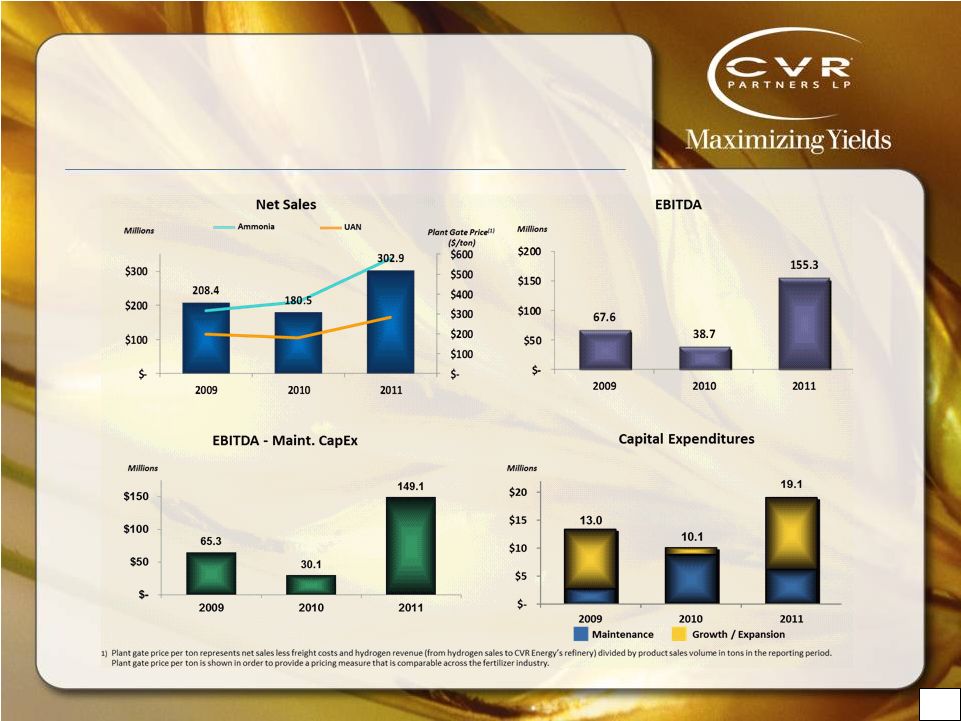

21 Non-GAAP Reconciliation EBITDA: Represents net income before the effect of interest expense, interest income, income tax expense (benefit) and depreciation and amortization. EBITDA is not a calculation based upon GAAP; however, the amounts included in EBITDA are derived from amounts included in the consolidated statement of operations of the Company. See below for reconciliation of net income to EBITDA, EBITDA to Adjusted EBITDA, & EBITDA less maintenance capital See below for reconciliation of net income to EBITDA & EBITDA to Adjusted EBITDA Adjusted EBITDA: Represents EBITDA adjusted for the impact of share-based compensation, and, where applicable, major scheduled turnaround expense and loss on disposition of assets. We present Adjusted EBITDA because it is a key measure used in material covenants in our credit facility. Adjusted EBITDA is not a recognized term under GAAP and should not be substituted for net income as a measure of our liquidity. Management believes that Adjusted EBITDA enables investors and analysts to better understand our liquidity and our compliance with the covenants contained in our credit facility. See below for reconciliation of LTM 06/30/12 EBITDA & Interest Expense (in $US millions) For the Fiscal Years 2009 2010 2011 Net income 57.9 $ 33.3 $ 132.4 $ Interest expense - - 4.0 Interest (income) (9.0) (13.1) - Depreciation and amortization 18.7 18.5 18.9 Income tax expense - - - EBITDA $ 67.6 $ Loss on disposition of assets - 1.4 - Turnaround - 3.5 - Share-based compensation 3.2 9.0 7.3 Adjusted EBITDA 70.8 $ 52.6 $ 162.6 $ EBITDA 67.6 $ 38.7 $ 155.3 $ Maintenance capital 2.3 8.6 6.2 EBITDA less maintenance capital 65.3 $ 30.1 $ 149.1 $ 155.3 (in $US millions) Interest EBITDA Expense 6 months ended 6/30/12 78.1 $ 2.2 $ 12 months ended 12/31/11 155.3 4.0 Less: 6 months ended 6/30/11 65.4 1.2 LTM 06/30/12 168.0 $ 5.0 $ $ 38.7 (in $US millions) 2011 2012 Net income 54.9 $ 65.3 $ Interest expense, net 1.2 2.2 Interest (income) - (0.1) Depreciation and amortization 9.3 10.6 Income tax expense - 0.1 EBITDA 65.4 $ $ 78.1 Share-based compensation 5.5 4.0 Adjusted EBITDA 70.9 $ 82.1 $ Six Months Ended June 30, |