UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Under § 240.14a-12 |

COLE CREDIT PROPERTY TRUST III, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

ATTENTION ADVISOR

In anticipation of our expected listing event, Cole Real Estate Investments would like to make you aware of a number of initiatives occurring with regards to Cole Credit Property Trust III, Inc. (CCPT III)

PROXY VOTE

In the coming weeks your clients will receive a proxy information packet asking them to amend the charter and vote for the board of directors for CCPT III.

Please encourage your clients to vote!

ACTION

ENCOURAGE YOUR CLIENTS TO VOTE

See “Please Vote” Flyer

DISTRIBUTION REINVESTMENT PLAN

As of May 1, 2013, CCPT III’s Distribution Reinvestment Plan is being suspended until further notice.

» All investors will continue to receive their full distributions.

» All future distributions after May 1, 2013 will be paid in cash.

» Any prior reinvested distributions will not be impacted.

» Our Investor Services team can provide you with assistance on directing cash distributions and answering your questions. For IRAs and other qualified accounts, distributions will be paid to the stockholders’ trust company of record.

SHARE REDEMPTION PROGRAM

CCPT III’s Share Redemption Program (SRP) is being suspended until further notice.

» All share redemption requests received from stockholders during the second quarter of 2013 and determined by CCPT III to be in good order on or before April 22, 2013 will be processed in accordance with the terms, conditions and limitations of the SRP.

» Any previously redeemed shares are not impacted.

» Any requests for redemptions received after April 22, 2013, or which are not in good order before the close of business on April 22, 2013, will not be processed.

ACTION

REMIND YOUR CLIENTS

Review CCPT III events timeline

CHOOSE AN OPTION

Moving forward, CCPT III will continue to use DST Systems, Inc. (DST) as its transfer agent, meaning you will still have access to positions through DST Vision.

What does this mean for stockholders?

Following the listing, stockholders will have these options:

| | |

STAY THE COURSE | | CONVERT THE ACCOUNT |

(which will result in their account being held directly at DST) | | (convert their shares into a brokerage account) |

They will not be charged any fee for maintaining accounts at the transfer agent | | Your brokerage firm and/or custodian will provide the necessary forms to complete this share movement |

| |

They can access their account online or over the phone and make changes and updates as needed as much as they do today | | Shares are typically moved through a multi-business day process |

| |

| |

| | DST will not charge a fee for a DRS share movement |

WHAT IS ON THE HORIZON?

Please see the attached timeline for details regarding certain events surrounding CCPT III. If you have any questions, please contact the Cole Sales Desk at 1-866-341-2653.

COLE REAL ESTATE INVESTMENTS®

1.866.341.2653 | WWW.COLECAPITAL.COM

2325 EAST CAMELBACK ROAD, SUITE 1100 | PHOENIX, ARIZONA 85016

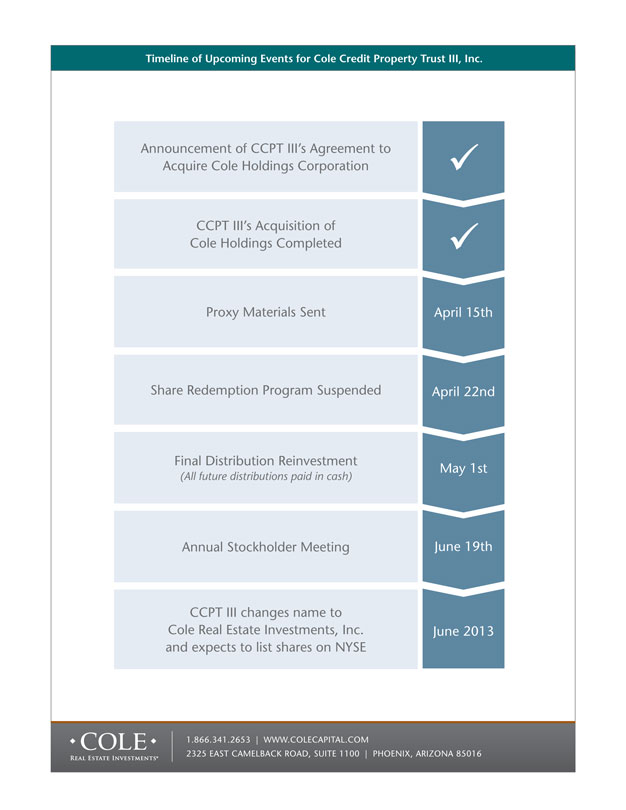

Timeline of Upcoming Events for Cole Credit Property Trust III, Inc.

| | |

Announcement of CCPT III’s Agreement to Acquire Cole Holdings Corporation | | ü |

CCPT III’s Acquisition of Cole Holdings Completed | | ü |

Proxy Materials Sent | | April 15th |

Share Redemption Program Suspended | | April 22nd |

Final Distribution Reinvestment (All future distributions paid in cash) | | May 1st |

Annual Stockholder Meeting | | June 19th |

CCPT III changes name to Cole Real Estate Investments, Inc. and expects to list shares on NYSE | | June 2013 |

COLE REAL ESTATE INVESTMENTS®

1.866.341.2653 | WWW.COLECAPITAL.COM

2325 EAST CAMELBACK ROAD, SUITE 1100 | PHOENIX, ARIZONA 85016