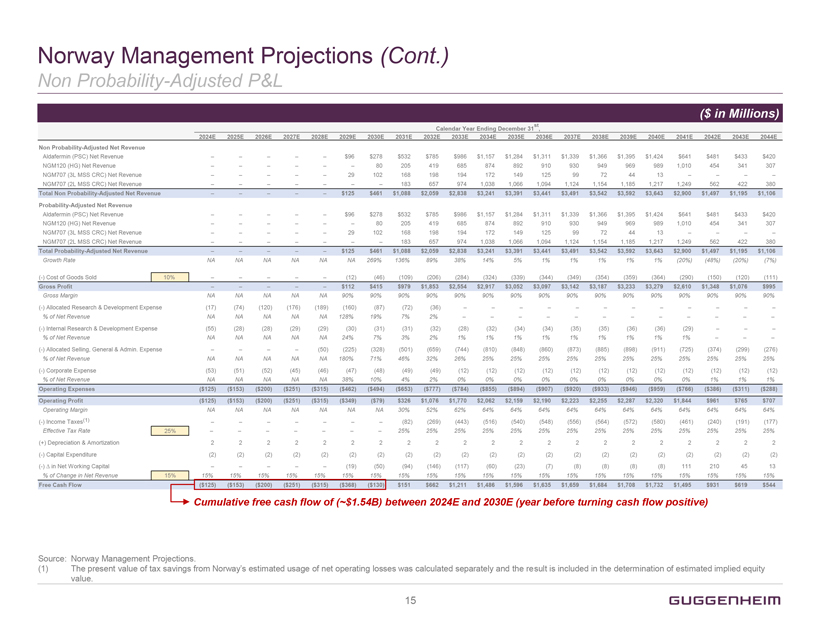

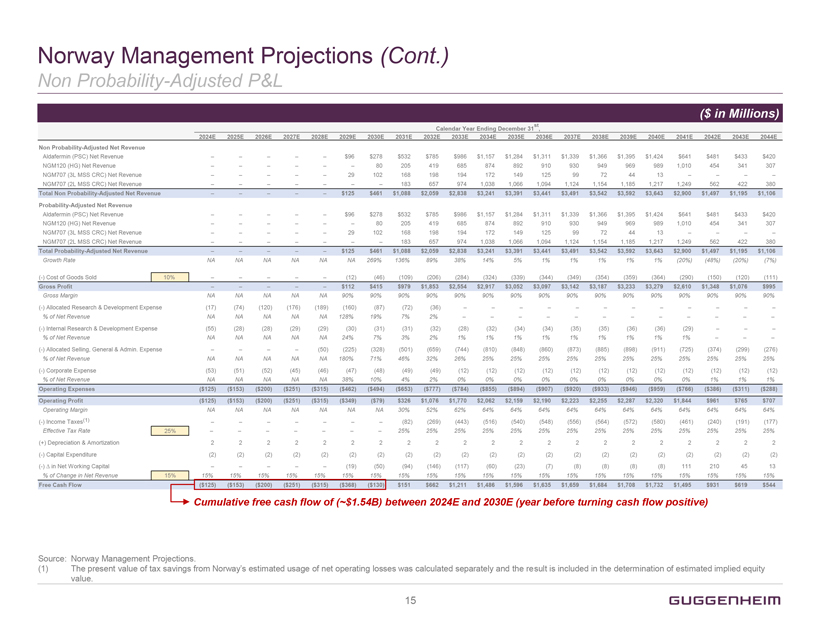

Norway Management Projections (Cont.) Non Probability-Adjusted P&L ($ in Millions) Calendar Year Ending December 31st , 2024E 2025E 2026E 2027E 2028E 2029E 2030E 2031E 2032E 2033E 2034E 2035E 2036E 2037E 2038E 2039E 2040E 2041E 2042E 2043E 2044E Non Probability-Adjusted Net Revenue Aldafermin (PSC) Net Revenue – – – – – $96 $278 $532 $785 $986 $1,157 $1,284 $1,311 $1,339 $1,366 $1,395 $1,424 $641 $481 $433 $420 NGM120 (HG) Net Revenue – – – – – – 80 205 419 685 874 892 910 930 949 969 989 1,010 454 341 307 NGM707 (3L MSS CRC) Net Revenue – – – – – 29 102 168 198 194 172 149 125 99 72 44 13 – – – – NGM707 (2L MSS CRC) Net Revenue – – – – – – – 183 657 974 1,038 1,066 1,094 1,124 1,154 1,185 1,217 1,249 562 422 380 Total Non Probability-Adjusted Net Revenue – – – – – $125 $461 $1,088 $2,059 $2,838 $3,241 $3,391 $3,441 $3,491 $3,542 $3,592 $3,643 $2,900 $1,497 $1,195 $1,106 Probability-Adjusted Net Revenue Aldafermin (PSC) Net Revenue – – – – – $96 $278 $532 $785 $986 $1,157 $1,284 $1,311 $1,339 $1,366 $1,395 $1,424 $641 $481 $433 $420 NGM120 (HG) Net Revenue – – – – – – 80 205 419 685 874 892 910 930 949 969 989 1,010 454 341 307 NGM707 (3L MSS CRC) Net Revenue – – – – – 29 102 168 198 194 172 149 125 99 72 44 13 – – – – NGM707 (2L MSS CRC) Net Revenue – – – – – – – 183 657 974 1,038 1,066 1,094 1,124 1,154 1,185 1,217 1,249 562 422 380 Total Probability-Adjusted Net Revenue – – – – – $125 $461 $1,088 $2,059 $2,838 $3,241 $3,391 $3,441 $3,491 $3,542 $3,592 $3,643 $2,900 $1,497 $1,195 $1,106 Growth Rate NA NA NA NA NA NA 269% 136% 89% 38% 14% 5% 1% 1% 1% 1% 1% (20%) (48%) (20%) (7%) (-) Cost of Goods Sold 10% – – – – – (12) (46) (109) (206) (284) (324) (339) (344) (349) (354) (359) (364) (290) (150) (120) (111) Gross Profit – – – – – $112 $415 $979 $1,853 $2,554 $2,917 $3,052 $3,097 $3,142 $3,187 $3,233 $3,279 $2,610 $1,348 $1,076 $995 Gross Margin NA NA NA NA NA 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% (-) Allocated Research & Development Expense (17) (74) (120) (176) (189) (160) (87) (72) (36) – – – – – – – – – – – – % of Net Revenue NA NA NA NA NA 128% 19% 7% 2% – – – – – – – – – – – – (-) Internal Research & Development Expense (55) (28) (28) (29) (29) (30) (31) (31) (32) (28) (32) (34) (34) (35) (35) (36) (36) (29) – – – % of Net Revenue NA NA NA NA NA 24% 7% 3% 2% 1% 1% 1% 1% 1% 1% 1% 1% 1% – – – (-) Allocated Selling, General & Admin. Expense – – – – (50) (225) (328) (501) (659) (744) (810) (848) (860) (873) (885) (898) (911) (725) (374) (299) (276) % of Net Revenue NA NA NA NA NA 180% 71% 46% 32% 26% 25% 25% 25% 25% 25% 25% 25% 25% 25% 25% 25% (-) Corporate Expense (53) (51) (52) (45) (46) (47) (48) (49) (49) (12) (12) (12) (12) (12) (12) (12) (12) (12) (12) (12) (12) % of Net Revenue NA NA NA NA NA 38% 10% 4% 2% 0% 0% 0% 0% 0% 0% 0% 0% 0% 1% 1% 1% Operating Expenses ($125) ($153) ($200) ($251) ($315) ($462) ($494) ($653) ($777) ($784) ($855) ($894) ($907) ($920) ($933) ($946) ($959) ($766) ($386) ($311) ($288) Operating Profit ($125) ($153) ($200) ($251) ($315) ($349) ($79) $326 $1,076 $1,770 $2,062 $2,159 $2,190 $2,223 $2,255 $2,287 $2,320 $1,844 $961 $765 $707 Operating Margin NA NA NA NA NA NA NA 30% 52% 62% 64% 64% 64% 64% 64% 64% 64% 64% 64% 64% 64% (-) Income Taxes(1) – – – – – – – (82) (269) (443) (516) (540) (548) (556) (564) (572) (580) (461) (240) (191) (177) Effective Tax Rate 25% – – – – – – – 25% 25% 25% 25% 25% 25% 25% 25% 25% 25% 25% 25% 25% 25% (+) Depreciation & Amortization 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 (-) Capital Expenditure (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (-) in Net Working Capital – – – – – (19) (50) (94) (146) (117) (60) (23) (7) (8) (8) (8) (8) 111 210 45 13 % of Change in Net Revenue 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% Free Cash Flow ($125) ($153) ($200) ($251) ($315) ($368) ($130) $151 $662 $1,211 $1,486 $1,596 $1,635 $1,659 $1,684 $1,708 $1,732 $1,495 $931 $619 $544 Cumulative free cash flow of (~$1.54B) between 2024E and 2030E (year before turning cash flow positive) Source: Norway Management Projections. (1) The present value of tax savings from Norway’s estimated usage of net operating losses was calculated separately and the result is included in the determination of estimated implied equity value. 15 GUGGENHEIM