UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

|

Direxion Shares ETF Trust |

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1)and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

EXPLANATORY NOTE

We are filing this amended definitive proxy statement (the “Amended Definitive Proxy Statement”) to update shareholder contact information contained in the Definitive Proxy Statement on Schedule 14A previously filed on December 10, 2021 (the “Original Filing”) in connection with the Special Meeting of Shareholders to be held on March 11, 2022. We will print and distribute to our shareholders the Amended Definitive Proxy Statement in lieu of the Original Filing.

DIREXION SHARES ETF TRUST

1301 Avenue of the Americas, 28th Floor

New York, NY 10019

December 10, 2021

Dear Shareholders:

You are being asked to vote on a proposal related to the Direxion Shares ETF Trust (the “Trust”) at a Special Meeting of Shareholders (“Special Meeting”) of each fund organized as a series of the Trust (each a “Fund” and collectively, the “Funds”). The Special Meeting is to be held at 241 N. Broadway, Suite 202, Milwaukee, WI 53202 on March 11, 2022, at 10 a.m. Central Time. The enclosed documents explain the proposal.

As discussed in more detail in the enclosed Proxy Statement, you are being asked to elect eight trustees to the Board of Trustees of the Trust (the “Board”). The election of the eight nominees includes six nominees who are not “interested persons” of the Trust within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended, and two that are “interested persons.” If elected, the six “non-interested persons” would serve on the Board as “Independent Trustees.”

The Trust’s Board has unanimously approved the proposal and recommends that you vote FOR the proposal described in the Proxy Statement.

We encourage you to read the attached Proxy Statement in full. Following this letter are questions and answers regarding this proxy solicitation. The information is designed to help you cast your vote as a shareholder of the Funds, and is being provided as a supplement to, and not a substitute for, your proxy materials.

The Notice of Special Meeting of Shareholders, the accompanying Proxy Statement, and the proxy card for the Funds are enclosed. Please read them carefully. If you are unable to attend the Special Meeting, we urge you to sign, date, and return the proxy card (or vote by Internet or telephone) so that your shares may be voted in accordance with your instructions. Voting your shares in a timely manner helps the Funds avoid additional costs.

Your vote is important to us. Thank you for taking the time to consider this important proposal.

Sincerely yours,

Angela Brickl

Secretary

- 1 -

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

OF

DIREXION SHARES ETF TRUST

Direxion Auspice Broad Commodity Strategy ETF

Direxion Flight to Safety Strategy ETF

Direxion Russell 1000® Value Over Growth ETF

Direxion Russell 1000® Growth Over Value ETF

Direxion NASDAQ-100® Equal Weighted Index Shares

Direxion Work From Home ETF

Direxion Moonshot Innovators ETF

Direxion World Without Waste ETF

Direxion Dynamic Hedge ETF

Direxion Fallen Knives ETF

Direxion Hydrogen ETF

Direxion Low Priced Stock ETF

Direxion Nanotechnology ETF

Direxion Daily S&P 500® Bear 1X Shares

Direxion Daily CSI 300 China A Share Bear 1X Shares

Direxion Daily S&P 500® Bull 2X Shares

Direxion Daily CSI 300 China A Share Bull 2X Shares

Direxion Daily CSI China Internet Index Bull 2X Shares

Direxion Daily MSCI Brazil Bull 2X Shares

Direxion Daily MSCI India Bull 2X Shares

Direxion Daily Russia Bull 2X Shares

Direxion Daily Cloud Computing Bull 2X Shares

Direxion Daily Cloud Computing Bear 2X Shares

Direxion Daily Energy Bull 2X Shares

Direxion Daily Energy Bear 2X Shares

Direxion Daily Gold Miners Index Bull 2X Shares

Direxion Daily Gold Miners Index Bear 2X Shares

Direxion Daily Junior Gold Miners Index Bull 2X Shares

Direxion Daily Junior Gold Miners Index Bear 2X Shares

Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares

Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares

Direxion Daily Robotics, Artificial Intelligence & Automation Index Bull 2X Shares

Direxion Daily 5G Communications Bull 2X Shares

Direxion Daily Travel & Vacation Bull 2X Shares

Direxion Daily Global Clean Energy Bull 2X Shares

Direxion Daily Select Large Caps & FANGs Bull 2X Shares

Direxion Daily US Infrastructure Bull 2X Shares

- 2 -

Direxion Daily Mid Cap Bull 3X Shares

Direxion Daily S&P 500® Bull 3X Shares

Direxion Daily S&P 500® Bear 3X Shares

Direxion Daily Small Cap Bull 3X Shares

Direxion Daily Small Cap Bear 3X Shares

Direxion Daily S&P 500® High Beta Bull 3X Shares

Direxion Daily S&P 500® High Beta Bear 3X Shares

Direxion Daily FTSE China Bull 3X Shares

Direxion Daily FTSE China Bear 3X Shares

Direxion Daily MSCI Emerging Markets Bull 3X Shares

Direxion Daily MSCI Emerging Markets Bear 3X Shares

Direxion Daily FTSE Europe Bull 3X Shares

Direxion Daily MSCI Mexico Bull 3X Shares

Direxion Daily MSCI South Korea Bull 3X Shares

Direxion Daily Aerospace & Defense Bull 3X Shares

Direxion Daily S&P Biotech Bull 3X Shares

Direxion Daily S&P Biotech Bear 3X Shares

Direxion Daily Consumer Discretionary Bull 3X Shares

Direxion Daily Financial Bull 3X Shares

Direxion Daily Financial Bear 3X Shares

Direxion Daily Healthcare Bull 3X Shares

Direxion Daily Homebuilders & Supplies Bull 3X Shares

Direxion Daily Industrials Bull 3X Shares

Direxion Daily Dow Jones Internet Bull 3X Shares

Direxion Daily Dow Jones Internet Bear 3X Shares

Direxion Daily Pharmaceutical & Medical Bull 3X Shares

Direxion Daily MSCI Real Estate Bull 3X Shares

Direxion Daily MSCI Real Estate Bear 3X Shares

Direxion Daily Regional Banks Bull 3X Shares

Direxion Daily Retail Bull 3X Shares

Direxion Daily Semiconductor Bull 3X Shares

Direxion Daily Semiconductor Bear 3X Shares

Direxion Daily Technology Bull 3X Shares

Direxion Daily Technology Bear 3X Shares

Direxion Daily Transportation Bull 3X Shares

Direxion Daily Utilities Bull 3X Shares

Direxion Daily 7-10 Year Treasury Bull 3X Shares

Direxion Daily 7-10 Year Treasury Bear 3X Shares

Direxion Daily 20+ Year Treasury Bull 3X Shares

Direxion Daily 20+ Year Treasury Bear 3X Shares

(each a “Fund” and collectively, the “Funds”)

241 N. Broadway, Suite 202

Milwaukee, WI 53202

(866) 476-7523

- 3 -

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting of shareholders (the “Special Meeting”) of the Direxion Shares ETF Trust (the “Trust”) and each Fund organized as a series of the Trust, will be held at the offices of Rafferty Asset Management, LLC (“Rafferty”), 241 N. Broadway, Suite 202, Milwaukee, WI 53202 on March 11, 2022, at 10 a.m. Central Time. The Special Meeting is being held to elect eight Trustees to the Trust’s Board of Trustees.

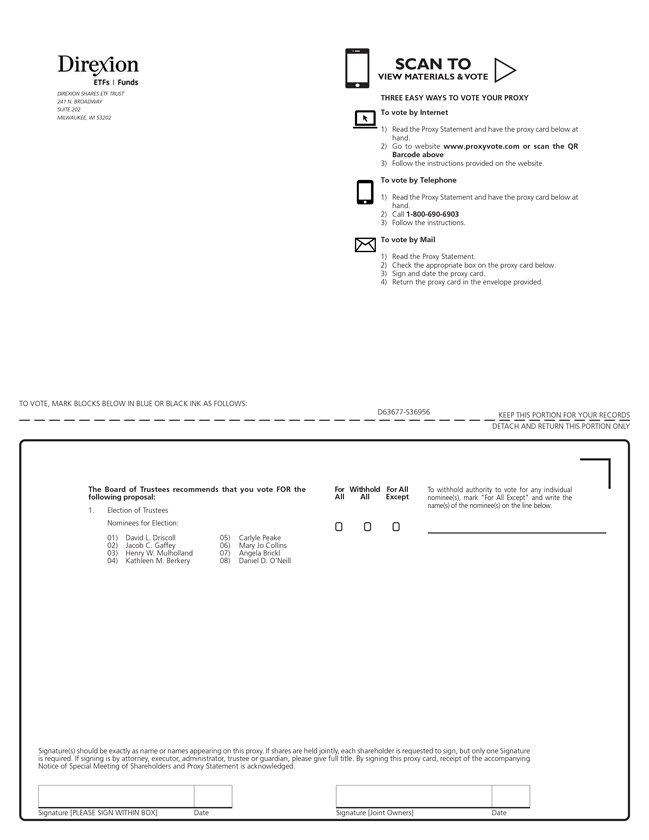

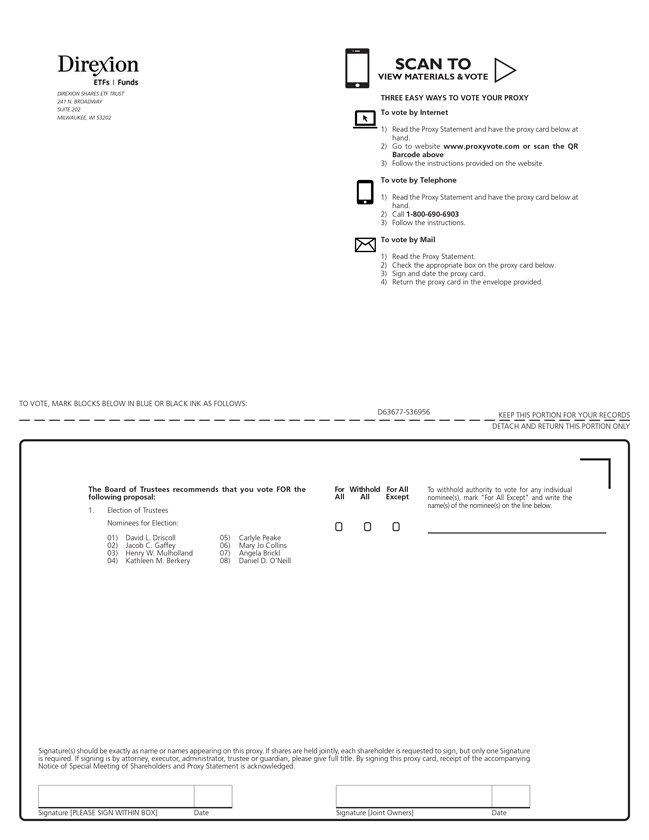

You are entitled to vote at the Special Meeting and any adjournment thereof if you owned shares of the Funds at the close of business on December 3, 2021. If you attend the Special Meeting, you may vote your shares at the meeting. Whether or not you intend to attend the Special Meeting, you may vote in any of the following ways:

| | (1) | Internet: Have your proxy card available. Vote on the Internet by accessing the website address on your proxy card. Enter your control number from your proxy card. Follow the instructions found on the website; |

| | (2) | Telephone: Have your proxy card available. You may vote by telephone by calling the toll-free number on your proxy card. Enter the control number on the proxy card and follow the instructions provided. (A confirmation of your telephone vote will be mailed to you.); or |

| | (3) | Mail: Vote, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope. |

Important Notice Regarding the Internet Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on March 11, 2022 or Any Adjournment Thereof. This Notice and the Proxy Statement are available on the Internet at www.proxyvote.com. On this website, you will be able to access the Notice, the Proxy Statement, any accompanying materials and any amendments or supplements to the foregoing material that are required to be furnished to shareholders.

We encourage you to access and review all of the important information contained in the proxy materials before voting.

By order of the Board of Trustees of the

Direxion Shares ETF Trust,

Angela Brickl

Secretary

Direxion Shares ETF Trust

Dated: December 10, 2021

- 4 -

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. TO AVOID THE NEED FOR FOLLOW-UP MAIL AND TELEPHONE SOLICITATION, PLEASE RETURN YOUR PROXY CARD PROMPTLY.

It is important that you vote even if your account was closed after the December 3, 2021 Record Date.

Shareholders are invited to attend the Special Meeting. Any shareholder who does not expect to attend the Special Meeting is urged to indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. If you sign, date and return the proxy card but give no instructions, your shares will be voted “FOR” the Proposals described above and “FOR” or “AGAINST” any other matter acted upon at the Meeting in the discretion of the persons named as proxy.

Alternatively, you may vote your proxy on the Internet or by telephone in accordance with the instructions on the enclosed proxy card. Any shareholder proposal submitted to a vote at the Special Meeting may be voted only in person or by written proxy.

To avoid the additional expense of further solicitation, we ask your cooperation in mailing your proxy promptly, no matter how large or small your holdings may be.

Only one proxy statement will be sent to two or more shareholders who share an address, unless such a shareholder writes or calls Rafferty Asset Management, LLC, 1301 Avenue of the Americas, 28th Floor, New York, NY 10019; (866) 476-7523.

Notice to Corporations and Partnerships: Proxy cards submitted but not signed by the appropriate persons as set forth in the voting instructions on the proxy card(s) will not be voted.

- 5 -

DIREXION SHARES ETF TRUST

Important Information to Help You Understand

and Vote on the Proposal

Please read the information in the proxy statement that follows the questions and answers below. We appreciate you placing your trust in the Direxion Shares ETF Trust and look forward to helping you achieve your financial goals.

Why am I receiving this proxy statement?

This proxy statement seeks your approval as a shareholder of a Fund that is a series of the Direxion Shares ETF Trust (the “Trust”) regarding the election of Trustees to the Trust’s Board of Trustees (the “Board”). On December 3, 2021, you owned shares of a Fund or Funds and, as a result, have a right to vote on the proposal.

What proposal am I being asked to vote on?

You are being asked to vote on the proposal to elect eight trustees, David L. Driscoll, Jacob C. Gaffey, Henry W. Mulholland, Kathleen M. Berkery, Carlyle Peake, Mary Jo Collins, Angela Brickl and Daniel D. O’Neill (the “Nominees”) to the Trust’s Board. Messrs. Driscoll, Gaffey, Mulholland, and O’Neill and Ms. Berkery are current members of the Trust’s Board. Mr. Peake and Mses. Collins and Brickl are not current members of the Board. The proxy statement describes the proposal in more detail.

Why am I being asked to elect eight Trustees?

The Trust and each Fund are overseen by the Board. The Board is recommending that shareholders of each Fund elect eight Trustees, six of whom are not “interested persons of the Funds within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended (“1940 Act”), and two of whom are considered to be “interested persons.” Therefore, if elected, the non-interested Nominees would serve on the Board as “Independent Trustees” under the 1940 Act, which is one of the federal securities laws governing the Funds. Each Nominee that is an interested person would serve as an “Interested Trustee.”

What role does the Board play?

The Trustees act as shareholder representatives. They have an obligation to serve the best interests of shareholders. The Trustees review each Fund’s

- 6 -

performance, oversee the Trust and the Funds’ activities and review contractual arrangements with companies that provide services to the Trust and Funds.

Do Trustees receive compensation for their services?

Each Independent Trustee receives compensation for his or her service on the Board. Trustees that are not Independent Trustees do not receive compensation for their service on the Board. The proxy statement provides details about each Nominee and compensation paid to the Independent Trustees.

Who is paying for my shareholder meeting and proxy statement?

The Funds will bear the costs, fees and expenses incurred in connection with the proxy statement, except certain Funds are subject to an Operating Expense Limitation Agreement or Operating Services Agreement, under which Rafferty has contractually agreed to limit certain expenses of the Funds.

What is the required vote?

The proposal to elect eight Trustees to the Board requires the affirmative vote of a plurality of the shares voted at the Special Meeting in person or by proxy.

What happens if the shareholders do not elect the Trustees?

If the Funds’ shareholders do not elect the eight Trustees to the Board, the current members of the Board will continue to serve as Trustees.

How does the Board suggest I vote in connection with the proposal?

After careful consideration, the Board unanimously recommends that you vote FOR the proposal.

How do I vote my shares?

You can vote in any of the following ways:

| | |

| Internet: | | Have your proxy card available. Vote on the Internet by accessing the website address on your proxy card. Enter your control number from your proxy card. Follow the instructions found on the website; |

- 7 -

| | |

| Telephone: | | Have your proxy card available. You may vote by telephone by calling the number on your proxy card. Enter the control number on the proxy card and follow the instructions provided (A confirmation of your telephone vote will be mailed to you.); or |

| |

| Mail: | | Vote, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope. |

How do I sign the proxy card if I vote by mail?

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

Joint Accounts: Both parties should sign, and the name(s) of the party or parties signing should conform exactly to the name(s) shown in the registration on the proxy card.

All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration.

When and where will the Special Meeting be held?

The Special Meeting will be held at 241 N. Broadway, Suite 202, Milwaukee, WI 53202 on March 11, 2022, at 10 a.m. Central Time, and any adjournment or postponement will be held at the same location. If you plan to attend the Special Meeting in person, please call toll-free 1-866-476-7523.

Whom should I call for more information about the proxy statement?

For more information regarding the proxy statement of the Special Meeting, please call toll-free 1-866-476-7523.

- 8 -

DIREXION SHARES ETF TRUST

1301 Avenue of the Americas, 28th Floor, New York, NY 10019

(866) 476-7523

PROXY STATEMENT

Special Meeting of Shareholders

December 10, 2021

INTRODUCTION

This Proxy Statement is being furnished to the shareholders of the funds organized as series (each a “Fund” and collectively, the “Funds”) of the Direxion Shares ETF Trust (the “Trust”) in connection with the solicitation of shareholder votes by proxy to be voted at the Special Meeting of Shareholders or any adjournments thereof (“Special Meeting”) to be held on March 11, 2022, at 10 a.m. Central Time at the offices of Rafferty Asset Management, LLC (“Rafferty”), 241 N. Broadway, Suite 202, Milwaukee, WI 53202. It is expected that the Notice of Special Meeting, Proxy Statement and proxy card will be first mailed to shareholders on or about December 20, 2021. As more fully described in this Proxy Statement, the purpose of the Meeting is to consider the election of eight Trustees to the Funds’ Board of Trustees (the “Board”).

OVERVIEW

Proposal: You are being asked to elect eight trustees, David L. Driscoll, Jacob C. Gaffey, Henry W. Mulholland, Kathleen M. Berkery, Carlyle Peake, Mary Jo Collins, Angela Brickl and Daniel D. O’Neill (the “Nominees”). Messrs. Driscoll, Gaffey, Mulholland, and O’Neill and Ms. Berkery are current members of the Trust’s Board. Mr. Peake and Mses. Collins and Brickl are not current members of the Board. No Nominee, with the exception of Mr. O’Neill and Ms. Brickl, is an “interested person” of the Trust or Funds within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended (“1940 Act”). Such non-interested persons are commonly referred to as “Independent Trustees.” Mr. O’Neill and Ms. Brickl, if elected, would each serve as an “Interested Trustee.” The Board is unanimously recommending that you approve the election of the Nominees.

- 9 -

VOTING INFORMATION

If the enclosed proxy card is executed properly and returned, shares represented by it will be voted at the Special Meeting in accordance with the instructions on the proxy. A proxy may nevertheless be revoked at any time prior to its use by written notification received by the Funds, by the execution of a subsequently dated proxy or by attending the Special Meeting and voting in person. However, if no instructions are specified on a proxy, shares will be voted “FOR” the Proposal (the “Proposal”) and “FOR” or “AGAINST” any other matters acted upon at the Meeting in the discretion of the persons named as proxies.

The close of business on December 3, 2021, has been established as the record date for the determination of shareholders entitled to notice of, and to vote at, the Special Meeting (“Record Date”). As of the Record Date, the Funds had 592,819,935 shares outstanding, entitled to the same number of votes. Each share will be entitled to one vote at the Special Meeting. Exhibit A lists the control persons and principal shareholders of the Funds.

Quorum and Adjournment: The presence at the Special Meeting, in person or by proxy, of shareholders entitled to cast one-third of the Funds’ outstanding shares are required for a quorum for the Proposal. In the event that a quorum is present at the Special Meeting but sufficient votes to approve the Proposal are not received, the persons named as proxies may propose one or more adjournments of such Special Meeting to permit further solicitation of proxies. The affirmative vote of less than one-third of the votes entitled to be cast represented in person or by proxy is sufficient for adjournment. In such case, the persons named as proxies will vote those proxies “FOR” such an adjournment, except they will vote those proxies required to be voted against such item “AGAINST” such an adjournment. A shareholder vote may be taken on the Proposal in this Proxy Statement prior to any such adjournment if sufficient votes have been received and it is otherwise appropriate. If a shareholder abstains from voting as to any matter, or if a broker returns a “non-vote” proxy, indicating a lack of authority to vote on a matter, then the shares represented by such abstention or non-vote will be treated as shares that are present at the Special Meeting for purposes of determining the existence of a quorum. However, abstentions and broker non-votes will be disregarded in determining the “votes cast” on an issue.

Required Vote: The election of eight Trustees to the Board requires a plurality of the shares voted in person or by proxy.

- 10 -

The most recent Annual and Semi-Annual Reports for the Funds, including financial statements, previously have been furnished to shareholders. If you would like to receive additional copies of these reports free of charge, please write to the Direxion Shares ETF Trust, 1301 Avenue of Americas, 28th Floor, New York, NY 10019 or call toll-free at (866) 476-7523. The reports also are available on the Funds’ website at www.direxion.com and the website of the Securities and Exchange Commission (“SEC”) at www.sec.gov.

PROPOSAL: ELECTION OF TRUSTEES FOR THE TRUST

The proposal relates to the election of eight Trustees to the Trust’s Board. The Board approved the nomination of eight individuals (each a “Nominee,” and collectively, the “Nominees”) for election as Trustees of the Trust. Shareholders are asked to elect the Nominees as Trustees at the Special Meeting on March 11, 2022 or an adjournment thereof at which shareholder approval is obtained (whichever is later, the “Election Effective Date”), each to hold office for life until his or her successor is elected or he or she is removed, resigns or retires.

The Nominees are David L. Driscoll, Jacob C. Gaffey, Henry W. Mulholland, Kathleen M. Berkery and Daniel D. O’Neill, each of whom is a current member of the Trust’s Board. In addition, the Trust’s Board has nominated Carlyle Peake, Mary Jo Collins and Angela Brickl, each of whom is not currently a member of the Board. No Nominee, with the exception of Mr. O’Neill and Ms. Brickl, is an “interested person” of the Trust, as defined in the 1940 Act. Such non-interested persons are commonly referred to as “Independent Trustees.” Mr. O’Neill and Ms. Brickl, if elected, would each serve as an “Interested Trustee.”

The Trust’s Nominating and Governance Committee (the “Nominating Committee”), which consists solely of Independent Trustees, considered recommendations for Trustee nominees, and considered and reviewed the qualifications, experience, and background of each of the Nominees. Based upon this review, the Nominating Committee recommended each Nominee to the Trust’s Board as a candidate for nomination as an Independent Trustee or Interested Trustee. After discussion and consideration of the matter, the Board voted to nominate the Nominees for election by shareholders. Each Nominee has consented to serve as a Trustee and to being named in this Proxy Statement.

- 11 -

INFORMATION CONCERNING THE NOMINEES

The information below provides pertinent information about each of the Nominees. This information includes their principal occupations and present positions, including any affiliation with Rafferty Asset Management, LLC (“Rafferty”) or Foreside Fund Services, LLC (“Distributor”), the length of service to the Funds, and the position, if any, they hold on the board of trustees/directors of companies other than the Funds. Information concerning the Officers of the Funds is included in Exhibit B. The principal address of each Trustee and Officer is 1301 Avenue of the Americas, 28th Floor, New York, NY 10019.

Independent Trustees

| | | | | | | | | | |

Name, Address

and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal

Occupation(s)

During Past Five Years | | # of Portfolios in Direxion Family of Investment Companies Overseen by Trustee(2) | | Other Trusteeships/ Directorships Held by

Trustee During Past

Five Years |

David L. Driscoll Age: 52 | | Trustee | | Lifetime of Trust until removal or resignation; Since 2014 | | Partner, King Associates, LLP, since 2004; Board Advisor, University Common Real Estate, since 2012; Principal, Grey Oaks LLP since 2003; Member, Kendrick LLC, since 2006. | | 118 | | None. |

Jacob C. Gaffey Age: 73 | | Trustee | | Lifetime of Trust until removal or resignation; Since 2014 | | Managing Director, Loomis & Co., 2012-2019. | | 118 | | None. |

Henry W. Mulholland Age: 58 | | Trustee | | Lifetime of Trust until removal or resignation; Since 2017 | | Managing Partner, Grove Hill Partners LLC, since 2016. | | 118 | | None. |

- 12 -

| | | | | | | | | | |

Name, Address

and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal

Occupation(s)

During Past Five Years | | # of Portfolios in Direxion Family of Investment Companies Overseen by Trustee(2) | | Other Trusteeships/ Directorships Held by

Trustee During Past

Five Years |

Kathleen M. Berkery Age: 54 | | Trustee | | Lifetime of Trust until removal or resignation; Since 2019 | | Chief Financial Officer, Student Sponsor Partners, since November 2021; Senior Manager – Trust & Estates, Rynkar, Vail & Barrett, LLC, since 2018; Financial Advisor, Lee, Nolan & Koroghlian Life Planning Group, 2010-2017. | | 118 | | None. |

Carlyle Peake Age: 50 | | Trustee | | Lifetime of Trust until removal or resignation; Since 2022 | | Head of US & LATAM Debt Syndicate, BBVA Securities, Inc., since 2011. | | 118 | | None. |

Mary Jo Collins Age: 65 | | Trustee | | Lifetime of Trust until removal or resignation; Since 2022 | | Managing Director, Imperial Capital LLC, since 2020; Director, Royal Bank of Canada, 2014-2020. | | 118 | | None. |

- 13 -

Interested Trustees

| | | | | | | | | | |

Name, Address

and Age | | Position(s) Held with Fund | | Term of Office and Length of Time Served | | Principal

Occupation(s)

During Past Five Years | | # of Portfolios in Direxion Family of Investment Companies Overseen by Trustee(3) | | Other Trusteeships/ Directorships Held by

Trustee During Past

Five Years |

Daniel D. O’Neill(1) Age: 53 | | Chairman

of the

Board of

Trustees | | Lifetime of Trust until removal or resignation; Since 2008 | | Chief Executive Officer, Rafferty Asset Management, LLC, since 2021; Managing Director of Rafferty Asset Management, LLC, January 1999 – January 2019. | | 118 | | None. |

Angela Brickl(2) Age: 45 | | Trustee, | | Lifetime of Trust until removal or resignation; Since 2022 | | Chief Operating Officer, Rafferty Asset Management, LLC since May 2021; General Counsel, | | 118 | | None. |

| | Chief

Compliance

Officer | | One Year; Since 2018 | | Rafferty Asset Management LLC, since October 2010; Chief Compliance | | | | |

| | | Secretary | | One Year; Since 2011 | | Officer, Rafferty Asset Management, LLC, since September 2012. | | | | |

| (1) | Mr. O’Neill is affiliated with Rafferty as he owns a beneficial interest in Rafferty and serves as an officer of Rafferty. |

| (2) | Ms. Brickl is affiliated with Rafferty because she serves as an officer of Rafferty. |

| (3) | The Direxion Family of Investment Companies consists of the Direxion Shares ETF Trust which, as of the date of this Proxy Statement, offers for sale to the public 79 of the 106 funds registered with the SEC, the Direxion Funds which, as of the date of this Proxy Statement, offers for sale to the public 12 funds registered with the SEC and the Direxion Insurance Trust which, as of the date of this Proxy Statement, does not have any funds registered with the SEC. |

In addition to the information set forth in the tables above and other relevant qualifications, experience, attributes or skills applicable to a particular Trustee, the following provides further information about the qualifications and experience of each Trustee.

- 14 -

Independent Trustees

Mr. Driscoll has significant experience with risk assessment and strategic planning as a partner and manager of various real estate partnerships and companies.

Mr. Gaffey has significant experience with providing investment banking and valuation services to various companies.

Mr. Mulholland has extensive experience with equity trading, risk management, equity market structure as well as managing regulatory and compliance matters.

Ms. Berkery has extensive experience with estate planning, estate administration, fiduciary income taxation, financial planning, finance, as well as business sales and development, and marketing.

Mr. Peake has extensive global capital markets experience, as well as experience with client relations and sales of securities by issuers and investors and valuing, structuring, and negotiating complex debt issues for corporate and sovereign entities.

Ms. Collins has extensive experience evaluating credit risk of investment grade securities, including corporate bonds, preferred stocks, and hybrid securities, as well as managing relationships with retail and institutional investors.

Interested Trustees

Mr. O’Neill has extensive experience in the investment management business, including as managing director of Rafferty. Mr. O’Neill was the Managing Director of Rafferty from 1999 through January 2019 and Chief Executive Officer of Rafferty since 2021.

Ms. Brickl has extensive experience in the investment management business, including as General Counsel of Rafferty since 2010, Chief Compliance Officer of Rafferty since 2012 and Chief Operating Officer of Rafferty since 2021.

Board Duties and Board Structure

The Trust is governed by its Board. The Board is responsible for and oversees the overall management and operations of the Trust and the Funds, which includes the general oversight and review of the Funds’ investment activities, in accordance with federal law and the law of the State of Delaware, as well as the stated policies of the Funds. The Board oversees the

- 15 -

Trust’s officers and service providers, including Rafferty, which is responsible for the management of the day-to-day operations of the Funds based on policies and agreements reviewed and approved by the Board. In carrying out these responsibilities, the Board regularly interacts with and receives reports from senior personnel of service providers, including personnel from Rafferty. The Board also is assisted by the Trust’s independent auditor (who reports directly to the Trust’s Audit Committee), independent counsel and other professionals as appropriate.

Risk Oversight

Consistent with its responsibility for oversight of the Trust and the Funds, the Board oversees the management of risks relating to the administration and operation of the Trust and the Funds. Rafferty, as part of its responsibilities for the day-to-day operations of the Funds, is responsible for day-to-day risk management for the Funds. The Board, in the exercise of its reasonable business judgment performs its risk management oversight directly and, as to certain matters, through its committees (described below) and through the Independent Trustees. The following provides an overview of the principal, but not all, aspects of the Board’s oversight of risk management for the Trust and the Funds.

The Board has adopted, and periodically reviews, policies and procedures designed to address risks to the Trust and the Funds. In addition, under the general oversight of the Board, Rafferty and other service providers to the Funds have themselves adopted a variety of policies, procedures and controls designed to address particular risks to the Funds. Different processes, procedures and controls are employed with respect to different types of risks.

The Board also oversees risk management for the Trust and the Funds through review of regular reports, presentations and other information from officers of the Trust and other persons. The Trust’s Chief Compliance Officer (“CCO”) and senior officers of Rafferty regularly report to the Board on a range of matters, including those relating to risk management. The Board also regularly receives reports from Rafferty and USBFS with respect to the Funds’ investments. In addition to regular reports from these parties, the Board also receives reports regarding other service providers to the Trust, either directly or through Rafferty, U.S. Bancorp Fund Services, LLC (“USBFS”), the Funds’ administrator, or the CCO, on a periodic or regular basis. At least annually, the Board receives a report from the CCO regarding the effectiveness of the Funds’ compliance program. Also, the Board

- 16 -

receives regular reports, presentations and other information from Rafferty, including in connection with the Board’s consideration of the renewal of each of the Trust’s agreements with Rafferty and the Trust’s distribution plan under Rule 12b-1 under the 1940 Act.

The CCO reports regularly to the Board on Fund valuation matters. The Audit Committee receives regular reports from the Trust’s independent registered public accounting firm on internal control and financial reporting matters. On at least a quarterly basis, the Independent Trustees meet with the CCO to discuss matters relating to the Funds’ compliance program.

Board Structure and Related Matters

The Independent Trustees constitute at least two-thirds of the Board. The Trustees discharge their responsibilities collectively as a Board, as well as through Board committees, each of which operates pursuant to a charter approved by the Board that delineates the specific responsibilities of that committee. The Board has established three standing committees: the Audit Committee, the Nominating and Governance Committee and the Qualified Legal Compliance Committee. For example, the Audit Committee is responsible for specific matters related to oversight of the Funds’ independent auditors, subject to approval of the Audit Committee’s recommendations by the Board. The members and responsibilities of each Board committee are summarized below.

The Board periodically evaluates its structure and composition as well as various aspects of its operations. The Chairman of the Board is not an Independent Trustee and the Board has chosen not to have a lead Independent Trustee. However, the Board believes that its leadership structure, including its Independent Trustees and Board committees, is appropriate for the Trust in light of, among other factors, the asset size and nature of the Funds, the number of series overseen by the Board, the arrangements for the conduct of the Funds’ operations, the number of Trustees, and the Board’s responsibilities. On an annual basis, the Board conducts a self-evaluation that considers, among other matters, whether the Board and its committees are functioning effectively and whether, given the size and composition of the Board and each of its committees, the Trustees are able to oversee effectively the number of series in the complex.

The Trust is part of the Direxion Family of Investment Companies, which is comprised of the 106 separate series within the Trust, 12 separate series within the Direxion Funds and no separate series within the Direxion

- 17 -

Insurance Trust. The same persons who constitute the Board also constitute the Boards of Trustees of the Direxion Funds and the Direxion Insurance Trust.

The Board holds four regularly scheduled meetings each year and the Independent Trustees hold one additional meeting in connection with the annual contract renewals. During the fiscal year ended October 31, 2021, the Board held four meetings and the Independent Trustees held one additional meeting. The Board may hold special meetings, as needed, to address matters arising between regular meetings. During a portion of each meeting, the Independent Trustees meet outside of management’s presence. The Independent Trustees may hold special meetings, as needed.

The Trustees of the Trust are identified in the tables above, which provide information regarding their age, business address and principal occupation during the past five years including any affiliation with Rafferty, the length of service to the Trust, and the position, if any, that they hold on the board of directors of companies other than the Trust as of the date of this Proxy Statement. Unless otherwise noted, an individual’s business address is 1301 Avenue of the Americas (6th Avenue), 28th Floor, New York, New York 10019.

Board Committees

The Trust has an Audit Committee, currently consisting of Messrs. Driscoll, Gaffey, and Mulholland and Ms. Berkery, each of whom is an Independent Trustee. The primary responsibilities of the Trust’s Audit Committee are set forth in its charter, which include making recommendations to the Board as to the engagement or discharge of the Trust’s independent registered public accounting firm (including the audit fees charged by the auditors), supervising investigations into matters relating to audit matters, reviewing with the independent registered public accounting firm of the results of audits, and addressing any other matters regarding audits. The Audit Committee met three times during the Trust’s most recent fiscal year.

The Trust also has a Nominating and Governance Committee, currently consisting of Messrs. Driscoll, Gaffey and Mulholland and Ms. Berkery, each of whom is an Independent Trustee. The primary responsibilities of the Nominating and Governance Committee are to make recommendations to the Board on issues related to the composition and operation of the Board and to communicate with management on those

- 18 -

issues. The Nominating and Governance Committee also evaluates and nominates Board member candidates. In evaluating Board member candidates, the Nominating and Governance Committee considers the extent to which potential candidates possess sufficiently diverse skill sets and diversity characteristics that would contribute to the Board’s overall effectiveness.. The Nominating and Governance Committee will consider nominees recommended by shareholders. Such recommendations should be in writing and addressed to a Fund with attention to the Nominating and Governance Committee Chair. In order to be considered by the Nominating and Governance Committee, any shareholder recommendation must include the following information regarding such person: (1) name; (2) date of birth; (3) education; (4) business, professional or other relevant experience and areas of expertise; (5) current business, professional or other relevant experience and areas of expertise; (6) current business and home addresses and contact information; (7) other board positions or prior experience; and (8) any knowledge and experience relating to investment companies and investment company governance. The Nominating and Governance Committee met three times during the Trust’s most recent fiscal year. The Nominating and Governance Committee has a charter, which is attached to this Proxy Statement as Exhibit C.

The Trust has a Qualified Legal Compliance Committee, currently consisting of Messrs. Driscoll, Gaffey and Mulholland and Ms. Berkery, each of whom is an Independent Trustee. The primary responsibility of the Qualified Legal Compliance Committee is to receive, review and take appropriate action with respect to any report made or referred to the Committee by an attorney of evidence of a material violation of applicable U.S. federal or state securities law, material breach of a fiduciary duty under U.S. federal or state law or a similar material violation by the Trust or by any officer, director, employee or agent of the Trust. The Audit Committee serves as the Qualified Legal Compliance Committee. The Qualified Legal Compliance Committee did not meet during the Trust’s most recent fiscal year.

- 19 -

Nominee Ownership of Shares of the Funds

| | | | | | | | | | | | | | | | |

Dollar Range of Equity

Securities Owned: | | Interested Trustees: | | Independent Trustees: |

| | | Daniel O’Neill | | Angela Brickl | | David L. Driscoll | | Jacob C. Gaffey | | Henry W. Mulholland | | Kathleen

M. Berkery | | Carlyle Peake | | Mary Jo Collins |

| | | | | | | | | |

| Direxion Auspice Broad Commodity Strategy ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Flight to Safety Strategy ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Russell 1000® Value Over Growth ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Russell 1000® Growth Over Value ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion NASDAQ-100® Equal Weighted Index Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Work From Home ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Moonshot Innovators ETF | | Over

$100,000 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion World Without Waste ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Dynamic Hedge ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Fallen Knives ETF | | Over

$100,000 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Hydrogen ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Low Priced Stock ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Nanotechnology ETF | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily S&P 500® Bear 1X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily CSI 300 China A Share Bear 1X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

- 20 -

| | | | | | | | | | | | | | | | |

| Direxion Daily S&P 500® Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily CSI 300 China A Share Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily CSI China Internet Index Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily MSCI Brazil Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily MSCI India Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Russia Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Cloud Computing Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Energy Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Energy Bear 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Gold Miners Index Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Gold Miners Index Bear 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Junior Gold Miners Index Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Junior Gold Miners Index Bear 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

- 21 -

| | | | | | | | | | | | | | | | |

| Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Robotics, Artificial Intelligence & Automation Index Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily 5G Communications Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Travel & Vacation Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Global Clean Energy Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Select Large Caps & FANGs Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily US Infrastructure Bull 2X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Mid Cap Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily S&P 500® Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily S&P 500® Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Small Cap Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Small Cap Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily S&P 500® High Beta Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily S&P 500® High Beta Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

- 22 -

| | | | | | | | | | | | | | | | |

| Direxion Daily FTSE China Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily FTSE China Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily MSCI Emerging Markets Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily MSCI Emerging Markets Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily FTSE Europe Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily MSCI Mexico Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily MSCI South Korea Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Aerospace & Defense Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily S&P Biotech Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily S&P Biotech Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Consumer Discretionary Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Financial Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Financial Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Healthcare Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

- 23 -

| | | | | | | | | | | | | | | | |

| Direxion Daily Homebuilders & Supplies Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Industrials Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Dow Jones Internet Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Dow Jones Internet Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Pharmaceutical & Medical Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily MSCI Real Estate Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily MSCI Real Estate Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Regional Banks Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Retail Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Semiconductor Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Semiconductor Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Technology Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Technology Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily Transportation Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

- 24 -

| | | | | | | | | | | | | | | | |

| Direxion Daily Utilities Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily 7-10 Year Treasury Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily 7-10 Year Treasury Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily 20+ Year Treasury Bull 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Direxion Daily 20+ Year Treasury Bear 3X Shares | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| Aggregate Dollar Range of Equity Securities in the Direxion Family of Investment Companies(1) | | Over

$100,000 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 | | $0 |

| (1) | The Direxion Family of Investment Companies consists of the Direxion Shares ETF Trust which, as of the date of this Proxy Statement, offers for sale to the public 79 of the 106 funds registered with the SEC, the Direxion Funds which, as of the date of this Proxy Statement, offers for sale to the public 12 funds registered with the SEC and the Direxion Insurance Trust which, as of the date of this Proxy Statement, does not have any funds registered with the SEC. |

No officer of the Trust beneficially owns shares of any of the Funds. As of November 30, 2021, the Trustees and officers as a group owned less than 1% of the outstanding shares of each Fund.

No Trustee or the Nominee, with the exception of Mr. O’Neill, has any beneficial ownership in the Trust’s investment adviser, Rafferty, its principal underwriter or any entity directly or indirectly controlling, controlled by, or under common control with the investment advisor or principal underwriter of the Trust. Mr. O’Neill has a beneficial ownership interest in the Trust’s investment adviser, Rafferty.

Compensation

As of October 31, 2021, each Trustee of the Direxion Family of Investment Companies who is not an employee of Rafferty or its affiliates receives an annual fee of $142,500 per year for their services as a Trustee for the Direxion Family of Investment Companies. If Mr. Peake and Ms. Collins

- 25 -

are elected to the Trust’s Board, they will receive the same annual compensation as the other Independent Trustees. If Ms. Brickl is elected to the Trust’s Board, she will not receive compensation as she will be an Interested Trustee.

Because Rafferty and other unaffiliated service providers perform substantially all of the services necessary for the operation of the Trust and the Funds, the Funds do not require employees. No officer, director or employee of Rafferty receives any compensation from the Trust or Funds for acting as a director or officer.

The following table shows the compensation earned by each Trustee for the Funds in the Trust for the Funds’ fiscal year end of October 31, 2021.

| | | | | | | | |

Name of Person, Position | | Aggregate Compensation From the Trust(1) | | Pension or Retirement

Benefits Accrued

As Part of the Trust’s Expenses | | Estimated Annual Benefits Upon

Retirement | | Aggregate Compensation From the

Direxion Family of Investment Companies Paid

to the

Trustees(2) |

| Interested Trustee |

Daniel D. O’Neill | | $0 | | $0 | | $0 | | $0 |

| Independent Trustees |

David L. Driscoll | | $106,875 | | $0 | | $0 | | $142,500 |

Jacob C. Gaffey | | $106,875 | | $0 | | $0 | | $142,500 |

Henry W. Mulholland | | $106,875 | | $0 | | $0 | | $142,500 |

Kathleen M. Berkery | | $106,875 | | $0 | | $0 | | $142,500 |

| (1) | Trustee compensation is allocated across the operational Funds of the Trust based on the proportion of the Fund’s net assets to the total net assets of the operational Funds of the Trust. |

| (2) | The Direxion Family of Investment Companies consists of the Direxion Shares ETF Trust which, as of the date of this Proxy Statement, offers for sale to the public 79 of the 106 funds registered with the SEC, the Direxion Funds which, as of the date of this Proxy Statement, offers for sale to the public 12 funds registered with the SEC and the Direxion Insurance Trust which, as of the date of this Proxy Statement, does not have any funds registered with the SEC. |

- 26 -

REQUIRED VOTE

The proposal to elect a new Trustee to the Board requires the affirmative vote of a plurality of the shares voted at the Special Meeting in person or by proxy.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE

“FOR” THE PROPOSAL

INFORMATION ABOUT THE TRUST’S INDEPENDENT ACCOUNTANT

The Trust’s financial statements for the fiscal year ended October 31, 2020 were audited by Ernest & Young (“E&Y”) of New York, NY, which serves as the Trust’s independent public accountant. E&Y has informed the Trust and the Funds that it has no material direct or indirect financial interest in the Trust or Funds. In the opinion of the Board, the services provided by E&Y are compatible with maintaining the independence of the auditors. The Board appointed E&Y as the independent accountant for the Trust for the fiscal year ending October 31, 2021. Representatives of E&Y have been given the opportunity to make a statement if they so desire and are not expected to be present at the Meeting.

Audit Fees

The aggregate fees billed by the Trust’s independent public accountant, E&Y, for professional services rendered in connection with the audit of the Trust’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $1,227,556 for the fiscal period ended October 31, 2020, and $1,337,875 for the fiscal period ended October 31, 2021.

Audit-Related Fees

There were no aggregate fees E&Y billed to the Trust for assurance and other related services that are reasonably related to the performance of the Trust’s audit and are not reported under “Audit Fees” above for the fiscal years ended October 31, 2020, and October 31, 2021. The aggregate fees E&Y billed to the Trust’s investment adviser and any entity controlling, controlled by, or under common control with the Trust’s investment adviser for assurance and other services directly related to the operations and financial reporting of the Trust were $0 for the fiscal period ended October 31, 2020, and $0 for the fiscal period ended October 31, 2021.

- 27 -

Tax Fees

The aggregate tax fees E&Y billed to the Trust for tax compliance, tax advice, and tax planning services were $660,503 for the fiscal period ended October 31, 2020, and $309,665 for the fiscal period ended October 31, 2021. There were no aggregate tax fees E&Y billed to the Trust’s investment adviser and any entity controlling, controlled by, or under common control with the Trust’s investment adviser for services directly related to the operations and financial reporting of the Trust for the fiscal years ended October 31, 2020, and October 31, 2021.

All Other Fees

For the fiscal years ended October 31, 2020, and October 31, 2021 the Trust did not pay E&Y any other fees (including non-audit fees). E&Y did not bill the Trust’s investment adviser or any entity controlling, controlled by, or under common control with the Trust’s investment advisor any fees for any other services directly related to the operations and financial reporting of the Trust for the fiscal years ended October 31, 2020, and October 31, 2021.

Pre-Approval Policies and Procedures

The Trust’s Audit Committee Charter provides that the Audit Committee (comprised of the Independent Trustees of the Trust) is responsible for pre-approval of all auditing services performed for the Trust. The Audit Committee reports to the Board regarding its approval of the engagement of the auditor and the proposed fees for the engagement, and the majority of the Board (including the members of the Board who are Independent Trustees) must approve the auditor at an in-person meeting (except to the extent that the Trust relies upon exemptive relief from the in-person meeting requirement). The Audit Committee also is responsible for pre-approval (subject to the de minimis exception for non-audit services described in the Securities Exchange Act of 1934, as amended, and applicable rule thereunder and not expecting to exceed $5,000) of all non-auditing services performed for the Trust or for any service affiliate of the Trust. The Trust’s Audit Committee pre-approved all fees described above which E&Y billed to each Fund within the Trust.

- 28 -

OTHER MATTERS

No business, other than as set forth above, is expected to come before the Meeting. Should any other matters requiring a vote of shareholders properly come before the Meeting, the persons named in the enclosed proxy will vote thereon in accordance with their best judgment in the interests of the Trust.

SOLICITATION OF PROXIES

The solicitation of proxies will be made primarily by mail but may also be made by telephone by Rafferty and Broadridge Investor Communication Solutions, Inc./Broadridge Financial Solutions, Inc. (“Broadridge”), professional proxy solicitors, who will be paid fees and expenses of approximately $872,435.21 for soliciting services. All expenses in connection with preparing this Proxy Statement and its enclosures and solicitation expenses that relate to the Proposal will be borne by the Funds. Rafferty has contractually agreed to limit certain expenses of the Funds as part of its Operating Expense Limitation Agreement or Operating Services Agreement, as applicable.

If votes are recorded by telephone, Rafferty and/or Broadridge will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions and to confirm that shareholder instructions have been properly recorded. Shareholders also may vote through a secure Internet site or by mail. Proxies by Internet or telephone may be revoked at any time before they are voted in the same manner that proxies voted by mail may be revoked.

INFORMATION ABOUT SERVICE PROVIDERS

Rafferty, 1301 Avenue of the Americas, 28th Floor, New York, NY 10019, serves as the investment adviser for each Fund in the Trust. As of November 30, 2021, Rafferty had approximately $28.6 billion of assets under management. Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, ME 04101, serves as the Funds’ distributor. U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, WI 53202, serves as the Funds’ administrator.

- 29 -

PAYMENTS OF COMMISSIONS TO AFFILIATED BROKERS

During the fiscal year ended October 31, 2021, the Funds made no payments of commissions to brokers affiliated with a Fund to execute portfolio transactions.

COMMUNICATIONS WITH TRUSTEES

Shareholders of the Fund who wish to communicate with Trustees (or to the Independent Trustees as a group) should send communications to the attention of the Secretary of the Trust, c/o Rafferty Asset Management, LLC, 1301 Avenue of the Americas, 28th Floor, New York, NY 10019, and all communications will be directed to the Trustee or Trustees indicated in the communication or, if no Trustee or Trustees are indicated, to all Trustees.

SHAREHOLDER PROPOSAL

As a general matter, the Trust and the Funds do not hold regular annual or other meetings of shareholders. Any shareholder who wishes to submit proposals to be considered at a special meeting of the Funds’ shareholders should send such proposals to the Direxion Shares ETF Trust at 1301 Avenue of the Americas, 28th Floor, New York, NY 10019, so as to be received a reasonable time before the proxy solicitation for that meeting is made. Shareholder proposals that are submitted in a timely manner will be provided to Board members for their consideration but not necessarily be included in the Funds’ proxy materials. Inclusion of such proposals is subject to limitations under the federal securities laws.

By order of the Board of Trustees,

Angela Brickl

Secretary

Direxion Shares ETF Trust

Dated: December 10, 2021

- 30 -

Exhibit A

Control Persons and Principal Holders of Securities

Control Persons are those beneficial owners who may have the power to exercise a controlling influence over the management or policies of a company as a result of their ownership of more than 25% of the voting securities of the company. Listed below are shareholders who owned of record or were known by the funds to own beneficially five percent or more of the outstanding shares of a class of the Fund as of November 15, 2021.

Direxion Daily Technology Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 23.86% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 20.75% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 13.19% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 10.62% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | | 9.68% | | | Record | |

Merrill Lynch, Pierce Fenner, Smith 4804 Deer Lake Drive E Jacksonville, FL 32246 | | N/A | | N/A | | 5.36% | | | Record | |

- 31 -

Direxion Daily Semiconductor Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | Fidelity

Global

Brokerage

Group, Inc. | | DE | | 25.00% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 17.22% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 15.91% | | | Record | |

Citigroup Global Markets, Inc. 700 Red Brook Blvd Suite 300 Owings Mills, MD 21117 | | N/A | | N/A | | 8.50% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | | 6.99% | | | Record | |

Merrill Lynch, Pierce Fenner, Smith 4804 Deer Lake Drive E Jacksonville, FL 32246 | | N/A | | N/A | | 5.21% | | | Record | |

Direxion Daily 20+ Treasury Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 21.20% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 17.60% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 11.73% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 11.12% | | | Record | |

Citigroup Global Markets, Inc. 700 Red Brook Blvd Suite 300 Owings Mills, MD 21117 | | N/A | | N/A | | 10.63% | | | Record | |

Apex Clearing Corp. 1700 Pacific Avenue Suite 1400 Dallas, TX 75201 | | N/A | | N/A | | 9.07% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | | 5.35% | | | Record | |

- 32 -

Direxion Daily 7-10 Treasury Bear 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | The Charles

Schwab

Corporation | | DE | | 27.48% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 13.16% | | | Record | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 9.87% | | | Record | |

Citigroup Global Markets, Inc. 700 Red Brook Blvd Suite 300 Owings Mills, MD 21117 | | N/A | | N/A | | 9.38% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 8.63% | | | Record | |

Pershing LLC 1 Pershing Plaza Jersey City, NJ 07399 | | N/A | | N/A | | 7.11% | | | Record | |

Brown Brothers Harriman & Co. 50 Milk Street Boston, MA 02109 | | N/A | | N/A | | 6.85% | | | Record | |

Direxion Daily 7-10 Year Treasury Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | Interactive

Brokers

Group, Inc. | | DE | | 30.82% | | | Record | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 16.10% | | | Record | |

The Bank of New York Mellon One Wall Street New York, NY 10286 | | N/A | | N/A | | 10.55% | | | Record | |

Apex Clearing Corp. 1700 Pacific Avenue Suite 1400 Dallas, TX 75201 | | N/A | | N/A | | 8.42% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 7.13% | | | Record | |

J.P. Morgan Chase Bank 14201 Dallas Parkway Dallas, TX 75254 | | N/A | | N/A | | 6.36% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 5.20% | | | Record | |

- 33 -

Direxion Daily Mid Cap Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | Fidelity

Global

Brokerage

Group, Inc. | | DE | | 26.53% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 20.58% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 20.18% | | | Record | |

Wells Fargo 420 Montgomery Street San Francisco, CA 94104 | | N/A | | N/A | | 5.02% | | | Record | |

Direxion Daily MSCI Real Estate Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 19.94% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 18.53% | | | Record | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 12.73% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | | 10.27% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 8.86% | | | Record | |

- 34 -

Direxion Daily FTSE China Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

Citigroup Global Markets, Inc. 700 Red Brook Blvd Suite 300 Owings Mills, MD 21117 | | N/A | | N/A | | 21.00% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 13.44% | | | Record | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 11.89% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 6.71% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 5.44% | | | Record | |

Direxion Daily Small Cap Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | Fidelity

Global

Brokerage

Group, Inc. | | DE | | 26.15% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 24.93% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 14.84% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | | 7.91% | | | Record | |

- 35 -

Direxion Daily S&P 500® Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 21.72% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 15.19% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 14.74% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 13.88% | | | Record | |

Citigroup Global Markets, Inc. 700 Red Brook Blvd Suite 300 Owings Mills, MD 21117 | | N/A | | N/A | | 5.94% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | | 5.85% | | | Record | |

Direxion Daily CSI 300 China A Share Bear 1X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

J.P. Morgan Chase Bank 14201 Dallas Parkway Dallas, TX 75254 | | JPMorgan

Chase &

Co. | | DE | | 90.93% | | | Record | |

Direxion Daily S&P 500® Bull 2X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | Fidelity

Global

Brokerage

Group, Inc. | | DE | | 41.11% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 11.55% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 11.42% | | | Record | |

Goldman Sachs & Co. 30 Hudson Street Jersey City, NJ 07302 | | N/A | | N/A | | 8.95% | | | Record | |

- 36 -

Direxion NASDAQ-100® Equal Weighted Index Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | The Charles

Schwab

Corporation | | DE | | 32.85% | | | Record | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 14.26% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 5.71% | | | Record | |

Direxion Daily FTSE Europe Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | Fidelity

Global

Brokerage

Group, Inc. | | DE | | 22.97% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 16.93% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 12.44% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | | 11.26% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 6.03% | | | Record | |

- 37 -

Direxion Daily MSCI South Korea Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

Citigroup Global Markets, Inc. 700 Red Brook Blvd Suite 300 Owings Mills, MD 21117 | | Citigroup

Financial

Products Inc. | | DE | | 39.56% | | | Record | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 14.16% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 8.63% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 8.38% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 6.30% | | | Record | |

Direxion Daily Financial Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 19.09% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 18.95% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 17.76% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | | 6.79% | | | Record | |

Brown Brothers Harriman & Co. 50 Milk Street Boston, MA 02109 | | N/A | | N/A | | 5.74% | | | Record | |

Merrill Lynch, Pierce Fenner, Smith 4804 Deer Lake Drive E Jacksonville, FL 32246 | | N/A | | N/A | | 5.44% | | | Record | |

- 38 -

Direxion Daily Healthcare Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | Fidelity

Global

Brokerage

Group, Inc. | | DE | | 25.26% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 15.84% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 13.84% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | �� | 8.08% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 7.85% | | | Record | |

Goldman Sachs & Co. 30 Hudson Street Jersey City, NJ 07302 | | N/A | | N/A | | 7.03% | | | Record | |

Direxion Daily CSI China Internet Index Bull 2X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

Citigroup Global Markets, Inc. 700 Red Brook Blvd Suite 300 Owings Mills, MD 21117 | | N/A | | N/A | | 24.86% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 16.80% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 13.04% | | | Record | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 10.42% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 5.97% | | | Record | |

- 39 -

Direxion Daily Russia Bull 2X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %

Ownership | | Type of Ownership | |

Citigroup Global Markets, Inc. 700 Red Brook Blvd Suite 300 Owings Mills, MD 21117 | | Citigroup

Financial

Products Inc. | | DE | | 25.58% | | | Record | |

National Financial Services LLC 200 Liberty Street New York, NY 10281 | | N/A | | N/A | | 14.10% | | | Record | |

TD Ameritrade Clearing LLC 1005 N Ameritrade Place Bellevue, NE 68005 | | N/A | | N/A | | 13.45% | | | Record | |

Brown Brothers Harriman & Co. 50 Milk Street Boston, MA 02109 | | N/A | | N/A | | 7.59% | | | Record | |

E*Trade Clearing LLC 34 Exchange Place Plaza II Jersey City, NJ 07311 | | N/A | | N/A | | 6.47% | | | Record | |

Interactive Brokers 8 Greenwich Office Park 2nd Floor Greenwich, CT 06831 | | N/A | | N/A | | 6.42% | | | Record | |

Charles Schwab & Co. 2423 E Lincoln Drive Phoenix, AZ 85016 | | N/A | | N/A | | 5.77% | | | Record | |

Direxion Daily MSCI Emerging Markets Bull 3X Shares

| | | | | | | | | | |

| Name and Address | | Parent

Company | | Jurisdiction | | %