UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

|

| Check the appropriate box: |

☐ Preliminary Proxy Statement |

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ Definitive Proxy Statement |

☐ Definitive Additional Materials |

☐ Soliciting Material under § 240.14a-12 |

FOX FACTORY HOLDING CORP.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than Registrant)

| | |

| Payment of Filing Fee (Check all boxes that apply): |

☒ No fee required. |

| ☐ Fee paid previously with preliminary materials |

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

March 22, 2023

A Message from our Chief Executive Officer

Dear Stockholders:

Thank you for your support of Fox Factory Holding Corp. We had another remarkable year in our company’s history. Despite the tough economic and operational backdrop, I am incredibly proud to say this was another record-shattering year for top and bottom line growth. As you consider these strong results, be mindful that our momentum is fueled by leaning on our core values - Leadership, Collaboration, Service, Trust, Agility & Ingenuity. I’m proud of our team’s dedication and tenacity as they capitalized on opportunities while navigating the challenges 2022 brought forward. We are pulling ahead of our competition thanks to the meaningful relationships with our OEMs, enthusiasts, and the continued application of our 5-year strategy. Our consistent strong performance relies on two primary factors: the power of our brands and the sustainability of our diversified portfolio.

Our stellar performance can be attributed to our expanded portfolio of high-performance products, which continues to deliver on quality, engineering, and service that consistently resonates with our end customers. Our impressive top and bottom-line performance clearly demonstrate that our customers differentiate our premium products from those of our competitors. Our brands represent what our company stands for – a culture of innovation and a commitment to deliver best-in-class products to our ever-growing base of performance-driven enthusiasts.

In 2022, we published our inaugural sustainability report that detailed our sustainability strategic framework. The strategy focuses on three integrated impact pillars: People, Planet, & Product - supported by excellence in business fundamentals. We also celebrated the one-year anniversary of Trail Trust, our signature global community outreach initiative. In our inaugural year, we partnered with over 70 nonprofits around the world to deliver on this mission, donating over $1 million across seven countries.

We are heading into 2023 with great momentum. Our plan is to position ourselves to seize growth opportunities and position us well for the eventual return of economic stability. We will continue to invest in the people, technology, and innovation that drive customer loyalty and retention. We firmly believe in our vision of building a $2B business by 2025 driven by the organic growth of our amazing brands. And as we remain focused on delivering our near term commitments, we will continue to lay the foundation for growth and success beyond 2025.

I hope that we can count on your continued support as an investor or customer—ideally both—and cordially invite you to attend Fox Factory's 2023 Annual Meeting of Stockholders, which will be held via webcast on Friday, May 5, 2023, at 1:00 p.m. Eastern Daylight TIme. Please note that this year's Annual Meeting will be held virtually, which means that you will be able to register and vote online by visiting www.proxypush.com/FOXF. Please visit www.proxydocs.com/FOXF for complete details. I look forward to speaking with you then.

| | |

| Sincerely, |

|

| Michael C. Dennison |

| Director and Chief Executive Officer |

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 5, 2023 Fox Factory Holding Corp.’s 2023 Annual Meeting of Stockholders (the "Annual Meeting") will be held via webcast on Friday, May 5, 2023, at 1:00 p.m. Eastern Daylight TIme. This year's Annual Meeting will be in virtual meeting format only, which means that you will be able to participate in the meeting, vote and submit your questions during the meeting online by visiting www.proxypush.com/FOXF. You will not be able to attend the Annual Meeting in person.

The purposes of the meeting are to:

1. Elect two Class I directors, as described in the Proxy Statement, each to serve for a term to expire at the 2026 Annual Meeting of Stockholders;

2. Ratify the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2023;

3. Vote on an advisory resolution to approve the Company’s executive compensation;

4. Amend our amended and restated certificate of incorporation (our "Certificate of Incorporation") to allow for the exculpation of officers; and

5. Amend and restate our Certificate of Incorporation to update, clarify and remove outdated provisions.

The stockholders will also consider and act upon such other matters as may properly come before the meeting, or any adjournment or postponement thereof.

These matters are more fully described in the Proxy Statement. The Board of Directors recommends that you vote "FOR" all the nominated directors, "FOR" the ratification of the independent public accountants, and "FOR" the advisory approval of the Company’s executive compensation, "FOR" the amendment to our Certificate of Incorporation to allow for the exculpation of officers, and "FOR" the amendment and restatement of our Certificate of Incorporation to update, clarify and remove outdated provisions. The Board of Directors knows of no other matters at this time that may be properly brought before the meeting.

Stockholders of record at the close of business on March 7, 2023 are entitled to notice of, and to vote at, the Annual Meeting and any subsequent adjournments or postponements thereof. A list of these stockholders will be available for inspection for 10 days preceding the Annual Meeting at our principal executive offices located at 2055 Sugarloaf Circle, Suite 300, Duluth GA 30097. The Notice of Annual Meeting, Proxy Statement, Proxy Card, Annual Report, and other Proxy Materials are first being sent or made available to stockholders on or about March 22, 2023.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

We are pleased to save costs and help protect the environment by using the Notice and Access method of delivery. Instead of receiving paper copies of our Proxy Materials in the mail, many stockholders will receive a Notice of Internet Availability of Proxy Materials ("Notice"), which provides an internet website address where stockholders can access electronic copies of Proxy Materials and vote. This website also has instructions for voting by telephone and for requesting paper copies of the Proxy Materials and proxy card. The Company's 2023 Proxy Statement and Annual Report for fiscal year 2022 are available online at www.proxydocs.com/FOXF. We encourage you to access and review such materials before voting.

Your vote is important to us. Whether or not you expect to attend the Annual Meeting via webcast, we urge you to consider the Proxy Statement carefully and to promptly vote your shares either by (1) voting through the internet at the website shown on the proxy card or Notice or by telephone at the telephone number shown on the proxy card or Notice; or (2) if you received paper copies of your Proxy Materials in the mail, complete, date, sign, and return the enclosed proxy card as promptly as possible. Completing a proxy card or voting through the internet or telephone will not prevent you from voting by following the instructions on the website during the webcast, but will assure that your vote is counted, if, for any reason, you are unable to attend. Our proxy tabulator, Mediant Communications, Inc., must receive any proxy that will not be delivered during the webcast to the Annual Meeting by 11:59 p.m. Eastern Daylight Time on Thursday, May 4, 2023.

| | |

| By Order of the Board of Directors, |

|

| Toby D. Merchant |

| Chief Legal Officer and Secretary |

| Duluth, GA |

| March 22, 2023 |

TABLE OF CONTENTS | | | | | |

| Page |

| PROXY SUMMARY | |

| QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT AND THE ANNUAL MEETING | |

| ELECTION OF CLASS I DIRECTORS (Proposal 1) | |

| RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Proposal 2) | |

| DIRECTOR COMPENSATION | |

| CORPORATE GOVERNANCE | |

| The Board of Directors | |

| Certain Relationships and Related Transactions and Director Independence | |

| Nominations of Directors and Diversity | |

| Corporate Social Responsibility | |

| Communications with the Directors | |

| Board of Directors, Executive Officers and Committees | |

| EXECUTIVE COMPENSATION | |

| Compensation Discussion and Analysis | |

| Summary Compensation Table - Fiscal Years 2022, 2021, and 2020 | |

| Grants of Plan-Based Awards Table - Fiscal Year 2022 | |

| Outstanding Equity Awards at Fiscal Year-End Table - Fiscal Year 2022 | |

| Stock Vested Table - Fiscal Year 2022 | |

| Equity Compensation Plan Information | |

| Equity-Based Incentive Plans | |

| Change of Control, Separation or Severance Benefits | |

| Employment Agreements | |

| Estimated Potential Payments upon Change of Control or Certain Termination Events | |

| CEO Pay Ratio | |

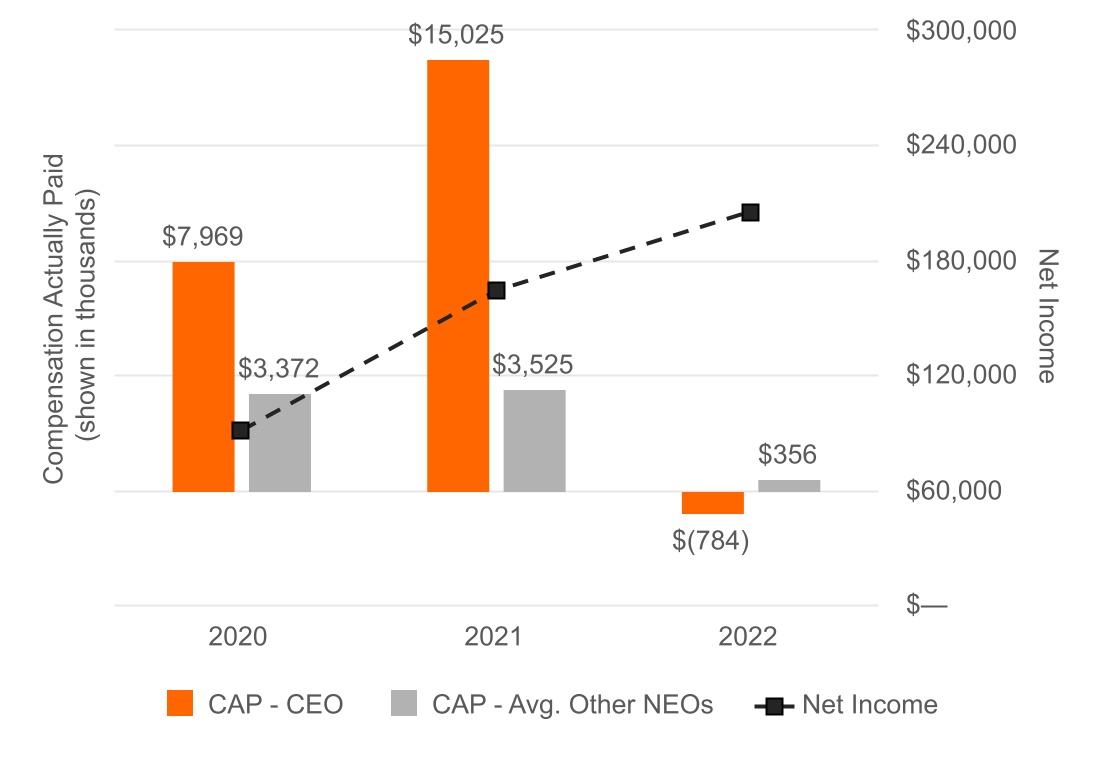

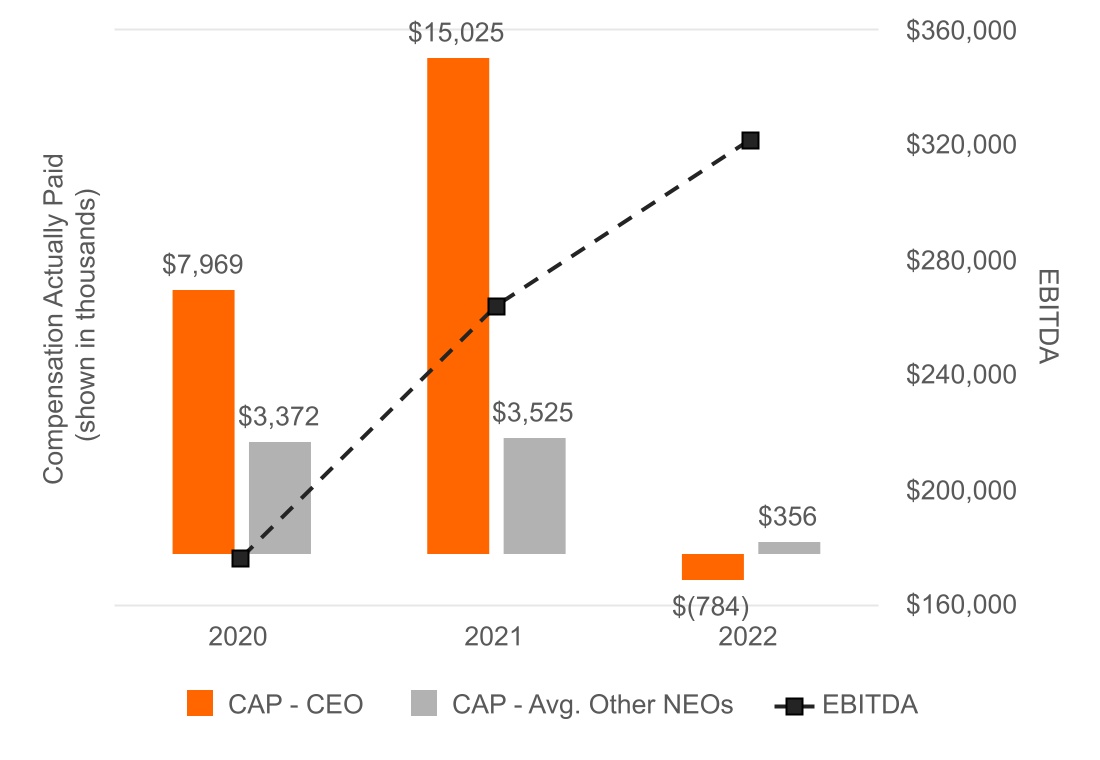

| Pay vs. Performance Comparison | |

| COMPENSATION COMMITTEE REPORT | |

| AUDIT COMMITTEE REPORT | |

| ADVISORY VOTE ON THE COMPANY'S EXECUTIVE COMPENSATION (Proposal 3) | |

| AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO ALLOW FOR THE EXCULPATION OF OFFICERS (Proposal 4) | |

| AMENDMENT AND RESTATEMENT OF OUR CERTIFICATE OF INCORPORATION TO UPDATE, CLARIFY AND REMOVE OUTDATED PROVISIONS (Proposal 5) | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| DELINQUENT SECTION 16(a) REPORTS | |

| SUBMISSION OF STOCKHOLDER PROPOSALS FOR 2024 | |

| ATTENDING THE ANNUAL MEETING VIA WEBCAST | |

| DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS | |

| ANNEX A - NON-GAAP MEASURES | |

| | | | | |

| ANNEX B - AMENDED AND RESTATED CERTIFICATE OF INCORPORATION | |

| This Proxy Statement and the accompanying materials contain “forward-looking” statements regarding Fox Factory Holding Corp.’s (the “Company”) current expectations within the meaning of the applicable securities laws and regulations. Forward-looking statements generally are identified by words such as “may,” “might,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “likely,” “potential” or “continue” or other similar terms or expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the Company’s control and are difficult to predict. These risks and uncertainties include, but are not limited to, the factors and risks detailed in the Company filings with the Securities and Exchange Commission, including the sections entitled “Special Note Regarding Forward-Looking Statements’ and “Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 30, 2022. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. |

PROXY SUMMARY

2023 Annual Meeting of Stockholders

| | | | | |

| Date and Time | Virtual Stockholder Meeting (Via Webcast) |

| May 5, 2023, 1:00 p.m. EDT | Register at www.proxydocs.com/FOXF |

| Record Date | Voting Eligibility |

| March 7, 2023 | Owners of our common stock as of the Record Date are entitled to vote on all matters |

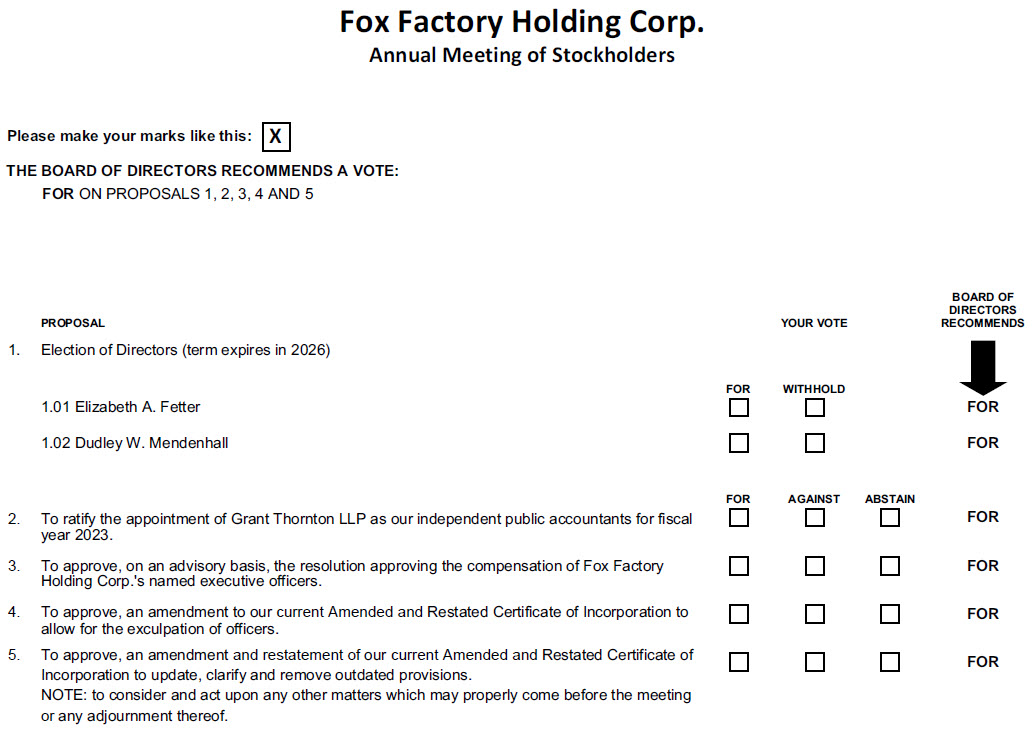

Voting Items and Board Recommendations

| | | | | | | | | | | |

| Item | Proposal | Board Vote Recommendation | Page Reference |

| | | |

| 1 | Elect two Class I directors | FOR | |

| | | |

| 2 | Ratify the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2023 | FOR | |

| | | |

| 3 | Approve an advisory resolution on our executive compensation | FOR | |

| | | |

| 4 | Approve the amendment to our Certificate of Incorporation to allow for the exculpation of officers | FOR | |

| | | |

| 5 | Approve the amendment and restatement of our Certificate of Incorporation to update, clarify and remove outdated provisions | FOR | |

| | | |

2022 Performance Highlights Overview of Business

Our company, Fox Factory Holding Corp., designs, engineers, manufactures and markets performance-defining products and systems for customers worldwide. Our premium brand, performance-defining products and systems are used primarily on bicycles ("bikes"), side-by-side vehicles ("side-by-sides"), on-road vehicles with and without off-road capabilities, off-road vehicles and trucks, all-terrain vehicles ("ATVs"), snowmobiles, and specialty vehicles and applications.

Some of our products are specifically designed and marketed to some of the leading cycling and powered vehicle original equipment manufacturers ("OEMs"), including Giant, Orbea, Canyon Bicycles, Yeti Cycles, Santa Cruz Bicycles, Trek Bicycles and Specialized in bikes, and Ford, Polaris, BRP, Toyota, Yamaha, Honda, and Jeep in powered vehicles, while others are distributed to consumers through a global network of dealers and distributors.

Additionally, we upfit trucks to be off-road capable, on-road vehicles with product offerings such as lift kits and components with our shock products, superchargers, interior accessories, wheels, tires, lighting, and body enhancements. We also offer mountain and road bike wheels and other performance-defining cycling components including cranks, chainrings, pedals, bars, stems, and seat posts.

FOX is an aspirational brand and we believe many of our OEMs often prominently display and incorporate our products to improve the marketability and consumer demand for their performance models, while professional athletes using our products are consistently successful in elite competitive events around the world providing our products exposure and demonstrating their performance capabilities, all of which, we believe, reinforces our premium brand image and positively influences the purchasing habits of enthusiasts and other consumers seeking high-performance products.

Based on our strong operational and financial results in 2022, as discussed below, as well as our outlook for 2023, we continue to opportunistically expand our total available market through potential acquisitions beyond our current product categories. We believe there may be opportunities to acquire other recognized brands that are valued by that same passionate customer. We are also evaluating “white space” opportunities to expand our premium brand into relevant performance-defining adjacencies.

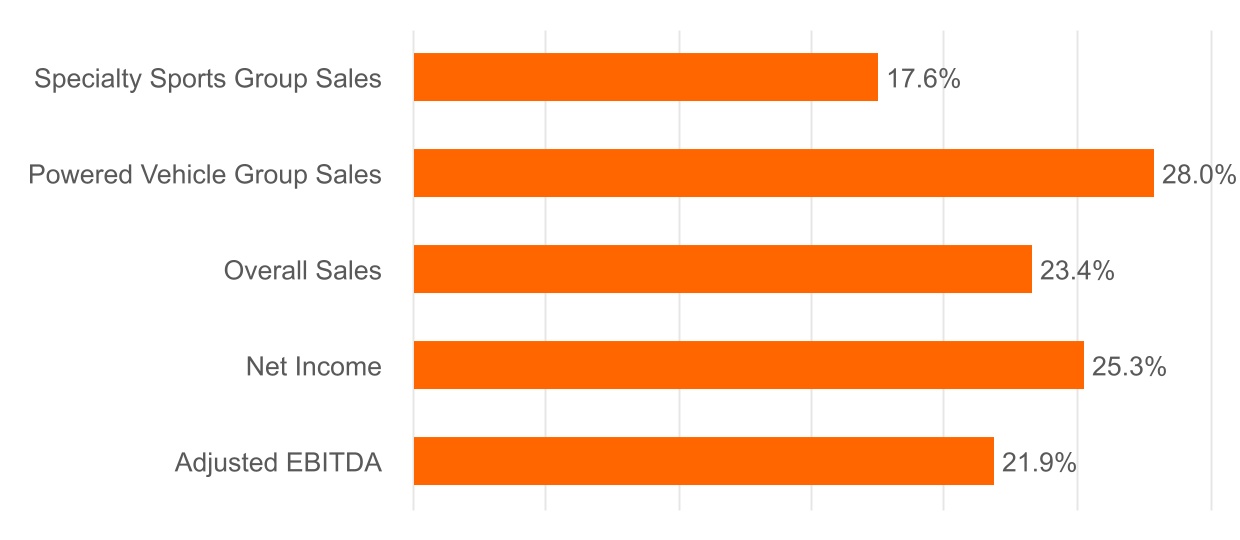

2022 Performance Highlights and Key Accomplishments

Record Financial Results

We delivered record financial results in fiscal year 2022. We benefited from consistent execution and favorable business fundamentals in our Powered Vehicles Group ("PVG") and in our Specialty Sports Group ("SSG") and the sustainability of our diversified portfolio. Our broad-based growth led to annual sales and profitability well above our initial expectations, despite the challenges presented by inflationary pressures and tightening monetary conditions.

FY2022 RESULTS

| | | | | |

| Sales | $1,602.5 million |

| |

| Net income | $205.3 million |

| |

| Earnings per diluted share | $4.84 |

| |

| Non-GAAP adjusted net income* | $232.7 million |

| |

| Adjusted earnings per diluted share* | $5.49 |

| |

| Adjusted EBITDA* | $321.8 million |

| |

* Reconciliations of non-GAAP measures are provided in Annex A, attached hereto.

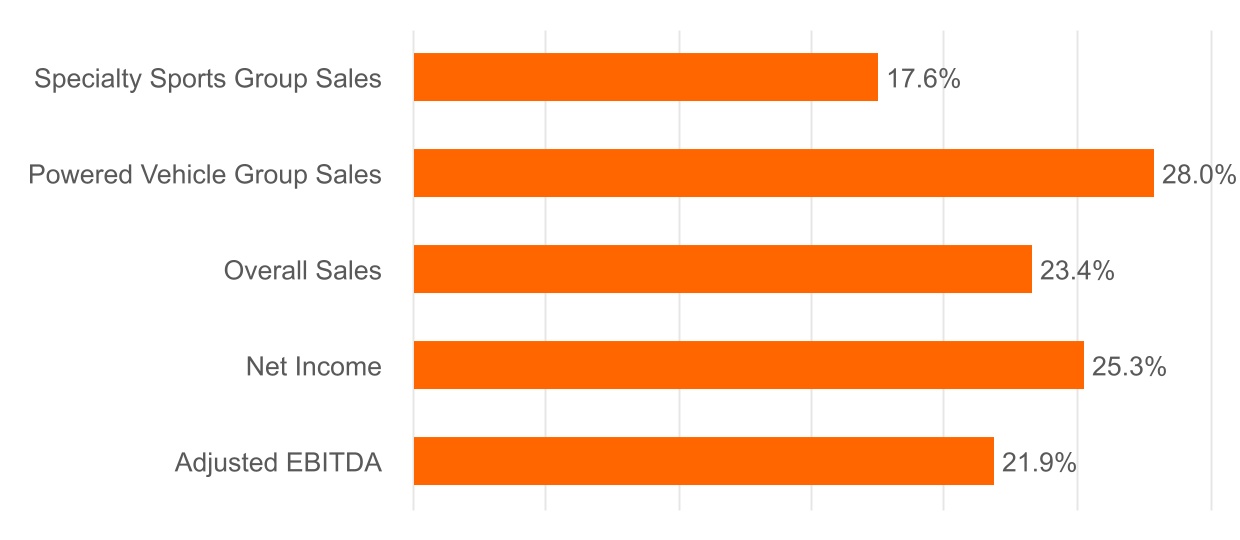

FY2022 Percentage Increases (Year over Year)

Key Management and Governance Developments

On August 5, 2022, Richard T. Winters agreed to step down from his role as President, PVG and transitioned to a Senior Executive Advisor role.

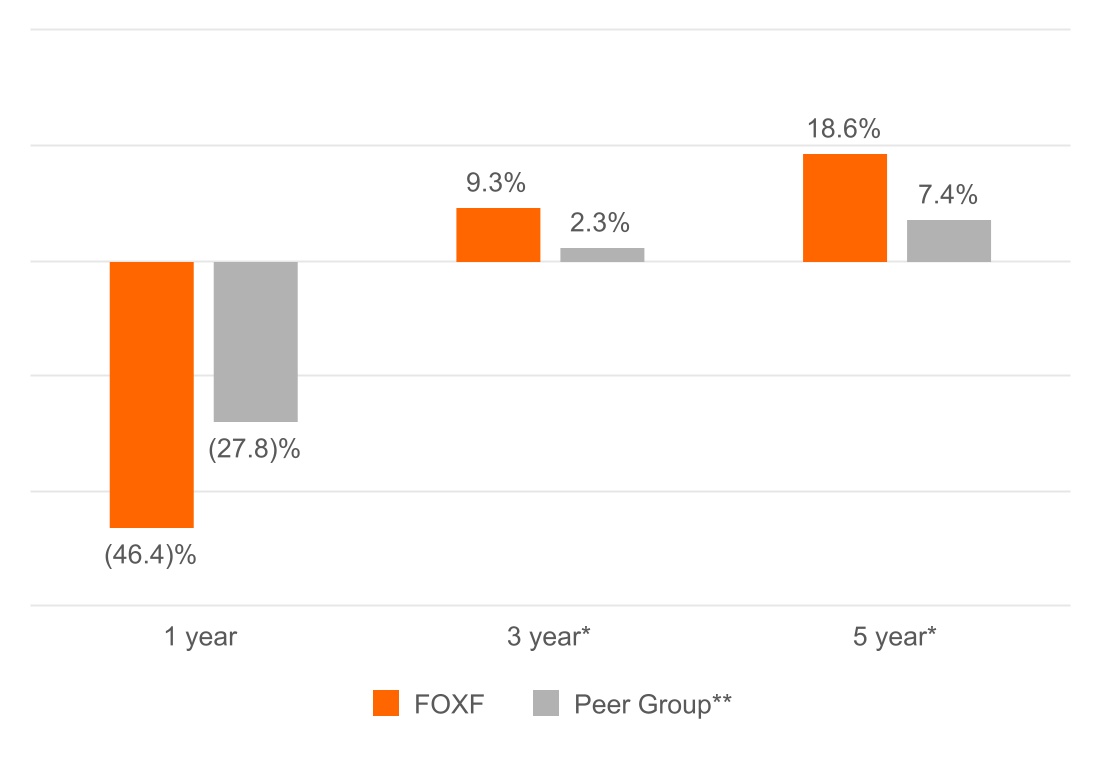

Say-on-Pay Responsiveness We value our stockholders' perspectives regarding our corporate governance, sustainability and executive compensation practices, as well as our business strategy and public disclosures. In May 2022, we were pleased to receive approximately 93% stockholder support for our Say-on-Pay proposal. Abstention votes and broker non-votes were at 3%.

We conduct ongoing reviews of both our governance and executive compensation practices to ensure that we maintain best practices and enhanced disclosure in our Proxy Statement and other Securities and Exchange Commission ("SEC") filings. We also work to expand and enhance our public disclosure around the topics of interest to our stockholders.

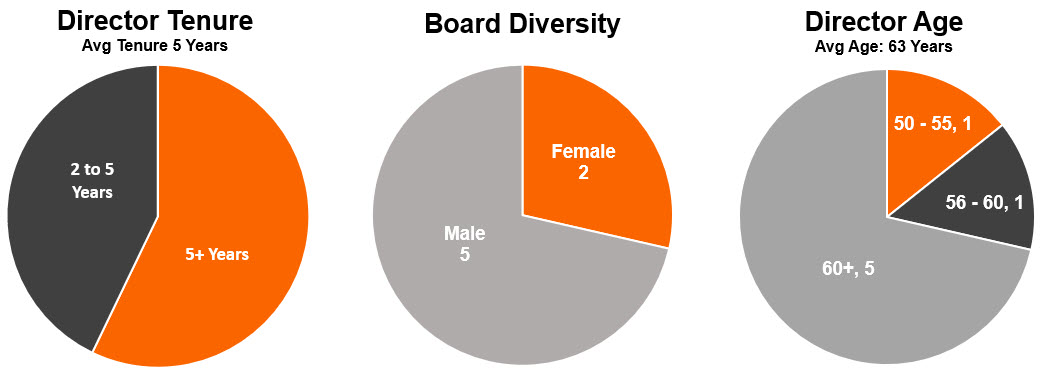

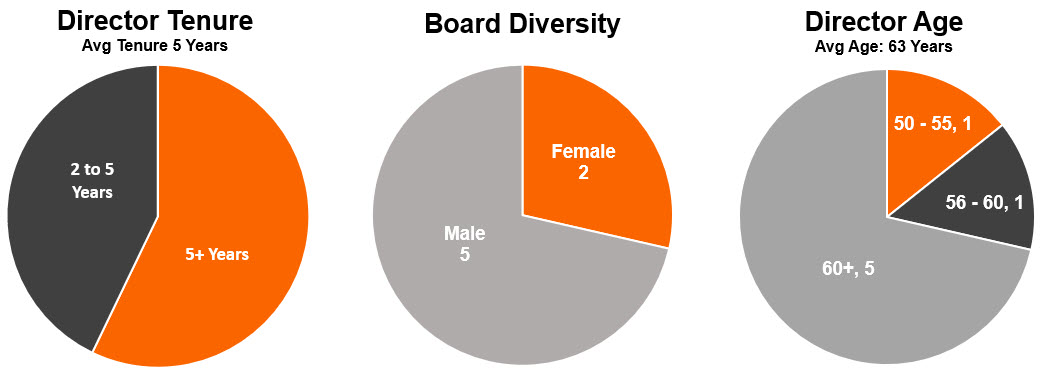

Strong, Well-Balanced Corporate Governance Practices •Highly Qualified Board. Our directors bring deep industry experience to provide effective oversight in the boardroom.

•Independent Board Leadership. The Board does not have a policy as to whether the Chair should be an independent director, but when the Chair is not an independent director, the independent directors appoint a “Lead Independent Director.” The Lead Independent Director is responsible for: approving Board meeting agendas; in consultation with the non-employee directors and the Executive Chair, when applicable, approving Board meeting schedules to ensure there is sufficient time for discussion of all agenda items; approving the type of information to be provided to directors for Board meetings; presiding at all executive sessions of the non-employee directors (which are held after all Board meetings); when applicable, serving as liaison between the Executive Chair and the independent directors; being available for consultation and direct communication with the Company’s stockholders; calling meetings of the non-employee directors when necessary and appropriate; and performing such other duties as the Board may from time to time designate.

•Focus on Board Diversity. The Board adopted a formal Board Inclusion and Diversity Policy in May 2021 to ensure the use of a diverse and inclusive lens in identifying, evaluating, nominating and selecting members of the Board. While this Policy is specifically applicable to the Board, it acts in concert with the behaviors outlined in the FOX Code of Ethics, Employee Handbook, and other global policies that outline the Company’s broader commitment to inclusion, diversity, and engagement.

•Mix of Company History and Fresh Ideas. We believe our current board tenure and composition reflects an appropriate mix of historical company knowledge and fresh perspectives.

•Awareness and Oversight of Sustainability Matters. In 2022, we embarked on a journey to identify the sustainability topics that we believe are most important to our stakeholders and business success through a comprehensive materiality assessment. We conducted over 40 interviews with company leaders, investors, athletes, and community nonprofits; held employee focus groups; and conducted desktop research to benchmark customers, competitors, and industry standards. This assessment informed our emerging sustainability strategy: Fox Factory Frontiers, which has three integrated impact pillars – People, Planet, and Product – supported by excellence in business fundamentals. This strategic framework is guiding our work in this space globally under the leadership of Jackie Martin, Chief Purpose and Inclusion Officer. The Nominating and Corporate Governance Committee Charter was updated in 2022 to reflect the Board’s growing oversight of the Company’s sustainability initiatives to ensure alignment with best practices. Please refer to the Corporate Social Responsibility section of this filing for an overview of the sustainability strategy.

The table below provides summary information about our two director nominees. Our directors are elected by a plurality of votes cast. For more information, refer to section Election of Class I Directors (Proposal 1). The Board recommends that you vote "FOR" both of the director nominees. | | | | | | | | | | | | | | |

| Name | Age | Director Since | Occupation | Committee(s) |

| Independent Directors |

| Elizabeth A. Fetter | 64 | June 2017 | Former CEO and President of Symmetricom Inc. | Chair of the Compensation Committee and Nominating and Corporate Governance Committee Member |

| Dudley W. Mendenhall | 68 | June 2013 | Former CFO of Solera Holding Inc.,

Former CFO of Websense Inc.,

Former CFO and Senior Vice President of K2 Inc. | Chair of the Board, Audit Committee Member, and Compensation Committee Member |

| | | | |

PROXY STATEMENT

Fox Factory Holding Corp. (which we refer to as “we,” “us,” “our,” “FOX” or the “Company”) is furnishing this Proxy Statement in connection with the solicitation by our Board of Directors (our “Board”) of proxies to vote at the 2023 Annual Meeting of Stockholders ("the Annual Meeting"), which will be held via webcast on Friday, May 5, 2023, at 1:00 p.m. Eastern Daylight TIme, or at any adjournment or postponement thereof.

We first sent or made available these Proxy Materials (as defined below) to our stockholders on or about March 22, 2023. A copy of this Proxy Statement, the proxy card and our Annual Report for fiscal year 2022 (collectively, the "Proxy Materials") can be found at the web address: www.proxydocs.com/FOXF. When we refer to the Company’s fiscal year, we mean the annual period ending on the Friday closest to December 31 of the stated year. Information in this Proxy Statement for 2022 generally refers to our 2022 fiscal year, which was from January 1, 2022 through December 30, 2022 (“fiscal year 2022”).

2023 ANNUAL MEETING INFORMATION

Date and Time. The Annual Meeting will be held “virtually” through a webcast on Friday, May 5, 2023, at 1:00 p.m. Eastern Daylight TIme. There will be no physical meeting location. The meeting will only be conducted via a webcast.

Access to the Webcast of the Annual Meeting. The webcast of the Annual Meeting will begin promptly at 1:00 p.m. Eastern Daylight TIme. Online access to the webcast will open approximately 30 minutes before the start of the Annual Meeting to allow time for you to log in and test your computer system. We encourage you to access the meeting prior to the start time.

Login Instructions. As the Annual Meeting is being conducted via a webcast, there is no physical meeting location. To attend the Annual Meeting, log in and register at www.proxydocs.com/FOXF. As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting and to vote and submit questions during the Annual Meeting. On the day of the Annual Meeting, stockholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the Annual Meeting. The Annual Meeting will begin promptly at 1:00 p.m. Eastern Daylight TIme. We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the virtual-only Annual Meeting platform, including any difficulties voting or submitting questions, you may call the technical support number that will be posted in your instructional email.

Submitting Questions at the Annual Meeting. Stockholders may submit questions when registering for the Annual Meeting or during the Annual Meeting once online access to the Annual Meeting is open. You will need your unique control number included on your proxy card (printed in the box and marked by an arrow) or on the instructions that accompanied your Proxy Materials. Questions pertinent to Annual Meeting matters will be answered during the Annual Meeting, subject to time constraints.

Voting Your Shares at the Annual Meeting. You may vote your shares at the Annual Meeting even if you have previously submitted your vote. For instructions on how to do so, see the section below titled “How do I vote my shares at the Annual Meeting?”.

QUESTIONS AND ANSWERS ABOUT

THIS PROXY STATEMENT AND THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will consider and vote on the following matters:

•Proposal 1: To elect two Class I directors, described in the Proxy Statement, each to serve for a term to expire at the 2026 Annual Meeting of Stockholders;

•Proposal 2: To ratify the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2023;

•Proposal 3: To vote on an advisory resolution to approve the Company's executive compensation;

•Proposal 4: To amend our amended and restated certificate of incorporation ("Certificate of Incorporation") to allow for the exculpation of officers; and

•Proposal 5: To amend and restate our Certificate of Incorporation to update, clarify and remove outdated provisions.

The stockholders will also consider and act on any other matters as may properly come before the meeting, or any adjournment or postponement thereof.

How are the Proxy Materials being delivered?

The SEC has adopted a “Notice and Access” rule that allows companies to deliver a Notice of Internet Availability of Proxy Materials, which we refer to as the Notice, to stockholders in lieu of a paper copy of the Proxy Materials. The Notice provides instructions as to how shares can be voted. Shares must be voted either by telephone, internet or by completing and returning a proxy card. Shares cannot be voted by marking, writing on and/or returning the Notice. Any Notices that are returned will not be counted as votes. Instructions for requesting a paper copy of the Proxy Materials are set forth on the Notice.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING:

The Proxy Materials are available at www.proxydocs.com/FOXF. Enter the unique control number located on the Notice or proxy card to access the Proxy Materials.

Who may attend the Annual Meeting?

Anyone who was a stockholder as of the close of business on March 7, 2023 may attend the Annual Meeting via webcast. Mediant Communications, Inc. (“Mediant”) has been selected as our inspector of election. As part of its responsibilities, Mediant is required to independently verify that you are a FOX stockholder eligible to attend the Annual Meeting and to determine whether you may vote in person at the Annual Meeting (via webcast).

Who is entitled to vote at the Annual Meeting?

Only stockholders of record of our common stock at the close of business on March 7, 2023, the record date, are entitled to vote at the Annual Meeting. There were 42,301,071 shares of our common stock outstanding on March 7, 2023. Such stockholders of record are entitled to cast one vote per share on all matters.

How do I participate in the Annual Meeting?

Instructions on how to connect and participate in the Annual Meeting, including how to demonstrate proof of ownership of our common stock, are posted at www.proxydocs.com/FOXF. To attend the Annual Meeting, log in and register at www.proxydocs.com/FOXF. You will need your unique control number that is printed in the box marked by the arrow on your Notice or your proxy card (if you received a printed copy of the Proxy Materials) to register and attend the Annual Meeting. Refer to Login Instructions above for more details.

How do I vote my shares at the Annual Meeting?

You may vote your shares at the Annual Meeting even if you have previously submitted your vote. To vote at the Annual Meeting, log in at www.proxypush.com/FOXF. You will need your unique control number included on your proxy card (printed in the box and marked by the arrow) or on the instructions that accompanied your Proxy Materials.

How do I vote my shares without attending the Annual Meeting?

Stockholders of record may vote their shares by appointing a proxy to vote on your behalf by promptly submitting the proxy card, which is solicited by the Board. Our Board has designated the persons named in the proxy card as proxies. The designated proxies are officers of the Company. They will vote as directed by the completed proxy card. Stockholders of record also have the opportunity to appoint another person to attend the Annual Meeting (via webcast) and vote on their behalf by inserting such other person’s name on the proxy card and returning the duly executed proxy card to us.

There are three ways to vote by proxy:

1.By Mail -

Complete, sign and date your proxy card and return it in the postage-paid envelope we have provided or follow instructions on your proxy card.

2.By Telephone - 1-866-284-5163

Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Daylight TIme on May 4, 2023. Have your proxy card in hand when you call and then follow the instructions.

3.By Internet - www.proxypush.com/FOXF

Use the internet to transmit your voting instructions and for electronic delivery of information until 11:59 p.m. Eastern Daylight TIme ("EDT") on May 4, 2023. Have your proxy card in hand when you access the website and then follow the instructions to obtain your records and to create an electronic voting instruction form.

If you received a proxy card in the mail but choose to vote by telephone or internet, you do not need to return your proxy card.

If your shares are held in the name of a bank, broker or other record holder, follow the voting instructions on the form that you receive from them. The availability of telephone or internet voting will depend on the bank’s, broker’s or other record holder’s voting process. Your bank, broker or other record holder may not be permitted to exercise voting discretion as to some of the matters to be acted upon. Therefore, please give voting instructions to your bank, broker or other record holder.

You may vote by telephone or internet until 11:59 p.m. Eastern Daylight TIme on May 4, 2023, or Mediant must receive your paper proxy card by 11:59 p.m. Eastern Daylight TIme on May 4, 2023.

How will my proxy be voted?

All properly completed, unrevoked proxies, which are received prior to the close of voting at the Annual Meeting, will be voted in accordance with the specifications made. If a properly executed, unrevoked written proxy card does not specifically direct the voting of shares covered, the proxy will be voted:

•FOR the individuals nominated as a director in Proposal 1, described in this Proxy Statement, for a term to expire at the 2026 Annual Meeting of Stockholders;

•FOR Proposal 2, the ratification of the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2023;

•FOR Proposal 3, the approval of the Company’s executive compensation;

•FOR Proposal 4, the amendment to our Certificate of Incorporation to allow for the exculpation of officers;

•FOR Proposal 5, the amendment and restatement of our Certificate of Incorporation to update, clarify and remove outdated provisions; and

in accordance with the judgment of the persons named in the proxy as to such other matters as may properly come before the Annual Meeting, or any adjournment or postponement thereof.

The Board is not aware of any other matters that may properly come before the Annual Meeting. However, should any such matters come before the Annual Meeting, it is the intention of the persons named in the proxy card to vote all proxies (unless otherwise directed by stockholders) in accordance with their judgment on such matters.

May I revoke or change my vote?

If you are a stockholder of record, you may revoke your proxy at any time before it is actually voted by giving written notice of revocation to our Corporate Secretary, by delivering a proxy bearing a later date or by attending and voting at the Annual Meeting. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request. If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other record holder or, if you have obtained a legal proxy from your bank, broker or other record holder giving you the right to vote your shares, by attending and voting at the Annual Meeting.

Will my vote be made public?

All proxies, ballots and voting materials that identify the votes of specific stockholders will generally be kept confidential, except as necessary to meet applicable legal requirements and to allow for the tabulation of votes and certification of the vote.

What constitutes a quorum, permitting the meeting to conduct its business?

The presence at the Annual Meeting, in person or by proxy, of holders of a majority of the issued and outstanding shares of common stock entitled to vote as of the record date is considered a quorum for the transaction of business. If you submit a properly completed proxy or if you attend the Annual Meeting to vote in person, your shares of common stock will be considered part of the quorum. Stockholders who participate in the Annual Meeting online will be considered to be attending the meeting in person for purposes of determining whether a quorum has been met.

Shares represented by proxies that are marked “Abstain” or "Withhold" will be counted as shares present for purposes of determining the presence of a quorum. Shares of stock entitled to vote that are represented by broker non-votes will be counted as shares present for purposes of determining the presence of a quorum. A broker non-vote occurs when the broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power to vote on that proposal without specific voting instructions from the beneficial owner.

How many votes are needed to approve a proposal?

Proposal 1

Assuming the presence of a quorum, each director nominee receiving a plurality of the votes cast at the Annual Meeting (in person or by proxy) will be elected as a director. No stockholder shall be permitted to cumulate votes for the election of directors. The election of directors is a non-discretionary item and brokers may not vote on Proposal 1 without specific voting instructions from beneficial owners, resulting in a broker non-vote. Broker non-votes and withheld votes are not counted toward the election of directors or toward the election of the individual nominees specified on the proxy, and therefore, have no effect on Proposal 1.

Proposal 2

Assuming the presence of a quorum, the affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting (via webcast) and entitled to vote is required to ratify the appointment of Grant Thornton LLP as our independent registered public accountants for fiscal year 2023. An abstention is not counted toward the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm, and the effect of an abstention is the same as a vote “Against” the ratification. Ratification of this appointment is a discretionary item upon which your bank or broker has the authority to vote uninstructed shares. Should your broker not indicate their vote relating to the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for fiscal year 2023, but otherwise appoint the proxies, your shares will be voted “For” the ratification of the appointment of Grant Thornton LLP as the independent registered public accounting firm for fiscal year 2023.

Proposal 3

Assuming the presence of a quorum, the affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote on the proposal is required to approve the advisory vote on executive compensation. Proposal 3 is a non-discretionary item and brokers may not vote on Proposal 3 without specific voting instructions from beneficial owners, resulting in a broker non-vote. An abstention is not counted toward the approval, and the effect of an abstention is the same as a vote “Against” the approval. Broker non-votes will have no impact on this proposal. Because the vote on this proposal is advisory in nature, it will not be binding on the Board. However, the Board will consider the outcome of the vote along with other factors when making its decision about the compensation of our Named Executive Officers. See "Compensation Discussion and Analysis - Say-on-Pay Outcome and Stockholder Outreach Efforts" for additional information.

Proposal 4

The proposal to amend our Certificate of Incorporation to allow for the exculpation of officers requires the affirmative vote of the holders of at least a majority of the outstanding shares entitled to vote thereon. Abstentions and broker non-votes will have the effect of a vote against this Proposal 4.

Proposal 5

The proposal to amend and restate our Certificate of Incorporation to the remove and clarify certain outdated provisions of our Certificate of Incorporation in Articles VIII, IX, XI and XII requires the affirmative vote of the holders of at least sixty-six and two-thirds percent (66 2/3%) of the outstanding shares entitled to vote thereon. Abstentions and broker non-votes will have the effect of a vote against this Proposal 5.

Who will count the vote?

Representatives of Mediant will tabulate the votes and act as the inspectors of election.

How can I find the voting results of the Annual Meeting?

We will report the voting results in a Current Report on Form 8-K within four business days of the Annual Meeting.

How is the solicitation being made?

We, the Company, are making this solicitation and as such, the cost of solicitation of proxies will be borne by us. Our directors, officers, and employees may make solicitation, personally or by telephone, email or fax. The Notice and, if requested, the Proxy Materials will be distributed to beneficial owners of common stock through brokers, custodians, nominees and other like parties, and we expect to reimburse such parties for their charges and expenses.

Where can I find more information about Fox Factory Holding Corp.?

We file reports and other information with the SEC. You may read and copy this information at the SEC’s public reference facilities. Please call the SEC at 1-800-SEC-0330 for information about these facilities. This information is also available at our website at http://investor.ridefox.com and at the internet site maintained by the SEC at http://www.sec.gov.

ELECTION OF CLASS I DIRECTORS

(PROPOSAL 1)

The Board of Fox Factory Holding Corp. is currently comprised of seven individuals and is divided into three classes serving staggered three-year terms. The terms of office of Classes I, II and III expire at different times in annual succession, with one class being elected at each Annual Meeting of Stockholders. Ms. Fetter and Mr. Mendenhall are Class I directors are up for election at this year’s Annual Meeting of Stockholders. Messrs. Dennison, Johnson, and Waitman are Class II directors and will serve until the 2024 Annual Meeting of Stockholders, or earlier in the case of such Class II director's earlier death, resignation or removal. Mr. Duncan and Ms. Hlay are Class III directors will serve until the 2025 Annual Meeting of Stockholders, or earlier in the case of such Class III director's earlier death, resignation or removal.

The Class I directors are proposed to be elected at the Annual Meeting to serve for a term to expire at the 2026 Annual Meeting of Stockholders or earlier in the case of such Class I director's earlier death, resignation or removal. The Board has nominated Ms. Fetter and Mr. Mendenhall for election as Class I directors. The nominees have indicated a willingness to stand for election and to serve if elected. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Unless otherwise indicated in your proxy, the persons named as proxies in the proxy card, or their substitutes, will vote your proxy for the nominee, who has been designated as such by the Board. In the event that a nominee for director withdraws or for any reason is not able to serve as a director, we will vote your proxy for any replacement nominee designated by the Nominating and Corporate Governance Committee and the Board, if such a replacement nominee is designated. The Nominating and Corporate Governance Committee recommended each nominee that the Board recommends to stockholders to the Board. The following paragraphs describe the business experience and education of our directors.

Directors Up for Re-Election | | | | | | | | |

| | Elizabeth A. Fetter Director Age: 64 Independent Director Since: June 2017 Committees: Chair of Compensation and Member of Nominating and Corporate Governance |

Elizabeth A. Fetter has served on our Board since June 2017. She currently serves as the Chair of the Compensation Committee and is a member of the Company's Nominating and Corporate Governance Committee. She has served on the McGrath Rentcorp Board of Directors since 2014. She previously served on the Board of Talend SA from January 2020 through August 2021, when the company went private with Thoma Bravo. She served on the Alliant International University Inc. Board of Directors from 2015 to 2017 and on the Connexed Technologies Inc. Board of Directors from 2004 through 2021. Ms. Fetter served as a member of the Symmetricom Inc. Board of Directors from 2000 to 2013 and was appointed President and Chief Executive Officer of Symmetricom Inc. in April 2013. She served in this capacity until Microsemi Corp. acquired Symmetricom Inc. in November 2013. Ms. Fetter previously was President and Chief Executive Officer of NxGen Modular LLC from 2011 to 2012, and was President, Chief Executive Officer and a Director of Jacent Technologies in 2007. She also served on the Quantum Corp. Board of Directors from 2005 to 2013 and on the Ikanos Corp. Board of Directors from 2008 to 2009. She previously was the Alliant International University Inc. chair of the board of trustees and served as a trustee from 2004 to 2013. Ms. Fetter earned a Bachelor of Arts degree in communications from Pennsylvania State University, a Master of Science degree in industrial administration from Carnegie Mellon University (Tepper & Heinz Schools) and an Advanced Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization.

Ms. Fetter has more than 25 years of public and private company board experience and, in addition, experience as a past chief executive officer, which qualifies her to serve on our Board. With significant experience in leadership and business development, Ms. Fetter brings to our Board a sophisticated understanding of public company operational requirements and strategic development.

| | | | | | | | |

| | Dudley W. Mendenhall Chair of the Board Age: 68 Independent Director Since: June 2013 Committees: Member of Audit and Compensation Audit Committee Financial Expert (as defined under SEC rules) |

Dudley W. Mendenhall joined FOX as a director of its subsidiary in February 2012 and was appointed to serve as Lead Independent Director of the Company's Board of Directors in June 2013. Mr. Mendenhall was then appointed Chair of the Board in July 2017 and served until June 2019, when he was then reappointed as Lead Independent Director. Mr. Mendenhall served as Lead Independent Director until April 2021, when he was once again appointed to Chair of the Board. Mr. Mendenhall also serves as members of both the Company's Audit and Compensation Committees. Since July 2012, Mr. Mendenhall has been an independent consultant providing financial advisory services. He was Vice President of Strategy, Planning and Operations in the office of Strategy and Technology at Hewlett-Packard Co. from January 2010 to July 2012; Chief Financial Officer of Solera Holdings Inc., a provider of software and services to the automobile insurance claims processing industry, from March 2009 to August 2010; and Chief Financial Officer of Websense Inc. from September 2007 to March 2009. From April 2003 to September 2007, Mr. Mendenhall was Senior Vice President and Chief Financial Officer of K2 Inc., an international sporting equipment manufacturer. He earned a Bachelor of Arts degree in economics from Colorado College.

Mr. Mendenhall’s experience as a chief financial officer at other public companies and his background in finance and accounting qualifies him to serve on our Board. With his substantial financial and accounting knowledge, Mr. Mendenhall brings important and valuable financial insight, accounting principles, and knowledge on financial reporting rules and regulations to our Board.

Directors Not Up for Re-Election | | | | | | | | |

| | Michael C. Dennison Director and Chief Executive Officer Age: 55 Non-Independent Director Since: February 2018 |

Michael C. Dennison joined FOX in August 2018 as President, Powered Vehicles Group and was named Chief Executive Officer in June 2019. Prior to joining the Company, he most recently was President and Chief Marketing Officer for Flex Ltd. (NASDAQ:FLEX) from February 2012 to August 2018, and has served as a director on the Board since February 2018. While at FLEX, Mr. Dennison served in a number of other leadership roles, from leading the procurement and global supply chain organizations for the company, to serving as Senior Vice President of Business Management for both the High-Velocity Solutions Group and the Mobile and Consumer Segment. Prior to joining Flex Ltd. he was the Regional Director at Arrow Electronics, based in New York. Mr. Dennison earned a Bachelor of Arts degree in liberal arts from Oregon State University in 1989.

Mr. Dennison serves as Chief Executive Officer and brings to the Board considerable expertise to reach strategic, operational, sales, and marketing objectives. Mr. Dennison has extensive management experience with international consumer products, high technology, and global supply chain management. Additionally, his deep institutional knowledge of FOX, its products, and customers coupled with his strategic acumen allows Mr. Dennison to provide the Board with unique insight into the Company’s operations.

| | | | | | | | |

| | Thomas E. Duncan Director Age: 58 Independent Director Since: July 2017 Committees: Chair of Nominating and Corporate Governance |

Thomas E. Duncan joined the Board in July 2017 and is chair of the Company's Nominating and Corporate Governance Committee. He is a managing board member of Positec Tool Corp., a global manufacturer and marketer of power tools and lawn and garden equipment and accessories, including the Rockwell and WORX brands. Prior to this he was a Vice President of Robert Bosch Tool Corp. from June 2001 to September 2003, and was a Vice President at Vermont American Corp. from September 1992 to June 2001 and until it was acquired by Robert Bosch Tool Corp. Mr. Duncan has been a director on the Outdoor Power Equipment Institute Board of Directors since October 2015 and a director on the Folks Center for International Business Board of Directors at University of South Carolina's Darla Moore School of Business since September 2016. In 2018, Mr. Duncan joined the Board of Directors of Fast Growing Trees (SP FGT Holdings LLC), a privately held e-commerce company. He earned a Bachelor of Arts degree in rhetoric from the University of Virginia and a Master of International Business from University of South Carolina's Darla Moore School of Business.

Mr. Duncan’s over 25 years of experience in the manufacturing and consumer durable goods industries gives him the qualifications to serve on our Board. We believe that his strong global business leadership and executive management skills provides our Board with a member who has a track record of success and knowledge of organizational and operational management relevant to a public company in the manufacturing industry.

| | | | | | | | |

| | Jean H. Hlay Director Age: 63 Independent Director Since: February 2019 Committees: Chair of Audit and Member of Compensation Audit Committee Financial Expert (as defined under SEC rules) |

Jean H. Hlay has served on the Board since February 2019, and was named chair of the Audit Committee of the Company in April 2021. She is also a member of the Company's Compensation Committee. She has more than 25 years of executive and senior leadership experience in the consumer branded products manufacturing and distribution industries. Ms. Hlay most recently was President and Chief Operating Officer of MTD Products, Inc., a privately owned, global manufacturer and distributor of residential and commercial outdoor power equipment with over 7,000 employees in 16 major locations worldwide. She was named to the MTD Products, Inc. Board of Directors in 2002, was appointed President and COO in 2009, and continued in both roles until 2018. Prior to MTD Ms. Hlay was Chief Financial Officer of Crossville Rubber Products, Inc./Plastivax, Inc., a manufacturer of rubber and vinyl floor mats serving the automotive industry, and she began her career at Price Waterhouse (now PwC). She has been serving on the Pella Corp. Board of Directors since 2012, and from 2006 to 2018 she served on the Outdoor Power Equipment Institute Board of Directors. Ms. Hlay also serves as a director for Blain's Supply, Buckeye Corrugated Inc. and BCD Parent, Inc., which is a parent company of American Trailer World (ATW). Ms. Hlay earned a Bachelor of Science, Business Administration degree in accounting from Bowling Green State University and is a CPA (inactive).

Ms. Hlay’s over 25 years of experience in the consumer products manufacturing industry as well as her background in finance and accounting gives her the qualifications to serve on our Board. Her customer-centric philosophy and commitment provides our Board with unique insight into consumer-branded manufacturing products and corporate strategy.

| | | | | | | | |

| | Sidney Johnson Director Age: 61 Independent Director Since: January 2021 Committees: Member of Nominating and Corporate Governance and Compensation |

Sidney Johnson has served on the Board since January 2021, and is a member of both the Company's Compensation Committee and Nominating and Corporate Governance Committee. Mr. Johnson has over 25 years of operational excellence and global supply chain experience in the technology, global mobility, and automotive manufacturing industries. He most recently serves as Head of Procurement and Automotive Sourcing at Harman International Industries, Inc. He began his career at General Motors in 1988, holding a variety of positions in operations, lean manufacturing, purchasing, and quality assurance before joining Delphi in 2000 as Purchasing Director. He spent over 25 years with Aptiv (formerly Delphi), with his last role as Senior Vice President, Global Supply Chain Management. In this role, he built supplier capabilities and implemented global sourcing strategies that allowed for greater business flexibility and cost efficiencies. Previously, he has served as Vice Chair of the National Minority Supplier Development Council Board of Directors and Advisory board member of the International Trade Centre, a joint agency between the World Trade Organization and the United Nations. Mr. Johnson earned a bachelor's degree in industrial engineering and technology from Central State University in Wilberforce, Ohio and a master's degree in industrial management from Wesleyan University in Indianapolis.

Mr. Johnson’s breadth of knowledge and experience in logistics and supply chain management brings to our Board a vital understanding of the national and international supply chain eco-system as FOX implements the next phase of efficiencies into its business and operations.

| | | | | | | | |

| | Ted D. Waitman Director Age: 73 Independent Director Since: June 2013 Committees: Member of Audit and Nominating and Corporate Governance |

Ted D. Waitman has served on the Board since June 2013, and is a member of both the Company's Audit Committee and Nominating and Corporate Governance Committee. Since 1978 he has held various leadership positions, including President and Chief Executive Officer of CPM Holdings Inc. since 1996 and Director at the same organization from 2003 to 2020, and served in an advisory capacity until 2022. From 2006 to 2008, Mr. Waitman was an independent director of Compass Diversified Holdings. He previously was a Director of the American Feed Industry Association and President of the Process Equipment Manufacturers' Association. Mr. Waitman earned a Bachelor of Science degree in industrial engineering from the University of Evansville.

With his extensive experience serving as a board member and in executive management roles for a number of companies, Mr. Waitman brings to our Board a valuable and insightful perspective on a multitude of issues facing public companies as well as considerable guidance on corporate development, business operations, and the manufacturing industry.

Required Vote for Election of Directors

The election of directors is by plurality vote of holders present, in person or by proxy at the Annual Meeting and entitled to vote thereon, with each nominee receiving a plurality of the votes cast to be elected as a director.

Recommendation of the Board

The Board recommends that you vote “FOR” both of the nominees, Ms. Fetter and Mr. Mendenhall, to be elected to our Board as Class I directors for a term ending at our 2026 Annual Meeting of Stockholders or earlier in the case of such director's death, resignation or removal.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(PROPOSAL 2)

General

Our Audit Committee has appointed Grant Thornton LLP as independent public accountants to examine our consolidated financial statements for fiscal year 2023, and has determined that it would be desirable to request that the stockholders ratify the appointment.

You may vote “For” or “Against” this proposal, or you may “Abstain” from voting.

Grant Thornton LLP is an independent registered public accounting firm and audited our financial statements for the fiscal years ended December 30, 2022, December 31, 2021, and January 1, 2021. Based on its past performance during these audits, the Audit Committee has selected Grant Thornton LLP as the independent auditor to perform the audit of our financial statements for fiscal year 2023. Information regarding Grant Thornton LLP can be found at www.grantthornton.com.

Representatives of Grant Thornton LLP are expected to be present at the Annual Meeting via live webcast, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Fees

The following table sets forth the total amount billed to us for the fiscal years ended December 30, 2022 and December 31, 2021 by Grant Thornton LLP.

| | | | | | | | |

| Fiscal Year

2022 | Fiscal Year

2021 |

Audit Fees (1) | $ | 2,310,029 | | $ | 2,208,669 | |

Audit-Related Fees (2) | 26,750 | | 20,000 | |

Tax Fees (3) | 138,352 | | 122,138 | |

All Other Fees (4) | 1,287 | | — | |

| Total | $ | 2,476,418 | | $ | 2,350,807 | |

(1)“Audit Fees” are aggregate fees billed by Grant Thornton LLP for professional services for the audit of our annual financial statements included in our annual reports on Form 10-K and for the review of our interim financial statements included in our quarterly reports on Form 10-Q or services that are normally provided by Grant Thornton LLP in connection with statutory and regulatory filings or engagements.

(2) "Audit-Related Fees" are aggregate fees billed by Grant Thornton LLP for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under "Audit Fees". These services include consultations and audits related to mergers and acquisitions; and services related to offering of common stock and consents for registration statements.

(3)“Tax Fees” are aggregate fees billed by Grant Thornton LLP for professional services rendered in connection with tax compliance, tax advice and tax planning.

(4)"All Other Fees" are aggregate fees billed by Grant Thornton LLP for all other professional services that do not reasonably relate to the performance of the audit, review of financial statements and were not rendered in connection with tax compliance, tax advice and tax planning.

The Audit Committee has evaluated Grant Thornton LLP’s qualification, performance and independence and has determined that services provided by Grant Thornton LLP were permitted under the rules and regulations concerning public accountant's independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as amended, as well as by the Public Company Accounting Oversight Board (the “PCAOB”).

Pre-Approval Policy

The Audit Committee’s policy is to pre-approve any independent accountant’s engagement to render audit and or permissible non-audit services (including the fees charged and proposed to be charged by independent accountants) subject to the de minimis exceptions under Section 10A(i)(1)(B) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as otherwise required by law. Non-audit services may include audit-related services, tax services, or other services. The Audit Committee annually reviews whether the provision of permitted non-audit services is compatible with maintaining the accountant’s independence. The Audit Committee pre-approved all "Audit Fees", "Audit-Related Fees" and "Tax Fees" in fiscal years 2022 and 2021.

Required Vote for Stockholder Approval

The affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote thereon is required to ratify the appointment.

Recommendation of the Board

The Board recommends that you vote “FOR” the ratification of the appointment of Grant Thornton LLP to serve as independent auditor for the Company for the fiscal year ending December 29, 2023.

DIRECTOR COMPENSATION

Non-employee Director Compensation for Fiscal Year 2022

Any non-employee director who, directly, indirectly, or beneficially owns 5% or more of outstanding securities or is employed by or represents a stockholder of us that, directly, indirectly, or beneficially owns 5% or more of the Company’s outstanding securities is not entitled to receive any cash compensation or equity-based compensation for his or her service on the Board. Such non-employee director is, however, entitled to receive reimbursement for reasonable expenses that he or she properly incurs in connection with attending Board meetings and performing duties as a director.

For fiscal year 2022, our Non-employee Director Compensation Plan, as amended and restated, provided for an annual cash retainer of $75,000, payable in quarterly increments, for service as a non-employee director of FOX. A non-employee director who serves as Chair of the Board is paid an additional annual retainer of $90,000 and an additional equity award outlined below, plus the other retainers and compensation he or she may receive. The Chairs of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are provided additional annual retainers of $25,000, $17,500 and $10,000, respectively. The Lead Independent Director, when applicable, is paid an additional annual retainer of $25,000. Each non-employee director serving on the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee is provided additional annual retainers of $10,000, $10,000, and $5,000, respectively. Finally, each of the non-employee directors is entitled to receive reimbursement for reasonable expenses that he or she properly incurs in connection with attending Board meetings and his or her duties as a director. In October 2022, the Compensation Committee reviewed market pay benchmarking of peer group and a broader group of comparably-sized companies and decided, in order to approximate market median levels, for fiscal year 2023, to increase: (i) the annual retainer of the Chair of the Nominating and Corporate Governance Committee to $17,500; and (ii) the annual retainer for each member of the Nominating and Corporate Governance Committee to $10,000.

Pursuant to our Non-employee Director Compensation Policy, as amended and restated, non-employee directors are also granted annual equity-based compensation awards in the form of restricted stock units ("RSUs") pursuant to the 2022 Omnibus Plan, as amended. These awards vest on the day immediately prior to the next Annual Meeting of Stockholders, subject to accelerated vesting in the event of the director’s death or a change in control of the Company and are subject to such additional terms and conditions as may be set forth in the applicable award agreement and plan. Subject to applicable laws and our policies in place for equity-based awards, through fiscal year 2022, the non-employee directors were entitled to receive an annual award of RSUs determined by dividing $140,000, by the closing price of our common stock on the date of grant. The Chair of the Board or our Lead Independent Director, as applicable, will receive an additional annual award of RSUs determined by dividing $15,000 by the closing price of our common stock on the date of grant. In fiscal year 2022, other than the Chair of the Board, Mr. Mendenhall, who received 1,908 RSUs on May 6, 2022, each other non-employee director received an award of 1,723 RSUs on May 6, 2022. These awards will vest on the day immediately prior to the 2023 Annual Meeting, subject to accelerated vesting in the event of a director’s death or a change in control of the Company. When applicable, the non-employee director who serves as the Chair or the Lead Independent Director is entitled to receive an additional award of RSUs determined by dividing $15,000 by the closing price of our common stock on the date of grant. In October 2022, the Compensation Committee decided, for fiscal year 2023, to increase the annual equity-based compensation award for each non-employee director to $150,000.

The following table sets forth information for the year ended December 30, 2022 regarding the compensation awarded to, earned by or paid to persons who served as our directors during fiscal year 2022 who are not Named Executive Officers.

| | | | | | | | | | | | | | | | | |

| DIRECTOR COMPENSATION - FISCAL YEAR 2022 |

| Name | Fees earned or paid in cash | | Stock awards (1) | | Total |

| Dudley W. Mendenhall | $ | 184,750 | | | $ | 155,000 | | | $ | 339,750 | |

| Thomas E. Duncan | $ | 85,000 | | | $ | 140,000 | | | $ | 225,000 | |

| Elizabeth A. Fetter | $ | 96,875 | | | $ | 140,000 | | | $ | 236,875 | |

| Jean H. Hlay | $ | 109,750 | | | $ | 140,000 | | | $ | 249,750 | |

| Sidney Johnson | $ | 89,750 | | | $ | 140,000 | | | $ | 229,750 | |

| Ted D. Waitman | $ | 90,000 | | | $ | 140,000 | | | $ | 230,000 | |

(1)Amounts in this column represent the aggregate grant date fair value computed in accordance with FASB Topic 718 of RSUs awarded in 2022 pursuant to the 2013 Omnibus Plan. The RSUs vest on the day before the Company's Annual Meeting.

CORPORATE GOVERNANCE

Our business and affairs are managed under the direction of our Board, which currently consists of seven members. The primary responsibilities of our Board are to provide oversight, strategic guidance, counseling and direction to our management.

The Board of Directors

Governance Guidelines

Our Board has adopted a set of governance guidelines (the "Governance Guidelines") to assist our Board and its committees in performing its duties and serving the best interests of our Company and our stockholders. The Governance Guidelines cover topics including, but not limited to, director selection and qualification, director responsibilities and operation of our Board, director access to management and independent advisors, director compensation, director orientation and continuing education, succession planning, recoupment of performance-based compensation and the annual evaluations of our Board.

Code of Ethics

Our Board has adopted a Code of Ethics that applies to all of our employees, officers and directors, including our principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions. The Code of Ethics is posted on our website http://investor.ridefox.com. The Code of Ethics can only be amended by the approval of a majority of our Board, including a majority of our independent directors. Any waiver to the Code of Ethics for an executive officer or director may only be granted by our Board and must be timely disclosed as required by applicable law. Any amendments to the Code of Ethics, or any waivers of its requirements, will be disclosed on our website at http://investor.ridefox.com or by filing with the SEC a Current Report on Form 8-K, in each case, if such disclosure is required by rules of the SEC or Nasdaq Listing Rules.

Leadership Structure

The Board believes its current leadership structure is best suited to serve the interest of the stockholders. The Board does not have a policy as to whether the Chair should be an independent director, but when the Chair is not an independent director, the independent directors appoint a “Lead Independent Director.” Mr. Mendenhall, an independent director, serves as our Board Chair. As Board Chair, Mr. Mendenhall is responsible for: approving Board meeting agendas; in consultation with the non-employee directors, when applicable, approving Board meeting schedules to ensure there is sufficient time for discussion of all agenda items; approving the type of information to be provided to directors for Board meetings; presiding at all executive sessions of the non-employee directors (which are held after every Board meeting); when applicable, serving as liaison between the Executive Chair and the independent directors; being available for consultation and direct communication with the Company’s stockholders; calling meetings of the non-employee directors when necessary and appropriate; and performing such other duties as the Board may from time to time designate. The Chief Executive Officer has general charge and management of the affairs, property and business of the corporation, under the oversight, and subject to the review and direction, of the Board, but does not serve in a leadership capacity on the Board.

Our Board has three standing committees, comprised solely of independent directors, the Audit Committee, chaired by Ms. Hlay; the Compensation Committee, chaired by Ms. Fetter; and the Nominating and Corporate Governance Committee, chaired by Mr. Duncan. The responsibilities and authority of each committee are described later in this Proxy Statement.

Risk Oversight

The Board believes risk management is an important aspect of our business. The Board oversees and regularly reviews the Company's management of material risks. While the Board as a whole ultimately has the responsibility for overseeing risk management, the Board has delegated certain duties with respect to risk oversight to our Audit Committee. In furtherance of such purpose, the Audit Committee Charter specifically requires the Audit Committee to discuss with management, the internal auditor or internal audit service provider, as the case may be, and the independent public accountant the Company’s major risk exposures (whether financial, operations or both) and the steps management has taken to monitor and control such exposure, including the Company’s risk assessment and risk management policies. The Board is regularly updated on the Audit Committee's findings.

Board Meetings

During fiscal year 2022, the Board held five meetings. All of our directors who served in fiscal year 2022 attended or participated in 75% or more of the aggregate of (1) the total number of meetings of the Board (held during the period for which such person has been a director) and (2) the total number of meetings held by all committees of the Board on which such person served (during the periods that such person served).

Attendance of Directors at the Annual Meeting

Pursuant to our Governance Guidelines, our directors are encouraged to attend our Annual Meetings of Stockholders. Six of our directors attended our 2022 Annual Meeting of Stockholders.

Stock Ownership Guidelines

Effective January 2, 2021, our Board established Stock Ownership Guidelines (the “Guidelines”) to promote a long-term perspective in managing FOX and to ensure alignment with stockholders, capital markets and public interests. The Chief Executive Officer, Chief Financial Officer, Chief Legal Officer and Group Presidents (collectively, the “Covered Executives”) and the non-employee directors of the Board (“Directors,” together with the Covered Executives the “Covered Executives and Directors”) are the individuals subject to the Guidelines. Each Covered Executive and Director is expected to acquire, and continue to hold during the term of his or her employment as a Covered Executive, or during his or her term as a Director, as applicable, ownership of FOX common stock (FOXF) having a value equal to: five times base salary for the Chief Executive Officer, three times base salary for the remainder of the Covered Executives, and five times the annual cash retainer for the Directors, rounded up to the nearest 500 shares (the “Ownership Requirement”). Additionally, Covered Executives and Directors must retain at least 50% of his or her net shares following the exercise of options, the vesting of restricted stock units or the vesting of performance share units until the applicable Ownership Requirement has been met. Covered Executives and Directors are required to achieve the applicable Ownership Requirement within five (5) years after first becoming subject to the Guidelines, but the Nominating and Corporate Governance Committee may grant a waiver to the Guidelines on a case-by-case basis. As of the date of this Proxy Statement, all Covered Executives and Directors met their Ownership Requirements or were on target to reach their expected position within the five-year timeline.

Policies

Hedging and Pledging Policy

Our Board has adopted the Policy Regarding Insider Trading, Tipping and Other Wrongful Disclosures, or the Insider Trading Policy. The Insider Trading Policy prohibits employees (including part-time and temporary employees), officers, directors, consultants and contractors of the Company from hedging transactions with respect to shares of our common stock. The Insider Trading Policy also requires directors, executive officers and designated insiders to obtain pre-approval from one of the Company's Designated Officers before pledging shares of our common stock.

Clawback Policy

Additionally, our Board has adopted the Policy Regarding Recoupment of Incentive Compensation upon Restatement or Misstatement of Financial Results, or as Required by Law, or the Clawback Policy. According to the Clawback Policy, if, in the opinion of the independent directors of the Board, the Company's financial results are materially misstated due in whole or in part to intentional fraud or misconduct by one or more of the Company's executive officers, the independent directors have the discretion to use their best efforts to remedy the fraud or misconduct and prevent its recurrence. The independent directors may, for up to five years following such misstatement and subject to the limitations herein, direct that the Company recover all or a portion of any bonus or incentive compensation paid, or cancel the stock-based awards granted, to the executive officer(s), as well as seek to recoup any gains realized with respect to equity-based awards, including stock options and RSUs. However, these "clawbacks" can only ensue if the following conditions have been met: (1) the bonus or incentive compensation to be recouped was calculated based upon the financial results that were restated, (2) one or more executive officers engaged in the intentional misconduct, and (3) the bonus or incentive compensation calculated under the restated financial results is less than the amount actually paid or awarded.

Certain Relationships and Related Transactions and Director Independence

Policies and Procedures for Related Party Transactions

Our Board has adopted a written related person transaction policy, which is included in our Code of Ethics and sets forth the policies and procedures for the review and approval or ratification of related person transactions. This policy covers, with certain exceptions set forth in Item 404 of Regulation S-K under the Securities Act of 1933, as amended (the “Securities Act”), any transaction, arrangement, or relationship, or any series of similar transactions, arrangements, or relationships in which we were or are to be a participant, the amount involved exceeds $120,000, and a related person had or will have a direct or indirect material interest, including, without limitation, purchases of goods or services by or from the related person or entities in which the related person has a material interest, indebtedness, guarantees of indebtedness, and employment by us of a related person. As provided by our Nominating and Corporate Governance Committee Charter, our Nominating and Corporate Governance Committee is responsible for reviewing and approving in advance any related party transaction and no related party transactions have been approved except in accordance with our policy.

Director Independence

The rules and listing standards of NASDAQ, or the Nasdaq Listing Rules, generally require a majority of the members of our Board satisfy the Nasdaq Listing Rules criteria for “independence.” No director qualifies as independent under the Nasdaq Listing Rules unless our Board affirmatively determines that the director does not have a relationship with us that would impair independence (directly or as a partner, stockholder or officer of an organization that has a relationship with us). Our Board has determined that Messrs. Mendenhall, Waitman, Johnson and Duncan and Mses. Fetter and Hlay are currently independent directors as defined under the Nasdaq Listing Rules. Mr. Dennison has been determined not to be independent by our Board.

Nominations of Directors and Diversity

Consideration of Director Nominees