Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2014

Or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File Number 001-34470

Echo Global Logistics, Inc.

(Exact name of the registrant as specified in its charter)

Delaware | | 20-5001120 |

(State or other jurisdiction of incorporation or

organization) | | (I.R.S. employer identification no.) |

600 West Chicago Avenue, Suite 725 | | |

Chicago, Illinois | | 60654 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (800) 354-7993

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.0001 per share | | The Nasdaq Global Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (section 229.405 of this Chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | | Accelerated filer x |

| | |

Non-accelerated filer o | | Smaller reporting company o |

(Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the common equity held by non-affiliates of the registrant as of June 30, 2014, the last business day of the registrant’s most recent completed second quarter, was $408,561,871 (based upon closing price of these shares on the Nasdaq Global Market).

The number of shares of the registrant’s common stock outstanding as of the close of business on February 25, 2015 was 23,825,869.

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K of Echo Global Logistics, Inc. (the “Company”) for the year ended December 31, 2014, originally filed on February 26, 2015 (the “Original Filing”). The Company is filing the Amendment solely for the purpose of setting forth the information required by Part III of Form 10-K. Except as expressly set forth herein, this Amendment does not reflect events occurring after the date of the Original Filing or modify or update any of the other disclosures contained therein in any way. Accordingly, this Amendment should be read in conjunction with the Original Filing and the Company’s other filings with the Securities and Exchange Commission. This Amendment consists solely of the preceding cover page, this explanatory note, Part III (Items 10 through 14), the signature page, and the certifications required to be filed as exhibits to this Amendment.

1

Table of Contents

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Directors and Executive Officers

The names of our current directors and executive officers and their ages, positions, biographies and outside directorships are set forth below. Also included for our directors is information regarding their specific experience, qualifications, attributes and skills that led to the conclusion that each director should serve on our Board.

Name | | Age | | Position |

Douglas R. Waggoner | | 56 | | Chief Executive Officer and Director |

David B. Menzel | | 53 | | President and Chief Operating Officer |

Kyle L. Sauers | | 43 | | Chief Financial Officer |

Evan Schumacher | | 45 | | Chief Commercial Officer |

Samuel K. Skinner(1)(2)(3) | | 77 | | Chairman of the Board |

Bradley A. Keywell (2)(3) | | 45 | | Director |

Matthew Ferguson(1)(2) | | 48 | | Director |

David Habiger (1)(2) | | 46 | | Director |

Nelda J. Connors (1)(3) | | 49 | | Director |

(1) Member of our Audit Committee.

(2) Member of our Compensation Committee.

(3) Member of our Nominating and Corporate Governance Committee.

Douglas R. Waggoner has served as our Chief Executive Officer since December 2006 and on our Board since February 2008. Mr. Waggoner will serve as our Chief Executive Officer until December 31, 2016, unless such term is otherwise terminated or renewed, pursuant to the terms of his employment agreement. Prior to joining Echo, Mr. Waggoner founded SelecTrans, LLC, a freight management software provider based in Chicago, Illinois. From April 2004 to December 2005, Mr. Waggoner served as the Chief Executive Officer of USF Bestway, and from January 2002 to April 2004, he served as the Senior Vice President of Strategic Marketing for USF Corporation. Mr. Waggoner served as the President and Chief Operating Officer of Daylight Transport from April 1999 to January 2002, Executive Vice President from October 1998 to April 1999, and Chief Information Officer from January 1998 to October 1998. From 1986 to 1998, Mr. Waggoner held a variety of positions in sales, operations, marketing and engineering at Yellow Transportation before eventually leaving the company as the Vice President of Customer Service. Mr. Waggoner holds a bachelor’s degree in Economics from San Diego State University. Mr. Waggoner provides the Board significant transportation industry-specific operations management and leadership experience.

David B. Menzel has served as our President since July 2014 and as our Chief Operating Officer since October 2013 and will continue to serve in such capacities until December 31, 2016, unless such term is otherwise terminated or renewed, pursuant to the terms of his employment agreement. From April 2008 to September 2013, Mr. Menzel served as our Chief Financial Officer. From May 2005 to March 2008, Mr. Menzel was the Chief Financial and Operating Officer of G2 SwitchWorks Corp., a travel technology company. From 2003 to 2005, Mr. Menzel served as a managing director of Parson Consulting, a management consulting firm. Mr. Menzel served as the Chief Executive Officer of YesMail, Inc. from 2000 to 2003, and as the Senior Vice President and Chief Financial Officer from 1999 to 2000. Mr. Menzel was also the Chief Financial Officer of Campbell Software from 1994 to 1999, and worked in the Audit and Financial Consulting Practice of Arthur Anderson LLP from 1985 to 1994. Mr. Menzel holds a bachelor’s degree in Accounting and a Masters of Accountancy from Florida State University.

Kyle L. Sauers has served as our Chief Financial Officer since October 2013 and will continue to serve in such capacity until December 31, 2016 unless such term is otherwise terminated or renewed, pursuant to the terms of his employment agreement. Mr. Sauers joined the company in 2011 as our Senior Vice President of Finance and Controller. Prior to Echo, Mr. Sauers was the General Manager of Varian Medical Systems’ Security & Inspection Products Division, a result of Varian’s acquisition of Bio-Imaging Research (“BIR”) where he had served on the board of directors and as Chief Financial Officer since 2005. BIR was a leading supplier of cargo screening systems and software. Prior to BIR, Mr. Sauers spent eight years at Sphere Communications, a leading VoIP software technology company, most recently as Chief Financial Officer. Before Sphere, Mr. Sauers served in various financial management positions at APAC Customer Services, a provider of outsourced customer care and acquisition services. Mr. Sauers began his career as part of the Audit and Business Advisory Practice at Arthur Andersen,

2

Table of Contents

where he served entrepreneurial and middle market companies. Mr. Sauers graduated from the University of Illinois with a B.S. Degree in Accounting and is a Certified Public Accountant.

Evan Schumacher has served as our Chief Commercial Officer since October 2013 and will continue to serve in such capacity until December 31, 2016, unless such term is otherwise terminated or renewed, pursuant to the terms of his employment agreement. Mr. Schumacher joined the Company in March 2013 with the acquisition of Open Mile, Inc. and served as Senior Vice President Truckload National Accounts. From October 2006 to October 2009, Mr. Schumacher served as Chief Executive Officer of Going.com, a social media website that was acquired by AOL in 2009. In October 2009, Mr. Schumacher founded Open Mile, Inc. and served as Chief Executive Officer until it was acquired by Echo in March 2013. Mr. Schumacher holds a bachelor’s degree from Northeastern University and earned his Master’s in Business Administration from Northwestern University’s Kellogg School of Management.

Samuel K. Skinner first joined our Board in September 2006 and has served as our non-executive Chairman of the Board since February 2007. Since May 2004, Mr. Skinner has been of counsel at the law firm Greenberg Traurig, LLP where he is the Chair of the Chicago Governmental Affairs Practice. Mr. Skinner served as Chairman, President and Chief Executive Officer of US Freightways Corporation from July 2000 to May 2003, and from 1993 to 1998 he served as President of Commonwealth Edison Company and its holding company Unicom Corporation. During his time at US Freightways, US Freightways was one of the largest transportation and logistics companies in the country until its merger with YRC. Mr. Skinner served as the Chief of Staff to President George H.W. Bush from December 1991 to August 1992, and from 1989 to 1991, he served as the Secretary of Transportation. In 1975, he was appointed by President Gerald R. Ford as the United States Attorney for the Northern District of Illinois. Mr. Skinner is currently a director of Navigant Consulting, Inc., Express Scripts, Inc., Virgin America and the Chicago Board of Options Exchange (CBOE) Inc. Mr. Skinner holds a Bachelor of Science degree from the University of Illinois and a Juris Doctor from DePaul University College of Law. Mr. Skinner brings to the Board extensive leadership experience and transportation and logistics industry experience in both the public and private sectors, operations management skills and experience with corporate governance and regulatory matters, having served as the chief executive officer of a large public company and a director of several public companies.

Bradley A. Keywell is a co-founder of the Company and has served on our Board since February 2005. Mr. Keywell is also a co-founder of Groupon, Inc. and has served on its board of directors since December 2006. In 2008, Mr. Keywell co-founded Lightbank LLC, a private investment firm specializing in information technology companies, and has served as a manager of Lightbank since that time. In April 2006, Mr. Keywell co-founded MediaBank, LLC, an electronic exchange and database that automates the procurement and administration of advertising media, and has served as a director or manager of Mediabank since that time. In 2014, Mr. Keywell co-founded Uptake Technologies LLC, an information technology company, and has served as Chief Executive Officer since that time. Mr. Keywell also serves as a trustee of Equity Residential, a real estate investment trust. Mr. Keywell serves on the boards of trustees of the Zell-Lurie Entrepreneurship Institute at the University of Michigan, the NorthShore University HealthSystem Foundation, and the Polsky Center of Entrepreneurship at the University of Chicago Booth School of Business. Mr. Keywell is the Chairman of the Illinois Innovation Council. Mr. Keywell is also the founder and Chairman of Chicago Ideas Week and the Connect to the Future Foundation. Mr. Keywell is an Adjunct Professor at the University of Chicago Booth School of Business. Mr. Keywell holds a bachelor’s degree from the University of Michigan and a Juris Doctor degree from the University of Michigan Law School. Mr. Keywell brings to the Board an in-depth knowledge and understanding of the information technology sector as well as public company director experience.

Matthew Ferguson has served on our Board since February 2010. Mr. Ferguson has served as the Chief Executive Officer of CareerBuilder.com, an online recruiting service, since 2004, and as its Chief Operating Officer and Senior Vice President from 2000 to 2004. Mr. Ferguson is a partner in Woodington Management, LLC, a real estate management company. Mr. Ferguson serves on the board of directors of Capella Education Company, a publicly traded for-profit postsecondary education company. He is also Chairman of the Board of Snehta, a small business platform. He received a Master’s in Business Administration from the University of Chicago, a Juris Doctor degree from Northwestern University and a bachelor’s degree from Indiana University. Mr. Ferguson brings to the Board extensive leadership experience, operations management skills and experience with corporate governance and regulatory matters, having served as chief executive officer of a large global company and its partnership with several publicly-held entities.

David Habiger has served on our Board since December 2012. From June 2011 to July 2012, Mr. Habiger served as the Chief Executive Officer of NDS Group Ltd. until it was acquired by Cisco Systems. Mr. Habiger served in various roles at Sonic Solutions, a digital media software company, from February 1993 to February 2011, most recently as President and Chief Executive Officer from September 2005 to February 2011. Mr. Habiger is also a director of Control4, DTS, Enova, Immersion, RealD and Textura. Mr. Habiger received his bachelor’s degree from St. Norbert College and his Master’s in Business Administration from the University of Chicago. He is a member of the National Association of Corporate Directors as well as the Center for Corporate Innovation. Mr. Habiger brings to the Board extensive leadership and management experience, having served as the chief executive officer of a public company, as well as public company board experience.

3

Table of Contents

Nelda J. Connors has served on our Board since April 2013. Ms. Connors is the founder, Chairwoman and Chief Executive Officer of Pine Grove Holdings, LLC, an advisory services and investment firm. She served as President and Chief Executive Officer of Atkore International Inc. from December 2010 until June 2011. Atkore, formerly the Electrical and Metal Products division of Tyco International, became privately held in December 2010, and Ms. Connors served as President of this Tyco division from April 2008. Prior to joining Tyco, she served as Vice President at Eaton Corporation from August 2002 to March 2008 where she held several positions in operations, continuous improvement and general management. Prior to joining Eaton, Ms. Connors was employed in a number of executive and management capacities in the automotive industry. Ms. Connors serves on the board of directors of Boston Scientific Corporation, the Federal Reserve Bank of Chicago, Blount International, Inc. and Vesuvius plc, and as a trustee for the Museum of Contemporary Arts in Chicago. Ms. Connors holds both bachelor’s and master’s degrees in mechanical engineering from the University of Dayton. Ms. Connors brings to the Board broad experience in the areas of operations and financial management and business strategy.

Family Relationships

There are no family relationships among any of the directors or executive officers of the Company.

Committees of the Board of Directors

The Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees operates under a written charter adopted by the Board.

Audit Committee. The Audit Committee currently consists of Messrs. Skinner, Ferguson and Habiger and Ms. Connors. Mr. Habiger serves as the chairman of our Audit Committee. The Audit Committee is composed of independent non-employee directors and is responsible for, among other things, reviewing and recommending to the Board internal accounting and financial controls and accounting principles and auditing practices to be employed in the preparation and review of our financial statements. In addition, the Audit Committee has the authority to engage public accountants to audit our annual financial statements and determine the scope of the audit to be undertaken by such accountants. Messrs. Skinner and Ferguson are our Audit Committee financial experts in 2014 under the SEC rule implementing Section 407 of the Sarbanes-Oxley Act of 2002.

Compensation Committee. The Compensation Committee currently consists of Messrs. Ferguson, Skinner, Keywell and Habiger. Mr. Ferguson serves as chairman of our Compensation Committee and will continue to serve as chairman if re-elected to the Board. The Compensation Committee is composed of independent non-employee directors and is responsible for, among other things, reviewing and approving compensation for our Chief Executive Officer and our other executive officers. Additionally, the Compensation Committee reviews and recommends to our Chief Executive Officer and the Board policies, practices and procedures relating to the compensation of managerial employees and the establishment and administration of certain employee benefit plans for managerial employees. The Compensation Committee has the authority to administer the Amended and Restated Echo Global Logistics, Inc. 2008 Stock Incentive Plan (our “2008 Plan”), and advise and consult with our officers regarding managerial personnel policies. The Compensation Committee continued to engage Aon Hewitt, a compensation consultant, in 2014 to review and make recommendations regarding our executive and director compensation program. See “Item 11. Executive Compensation—Compensation Discussion and Analysis” for a discussion of the Company’s processes and procedures for considering and determining executive and director compensation. In accordance with the requirements of Regulation S-K, the Company has determined that no conflict of interest has arisen with respect to the work of Aon Hewitt as compensation consultant to the Compensation Committee.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently consists of Messrs. Skinner and Keywell and Ms. Connors. Mr. Skinner serves as the chairman of our Nominating and Corporate Governance Committee and will continue to serve as chairman if re-elected to the Board. The Nominating and Corporate Governance Committee is composed of independent non-employee directors and is responsible for, among other things, assisting the Board with its responsibilities regarding:

· the identification of individuals qualified to become directors;

· the selection of the director nominees for the next annual meeting of stockholders; and

· the selection of director candidates to fill any vacancies on the Board.

In evaluating and determining whether to nominate a candidate for a position on the Company’s Board, the Nominating and Corporate Governance Committee will consider the candidate’s professional ethics and values, relevant management experience and a commitment to enhancing stockholder value. In evaluating candidates for nomination, the Nominating and Corporate Governance Committee utilizes a variety of methods. The Company does not have a formal policy with regard to the

4

Table of Contents

consideration of diversity in identifying candidates, but the Nominating and Corporate Governance Committee strives to nominate candidates with a variety of complementary skills so that, as a group, the Board will possess the appropriate level of talent, skills and expertise to oversee the Company’s businesses. The Company regularly assesses the size of the Board, whether any vacancies are expected due to retirement or otherwise, and the need for particular expertise on the Board. Candidates may come to the attention of the Nominating and Corporate Governance Committee from current Board members, stockholders, professional search firms, officers or other persons. The Nominating and Corporate Governance Committee will review all candidates in the same manner regardless of the source of recommendation.

Nominations to the Board of Directors

There have been no material changes to the procedures by which our stockholders may recommend nominees to our Board from those procedures set forth in our Amended and Restated By-Laws. The Nominating and Corporate Governance Committee will consider stockholder recommendations of candidates when the recommendations are properly submitted. Any stockholder recommendations which are submitted under the criteria summarized above should include the candidate’s name and qualifications for Board membership and should be addressed to Kyle L. Sauers, Corporate Secretary, Echo Global Logistics, Inc., 600 West Chicago Avenue, Suite 725, Chicago, Illinois 60654. For purposes of potential nominees to be considered at an annual stockholders’ meeting, the Corporate Secretary must receive this information no earlier than 120 days prior to the anniversary of the annual stockholder meeting for the prior year, and no later than 90 days prior to such anniversary. The notice must set forth the candidate’s name, age, business address, residence address, principal occupation or employment, the number of shares beneficially owned by the candidate and information that would be required to solicit a proxy under federal securities law. In addition, the notice must include the stockholder’s name, address and the number of shares beneficially owned (and the period they have been held).

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires our directors, executive officers and holders of more than 10% of our common stock to file with the SEC reports regarding their ownership and changes in ownership of our common stock. They are also required to provide us with copies of any forms they file.

Based solely on our review of the reports furnished to us, we believe that during the last fiscal year, all reports filed by our directors and executive officers under Section 16(a) were made timely, other than a Form 4 for Mr. Sauers filed on January 15, 2014 and a Form 4 for Peter Rogers filed on March 26, 2015.

Code of Ethics

We have adopted a code of ethics, which is posted in the Investor section on our website at http://www.echo.com. We intend to include on our website any amendments to, or waivers from, a provision of the code of ethics that applies to our principal executive officer, principal financial officer, or controller that relates to any element of the code of ethics definition contained in Item 406(b) of SEC Regulation S-K.

Item 11. Executive Compensation.

Compensation Discussion and Analysis

Overview

This compensation discussion describes the material elements of compensation awarded to, earned by, or paid to each of our named executive officers. This compensation discussion focuses on the information contained in the following tables and related footnotes for primarily 2014.

The principal elements of our executive compensation program are base salary, annual cash incentives, long-term equity incentives generally in the form of restricted stock and (beginning in 2013) performance shares, other benefits and perquisites, post-termination severance and acceleration of stock options, restricted stock and performance share vesting for certain named executive officers upon termination and/or a change in control. Our other benefits and perquisites consist of life and health insurance benefits and a qualified 401(k) savings plan and include reimbursement for certain medical insurance and other payments. Our philosophy is to position the aggregate of these elements at a level that is commensurate with our size and sustained performance

In 2014, the Company reached several financial milestones. Revenue for the year ended December 31, 2014 was $1,173.4 million compared to $884.2 million for the year ended December 31, 2013, representing a 32.7% increase. For the year ended December 31, 2014, the Company achieved Company Earnings Before Interest, Depreciation and Amortization (“EBITDA”) of $41.4 million compared to EBITDA of $33.8 million for the year ended December 31, 2013, representing a

5

Table of Contents

22.5% increase. In arriving at the 2014 EBITDA used to compute the non-equity incentive pay of our named executive officers, the Compensation Committee removed certain items it did not deem as routine operating costs, as described below. In 2014, the Company achieved $45.1 million in adjusted EBITDA (as defined in “-Annual Cash Incentives” below), representing a 33.9% increase from 2013. In addition to the financial growth, the Company also acquired and successfully integrated three companies in 2014. As a result of the 2014 performance of the Company, our named executive officers, Douglas R. Waggoner, Kyle L. Sauers, David B. Menzel and Evan Schumacher earned non-equity incentive plan compensation of $1,182,188, $463,125, $712,500 and $337,500, respectively. For further discussion, see “—Annual Cash Incentives” below.

Advisory Vote on Executive Compensation

At our 2011 annual meeting, in a non-binding vote, a majority of our stockholders indicated a desire to vote on executive compensation once every three years. In accordance with the voting results, we intend to provide stockholders with an opportunity to cast an advisory vote to approve our executive compensation every three years until the next required advisory vote on the frequency of future advisory votes on executive compensation, which will occur at our 2017 annual meeting. Further, in light of the stockholder approval of our executive compensation (by over 96% of shares represented at the 2014 annual meeting), the Compensation Committee did not make changes to our program based on the results of the stockholder advisory vote but will continue to monitor and consider the results of future votes. Our next stockholder advisory vote on executive compensation will be held at our annual meeting in 2017.

We encourage stockholders to review this Compensation Discussion and Analysis, the compensation tables and the related narrative disclosures which outline the objectives of and the philosophy behind our compensation program.

Compensation Program Objectives and Philosophy

In General. The objectives of our compensation programs are to:

· attract, motivate and retain talented and dedicated executive officers,

· provide our executive officers with both cash and equity incentives to further our interests and those of our stockholders, and

· provide employees with long-term incentives so we can retain them and provide stability during periods of rapid growth.

Generally, the compensation of our executive officers is composed of base salary, annual cash incentives and equity awards in the form of restricted stock awards and (beginning in 2013) performance shares. In setting base salaries, the Compensation Committee generally reviewed the individual contributions of the particular executive. For 2014, annual incentive compensation was based in part on individual performance as evaluated by the Compensation Committee and in part on the Company’s progress toward achieving a specified revenue and EBITDA target. For 2014, the revenue target was $1,060 million and the adjusted EBITDA target was $39.1 million. Actual revenue was $1,173 million and adjusted EBITDA achievement was $45.1 million. For 2015, annual incentive compensation will be based on individual objectives for our executive officers, the Company’s revenue and adjusted EBITDA, and stock performance under our Annual Incentive Plan. In addition, restricted stock and performance shares are granted to provide the opportunity for long-term compensation based upon the performance of our common stock and our relative total shareholder return over time.

Competitive Market. We define our competitive market for executive talent and investment capital to be the transportation and technology services industries. The Compensation Committee engaged Aon Hewitt, a nationally recognized and reputable executive compensation consulting firm, to present various compensation benchmarks to the Compensation Committee in preparation for executive compensation decisions. The report included the compensation elements of salary, incentive compensation, and equity compensation, both separately and combined. The report considered general industry trends and proxy data from Midwest-based asset and non-asset based transportation and logistics companies and business process outsourcing companies. The report utilized the following peer group in its analysis:

· Advent Software (ADVS)

· CH Robinson Worldwide (CHRW)

· Forward Air Corp (FWRD)

· Hub Group Inc (HUBG)

· Hunt (JB) Transportation Services (JBHT)

· Informatica Corp (INFA)

· Innerworkings (INWK)

· JDA Software Group (JDAS)

· Landstar System Inc. (LSTR)

· Manhattan Associates Inc (MANH)

· Pegasystems (PEGA)

6

Table of Contents

The consulting firm provided the report data and explained the data and reports to the Committee. The data was used to determine the market reference points of total compensation for our chief executive officer, chief financial officer, and other executive officers, for consideration when determining their total cash and total direct compensation. No specific percentile of the market data was targeted when making this determination. This report was used in making 2012, 2013 and 2014 compensation decisions.

Compensation Process. For each of our named executive officers, the Compensation Committee will review and approve all elements of compensation taking into consideration recommendations from our Chief Executive Officer (for compensation other than his own).

Elements of Compensation Program

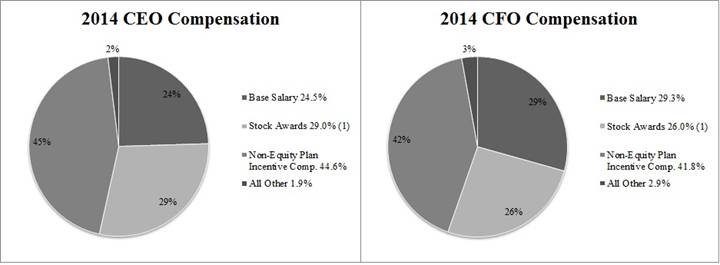

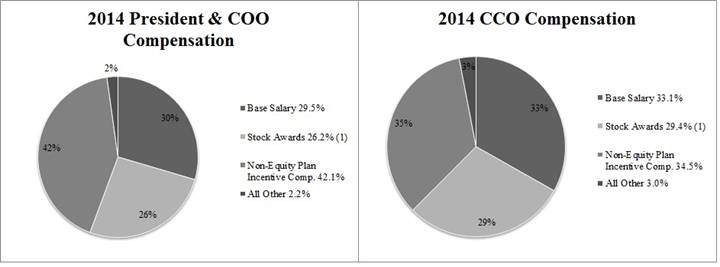

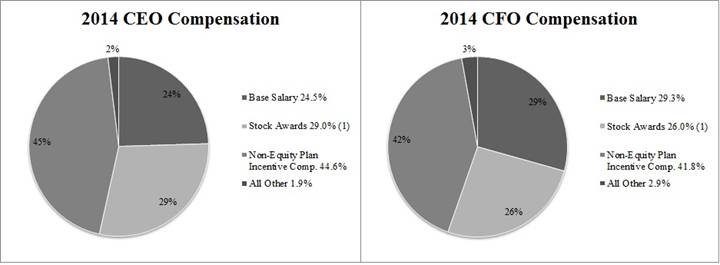

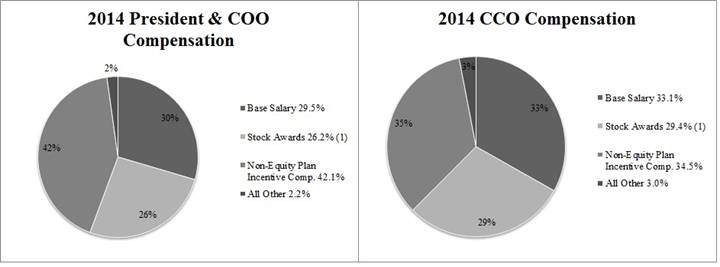

The principal elements of our executive compensation program are base salary, annual performance-based cash incentives, long-term equity incentives generally in the form of restricted stock and (beginning in 2013) performance shares, and other benefits and perquisites. Below is a percentage breakdown by element of the compensation for named executive officers followed by a detailed discussion of each element:

7

Table of Contents

(1) Consists of a combination of restricted stock awards and performance shares, with each component representing 50% of the total number of shares granted to each executive.

Base Salaries

In General. We provide the opportunity for our named executive officers and other executives to earn a competitive annual base salary. A minimum base salary is provided for each named executive officer in their employment agreements. The Compensation Committee reviews base salaries annually and adjusts base salaries in accordance with its compensation philosophy. The Compensation Committee strives to set executive officer base salaries at levels competitive with those provided to executives with similar responsibilities in businesses comparable to ours. We engaged in a formal benchmarking study in 2012, which was used for 2012, 2013 and 2014 executive compensation decisions. No specific percentile of the market data from the study was targeted when making compensation decisions. In determining base salaries of our executive officers, the Compensation Committee considers the results of this study as well as the performance of each executive, the nature of his or her responsibilities and the Company’s general compensation practices. Mr. Waggoner recommended to the compensation committee the base salaries of the executive officers, excluding himself, in 2014. This recommendation included an adjustment during 2014 to Mr. Menzel’s base salary as a result of his promotion to President and Chief Operating Officer and an increase in responsibilities. It also included an increase to Mr. Sauers’ and Mr. Schumacher’s base salaries as a result of increased responsibilities with the Company’s growth and expansion. Except as noted, the table below shows our named executive officers’ base salary increases since 2013:

Name and Principal Position | | 2013 | | 2014 | | Percent

Increase | | 2015 | | Percent

Increase | |

| | | | | | | | | | | |

Douglas R. Waggoner Chief Executive Officer | | 650,000 | | 650,000 | | — | % | 700,000 | | 8 | % |

| | | | | | | | | | | |

Kyle L. Sauers Chief Financial Officer (1) | | 325,000 | | 325,000 | | — | % | 395,000 | | 22 | % |

| | | | | | | | | | | |

David B. Menzel President & Chief Operating Officer (2) | | 500,000 | | 500,000 | | — | % | 525,000 | | 5 | % |

| | | | | | | | | | | |

Evan Schumacher Chief Commercial Officer (3) | | 325,000 | | 325,000 | | — | % | 350,000 | | 8 | % |

(1) Mr. Sauers’ base salary for 2013 is listed. However, Mr. Sauers was appointed as the Company’s Chief Financial Officer on October 7, 2013.

(2) Mr. Menzel’s base salary for 2013 for the office of Chief Operating Officer is listed. Mr. Menzel was appointed as the Company’s Chief Operating Officer on October 7, 2013. He previously held the position of Chief Financial Officer. In July of 2014, Mr. Menzel was promoted to President and Chief Operating Officer.

(3) Mr. Schumacher’s base salary for 2013 is listed. However, Mr. Schumacher was appointed as the Company’s Chief Commercial Officer on October 7, 2013.

Annual Cash Incentives

Determination of Awards. We provide the opportunity for our named executive officers and other executives to earn an annual cash incentive award. In 2014, the targeted annual cash incentive awards were 75% of base salary for Mr. Waggoner, 60% of base salary for Mr. Sauers, 60% of base salary for Mr. Menzel and 46% of base salary for Mr. Schumacher. The

8

Table of Contents

Compensation Committee set these targets based on the compensation benchmarks presented in the peer group study as well as executive tenure, experience and performance expectations. The bonuses were to be earned based on a combination of individual and Company performance, with the individual portion representing the following percentages of the total bonus opportunities: Mr. Waggoner—15%; Messrs. Sauers and Menzel—25%; and Mr. Schumacher—50%. The maximum percentage that may be earned with respect to the individual component is 250% of target and the maximum percentage that may be earned with respect to the Company performance component is 250% of target. Actual performance achieved in 2014 was 200% of target for each named executive officer’s individual component and 250% of target for the Company performance component. As a result, the bonus awards for 2014 ranged between 225% to 243% of the target bonus opportunities, resulting in the payment of the bonus amounts described in the table below.

Discretionary Adjustments. The Compensation Committee may make reasonable adjustments to our overall corporate performance goals and our actual performance results that may cause differences between the numbers used for our performance goals and the numbers reported in our financial statements. These adjustments may exclude all or a portion of both the positive or negative effect of external events that are outside the control of our executives, such as natural disasters, litigation, or regulatory changes in accounting or taxation standards. These adjustments may also exclude all or a portion of both the positive or negative effect of unusual or significant strategic events that are within the control of our executives but that are undertaken with an expectation of improving our long-term financial performance, such as restructurings, acquisitions, or divestitures. The Committee adjusted EBITDA as described below related to acquisition-related expenses and changes to the contingent consideration liability.

EBITDA and Revenue Performance Goals and Individual Performance. Consistent with our performance-based approach, and given the broader responsibilities of our named executive officers, the annual incentive compensation for our named executive officers is partially based on the Company’s revenue (60% of Company performance component) and partially based on the percentage growth of overall Company EBITDA (before deducting the expense of the executive annual incentive compensation) (40% of Company performance component). For 2014, the Company achieved $41.4 million in EBITDA. This EBITDA figure was adjusted for the impact of 2014 acquisition-related costs and changes in the contingent consideration liability. The cumulative impact of these adjustments was a $3.7 million increase to our 2014 EBITDA. As a result, for 2014, the Company achieved adjusted EBITDA of $45.1 million, compared to a target of $39.1 million. This adjusted EBITDA met 250% of the adjusted EBITDA target. The Company achieved revenue of $1,173.4 million, compared to a target of $1,060.6 million. This revenue met 250% of the revenue target. In addition, each of the named executive officer achieved 200% of their individual performance objectives. This assessment of individual performance for the named executive officers was based on the compensation committee’s determination that each executive made significant contributions to the performance and growth of the Company in 2014. Specifically the Compensation Committee recognized individual performance as follows: Mr. Waggoner led an effort to further invest in our people across all areas of the business in an effort to increase retention and employee engagement. Mr. Sauers was integral in the identification and execution of three acquisitions. Mr. Menzel led continued expansion of the truckload portion of the business and directed the integration of the aforementioned 2014 acquisitions. Mr. Schumacher led the successful incorporation of Salesforce into the Company’s Optimizer platform and continued expansion of the Company’s managed transportation client base.

The table below shows cash bonuses earned by our named executive officers in 2014:

Name | | 2014

($) | |

Douglas R. Waggoner | | 1,182,188 | |

Kyle L. Sauers | | 463,125 | |

David B. Menzel | | 712,500 | |

Evan Schumacher | | 336,375 | |

Long-term Equity Incentives

In General. We provide the opportunity for our named executive officers and other executives to earn a long-term equity incentive award. We believe that one of the best ways to align the interests of stockholders and executives is by providing those individuals who have substantial responsibility over the management, performance and growth of the Company with an opportunity to have a meaningful ownership position in the Company. We maintain our 2008 Plan pursuant to which we may grant equity and other incentive awards to our executive officers and other employees. We believe that management having strong economic incentives will inspire management to act in the best interest of the Company and its stockholders.

Equity Awards. In the past, we have used stock options as a form of equity compensation because stock options provide a relatively straightforward incentive for our executives and result in less immediate dilution of existing stockholders’ interests. In 2011, we began to mainly issue restricted stock to named executive officers and other key employees, which practice we continued in 2012, 2013, 2014 and 2015. The shift to restricted stock grants was implemented to align our equity award program with those companies identified as our “peer group.” We believe the restricted stock grants are an effective tool for

9

Table of Contents

creating long-term ownership and aligning our employees’ interests with those of our stockholders, which includes the retention of our key employees. These restricted shares vest ratably over a five year period for 2011 grants and a four year period for 2012, 2013, 2014 and 2015 grants.

Beginning in 2013, we began to issue a combination of restricted stock awards and performance shares to our named executive officers on an annual basis, with each component representing 50% of the total number of shares granted to each executive. The stock awards were issued as a percentage of base salary set by the Compensation Committee based on compensation benchmarks presented in the peer group study as well as executive tenure, experience and performance expectations. The restricted stock awards vest in equal installments on each of the first four anniversaries of the grant date and are on terms similar to those of the Company’s 2012 restricted stock awards. The 2013 performance share awards can be earned based on the Company’s attainment of certain levels of cumulative diluted earnings per share (EPS) during the three-year performance period beginning with the grant year. The 2014 and 2015 performance share awards are earned based on our relative total stockholder return against a peer group over 1, 2 and 3 year periods. This peer group consists of similar companies in the transportation and freight brokerage industry. The amount of performance shares earned can range from 50% of the target amount for achieving the threshold performance goal to 150% for achieving the maximum performance goal for the 2013 awards and 50% of target amount for achieving the threshold performance goal to 200% for achieving the maximum performance goal for the 2014 awards and 2015 awards. The 2014 performance shares are scheduled to vest, depending on performance, 20% on the first anniversary of the grant date, 30% on the second anniversary of the grant date and 50% on the third anniversary of the grant date. The Company shifted from earnings per share to relative total stockholder return as the metric for measuring performance shares and raised the maximum to 200% of the target amount based on the Compensation Committee deeming these measurements to be more aligned with the interests of the stockholders. No performance shares will be earned if the threshold goal is not achieved. Earned performance shares are convertible into shares of the Company’s common stock on a 1-for-1 basis after the end of the performance period.

Grants of all equity awards to our named executive officers in 2013, 2014 and 2015 (to date) are summarized in the following table:

| | Number of Shares | |

Name | | 2013

(Performance

Share) | | 2013

(Restricted

Stock) | | 2014

(Performance

Share) | | 2014

(Restricted

Stock) | | 2015

(Performance

Share) | | 2015

(Restricted

Stock) | |

Douglas R. Waggoner | | 15,159 | | 15,159 | | 18,667 | | 18,667 | | 32,747 | | 32,747 | |

Kyle L. Sauers | | 2,081 | | 51,415 | | 7,000 | | 7,000 | | 11,087 | | 11,087 | |

David B. Menzel | | 7,871 | | 32,538 | | 10,770 | | 10,770 | | 17,192 | | 17,192 | |

Evan Schumacher | | — | | 49,334 | | 7,000 | | 7,000 | | 8,187 | | 8,187 | |

On March 26, 2013, Messrs. Waggoner, Sauers and Menzel received restricted stock grants of 15,159, 2,081 and 7,871 shares, respectively. The fair market value on the date of grant of each share of restricted stock was $21.44. The restricted stock vests in four equal annual installments beginning on March 26, 2014. On March 26, 2013, Messrs. Waggoner, Sauers and Menzel also received awards with respect to a target number of performance shares of 15,159, 2,081 and 7,871, respectively. The performance shares vest based on the Company’s attainment of certain levels of cumulative diluted EPS during the three-year performance period beginning on January 1, 2013. On October 7, 2013, in connection with their promotions, Messrs. Menzel, Sauers and Schumacher received one time restricted stock grants of 24,667, 49,334 and 49,334 shares, respectively. The fair market value on the date of grant of each share of restricted stock was $20.27. The restricted stock vests in four equal annual installments beginning on October 7, 2014.

On March 25, 2014, Messrs. Waggoner, Sauers, Menzel and Schumacher received restricted stock grants of 18,667, 7,000, 10,770 and 7,000 shares, respectively. The fair market value on the date of grant of each share of restricted stock was $17.41. The restricted stock vests in four equal annual installments beginning on March 25, 2015. On March 25, 2014, Messrs. Waggoner, Sauers, Menzel and Schumacher also received awards with respect to a target number of performance shares of 18,667, 7,000, 10,770 and 7,000, respectively.

On February 13, 2015, Messrs. Waggoner, Sauers, Menzel and Schumacher received restricted stock grants of 32,747, 11,087, 17,192 and 8,187 shares, respectively. The fair market value on the date of grant of each share of restricted stock was $26.72. The restricted stock vests in four equal annual installments beginning on February 13, 2016. On February 13, 2015, Messrs. Waggoner, Sauers, Menzel and Schumacher also received awards with respect to a target number of performance shares of 32,747, 11,087, 17,192 and 8,187, respectively. The 2014 and 2015 performance share awards are earned based on our relative total stockholder return against a peer group over 1, 2 and 3 year periods. The peer group for these awards consists

10

Table of Contents

of Arkansas Best Corporation, CH Robinson, Con-way, Expeditors International, Forward Air, Hub Group, JB Hunt, Knight Transportation, Landstar, Roadrunner, UTi Worldwide, and XPO Logistics.

Pursuant to the performance share award agreements, upon a termination of service during the performance period due to retirement after age 65, death, or disability, the executive will vest in a pro-rata portion of the awarded 2013 and 2014 performance shares based on actual Company performance during the relevant performance period. Upon a termination of service by the Company without cause during the twelve month period following a change in control, the executive will vest in a pro-rata portion of the awarded performance shares assuming a target level of Company performance during the relevant performance period. Upon any other termination of service, unvested performance shares are forfeited.

The vesting of certain of our named executive officers’ restricted stock and performance share awards is accelerated pursuant to the terms of their employment agreements in certain termination and/or change in control events. These terms are more fully described in “—Employment Agreements” and “—Potential Payments upon Termination or Change in Control.”

Stock Ownership Requirements. In order to ensure alignment with our shareholders, the Compensation Committee has established stock ownership requirements for our officers. These requirements became effective February 3, 2010. The Compensation Committee believes that linking a significant portion of the executive officer’s personal holdings to the Company’s success, as reflected in the stock price, provides officers with a stake similar to that of our stockholders. Therefore, executive officers are expected to acquire and hold a significant amount of the Company’s stock. The Compensation Committee has established stock ownership requirements based on all shares of Company stock owned by an executive officer, including vested stock options, vested restricted stock and stock beneficially owned by the officer, including owned in a trust, by a spouse, or dependent children for our executive officers as follows:

· Chief Executive Officer: four times base salary

· other executive officers: three times base salary

All executive officers have three years to meet their ownership requirements from the effective date, February 3, 2010. New officers are expected to meet their ownership requirement within three years of being named an executive officer. As of December 31, 2014, all named executive officers met their ownership requirement.

Executive Benefits and Perquisites

In General. We provide the opportunity for our named executive officers and other executives to receive certain perquisites and general health and welfare benefits. We also offer participation in our defined contribution 401(k) plan. We match employee contributions up to 25% on the first 6% of an employee’s salary deferred under our 401(k) plan. We provide these benefits to provide an additional incentive for our executives and to remain competitive in the general marketplace for executive talent. We also provide a modest amount of personal benefits and perquisites that we believe are highly valued and support our retention objectives. For more information, see “Summary Compensation Table.”

Change in Control and Severance Benefits

In General. We provide the opportunity for certain of our named executive officers to be protected under the severance and change in control provisions contained in their employment agreements. We provide this opportunity to attract and retain an appropriate caliber of talent for the position. Our severance and change in control provisions for the named executive officers are summarized in “—��Employment Agreements” and “— Potential Payments upon Termination or Change in Control.” We intend to periodically review the level of the benefits in these agreements. We believe our arrangements are reasonable in light of the fact that cash severance is limited to two years for Mr. Waggoner and Mr. Menzel, and one year for Mr. Sauers and Mr. Schumacher (each at a rate equal to their then current base salary and the average of the three most recent performance bonus payments), there is no cash severance increase with a change in control and there are no “single trigger” benefits upon a change in control other than accelerated the vesting of certain of the named executive officers’ equity awards.

Effect of Accounting and Tax Treatment on Compensation Decisions

Section 162(m) of the Internal Revenue Code generally imposes a limit on the amount of compensation that we may deduct in any one year with respect to our chief executive officer and each of our next three most highly compensated executive officers other than our chief financial officer, unless certain specific and detailed criteria are satisfied. Performance-based compensation, as defined in the Code, is fully deductible if the programs are approved by stockholders and meet other requirements.

In the review and establishment of our compensation programs, we consider the anticipated accounting and tax implications to us and our executives. However, these factors alone are not dispositive, and we also consider the cash and non-

11

Table of Contents

cash impact of the programs and whether a program is consistent with our overall compensation philosophy and objectives. Certain awards under the 2008 Plan and the Annual Incentive Plan, may be designed to satisfy the requirements of performance-based compensation under Section 162(m). However, the Company retains the discretion to grant awards that are not designed to qualify as performance-based compensation. We will continue to assess the impact of Section 162(m) on our compensation practices and determine whether to design our equity and cash awards to qualify as performance-based compensation.

12

Table of Contents

EXECUTIVE COMPENSATION

The following table shows information concerning 2014, 2013 and 2012 compensation for our named executive officers.

SUMMARY COMPENSATION TABLE

Name and Principal Position | | Year | | Salary

($) (1) | | Bonus

($) | | Stock

Awards (2) | | Non-Equity Plan

Incentive

Compensation ($) | | All Other

Compensation

($) (3) | | Total

($) | |

Douglas R. Waggoner | | 2014 | | 650,000 | | — | | 768,136 | | 1,182,188 | | 51,330 | | 2,651,654 | |

Chief Executive Officer | | 2013 | | 650,000 | | 75,000 | | 650,000 | | — | | 28,881 | | 1,403,881 | |

| | 2012 | | 650,000 | | — | | 2,473,500 | | 150,000 | | 38,833 | | 3,312,333 | |

Kyle L. Sauers (4) | | 2014 | | 325,000 | | — | | 288,043 | | 463,125 | | 31,482 | | 1,107,650 | |

Chief Financial Officer | | 2013 | | 271,424 | | 43,838 | | 1,089,230 | | — | | 6,542 | | 1,411,034 | |

David B. Menzel | | 2014 | | 500,000 | | — | | 443,175 | | 712,500 | | 37,569 | | 1,693,244 | |

President & Chief Operating Officer | | 2013 | | 461,731 | | 69,375 | | 837,500 | | — | | 34,081 | | 1,402,687 | |

| | 2012 | | 450,000 | | 88,540 | | 1,236,750 | | 86,460 | | 26,668 | | 1,888,418 | |

Evan Schumacher (4) | | 2014 | | 325,000 | | — | | 288,043 | | 336,375 | | 29,890 | | 980,433 | |

Chief Commercial Officer | | 2013 | | 220,320 | | 127,500 | | 1,000,000 | | — | | 6,142 | | 1,353,962 | |

(1) The salary amounts reflect the actual base salary payments made to the Named Executive Officers. Mr. Menzel was promoted from Chief Financial Officer to Chief Operating Officer on October 7, 2013 and his salary increased from $450,000 to $500,000. Mr. Sauers was appointed to Chief Financial Officer on October 7, 2013 at an annual salary of $325,000; accordingly his reported salary reflects the amount earned prior to his promotion and the pro-rated amount earned in 2013 after his promotion. Mr. Schumacher was appointed to Chief Commercial Officer on October 7, 2013 at an annual salary of $325,000; accordingly his reported salary reflects the pro-rated amount earned in 2013.

(2) Value of restricted stock awards is based on the closing value of the Company’s stock on the date of grant pursuant to Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC Topic 718”). A combination of restricted stock awards and performance-based restricted shares with a market condition were issued with each representing 50% of the total number of shares granted. A grant-date fair value assessment was performed based on the market condition of the performance shares at grant date. For 2014, includes for Mr. Waggoner, performance-based restricted shares of 18,667 with a grant date fair value of $443,136; for Mr. Sauers, performance-based restricted shares of 7,000 with a grant date fair value of $166,173; for Mr. Menzel, performance-based restricted shares of 10,770 with a grant date fair value of $255,669; and for Mr. Schumacher, performance-based restricted shares of 7,000 with a grant date fair value of $166,173. The grant date fair value of performance-based restricted stock was computed by multiplying the target number of restricted share awarded by the closing price on the market-trading day of the grant. The maximum award that can be earned at the end of the performance period if maximum performance is achieved, based on the grant date value of the Company’s common stock, is as follows: Mr. Waggoner - $886,272; Mr. Sauers - $332,346; Mr. Menzel - $511,338; and Mr. Schumacher - $332,346.

(3) For 2014, includes, for Mr. Waggoner, medical, dental and vision reimbursement of $18,569, a combined life insurance and car allowance of $31,165 and short term disability reimbursement of $1,596; for Mr. Sauers, medical, dental and vision reimbursement of $18,569, a car allowance of $12,000 and short term disability reimbursement of $913; for Mr. Menzel, medical, dental and vision reimbursement of $18,569 and a car allowance of $19,000; and for Mr. Schumacher, medical and dental reimbursement of $17,890 and car allowance of $12,000.

(4) Mr. Sauers and Mr. Schumacher were not Named Executive Officers for 2012, and as a result only their 2013 and 2014 compensation information is included.

13

Table of Contents

2014 GRANTS OF PLAN-BASED AWARDS

The following table summarizes our awards made to our named executive officers under any plan during the fiscal year ended December 31, 2014:

| | Grant | | Estimated future payouts under non-

equity incentive plan awards (1)

($) | | Estimated future payouts under

equity incentive plan awards (2)

(#) | | All Other

Stock Awards:

Number of

Shares of Stock

or Units | | Grant Date

Fair Value of

Stock and

Option | |

Name | | Date | | Target | | Maximum | | Threshold | | Target | | Maximum | | (#)(3) | | Awards($)(4) | |

Douglas R. Waggoner | | 3/25/2014 | | | | | | 9,333 | | 18,667 | | 37,334 | | | | 443,136 | |

| | 3/25/2014 | | | | | | | | | | | | 18,667 | | 325,000 | |

| | | | 487,500 | | 1,218,750 | | | | | | | | | | | |

Kyle L. Sauers | | 3/25/2014 | | | | | | 3,500 | | 7,000 | | 14,000 | | | | 166,173 | |

| | 3/25/2014 | | | | | | | | | | | | 7,000 | | 121,870 | |

| | | | 195,000 | | 487,500 | | | | | | | | | | | |

David B. Menzel | | 3/25/2014 | | | | | | 5,385 | | 10,770 | | 21,540 | | | | 255,669 | |

| | 3/25/2014 | | | | | | | | | | | | 10,770 | | 187,510 | |

| | | | 300,000 | | 750,000 | | | | | | | | | | | |

Evan Schumacher | | 3/25/2014 | | | | | | 3,500 | | 7,000 | | 14,000 | | | | 166,173 | |

| | 3/25/2014 | | | | | | | | | | | | 7,000 | | 121,870 | |

| | | | 149,500 | | 373,750 | | | | | | | | | | | |

(1) The non-equity incentive awards made during 2014 were based on individual performance and the Company’s revenue performance and overall EBITDA growth. Because the formula pays out percentages over certain ranges of performance, the awards do not have a specific payout based on a threshold. As a result, we have omitted the threshold column. For a more detailed description of this plan, see “—Compensation Program Objectives and Philosophy.”

(2) The amounts listed reflect restricted stock awarded with performance-based restrictions. The performance shares awards are earned based on our relative total stockholder return against a peer group over 1, 2 and 3 year periods. Information related to the performance-based restrictions associated with these shares is contained in Compensation Discussion and Analysis. For 2014, includes for Mr. Waggoner, performance-based restricted shares of 18,667 with grant date fair value of $443,136; for Mr. Sauers, performance-based restricted shares of 7,000 with grant date fair value of $166,173; for Mr. Menzel, performance-based restricted shares of 10,770 with grant date fair value of $255,669; and for Mr. Schumacher, performance-based restricted shares of 7,000 with grant date fair value of $166,173. The current assumed probable outcome is that the maximum award will be earned.

(3) The amounts listed reflect restricted stock granted under the 2008 Plan. For more information on the terms of these awards, see “— Long-term Equity Incentives — Equity Awards”.

(4) Grant date fair value of each equity award determined pursuant to ASC Topic 718. The value of the restricted stock was calculated using the closing price on the day of issuance of $17.41 for shares granted on March 25, 2014.

14

Table of Contents

OUTSTANDING EQUITY AWARDS AT 2014 FISCAL YEAR-END

The following table summarizes the number of securities underlying outstanding plan awards for each named executive officer as of December 31, 2014.

| | Option Awards | | Stock Awards | |

Name | | Number of

Securities

Underlying

Unexercised

Options

Exercisable

(#) | | Number of

Securities

Underlying

Unexercised

Options

Unexercisable

(#) | | Option

Exercise

Price ($) | | Option

Expiration

Date | | Number of

Shares of

Stock that

Have Not

Vested (#) | | Market

Value of

Shares of

Stock that

Have Not

Vested ($) | | Equity

Incentive

Plan Awards:

Awards of

Unearned

Shares, Units

or Other

Rights that

have not

Vested (#) | | Equity

Incentive

Plan Awards:

Market or

Payout Value

of Unearned

Shares, Units

or Other

Rights that

have not

Vested ($) (5) | |

Douglas R. Waggoner (1) | | 240,102 | | — | | 3.68 | | 11/1/2016 | | | | | | | | | |

| | 5,000 | | — | | 8.10 | | 9/28/2017 | | | | | | | | | |

| | 45,000 | | — | | 6.94 | | 6/24/2019 | | | | | | | | | |

| | 160,000 | | 40,000 | | 11.31 | | 2/26/2020 | | | | | | | | | |

| | | | | | | | | | 105,036 | | 3,067,051 | | | | | |

| | | | | | | | | | | | | | 45,184 | | 1,319,373 | |

Kyle L. Sauers (2) | | 15,000 | | 10,000 | | 11.78 | | 1/10/2021 | | | | | | | | | |

| | | | | | | | | | 60,561 | | 1,768,381 | | | | | |

| | | | | | | | | | | | | | 15,041 | | 439,197 | |

David B. Menzel (3) | | 82,500 | | — | | 11.72 | | 4/7/2018 | | | | | | | | | |

| | 80,000 | | 20,000 | | 11.31 | | 2/26/2020 | | | | | | | | | |

| | 30,000 | | 20,000 | | 12.08 | | 1/11/2021 | | | | | | | | | |

| | | | | | | | | | 156,813 | | 4,578,940 | | | | | |

| | | | | | | | | | | | | | 25,476 | | 743,899 | |

Evan Schumacher (4) | | — | | — | | — | | — | | | | | | | | | |

| | | | | | | | | | 44,000 | | 1,284,800 | | | | | |

| | | | | | | | | | | | | | 14,000 | | 408,800 | |

(1) Mr. Waggoner’s options to purchase 40,000 shares of common stock at an exercise price of $11.31 per share vest on February 26, 2015. Mr. Waggoner’s 105,036 shares of restricted stock were issued on January 13, 2012, March 26, 2013 and March 25, 2014. Of Mr. Waggoner’s shares, 75,000 vest in two equal installments on January 13 of each 2015 and 2016; 11,369 vest in three equal installments on March 26 of each 2015, 2016 and 2017; and 18,667 vest in in four equal installments on March 25 of each of 2015, 2016, 2017 and 2018.

(2) Mr. Sauers’ options to purchase 10,000 shares of common stock at an exercise price of $11.78 per share vest in two equal installments beginning on January 10 of each of 2015 and 2016. Mr. Sauers’ 60,561 shares of restricted stock were issued on January 10, 2011, February 17, 2012, March 26, 2013, October 7, 2013 and March 25, 2014. Of Mr. Sauers’ shares, 10,000 vest in two equal installments on January 10 of each of 2015 and 2016; 5,000 shares vest in two equal installments on February 17 of each of 2015 and 2016; 1,561 shares vest in three equal installments on March 26 of each of 2015, 2016 and 2017; 37,000 shares vest in three equal installments on October 7 of each of 2015, 2016 and 2017; and 7,000 vest in four equal installments on March 25 of each of 2015, 2016, 2017 and 2018.

(3) Mr. Menzel’s options to purchase 20,000 shares of common stock at an exercise price of $11.31 per share vest on February 26, 2015. Mr. Menzel’s options to purchase 20,000 shares of common stock at an exercise price of $12.08 vest in two equal installments on January 11 of each of 2015 and 2016. Mr. Menzel’s 112,674 shares of restricted stock were issued on January 11, 2011, January 13, 2012, March 26, 2013, October 7, 2013 and March 25, 2014. Of Mr. Menzel’s shares, 40,000 shares vest in two equal installments on January 11 of each of 2015 and 2016; 37,500 vest in two equal installments on January 13 of each 2015 and 2016; 5,903 vest in three equal installments on March 26 of each of 2015, 2016 and 2017; 18,500 vest in three equal installments on October 7 of each of 2015, 2016 and 2017; and 10,770 vest in four equal installments on March of each of 2015, 2016, 2017 and 2018.

15

Table of Contents

(4) Mr. Schumacher’s 44,000 shares of restricted stock were issued on October 7, 2013 and March 25, 2014. Of Mr. Schumacher’s shares, 37,000 shares vest in three equal installments on October 7 of each of 2015, 2016 and 2017; and 7,000 vest in four equal installments on March 25 of each of 2015, 2016, 2017 and 2018.

(5) These amounts are based on the market value of Company shares on December 31, 2014, which was $29.20. As of December 31, 2014, the 2013 performance share awards were tracking below the threshold level of performance while the 2014 performance share awards were tracking above the target level of performance. Therefore, in accordance with applicable SEC rules, the 2013 performance shares are reported at the threshold level in the table and 2014 performance shares are reported at the maximum level of performance in the table. If the threshold level of performance is achieved with respect to the 2013 performance shares, the named executive officers would receive the following cumulative number of shares after the March 24, 2017 final vesting date: Mr. Waggoner—7,850 shares; Mr. Sauers—1,041 shares; and Mr. Menzel—3,936 shares. If the maximum level of performance is achieved with respect to the 2014 performance shares, the named executive officers would receive the following cumulative number of shares after the March 24, 2017 final vesting date: Mr. Waggoner—37,334 shares; Mr. Sauers—14,000 shares; Mr. Menzel—21,540 shares; and Mr. Schumacher—14,000 shares. The 2013 performance shares are scheduled to vest, depending on performance, following the completion of the three year performance period ending December 31, 2015. The 2014 performance shares are scheduled to vest, depending on performance, 20% on the first anniversary of the grant date, 30% on the second anniversary of the grant date and 50% on the third anniversary of the grant date.

16

Table of Contents

2014 OPTION EXERCISES AND STOCK VESTED TABLE

The following table summarizes the exercise of options by, and vesting of restricted stock awards of, our named executive officers during 2014:

| | Option Awards | | Stock Awards | |

Name | | Number of Shares

Acquired on Exercise | | Value Realized

on Exercise | | Number of Shares

Acquired on Vesting | | Value Realized

on Vesting | |

Douglas R. Waggoner | | 124,188 | | $ | 2,844,375 | | 41,290 | | $ | 844,472 | |

Kyle L. Sauers | | — | | $ | — | | 20,354 | | $ | 447,801 | |

David B. Menzel | | | | | | 46,885 | | $ | 986,368 | |

Evan Schumacher | | — | | $ | — | | 12,334 | | $ | 294,154 | |

2014 PENSION BENEFITS

We do not sponsor any qualified or non-qualified defined benefit plans.

2014 NONQUALIFIED DEFERRED COMPENSATION

We do not maintain any non-qualified deferred compensation plans.

EMPLOYMENT AGREEMENTS

Employment Agreement with Douglas R. Waggoner

We entered into an employment agreement with Douglas R. Waggoner, our Chief Executive Officer, on November 1, 2006, which was amended and restated as of September 24, 2009, was further amended and restated as of January 1, 2012, and finally amended and restated as of October 7, 2013. Pursuant to his amended and restated employment agreement on October 7, 2013, Mr. Waggoner is entitled to an initial base salary of $650,000 per year. In addition to base salary, Mr. Waggoner is eligible for an annual performance bonus. Mr. Waggoner also has a right to be reimbursed for the full amount of his medical insurance costs under our insurance programs. Mr. Waggoner is also entitled to a combined automobile allowance and life insurance allowance not to exceed $31,500 per year.

Subject to Mr. Waggoner’s execution of a general release and waiver, if Mr. Waggoner’s employment is terminated by us for any reason other than for Cause (as described in the narrative to the Potential Payments Upon Termination or Change in Control section), or if Mr. Waggoner terminates his employment for Good Reason (as defined below), Mr. Waggoner is entitled to:

· receive an amount equal to the product of two (2) times the sum of (A) Mr. Waggoner’s base salary as in effect on the date of termination, and (B) the average of the three most recent annual Performance Bonuses received by Mr. Waggoner preceding the date of his termination, payable in equal installments over a twenty-four (24) month period following the termination of Mr. Waggoner’s employment in accordance with the Company’s normal payroll procedures;

· additional vesting of unvested equity awards as would have vested had Waggoner remained employed for an additional 12 months following the date of termination; and

· continuation of Company-provided insurance benefits for Mr. Waggoner and his dependents until such time Mr. Waggoner has secured comparable benefits through another organization’s benefits program, subject to a maximum of 24 months following termination of employment.

In the event of a Change in Control, Mr. Waggoner is entitled to immediate vesting of 50% of all outstanding unvested equity awards. In the event Mr. Waggoner is terminated (other than for Cause), or terminates his employment for Good Reason, three months prior to the public announcement of a proposed Change of Control or within 12 months following a Change of Control, Mr. Waggoner is entitled to the benefits described above and the immediate vesting of all unvested equity awards.

17

Table of Contents

For purposes of Mr. Waggoner’s employment agreement, “Change of Control” has the same meaning as set forth in our 2008 Plan as described in the narrative to “—Potential Payments Upon Termination or Change in Control.” Further, a termination for “Good Reason” occurs if Mr. Waggoner terminates his employment for any of the following reasons: (i) we materially reduce Mr. Waggoner’s duties or responsibilities below what is customary for his position in a business that is similar to our Company without Mr. Waggoner’s consent, (ii) we require Mr. Waggoner to relocate his office more than 100 miles from his current office without his consent, or (iii) we materially breach the terms of the employment agreement. Mr. Waggoner must provide notice to the Company within a period not to exceed 90 days of the initial existence of the condition. Upon such notice, the Company shall have 30 days during which it may remedy the condition.

Mr. Waggoner’s employment agreement terminates on December 31, 2016.

Employment Agreement with Kyle L. Sauers

We entered into an employment agreement with Kyle L. Sauers, our Chief Financial Officer, on January 10, 2011, which was amended and restated as of October 7, 2013. Pursuant to his amended and restated employment agreement, Mr. Sauers is entitled to an initial base salary of $325,000 per year. In addition to base salary, Mr. Sauers is eligible for an annual performance bonus and has a right to be reimbursed for the full amount of his medical insurance costs under our insurance programs. Mr. Sauers is also entitled to a combined automobile allowance and life insurance allowance not to exceed $12,000 per year.

In connection with the execution of the amended employment agreement in 2013, Mr. Sauers received a one-time equity award with a grant date value of approximately $1,000,000. The award was in the form of restricted stock which vests in equal installments on each of the first four anniversaries of the grant date.

Subject to Mr. Sauers’ execution of a general release and waiver, if Mr. Sauers is terminated for any reason other than for Cause (as described in the narrative to the Potential Payments upon Termination or Change in Control section below) or if Mr. Sauers terminates his employment for Good Reason, Mr. Sauers is entitled to

· receive an amount equal to the sum of (A) Mr. Sauers’ base salary as in effect on the date of termination, and (B) the average of the three most recent annual Performance Bonuses received by Mr. Sauers preceding the date of his termination, payable in equal installments over a twelve (12) month period following the termination of Mr. Sauers’ employment in accordance with the Company’s normal payroll procedures;

· additional vesting of unvested equity awards issued as would have vested had Mr. Sauers remained employed for an additional 12 months following the date of termination; and

· continuation of Company-provided insurance benefits for Mr. Sauers and his dependents until the earlier of: (i) 12 months following termination or (ii) the date Mr. Sauers has secured comparable benefits through another organization’s benefits program.

In the event of a Change in Control, Mr. Sauers is entitled to immediate vesting of 50% of all outstanding unvested equity awards. In the event Mr. Sauers is terminated (other than for Cause), or terminates his employment for Good Reason, three months prior to the public announcement of a proposed Change of Control or within 12 months following a Change of Control, Mr. Sauers is entitled to the benefits described above and the immediate vesting of all unvested equity awards.

For purposes of Mr. Sauers’ employment agreement, “Change of Control” has the same meaning as set forth in our 2008 Plan as described in the narrative to “—Potential Payments Upon Termination or Change in Control.” Further, a termination for “Good Reason” occurs if Mr. Sauers terminates his employment for any of the following reasons: (i) we materially reduce Mr. Sauers’ duties or responsibilities below what is customary for his position in a business that is similar to our Company without Mr. Sauers’ consent, (ii) we require Mr. Sauers to relocate his office more than 50 miles from his current office without his consent, or (iii) we materially breach the terms of the employment agreement. If one or more of the above conditions exist, Mr. Sauers must provide notice to the Company within a period not to exceed 90 days of the initial existence of the condition. Upon such notice, the Company shall have 30 days during which it may remedy the condition.

Mr. Sauers’ employment agreement terminates on December 31, 2016.

Employment Agreement with David B. Menzel

We entered into an employment agreement with David B. Menzel, our President and Chief Operating Officer, on April 7, 2008, which was amended and restated as of January 1, 2012 and further amended and restated as of October 7, 2013. Pursuant to his amended and restated employment agreement, Mr. Menzel is entitled to an initial base salary of $500,000 per year. In addition to base salary, Mr. Menzel is eligible for an annual performance bonus and has a right to be reimbursed for the full amount of his medical insurance costs under our insurance programs. Mr. Menzel is also entitled to a combined automobile allowance and life insurance allowance not to exceed $19,000 per year.

18

Table of Contents

In connection with the execution of the amended employment agreement in 2013, Mr. Menzel received a one-time equity award with a grant date value of approximately $500,000. The award was in the form of restricted stock which vests in equal installments on each of the first four anniversaries of the grant date.

Subject to Mr. Menzel’s execution of a general release and waiver, if Mr. Menzel is terminated for any reason other than for Cause (as described in the narrative to the Potential Payments upon Termination or Change in Control section below) or if Mr. Menzel terminates his employment for Good Reason, Mr. Menzel is entitled to

· receive an amount equal to two (2) times the sum of (A) Mr. Menzel’s base salary as in effect on the date of termination, and (B) the average of the three most recent annual Performance Bonuses received by Mr. Menzel preceding the date of his termination, payable in equal installments over a twenty-four (24) month period following the termination of Mr. Menzel’s employment in accordance with the Company’s normal payroll procedures;

· additional vesting of unvested equity awards as would have vested had Mr. Menzel remained employed for an additional 12 months following the date of termination; and

· continuation of Company-provided insurance benefits for Mr. Menzel and his dependents until the earlier of: (i) 24 months following termination or (ii) the date Mr. Menzel has secured comparable benefits through another organization’s benefits program.

In the event of a Change in Control, Mr. Menzel is entitled to immediate vesting of 50% of all outstanding unvested equity awards. In the event Mr. Menzel is terminated (other than for Cause), or terminates his employment for Good Reason, three months prior to the public announcement of a proposed Change of Control or within 12 months following a Change of Control, Mr. Menzel is entitled to the benefits described above and the immediate vesting of all unvested equity awards.

For purposes of Mr. Menzel’s employment agreement, “Change of Control” has the same meaning as set forth in our 2008 Plan as described in the narrative to “—Potential Payments Upon Termination or Change in Control.” Further, a termination for “Good Reason” occurs if Mr. Menzel terminates his employment for any of the following reasons: (i) we materially reduce Mr. Menzel’s duties or responsibilities below what is customary for his position in a business that is similar to our Company without Mr. Menzel’s consent, (ii) we require Mr. Menzel to relocate his office more than 50 miles from his current office without his consent, or (iii) we materially breach the terms of the employment agreement. If one or more of the above conditions exist, Mr. Menzel must provide notice to the Company within a period not to exceed 90 days of the initial existence of the condition. Upon such notice, the Company shall have 30 days during which it may remedy the condition.

Mr. Menzel’s employment agreement terminates on December 31, 2016.