Exhibit 99.1

Lorillard

2014 CAGNY Conference

Newport

Cigarettes

Newport

Cigarettes

blu

February 18, 2014

Lorillard 1

Murray S. Kessler

Chairman, President and Chief Executive Officer

Lorillard 2

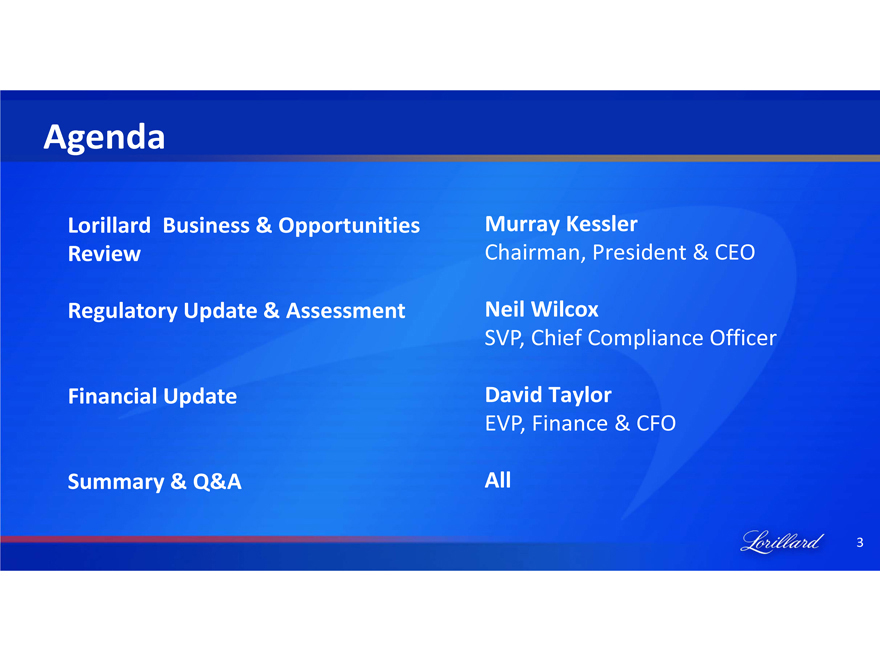

Agenda

Lorillard Business & Opportunities Review

Regulatory Update & Assessment Financial Update Summary & Q&A

Murray Kessler

Chairman, President & CEO

Neil Wilcox

SVP, Chief Compliance Officer

David Taylor

EVP, Finance & CFO

All

Lorillard 3

Safe Harbor Disclaimer

You are cautioned that certain statements made in this presentation are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements, and may contain the words “expect”, “intend”, “plan”, “anticipate”, “estimate”, “believe”, “will be”, “will continue”, “will likely result”, and similar expressions. In addition, any statement that may be provided by management concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible actions by Lorillard, Inc. are also forward-looking statements as defined by the Act.

Forward-looking statements are based on current expectations and projections about future events and are inherently subject to a variety of risks and uncertainties, many of which are beyond the control of Lorillard, Inc., and could cause actual results to differ materially from those anticipated or projected.

Information describing factors that could cause actual results to differ materially from those in forward-looking statements is available in Lorillard, Inc.’s various filings with the Securities and Exchange Commission (“SEC”). These filings are available from the SEC over the Internet or on hard copy, and are, in some cases, available from Lorillard, Inc. as well.

Forward-looking statements speak only as of the time they are made, and Lorillard, Inc. expressly disclaims any obligation or undertaking to update these statements to reflect any change in expectations or beliefs or any change in events, conditions or circumstances on which any forward-looking statement is based.

This forward-looking statements disclaimer is only a brief summary of Lorillard, Inc.’s statutory forward-looking-statements disclaimer. You are urged to read that disclaimer, which is included in Lorillard Inc.’s Form 10-K and Form 10-Q filings with the SEC.

Lorillard 4

Regulation G Compliance

You are also reminded that during this presentation, certain non-GAAP financial measures, such as Adjusted Earnings Per Share may be discussed. These measures should not be considered an alternative to net income, or any other measure of financial performance or liquidity presented in accordance with generally accepted accounting principles (GAAP). These measures are not necessarily comparable to a similarly titled measure of another company. Please refer to Appendix A for information that reconciles these measures with the most comparable GAAP measures.

Lorillard 5

Lorillard Has Built Very Strong Brands Through a Long-Term Focus

The #2 U.S. Cigarette Brand - Newport®

The #1 U.S. Menthol Brand - Newport

The #1 U.S. electronic cigarette – blu eCigs®

– Newly-acquired international e-cigarette business - SKYCIG®

Newport

Cigarettes

Blu CGS

Source: MSA, Inc. retail shipment database. As of full year ended 12/31/2013.

Newport

Box 100s

Lorillard 6

In Cigarettes, Lorillard has Gained Market Share For Eleven Consecutive Years

Lorillard Retail Market Share of U.S. Cigarettes

16%

14%

12%

10%

8%

6%

4%

2%

0%

8.7%

9.0%

9.2%

9.6%

10.0%

10.4%

11.0%

11.8%

12.9%

14.1%

14.4%

14.9%

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Newport

Total Lorillard

Source: MSA, Inc. retail shipment database.

Lorillard 7

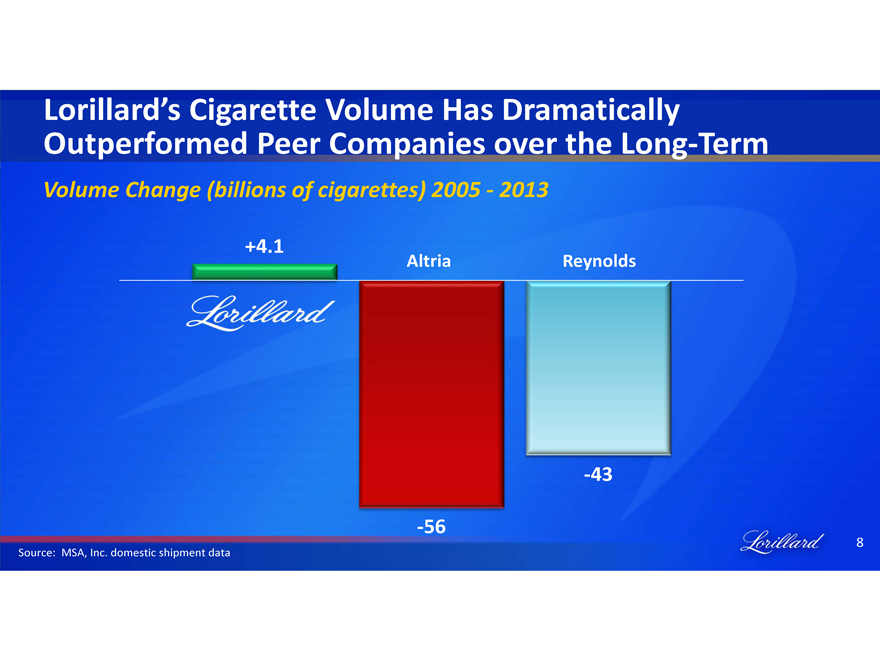

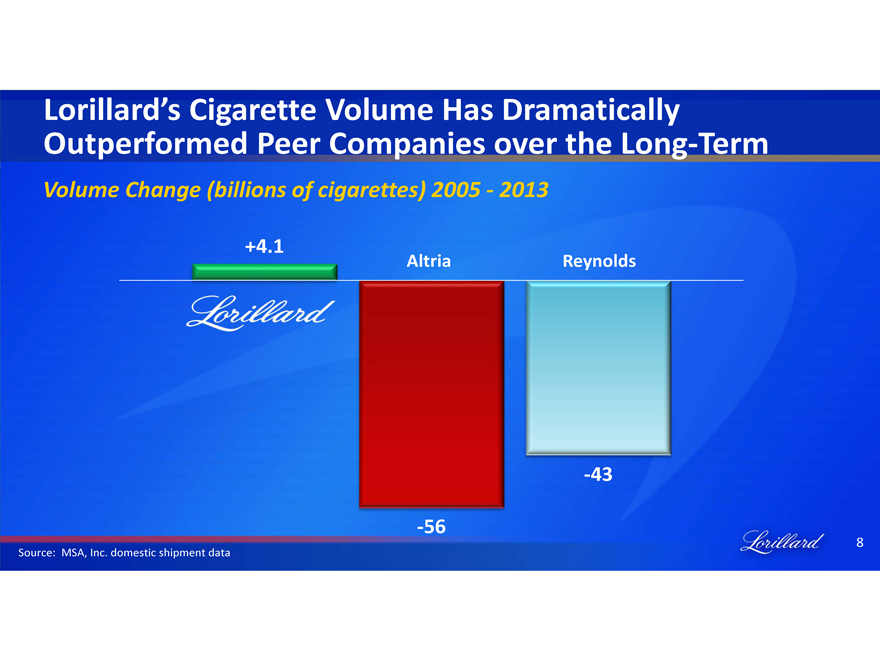

Lorillard’s Cigarette Volume Has Dramatically Outperformed Peer Companies over the Long-Term

Volume Change (billions of cigarettes) 2005 - 2013

+4.1 Altria Reynolds

Lorillard

-43

-56

Source: MSA, Inc. domestic shipment data

Lorillard 8

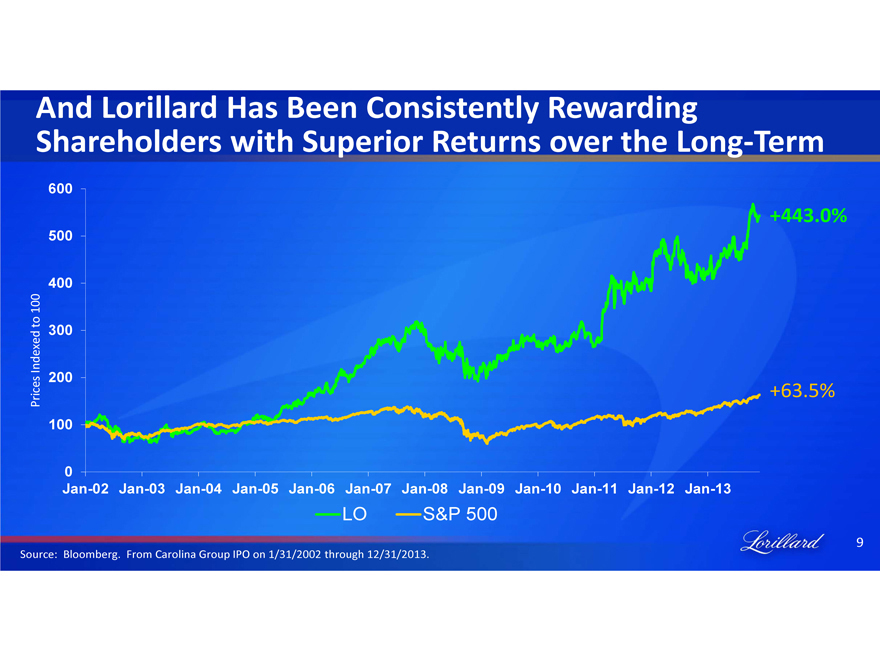

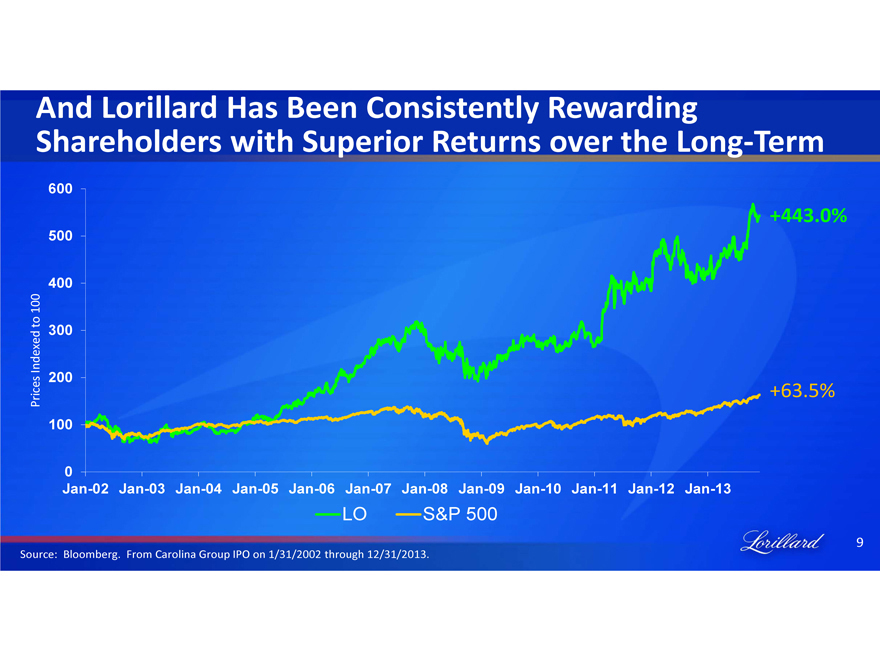

And Lorillard Has Been Consistently Rewarding

Shareholders with Superior Returns over the Long-Term

Prices Indexed to 100

600 500 400 300 200 100 0

+443.0%

+63.5%

Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13

LO S&P 500

Source: Bloomberg. From Carolina Group IPO on 1/31/2002 through 12/31/2013.

Lorillard 9

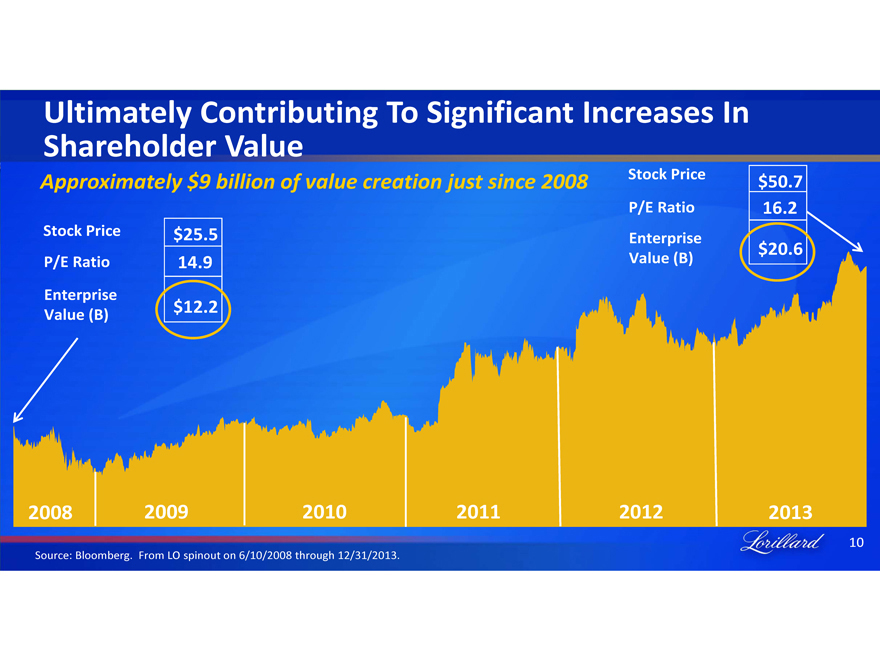

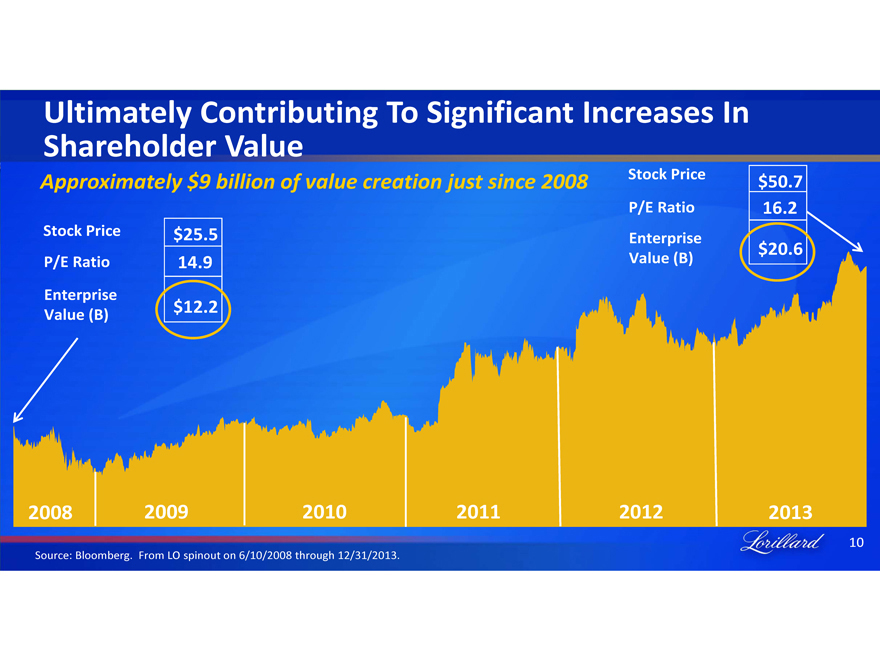

Ultimately Contributing To Significant Increases In Shareholder Value

Approximately $9 billion of value creation just since 2008

Stock Price $25.5

P/E Ratio 14.9

Enterprise

Value (B) $12.2

Stock Price $50.7

P/E Ratio 16.2

Enterprise

Value (B) $20.6

2008 2009 2010 2011 2012 2013

Source: Bloomberg. From LO spinout on 6/10/2008 through 12/31/2013.

Lorillard 10

Key Elements of Lorillard’s Consistent Success Over The Long-Term

1. Focus on the Core

2. A Passion for Brand-Building

3. Lean Cost Structure Mentality

4. Pursuing Close-in Adjacencies without Distracting or Detracting from the Core Menthol Business

5. Shareholder-Friendly Policies

6. Recognition that Top People Make a Significant Difference

Lorillard 11

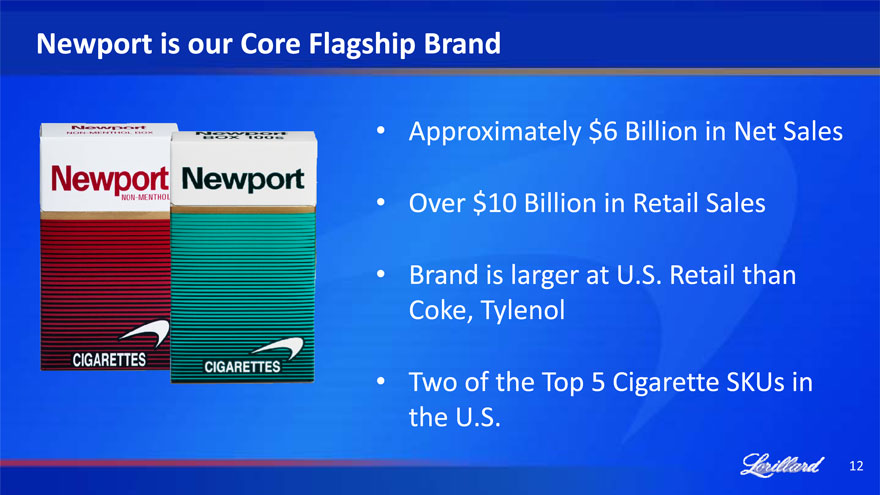

Newport is our Core Flagship Brand

Newport

Non-Mentol Box

Newport

Non-Mentol

CIGARETTES

Newport

BOX 100s

CIGARETTES

Approximately $6 Billion in Net Sales

Over $10 Billion in Retail Sales

Brand is larger at U.S. Retail than Coke, Tylenol

Two of the Top 5 Cigarette SKUs in the U.S.

Lorillard 12

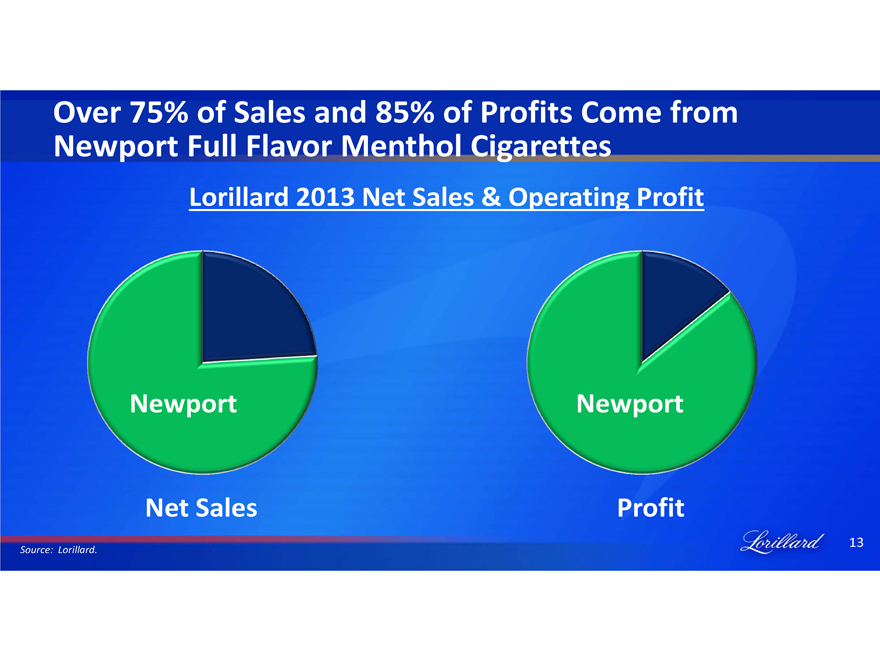

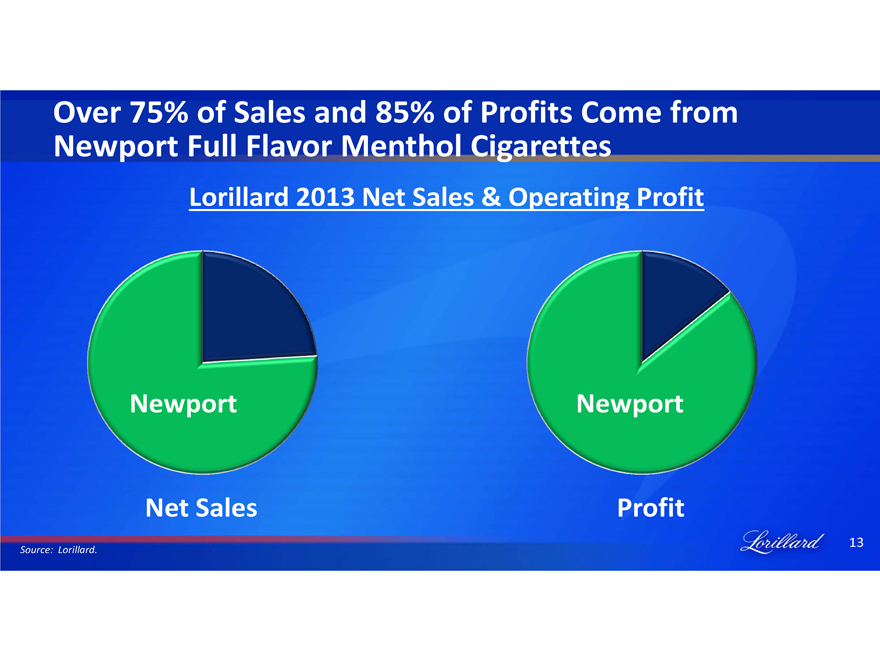

Over 75% of Sales and 85% of Profits Come from Newport Full Flavor Menthol Cigarettes

Lorillard 2013 Net Sales & Operating Profit

Newport

Net Sales

Newport

Profit

Source: Lorillard.

Lorillard 13

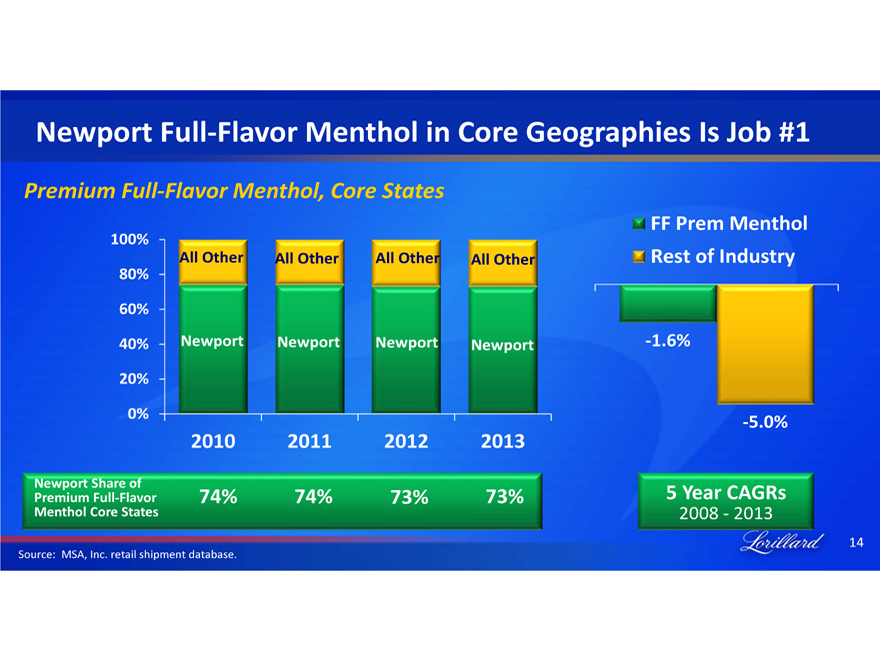

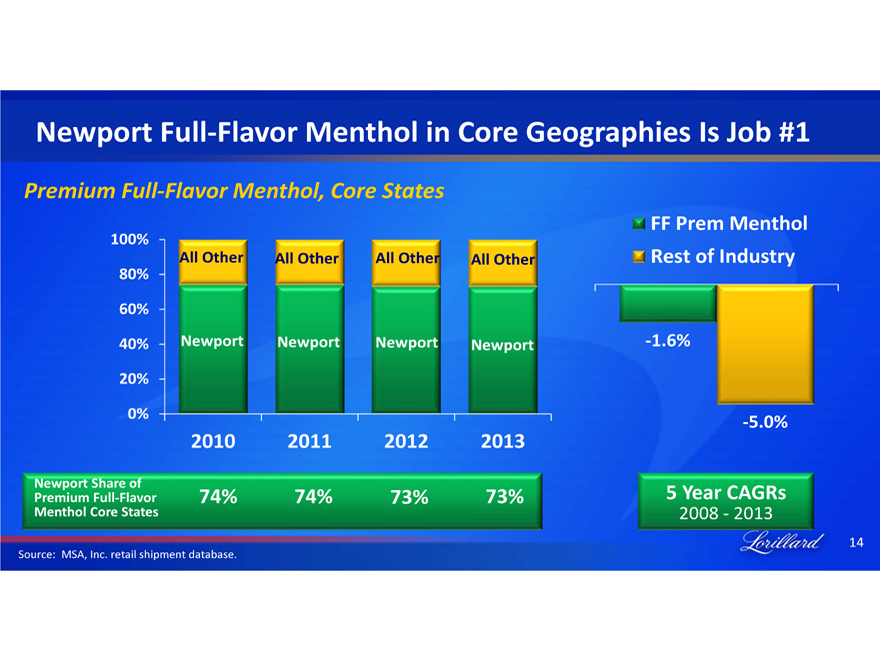

Newport Full-Flavor Menthol in Core Geographies Is Job #1

Premium Full-Flavor Menthol, Core States

100%

All Other

All Other

All Other

All Other

80%

60%

40%

Newport

Newport

Newport

Newport

20%

0%

FF Prem Menthol

Rest of Industry

-1.6%

-5.0%

Newport Share of Premium Full-Flavor Menthol Core States

74%

74%

73%

73%

5 Year CAGRs

2008 - 2013

Source: MSA, Inc. retail shipment database.

Lorillard 14

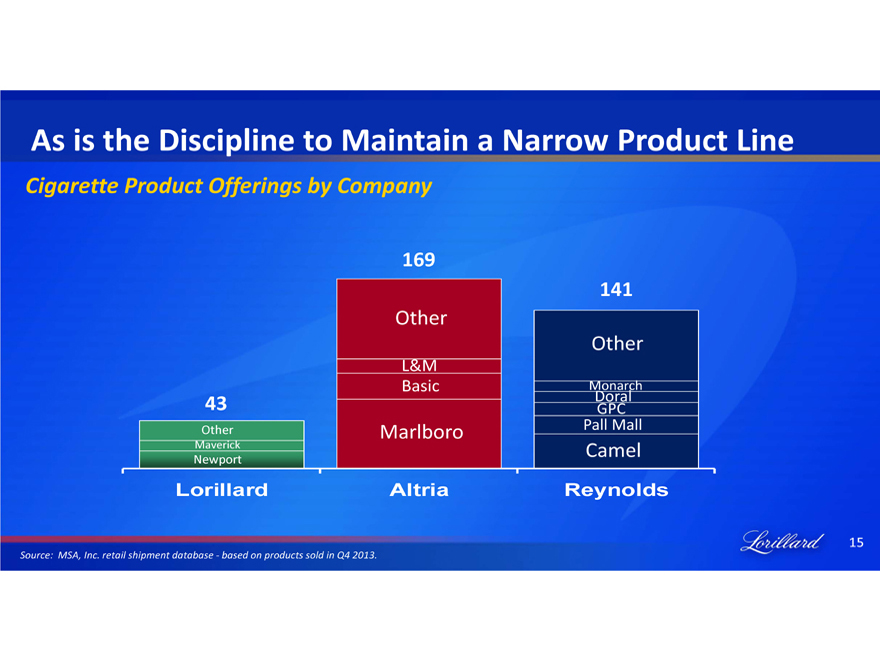

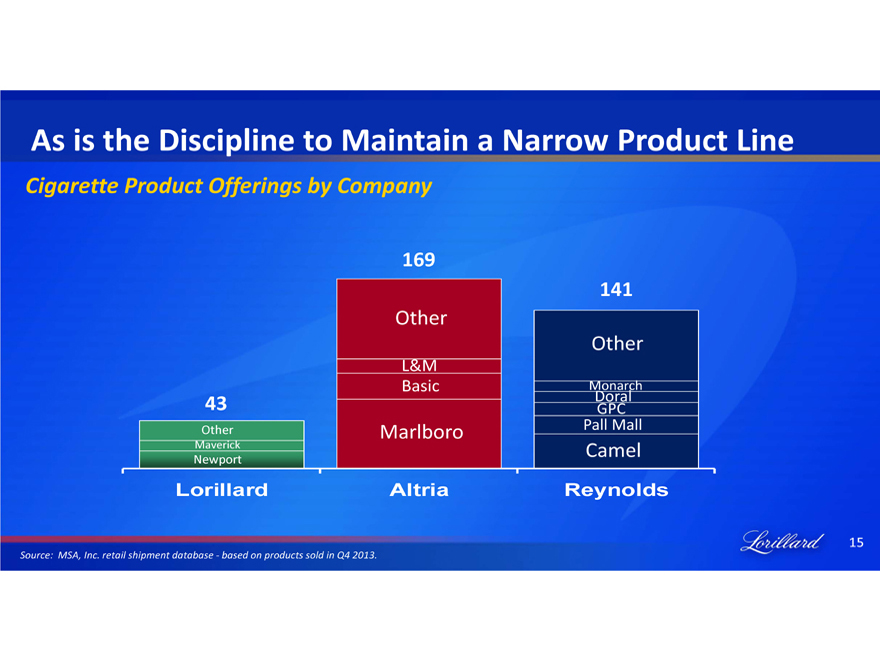

As is the Discipline to Maintain a Narrow Product Line

Cigarette Product Offerings by Company

43

Other

Maverick

Newport

Lorillard

169

Other

L&M

Basic

Marlboro

Altria

141

Other

Monarch

Doral GPC

Pall Mall

Camel

Reynolds

Source: MSA, Inc. retail shipment database - based on products sold in Q4 2013.

Lorillard 15

This Focus Allows for Greater Operational Efficiency And Enhanced Profitability

Long Manufacturing Runs

Sales Force Focus

Consistency within Retail Shelf Space

Focused Brand Management

Lorillard 16

Key Elements of Lorillard’s Consistent Success Over The Long-Term

1. Focus on the Core

2. A Passion for Brand-Building

3. Lean Cost Structure Mentality

4. Pursuing Close-in Adjacencies without Distracting or Detracting from the Core Menthol Business

5. Shareholder-Friendly Policies

6. Recognition that Top People Make a Significant Difference

Lorillard 17

Brand-Building is Also a Top Priority

Brand-Building Initiatives

Advertising

Product

Newport

pleasure!

Consistent 40-year campaign

Distinctive & recognizable

Proven messaging

Newport

BOX 100s

Newport

CIGARETTES

Iconic brand

Consumer preferred

Unique taste profile

Merchandising

275,000+ retail stores

New product visibility

Best relationships in industry

Lorillard 18

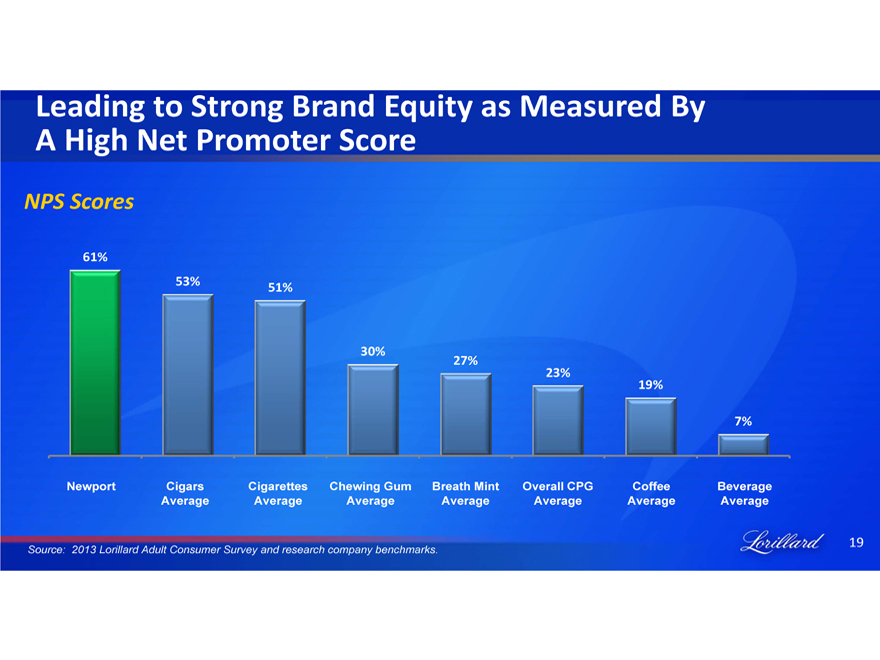

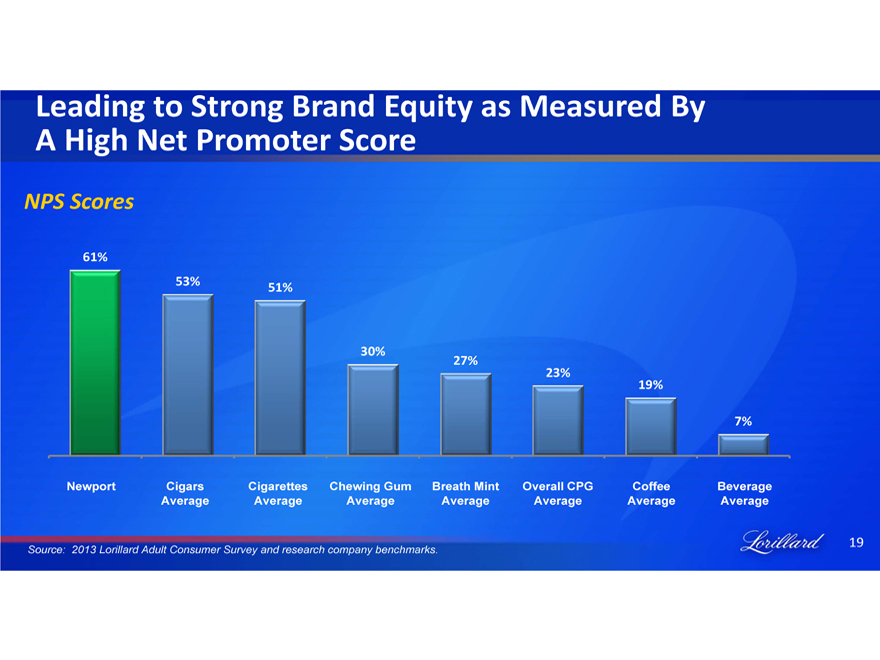

Leading to Strong Brand Equity as Measured By A High Net Promoter Score

NPS Scores

61% 53% 51% 30% 27% 23% 19% 7%

Newport

Cigars Average

Cigarettes Average

Chewing Gum Average

Breath Mint Average

Overall CPG Average

Coffee Average

Beverage Average

Source: 2013 Lorillard Adult Consumer Survey and research company benchmarks.

Lorillard 19

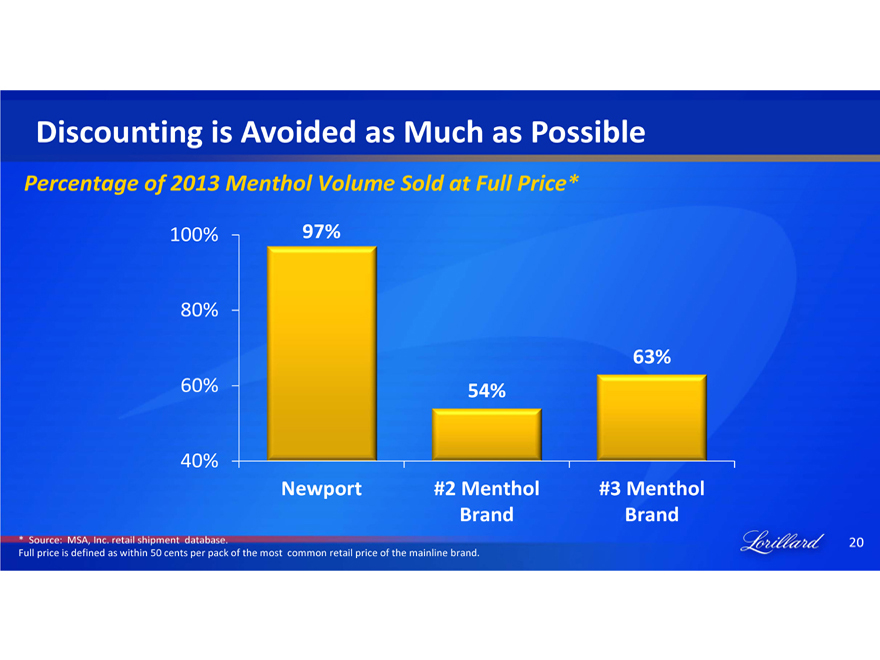

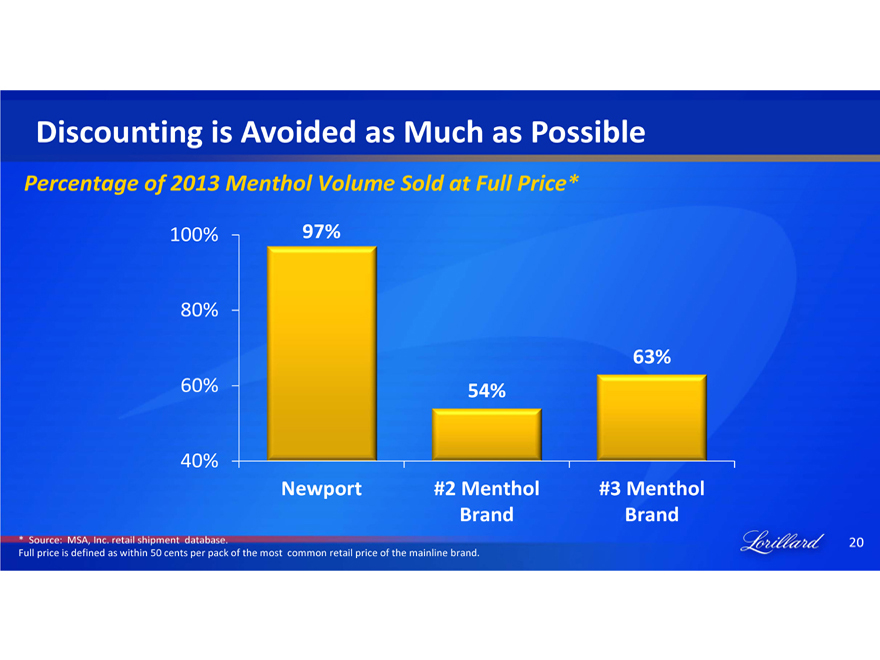

Discounting is Avoided as Much as Possible

Percentage of 2013 Menthol Volume Sold at Full Price*

100%

97%

80%

63%

60%

54%

40%

Newport

#2 Menthol Brand

#3 Menthol Brand

* Source: MSA, Inc. retail shipment database.

Full price is defined as within 50 cents per pack of the most common retail price of the mainline brand.

Lorillard 20

All of this Results in Newport Commanding a Premium Price

Average Retail Price Per Pack of Major Cigarette Brands

$ 6.45

$ 6.52

$6.50

$6.36

Newport

$6.25

$6.28

$6.24

Marlboro

$6.00

Camel

$5.64

$5.62

$5.60

$5.50

2011

2012

2013

Source: Nielsen Convenience store scanner data, 2011 - 2013

Lorillard 21

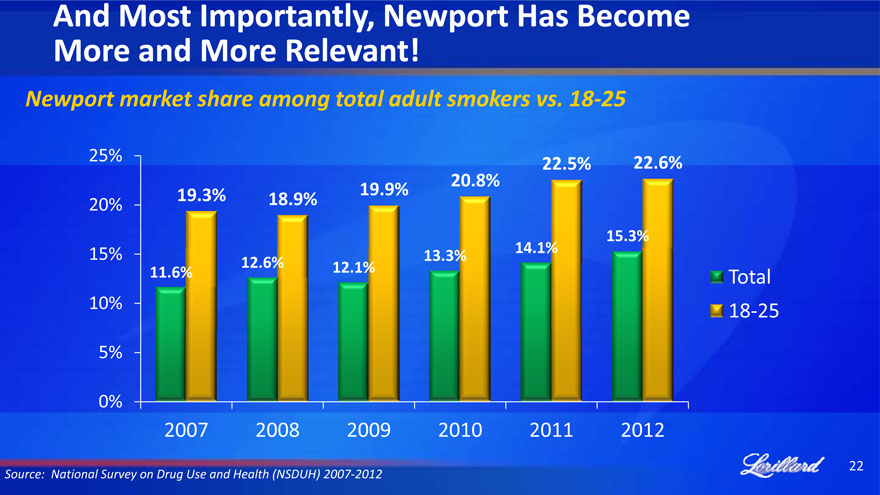

And Most Importantly, Newport Has Become More and More Relevant!

Newport market share among total adult smokers vs. 18-25

25%

22.5%

22.6%

20.8%

20%

19.3%

18.9%

19.9%

15.3%

15%

13.3%

14.1%

12.6%

12.1%

11.6%

Total

10%

18-25

5%

0%

2007

2008

2009

2010

2011

2012

Source: National Survey on Drug Use and Health (NSDUH) 2007-2012

Lorillard 22

Key Elements of Lorillard’s Consistent Success Over The Long-Term

1. Focus on the Core

2. A Passion for Brand-Building

3. Lean Cost Structure Mentality

4. Pursuing Close-in Adjacencies without Distracting or Detracting from the Core Menthol Business

5. Shareholder-Friendly Policies

6. Recognition that Top People Make a Significant Difference

Lorillard 23

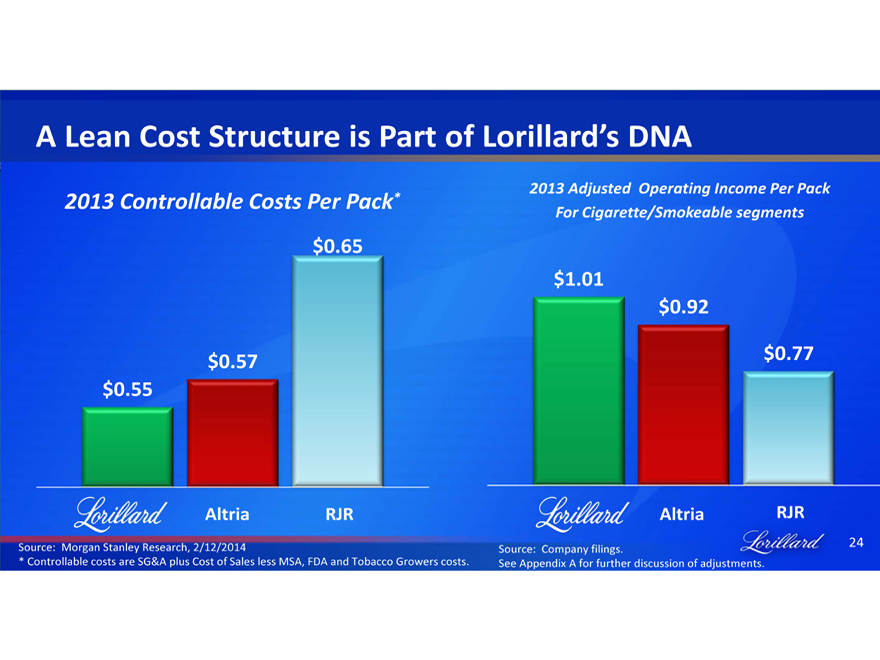

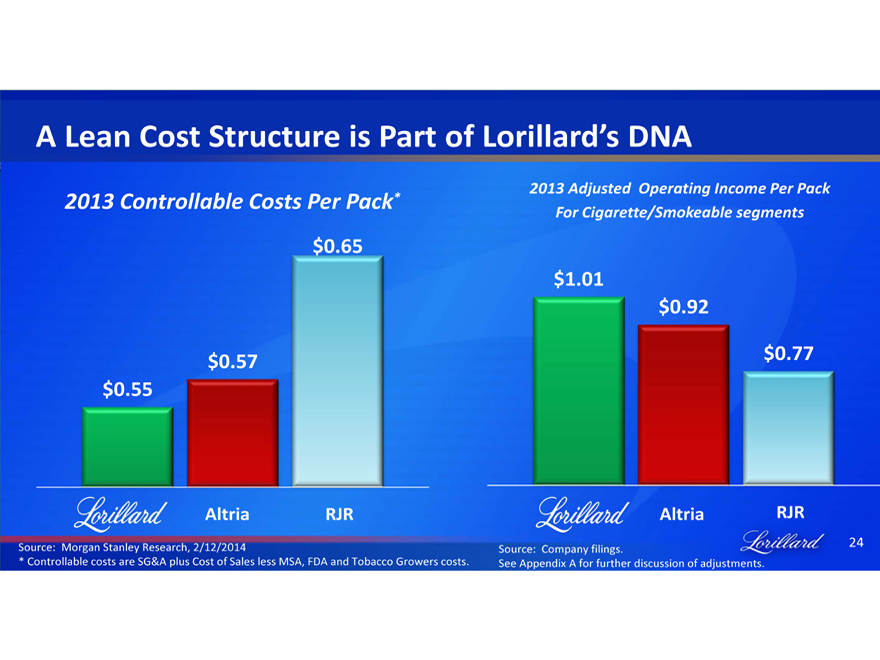

A Lean Cost Structure is Part of Lorillard’s DNA

2013 Controllable Costs Per Pack*

$0.65

$0.57

$0.55

Lorillard Altria RJR

2013 Adjusted Operating Income Per Pack For Cigarette/Smokeable segments

$1.01

$0.92

$0.77

Lorillard Altria RJR

Source: Morgan Stanley Research, 2/12/2014 Source: Company filings.

* Controllable costs are SG&A plus Cost of Sales less MSA, FDA and Tobacco Growers costs. See Appendix A for further discussion of adjustments.

Lorillard 24

Key Elements of Lorillard’s Consistent Success Over The Long-Term

1. Focus on the Core

2. A Passion for Brand-Building

3. Lean Cost Structure Mentality

4. Pursuing Close-in Adjacencies without Distracting or Detracting from the Core Menthol Business

5. Shareholder-Friendly Policies

6. Recognition that Top People Make a Significant Difference

Lorillard

25

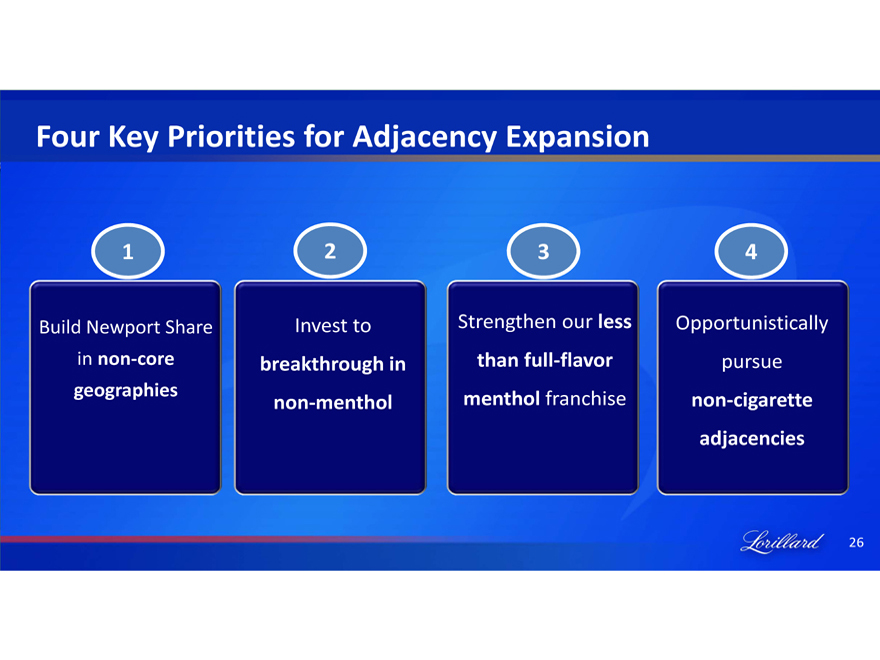

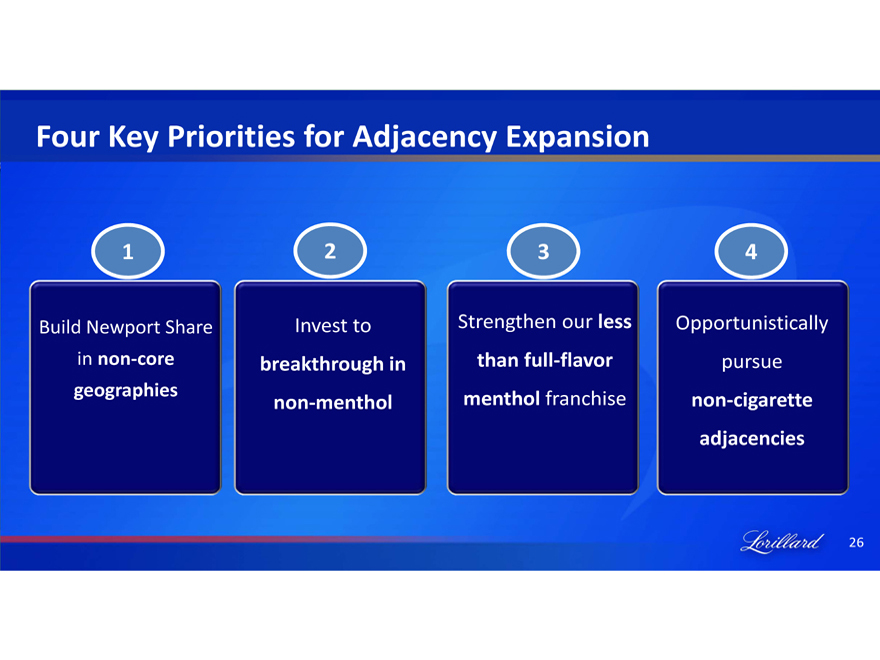

Four Key Priorities for Adjacency Expansion

1234

Build Newport Share in non-core geographies

Invest to breakthrough in non-menthol

Strengthen our less than full-flavor menthol franchise

Opportunistically pursue non-cigarette adjacencies

Lorillard

26

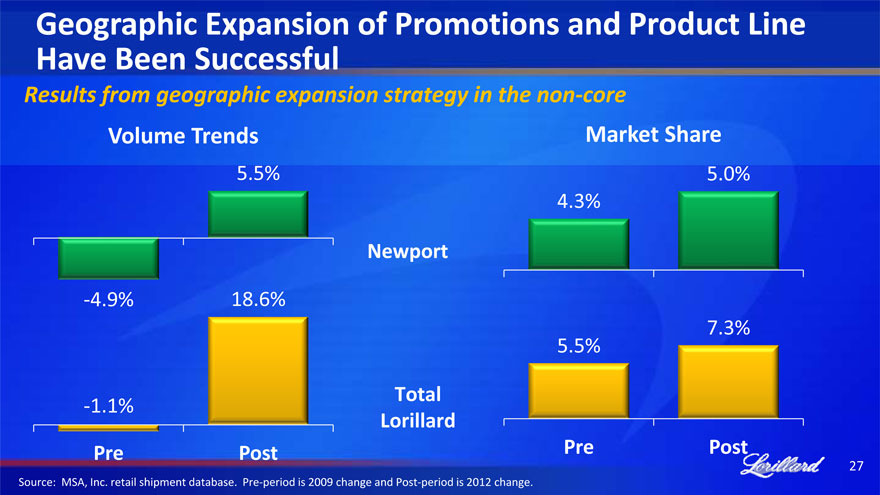

Geographic Expansion of Promotions and Product Line Have Been Successful

Results from geographic expansion strategy in the non-core

Volume Trends

5.5%

Newport

-4.9%

18.6%

-1.1%

Total

Lorillard

Pre

Post

Market Share

5.0%

4.3%

7.3%

5.5%

Pre

Post

Source: MSA, Inc. retail shipment database. Pre period is 2009 change and Post period is 2012 change.

Lorillard 27

As Has Lorillard’s Entry into Non-Menthol, with Newport Red

46 B units

Newport

RJR

Altria

100%

80%

60%

40%

20%

0%

2013

Premium Non-Menthol Full Flavor Units by Brand

Newport NON-MENTHOL BOX

Newport NON-MENTHOL

CIGARETTES

0.9% retail market share

2.4 billion units in 2013

Pricing up more than 35% since 2010 launch

Source: MSA, Inc. retail shipment database.

Lorillard

28

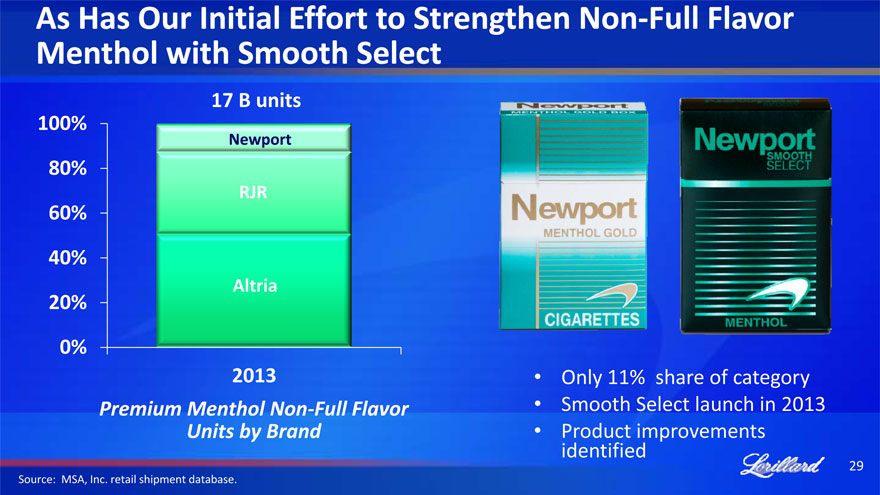

As Has Our Initial Effort to Strengthen Non-Full Flavor Menthol with Smooth Select

17 B units

100%

Newport

80%

RJR

60%

40%

Altria

20%

0%

2013

Premium Menthol Non-Full Flavor

Units by Brand

Newport

MENTHOL GOLD BOX

Newport

MENTHOL GOLD

CIGARETTES

Newport SMOOTH SELECT

MENTHOL

Only 11% share of category

Smooth Select launch in 2013

Product improvements identified

Source: MSA, Inc. retail shipment database.

Lorillard

29

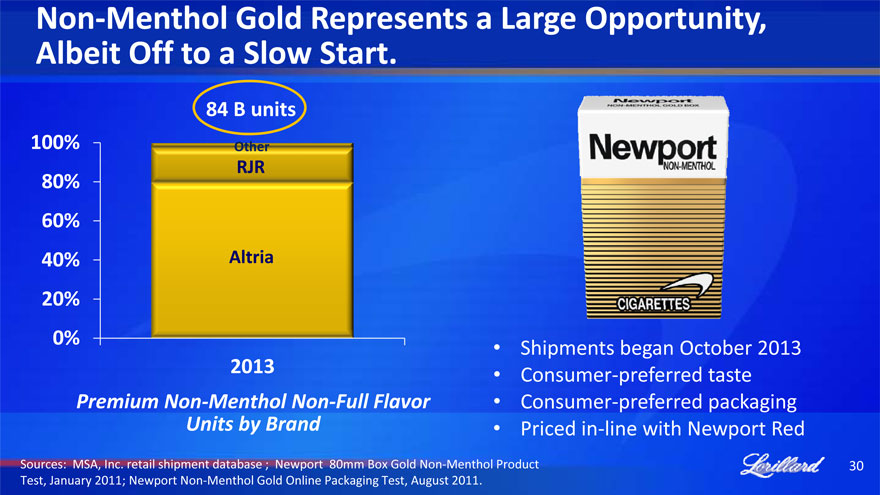

Non-Menthol Gold Represents a Large Opportunity, Albeit Off to a Slow Start.

84 B units

100%

Other

RJR

80%

60%

40%

Altria

20%

0%

2013

Premium Non-Menthol Non-Full Flavor Units by Brand

Shipments began October 2013

Consumer-preferred taste

Consumer-preferred packaging

Priced in-line with Newport Red

Sources: MSA, Inc. retail shipment database ; Newport 80mm Box Gold Non Menthol Product Test,

January 2011; Newport Non-Menthol Gold Online Packaging Test, August 2011;

Lorillard

30

Our Entry into e-Cigarettes Has Been Another Success For the Company

Rise from the Ashes

blu TM ELECTRONIC CIGARETTES

blu

National retail roll-out –136,000+ outlets currently

National TV and print advertising campaign ($40 MM 2013 marketing spend)

Product enhancements & quality controls

Increased manufacturing capacity & inventory

Lorillard

31

Brand-Building is Also the Top Priority in e-Cigarettes

Stephen Dorff

Jenny McCarthy

Lorillard

32

2013_Event_marketing_recap_-_Internal_Use_Only_

blu™ eCIGS

ELECTRONIC

CIGARETTES

NOT FOR SALE TO MINORS blu eCigs® electronic cigarettes are not a smoking cessation product and have not been evealuated by the Food and Drug Administration, nor are they intended to treat, prevent or cure any disease or condition. ©2013 LOEC,INC

blu™ and blu eCigs® are trademarks of Lorillard Technologies, Inc.

INTERNAL USE ONLY

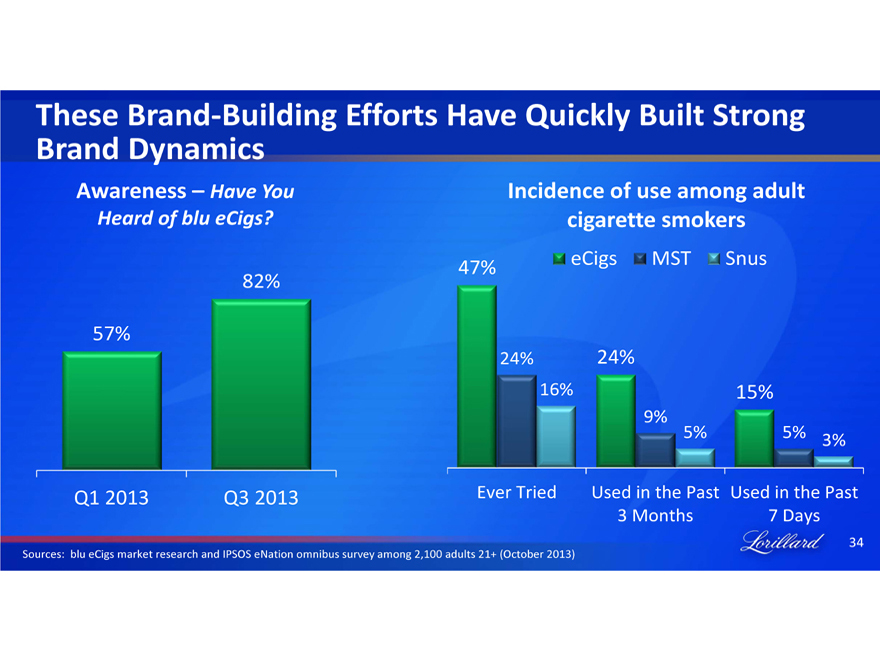

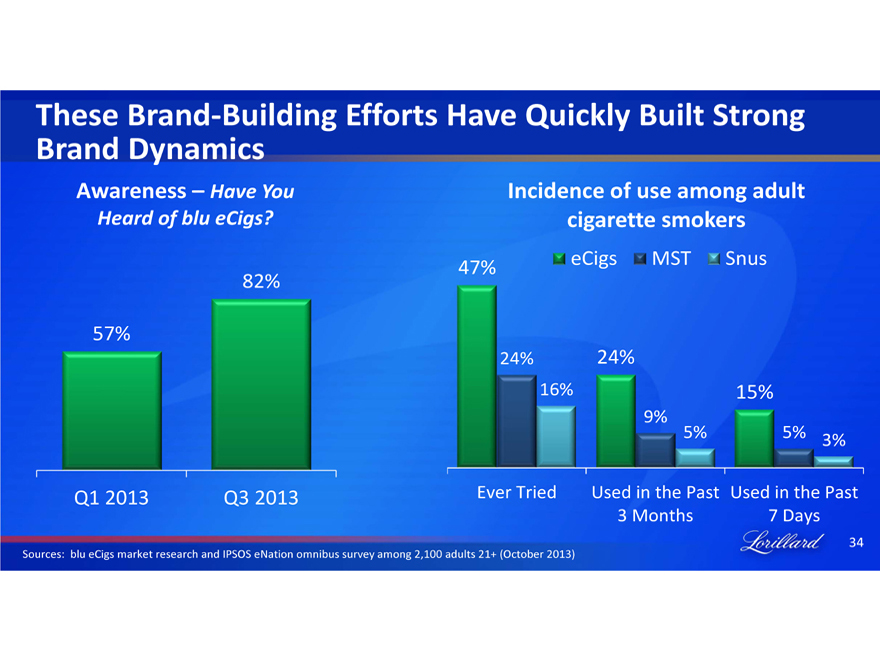

These Brand-Building Efforts Have Quickly Built Strong Brand Dynamics

Awareness – Have You Heard of blu eCigs?

57%

82%

Q1 2013

Q3 2013

Incidence of use among adult

cigarette smokers

eCigs

MST

Snus

47% 24% 16% 24% 9% 5% 15% 5% 3%

Ever Tried

Used in the Past

Used in the Past

3 Months

7 Days

Sources: blu eCigs market research and IPSOS eNation omnibus survey among 2,100 adults 21+ (October 2013)

Lorillard

34

And Have Made blu the Clear e-Cig Category Leader!

Quarterly blu eCigs Retail Market Share

40%+ Market Share

~136,000 Retail

Outlets

50%

48%

40%

~10% Market Share*

34%

30%

~12,000 Retail

Outlets

20%

15%*

10%*

10%

0%

Q2 2012

Q3 2012

Q4 2012

Q4 2013

EPS Accretive in Year 1

Source: MSA, Inc. retail shipment database for electronic cigarettes, as of Dec. 31, 2013. * blu eCigs internal estimates.

Lorillard

35

We Also Completed Another e-Cigarette Acquisition – The First Step in Global Expansion

Demonstrated track record of bringing innovative products to market

Provides platform for further geographic expansion

Establishes Lorillard as a global leader in tobacco harm reduction

Lorillard

36

It is Our Goal to Build blu eCigs into a Global Brand

Re-branding of SKYCIG to blu eCigs

Transitioning of the brands in the UK

blu eCigs brand to be expanded into Western Europe

Requires incremental investment

blu by SKYCIG

Lorillard

37

Key Elements of Lorillard’s Consistent Success Over The Long-Term

1. Focus on the Core

2. A Passion for Brand-Building

3. Lean Cost Structure Mentality

4. Pursuing Close-in Adjacencies without Distracting or Detracting from the Core Menthol Business

5. Shareholder-Friendly Policies

6. Recognition that Top People Make a Significant Difference

Lorillard

38

Rewarding Shareholders is Always Top-of-Mind

Focused on generating cash flow

70-75% dividend payout ratio

Dividend growth tied to earnings

Modest capital spending needs

Excess cash from operations targeted to share repurchases

Transparency in financial reporting, although no guidance

Lorillard

39

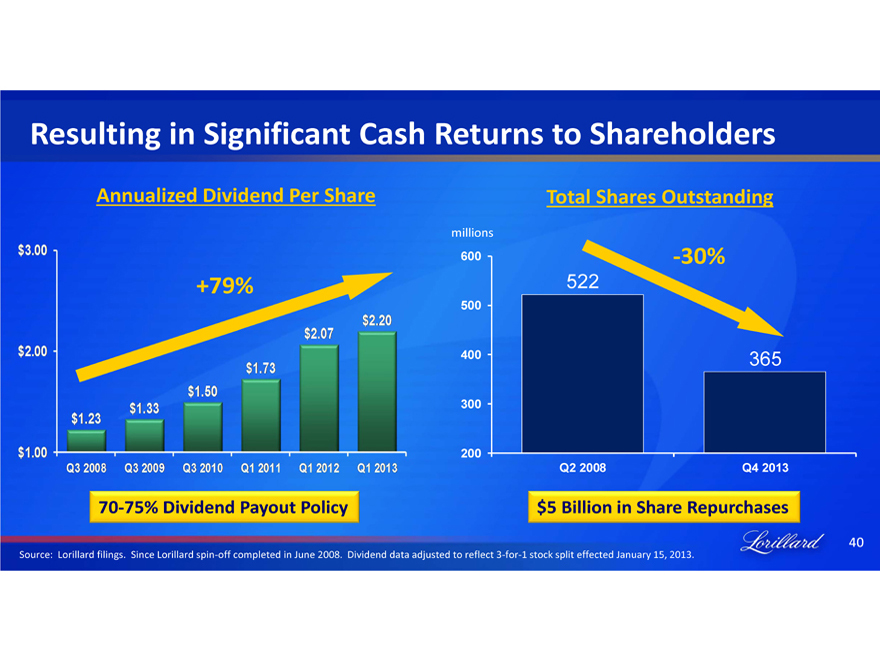

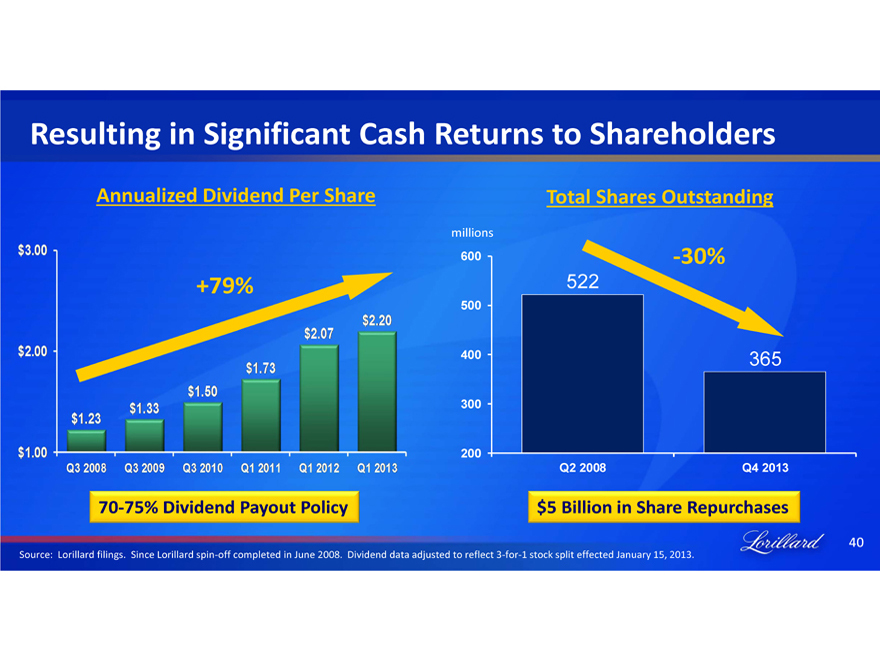

Resulting in Significant Cash Returns to Shareholders

Annualized Dividend Per Share

$3.00

+79%

$2.20

$2.00

$2.07

$1.73

$1.50

$1.33

$1.00

$1.23

Q3 2008

Q3 2009

Q3 2010

Q3 2011

Q3 2012

Q3 2013

70-75% Dividend Payout Policy

Total Shares Outstanding

millions

600

-30%

522

500

400

365

300

200

Q2 2008

Q4 2013

$5 Billion in Share Repurchases

Source: Lorillard filings. Since Lorillard spin-off completed in June 2008. Dividend data adjusted to reflect 3-for-1

stock split effected January 15, 2013.

Lorillard

40

Key Elements of Lorillard’s Consistent Success Over The Long-Term

1. Focus on the Core

2. A Passion for Brand-Building

3. Lean Cost Structure Mentality

4. Pursuing Close-in Adjacencies without Distracting or Detracting from the Core Menthol Business

5. Shareholder-Friendly Policies

6. Recognition that Top People Make a Significant Difference

Lorillard 41

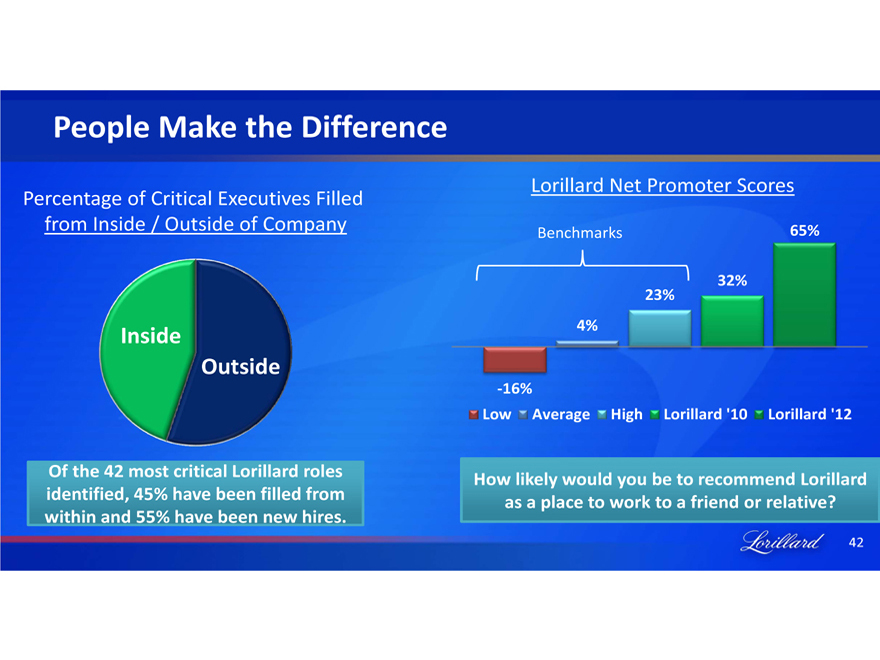

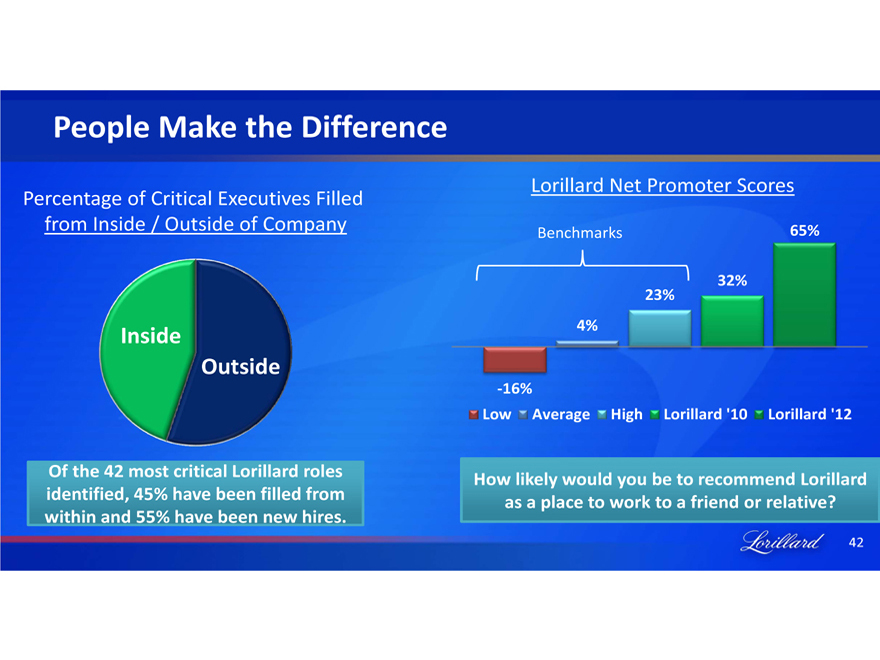

People Make the Difference

Percentage of Critical Executives Filled from Inside / Outside of Company

Inside

Outside

Of the 42 most critical Lorillard roles identified, 45% have been filled from within and 55% have been new hires.

Lorillard Net Promoter Scores

Benchmarks

65%

32%

23%

4%

-16%

Low Average High Lorillard ‘10 Lorillard ‘12

How likely would you be to recommend Lorillard as a place to work to a friend or relative?

Lorillard

42

Compensation and Governance Philosophies Align With Shareholder Interests

Short-Term

40% operating profit

40% Newport market share

20% individual goals

Long-Term

50-80% of compensation in shares with 3-year vesting

Tied to EPS targets

Compensation policies coupled with strong governance

Declassified board

Stock ownership requirements

No hedging policy

Majority voting

Lead independent director

No employment agreements

No change in control gross-ups

Lorillard

43

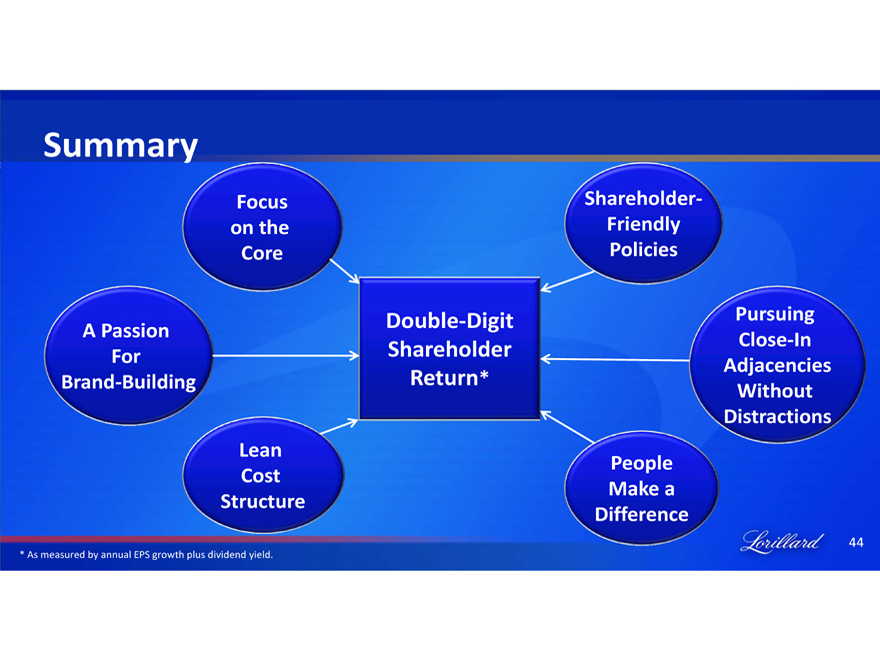

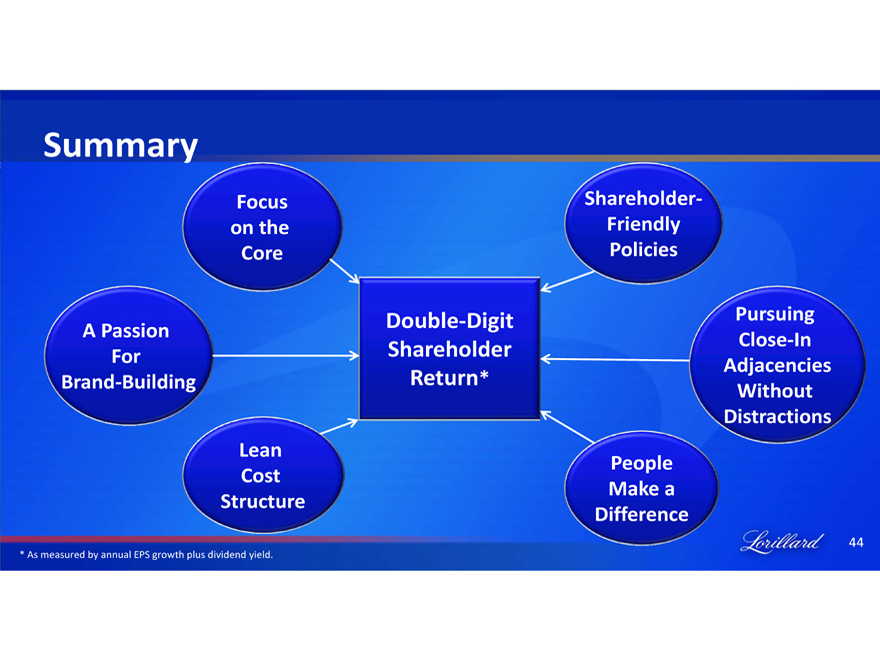

Summary

Focus on the Core

Shareholder- Friendly Policies

A Passion For Brand-Building

Double-Digit Shareholder Return*

Pursuing Close-In Adjacencies Without Distractions

Lean Cost Structure

People Make a Difference

* As measured by annual EPS growth plus dividend yield.

Lorillard

44

Regulatory Update & Assessment

Neil Wilcox

SVP, Chief Compliance Officer

Lorillard

45

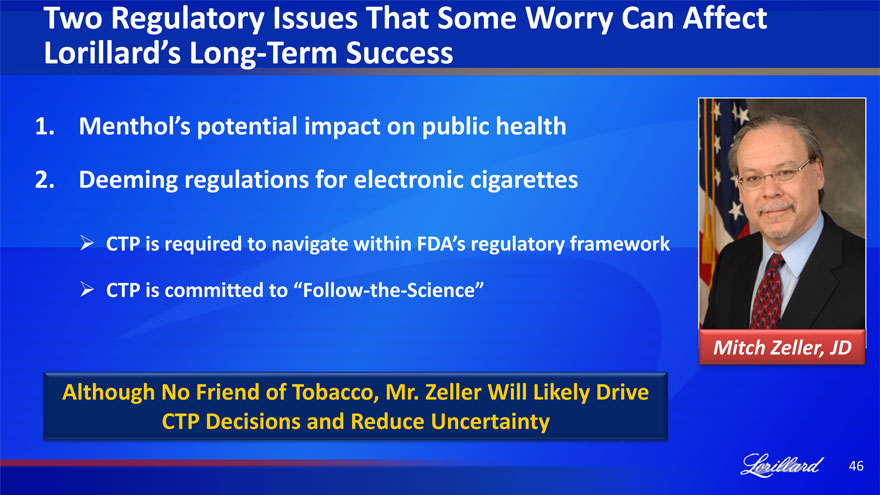

Two Regulatory Issues That Some Worry Can Affect Lorillard’s Long-Term Success

1. Menthol’s potential impact on public health

2. Deeming regulations for electronic cigarettes

CTP is required to navigate within FDA’s regulatory framework

CTP is committed to “Follow-the-Science”

Mitch Zeller, JD

Although No Friend of Tobacco, Mr. Zeller Will Likely Drive CTP Decisions and Reduce Uncertainty

Lorillard

46

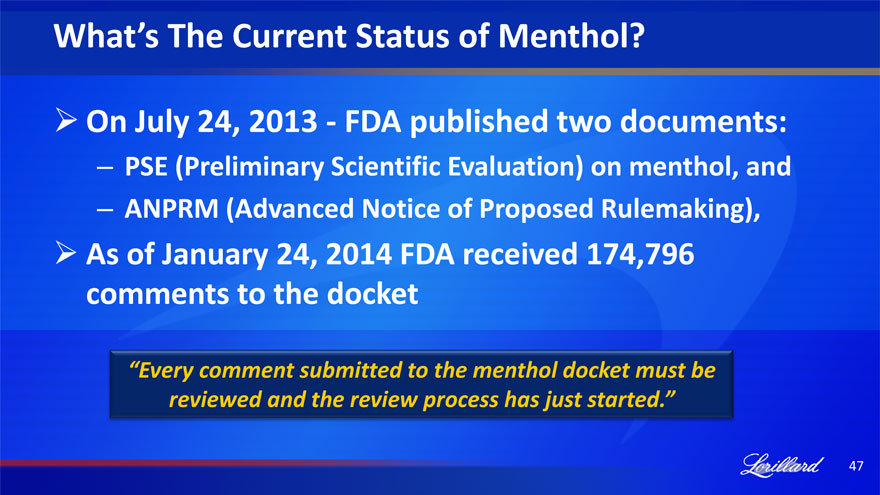

What’s The Current Status of Menthol?

On July 24, 2013 -FDA published two documents:

PSE (Preliminary Scientific Evaluation) on menthol, and

ANPRM (Advanced Notice of Proposed Rulemaking),

As of January 24, 2014 FDA received 174,796 comments to the docket

Every comment submitted to the menthol docket must be reviewed and the review process has just started.”

Lorillard

47

Lorillard’s View on CTP’s Menthol Assessment

Ø FDA’s PSE is Fundamentally Flawed

– Lack of transparency in FDA’s selection and weighting of studies

– FDA’s conclusions often based on strained interpretations of data and not supported by suitable evidence

– FDA inappropriately uses “association” instead of causation

– FDA appears to ignore some studies and peer review comments

– FDA relies upon unpublished and non-peer reviewed studies

– Conclusions are not supported by scientific evidence

Lorillard

48

What’s the Likelihood of FDA Action?

According to Mitch Zeller, “FDA has met its congressional obligations as required by the TCA:

- TPSAC completed report on menthol

- PSE & ANPRM published

- Completing these requirements does not imply future rule-making and FDA is not obligated to take any action.”

Lorillard

49

Lorillard Agrees with Comments from the CTP Director

“It would be inappropriate for me to prejudge any potential action that we could take other than to say we’re in information-seeking mode.”

“We want more evidence, more information as we ponder any potential action that we could take.”

Mitch Zeller, Director, FDA Center for Tobacco Products

-National Public Radio Interview, January 2, 2014

Lorillard

50

Lorillard’s Position on Menthol is Based on Science

Scientific evidence does not support a finding that

a product standard related to menthol would be

“appropriate for public health”

We continue to believe that the science does not provide a basis for

regulating menthol cigarettes differently from non-menthol cigarettes

FDA-NIH funded PATH Studies may provide additional information on

menthol over the next several years – which should show no difference

FDA review of the menthol issue could be a very long process

Lorillard is fully prepared to respond to any FDA action on menthol

Lorillard 51

FDA’s Deeming Regulations for e-Cigarettes

Lorillard intends to hold regulators to science-based decisions

• Lorillard supports reasonable regulations for e-cigs including:

– Minimum age of purchase laws restricting sales to minors

– Product quality and safety standards

– Science-based regulation - proportional with harm reduction potential

• Lorillard believes e-cig regulations should also allow marketing freedoms including:

– Broad retail and online availability

– Marketing freedom to communicate with adult consumers and inform of product advantages and attributes

– Flavors acceptable as a choice for adult consumers

– Flexibility enabling the swift introduction of new products

Lorillard 52

Lorillard is Well Positioned for Opportunities!

Lorillard has FDA expertise as demonstrated by obtaining the only two authorizations for SE cigarette products

FDA is mandated to “follow-the-science” when justifying regulations – the science is simply not there for regulating menthol in cigarettes

E-cigs quite possibly represent the most important harm reduction potential in the history of cigarettes

E-cig regulations must be intelligently flexible

Lorillard 53

Summary

Excellent communications have been established with CTP

We have received the first and only SE Orders for new cigarette products

We look forward to working with the FDA on e-cig regulations

We have communicated our views on menthol in cigarettes to CTP – supported by robust science

Lorillard’s is well prepared for all regulatory requirements and actions

Lorillard 54

Financial Update

David Taylor

EVP, Finance and Planning & CFO

Lorillard 55

Lorillard Formula for Success is Unchanged

Industry Leading Fundamentals

Lean Cost Structure

Focus on Returning

Cash to Shareholders

Consistent Delivery of a Double Digit Total Shareholder Return Over the Long-Term

* Double-digit shareholder return as measured by EPS growth and the dividend yield.

Lorillard 56

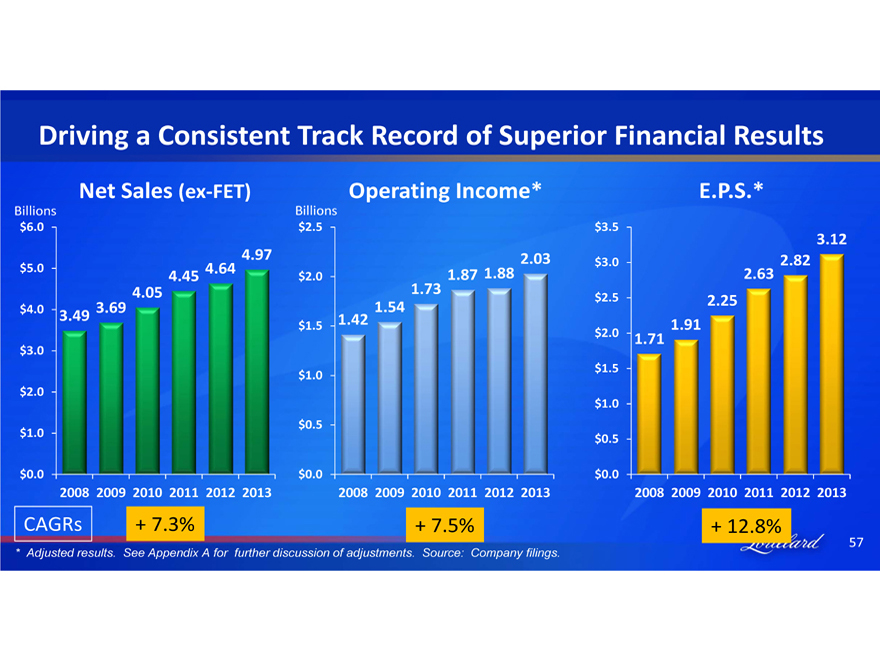

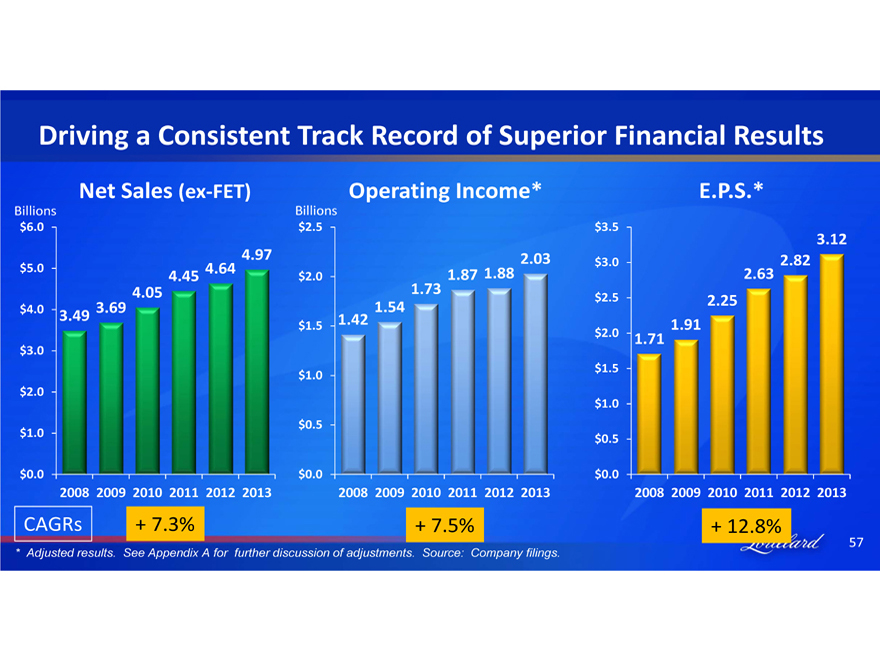

Driving a Consistent Track Record of Superior Financial Results

Net Sales (ex-FET)

Billions

$6.0 $5.0 $4.0 $3.0 $2.0 $1.0 $0.0

3.49 3.69 4.05 4.45 4.64 4.97

2008 2009 2010 2011 2012 2013

+ 7.3%

Operating Income*

Billions

$2.5 $2.0 $1.5 $1.0 $0.5 $0.0

1.42 1.54 1.73 1.87 1.88 2.03

2008 2009 2010 2011 2012 2013

+ 7.5%

E.P.S.*

$3.5 $3.0 $2.5 $2.0 $1.5 $1.0 $0.5 $0.0

1.71 1.91 2.25 2.63 2.82 3.12

2008 2009 2010 2011 2012 2013

+ 12.8%

CAGRs

* Adjusted results. See Appendix A for further discussion of adjustments. Source: Company filings.

Lorillard 57

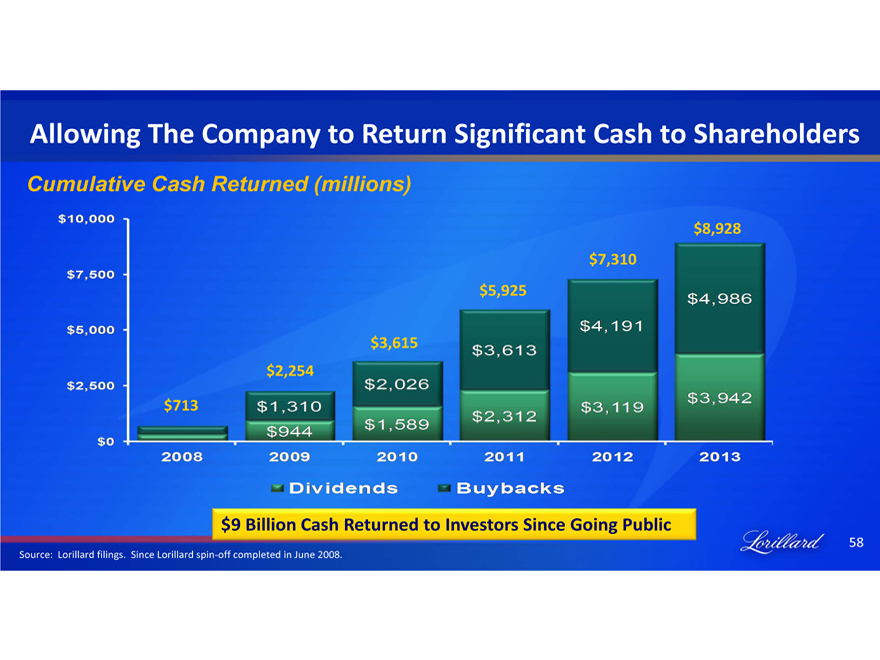

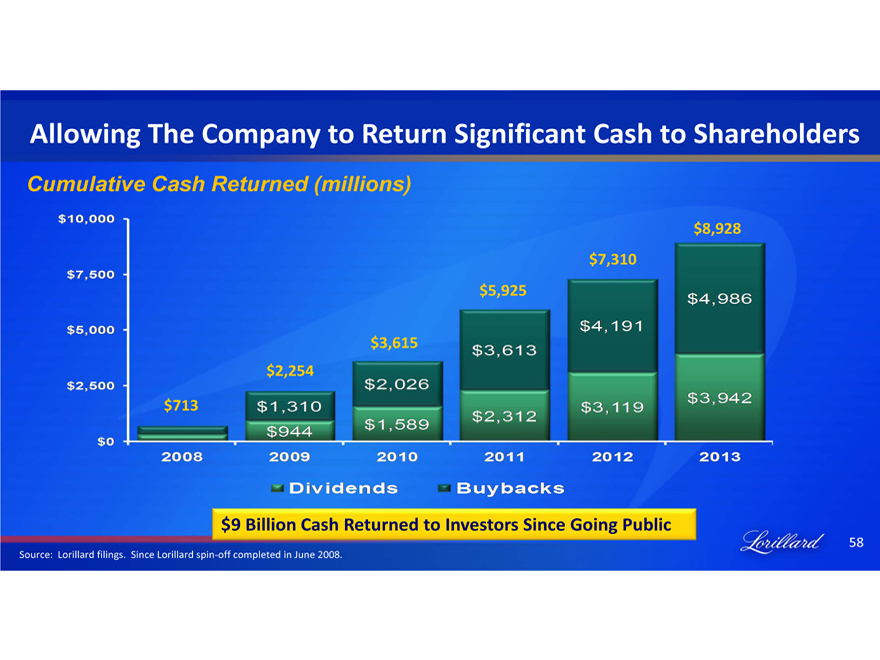

Allowing The Company to Return Significant Cash to Shareholders

Cumulative Cash Returned (millions)

$10,000

$7,500

$5,000

$2,500

$0

$8,928 $7,310 $5,925

$3,615 $2,254

$713

$1,310

$944

$2,026

$1,589

$3,613

$2,312

$4,191

$3,119

$4,986

$3,942

2008 2009 2010 2011 2012 2013

Dividends

Buybacks

$9 Billion Cash Returned to Investors Since Going Public

Source: Lorillard filings. Since Lorillard spin-off completed in June 2008.

Lorillard 58

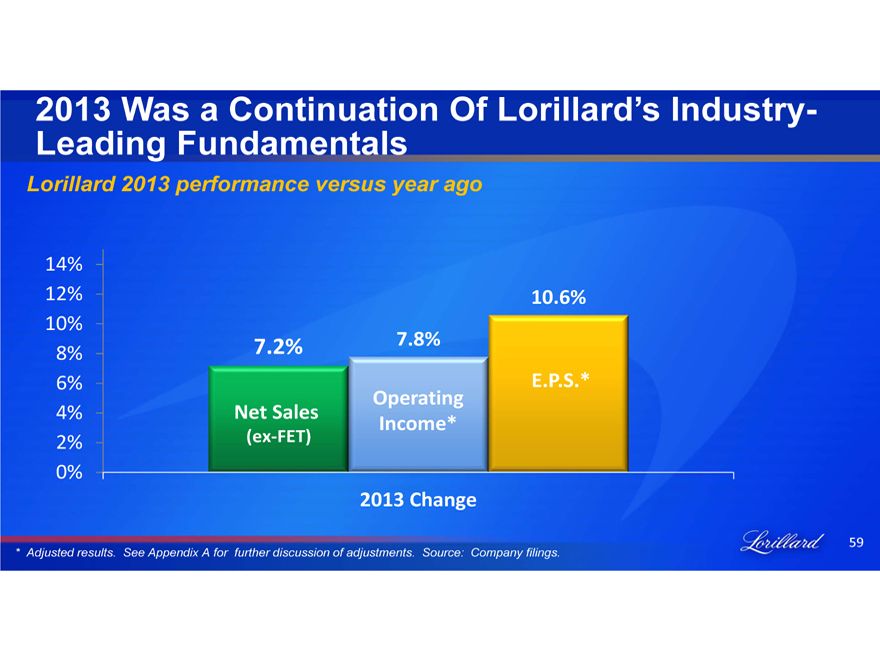

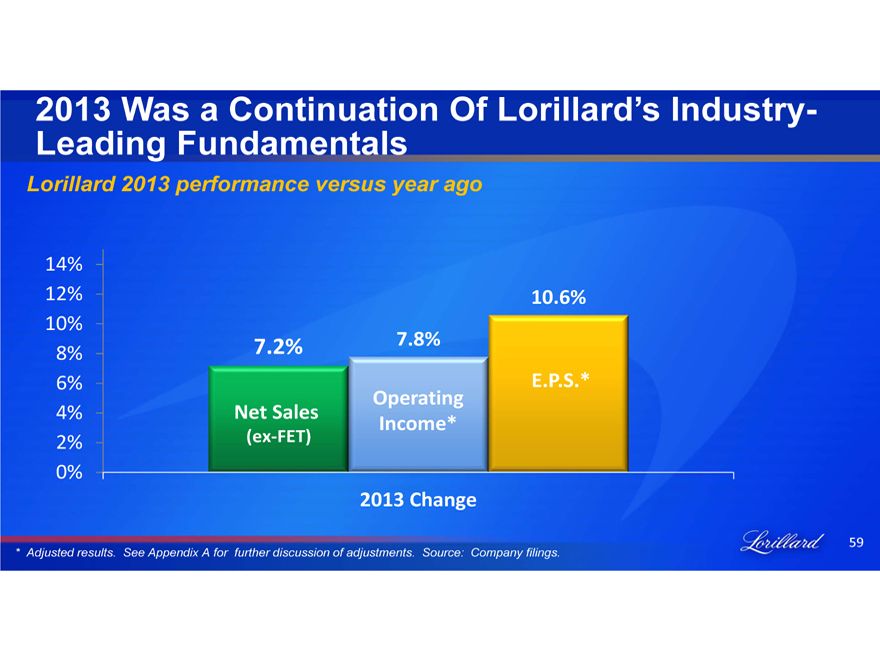

2013 Was a Continuation Of Lorillard’s Industry-Leading Fundamentals

Lorillard 2013 performance versus year ago

14%

12% 10.6%

10%

7.2% 7.8%

8%

6% E.P.S.* Operating

4% Net Sales

Income*

2% (ex-FET)

0%

2013 Change

* Adjusted results. See Appendix A for further discussion of adjustments. Source: Company filings.

Lorillard 59

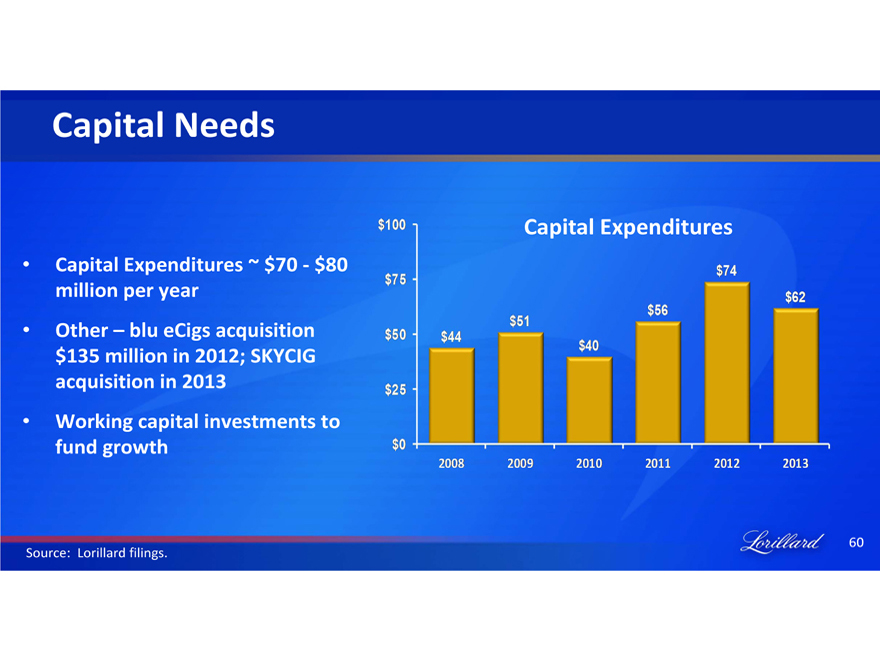

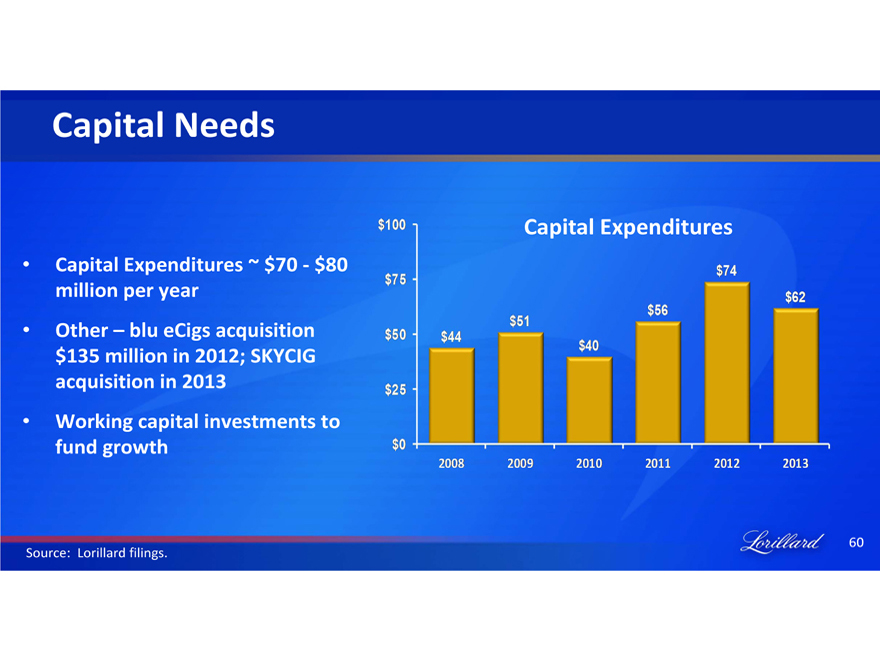

Capital Needs

Capital Expenditures ~ $70 - $80 million per year

Other – blu eCigs acquisition $135 million in 2012; SKYCIG acquisition in 2013

Working capital investments to fund growth

Capital Expenditures

$100 $75 $50 $25 $0

$44 $51 $40 $56 $74 $62

2008 2009 2010 2011 2012 2013

Source: Lorillard filings.

Lorillard

60

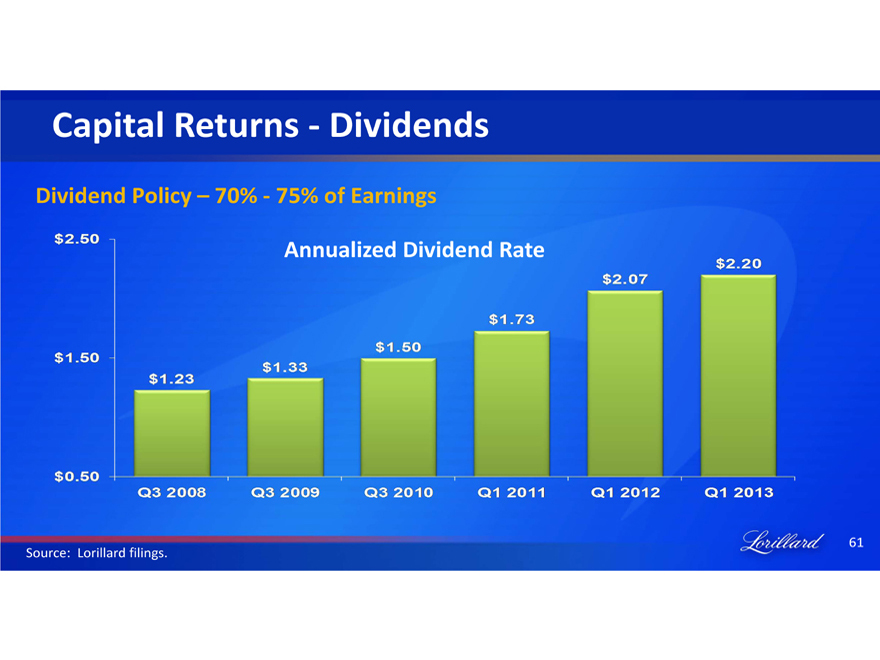

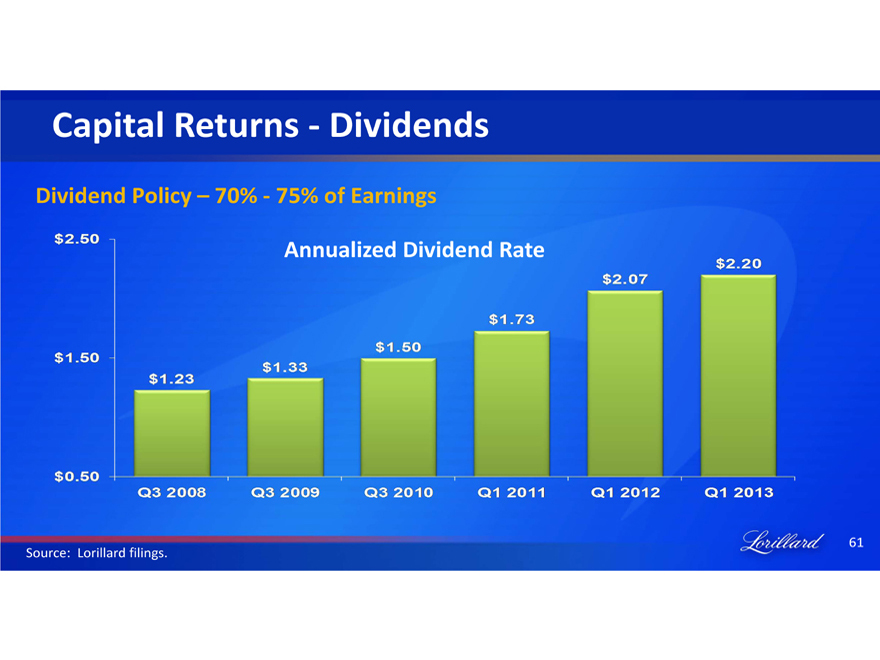

Capital Returns - Dividends

Dividend Policy – 70% - 75% of Earnings

Annualized Dividend Rate

$2.50

$1.50

$0.50

$1.23 $1.33 $1.50 $1.73 $2.07 $2.20

Q3 2008 Q3 2009 Q3 2010 Q1 2011 Q1 2012 Q1 2013

Source: Lorillard filings.

Lorillard 61

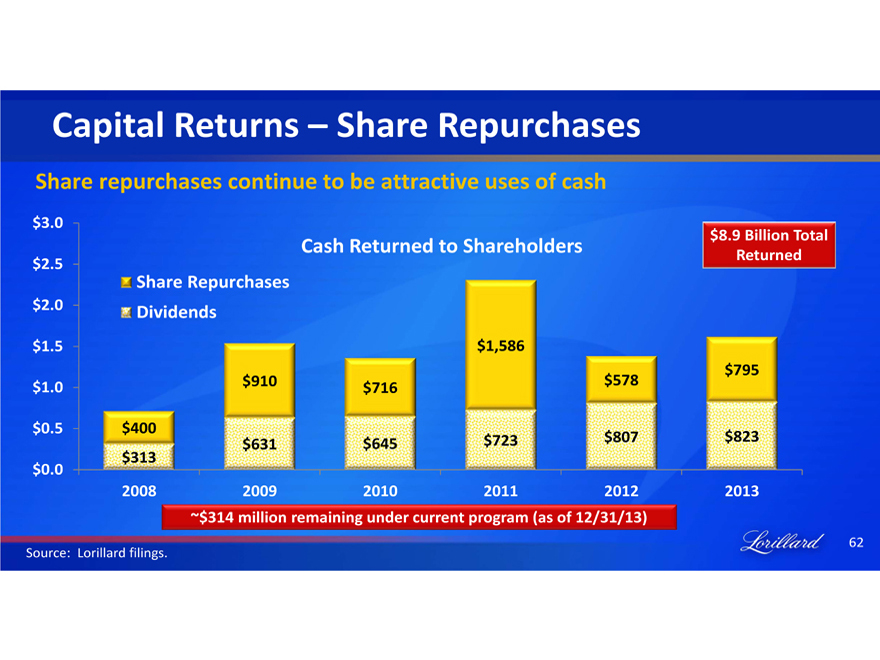

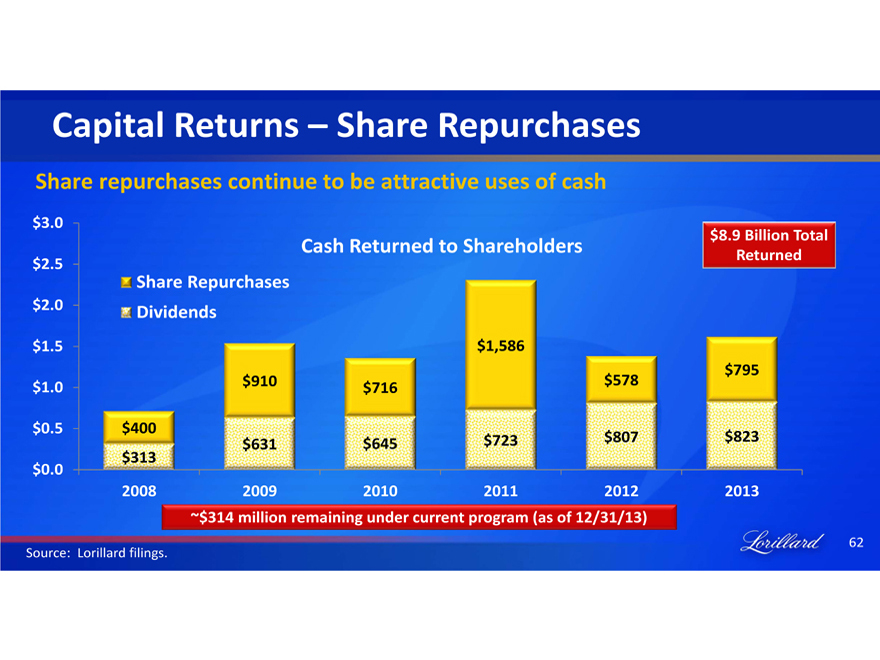

Capital Returns – Share Repurchases

Share repurchases continue to be attractive uses of cash

$3.0 $8.9 Billion Total

Cash Returned to Shareholders

Returned

$2.5

Share Repurchases

$2.0 Dividends

$1.5 $1,586 $795 $910 $578

$1.0 $716

$0.5 $400 $723 $807 $823 $631 $645 $313

$0.0

2008 2009 2010 2011 2012 2013

~$314 million remaining under current program (as of 12/31/13)

Source: Lorillard filings.

Lorillard 62

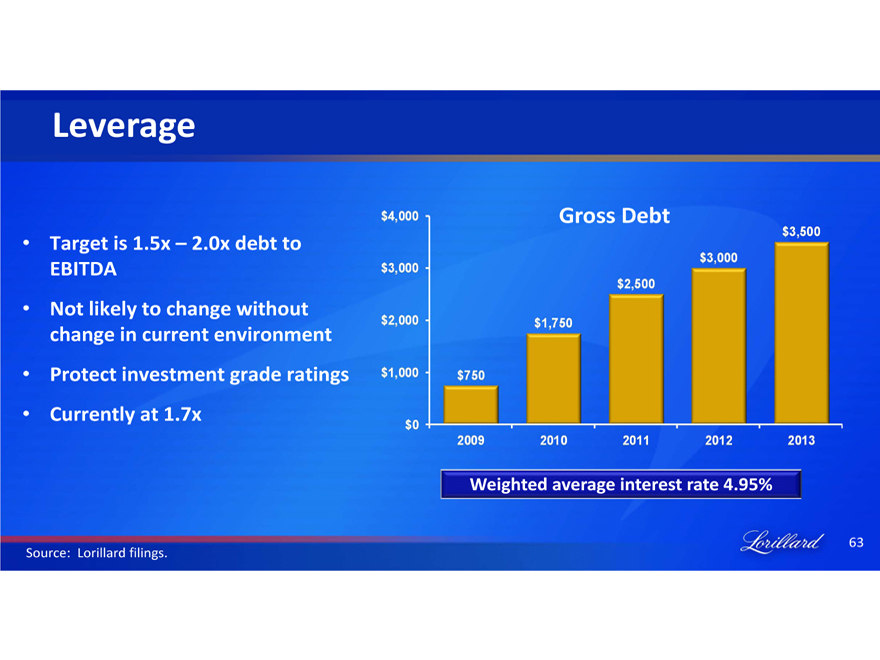

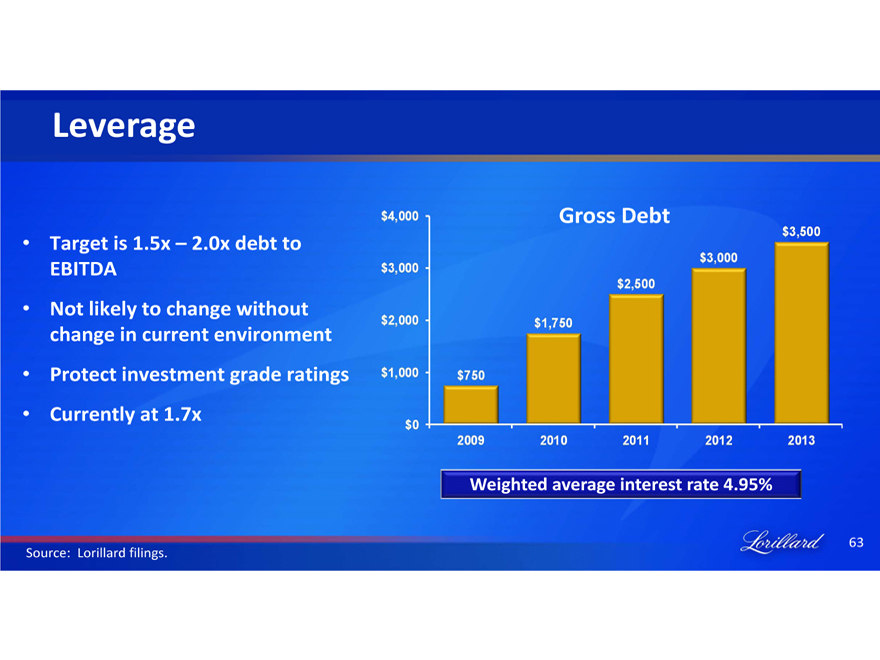

Leverage

Target is 1.5x – 2.0x debt to EBITDA

Not likely to change without change in current environment

Protect investment grade ratings

Currently at 1.7x

Gross Debt

$4,000 $3,000 $2,000 $1,000 $0

$750 $1,750 $2,500 $3,000 $3,500

2009 2010 2011 2012 2013

Weighted average interest rate 4.95%

Source: Lorillard filings.

Lorillard 63

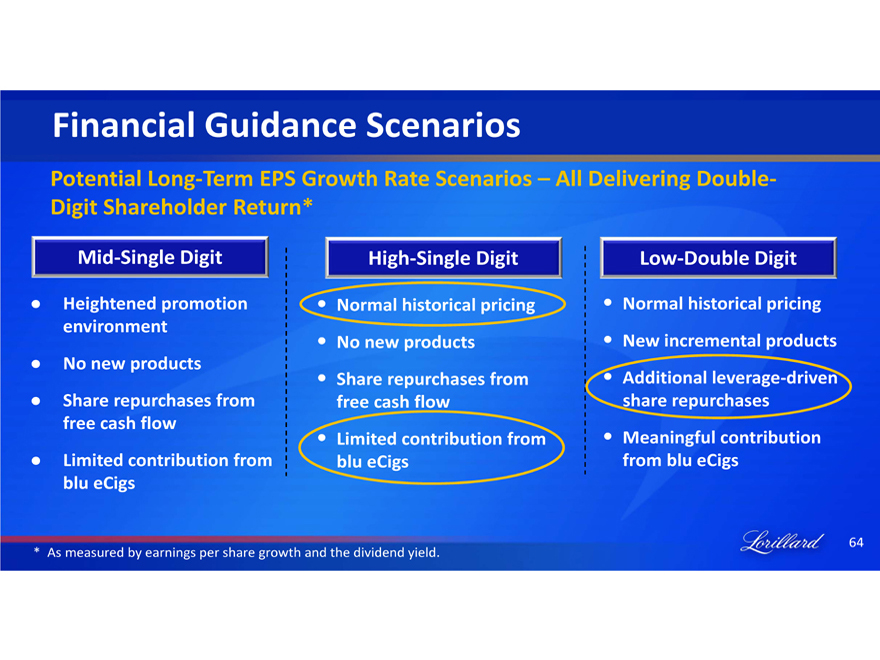

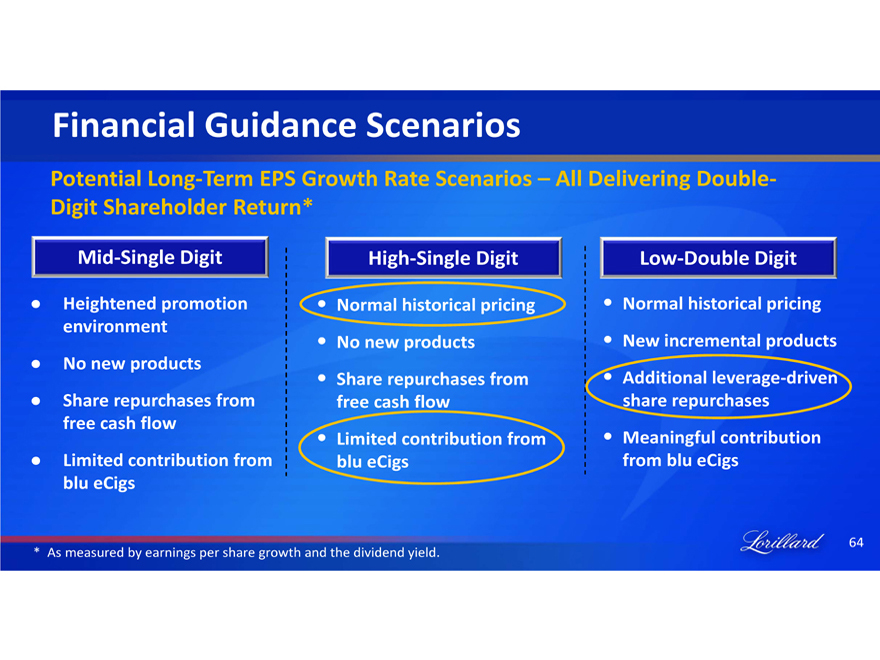

Financial Guidance Scenarios

Potential Long-Term EPS Growth Rate Scenarios – All Delivering Double-Digit Shareholder Return*

Mid-Single Digit

Heightened promotion environment

No new products

Share repurchases from free cash flow

Limited contribution from blu eCigs

High-Single Digit

Normal historical pricing

No new products

Share repurchases from free cash flow

Limited contribution from blu eCigs

Low-Double Digit

Normal historical pricing

New incremental products

Additional leverage-driven share repurchases

Meaningful contribution from blu eCigs

* As measured by earnings per share growth and the dividend yield.

Lorillard 64

Financial Outlook

Some positive factors in place:

Share repurchase program increased following $500 million debt issuance in May 2013

Partial settlement of NPM dispute provides liquidity and some continuing earnings benefit

Obligations for the Federal Assessment for Tobacco Growers will end in 2014 ($120 million in 2013)

Opportunities exist for cost savings in e-cigarette supply chain

Lorillard 65

Summary

All elements are in place to continue our history of superior financial results

Positioned to deliver robust earnings growth

We remain committed to rewarding shareholders with cash returns

Lorillard 66

Lorillard

Questions

Murray S. Kessler

Chairman, President and Chief Executive Officer

David H. Taylor

Executive Vice President and Chief Financial Officer

Neil L. Wilcox, DVM, MPH

Senior Vice President and Chief Compliance Officer

Lorillard 69

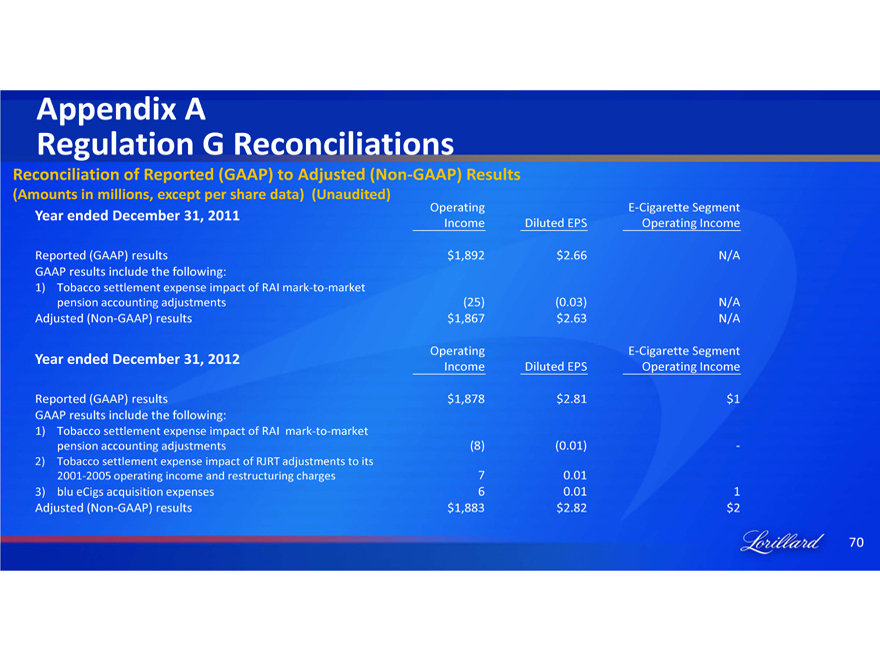

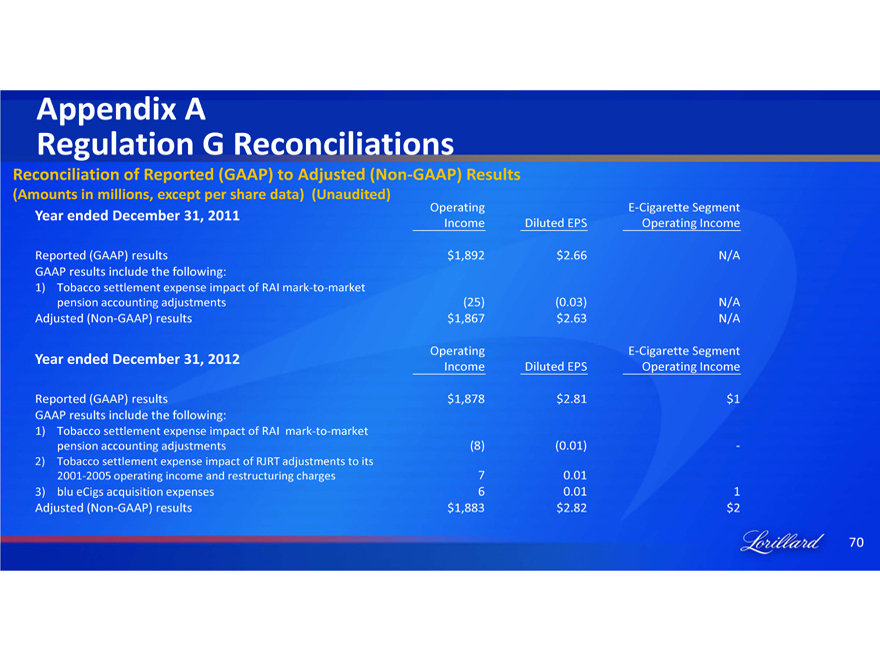

Appendix A

Regulation G Reconciliations

Reconciliation of Reported (GAAP) to Adjusted (Non-GAAP) Results

(Amounts in millions, except per share data) (Unaudited)

Year ended December 31, 2011

Reported (GAAP) results

GAAP results include the following:

1) Tobacco settlement expense impact of RAI mark-to-market

pension accounting adjustments

Adjusted (Non-GAAP) results

Year ended December 31, 2012

Reported (GAAP) results

GAAP results include the following:

1) Tobacco settlement expense impact of RAI mark-to-market pension accounting adjustments

2) Tobacco settlement expense impact of RJRT adjustments to its 2001-2005 operating income and restructuring charges

3) blu eCigs acquisition expenses Adjusted (Non-GAAP) results

Operating Income

$1,892

(25)

$1,867

Operating Income

$1,878

(8)

7

6

$1,883

Diluted EPS

$2.66

(0.03)

$2.63

Diluted EPS

$2.81

(0.01)

0.01

0.01

$2.82

E-Cigarette Segment Operating Income

N/A

N/A

N/A

E-Cigarette Segment Operating Income

$1

1

-

$2

Lorillard 70

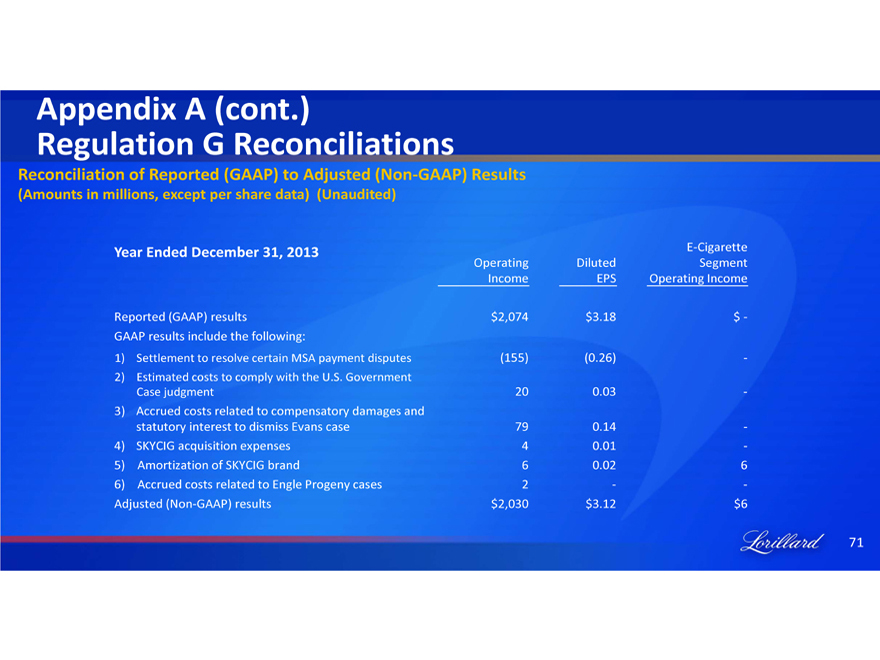

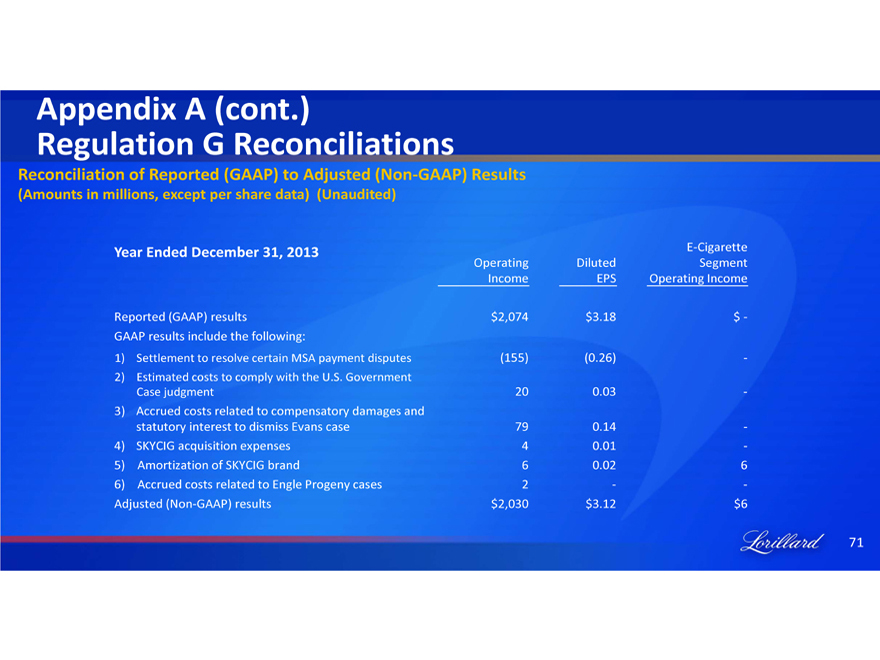

Appendix A (cont.)

Regulation G Reconciliations

Reconciliation of Reported (GAAP) to Adjusted (Non-GAAP) Results

(Amounts in millions, except per share data) (Unaudited)

Year Ended December 31, 2013

E-Cigarette

Operating

Diluted

Segment

Income

EPS

Operating Income

Reported (GAAP) results

$2,074

$3.18

$ -

GAAP results include the following:

1) Settlement to resolve certain MSA payment disputes

(155)

(0.26)

-

2) Estimated costs to comply with the U.S. Government

Case judgment

20

0.03

-

3) Accrued costs related to compensatory damages and statutory interest to dismiss Evans case

79

0.14

-

4) SKYCIG acquisition expenses

4

0.01

-

5) Amortization of SKYCIG brand

6

0.02 6

6) Accrued costs related to Engle Progeny cases

2

-

-

Adjusted (Non-GAAP) results

$2,030

$3.12

$6

Lorillard 71

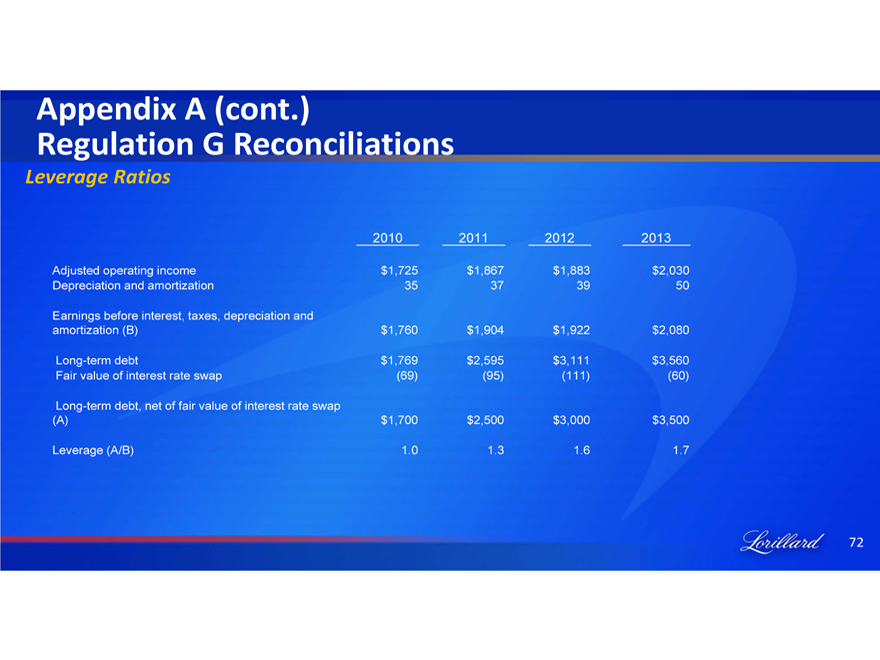

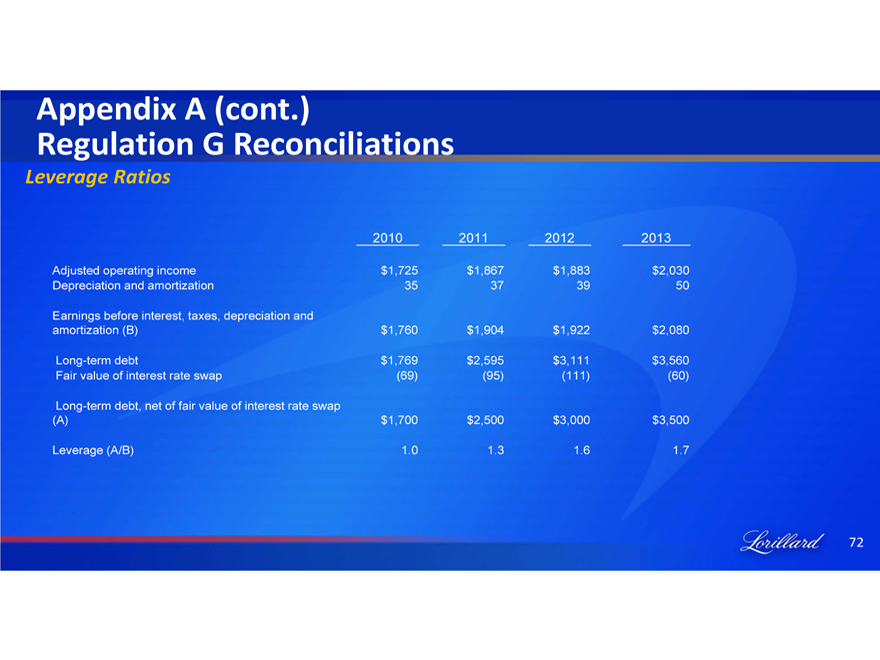

Appendix A (cont.)

Regulation G Reconciliations

Leverage Ratios

2010

2011

2012

2013

Adjusted operating income

$1,725

$1,867

$1,883

$2,030

Depreciation and amortization

35

37

39

50

Earnings before interest, taxes, depreciation and amortization (B)

$1,760

$1,904

$1,922

$2,080

Long-term debt

$1,769

$2,595

$3,111

$3,560

Fair value of interest rate swap

(69)

(95)

(111)

(60)

Long-term debt, net of fair value of interest rate swap

(A)

$1,700

$2,500

$3,000

$3,500

Leverage (A/B)

1.0

1.3

1.6

1.7

Lorillard

72

Lorrilard

Lorillard 73