UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

INFORMATION STATEMENT PURSUANT TO SECTION 14(c)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

o Preliminary Information Statement

þ Definitive Information Statement

o Confidential for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

One E-Commerce Corporation

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

þ No fee required

o Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

o Fee previously paid with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

INFORMATION STATEMENT

OF

ONE E-COMMERCE CORPORATION

1370 Avenue of the Americas, Suite 902

New York, New York 10019

Tel. (858) 699-8313

Fax (212) 245-4165

February 1, 2012

GENERAL

This Information Statement is being distributed to the holders of record of common stock, par value $.001 per share, of One E-Commerce Corporation, a Nevada corporation (the "Company" or “we”’), holders of record of Series A preferred stock, par value $.001 per share, of the Company, and holders of record of Series B preferred stock, par value $.001 per share, of the Company, at the close of business on January 19, 2012 (the "Record Date") under Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). This Information Statement is first being mailed to the stockholders of the Company on or about February 1, 2012.

The Information Statement advises shareholders of the following amendments to our Articles of Incorporation (the “Amendment”) approved on January 12, 2012 by the board of directors and the holders of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take the action at a meeting at which all shares entitled to vote thereon were present and voted:

| | ● | to change our name to Islet Sciences, Inc. (the “Name Change”); |

| | ● | to increase the total number of authorized shares of capital stock of the Company from 50,500,000 shares to 110,000,000 shares, consisting of 100,000,000 shares of common stock and 10,000,000 shares of preferred stock (the “Increase of Authorized Shares”); and |

| | ● | to authorize the board of directors to effect a one for forty-five (1:45) Reverse Split of the outstanding shares of our common stock (the ���Reverse Split”). |

A copy of the substantive text of the Amendment is attached to this Information Statement as Exhibit A.

These corporate actions will become effective on the filing of a certificate of amendment to our articles of incorporation with the Secretary of State of Nevada which filing will occur at least 20 days after the date of the mailing of this Information Statement to our shareholders.

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS AND NO STOCKHOLER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED HEREIN PURSUANT TO SECTION 14(C) OF THE EXCHANGE ACT AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION 14C. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

| By order of the Board of Directors |

| |

| /s/ John Steel |

| John Steel |

| Chief Executive Officer and Director |

INTRODUCTION

Pursuant to an Agreement and Plan of Merger dated December 30, 2011 (the “Merger Agreement”), ONCE, Inc. a Delaware corporation which was wholly owned by us (the “Merger Sub”) was merged with and into Islet Sciences, Inc., a Delaware corporation (“ISI”), and in exchange of all the outstanding capital stock of ISI, former shareholders of ISI received a total number of 38,050.87 shares of our Series B Preferred Stock, par value $.001 per share (“Series B Preferred”) and 1,173 shares of Series A Preferred Stock, par value $.001 per share (the “Series A Preferred”) (such transaction, the “Merger”). Such Series A Preferred Stock will be automatically converted into a total of 1,173,000 shares of our common stock, par value $.001 (the “Common Stock”) upon the effectiveness of a 1-for-45 reverse split of the Common Stock (the “Reverse Split”). Holders of Series A Preferred will also receive the Company’s warrants to purchase an aggregate of 586,500 shares of Common Stock at an exercise price of $1.00 per share. Shares of Series B Preferred will be automatically converted into an aggregate of 38,050,870 shares of Common Stock, at a conversion ratio of one share of Series B Preferred for one thousand shares of Common Stock upon effectiveness of the Reverse Split. In connection with the Merger, ISI agreed to cancel 9,902,180 shares of Common Stock held by it effective upon the effectiveness of the Reverse Split.

As a result of the Merger, ISI became our wholly-owned subsidiary, which is a development-stage biotechnology company with patented technologies focused on transplantation therapy for people with insulin-dependent diabetes. We therefore ceased being a shell company as such term is defined in Rule 12b-2 under the Exchange Act.

The Name Change, Increase of Authorized Shares, and the Reverse Split, were approved by the holders of a majority of our common stock and preferred stock voting together on January 19, 2012.

For additional information concerning the transactions relating to the reverse merger, the related transactions and the business of Islet Sciences, Inc., see Items 1.01 and 2.01 of our Current Report on Form 8-K filed with the SEC on January 6, 2012.

AUTHORIZATION BY THE BOARD OF DIRECTORS AND THE MAJORITY STOCKHOLDERS

Under the Nevada Revised Statutes and the Company’s Bylaws, any action that can be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if the holders of outstanding stock having not less than the minimum number of votes that will be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted consent to such action in writing. The approval of the Amendment requires the affirmative vote or written consent of a majority of the voting power of the issued and outstanding shares of Common Stock and Series B Preferred. Each stockholder of Common Stock is entitled to one vote per share of Common Stock held of record on any matter which may properly come before the stockholders. The holder of each share of Series A Preferred is entitled to the number of votes equal to the number of shares of Common Stock into which such share of Series A Preferred could be converted, being 1,000 shares as of the record date. The holder of each share of Series B Preferred is entitled to the number of votes equal to the number of shares of Common Stock into which such share of Series B Preferred could be converted, being 1,000 as of the record date.

On the Record Date, the Company had (i) 18,317,200 shares of Common Stock issued and outstanding with the holders thereof being entitled to cast one vote per share, (ii) 1,173 shares of Series A Preferred issued and outstanding with the holders thereof being entitled to cast one thousand votes per share, and (iii) 38,050.87 shares of Series B Preferred issued and outstanding with the holders thereof being entitled to cast one thousand votes per share.

On January 12, 2012, our Board of Directors unanimously adopted resolutions approving the Amendment and recommended that our stockholders approve the Amendment.

On January 19, 2012, the following holders of our Common Stock and Series B Preferred, entitled to a total of approximately 55% of the votes, consented in writing to the Amendment as follows:

| Name | | Number of Securities | | Percentage of

total votes | |

| Islet Sciences, Inc. | | 9,902,180 shares of Common Stock | | | 17.2 | % |

| John Steel | | 7,366 shares of Series B Preferred | | | 12.8 | % |

| Charles Dupont | | 5,710 shares of Series B Preferred | | | 9.9 | % |

| Charles Rhodes | | 3,000 shares of Series B Preferred | | | 5.2 | % |

| H.S. Perlin Co., Inc. Defined Benefit Pension Plan | | 2,000 shares of Series B Preferred | | | 3.5 | % |

| The Perlin Family Trust | | 1,700 shares of Series B Preferred | | | 2.9 | % |

| Jonathan Lakey | | 2,000 shares of Series B Preferred | | | 3.5 | % |

Accordingly, we have obtained all necessary corporate approvals in connection with the Amendment. We are not seeking written consent from any other stockholder, and the other stockholders will not be given an opportunity to vote with respect to the actions described in this Information Statement. This Information Statement is furnished solely for the purposes of advising stockholders of the action taken by written consent and giving stockholders notice of such actions taken as required by the Exchange Act.

As the actions taken by the majority stockholders were by written consent, there will be no security holders’ meeting and representatives of the principal accountants for the current year and for the most recently completed fiscal year will not have the opportunity to make a statement if they desire to do so and will not be available to respond to appropriate questions from our stockholders.

We will, when permissible following the expiration of the 20 day period mandated by Rule 14c of the Exchange Act and the provisions of the Nevada Revised Statutes, file the Amendment with the Nevada Secretary of State’s Office. The Amendment will become effective upon such filing and we anticipate that such filing will occur approximately 20 days after this Information Statement is first mailed to our stockholders, except for the Reverse Split, which will become effective on the first date permitted or determined by FINRA as the effective date of the Reverse Split, subject to the prior filing of the certificate of amendment.

DESCRIPTION OF THE COMPANY’S SECURITIES

Common Stock

We are currently authorized to issue up to 50,000,000 shares of common stock, par value $0.001 per share. Holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of our stockholders. Holders of our common stock are entitled to receive dividends ratably, if any, as may be declared by the Board of Directors out of legally available funds, subject to any preferential dividend rights of any outstanding preferred stock (there are none currently). Upon our liquidation, dissolution or winding up, the holders of our common stock are entitled to receive ratably our net assets available after the payment of all debts and other liabilities and subject to the prior rights of any outstanding preferred stock.

Holders of our common stock have no preemptive, subscription, redemption or conversion rights. The outstanding shares of common stock are fully paid and non-assessable. The rights, preferences and privileges of holders of our common stock are subject to, and may be adversely affected by, the rights of holders of shares of any series of preferred stock which we may designate and issue in the future without further shareholder approval.

As of January 19, 2012, there were 18,317,200 shares of common stock issued and outstanding.

Preferred Stock

We are currently authorized to issue up to 500,000 shares of “blank check” preferred stock, par value $0.001 per share. Our Board of Directors has the authority, without further action by the stockholders, to issue from time to time the blank check preferred stock in one or more series for such consideration and with such relative rights, privileges, preferences and restrictions that the Board may determine. The preferences, powers, rights and restrictions of different series of preferred stock may differ with respect to dividend rates, amounts payable on liquidation, voting rights, conversion rights, redemption provisions, sinking fund provisions and purchase funds and other matters. The issuance of preferred stock could adversely affect the voting power or other rights of the holders of common stock.

In connection with the Merger, the Company filed with the Secretary of State of the State of Nevada a Certificate of Designations of Preferences and Rights of Series A Preferred Stock (the “Series A Certificate”) and a Certificate of Designations of Preferences and Rights of Series B Preferred Stock (the “Series B Certificate”). Pursuant to the Series A Certificate, there are 7,000 shares of Series A Preferred Stock authorized. Pursuant to the Series B Certificate, there are 40,000 shares of Series B Preferred Stock authorized. Series A and Series B Preferred Stock are entitled to receive dividends on an as converted basis with the holders of the Company’s common stock.

The holders of the Series A and Series B Preferred Stock are entitled to vote together with the holders of the Company’s common stock, with each such holder entitled to the number of votes equal to the number of shares of the Company’s common stock into which such Series A and Series B Preferred Stock would be converted if converted on the record date for the taking of a vote.

Each share of Series A and Series B Preferred Stock is automatically convertible, upon the effectiveness of the Reverse Split, into 1,000 shares of the Company’s common stock, subject to future adjustments as provided for in the Series A and Series B Certificates.

As of January 19, 2012, there were 1,173 shares of Series A Preferred Stock and 38,050.87 shares of Series B Preferred Stock issued and outstanding.

Notes

The Company has currently the following convertible and promissory notes issued and outstanding all of which are held by ISI:

| Issue Date | | Interest Rate | | Maturity Date | | Conversion Rate | | | Amount | |

| December 31, 1999 | | | 10% | | December 31, 2000 | | $ | 0.1000 | | | $ | 190,010 | |

| December 31, 1999 | | | 10% | | December 31, 2000 | | $ | 0.1000 | | | | 72,580 | |

| April 27, 2000 | | | 10% | | July 27, 2000 | | $ | 0.0054 | | | | 98,168 | |

| May 16, 2000 | | | 10% | | July 27, 2000 | | $ | 0.1000 | | | | 75,000 | |

| July 19, 2000 | | | 10% | | September 19, 2000 | | $ | 0.0054 | | | | 33,700 | |

| September 28, 2000 | | | 10% | | December 28, 2000 | | $ | 0.0054 | | | | 15,000 | |

| October 2, 2009 | | | 10% | | October 2, 2011 | | $ | N/A | | | | 10,000 | |

| August 9, 2010 | | | 10% | | May 18, 2011 | | $ | N/A | | | | 20,000 | |

| | | | | | | | | | | | $ | 514,458 | |

The notes are convertible into 30,573,664 shares of common.

In connection with the closing of the Merger, Islet agreed to cancel the outstanding notes of the Company and the interest accrued thereon effective upon the effectiveness of the Reverse Split.

AMENDMENT TO OUR ARTICLES OF INCORPORATION

Our current Articles of Incorporation state that the name of the Company is “One E-Commerce Corporation.” On January 12, 2012, our Board of Directors approved, subject to receiving the approval of the holders of a majority of our outstanding capital stock, an amendment to our Articles of Incorporation to change our name to “Islet Sciences, Inc.”, effect a 1-for-45 Reverse Split of our issued and outstanding Common Stock, and increase the total number of authorized shares to 110,000,000. Our majority stockholders approved the Amendment pursuant to a Written Consent dated as of January 19, 2012. The substantive text of the proposed Amendment is attached hereto as Exhibit A.

The Amendment will become effective following the filing with the Secretary of State of Nevada, which will occur promptly following the 20th day after the mailing of this Information Statement to our stockholders as of the Record Date, except for the Reverse Split, which will become effective on the first date permitted or determined by FINRA as the effective date of the Reverse Split, subject to the prior filing of the certificate of amendment.

Our Board of Directors has determined that the change of our name to “Islet Sciences, Inc.” is in the best interests of our stockholders and will more accurately reflect our new business operations as described in our Current Report on Form 8-K filed on January 6, 2012.

| 2. | Adoption of 1-for-45 Reverse Split |

The Reverse Split has been adopted pursuant to the Merger Agreement as well as to provide us with greater flexibility with respect to our capital structure for such purposes as additional equity financings and future stock based acquisitions. Our Board of Directors unanimously approved, subject to stockholder approval, the 1-for-45 Reverse Split of our issued and outstanding Common Stock, which will be effectuated in conjunction with the adoption of the Amendment. Our majority stockholders also approved this action in the Written Consent.

The Reverse Split will reduce the number of issued and outstanding shares of our Common Stock outstanding prior to the split. The Reverse Split will become effective on the first date permitted or determined by FINRA as the effective date of the Reverse Split (the “Effective Date”), subject to the prior filing of the Amendment with the Secretary of State of the State of Nevada following the expiration of the 20 day period mandated by Rule 14c of the Exchange Act. We currently have no plans, agreements, proposals, arrangements, or understandings for the issuance of additional shares of Common Stock for any purpose, including future acquisitions or financing transactions. We may consider issuing additional shares in the future, but at this time we have no definite plans in this regard.

On the Effective Date, 45 shares of Common Stock will automatically be combined and changed into one share of Common Stock. The table below sets forth, as of the Record Date and as of the Effective Date, the following information both before and after the proposed Reverse Split and Increase of Authorized Shares:

| | ● | the number of issued and outstanding shares of Common Stock; and |

| | ● | the number of authorized but unissued and unreserved shares of Common Stock. |

| | | Capital Structure prior to the Reverse Stock Split and Increase in Authorized Shares | | | Capital Structure after the Reverse Stock Split and Increase in Authorized Shares | |

| | | (As of Record Date) | | | (On Effective Date) | |

| | | | | | | |

| Issued and outstanding Common Stock | | | 18,317,200 | (2) | | | 187,000 | (1)(2) |

| | | | | | | | | |

| Authorized but unissued and unreserved Common Stock | | | 31,682,800 | | | | 99,813,000 | (1) |

(1) Numbers of shares shown after the Reverse Split are approximate due to the fact that the number of shares to be received by each shareholder will be rounded up to the nearest whole number.

(2) Immediately upon the effectiveness of the Reverse Split, 9,902,180 pre-split shares of Common Stock currently held by Islet Sciences, Inc., a Delaware corporation (ISI), our wholly-owned subsidiary, will be cancelled.

Purposes for Reverse Split and Effects on Common Stock

As shown in the table above, the Reverse Split will decrease the total number of issued and outstanding shares of our Common Stock. The pre-split holders of our common stock will hold approximately 187,000 shares of common stock subsequent to the Reverse Split after giving effect to the cancellation of shares currently held by ISI. The Reverse Split has been implemented to provide us with greater flexibility with respect to our capital structure for such purposes as additional equity financings and future stock based acquisitions.

On the Effective Date, 45 shares of Common Stock will automatically be combined and changed into one share of Common Stock. No additional action on our part or any stockholder will be required in order to effect the Reverse Split.

No fractional shares of post-Reverse Split Common Stock will be issued to any stockholder. Accordingly, stockholders of record who would otherwise be entitled to receive fractional shares of post-Reverse Split Common Stock, will, if they hold a fractional share, receive a full share of our Common Stock.

We will obtain a new CUSIP number for our Common Stock at the time of the Reverse Split. Following the effectiveness of the Reverse Split, every 45 shares of Common Stock presently outstanding, without any action on the part of the stockholder, will represent one share of Common Stock. Subject to the provisions for elimination of fractional shares, as described above, consummation of the Reverse Split will not result in a change in the relative equity position or voting power of the holders of Common Stock.

There are no arrears in dividends or defaults in principal or interest in respect to the securities which are to be exchanged.

Federal Income Tax Consequences of the Reverse Split

The combination of 45 shares of pre-Reverse Split Common Stock into one share of post-Reverse Split Common Stock should be a tax-free transaction under the Internal Revenue Code of 1986, as amended, and the holding period and tax basis of the pre-Reverse Split Common Stock will be transferred to the post-Reverse Split Common Stock.

This discussion should not be considered as tax or investment advice, and the tax consequences of the Reverse Split may not be the same for all stockholders. Stockholders should consult their own tax advisors to know their individual Federal, state, local and foreign tax consequences.

Potential Anti-takeover Effects of Reverse Split

The Reverse Split could have an anti-takeover effect because the authorized shares are not being reduced by the Reverse Split, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover of the Company more difficult than if the authorized shares were also reduced by the Reverse Split. For example, we could issue additional shares so as to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company. Similarly, the issuance of additional shares to certain persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. However, the Reverse Split has been effected for the primary purpose of providing us with greater flexibility with respect to our capital structure for such purposes as additional equity financings and future stock based acquisitions, and not to construct or enable any anti-takeover defense or mechanism on behalf of the Company. Although the remainder of significant amounts of authorized shares of common stock could, under certain circumstances, have an anti-takeover effect, the Reverse Split proposal is not being undertaken in response to any effort of which our Board of Directors is aware to accumulate shares of our Common Stock or obtain control of the Company.

| 3. | Increase of Authorized Shares |

As of the date of this Information Statement, the Company was authorized, pursuant to its Articles of Incorporation, to issue up to 50,500,000 shares of Common Stock, and there were 18,317,200 shares of Common Stock issued and outstanding. The board and majority stockholders approved an amendment to the Articles to increase the total authorized share capital of the Company from 50,500,000 shares to 110,000,000 shares, consisting of 100,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock, without changing the par value of either the Common Stock or the Preferred Stock. The purpose of this proposed increase in authorized share capital is to make available additional shares of common stock for issuances for general corporate purposes, including the conversion of the outstanding Series A Preferred and the Series B Preferred, exercise of the warrants, financing activities and possible acquisitions, without the requirement of further action by the shareholders of the Company. The Board of Directors has considered potential uses of the additional authorized shares of capital stock, which may include the seeking of additional equity financing through public or private offerings, possible acquisitions, establishing employee or director equity compensation plans or arrangements or for other general corporate purposes. Increasing the authorized number of shares of the capital stock of the Company will provide the Company with greater flexibility and allow the issuance of additional shares of capital stock in most cases without the expense or delay of seeking further approval from the shareholders. The Company is at all times investigating additional sources of financing which the Board of Directors believes will be in the Company's best interests and in the best interests of the shareholders of the Company.

The shares of common stock and preferred stock do not carry any pre-emptive rights. The adoption of the increase in authorized share capital will not of itself cause any changes in the Company's capital accounts. The increase in authorized share capital will not have any immediate effect on the rights of existing shareholders. However, the Board of Directors will have the authority to issue authorized shares of capital stock without requiring future approval from the shareholders of such issuances, except as may be required by applicable law or exchange regulations. To the extent that additional authorized shares of capital stock are issued in the future, they will decrease the existing shareholders' percentage equity ownership interests and could be issued at prices lower than the prices at which existing shareholders purchased their shares. Any such issuance of additional shares of capital stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of common stock of the Company.

One of the effects of the increase in authorized share capital, if adopted, however, may be to enable the Board of Directors to render it more difficult to or discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of present management. The Board of Directors would, unless prohibited by applicable law, have additional shares of capital stock available to effect transactions (including private placements) in which the number of the Company's outstanding shares would be increased and would thereby dilute the interest of any party attempting to gain control of the Company. Such action, however, could discourage an acquisition of the Company which the shareholders of the Company might view as desirable.

The Company has no current plans, proposals or arrangements to issue any of the additional shares that will become authorized share capital of the Company pursuant to the Increase of Authorized Shares.

DISSENTER’S RIGHTS

Under Nevada law, holders of our capital stock are not entitled to dissenter’s rights of appraisal with respect to the proposed amendment to our Articles of Incorporation and the adoption of the Amendment.

DISTRIBUTION AND COSTS

We will pay the cost of preparing, printing and distributing this Information Statement. Only one Information Statement will be delivered to multiple shareholders sharing an address, unless contrary instructions are received from one or more of such shareholders. Upon receipt of a written request at the address noted above, we will deliver a single copy of this Information Statement and future shareholder communication documents to any shareholders sharing an address to which multiple copies are now delivered.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our common stock as of the date of this Information Statement by (i) any person or group with more than 5% of any class of voting securities, (ii) each director, (iii) our chief executive officer and each other executive officer whose cash compensation for the most recent fiscal year exceeded $100,000 and (iv) all such executive officers and directors as a group. Unless otherwise specified, the address of each of the persons set forth below is in care of the Company, 1370 Avenue of the Americas, Suite 902, New York, New York 1001. Except as indicated in the footnotes to this table and subject to applicable community property laws, the persons named in the table to our knowledge have sole voting and investment power with respect to all shares of securities shown as beneficially owned by them.

| Name | | Office | | Shares Beneficially Owned(1)(2) | | | Percent of Class(3) | |

| | | | | | | | | |

| Officers and Directors | | | | | | | | |

| | | | | | | | | |

| John Steel | | Director and CEO | | | 7,366,668 | | | | 18.7 | % |

| | | | | | | | | | | |

| Richard Egan | | CFO | | | 50,000 | | | | * | |

| | | | | | | | | | | |

| George D. Todaro | | Director | | | 300,000 | | | | * | |

| | | | | | | | | | | |

Joel D. Perlin(4) | | Director | | | 3,700,000 | | | | 9.4 | % |

| | | | | | | | | | | |

All officers and directors as a group (4 persons named above) | | | | | 11,416,668 | | | | 28.9 | % |

| | | | | | | | | | | |

| 5% Securities Holders | | | | | | | | | | |

| | | | | | | | | | | |

Charles Dupont 13740 Nob Avenue Belmar, California 92014 | | | | | 5,710,000 | | | | 14.5 | % |

| | | | | | | | | | | |

Charles Rhodes 1038 Chalcedony Street San Diego, California 92109 | | | | | 3,000,000 | | | | 7.6 | % |

| | | | | | | | | | | |

Jonathan Lakey 34A McClung Ct. Edmonton, AB Canada | | | | | 2,050,000 | | | | 5.2 | % |

| | | | | | | | | | | |

Sand Dollar LLC 600 E. Speedway Tuscon, Arizona 85705 | | | | | 3,591,729 | | | | 9.1 | % |

_____________

| * | Less than 1%. |

| | |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. |

| | |

| (2) | Represent shares of the Company’s common stock issuable upon conversion of Series B preferred stock of the Company. |

| (3) | Based on 39,410,870 shares of the Company’s common stock outstanding after giving effect to the Merger and the Reverse Split, including cancellation of 9,902,180 shares of common stock currently held by Islet Sciences, Inc., our wholly-owned subsidiary. |

| (4) | Includes shares held by entities affiliated with or controlled by Mr. Perlin as follows: |

| | - | 2,000,000 shares held by H.S. Perlin Co., Inc., Defined Benefit Pension Plan |

| | - | 1,700,000 shares held by The Perlin Family Trust (DTD 12/27/95) |

CHANGE IN CONTROL

As of the date of this Information Statement, there were no arrangements which may result in a change in control of the Company.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

We will only deliver one information statement to multiple stockholders sharing an address, unless we have received contrary instructions from one or more of the stockholders. Also, we will promptly deliver a separate copy of this information statement and future stockholder communication documents to any stockholder at a shared address to which a single copy of this information statement was delivered, or deliver a single copy of this information statement and future stockholder communication documents to any stockholder or stockholders sharing an address to which multiple copies are now delivered, upon written request to us at our address noted above. Stockholders may also address future requests regarding delivery of information statements and/or annual reports by contacting us at the address noted above.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports, proxy statements and other information with the SEC. The periodic reports and other information we have filed with the SEC, may be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington DC 20549. You may obtain information as to the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a Web site that contains reports, proxy statements and other information about issuers, like the Company, who file electronically with the SEC. The address of that site is www.sec.gov. Copies of these documents may also be obtained by writing our secretary at the address specified above.

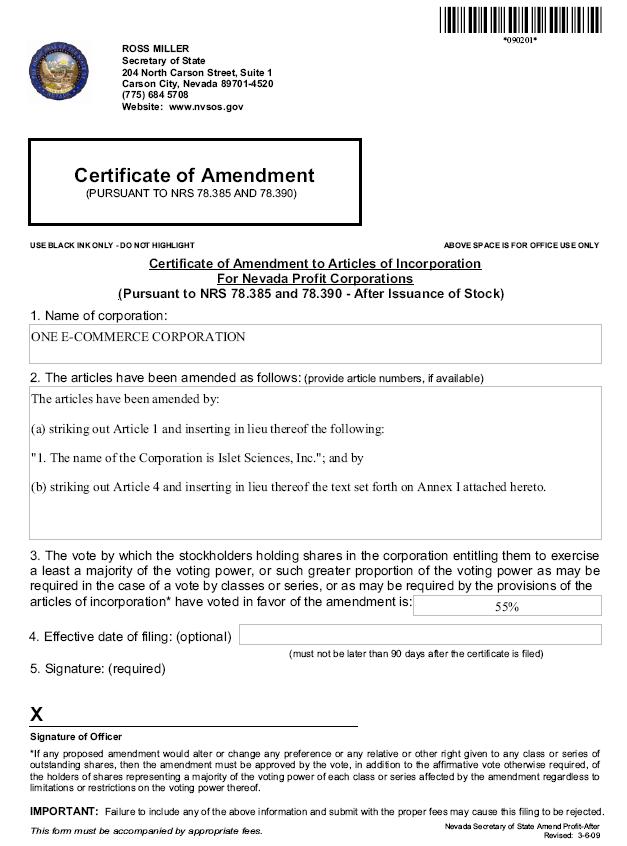

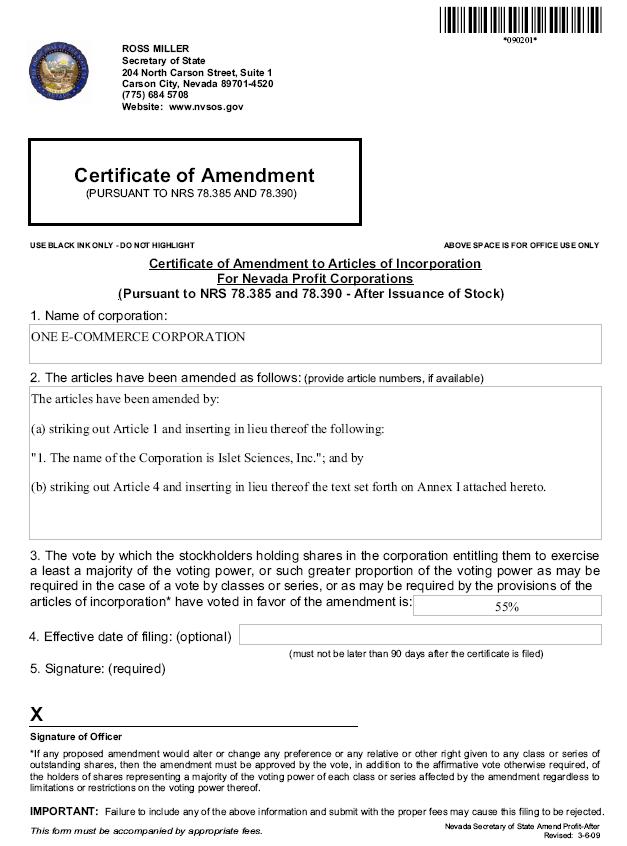

EXHIBIT A

CERTIFICATE OF AMENDMENT TO ARTICLES OF INCORPORATION

Annex I

to The Certificate of Amendment

to The Articles of Incorporation

of One E-Commerce Corporation

“4. (a) The total number of shares of all classes of capital stock which the Corporation shall have authority to issue is ONE HUNDRED TEN MILLION SHARES, par value $0.001 per share, of which ONE HUNDRED MILLION shares shall be shares of common stock, par value of $.001 per share (hereinafter called “Common Stock”) and TEN MILLION shares shall be shares of preferred stock, par value of $.001 per share (hereinafter called “Preferred Stock”). Each holder of the shares of Common Stock shall be entitled to one vote for each share of Common Stock held by them of record at the time duly set for determination of the holders thereof entitled to vote.

(b) The designations and the powers, preferences and rights, and the qualifications, limitations or restrictions thereof, of the Preferred Stock shall be as follows:

The Board of Directors is expressly authorized at any time, and from time to time, to provide for the issuance of shares of Preferred Stock in one or more series, voting powers and with such designations, preferences and relative, participating, optional or other special rights, and qualifications, limitations or restrictions thereof, as shall be stated and expressed in the resolution or resolutions providing for the issue thereof adopted by the Board of Directors, and as stated and expressed in these Articles of Incorporation, or any amendment thereto, including (but without limiting the generality of the foregoing) the following:

| | (i) | the designation of such series; |

| | (ii) | the dividend rate of such series, the conditions and dates upon which such dividends shall be payable, the preference or relation which such dividends shall bear to the dividends payable on any other class or classes or on any other series of any class or classes of capital stock, and whether such dividends shall be cumulative or non-cumulative; |

| | (iii) | whether the shares of such series shall be subject to redemption by the Corporation, and, if made subject to such redemption, the times, prices and other terms and conditions of such redemption; |

| | (iv) | the terms and amount of any sinking fund provided for the purchase or redemption of the shares of such series; |

| | (v) | whether or not the shares of such series shall be convertible into or exchangeable for shares of any other class or classes or of any other series of any class or classes of capital stock of the Corporation, and, if provision be made for conversion or exchange, the times, prices, rates, adjustments and other terms and conditions of such conversion or exchange; |

| | (vi) | the extent, if any, to which the holders of the shares of such series shall be entitled to vote as a class or otherwise with respect to the election of the directors or otherwise; |

| | (vii) | the restrictions, if any, on the issue or reissue of any additional Preferred Stock; and the rights of the holders of the shares of such series upon the dissolution of, or upon the distribution of assets of, the Corporation. |

(c) Effective upon the “Effective Date” (as defined below), the outstanding shares of Common Stock of the Corporation shall be combined on the basis that forty five (45) of such shares of Common Stock shall become one (1) share of Common Stock without changing the par value of the shares of the Corporation (the “Reverse Stock Split”); provided that no fractional shares of the Corporation shall be issued in connection with the Reverse Stock Split and the number of shares to be received by a stockholder shall be rounded up to the nearest whole number of shares in the event that such stockholder would otherwise be entitled to receive a fractional share as a result of the Reverse Stock Split.

The “Effective Date” shall be the first date permitted or determined by the Financial Industry Regulatory Authority (FINRA) as the effective date of such Reverse Stock Split, subject to the prior filing and recording of this Amendment in the office of the Secretary of State of the State of Nevada.”

A-2