UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

| | |

Filed by the Registrant x | | Filed by a Party other than the Registrant ¨ |

|

|

| Check the appropriate box: |

¨ Preliminary Proxy Statement |

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement |

¨ Definitive Additional Materials |

¨ Soliciting Material Pursuant to § 240.14a-12 |

FOX FACTORY HOLDING CORP.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than Registrant)

|

|

| Payment of Filing Fee (Check the appropriate box): |

x No fee required. |

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) Title of each class of securities to which transaction applies: |

2) Aggregate number of securities to which transaction applies:

|

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

4) Proposed maximum aggregate value of transaction:

|

5) Total fee paid:

|

¨ Fee paid previously with preliminary materials. |

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

|

2) Form, Schedule or Registration Statement No.:

|

3) Filing Party:

|

4) Date Filed:

|

Fox Factory Holding Corp.

915 Disc Drive

Scotts Valley, CA 95066

(831) 274-8336

March 15, 2018

Dear Stockholders of Fox Factory Holding Corp.:

You are cordially invited to attend the 2018 Annual Meeting of Stockholders of Fox Factory Holding Corp. (the "Annual Meeting"), which will be held Thursday, May 3, 2018, at 1 p.m., Pacific Time, at our corporate headquarters located at 915 Disc Drive, Scotts Valley, CA 95066. Holders of common stock are entitled to vote at the Annual Meeting on the basis of one vote for each share held.

In accordance with U.S. Securities and Exchange Commission ("SEC") rules, we are sending stockholders a Notice of Internet Availability of Proxy Materials (the "Notice") with instructions for accessing proxy materials and voting via the internet. This Notice also provides information on how stockholders may obtain paper copies of our proxy materials if they so wish.

Your vote is very important to us. We ask each stockholder to please assist us in preparing for the meeting by following the voting procedures contained in the proxy statement, proxy card or voting instruction form. Whether or not you expect to attend the Annual Meeting, we urge you to consider the accompanying proxy statement carefully and to promptly vote your shares either by telephone, internet, or, if you received paper copies of your proxy materials in the mail, by completing, signing, dating and returning the enclosed proxy card so that your shares may be voted in accordance with your wishes and the presence of a quorum may be assured. Completing a proxy card or voting through the internet or telephone will not prevent you from voting in person should you be able to attend the meeting, but will assure that your vote is counted, if, for any reason, you are unable to attend.

I look forward to hosting you at our Scotts Valley headquarters in May.

|

|

| Very truly yours, |

|

| Larry L. Enterline |

| Chief Executive Officer |

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 3, 2018

Fox Factory Holding Corp.’s 2018 Annual Meeting of Stockholders (the "Annual Meeting") will be held on Thursday, May 3, 2018, at 1 p.m., Pacific Time, at our corporate headquarters located at 915 Disc Drive, Scotts Valley, CA 95066.

The purposes of the meeting are:

| |

| 1. | To elect two Class II directors, described in the proxy statement, each to serve for a term to expire at the 2021 Annual Meeting of Stockholders; |

| |

| 2. | To ratify the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2018; |

| |

| 3. | To vote on a resolution to approve the Company’s executive compensation; |

| |

| 4. | To vote on the frequency of future advisory votes on the Company's executive compensation; and |

| |

| 5. | To consider and act upon such other matters as may properly come before the meeting, or any adjournment or postponement thereof. |

These matters are more fully described in the proxy statement. The Board of Directors recommends that you vote "FOR ALL" the nominated directors, "FOR" the ratification of the independent public accountants, "FOR" the advisory approval of the Company’s executive compensation, and to conduct an advisory vote on the Company's executive compensation every "ONE YEAR." The Board of Directors knows of no other matters at this time that may be properly brought before the meeting.

Stockholders of record at the close of business on March 6, 2018 are entitled to notice of, and to vote at the Annual Meeting and any subsequent adjournments or postponements thereof. A list of these stockholders will be available for inspection for 10 days preceding the Annual Meeting at our corporate headquarters located at 915 Disc Drive, Scotts Valley, CA 95066. The notice of annual meeting, proxy statement, proxy card, and other proxy materials are first being sent or made available to stockholders on or about March 15, 2018.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

We are pleased to save costs and help protect the environment by using the Notice and Access method of delivery. Instead of receiving paper copies of our proxy materials in the mail, many stockholders will receive a Notice of Internet Availability of Proxy Materials ("Notice") which provides an internet website address where stockholders can access electronic copies of proxy materials and vote. This website also has instructions for voting by telephone and for requesting paper copies of the proxy materials and proxy card. The Company's 2018 proxy statement and Annual Report for fiscal year 2017 are available online at www.proxyvote.com. We encourage you to access and review such materials before voting.

Your vote is very important to us. Whether or not you expect to attend the Annual Meeting, we urge you to consider the proxy statement carefully and to promptly vote your shares either by (1) voting through the internet at the website shown on the proxy card or Notice or by telephone at the telephone number shown on the proxy card or Notice; or (2) if you received paper copies of your proxy materials in the mail, complete, date, sign, and return the enclosed proxy card as promptly as possible. Completing a proxy card or voting through the internet or telephone will not prevent you from voting in person should you be able to attend the meeting, but will assure that your vote is counted, if, for any reason, you are unable to attend. Our proxy tabulator, Broadridge Financial Solutions, Inc. must receive any proxy that will not be delivered in person to the Annual Meeting by 11:59 p.m., Eastern Time on Wednesday, May 2, 2018.

|

|

| By Order of the Board of Directors, |

| |

|

| David Haugen |

| Corporate Secretary |

Scotts Valley, California

March 15, 2018

TABLE OF CONTENTS

|

| |

| | Page |

| QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT AND THE ANNUAL MEETING | |

| ELECTION OF CLASS II DIRECTORS (Proposal 1) | |

| RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Proposal 2) | |

| DIRECTOR COMPENSATION | |

| CORPORATE GOVERNANCE | |

| The Board of Directors | |

| Certain Relationships and Related Transactions and Director Independence | |

| Nominations of Directors and Diversity | |

| Communications with the Directors | |

| Board of Directors, Executive Officers and Committees | |

| EXECUTIVE COMPENSATION | |

| Compensation Discussion and Analysis | |

| Summary Compensation Table | |

| Grants of Plan-Based Awards Table | |

| Outstanding Equity Awards at Fiscal Year-End Table | |

| Option Exercises and Stock Vested Table | |

| Equity Compensation Plan Information | |

| COMPENSATION COMMITTEE REPORT | |

| AUDIT COMMITTEE REPORT | |

| ADVISORY VOTE ON THE COMPANY'S EXECUTIVE COMPENSATION (Proposal 3) | |

| ADVISORY VOTE ON THE FREQUENCY OF ADVISORY VOTES ON EXECUTIVE COMPENSATION (Proposal 4) | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

| SUBMISSION OF STOCKHOLDER PROPOSALS FOR 2019 | |

| DIRECTIONS TO THE ANNUAL MEETING | |

| DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS | |

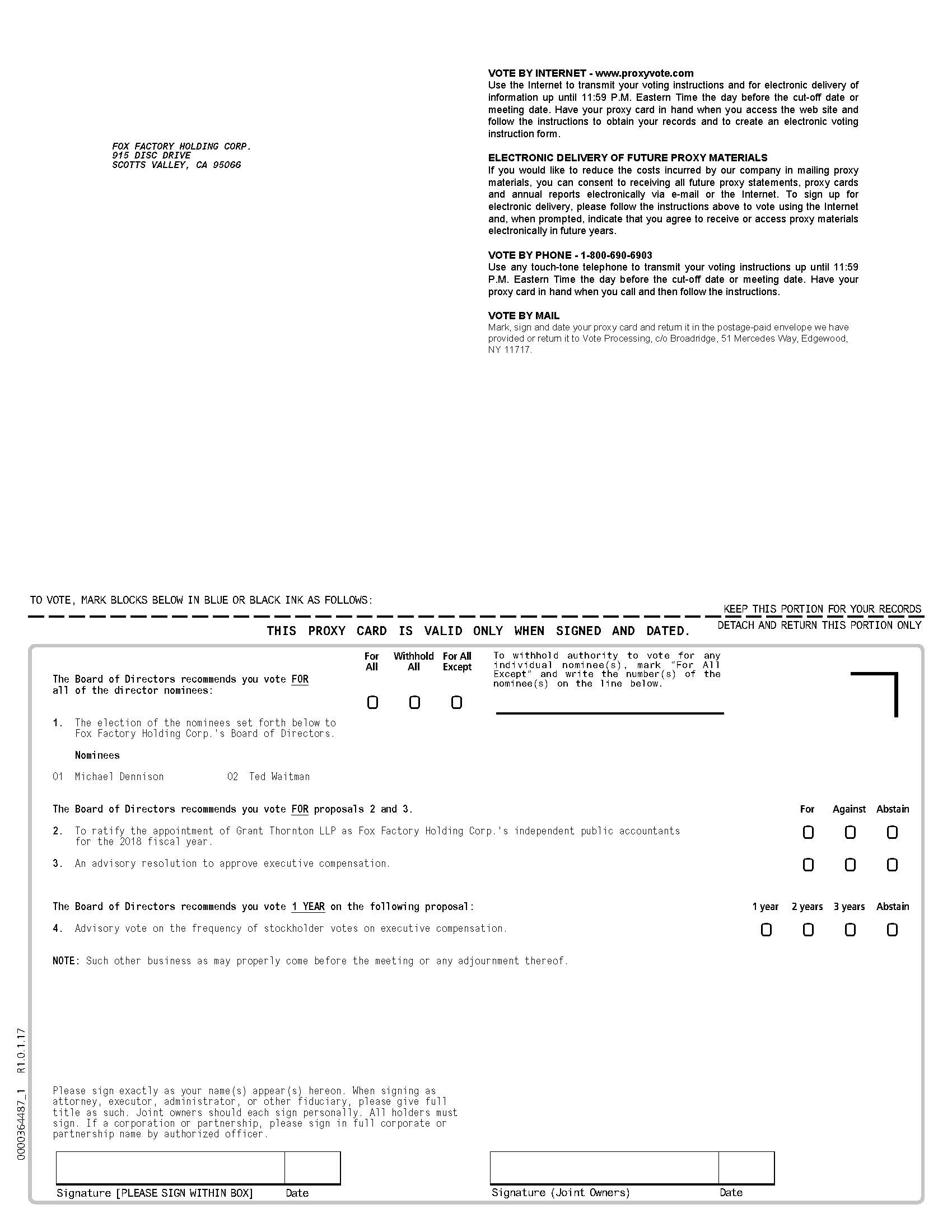

| PROXY CARD | |

Fox Factory Holding Corp.

915 Disc Drive

Scotts Valley, CA 95066

(831) 274-8336

March 15, 2018

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 3, 2018

Fox Factory Holding Corp. (which we refer to as “we,” “us,” “our,” “FOX” or the “Company”) is furnishing this proxy statement in connection with the solicitation by our Board of Directors (our “Board”) of proxies to vote at the 2018 Annual Meeting of Stockholders on May 3, 2018, at 1 p.m., Pacific Time (the “Annual Meeting”), or at any adjournment or postponement thereof, at our corporate headquarters located at 915 Disc Drive, Scotts Valley, CA 95066. We first sent or made available these Proxy Materials (as defined below) to our stockholders on or about March 15, 2018. A copy of this proxy statement, the proxy card and our Annual Report for fiscal year 2017 (collectively, the "Proxy Materials") can be found at the web address www.proxyvote.com.

QUESTIONS AND ANSWERS ABOUT

THIS PROXY STATEMENT AND THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will consider and vote on the following matters:

| |

| • | Proposal 1: To elect two Class II directors, described in the proxy statement, each to serve for a term to expire at the 2021 Annual Meeting of Stockholders. |

| |

| • | Proposal 2: To ratify the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2018. |

| |

| • | Proposal 3: To vote on a resolution to approve the Company's executive compensation. |

| |

| • | Proposal 4: To vote on the frequency of future advisory votes on the Company's executive compensation. |

The stockholders will also consider and act on any other matters as may properly come before the meeting, or any adjournment or postponement thereof.

How are the proxy materials being delivered?

The Securities and Exchange Commission, which we referred to as the SEC, has adopted a “Notice and Access” rule that allows companies to deliver a Notice of Internet Availability of Proxy Materials, which we refer to as the Notice, to stockholders in lieu of a paper copy of the Proxy Materials. The Notice provides instructions as to how shares can be voted. Shares must be voted either by telephone, internet or by completing and returning a proxy card. Shares cannot be voted by marking, writing on and/or returning the Notice. Any Notices that are returned will not be counted as votes. Instructions for requesting a paper copy of the Proxy Materials are set forth on the Notice.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING:

The Proxy Materials are available at www.proxyvote.com. Enter the 12-digit control number located on the Notice or proxy card to access the Proxy Materials.

Who may attend the Annual Meeting?

Anyone who was a stockholder as of the close of business on March 6, 2018, may attend the Annual Meeting. Broadridge Financial Solutions, Inc. (“Broadridge”) has been selected as our inspector of election. As part of its responsibilities, Broadridge is required to independently verify that you are a FOX stockholder eligible to attend the Annual Meeting and to determine whether you may vote in person at the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record of our common stock at the close of business on March 6, 2018, the record date, are entitled to vote at the Annual Meeting. There were 37,656,314 shares of our common stock outstanding on March 6, 2018. Such stockholders of record are entitled to cast one vote per share on all matters.

What documents am I required to bring in order to vote at the Annual Meeting if I am voting as a stockholder?

The documents you will need to provide to be admitted to the Annual Meeting depend on whether you are a stockholder of record or you represent a stockholder of record. If you are a stockholder of record holding shares in your own name, you must bring to the Annual Meeting a form of government-issued photo identification (e.g., a driver’s license or passport). Trustees who are individuals and named as stockholders of record are in this category. If you attend on behalf of a stockholder of record, whether such stockholder is an individual, corporation, trust or partnership, you must bring to the Annual Meeting a form of government-issued photo identification (e.g., a driver’s license or passport) and either a letter from that stockholder of record authorizing you to attend the Annual Meeting on their behalf or we must have received by 11:59 p.m. Eastern Time, on May 2, 2018 a duly executed proxy card from the stockholder of record appointing you as proxy.

What documents am I required to bring in order to vote at the Annual Meeting if I am voting as a beneficial owner?

If your shares are held in street name, your name does not appear on the share register of the Company. The documents you will need to provide to be admitted to the Annual Meeting depend on whether you are a beneficial owner or you represent a beneficial owner. If you are a beneficial owner, you must bring to the Annual Meeting a form of government-issued photo identification (e.g., a driver’s license or passport) and either a legal proxy that you have obtained from your bank or broker or your most recent brokerage account statement or a recent letter from your bank or broker showing that you own shares of the Company. If you attend on behalf of a beneficial owner, you must bring to the Annual Meeting a letter from the beneficial owner authorizing you to represent such beneficial owner’s shares at the Annual Meeting and the identification and documentation specified above for individual beneficial owners.

How do I vote my shares in person at the Annual Meeting?

Stockholders of record may vote their shares in person at the Annual Meeting by ballot. Each proposal has a separate ballot. You must properly complete, sign, date and return the ballots to the inspector of election at the Annual Meeting to vote in person. To receive ballots, you must bring with you the documents described above. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

How do I vote my shares without attending the Annual Meeting?

Stockholders of record may vote their shares by appointing a proxy to vote on your behalf by promptly submitting the proxy card, which is solicited by the Board. The persons named in the proxy card have been designated as proxies by our Board. The designated proxies are officers of the Company. They will vote as directed by the completed proxy card. Stockholders of record also have the opportunity to appoint another person to attend the Annual Meeting and vote on their behalf by inserting such other person’s name on the proxy card and returning the duly executed proxy card to us.

There are three ways to vote by proxy:

Complete, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing; c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717.

| |

| 2. | By Telephone - 1-800-690-6903 |

Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time May 2, 2018. Have your proxy card in hand when you call and then follow the instructions.

| |

| 3. | By Internet - www.proxyvote.com |

Use the internet to transmit your voting instructions and for electronic delivery of information until 11:59 p.m. Eastern Time on May 2, 2018. Have your proxy card in hand when you access the web site and then follow the instructions to obtain your records and to create an electronic voting instruction form.

If you received a proxy card in the mail but choose to vote by telephone or internet, you do not need to return your proxy card.

If your shares are held in the name of a bank, broker or other record holder, follow the voting instructions on the form that you receive from them. The availability of telephone or internet voting will depend on the bank’s, broker’s or other record holder’s voting process. Your bank, broker or other record holder may not be permitted to exercise voting discretion as to some of the matters to be acted upon. Therefore, please give voting instructions to your bank, broker or other record holder.

You may vote by telephone or internet until 11:59 p.m. Eastern Time, on May 2, 2018, or Broadridge must receive your paper proxy card by 11:59 p.m. Eastern Time on May 2, 2018.

How will my proxy be voted?

All properly completed, unrevoked proxies, which are received prior to the close of voting at the Annual Meeting, will be voted in accordance with the specifications made. If a properly executed, unrevoked written proxy card does not specifically direct the voting of shares covered, the proxy will be voted:

| |

| • | FOR ALL the individuals nominated as a director in Proposal 1, described in this proxy statement, for a term to expire at the 2021 Annual Meeting of Stockholders; |

| |

| • | FOR Proposal 2, the ratification of the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2018; |

| |

| • | FOR Proposal 3, the approval of the Company’s executive compensation; |

| |

| • | ONE YEAR for Proposal 4, the frequency of which future advisory votes on the Company's executive compensation are to occur; and |

| |

| • | in accordance with the judgment of the persons named in the proxy as to such other matters as may properly come before the Annual Meeting, or any adjournment or postponement thereof. |

The Board is not aware of any other matters that may properly come before the Annual Meeting. However, should any such matters come before the Annual Meeting, it is the intention of the persons named in the proxy card to vote all proxies (unless otherwise directed by stockholders) in accordance with their judgment on such matters.

May I revoke or change my vote?

If you are a stockholder of record, you may revoke your proxy at any time before it is actually voted by giving written notice of revocation to our Corporate Secretary, by delivering a proxy bearing a later date or by attending and voting in person at the Annual Meeting. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request. If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other record holder or, if you have obtained a legal proxy from your bank, broker or other record holder giving you the right to vote your shares, by attending the meeting and voting in person.

Will my vote be made public?

All proxies, ballots and voting materials that identify the votes of specific stockholders will generally be kept confidential, except as necessary to meet applicable legal requirements and to allow for the tabulation of votes and certification of the vote.

What constitutes a quorum, permitting the meeting to conduct its business?

The presence at the Annual Meeting, in person or by proxy, of holders of a majority of the issued and outstanding shares of common stock entitled to vote as of the record date is considered a quorum for the transaction of business. If you submit a properly completed proxy or if you appear at the Annual Meeting to vote in person, your shares of common stock will be considered part of the quorum.

Shares represented by proxies that are marked “Abstain” or "Withhold" or will be counted as shares present for purposes of determining the presence of a quorum. Shares of stock entitled to vote that are represented by broker non-votes will be counted as shares present for purposes of determining the presence of a quorum. A broker non-vote occurs when the broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power to vote on that proposal without specific voting instructions from the beneficial owner.

How many votes are needed to approve a proposal?

Proposal 1

Assuming the presence of a quorum, each director nominee receiving a plurality of the votes cast at the Annual Meeting (in person or by proxy) will be elected as a director. No stockholder shall be permitted to cumulate votes for the election of directors. The election of directors is a non-discretionary item and brokers may not vote on Proposal I without specific voting instructions from beneficial owners, resulting in a broker non-vote. Broker non-votes and withheld votes are not counted toward the election of directors or toward the election of the individual nominees specified on the proxy, and therefore, have no effect on Proposal 1.

Proposal 2

Assuming the presence of a quorum, the affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote is required to ratify the appointment of Grant Thornton LLP as our independent registered public accountants for fiscal year 2018. An abstention is not counted toward the ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm, and the effect of an abstention is the same as a vote “Against” the ratification. Ratification of this appointment is a discretionary item upon which your bank or broker has the authority to vote uninstructed shares. Should your broker not indicate their vote relating to the ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm for fiscal year 2018, but otherwise appoint the proxies, your shares will be voted “For” the ratification of the selection of Grant Thornton as the independent registered public accounting firm for fiscal year 2018.

Proposal 3

Assuming the presence of a quorum, the affirmative vote of a majority of the shares present in person or by proxy, at the Annual Meeting and entitled to vote on the proposal is required to approve the advisory vote on executive compensation. Proposal 3 is a non-discretionary item and brokers may not vote on Proposal 3 without specific voting instructions from beneficial owners, resulting in a broker non-vote. Because the vote on this proposal is advisory in nature, it will not be binding on the Board. However, the Board will consider the outcome of the vote along with other factors when making its decision about the compensation of our Named Executive Officers. See "Compensation Discussion and Analysis-Consideration of Say on Pay Vote Results" for additional information.

Proposal 4

Regarding the vote on whether the advisory vote on executive compensation should be held every one, two or three years, the frequency option that receives the plurality of votes cast on this proposal will be deemed the preferred option of stockholders. Proposal 4 is a non-discretionary item and brokers may not vote on Proposal 4 without specific voting instructions from beneficial owners, resulting in a broker non-vote. Because the vote on this proposal is advisory in nature, it will not be binding on the Board.

Who will count the vote?

Representatives of Broadridge will tabulate the votes and act as the inspectors of election.

How can I find the voting results of the Annual Meeting?

We will report the voting results in a Current Report on Form 8-K within four business days of the Annual Meeting.

How is the solicitation being made?

This solicitation is being made by us, the Company, and as such the cost of solicitation of proxies will be borne by us. Solicitation may be made by our directors, officers, and employees, personally or by telephone, email or fax. The Notice and, if requested, the Proxy Materials, will be distributed to beneficial owners of common stock through brokers, custodians, nominees and other like parties, and we expect to reimburse such parties for their charges and expenses.

Where can I find more information about Fox Factory Holding Corp.?

We file reports and other information with the SEC. You may read and copy this information at the SEC’s public reference facilities. Please call the SEC at 1-800-SEC-0330 for information about these facilities. This information is also available at our website at http://investor.ridefox.com/ and at the internet site maintained by the SEC at http://www.sec.gov.

ELECTION OF CLASS II DIRECTORS

(PROPOSAL I)

The Board of Fox Factory Holding Corp. is currently comprised of seven individuals and is divided into three classes serving staggered three year terms. The terms of office of Classes I, II and III expire at different times in annual succession, with one class being elected at each Annual Meeting of Stockholders. Messrs. Waitman and Dennison are Class II directors and are up for election at this year’s Annual Meeting of Stockholders. Messrs. Enterline, Fox and Duncan are Class III directors and will serve until the 2019 Annual Meeting of Stockholders, or earlier in the case of their death, resignation or removal. Mr. Mendenhall and Ms. Fetter are Class I directors and will serve until the 2020 Annual Meeting of Stockholders, or earlier in the case of their death, resignation or removal.

The Class II directors are proposed to be elected at the Annual Meeting to serve for a term to expire at the 2021 Annual Meeting of Stockholders or earlier in the case of their death, resignation or removal. The Board has nominated Messrs. Waitman and Dennison for election as Class II directors. The nominees have indicated a willingness to stand for election and to serve if elected. You may vote "For All" or "Withhold All" for the nominees, or "For All Except" and indicate which nominee you are withholding your vote on. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Unless otherwise indicated in your proxy, the persons named as proxies in the proxy card, or their substitutes, will vote your proxy for the nominee, who has been designated as such by the Board. In the event that a nominee for director withdraws or for any reason is not able to serve as a director, we will vote your proxy for any replacement nominee designated by the Nominating and Corporate Governance Committee and the Board, if such a replacement nominee is designated. Each nominee recommended by the Board to stockholders was recommended to the Board by the Nominating and Corporate Governance Committee. The following paragraphs describe the business experience and education of our directors.

Directors Up for Election

Michael Dennison. Mr. Dennison joined us as a director of our Company in February 2018 to fill the vacancy created by Mr. Nichols' resignation. Mr. Dennison was brought to the Board’s attention as a potential director candidate through the professional networks of the Company's Chief Executive Officer and Board of Directors. Mr. Dennison has more than 25 years of consumer technology and business management experience focused on driving strategy, transformation and scale. He is currently the President of the Consumer Technologies Group at Flex (NASDAQ: FLEX), the Sketch-to-Scale™ solutions provider that designs and builds Intelligent Products for a Connected World™. Since joining Flex in 1999, Mr. Dennison has served in a number of leadership roles, from leading procurement and global supply chain organizations for the company, to serving as Senior Vice President of Business Management for both the High-Velocity Solutions group, and the Mobile and Consumer Segment. Prior to joining Flex, he was the Regional Director at Arrow Electronics, based in New York. Mr. Dennison holds a BA in liberal arts from Oregon State University.

Mr. Dennison’s extensive management experience with international consumer products, high-technology, and global supply chain management qualifies him to serve on our Board.

Ted Waitman. Mr. Waitman has served as a director of our Company since June 2013. Since 1978, Mr. Waitman has held various leadership positions, including serving as President and Chief Executive Officer since 1996 and as a director since 2003, at CPM Holdings, Inc., a designer and manufacturer of process equipment for the animal feed and oilseed processing industries. From 2006 to 2008, he served as an independent director of Compass Group Diversified Holdings LLC ("Compass"). Mr. Waitman was also previously a director of the American Feed Industry Association and president of the Process Equipment Manufacturers’ Association. Mr. Waitman earned a BS in Industrial Engineering from the University of Evansville in 1973.

Mr. Waitman’s various leadership positions and extensive management and operating experience qualifies him to serve on our Board.

Required Vote for Election of Directors

The election of directors is by plurality vote of holders present, in person or by proxy at the Annual Meeting and entitled to vote thereon, with each nominee receiving a plurality of the votes cast to be elected as a director.

Recommendation of the Board

The Board recommends that you vote “FOR ALL” the nominees, Messrs. Dennison and Waitman, to be elected to our Board as Class II directors for a term ending at our 2021 Annual Meeting of Stockholders.

Directors Not Up for Election

The following paragraphs describe the business experience and education of our Class I and Class III directors (not standing for election).

Larry L. Enterline. Mr. Enterline first joined us in March 2011. Prior to our initial public offering ("IPO"), which occurred in August 2013, Mr. Enterline served as Chief Executive Officer and director of our main operating subsidiary ("our Subsidiary"). In connection with our IPO, Mr. Enterline was named our Chief Executive Officer in May 2013 and appointed as a director in June 2013 in addition to his service in such roles at our Subsidiary. Since April 2010, Mr. Enterline has served as the Chief Executive Officer of Vulcan Holdings, Inc., his private investment holding and consulting services company. From January 2006 to April 2010, Mr. Enterline was Chief Executive Officer of COMSYS IT Partners, Inc., an IT staffing and solutions company. From October 2005 to July 2017, Mr. Enterline served on the board of directors of Concurrent Computer Corporation (NASDAQ: CCUR), a provider of software, hardware and professional services for the video market and the high-performance, real-time market. From April 2005 to September 2011, Mr. Enterline served on the board of directors of Raptor Networks Technology, Inc., now known as Mabwe Minerals Inc. (PINK: MBWE), which, at the time of Mr. Enterline’s membership on the board, was engaged in the data network switching industry. From 1989 to 2000, Mr. Enterline served in various management roles, including Senior Vice President of Worldwide Sales and Service Organization, at Scientific-Atlanta, Inc., a Georgia-based manufacturer of cable television, telecommunications and broadband equipment. Mr. Enterline serves on the board of directors of Hi Hope Service Center Inc., and as trustee of The Enterline Foundation, both of which are charitable, 501(c)(3) non-profit organizations. Mr. Enterline earned a BSEE in Engineering from Case Western Reserve University in 1974, and an MBA from Cleveland State University in 1988.

Mr. Enterline’s current position as our Chief Executive Officer and as Chief Executive Officer of our Subsidiary, service on other public company boards and leadership experience give him the qualifications and skills to serve on our Board.

Dudley Mendenhall. Mr. Mendenhall joined us as a director of our Subsidiary, in February 2012. He was appointed as a director of our Company in June 2013, and appointed as Chairman of the Board in July, 2017. Currently Mr. Mendenhall is an independent consultant providing financial advisory services and serves on the board of a private company. From November 2013 to August 2015, Mr. Mendenhall served as Chief Financial Officer and Chief Operating Officer of Clique Intelligence, Inc., an information technology company. From July 2012 to November 2013, Mr. Mendenhall was an independent consultant providing financial advisory services. From January 2011 to July 2012, he was Vice President, Strategy, Planning and Operations in the office of Strategy and Technology at Hewlett-Packard Company. From March 2009 to August 2010, Mr. Mendenhall served as Chief Financial Officer of Solera Holdings, Inc., a provider of software and services to the automobile insurance claims processing industry. From September 2007 to March 2009, Mr. Mendenhall was Chief Financial Officer of Websense, Inc., a company providing integrated web, data and email security solutions. From April 2003 to September 2007, Mr. Mendenhall was Senior Vice President and Chief Financial Officer of K2, Inc., an international sporting equipment manufacturer. Mr. Mendenhall earned a BA in Economics and Political Science from Colorado College in 1977.

Mr. Mendenhall’s experience as chief financial officer at public companies and his background in finance and accounting assists our Board with financial review and risk management obligations.

Thomas Duncan. Mr. Duncan joined us as a director of our Company in July 2017. Since 2003, Mr. Duncan has served as the President and Chief Executive Officer of the North American division of Positec Tool Corporation (“Positec”), a global manufacturer and marketer of power tools, lawn and garden equipment and accessories, including the Rockwell and WORX brands. Prior to joining Positec, Mr. Duncan served as a Vice President of Robert Bosch Tool Corporation ("Bosch") from June 2001 to September 2003. From September 1992 to June 2001, Mr. Duncan served as a Vice President at Vermont American Corporation until they were acquired by Bosch. Mr. Duncan has been a director on the Outdoor Power Equipment Institute board of directors since October 2015 and a director on the Folks Center for International Business board of directors at University of South Carolina's Darla Moore School of Business since September 2016. Mr. Duncan holds a BA in Rhetoric from the University of Virginia and a Masters of International Business from University of South Carolina's Darla Moore School of Business.

Mr. Duncan's 25 years of experience in the manufacturing and consumer durable goods industry gives him the qualifications to serve on our Board.

Elizabeth Fetter. Ms. Fetter has served as a director of our Company since June 2017. Since 2014, Ms. Fetter has served on the board of directors of McGrath Rentcorp, a leading manager of diversified portfolio of business-to-business equipment rental providers worldwide. She also serves on the board of directors of Alliant International University, Inc., a private equity funded university since 2015 and Connexed Technologies, Inc., a provider of web-based camera management and video storage solutions since 2004. Ms. Fetter served as a member of the board of directors of Symmetricom, Inc., a provider of timekeeping technologies, instruments and solutions from 2000 to 2013 and was appointed as President and Chief Executive Officer of Symmetricom in April 2013. She served in these capacities until Symmetricom's acquisition by Microsemi Corporation in November 2013. Ms. Fetter previously served as President and Chief Executive Officer of NxGen Modular LLC, a provider of modular buildings and assemblies from 2011 to 2012. In 2007, Ms. Fetter was President, Chief Executive Officer and a director of Jacent Technologies, a privately held supplier of on-demand ordering solutions for the restaurant industry. Ms. Fetter also served on the boards of Quantum Corporation, a data storage company, from 2005 to 2013 and Ikanos Corporation, a provider of broadband solutions from 2008 to 2009. She previously held the position of Chair of the Board of Trustees of Alliant International University, Inc. where she served as a trustee from 2004 to 2013. Ms. Fetter holds a BA in Communications from Pennsylvania State University, an MS in Industrial Administration from Carnegie Mellon University (Tepper & Heinz Schools) and an Advanced Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization.

Ms. Fetter's over 25 years of public and private company board service and past chief executive officer experience at multiple firms gives her the qualifications to serve on our Board.

Robert C. Fox, Jr. Mr. Fox is the founder of our Subsidiary and has served as a director of our Company since January 2008. He served as Chief Executive Officer of our Subsidiary from its inception in February 1978 until January 2008. From January 2008 to June 2009, he served as Chief Engineering Officer of our Subsidiary. Mr. Fox earned a BS in Physics from Santa Clara University in 1961, and an MBA from Santa Clara University in 1968.

As the founder of our Subsidiary, Mr. Fox brings a deep understanding of our history, culture and technology to our Board, which enables him to advise our Board on all aspects of our business, while bringing historic knowledge and continuity to our Board.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(PROPOSAL 2)

General

Our Audit Committee has appointed Grant Thornton LLP as independent public accountants to examine our consolidated financial statements for the fiscal year ending December 28, 2018, and has determined that it would be desirable to request that the stockholders ratify the appointment.

You may vote “For” or “Against” this proposal, or you may “Abstain” from voting.

Grant Thornton LLP is an independent registered public accounting firm and audited our financial statements for the fiscal years ended December 29, 2017, December 30, 2016, and December 31, 2015. Based on its past performance during these audits, the Audit Committee has selected Grant Thornton LLP as the independent auditor to perform the audit of our financial statements for fiscal year 2018. Information regarding Grant Thornton LLP can be found at www.grantthornton.com.

Representatives of Grant Thornton LLP are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so and are also expected to be available to respond to appropriate questions.

Fees

The following table sets forth the total amount billed to us for the fiscal years ended December 29, 2017, December 30, 2016 and December 31, 2015 by Grant Thornton LLP.

|

| | | | | | | | | |

| | 2017 | 2016 | 2015 |

| Audit Fees (1) | $ | 1,377,610 |

| $ | 883,647 |

| $ | 836,792 |

|

| Audit-Related Fees (2) | 236,886 |

| 234,182 |

| 63,874 |

|

| Tax Fees (3) | 47,644 |

| 68,358 |

| 61,974 |

|

| Totals | $ | 1,662,140 |

| $ | 1,186,187 |

| $ | 962,640 |

|

| |

| (1) | “Audit Fees” are fees billed by Grant Thornton LLP for professional services for the audit of our annual financial statements included in our annual reports on Form 10-K and for the review of our interim financial statements included in our quarterly reports on Form 10-Q. |

| |

| (2) | "Audit-Related Fees" are fees billed by Grant Thornton LLP for professional services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under “Audit Fees.” These services include consultations and audits related to mergers and acquisitions, and services related to offering of common stock and consents for registration statements. |

| |

| (3) | “Tax Fees” are fees billed by Grant Thornton LLP for professional services rendered in connection with tax compliance, tax advice and corporate tax planning. |

The Audit Committee has evaluated Grant Thornton LLP’s qualification, performance and independence and has determined that services provided by Grant Thornton LLP were permitted under the rules and regulations concerning public accountant's independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as amended, as well as by the Public Company Accounting Oversight Board (the “PCAOB”).

Pre-Approval Policy

The Audit Committee’s policy is to pre-approve any independent accountant’s engagement to render audit and or permissible non-audit services (including the fees charged and proposed to be charged by independent accountants) subject to the de minimus exceptions under Section 10A(i)(1)(B) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as otherwise required by law. Non-audit services may include audit-related services, tax services, or other services. The Audit Committee annually reviews whether the provision of permitted non-audit services is compatible with maintaining the accountant’s independence. The Audit Committee pre-approved all "Audit-Related Fees" and "Tax Fees" in fiscal years 2017 and 2016.

Required Vote for Stockholder Approval

The affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote thereon is required to ratify the appointment.

Recommendation of the Board

The Board recommends that you vote “FOR” the ratification of the selection of Grant Thornton LLP to serve as independent auditor for the Company for the fiscal year ending December 28, 2018.

DIRECTOR COMPENSATION

Non-employee Director Compensation for Fiscal Year 2017

Any non-employee director who, directly or indirectly, beneficially owns 5% or more of outstanding securities or is employed by or represents a stockholder of us that, directly or indirectly, beneficially owns 5% or more of the Company’s outstanding securities is not entitled to receive any cash compensation or equity-based compensation for his or her service on the Board. Such non-employee director is, however, entitled to receive reimbursement for reasonable expenses that he or she properly incurs in connection with attending Board meetings and performing duties as a director.

For fiscal year 2017, our Non-employee Director Compensation Plan, as amended and restated, provided for an annual cash retainer of $50,000, payable quarterly for service as a non-employee director of Fox Factory Holding Corp. Our Chairman of the Board is paid an additional annual retainer of $25,000, plus the other retainers and compensation he may receive. The chairpersons of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are provided additional retainers of $15,000, $7,500 and $7,500 respectively. Each non-employee director serving on a committee of the Board is paid an additional $1,000 for each meeting of the committee attended by such director telephonically or in person. Finally, each of the non-employee directors is entitled to receive reimbursement for reasonable expenses that they properly incur in connection with attending Board meetings and their duties as a director. For fiscal year 2017, such annual retainers were prorated for mid-year appointments with respect to Ms. Fetter's and Mr. Duncan's appointments and Mr. Mendenhall's Chairmanship appointment.

Pursuant to our Non-employee Director Compensation Plan, as amended and restated, non-employee directors are also granted annual equity-based compensation awards in the form of restricted stock units ("RSUs") pursuant to the Fox Factory Holding Corp. 2013 Omnibus Incentive Plan, as amended (the "2013 Omnibus Plan"). These awards vest on the day immediately prior to the next Annual Meeting of Stockholders, subject to accelerated vesting in the event of the director’s death or a change in control of the Company and are subject to such additional terms and conditions as may be set forth in the applicable award agreement and plan. Subject to applicable laws and our policies in place for equity-based awards, through fiscal year 2017, the non-employee directors were entitled to receive an annual award of RSUs determined by dividing $50,000, by the closing price of our common stock on the date of grant. In fiscal year 2017, each non-employee director received an award of 1,555 RSUs on May 4, 2017, or for directors appointed during fiscal year 2017, a pro-rata award reflecting their term of service in 2017. These awards will vest on the day immediately prior to the Annual Meeting, subject to accelerated vesting in the event of a director’s death or a change in control of the Company. The Chairman of the Board is entitled to receive an additional annual award of RSUs determined by dividing $15,000, by the closing price of our common stock on the date of grant, which was prorated for Mr. Mendenhall in 2017 based on his appointment as Chairman of the Board.

The following table sets forth information for the year ended December 29, 2017 regarding the compensation awarded to, earned by or paid to persons who served as our directors during fiscal year 2017 who are not Named Executive Officers. Mr. Fox, the founder of our Subsidiary, received no compensation for his services as a director in fiscal year 2017.

|

| | | | | | | | | | | | | | | |

| Name | Fees earned or paid in cash | | Stock awards (1) | | All other compensation | | Total |

| Dudley Mendenhall (2) | $ | 88,750 |

| | $ | 61,378 |

| | $ | — |

| | $ | 150,128 |

|

| Michael Dennison (3) | — |

| | — |

| | — |

| | — |

|

| Thomas Duncan (4) | 9,375 |

| | 38,916 |

| | — |

| | 48,291 |

|

| Elizabeth Fetter (5) | 18,973 |

| | 44,517 |

| | — |

| | 63,490 |

|

| Robert C. Fox, Jr. | — |

| | — |

| | 31,200 |

| (9) | 31,200 |

|

| Joseph Hagin (6) | 10,000 |

| | — |

| | — |

| | 10,000 |

|

| Carl Nichols (7) | 63,000 |

| | 50,000 |

| | — |

| | 113,000 |

|

| Elias Sabo (8) | — |

| | — |

| | — |

| | — |

|

| Ted Waitman | 62,000 |

| | 50,000 |

| | — |

| | 112,000 |

|

| |

| (1) | Amounts in this column represent the aggregate grant date fair value computed in accordance with FASB Topic 718 of RSUs awarded in 2017 pursuant to the 2013 Omnibus Plan. With the exception of those granted to Mr. Nichols, the RSUs vest on the day before the Company's Annual Meeting. |

| |

| (2) | Mr. Mendenhall was appointed as Chairman of our Board on July 24, 2017. |

| |

| (3) | Mr. Dennison was appointed to our Board effective February 23, 2018. |

| |

| (4) | Mr. Duncan was appointed to our Board effective July 24, 2017. |

| |

| (5) | Ms. Fetter was appointed to our Board effective June 13, 2017. |

| |

| (6) | Mr. Hagin resigned from our Board effective January 12, 2017. |

| |

| (7) | Mr. Nichols resigned from our Board effective January 5, 2018. In recognition of his service, the Board accelerated the vesting of restricted stock award granted in 2017. |

| |

| (8) | Mr. Sabo resigned from our Board effective July 24, 2017. |

| |

| (9) | Consists of $45 paid for life insurance, $21,709 paid for medical and dental plan premiums, and approximately $9,446 in expenses incurred by the Company in connection with the secondary offering of Mr. Fox's shares off of our Registration Statement on Form S-3 in March 2017. |

CORPORATE GOVERNANCE

Our business and affairs are managed under the direction of our Board, which currently consists of seven members. The primary responsibilities of our Board are to provide oversight, strategic guidance, counseling and direction to our management.

The Board of Directors

Governance Guidelines

Our Board has adopted a set of governance guidelines (the "Governance Guidelines") to assist our Board and its committees in performing their duties and serving the best interests of our Company and our stockholders. The Governance Guidelines cover topics including, but not limited to, director selection and qualification, director responsibilities and operation of our Board, director access to management and independent advisors, director compensation, director orientation and continuing education, succession planning, recoupment of performance-based compensation and the annual evaluations of our Board.

Code of Ethics

Our Board has adopted a Code of Ethics that applies to all of our employees, officers and directors, including our principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions. The Code of Ethics is posted on our website http://investor.ridefox.com/. The Code of Ethics can only be amended by the approval of a majority of our Board, including a majority of our independent directors. Any waiver to the Code of Ethics for an executive officer or director may only be granted by our Board and must be timely disclosed as required by applicable law. Any amendments to the Code of Ethics, or any waivers of its requirements, will be disclosed on our website at http://investor.ridefox.com/ or by filing with the SEC a Current Report on Form 8-K, in each case if such disclosure is required by rules of the SEC or Nasdaq Listing Rules.

Leadership Structure

The Board believes its current leadership structure best serves the interest of the stockholders. The Board does not have a policy as to whether the Chairman should be an independent director, but when the Chairman is not an independent director , the independent directors appoint a “Lead Independent Director.” Mr. Mendenhall, an independent director, is our Chairman and leads our Board. He presides at all meetings of stockholders and the Board. Mr. Enterline, as Chief Executive Officer, has general charge and management of the affairs, property and business of the corporation, under the oversight, and subject to the review and direction, of the Board. The separation of the roles of Chief Executive Officer and the Chairman allows the Chief Executive Officer to focus primarily on leading the day-to-day operations of the Company while the Chairman can focus on leading the Board in its consideration of strategic issues and monitoring corporate governance, community relations and stockholder issues.

Our Board has three standing committees, comprised solely of independent directors, the Audit Committee, chaired by Mr. Mendenhall, the Compensation Committee, chaired by Mr. Waitman, and the Nominating and Corporate Governance Committee, chaired by Mr. Duncan. The responsibilities and authority of each committee are described below.

Risk Oversight

The Board believes risk management is an important aspect of our business. While the Board as a whole ultimately has the responsibility for overseeing risk management, the Board has delegated certain duties with respect to risk oversight to our Audit Committee. In furtherance of such purpose, the Audit Committee Charter specifically requires the Audit Committee to discuss with management, the internal auditor or internal audit service provider, as the case may be, and the independent public accountant the Company’s major risk exposures (whether financial, operations or both) and the steps management has taken to monitor and control such exposure, including the Company’s risk assessment and risk management policies. The Audit Committee reports back to the Board with its findings.

Board Meetings

During fiscal year 2017, the Board held four meetings. All of our directors who served in fiscal year 2017 attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board (held during the period for which such person has been a director) and (ii) the total number of meetings held by all committees of the Board on which such person served (during the periods that such person served).

Attendance of Directors at the Annual Meeting

Pursuant to our Governance Guidelines, our directors are encouraged to attend our Annual Meetings of Stockholders. Two of our directors attended our 2017 Annual Meeting of Stockholders.

Policies

Hedging and Pledging Policy

Our Board has adopted the Policy Regarding Insider Trading, Tipping and Other Wrongful Disclosures, or the Insider Trading Policy. The Insider Trading Policy prohibits employees (including part-time and temporary employees), officers, directors, consultants and contractors of the Company from hedging transactions with respect to shares of our common stock. The Insider Trading Policy also requires directors, executive officers and designated insiders to obtain pre-approval from one of the Company's Compliance Officers before pledging shares of our common stock.

Clawback Policy

Additionally, our Board has adopted the Policy Regarding Recoupment of Incentive Compensation upon Restatement or Misstatement of Financial Results, or as Required by Law, or the Clawback Policy. According to the Clawback Policy, if, in the opinion of the independent directors of the Board, the Company's financial results are materially misstated due in whole or in part to intentional fraud or misconduct by one or more of the Company's executive officers, the independent directors have the discretion to use their best efforts to remedy the fraud or misconduct and prevent its recurrence. The independent directors may, for up to five (5) years following such misstatement and subject to the limitations herein, direct that the Company recover all or a portion of any bonus or incentive compensation paid, or cancel the stock-based awards granted, to the executive officer(s), as well as seek to recoup any gains realized with respect to equity-based awards, including stock options and RSUs. However, these "clawbacks" can only ensue if the following conditions have been met: (1) the bonus or incentive compensation to be recouped was calculated based upon the financial results that were restated, (2) one or more executive officers engaged in the intentional misconduct, and (3) the bonus or incentive compensation calculated under the restated financial results is less than the amount actually paid or awarded.

Certain Relationships and Related Transactions and Director Independence

Policies and Procedures for Related Party Transactions

Our Board has adopted a written related person transaction policy, which sets forth the policies and procedures for the review and approval or ratification of related person transactions. This policy covers, with certain exceptions set forth in Item 404 of Regulation S-K under the Securities Act of 1933, as amended (the “Securities Act”), any transaction, arrangement, or relationship, or any series of similar transactions, arrangements, or relationships in which we were or are to be a participant, the amount involved exceeds $120,000, and a related person had or will have a direct or indirect material interest, including, without limitation, purchases of goods or services by or from the related person or entities in which the related person has a material interest, indebtedness, guarantees of indebtedness, and employment by us of a related person. As provided by our Nominating and Corporate Governance Committee Charter, our Nominating and Corporate Governance Committee is responsible for reviewing and approving in advance any related party transaction and no related party transactions have been approved except in accordance with our policy.

Transactions with Related Parties

In addition to the director and executive officer compensation arrangements discussed under “Director Compensation” and “Executive Compensation,” the following is a summary of material provisions of transactions occurring since December 31, 2016, of which we have been a party and in which the amount involved exceeded or will exceed $120,000 and in which any of our directors, executive officers, beneficial holders of more than 5% of our common stock, or entities affiliated with them, have had or will have a direct or indirect material interest.

Real Property Leases. Under a triple net lease dated July 1, 2003, we rent our Watsonville, California manufacturing and office facilities from Robert C. Fox, Jr., the founder of our Subsidiary and a minority stockholder and director of our Company. Under this lease, we paid Mr. Fox $0.7 million for the year ended December 29, 2017, $0.8 million for the year ended December 30, 2016, and $1.2 million for the year ended December 31, 2015. The lease ends on June 30, 2020, and is subject to annual adjustments for cost-of-living based upon the Consumer Price Index. Under a sublease dated January 1, 2012 and sublease addendum dated June 28, 2013, we subleased approximately 3,665 square feet of space on the first floor of the building of our headquarters, 915 Disc Drive, Scotts Valley, California, to Mr. Fox. These premises are permitted to be used for research and development and office space. Under this sublease, Mr. Fox paid rent in the amount of $5,000 per month through June 30, 2015, at which time the sublease was canceled.

Related Party Employment. A family member of Mr. Fox, the founder of our Subsidiary and director of our Company, is employed by our Subsidiary as Director of Bike Operations. During the year ended December 29, 2017, the Director of Bike Operations earned salary of approximately $140,000 as well as incentive compensation of approximately $25,000. In July 2017, the Director of Bike Operations was awarded 650 RSUs with an aggregate market value of $24,993. The RSUs vest in four annual installments beginning in July 2018.

Compass. Compass Group Diversified Holdings, LLC ("Compass"), our former sponsor, was a selling stockholder in various offerings of common stock, which closed March 13, 2017, November 22, 2016, August 12, 2016, March 16, 2016, and July 16, 2014, respectively. Compass is managed by CGM. In addition, one of our former directors, Elias Sabo, owns a portion and is the sole manager of CGM.

Registration Rights Agreement. We entered into a registration rights agreement with Compass and certain other stockholders, which was most recently amended and restated in May 2013. The registration rights agreement provides our stockholders and their permitted transferees with certain demand registration rights in respect of the shares of our common stock held by them. Compass and Robert C. Fox, Jr. have exercised their rights under the registration rights agreement at various times. Both Compass and Robert C. Fox, Jr. have had certain of their shares of our common stock owned by them registered, pursuant to the registration rights agreement, on our Form S-1 Registration Statement filed in connection with our initial public offering in 2013 (File No. 333-189841), on our Form S-1 Registration Statement filed in connection with our follow-on public offering in 2014 (File No. 333-196945) and most recently on our Form S-3 Registration Statement (File No. 333-203146) initially filed in March, 2015 and supplemented by our prospectus supplements dated March 7, 2017, November 16, 2016, August 8, 2016, and March 11, 2016 to the base prospectus contained in the Registration Statement, filed by the Company with the Securities and Exchange Commission pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended. We estimate that we will spend approximately $4 million in the aggregate on registering our common stock under the Registration Statements mentioned above, such estimate includes the estimate of expenses relating to the most recent registration in March, 2017 and is inclusive of expenses incurred with respect to the registration of our common stock by us and by Compass and Robert C. Fox, Jr.

Director Independence

The rules and listing standards of NASDAQ, or the Nasdaq Listing Rules, generally require a majority of the members of our Board satisfy the Nasdaq Listing Rules criteria for “independence.” No director qualifies as independent under the Nasdaq Listing Rules unless our Board affirmatively determines that the director does not have a relationship with us that would impair independence (directly or as a partner, stockholder or officer of an organization that has a relationship with us). Our Board has determined that Messrs. Mendenhall, Waitman, Dennison, and Duncan and Ms. Fetter are currently independent directors as defined under the Nasdaq Listing Rules. Additionally, while serving as directors of the Company in 2017, Mr. Carl Nichols and Mr. Joseph Hagin were determined by the Board to be independent directors as defined under the Nasdaq Listing Rules. Mr. Enterline and Mr. Fox have been determined to not be independent by our Board and Mr. Elias Sabo was determined to not be independent by our Board during his service on the Board in 2017. See “Certain Relationships and Related Transactions and Director Independence-Related Party Employment” and “Certain Relationships and Related Transactions and Director Independence-Real Property Leases” above for additional information.

Nominations of Directors and Diversity

Consideration of Director Nominees

The Nominating and Corporate Governance Committee annually assesses the size and composition of the Board in light of our operating requirements and has determined that seven is the appropriate number of directors to have on the Board. The Nominating and Corporate Governance Committee also identifies and makes recommendations to the Board with respect to candidates for election as directors by stockholders at our Annual Meetings of Stockholders. The Nominating and Corporate Governance Committee reviews candidates with certain criteria in mind, including, but not limited to: (a) qualities of intelligence, honesty, perceptiveness and responsibility; (b) a general interest in FOX and a recognition that, as a member of the Board, each director is accountable to the stockholders of FOX; (c) having a background that demonstrates an understanding of business and financial affairs of other organizations of comparable or large purpose, complexity and size, and subject to similar or greater legal restrictions and oversight; (d) being able to contribute to the effective management of the Company, taking into account the needs of the Company and such factors as the individual’s experience, perspective, skills and knowledge of the industries in which the Company and its subsidiaries operate; (e) having no conflict of interest or legal impediment that would interfere with the duty of loyalty owed to the Company and its stockholders; (f) having no relationships that might impair his or her independence, including, but not limited to, business, financial or family relationships with the Company’s management; (g) possessing skills necessary for service on any Board committee; (h) being compatible and able to work well with other directors and executives in a team effort with a view to a long-term relationship with the Company as a director; and (i) possessing skills necessary for service on any Board committee. These criteria are set forth in the Nominating and Corporate Governance Committee Charter.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders provided the procedures set forth below are followed by stockholders in submitting recommendations, as provided for in the Fox Factory Holding Corp. Policy Regarding Security Holder Recommendations of Director Nominees. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates a candidate for nomination to the Board based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board at an Annual Meeting of Stockholders must do so by delivering no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s Annual Meeting of Stockholders a written recommendation to the Nominating and Corporate Governance Committee c/o Fox Factory Holding Corp., 915 Disc Drive, Scotts Valley, CA 95066, Attn: General Counsel and must meet the deadlines and other requirements set for in our Amended and Restated Bylaws (the “Bylaws”), the Fox Factory Holding Corp. Policy Regarding Security Holder Recommendations of Director Nominees and the rules and regulations of the SEC. If a proposed director candidate is recommended by a stockholder in accordance with the procedural requirements discussed above, the General Counsel will provide the stockholder recommendation to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will evaluate the proposed director’s candidacy and recommend whether the Board should nominate the proposed director candidate for election by our stockholders.

Diversity

The Nominating and Corporate Governance Committee has adopted a formal Diversity Policy within the Nominating and Corporate Governance Committee Charter. The Nominating and Corporate Governance Committee believes that differences in experiences, knowledge, skills and viewpoints enhance the Board’s overall performance. The Nominating and Corporate Governance Committee implements its Diversity Policy by considering such characteristics, among others, in selecting, evaluating and recommending proposed director candidates. In accordance with the Nominating and Corporate Governance Committee Charter, the Board performs an annual self-assessment of its performance and effectiveness, which seeks to identify any specific areas requiring improvement, including with respect to diversity.

Communications with the Directors

Stockholders wishing to communicate with the Board or an individual director may send a written communication to the Board or such director, c/o Fox Factory Holding Corp., 915 Disc Drive, Scotts Valley, CA 95066, Attn: General Counsel. Communications may also be sent to the General Counsel by email at dhaugen@ridefox.com.

Each communication must be in the form described in the Fox Factory Holding Corp. Process for Security Holder Communications with the Board of Directors, which is posted on our website at http://investor.ridefox.com/. Communications determined by our General Counsel to be appropriate for presentation to the Board or such director will be submitted to the Board or such director on a periodic basis. Any communications that concern questionable accounting or auditing matters involving us will be handled in accordance with the terms or our Code of Ethics.

Board of Directors, Executive Officers and Committees

Certain Information Regarding our Directors and Executive Officers

The name and age of each director, nominee and executive officer and the positions held by each of them as of the date of this proxy statement are as follows:

|

| | | | | | |

| Name | | Age | | Class | | Position |

| Larry L. Enterline | | 65 | | Class III | | Director and Chief Executive Officer |

| Zvi Glasman | | 54 | | - | | Chief Financial Officer and Treasurer |

| Thomas Wittenschlaeger | | 60 | | - | | President, Powered Vehicles Division |

| William H. Katherman | | 59 | | - | | Senior Vice President, Global Operations |

| Wesley Allinger | | 53 | | - | | Vice President and General Manager, Bicycle Division |

| Dudley Mendenhall | | 63 | | Class I | | Director and Chairman of the Board |

| Michael Dennison (1) | | 50 | | Class II | | Director |

| Thomas Duncan (2) | | 53 | | Class III | | Director |

| Elizabeth Fetter (3) | | 59 | | Class I | | Director |

| Robert C. Fox, Jr. | | 78 | | Class III | | Director |

| Ted Waitman | | 68 | | Class II | | Director |

(1) Mr. Dennison was appointed to our Board effective February 23, 2018.

(2) Mr. Duncan was appointed to our Board effective July 24, 2017.

(3) Ms. Fetter was appointed to our Board effective June 13, 2017.

Executive Officers who are not Directors

Zvi Glasman first joined us in January 2008, prior to our IPO, as Chief Financial Officer of our Subsidiary, initially as a consultant until his employment under the same title in September 2008. In connection with our IPO, which occurred in August 2013, we engaged Mr. Glasman to serve directly as our Chief Financial Officer, in addition to his position with our Subsidiary. Prior to joining our Subsidiary, Mr. Glasman served as Chief Financial Officer of Motive Eyewear, Inc., an eyewear supplier, from 2005 until 2008. From 2003 to 2005, he was Chief Financial Officer at Marshall & Swift, a software company focused on providing valuation solutions to the insurance and real estate industries, and from 2001 to 2003, he served as Chief Financial Officer of RealTimeImage Inc. ("RTI"), an internet infrastructure company providing imaging products and services for the graphic arts and medical communities. Mr. Glasman is an inactive certified public accountant. He earned a BS in Finance from Pennsylvania State University in 1985.

Thomas Wittenschlaeger has served as President, Powered Vehicles Division since May 2017. Prior to serving in this role, Mr. Wittenschlaeger served as Vice President and General Manager, Powered Vehicles Division from January 2015 to May 2017. Prior to joining the Company, Mr. Wittenschlaeger served as President of NanTronics, Inc. a provider of fiber networks, data centers, cloud computing and associated algorithmic software from 2012 to 2015. From 2011 to 2012, he served as Chairman and Chief Executive Officer of Keyon Communications Holdings, Inc., a provider of rural broadband services within the United States. From 2007 to 2012, he served on the board of directors of Lantronix, a leading global provider of IoT technologies and products, including in the capacity of Chairman of the board. From 2004 to 2011, Mr. Wittenschlaeger served as Chairman and Chief Executive Officer of Raptor Networks Technology, Inc., which was engaged in the core network switching and fabric computing industry. Mr. Wittenschlaeger has also held various executive-level positions across multiple industries, including 16 years at the Hughes Aircraft Company. Mr. Wittenschlaeger graduated from the U.S. Naval Academy in 1979 with a BS in Electrical Engineering, is a graduate of the Executive Program in Management at UCLA and served in the U.S. Navy in nuclear submarines from 1979 to 1984.

William H. Katherman has served as Senior Vice President, Global Operations since February 2014. Prior to this role, Mr. Katherman served as the Company’s Vice President, Supply Chain since September 2012. Prior to joining the Company, Mr. Katherman served as Managing Director of Cisco Systems Video Technology, a producer of Cable Television Set-top Boxes, based in Shanghai, China from 2009 to 2012. From 1996 to 2008, Mr. Katherman served in various management roles, including Vice President and Managing Director of Asia Operations, based in Shanghai, China for Scientific-Atlanta, Inc., a Georgia-based manufacturer of cable television, telecommunications and broadband equipment. Mr. Katherman is a graduate of General Electric’s Financial Management Program and earned a BS in Business Administration from the University of Kansas in 1980.

Wesley Allinger has served as Vice President and General Manager, Bicycle Division since January 2014. Prior to serving in this role, Mr. Allinger served as the General Manager for the powersports division of the Company from 2007 to 2013 and Engineering Manager for the powersports division of the Company from 2001 to 2007. Prior to joining the Company, Mr. Allinger served in various engineering capacities including Director of Engineering at RockShox, a producer of bicycle suspension products, from 1997 to 2001. Mr. Allinger worked as an engineer at General Motors from 1989 to 1997, including work associated with vehicle ride and handling and interior Acoustics. Mr. Allinger spent two years working for a structural consulting firm in Warren, Michigan. Mr. Allinger earned his BS in Engineering from Oakland University in Rochester, Michigan, in 1988.

Executive officers. Our executive officers are elected by, and serve at the discretion of, our Board. There are no familial relationships between our directors and executive officers.

Committees of the Board of Directors

The composition and responsibilities of each of the separately designated standing committees of our Board are described below. Members serve on these committees until their earlier death, resignation or removal.

Audit Committee. Our Audit Committee held four meetings during fiscal year 2017 and is currently comprised of Ms. Fetter and Messrs. Mendenhall and Waitman, with Mr. Mendenhall serving as Chairman of the committee. Our Board has determined that each member of the Audit Committee is “independent” and “financially literate” under the Nasdaq Listing Rules and the SEC rules and regulations and that Mr. Mendenhall is an “audit committee financial expert” under the rules of the SEC. The responsibilities of the Audit Committee are included in its written charter, a current copy of which is available on our website http://investor.ridefox.com/. The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Exchange Act. The functions of this committee include, among others:

| |

| • | appointing, retaining, terminating, determining compensation for, and overseeing the independent registered public accounting firm; |

| |

| • | reviewing the scope of the audit by the independent registered public accounting firm; |

| |

| • | inquiring into the effectiveness of our accounting and internal control functions; |

| |

| • | assisting our Board in fulfilling its oversight responsibilities relating to the integrity of our financial statements, our compliance with legal and regulatory requirements, our adherence to policies regarding ethics and business practices and our enterprise risk-management practices; |

| |

| • | approving, or pre-approving, all audit and all permissible non-audit services, other than de minimus non-audit services, to be performed by the independent registered public accounting firm; and |

| |

| • | obtaining and reviewing a report by the independent registered public accounting firm, at least annually, that describes our internal control procedures, any material issues with such procedures, and any steps taken to deal with such issues. |

Compensation Committee. Our Compensation Committee held five meetings in fiscal year 2017 and is currently comprised of Ms. Fetter and Messrs. Mendenhall and Waitman, with Mr. Waitman serving as Chairman of the committee. Our Board has determined that each member of the committee is “independent” under the Nasdaq Listing Rules and all applicable laws. Each of the members of this committee is also a “nonemployee director” as that term is defined under Rule 16b-3 of the Exchange Act and an “outside director” as that term is defined in Treasury Regulations Section 1.162-27(3). The responsibilities of the Compensation Committee are included in its written charter, a current of which is available on our website http://investor.ridefox.com/. The functions of this committee include, among others:

| |

| • | determining, or recommending to our Board for determination, the compensation of our Chief Executive Officer, our other executive officers, and direct reports to the Chief Executive Officer, and reviewing and approving or recommending to our Board for approval performance goals relevant to such compensation; |

| |

| • | evaluating and recommending the type and amount of compensation to be paid or awarded to the members of our Board; |

| |

| • | approving, periodically evaluating and proposing amendments to long-term incentive plans; |

| |

| • | evaluating and recommending to our Board new equity incentive plans, compensation plans and similar programs advisable for us, as well as recommending to our Board the modification or termination of existing plans and programs; and |

| |

| • | establishing or recommending policies with respect to compensation arrangements, including recoupment policies. |

The Compensation Committee may delegate authority to the Chief Executive Officer to grant rights in, or options to purchase, shares of our common stock to eligible employees who are not executive officers, subject to certain limitations.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee held 12 meetings in fiscal year 2017 and is currently comprised of Messrs. Mendenhall, Duncan and Waitman, with Mr. Duncan serving as Chairman of the committee. Our Board has determined that each member of the committee is “independent” under the Nasdaq Listing Rules and all applicable laws. The responsibilities of the Nominating and Corporate Governance Committee are included in its written charter, a current copy which is available on our website http://investor.ridefox.com/. The functions of this committee include, among others:

| |