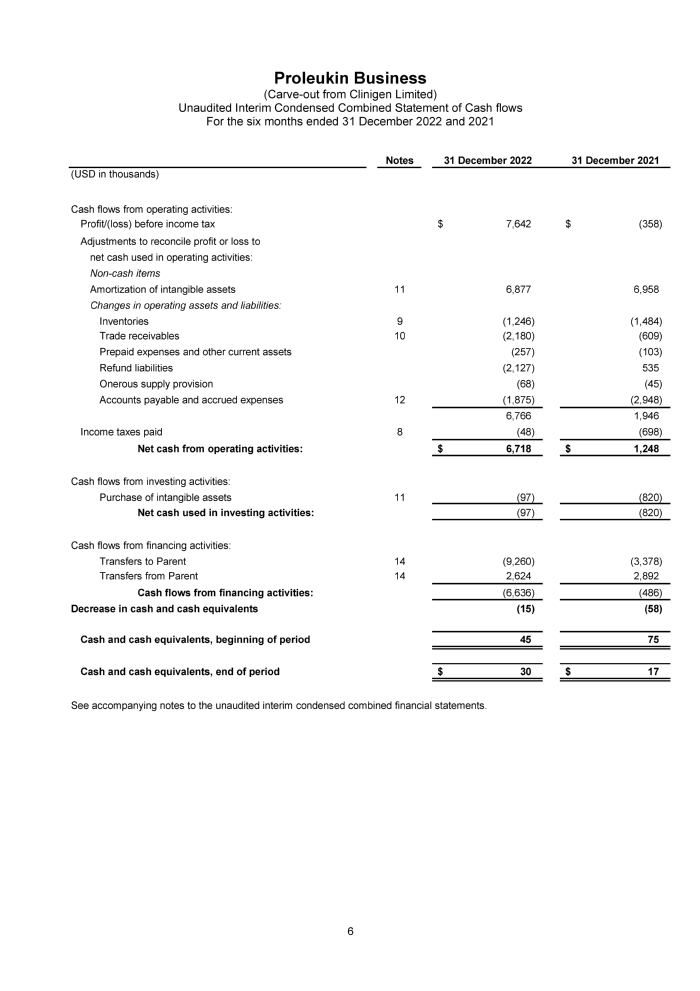

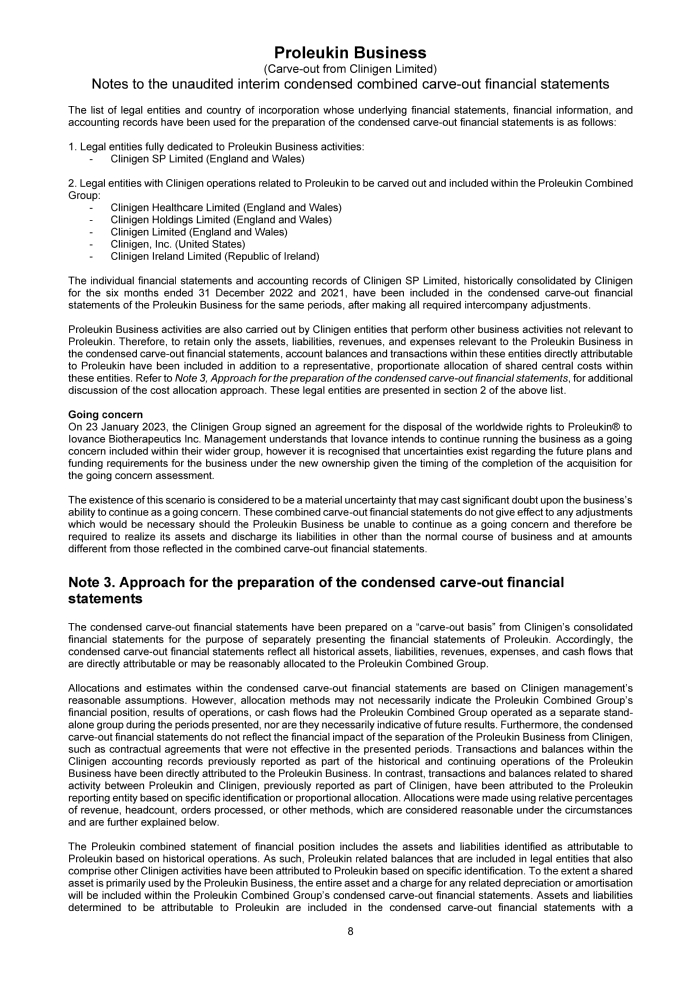

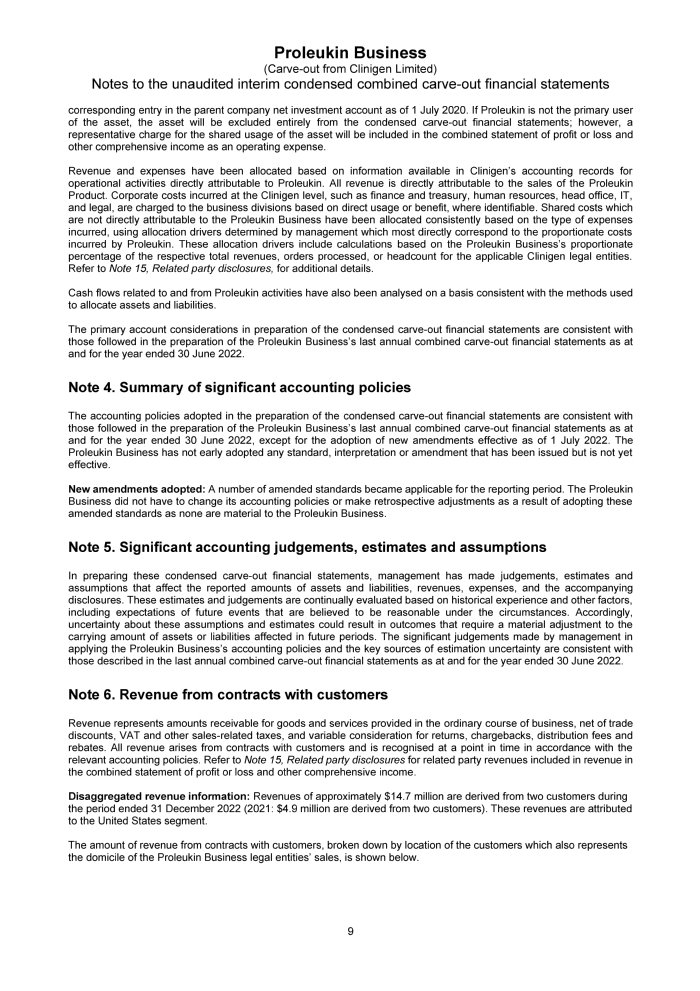

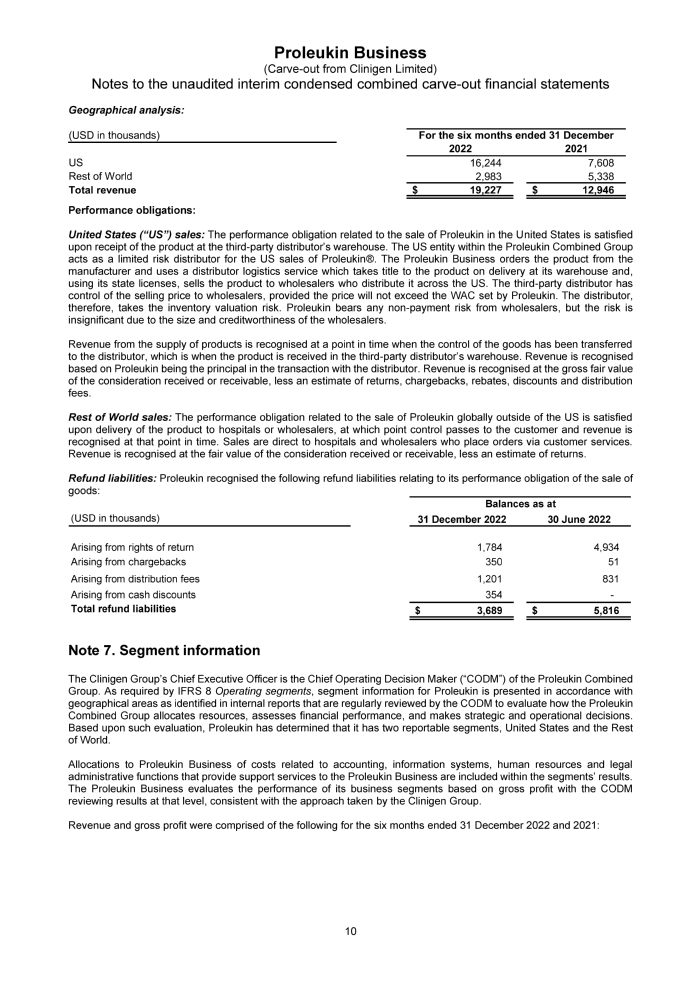

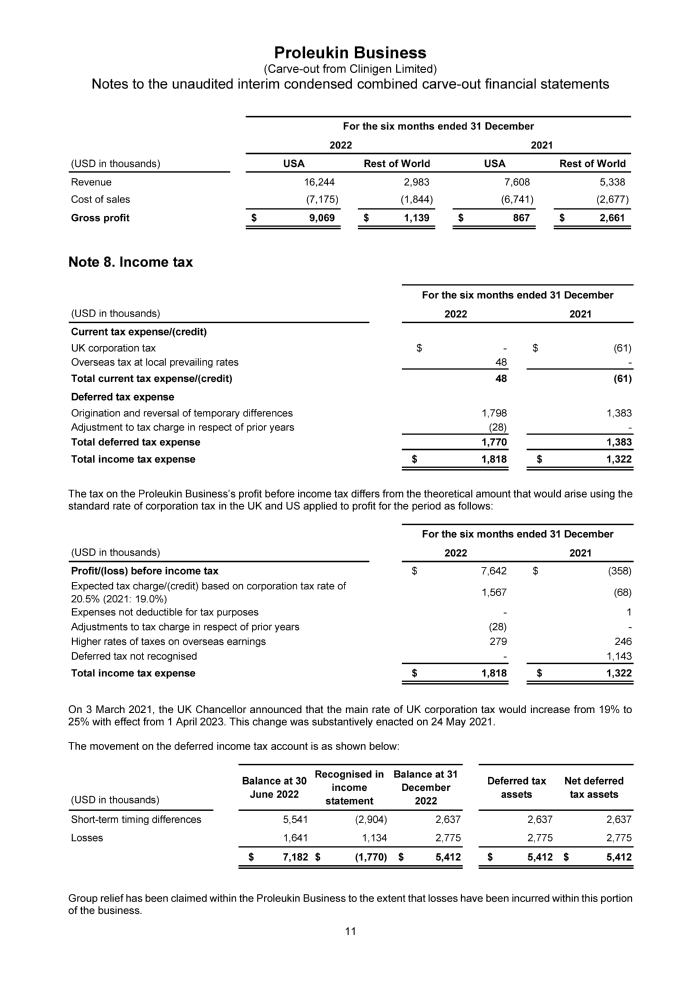

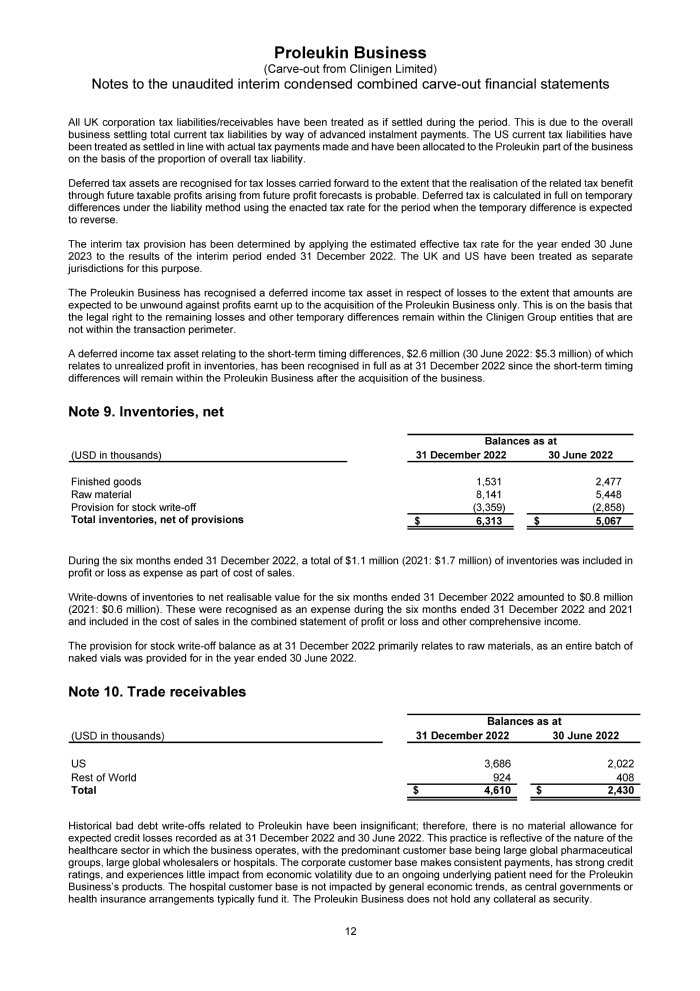

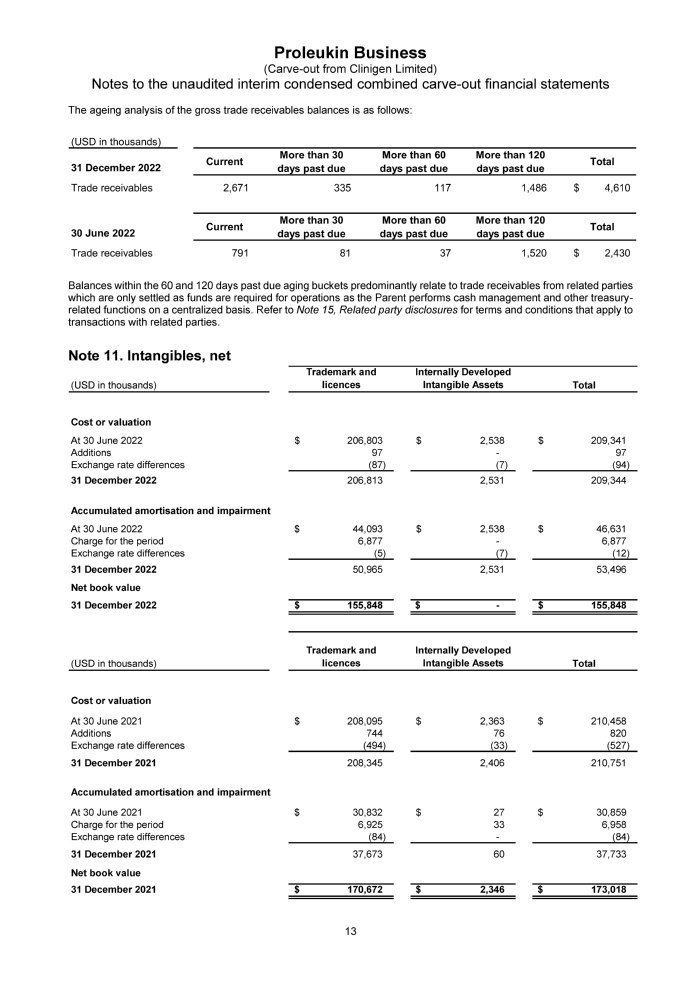

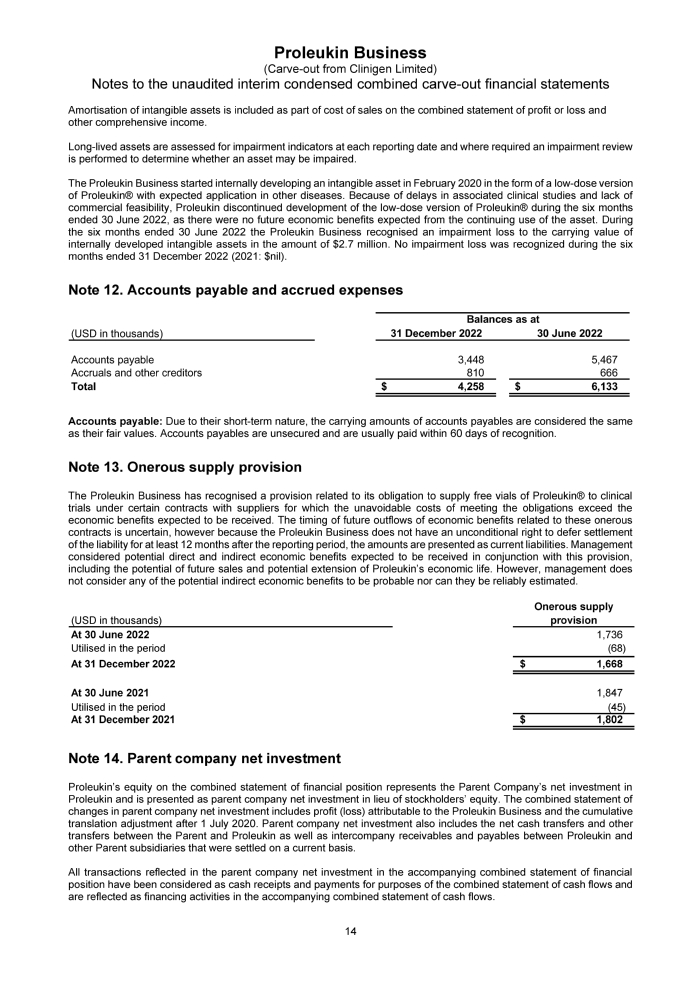

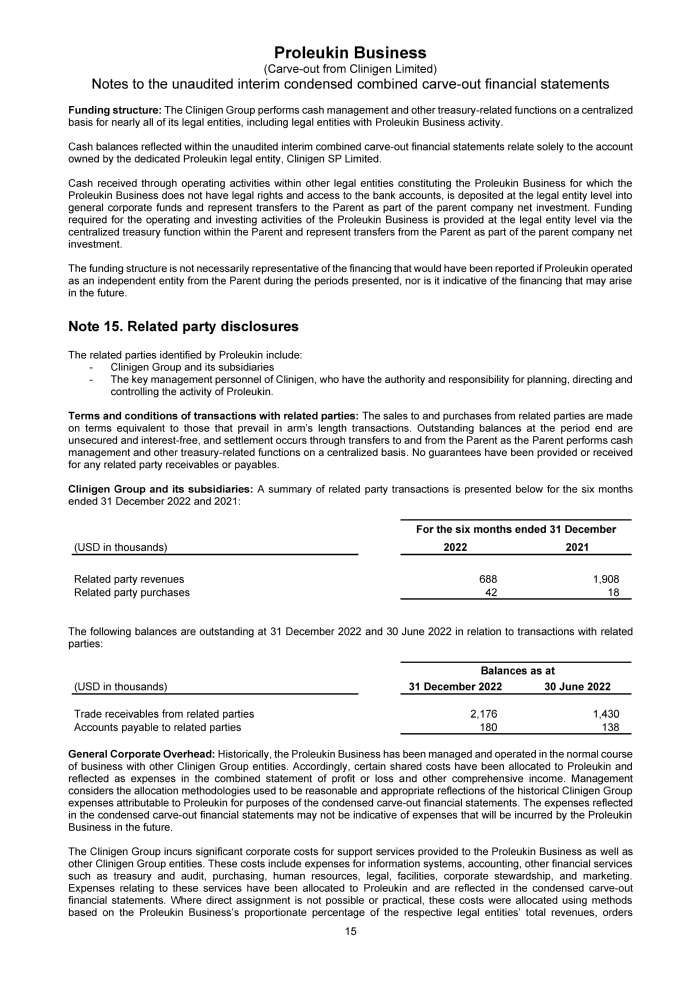

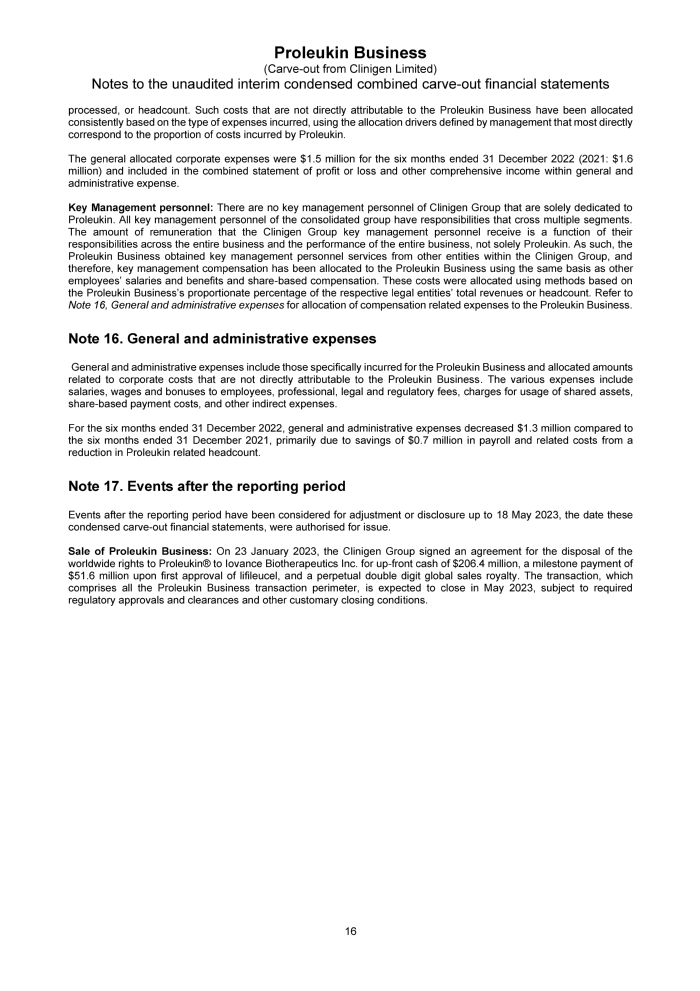

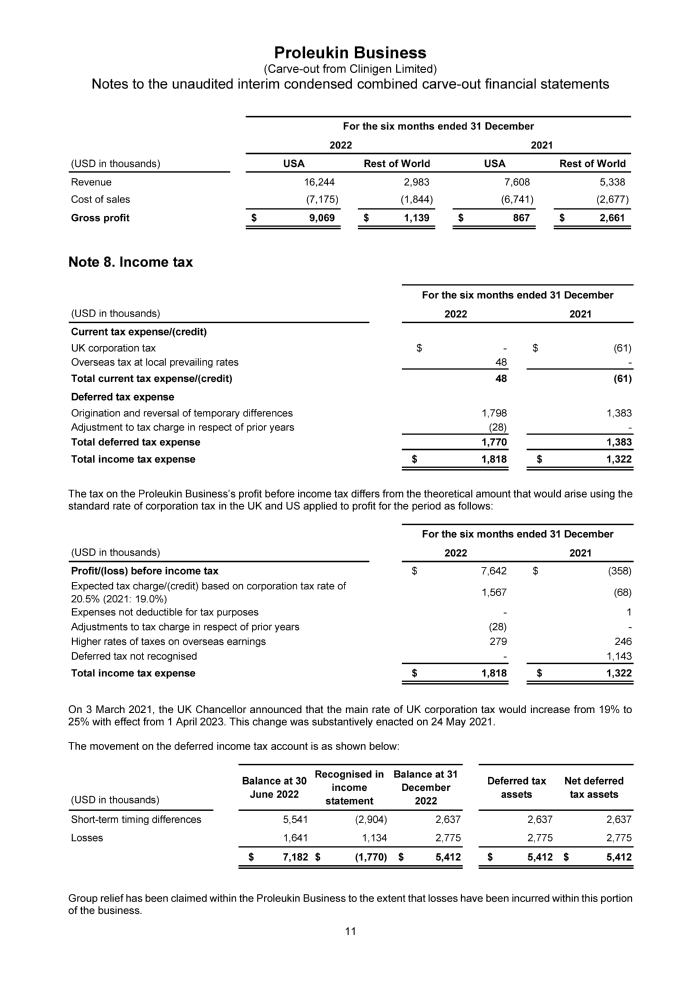

| Proleukin Business (Carve-out from Clinigen Limited) Notes to the unaudited interim condensed combined carve-out financial statements 11 Note 8. Income tax The tax on the Proleukin Business’s profit before income tax differs from the theoretical amount that would arise using the standard rate of corporation tax in the UK and US applied to profit for the period as follows: On 3 March 2021, the UK Chancellor announced that the main rate of UK corporation tax would increase from 19% to 25% with effect from 1 April 2023. This change was substantively enacted on 24 May 2021. The movement on the deferred income tax account is as shown below: Group relief has been claimed within the Proleukin Business to the extent that losses have been incurred within this portion of the business. (USD in thousands) USA Rest of World USA Rest of World Revenue 16,244 2,983 7,608 5,338 Cost of sales (7,175) (1,844) (6,741) (2,677) Gross profit $ 9,069 $ 1,139 $ 867 $ 2,661 2022 2021 For the six months ended 31 December (USD in thousands) 2022 2021 Current tax expense/(credit) UK corporation tax $ - $ (61) Overseas tax at local prevailing rates 48 - Total current tax expense/(credit) 48 (61) Deferred tax expense Origination and reversal of temporary differences 1,798 1,383 Adjustment to tax charge in respect of prior years (28) - Total deferred tax expense 1,770 1,383 Total income tax expense $ 1,818 $ 1,322 For the six months ended 31 December (USD in thousands) 2022 2021 Profit/(loss) before income tax $ 7,642 $ (358) Expected tax charge/(credit) based on corporation tax rate of 20.5% (2021: 19.0%) 1,567 (68) Expenses not deductible for tax purposes - 1 Adjustments to tax charge in respect of prior years (28) - Higher rates of taxes on overseas earnings 279 246 Deferred tax not recognised - 1,143 Total income tax expense $ 1,818 $ 1,322 For the six months ended 31 December (USD in thousands) Balance at 30 June 2022 Recognised in income statement Balance at 31 December 2022 Deferred tax assets Net deferred tax assets Short-term timing differences 5,541 (2,904) 2,637 2,637 2,637 Losses 1,641 1,134 2,775 2,775 2,775 $ 7,182 $ (1,770) $ 5,412 $ 5,412 $ 5,412 |