Result Of Lorillard’s Remarkable Brand Strength, Investors Have Been Rewarded Over the Long-term

500 +366.4%

400

100 300

to

Indexed 200

Prices +40.5%

100

0

Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13

LO S&P 500

Source: Bloomberg. From Carolina Group IPO on 1/31/2002 through 6/25/2013.

75

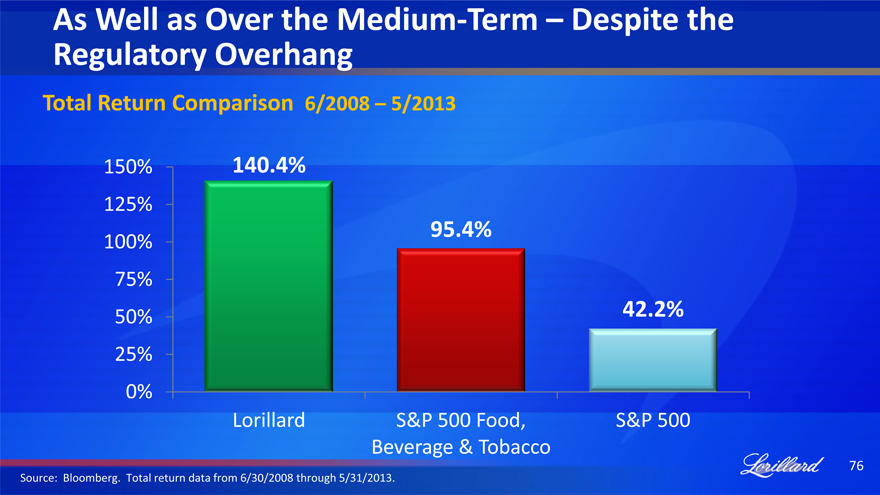

As Well as Over the Medium-Term – Despite the Regulatory Overhang

Total Return Comparison 6/2008 – 5/2013

150% 140.4%

125%

100% 95.4%

75%

50% 42.2%

25%

0%

Lorillard S&P 500 Food, S&P 500

Beverage & Tobacco

Source: Bloomberg. Total return data from 6/30/2008 through 5/31/2013.

76

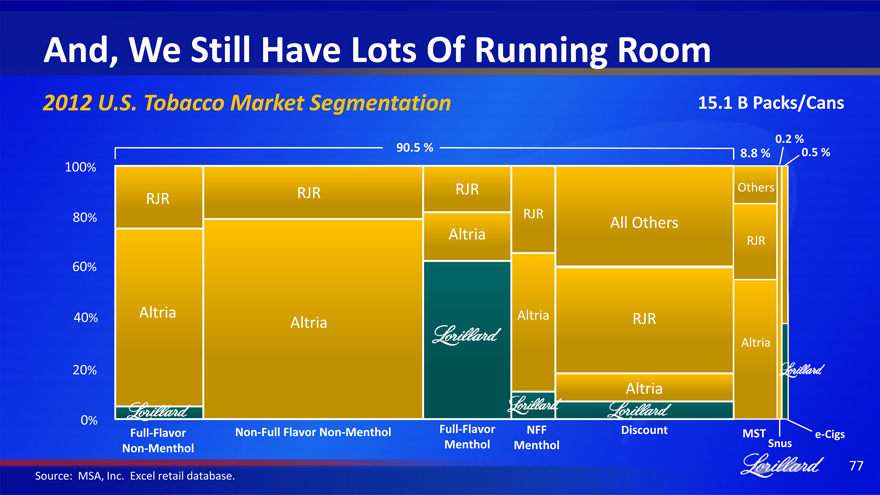

And, We Still Have Lots Of Running Room

2012 U.S. Tobacco Market Segmentation 15.1 B Packs/Cans

0.2 %

90.5 % 8.8 % 0.5 %

100%

RJR RJR RJR Others

80% RJR All Others

Altria RJR

60%

40% Altria Altria Altria RJR

Altria

20%

Altria

0%

Non-Full Flavor Non-Menthol Full-Flavor MST -Cigs

Non-Menthol Menthol Menthol Sn s

77

Source: MSA, Inc. Excel retail database.

Summary

Delivering superior results despite competitive environment

Gaining market share for the 11th consecutive year

Launching adjacent new products to accelerate growth

Continuing to be first and best in e-cigarettes with blu eCigs

Remaining focused on tight cost control

As always, rewarding shareholders is the top priority

78

While Lorillard’s Fundamentals Clearly Lead The Industry, Regulation Worries Investors

Agenda

Introduction Bob Bannon – Investor Relations

Strategic Plan Update Murray Kessler – Chairman, President & CEO

Regulatory Update Neil Wilcox – SVP, Chief Compliance Officer

Bill True – SVP, R&D

Legal Update Ron Milstein – EVP, Legal & General Counsel

Financial Guidance (Lorillard-Style) David Taylor – EVP, Finance & CFO

Additional Q&A All

79

Regulatory Update

Neil Wilcox, SVP & Chief Compliance Officer Bill True, SVP Research & Development

June 27, 2013

80

Update On The Regulatory Environment

Lorillard’s preparations for FDA regulations Corporate Compliance infrastructure New FDA / CTP Director Substantial Equivalence (SE) FDA e-cigarettes deeming regulation Menthol

81

What Has Lorillard Done To Ensure Regulatory Compliance?

Established a new Corporate Compliance department

Recruited team to build a foundation of excellence based upon demonstrated expertise Ensured corporate policies and procedures that meet or exceed all federal, state and local regulations Established a “Culture of FDA Compliance” across the enterprise Invested to modernize manufacturing facility

82

Lorillard’s Sustained Effort To Modernize And Prepare For FDA Compliance

Implemented Modernized Equipment for NTRM (Non-Tobacco Related Material) Detection

Advanced screen systems State-of-the-art sorters

Microwave and magnetic detection systems

83

Lorillard’s Sustained Effort To Modernize And Prepare For FDA Compliance

Installed Significant Engineering

Upgrades

Robotic Palletizers by Complex State-of-the-art Dryers RFID (Radio Frequency Identification) system upgrade Upgraded blending and menthol systems New Maker and Rod Making complexes Improved product tracking and tracing

84

Lorillard’s Sustained Effort to Modernize and Prepare for FDA Compliance

We continue to Build our Processes and Capabilities

IT Modernization

In-Sourcing of R&D analyte testing Upgraded Pilot Plant

Lorillard’s Manufacturing, IT and R&D are Well

Prepared for FDA Regulations

85

Rigorous Regulatory Compliance Preparations

Prepared for FDA Inspections

External consultant audits Training Internal audits Practice inspections

86

What Were The Results Of Our Regulatory Compliance Preparations?

FDA conducted unannounced routine inspections of all Lorillard facilities At FDA’s request during the inspections, we provided:

Over 5,000 pages of documents

127 SOPs (Standard Operating Procedures)

Operations’ Work Instructions for every work station Complete listing of all ingredients and packaging supplies Bills of Materials for twelve targeted brands

All requested information provided within turn-around time <2 hours

87

FDA Inspector Feedback – “Outstanding”

Wrap-up session:

Exceptional preparation (efficiency of responses and quality of information)

“A Model of Cooperation”

Inspectors praised our level of sophistication

Provided FDA an opportunity to learn about the industry Established a baseline for GMP preparedness

Lorillard’s Compliance Infrastructure is Ready to Meet a ll

Regulatory Challenges

88

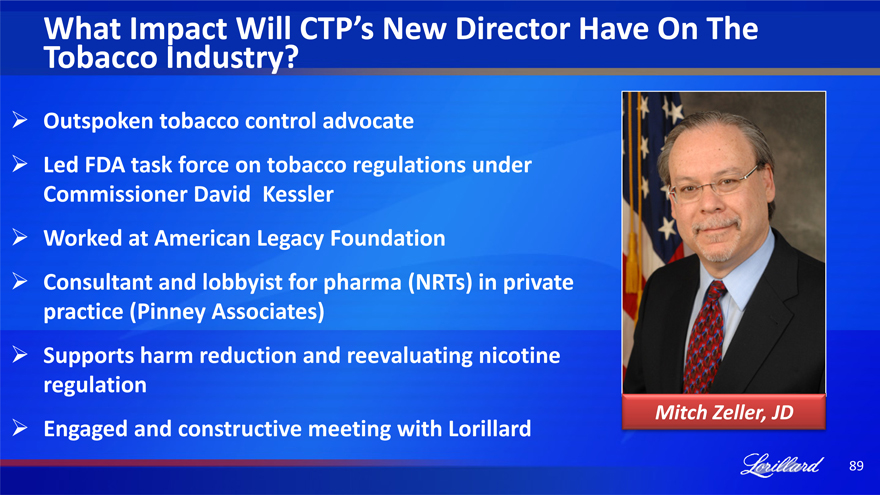

What Impact Will CTP’s New Director Have On The Tobacco Industry?

Outspoken tobacco control advocate

Led FDA task force on tobacco regulations under Commissioner David Kessler Worked at American Legacy Foundation Consultant and lobbyist for pharma (NRTs) in private practice (Pinney Associates) Supports harm reduction and reevaluating nicotine regulation Engaged and constructive meeting with Lorillard

Mitch Zeller, JD

89

What Impact Will CTP’s New Director Have on the Tobacco Industry?

Mitch Zeller, JD

Expected to drive a more aggressive regulatory agenda Committed to “Follow-the-Science” Required to navigate within FDA’s regulatory framework Top three priorities:

SE submissions Deeming Regulation Menthol

Although No Friend of Tobacco, Mr. Zeller Will Likely Drive

Decisions and Reduce Uncertainty

90

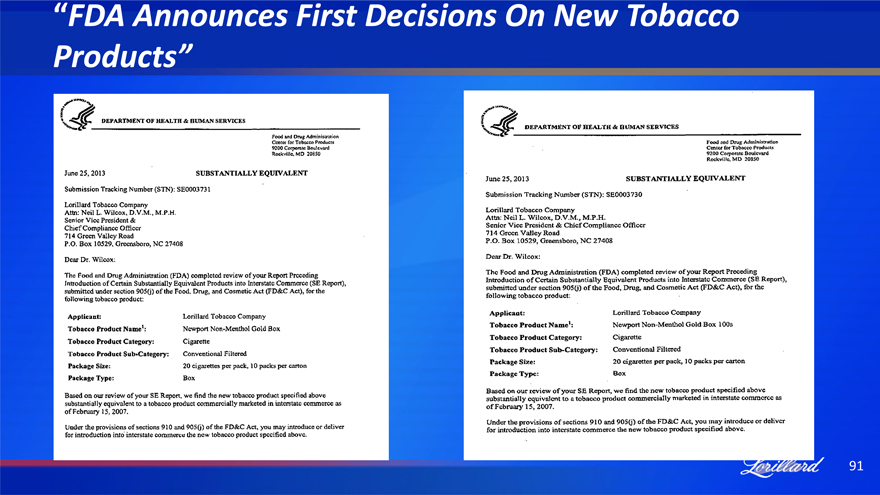

“FDA Announces First Decisions On New Tobacco Products”

91

“…Today’s SE orders allow the marketing of two new Lorillard Tobacco Company tobacco products: Newport Non-Menthol Gold Box 100s and Newport Non-Menthol Gold Box. The agency has found these two products to be substantially equivalent to predicate products, based on the company’s submissions and other readily available science and information that demonstrate that each product will not present more harm to the public health than the predicate.” 91

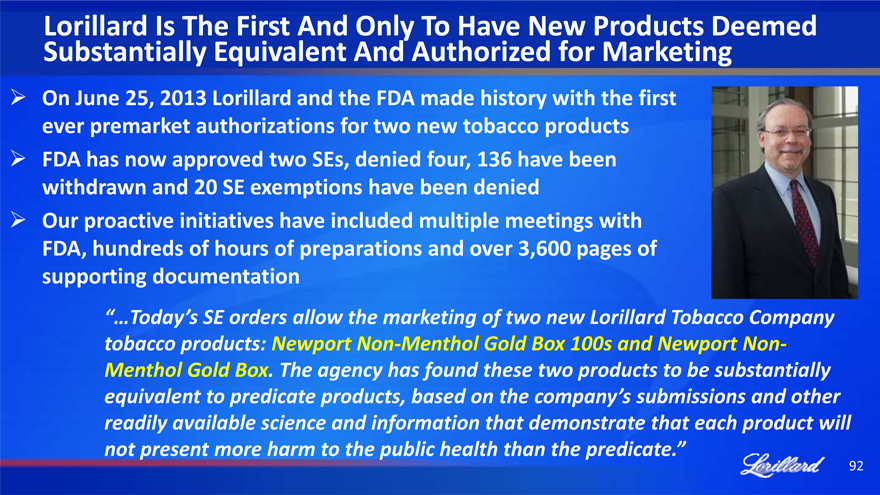

Lorillard Is The First And Only To Have New Products Deemed Substantially Equivalent And Authorized for Marketing

On June 25, 2013 Lorillard and the FDA made history with the first ever premarket authorizations for two new tobacco products FDA has now approved two SEs, denied four, 136 have been withdrawn and 20 SE exemptions have been denied Our proactive initiatives have included multiple meetings with FDA, hundreds of hours of preparations and over 3,600 pages of supporting documentation

92

What Is The Current Status Of E-cigarettes And Deeming Regulations?

FDA announced intention to regulate e-cigarettes in 2011 Primary concern: Over Regulation

Prevent clear public health benefits Inhibit new technological advancements Stifle product innovation

Fair regulations are needed

Ensure product safety and quality Prevent underage use

93

What Is The Current Status Of E-Cigarettes And Deeming Regulations?

Mr. Zeller appears to support e-cigarette’s harm reduction potential Deeming regulations expected this year We anticipate initial draft regulations to be somewhat restrictive

Lorillard is prepared to vigorously respond with a harm reduction strategy This approach is strongly supported by UK and other countries Public pressure will demand flexibility and allow for continued improvements Final regulations will take some time

94

Summary

Lorillard’s compliance infrastructure is well established We have successfully passed routine inspections We are well prepared for GMPs when implemented Excellent communications have been established with CTP

We have received the first and only SE Orders for new tobacco products We look forward to working with the FDA on e-cig regulations Lorillard’s is well prepared for all regulatory requirements and actions

95

But…

What About Potential Regulatory Action on Menthol?

96

Review of Menthol Science

William R. True, Ph.D. Senior Vice President Research and Development

97

What Do We Mean by Sound Science

Robust design to support study objective / hypothesis Conclusions drawn clearly explained and supported by data Reproducible Full Transparency

Data availability

Data selection and statistical treatment explained clearly Study limitations

Weight of evidence across multiple studies

98

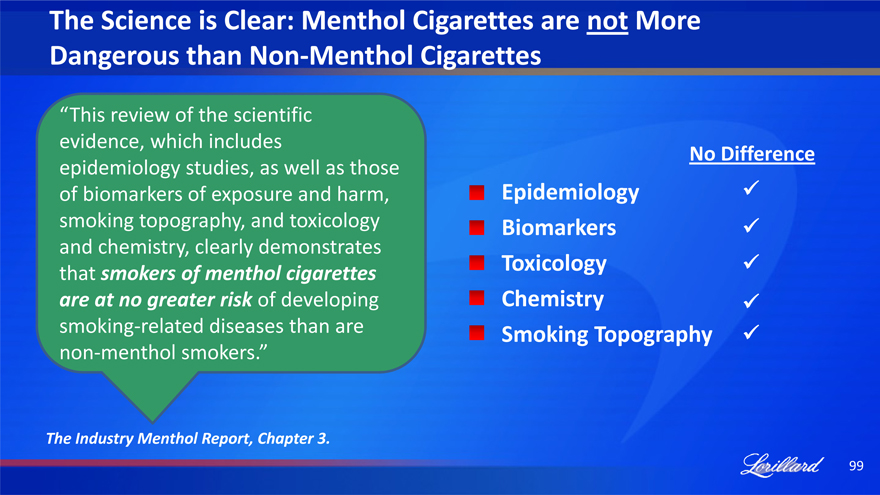

The Science is Clear: Menthol Cigarettes are not More Dangerous than Non-Menthol Cigarettes

“This review of the scientific evidence, which includes epidemiology studies, as well as those of biomarkers of exposure and harm, smoking topography, and toxicology and chemistry, clearly demonstrates that smokers of menthol cigarettes are at no greater risk of developing smoking-related diseases than are non-menthol smokers.”

Epidemiology Biomarkers Toxicology Chemistry Smoking Topography

No Difference

The Industry Menthol Report, Chapter 3.

99

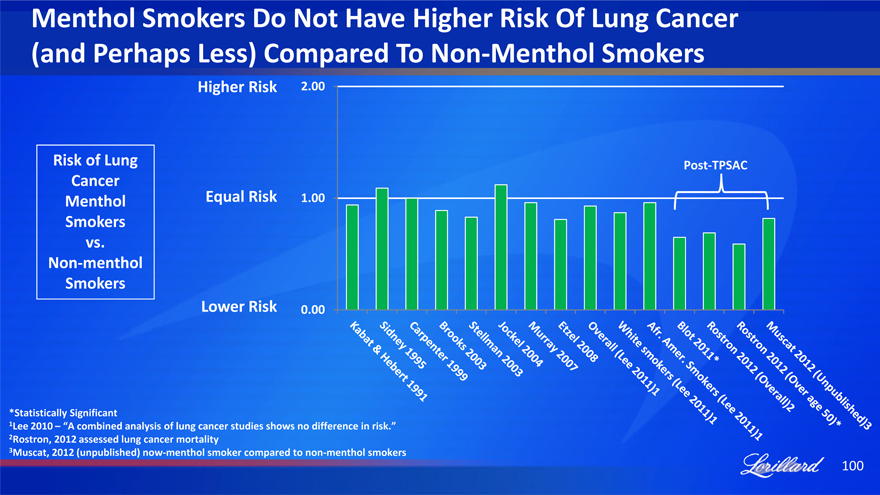

Menthol Smokers Do Not Have Higher Risk Of Lung Cancer (and Perhaps Less) Compared To Non-Menthol Smokers

Risk of Lung Cancer Menthol Smokers vs. Non-menthol Smokers

Higher Risk 2.00 Equal Risk 1.00 Lower Risk 0.00

*Statistically Significant

1Lee 2010 – “A combined analysis of lung cancer studies shows no difference in risk.” 2Rostron, 2012 assessed lung cancer mortality 3Muscat, 2012 (unpublished) now-menthol smoker compared to non-menthol smokers

Post-TPSAC

100

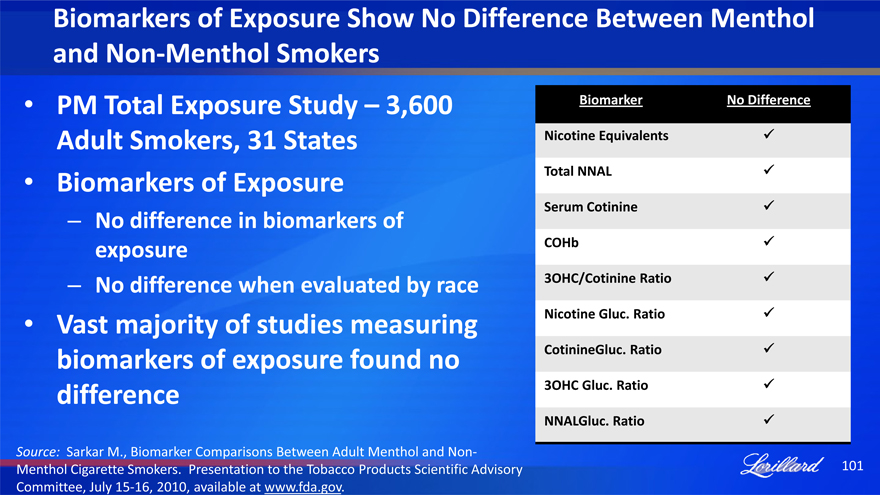

Biomarkers of Exposure Show No Difference Between Menthol and Non-Menthol Smokers

PM Total Exposure Study – 3,600 Adult Smokers, 31 States Biomarkers of Exposure

– No difference in biomarkers of exposure

– No difference when evaluated by race

Vast majority of studies measuring biomarkers of exposure found no difference

Source: Sarkar M., Biomarker Comparisons Between Adult Menthol and Non-Menthol Cigarette Smokers. Presentation to the Tobacco Products Scientific Advisory Committee, July 15-16, 2010, available at www.fda.gov.

Biomarker Nicotine Equivalents Total NNAL

Serum Cotinine COHb 3OHC/Cotinine Ratio Nicotine Gluc. Ratio CotinineGluc. Ratio 3OHC Gluc. Ratio NNALGluc. Ratio

No Difference

101

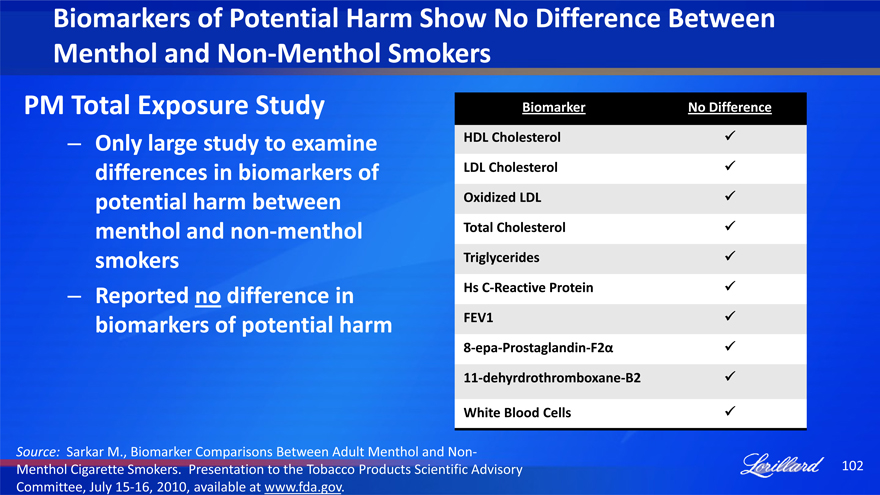

Biomarkers of Potential Harm Show No Difference Between Menthol and Non-Menthol Smokers

PM Total Exposure Study

Only large study to examine

differences in biomarkers of

potential harm between

menthol and non-menthol

smokers

Reported no difference in

biomarkers of potential harm

Biomarker No Difference

HDL Cholesterol

LDL Cholesterol

Oxidized LDL

Total Cholesterol

Triglycerides

Hs C-Reactive Protein

FEV1

8-epa-Prostaglandin-F2?

11-dehyrdrothromboxane-B2

White Blood Cells

Source: Sarkar M., Biomarker Comparisons Between Adult Menthol and Non- 101 Menthol Cigarette Smokers. Presentation to the Tobacco Products Scientific Advisory Committee, July 15-16, 2010, available at www.fda.gov.

102

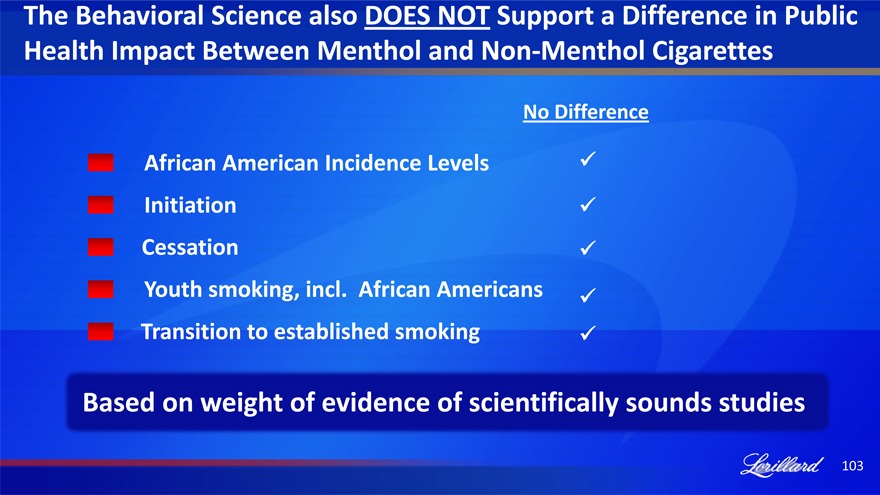

The Behavioral Science also DOES NOT Support a Difference in Public Health Impact Between Menthol and Non-Menthol Cigarettes

No Difference

African American Incidence Levels Initiation Cessation Youth smoking, incl. African Americans Transition to established smoking

Based on weight of evidence of scientifically sounds studies

103

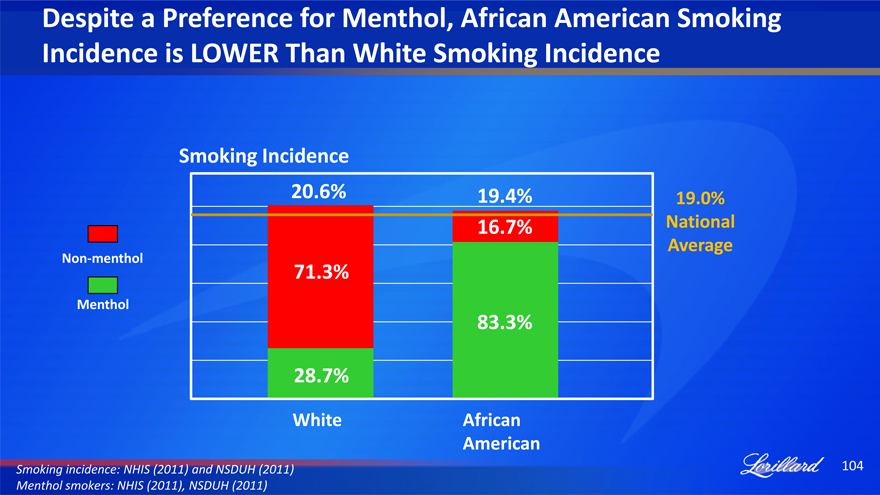

Despite a Preference for Menthol, African American Smoking Incidence is LOWER Than White Smoking Incidence

Smoking Incidence

20.6% 19.4% 19.0%

16.7% National

Average

Non-menthol 71.3%

Menthol

83.3%

28.7%

White African

American

Smoking incidence: NHIS (2011) and NSDUH (2011) 103 Menthol smokers: NHIS (2011), NSDUH (2011)

104

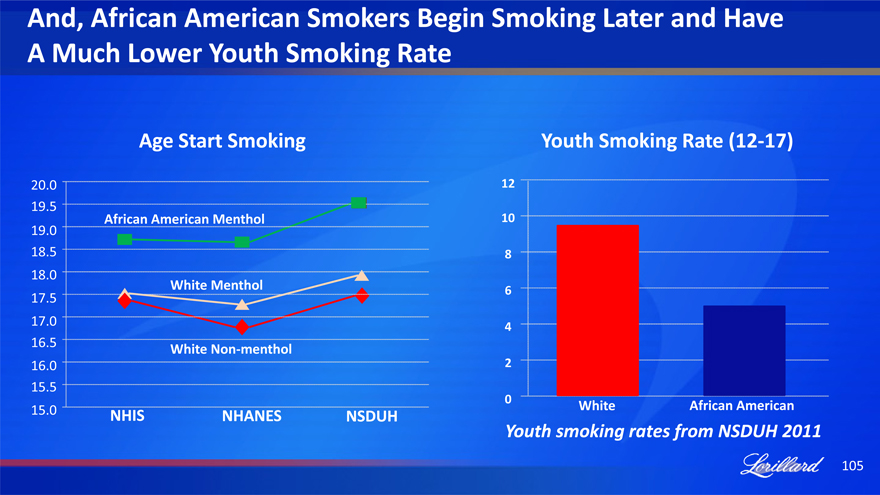

And, African American Smokers Begin Smoking Later and Have A Much Lower Youth Smoking Rate

Age Start Smoking

20.0

19.5

African American Menthol

19.0

18.5

18.0 White Menthol

17.5

17.0

16.5 White Non-menthol

16.0

15.5

15.0 NHIS NHANES NSDUH

Youth Smoking Rate (12-17)

12

10

8

6

4

2

0 White African American

Youth smoking rates from NSDUH 2011

105

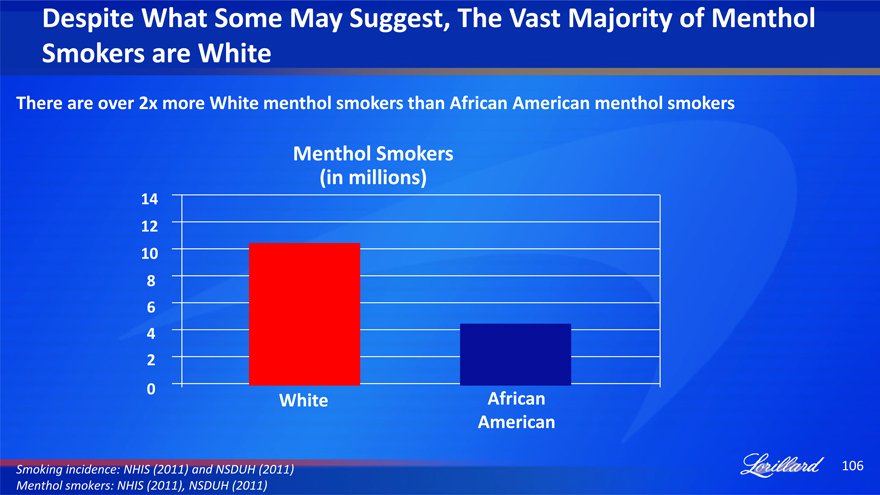

Despite What Some May Suggest, The Vast Majority of Menthol Smokers are White

There are over 2x more White menthol smokers than African American menthol smokers

Menthol Smokers

(in millions)

14

12

10

8

6

4

2

0 White African

American

Smoking incidence: NHIS (2011) and NSDUH (2011) 105 Menthol smokers: NHIS (2011), NSDUH (2011)

106

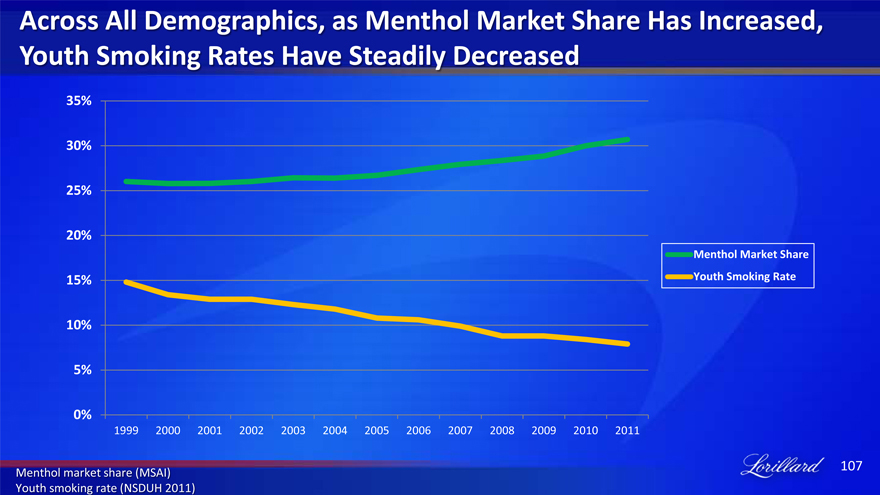

Across All Demographics, as Menthol Market Share Has Increased, Youth Smoking Rates Have Steadily Decreased

35%

30%

25%

20%

Menthol Market Share

15% Youth Smoking Rate

10%

5%

0%

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Menthol market share (MSAI) Youth smoking rate (NSDUH 2011)

107

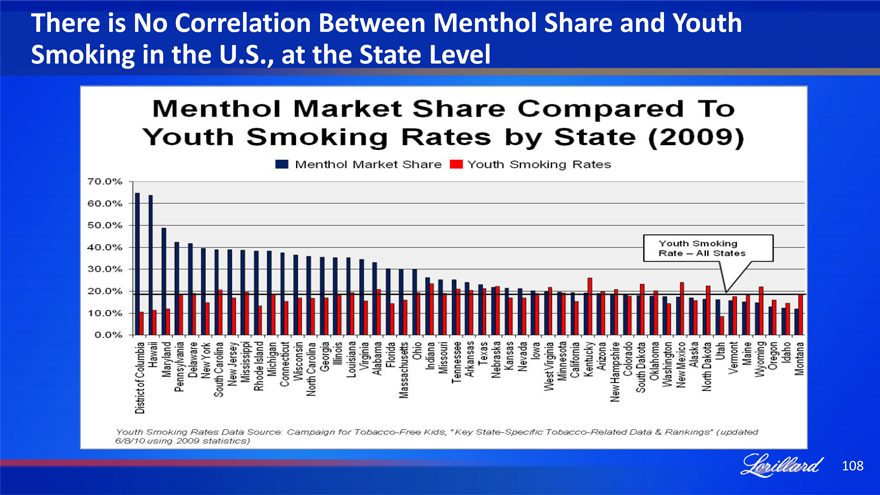

There is No Correlation Between Menthol Share and Youth Smoking in the U.S., at the State Level

108

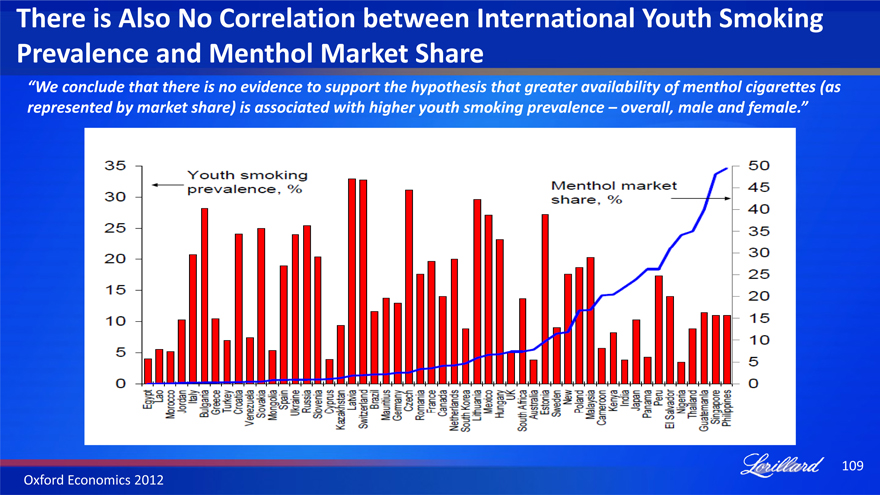

There is Also No Correlation between International Youth Smoking Prevalence and Menthol Market Share

“We conclude that there is no evidence to support the hypothesis that greater availability of menthol cigarettes (as represented by market share) is associated with higher youth smoking prevalence – overall, male and female.”

Oxford Economics 2012

109

And Despite Claims That Menthol Makes Cigarettes Less Harsh, Smokers Disagree and Instead Choose Menthol for Flavor

2010 CPS-TUS reasons for smoking menthol/non-menthol cigarettes

First national survey to contain these questions

100% 90%

80% Menthol

70%

60% Nonmenthol

50% 40% 30% 20% 10% 0%

First wave of 2010 data is available (Two additional waves to come)

Source: Current

110

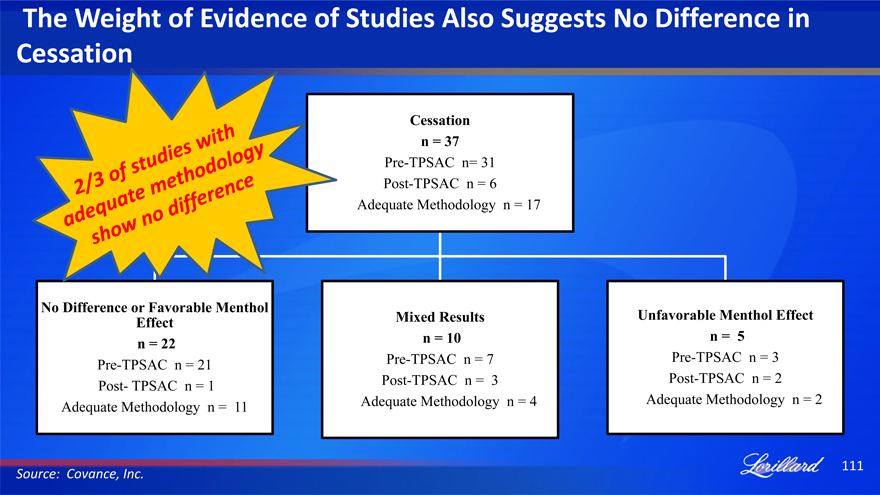

The Weight of Evidence of Studies Also Suggests No Difference in Cessation

Cessation n = 37

Pre-TPSAC n= 31 Post-TPSAC n = 6 Adequate Methodology n = 17

No Difference or Effect Favorable Menthol n = 22

Pre-TPSAC n = 21 Post- TPSAC n = 1 Adequate Methodology n = 11

Mixed Results n = 10

Pre-TPSAC n = 7 Post-TPSAC n = 3 Adequate Methodology n = 4

Unfavorable Menthol Effect n = 5

Pre-TPSAC n = 3 Post-TPSAC n = 2 Adequate Methodology n = 2

Source: Covance, Inc.

Population Survey, Tobacco Use Supplement.

111

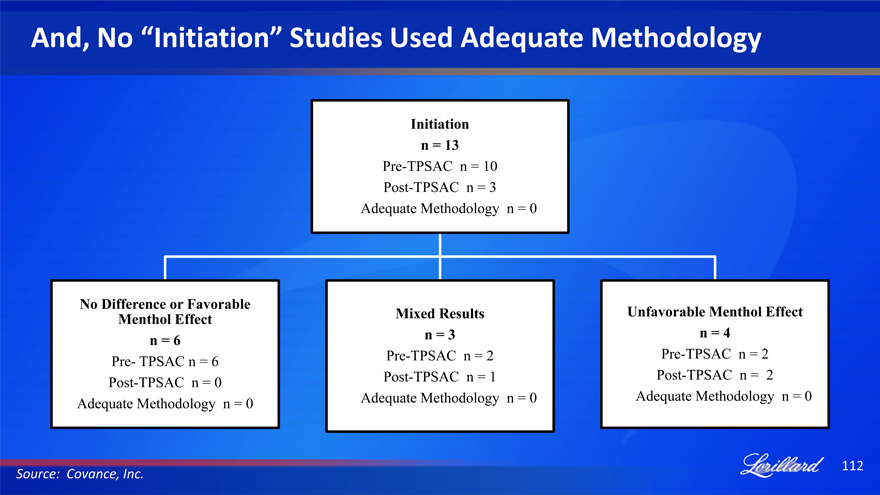

And, No “Initiation” Studies Used Adequate Methodology

Initiation n = 13

Pre-TPSAC n = 10 Post-TPSAC n = 3 Adequate Methodology n = 0

No Difference Menthol or Effect Favorable n = 6

Pre- TPSAC n = 6 Post-TPSAC n = 0 Adequate Methodology n = 0

Mixed Results n = 3

Pre-TPSAC n = 2 Post-TPSAC n = 1 Adequate Methodology n = 0

Unfavorable Menthol Effect n = 4

Pre-TPSAC n = 2 Post-TPSAC n = 2 Adequate Methodology n = 0

Source: Covance, Inc

112

FDA Authors and even TPSAC Agreed that Additional

Research on the Topic of Initiation is Needed

Overall, there is a paucity of data on this topic. A lack of data prevents further conclusions on the role of menthol cigarettes in the initiation of smoking.

- “Menthol and Initiation of Smoking”

FDA draft white paper, published May 23, 2011 in Tobacco Induced Diseases

In the course of reviewing the evidence related to its charge, TPSAC noted gaps in understanding of menthol cigarettes and public health that should be addressed with further research.

….

Cohort studies of adolescents and young adults should be carried out that follow participants from experimentation to initiation to dependence. These studies would provide an improved understanding of the risk for moving across this sequence that is associated with menthol cigarette availability.

- TPSAC Menthol Report, March 2011

113

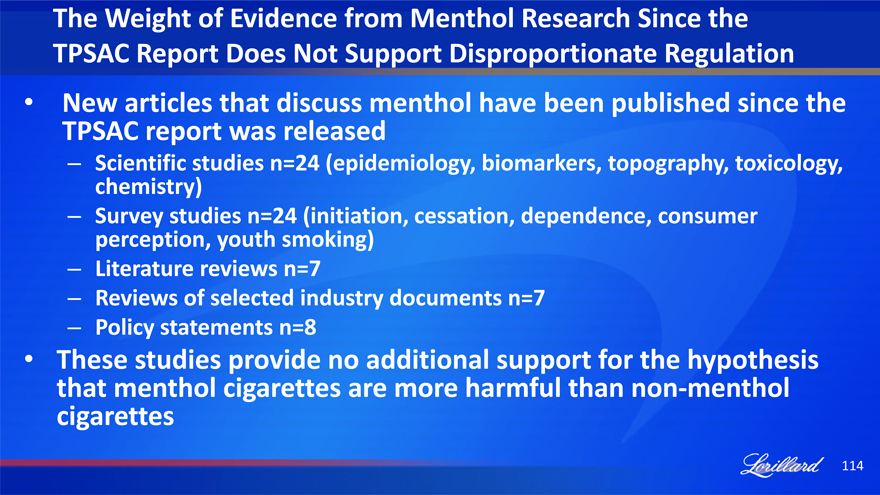

The Weight of Evidence from Menthol Research Since the TPSAC Report Does Not Support Disproportionate Regulation

TPSAC New articles report that was discuss released menthol have been published since the

chemistry) Scientific studies n=24 (epidemiology, biomarkers, topography, toxicology, – perception, Survey studies youth n=24 smoking) (initiation, cessation, dependence, consumer

Literature reviews n=7

Reviews of selected industry documents n=7

Policy statements n=8

These that menthol studies cigarettes provide no are additional more harmful support than for non-menthol the hypothesis cigarettes

114

With the Evidence So Clear that There is No Difference,

How did TPSAC reach its Conclusion?

“Removal of menthol cigarettes from the marketplace would benefit public health in the United States.”

TPSAC, March 2011

115

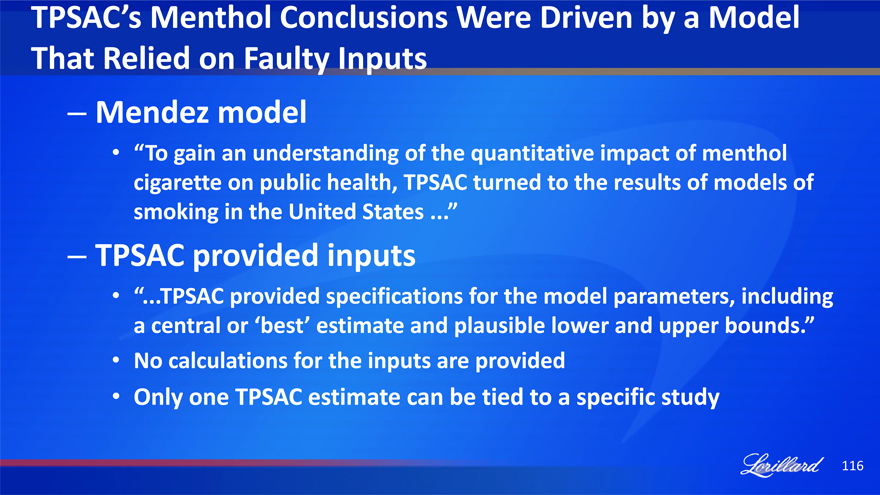

TPSAC’s Menthol Conclusions Were Driven by a Model That Relied on Faulty Inputs

Mendez model

“To gain an understanding of the quantitative impact of menthol cigarette on public health, TPSAC turned to the results of models of smoking in the United States .”

TPSAC provided inputs

“.TPSAC provided specifications for the model parameters, including a central or ‘best’ estimate and plausible lower and upper bounds.”

No calculations for the inputs are provided

Only one TPSAC estimate can be tied to a specific study

116

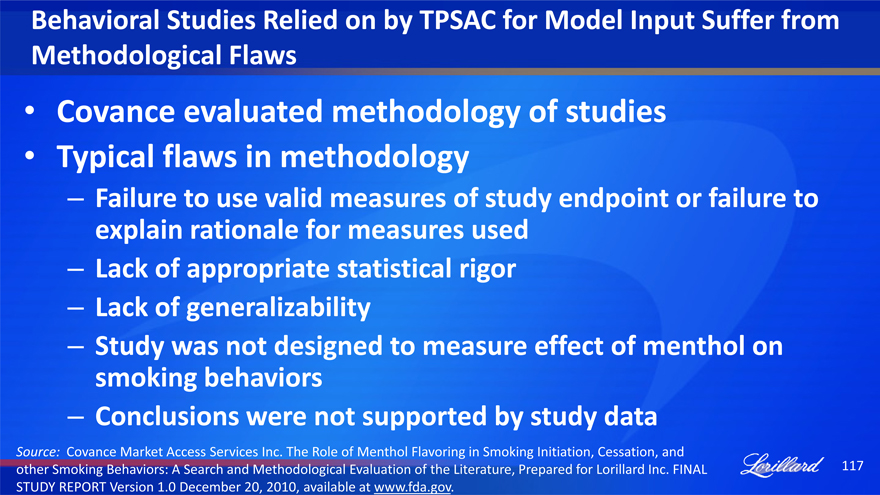

Behavioral Studies Relied on by TPSAC for Model Input Suffer from Methodological Flaws

Covance evaluated methodology of studies

Typical flaws in methodology

Failure to use valid measures of study endpoint or failure to explain rationale for measures used

Lack of appropriate statistical rigor

Lack of generalizability

Study was not designed to measure effect of menthol on smoking behaviors

Conclusions were not supported by study data

Source: Covance Market Access Services Inc. The Role of Menthol Flavoring in Smoking Initiation, Cessation, and 116 other Smoking Behaviors: A Search and Methodological Evaluation of the Literature, Prepared for Lorillard Inc. FINAL

STUDY REPORT Version 1.0 December 20, 2010, available at www.fda.gov.

117

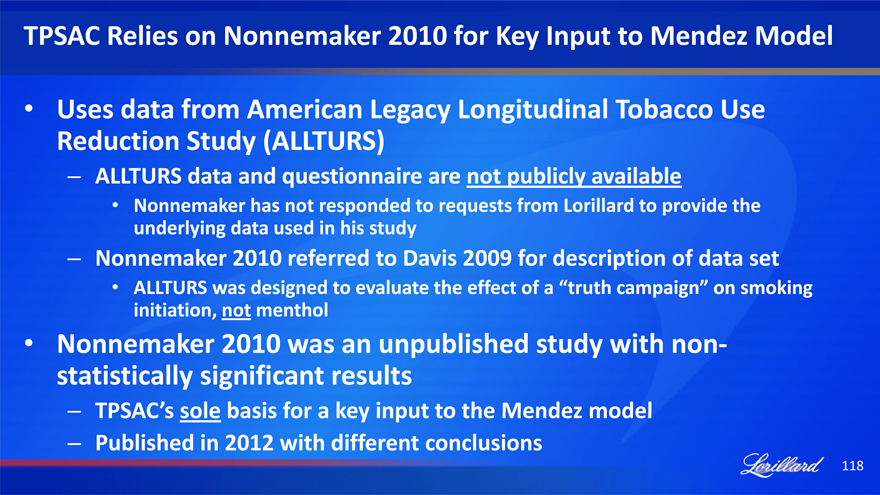

TPSAC Relies on Nonnemaker 2010 for Key Input to Mendez Model

Uses data from American Legacy Longitudinal Tobacco Use Reduction Study (ALLTURS)

ALLTURS data and questionnaire are not publicly available

Nonnemaker has not responded to requests from Lorillard to provide the underlying data used in his study

Nonnemaker 2010 referred to Davis 2009 for description of data set

ALLTURS was designed to evaluate the effect of a “truth campaign” on smoking initiation, not menthol

Nonnemaker 2010 was an unpublished study with non-statistically significant results

TPSAC’s sole basis for a key input to the Mendez model

Published in 2012 with different conclusions

118

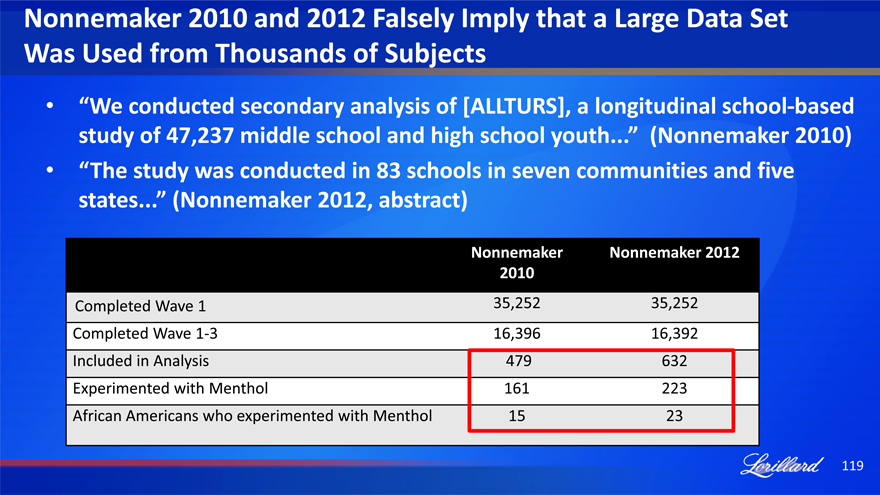

Nonnemaker 2010 and 2012 Falsely Imply that a Large Data Set Was Used from Thousands of Subjects

“We conducted secondary analysis of [ALLTURS], a longitudinal school-based study of 47,237 middle school and high school youth.” (Nonnemaker 2010)

“The study was conducted in 83 schools in seven communities and five states.” (Nonnemaker 2012, abstract)

Nonnemaker Nonnemaker 2012 2010

Completed Wave 1 35,252 35,252 Completed Wave 1-3 16,396 16,392 Included in Analysis 479 632 Experimented with Menthol 161 223 African Americans who experimented with Menthol 15 23

119

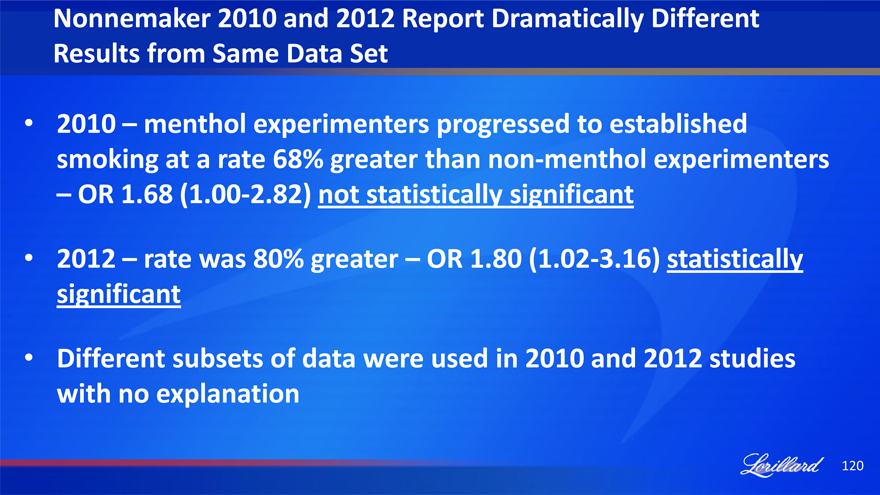

Nonnemaker 2010 and 2012 Report Dramatically Different Results from Same Data Set

2010 – menthol experimenters progressed to established smoking at a rate 68% greater than non-menthol experimenters

OR 1.68 (1.00-2.82) not statistically significant

2012 – rate was 80% greater – OR 1.80 (1.02-3.16) statistically significant

Different subsets of data were used in 2010 and 2012 studies with no explanation

120

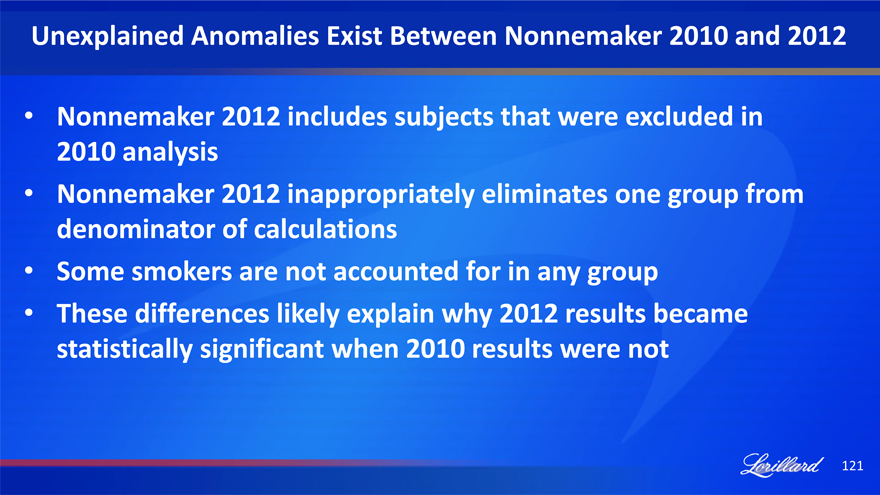

Unexplained Anomalies Exist Between Nonnemaker 2010 and 2012

Nonnemaker 2012 includes subjects that were excluded in 2010 analysis

Nonnemaker 2012 inappropriately eliminates one group from denominator of calculations

Some smokers are not accounted for in any group

These differences likely explain why 2012 results became statistically significant when 2010 results were not

121

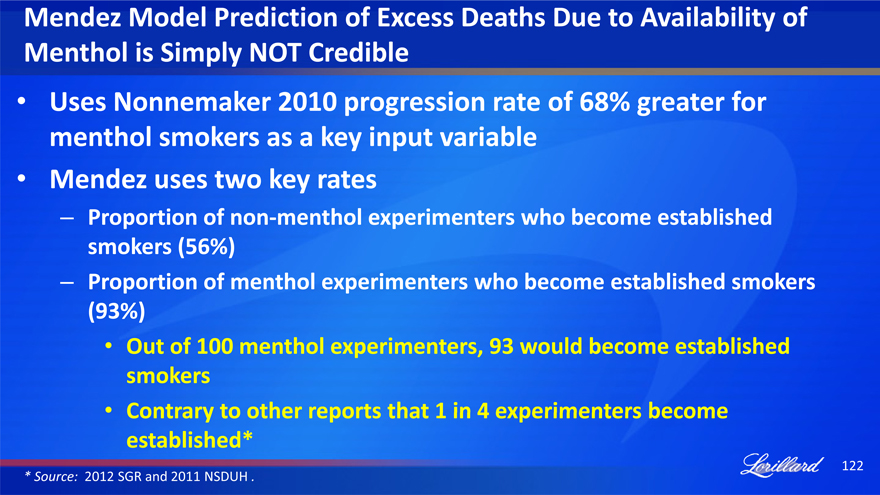

Mendez Model Prediction of Excess Deaths Due to Availability of Menthol is Simply NOT Credible

Uses Nonnemaker 2010 progression rate of 68% greater for menthol smokers as a key input variable

Mendez uses two key rates

Proportion of non-menthol experimenters who become established smokers (56%)

Proportion of menthol experimenters who become established smokers (93%)

Out of 100 menthol experimenters, 93 would become established smokers

Contrary to other reports that 1 in 4 experimenters become established*

* Source: 2012 SGR and 2011 NSDUH .

122

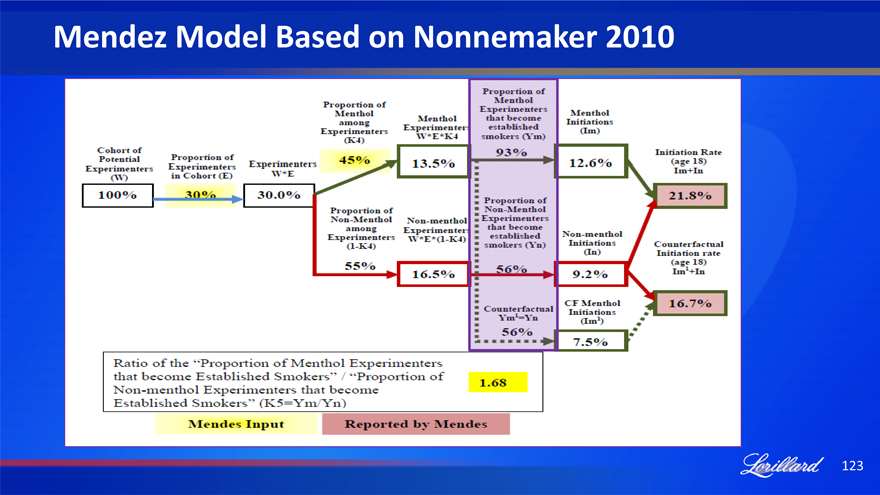

Mendez Model Based on Nonnemaker 2010

Cohort of potential Experimenters (W)

100%

Proportion of Experimenters in Cohort (E)

30%

Experimenters W*E

30.0%

Proportion of Menthol among Experimenters (K4)

45%

Menthol Experimenter W*E*K4

13.5%

Proportion of Menthol Experimenters that become established smokers (Ym)

93%

Proportion of Non-Menthol Experimenters that become established smokers (Yn)

56%

Counterfactual Ym1-Yn

56%

Menthol Initiations (Im)

12.6%

Initiation Rate (age 18) Im+In

21.8%

Proportion of Non-Menthol among Experimenters (1-K4)

55%

Non-menthol Experimenter W*E*(1-K4)

16.5%

Non-menthol Initiations (In)

9.2%

Counterfactual Initiation rate (age 18) Im1+In

16.7%

CF Menthol Initiations (Im1)

7.5%

Ratio of the “Proportion of Menthol Experimenters that become Established Smokers” / “Proportion of Non-menthol Experimenters that become Established Smokers” (K5=Ym/Yn)

1.68

Mendes Input

Reported by Mendes

123

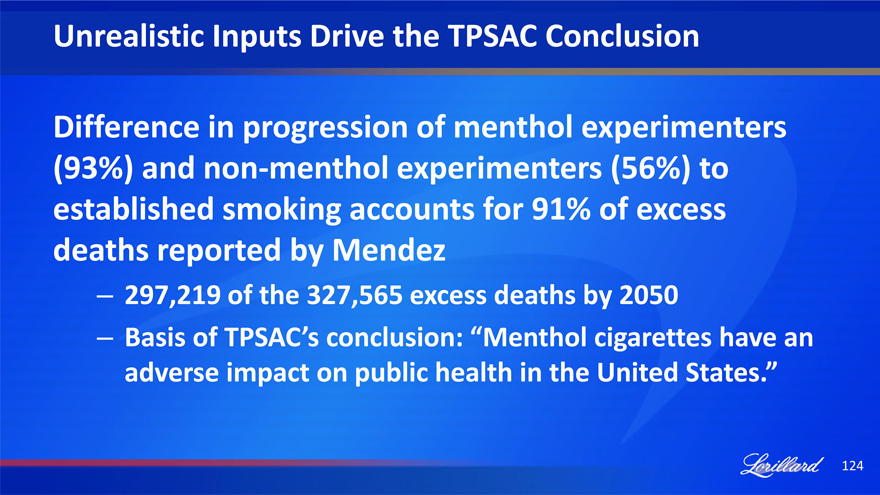

Unrealistic Inputs Drive the TPSAC Conclusion

Difference in progression of menthol experimenters (93%) and non-menthol experimenters (56%) to established smoking accounts for 91% of excess deaths reported by Mendez

297,219 of the 327,565 excess deaths by 2050

Basis of TPSAC’s conclusion: “Menthol cigarettes have an adverse impact on public health in the United States.”

124

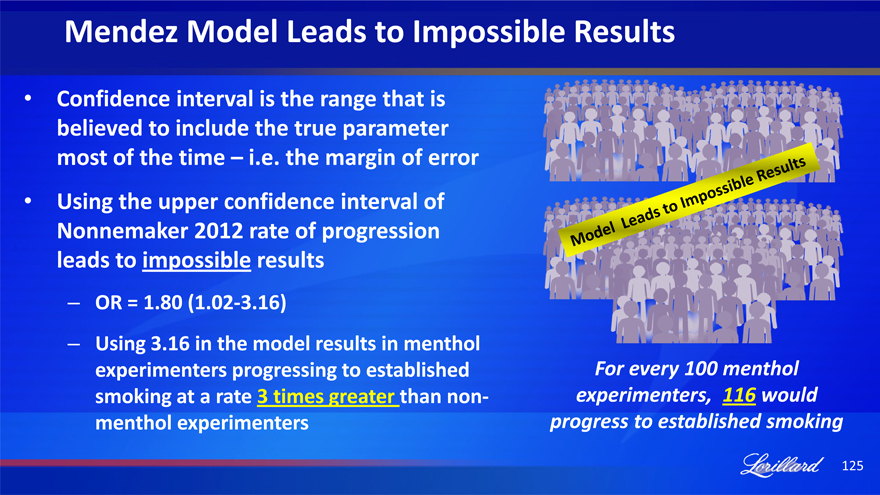

Mendez Model Leads to Impossible Results

Confidence interval is the range that is b ed to include the true parameter of the time – i.e. the margin of error

Using the upper confidence interval of Nonnemaker 2012 rate of progression leads to impossible results

OR = 1.80 (1.02-3.16)

Using 3.16 in the model results in menthol experimenters progressing to established smoking at a rate 3 times greater than non-menthol experimenters

Model Leads to Impossible Results

For every 100 menthol experimenters, 116 would progress to established smoking

125

TPSAC’s Conclusion was NOT Based on Sound Science

A product of a biased and conflicted panel

Relied on a single model that was not well understood

Over reliance on a single flawed study for inputs to their model

126

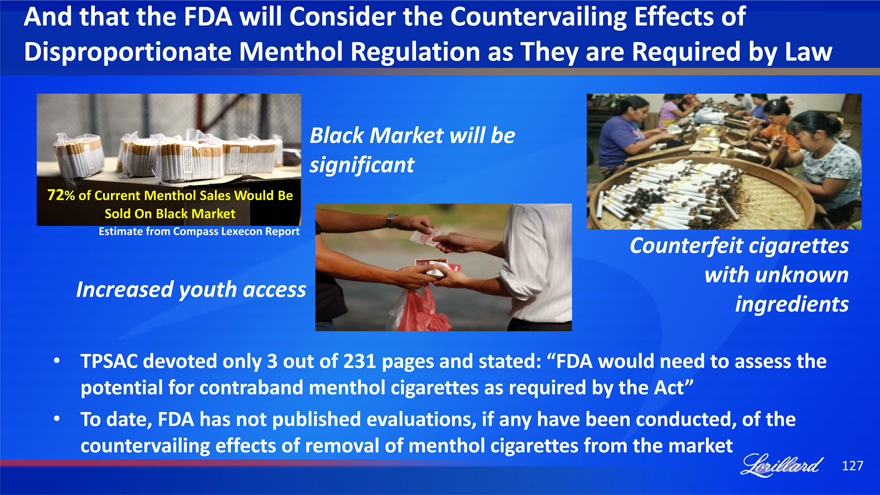

And that the FDA will Consider the Countervailing Effects of Disproportionate Menthol Regulation as They are Required by Law

72% of current Menthol Sales Would Be Sold On Black Market

Estimate from Compass Lexecon Report

Black Market will be significant

Increased youth access

Counterfeit cigarettes with unknown ingredients

TPSAC devoted only 3 out of 231 pages and stated: “FDA would need to assess the potential for contraband menthol cigarettes as required by the Act”

To date, FDA has not published evaluations, if any have been conducted, of the countervailing effects of removal of menthol cigarettes from the market

127

We Don’t Believe the FDA will Ignore Many Major Government Bodies that Have Warned about Contraband Risks

Further, the illicit [tobacco] trade has been linked to organized crime and violent crime, and poses a serious risk to our national security.”

— Department of Treasury Report to Congress, 2/4/2010

Law enforcement intelligence reports have indicated that gangs and other organized crime rings have increasingly begun to focus their efforts on cigarette trafficking as a source of revenue. The profit margins on black market cigarettes are now greater than for cocaine, heroin or illegal firearms.”

— Report of the Virginia State Crime Commission (SJR 21, 2010)

Banning all cigarettes – or any type of cigarette favored by a large portion of U.S. smokers – could significantly increase the existing black market for cigarettes and all the attendant contraband trafficking and other illegal activity. There is already a sizeable black market for cigarettes in the United States.”

— United States Trade Representative report to WTO, 11/16/2010

128

Going Forward

Waiting on FDA announcement on menthol

FDA-NIH funded PATH Studies may provide additional information on menthol over the next several years – which should show no difference

We continue to believe that the science does not provide a basis for regulating menthol cigarettes differently from non-menthol cigarettes

Lorillard is fully prepared to respond to any FDA action on menthol

129

While Lorillard’s Fundamentals Clearly Lead The Industry, Regulation And Litigation Can Be Concerns

Agenda

Introduction Bob Bannon – Investor Relations

Strategic Plan Update Murray Kessler – Chairman, President & CEO

Regulatory Update Neil Wilcox – SVP, Chief Compliance Officer

Bill True – SVP, R&D

Legal Update Ron Milstein – EVP, Legal & General Counsel

Financial Guidance (Lorillard-Style) David Taylor – EVP, Finance & CFO

Additional Q&A All

130

Legal Update

Ron Milstein EVP, Legal & External Affairs, General Counsel & Secretary

June 27, 2013

131

Lorillard Litigation

History of successfully managing tobacco litigation

– Successfully transitioned to new national counsel (HHR) in 2012

Challenges manageable going forward

132

Lorillard Litigation (cont.)

Product liability litigation

Individual

Class actions

Health-care reimbursement

Kent filter

Other litigation

FDA related

133

Individual Cases

Traditional individual cases West Virginia consolidated case Engle Progeny suits

134

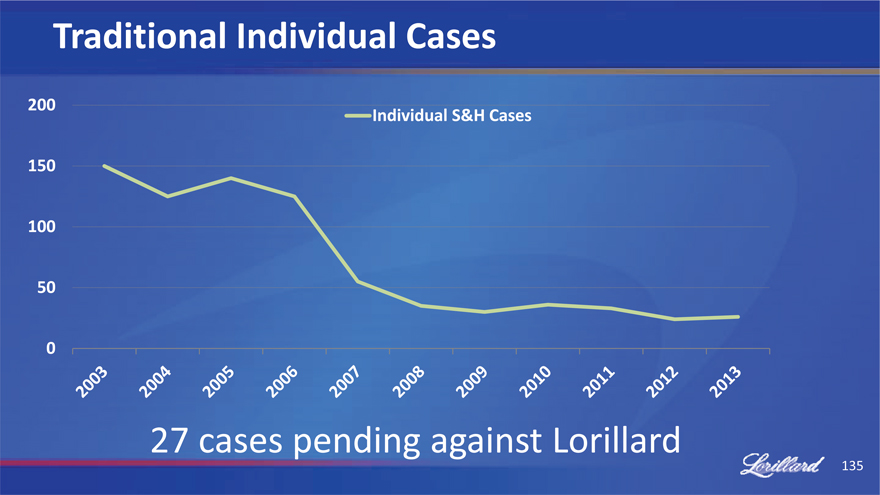

Traditional Individual Cases

200 150 100 50 0

Individual S&H Cases

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

27 cases pending against Lorillard

135

Traditional Individual Lawsuits

Evans v. Lorillard (Superior Court, Boston, MA)

December 2010 jury verdict against Lorillard

$35M compensatory / $81M punitive damages assessed by jury

decision Massachusetts on June Supreme 11, 2013 Judicial Court issued appellate

Reversed new trial trial court on $81M punitive damages award and ordered

Liability claim limited for retrial (other negligence claims vacated)

Upheld compensatory damage award of $35M (plus interest)

Massachusetts Company assessing Supreme its options Judicial for Court reconsideration or further appeal by

136

Traditional Individual Lawsuits

Two traditional individual trials scheduled for 2013

New York California

137

West Virginia

then Multi-phase individual trial, trials with if common necessary issues proceeding first, 600 individual cases consolidated for liability phase Only 31 cases involved claims against Lorillard Defense one) verdict entered May 2013 on all counts (but

– Only remaining count involves certain low-tar cigarettes

Lorillard should have no follow-on individual cases Appeal by plaintiffs possible

139

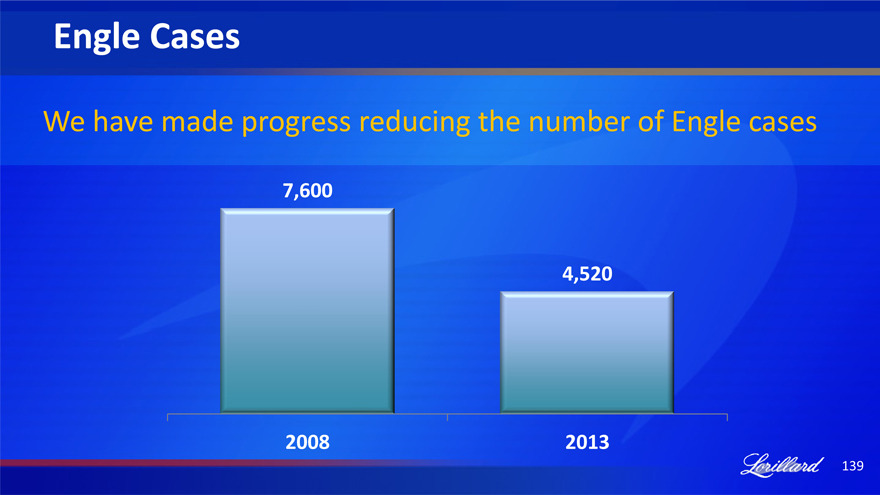

Engle Cases

We have made progress reducing the number of Engle cases

7,600

2008

4,520

2013

139

Engle Cases (cont.)

TRIAL RESULT INDUSTRY LORILLARD

Trial to Verdict 96 13

Defense Verdicts 33 3

Plaintiff Verdicts 63 10

Trials Concluded before Verdict 28 5

Range of Loss on Plaintiff $1,400-$70.9M $4,500-$33M

Verdicts

140

Engle Cases (cont.)

• Four Engle trials scheduled in Q3 2013

• Appeals pending in FL and US Supreme Courts over Engle Phase 1 findings

• Duke/Walker (11th Circuit)

– Oral argument set for July 12, 2013

• Douglas (US Supreme Court)

– Certiorari petition pending

• To date, $15,500 paid by Lorillard in Engle progeny judgments

141

Class Actions

• No active suits pending against Lorillard

• Lorillard is not a defendant in “Lights” class action cases

142

Health Care Reimbursement Cases

• DOJ RICO suit

– Last details implementing Judge Kessler’s order on corrective advertising to be addressed

– Company expects to spend approximately $20M to comply and reserved in 1Q 2013 accordingly

143

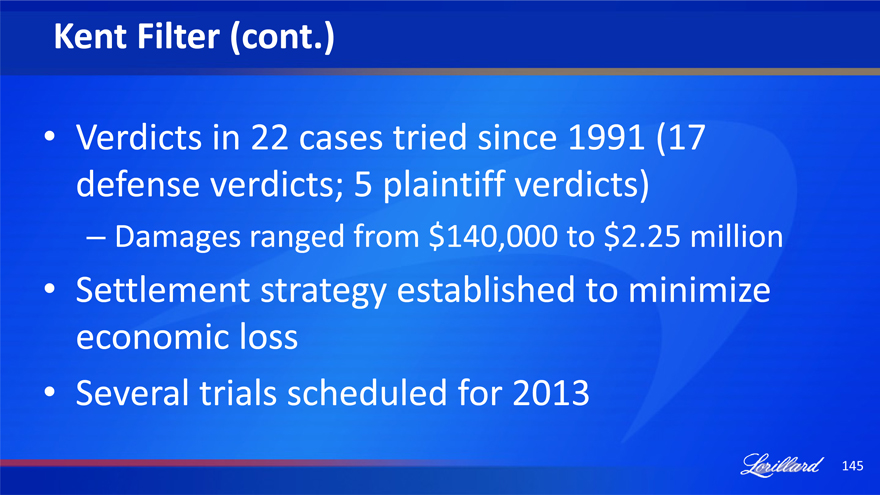

Kent Filter

• Allege cigarette injury filter from asbestos in original Kent

– Manufactured between 1952 and 1956

– Claims usually involve mesothelioma

– Smoking and health not an issue

• plants Worker claims from asbestos exposure in the

• Smoker claims

– 60 pending suits

144

Kent Filter (cont.)

• Verdicts in 22 cases tried since 1991 (17 defense verdicts; 5 plaintiff verdicts)

– Damages ranged from $140,000 to $2.25 million

• Settlement strategy established to minimize economic loss

• Several trials scheduled for 2013

145

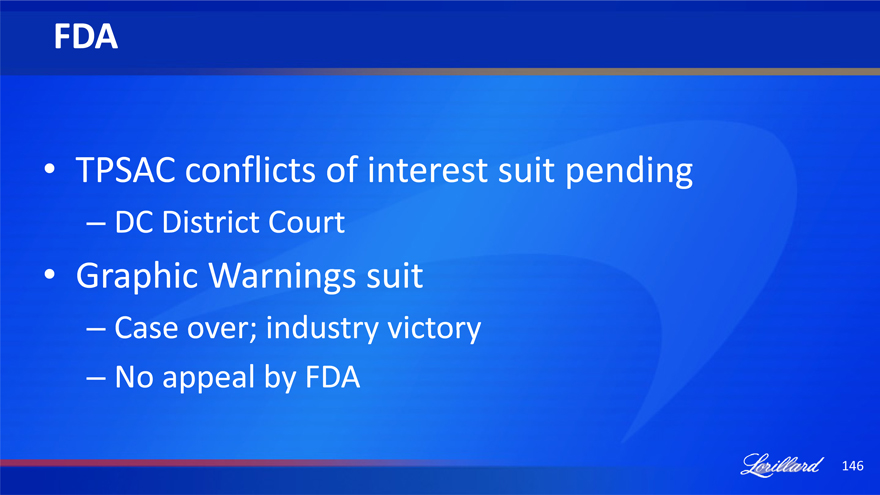

FDA

• TPSAC conflicts of interest suit pending

– DC District Court

• Graphic Warnings suit

– Case over; industry victory

– No appeal by FDA

146

Summary

• Engle is company’s greatest litigation expense and risk

• The Company is performing well defending Engle cases and the risk appears manageable

• All other cases are declining, except Kent Filter

• All cases appear manageable

147

While Lorillard’s Fundamentals Clearly Lead The Industry, Regulation And Litigation Can Be Concerns

Agenda

Introduction

Strategic Plan Update

Regulatory Update

Legal Update

Financial Guidance (Lorillard-Style)

Additional Q&A

Bob Bannon – Investor Relations

Murray Kessler – Chairman, President & CEO

Neil Wilcox – SVP, Chief Compliance Officer

Bill True – SVP, R&D

Ron Milstein – EVP, Legal & General Counsel

David Taylor – EVP, Finance & CFO

All

148

Financial Guidance (Lorillard-Style)

David Taylor EVP, Finance and Planning & Chief Financial Officer

June 27, 2013

149

Financial Guidance (Lorillard-Style)

• Philosophy – no explicit earnings guidance

• Promotes longer-term thinking and decision-making

• Recognize the issues this may create

150

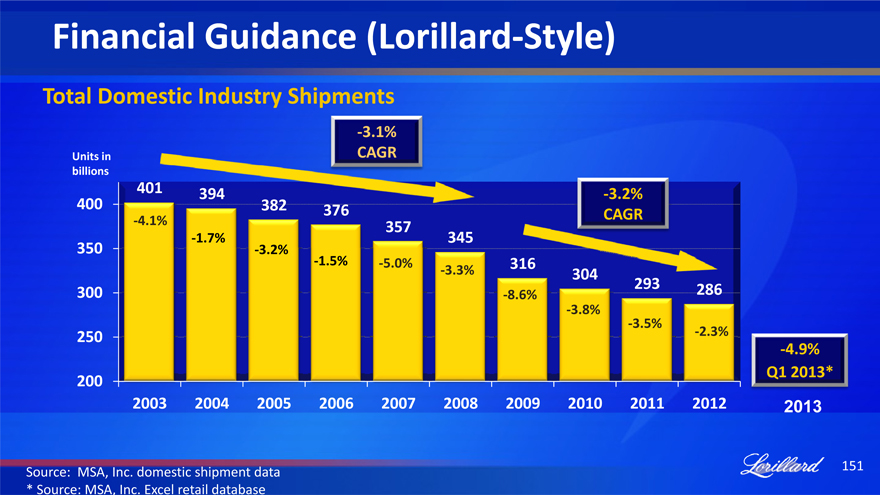

Financial Guidance (Lorillard-Style)

Total Domestic Industry Shipments

-3.1%

Units in

billions

401 -3.2%

400

-4.1% 357 CAGR

-1.7% 345

350 -3.2%

-1.5% -5.0% -3.3%

300 -8.6% 293 286

-3.8%

-3.5%

250 -2.3% -4.9%

200 Q1 2013*

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Source: MSA, Inc. domestic shipment data

*Source: MSA, Inc. Excel retail database

151

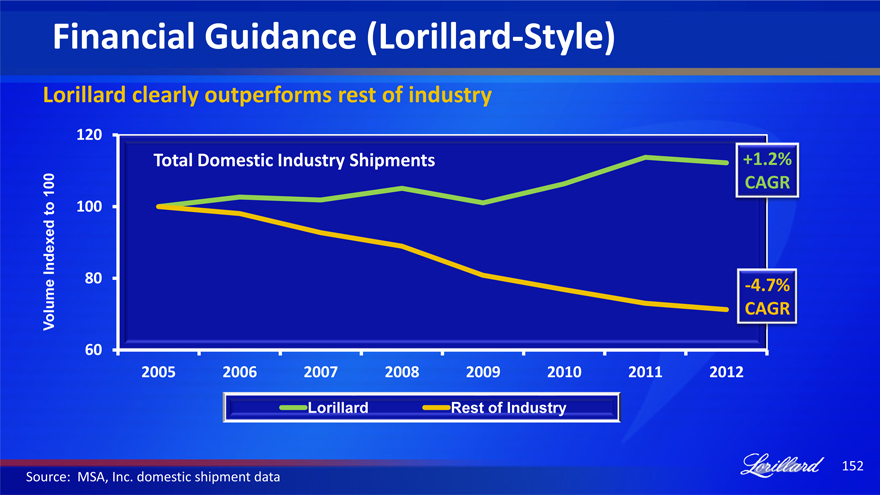

Financial Guidance (Lorillard-Style)

Lorillard clearly outperforms rest of industry

120

Total Domestic Industry Shipments +1.2%

100 CAGR

to 100

Indexed

Volume 80 CAGR -4.7%

60

2005 2006 2007 2008 2009 2010 2011 2012

Lorillard Rest of Industry

Source: MSA, Inc. domestic shipment data

152

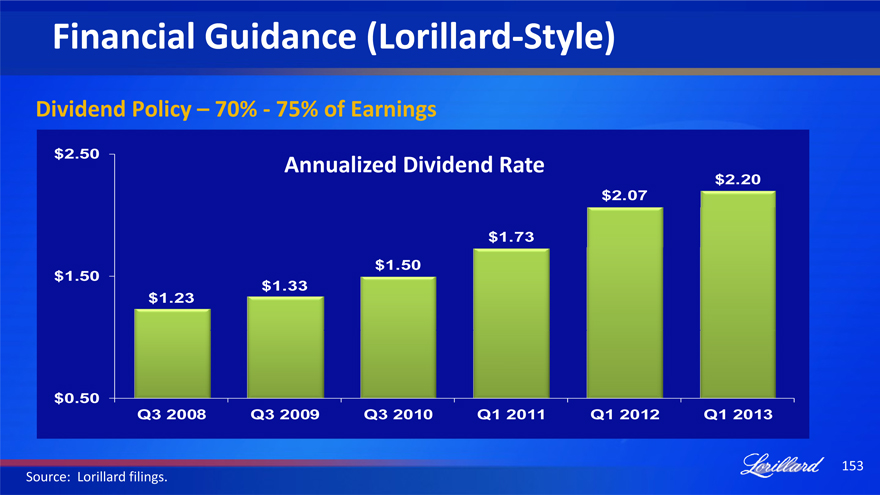

Financial Guidance (Lorillard-Style)

Dividend Policy – 70%—75% of Earnings

$2.50 Annualized Dividend Rate

$2.20

$2.07

$1.73

$1.50

$1.50 $1.33

$1.23

$0.50

Q3 2008 Q3 2009 Q3 2010 Q1 2011 Q1 2012 Q1 2013

Source: Lorillard filings.

153

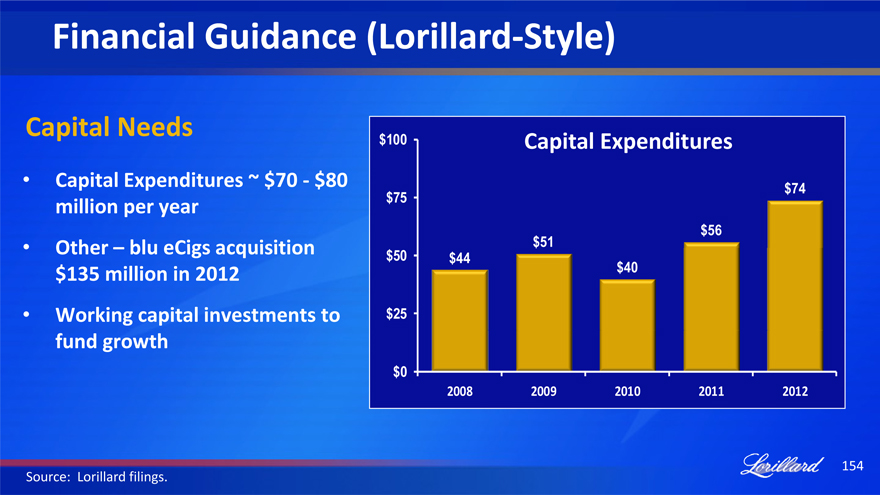

Financial Guidance (Lorillard-Style)

Capital Needs

• Capital Expenditures ~ $70—$80 million per year

• Other – blu eCigs acquisition $135 million in 2012

• Working capital investments to fund growth

$100 Capital Expenditures

$75 $74

$56

$51

$50 $44 $40

$25

$0

2008 2009 2010 2011 2012

Source: Lorillard filings.

154

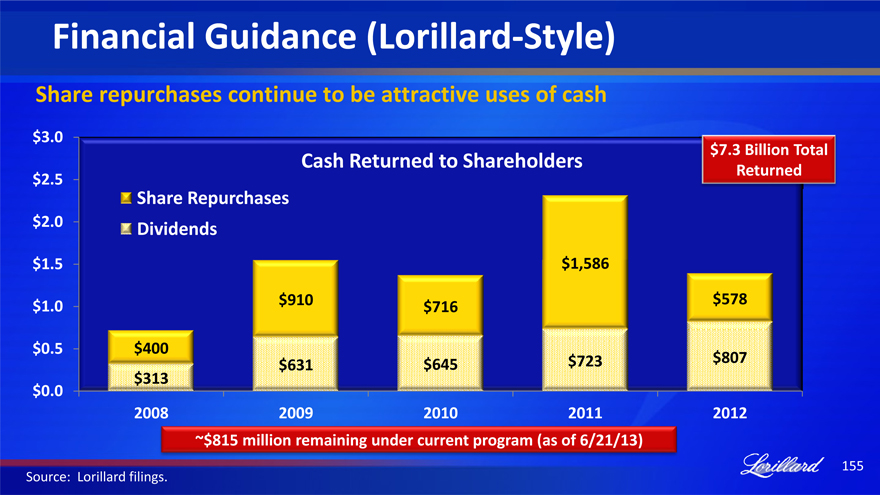

Financial Guidance (Lorillard-Style)

Share repurchases continue to be attractive uses of cash

$ 3.0

Cash Returned to Shareholders $7.3 Billion Total

$ 2.5 Returned

Share Repurchases

$ 2.0 Dividends

$ 1.5 $1,586

$ 1.0 $910 $ 716 $578

$ 0.5 $ 400 $631 $ 645 $723 $807

$ 0.0 $ 313

2008 2009 2010 2011 2012

~$815 million remaining under current program (as of 6/21/1

Source: Lorillard filings.

155

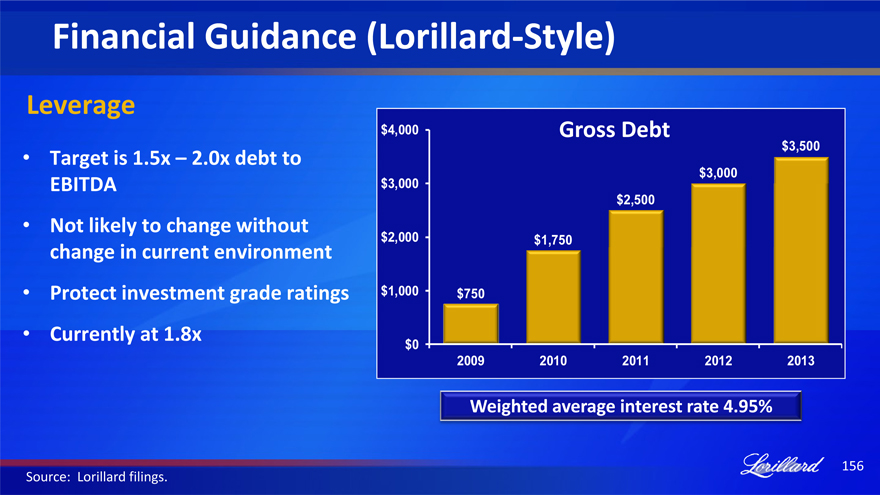

Financial Guidance (Lorillard-Style)

Leverage

•

Target is 1.5x – 2.0x debt to

EBITDA

•

Not likely to change without

change in current environment

•

Protect investment grade ratings

•

Currently at 1.8x

$4,000 Gross Debt

$3,500

$3,000

$3,000

$2,500

$2,000 $1,750

$1,000 $750

$0

2009 2010 2011 2012 2013

Weighted average interest rate 4.95%

Source: Lorillard filings.

156

Financial Guidance (Lorillard-Style)

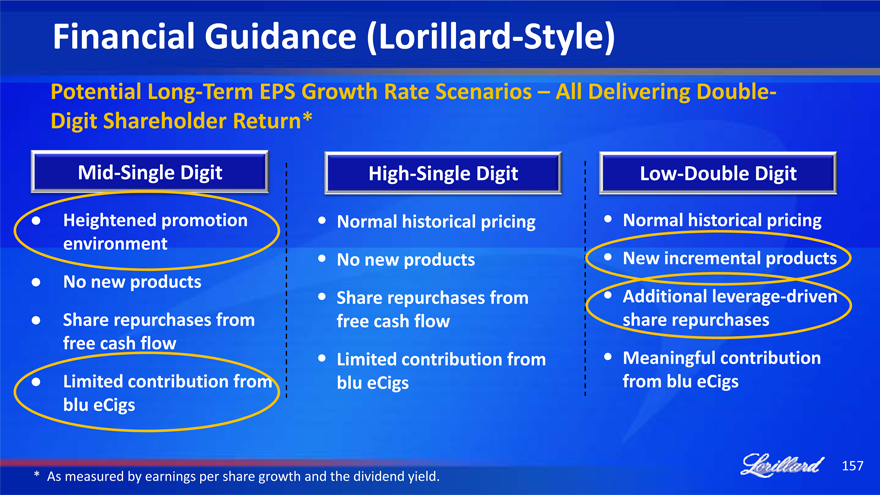

Potential Long-Term EPS Growth Rate Scenarios – All Delivering Double-Digit Shareholder Return*

Mid-Single Digit High-Single Digit Low-Double Digit

• Heightened promotion • Normal historical pricing • Normal historical pricing

environment • No new products • New incremental products

• No new products • Share repurchases from • Additional leverage-driven

• Share repurchases from free cash flow share repurchases

free cash flow • Limited contribution from • Meaningful contribution

• Limited contribution from blu eCigs from blu eCigs

blu eCigs

* As measured by earnings per share growth and the dividend yield.

157

Financial Guidance (Lorillard-Style)

Some positive factors in place:

• Share repurchase program increased following $500 million debt issuance in May 2013

• Recent FDA authorization for Newport Non-Menthol Gold

• Partial settlement of NPM dispute provides liquidity and some continuing earnings benefit

• Obligations for the Federal Assessment for Tobacco Growers will end in 2014 ($118 million in 2012)

• Opportunities exist for cost savings in blu eCigs supply chain

158

Financial Guidance (Lorillard-Style)

Incentive compensation structure aligns with goals

Annual plan balance between Newport market share and operating profit

Long-term incentives are paid in common shares with 3-year vesting – variable with EPS targets

Source: Lorillard filings.

159

Summary

All elements are in place to continue our history of superior financial results

Poised to accelerate earnings growth:

New products

e-cigarette growth

We remain committed to rewarding shareholders with cash returns

161

Murray S. Kessler

Chairman, President and Chief Executive Officer

162

Conclusions

Lorillard’s ongoing Strategic Plan has resulted in continued outperformance

Incremental new products and blu eCigs should accelerate growth even further

The right management team is in place to handle all potential regulatory and legal outcomes

Lorillard remains committed to rewarding shareholders through returning its significant free cash flow

163

Questions

164

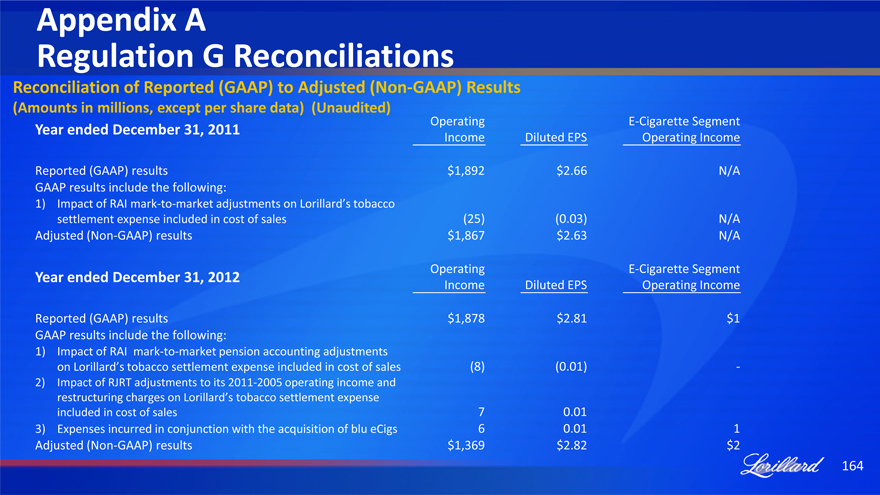

Appendix A

Regulation G Reconciliations

Reconciliation of Reported (GAAP) to Adjusted (Non-GAAP) Results

(Amounts in millions, except per share data) (Unaudited)

Year ended December 31, 2011 Operating E-Cigarette Segment

Income Diluted EPS Operating Income

Reported (GAAP) results $1,892 $2.66 N/A

GAAP results include the following:

1) Impact of RAI mark-to-market adjustments on Lorillard’s tobacco

settlement expense included in cost of sales (25) (0.03) N/A

Adjusted (Non-GAAP) results $1,867 $2.63 N/A

Year ended December 31, 2012 Operating E-Cigarette Segment

Income Diluted EPS Operating Income

Reported (GAAP) results $1,878 $2.81 $1

GAAP results include the following:

1) Impact of RAI mark-to-market pension accounting adjustments

on Lorillard’s tobacco settlement expense included in cost of sales (8) (0.01) -

2) Impact of RJRT adjustments to its 2011-2005 operating income and

restructuring charges on Lorillard’s tobacco settlement expense

included in cost of sales 7 0.01

3) Expenses incurred in conjunction with the acquisition of blu eCigs 6 0.01 1

Adjusted (Non-GAAP) results $1,369 $2.82 $2

165

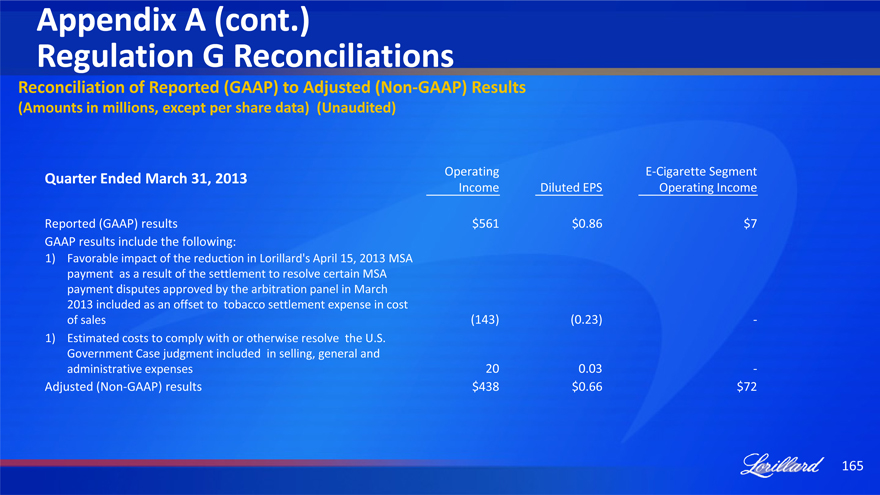

Appendix A (cont.)

Regulation G Reconciliations

Reconciliation of Reported (GAAP) to Adjusted (Non-GAAP) Results

(Amounts in millions, except per share data) (Unaudited)

Quarter Ended March 31, 2013 Operating E-Cigarette Segment

Income Diluted EPS Operating Income

Reported (GAAP) results $561 $0.86 $7

GAAP results include the following:

1) Favorable impact of the reduction in Lorillard’s April 15, 2013 MSA

payment as a result of the settlement to resolve certain MSA

payment disputes approved by the arbitration panel in March

2013 included as an offset to tobacco settlement expense in cost

of sales (143) (0.23) -

1) Estimated costs to comply with or otherwise resolve the U.S.

Government Case judgment included in selling, general and

administrative expenses 20 0.03 -

Adjusted (Non-GAAP) results $438 $0.66 $72

166

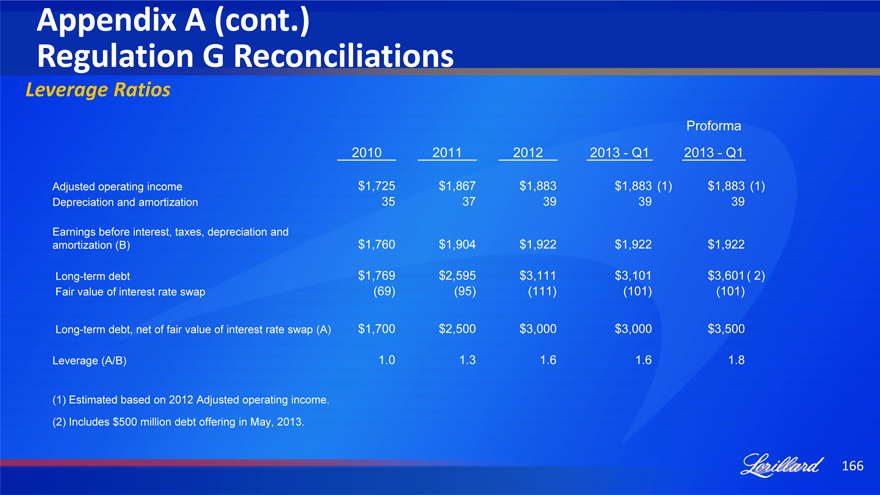

Appendix A (cont.)

Regulation G Reconciliations

Leverage Ratios

Proforma

2010 2011 2012 2013—Q1 2013—Q1

Adjusted operating income $ 1,725 $ 1,867 $ 1,883 $ 1,883 (1) $ 1,883 (1)

Depreciation and amortization 35 37 39 39 39

Earnings before interest, taxes, depreciation and

amortization (B) $ 1,760 $ 1,904 $ 1,922 $ 1,922 $ 1,922

Long-term debt $ 1,769 $ 2,595 $ 3,111 $ 3,101 $ 3,601 ( 2)

Fair value of interest rate swap (69) (95) (111) (101) (101)

Long-term debt, net of fair value of interest rate swap (A) $ 1,700 $ 2,500 $ 3,000 $ 3,000 $ 3,500

Leverage (A/B) 1.0 1.3 1.6 1.6 1.8

Estimated based on 2012 Adjusted operating income.

Includes $500 million debt offering in May, 2013.

167

Appendix A (cont.)

Regulation G Reconciliations

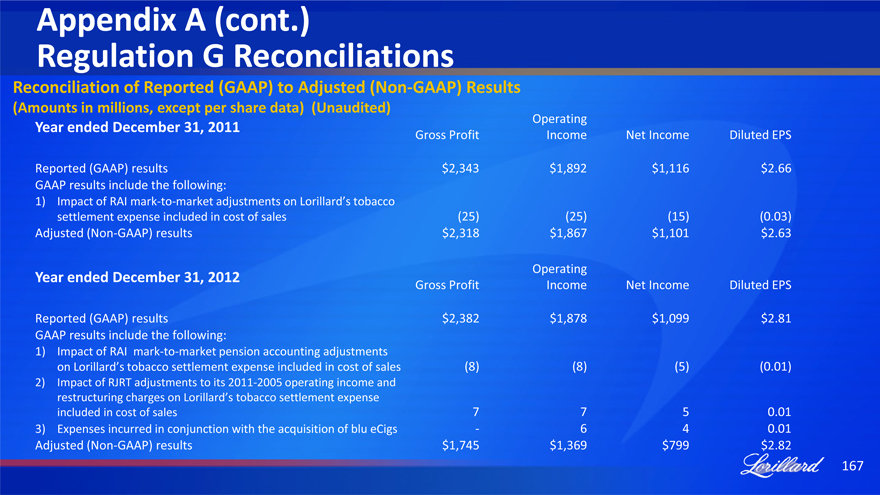

Reconciliation of Reported (GAAP) to Adjusted (Non-GAAP) Results

(Amounts in millions, except per share data) (Unaudited)

Year ended December 31, 2011 Operating

Gross Profit Income Net Income Diluted EPS

Reported (GAAP) results $2,343 $1,892 $1,116 $2.66

GAAP results include the following:

1) Impact of RAI mark-to-market adjustments on Lorillard’s tobacco

settlement expense included in cost of sales (25) (25) (15) (0.03)

Adjusted (Non-GAAP) results $2,318 $1,867 $1,101 $2.63

Year ended December 31, 2012 Operating

Gross Profit Income Net Income Diluted EPS

Reported (GAAP) results $2,382 $1,878 $1,099 $2.81

GAAP results include the following:

1) Impact of RAI mark-to-market pension accounting adjustments

on Lorillard’s tobacco settlement expense included in cost of sales (8) (8) (5) (0.01)

2) Impact of RJRT adjustments to its 2011-2005 operating income and

restructuring charges on Lorillard’s tobacco settlement expense

included in cost of sales 7 7 5 0.01

3) Expenses incurred in conjunction with the acquisition of blu eCigs — 6 4 0.01

Adjusted (Non-GAAP) results $1,745 $1,369 $799 $2.82

168

Lorillard

169