Exhibit 99.1

INFORMATION STATEMENT

SMG Industries Inc.

June 16, 2023

SMG Industries Inc.

This Information Statement is being furnished by SMG Industries Inc., a Delaware corporation (the “Company”), to holders of the Company’s issued and outstanding common stock (the “Stockholders”), in connection with the Company’s request that a majority of Stockholders of record as of the close of business on June 7, 2023 (the “Record Date”) approve, in the manner and for the purposes specified in this Information Statement, the proposed issuance by the Company of certain debt-to-equity conversion rights to certain holders of non-convertible debt of the Company. To indicate your approval, please return a PDF of the signed and dated signature page to Exhibit D hereto promptly by electronic mail to matt@smgindustries.com not later than July 31, 2023.

The Company is a transportation services company that hauls infrastructure components and large industrial equipment through its wholly owned subsidiaries. The Company proposes to acquire all the outstanding equity interests in another group of transportation and related companies (the “Target Companies”), as further discussed in this Information Statement (the “Proposed Acquisition”). In connection with the Proposed Acquisition, the Company intends to borrow approximately $57,000,000 from various commercial lenders (the “New Lenders”), as also further discussed in this Information Statement. To accomplish the contemplated borrowing from the New Lenders, the Company’s Board of Directors has deemed it in the best interests of the Company to retire as much of the Company’s current debt by converting such existing debt to equity to the extent possible and otherwise paying off remaining existing debt to the extent practicable, some of which is convertible under the terms of its issuance into shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), and some of which is not convertible under the terms of its issuance.

Accordingly, the Company plans to take the following steps:

1. Regarding the Company’s non-convertible debt, the Company plans to offer conversion rights to certain holders of such debt and request that they elect, prior to the closing of the Proposed Acquisition (the “Closing”), to convert their debt into shares of Common Stock. Upon Closing, and to the extent permitted by the terms of the Company’s existing debt or upon the consent of the holders of such debt, the Company intends to pay off any remaining non-convertible debt that shall not have been converted into Common Stock, with payment to come from the proceeds of the loans from the New Lenders (the “New Loans”); and

2. Regarding the Company’s convertible debt, the Company plans to request that holders of such debt elect to convert their debt into shares of Common Stock prior to the Closing, pursuant to the existing terms of their convertible debt. Upon Closing, the Company intends to pay off any remaining convertible debt that shall not have converted to Common Stock, with payment to come from the proceeds of the New Loans. The Company has the right to prepay all of its convertible debt at any time without penalty.

To comply with the “safe harbor” in Section 144 of the Delaware General Corporation Law (the “DGCL”) (as described in Exhibit A and Exhibit B to this Information Statement and elsewhere below), this Information Statement solicits the written consent of the Stockholders to the conversion rights offering as further described in this Information Statement (the “Conversion Rights Offering”). Because certain members of the Company’s Board of Directors (the “Board”) have a financial interest in the Conversion Rights Offering, the Board has determined to seek approval of the Conversion Rights Offering by the written consent of (a) Stockholders that hold a majority of all outstanding shares of Common Stock as of the Record Date, and (b) Disinterested Stockholders (hereinafter defined) that hold a majority of all outstanding shares of Common Stock held by all Disinterested Stockholders as of the Record Date. The “Disinterested Stockholders” are those Stockholders that, as of the Record Date, (i) did not hold convertible debt, or non-convertible debt that will be offered conversion rights, and (ii) that are neither directors nor officers of the Company. Additional information regarding the Conversion Rights Offering is set forth in that certain Debt Conversion Presentation, dated June 8, 2023, which is attached hereto as Exhibit C and was provided to the holders of the Company’s outstanding debt that received Conversion Rights (as defined below) in the Conversion Rights Offering.

Your consideration of and written consent to the matters described in this Information Statement by not later than July 31, 2023 is very important.

This Information Statement is being sent to the Company’s Stockholders on or about June 16, 2023. On the Record Date, there were 47,739,404 shares of the Company’s Common Stock outstanding and entitled to consent, including a total of 28,247,826 shares, or approximately 57% of the outstanding Common Stock, that was beneficially owned by the Company’s directors and executive officers.

The DGCL provides that no contract or transaction between a corporation and one or more of its directors or officers shall be void or voidable solely for this reason, or solely because the director or officer is present at or participates in the meeting of the board or committee which authorizes the contract or transaction, or solely because any such director’s or officer’s votes are counted for such purpose, if the material facts as to the director’s or officer’s relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by vote of the stockholders.

The DGCL and the Amended and Restated By-Laws of the Company allow the Stockholders to act by written consent in lieu of holding a meeting. Moreover, pursuant to the DGCL, unless otherwise provided in the Company’s Amended and Restated Certificate of Incorporation, the written consent need be signed only by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. The Company’s Amended and Restated Certificate of Incorporation does not otherwise provide and, accordingly, the written consent requested in this Information Statement need be signed only by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

You should only consider and rely on the information contained in this Information Statement. You should not rely on any information or representations that are not in, or made part of, this Information Statement. You should not assume that the information in this Information Statement is accurate as of any date other than the date of this Information Statement except as otherwise specifically indicated in this Information Statement. No persons have been authorized to give any information or to make any representations or statements (other than those contained in this Information Statement) regarding the Conversion Rights Offering or the other matters discussed herein and, if given or made, any such representations or information provided must not be relied on as having been authorized or sanctioned by the Company or any other person.

This document is not an offer to sell to anyone, or a solicitation of an offer to buy from anyone, any securities. The information contained in this Information Statement is not intended to be legal, tax or investment advice. You should consult your own counsel, accountants and investment advisors as to legal, tax and other matters, respectively, concerning the Conversion Rights Offering or the other matters discussed herein. The information contained in this Information Statement, or any other information provided in connection herewith, is not to be relied upon or used for any other purpose.

TABLE OF CONTENTS

Page

| CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS | | 3 |

| | | |

| INFORMATION ABOUT THE PARTIES | | 4 |

| | | |

| The Company | | 4 |

| | | |

| Company Subsidiaries | | 4 |

| | | |

| Principal Stockholders | | .4 |

| | | |

| Target Companies | | 6 |

| | | |

| Company DEBT | | 6 |

| | | |

| Non-Convertible Debt | | 6 |

| | | |

| Convertible Debt | | 7 |

| | | |

| Institutional/Commercial Debt | | 8 |

| | | |

| Company Debt Owed to Members of the Board of Directors | | 10 |

| | | |

| Company Debt Owed to Other Principal Stockholders | | 13 |

| | | |

| THE CONVERSION RIGHTS OFFERING | | 14 |

| | | |

| The Proposed Acquisition | | 14 |

| | | |

| Terms of the Conversion Rights Offering | | 15 |

| | | |

| Existing Convertible Debt | | 16 |

| | | |

| End Date | | 16 |

| | | |

| Estimate of the Company’s Debt that will Convert to Common Stock | | 16 |

| | | |

| Dilution | | 16 |

| | | |

| The Company’s Reasons for the Conversion Rights Offering | | 17 |

| | | |

| Interests of Certain Persons in the Conversion Rights Offering | | 18 |

| | | |

| Tax Consequences | | 19 |

| | | |

| STOCKHOLDER ACTION BY WRITTEN CONSENT | | 19 |

Exhibits

Exhibit A – Summary of Interested Director Provisions under the General Corporation Law of the State of Delaware.

Exhibit B – General Corporation Law of the State of Delaware - Section 144 – Interested Directors; Quorum.

Exhibit C – Debt Conversion Presentation, dated June 8, 2023.

Exhibit D – Written Consent in Lieu of a Special Meeting of the Stockholders of SMG Industries Inc.

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

In this Information Statement, the Company may make certain forward-looking statements, including statements regarding its plans, strategies, objectives, expectations, intentions and resources that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The Securities and Exchange Commission (“SEC”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This Information Statement contains such “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

The statements contained in this Information Statement that are not historical fact are forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995), within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements may be identified by the use of forward-looking terminology such as “should,” “could,” “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intends,” “continue,” or similar terms or variations of those terms or the negative of those terms. All forward-looking statements are management’s present expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These statements appear in a number of places in this Information Statement and include statements regarding the intent, belief or current expectations of SMG Industries Inc. Forward-looking statements are merely the Company’s current predictions of future events. Investors are cautioned that any such forward-looking statements are inherently uncertain, are not guaranties of future performance and involve risks and uncertainties. Actual results may differ materially from the Company’s predictions. There are a number of factors that could negatively affect the Company’s business and the value of its securities, including, but not limited to, fluctuations in the market price of its Common Stock; changes in its plans, strategies and intentions; changes in market valuations associated with its cash flows and operating results; the impact of significant acquisitions, dispositions and other similar transactions; the Company’s ability to attract and retain key employees; changes in financial estimates or recommendations by securities analysts; asset impairments; decreased liquidity in the capital markets; and changes in interest rates. Such factors could materially affect the Company’s future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. Although the Company has sought to identify the most significant risks to its business, the Company cannot predict whether, or to what extent, any of such risks may be realized, nor is there any assurance that it has identified all possible issues it might face.

In light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in this Information Statement might not occur. Stockholders are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this Information Statement. The Company is not under any obligation, and it expressly disclaims any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise except as may be required by applicable law. All subsequent forward-looking statements attributable to the Company or to any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. The Company urges readers to carefully review and consider the various disclosures it makes in this Information Statement and its reports filed with the SEC that attempt to advise interested parties of the risks, uncertainties and other factors that may affect the Company’s business, including the risk factors included in its reports filed with the SEC under Item 1A “Risk Factors.”

INFORMATION ABOUT THE PARTIES

The Company.

The Company is a transportation services company that operates throughout the southwest region of the United States. The Company transports infrastructure components and hauls large industrial equipment through its wholly owned subsidiaries. The Company is a Delaware corporation formed in January 2008. The Company’s principal offices are located at 20475 SH-249, Suite 450, Houston, Texas 77070, and its telephone number is (713) 955-3497. The Company’s Common Stock is traded on the OTCQB market under the ticker symbol “SMGI.” The Company maintains a website at https://smgindustries.com. The Company’s website is not incorporated into this Information Statement, and you should not consider it a part of this Information Statement.

Company Subsidiaries.

The Company operates through its wholly owned operating subsidiaries (the “Company Subsidiaries”):

5J Trucking, LLC, a Texas limited liability company (“5J Trucking”);

5J Oilfield Services, LLC, a Texas limited liability company (“5J Oilfield Services”);

5J Specialized LLC, a Texas limited liability company (“5J Specialized”);

5J Transportation LLC, a Texas limited liability company; and

5J Logistics Services LLC, a Texas limited liability company.

The Company’s nonoperating subsidiaries are:

Trinity Services, L.L.C., a Louisiana limited liability company (“Trinity Services”); and

Momentum Water Transfer Services LLC, a Texas limited liability company (“Momentum Water”).

Principal Stockholders.

The following table sets forth, as of the Record Date, information regarding the beneficial ownership of our Common Stock based upon the most recent information available to us for: (i) each person known by us to own beneficially five percent (5)% or more of our outstanding Common Stock, (ii) each of our officers and directors, and (iii) all of our officers and directors as a group. Unless otherwise indicated, each of the persons listed below has sole voting and investment power with respect to the shares beneficially owned by them. As of March 31, 2023, there were 47,739,284 shares of our Common Stock issued and outstanding. Except as otherwise listed below, the address of each person is 20475 State Hwy 249, Suite 450, Houston Texas 77070.

| | | Amount of Beneficial | | | | |

| | | Ownership of Common | | | Percent of Common | |

| Name | | Stock (1) | | | Stock | |

| George Gilman (7) | | | 3,457,630 | | | | 7.1 | % |

| Dane Stewart (8) | | | 4,025,000 | | | | 8.3 | % |

| Richard Fallin (9) | | | 11,500,000 | | | | 23.7 | % |

| | | | | | | | | |

| Directors and Executive Officers: | | | | | | | | |

| Matthew Flemming (2) | | | 1,600,000 | | | | 3.3 | % |

| Steven Madden (3) | | | 63,040,480 | | | | 66.5 | % |

| Newton Dorsett (4) | | | 3,376,840 | | | | 6.9 | % |

| Joseph Page | | | — | | | | — | |

| Allen Parrott | | | — | | | | — | |

| Brady Crosswell (5) | | | 6,900,000 | | | | 14.2 | % |

| Todd Riedel | | | — | | | | — | |

| James E. Frye (6) | | | 10,890,434 | | | | 22.5 | % |

| All Directors and Current Executive Officers as a group (7 persons) (1)-(6) | | | 85,807,754 | | | | 78.5 | % |

* less than one percent

| (1) | Pursuant to the rules and regulations of the SEC, shares of Common Stock that an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants or the conversion of convertible promissory notes are deemed to be outstanding for the purposes of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person shown in the table. |

| (2) | Flemming Family Trust, an irrevocable trust, is the owner of 600,000 the shares. Rolf O. Flemming, father to Matthew Flemming, is the grantor of the trust and Matthew Flemming is the trustee. Certain of his immediate relatives are the beneficiaries. Includes 1,000,000 shares of Common Stock issuable upon the exercise of options held by Mr. Flemming. |

| (3) | Includes: (i) 43,144,390 shares of Common Stock issuable upon the conversion of convertible promissory notes held by Mr. Madden, (ii) 1,848,000 shares of Common Stock and 3,660,000 shares of Common Stock issuable upon the conversion of a convertible promissory note held by Apex Heritage Investments, LLC (“Apex Heritage Investments”), over which Mr. Madden has sole voting and investment control, and (iii) 375,000 shares held by Madden Heritage Foundation, over which Mr. Madden has sole voting and investment control. The business address of Steven H. Madden is 9821 Katy Freeway #880, Houston, Texas 77024. |

| (4) | Includes 775,920 shares of Common Stock issuable upon the conversion of convertible promissory notes held by Mr. Dorsett. The address for Mr. Dorsett is 220 Travis Street, 5th Floor, Shreveport, LA 71101. |

| (5) | Includes: (i) 2,525,000 shares of Common Stock and 4,000,000 shares of Common Stock issuable upon the conversion of convertible promissory notes held by Grey Fox Investments LLC, of which Mr. Crosswell is the sole member and manager and over which he has sole voting and investment control, and (ii) 375,000 shares of Common Stock held by Grey Fox Secured Funding LP, over which Mr. Crosswell has sole voting and investment control over the shares. The business address of Grey Fox Investments LLC is 5851 San Felipe, Suite 230, Houston, Texas 77057. |

| (6) | Includes 8,707,090 shares of Common Stock issuable upon the conversion of convertible promissory notes held by Mr. Frye. |

| (7) | Includes: (i) 650,015 shares of Common Stock held by Aeneas, LC, of which Mr. Gilman is the manager and over which he has sole voting and investment control, (ii) 812,164 shares of Common Stock held by The Mary Payne Family Trust, of which Mr. Gilman is the trustee and over which he has sole voting and investment control, (iii) 140,000 shares of Common Stock issuable upon the conversion of a convertible note held by the Mary Payne Trust, (iv) 195,000 shares of Common Stock issuable upon the exercise of warrants held by The Mary Payne Trust, and (v) 803,334 shares of Common Stock issuable upon the exercise of warrants held by Mr. Gilman. |

| (8) | Includes: (i) 300,000 shares of Common Stock and 2,000,000 shares of Common Stock issuable upon the conversion of a convertible promissory note held by Stewart Investment Partners Ltd. of which Mr. Stewart is the managing partner and over which he has sole voting and investment control, and (ii) 225,000 shares of Common Stock and 1,500,000 shares of Common Stock issuable upon the conversion of a convertible promissory note held by Whitewing Investment Partners I, Ltd., of which Mr. Stewart is the managing partner and over which he has sole voting and investment control. The business address for Mr. Stewart is 7500 San Felipe, Suite 1060, Houston, Texas 77063. |

| (9) | Includes 10,000,000 shares of Common Stock issuable upon the conversion of convertible promissory notes held by Mr. Fallin. The address for Mr. Fallin is 9545 Katy Freeway, Houston, Texas 77024. |

Each of Messrs. Madden, Dorsett, Frye, Gilman, Stewart and Fallin directly or indirectly holds certain non-convertible debt that will be offered conversion rights in the Conversion Rights Offering as further described below under the captions “Company Debt Owed to Members of the Board of Directors” and “Company Debt Owed to Other Principal Stockholders.”

Target Companies.

The Target Companies are six operating limited liability companies operating under common ownership that focus on the transportation services market. Their services include full truckload, dry bulk, liquids, intermodal, less-than-truckload, heavy haul, drayage and transload, primarily in the Northeastern United States.

Company DEBT

The following describes the Company’s debt as of May 31, 2023:

Non-Convertible Debt.

The following describes the Company’s outstanding non-convertible debt:

Senior Secured Bridge Debt. The Company Subsidiaries owe Amerisource Funding, Inc., a Texas corporation (“Amerisource Funding”), and certain other participants in the loan, aggregate principal and accrued unpaid interest in the amount of $15,490,987 under a First Amended and Restated Commercial Promissory Note dated September 7, 2021 in the original principal amount of $16,740,000 (the “Bridge Debt”). The Company has guaranteed payment of the Bridge Debt. The Bridge Debt matures on or about September 7, 2026. Amerisource Funding and the participants in the Bridge Debt do not have any rights to convert the Bridge Debt to Common Stock or other Company equity. The Company intends to offer Amerisource Funding and the other participants in the Bridge Debt conversion rights in the Conversion Rights Offering and to pay off any remaining portion of the Bridge Debt that is not converted. The Company has the right to prepay the Bridge Debt at any time without penalty.

Short-Term Promissory Notes. The Company owes various persons aggregate principal and accrued unpaid interest in the amount of $3,386,990 under 21 short-term Promissory Notes of various dates (the “Short-Term Notes”). All the Short-Term Notes mature on June 30, 2023 except one, which matures on March 31, 2024 (the “Cox Short-Term Note”). The holders of the Short-Term Notes do not have any rights to convert the debt under the Notes to Common Stock or other Company equity. The Company intends to offer the holders of the Short-Term Notes (except the holder of the Cox Short-Term Note) conversion rights in the Conversion Rights Offering and to pay off any remaining portion of the Short-Term Notes (other than the Cox Short-Term Note) that is not converted. Because the Company does not have the right to prepay the Short-Term Notes, any early repayment would be subject to the consent of the holders of the Short-Term Notes.

Frye Seller Note. 5J Oilfield Services owes principal and accrued unpaid interest in the amount of $2,565,403 under a 10% Secured Promissory Note dated February 27, 2020, in the original principal amount of $2,000,000 payable to James E. Frye, Jr. (the “Frye Seller Note”). The Company has guaranteed payment of the Frye Seller Note. The holder of the Frye Seller Note does not have any rights to convert the debt under the Frye Seller Note to Common Stock or other Company equity. The Company intends to offer the holder of the Frye Seller Note conversion rights in the Conversion Rights Offering with respect to the Frye Seller Note. The Frye Seller Note matured on February 27, 2023, and the Company intends to repay all principal and accrued unpaid interest that is not converted into Common Stock.

Convertible Debt.

The following describes the Company’s outstanding Convertible Debt:

Stretch Debt. The Company owes Amerisource Leasing Corporation, a Texas corporation (“Amerisource Leasing”), and certain other participants in the loan, principal and accrued unpaid interest in the amount of $1,600,000 under a Commercial Promissory Note dated February 27, 2020 in the original principal amount of $1,600,000 (the “Stretch Debt”). 5J Trucking and 5J Oilfield Services have guaranteed payment of the Stretch Debt. The Stretch Debt matures on June 30, 2023.

Amerisource Leasing and the other participants in the Stretch Debt have the right to convert the principal and accrued unpaid interest under the Stretch Debt into shares of Common Stock at a conversion price of $0.25 per share. The Company intends to request Amerisource Leasing and the other participants in the Stretch Debt exercise their conversion rights. The Stretch Debt matures on June 30, 2023, and the Company intends to repay all principal and accrued unpaid interest that is not converted into Common Stock.

Secured Convertible Promissory Notes. The Company owes aggregate principal and accrued unpaid interest in the amount of $8,160,771 to various purchasers of 34 Secured Convertible Promissory Notes in the aggregate original principal amount of $7,979,199 (the “Convertible Notes #1”). The Convertible Notes #1 are guaranteed by 5J Oilfield, 5J Trucking, Trinity Services, 5J Specialized and Momentum Water. The Convertible Notes #1 mature on various dates ranging from June 30, 2023 through March 30, 2025.

The holders of the Convertible Notes #1 have the right to convert the principal and accrued unpaid interest under the Convertible Notes #1 into shares of Common Stock at a conversion price of $0.10 per share. The Company intends to request the holders of the Convertible Notes #1 to exercise their conversion rights or be paid off as further described below. The Company has the right to prepay the Convertible Notes #1 at any time without penalty.

Institutional/Commercial Debt.

The following describes the Company’s outstanding institutional or commercial debt not described under the captions “Non-Convertible Debt” or “Convertible Debt” above:

Amerisource Revolving Line of Credit and Term Loan. The Company, 5J Trucking and 5J Oilfield Services owe Amerisource Funding principal and accrued unpaid interest in the amount of $12,613,238 pursuant to a Revolving Accounts Receivable Assignment and Term Loan Financing and Security Agreement dated February 27, 2020 between the Company, 5J Trucking and 5J Oilfield Services, on the one hand, and Amerisource Funding, on the other (the “Amerisource Debt Facility”). The Amerisource Debt Facility is not convertible into shares of Common Stock and the Company does not intend to offer Amerisource Funding conversion rights with respect to the Amerisource Debt Facility. The Company intends to terminate and pay off the Amerisource Debt Facility using the proceeds of the New Loans. Upon termination of the Amerisource Debt Facility, the Company will incur an early termination fee of one percent of the Amerisource Debt Facility.

Equify Financial Purchase Money Notes. 5J Specialized owes Equify Financial, LLC (“Equify Financial”) aggregate principal and accrued unpaid interest in the amount of $617,574 under two Promissory Notes (the “Equify Financial Promissory Notes”). The Equify Financial Promissory Notes, which are dated July 20, 2020 and January 27, 2022, are payable in installments, with the final payment due on July 1, 2023 and May 1, 2026, respectively. The Company will not offer Equify Financial conversion rights but intends to pay off the Equify Financial Promissory Notes using the proceeds of the New Loans. The Company has the right to prepay the Equify Financial Promissory Notes at any time, subject to a prepayment penalty of 0.19% of the principal amount being prepaid multiplied by the number of calendar months between the date of prepayment and the applicable maturity date.

Red River Bank Term Loan. Trinity Services owes Red River Bank approximately $136,947 under a Promissory Note dated July 21, 2021 in the original principal amount of $200,225. This loan matures on July 21, 2026, is not convertible into shares of Common Stock, the Company does not intend to offer Red River Bank conversion rights with respect to this loan and the Company does not intend to prepay this loan.

Vera Bank Promissory Note. 5J Trucking owes VeraBank, National Association ("VeraBank"), approximately $93,834 under a Promissory Note dated November 30, 2022. This loan matures on November 30, 2025 and is not convertible into shares of Common Stock, the Company does not intend to offer VeraBank conversion rights with respect to this loan and the Company does not intend to prepay this loan.

U.S. Small Business Administration Loans. The Company owes the U.S. Small Business Administration (the “SBA”) approximately $148,722 under an Economic Injury Disaster Loan evidenced by a Note dated August 30, 2020 in the original principal amount of $150,000 with a 30-year term. This loan is not convertible into shares of Common Stock, the Company does not intend to offer the SBA conversion rights with respect to this loan and the Company does not intend to prepay this loan.

5J Trucking owes the SBA approximately $148,987 under an Economic Injury Disaster Loan evidenced by a Note dated September 2, 2020 in the original principal amount of $150,000 with a 30-year term. This loan is not convertible into shares of Common Stock, the Company does not intend to offer the SBA conversion rights with respect to this loan and the Company does not intend to prepay this loan.

Momentum Water owes the SBA approximately $89,223 under an Economic Injury Disaster Loan evidenced by a Note dated June 17, 2020 in the original principal amount of $90,000 with a 30-year term. This loan is not convertible into shares of Common Stock, the Company does not intend to offer the SBA conversion rights with respect to this loan and the Company does not intend to prepay this loan.

Trinity Services owes the SBA approximately $148,694 under an Economic Injury Disaster Loan evidenced by a Note dated May 27, 2020 in the original principal amount of $150,000 with a 30-year term. This loan is not convertible into shares of Common Stock, the Company does not intend to offer the SBA conversion rights with respect to this loan and the Company does not intend to prepay this loan.

Insurance Premium Notes. 5J Trucking and 5J Oilfield Services have financed certain insurance premiums in the aggregate amount of $1,850,157 with IPFS Corporation (“IPFS”). These loans are not convertible into shares of Common Stock, the Company does not intend to offer IPFS conversion rights with respect to these loans and the Company does not intend to prepay these loans.

Pickup Truck Loans. 5J Trucking owes GM Financial and Ally Bank an aggregate of approximately $316,528 for the purchase of five pickup trucks. The maturity dates of these loans range from March 2027 to February 2029. These loans are not convertible into shares of Common Stock, the Company does not intend to offer GM Financial or Ally Bank conversion rights with respect to these loans and the Company does not intend to prepay these loans.

Company Debt Owed to Members of the Board of Directors.

The Company’s Board consists of seven members. The debt the Company owes to the Board members is described below. As described under “Company Debt” above, the Company owes the debt identified below either directly, or indirectly through various of the Company Subsidiaries. Directors that directly or indirectly hold non-convertible debt to which conversion rights will be offered have a financial interest in the Conversion Rights Offering and for that reason the Company is requesting the consent of the Stockholders (including the Disinterested Stockholders as a group) to the Conversion Rights Offering.

Steven H. Madden.

Senior Secured Bridge Debt. Mr. Steven H. Madden (“Mr. Madden”) owns 50% of Asphalt Transportation, Inc. (“Asphalt Transportation”). The Company owes Asphalt Transportation $864,663 in principal and accrued but unpaid interest under the Bridge Debt. The Company intends to offer Asphalt Transportation conversion rights in the Conversion Rights Offering with respect to its participation in the Bridge Debt. The Company intends to pay off the portion (if any) of the debt owed to Asphalt Transportation under the Bridge Debt that Asphalt Transportation does not elect to convert on or before the Final Exercise Date (as defined under “Terms of the Conversion Rights Offering” below). The Company has the right to prepay the Bridge Debt at any time without penalty.

Mr. Madden also owns Apex Heritage Investments. The Company owes Apex Heritage Investments $1,469,927 in aggregate principal and accrued but unpaid interest under the Bridge Debt. The Company intends to offer Apex Heritage Investments conversion rights in the Conversion Rights Offering with respect to its participation in the Bridge Debt. The Company intends to pay off the portion (if any) of the debt owed to Apex Heritage Investments under the Bridge Debt that Apex Heritage Investments does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Bridge Debt at any time without penalty.

Mr. Joe Madden is Mr. Madden’s uncle. The Company owes Mr. Joe Madden $293,985 in principal and accrued but unpaid interest under the Bridge Debt. The Company intends to offer Mr. Joe Madden conversion rights in the Conversion Rights Offering with respect to his participation in the Bridge Debt. The Company intends to pay off the portion (if any) of the debt owed to Mr. Joe Madden under the Bridge Debt that Mr. Joe Madden does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Bridge Debt at any time without penalty.

Short-Term Promissory Notes. The Company owes Mr. Steven Madden, individually, $1,395,025 in aggregate principal and accrued but unpaid interest under seven Short-Term Notes. The Company intends to offer Mr. Madden conversion rights in the Conversion Rights Offering with respect to all his Short-Term Notes and to pay off the portion (if any) of such Short-Term Notes that Mr. Madden does not elect to convert on or before the Final Exercise Date. Because the Company does not have the right to prepay the Short-Term Notes, any early repayment would be subject to the consent of Mr. Madden.

Stretch Debt. Mr. Steven Madden is the Chairman and Chief Executive Officer of Apex Heritage Group, a group of companies that includes Apex Heritage Investments LLC (“Apex Heritage Investments”). The Company owes Apex Heritage Investments $500,000 in original principal and accrued but unpaid interest under the Stretch Debt. The Stretch Debt matures on June 30, 2023, and the Company intends to pay off the portion (if any) of the debt owed to Apex Heritage Investments under the Stretch Debt that Apex Heritage Investments does not elect to convert on or before the Final Exercise Date.

Secured Convertible Promissory Notes. The Company owes Apex Heritage Investments $375,327 in aggregate original principal and accrued but unpaid interest under two Convertible Notes #1. The Company intends to pay off the portion (if any) of the debt owed to Apex Heritage Investments under its Convertible Notes #1 that Apex Heritage Investments does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Convertible Notes #1 at any time without penalty.

The Company also owes Mr. Steven Madden $5,094,385 in aggregate original principal and accrued but unpaid interest under 21 Convertible Notes #1. The Company intends to pay off the portion (if any) of the debts owed to Mr. Madden under its Convertible Notes #1 that Mr. Madden does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Convertible Notes #1 at any time without penalty.

Brady Crosswell.

Short-Term Promissory Notes. Mr. Crosswell currently serves as the Manager of the General Partnership of Grey Fox Investments, LP (“Grey Fox Investments”). The Company owes Grey Fox Investments $507,397 in original principal and accrued but unpaid interest under two Short-Term Notes. The Company intends to offer Grey Fox Investments conversion rights in the Conversion Rights Offering with respect to its Short-Term Notes and to pay off the portion (if any) of such Short-Term Notes that Grey Fox Investments does not elect to convert on or before the Final Exercise Date. Because the Company does not have the right to prepay the Short-Term Notes, any early repayment would be subject to the consent of Grey Fox Investments.

Stretch Debt. The Company owes Grey Fox Investments $257,500 in original principal and accrued but unpaid interest under the Stretch Debt. The Stretch Debt matures on June 30, 2023, and the Company intends to pay off the portion (if any) of the debt owed to Grey Fox Investments under the Stretch Debt that Grey Fox Investments does not elect to convert on or before the Final Exercise Date.

Secured Convertible Promissory Notes. The Company owes Grey Fox Investments $307,397 in aggregate original principal and accrued but unpaid interest under one Convertible Note #1. The Company intends to pay off the portion (if any) of the debt owed to Grey Fox Investments under its Convertible Note #1 that Grey Fox Investments does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Convertible Notes #1 at any time without penalty.

James E. Frye, Jr.

Senior Secured Bridge Debt. The Company owes Mr. Frye $432,332 in principal and accrued but unpaid interest under the Bridge Debt. The Company intends to offer Mr. Frye conversion rights in the Conversion Rights Offering with respect to his participation in the Bridge Debt. The Company intends to pay off the portion (if any) of the debt owed to Mr. Frye under the Bridge Debt that Mr. Frye does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Bridge Debt at any time without penalty.

Short-Term Promissory Notes. The Company owes Mr. Frye $189,520 in principal and accrued but unpaid interest under two Short-Term Notes. The Company intends to offer Mr. Frye conversion rights in the Conversion Rights Offering with respect to his Short-Term Note and to pay off the portion (if any) of such Short-Term Note that Mr. Frye does not elect to convert on or before the Final Exercise Date. Because the Company does not have the right to prepay the Short-Term Notes, any early repayment would be subject to the consent of Mr. Frye.

Frye Seller Note. The Company owes Mr. Frye $2,565,403 in original principal and accrued but unpaid interest under the Frye Seller Note. The Company intends to offer Mr. Frye conversion rights in the Conversion Rights Offering with respect to the Frye Seller Note. The Frye Seller Note matured on February 27, 2023, and the Company intends to repay all principal and accrued unpaid interest that is not converted into Common Stock.

Frye Accounts Receivable Note. The Company owes Mr. Frye $565,403 in original principal and accrued but unpaid interest under the Frye Accounts Receivable Note. This note is not convertible into shares of Common Stock, the Company does not intend to offer Mr. Frye conversion rights with respect to this note and the Company intends to repay this note as designed through the collection of old discharged accounts receivable when collected.

Secured Convertible Promissory Notes. The Company owes Mr. Frye $892,179 in aggregate original principal and accrued but unpaid interest under five Convertible Notes #1. The Company intends to pay off the portion (if any) of the debts owed to Mr. Frye under his Convertible Notes #1 that Mr. Frye does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Convertible Notes #1 at any time without penalty.

Newton Dorsett.

Senior Secured Bridge Debt. The Company owes Mr. Dorsett $2,593,990 in original principal and accrued but unpaid interest under the Bridge Debt. The Company intends to offer Mr. Dorsett conversion rights in the Conversion Rights Offering with respect to his participation in the Bridge Debt. The Company intends to pay off the portion (if any) of the debt owed to Mr. Frye under the Bridge Debt that Mr. Dorsett does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Bridge Debt at any time without penalty.

Short-Term Promissory Notes. The Company owes Mr. Dorsett $617,753 in principal and accrued but unpaid interest under two Short-Term Notes. The Company intends to offer Mr. Dorsett conversion rights in the Conversion Rights Offering with respect to his Short-Term Notes and to pay off the portion (if any) of such Short-Term Notes that Mr. Dorsett does not elect to convert on or before the Final Exercise Date. Because the Company does not have the right to prepay the Short-Term Notes, any early repayment would be subject to the consent of Mr. Dorsett.

Secured Convertible Promissory Notes. The Company owes Mr. Dorsett $79,505 in original principal and accrued but unpaid interest under one Convertible Note #1. The Company intends to pay off the portion (if any) of the debt owed to Mr. Dorsett under his Convertible Note #1 that Mr. Dorsett does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Convertible Notes #1 at any time without penalty.

Company Debt Owed to Other Principal Stockholders.

The debt the Company owes to other greater than 5% Stockholders is described below.

George Gilman.

Short-Term Promissory Notes. The Company owes the Mary Payne Family Trust $102,958 in principal and accrued but unpaid interest under a Short-Term Note. Mr. Gilman is the Trustee of the Trust. The Company intends to offer the trust conversion rights in the Conversion Rights Offering with respect to its Short-Term Note and to pay off the portion (if any) of such Short-Term Note that the trust does not elect to convert on or before the Final Exercise Date. Because the Company does not have the right to prepay the Short-Term Notes, any early repayment would be subject to the consent of the Mary Payne Family Trust.

Dane Stewart.

Senior Secured Bridge Debt. The Company owes Stewart Investment Partners, Ltd. (“Stewart Investment Partners”) $432,332 in principal and accrued but unpaid interest under the Bridge Debt. Mr. Stewart is the Managing Partner of Stewart Investment Partners. The Company intends to offer Stewart Investment Partners conversion rights in the Conversion Rights Offering with respect to its participation in the Bridge Debt. The Company intends to pay off the portion (if any) of the debt owed to Stewart Investment Partners under the Bridge Debt that Stewart Investment Partners does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Bridge Debt at any time without penalty.

Secured Convertible Promissory Notes. The Company owes Stewart Investment Partners $204,932 in aggregate original principal and accrued but unpaid interest under one Convertible Note #1. The Company intends to pay off the portion (if any) of the debt owed to Stewart Investment Partners under its Convertible Note #1 that Stewart Investment Partners does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Convertible Notes #1 at any time without penalty.

The Company owes Whitewing Investment Partners I, Ltd. (“Whitewing”) $153,699 in principal and accrued but unpaid interest under one Convertible Note #1. Mr. Stewart is the Managing Partner of Whitewing. The Company intends to pay off the portion (if any) of the debt owed to Whitewing under its Convertible Note #1 that Whitewing does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Convertible Note #1 at any time without penalty.

Richard Fallin.

Senior Secured Bridge Debt. The Company owes RFallin Series, LLC (“RFallin”) $432,332 in principal and accrued but unpaid interest under the Bridge Debt. The Company intends to offer RFallin conversion rights in the Conversion Rights Offering with respect to his participation in the Bridge Debt. The Company intends to pay off the portion (if any) of the debt owed to RFallin under the Bridge Debt that RFallin does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Bridge Debt at any time without penalty.

Secured Convertible Promissory Notes. The Company owes Mr. Fallin $1,024,658 in aggregate original principal and accrued but unpaid interest under two Convertible Notes #1. The Company intends to pay off the portion (if any) of the debt owed to Mr. Fallin under his Convertible Notes #1 that Mr. Fallin does not elect to convert on or before the Final Exercise Date. The Company has the right to prepay the Convertible Notes #1 at any time without penalty.

THE CONVERSION RIGHTS OFFERING

The Proposed Acquisition.

The Company has entered into a non-binding letter of intent (as amended from time to time, the “Letter of Intent”) to acquire, either directly or by way of merger or consolidation, 100% of the equity interests of the Target Companies. The expected purchase price for the Target Companies is $53,250,000 (the “Purchase Price”), which is expected to be paid at closing as follows: (i) $31,000,000 in cash (the “Cash Consideration”); (ii) $19,250,000 in equity of the Company (the “Stock Consideration”); and (iii) issuance by the Company of a $3,000,000 promissory note to the sellers (the “Seller Note”). The Purchase Price is subject to customary adjustments based upon the net working capital of the Target Companies as of the closing date. The Company also intends to purchase the warehouse business of an affiliate of the Target Companies at a future date for $2,500,000.

The Purchase Price represents the total consideration payable by the Company in connection with the Proposed Acquisition. Any outstanding warrants, options, or other rights to acquire equity of the Target Companies will be exercised in full or terminated immediately prior to the closing such that in no event will the exercise or non-exercise of any outstanding rights to acquire Target Companies’ securities result in an effective increase of the Purchase Price. In connection with the Stock Consideration in the Proposed Acquisition, the sellers will be granted two board seats on the Company’s board for a total of seven seats. The precise structure of the Proposed Acquisition is subject to completion of due diligence investigations by the Company and the sellers, background checks of current owners and managers, and the appropriate approvals to proceed with the Proposed Acquisition by the board of directors of the Company.

In connection with the Proposed Acquisition, the Company also intends to lease certain of the Target Companies’ properties at current rates for a three- to five-year period, with an option to acquire each property at an agreed upon purchase price during the term.

The closing of the Proposed Acquisition will be subject to the satisfaction of customary closing conditions, which may include, among other things, (i) satisfactory results of business, technical, financial, accounting, legal and tax due diligence of the Company and the sellers; (ii) the negotiation, documentation and execution of definitive acquisition documents acceptable to all parties; (iii) the receipt of any necessary regulatory approvals or clearances and any material consents of third parties required to consummate the Proposed Acquisition; (iv) the absence of any material adverse change affecting the business, financial condition or results of operations of the Target Companies; (v) the debt financing being committed to the Company; (vi) the execution of employment agreements with certain key members of management of the Target Companies to be identified by the parties, with terms and conditions reasonably satisfactory to the parties, and (vii) delivery of audited financial statements of the Target Companies as reasonably requested by the Company.

The definitive acquisition documents for the Proposed Acquisition are expected to contain representations and warranties from the parties customary for transactions of this type and amount of consideration. The sellers will be expected to jointly and severally indemnify the Company and its affiliates and representatives after the closing for claims relating to retained liabilities and any breach of any representation, warranty or covenant up to a cap of 30% of the Purchase Price, except for any losses resulting from fraud, intentional misstatements or breaches of fundamental representations, which shall not be limited. The sellers will also be expected to indemnify the Company in full for all claims made after the closing related to actions that occurred prior to closing of the Proposed Acquisition.

The general terms of the Seller Note to be issued by the Company are 72 months of equal principal and interest payments, with a 6 percent interest rate per annum. The Seller Note will be subordinate to the New Loans and will be guaranteed by all the Company Subsidiaries.

The Company intends to borrow $57,000,000 to pay the Cash Consideration due at the closing of the Proposed Acquisition and to refinance most of the Company’s debt that does not convert to Common Stock pursuant to new or existing conversion rights. The remaining amount of cash will be reserved for working capital and liquidity requirements under the New Loans and for the operations and growth of the combined companies going forward. The New Loans are expected to be structured as a revolving credit facility in an amount up to $25,000,000 and a term loan in an amount up to $32,000,000.

Terms of the Conversion Rights Offering.

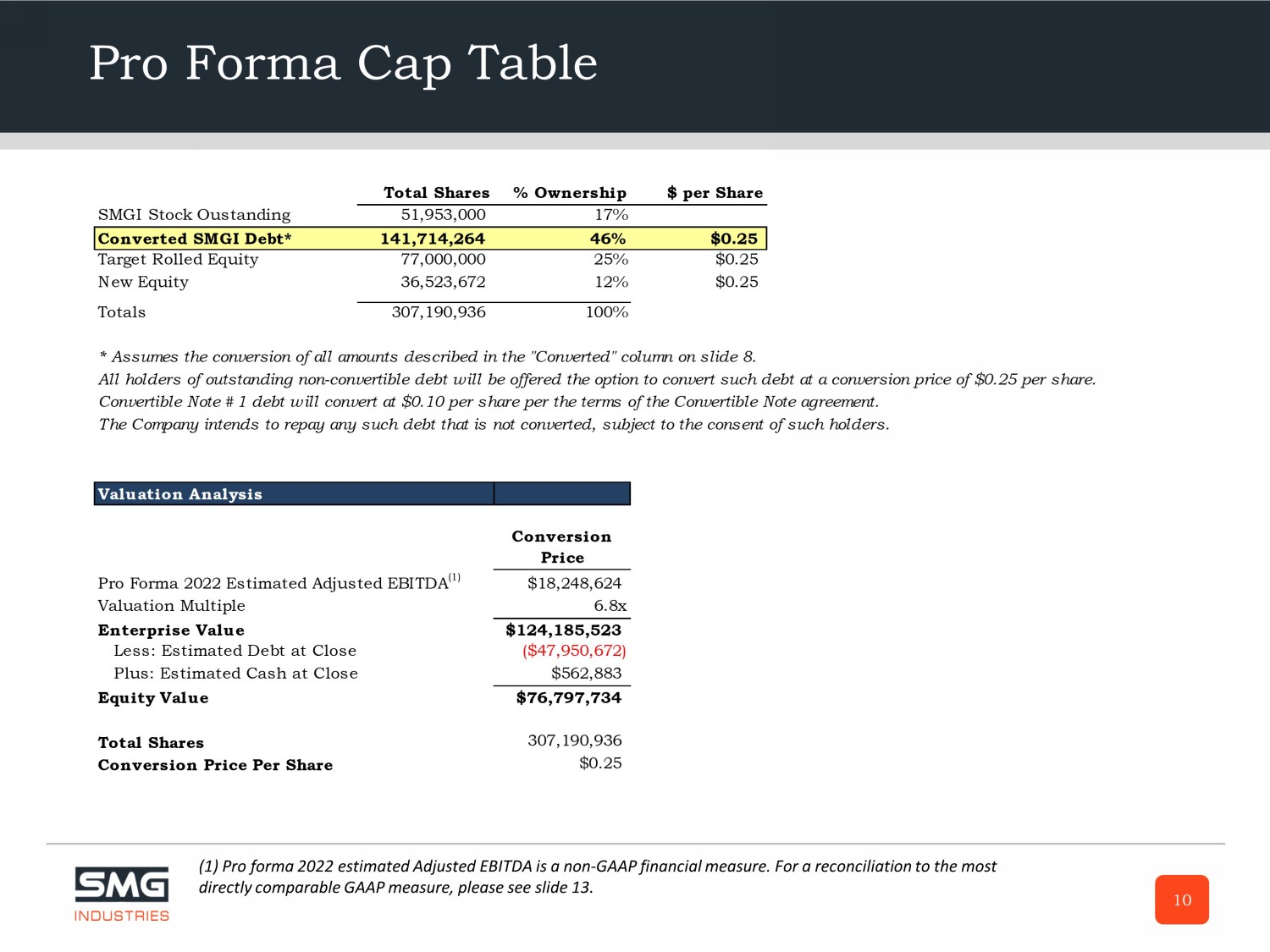

The Board has approved an offering to the holders of certain of the existing non-convertible debt, comprised of the Bridge Debt, the Short-Term Promissory Notes (other than the Cox Short-Term Note) and the Frye Seller Note of rights to convert the amount of principal and interest of their non-convertible debt into shares of Common Stock at a conversion price of $0.25 per share effective as of the Closing (the “Conversion Rights”). As of the Record Date, the aggregate principal and accrued unpaid interest of the foregoing non-convertible debt was $21,443,380, which, if all of it were to convert at $0.25 per share, would convert to a total of 85,773,522 shares of Common Stock.

As part of the Conversion Rights Offering, the Company will notify each recipient of Conversion Rights in writing that, if the recipient does not elect by written notice to the Company to exercise its Conversion Rights in full by not later than 5:00 p.m. Central Time on July 31, 2023 (the “Final Exercise Date”), then the recipient’s remaining Conversion Rights will thereupon expire and be of no further force or effect and, upon the Closing, to the extent permitted by the terms of the Company’s existing debt or upon the consent of the holders of such debt, the Company intends to pay off the outstanding principal and all accrued unpaid interest of the unconverted portion of the recipient’s non-convertible debt that is subject to the Conversion Rights Offering. All shares of Common Stock acquired as a result of the exercise of the Conversion Rights will be fully paid and non-assessable shares of unregistered Common Stock.

Existing Convertible Debt.

The Stretch Debt and the Convertible Notes #1 (collectively, the “Convertible Debt”) are convertible into shares of Common Stock. The principal and accrued unpaid interest of the Stretch Debt are convertible into shares of Common Stock at a price of $0.25 per share. The principal and accrued unpaid interest of the Convertible Notes #1 are convertible into shares of Common Stock at a price of $0.10 per share. As of the Record Date, the aggregate principal and accrued unpaid interest of the foregoing Convertible Debt was $9,808,771, which, if all of it were to convert at $0.25 per share or $0.10 per share (as the case may be), would convert to a total of 88,199,717 shares of Common Stock.

If the Conversion Rights Offering is approved by the Stockholders in the manner described in this Information Statement, the Company will also, separate from but in conjunction with the Conversion Rights Offering, notify each holder of Convertible Debt in writing that the Company intends to pay off his or her Convertible Debt upon the Closing unless prior to payment the holder elects to convert his or her Convertible Debt into shares of Common Stock in accordance with the existing terms of his or her respective Convertible Debt. All shares of Common Stock acquired as a result of the exercise of the existing conversion rights of the Convertible Debt will be fully paid and non-assessable shares of unregistered Common Stock.

End Date.

If the Company does not obtain the New Loans or consummate the Proposed Acquisition by August 31, 2023 (the “End Date”), the Company may (i) deem the exercise by the holders of non-convertible debt of their Conversion Rights to be automatically revoked and such holders restored to their status as holders of the non-convertible debt as of immediately prior to the exercise of their Conversion Rights and (ii) elect not to pay off any of the debt remaining after any conversion.

Dilution.

As described under the caption “Terms of the Conversion Rights Offering” and “End Date” above, the Company intends to issue to holders of certain of the Company’s non-convertible debt the right to elect to convert the principal and accrued unpaid interest of their non-convertible debt into shares of Common Stock at a conversion price of $0.25 per share. Over the course of the last 90 days, the market price of the Common Stock has ranged from $0.122 per share to $0.390 per share. Assuming a market price of less than $0.25 per share on the date of Closing of the Proposed Acquisition, the Company believes that the exercise of the Conversion Rights pursuant to the Conversion Rights Offering and the issuance of additional shares of Common Stock following such exercise will not, in and of itself, result in a dilution of the value of the shares of Common Stock. Instead, the Company believes that the consummation of the Proposed Acquisition will result in an increased valuation of the Company and that such increased valuation is likely to offset any dilution in the value of the Common Stock that might occur if the market price per share should, on the effective date of conversion, exceed the exercise price per share of the conversion.

The Company’s Reasons for the Conversion Rights Offering.

After careful consideration, the Board has determined that the Conversion Rights Offering is in the best interests of the Company and the Stockholders and has approved the Conversion Rights Offering. In reaching this determination, the Board considered a number of factors that it believed supported its decision, including the following:

• The elimination of existing Company debt through the Conversion Rights Offering will facilitate the Company’s consummation of the New Loans and the Proposed Acquisition. The Company is currently highly leveraged, which limits its ability to finance the Proposed Acquisition.

• Management projections indicate the Company may experience solvency issues on a stand-alone basis absent a significant equity capital raise or restructuring such as the Conversion Rights Offering.

• The exercise of Conversion Rights pursuant to the Conversion Rights Offering together with the exercise of existing conversion rights and the obtaining of the New Loans should result in the consolidation of the Company’s outstanding debt.

• The Board believes that the Proposed Acquisition, which the Conversion Rights Offering is intended to facilitate, is in the best interests of the Company and the Stockholders given the competitive position of the Company, the significant, continuing challenges in growing the Company’s business, the nature of the business and the industry in which the Company competes, economic and market conditions, on both a historical and a prospective basis, the strategic objectives of the Company and the risks involved in achieving those objectives.

• The Board expects the Proposed Acquisition to grow the Company’s business by diversifying its business lines to include dry bulk, intermodal and non-hazardous liquid freight shipping, reducing cyclicality and customer concentration, and increasing meaningful cross-selling opportunities.

• Although there can be no assurance, the Board anticipates that combining the Company’s business with that of the Target Companies will enhance the value of the Common Stock.

The Board also considered a variety of risks and other potentially negative factors concerning the Conversion Rights Offering, including the following:

• The Board anticipates that the holders of a substantial amount of the Company’s non-convertible debt that will be offered conversion rights will elect to convert their debt to Common Stock. The Board also anticipates that the holders of a substantial amount of the Company’s convertible debt will also elect to convert their debt to Common Stock. Nonetheless, there can be no assurance as to the amount of convertible and non-convertible debt that their respective holders will elect to convert to Common Stock. Accordingly, the Company may seek to pay off a greater portion of convertible and non-convertible debt than anticipated.

• Any conversion pursuant to the Conversion Rights Offering will, if the market price of the Common Stock on the effective date of the conversion exceeds the price paid for the Common Stock pursuant to the exercise of the Conversion Rights, dilute the current Stockholders, especially the Disinterested Stockholders, none of whom will have the opportunity to acquire additional shares of Common Stock through the exercise of Conversion Rights pursuant to the Conversion Rights Offering or through the exercise of existing conversion rights.

The foregoing discussion of the factors considered by the Board is not intended to be exhaustive, but, rather, includes some of the material factors considered by the Board. In reaching its decision to declare the Conversion Rights Offering advisable and determining that the Conversion Rights Offering is in the best interests of the Company and its Stockholders, and in approving the Conversion Rights Offering, the Board did not quantify or assign any relative weights to the factors considered, and individual directors may have given different weights to different factors. The Board considered all these factors as a whole, including discussions with, and questioning of, our management and financial and legal advisors, and overall considered the factors to be favorable to, and to support, its decision.

Interests of Certain Persons in the Conversion Rights Offering.

The Stockholders should be aware that certain Stockholders, directors, officers and employees have interests in the Conversion Rights Offering that are different from, and in addition to, their interests as Stockholders generally. Of the $21,443,380 of principal and accrued unpaid interest of non-convertible debt to which Conversion Rights will be offered, $19,444,501 of principal and accrued unpaid interest is held by directors, officers and other 5% or greater Stockholders. If all directors, officers and other 5% or greater Stockholders of the Company elect to exercise their respective Conversion Rights pursuant to the Conversion Rights Offering, they will increase their aggregate beneficial ownership of Common Stock from 104,790,384 shares of Common Stock to 182,568,388 shares of Common Stock.

Tax Consequences.

NONE OF THE COMPANY, ANY COMPANY SUBSIDIARY, ANY OF THE TARGET COMPANIES OR ANY OTHER PERSON IS PROVIDING INFORMATION REGARDING THE POTENTIAL TAX CONSEQUENCES OF THE CONVERSION RIGHTS OFFERING OR THE EXERCISE OF ANY CONVERSION RIGHTS. HOLDERS OF COMPANY DEBT TO WHOM CONVERSION RIGHTS MAY BE OFFERED OR WHO MAY BE REQUESTED TO EXERCISE EXISTING CONVERSION RIGHTS ARE STRONGLY URGED TO CONSULT THEIR RESPECTIVE TAX ADVISORS AS TO THE SPECIFIC TAX CONSEQUENCES TO THEM OF THE CONVERSION RIGHTS OFFERING OR THE EXERCISE OR NON-EXERCISE OF ANY CONVERSION RIGHTS, INCLUDING THE APPLICABILITY AND EFFECT OF U.S. FEDERAL, STATE, LOCAL, FOREIGN AND OTHER TAX LAWS IN THEIR PARTICULAR CIRCUMSTANCES.

DEPENDING ON A NUMBER OF FACTORS, THE CONVERSION RIGHTS OFFERING MAY GIVE RISE TO TAXABLE INCOME FOR THE COMPANY. THE AMOUNT OF ANY SUCH TAXABLE INCOME WILL DEPEND IN PART ON THE PRICE OF THE COMPANY’S COMMON STOCK ON THE DATE OF THE CONVERSION.

STOCKHOLDER ACTION BY WRITTEN CONSENT

The Board is using this Information Statement to solicit the written consent of its Stockholders as of the Record Date to the Conversion Rights Offering described in this Information Statement.

Four of the current seven members of the Board have a financial interest in the Conversion Rights Offering because, directly or indirectly, they hold non-convertible debt that will be offered Conversion Rights and, therefore, the opportunity to convert the debt into shares of Common Stock or be paid off prior to maturity. The non-convertible debt of these directors (the “Interested Directors”) does not have such rights. The Conversion Rights Offering is therefore a transaction in which the Interested Directors have a financial interest.

Additionally, the same four directors hold convertible debt and therefore have an interest in the pay-off of their convertible debt prior to its maturity (to the extent they do not elect to convert their convertible debt into shares of Common Stock).

Under Delaware corporate law, an “interested director” transaction is not void or voidable simply because one or more directors or officers has a financial interest in the transaction if one of three conditions are met, including if the material facts as to the director or officer’s relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by vote of the stockholders.

In connection with the Conversion Rights Offering, the Board has determined to seek approval of the Conversion Rights Offering by the written consent of (a) Stockholders that hold a majority of all outstanding shares of Common Stock as of the Record Date, and (b) Disinterested Stockholders that hold a majority of all outstanding shares of Common Stock held by all Disinterested Stockholders as of the Record Date. The Disinterested Stockholders are those Stockholders that, as of the Record Date, (i) did not hold convertible debt, or non-convertible debt that will be offered conversion rights, and (ii) that are neither directors nor officers of the Company.

If you desire to consent to and approve the Conversion Rights Offering, please date and sign the accompanying signature page to the Written Consent in Lieu of a Special Meeting of the Stockholders of SMG Industries Inc., which is attached to this Information Statement as Exhibit D. Please return a PDF of the signed and dated signature page promptly by electronic mail to matt@smgindustries.com not later than July 31, 2023. Our officers, directors, employees, consultants, agents and representatives may solicit written consents in person or by telephone, fax or email, and may also circulate electronic signature requests. We will pay these officers, directors, employees, consultants, agents and representatives no additional compensation for these services. If you do not timely complete and return the signature page or otherwise provide your consent, the effect will be to decline to consent to the Conversion Rights Offering.

EXHIBIT A

INTERESTED DIRECTOR TRANSACTIONS

Section 144 of the Delaware General Corporation Law provides a “safe harbor” for transactions between a corporation and one or more of its directors or officers, or between a corporation and another entity in which a director or officer has a financial interest (“self-interested transactions”). The statute provides that a self-interested transaction is not “void or voidable” solely because of a director or an officer’s interest in the transaction.

The Section 144 safe harbor applies if the self-interested transaction (1) is approved by a majority of fully informed disinterested directors, or (2) is approved in good faith by a vote of fully informed stockholders, or (3) is “fair as to the corporation” at the time it is approved by the board of directors, a committee of the board, or the stockholders.

EXHIBIT B

GENERAL CORPORATION LAW OF THE STATE OF DELAWARE

SECTION 144 – INTERESTED DIRECTORS; QUORUM.

(a) No contract or transaction between a corporation and 1 or more of its directors or officers, or between a corporation and any other corporation, partnership, association, or other organization in which 1 or more of its directors or officers, are directors or officers, or have a financial interest, shall be void or voidable solely for this reason, or solely because the director or officer is present at or participates in the meeting of the board or committee which authorizes the contract or transaction, or solely because any such director’s or officer’s votes are counted for such purpose, if:

(1) The material facts as to the director’s or officer’s relationship or interest and as to the contract or transaction are disclosed or are known to the board of directors or the committee, and the board or committee in good faith authorizes the contract or transaction by the affirmative votes of a majority of the disinterested directors, even though the disinterested directors be less than a quorum; or

(2) The material facts as to the director’s or officer’s relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by vote of the stockholders; or

(3) The contract or transaction is fair as to the corporation as of the time it is authorized, approved or ratified, by the board of directors, a committee or the stockholders.

(b) Common or interested directors may be counted in determining the presence of a quorum at a meeting of the board of directors or of a committee which authorizes the contract or transaction.

EXHIBIT C

DEBT CONVERSION PRESENTATION

(See Attachment)

Debt Conversion Presentation JUNE 08, 2023

Legal Disclaimer Forward - Looking Statements This presentation includes certain estimates, projections and forward - looking statements provided by SMG Industries Inc . , (the “Company”) with respect to the anticipated future performance of the Company . Such estimates, projections, and forward - looking statements reflect various assumptions of management concerning the future performance of the Company, and are subject to significant business, economic, and competitive uncertainties and contingencies, many of which are beyond the control of the Company . Forward - looking statements may be identified by the use of forward - looking terminology such as “should,” “could,” “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intends,” “continue,” or similar terms or variations of those terms or the negative of those terms . All estimates, projections and forward - looking statements are management’s present expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the estimates, projections and forward - looking statements . These estimates, projections and statements appear in a number of places in this presentation and include statements regarding the intent, belief or current expectations of the Company . Estimates, projections and forward - looking statements are merely our current predictions of future events . Investors are cautioned that any such estimates, projections and forward - looking statements are inherently uncertain, are not guaranties of future performance and involve risks and uncertainties . Actual results may differ materially from our predictions . There are a number of factors that could negatively affect our business and the value of our securities, including, but not limited to, fluctuations in the market price of our common stock ; changes in our plans, strategies and intentions ; changes in market valuations associated with our cash flows and operating results ; the impact of significant acquisitions, dispositions and other similar transactions ; our ability to attract and retain key employees ; changes in financial estimates or recommendations by securities analysts ; asset impairments ; decreased liquidity in the capital markets ; and changes in interest rates . Such factors could materially affect our Company’s future operating results and could cause actual events to differ materially from those described in estimates, projections and forward - looking statements relating to our Company . Although we have sought to identify the most significant risks to our business, we cannot predict whether, or to what extent, any of such risks may be realized, nor is there any assurance that we have identified all possible issues that we might face . Accordingly, there can be no assurance that such estimates, projections and forward - looking statements will be realized . The actual results may vary from the anticipated results, and such variations may be material . No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward - looking statements based thereon . In light of these assumptions, risks and uncertainties, the results and events discussed in the estimates, projections and forward - looking statements contained in this presentation might not occur . You are cautioned not to place undue reliance on the estimates, projections and forward - looking statements, which speak only as of the date of this presentation . The Company is not under any obligation, and it expressly disclaims any obligation, to update or alter any estimates, projections or forward - looking statements, whether as a result of new information, future events or otherwise except as may be required by applicable law . The Company urges readers to carefully review and consider the various disclosures the Company makes in its reports filed with the Securities and Exchange Commission that attempt to advise interested parties of the risks, uncertainties and other factors that may affect the Company’s business, including the risk factors included in its Annual Report on Form 10 - K for the year ended December 31 , 2022 under Part I, Item 1 A . “Risk Factors . ” Non - GAAP Information This presentation includes “non - GAAP financial measures” as that term is defined in Regulation G. Further discussion regarding o ur use of non - GAAP financial measures, as well as the most directly comparable GAAP financial measures and information reconciling these no n - G AAP financial measures to our financial results prepared in accordance with GAAP, are included in slide 13 of this presentation. The non - GAAP financial measures should not be considered a substitute for, or superior to, the financial measures prepared in accordance with GAAP. 2

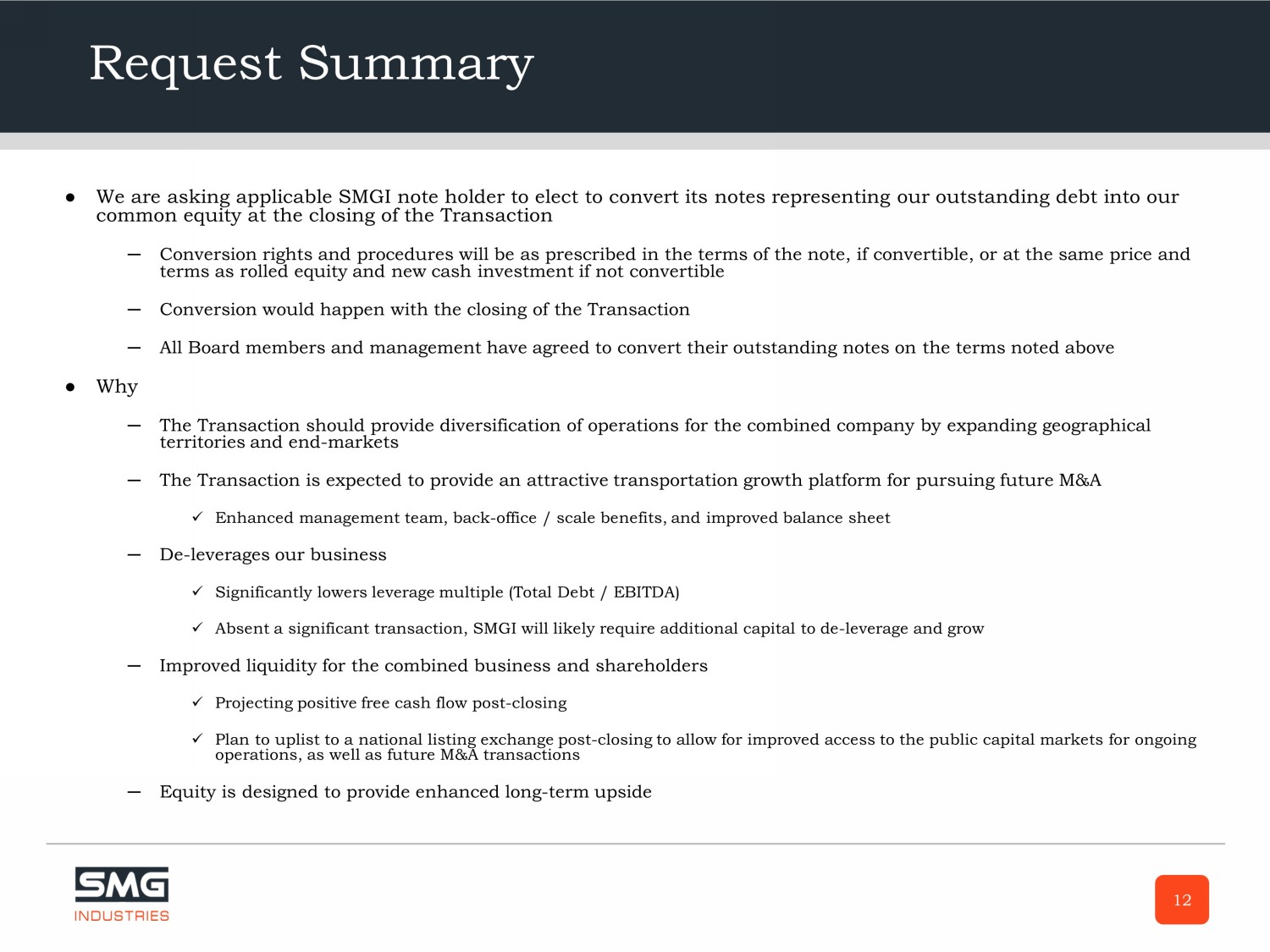

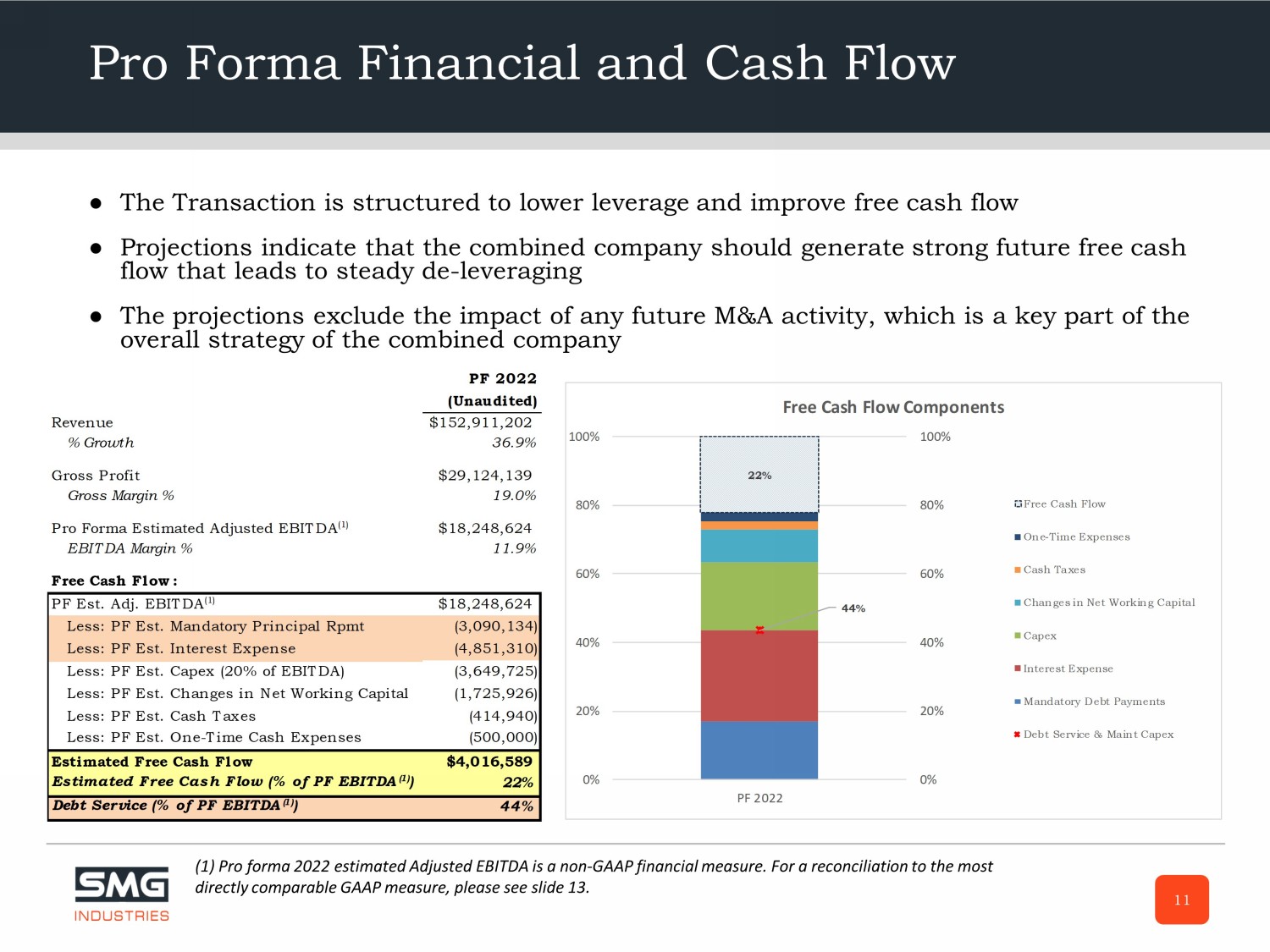

Executive Summary ● SMGI has entered into a non - binding letter of intent (“LOI”) to acquire a diversified transportation business (the “Target”) located in the Northeastern United States (the “Transaction”) ● If consummated, the Transaction is estimated to approximately double our annual revenue, diversify our business operations, improve our balance sheet and add experience and expertise to the leadership team ─ Pro Forma 2022 Revenue of $153 million ─ Pro Forma 2022 estimated Adjusted EBITDA 1 of $18.2 million, including anticipated synergies of $2.5 million ● In order to finance the Transaction, the SMGI Board is requesting that each SMGI note holder elect to convert its notes representing our outstanding debt into our common equity ─ SMGI is currently highly leveraged, which limits our ability to finance the Transaction ─ Equity issued to SMGI note holders upon conversion of their notes is expected to be issued at the same valuation as new cash equity and rollover equity issued to Target 3 (1) Pro forma estimated Adjusted EBITDA is a non - GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, please see slide 13.

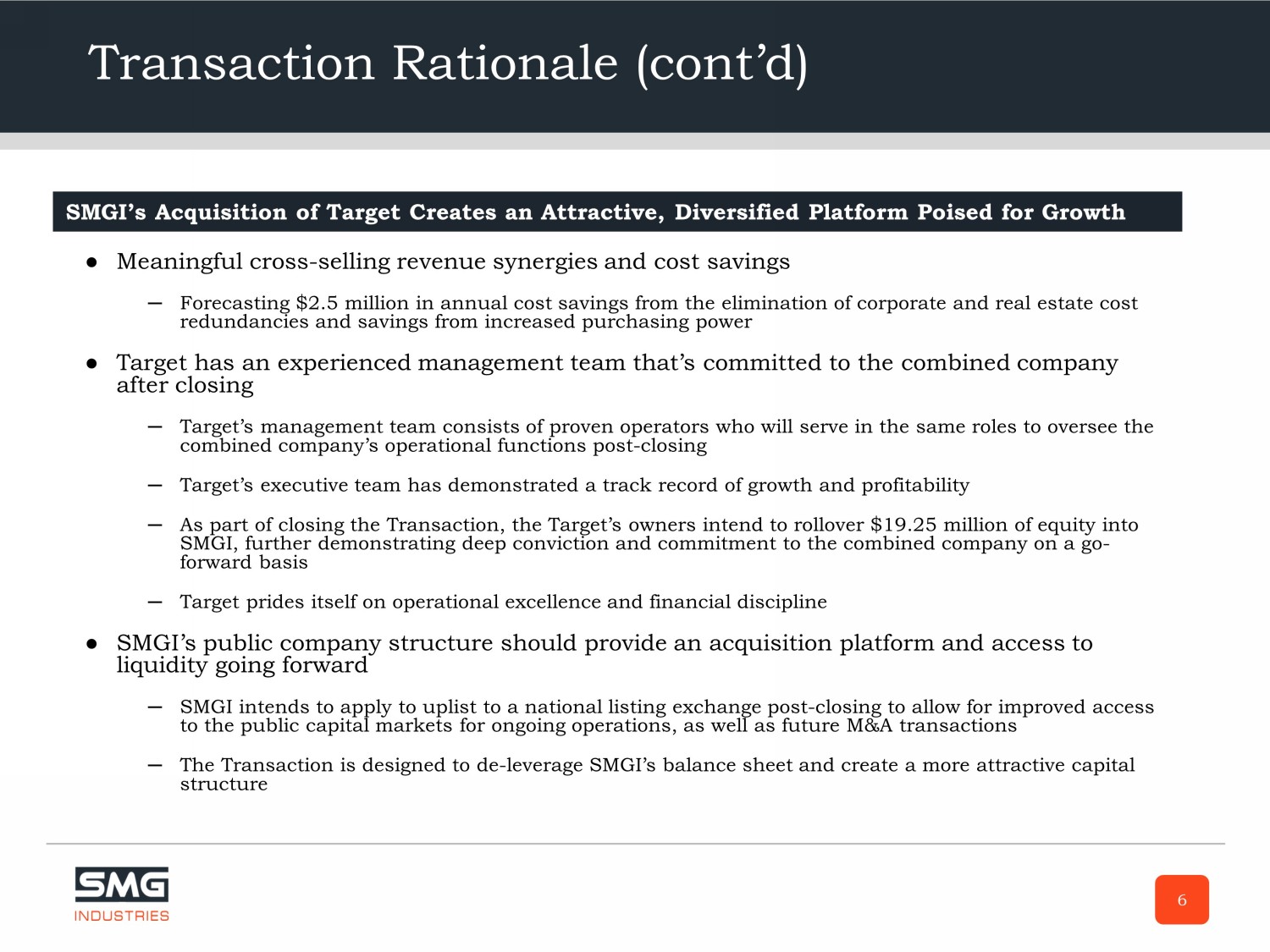

Transaction Overview ● SMGI is in the process of negotiating the Transaction, pursuant to which SMGI will acquire the Target, a leading transportati on logistics provider offering customized transportation solutions to its customers ─ Target has a strong presence in the Mid - Atlantic region and a diversified range of service offerings including domestic transpor tation that encompasses full truckload, dry bulk, non - hazardous liquids, intermodal, LTL, heavy haul, and an “asset - lite” brokerage business . Additionally, Target's integration of international freight forwarding, commercial tank cleaning, warehousing and transloadin g s ervices allows for comprehensive solutions, catering to diverse customer needs. This strategic approach strengthens Target's market position a nd has established a platform for continued success and growth, making it a compelling acquisition opportunity for SMGI ● Under the terms of the LOI, SMGI has negotiated a purchase price to acquire Target for $55.75 million, with $31 million of ca sh due at closing, subject to entering a definitive agreement ─ As part of the Transaction, Target’s sellers would roll $19.25 million of equity into SMGI and would receive a $3.0 million S ubo rdinated Seller Note; additionally, SMGI would agree to pursue the acquisition of Target’s warehousing business for $2.5 million in the futur e ─ The LOI - negotiated purchase price equates to 4.9x Target’s 2022 Adjusted EBITDA¹ of $11.4 million ● The intended pro forma financing structure is expected to be as follows: ─ $25 million Revolving Credit Facility (“Revolver”) with a national lender, ~$17 million available at closing with $12 million fu nded at closing ─ $32 million Senior Secured Term Loan Facility (“Term Loan”) with a national lender, interest only due for the first six month s ● Proceeds from the Revolver and Term Loan will be used to fund the Transaction, refinance a significant portion of SMGI’s exis tin g debt, and pay fees and expenses ─ Pro forma for the Transaction, total funded senior debt leverage ratio will be ~2.6x, based on pro forma 2022 estimated Adjus ted EBITDA 1 of $18.2 million (which includes an estimated $2.5 million of projected cost synergies) ● The Company is seeking to close and fund the Transaction during Summer 2023, subject to entering into definitive acquisition agreements and obtaining required consents 4 (1) Target’s 2022 Adjusted EBITDA and pro forma 2022 estimated Adjusted EBITDA are non - GAAP financial measures. For reconciliations to the most directly comparable GAAP measures, please see slide 13.

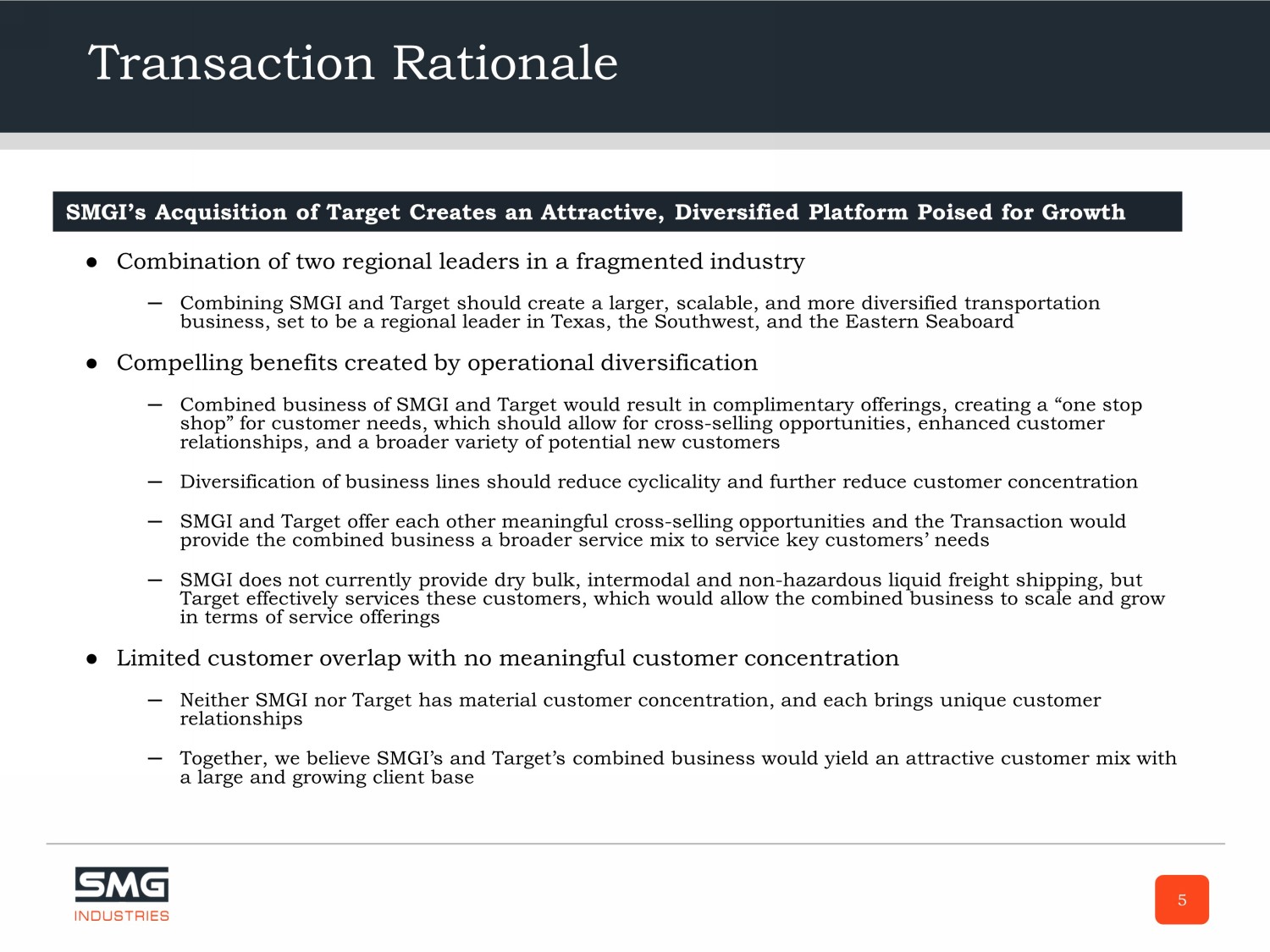

Transaction Rationale ● Combination of two regional leaders in a fragmented industry ─ Combining SMGI and Target should create a larger, scalable, and more diversified transportation business, set to be a regional leader in Texas, the Southwest, and the Eastern Seaboard ● Compelling benefits created by operational diversification ─ Combined business of SMGI and Target would result in complimentary offerings, creating a “one stop shop” for customer needs, which should allow for cross - selling opportunities, enhanced customer relationships, and a broader variety of potential new customers ─ Diversification of business lines should reduce cyclicality and further reduce customer concentration ─ SMGI and Target offer each other meaningful cross - selling opportunities and the Transaction would provide the combined business a broader service mix to service key customers’ needs ─ SMGI does not currently provide dry bulk, intermodal and non - hazardous liquid freight shipping, but Target effectively services these customers, which would allow the combined business to scale and grow in terms of service offerings ● Limited customer overlap with no meaningful customer concentration ─ Neither SMGI nor Target has material customer concentration, and each brings unique customer relationships ─ Together, we believe SMGI’s and Target’s combined business would yield an attractive customer mix with a large and growing client base 5 SMGI’s Acquisition of Target Creates an Attractive, Diversified Platform Poised for Growth