Exhibit 99.1

A Highly Attractive Real Estate Portfolio and A Leading Real Estate Investment Manager

Disclaimer

This presentation may be deemed to be solicitation material in respect of the charter amendments to be presented to Cole Credit Property Trust III, Inc.’s (“CCPT III”) stockholders for consideration at the 2013 annual stockholders’ meeting of CCPT III. CCPT III has filed a preliminary proxy statement and expects to file a definitive proxy statement with the Securities and Exchange Commission (“SEC”) in connection with the 2013 annual stockholders’ meeting. STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the definitive proxy statement and other relevant documents filed with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by CCPT III with the SEC will be available free of charge by directing a written request to Cole Credit Property Trust III, Inc., 2325 East Camelback Road, Suite 1100, Phoenix, Arizona 85016, Attention: Investor Relations.

CCPT III and its directors and executive officers and other members of management may be deemed to be participants in the solicitation of proxies in respect of the charter amendments to be considered at the 2013 annual stockholders’ meeting of CCPT III. Information regarding the interests of CCPT III’s directors and executive officers in the proxy solicitation will be included in CCPT III’s definitive proxy statement.

This presentation contains a description of certain terms of the merger agreement pursuant to which CCPT III will acquire Cole Holdings Corporation (“Cole Holdings”). A copy of the merger agreement has been filed as an exhibit to a Form 8-K CCPT III filed with the SEC on March 8, 2013. The description of the merger agreement contained in this presentation does not purport to be complete and is qualified in its entirety by reference to the full text of the merger agreement.

2

Forward-Looking Statements

In addition to historical information, this presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which CCPT III operates, include beliefs of and assumptions made by CCPT III’s management, and involve risks and uncertainties that could significantly affect the financial results of CCPT III. Words such as “may,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “projects,” “seeks,” “estimates,” “would,” “could” and “should” and variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving CCPT III and Cole Holdings, future financial and operating results, and the combined company’s plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to earnings accretion, cost savings, an anticipated NYSE listing and increased liquidity — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, international, regional and local economic climates, (ii) changes in financial markets, interest rates, credit spreads, and foreign currency exchange rates, (iii) changes in the real estate markets, (iv) continued ability to source new investments, (v) increased or unanticipated competition for our properties, (vi) risks associated with acquisitions, (vii) maintenance of real estate investment trust status, (viii) availability of financing and capital, (ix) changes in demand for developed properties, (x) risks associated with the ability to consummate the CCPT III – Cole Holdings transaction and the timing of the closing of the transaction, and (xi) those additional risks and factors discussed in reports filed with the SEC by CCPT III from time to time. CCPT III does not make any undertaking with respect to updating any forward-looking statements appearing in this presentation.

3

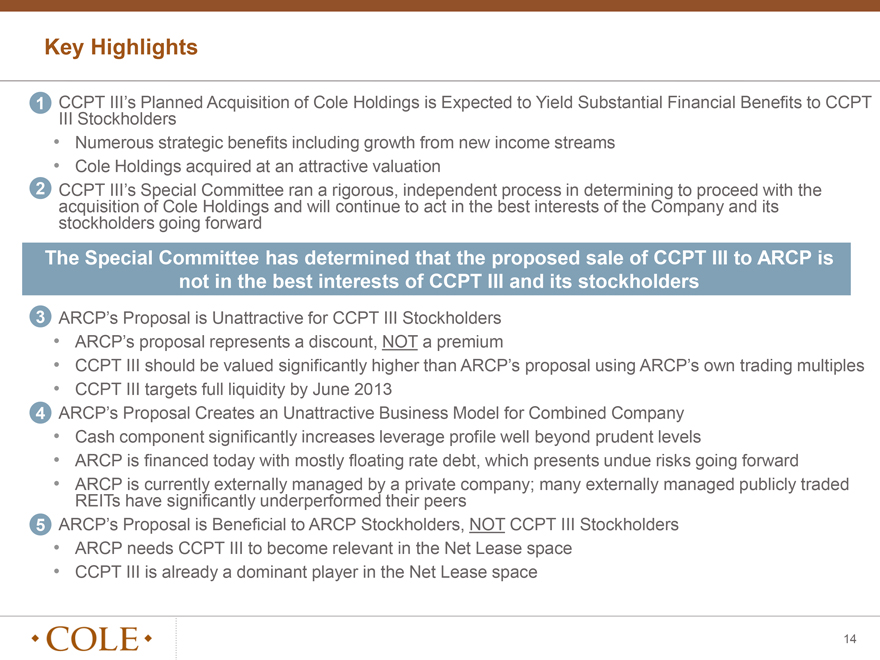

Key Highlights

1CCPT III’s Planned Acquisition of Cole Holdings is Expected to Yield Substantial Financial Benefits to CCPT

III Stockholders

Numerous strategic benefits including growth from new income streams

Cole Holdings acquired at an attractive valuation

2CCPT III’s Special Committee ran a rigorous, independent process in determining to proceed with the acquisition of Cole Holdings and will continue to act in the best interests of the Company and its stockholders going forward

The Special Committee has determined that the proposed sale of CCPT III to ARCP is not in the best interests of CCPT III and its stockholders

3ARCP’s Proposal is Unattractive for CCPT III Stockholders

ARCP’s proposal represents a discount, NOT a premium

CCPT III should be valued significantly higher than ARCP’s proposal using ARCP’s own trading multiples

CCPT III targets full liquidity by June 2013

4 ARCP’s Proposal Creates an Unattractive Business Model for Combined Company

Cash component significantly increases leverage profile well beyond prudent levels

ARCP is financed today with mostly floating rate debt, which presents undue risks going forward

ARCP is currently externally managed by a private company; many externally managed publicly traded REITs have significantly underperformed their peers

5 ARCP’s Proposal is Beneficial to ARCP Stockholders, NOT CCPT III Stockholders

ARCP needs CCPT III to become relevant in the Net Lease space

CCPT III is already a dominant player in the Net Lease space

4

CCPT III’s Planned Acquisition of Cole Holdings is Expected to Yield

1

Substantial Financial Benefits to CCPT III Stockholders

CCPT III is one of the largest REITs focused on the net-lease commercial real estate sector, and

SCALE following a listing, Cole Real Estate Investments would be the second largest publicly-traded REIT in the

net-lease sector

CCPT III stockholders will continue to benefit from the knowledge and operational efficiencies resulting

CONSISTENCY from seamless integration of the same real estate management platform that has acquired and managed

the real estate assets of CCPT III since its inception

VALUE Transaction is expected to be immediately accretive to CCPT III’s funds from operations and to support

an increase in CCPT III’s annualized dividend to $0.70 per share upon closing

Stockholders will have even greater access to liquidity/flexibility to sell or retain shares based on public

market value

Represents opportunity to achieve a liquidity event substantially earlier than was previously

LIQUIDITY anticipated for CCPT III stockholders

CCPT III Listing expected June 2013

CCPT III expects no share lockups – 100% to be freely tradable on Day 1

Tender offer for shares to support liquidity upon listing is being considered by CCPT III

Cole Real Estate Investments will have the opportunity not only to continue raising capital from retail

ACCESS distribution channels, but also to increase its access to institutional investors and related capital sources

Better positioned to seek other accretive opportunities beyond organic capital raising opportunities

Cole Real Estate Investments will benefit from its new income stream of fees earned from the

GROWTH management of other real estate vehicles as well as the efficiencies resulting from the elimination of its

external management fees

5

CCPT III’s Planned Acquisition of Cole Holdings is Expected to Yield

1

Substantial Financial Benefits to CCPT III Stockholders

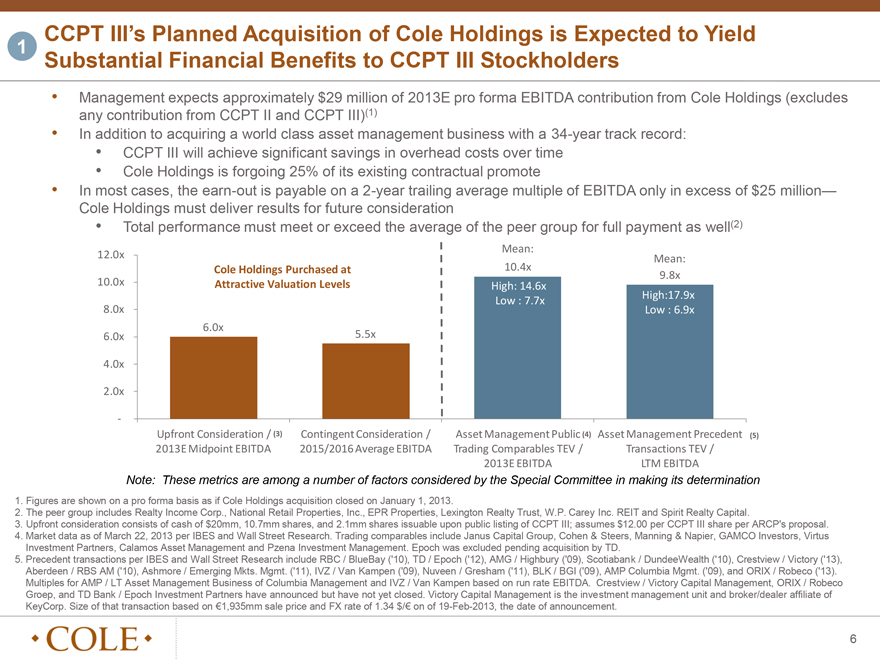

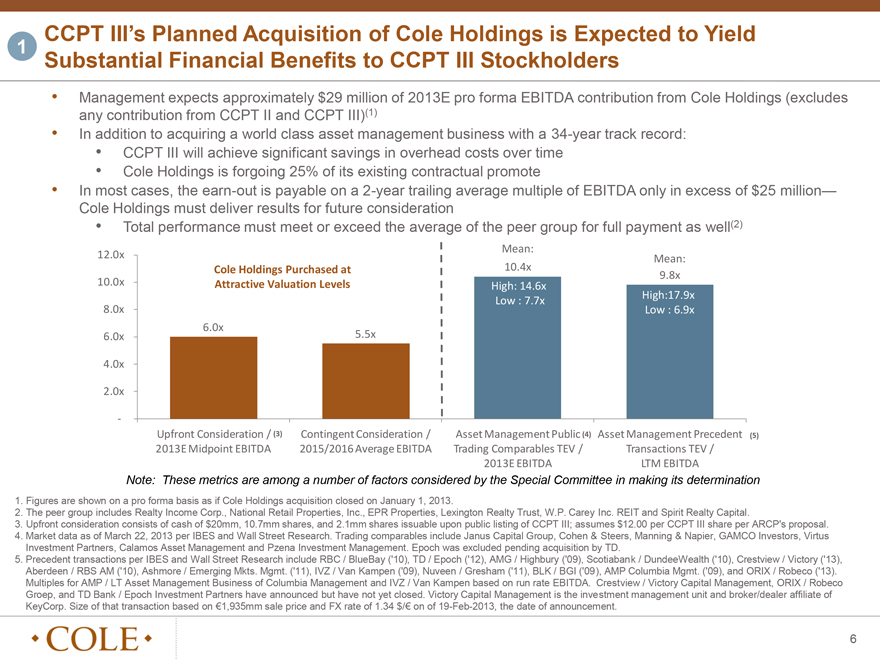

• Management expects approximately $29 million of 2013E pro forma EBITDA contribution from Cole Holdings (excludes any contribution from CCPT II and CCPT III)(1)

• In addition to acquiring a world class asset management business with a 34-year track record:

• CCPT III will achieve significant savings in overhead costs over time

• Cole Holdings is forgoing 25% of its existing contractual promote

• In most cases, the earn-out is payable on a 2-year trailing average multiple of EBITDA only in excess of $25 million—Cole Holdings must deliver results for future consideration

• Total performance must meet or exceed the average of the peer group for full payment as well(2)

Mean:

12.0x Mean:

Cole Holdings Purchased at 10.4x 9.8x

10.0x Attractive Valuation Levels High: 14.6x

Low : 7.7x High:17.9x

8.0x Low : 6.9x

6.0x

6.0x 5.5x

4.0x

2.0x

-

Upfront Consideration / (3) Contingent Consideration / Asset Management Public (4) Asset Management Precedent (5)

2013E Midpoint EBITDA 2015/2016 Average EBITDA Trading Comparables TEV / Transactions TEV /

2013E EBITDA LTM EBITDA

Note: These metrics are among a number of factors considered by the Special Committee in making its determination

1. Figures are shown on a pro forma basis as if Cole Holdings acquisition closed on January 1, 2013.

2. The peer group includes Realty Income Corp., National Retail Properties, Inc., EPR Properties, Lexington Realty Trust, W.P. Carey Inc. REIT and Spirit Realty Capital.

3. Upfront consideration consists of cash of $20mm, 10.7mm shares, and 2.1mm shares issuable upon public listing of CCPT III; assumes $12.00 per CCPT III share per ARCP’s proposal.

4. Market data as of March 22, 2013 per IBES and Wall Street Research. Trading comparables include Janus Capital Group, Cohen & Steers, Manning & Napier, GAMCO

Investors, Virtus Investment Partners, Calamos Asset Management and Pzena Investment Management. Epoch was excluded pending acquisition by TD.

5. Precedent transactions per IBES and Wall Street Research include RBC / BlueBay (‘10), TD / Epoch (‘12), AMG / Highbury (‘09), Scotiabank / DundeeWealth (‘10), Crestview / Victory (‘13), Aberdeen / RBS AM (‘10), Ashmore / Emerging Mkts. Mgmt. (‘11), IVZ / Van Kampen (‘09), Nuveen / Gresham (‘11), BLK / BGI (‘09), AMP Columbia Mgmt. (‘09), and ORIX / Robeco (‘13).

Multiples for AMP / LT Asset Management Business of Columbia Management and IVZ / Van Kampen based on run rate EBITDA. Crestview / Victory Capital Management, ORIX / Robeco Groep, and TD Bank / Epoch Investment Partners have announced but have not yet closed. Victory Capital Management is the investment management unit and broker/dealer affiliate of KeyCorp. Size of that transaction based on €1,935mm sale price and FX rate of 1.34 $/€ on of 19-Feb-2013, the date of announcement.

6

CCPT III’s Special Committee Ran a Rigorous, Independent Process in the

2

Acquisition of Cole Holdings

The CCPT III – Cole Holdings transaction was negotiated exclusively by a Special Committee comprised entirely of independent directors, each of whom has significant REIT industry experience

The Special Committee met 50 times over the course of 4 months to evaluate the transaction and other strategic alternatives

In addition to its own expertise, the Special Committee engaged a full suite of legal, accounting and financial advisors to assist it:

Goldman Sachs and Lazard to provide financial advice

Wachtell, Lipton, Rosen & Katz and Venable LLP to provide legal advice

Morris, Manning & Martin, LLP and Venable LLP, as well as an internationally-recognized public accounting firm, to help it perform due diligence on Cole Holdings

Robert A. Stanger & Co. to help it perform due diligence, provide advice on Cole

Holdings’ business model and financial projections and provide general advice on the non-traded REIT industry

After its review of the transaction and other strategic alternatives, including the advice of its advisors, the Special Committee unanimously concluded that the CCPT III – Cole Holdings transaction was in the best interests of CCPT III and its stockholders

7

ARCP’s Proposal Represents a Discount, NOT a Premium

3

Near Term Liquidity Event to Represent Greater Opportunity for Stockholders

CCPT III Listing expected June 2013

CCPT III expects no share lockups – 100% to be freely tradable on Day 1

Tender offer for shares to support liquidity upon listing is being considered by

CCPT III

CCPT III believes CCPT III stockholders will have significant value under the current planned listing in a few months

ARCP proposal for CCPT III is therefore at a discount, NOT a premium

References by ARCP to a “premium” on a notional $10.00 per share for an offering that commenced in 2009 are completely misleading

8

ARCP’s Proposal Represents a Discount, NOT a Premium

3

Significant Value in Current Strategy – 2013 Financial Ranges

Set forth below are management’s estimates of financial ranges for 2013E key financial statistics

Note: All $ in millions, except

per share data; All US GAAP except FFO 2013PF(1)

and AFFO

CCPT III Pre-Merger Revenue $613 – $623

Cole Holdings Revenue $224 – $277

TOTAL REVENUES $837 – $900

TOTAL EBITDA $576 – $603

FFO PER SHARE $0.80 – $0.85

AFFO PER SHARE $0.77 – $0.82

Key assumptions include:

Anticipated CCPT III real estate acquisitions of approximately $775 million in 2013 at a 7.3% cap rate (midpoint of financial ranges)

Expected EBITDA contribution from Cole Holdings of $29 million (midpoint of financial ranges)

Pro forma overhead savings from Cole Holdings acquisition of approximately $43 million

Excludes impact of CCPT II and CCPT III for the full year (pro forma)

A share repurchase in connection with the planned listing is being considered

Financial ranges do not reflect the potential accretive impact from such a buyback

1. Figures are shown on a pro forma basis as if Cole Holdings acquisition closed on January 1, 2013.

9

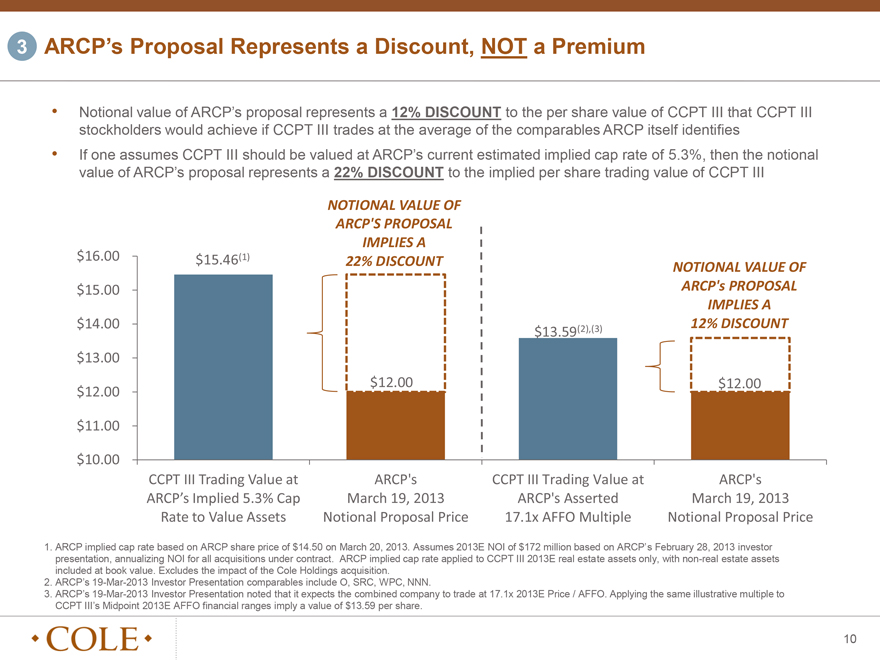

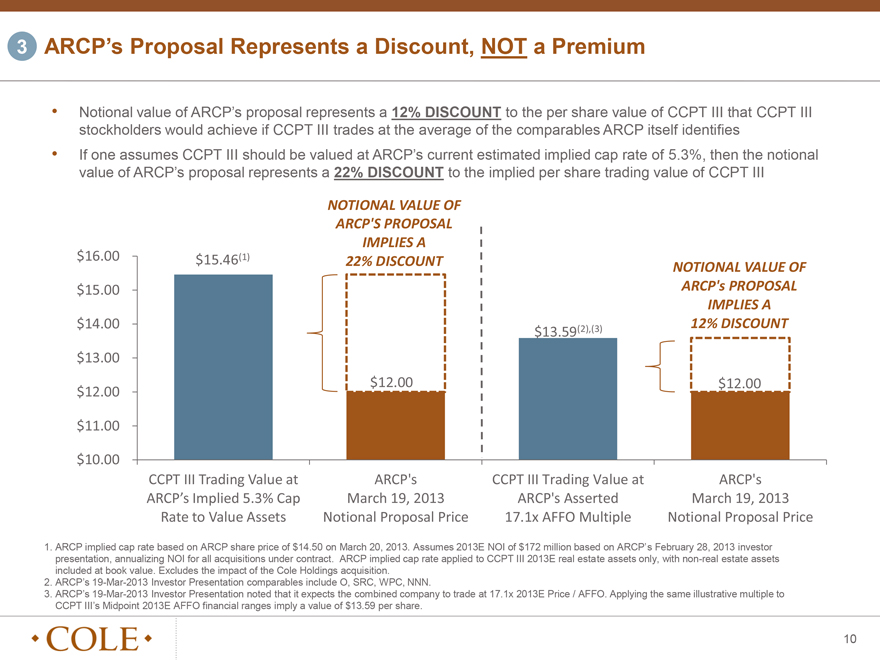

3 ARCP’s Proposal Represents a Discount, NOT a Premium

Notional value of ARCP’s proposal represents a 12% DISCOUNT to the per share value of CCPT III that CCPT III stockholders would achieve if CCPT III trades at the average of the comparables ARCP itself identifies

If one assumes CCPT III should be valued at ARCP’s current estimated implied cap rate of 5.3%, then the notional value of ARCP’s proposal represents a 22% DISCOUNT to the implied per share trading value of CCPT III

NOTIONAL VALUE OF

ARCP’S PROPOSAL

IMPLIES A

$16.00 $ 15.46(1) 22% DISCOUNT NOTIONAL VALUE OF

$15.00 ARCP’s PROPOSAL

IMPLIES A

$14.00 12% DISCOUNT

$13.59(2),(3)

$13.00

$12.00 $12.00 $12.00

$11.00

$10.00

CCPT III Trading Value at ARCP’s CCPT III Trading Value at ARCP’s

ARCP’s Implied 5.3% Cap March 19, 2013 ARCP’s Asserted March 19, 2013

Rate to Value Assets Notional Proposal Price 17.1x AFFO Multiple Notional Proposal Price

1. ARCP implied cap rate based on ARCP share price of $14.50 on March 20, 2013. Assumes 2013E NOI of $172 million based on ARCP’s February 28, 2013 investor presentation, annualizing NOI for all acquisitions under contract. ARCP implied cap rate applied to CCPT III 2013E real estate assets only, with non-real estate assets included at book value. Excludes the impact of the Cole Holdings acquisition.

2. ARCP’s 19-Mar-2013 Investor Presentation comparables include O, SRC, WPC, NNN.

3. ARCP’s 19-Mar-2013 Investor Presentation noted that it expects the combined company to trade at 17.1x 2013E Price / AFFO. Applying the same illustrative multiple to CCPT III’s Midpoint 2013E AFFO financial ranges imply a value of $13.59 per share.

10

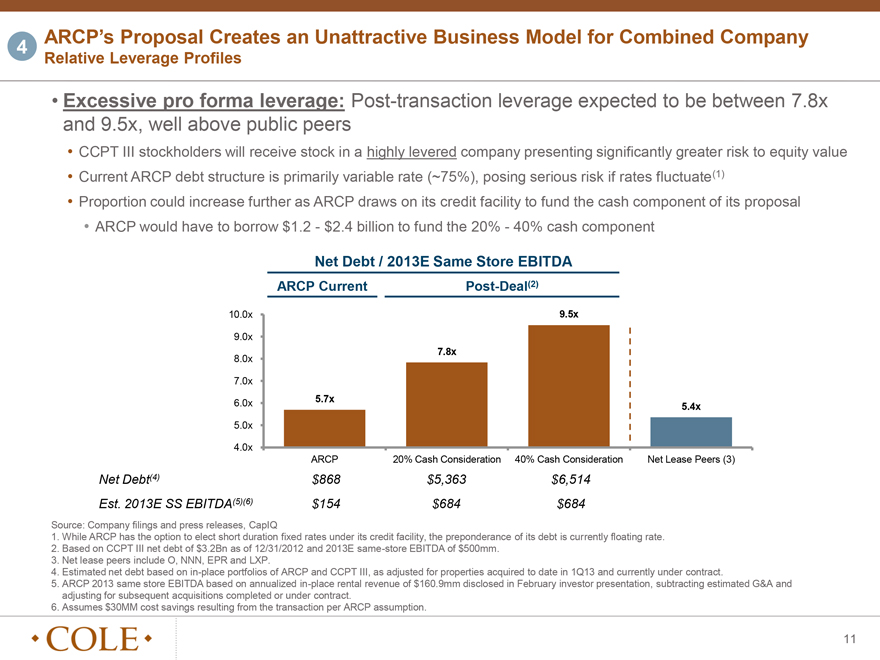

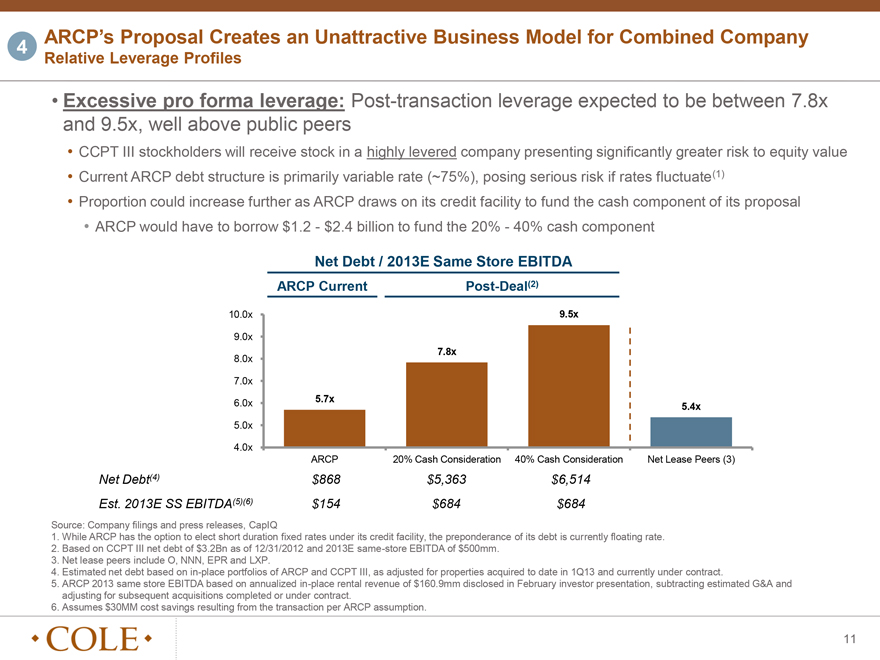

ARCP’s Proposal Creates an Unattractive Business Model for Combined Company

4

Relative Leverage Profiles

Excessive pro forma leverage: Post-transaction leverage expected to be between 7.8x and 9.5x, well above public peers

CCPT III stockholders will receive stock in a highly levered company presenting significantly greater risk to equity value

Current ARCP debt structure is primarily variable rate (~75%), posing serious risk if rates fluctuate(1)

Proportion could increase further as ARCP draws on its credit facility to fund the cash component of its proposal

ARCP would have to borrow $1.2—$2.4 billion to fund the 20%—40% cash component

Net Debt / 2013E Same Store EBITDA

ARCP Current Post-Deal(2)

10.0x 9.5x

9.0x

7.8x

8.0x

7.0x

5.7x

6.0x 5.4x

5.0x

4.0x

ARCP 20% Cash Consideration 40% Cash Consideration Net Lease Peers (3)

Net Debt(4) $868 $5,363 $6,514

Est. 2013E SS EBITDA(5)(6) $154 $684 $684

Source: Company filings and press releases, CapIQ

1. While ARCP has the option to elect short duration fixed rates under its credit facility, the preponderance of its debt is currently floating rate.

2. Based on CCPT III net debt of $3.2Bn as of 12/31/2012 and 2013E same-store EBITDA of $500mm.

3. Net lease peers include O, NNN, EPR and LXP.

4. Estimated net debt based on in-place portfolios of ARCP and CCPT III, as adjusted for properties acquired to date in 1Q13 and currently under contract.

5. ARCP 2013 same store EBITDA based on annualized in-place rental revenue of $160.9mm disclosed in February investor presentation, subtracting estimated G&A and adjusting for subsequent acquisitions completed or under contract.

6. Assumes $30MM cost savings resulting from the transaction per ARCP assumption.

11

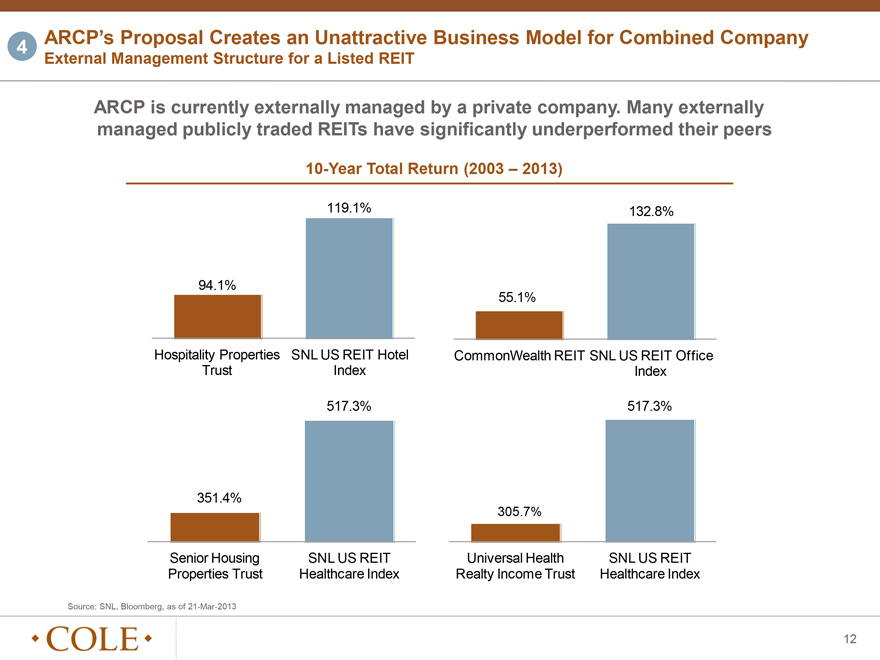

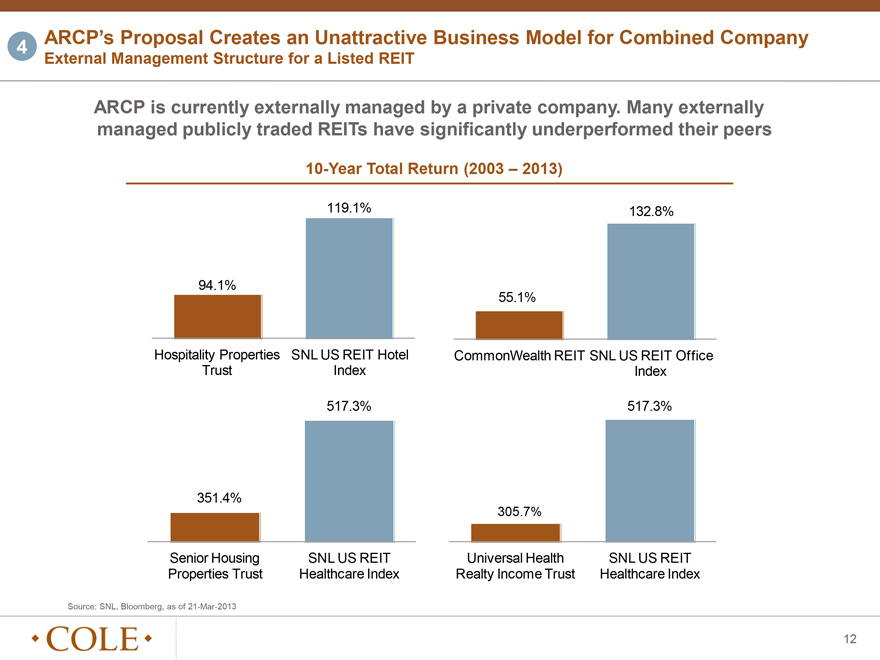

ARCP’s Proposal Creates an Unattractive Business Model for Combined Company

4

External Management Structure for a Listed REIT

ARCP is currently externally managed by a private company. Many externally managed publicly traded REITs have significantly underperformed their peers

10-Year Total Return (2003 – 2013)

119.1% 132.8%

94.1%

55.1%

Hospitality Properties SNL US REIT Hotel CommonWealth REIT SNL US REIT Office

Trust Index Index

517.3% 517.3%

351.4%

305.7%

Senior Housing SNL US REIT Universal Health SNL US REIT

Properties Trust Healthcare Index Realty Income Trust Healthcare Index

Source: SNL, Bloomberg, as of 21-Mar-2013

12

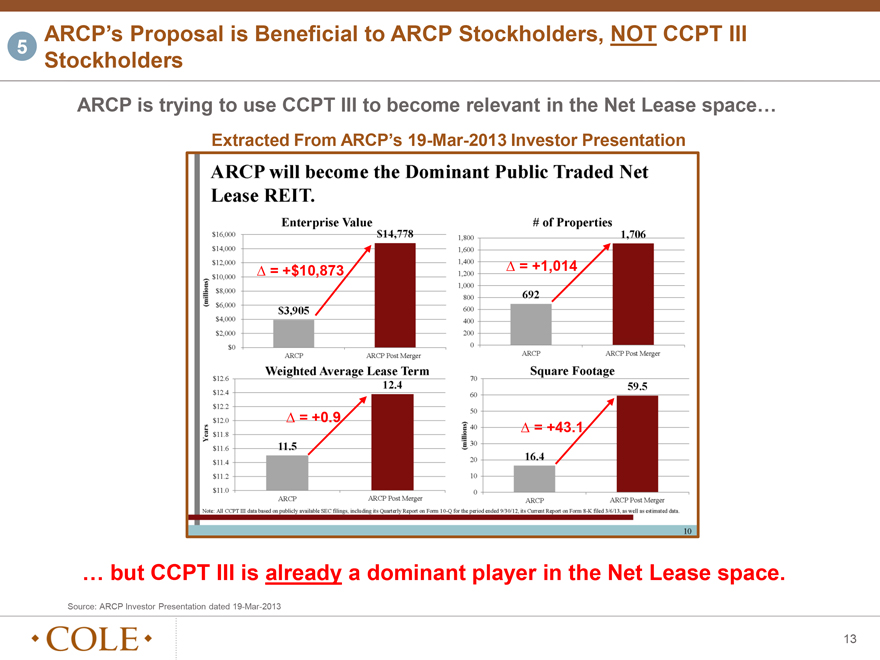

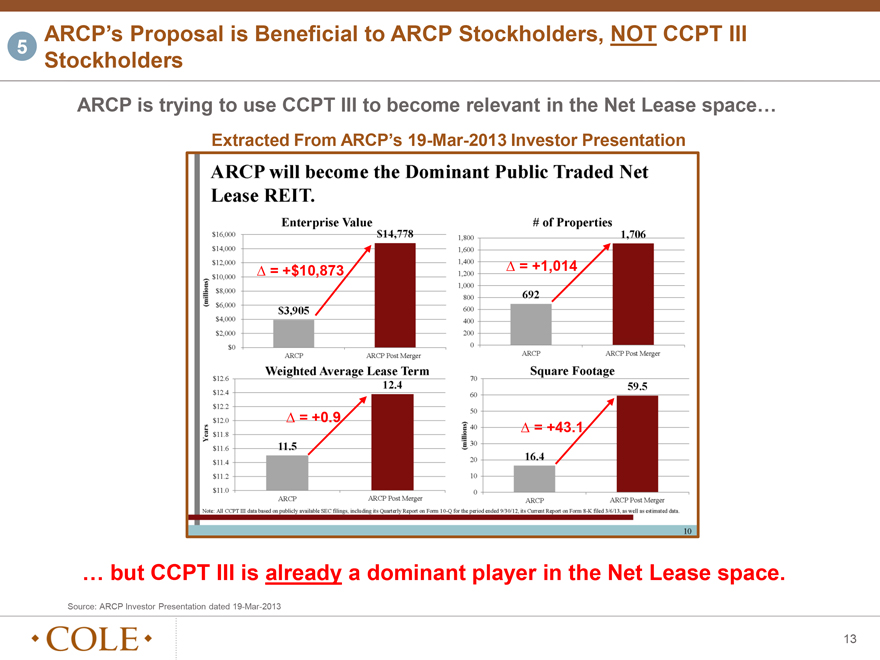

ARCP’s Proposal is Beneficial to ARCP Stockholders, NOT CCPT III

5

Stockholders

ARCP is trying to use CCPT III to become relevant in the Net Lease space…

Extracted From ARCP’s 19-Mar-2013 Investor Presentation

= +$10,873 ? = +1,014

= +0.9

= +43.1

but CCPT III is already a dominant player in the Net Lease space.

Source: ARCP Investor Presentation dated 19-Mar-2013

13

Key Highlights

1 CCPT III’s Planned Acquisition of Cole Holdings is Expected to Yield Substantial Financial Benefits to CCPT

III Stockholders

Numerous strategic benefits including growth from new income streams

Cole Holdings acquired at an attractive valuation

2 CCPT III’s Special Committee ran a rigorous, independent process in determining to proceed with the

acquisition of Cole Holdings and will continue to act in the best interests of the Company and its

stockholders going forward

The Special Committee has determined that the proposed sale of CCPT III to ARCP is

not in the best interests of CCPT III and its stockholders

3 ARCP’s Proposal is Unattractive for CCPT III Stockholders

ARCP’s proposal represents a discount, NOT a premium

CCPT III should be valued significantly higher than ARCP’s proposal using ARCP’s own trading multiples

CCPT III targets full liquidity by June 2013

4 ARCP’s Proposal Creates an Unattractive Business Model for Combined Company

Cash component significantly increases leverage profile well beyond prudent levels

ARCP is financed today with mostly floating rate debt, which presents undue risks going forward

ARCP is currently externally managed by a private company; many externally managed publicly traded

REITs have significantly underperformed their peers

5 ARCP’s Proposal is Beneficial to ARCP Stockholders, NOT CCPT III Stockholders

ARCP needs CCPT III to become relevant in the Net Lease space

CCPT III is already a dominant player in the Net Lease space

14