UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 3, 2025

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36040

Fox Factory Holding Corp.

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| Delaware | 26-1647258 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

2055 Sugarloaf Circle, Suite 300, Duluth GA 30097

(Address of Principal Executive Offices) (Zip Code)

(831) 274-6500

(Registrant’s Telephone Number, Including Area Code)

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 per share | FOXF | The NASDAQ Stock Market LLC |

| | (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If any emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

Based upon the closing price of the registrant's common stock on the NASDAQ Global Select Market on June 28, 2024 (the last business day of the registrant’s most recently completed second fiscal quarter), the approximate aggregate market value of the common stock held by non-affiliates of the registrant was approximately $1,338,778,148. As of February 20, 2025, there were 41,683,905 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement for the 2024 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K are incorporated by reference in Part III, Items 10-14 of this Annual Report on Form 10-K.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements, which are subject to the “safe harbor” created by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We may make forward-looking statements in our United States (“U.S.”) Securities and Exchange Commission (“SEC”) filings, press releases, news articles, earnings presentations and when we are speaking on behalf of the Company. Forward-looking statements generally relate to future events or our future financial or operating performance that involve substantial risks and uncertainties. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “likely,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Annual Report on Form 10-K are subject to numerous risks and uncertainties, including but not limited to risks related to:

•changes in general economic conditions, including market and macro-economic disruptions resulting from escalating tensions between China and Taiwan, the on-going Russian war in Ukraine, the Israel-Palestine conflict, or similar events, or due to inflation, higher interest rates, or tariffs;

•our dependency on a limited number of suppliers for materials, product parts, and vehicle chassis could lead to an increase in material costs, disruptions in our supply chain, or reputational costs;

•our ability to develop new and innovative products in our current end-markets;

•our ability to leverage our technologies and brand to expand into new categories and end-markets;

•the spread of highly infectious or contagious disease, such as COVID-19, could cause severe disruptions in the U.S. and global economy, which could in turn disrupt the business activities and operations of our customers, as well as our businesses and operations;

•our ability to increase our aftermarket penetration;

•our ability to accelerate international growth;

•our exposure to exchange rate fluctuations;

•the loss of key customers;

•our ability to improve operating and supply chain efficiencies;

•our ability to enforce our intellectual property rights;

•our future financial performance, including our net sales, cost of sales, gross profit or gross margins, operating expenses, ability to generate positive cash flow and ability to maintain our profitability;

•our ability to maintain our premium brand image and high-performance products;

•our ability to execute our cost optimization efforts;

•our ability to maintain relationships with the professional athletes and race teams we sponsor;

•our ability to selectively add additional dealers and distributors in certain geographic markets;

•the growth of the markets in which we compete, our expectations regarding consumer preferences and our ability to respond to changes in consumer preferences;

•changes in demand for performance-defining products;

•the loss of key personnel, management and skilled engineers;

•our ability to successfully identify, evaluate and manage potential or completed acquisitions and to benefit from such acquisitions;

•the outcome of pending litigation;

•future disruptions in the operations of our manufacturing facilities;

•our ability to adapt our business model to mitigate the impact of certain changes in tax laws and other regulatory matters;

•changes in the relative proportion of profit earned in the numerous jurisdictions in which we do business and in tax legislation, case law and other authoritative guidance in those jurisdictions;

•product recalls and product liability claims; and

•future economic or market conditions.

You should not rely upon forward-looking statements as predictions of future events. We based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations, and prospects and the outcomes of any of the events described in any forward-looking statements are subject to risks, uncertainties, and other factors. In addition to the risks, uncertainties and other factors discussed above and elsewhere in this Annual Report on Form 10-K, the risks, uncertainties and other factors expressed or implied discussed in Item 1A. Risk Factors of this Annual Report on Form 10-K could cause or contribute to actual results differing materially from those set forth in any forward-looking statement. Moreover, we operate in a very competitive and challenging environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. We cannot assure you that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur and you should not place undue reliance on our forward-looking statements. Actual results, events, or circumstances could differ materially from those contemplated by, set forth in, or underlying any forward-looking statements. For all of these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements in Section 27A of the Securities Act and Section 21E of the Exchange Act.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

Fox Factory Holding Corp.

FORM 10-K

Table of Contents

| | | | | | | | |

| | Page |

| | |

| PART I. | | |

| Item 1 | Business | |

| Item 1A | Risk Factors | |

| Item 1B | Unresolved Staff Comments | |

| Item 1C | Cybersecurity | |

| Item 2 | Properties | |

| Item 3 | Legal Proceedings | |

| Item 4 | Mine Safety Disclosures | |

| | |

| PART II. | | |

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| Item 6 | Reserved | |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8 | Financial Statements and Supplementary Data | |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| Item 9A | Controls and Procedures | |

| Item 9B | Other Information | |

| Item 9C | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| | |

| PART III. | | |

| Item 10 | Directors, Executive Officers and Corporate Governance | |

| Item 11 | Executive Compensation | |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14 | Principal Accountant Fees and Services | |

| | |

| PART IV. | | |

| Item 15 | Exhibits, Financial Statement Schedules | |

| Item 16 | Form 10-K Summary | |

| | |

| Signatures | |

| |

| Financial Statements | |

| Management’s Report on Internal Control Over Financial Reporting | |

| Reports of Independent Registered Public Accounting Firm | |

| Consolidated Balance Sheets as of January 3, 2025 and December 29, 2023 | |

| Consolidated Statements of Income for the years ended January 3, 2025, December 29, 2023 and December 30, 2022 | |

| Consolidated Statements of Comprehensive Income for the years ended January 3, 2025, December 29, 2023 and December 30, 2022 | |

| Consolidated Statements of Stockholders’ Equity for the years ended January 3, 2025, December 29, 2023 and December 30, 2022 | |

| Consolidated Statements of Cash Flows for the years ended January 3, 2025, December 29, 2023 and December 30, 2022 | |

| Notes to Consolidated Financial Statements | |

PART I

ITEM 1. BUSINESS

Our company, Fox Factory Holding Corp., is a global leader in the design, engineering, manufacturing and marketing of premium products and systems that deliver championship-level performance for customers worldwide. Fox Factory Holding Corp. is the holding company of Fox Factory, Inc. As used herein, “Fox Factory,” “FOX,” the “Company,” “we,” “our,” and similar terms refer to Fox Factory Holding Corp. and its subsidiaries, unless the context indicates otherwise. Our premium brand, performance-defining products and systems are used primarily on bicycles (“bikes”), side-by-side vehicles (“side-by-sides”), on-road vehicles with and without off-road capabilities, off-road vehicles and trucks, all-terrain vehicles (“ATVs”), snowmobiles, and specialty vehicles and applications. In addition, we also offer premium baseball and softball gear and equipment. Some of our products are specifically designed and marketed to some of the leading cycling and powered vehicle original equipment manufacturers (“OEMs”), while others are distributed to consumers through a global network of dealers and distributors and through direct-to-consumer channels.

Fox Factory, Inc., our operating subsidiary, was incorporated in California in 1978. Fox Factory Holding Corp. was incorporated in Delaware on December 28, 2007. In October 2018, we announced the relocation of our business headquarters from Scotts Valley, California to Braselton, Georgia, which was effective on December 31, 2018. In June 2021, we established a principal executive office in Duluth, Georgia.

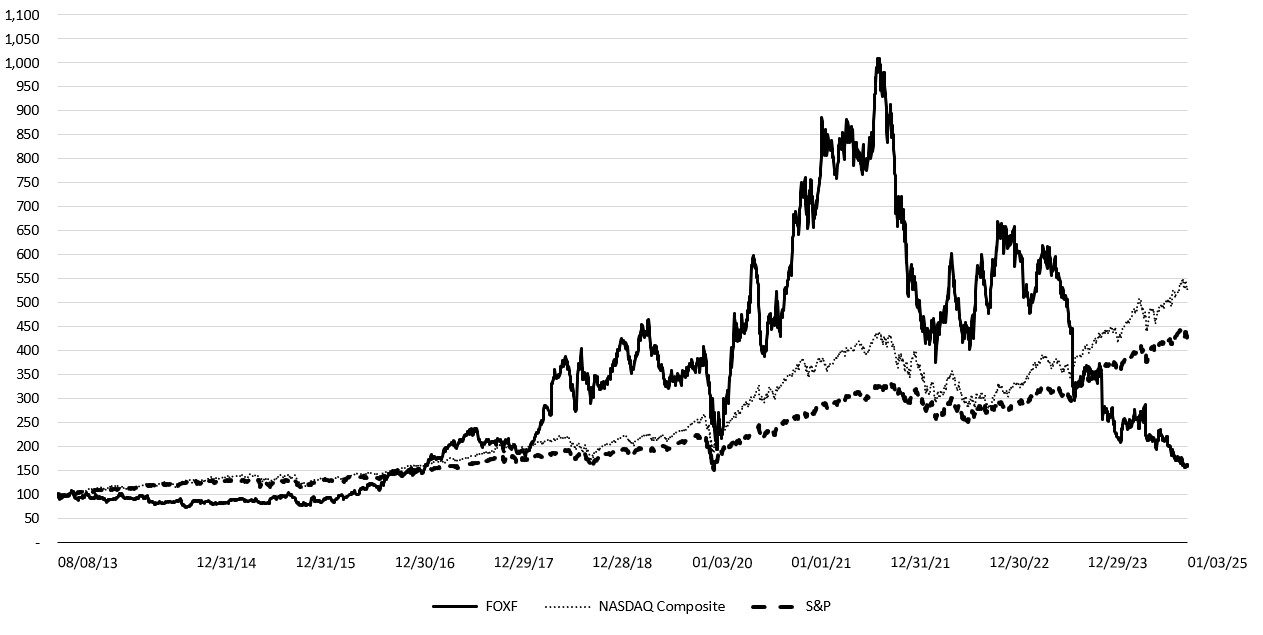

In August 2013, we completed an initial public offering (“IPO”) of our common stock. Our common stock is traded on the NASDAQ Global Select Market (the “NASDAQ”) under the symbol “FOXF.”

Description of our business

We are a designer, engineer, manufacturer and marketer of performance-defining products and systems used primarily on bikes, off-road vehicles and trucks, side-by-sides, on-road vehicles with and without off-road capabilities, ATVs, snowmobiles, and specialty vehicles and applications, and premium baseball and softball gear and equipment. We believe our products offer innovative design, performance, durability and reliability. Our brand is associated with high-performance and technologically advanced products, by which we generally mean products that provide users with improved control and comfort while riding over rough terrain in varied environments or providing improved control and responsiveness for on-road only vehicles or out on a ball field. We believe that the performance of our products has been demonstrated by, and our brand benefits from, the success of professional athletes who use our products in elite competitive events, such as the Olympic Games, the Union Cycliste Internationale Mountain Bike World Cup, the X Games, the Baja 1000, and professional baseball, including Major League Baseball. We believe the exposure our products receive when used by successful professional athletes positively influences the purchasing habits of enthusiasts and other consumers seeking high-performance products. We believe that our strategic focus on the performance and racing segments in our markets influences many aspiring and enthusiast consumers who we believe seek to emulate the performance of professional and other elite athletes.

We design our products for, and market our products to, some of the world’s leading cycling and automotive OEMs and to consumers through the aftermarket channel. Many of our OEM customers, including Specialized, Trek Bicycles, Giant, Cube, Orbea, Canyon Bicycles, Santa Cruz Bicycles, and Yeti Cycles in Specialty Sports and BRP, Ford Motor Company (“Ford”), Polaris, Toyota, 4 Wheel Parts, Kawasaki, Yamaha, Stellantis, CF Moto, and Honda in Powered Vehicles and Aftermarket Applications, are among the market leaders in their respective product categories, and help shape, as well as respond to, consumer trends in their respective categories. We believe that OEMs often prominently display and incorporate our products to improve the marketability and consumer demand for their performance models, which reinforces our brand image. In addition, consumers select our products in the aftermarket channel where we market through a global network of dealers and distributors, as well as our direct to customer platforms.

Industry

We participate in large global markets for bikes, powered vehicles, and baseball equipment used by recreational and professional consumers. Today, our products for bicycles are primarily for mountain bikes, e-bikes and gravel bikes. Our products for powered vehicles are used primarily on off-road vehicles and trucks, on-road vehicles with and without off-road capabilities, side-by-sides, ATVs, snowmobiles, specialty vehicles and applications, including military, and motorcycles.

We focus on premium-priced products within each of these categories, which we consider to be the high-end segment because of their higher retail sale prices, where we believe consumers prefer well-designed, performance-oriented equipment. We believe that performance-defining products, which include suspension systems, as well as wheels, cranks, and other components, are critical to the performance of the bikes and powered vehicles in the product categories in which we focus and that technical features, component performance, product design, durability, reliability, and brand recognition strongly influence consumer-purchasing decisions.

We believe the high-end segments in which we participate are well positioned for growth due to several factors, including:

•increasing consumer appetite for performance-defining products;

•increasing average retail sales prices, which we believe are driven by differentiated and feature-rich products with advanced technologies;

•continuing product cycle innovation, which we observed often motivates consumers to upgrade and purchase new products for enhanced performance; and

•increasing sales opportunities for high-end bikes, powered vehicles, and premium baseball equipment in international markets.

As vehicles in our end-markets evolve and grow more capable, performance-defining products and systems have become, and we believe will continue to be, increasingly more important for improved performance and control. Additionally, we believe there are opportunities to continue to leverage our technical know-how of suspension products to provide solutions beyond our current applications and end-markets.

Our competitive strengths

Broad offering of performance-defining products across multiple consumer markets

Our performance-defining products enhance vehicle performance across multiple consumer markets. Through the use of adjustable suspension, position sensitive damping, multiple air spring technologies, lightweight and rigid materials, and other technologies and methods, our products improve the performance and control of the vehicles used by our consumers. We believe our reputation for performance-defining products is reinforced by the successful finishes in world class competitive events by athletes incorporating our products in their vehicles, gear and equipment.

Premium brand with strong consumer loyalty

We believe that we developed a reputation for performance-defining products and that we own and license established trademarks, such as FOX®, FOX RACING SHOX®, BLACK WIDOW®, ROCKY RIDGE®, METHOD RACE WHEELS®, BDS®, BAJA KITS®, RACE FACE®, MARZOCCHI®, MARUCCI®, VICTUS®, BAUM BAT®, LIZARD SKINS®, and BASEBALL PERFORMANCE LAB®, which are perceived as premium brands. As such, our performance-defining products are generally sold at premium prices. We take great effort to maintain our brands in the eyes of consumers. For instance, our FOX® logo is prominently displayed on our FOX® branded products used on bikes and powered vehicles sold by our OEM customers, which helps further reinforce our brand image. We believe that our brands achieved strong loyalty from our consumers. To support our brands, we introduce new products that we believe feature innovative technologies designed to improve performance and enhance our brand loyalty with consumers.

Track record of innovation and new product introductions

Innovation, including new product development, is a key component of our growth strategy. Due to our experience in suspension engineering and design in multiple markets and with a variety of vehicles, solutions we develop for use in one market can ultimately be deployed across multiple markets. For example, we believe our success in the high-end ATV category led to the widespread adoption of our suspension technology in the side-by-side market. Our innovative product development and speed to market are supported by:

•our racing culture, including on-site technical race support for professional athletes, which provides us with unique real-time insights as to the evolving performance-defining product needs of those participating in challenging world-class events and is an integral part of our research and development efforts;

•ongoing research and development through a team of full-time engineers and numerous other technicians and employees who spend at least part of their time testing and using our products and helping develop engineering-based solutions to enhance our product offerings;

•feedback from professional athletes, race teams, enthusiasts and other consumers who use our products;

•strategic and collaborative relationships with OEM customers, which furthers our ability to extend technologies and applications across end-markets; and

•our integrated manufacturing facilities and performance testing centers, which allow us to quickly move from concept to product.

Over the past several years, we have developed multiple new products, such as:

•Fox Factory Silverado 1500, the first Fox upfitted vehicle showcasing Semi-Active Dual Live Valve Shocks, Baja Kits Long-Travel Suspension with 15” Wheel Travel, Supercharged to 700, and a host of additional exclusive performance and design upgrades.

•Semi-active Dual Live Valve shocks with compression and rebound control, for ultimate confidence and control, which such technology is currently being used in utility terrain vehicles (“UTVs”) and the top tier of off-road performance trucks;

•Live Valve, our proprietary semi-active, electronic suspension that processes data from multiple vehicle sensors to adjust the suspension virtually instantaneously to the demands of changing terrain, which such technology is currently used in UTVs, trucks, and mountain bikes;

•The next generation of Live Valve combined with a 3.1-inch diameter anodized aluminum shock body, specifically designed to withstand the higher internal pressures created by the new valve’s wider dynamic range, which such technology has been adopted at the top tier of trucks in the U.S.;

•Electronically adjustable rear suspension pre-load allowing a user to easily compensate for the additional weight and bring a vehicle back to optimal ride height, which such technology is currently in use on select motorcycles to adapt to added passenger and luggage weight without using tools;

•Ridetech RidePro E5 Air Suspension Control System, improving comfort and performance to your vehicle, which such technology is currently being used in many classic muscle car and truck applications;

•Ridetech 62-67 Nova Suspension System (Coil-Over & Air), complete suspension upgrades with either coil or air sprung adjustable shocks that bring modern performance to vintage and classic muscle cars;

•Ridetech 67-69 Camaro Subframe – this product goes one step beyond Ridetech’s suspension kits and replaces the entire subframe to allow larger wheel and tire fitments, modern steering and modern powertrains. This gives consumers the option to solve many pain points with a single product that delivers performance gains beyond that of a typical suspension-only upgrade;

•XT Series of lift kits to better serve the go-fast off road market. These suspension kits come standard with top of the line shock technology;

•BDS Tundra Lift Kits incorporate Toyota Tundra that provide shock, suspension and ground clearance upgrades to aid off-road performance;

•Market leading 3-4” Bronco suspension lift products that are custom designed to each model configuration and that range from load spacers and coil-overs, to remote adjustable shocks for increased off-road performance, comfort and control;

•Fox Grip SL, Grip X and Grip X2 line of innovative dampers for all Fox Factory series forks. This new line of innovative dampers builds of the highly successful and race proven GRIP architecture. Further living into our purpose-built suspension philosophy; the Grip SL is focused on XC and endurance applications, Grip X on trail and all-mountain riding, and Grip X2 is our highest performing gravity-focusing damper. The Grip X2 damper was awarded 2024 suspension product of the year by the largest global mountain bike media site (Pinkbike.com).

•Rhythm series fork products developed to address a lower price point offering without compromising proven FOX performance;

•FOX AWL suspension fork for the growing electronic sports utility vehicle (“eSUV”) commuter and e-mobility segment combining the confidence and stability of off-road capable suspension with the convenience of direct mount compatibility with full wrap fenders, lights, and anti-lock braking system, which such technology is found on a wide range of electric bikes;

•Race Face Vault Hub, a 120-point high-engagement mountain bike hubset featuring tool-free end caps that simplify conversion among all major axle standards and is approved for e-bike applications, which such technology is found in select Race Face mountain bike wheels and as standalone hubs;

•Easton EC90 SL Crankset, a versatile and ultralight gravel road bike crankset that allows quick conversion between 1x and 2x chainring configurations;

•Method Raised Wheels, a series of new wheels featuring innovative new styles ranging from bold to sophisticated. Raised series of wheels is a fusion of design and best structural warranty, giving consumers unmatched visual appeal and piece of mind;

•The Marucci CATX2, a premium metal baseball bat engineered for elite performance, that features patented anti-vibration technology in both the knob and the end of the barrel for a smoother swing;

•The Marucci MXB Footwear Collection, the first baseball and softball footwear to feature the BOA® Fit System, allowing a more personalized fit for athletes during play; and

•The Marucci CATX Puck Knob, the first metal bat featuring an integrated puck knob that optimizes the weight distribution of the bat.

Strategic brand for OEMs, dealers and distributors, and retailers

Through our strategic relationships, we are often sought out by our OEM customers and work closely with them to develop and design new products and product enhancements. We believe our collaborative approach and product development processes strengthen our relationships with our OEM customers. We believe consumers value our branded products when selecting performance bikes and powered vehicles, and as a result, OEMs purchase and incorporate our products in their bikes and powered vehicles in order to increase the sales of their premium-priced products. In addition, we believe the inclusion of our products on high-end bikes and powered vehicles reinforces our premium brand image which helps to drive our sales in the aftermarket channel where dealers and distributors sell our products to consumers.

Experienced management team

We have an experienced senior management team led by Michael C. Dennison, our Chief Executive Officer. Many members of our management team and many of our employees are avid users of our products, which further extends their knowledge of, and expertise in, our products and end-markets. We are able to attract and retain highly trained and specialized employees who enhance our Company culture and serve as strong brand advocates.

Our strategy

Our goal is to expand our leadership position in designing, engineering, manufacturing and marketing performance-defining products designed to enhance ride dynamics and performance. We intend to focus on the following key strategies in pursuit of this goal:

Continue to develop new and innovative products in current end-markets

We intend to continue to develop and introduce new and innovative products in our current end-markets to improve ride dynamics and performance for our consumers. For example, our patented position-sensitive damping systems provide terrain optimized ride characteristics across many of our product lines. We believe that performance and control are important to our consumer base, and that our frequent introduction of products with innovative and improved technologies increases both OEM and aftermarket demand as consumers seek out products for their vehicles that can deliver these characteristics. We also believe evolving market trends, such as changing bike wheel and tire sizes and increasing adoption rates of off-road capable, on-road trucks should increase demand for vehicles in our end-markets, which, in turn, should increase demand for our suspension products.

Leverage technology and brand to expand into new categories and end-markets

We believe innovation is the foundation of our company. As we continue to leverage the latest technology to develop a diverse portfolio of performance-defining products, our Powered Vehicle Group facility extends our ability to not only scale to newer levels but also do it efficiently. We have great relations with our OEM and aftermarket partners and given our key distinct strengths, we believe we have and will continue to win more applications. Leveraging our technology and scale, we successfully expanded into recreational vehicles and street car applications, international truck and sports utility vehicle (“SUV”) applications, and entry premium bike applications, and we believe there are opportunities to further penetrate these markets and grow with more pioneering product applications. Additionally, to grow our end user base, we are now looking at ways to explore international opportunities with some of our applications.

Opportunistically expand our business platform through acquisitions

Over the past several years, we completed acquisitions that we believe enhance our business and strategically expand our product offerings. In March 2020, we acquired substantially all the issued and outstanding capital stock of SCA Performance Holdings, Inc. (“SCA”), a leading OEM authorized specialty vehicle manufacturer for light duty trucks and sport utility vehicles. In May 2021, through our wholly owned subsidiary, SCA, we acquired all of the issued and outstanding stock of Manifest Joy LLC (“Outside Van”), a custom van conversion company that designs and custom engineers recreational vehicles. In December 2021, through our wholly owned subsidiary, Shock Therapy Suspension, Inc., we acquired substantially all the assets of Shock Therapy LLC (“Shock Therapy”), a premier suspension tuning company in the off-road industry. In March 2023, we purchased all of the outstanding equity of CWH Blocker Corp., (“Blocker”), and thereafter, through Blocker, acquired all of the outstanding equity interest of CWH Holdco, LLC, the parent company of Custom Wheel House, LLC (“Custom Wheel House”). Custom Wheel House is a designer, marketer, and distributor of high-performance wheels, performance off-road tires, and accessories, including the premier flagship brand Method Race Wheels. In November 2023, through our wholly owned subsidiary, Marucci Merger Sub, Inc., we acquired substantially all the issued and outstanding capital stock of Wheelhouse Holdings, Inc., the parent company of Marucci Sports, LLC (“Marucci”), a leading designer, manufacturer, and marketer of highly engineered premium wood, aluminum and composite baseball bats as well as other diamond sports products. In December 2024, through our wholly owned subsidiary, Marzocchi Suspension Holding S.r.l., we acquired all of the outstanding equity of Marzocchi Suspension S.r.l. (“Marzocchi”), a leader in motorbike suspension manufacturing. The Company expects that these acquisitions will continue to support the expansion of its North American geographic manufacturing footprint and the broadening of its product offerings in the automotive and sport industries. We believe there is opportunity to expand our total available market by broadening our acquisition focus to include a more diverse range of performance products that add to or improve our customers’ enjoyment of their activities of choice. We also believe that our passionate customer base has a desire for other types of performance products beyond those that attach to a vehicle or bike.

Increase our aftermarket penetration

We currently have a broad aftermarket distribution network of thousands of retail dealers and distributors worldwide. We intend to further penetrate the aftermarket channel by selectively adding dealers and distributors in certain geographic markets, increasing our internal sales force and strategically expanding aftermarket-specific products and services to existing vehicle platforms.

Accelerate international growth

We believe international expansion represents a significant opportunity for us and we have, and intend to continue to, selectively increase infrastructure investments and focus on identified geographic regions. We believe that rising consumer discretionary income in a number of developing markets and increasing consumer preferences for premium performance bikes and powered vehicles should contribute to increasing demand for our products. In addition, we believe increasing international viewership of racing and extreme sports and other outdoor events, such as the Union Cycliste Internationale Mountain Bike World Cup and X Games, is contributing to the growth of international participation in activities in which our products are used. We intend to leverage the recognition of our brands to capitalize on these trends by globally increasing our sales to both OEMs and dealers and distributors, particularly in markets where we perceive significant opportunities.

Improve operating and supply chain efficiencies

In the fourth quarter of 2021, we completed the construction of an approximately 336,000 square foot state-of-the-art facility in Hall County, Georgia (the “Gainesville Facility”) to diversify our manufacturing platform and provide additional long-term capacity to support growth in our Powered Vehicles Group. The Gainesville Facility is used for manufacturing, warehousing, distribution and office space. Additionally, we completed the transition of our Watsonville, California facility (the “Watsonville Facility”) and the relocation of our powered vehicles suspension manufacturing to the Gainesville Facility in the first quarter of 2022.

Seasonality

Certain portions of our business are seasonal; we believe this seasonality is due to the delivery of new products. As we diversified our product offerings and our product launch cycles, seasonal fluctuations are becoming less material.

Competition

The markets for performance-defining products are highly competitive. We compete with other companies that produce products for sale to OEMs, dealers and distributors, and retailers as well as with OEMs that produce their own line of products for their own use. Some of our competitors may have greater financial, research and development or marketing resources than we do. Competition in the high-end segment of the performance-defining market revolves around technical features, performance, product design, innovation, reliability and durability, brand, time to market, customer service and reliable order execution. While the pricing of competing products is always a factor, we believe the performance of our products helps justify our premium pricing. Within our markets, we compete with several large companies and numerous small companies that provide branded and unbranded products across many of our product lines. These competitors can be divided into the following categories:

Powered Vehicles Group (“PVG”)

Within the market for off-road and specialty vehicle suspension components, we compete with ThyssenKrupp Bilstein Suspension GmbH (commonly known as “Bilstein”), King Shock Technology, Inc. (commonly known as “King Shocks”), Icon Vehicle Dynamics, Sway-A-Way, Pro Comp USA Suspension, Rancho (“Tenneco”), and others.

Within the market for powered vehicle suspension components, we compete with several companies in different submarkets. In the ATV and side-by-side markets, outside of vertically-integrated OEMs, we compete with ZF Sachs (ZF Friedrichshafen AG), and Walker Evans Racing for OEM business and Elka Suspension Inc., Öhlins Racing AB, Works Performance Products, and Penske Racing Shocks / Custom Axis, Inc. for aftermarket business, and others. In the snowmobile market, we compete with KYB (Kayaba Industry Co., Ltd.), Öhlins Racing AB, Walker Evans Racing, Works Performance Products, Inc., Penske Racing Shocks / Custom Axis, Inc, and others.

Aftermarket Applications Group (“AAG”)

In the market for suspension systems, or lift kits, we compete with TransAmerican Wholesale/Pro Comp USA, Rough Country Suspension Systems, TeraFlex, Falcon, ReadyLIFT Suspension, Tuff Country EZ-Ride Suspension, Rusty’s Off-Road, MTS Offroad, Thumper Fab, and others.

In the market for upfitted vehicles, we compete with Roush Performance, Waldoch, Sherrod Vans, American Luxury Coach, DSI Custom Vehicles, Storyteller Overland, Remote Vans, Winnerbago, Airstream, Grench, Grit Overland, Roadtrek, Pleasureway, Benchmark, Sync Vans, Titan Van, Off Highway Vans, and others. In the market for aftermarket wheels, we compete with Wheel Pros (KMC, Black Rhino, Fuel, XD Wheels) and Raceline, as well as others.

Specialty Sports Group (“SSG”)

Within the market for bike suspension components, we compete with several companies that manufacture front and rear suspension products, including RockShox (a subsidiary of SRAM Corp.), X-Fusion Shox (a wholly owned subsidiary of A-Pro), Manitou (a subsidiary of HB Performance Systems), SR Suntour, DT Swiss (a subsidiary of Vereinigte Drahtwerke AG), Cane Creek Cycling, DVO Suspension, Bos-Mountain Bike Suspensions, and Öhlins Racing AB. In the market for other bike components, we compete with SRAM, Truvativ and Zipp (all subsidiaries of SRAM Corp.), DT Swiss (a subsidiary of Vereinigte Drahtwerke AG), Mavic (a subsidiary of Bourrelier), and Shimano, as well as others.

Within the market for baseball and softball gear and equipment, we compete with offerings from multiple large baseball equipment manufacturers, including Easton (under the Easton and Rawlings brands) and Wilson Sporting Goods Company (under the Wilson, DeMarini, Louisville Slugger, and Evoshield brands), and numerous smaller wood bat specific brands including Old Hickory, Chandler Bats, Tucci, Dove Tail, Sam Bat, and D-Bat, as well as others.

Our products

We design, engineer and manufacture performance-defining products, of which a significant portion is suspension products. These suspension products dissipate the energy and force generated by bikes and powered vehicles while they are in motion. Suspension products allow wheels or skis (in the case of snowmobiles) to move up and down to absorb bumps and shocks while maintaining contact with the ground for better control. Our products use adjustable suspension, position-sensitive damping, electronically controllable damping, multiple air spring technologies, low weight and structural rigidity, all of which improve user control for greater performance. We also offer premium baseball and softball gear and equipment.

We use high-grade materials in our products and developed a number of sophisticated assembly processes to maintain quality across all product lines. Our suspension products are assembled according to precise specifications throughout the assembly process to create consistently high-performance levels and customer satisfaction.

Powered Vehicles

In our powered vehicle product categories, we offer premium products under the FOX brand for off-road vehicles and trucks, side-by-sides, on-road vehicles with and without off-road capabilities, ATVs, snowmobiles, specialty vehicles and applications, and motorcycles. In each of the years ended January 3, 2025, December 29, 2023 and December 30, 2022, approximately 33%, 36% and 27%, respectively, of our net sales were attributable to net sales of powered vehicles related products.

Products for these vehicles are designed for use on roads, trail riding, racing, and to help maximize performance and comfort. Our products have also been used on limited quantities of off-road military vehicles and other small-scale select military applications. Our aftermarket truck suspension component products in the powered vehicles category range from two-inch bolt-on shocks to our patented position sensitive internal bypass shocks. In addition, we manufacture suspension systems that enhance the handling and ride quality of muscle cars, trucks, sports cars and hot rods. With the recent acquisition of Marzocchi in 2024, we expanded our product portfolio to include Marzocchi motorcycle shocks, forks, cushioning, and hydraulic components. This acquisition enhances our market position by aligning us with Marzocchi's established client base, which includes leading motorcycle manufacturers such as Ducati, BMW, and Triumph.

Aftermarket Applications

Our range of aftermarket applications products includes premium products under the BDS Suspension, Zone Offroad, JKS Manufacturing, RT Pro UTV, 4x4 Posi-Lok, Ridetech, Fox Factory Vehicles, Black Widow, Rocky Ridge, Outside Van, and Custom Wheel House brands, including Method Race Wheels, designed for off-road vehicles and trucks, side-by-sides, on-road vehicles with or without off-road capabilities, specialty vehicles and applications, and commercial trucks. In each of the years ended January 3, 2025, December 29, 2023 and December 30, 2022, approximately 30%, 38% and 31%, respectively, of our net sales were attributable to net sales of aftermarket applications related products.

We also offer lift kits and components with our shock products and aftermarket accessory packages for use in trucks. With the recent acquisitions of Shock Therapy in December 2021 and Custom Wheel House in 2023, we added suspension tuning services and high-performance wheels, off-road tires and accessories to the portfolio. Our upfitting category leverages our strong partnerships with Ford, General Motors, Jeep, Nissan and RAM, enabling us to obtain truck, van and SUV chassis directly from the manufacturers’ facilities. We seek to improve each vehicle’s capability with high quality, proprietary components and products, such as lift kits, shock products, superchargers, interior accessories, wheels, tires, lighting, and body enhancements, while still maintaining the factory warranty and safety standards that our customers expect. Our upfitting category includes brands such as Black Widow, Rocky Ridge, Badlander, Black Ops, Harley-Davidson and Shelby American.

Specialty Sports

Our bike product offerings are used on a wide range of performance mountain bikes, e-bikes and gravel bikes under the FOX, Race Face, Easton Cycling and Marzocchi brands. Primarily for the mountain bike market, we offer mid-end and high-end front fork and rear suspension products designed for cross-country, trail, all-mountain, free-ride and downhill riding. Our mountain bike suspension products are sold in five series and under the Marzocchi brand: (i) our Marzocchi BOMBER series, designed for a rider who values ease of use over adjustability; (ii) our FOX Rhythm series, designed to provide FOX performance at the entry price point of the high-end mountain bikes segment; (iii) our FOX Performance series, designed for demanding enthusiasts; (iv) our FOX Performance Elite series, designed for experienced and expert riders; and (v) our FOX Factory series, designed for maximum performance at a professional level. We also offer mountain and gravel bike wheels and other performance-defining cycling components under the Race Face and Easton Cycling brands including cranks, chainrings, pedals, bars, stems, and seat posts.

We offer six categories of baseball and softball products under the Marucci brands: (i) metal bats, (ii) wood bats, (iii) apparel & accessories, (iv) batting gloves, (v) fielding gloves, and (vi) bags & protective equipment. Our product strategy encompasses producing high quality products recognized by consumers for their performance, craftsmanship, and value, and building on a rich history to introduce innovative new products.

In each of the years ended January 3, 2025, December 29, 2023 and December 30, 2022, approximately 37%, 26% and 42%, respectively, of our net sales were attributable to net sales of specialty sports-related products.

Research and development

Research and development are at the core of our product innovation and market leadership strategy. We have a growing team of engineers and technicians focused on designing innovative products and developing engineering-based solutions to enhance our product offerings. In addition, a large number of our other employees, many of whom use our products in their recreational activities, contribute to our research and development and product innovation initiatives. Their involvement in the development of new products ranges from participating in initial brainstorming sessions to test riding products in development. Product development also includes collaborating with OEM customers across end-markets, field testing by professional athletes and sponsored race teams and working with enthusiasts and other users of our products. This feedback helps us to develop innovative products that meet our demanding standards as well as the evolving needs of professional and recreational end users and to quickly commercialize these products.

Our research and development activities are supported by state-of-the-art engineering software design tools, integrated manufacturing facilities and a performance-testing center equipped to enhance product safety, durability and performance. Our testing center collects data and tests products prior to and after commercial introduction. Suspension products undergo a variety of rigorous performance and accelerated life tests before they are introduced into the market. Baseball and softball products are also subject to rigorous product validation on the field and in the Marucci performance lab where professional and amateur players test and provide feedback before product rollout and distribution. Research and development expenses totaled approximately $60.3 million, $53.2 million and $56.2 million in fiscal years 2024, 2023 and 2022, respectively.

Intellectual property

Intellectual property is an important aspect of our business. We rely upon a combination of patents, trademarks, trade names, licensing arrangements, trade secrets, know-how and proprietary technology and we secure and protect our intellectual property rights.

Our intellectual property counsel diligently protects our new technologies with patents and trademarks and defends against patent infringement allegations. We patent our proprietary technologies related to vehicle suspension and other products in the U.S. and various foreign patent offices. Our principal intellectual property also includes our registered trademarks in the U.S. and a number of international jurisdictions, including the marks of FOX® and others from subsidiaries. Although our intellectual property is important to our business operations and constitutes a valuable asset in the aggregate, we do not believe that any single patent, trademark or trade secret is critical to the success of our business as a whole. We cannot be certain that our patent applications will be issued or that any issued patents will provide us with any competitive advantages or will not be challenged by third parties.

In addition to the foregoing protections, we generally control access to and use of our proprietary and other confidential information using internal and external controls, including contractual protections with employees, OEMs, distributors and others.

Customers

Our OEM customers include market leaders in their respective categories, and they help define, as well as respond to, consumer trends in their respective industries. These OEM customers include our products on a number of their performance models. We believe OEMs often use our products to improve the marketability and demand of their own products, which, in turn, strengthens our brand image. In addition, consumers select our performance-defining products in the aftermarket channel, where we market through a global network of dealers and distributors. We currently sell to approximately 250 OEMs and distribute our products to more than 16,000 retail dealers and distributors worldwide. In 2024, approximately 44% of our net sales resulted from net sales to OEM customers, approximately 49% resulted from net sales to dealers and distributors for resale in the aftermarket channel, and approximately 7% resulted from net sales through direct-to-consumer channels. No material portion of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the U.S. government.

Net sales attributable to our 10 largest customers, which can vary from year-to-year, collectively accounted for approximately 36%, 35%, and 35% of our net sales in fiscal years 2024, 2023 and 2022, respectively. In 2024 and 2023, our sales to Ford, a powered vehicles OEM, accounted for approximately 15% and 13% of total net sales, respectively. In 2022, no single customer represented 10% or more of our sales.

Although we refer to the branded bike OEMs that use our products throughout this document as “our customers,” “our OEM customers” or “our bike OEM customers,” branded bike OEMs often use contract manufacturers to manufacture and assemble their bikes. As a result, even though we typically negotiate price and volume requirements directly with our bike OEM customers, the contract manufacturer may place the purchase order and therefore assumes the payment responsibilities.

Our North American net sales totaled $1,097.3 million, $1,127.6 million, and $1,009.2 million, or 79%, 77% and 63%, of our total net sales in 2024, 2023 and 2022, respectively. Our international net sales totaled $296.6 million, $336.6 million and $593.3 million or 21%, 23% and 37% of our total net sales in fiscal years 2024, 2023 and 2022, respectively. Net sales attributable to countries outside the U.S. are based on shipment location. Our international net sales, however, do not necessarily reflect the location of the end users of our products, as many of our products are incorporated into bikes and powered vehicles that are assembled at international locations and then shipped back to the U.S. Additional information about our product revenues and certain geographical information is available in Note 2. Revenues of the Notes to Consolidated Financial Statements in this Annual Report on Form 10-K. Powered Vehicles

We sell our powered vehicle suspension products to OEMs, including BRP, Ford, Polaris, Toyota, Kawasaki, Yamaha, Stellantis, CF Moto, Ducati, BMW, Triumph, and Honda. We also are continually nurturing and developing relationships with our existing and new OEMs, as the powered vehicles market continues to grow. After incorporating our products on their powered vehicles, OEMs typically sell their powered vehicles to independent dealers, which then sell directly to consumers.

Aftermarket Applications

In the aftermarket, we typically sell suspension products to dealers and distributors, both domestically and internationally. Our dealers sell directly to consumers. When we sell to our distributors, they sell to independent dealers, which then sell directly to consumers. In our upfitting product category, we sell to a broad network of automotive dealerships, including Ford, General Motors, and Stellantis (Ram and Jeep).

Specialty Sports

We sell our bike suspension and components products to a broad network of domestic and international bike OEMs, including Specialized, Trek Bicycles, Giant, Cube, Orbea, Canyon Bicycles, Santa Cruz Bicycles, and Yeti Cycles. We have long-standing relationships with many of the top bike OEMs. After incorporating our products on their bikes, OEMs typically sell their bikes to independent dealers, which then sell directly to consumers.

In the aftermarket, we typically sell to North American dealers and through distributors internationally. Our dealers sell directly to aftermarket consumers. Our overseas distributors sell to independent dealers, which then sell directly to consumers.

We sell our baseball and softball gear and equipment products through several channels including big box retailers; direct-to-consumer, direct-to-team, the company's experiential clubhouse retail stores and other owned channels; and third-party e-commerce and resellers.

Sales and marketing

We employ specialized and dedicated sales professionals. Each sales professional is fully responsible for servicing either OEM or aftermarket customers within our product categories, which ensures that our customers are in contact with capable and knowledgeable sales professionals to address their specific needs. We strongly believe that providing a high level of service to our end customers is essential to maintaining our reputational excellence in the marketplace. Our sales professionals receive training on the brands’ latest products and technologies and attend trade shows and events to increase their market knowledge.

Our marketing strategy focuses on strengthening and promoting our brands in the marketplace. We strategically focus our marketing efforts on enthusiasts seeking high-end, performance-defining products and systems through promotions at destination riding locations and individual and team sponsorships. We believe the performance of our products has been demonstrated by, and our brands benefit from, the success of professional athletes who use our products in elite competitive events such as the Olympic Games, the Union Cycliste Internationale Mountain Bike World Cup, the X Games, the Baja 1000, and Major League Baseball games. We also believe these successes positively influence the purchasing habits of enthusiasts and other consumers seeking performance-defining products.

We believe that our strategic focus on the performance and racing segments in our markets, including our sponsorships of a number of professional athletes and race teams, influences many aspiring and enthusiast consumers and enables our products to be sold at premium price points. In order to continue to enhance our brand image, we will need to maintain our position in the suspension products industry and to continue to provide high-quality products and services.

We have also been able to develop long-term strategic relationships with leading OEMs. Our reputation for performance-defining products plays a critical role in our aftermarket sales to consumers.

In addition to our websites and traditional marketing channels, such as print advertising and tradeshows, we maintain an active social media presence, including Instagram feeds, Facebook pages, YouTube channels, Vimeo channels and Twitter feeds to increase brand awareness, foster loyalty and build a community of users. As strategies and marketing plans are developed for our products, our internal marketing and communications group works to ensure brand cohesion and consistency.

Manufacturing

We manufacture and complete final assembly on most of our products. By controlling the manufacturing process of our products, we can maintain our strict quality standards, customize our machines and processes for the specific requirements of our products, and quickly respond to feedback we receive on our products in development and otherwise. Furthermore, manufacturing our own products enables us to adjust our labor and production inputs to meet seasonal demands and the customized requirements of some of our customers.

Powered Vehicles

In the fourth quarter of 2021, we completed the construction of our Gainesville Facility to diversify our manufacturing platform and provide additional long-term capacity to support growth in our PVG.

Furthermore, we strategically reallocated a majority of the aftermarket production to our El Cajon, CA facility, leveraging its capabilities and optimizing resource allocation.

Aftermarket Applications

We expanded our existing product mix to other areas in the upfitting, high-performance wheels, off-road tires and accessories businesses, enhancing our market reach and product offerings. These initiatives significantly contributed to the increased manufacturing and production output, positioning us favorably to meet growing demand and capitalize on market opportunities.

Specialty Sports

With the acquisition of Marucci in 2023, we expanded our manufacturing footprint to baseball and softball gear and equipment products. We maintain a vertically integrated wood bat manufacturing process with domestic production facilities in Baton Rouge. LA and King of Prussia, PA, supported by two timber mills and a wood drying facility. The Company sources other product lines, including metal bats, apparel, and accessories, from an established international supplier network.

Suppliers and raw materials

The primary raw materials used in the production of our products are aluminum, magnesium, carbon and steel. We generally use multiple suppliers for our raw materials and believe that our raw materials are in adequate supply and available from many suppliers at competitive prices. We do, however, depend on a limited number of suppliers for certain of our components. If our current suppliers for such components are unable to timely fill orders, or if we are required to transition to other suppliers, we could experience significant production delays or disruption to our business. Please read Item 1A. Risk Factors – Risks Related to Our Business and Operations - “We depend on a limited number of suppliers for our materials and component parts for some of our products, and the loss of any of these suppliers or an increase in cost of raw materials could harm our business.” In addition, prices for our raw materials fluctuate from time to time. While we have been able to mitigate the impacts of price fluctuations on our business historically, we actively monitor current market conditions and price trends. We also have OEM partners that supply vehicle chassis used in our upfitting operations. Our operations could be, and have been, negatively impacted if we are not able to receive vehicle chassis according to our production needs, or if an OEM decides to discontinue supplying chassis for other reasons.

We work closely with our supply base, and depend upon certain suppliers to provide raw inputs, such as forgings, castings and molded polymers optimized for weight, structural integrity, wear and cost. In certain circumstances, we depend upon a limited number of suppliers for such raw inputs. We typically have no firm contractual sourcing agreements with our suppliers other than purchase orders.

Miyaki is the exclusive producer of the Kashima coating for our suspension component tubes. As part of our agreement with Miyaki, or the Kashima Agreement, we have been granted the exclusive right to use the trademark “KASHIMACOAT” on products comprising the aluminum finished parts for suspension components (e.g., tubes) and on related sales and marketing material worldwide, subject to a minimum year order and certain other exclusions.

Human Capital Resources

Employee Overview

As of January 3, 2025, we had approximately 4,100 employees in the U.S., Canada, Europe, Taiwan, Thailand and Australia. Our employees are primarily located in the U.S. We also use temporary employees at our manufacturing facilities to help us meet seasonal demands. None of our employees are subject to collective bargaining agreements.

Health and Safety

Employee health and safety in the workplace is one of our top priorities. We are committed to providing a safe and healthy work environment by following guidance from relevant health and safety organizations, as well as state and local regulations. We have implemented measures to support employee well-being, including offering paid sick leave or paid time off for illness and absences. Our commitment to employee safety and well-being remains a top priority.

Inclusion, Diversity and Engagement

At FOX, we believe that people are our greatest asset. Therefore, we are committed to building and maintaining an inclusive workplace in which all employees feel they belong, are empowered to be their best, and inspired to deliver maximum performance. Our employees have diverse skills, experiences and unique perspectives that collectively contribute to greater opportunities for engagement, innovation and business growth. Our commitment to Inclusion, Diversity, and Engagement aligns with our values of Leadership, Trust, Service, Agility, Ingenuity, and Collaboration and is a critical component of being a purpose-led organization. The Inclusion, Diversity, and Engagement strategy is sponsored by the entire Executive Leadership Team and is centered on the following objectives:

•build a globally diverse, high-performing workforce that mirrors the populations around us;

•foster an inclusive workplace culture where all feel like they are heard, welcomed, valued, and empowered; and

•engage our people in making an impact in the marketplace where we live, work, and play.

Employee Benefits

Our employee benefits are designed to attract and retain our employees and include medical, health and dental insurance, short-term and long-term disability insurance, accidental death and disability insurance, voluntary supplemental coverages, discount programs, and our 401(k) Plan. As part of the 401(k) Plan, FOX matches 50% of the first 6% of compensation contributed by the employee, including executive officers, into the 401(k) Plan.

Practices related to working capital items

Government regulation

Environmental

Our manufacturing operations, facilities and properties in the U.S., Europe, Canada, and Taiwan are subject to evolving foreign, international, federal, state and local environmental and occupational health and safety laws and regulations, including those governing air emissions, wastewater discharge and the storage and handling of chemicals and hazardous substances. If we fail to comply with such laws and regulations, we could be subject to significant fines, penalties, costs, liabilities or restrictions on operations, which could negatively affect our financial condition.

We believe that our operations are in compliance, in all material respects, with applicable environmental and occupational health and safety laws and regulations, and our compliance with such laws and regulations has not had, nor is it expected to have, a material impact on our earnings or competitive position. However, new requirements, more stringent application of existing requirements or the discovery of previously unknown environmental conditions could result in material environmental related expenditures in the future. For example, in March 2024, the SEC approved new rules for extensive and prescriptive climate-related disclosures in annual reports and registration statements, which would also require inclusion of certain climate-related financial metrics in a note to companies’ audited financial statements; however, the implementation and enforcement of these rules has been paused and enjoined due to ongoing litigation between the SEC, certain U.S. states and other entities. Please read “Risks Related to Laws and Regulations - Increasing focus on environmental, social and governance responsibility may impose additional costs on us and expose us to new risks” within Item 1A. Risk Factors in this Annual Report on Form 10-K.. Employment

We are subject to numerous foreign, federal, state and local government laws and regulations governing our relationships with our employees, including those relating to minimum wage, overtime, working conditions, hiring and firing, non-discrimination, work permits and employee benefits. We believe that our operations are conducted in compliance, in all material respects, with such laws and regulations. We never experienced a material work stoppage or disruption to our business relating to employee matters. We believe that our relationship with our employees is good.

Consumer safety

We are subject to the jurisdiction of the U.S. Consumer Product Safety Commission (“CPSC”), and other federal, state and foreign regulatory bodies including the National Highway Traffic Safety Administration (“NHTSA”), which enforces the Federal Motor Vehicle Safety standards. Under CPSC regulations, a manufacturer of consumer goods is obligated to notify the CPSC, if, among other things, the manufacturer becomes aware that one of its products has a defect that could create a substantial risk of injury. If the manufacturer has not already undertaken to do so, the CPSC may require a manufacturer to recall a product, which may involve product repair, replacement or refund. During the past three years, we initiated one voluntary product recall. For additional information, see Item 1A. Risk Factors in this Annual Report on Form 10-K. Government contracts

No material portion of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the U.S. government.

Financial information about segments and geographic areas

We operate in three reportable segments: PVG, AAG, and SSG. Through these segments, we focus on manufacturing, sale and service of performance-defining products. PVG is comprised of sales to off-road and power sports OEM and aftermarket businesses that sell shocks directly to dealers and distributors. AAG is comprised of aftermarket businesses that offer custom vehicle shock, tuning, suspension, lift kit, upfitting, and wheel and tire solutions for automotive and power sports enthusiasts. SSG consists of sales to OEM and aftermarket businesses that provide components for performance mountain bikes, e-bikes, and gravel bikes, as well as sales through dealers, distributors, and direct-to-customer channels, offering premium baseball and softball equipment. Additional information about our product segments and certain geographic information is available in Note 2. Revenues and Note 5. Property, Plant and Equipment, net of the Notes to Consolidated Financial Statements in this Annual Report on Form 10-K. Corporate and available information

Our principal executive offices are located at 2055 Sugarloaf Circle, Suite 300, Duluth, GA 30097, and our telephone number is (831) 274-6500. Our website address is www.ridefox.com.

We file reports with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any other filings required by the SEC. We make available through the Investor Relations section of our website, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information on our website is not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC.

The public may read and copy any materials we file with the SEC at the SEC’s Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

ITEM 1A. RISK FACTORS

Our business, financial condition, operating results and prospects could be materially and adversely affected by various risks and uncertainties that are described herein. In addition to the risks and uncertainties discussed elsewhere in this Annual Report on Form 10-K, you should carefully consider the risks and uncertainties described below. If any of these risks actually occur, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline.

Summary of Risk Factors

The risks described below include, but are not limited to, the following:

Risks Related to Our Business and Operations

•the impact of the risks associated with international geopolitical conflicts is uncertain, but may prove to negatively impact our business and operations;

•our dependency on a limited number of suppliers for materials, component parts, and vehicle chassis could lead to an increase in material costs, disruptions in our supply chain, or reputational costs;

•failure to effectively compete against competitors, enhance existing products or develop, manufacture and market new products that respond to consumer needs and preferences and achieve market acceptance could result in a decrease in demand for our products and negatively impact our business and financial results;

•our performance-defining products, and the bikes and powered vehicles into which many of them are incorporated, are discretionary purchases and may be adversely impacted by changes in the economy, a shrinking market for these powered vehicles, or a material decline in demand for the high-end bikes that make up a significant portion of our sales;

•our business, financial condition and results of operations have been and may continue to be adversely affected by global public health epidemics or pandemics, including the ongoing effects of the COVID-19 pandemic;

•our business depends substantially on our ability to maintain our premium brand image, the continued expansion of the market and demand for our products, and to attract and retain experienced and qualified talent;

•changes in our customer, channel and product mix could place demands that are more rigorous on our infrastructure and cause our profitability percentages to fluctuate;

•a disruption in the operations of our facilities or along our global supply chain, such as work stoppages, labor strikes, or infrastructure issues, could have a negative effect on our business, financial condition or results of operations;

•we may not be able to sustain our past growth or successfully implement our growth strategy, which may have a negative effect on our business, financial condition or results of operations;

•our cost optimization efforts may not succeed or may be significantly delayed;

•the loss of the support of professional athletes for our products, or the inability to attract new professional athletes or disruption in relationships with dealers and distributors may harm our business;

•our business is dependent in large part on our relationships with dealers and distributors and their success and the orders we receive from our OEM customers and from their success. The loss of all or a substantial portion of our sales to any of these customers, including a group of relatively small number of customers that account for a substantial portion of our sales, could have a material adverse impact on us and our results of operations;

•our international operations are exposed to risks associated with conducting business globally;

•our sales could be impacted by the disruption of sales by other manufacturers or if other manufacturers enter into the specialty markets in which we operate;

•if we are unable to enforce our intellectual property rights, our reputation and sales could be adversely affected, while intellectual property disputes could lead to significant costs or the inability to sell products;

•if we inaccurately forecast demand for our products or inaccurately predict destocking and restocking cycles and production schedules, we may manufacture insufficient or excess quantities or our manufacturing costs could increase;

•product recalls and significant product repair and/or replacement due to product warranty costs and claims have had, and in the future could have, a material adverse impact on our business;

•an adverse determination in any material product liability claim against us could adversely affect our operating results or financial condition;

•we and our employees are subject to certain risks in our manufacturing and in the testing of our products;

•fuel shortages, or high prices for fuel, could have a negative effect on the use of powered vehicles that use our products;

•we do not control our suppliers, athletic programs, OEMs, other customers, or partners, or require them to comply with a formal code of conduct, and actions that they might take could harm our reputation and sales;

•we may incur higher employee costs in the future;

•we rely on increasingly complex information systems for management of our various functions. If our information systems fail to perform these functions adequately, if we or our vendors or partners experience an interruption in our operations, or if we are impacted by cybersecurity attacks or data privacy issues, our business could suffer;

•we have grown and may continue to grow through acquisitions, and we may not be able to effectively integrate businesses we acquire, or we may not be able to identify or complete future acquisitions on favorable terms, or at all;

•our operating results are subject to quarterly variations in our sales, which could make our operating results difficult to predict and could adversely affect the price of our common stock;

•qualitative data and limited sources support our beliefs regarding the future growth of the performance-defining product market and may not be reliable;

•the current inflation and changes in interest rates in response, could negatively impact our cash flows due to higher debt costs or negatively impact our customers’ ability to finance powered vehicles or bikes that include our products;

Risks Related to Our Indebtedness and Liquidity

•our amended credit agreement with Wells Fargo Bank, National Association, and other named lenders (“2022 Credit Facility”) places operating restrictions on us and creates default risks, and the variable rate makes us more vulnerable to increases in interest rates;

•we continue to have the ability to incur debt, and our levels of debt may affect our operations and our ability to pay the principal of and interest on our debt;

•we may incur losses on interest rate swap and hedging arrangements;

Risks Related to Laws and Regulations

•changes in tax laws and regulations or other factors could cause our income tax obligations to increase, potentially reducing our net income and adversely affecting our cash flows;

•we are subject to extensive U.S. federal and state, foreign and international safety, environmental, employment practices and other government regulations that may require us to incur expenses or modify product offerings in order to maintain compliance with such regulation, which could have a negative effect on our business and results of operations;

•unpredictability in increasingly stringent emission standards and increasing focus on environmental, social and governance responsibility, including climate change, may impose additional costs and new risks on us;

•we are subject to employment practice laws and regulations, and, as such, are exposed to litigation risks;

•we are subject to environmental laws and regulations and potential exposure, costs and liabilities due to laws and regulations regarding conflict minerals, environmental matters, land-use, and noise and air pollution may have a negative impact on our future sales and results of operations;

•we retain certain personal information about individuals and are subject to various privacy and consumer protection laws;

•our vendors and any potential commercial partners may engage in misconduct or other improper activities, including non-compliance with regulatory standards and requirements;

•U.S. policies related to global trade and tariffs could have a material adverse effect on our results of operations;