Exhibit 99.1

Debt Conversion Presentation JUNE 08, 2023

Legal Disclaimer Forward - Looking Statements This presentation includes certain estimates, projections and forward - looking statements provided by SMG Industries Inc . , (the “Company”) with respect to the anticipated future performance of the Company . Such estimates, projections, and forward - looking statements reflect various assumptions of management concerning the future performance of the Company, and are subject to significant business, economic, and competitive uncertainties and contingencies, many of which are beyond the control of the Company . Forward - looking statements may be identified by the use of forward - looking terminology such as “should,” “could,” “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intends,” “continue,” or similar terms or variations of those terms or the negative of those terms . All estimates, projections and forward - looking statements are management’s present expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the estimates, projections and forward - looking statements . These estimates, projections and statements appear in a number of places in this presentation and include statements regarding the intent, belief or current expectations of the Company . Estimates, projections and forward - looking statements are merely our current predictions of future events . Investors are cautioned that any such estimates, projections and forward - looking statements are inherently uncertain, are not guaranties of future performance and involve risks and uncertainties . Actual results may differ materially from our predictions . There are a number of factors that could negatively affect our business and the value of our securities, including, but not limited to, fluctuations in the market price of our common stock ; changes in our plans, strategies and intentions ; changes in market valuations associated with our cash flows and operating results ; the impact of significant acquisitions, dispositions and other similar transactions ; our ability to attract and retain key employees ; changes in financial estimates or recommendations by securities analysts ; asset impairments ; decreased liquidity in the capital markets ; and changes in interest rates . Such factors could materially affect our Company’s future operating results and could cause actual events to differ materially from those described in estimates, projections and forward - looking statements relating to our Company . Although we have sought to identify the most significant risks to our business, we cannot predict whether, or to what extent, any of such risks may be realized, nor is there any assurance that we have identified all possible issues that we might face . Accordingly, there can be no assurance that such estimates, projections and forward - looking statements will be realized . The actual results may vary from the anticipated results, and such variations may be material . No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward - looking statements based thereon . In light of these assumptions, risks and uncertainties, the results and events discussed in the estimates, projections and forward - looking statements contained in this presentation might not occur . You are cautioned not to place undue reliance on the estimates, projections and forward - looking statements, which speak only as of the date of this presentation . The Company is not under any obligation, and it expressly disclaims any obligation, to update or alter any estimates, projections or forward - looking statements, whether as a result of new information, future events or otherwise except as may be required by applicable law . The Company urges readers to carefully review and consider the various disclosures the Company makes in its reports filed with the Securities and Exchange Commission that attempt to advise interested parties of the risks, uncertainties and other factors that may affect the Company’s business, including the risk factors included in its Annual Report on Form 10 - K for the year ended December 31 , 2022 under Part I, Item 1 A . “Risk Factors . ” Non - GAAP Information This presentation includes “non - GAAP financial measures” as that term is defined in Regulation G. Further discussion regarding o ur use of non - GAAP financial measures, as well as the most directly comparable GAAP financial measures and information reconciling these no n - G AAP financial measures to our financial results prepared in accordance with GAAP, are included in slide 13 of this presentation. The non - GAAP financial measures should not be considered a substitute for, or superior to, the financial measures prepared in accordance with GAAP. 2

Executive Summary ● SMGI has entered into a non - binding letter of intent (“LOI”) to acquire a diversified transportation business (the “Target”) located in the Northeastern United States (the “Transaction”) ● If consummated, the Transaction is estimated to approximately double our annual revenue, diversify our business operations, improve our balance sheet and add experience and expertise to the leadership team ─ Pro Forma 2022 Revenue of $153 million ─ Pro Forma 2022 estimated Adjusted EBITDA 1 of $18.2 million, including anticipated synergies of $2.5 million ● In order to finance the Transaction, the SMGI Board is requesting that each SMGI note holder elect to convert its notes representing our outstanding debt into our common equity ─ SMGI is currently highly leveraged, which limits our ability to finance the Transaction ─ Equity issued to SMGI note holders upon conversion of their notes is expected to be issued at the same valuation as new cash equity and rollover equity issued to Target 3 (1) Pro forma estimated Adjusted EBITDA is a non - GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, please see slide 13.

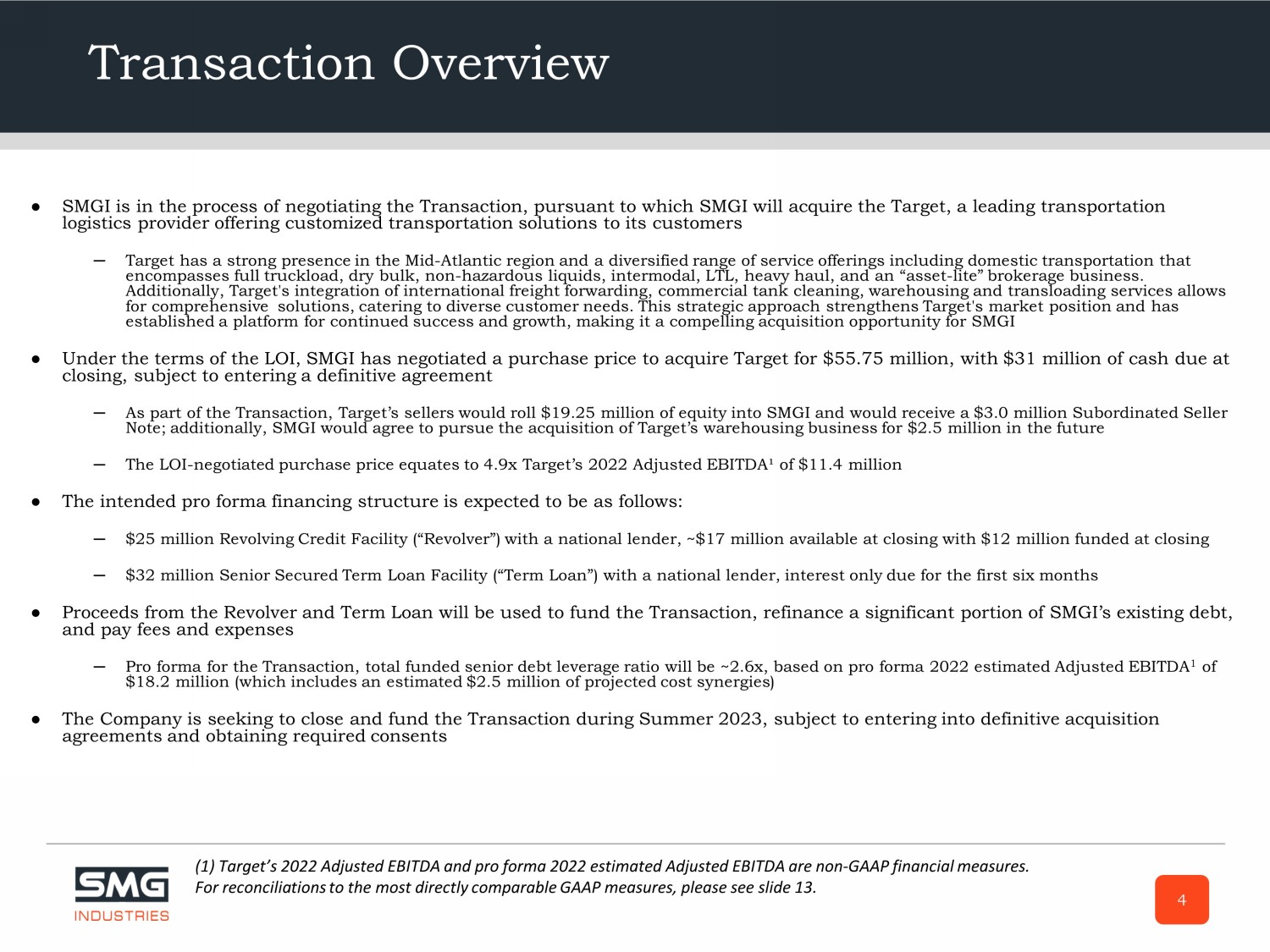

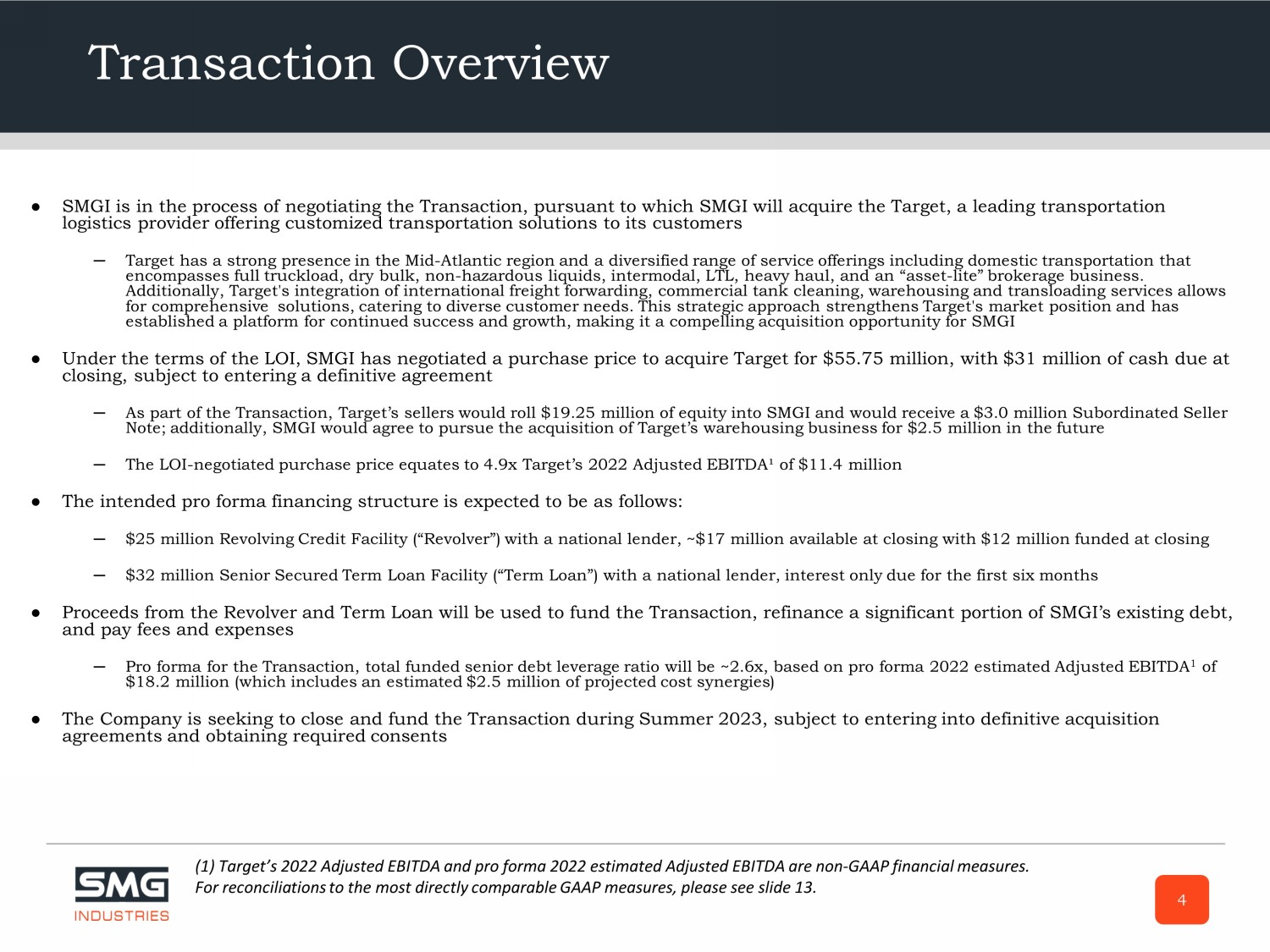

Transaction Overview ● SMGI is in the process of negotiating the Transaction, pursuant to which SMGI will acquire the Target, a leading transportati on logistics provider offering customized transportation solutions to its customers ─ Target has a strong presence in the Mid - Atlantic region and a diversified range of service offerings including domestic transpor tation that encompasses full truckload, dry bulk, non - hazardous liquids, intermodal, LTL, heavy haul, and an “asset - lite” brokerage business . Additionally, Target's integration of international freight forwarding, commercial tank cleaning, warehousing and transloadin g s ervices allows for comprehensive solutions, catering to diverse customer needs. This strategic approach strengthens Target's market position a nd has established a platform for continued success and growth, making it a compelling acquisition opportunity for SMGI ● Under the terms of the LOI, SMGI has negotiated a purchase price to acquire Target for $55.75 million, with $31 million of ca sh due at closing, subject to entering a definitive agreement ─ As part of the Transaction, Target’s sellers would roll $19.25 million of equity into SMGI and would receive a $3.0 million S ubo rdinated Seller Note; additionally, SMGI would agree to pursue the acquisition of Target’s warehousing business for $2.5 million in the futur e ─ The LOI - negotiated purchase price equates to 4.9x Target’s 2022 Adjusted EBITDA¹ of $11.4 million ● The intended pro forma financing structure is expected to be as follows: ─ $25 million Revolving Credit Facility (“Revolver”) with a national lender, ~$17 million available at closing with $12 million fu nded at closing ─ $32 million Senior Secured Term Loan Facility (“Term Loan”) with a national lender, interest only due for the first six month s ● Proceeds from the Revolver and Term Loan will be used to fund the Transaction, refinance a significant portion of SMGI’s exis tin g debt, and pay fees and expenses ─ Pro forma for the Transaction, total funded senior debt leverage ratio will be ~2.6x, based on pro forma 2022 estimated Adjus ted EBITDA 1 of $18.2 million (which includes an estimated $2.5 million of projected cost synergies) ● The Company is seeking to close and fund the Transaction during Summer 2023, subject to entering into definitive acquisition agreements and obtaining required consents 4 (1) Target’s 2022 Adjusted EBITDA and pro forma 2022 estimated Adjusted EBITDA are non - GAAP financial measures. For reconciliations to the most directly comparable GAAP measures, please see slide 13.

Transaction Rationale ● Combination of two regional leaders in a fragmented industry ─ Combining SMGI and Target should create a larger, scalable, and more diversified transportation business, set to be a regional leader in Texas, the Southwest, and the Eastern Seaboard ● Compelling benefits created by operational diversification ─ Combined business of SMGI and Target would result in complimentary offerings, creating a “one stop shop” for customer needs, which should allow for cross - selling opportunities, enhanced customer relationships, and a broader variety of potential new customers ─ Diversification of business lines should reduce cyclicality and further reduce customer concentration ─ SMGI and Target offer each other meaningful cross - selling opportunities and the Transaction would provide the combined business a broader service mix to service key customers’ needs ─ SMGI does not currently provide dry bulk, intermodal and non - hazardous liquid freight shipping, but Target effectively services these customers, which would allow the combined business to scale and grow in terms of service offerings ● Limited customer overlap with no meaningful customer concentration ─ Neither SMGI nor Target has material customer concentration, and each brings unique customer relationships ─ Together, we believe SMGI’s and Target’s combined business would yield an attractive customer mix with a large and growing client base 5 SMGI’s Acquisition of Target Creates an Attractive, Diversified Platform Poised for Growth

Transaction Rationale (cont’d) ● Meaningful cross - selling revenue synergies and cost savings ─ Forecasting $2.5 million in annual cost savings from the elimination of corporate and real estate cost redundancies and savings from increased purchasing power ● Target has an experienced management team that’s committed to the combined company after closing ─ Target’s management team consists of proven operators who will serve in the same roles to oversee the combined company’s operational functions post - closing ─ Target’s executive team has demonstrated a track record of growth and profitability ─ As part of closing the Transaction, the Target’s owners intend to rollover $19.25 million of equity into SMGI, further demonstrating deep conviction and commitment to the combined company on a go - forward basis ─ Target prides itself on operational excellence and financial discipline ● SMGI’s public company structure should provide an acquisition platform and access to liquidity going forward ─ SMGI intends to apply to uplist to a national listing exchange post - closing to allow for improved access to the public capital markets for ongoing operations, as well as future M&A transactions ─ The Transaction is designed to de - leverage SMGI’s balance sheet and create a more attractive capital structure 6 SMGI’s Acquisition of Target Creates an Attractive, Diversified Platform Poised for Growth

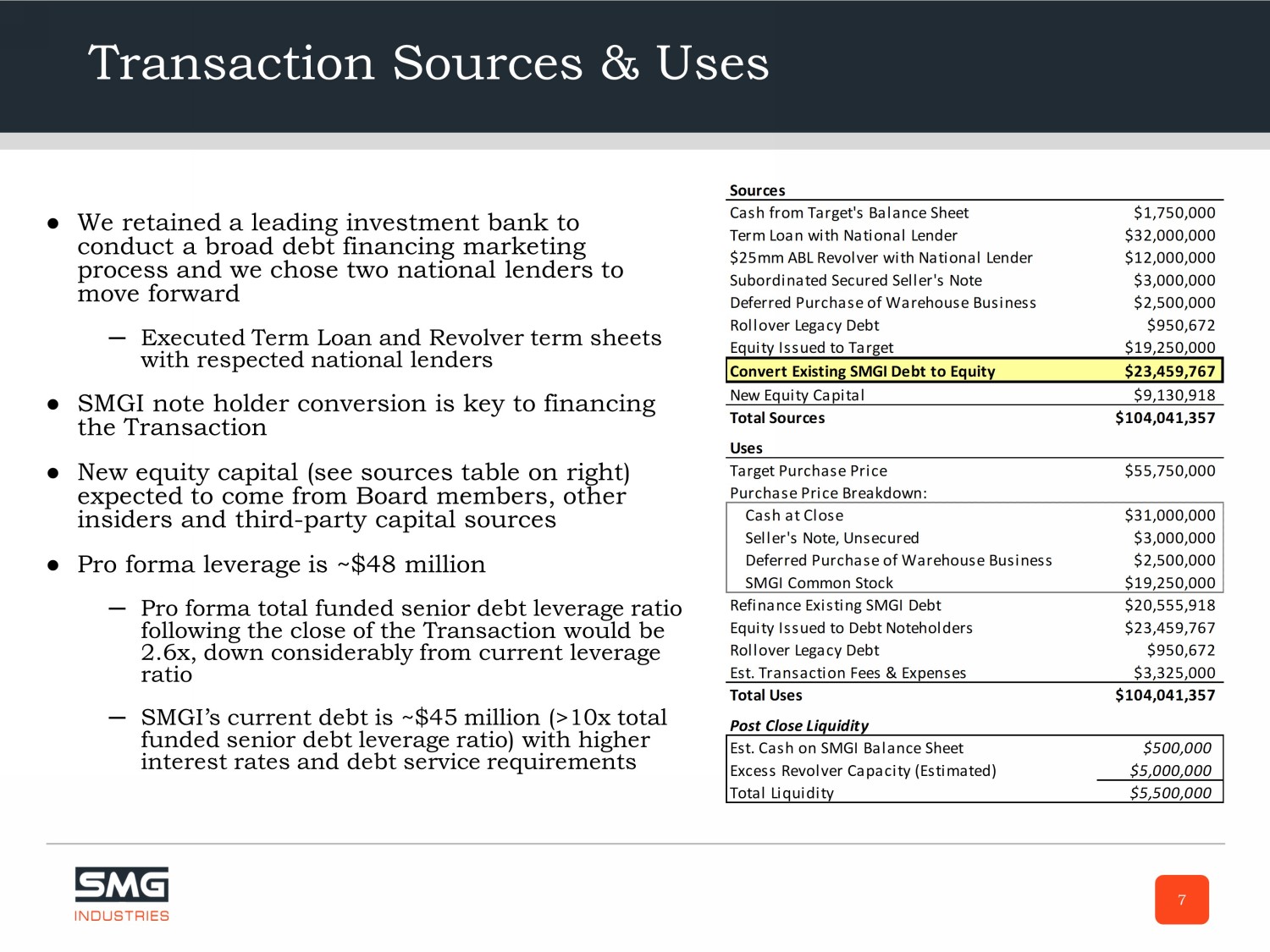

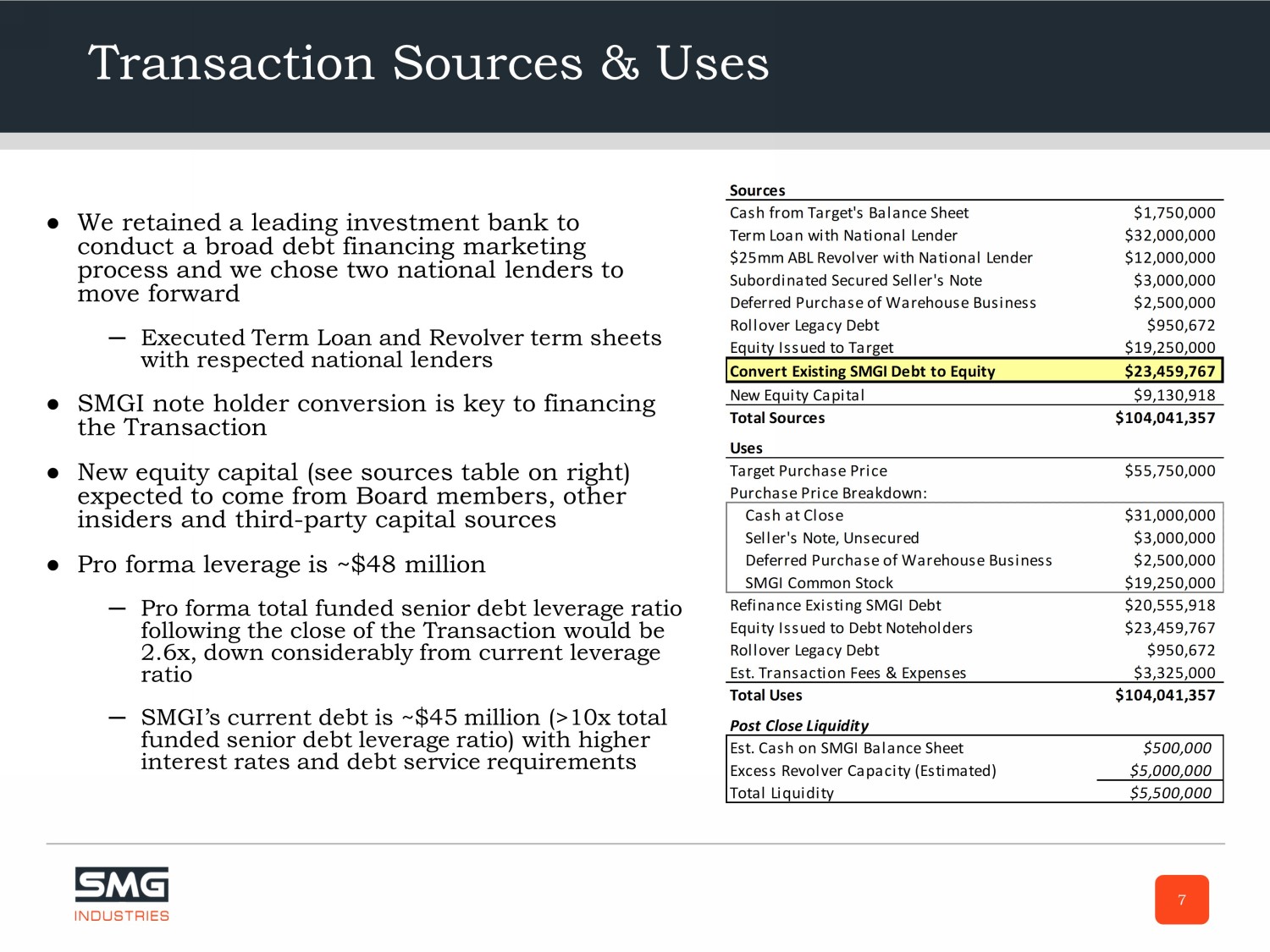

Transaction Sources & Uses 7 ● We retained a leading investment bank to conduct a broad debt financing marketing process and we chose two national lenders to move forward ─ Executed Term Loan and Revolver term sheets with respected national lenders ● SMGI note holder conversion is key to financing the Transaction ● New equity capital (see sources table on right) expected to come from Board members, other insiders and third - party capital sources ● Pro forma leverage is ~$48 million ─ Pro forma total funded senior debt leverage ratio following the close of the Transaction would be 2.6x, down considerably from current leverage ratio ─ SMGI’s current debt is ~$45 million (>10x total funded senior debt leverage ratio) with higher interest rates and debt service requirements Sources Cash from Target's Balance Sheet $1,750,000 Term Loan with National Lender $32,000,000 $25mm ABL Revolver with National Lender $12,000,000 Subordinated Secured Seller's Note $3,000,000 Deferred Purchase of Warehouse Business $2,500,000 Rollover Legacy Debt $950,672 Equity Issued to Target $19,250,000 Convert Existing SMGI Debt to Equity $23,459,767 New Equity Capital $9,130,918 Total Sources $104,041,357 Uses Target Purchase Price $55,750,000 Purchase Price Breakdown: Cash at Close $31,000,000 Seller's Note, Unsecured $3,000,000 Deferred Purchase of Warehouse Business $2,500,000 SMGI Common Stock $19,250,000 Refinance Existing SMGI Debt $20,555,918 Equity Issued to Debt Noteholders $23,459,767 Rollover Legacy Debt $950,672 Est. Transaction Fees & Expenses $3,325,000 Total Uses $104,041,357 Post Close Liquidity Est. Cash on SMGI Balance Sheet $500,000 Excess Revolver Capacity (Estimated) $5,000,000 Total Liquidity $5,500,000

SMGI Current Debt Summary ● Our Board is asking each SMGI note holder to convert its notes representing our outstanding debt into our common equity ─ Our existing line of credit lender and several equipment lenders will be refinanced with the Transaction ─ Board members and management have already committed to rolling $18.2 million of the $23.4 million outstanding ● Our current debt structure is likely unsustainable without additional capital injection ─ Management projections indicate that SMGI may experience solvency issues on a stand - alone basis absent a significant equity capi tal raise or restructuring 8 Transaction Adjustments Debt Type Security/Pledged Payment Frequency Interest Rate (Current) Current Principal Notes Refinance Remain Converted Working Capital (RLOC) RLOC (Amerisource) AR Monthly 8.2% 11,850,519 Working Capital LOC 11,850,519 - - Direct Asset Based Loans Bridge Debt (Amerisource) Assets Monthly 12% 15,775,683 $7,114,175 - 8,661,508 Misc. Term Debt (Equip financing) Assets Monthly 1,272,005 Term Debt 1,041,224 230,781 - Gov't Debt: SBA, EIDL Gov't Debt: SBA, EIDL Monthly 3.75% 536,558 EIDL Loans - 536,558 - Closely Held Debt or Convertible Debt Convertible Note #1 2nd Lien Quarterly 10% 7,979,199 Private Debt Holders - - 7,979,199 Stretch Debt 2nd Lien Quarterly 12% 1,600,000 Private Debt Holders 550,000 - 1,050,000 Seller Note 2nd Lien Monthly 10% 2,565,403 Closely Held Debt Holders - - 2,565,403 Short Term Notes 2nd Lien Monthly 12% 1,679,098 Closely Held Debt Holders - - 1,679,098 Short Term Notes - Jan 2023 2nd Lien Monthly 12% 1,000,000 Closely Held Debt Holders - - 1,000,000 Other Private Holders Legacy Debt 2nd Lien Quarterly 10% 707,892 Private Debt Holders - 183,333 524,559 44,966,357 20,555,918 950,672 23,459,767

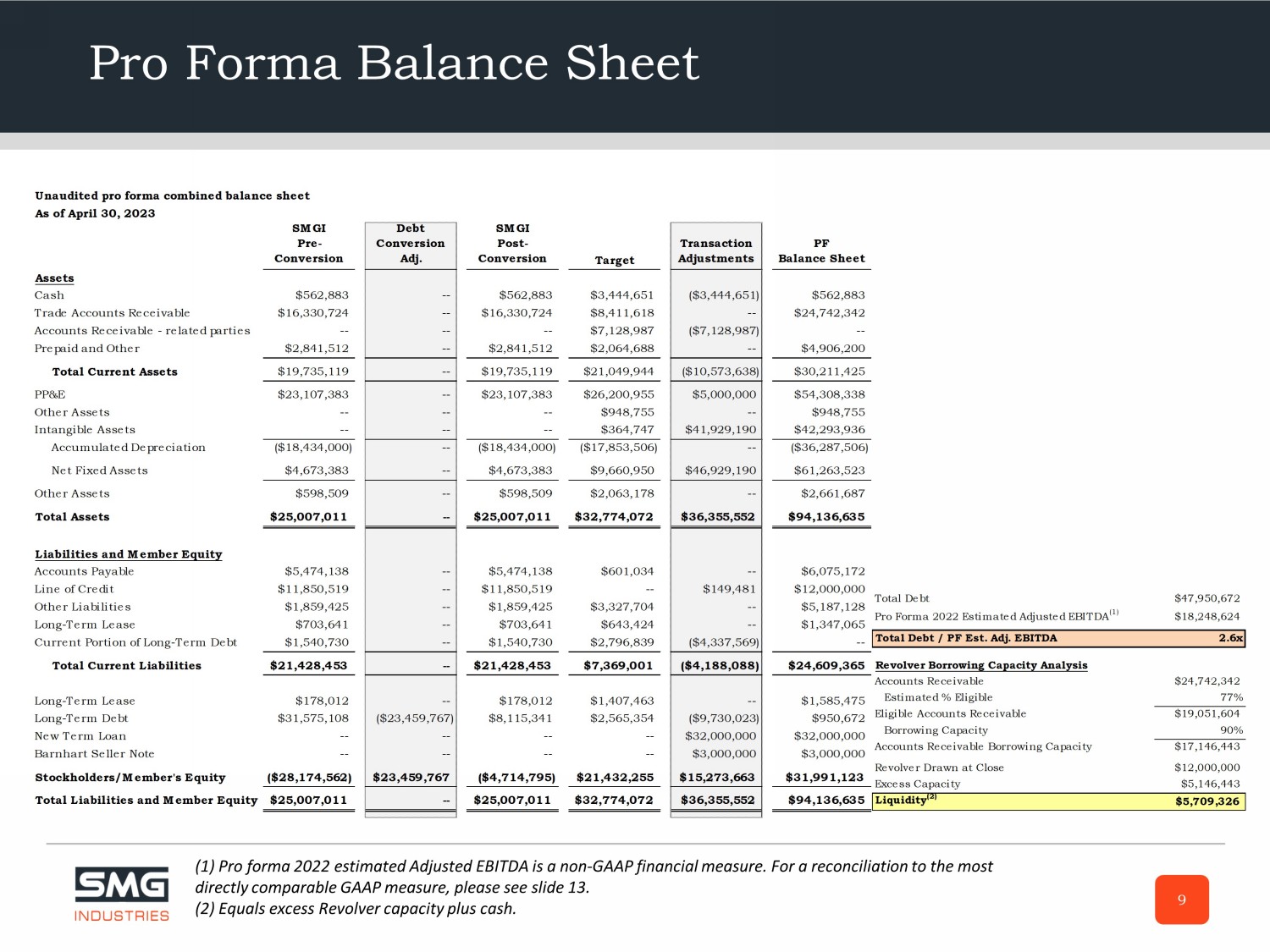

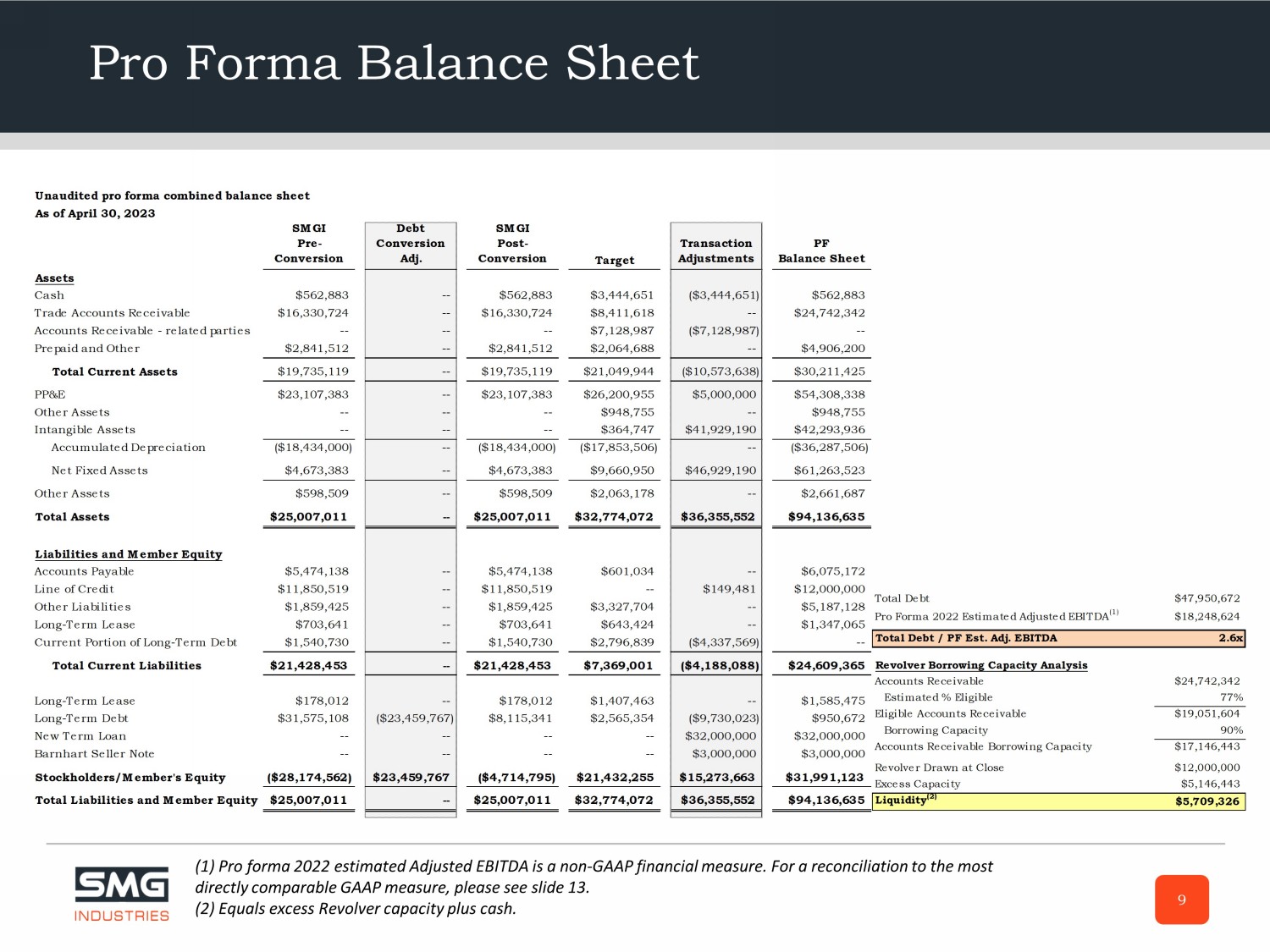

Pro Forma Balance Sheet 9 (1) Pro forma 2022 estimated Adjusted EBITDA is a non - GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, please see slide 13. (2) Equals excess Revolver capacity plus cash. Total Debt $47,950,672 Pro Forma 2022 Estimated Adjusted EBITDA (1) $18,248,624 Total Debt / PF Est. Adj. EBITDA 2.6x Revolver Borrowing Capacity Analysis Accounts Receivable $24,742,342 Estimated % Eligible 77% Eligible Accounts Receivable $19,051,604 Borrowing Capacity 90% Accounts Receivable Borrowing Capacity $17,146,443 Revolver Drawn at Close $12,000,000 Excess Capacity $5,146,443 Liquidity (2) $5,709,326

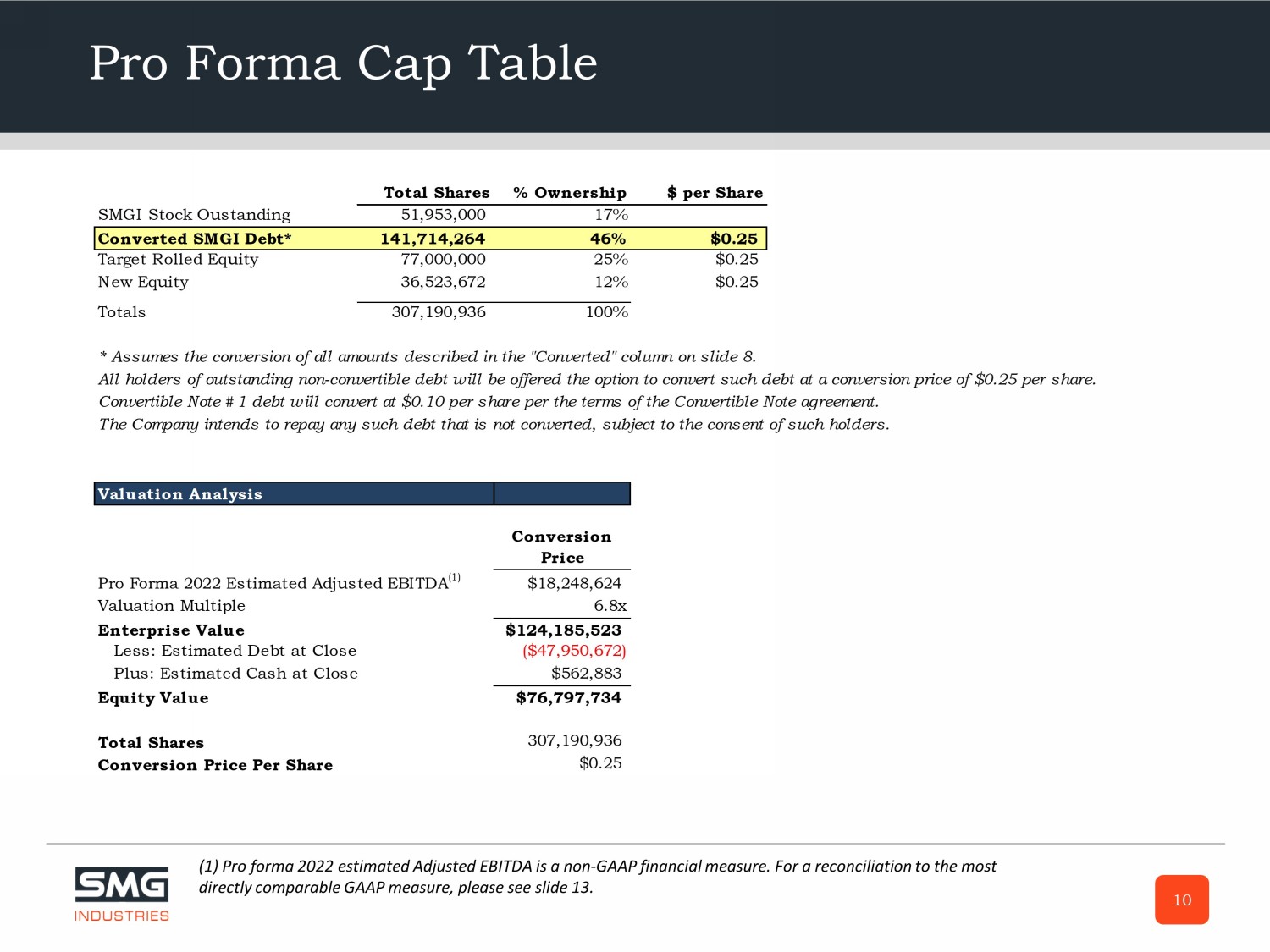

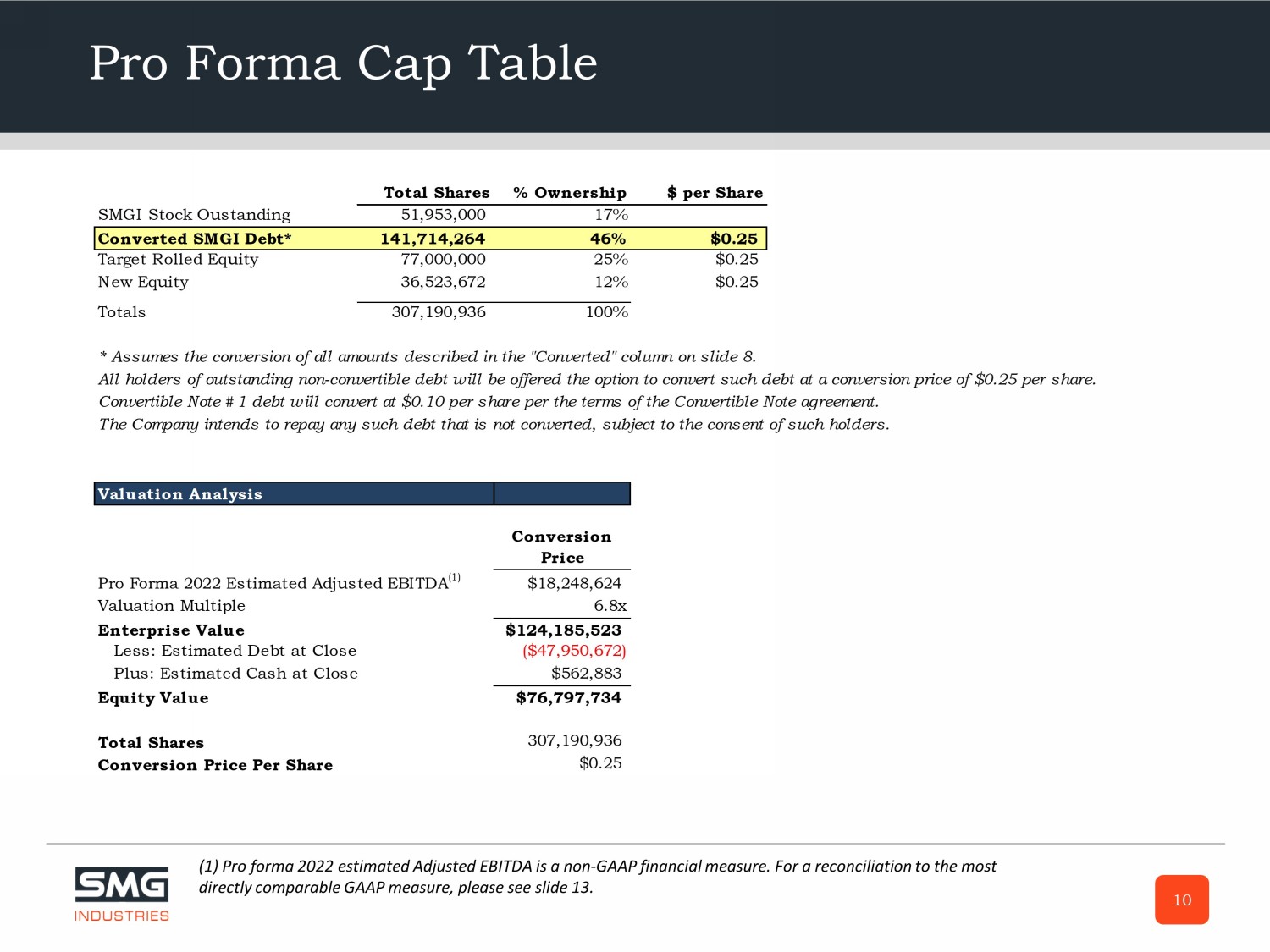

Pro Forma Cap Table 10 (1) Pro forma 2022 estimated Adjusted EBITDA is a non - GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, please see slide 13. Total Shares % Ownership $ per Share SMGI Stock Oustanding 51,953,000 17% Converted SMGI Debt* 141,714,264 46% $0.25 Target Rolled Equity 77,000,000 25% $0.25 New Equity 36,523,672 12% $0.25 Totals 307,190,936 100% * Assumes the conversion of all amounts described in the "Converted" column on slide 8. All holders of outstanding non-convertible debt will be offered the option to convert such debt at a conversion price of $0.25 per share. Convertible Note #1 debt will convert at $0.10 per share per the terms of the Convertible Note agreement. The Company intends to repay any such debt that is not converted, subject to the consent of such holders. Valuation Analysis Conversion Price Pro Forma 2022 Estimated Adjusted EBITDA (1) $18,248,624 Valuation Multiple 6.8x Enterprise Value $124,185,523 Less: Estimated Debt at Close ($47,950,672) Plus: Estimated Cash at Close $562,883 Equity Value $76,797,734 Total Shares 307,190,936 Conversion Price Per Share $0.25

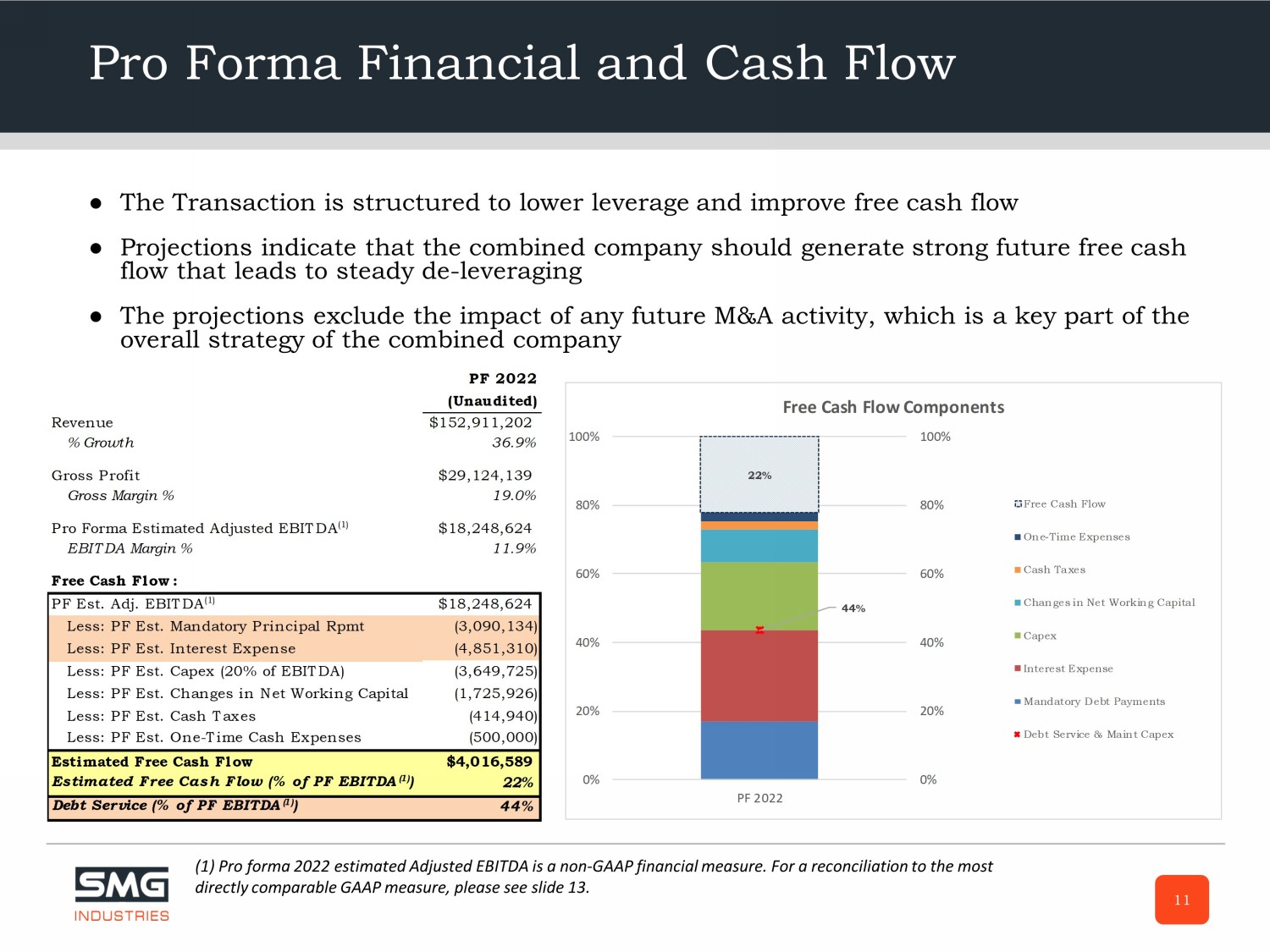

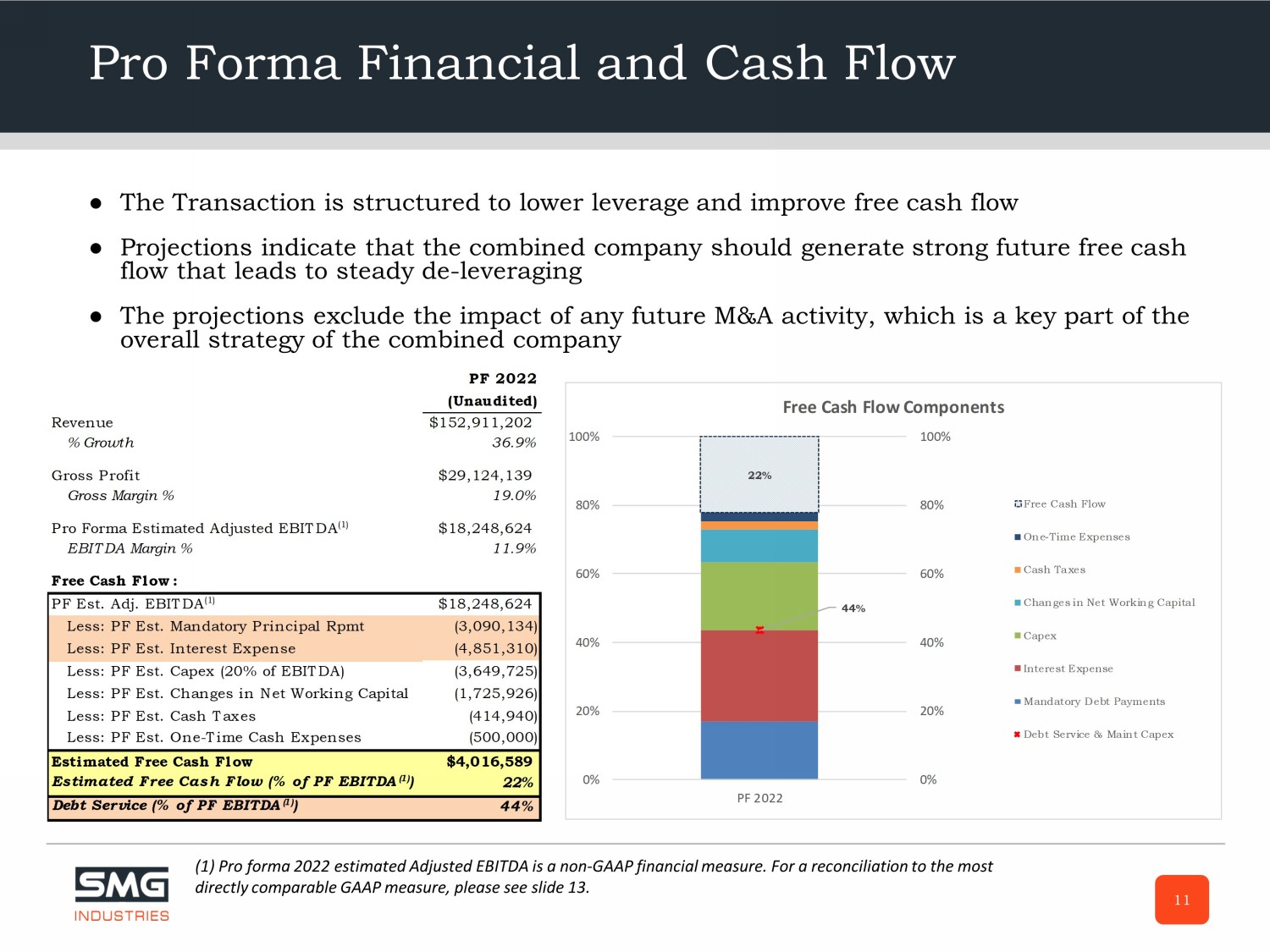

Pro Forma Financial and Cash Flow 11 ● The Transaction is structured to lower leverage and improve free cash flow ● Projections indicate that the combined company should generate strong future free cash flow that leads to steady de - leveraging ● The projections exclude the impact of any future M&A activity, which is a key part of the overall strategy of the combined company PF 2022 (Unaudited) Revenue $152,911,202 % Growth 36.9% Gross Profit $29,124,139 Gross Margin % 19.0% Pro Forma Estimated Adjusted EBITDA(1) $18,248,624 EBITDA Margin % 11.9% Free Cash Flow: % of EBITDA PF Est. Adj. EBITDA(1) $18,248,624 Less: PF Est. Mandatory Principal Rpmt (3,090,134) Less: PF Est. Interest Expense (4,851,310) Less: PF Est. Capex (20% of EBITDA) (3,649,725) Less: PF Est. Changes in Net Working Capital (1,725,926) Less: PF Est. Cash Taxes (414,940) Less: PF Est. One-Time Cash Expenses (500,000) Estimated Free Cash Flow $4,016,589 Estimated Free Cash Flow (% of PF EBITDA(1)) 22% Debt Service (% of PF EBITDA(1)) 44% 22% 44% 0% 20% 40% 60% 80% 100% 0% 20% 40% 60% 80% 100% PF 2022 Free Cash Flow Components Free Cash Flow One-Time Expenses Cash Taxes Changes in Net Working Capital Capex Interest Expense Mandatory Debt Payments Debt Service & Maint Capex (1) Pro forma 2022 estimated Adjusted EBITDA is a non - GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, please see slide 13.

Request Summary ● We are asking applicable SMGI note holder to elect to convert its notes representing our outstanding debt into our common equity at the closing of the Transaction ─ Conversion rights and procedures will be as prescribed in the terms of the note, if convertible, or at the same price and terms as rolled equity and new cash investment if not convertible ─ Conversion would happen with the closing of the Transaction ─ All Board members and management have agreed to convert their outstanding notes on the terms noted above ● Why ─ The Transaction should provide diversification of operations for the combined company by expanding geographical territories and end - markets ─ The Transaction is expected to provide an attractive transportation growth platform for pursuing future M&A x Enhanced management team, back - office / scale benefits, and improved balance sheet ─ De - leverages our business x Significantly lowers leverage multiple (Total Debt / EBITDA) x Absent a significant transaction, SMGI will likely require additional capital to de - leverage and grow ─ Improved liquidity for the combined business and shareholders x Projecting positive free cash flow post - closing x Plan to uplist to a national listing exchange post - closing to allow for improved access to the public capital markets for ongoing operations, as well as future M&A transactions ─ Equity is designed to provide enhanced long - term upside 12

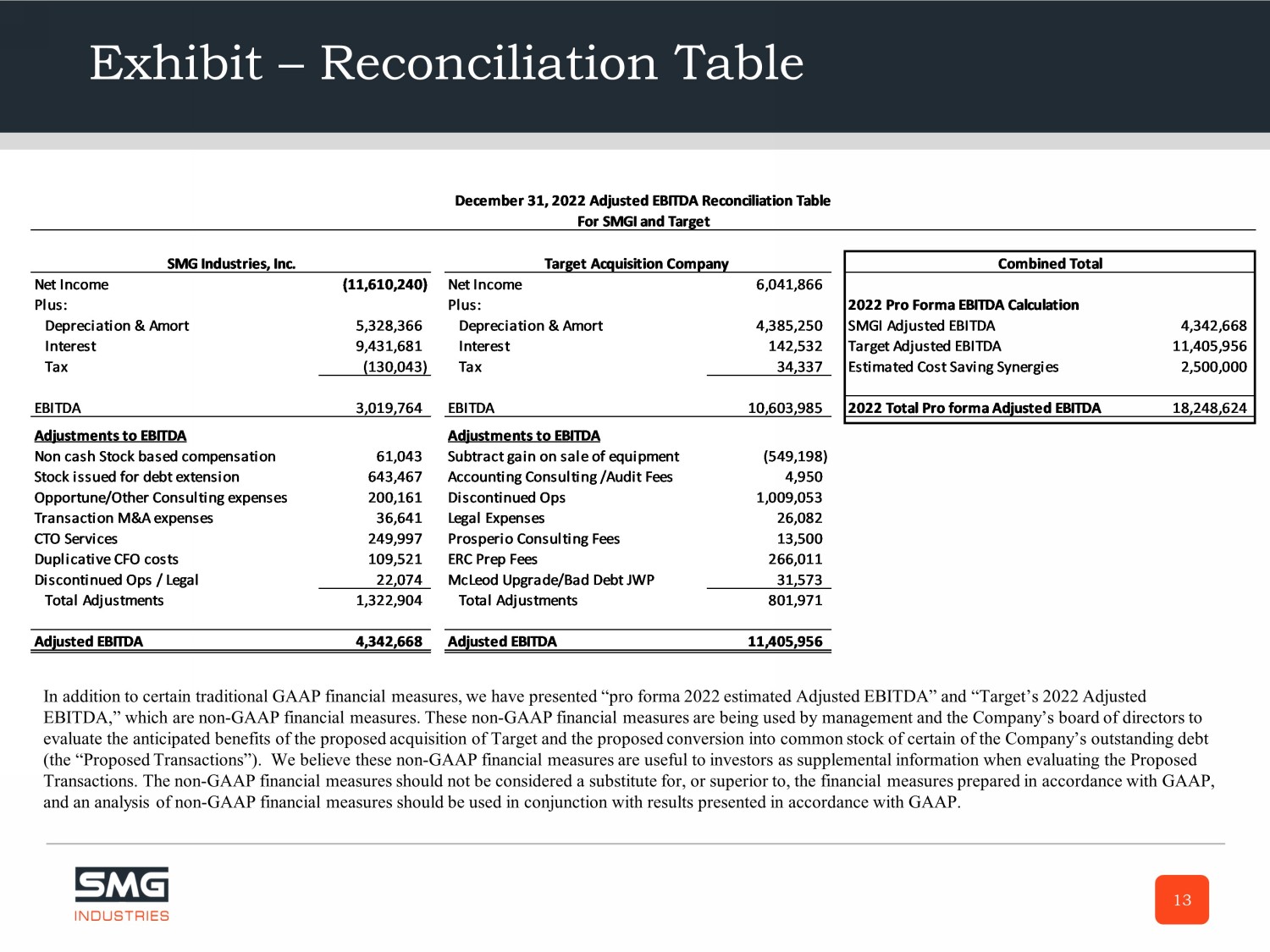

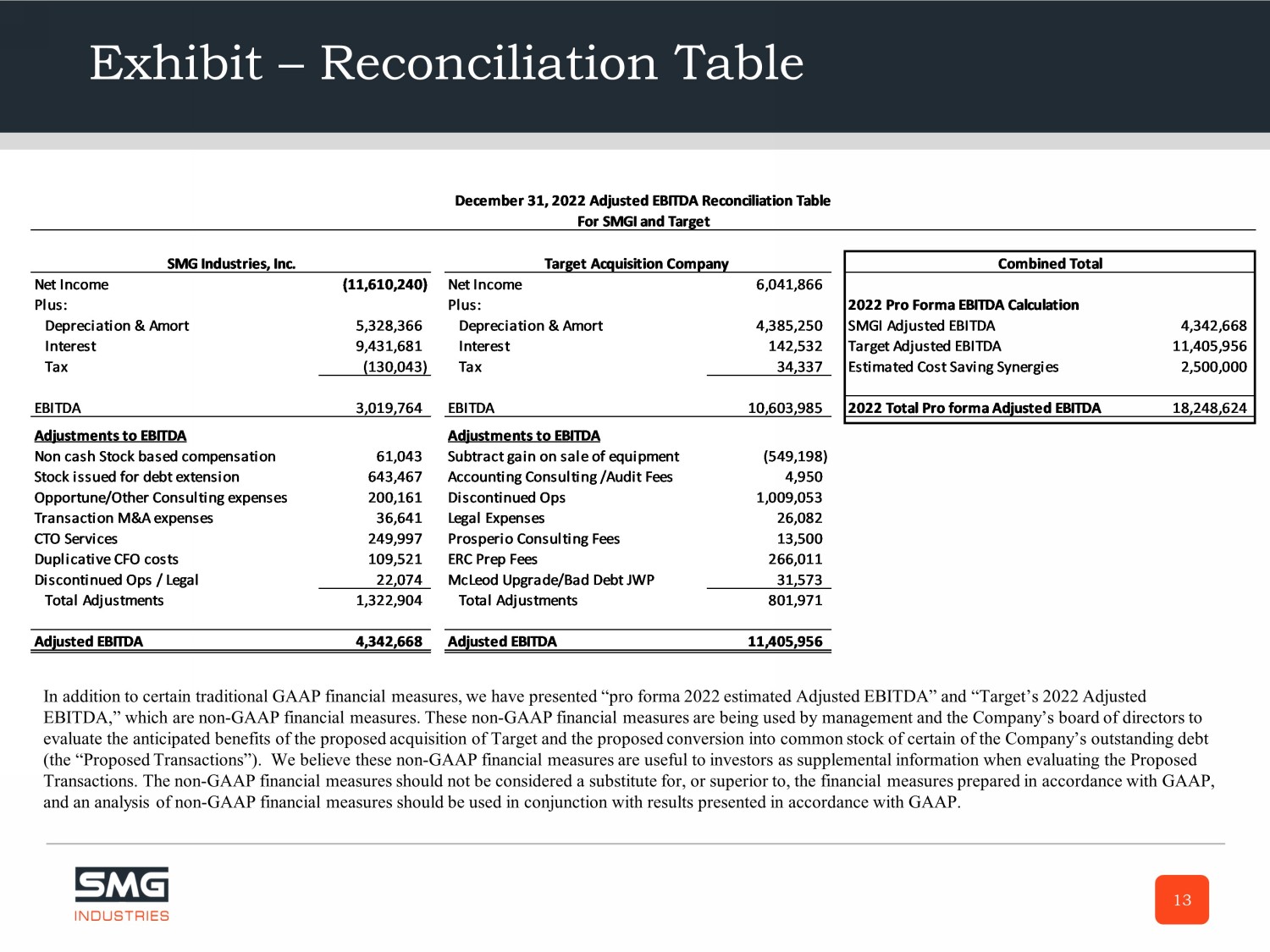

Exhibit – Reconciliation Table 13 In addition to certain traditional GAAP financial measures, we have presented “pro forma 2022 estimated Adjusted EBITDA” and “Ta rget’s 2022 Adjusted EBITDA,” which are non - GAAP financial measures. These non - GAAP financial measures are being used by management and the Company’s board of directors to evaluate the anticipated benefits of the proposed acquisition of Target and the proposed conversion into common stock of cert ain of the Company’s outstanding debt (the “Proposed Transactions”). We believe these non - GAAP financial measures are useful to investors as supplemental information when evaluating the Proposed Transactions. The non - GAAP financial measures should not be considered a substitute for, or superior to, the financial measures prepared in accordance with GAAP, and an analysis of non - GAAP financial measures should be used in conjunction with results presented in accordance with GAAP.