Filed Pursuant to Rule 424(b)(3)

File No. 333-155507

Supplement No. 1

dated January 11, 2010

to the Prospectus

dated december 9, 2009

PROSPECTUS

GRANT HARTFORD CORPORATION

2,717,088 Shares Common Stock

This Prospectus relates to up to 2,717,088 shares of common stock, no par value, per share of Grant Hartford Corporation that the selling shareholders named in this Prospectus, or their transferees may offer from time to time. Of the shares of common stock offered hereby: (i) 1,886,893 shares were issued to the selling shareholders; and (ii) up to 830,195 are issuable upon the exercise of warrants. Such shares and warrants were issued to the selling shareholders pursuant to three exempt offerings that we completed on March 23, 2007, October 31, 2007 and May 31, 2008 respectively (see section "Selling Shareholders"). This is our initial registration of common stock. Our securities are not currently listed on any securities exchange, nor are they quoted on the Over-the-Counter Bulletin Board ("OTCBB"). Until our common stock is quoted on the OTCBB or is listed on an exchange, the common stock offered hereby will be sold at a fixed price of $0.80 per share; thereafter the common stock offered hereby may be offered and sold at prevailing market prices, or at privately negotiated prices.

These securities will be offered for sale by the selling shareholders identified in this Prospectus or their transferees in accordance with the methods and terms described in the section of this Prospectus entitled "Plan of Distribution." We will not receive any of the proceeds from the sale of these shares. However, if all of the warrants are exercised for cash (and assuming there are no adjustments to the purchase price prior to exercise) we will receive $1,363,440 in gross proceeds. If some or all of the warrants are exercised, the money we receive will be used for general corporate purposes, including working capital requirements. We will pay all expenses, except for the brokerage expenses, fees, discounts and commissions, which will all be paid by the selling shareholders, incurred in connection with the offering described in this Prospectus. Our common stock and warrants are more fully described in the section of this Prospectus entitled "Description of Securities."

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is December 9, 2009.

i

GRANT HARTFORD CORPORATION

TABLE OF CONTENTS

| Page |

Prospectus Summary | 1 |

The Offering | 6 |

Risk Factors | 7 |

Note Regarding Forward-looking Statements | 18 |

Use of Proceeds | 18 |

Determination of Offering Price | 18 |

Market For Common Equity and Related Shareholder Matters | 19 |

Divind Policy | 23 |

Equity Compensation Plan Information | 23 |

Dilution | 23 |

Selected Financial Information | 24 |

Management's Discussion and Analysis of Financial Condition and Results of Operations | 24 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 35 |

Description of Business | 36 |

Glossary of Terms | 63 |

Description of Properties | 67 |

Legal Proceedings | 68 |

Directors, Executive Officers and Control persons | 68 |

Executive Compensation | 73 |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | 75 |

Selling Shareholders | 77 |

Plan of Distribution | 80 |

Description of Securities | 83 |

Legal Matters | 85 |

Experts | 85 |

Interest of Named Experts and Counsel | 85 |

Where You Can Best Find More Information | 86 |

Financial Statements | F/S |

ii

Unless the context otherwise requires, references in this Prospectus to "the company," "our company," "we," "our" and "us" means Grant Hartford Corporation. "$" refers to U.S. dollars.

You should rely only on the information contained in this Prospectus and in any free writing prospectus which we file with the Securities and Exchange Commission. We have not authorized anyone to provide you with information different from that contained in this Prospectus or such free writing prospectus, if any. Any offers to sell common stock will be made only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus or of any sale of the shares of common stock.

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of this Prospectus and provides an overview of the material aspects of this offering. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire Prospectus carefully, including the risks discussed under "Risk Factors," our financial statements and the related notes included in this prospectus and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

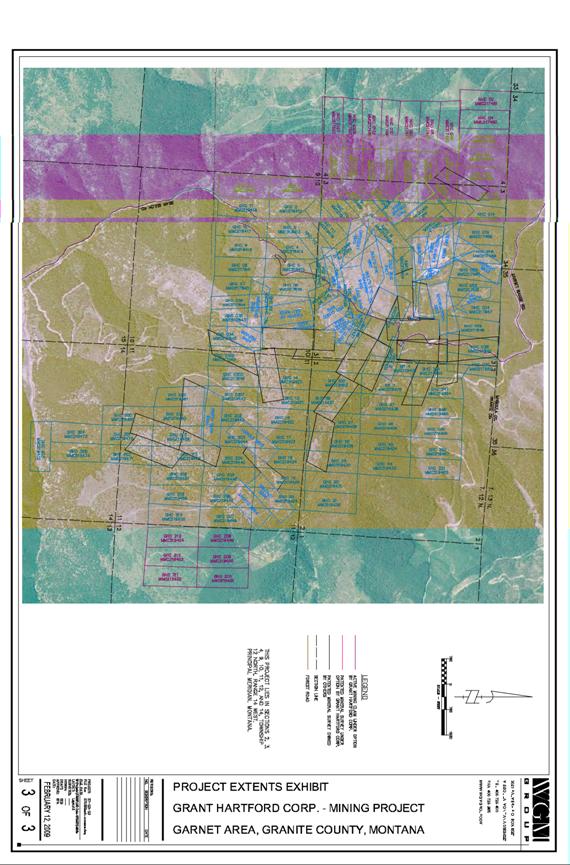

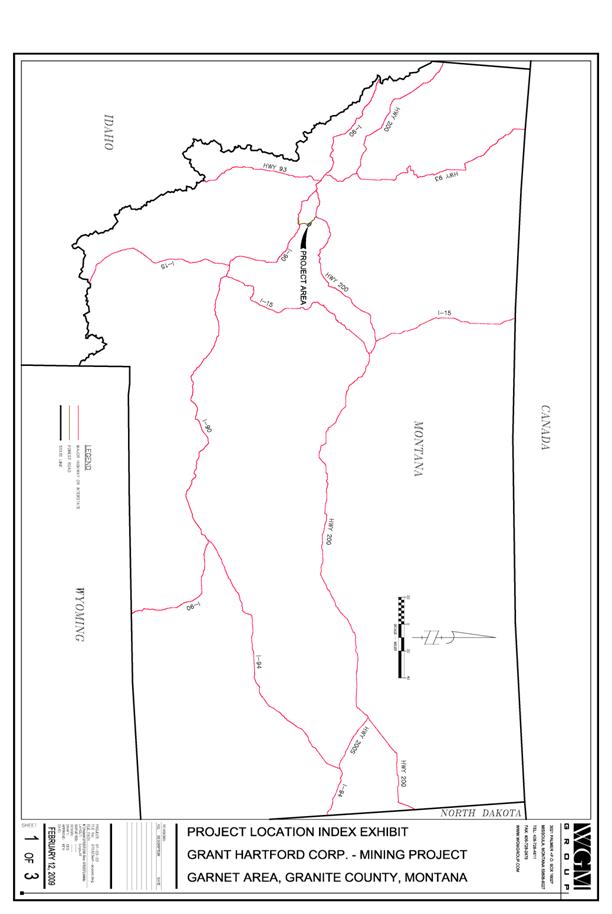

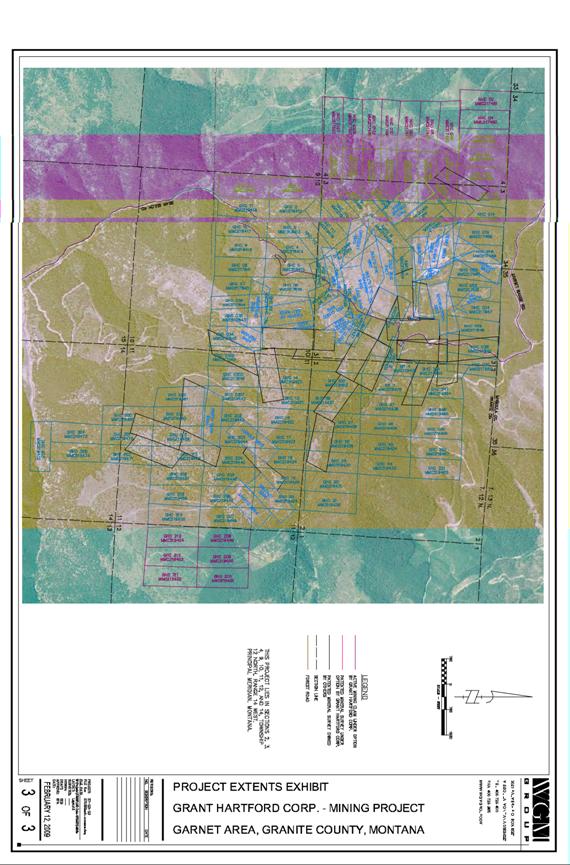

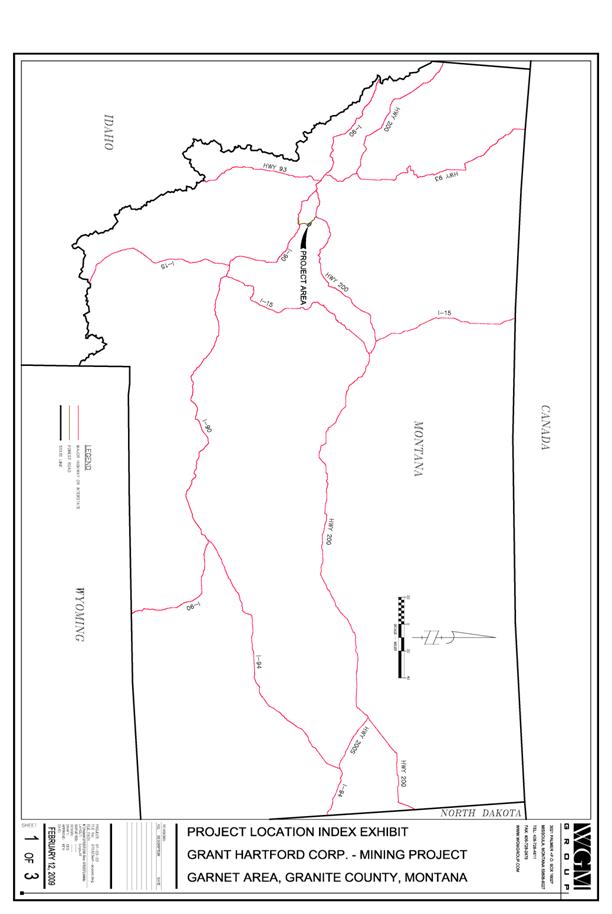

Grant Hartford Corporation

Our Company is a mineral exploration, development and production company, that is currently in the exploration stage of historically designated mineralized material on the Garnet Mineral Property, located in Missoula, Montana. We have acquired an exclusive option to purchase the mineral rights to 23 patented mineral claims and 122 unpatented mineral claims located within the Garnet Mining District of Granite County, Montana from Commonwealth Resources, L.L.C. Commonwealth Resources, L.L.C., is owned by Aaron Charlton, Creative Financial P.S. Plan, Kim Charlton-Benson and Eric Sauve. Mr. Eric Sauve is our president, CEO, CFO, and Director. Mr. Aaron Charlton is our Senior Consultant. Messrs. Charlton and Sauve are two of the Company's five full time employees. Aaron Charlton and Eric Sauve are related parties to our Company, Grant Hartford Corporation. The owner of record of 122 unpatented claims is Commonwealth Resources, L.L.C. Commonwealth Resources, LLC holds these 122 unpatented and 23 patented claims pursuant to the terms of the Grant Hartford Option Agreement for our Company. Commonwealth Resources, L.L.C. retained the services of WGM Survey Co. of Missoula, Montana to physically stake and record ownership in these 122 unpatented mineral claims with Granite County, Montana and the Bureau of Land Management. The owner of record on 22 of the 23 patented mineral claims is Commonwealth Resources, L.L.C. The owner of record of one (1) patented claim, the Free Coin, is River Terrace Estates, Inc. Commonwealth Resources, L.L.C. entered into a Mining Lease between River Terrace Estates, Inc. and Commonwealth Resources, L.L.C. which provides for a lease and option to purchase the Free Coin patented mining claim. This Mining Lease has been partially assigned to Grant Hartford Corporation both by the terms of the Grant Hartford Option Agreement between Commonwealth Resources, L.L.C. and the Company and through a Partial Assignment of Amended Mining Lease, which assigned to GHC the leasehold interest in the Amended Mining Lease and the right to acquire, upon exercise of the purchase option defined in the Lease and Amended Lease, the mineral rights in and to the mining claim. The material terms of the Free Coin patented mining claim transaction are further set forth in the "Material Terms of Related Party Agreements" section of this Prospectus on page 38.

1

The 122 unpatented mineral claims are administered by the United States Bureau of Land Management ("BLM") under the provisions provided for by the 1872 Mining Law. Commonwealth Resources, L.L.C.'s interest in these 122 unpatented mineral claims will continue into perpetuity provided that Commonwealth Resources, L.L.C. pays a $125 maintenance fee each year on each mineral claim in compliance with the Bureau of Land Management regulations pertaining to unpatented mining claims. The required amount of expenditure for Commonwealth Resources, L.L.C. to hold these 122 claims is $15,250 per year. Grant Hartford Corporation has the initial responsibility to pay these fees on behalf of Commonwealth Resources, L.L.C., pursuant to the Grant Hartford Option Agreement. The terms of the Grant Hartford Option Agreement are further set forth in the "Material Terms of Related Party Agreements" section of this Prospectus on page 38. The maintenance figure is set by the BLM and can be altered only in its sole discretion.

The 23 patented mining claims are fee simple properties. Commonwealth Resources, L.L.C.'s interest in these 22 patented mineral claims will continue in perpetuity, provided that Commonwealth Resources, L.L.C. pays the assessed property taxes for each respective mining claim to Granite County, Montana. The current required tax expenditure for Commonwealth Resources, L.L.C. to hold these 22 patented claims is $1,362 per year. Grant Hartford Corporation has the initial responsibility to pay these property taxes on behalf of Commonwealth Resources, L.L.C., pursuant to the Grant Hartford Option Agreement. The terms of the Grant Hartford Option Agreement are further set forth in the "Material Terms of Related Party Agreements" section of this Prospectus on page 38. Commonwealth Resources, L.L.C.'s interest in the Free Coin patented mineral claim will continue for a period of seven (7) year beginning on March 29, 2007, provided that Commonwealth Resources, L.L.C. complies with the material terms of the Amended Mining Lease, which are set forth in the "Material Terms of Related Party Agreements" section of this Prospectus on page 38.

We entered into the Grant Hartford Option Agreement, which conveys an exclusive option to purchase the mineral rights on the 23 patented mining claims and an exclusive option to purchase the 122 unpatented mining claims from Commonwealth Resources, L.L.C. Pursuant to this contract, we have the right to explore for minerals, develop potential mining targets, and enter into limited gold production. The terms of this Grant Hartford Option Agreement requires the issuance by us of 19,000,000 shares of our no par value common stock, annual Option payments by us of $190,000 during the first five (5) year period and $400,000 during the final two (2) year period of the Grant Hartford Option Agreement and an annual access lease payment of $60,000. The agreement was executed on June 15, 2007 for a term of seven (7) years. We may exercise our option to purchase the mineral rights to the patented claims and the unpatented claims at any time for a cash payment to Commonwealth Resources, L.L.C. of $7,000,000. The material terms of the Grant Hartford Option Agreement are further set forth in the "Material Terms of Related Party Agreements" section of this Prospectus on page 38.

The "Garnet Project Summary," prepared by Pegasus Gold Corporation, the "Mineral Property Valuation of the Garnet and Copper Cliff Mining Districts in Granet and Missoula Counties," by John C. Brower, Ph.D., and the "Geologic Examination of the Economic Potential for Gold Mining at the Garnet Area Gold Mining Property," by Thomas J. Peters, who was commissioned by Grant Hartford Corporation to confirm and update the previous studies, together enable the Company to proceed with exploration activities to further designate mineralized material. The fore mentioned, Pegasus Gold Corporation, allowed its option to the Garnet Mineral Property to lapse in 1993 and subsequently filed for bankruptcy. In the Garnet Geology section of this Registration Statement, located on Page 50, the Company uses selected geological descriptions

2

from Dr. John Brower's "Mineral Property Valuation of the Garnet and Copper Cliff Mining District in Garnet and Missoula Counties." However, Dr. Brower's has declined to provide his consent to use this information to Grant Hartford Corporation, due to the age of the report, which is dated September 1999, and the fact that a third party entity commissioned Dr. Brower to prepare the report, thus he does not own the report. Grant Hartford hereby adopts these geological conclusions as our own and directs investors to review Risk Factor 10, "Non-Consent to Use Geological Reports," on page 10 of this amended Form S-1.

The Company's drilling program was designed to quantify, through the use of definition drilling, both open pit and underground mine, mineralized material targets identified by the previous Pegasus exploration program. The Company intends to use this information to proceed with a prefeasibility or scoping study in order to determine the existence of proven/probable reserves.

During 2008, GHC completed 54 drill holes, with total drill footage of 12,497.5 feet. All holes were completed during the third and fourth quarters of 2008. Original drill plans included drilling on over eight (8) targets. Due to the promising results obtained in the first three zones drilled, drilling was concentrated on these three zones. The drilling plan called for definition drilling near designated mineralized material zones encountered by Pegasus between 1989 and 1992.

In 2009 the Company intends to drill numerous other targets not drilled in 2008 as well as improve the establishment of continuity between drill holes in zones previously drilled in our exploration activities to support prefeasibility or scoping studies.

We are in the exploration stage of our business plan. We have not, as yet, earned any revenues from our planned operations. As of December 31, 2008, we had $1,535 cash on hand and liabilities of $923,338. As of June 30, 2009, the Company had total liabilities of $2,018,606. A portion of the Company's liabilities include short-term notes payable totaling $955,150, due on or before June 2010 at interest rates ranging from 11.11% to 12.50%, and the salaries of the Company's President, Eric Sauve, and the Company's Senior Consultant, Aaron Charlton, which increased from $5,000 to $15,000 per month ($180,000 per year) as of June 30, 2008, and increased by six percent (6%) on June 30, 2009, from $15,000 to $15,900 per month ($190,800 per year) pursuant to their Employment Agreements (the material terms of these Employment Agreements can be found on page 73 and 74 of this Form S-1). Accordingly, our working capital position as of December 31, 2008 was ($617,930). Since our inception through December 31, 2008, we have incurred a net loss of $1,218,923. We attribute our net loss to having no revenues to offset our expenses and the professional fees related to organizing our company, acquisition of the 145 patented and unpatented mining claims, and the operation of our business. The Company anticipates incurring capital expenditures of $1,818,000 for the fiscal year ending December 31, 2009. The average monthly capital expenditure for that period of time is estimated to be $167,333. Our current working capital is not sufficient to enable us to complete Phase I of the exploration program on the property. Accordingly, we will require additional financing. In the event that available capital is insufficient to sustain minimum operations, we may be compelled to discontinue our business.

The Company's fiscal year end is December 31.

3

Organization

We were organized on March 15, 2007, under the laws of the State of Montana. Our principal office is located at 619 South West Higgins, Suite O, Missoula, Montana 59803. The Company's phone number is (406) 531-3363.

2007 Exempt Offering

On March 23, 2007, we completed our first exempt offering pursuant to Section 4(2) of the Securities Act of 1933, as amended. The Company issued 280,000 shares of the Company's no par value common stock to two (2) accredited investors at a purchase price of $0.125 per share, for an aggregate price of $35,000.

2007 Exempt Offering

On October 31, 2007, we completed a second exempt offering pursuant to Section 4(2) of the Securities Act of 1933, as amended. The Company issued 793,900 shares of the Company's no par value common stock to 45 accredited investors at a purchase price of $0.50 per share, for an aggregate price of $396,950.

2008 Exempt Offering

On May 31, 2008, we completed a third exempt offering pursuant to Section 4(2) of the Securities Act of 1933, as amended. The Company issued 236,295 shares of the Company's no par value common stock to 11 accredited investors at a purchase price of $0.80 per share, for an aggregate price of $189,036.

2008 Convertible Note Offering

Between July 22, 2008 and November 6, 2008, the Company entered into eight (8) Non-Transferable Convertible Notes (the "Notes") in the aggregate sum of $271,500. The Notes were entered into pursuant to exempt transactions.

The material terms of the Non-Transferable Convertible Notes (the "Notes") are as follows: The Notes are for a term of two (2) years, wherein interest is due semi-annually at a varying interest rate depending upon the Note, between 12% and 14%. The Lender may choose to convert to common stock at any time, however, if conversion is made prior to six (6) months from the date of signing, the conversion price will include interest for a six (6) month period. At conversion, all or any portion of the unpaid balance and accrued interest may be converted into common stock at a conversion price equal to the closing market price of the common stock. If conversion takes place on the date GHC is first listed on the Over The Counter Bulletin Board ("OTCBB"), Lender may convert at a conversion price of 95% of the initial share price quoted on the day of conversion. Upon conversion Lender shall receive additional shares of GHC common stock, over and above the converted amount, in the form of an Incentive Bonus equal to the principal amount of the Note, multiplied by 2.5% and divided by the share price at conversion. GHC will offer to include any common stock held by Lender upon conversion, in any subsequent registration statement pursuant to the Securities Act. GHC will give a thirty day notice of intention to file said registration statement to Lender and Lender has 10 days to accept such registration, once GHC gives notice. Default on the Note by GHC may occur if one or more of the following events take place: nonpayment, GHC filing bankruptcy, and the appointment of

4

receiver, custodian, trustee or assignee to take possession of the property. GHC has fifteen (15) days to cure the default, which would include the payment of a late fee of 15% the semi-annual interest payment and any costs and legal fees associated with the default to Lender. The net proceeds to GHC on each Note is the principal sum of the Note. The aggregate net proceeds to date on the eight (8) Notes is $271,500. Leo Sauve holds two of the eight Notes, totaling $26,000.00, and is the father of Eric Sauve, our President and CEO.

2009 Promissory Notes

Between January 1, 2009 and September 30, 2009 the Company entered into fifty-nine (59) Promissory Notes (the "Promissory Notes") in the aggregate sum of $2,332,266. The Promissory Notes were entered into pursuant to a corporate debt transaction.

The material terms of the Promissory Notes are as follows: The Promissory Notes are for a term of one (1) year, whereby interest is due at the end of the term at a rate of 12.5%. Default on the Promissory Notes by GHC may occur if the principal and interest is not paid on the due date. If said sum is not paid when due, the indebtedness shall bear interest at the rate of 15% per annum from the date of default, or declaration of default, whichever shall first occur. The Note Holder shall be entitled to collect all reasonable costs and expenses of collection and/or suit, including, but not limited to, reasonable attorney's fees.

5

The Offering

Shares Being Offered | Up to 2,717,088 shares of common stock, including 1,886,893 shares of common stock that were issued to the selling shareholders and up to 830,195 shares issuable upon the exercise of outstanding warrants. |

Use of Proceeds | We will not receive any proceeds from the sale of the shares offered hereby. We will, however, receive the proceeds from the exercise of warrants, if and when, they are exercised. Any such proceeds will be used for working capital and general corporate expenses. |

Common Stock issued

and outstanding as of

September 30, 2009 | 21,450,195 shares of our common stock are issued and outstanding as of the date of this Prospectus. |

Risk Factors | Prospective investors should carefully consider the Risk Factors before buying the common stock offered hereby. |

Summary Financial Information

Balance Sheet Data | As of December 31, 2007

(Audited). | As of December 31, 2008

(Audited). | As of September 30, 2009

(Unaudited). |

Cash | $ 90,873 | $ 1,535 | $ 77,392 |

Total Assets | $ 2,598,550 | $ 2,704,036 | $ 3,162,772 |

Total Liabilities | $ 660,822 | $ 923,338 | $ 3,473,158 |

Total Stockholder's Equity | $ 1,937,728 | $ 1,780,698 | $ (310,386) |

| | | |

Statement of Loss and Deficit | From inception,

March 15, 2007,

to December 31, 2007

(Audited). | From inception,

March 15, 2007,

to December 31, 2008

(Audited). | From inception,

March 15, 2007,

to September 30, 2009

(Unaudited). |

Revenue | $ 0 | $ 0 | $ 0 |

Loss for the Period | $ (247,857) | $ (1,218,923) | $ (3,310,007) |

6

RISK FACTORS

An investment in our shares is speculative and involves a high degree of risk. Therefore, you should not invest in our shares unless you are able to bear a loss of your entire investment. You should carefully consider the following factors as well as the other information contained herein before deciding to invest in our shares. Factors that could cause actual results to differ from our expectations, statements or projections include the risks and uncertainties relating to our business described above. This Prospectus and statements that we may make from time to time may contain forward-looking information. There can be no assurance that actual results will not differ materially from our expectations, statements or projections.

Risk Factors Relating to Our Business

1: We have limited operating history and limited historical financial information upon which you may evaluate our performance.

You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like ours, are in the exploration stage. We may not successfully address these risks and uncertainties or successfully implement our business plan. If we fail to do so, it could materially harm our business and impair the value of our common stock. Even if we accomplish these objectives, we may not generate positive cash flows or profits that we anticipate in the future.

Unanticipated problems, expenses and delays are frequently encountered in establishing a new business and in the exploration stages of the search for mineral deposits. These include, but are not limited to, inadequate funding, competition, and unsuccessful mineralized material exploration. Our failure to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce or curtail operations. No assurance can be given that we can or will ever operate profitably.

2: We will require additional funding

As of September 30, 2009, we had cash in the amount of $77,392. Our 2009 exploration program will require approximately $1,140,000 to complete. We will require additional financing in order to begin and complete future phases of the recommended exploration programs, as well as any additional exploration. We currently do not have any operations and have no income. Our business plan calls for significant exploration expenses. We will also require additional financing if further exploration programs are necessary. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. In the event that our exploration programs are successful in sufficiently estimating the mineralized material continuity between drill holes and we exercise our property purchase option, we will require additional funds in order to place the patented and unpatented mining claims into the development and commercial production stages. We currently do not have any arrangements for financing and we may not be able to obtain financing when required and on favorable terms. Obtaining additional financing would be subject to a number of factors, including the market prices for gold, silver and other metallic minerals and the costs of exploring for, developing and producing these materials. These factors may make the timing, amount, terms, or conditions for additional financing unavailable to us, which would force us to reduce our operations or even cease operations.

7

3: Auditor has raised substantial doubt about our ability to continue as a going concern

The report of our independent auditor regarding our audited financial statements for the period ended December 31, 2008 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report are that we have an accumulated deficit since inception of (1,218,923) for the period from our inception, March 15, 2007, to December 31, 2008 and have no revenues. Our future is dependent upon our ability to obtain financing and upon successful exploration and future development and productions stages on the patented and unpatented mining claims. This is a significant risk to investors who purchase shares of our common stock because there is an increased risk that we may not be able to generate and/or raise enough capital to remain operational for an indefinite

period of time. Potential investors should also be aware of the difficulties normally encountered in the exploration stage of mining companies and the high rate of failure of such enterprises. Our auditor's concern may inhibit our ability to raise financing because we may not remain operational for an indefinite period of time resulting in potential investors failing to receive any return on their investment. Persons who cannot afford to lose their entire investment should not invest in this offering.

4: We are a new company with no history

We have just begun exploration of our mining claim holdings for which we have acquired our options. As a result, we have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on March 15, 2007, and to date, we have been involved primarily in organizational activities, the acquisition of an option to purchase interests in 145 patented and unpatented mining claims, obtaining an independent consulting geologist's report on these mining claims, and completing our 2008 exploration program. There is no history upon which to base any assumption as to the likelihood that we will prove successful. We have not earned any revenues as of the date of this prospectus, and thus, we face a high risk of business failure.

5: We rely on consultants

We have a written agreement with our consulting geologist, Thomas J. Peters; that requires him to review all of the historical information available on the mining claims we have under option, the results from the previous exploration work performed on these mining claims, and to make recommendations based on those reviews. We also have an oral agreement and written confirmation with our consulting geologist, Ted Antonioli, to perform geological recommendations and assist in the permitting process. We also have an agreement with the University of Montana to utilize the Geological Department and Geographical Information Systems Department to digitize data and have a verbal agreement retaining the services of Dr. James Sears. In addition, we have agreements with: Norris Labs to perform analyses on geological samples; Kirk Engineering for a water base line study and survey for a mill and tailings impoundment; with BJ Ambrose for his full time services as the Vice President of Corporate Finance; with Tim Matthews for his full time services as the Vice President of Marketing; with J. Robert Flesher for his full time services as Vice President of Mining and Geology; with Aaron Charlton for full time management services and with Eric Sauve for full time management services.

8

Each of these functions requires the services of persons in high demand in the industry and these persons may or may not always be available when needed. The implementation of our business plan may be impaired if these parties do not perform in accordance with their written and oral agreements.

6: Common ownership of GHC and Commonwealth Resources, L.L.C.

Our sole material assets are the options to the Garnet Mining Claims, which claims are owned, or optioned by Commonwealth Resources, L.L.C. The Optionor, Commonwealth Resources, L.L.C. is owned in part by Mr. Eric Sauve, who is the President, CEO, CFO and Director of Grant Hartford Corporation. In addition, Mr. Aaron Charlton, who is a Senior Consultant to the Company, is likewise a majority owner and the Managing Member of Commonwealth Resources,

L.L.C. Mr. Charlton negotiated in good faith on behalf of and for the best interest of Commonwealth Resources L.L.C. and Mr. Eric Sauve negotiated on behalf of and in good faith and at arm's length for the best interest of Grant Hartford Corporation. The negotiations concluded in a Letter of Intent which was signed on March 22, 2007. The Option Agreement became effective on June 15, 2007. At the time the Option Agreement became effective Eric Sauve was not a Membership owner of Commonwealth Resources L.L.C. and did not become a member until August 31, 2007. We, at this point, have not voluntarily implemented various corporate governance measures, in the absence of which, stockholders may have more limited protections against interested director transactions, conflicts of interest and similar matters. In the interim, or until such time as we adopt more definitive conflict of interest and ethics rules, which will include the rules set forth in the Sarbanes-Oxley Act of 2002, Federal legislation. Any future potential conflicts will be governed by the independent members of the Board of Directors. However, any conflict of interest with our President, CEO, CFO, Directors and our Senior Consultant, could result in a loss of confidence by our shareholders or potential investors and could result in a disruption to the business, adversely affecting our Company and the existing shareholders.

7: Potential Conflict of Interest Between Grant Hartford Corporation and Garnet Range Resources, LLC

On July 6, 2009, the Company and Garnet Range Resources, LLC ("Garnet") entered into an agreement wherein Garnet would provide the following services to GHC: the rental and operation of heavy equipment, labor on the Garnet Mineral Property and coordination of the exploration project management with GHC. The material terms of this agreement are further set forth on page 38 of this Amended Form S-1 in the "Material Terms of Related Party Agreements" section. Mr. Eric Sauve, the President, CEO, CFO and Director of Grant Hartford Corporation, is a related party to GHC and is also a 50% owner of Garnet. Joyce L. Charlton is the Managing Member, and 50% owner of Garnet and is the wife of Aaron Charlton, the Senior Consultant of GHC, a related party to GHC and the Managing Member of Commonwealth Resources, LLC, the company that GHC has optioned its mineral interests from. Since Eric Sauve and Joyce Charlton are related parties to the Company and these related parties own 100% of Garnet, there is an appearance of a conflict of interest. However, Mr. Sauve took this matter

9

to the Board of Directors for their consideration of the Agreement. Mr. Sauve recused himself from the vote and the Board of Directors agreed that this Agreement would be beneficial to the Company and it was acting in the ordinary course of business. Any transaction with our President, CEO, CFO, Directors and Senior Consultant and his wife could be perceived as a conflict of interest which could result in a loss of confidence by our shareholders or potential investors and could result in a disruption to our business, which could adversely affect our Company and the existing shareholders.

8: Laps of Insurance on the Part of Garnet Range Resources, LLC.

While Garnet Range Resources, LLC ("Garnet") is responsible to perform the following services to GHC: the rental and operation of heavy equipment, labor on the Garnet Mineral Property and coordination of the exploration project management with GHC, Garnet does not specify that it will indemnify GHC for work stoppage, delays or interruption of operations, as a result of not being able to provide these services on a timely manner. This lack of performance on the part of Garnet could cause increased costs, monetary losses, legal liability and possible adverse governmental action. Thus, the inability of Garnet to perform could have an adverse effect on the Company's financial position and have an adverse effect on the shareholders. The potential costs associated with losses or liabilities not covered by Garnet's insurance will have a material adverse effect on the Company's financial position and have an adverse effect on the shareholders. The material terms of this agreement are further set forth on page 38 of this Amended Form S-1 in the "Material Terms of Related Party Agreements" section.

9: Unanticipated issues may occur

Potential investors should be aware of the difficulties normally encountered by new exploration stage companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration stage. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The exploration stage also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which the Company cannot insure, or against which it may elect not to insure. At the present time, we have no insurance coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in determining the existence of proven/probable reserve deposits. Problems such as unusual or unexpected formations and other conditions are involved in exploration and often result in unsuccessful exploration efforts.

10: Non-Consent to Use Geological Reports

The Company has been unable to obtain consents for two of our historical geological reports; the "Garnet Project Summary," prepared by Pegasus Gold Corporation and the "Mineral Property Valuation of the Garnet and Copper Cliff Mining Districts in Garnet and Missoula Counties," prepared by Dr. John C. Brower, Ph.D. The Company has deemed it necessary to include

10

portions of these reports, without the expert consents and with the acknowledgement that the reports are over ten years old; because the information in these reports describe the historical geological condition of the property, and historical exploratory mineralized material findings on the property. This information was a contributing factor in entering into the Grant Hartford Option Agreement with Commonwealth Resources, L.L.C. (the material terms of the Grant Hartford Option Agreement can be found on page 38 of this Form S-1), and to the development of Grant Hartford's current exploratory drilling program on the Garnet Mineral Property. If a shareholder relies on these geology reports, which lack the proper expert consent, the shareholder will not be able to recover from the authors of these reports for any claims relating to the investors' reliance on these reports.

The Company has agreed to adopt the conclusions made in the reports as the Company's own. While the Company has adopted the conclusions, the Company may not have sufficient assets to support a legal judgment should shareholders have a reason to obtain a judgment against the Company regarding these conclusions. The inability to collect on a judgment could have a detrimental effect on the litigating shareholders and on new shareholders. Information from, and references to, these geological reports can be found on pages: 2, 38, 40, 51, 53, 54 and 85 of this Form S-1.

11: We will continue to incur losses for the foreseeable future

Prior to completion of the exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur continuing and significant losses into the foreseeable future. As a result of continuing losses, we may exhaust all of our resources and be unable to complete exploration of our optioned mineral claims. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to generate profits or continue operations if we are unable to generate significant revenues from future mining of the mineral claims even if we exercise our options. There is limited history upon which to base any assumption as to the likelihood that we will be successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

12: Because access to the mineral property may be restricted by inclement weather, the Company may be delayed in its exploration efforts

Access to the mineral property may be restricted during parts of the year, due to weather in the area. The property is in a mountainous area in the Garnet Mining District, Granite County, Montana. The terrain is mountainous, and the property is accessed by county roads, Bureau of Land Management roads, and private roads. Although these roads have been used for exploration in the past, they are best traveled by four-wheel drive vehicles from spring to the beginning of winter. During the winter months, heavy snowfall can make it difficult to undertake work programs. We do not currently plan drilling operations in the winter months. Frequent inclement weather in the winter months makes exploration activities difficult and the planning of exploration activities challenging. As a result, any attempt to explore the property is largely limited to the times when weather permits such activities. The most efficient time for us to conduct our work programs is during the months of May through November. These limitations can result in significant delays in our exploration efforts, as well as any future production, in the event of unsuccessful determination of the existence of proven/probable reserves. Delays in exploration and drilling due to inclement weather could significantly increase the time that it would take to generate any operating revenues or prohibit achieving profitable operations.

11

13: If management cannot devote sufficient time to operations, its business may fail

Mr. Sauve, our President, Chief Executive Officer and Chief Financial Officer, devotes his full time and attention to our business affairs. We have an Employment Agreement with Mr. Sauve. Mr. Aaron Charlton, our Senior Consultant, also devotes his full time and attention to our business affairs. We have an Employment Agreement with Mr. Charlton. J. Robert Flesher, our Vice President of Mining and Geology, devotes his full time and attention to our development program. We have an oral Employment Agreement with Mr. J. Robert Flesher. BJ Ambrose, our Vice President of Corporate Finance, devotes his full time and attention to our business affairs. We have an Employment Agreement with Mr. Ambrose. Tim Matthews, our Vice President of Marketing, devotes his full time and attention to our business affairs. We have an Employment Agreement with Mr. Matthews. (See "Material Terms of Employment Agreements" on page 73.) Currently, we retain the services of five consulting geologists on a part-time basis. If our management is unable to devote a sufficient amount of time to manage our operations, our business could fail.

14: Sales of substantial amounts of common stock may adversely affect prevailing market price

Our President, Mr. Eric Sauve, is the beneficial owner of 3,215,530 shares of our common stock, which equates to 14.31% of our issued and outstanding common stock. Our Senior Consultant, Aaron Charlton, is beneficial owner of 9,423,066 shares of our common stock which equates to 41.92% of our issued and outstanding common stock. Rodney Haynes beneficially owns 4,742,076 shares of our common stock which equates to 21.09% of our issued and outstanding common stock. There is presently no public market for our common stock; however, we propose to apply for quotation of our common stock on the NASD Over-The-Counter Bulletin Board ("OTCBB") upon the effectiveness of this Registration Statement, of which this Prospectus forms a part. If our shares are publicly traded on the OTCBB, Mr. Sauve, Mr. Charlton and/or Creative Finance PFP will be eligible to sell their shares publicly, subject to the volume limitations of Rule 144. The sale of a large number of shares at any price may cause the market price to fall. Sales of substantial amounts of common stock or the perception that such transactions could occur, may materially and adversely affect prevailing market prices for our common stock.

15: The mine exploration business is highly competitive

The mine exploration business is highly competitive. Our preparation activities will be focused on exploring our mineral property in order to determine the existence of proven/probable reserves. Many of our competitors have greater financial resources than we have. As a result, we may experience difficulty competing with other businesses regarding availability of equipment and qualified personnel. If we are unable to retain qualified personnel, or locate needed equipment while conducting exploration activities, we may be unable to enter into the development and production stages and may be unable to achieve profitable operations.

16: A ready market may not exist for the sale of the future identified proven/probable reserves

Even if the Company is able to successfully explore, develop and prepare an established commercially minable proven/probable reserve deposit, a ready market may not exist for the sale of the extracted proven/probable reserves. Numerous factors beyond our control may affect the

12

marketability of gold proven/probable reserves that are prepared for production. These factors include market fluctuations, the proximity and capacity of natural resource markets, processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, and environmental laws and regulations. These factors could inhibit our ability to sell proven/probable reserves in the event that the Company is able to successfully explore, develop and prepare an established commercially minable proven/probable reserve deposit for extraction.

17: There is a risk that new regulations could increase our costs

The Montana Department of Environmental Quality and the Bureau of Land Management have jurisdiction and enforce laws and enact and enforce rules and regulations relating to the exploration, development and production of proven/probable reserves. We will be subject to these laws, rules and regulations as we carry out our exploration program. We are required to obtain drilling permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws, rules and regulations. Currently, we have not experienced any difficulty with compliance of any laws or regulations which affect our business. While we have planned exploration program budgets for regulatory compliance, there is a risk that new laws, rules or regulations could increase our costs of doing business, preventing us from carrying out our exploration program and, therefore, adversely affecting our operational results.

18: In the event that our mining claims become invalid, we will lose all rights that we have in the 23 patented and 122 unpatented mining claims

The 23 patented and 122 unpatented mining claims are owned by Commonwealth Resources, L.L.C. and are under an option to us. WGM Group, a professional survey company in Missoula, Montana, surveyed, staked and filed all 122 unpatented claims. These claims were staked on public lands administered by the Bureau of Land Management. The right to conduct exploration, development and production mining programs on these 122 unpatented mining claims is subject to permitting by the Bureau of Land Management. The right to conduct exploration, development and production mining programs on the 23 patented mining claims is subject to permitting by the Montana Department of Environmental Quality. The invalidity of any claims would have an adverse affect on any future revenues.

In order to keep the 122 unpatented mining claims in good standing, the Bureau of Land Management requires that an annual maintenance fee be paid before August 31st of each year. In the event that these maintenance fees are not paid by the August 31st deadline, the mining claims become invalid and revert to the Bureau of Land Management. In the event that our mining claims become invalid, we will lose all rights that we have in the 122 unpatented mining claims.

In order to keep the 23 patented mining claims in good standing, the Granite County, Montana Treasurer requires assessed property taxes to be paid for each respective mining claim by the July 31st of each year. If, or when, property taxes become three years delinquent, we risk losing our rights in the 23 patented mining claims by operation of law.

Grant Hartford Corporation has the initial responsibility to pay the Bureau of Land Management annual assessment fees, which are currently $125 for each 122 unpatented claim for a total annual amount of $15,250 and the property taxes on the 23 patented claims in the annual amount of $1,362. If these fees are not satisfied by GHC, Commonwealth Resources, L.L.C. will then

13

make arrangements for payment of such fees. Failing both companies' fee payment, GHC would lose its rights in the claims and the shareholders would be subsequently adversely affected.

19: In the event we fail to make our scheduled option payments, we will lose all interest that we have in the patented and unpatented mining claims

The 23 patented and 122 unpatented mining claims are owned or optioned by Commonwealth Resources, L.L.C. and are under option to us from Commonwealth Resources, L.L.C. Under the Grant Hartford Option Agreement, we are required to make annual option payments of $190,000, for the first five (5) year period of the agreement and $400,000 for the final two (2) year period, and annual access lease payments of $60,000 in order to keep our option to purchase the mineral rights to the patented and unpatented mining claims valid. In the event that the option payment and access lease payment are not paid by the deadline, and Commonwealth Resources L.L.C. is unwilling to negotiate an extension, we risk losing all rights in and to the claims.

20: Compliance with Sarbanes-Oxley may result in our inability to achieve profitability

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties relating to publicly-traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act and its costs to remain in compliance with the federal securities regulations. Additionally, we may be unable to attract and retain qualified officers, directors and board committee members, which are required pursuant to the Sarbanes-Oxley Act of 2002, in order to provide effective management. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly to attract or may deter qualified individuals from accepting these roles. Significant costs incurred as a result of becoming a public company could divert the use of finances from our operations resulting in the Company's inability to achieve profitability.

Risk Factors Relating to Our Common Stock

21: We may be exposed to potential risks relating to our internal control over financial reporting and our ability to have those controls attested to by our independent registered public accounting firm.

Section 404 of the Sarbanes-Oxley Act of 2002 requires public companies to include a report of management on the company's internal control over financial reporting in their annual reports, including Form 10-KSB. In addition, the independent registered public accounting firm auditing a company's financial statements must also attest to and report on management's assessment of the effectiveness of the company's internal control over financial reporting as well as the operating effectiveness of the company's internal controls. We are not yet subject to these requirements. We have not yet begun evaluating our internal control systems in order to allow our management to report on, and our independent registered public accounting firm to attest to,

14

our internal controls as a required part of our Annual Report on Form 10-KSB beginning with our report for the fiscal year ending December 31, 2008 in relation to our management's report and for our fiscal year ending December 31, 2009 relative to our accounting firm's attestation.

While we expect to expend significant resources over the next few months in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act of 2002, there is a risk that we will not be able to comply with all of the requirements imposed by this rule. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive an unqualified attestation from our independent registered public accounting firm with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with their audit of our financial statements, and in the further event that they are unable to devise alternative procedures in order to satisfy themselves as to the material accuracy of our financial statements and related disclosures, it is possible that we would receive a qualified or an adverse audit opinion on those financial statements which could also adversely affect the market price of our common stock and our ability to secure additional financing as needed.

22: Indemnification of Officers and Directors.

Our Bylaws provide for indemnification to the fullest extent permitted by Montana law for any person whom we may indemnify thereunder; including our directors, officers, employees and agents. As a result, stockholders may be unable to recover damages against directors for actions taken by them in good faith and with the belief that such actions served the best interests of the Corporation, whether or not such actions actually did. Our Bylaws, therefore, may reduce the likelihood of derivative litigation against directors and other types of stockholder litigation, even though such action, if successful, might otherwise benefit us and our stockholders.

23: We are subject to "Penny Stock" rules

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on NASDAQ). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation to the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Consequently, these requirements may have the effect of reducing

15

the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock, may find it difficult to sell their shares.

24: We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We have offered and sold our common stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as amended (the "Securities Act"), as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We have not received a legal opinion to the effect that any of our prior offerings were exempt from registration under any federal or state law. Instead, we have relied upon the operative facts as the basis for such exemptions, including information provided by investors themselves.

If any prior offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not, in fact, qualify for the exemptions upon which we have relied, we may become subject to significant fines and penalties imposed by the Securities and Exchange Commission (the "SEC") and state securities agencies.

25: We do not expect to distribute cash dividends.

We do not anticipate paying any cash dividends on our shares because we intend to retain our earnings to finance our mining business. We cannot assure you that our operations will result in sufficient revenues to enable us to operate at profitable levels or to generate a positive cash flow. Therefore, investors who anticipate the need for immediate income in the form of dividends should refrain from the purchase of our shares. In the future, our Board of Directors will decide whether to declare any cash dividends based on the conditions then existing, including our earnings and financial condition.

26: There is no public trading market for our common stock and no public market may develop.

Currently, there is no trading market for our common stock, and there can be no assurance that such a market will commence in the future. There can be no assurance that an investor will be able to liquidate his or her investment without considerable delay, if at all. If a trading market does commence, the price may be highly volatile. Factors discussed herein may have a significant impact on the market price of the shares offered. Moreover, our common stock in all likelihood will trade at a price below $5.00 per share and become subject to the "penny stock" rules enacted by the SEC. This would increase the likelihood that many brokerage firms will not participate in a potential future market for our common stock. Those rules require, as a condition to brokers effecting transactions in certain defined securities (unless such transaction is subject to one or more exemptions), that the broker obtain from its customer or client a written representation concerning the customer's financial situation, investment experience and

16

investment objectives. Compliance with these procedures tends to discourage most brokerage firms from participating in the market for certain low-priced securities.

27: A purchaser of our shares runs the risk of losing his entire investment.

Only persons that can bear the economic risk of their investment for an indefinite period of time and can afford the total loss of their investment should consider the purchase of our shares.

28: Issuance of additional securities.

Our Board of Directors has authority to issue additional shares of common stock or other securities without the consent or vote of our stockholders. The issuance of additional shares, whether in respect of a transaction involving a business opportunity or otherwise, may have the effect of further diluting the proportionate equity interest and voting power of our stockholders. In the event of such future acquisitions, we could issue equity securities which would dilute current stockholders' percentage ownership, incur substantial debt or assume contingent liabilities. Such actions by the Board of Directors could materially adversely affect our operating results and/or the value of our common stock.

29: If our shares are quoted on the Over-The-Counter Bulletin Board (OTCBB), we will be required to remain current in our filings with the SEC and our shares will not be eligible for quotation if we are not current in our filings with the SEC.

In the event that our shares are quoted on the OTCBB, we will be required to remain current in our filings with the SEC in order for our common stock to be eligible for quotation on the OTCBB. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 or 60 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the OTCBB, investors in our common stock may find it difficult to sell their shares.

30: Voting Control by Commonwealth Resources, LLC.

Commonwealth Resources, L.L.C., owns, collectively, approximately 74.08%, or 16,653,302 shares of our total beneficially owned common stock. Commonwealth Resources, L.L.C. is comprised of four interest holders, which together own the 16,653,302 shares of our Company's common stock. The interest holders and their beneficially owned shares are as follows: Eric Sauve, 1,815,330 shares, Aaron Charlton, 9,423,066 shares, Kim Charlton-Benson, 1,832,830 shares and Rodney Haynes, 3,582,076 shares. Accordingly, these stockholders, as a group, will be able to control, among other things, the outcome of stockholders votes, including the election of directors, adoption of amendments to our Bylaws and Articles of Incorporation and approval of significant corporate transactions such as mergers.

Mr. Eric Sauve is the President, CEO, CFO and Director of our Company. Mr. Aaron Charlton is our Senior Consultant, who supervises the drilling program, deals with contractors and is the Company's liaison with the BLM, state and local agencies. Any conflicts of interest could delay the implementation of our business plan, which could have a detrimental effect on our business.

17

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus, and the documents incorporated in it by reference, contains forward-looking statements that involve known and unknown risks and uncertainties. Examples of forward-looking statements include: projections of capital expenditures, competitive pressures, revenues, growth prospects, product development, financial resources and other financial matters. You can identify these and other forward-looking statements by the use of words such as "may," "will," "should," "plans," "anticipates," "believes," "estimates," "predicts," "intends," "potential" or the negative of such terms, or other comparable terminology.

Our ability to predict the results of our operations or the effects of various events on our operating results is inherently uncertain. Therefore, we caution you to consider carefully the matters described under the caption "Risk Factors" and certain other matters discussed in this Prospectus, the documents incorporated by reference in this Prospectus, and other publicly available sources. These factors and many other factors beyond the control of our management could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by the forward-looking statements.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the common stock offered by this Prospectus. However, if all of the warrants to purchase the common stock covered by this Prospectus are exercised in full, we would receive gross proceeds of approximately $1,363,440. We would use any such proceeds for working capital and general corporate purposes. There can be no assurance that the selling shareholders or their transferees will choose to exercise any of the warrants. We have agreed to bear all expenses relating to the registration of the common stock registered pursuant to the registration statements of which this Prospectus is a part.

DETERMINATION OF OFFERING PRICE

The selling shareholders may sell shares from time to time, initially at a fixed price equal to $0.80 per share. The offering price was determined based upon the price at which we most recently sold our common stock in private transactions. However, we cannot determine what the market value of our common stock will be either now or at the time of sale. There is no relationship between this price and the Company's assets, earnings, book value or any other objective criteria of value. Our common stock is not traded on any national securities exchange and is not quoted on any over-the-counter market. If our shares become quoted on the Over The

Counter Bulletin Board ("OTCBB"), the selling shareholders may sell all, or a portion, of their shares in the over-the-counter market at prices prevailing at the time of sale, or related to the market price at the time of sale, or at other negotiated prices.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. The selling shareholders of the issued and outstanding common shares are offering 1,886,893 shares of common stock through this prospectus. All of the shares were acquired from us by the selling shareholders in exempt transactions. The selling shareholders purchased their shares in three exempt offerings that were completed on March 23, 2007, October 31, 2007 and May 31, 2008, respectively.

18

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Currently, there is no public market for our capital stock, and we have not applied to have our common stock listed on any exchange or quoted by any quotation service. We intend to seek out a market maker to apply to have our common stock quoted on the OTCBB upon effectiveness of this Registration Statement. We are presently not required to comply with the disclosure policies of any exchange or quotation service. There are 1,030,195 shares of our common stock currently issuable upon exercise of warrants, of which 830,195 shares are covered by this Registration Statement. In addition, there are 21,450,195 shares of our common stock currently issued and outstanding, of which 1,886,893 shares are covered by this Registration Statement. In addition all of the 21,450,195 shares of outstanding common stock could be sold under Rule 144 beginning 90 days after we file this Registration Statement.

Effective February 15, 2008, Rule 144 was amended to provide, among other things, that, with certain exceptions, persons not affiliated with the issuer holding restricted securities of reporting companies for at least six months may each freely sell (subject only to the Rule 144(c) public information requirement until the securities have been held for one year) and non-affiliates of non-reporting companies may freely resell restricted securities after satisfying a 12-month holding period. The provision permitting free sales after a six month holding period does not apply to securities issued by a shell company or any company which has ever been a shell company before such shares were issued. Such shares can only be sold under Rule 144 at least twelve months after the issuer has (1) ceased to be a shell company, (2) has filed current "Form 10 information" and (3) become a reporting company under the Securities Exchange Act of 1934 (the "Exchange Act") and made all required periodic filings for one year.

Our shares which were issued to the original shareholders, were issued at a time when we were an operating company and our Company had never been a shell company. Therefore, beginning 90 days after we become a reporting company by filing this Registration Statement, such shareholders may freely sell their shares under Rule 144 as amended, since they have held them for at least six months.

Rules Governing Low-Price Stocks

Our shares of common stock currently are not traded on any stock exchange or quoted on any stock quotation system. Upon the registration statement in which this Prospectus is included, becoming effective, we will seek out a market maker to apply for quotation of our common stock on the OTCBB.

Quotations on the OTCBB reflect inter-dealer prices, without retail mark-up, markdown or commission and may not reflect actual transactions. Our common stock may be subject to certain rules adopted by the SEC that regulate broker-dealer practices in connection with transactions in "penny stocks." Penny stocks generally are securities with a price of less than $5.00, other than securities registered on certain national exchanges or quoted on the NASDAQ system, provided that the exchange or system provides current price and volume information with respect to transactions in such securities. The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in our shares which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market.

19

The penny stock rules require broker-dealers, prior to a transaction in a penny stock not otherwise exempt from the rules, to make a special suitability determination for the purchaser to receive the purchaser's written consent to the transaction prior to sale, to deliver standardized risk disclosure documents prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities.

Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer's account and information with respect to the limited market in penny stocks.

Common Stockholders of Record

As of December 31, 2008, we had 61 stockholders of record. However, this number does not include stockholders whose shares are held in trust by other entities and stockholders whose stock was held in nominee or street name by brokers, so the total number of beneficial stockholders of our shares is greater than the number of stockholders of record.

Except as described below, none of the selling shareholders: (1) have had a material relationship with the Company other than as a shareholder at any time within the past two years; or (2) have ever been one of the Company's officers or directors. However, there are two exceptions, in that Brian Blevins was a Director of our Company for a period of two months and David Rodli, Esq. represents Grant Hartford Corporation as General Legal Counsel and currently acts as the Company's Registered Agent. David Rodli represents Commonwealth Resources, L.L.C. as General Legal Counsel.

* | Maureen Sauve, the President's mother, does not live at the same address as Eric Sauve, holds 2,100 shares of common stock in Grant Hartford Corporation, and has had no business relationships with our Company, |

* | Lauren Sauve, the President's sister, is the beneficial owner of 2,100 shares of common stock in our Company, and has had no business relationships with us, |

* | Leo Sauve, the President's father, is the beneficial owner of 204,200 shares of common stock of our Company, and has had no business relationships with us, |

* | Valerie Sauve, the President's sister, is the beneficial owner of 3,350 shares of common stock in our Company, and has had no business relationships with Grant Hartford Corporation, |

* | Brian Blevins, a Director between March 15, 2007 and May 16, 2007, is the beneficial owner of 120,000 shares of common stock in our Company and currently has no business relationships with us. |

* | David Rodli, GHC's Registered Agent and General Legal Counsel who is the holder of record of 145,000 shares of the Company's no par value common stock. David Rodli, Esq., has been General Legal Counsel for the Company since its inception. |

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

20

* | On such public markets or exchanges as the common stock may from time to time be trading; |

* | In privately negotiated transactions; |

* | Through the writing of options on the common stock; |

* | In short sales, or; |

* | In any combination of these methods of distribution. |

The sales price to the public is fixed at $0.80 per share until such time as the shares of our common stock become traded on the OTCBB or another exchange. Although we intend to apply for quotation of our common stock on the OTCBB, public trading of our common stock may never materialize. If our common stock becomes traded on the OTCBB, or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for the our stock at the time of resale. In these circumstances, the sales price to the public may be:

* | The market price of our common stock prevailing at the time of sale; |

* | A price related to such prevailing market price of our common stock, or; |

* | Such other price as the selling shareholders determine from time to time. |

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144.

The selling shareholders may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as an agent may receive a commission from the selling shareholders or from such purchaser if they act as agent for the purchaser. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities and Exchange Act of 1934, as amended, in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things,:

* | Not engage in any stabilization activities in connection with our common stock; |

* | Furnish each broker or dealer through which common stock may be offered, such copies of this Prospectus, as amended from time to time, as may be required by such broker or dealer; and; |

* | Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Securities Exchange Act, as amended. |

We are not currently a party to any legal proceedings.

21

Previous Issuance and Offerings of Our Common Shares

On March 22, 2007, we issued 1,000,000 common shares at a price of $0.001 per share to our President and CEO as founders' shares, pursuant to an exempt transaction.

On March 23, 2007, we completed our first exempt offering pursuant to Section 4(2) of the Securities Act of 1933, as amended. We issued 280,000 shares of the Company's no par value common stock to two (2) accredited investors at a purchase price of $0.125 per share, for an aggregate price of $35,000.

On March 22, 2007, we signed a Letter of Intent with Commonwealth Resources, L.L.C. which required us to issue 14,000,000 shares of the Company's no par value common stock and 5,000,000 shares of the Company's preferred stock, subject to entering into a final option agreement. On June 15, 2007, pursuant to the terms of the Grant Hartford Option Agreement regarding the Garnet Mineral property, we issued 14,000,000 of the Company's no par value common shares at $0.125 per share, for a total consideration valued at $1,750,000. The shares were issued pursuant to an exempted transaction. At the time of issuance, the 14,000,000 shares of the Company's no par value common stock represented 91.6% of the Company's issued and outstanding common stock.

On June 18, 2007, we issued 100,000 common shares at a price of $0.001 to one of our Directors as founders' shares. The shares were issued pursuant to an exempted transaction.

On October 31, 2007, we completed a second exempt offering pursuant to Section 4(2) of the Securities Act of 1933, as amended. We issued 793,900 shares of the Company's no par value common stock to 45 accredited investors at a purchase price of $0.50 per share, for an aggregate price of $396,950.

On October 24, 2007, we issued 25,000 common shares at a price of $0.001 to one of our Directors as founders' shares. The shares were issued pursuant to an exempted transaction.

On December 10, 2007, we issued 10,000 common shares at a price of $0.001 per share to our Vice President as founders' shares. The shares were issued pursuant to an exempted transaction.

On December 17, 2007, we issued 5,000 common shares at a price of $0.50 per share to David Rodli, our General Counsel, pursuant to the terms of a retainer agreement. The shares were issued pursuant to an exempted transaction.

On January 24, 2008 the Company amended its Option Agreement with Commonwealth Resources L.L.C., wherein the Company issued 5,000,000 common shares at no par value in exchange for the 5,000,000 preferred shares as originally contemplated in the Option Agreement. The shares were issued pursuant to an exempt transaction. The issuance of the 5,000,000 shares of the Company's no par value common stock completed the transaction that began pursuant to the initial issuance of the 14,000,000 shares of the Company's no par value common stock on June 15, 2007. Thus, the total sum of 19,000,000 shares of the Company's no par value common stock, were issued at $0.125 per share for a total combined consideration of $2,375,000. At the time of the final issuance, the combined 19,000,000 shares of the Company's no par value common stock represented 89.6% of the Company's issued and outstanding common stock.

22

On May 31, 2008, we completed a third exempt offering pursuant to Section 4(2) of the Securities Act of 1933, as amended. We issued 236,295 shares of the Company's no par value common stock to 11 accredited investors at a purchase price of $0.80 per share, for an aggregate price of $189,036.

Between July 22, 2008 and November 6, 2008, the Company entered into eight (8) Non-Transferable Convertible Notes (the "Notes") in the aggregate sum of $271,500. The Notes were entered into pursuant to exempt transactions. The material terms of the Convertible Notes are further set forth in the "2008 Convertible Note Offering" section of this Prospectus on page 4.