Filed by Reynolds American Inc.

Commission File No. 1-32258

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Lorillard, Inc.

Commission File No. 001- 34097

Date: September 4, 2014

|

Reynolds American Business Update September 2014 Susan M. Cameron RAI President and Chief Executive Officer |

|

Forward Looking Information This presentation contains forward-looking information. Future results or events can be impacted by a number of factors that could cause actual results to be materially different from our projections. These factors are listed in RAI’s second-quarter 2014 earnings release and in the company’s SEC filings. Except as provided by federal securities laws, RAI is not required to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. Web Disclosure RAI’s website, www.reynoldsamerican.com, is the primary source of publicly disclosed news about RAI and its operating companies. Those wishing to stay on top of company news can sign up for email alerts by going to Shareholder Tools on the website’s Investors Section. |

|

Adjusted Vs. GAAP RAI management uses ‘adjusted’ (non-GAAP) measurements to set performance goals and to measure the performance of the overall company, and believes that investors’ understanding of the underlying performance of the company’s continuing operations is enhanced through the disclosure of these metrics. ‘Adjusted’ (non- GAAP) results are not, and should not be viewed as, substitutes for ‘reported’ (GAAP) results. A reconciliation of GAAP to Adjusted results is at the end of this presentation. |

|

Agenda • Transformation vision & strategy • Operating companies’ performance • Financial update • The road ahead • Q&A |

|

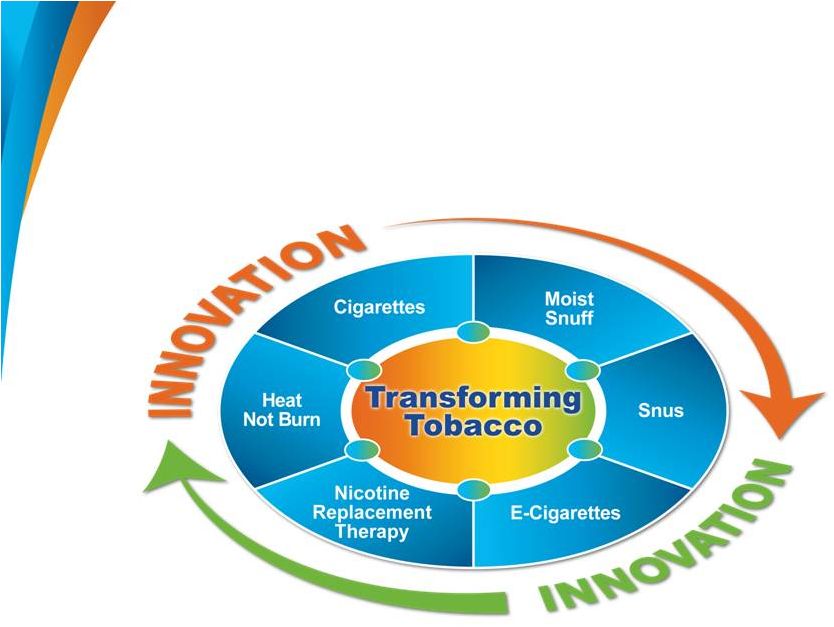

Our Vision: We will achieve market leadership by transforming the tobacco industry. We will lead change in our industry by: • Driving innovation throughout our businesses • Redefining enjoyment for adult tobacco consumers • Reducing the harm caused by smoking • Accelerating the decline in youth tobacco use • Resolving controversial issues related to the use of tobacco |

|

Market Leadership Vision • Achieve market leadership of a ‘transformed’ industry that looks very different from today’s • Defined by volume, share, value and influence Driven by premium growth brands in combustibles, and leadership in smoke- free categories Measured against the universe of tobacco and nicotine- replacement products Recognized as the industry leader in vision, direction, expertise and capabilities |

|

Long-Term Commercial Interests Align With Key Stakeholder Interests Tobacco Harm Reduction is the right thing to do… Youth Tobacco Prevention is the right thing to do… Operating with integrity is the right thing to do… And drives margin growth And will reduce costs and further restrictions And enhances RAI’s long- term sustainability |

|

Our Transformation Growth Model • Diverse portfolio of distinctive products • Profitable high-equity brands • Development / commercialization of innovations • Superior consumer / customer engagement • Managing cost / resources • Shaping external environment |

|

U.S. Tobacco Industry • Environment remains highly competitive • 2014 industry volume outlook – Cigarettes declining about 4 percent – Moist snuff growing about 4 percent • Adult tobacco consumer shifting to smoke-free |

|

Operating Companies’ Portfolio |

|

• Leader in super premium with 1.6 share • Loyal franchise based on unique additive- free styles • Growing interest in organic tobacco styles • Santa Fe operating margin of about 50 percent |

|

R.J. Reynolds • Strong growth-brand gains driven by equity- building investment • Moderating total cigarette share decline • Growing operating income and margin |

|

• 10.2 percent cigarette market share • Rich history of innovation • Robust growth in premium menthol • Strong demographics • Camel SNUS leads category with about 80 percent share |

|

• 9.3 percent market share • No. 1 traditional value brand • Growing in value menthol • True value proposition – lasts longer |

|

• 31.4 percent moist-snuff market share • Premium quality and strong brand equity • Growing share in a growing category • American Snuff operating margin of more than 55 percent |

|

Leading Innovation • RAI’s operating companies are the best in product development – Superior R&D expertise and proprietary technology – Leader in taking truly differentiated ideas from concept to market • New product formats offer strong growth potential – Higher margin than cigarettes – Address shifting consumer preferences • Pursuing technology-sharing agreement with BAT – Focus is on next-generation products |

|

Innovation Is Key To Success • Sustainability requires innovation in evolving industry – Consumer preferences shifting, migration to smoke-free underway • The innovation advantage – Anticipates / satisfies emerging consumer desires – Provides meaningful product points of difference – Enhances brand equity – Provides greater consumer value – Increases profits |

|

The Game Changer • Performance beat expectations in first major markets of Colorado and Utah – Quickly became No. 1 brand in both states – Tripled size of each state’s e-cig category – Strong repeat purchases • Product quality / highly differentiated features • Premium-priced / high-margin platform • 2014 national expansion progressing smoothly • Next-generation styles in development |

|

• Compelling strategic and commercial addition to portfolio • FDA supports expanded use of NRTs • Expanding Zonnic gum distribution to 25,000 retail outlets • Distribution focused on convenience / gas stores |

|

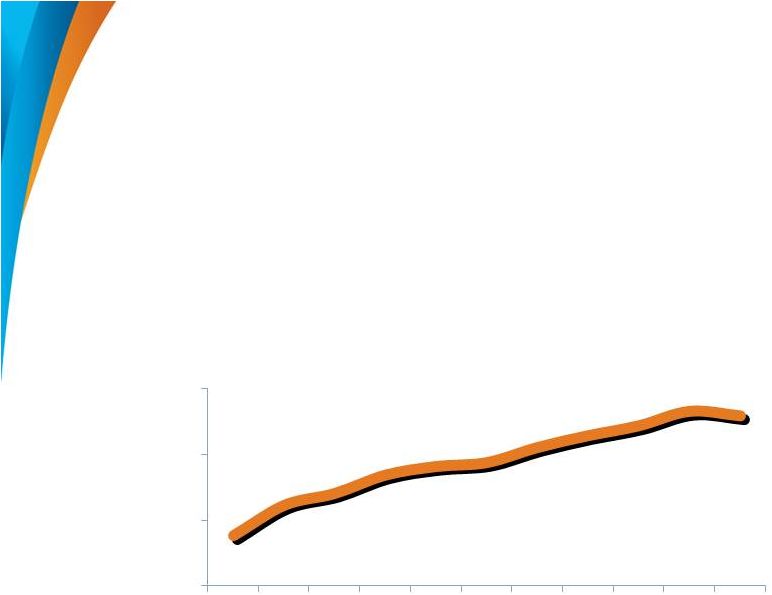

Driving Efficiencies • Intense focus on efficiency, productivity improvements • Embedded across all areas • Results reflected in RAI’s strong adj. operating margin improvement RAI Adj. Operating Margin Reconciliation of GAAP to Adjusted results is in Appendix. Adjusted results primarily exclude charges for Engle progeny lawsuits, trademark impairments, restructuring, merger integration, one-time benefit from the NPM partial settlement and mark-to-market adjustments and includes B&W/Lane 2004 pre-merger results. 2Q14 YTD 10% 20% 30% 40% 2004 2007 2010 2013 36.0% |

|

Successfully Engaging • Innovative workforce • Highly engaged employees, ranked in top quartile of companies • R.J. Reynolds Trade Marketing benchmarked above all other fast-moving consumer goods in customer satisfaction • Gaining momentum on initiatives supporting Transformation in legislative and policy arena |

|

Focused On Responsibility • Responsibility essential for integrity of our businesses – and our credibility • Transforming Tobacco strategy drives conflict resolution and commercial success – Tobacco harm reduction – Youth tobacco prevention – Commercial integrity, to shape level playing field |

|

Engle Progeny Litigation Update • Docket is down almost 60% from its peak in 2008 • Trial success rate remains stable to improving – Approximately 65% for 2014 – consistent with overall results – Positive trend year-over-year despite periodic losses – Robinson – ($23.6B punitive award) • Grossly excessive and violates state and Constitutional law • Expect the trial judge to reduce or reverse and will appeal, if necessary • $5M bond cap applies • Activity level remains high; will continue to manage appropriately |

|

RAI 2014 Performance 2014 2013 Change Operating Income $1,473 $1,490 (1.1)% Net Income $ 860 $ 860 0.0% EPS $ 1.60 $ 1.56 2.6% Reconciliation of GAAP to Adjusted results is in Appendix. Adjusted results exclude a one-time benefit from the NPM Partial Settlement, charges for Engle progeny lawsuits and implementation costs, a gain from discontinued operations and charges for other tobacco-related litigation First-half adjusted results |

|

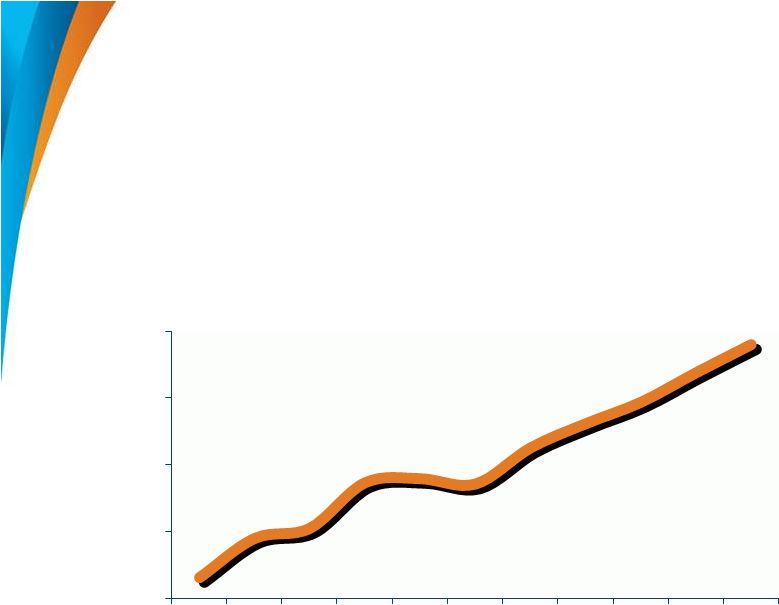

Maximizing Shareholder Value • Dividend yield of about 5 percent • Completed $2.5 billion share buyback program • Adj. EPS more than doubled since 2004 RAI Adj. EPS Reconciliation of GAAP to Adjusted results is in Appendix. Adjusted results primarily exclude charges for Engle progeny lawsuits, trademark impairments, restructuring, merger integration, one-time benefit from the NPM partial settlement and mark-to-market adjustments and includes B&W/Lane 2004 pre-merger results. 2Q14 YTD $1.50 $2.00 $2.50 $3.00 $3.50 2004 2007 2010 2013 $3.35 to $3.45 (7/29/14) |

|

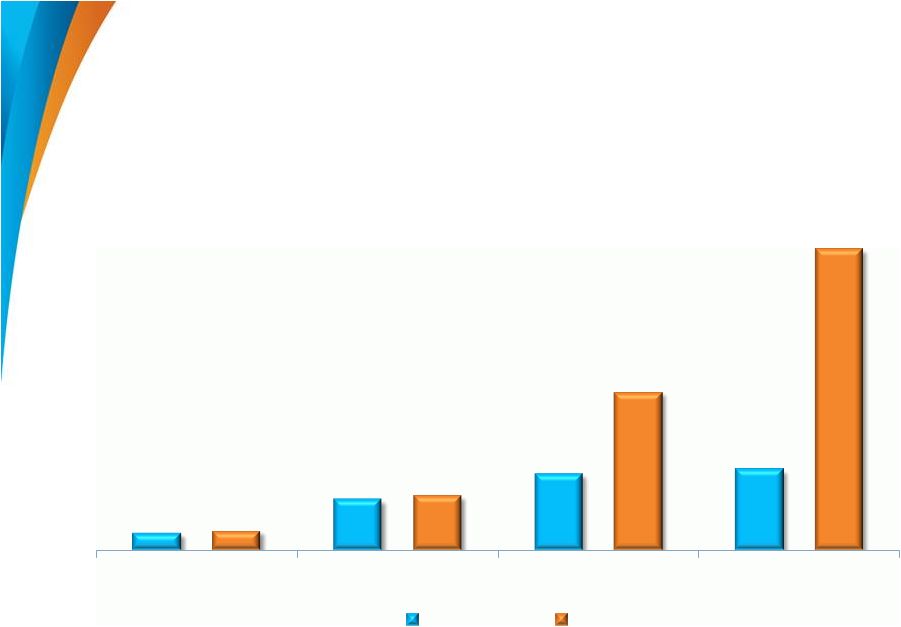

Excellent Total Shareholder Return Outpacing S&P 500 over the long term Through August 29, 2014 Source: Bloomberg 25% 77% 116% 123% 29% 83% 242% 462% 1-Year 3-Year 5-Year 10-Year S&P 500 RAI |

|

The Next Step in Our Transformation Journey Transformation timeline 2006 2004 2009 2009 2009 2012 2015 RJRT B&W MERGER ASC ACQUISITION; SNUS INTRO DISSOLVABLE TOBACCO TESTING SNUS NATIONAL EXPANSION NRT NICONOVUM VUSE DIGITAL E-CIG LORILLARD ACQUISITION |

|

Leading category positions Strength across price points Enhanced growth profile Balanced Portfolio of Strong Key Brands |

|

Compelling Strategic Rationale • Unique portfolio of iconic brands • Enhanced growth profile • Complementary geographic strengths • Stronger competitive position • Increased scale and significant synergies |

|

Transaction Highlights • $50.50 in cash and 0.2909 Reynolds American share per Lorillard share • Represents $68.88 per Lorillard share (a) • Total enterprise value of $27.4 billion, 13x LTM EBITDA Transaction Consideration • Lorillard shareholders to own approx. 15% in pro forma Reynolds American • British American Tobacco to invest $4.7 billion to fund transaction, maintaining 42% ownership • Divest KOOL, Salem, Winston, Maverick and blu to Imperial for $7.1 billion (pre-tax) Structure • Strengthens R.J. Reynolds’ position in U.S. cigarette market • Enhances R.J. Reynolds’ growth and margin profile • Approximately $800 million of cost savings on run-rate basis pre-divestitures • Accretive in first full year; strong double-digit accretion in year two and beyond Value Creation • Closing expected in first half of 2015 • Subject to regulatory and shareholder approvals Timing and Approvals (a) Based on RAI share price of $63.18 on July 14, 2014 |

|

Summary • Increasing profitability in evolving environment • Investing in equity of powerful key brands across categories • Creating new revenue streams with transformative innovations • Delivering shareholder value • Setting the stage for RAI’s next phase of growth |

|

Appendix Reynolds American Inc. Reconciliation of GAAP to Adjusted Results (Dollars in Millions) (Unaudited) 2Q YTD 2004 1,2 2005 2 2006 2 2007 2008 2009 2010 2011 2012 2013 2014 GAAP Operating Income: $882 $1,459 $1,930 $2,418 $567 $1,763 $2,432 $2,399 $2,214 $3,132 $1,426 The GAAP results include the following expense (income): B&W/Lane GAAP results 328 Proforma adjustments (128) Premerger B&W integration costs 35 Trademark and other intangible asset impairment charges 199 200 90 65 318 567 32 48 129 32 Restructuring charge 5 2 1 90 56 149 Merger integration costs 130 107 45 RAI settlements 50 Phase II growers'trust offset (69) (27) RAI returned goods reserve adjustment 38 Federal tobacco buyout assessment 81 (9) Loss on sale of assets 24 Implementation costs 60 23 24 8 Scott lawsuit 139 Engle progeny lawsuits 64 37 18 71 Other tobacco -related litigation charges 5 34 2 Asset impairment and exit charges 38 One -time benefit from NPM Partial Settlement (219) (34) MTM pension/postretirement adjustment - - - (43) 1,527 49 110 145 329 - - Total adjustments 588 387 127 22 1,935 672 240 419 649 (111) 47 Adjusted operating income $1,470 $1,846 $2,057 $2,440 $2,502 $2,435 $2,672 $2,818 $2,863 $3,021 $1,473 Net income per diluted share: Reported GAAP $1.37 $1.77 $2.05 $2.35 $0.76 $1.64 $1.92 $2.40 $2.24 $3.14 $1.59 Non-GAAP adjusted $1.66 $1.96 $2.03 $2.37 $2.40 $2.36 $2.63 $2.81 $2.97 $3.19 $1.60 Net Sales $8,323 $8,256 $8,510 $9,023 $8,845 $8,419 $8,551 $8,541 $8,304 $8,236 $4,097 Operating margins: GAAP 10.6% 17.7% 22.7% 26.8% 6.4% 20.9% 28.4% 28.1% 26.7% 38.0% 34.8% Adjusted 17.7% 22.4% 24.2% 27.0% 28.3% 28.9% 31.2% 33.0% 34.5% 36.7% 36.0% (1) Includes proforma GAAP adjustments as if the merger of B&W/Lane had been completed on January 1, 2004. (2) Not adjusted to reflect change in accounting for pension and postretirement. RAI management uses “adjusted” (non-GAAP) measurements to set performance goals and to measure the performance of the overall company, and believes that investors’ understanding of the underlying performance of the company’s continuing operations is enhanced through the disclosure of these metrics. “Adjusted” (non-GAAP) results are not, and should not, be viewed as, substitutes for “reported” (GAAP) results. |

[Announcer]

Good morning, I think we will get started on our next presentation. It’s a pleasure to welcome Susan Cameron, CEO of Reynolds American to the conference. Susan returned to the CEO position in May, a role she previously held from 2004 through 2011, we look forward to hearing Susan’s take on the current US tobacco landscape and evolution into next generation products. With that, I’ll turn it over to Susan.

[Susan M. Cameron]

Good morning everyone. It’s good to be here.

Before I begin, I’ll give you a moment to read our precautionary statement on forward-looking information. We will be discussing some forward-looking information today… and actual results could be different from our forecast. These risk factors are listed in RAI’s second-quarter earnings release on our website and in the SEC filings.

As always, I’ll focus on adjusted results. A reconciliation of adjusted to GAAP results is at the end of my presentation.

At the top of my agenda today is a recap of RAI’s transformation vision and strategy, which guides every aspect of our businesses. I’ll also discuss our operating companies’ key brands and performance, followed by a quick financial update. Then we’ll take a look at the exciting road ahead for Reynolds American… followed by a short Q&A.

As many of you know, RAI’s vision is to achieve market leadership over the long term, and for us that means we have to lead change in our industry. And we’re doing just that … by driving innovation across our businesses … and redefining enjoyment for adult tobacco consumers. Reducing the harm caused by tobacco is another key part of our transformation strategy… as well as accelerating the decline in youth tobacco use … and resolving controversial issues related to tobacco. So let me tell you what we mean by market leadership.

Our vision is to achieve market leadership in a transformed industry that looks very different than the one we have today… and I would say we are well on our way to achieving that leadership position. We define market leadership in terms of volume, share, value and influence … as measured against the universe of tobacco and nicotine-replacement products. Our growth will be driven by premium brands in combustibles and leadership in smoke-free categories, and our goal is to be recognized as the industry leader in vision, direction, expertise and capabilities

In addition, RAI’s transformation strategy aligns our companies’ commercial interests with those of key stakeholders. Tobacco harm reduction is not just the right thing to do… growth in smoke-free products will also drive higher margin. Youth tobacco prevention is not just the right thing to do… it will also reduce costs and additional restrictions. Operating our businesses responsibly is not just the right thing to do… it also enhances RAI’s long-term sustainability. So how are we going to achieve these transformation goals?

Our growth model in this transforming environment has six major components – Our operating companies offer a diverse portfolio of distinctive products at different price points… and they’re focused on advancing these profitable high-equity brands. Our companies are leading the development and commercialization of highly differentiated innovations across categories. They’re also deploying superior consumer and customer engagement. And they are maintaining a keen focus on effectively managing costs and resources. RAI and its companies are also working hard to create a more favorable external environment in which to do business, and that includes the successful navigation of regulatory, legal and societal issues. Now let’s take a quick look at current industry dynamics…

It’s fair to say that the U.S. tobacco industry remains competitive and evolving. This year, we expect cigarette volumes to decline about four percent … with moist-snuff growing at about that same rate. The lack of a strong broad-based economic recovery continues to play a role, but we’re also seeing a growing impact from the move by adult tobacco consumers to smoke-free options. Even so, our companies are finding new opportunities for growth within their broad portfolio of brands.

This portfolio consists of brands across a broad spectrum of the tobacco and nicotine landscape… and innovation is the key to their success. Let’s take a look at how these brands and the operating companies are performing…

Santa Fe’s Natural American Spirit is a Top 10 brand that achieved a market share of 1.6 percent in the second quarter of this year. It’s the leading super-premium cigarette – all the more remarkable because it has never been discounted. Natural American Spirit has a very loyal franchise, largely based on its unique additive-free styles… and there’s growing interest in styles made with organic tobacco. NAS has delivered double digit volume growth over the past several years… in a category that is declining. The company has an operating margin of about 50 percent … and that’s taking into account the investment they are making in enhancing Natural American Spirit’s equity.

At R.J. Reynolds, underlying financial performance has dramatically improved over the past decade… despite the decline in cigarette volumes. That’s in large part the result of the company’s focus on its growth brands, Camel and Pall Mall, which continue to benefit from effective equity-building initiatives. In addition, the company’s continuous productivity improvements have made a big difference to the bottom line.

The company’s iconic premium brand, Camel, is on a strong upward trajectory… with cigarette market share of more than 10 percent in the second quarter. Camel’s growth is being driven by the brand’s high-quality offerings and its premium equity in which the company continues to invest. The brand also benefits from the company’s industry-leading consumer engagement, and its very favorable demographics. And with Camel SNUS, we continue to see steady performance and it continues to hold about 80 percent share of the growing SNUS market. Camel SNUS offers convenience, and different opportunities to enjoy tobacco, and is a great option for people who want to switch from cigarettes.

Pall Mall is also doing well... and together with Camel, it has helped to moderate R.J. Reynolds’ overall share decline. Pall Mall has grown steadily in recent years and now has 9.3 percent of the market… making it the biggest cigarette value brand by a wide margin. Pall Mall is a true value proposition… and as I always say, that’s because it has more puffs than any other cigarette … it truly is longer lasting. But Pall Mall also offers great quality… at an affordable price. Now let’s move to American Snuff and its flagship Grizzly brand.

Grizzly continues to drive strong performance at American Snuff. The brand offers premium quality and outstanding brand equity… and it continues to grow volume and share in a very competitive market. For the second quarter, Grizzly reported market share of 31.4 percent. Its strong appeal is reflected in American Snuff’s results… which includes an impressive operating margin of more than 55 percent. As I mentioned earlier, RAI’s operating companies are driving innovation across their businesses as part of our transformation strategy…

In fact, our companies are the industry leaders in innovation. They have superior R&D expertise and technology… and they’re masters at taking truly differentiated product ideas from concept to market. Let me remind you that these new platforms are high margin … and they offer strong potential for further growth. As you know, we are also pursuing a technology-sharing agreement with British American Tobacco… and the focus of this will be on the development and commercialization of next-generation products, specifically electronic cigarettes and heat not burn. So why is innovation so critical to our success?

In short, it gives customers a reason to prefer our companies’ brands… and that gives us a competitive advantage. This is especially important for sustainability in an evolving industry like tobacco… where consumer preferences are changing and they are looking for satisfying smoke-free alternatives. Through innovation, our companies are able to anticipate emerging consumer desires … provide

- 2 -

meaningful product points of difference… enhance brand equity… and provide greater value to consumers. And that all translates into profitable brands. We have a history of pioneering innovations… Camel Crush is one, Camel SNUS is another. And now we have VUSE, a game changer in the vapor category…

It’s still early days in the national roll-out, but I’m delighted with the brand’s strong performance. VUSE quickly became the Number One brand in its first major markets of Colorado and Utah… and tripled the size of the category in both of those states. Eighty percent of its sales are replacement cartridges, which indicates strong repeat purchase. As you know, Vuse’s national distribution began in late June… and it’s going very well. The brand is now in about 32,000 selected retail outlets. VUSE’s product quality and highly differentiated features that meet smokers expectations are driving its growth … and plans are well under way to enhance this competitive advantage. Niconovum is also making its mark…

Niconovum was a compelling strategic and commercial addition to the RAI group of companies. Not only did Niconovum give us entry into the nicotine replacement therapy market… with additional growth potential… but it also added another component to our tobacco harm reduction strategy. The company’s Zonnic Gum has been attracting positive interest in Iowa… and I’m pleased to report that it’s about to be expanded nationally into about 25,000 selected retail outlets. So that’s an update on our companies’ key brands. Now I’ll focus on the rest of our growth model.

We’re known for our continuous productivity improvement and that focus is critical… because it takes significant resources to build key brands and bring new innovations to market. And I think this graph on RAI’s operating margin shows just how successful we’ve been on this front … with margin more than doubling over the past decade. And a significant contributor to that growth… is the transformation of R.J. Reynolds’ cigarette portfolio… which went from about 840 skus in 2004 to about 150 today. Effective engagement is another competitive advantage…

We have a very talented, innovative workforce… and our high performing culture is really one of our key strengths. Our employees are highly engaged and highly regarded… for example, in customer satisfaction surveys, the sales force at R.J. Reynolds is benchmarked above those at all other fast-moving consumer goods companies. Our employees are also making a difference in the broader arena and building support for our transforming tobacco initiatives.

In addition, we are deeply committed to operating in a responsible manner. Doing the right thing is essential for the integrity of our businesses. That’s why our transforming tobacco strategy focuses on three key components – tobacco harm reduction … youth tobacco prevention… and commercial integrity. This helps us drives conflict resolution… and also makes commercial sense.

Before I cover the financials, I’ll provide a quick update on the Engle progeny litigation. The docket is down almost 60% from its peak in 2008. And we continue to see good success… and a positive trend in the cases that have gone to trial – and we have a success rate of about 65% this year to date. There are obviously some outliers… like the Robinson case… where the jury awarded over $23 billion. This is in violation of both sate and constitutional law… and is grossly excessive. We fully expect the judge in that case to reverse or reduce the award. And I would remind you that the $5 million bond cap does apply here. The activity level remains high… and we will continue to effectively manage these cases. Now I’ll move onto a short financial update and talk about what lies ahead …

This is just a snap shot of our first half performance in which RAI increased adjusted EPS by 2.6 percent. I would remind you that these results reflect substantial investment in the VUSE expansion… as well as initiatives to build the equity of our companies’ key brands. And this spending positions us well for long-term sustainability. RAI is committed to returning value to shareholders…

- 3 -

One way we do this is through a consistent and attractive dividend… and our current annualized dividend of $2.68 gives shareholders a yield of almost five percent. During the second quarter, we also completed our $2.5 billion share repurchase program… and that has also benefited EPS. RAI’s EPS has more than doubled since 2004… and for 2014, we expect adjusted growth in the range of 5 to just over 8 percent.

We’re proud of our long record on delivering excellent total shareholder return… which has significantly outpaced the S&P 500 over the long term. Before I focus on the next step in our transformation journey, I’d like to highlight some of the major milestones since RAI’s transformation, I mean formation ten years ago… our 10 year anniversary was August first

The combination of R.J. Reynolds and Brown & Williamson signaled the start of our move into total tobacco, the first in the industry to do so. In 2006, RAI’s acquisition of American Snuff gave us entry into what is a very profitable and growing moist-snuff segment. Around that time, R.J. Reynolds introduced its first smoke-free innovation, Camel SNUS. And in 2009, RAI acquired Niconovum, a nicotine replacement therapy company. In 2012, R.J. Reynolds Vapor Company entered the emerging e-cigarette category… with its highly differentiated VUSE digital vapor cigarette which is now in national distribution. And of course, the next big step-change for RAI is the proposed acquisition of Lorillard, which we announced on July 15.

With the proposed addition of Lorillard’s powerful Newport brand… RAI’s companies will have a combined brand portfolio that reflects an enhanced growth profile, with diversification and strength across categories, across geography and across price points. This represents the most balanced portfolio in the industry… and will allow us to best-position ourselves for the continued transformation of tobacco.

As I’ve said from the start, this transaction is compelling, strategic and serves to create further value. Our acquisition of Lorillard will increase scale, generate considerable cost synergies and efficiencies, and enhance geographic diversification… all of which will result in new revenue opportunities and benefits to our adult tobacco consumers. And the transaction supports Reynolds American’s ongoing efforts to lead the transformation of the tobacco industry. I’d like to recap a few of the transaction highlights…

Reynolds American will acquire Lorillard in a cash and share transaction which values Lorillard at $27.4 billion, based on the share price on the day of the announcement. As part of this transaction, Imperial Tobacco will be purchasing the KOOL, Salem, Winston, Maverick and blu brands… and British American Tobacco will be investing $4.7 billion to maintain their 42 percent ownership in Reynolds American. Additionally, RAI and British American Tobacco have in principle agreed to pursue an ongoing initiative for the development and commercialization of next-generation products… including heat-not-burn and electronic cigarettes. We’re working diligently to obtain clearance from regulators… as well as shareholder and other required approvals… and I remain confident that the transaction will close in the first half of next year. This is a very attractive transaction for Reynolds American shareholders… which will enhance our financial profile and long term growth. So, in summary…

RAI and its operating companies are well positioned for the road ahead. We have the right businesses… the right brand portfolios… and an aligned infrastructure. We’re increasing profitability in an evolving environment, while our companies continue to invest in… and build… the long-term equity of our key brands across categories. Our companies are also creating new, meaningful revenue streams, with transformative innovations such as VUSE. As a result, RAI is delivering excellent value to shareholders … and now, we’re setting the stage for our next phase of growth with the Lorillard transaction. I’d like to wrap up with a very important point…

- 4 -

Our strategy to transform the tobacco industry is much more than an ambitious long-term goal because it lies at the very center of a powerful intersection with the interests of our key stakeholders. This strategy is driving. and will continue to drive … commercial success across our companies, while returning great value to shareholders. In addition, we believe that our transformation strategy also allows us to meet society’s expectations of how we should operate responsibly. And that concludes my prepared remarks, thank you for your interest today. I’m happy to take some questions…

- 5 -

Cautionary Statement Regarding Forward-Looking Statements

Statements included in this communication that are not historical in nature, including financial estimates and statements as to regulatory approvals and the expected timing, completion and effects of the proposed transactions (the Proposed Transactions), relating to the consummation of the previously announced Proposed Transactions with Reynolds American, Lorillard, Inc. (Lorillard), Imperial Tobacco Group PLC (Imperial) and British American Tobacco p.l.c., constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. When used in this communication and in documents incorporated by reference, forward-looking statements include, without limitation, statements regarding the benefits of the Proposed Transactions, including future financial and operating results, the combined company’s plans, expectations, beliefs, intentions and future strategies, and other statements that are not historical facts, that are signified by the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should” and similar expressions. These statements regarding future events or the future performance or results of the combined company inherently are subject to a variety of risks, contingencies and uncertainties that could cause actual results, performance or achievements to differ materially from those described in or implied in the forward-looking statements.

Among the risks, contingencies and uncertainties that could cause actual results to differ from those described in the forward-looking statements or could result in the failure of the Proposed Transactions to be consummated or, if consummated, could have an adverse effect on the results of operations, cash flows and financial position of Reynolds American, are the following: the failure to obtain necessary shareholder approvals for the Proposed Transactions; the failure to obtain necessary regulatory or other approvals for the Proposed Transactions; the failure to satisfy required closing conditions or consummate the Proposed Transactions in a timely manner; the occurrence of any event giving rise to the right of a party to terminate a Proposed Transaction; the obligation to consummate the Proposed Transactions even if financing is not available or is available on terms other than those currently anticipated, including financing less favorable to Reynolds American than its current commitments, due to the absence of a financing condition in connection with the Lorillard transaction; the possibility of selling the brands and other assets currently expected to be divested or which otherwise might be divested on terms less favorable than the Imperial transaction, due to the absence of a condition in connection with the Lorillard transaction that the Imperial transaction be consummated; the obligation to consummate the Proposed Transactions even if there are adverse governmental developments with respect to menthol in cigarettes; the possibility of management distraction as a result of the Proposed Transactions; the failure to realize projected synergies and other benefits from the Proposed Transactions; Reynolds American’s obligations to indemnify Imperial for specified matters and to retain certain liabilities related to the divested brands and other assets; and the effect of the announcement of the Proposed Transactions on the ability to retain customers and retain and hire key personnel, maintain relationships with suppliers, and on operating results and businesses generally. Discussions of additional risks, contingencies and uncertainties are contained in Reynolds American’s and Lorillard’s filings with the Securities and Exchange Commission (the SEC).

Due to these risks, contingencies and other uncertainties, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of such statements. Except as provided by federal securities laws, Reynolds American is under no obligation to, and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise.

Additional Information

Reynolds American will file with the SEC a registration statement on Form S-4 that will include the Joint Proxy Statement of Reynolds American and Lorillard that also constitutes a prospectus of Reynolds American. Reynolds American and Lorillard plan to mail to their respective shareholders the Joint Proxy Statement/Prospectus in connection with the Proposed Transactions. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT REYNOLDS AMERICAN, LORILLARD, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Joint Proxy Statement/Prospectus and other documents filed with the SEC by Reynolds American and Lorillard through the website maintained by the SEC at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the Joint Proxy Statement/Prospectus and other documents filed with the SEC by Reynolds American by contacting Reynolds American Investor Relations at raiinvestorrelations@reynoldsamerican.com or by calling (336)741-5165 or at Reynolds American’s website at www.reynoldsamerican.com, and will be able to obtain free copies of the Joint Proxy Statement/Prospectus and other documents filed with the SEC by Lorillard by contacting Lorillard Investor Relations at investorrelations@lortobco.com or by calling (336)335-7000 or at Lorillard’s website at www.lorillard.com.

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the acquisition, the merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Reynolds American and Lorillard and certain of their respective directors and executive officers and employees may be considered participants in the solicitation of proxies from the respective shareholders of Reynolds American and stockholders of Lorillard in respect of the Proposed Transactions contemplated by the Joint Proxy Statement/Prospectus. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the respective shareholders of Reynolds American and stockholders of Lorillard in connection with the Proposed Transactions, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement/Prospectus when it is filed with the SEC. Information regarding Reynolds American’s directors and executive officers is contained in Reynolds American’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013, which is filed with the SEC. Information regarding Lorillard’s directors and executive officers is contained in Lorillard’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013, which is filed with the SEC.