- ASMB Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-3 Filing

Assembly Biosciences (ASMB) S-3Shelf registration

Filed: 26 Nov 14, 12:00am

As filed with the Securities and Exchange Commission on November 26, 2015

Registration Statement No. 333-______

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ASSEMBLY BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 20-8729264 (I.R.S. Employer Identification No.) |

99 Hudson Street, 5th Floor

New York, New York 10013

Telephone: (646) 706-5208

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

RUSSELL H. ELLISON

Chief Executive Officer

Assembly Biosciences, Inc.

99 Hudson Street, 5th Floor

New York, New York 10013

Telephone: (646) 706-5208

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

ALEXANDER M. DONALDSON

Wyrick Robbins Yates & Ponton LLP

4101 Lake Boone Trail, Suite 300

Raleigh, North Carolina 27607

Telephone: (919) 781-4000

Fax (919) 781-4865

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(c) under the Securities Act, check the following box.¨

If this Form is a post-effective amendment filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” (as defined in Rule 12b-2 of the Act) (Check one):

| Large accelerated filer¨ | Accelerated filer¨ |

| Non-accelerated filer¨(Do not check if smaller reporting company) | Smaller reporting companyx |

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered (1) | Proposed maximum aggregate offering price per unit (2) | Proposed maximum aggregate offering price | Amount of registration fee | ||||||||||||

| Common stock, $0.001 par value per share | — | $ | — | $ | — | $ | — | |||||||||

| Preferred stock, $0.001 par value per share | — | — | — | — | ||||||||||||

| Warrants | — | — | — | — | ||||||||||||

| Debt Securities | — | — | — | — | ||||||||||||

| Units | — | — | — | — | ||||||||||||

| Total | — | — | $ | 120,000,000 | $ | 13,944 | (3) | |||||||||

| (1) | There are being registered hereunder such indeterminate number of shares of common stock and preferred stock, such indeterminate principal amount of debt securities, such indeterminate number of warrants to purchase common stock, preferred stock or debt securities, and such indeterminate number of units as shall have an aggregate initial offering price not to exceed $120,000,000, less the aggregate dollar amount of all securities previously issued hereunder. If any debt securities are issued at an original issued discount, then the offering price of such debt securities shall be in such greater principal amount as shall result in an aggregate offering price not to exceed $120,000,000, less the aggregate dollar amount of all securities previously issued hereunder. Any securities registered hereunder may be sold separately or as units with the other securities registered hereunder. The proposed maximum offering price per unit will be determined, from time to time, by the Registrant in connection with the issuance by the Registrant of the securities registered hereunder. The securities registered hereunder also include such indeterminate number of shares of common stock and preferred stock and amount of debt securities as may be issued upon conversion of or exchange for preferred stock or debt securities that provide for conversion or exchange, upon exercise of warrants or pursuant to the antidilution provisions of any of such securities. In addition, pursuant to Rule 416 under the Securities Act, the shares being registered hereunder include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transaction. | |

| (2) | The proposed maximum offering price per unit will be determined from time to time by the Registrant in connection with, and at the time of, the issuance of the securities and is not specified as to each class of security pursuant to General Instruction II.D. of Form S-3, as amended. | |

| (3) | Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended, based on the proposed maximum aggregate offering price of all securities listed. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities or accept an offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated November 26, 2014

Prospectus

$120,000,000 of

Common Stock,

Preferred Stock,

Warrants,

Debt Securities and/or

Units

From time to time, we may offer up to $120,000,000 of any combination of the securities described in this prospectus, either individually or in units,in one or more offerings in amounts, at prices and on the terms that we will determine at the time of offering. We may also offer common stock or preferred stock upon conversion of debt securities, common stock upon conversion of preferred stock, or common stock, preferred stock or debt securities upon the exercise of warrants.

Each time we sell securities, we will provide specific terms of the securities offered in a supplement to this prospectus. The prospectus supplement may also add, update or change information contained in this prospectus. We will specify in any accompanying prospectus supplement the terms of any offering. You should read this prospectus and the applicable prospectus supplement, as well as any documents incorporated by reference in this prospectus and any prospectus supplement, carefully before you invest in any securities.This prospectus may not be used by us to consummate a sale of securities unless accompanied by the applicable prospectus supplement.

We will sell these securities directly to our stockholders or to other purchasers or through agents on our behalf or through underwriters or dealers as designated from time to time. If any agents or underwriters are involved in the sale of any of these securities, the applicable prospectus supplement will provide the names of the agents or underwriters and any applicable fees, commissions or discounts.

Our common stock trades on the NASDAQ Capital Market under the trading symbol “ASMB.” On November 25, 2014, the reported closing price of our common stock was $8.60 per share. We recommend that you obtain current market quotations for our common stock prior to making an investment decision.

As of November 24, 2014, the aggregate market value of our outstanding common stock held by non-affiliates was $69,758,495 based on 10,647,059 shares of our common stock outstanding on October 20, 2014, of which 7,708,121 shares were held by non-affiliates, and a price of $9.05 per share, the closing price for our common stock on October 20, 2014. During the 12 calendar months prior to and including the date of this prospectus, we have sold securities with an aggregate market value of $15,989,639 pursuant to General Instruction I.B.6 of Form S-3.

You should carefully read this prospectus, the prospectus supplement relating to any specific offering of securities and all information incorporated by reference herein and therein.

Investing in our securities involves a high degree of risk. These risks are discussed in this prospectus under “Risk Factors” beginning on page 8 and in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ___ , 201__

TABLE OF CONTENTS

| i |

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process.Under this shelf registration process, we may offer shares of our common stock and preferred stock, various series of debt securities and/or warrants to purchase any of such securities, either individually or in units, in one or more offerings, up to a total dollar amount of $120,000,000.This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will contain specific information about the terms of that offering.

This prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement, including its exhibits. Prospectus supplements may also add, update or change information contained or incorporated by reference in this prospectus. However, no prospectus supplement will fundamentally change the terms that are set forth in this prospectus or offer a security that is not registered and described in this prospectus at the time of its effectiveness. This prospectus, together with the applicable prospectus supplements and the documents incorporated by reference into this prospectus, includes all material information relating to this offering. You should carefully read this prospectus, the applicable prospectus supplement, the information and documents incorporated herein by reference and the additional information under the heading “Where You Can Find More Information” before making an investment decision.

You should rely only on the information we have provided or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained or incorporated by reference in this prospectus. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information we have incorporated herein by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

To the extent there are inconsistencies between any prospectus supplement, this prospectus and any documents incorporated by reference, the document with the most recent date will control.

This prospectus may not be used to consummate sales of our securities, unless it is accompanied by a prospectus supplement.

Unless the context otherwise requires, “Assembly,” the “company,” “we,” “us,” “our” and similar names refer to Assembly Biosciences, Inc.

| 1 |

The following summary is qualified in its entirety by, and should be read together with, the more detailed information and financial statements and related notes thereto appearing elsewhere or incorporated by reference in this prospectus and any prospectus supplement. Before you decide to invest in our securities, you should read the entire prospectus and the prospectus supplement carefully, including the risk factors and the financial statements and related notes included or incorporated by reference in this prospectus and the prospectus supplement.

Business Overview

We are a biopharmaceutical company that aspires to scientific leadership in the field of infectious diseases by:

| · | discovering treatments for patients with Hepatitis B virus, or HBV; and |

| · | addressing diseases associated with the disruption of normal gut flora, such as clostridium difficile associated diarrhea or CDAD. |

We are developing two proprietary platforms to achieve our goals: (i) an HBV-cure platform focused on oral drugs with novel direct-acting mechanisms, and (ii) an orally-delivered microbiome therapeutics platform for treating CDAD, which we refer to as our microbiome program.

The HBV-Cure Platform

HBV is an underappreciated global epidemic with twice as many people infected (over 350 million globally) and a higher mortality and morbidity rate than Hepatitis C and HIV, combined — over 600,000 people die every year from HBV-related causes. Less than 5% are diagnosed and treated today, and there is a low cure rate with current chronic therapies.

The current therapies for HBV, such as the reverse transcriptase inhibitors entecavir or tenofovir, potently suppress virus production (commonly referred to as “viral load”), but they continue to allow for a living virus and production of viral proteins and specifically viral antigens such as HBsAg. Current therapies must therefore be taken chronically, submitting patients to their associated significant and treatment limiting side effects.

By comparison, modulation of key aspects of the viral replication reservoir in other viruses, such as the new therapies for Hepatitis C for instance, has shown to be key for increasing the rates of curing patients. The viral reservoir for HBV is the intra-nuclear covalently closed circular DNA, or cccDNA. We believe that a “functional cure” is possible by developing drugs that target multiple aspects of the viral life cycle, and specifically the HBV viral reservoir.

| 2 |

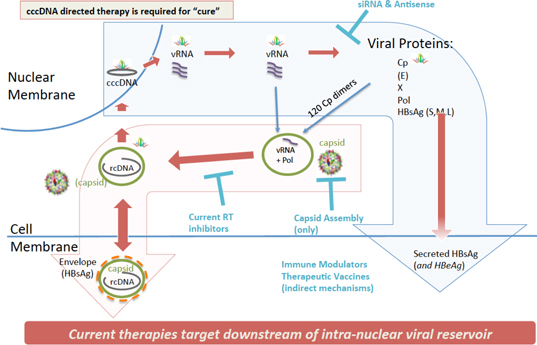

Figure 1 – The HBV life cycle with emphasis on the role of core protein and cccDNA relative to existing other approaches.

Other HBV treatments in development include immunomodulatory approaches, such as the TLR (Toll-like receptors: a class of proteins that play a key role in the innate immune system) programs and therapeutic vaccine programs that rely on the body’s immune system to clear virus; and siRNA (small interfering Ribo Nucleic Acid: a class of double-stranded RNA) approaches that target and rely on the degradation of the viral RNA, reducing RNA-to-protein translation, and also rely on the body’s immune system to potentially clear the virus. While these approaches are differentiated from the current standard of care therapies, they do not directly target the viral reservoir (see Figure 1).

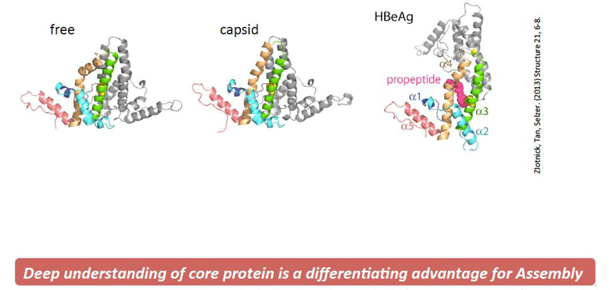

We have discovered a series of new compounds based on the seminal research of our co-founder Dr. Adam Zlotnick focusing on HBV core protein – a unique viral protein that is required for HBV lifecycle, and has no human homologue, meaning the HBV core protein is unique from any human protein. Our molecules, known as Core protein Allosteric Modulators, or CpAMs, are capable of targeting and altering certain key proteins of HBV. The HBV core protein is a pleiotropic protein, or it is a protein that has more than one effect, and it flexes into multiple conformations required for several steps of the HBV lifecycle including interaction with the HBV intra-nuclear reservoir: cccDNA (see Figures 1 and 2).

Figure 2 – HBV core protein is pleiotropic, which allows it to have multiple function in the HBV life cycle, including being required for cccDNA activity.

Modulation of these specific forms of HBV core proteins with our CpAMs has demonstrated preclinical proof of principle. We have shown in multiple cell models that our CpAMs can selectively reduce the production of viral antigens such as HBsAg and HBeAg—viral proteins which reflect the activity of cccDNA— and can reduce viral load. We believe that our CpAMs are the first of this novel class of molecules to show such effects in preclinical models.

We believe the key advantages of our approach will be:

| · | Convenience – we plan to offer a convenient oral pill formulation; |

| · | Combination therapy – we believe our product candidate may be used as either a single agent or in combination with existing therapies; |

| · | Immune response – our product candidate should not require an immune response, but may still benefit from this if reducing viral antigen and pre-genomic RNA supports anti HBV immunity; |

| · | Efficacy – since our CpAMs could target multiple aspects of the viral life cycle they may demonstrate an efficacy advantage over other approaches; and |

| 3 |

| · | Safety – since HBV core protein is a unique viral protein with no human homologue, there could be safety advantages due to a potentially reduced risk of off target activity. |

We are planning to select in mid-2015 a first generation lead molecule for development, and to initiate clinical trials in the first half of 2016. Our CpAM platform offers a multi-generation pipeline and we plan to advance second and third generation HBV-targeted molecules into clinical development rapidly behind the first program.

Our in-licensed intellectual property portfolio includes multiple patents filed in generally two categories: (i) platform patent applications, which include multiple applications filed and others in process that cover mechanisms of action, methods of treatment, and assays among other platform-related claims; and (ii) composition of matter applications for our several chemical series.

The CDAD Microbiome Platform

Our second program is based on a novel coating and encapsulation technology that allows for targeted delivery of complex agents to select regions of the gastrointestinal, or GI, tract.

We are currently focusing our technology on delivering beneficial specificbacteria to treat CDAD. CDAD is a major health problem with more than a five-fold increase in CDAD-associated deaths between 1999 and 2007, and CDAD is the leading cause of death associated with gastroenteritis in the U.S. This translates to an estimated 14,000 Americans that die from causes linked to CDAD each year.

There has been considerable experience reported in the literature of treating CDAD with fecal material transplant, or FMT. In addition, there are preliminary studies using selected bacterial strains and of bacterial spores from processed FMT. These reports have demonstrated a significant and growing precedent of successful cures in patients, and provide an excellent path for potentially curative therapy using a targeted and specific microbiome therapy.

We believe that by providing the benefits found in FMT therapy, in an oral capsule that contains specific bacteria rather than whole or processed feces, clinical adoption could be increased.

Our current research plan includes collaborations with key leaders in the microbiome field, while diligently developing the chemistry, manufacturing, and controls systems for supporting U.S. Food and Drug Administration regulated clinical trials and eventual commercial supply. We anticipate a clinical proof of principle for the delivery technology in the second quarter of 2015. Additionally, we expect to select our specific microbiome strain leads for development in mid-2015 and to initiate clinical trials in early 2016.

Our Strategy

We plan to build a multi-product company, based on our expertise in HBV and microbiome therapeutics, that discovers, develops, and commercializes first-in-class medicines to treat HBV, CDAD, and potentially other viruses and infectious diseases. Key elements of our strategy include:

| · | Aggressively pursuing the development of novel medicines to increase the cure rates in HBV, CDAD, and other infectious diseases of high unmet medical need; |

| · | Maintaining our leadership and competitive advantage in the fields of direct-acting HBV therapies and orally deliverable microbiome therapies for CDAD; |

| · | Continuing to build a multi-product platform for HBV, CDAD and other infectious diseases to generate medicines to increase cure rates; and |

| · | Maintaining a commitment to the advancement of innovative science in drug development. |

Our Guiding Principles

We and our employees are committed to increasing cure rates for patients with serious infections. This commitment drives our efforts for applying cutting edge science toward the development and commercialization of novel approaches to treating HBV and CDAD. We pledge to:

| 4 |

| · | Follow the science and do what is right for patients; |

| · | Maintain a culture of open communication and decision-making based on a deep understanding of our science and an appropriate allocation of resources; |

| · | Leverage strategic relationships with academic and corporate partners where and when appropriate; and |

| · | Execute relentlessly. |

Company History

On July 11, 2014, we merged with Assembly Pharmaceuticals Inc. in a reverse triangular merger with our wholly owned subsidiary, which we refer to as the Assembly Merger. In connection with the Assembly Merger, on July 11, 2014, we changed our name from Ventrus Biosciences, Inc. to Assembly Biosciences, Inc. We were incorporated in Delaware in October 2005 under the name South Island Biosciences, Inc. (which was changed to Ventrus Biosciences, Inc. in April 2007).

Corporate Information

Our executive offices are at 99 Hudson Street in New York, NY, 10013, and our research facility is at 953 Indiana Street, in San Francisco, CA 94103. Our telephone number is (646) 706-5208, and our website address iswww.assemblybio.com. The information contained on our website is not a part of, and should not be construed as being incorporated by reference into, this prospectus supplement.

As used in this prospectus supplement, unless the context otherwise requires, references to “Assembly,” “we,” “us,” “our” and similar references refer to Assembly Biosciences, Inc. and our wholly owned subsidiary Assembly Pharmaceuticals, Inc.

| 5 |

Offerings Under This Prospectus

We may offer shares of our common stock and preferred stock, various series of debt securities and/or warrants to purchase any of such securities, either individually or in units, with a total value of up to $120,000,000 from time to time under this prospectus at prices and on terms to be determined by market conditions at the time of any offering. This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities.

The prospectus supplement also may add, update or change information contained in this prospectus or in documents we have incorporated by reference into this prospectus. However, no prospectus supplement will fundamentally change the terms that are set forth in this prospectus or offer a security that is not registered and described in this prospectus at the time of its effectiveness.

This prospectus may not be used to consummate a sale of any securities unless it is accompanied by a prospectus supplement.

We may sell the securities directly to investors or to or through agents, underwriters or dealers. We, and our agents or underwriters, reserve the right to accept or reject all or part of any proposed purchase of securities. If we offer securities through agents or underwriters, we will include in the applicable prospectus supplement:

| · | the names of those agents or underwriters; |

| · | applicable fees, discounts and commissions to be paid to them; |

| · | details regarding over-allotment options, if any; and |

| · | the net proceeds to us. |

Common Stock

We may issue shares of our common stock from time to time. The holders of common stock are entitled to one vote per share on all matters to be voted upon by stockholders. Subject to preferences that may be applicable to any outstanding preferred stock, the holders of common stock are entitled to receive ratably any dividends that may be declared from time to time by our board of directors out of funds legally available for that purpose. In the event of our liquidation, dissolution or winding up, the holders of common stock are entitled to share ratably in all assets remaining after payment of liabilities, subject to prior distribution rights of any preferred stock then outstanding.

Preferred Stock

We may issue shares of our preferred stock from time to time, in one or more series. Our board of directors will determine the rights, preferences, privileges and restrictions of the preferred stock, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series, without any further vote or action by stockholders. Convertible preferred stock will be convertible into our common stock or exchangeable for our other securities. Conversion may be mandatory or at your option or both and would be at prescribed conversion rates.

If we sell any series of preferred stock under this prospectus and applicable prospectus supplements, we will fix the rights, preferences, privileges and restrictions of the preferred stock of such series in the certificate of designation relating to that series. We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of any certificate of designation that describes the terms of the series of preferred stock we are offering before the issuance of the related series of preferred stock. We urge you to read the applicable prospectus supplement related to the series of preferred stock being offered, as well as the complete certificate of designation that contains the terms of the applicable series of preferred stock.

| 6 |

Warrants

We may issue warrants for the purchase of common stock, preferred stock and/or debt securities in one or more series. We may issue warrants independently or together with common stock, preferred stock and/or debt securities, and the warrants may be attached to or separate from these securities. We will evidence each series of warrants by warrant certificates that we will issue under a separate agreement. We may enter into warrant agreements with a bank or trust company that we select to be our warrant agent. We will indicate the name and address of the warrant agent in the applicable prospectus supplement relating to a particular series of warrants.

In this prospectus, we have summarized certain general features of the warrants. We urge you, however, to read the applicable prospectus supplement related to the particular series of warrants being offered, as well as the warrant agreements and warrant certificates that contain the terms of the warrants. We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of warrant agreement or warrant certificate containing the terms of the warrants we are offering before the issuance of the warrants.

Debt Securities

We may offer debt securities from time to time, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. The senior debt securities will rank equally with any other unsecured and unsubordinated debt. The subordinated debt securities will be subordinate and junior in right of payment, to the extent and in the manner described in the instrument governing the debt, to all of our senior indebtedness. Convertible debt securities will be convertible into or exchangeable for our common stock or our other securities. Conversion may be mandatory or at your option or both and would be at prescribed conversion rates.

With respect to any debt securities that we issue, we will issue such debt securities under an indenture, which we would enter into with the trustee named in the indenture. Any indenture would be qualified under the Trust Indenture Act of 1939.

Units

We may issue units consisting of common stock, preferred stock, debt securities and/or warrants for the purchase of common stock, preferred stock and/or debt securities in one or more series. In this prospectus, we have summarized certain general features of the units. We urge you, however, to read the applicable prospectus supplement related to the series of units being offered, as well as the unit agreements that contain the terms of the units. We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference reports that we file with the SEC, the form of unit agreement and any supplemental agreements that describe the terms of the series of units we are offering before the issuance of the related series of units.

| 7 |

Investing in our common stock involves risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties described below. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent annual report on Form 10-K which is on file with the SEC and is incorporated herein by reference, and which has been and may be amended, supplemented or superseded from time to time by other reports we have filed and may file with the SEC in the future. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. If any of these risks actually occurs, our business, business prospects, financial condition or results of operations could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section above entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to Our Business

We have no approved products and currently are dependent on the success of our HBV and microbiome therapies.

To date, we have no approved product on the market and have generated no product revenues. Our prospects are substantially dependent on our ability to develop and commercialize our HBV and microbiome therapies. Unless and until we receive approval from the U.S. Food and Drug Administration, or FDA, and other regulatory authorities for our product candidates, we cannot sell our product candidates and will not have product revenues. We will have to fund all of our operations and capital expenditures from cash on hand, any licensing fees and any future securities offerings or debt financings.

We have a limited operating history and a history of operating losses, and expect to incur significant additional operating losses.

We were established in October 2005, began active operations in the spring of 2007 and have only a limited operating history. In addition, we have terminated our programs related to our three prior product candidates. Therefore, there is limited historical financial information upon which to base an evaluation of our performance. Our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies in their early stages of operations. We have generated losses since we began operations and, as of September 30, 2014, we had an accumulated deficit of $129.3 million. We expect to incur substantial additional losses over the next several years as we continue to pursue our research, development, preclinical studies and clinical trial activities. The amount of future losses and when, if ever, we will achieve profitability are uncertain. We have no products that have generated any commercial revenue, do not expect to generate revenues from the commercial sale of products unless and until our HBV or microbiome therapies or any other product candidate is approved by the FDA for sale, and we might never generate revenues from the sale of products.

We are not currently profitable and might never become profitable.

We have a history of losses and expect to incur significant operating and capital expenditures and resultant substantial losses and negative operating cash flow for the next several years, and beyond if we do not successfully launch and commercialize our HBV therapy or our microbiome program. We might never achieve or maintain profitability. We anticipate that our expenses will continue to be substantial in the foreseeable future as we:

| · | continue to undertake research and development to identify potential product candidates; |

| · | continue to undertake preclinical studies and clinical trials for our product candidates; and |

| · | seek regulatory approvals for our product candidates. |

As a result, we will need to generate significant revenues in order to achieve and maintain profitability. Our ability to generate revenue and achieve profitability will depend on, among other things:

| · | successful completion of research, preclinical studies and clinical trials for our product candidates; |

| 8 |

| · | obtaining necessary regulatory approvals from the FDA and international regulatory agencies for our product candidates; |

| · | establishing manufacturing, sales, and marketing arrangements with third parties for any approved products; and |

| · | raising sufficient funds to finance our activities, if and when needed. |

We might not succeed at any of these undertakings. If we are unsuccessful at some or all of these undertakings, our business, prospects, and results of operations might be materially adversely affected.

Pre-clinical testing and clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results.

Preclinical studies and clinical testing are expensive, can take many years to complete and their outcome is highly uncertain. Failure can occur at any time during the preclinical study and clinical trial processes due to inadequate performance of a drug candidate or inadequate adherence by patients or investigators to clinical trial protocols. In addition, the results of preclinical studies and early clinical trials of product candidates may not be predictive of the results of later-stage clinical trials. For example, in late June 2012, we reported that our Phase III randomized, double-blind, placebo-controlled clinical trial of iferanserin in patients with hemorrhoidal disease did not meet its endpoints, despite favorable Phase II trial results. We also reported in February 2014 that our second Phase III clinical trial for the treatment of anal fissures diltiazem demonstrated no significant improvement compared to placebo despite favorable results in a prior Phase III trial. These same risks apply to our planned development of our current and any other product candidates.

We are an early stage company and might not be able to commercialize any product candidates.

We are an early stage company and have not demonstrated our ability to perform the functions necessary for the successful commercialization of any product candidates. The successful commercialization of any product candidates will require us to perform a variety of functions, including:

| · | continuing to undertake research and development and preclinical studies and clinical trials; |

| · | participating in regulatory approval processes; |

| · | formulating and manufacturing products; and |

| · | conducting sales, marketing and distribution activities. |

Our development of our product candidates is subject to the risks of failure and delay inherent in the development of new pharmaceutical products and products based on new technologies, including:

| · | delays in product development, preclinical and clinical testing; |

| · | unplanned expenditures in product development, preclinical and clinical testing; |

| · | failure of a product candidate to demonstrate acceptable safety and efficacy; |

| · | failure to receive regulatory approvals; |

| · | emergence of superior or equivalent products; |

| · | inability to manufacture and sell on our own, or through any others, product candidates on a commercial scale or at a financially viable cost; and |

| · | failure to achieve market acceptance. |

| 9 |

Because of these risks, our research and development efforts might not result in any commercially viable products. If we do not successfully complete a significant portion of these development efforts, obtain required regulatory approvals, and have commercial success with any approved products, our business, financial condition and results of operations will be materially harmed.

The results of earlier studies and trials for any of our product candidates might not be predictive of the results in any future studies or trials.

The results of any earlier study or trial for any of our product candidates may not be predictive of the results for any future studies or trials. Further, the results of any study or trial for any of our product candidates may not be as positive as the results for any prior studies or trials, if at all. In addition, unforeseen safety issues could emerge in any future study or trial, which could severely hamper the likelihood of FDA or other regulatory approval of any product candidate. If any of these events were to occur, the development of any product candidate could be significantly delayed and more expensive than anticipated, and could lead us to abandon our development efforts entirely, any of which would have a significant adverse effect on our business.

We may need additional financing to complete the development of any product candidate and fund our activities in the future.

We anticipate that we will incur operating losses for the next several yearsas we continue to develop our HBV therapy and our microbiome program as well as initiate any development of any other product candidate and will require substantial funds during that time to support our operations. We expect that our current resources will provide us with sufficient capital to fund our operations into the second quarter of 2016. However, we might consume our available capital before that time if, for example, we are not efficient in managing our resources or if we encounter unforeseen costs, delays or other issues or if regulatory requirements change. If that happens, we may need additional financing to continue the development of our HBV therapy and our microbiome program. Thereafter, we will need additional capital to fund our operations in the future. However, there is no assurance that we will be successful in raising any necessary additional capital on terms that are acceptable to us, or at all. If such event or other unforeseen circumstances occurred and we were unable to raise capital, we could be forced to discontinue product development, sacrifice attractive business opportunities, cease operations entirely and sell or otherwise transfer all or substantially all of our remaining assets.

We are dependent on a license relationship for each of our HBV therapy and our microbiome program.

Our license agreement with Indiana University Research and Technology Corporation, or IURTC, from whom we have licensed our HBV therapy, requires us to make milestone payments based upon the successful accomplishment of clinical and regulatory milestones related to our HBV therapy. The total amount of all potential future milestone payments at September 30, 2014 is $825,000. We also are obligated to pay IURTC royalty payments based on net sales of the licensed technology, which increase if we sublicense our rights to a non-affiliate third party. We are also obligated to pay diligence maintenance fees ($25,000-$100,000) each year to the extent that the royalty, sublicensing, and milestone payments to IURTC are less than the diligence maintenance fee for that year. Our license with Therabiome, LLC, from whom we have licensed our microbiome program, also requires us to pay regulatory and clinical milestones as well as royalty payments to Therabiome. If we breach any of these obligations, we could lose our rights to our microbiome program. If we fail to comply with similar obligations to any other licensor, it would have the right to terminate the license, in which event we would not be able to commercialize drug candidates or technologies that were covered by the license. Also, the milestone and other payments associated with licenses will make it less profitable for us to develop our drug candidates than if we owned the technology ourselves.

We depend on our collaboration with Adam Zlotnick, the scientific founder of our HBV therapy. If that collaboration is not maintained, we may not be able to capitalize on the market potential of our HBV therapy.

Dr. Adam Zlotnick is the founder of our HBV therapy. We have entered into a three-year consulting agreement with Dr. Zlotnick pursuant to which he serves as the Chairman of our Scientific Advisory Board and provides consulting services as we request. Dr. Zlotnick could refuse to extend the agreement after its three-year term expires or we could terminate the consulting agreement for cause or no cause. Although Dr. Zlotnick assigned to us any rights to intellectual property related to our HBV therapy that arise during the term of the consulting agreement, and while the consulting agreement contains a non-compete during the term of the agreement, the loss of Dr. Zlotnick’s services could materially impair our ability to further the development of our HBV therapy.

| 10 |

Failure to integrate Assembly Pharmaceutical, Inc. into our operations successfully could adversely affect our business.

On July 11, 2014, we effected the Assembly Merger whereby Assembly Pharmaceuticals, Inc. became our wholly owned subsidiary. Our integration of the operations and personnel of Assembly may require significant efforts, including significant amounts of management’s time, and result in additional expenses. Factors that will affect the success of the merger include the strength of our combined technology, our ability to execute our business strategy, our ability to adequately fund research and development and retain key employees, and results of clinical trials, regulatory approvals and reimbursement levels of any approved product. Our failure to successfully manage the Assembly Merger could have a material adverse impact on our business. In addition, we cannot be certain that Assembly Pharmaceuticals’ technology will be successfully developed or, if approved, become profitable or remain so.

Corporate and academic collaborators might take actions to delay, prevent, or undermine the success of our product candidates.

Our operating and financial strategy for the development, preclinical and clinical testing, manufacture, and commercialization of drug candidates heavily depends on collaborating with corporations, academic institutions, licensors, licensees, and other parties. However, there can be no assurance that we will successfully establish these collaborations. In addition, should a collaboration be terminated, replacement collaborators might not be available on attractive terms, or at all. The activities of any collaborator will not be within our control and might not be within our power to influence. There can be no assurance that any collaborator will perform its obligations to our satisfaction or at all, that we will derive any revenue or profits from these collaborations, or that any collaborator will not compete with us. If any collaboration is not successful, we might require substantially greater capital to undertake development and marketing of our proposed products and might not be able to develop and market these products effectively, if at all. In addition, a lack of development and marketing collaborations might lead to significant delays in introducing proposed products into certain markets and/or reduced sales of proposed products in such markets.

We rely on data provided by our collaborators and others that has not been independently verified and could prove to be false, misleading, or incomplete.

We rely on third-party vendors, scientists, and collaborators to provide us with significant data and other information related to our projects, preclinical studies and clinical trials, and our business. If these third parties provide inaccurate, misleading, or incomplete data, our business, prospects, and results of operations could be materially adversely affected.

Preclinical and clinical testing required for our product candidates is expensive and time-consuming, and the outcome is uncertain.

In order to obtain FDA approval to market a new drug product, we must demonstrate safety and effectiveness in humans. To meet these requirements, we must conduct extensive preclinical testing and sufficient adequate and well-controlled clinical trials. Conducting clinical trials is a lengthy, time consuming, and expensive process. The length of time might vary substantially according to the type, complexity, novelty, and intended use of the product candidate, and often can be several years or more per trial. Delays associated with product candidates for which we are directly conducting preclinical studies or clinical trials might cause us to incur additional operating expenses. The commencement and rate of completion of clinical trials might be delayed by many factors, including, for example:

| · | the lack of effectiveness during clinical trials; |

| · | the emergence of unforeseen safety issues; |

| 11 |

| · | inability to manufacture sufficient quantities of qualified materials under current Good Manufacturing Practices, or cGMPs, for use in clinical trials; |

| · | slower than expected rates of patient recruitment; |

| · | failure to recruit a sufficient number of patients; |

| · | modification of clinical trial protocols; |

| · | changes in regulatory requirements for clinical trials; |

| · | delays, suspension, or termination of clinical trials by the institutional review board or ethics committee responsible for overseeing the study at a particular study site; and |

| · | government, institutional review board, ethics committee, or other regulatory delays or clinical holds requiring suspension or termination of the trials. |

The results from preclinical testing and early clinical trials are not necessarily predictive of results obtained in later clinical trials. Accordingly, even if we obtain or have obtained positive results from preclinical studies or early clinical trials, we might not achieve the same success in future clinical trials. For example, positive results were observed in earlier clinical trials of each of our two prior product candidates, but the subsequent clinical trials were not successful. Further, clinical trials might not provide statistically significant data supporting a product candidate’s safety and effectiveness to meet the requisite regulatory approvals.

We have used and intend to continue to rely on one or more contract research organizations, or CROs, to conduct our preclinical studies and clinical trials. We are highly dependent on these CROs to conduct our trials in accordance with the requirements of the FDA and good scientific practice. In the event the CROs fail to perform their duties in such a fashion, we may not obtain regulatory approval for any of our product candidates.

The failure of preclinical studies and clinical trials to demonstrate safety and effectiveness for the desired indications could harm the development of that product candidate and other product candidates. This failure could cause us to abandon a product candidate and could delay development of other product candidates. Any delay in, or termination of, our preclinical studies or clinical trials would delay the filing of our New Drug Applications, or NDAs, with the FDA and, ultimately, our ability to commercialize our product candidates and generate product revenues. Any change in, or termination of, our clinical trials could materially harm our business, financial condition, and results of operation.

Unforeseen safety issues could hinder the development of our product candidates and their adoption, if approved.

Safety issues could arise during development of our product candidates, which might delay testing or prevent further development entirely. We have not yet tested our HBV therapy or our microbiome therapy and safety issues could arise during that planned testing or testing of any other product candidates. If a product is approved, any limitation on use that might be necessary could hinder its adoption in the marketplace. In addition, if any product is approved, it could be used against any instructions that we publish that limit its use, which could subject us to litigation.

We lack suitable facilities for certain preclinical and clinical testing and expect to rely on third parties to conduct some of our research and preclinical testing and our clinical trials and those third parties may not perform satisfactorily, including failing to meet deadlines for the completion of such research, testing or trials.

We do not have sufficient facilities to conduct all of our anticipated preclinical and clinical testing. As a result, we expect to contract with third parties to conduct most or all preclinical and clinical testing required for regulatory approval for our product candidates. We currently plan to outsource all clinical testing to third parties and are reliant on the services of these third parties to conduct studies on our behalf. If we are unable to continue with or retain third parties for these purposes on acceptable terms, we may be unable to successfully develop our product candidates. In addition, any failures by third parties to adequately perform their responsibilities may delay the submission of our product candidates for regulatory approval, which would impair our financial condition and business prospects.

| 12 |

Our reliance on these third parties for research and development activities also reduces our control over these activities but will not relieve us of our responsibilities. For example, we are responsible for ensuring that each of our studies is conducted in accordance with the applicable protocol, legal, regulatory and scientific requirements and standards, and our reliance on third parties does not relieve us of our regulatory responsibilities. Furthermore, these third parties may also have relationships with other entities, some of which may be our competitors. In addition, these third parties are not our employees, and except for remedies available to us under our agreements with such third parties, we cannot control whether or not they devote sufficient time and resources to our clinical, nonclinical and preclinical programs. If these third parties do not successfully carry out their contractual duties or obligations or meet expected deadlines, if they need to be replaced or if the quality or accuracy of the clinical data they obtain is compromised due to the failure to adhere to our clinical protocols, regulatory requirements or for other reasons, our research, preclinical studies or clinical trials may be extended, delayed or terminated and we may not be able to obtain, or may be delayed in obtaining, regulatory approvals for our product candidates. As a result, our results of operations and business prospects would be harmed, our costs could increase and our ability to generate revenues could be delayed.

We will rely exclusively on third parties to formulate and manufacture our product candidates.

We do not have and do not intend to establish our own manufacturing facilities. Consequently, we lack the physical plant to formulate and manufacture our own product candidates. If any product candidate we might develop or acquire in the future receives FDA approval, we will rely on one or more third-party contractors to manufacture our products. If, for any reason, we become unable to rely on any future source to manufacture our product candidates, either for clinical trials or, at some future date, for commercial quantities, then we would need to identify and contract with additional or replacement third-party manufacturers to manufacture compounds for preclinical, clinical and commercial purposes. We might not be successful in identifying additional or replacement third-party manufacturers, or in negotiating acceptable terms with any that we do identify. If we are unable to secure and maintain third-party manufacturing capacity, the development and sales of our products and our financial performance might be materially affected.

In addition, before any of our collaborators can begin to commercially manufacture our product candidates, each manufacturing facility and process is subject to regulatory review. Manufacturing of drugs for clinical and commercial purposes must comply with the FDA’s cGMPs, and applicable non-U.S. regulatory requirements. The cGMP requirements govern quality control and documentation policies and procedures. Complying with cGMP and non-U.S. regulatory requirements will require that we expend time, money, and effort in production, recordkeeping, and quality control to assure that the product meets applicable specifications and other requirements. Any contracted manufacturing facility must also pass a pre-approval inspection prior to FDA approval. Failure to pass a pre-approval inspection might significantly delay FDA approval of our product candidates. If any of our future collaborators fails to comply with these requirements, it would be subject to possible regulatory action which could limit the jurisdictions in which we are permitted to sell our products, if approved. As a result, our business, financial condition, and results of operations might be materially harmed.

Our reliance on third-party manufacturers exposes us to the following risks:

| · | We might be unable to identify manufacturers for commercial supply on acceptable terms or at all because the number of potential manufacturers is limited and the FDA must approve any replacement contractor. This approval would generally require compliance inspections. In addition, a new manufacturer would have to be educated in, or develop substantially equivalent processes for, production of our products after receipt of FDA approval, if any. |

| · | Our third-party manufacturers might be unable to formulate and manufacture our product candidates in the volume and of the quality required to meet our clinical and, if approved, commercial needs. |

| · | Our contract manufacturers might not perform as agreed or might not remain in the contract manufacturing business for the time required to supply our clinical trials or to successfully produce, store and distribute our products. |

| 13 |

| · | One or more of our contract manufacturers could be foreign, which increases the risk of shipping delays and adds the risk of import restrictions. |

| · | Drug manufacturers are subject to ongoing periodic unannounced inspection by the FDA and corresponding state agencies to ensure strict compliance with cGMP and other government regulations and corresponding foreign requirements. We would not have complete control over third-party manufacturers’ compliance with these regulations and requirements. |

| · | If any third-party manufacturer makes improvements in the manufacturing process for our product candidates, we might not own, or might have to share, the intellectual property rights to the innovation with our licensors. |

| · | We might compete with other companies for access to these manufacturers’ facilities and might be subject to manufacturing delays if the manufacturers give other clients higher priority than us. |

Each of these risks could delay our development efforts, preclinical studies and clinical trials or the approval, if any, of our product candidates by the FDA or the commercialization of our product candidates and could result in higher costs or deprive us of potential product revenues. As a result, our business, financial condition, and results of operations might be materially harmed.

If we cannot compete successfully for market share against other drug companies, we might not achieve sufficient product revenues and our business will suffer.

If our product candidates receive FDA approval, they will compete with a number of existing and future drugs and therapies developed, manufactured and marketed by others. Existing or future competing drugs might provide greater therapeutic convenience or clinical or other benefits for a specific indication than our product candidates, or might offer comparable performance at a lower cost. If our product candidates fail to capture and maintain market share, we might not achieve sufficient product revenues and our business will suffer.

We might compete against fully integrated pharmaceutical companies and smaller companies that are collaborating with larger pharmaceutical companies, academic institutions, government agencies and other public and private research organizations. Many of these competitors, either alone or together with their collaborative partners, operate larger research and development programs or have substantially greater financial resources than we do, as well as significantly greater experience in:

| · | developing drugs; |

| · | undertaking preclinical testing and human clinical trials; |

| · | obtaining FDA and other regulatory approvals of drugs; |

| · | formulating and manufacturing drugs; and |

| · | launching, marketing and selling drugs. |

We might not obtain the same resources and experience as our competitors. If we are unable to perform these tasks effectively and efficiently, our results of operations might be materially adversely affected.

Developments by competitors might render our product candidates or technologies obsolete or non-competitive.

The pharmaceutical and biotechnology industries are intensely competitive. In addition, the clinical and commercial landscape for HBV and CDAD is rapidly changing; we expect new data from commercial and clinical-stage products to continue to emerge. We will compete with organizations that have existing treatments and that are or will be developing treatments for the indications that our product candidates target. If our competitors develop effective treatments for HBV, CDAD or any other indication or field we might pursue, and successfully commercialize those treatments, our business and prospects might be materially harmed, due to intense competition in these markets.

| 14 |

If we are not able to develop collaborative marketing relationships with licensees or partners, or create an effective internal sales, marketing, and distribution capability, we might be unable to market our products successfully.

To market our product candidates, if approved, we will have to establish our own marketing and sales force or out-license our product candidates to, or collaborate with, larger firms with experience in marketing and selling pharmaceutical products. There can be no assurance that we will be able to successfully establish our own marketing capabilities or establish marketing, sales, or distribution relationships with third parties; that such relationships, if established, will be successful; or that we will be successful in gaining market acceptance for our product candidates. To the extent that we enter into any marketing, sales, or distribution arrangements with third parties, our product revenues will be lower than if we marketed and sold our products directly, and any revenues we receive will depend upon the efforts of such third parties. If we are unable to establish such third-party sales and marketing relationships, or choose not to do so, we will have to establish our own in-house capabilities. We, as a company, have no experience in marketing or selling pharmaceutical products and currently have no sales, marketing, or distribution infrastructure. To market any of our products directly, we would need to develop a marketing, sales, and distribution force that both has technical expertise and the ability to support a distribution capability. To establish our own marketing, sales, and distribution capacity would significantly increase our costs, and require substantial additional capital. In addition, there is intense competition for proficient sales and marketing personnel, and we might not be able to attract individuals who have the qualifications necessary to market, sell, and distribute our products. There can be no assurance that we will be able to establish internal marketing, sales, or distribution capabilities.

Physicians and patients might not accept and use our drugs.

Even if the FDA approves one of our product candidates, physicians and patients might not accept and use it. Acceptance and use of our products will depend upon a number of factors, including:

| · | perceptions by members of the health care community, including physicians, about the safety and effectiveness of our product; |

| · | cost-effectiveness of our product relative to competing products or therapies; |

| · | availability of reimbursement for our product from government or other healthcare payors; and |

| · | effective marketing and distribution efforts by us and our licensees and distributors, if any. |

If our current product candidates are approved, we expect sales to generate substantially all of our revenues for the foreseeable future, and as a result, the failure of these products to find market acceptance would harm our business and would require us to seek additional financing.

Our ability to generate product revenues will be diminished if our products sell for inadequate prices or patients are unable to obtain adequate levels of reimbursement.

Our ability to commercialize our product candidates, if approved, alone or with collaborators, will depend in part on the extent to which reimbursement will be available from:

| · | government and health administration authorities; |

| · | private health maintenance organizations and health insurers; and |

| · | other healthcare payors. |

Significant uncertainty exists as to the reimbursement status of newly approved healthcare products. Healthcare payors, including Medicare, are challenging the prices charged for medical products and services. Government and other healthcare payors increasingly attempt to contain healthcare costs by limiting both coverage and the level of reimbursement for drugs. Even if our product candidates are approved by the FDA, insurance coverage might not be available, and reimbursement levels might be inadequate, to cover our products. If government and other healthcare payors do not provide adequate coverage and reimbursement levels for our products, once approved, market acceptance of such products could be reduced.

| 15 |

Proposals to modify the current health care system in the U.S. to improve access to health care and control its costs are continually being considered by the federal and state governments. In March 2010, the U.S. Congress passed landmark healthcare reform legislation, of which the coverage and reimbursement provisions went into effect in late 2013. We cannot predict what impact on federal reimbursement policies and regulatory compliance landscape this legislation will have in general or on our business specifically. We expect continued judicial and legislative review and assessment of this legislation and possibly alternative health care reform proposals. We cannot predict judicial results or whether new proposals will be made or adopted, when they may be adopted or what impact they may have on us if they are adopted.

Health administration authorities in countries other than the U.S. may not provide reimbursement for our product candidates at rates sufficient for us to achieve profitability, or at all. Like the U.S., these countries could adopt health care reform proposals and could materially alter their government-sponsored health care programs by reducing reimbursement rates.

Any reduction in reimbursement rates under Medicare or private insurers or foreign health care programs could negatively affect the pricing of our product candidates. If we are not able to charge a sufficient amount for our products, then our margins and our profitability will be adversely affected.

If we lose key management or scientific personnel, cannot recruit qualified employees, directors, officers, or other significant personnel or experience increases in our compensation costs, our business might materially suffer.

We are highly dependent on the services of our Chairman and Chief Executive Officer, Dr. Russell H. Ellison, our President and Chief Operating Officer, Derek Small, our Chief Medical Officer and Vice President of Research and Development, Dr. Uri Lopatin, our Chief Scientific Officer, Dr. Lee D. Arnold, and our Chief Financial Officer, David J. Barrett. Our employment agreements with Dr. Ellison, Mr. Small, Dr. Lopatin, Dr. Arnold and Mr. Barrett do not ensure their retention. This is also true for our other management team members, both present and future.

Furthermore, our future success also depends, in part, on our ability to identify, hire, and retain additional management team members as our operations grow. We expect to experience intense competition for qualified personnel and might be unable to attract and retain the personnel necessary for the development of our business. Finally, we do not currently maintain, nor do we intend to obtain in the future, “key man” life insurance that would compensate us in the event of the death or disability of any of the members of our management team.

If we cannot enforce non-compete and confidentiality provisions applicable to our employees and consultants, our business might materially suffer.

We include a non-compete provision in any employment agreement we enter into with an employee, including those for Messrs. Small and Barrett and Drs. Ellison and Arnold, that runs during the term of the agreement and for a period of time after termination, depending on the individual.

We include a confidentiality provision in any employment or consulting agreement we enter into with an employee or a consultant. The confidentiality provision runs during the term of the agreement and thereafter without limit.

For future employees with whom we do not enter into an employment agreement, we will enter into a confidentiality agreement with the same provisions described above.

To be able to enforce these non-compete and confidentiality provisions we would need to know of any breach and have sufficient funds to enforce the provisions. We cannot assure you that we would know of or be able to afford enforcement of any breach. In addition, such provisions are subject to state law and interpretation by courts, which could limit the scope and duration of these provisions. Any limitation on or non-enforcement of these non-compete and confidentiality provisions could have an adverse effect on our business.

| 16 |

If we are unable to hire additional qualified personnel, our ability to grow our business might be harmed.

At October 31, 2014, we had 18 employees, 10 consultants and multiple contract research organizations with whom we have contracted. We will need to hire or contract with additional qualified personnel with expertise in clinical research and testing, government regulation, formulation and manufacturing and sales and marketing to commercialize our HBV therapy and our microbiome program or any other product candidate we may seek to develop. We compete for qualified individuals with numerous biopharmaceutical companies, universities and other research institutions. Competition for these individuals is intense, and we cannot be certain that our search for such personnel will be successful. Attracting and retaining qualified personnel will be critical to our success.

We might not successfully manage our growth.

Our success will depend upon the expansion of our operations and the effective management of our growth, which will place a significant strain on our current and future management and other administrative and operational resources. To manage this growth, we must expand our facilities, augment our operational, financial and management systems and hire and train additional qualified personnel. If we are unable to manage our growth effectively, our business would be harmed.

We might seek to develop our business through acquisitions of or investment in new or complementary businesses, products or technologies, and the failure to manage these acquisitions or investments, or the failure to integrate them with our existing business, could have a material adverse effect on us.

We might consider opportunities to acquire or invest in other technologies, products and businesses that might enhance our capabilities or complement our current product candidates. Potential and completed acquisitions and strategic investments involve numerous risks, including potential problems or issues associated with the following:

| · | assimilating the purchased technologies, products or business operations; |

| · | maintaining uniform standards, procedures, controls and policies; |

| · | unanticipated costs associated with the acquisition or investment; |

| · | diversion of our management’s attention from our preexisting business; |

| · | maintaining or obtaining the necessary regulatory approvals or complying with regulatory standards; and |

| · | adverse effects on existing business operations. |

We have no current commitments with respect to any acquisition or investment in other technologies or businesses. We do not know if we will identify suitable acquisitions, whether we will be able to successfully complete any acquisitions, or whether we will be able to successfully integrate any acquired product, technology or business into our business or retain key personnel, suppliers or collaborators.

Our ability to successfully develop our business through acquisitions would depend on our ability to identify, negotiate, complete and integrate suitable target businesses or technologies and obtain any necessary financing. These efforts could be expensive and time consuming and might disrupt our ongoing operations. If we are unable to efficiently integrate any acquired business, technology or product into our business, our business and financial condition might be adversely affected.

| 17 |

Risks Related to Our Regulatory and Legal Environment

We are subject to extensive and costly government regulation.

Product candidates employing our technology are subject to extensive and rigorous domestic government regulation including regulation by the FDA, the Centers for Medicare and Medicaid Services, other divisions of the U.S. Department of Health and Human Services, the U.S. Department of Justice, state and local governments, and their respective foreign equivalents. The FDA regulates the research, development, preclinical and clinical testing, manufacture, safety, effectiveness, record-keeping, reporting, labeling, storage, approval, advertising, promotion, sale, distribution, import, and export of pharmaceutical products. The FDA regulates small molecule chemical entities, whether administered orally, topically or by injection, as drugs, subject to an NDA, under the Federal Food, Drug, and Cosmetic Act. If products employing our technologies are marketed abroad, they will also be subject to extensive regulation by foreign governments, whether or not they have obtained FDA approval for a given product and its uses. Such foreign regulation might be equally or more demanding than corresponding U.S. regulation.

Government regulation substantially increases the cost and risk of researching, developing, manufacturing, and selling our product candidates. The regulatory review and approval process, which includes preclinical testing and clinical trials of each product candidate, is lengthy, expensive, and uncertain. We or our collaborators must obtain and maintain regulatory authorization to conduct clinical trials and approval for each product we intend to market, and the manufacturing facilities used for the products must be inspected and meet legal requirements. Securing regulatory approval requires submitting extensive preclinical and clinical data and other supporting information for each proposed therapeutic indication in order to establish the product’s safety and efficacy for each intended use. The development and approval process might take many years, requires substantial resources, and might never lead to the approval of a product.

Even if we are able to obtain regulatory approval for a particular product, the approval might limit the intended medical uses for the product, limit our ability to promote, sell, and distribute the product, require that we conduct costly post-marketing surveillance, and/or require that we conduct ongoing post-marketing studies. Material changes to an approved product, such as, for example, manufacturing changes or revised labeling, might require further regulatory review and approval. Once obtained, any approvals might be withdrawn, including, for example, if there is a later discovery of previously unknown problems with the product, such as a previously unknown safety issue.

If we, our collaborators, or our contract manufacturers fail to comply with applicable regulatory requirements at any stage during the regulatory process, such noncompliance could result in, among other things, delays in the approval of applications or supplements to approved applications; refusal of a regulatory authority, including the FDA, to review pending market approval applications or supplements to approved applications; untitled letters or warning letters; fines; import and export restrictions; product recalls or seizures; injunctions; total or partial suspension of production; civil penalties; withdrawals of previously approved marketing applications or licenses; recommendations by the FDA or other regulatory authorities against governmental contracts; and/or criminal prosecutions.

We might not obtain the necessary U.S. or worldwide regulatory approvals to commercialize any product candidate.