UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

________________________________________

FORM 10-K

________________________________________

| (Mark one) | |

| x | Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2010 or |

| o | Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission file number 001-34470

ECHO GLOBAL LOGISTICS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 20-5001120 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

600 West Chicago Avenue, Suite 725 Chicago, Illinois | 60654 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's Telephone Number, Including Area Code: (800) 354-7993

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.0001 per share | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer x | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

At June 30, 2010, there were 21,842,242 shares of common stock outstanding held by nonaffiliates of the registrant, and the aggregate market value of the common stock (based upon closing price of these shares on the Nasdaq Global Market) was $127,278,896.

The number of shares of the registrant's common stock outstanding as of the close of business on March 10, 2011 was 22,361,433.

Documents incorporated by reference:

Portions of the Registrant's Proxy Statement for its Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K, provided, that if such proxy statement is not filed with the Commission within 120 days after the end of the fiscal year covered by this Form 10-K, an amendment to this Form 10-K shall be filed no later than the end of such 120-day period.

TABLE OF CONTENTS

| PART I | ||

| Part II | ||

| Part III | ||

| Part IV | ||

2

Item 1. Business

Unless otherwise indicated or the context otherwise requires, references in this Annual Report on Form 10-K to "Echo Global Logistics, Inc.," "Echo," the "Company," "we," "us" or "our" are to Echo Global Logistics, Inc., a Delaware corporation and subsidiaries.

Certain statements in this Annual Report on Form 10-K are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act"), and Section 21E if the Securities Exchange Act of 1934, as amended (the Exchange Act"). These statements involve a number of risks, uncertainties, and other factors that could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Factors which could materially affect such forward-looking statements can be found in the section entitled "Risk Factors" in Part I, Item IA and Part I, Item 7 entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this Annual Report on Form 10-K. Investors are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date hereof and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

Our Company

We are a leading provider of technology enabled transportation and supply chain management services, delivered on a proprietary technology platform serving the transportation and logistics needs of our clients. Our web-based technology platform compiles and analyzes data from our network of over 24,000 transportation providers to serve our clients' shipping and freight management needs. Our technology platform, composed of web-based software applications and a proprietary database, enables us to identify excess transportation capacity, obtain competitive rates, and execute thousands of shipments every day while providing high levels of service and reliability. We focus primarily on arranging transportation across truckload (TL) and less than truck load (LTL), and we also offer small parcel, inter-modal (which involves moving a shipment by rail and truck), domestic air, expedited and international transportation services. Our core logistics services include rate negotiation, shipment execution and tracking, carrier management, routing compliance, freight bill audit and payment and performance management and reporting, including executive dashboard tools.

We believe our ability to identify and utilize excess capacity solves a long-standing transportation industry problem of failing to match demand with available supply and benefits both our clients and the carriers in our network. Through our proprietary technology platform and the real-time market information stored in our database, we are able to identify and utilize transportation providers with unused capacity on routes that our clients can employ. Our carrier network consists of over 24,000 transportation providers that have been selected based on their ability to effectively serve our clients in terms of price, capabilities, geographic coverage and quality of service. We believe the carriers in our network also benefit from the opportunity to serve the transportation needs of our clients with minimal sales, marketing or customer service expense.

Our proprietary web-based technology platform, Evolved Transportation Manager (ETM), allows us to analyze our clients' transportation requirements and provide recommendations that can result in cost savings for our enterprise clients of approximately 5% to 15%. Our clients communicate their transportation needs to us electronically through our EchoTrak web portal, other computer protocols, or by phone. Using pricing, service and available capacity data derived from our carrier network, historical transaction information and external market sources, ETM analyzes the capabilities and pricing options of our carrier network and recommends cost-effective shipping alternatives. The prices we quote to our clients for their shipping needs include the market cost of fuel, which we pass through to our clients. After the carrier is selected, either by the client or us, we use our ETM technology platform to manage all aspects of the shipping process.

Our clients gain access to our carrier network through our proprietary web-based technology platform, which enables them to capitalize on our logistics knowledge, pricing intelligence and purchasing leverage. In some instances, our clients have eliminated their internal logistics departments altogether, allowing them to reduce overhead costs, redeploy internal resources and focus on their core businesses. Using our web-based software applications also provides our clients with the ability to track individual shipments, transfer shipment-level data to their financial management systems and create customized dashboards and reports detailing carrier activity on an enterprise-wide basis. These features provide our clients with greater visibility, business analytics and control of their freight expenditures.

We procure transportation and provide logistics services for more than 22,800 clients across a wide range of industries, such as manufacturing, construction, consumer products and retail. Our clients fall into two categories, enterprise and transactional. We typically enter into multi-year contracts with our enterprise clients, which are often on an exclusive basis for a specific transportation mode or point of origin. As part of our value proposition, we also provide core logistics services to these

3

clients, including the management of both freight expenditures and logistical issues surrounding freight to be transported. We provide transportation and logistics services to our transactional clients on a shipment-by-shipment.

We were formed as a Delaware limited liability company in January 2005. We converted our legal form to a Delaware corporation in June 2006. In October 2009, we completed an initial public offering of our shares of common stock. Upon the completion of our initial public offering, our common stock became listed on the Nasdaq Global Market under the symbol “ECHO.”

Our Strategy

Our objective is to become the premier provider of transportation and logistics services to corporate clients in the United States. Our business model and technological advantage have been the main drivers of our historical results and have positioned us for continued growth. The key elements of our strategy include:

Expand our client base. We intend to develop new long-term client relationships by using our industry experience and expanding our sales and marketing activities. As of December 31, 2010, we had contracts with 148 enterprise clients, and the total number of enterprise clients increased by 30 and 32 in 2009 and 2010, respectively. We seek to attract new enterprise clients by targeting companies with substantial transportation needs and demonstrating our ability to reduce their transportation costs by using our ETM technology platform. In addition, we plan to continue to hire additional sales representatives to build our transactional business across all major modes. We believe our business model provides us with a competitive advantage in recruiting sales representatives as it enables our representatives to leverage our proprietary technology and carrier network to market a broader range of services to their clients at competitive prices.

Further penetrate our established client base. We believe our established client base presents a substantial opportunity for growth. As we demonstrate our ability to execute shipments with high levels of service and favorable pricing, we are able to strengthen our relationships with our clients, penetrate incremental modes and geographic areas and generate more shipments. As we become more fully integrated into the businesses of our transactional clients and are able to identify additional opportunities for efficiencies, we seek to further penetrate our client base by selling our enterprise services to those clients. Of our 148 enterprise clients as of December 31, 2010, 80 began as our transactional clients.

Further invest in our proprietary technology platform. We intend to continue to improve and develop Internet and software-based information technologies that are compatible with our ETM platform. In order to continue to meet our clients' transportation requirements, we intend to invest in specific technology applications and personnel in order to improve and expand our offering. As of December 31, 2010, we had approximately 1,200 individual active users of ETM and as the number of users expands, we will continue to invest in both IT development and infrastructure.

Selectively pursue strategic acquisitions. We have grown, in part, through acquisitions. We intend to selectively pursue strategic acquisitions that complement our business relationships and logistics expertise and expand our business into new geographic markets. Our objective is to increase our presence and capabilities in major commercial freight markets in the United States. We may also evaluate opportunities to access attractive markets outside the United States from time to time, or selectively consider strategic relationships that add new long-term client relationships, enhance our services or complement our business strategy.

Our Proprietary Technology Platform

Our proprietary ETM technology platform allows us to analyze our clients' transportation requirements and provide customized shipping recommendations that can result in cost savings of approximately 5% to 15% for our enterprise clients. We collect and store pricing and market capacity data in our ETM database from each interaction with carriers, and our database expands as a result of these interactions. We have also developed data acquisition tools that retrieve information from both private and public transportation databases, including subscription-based sources and public transportation rate boards, and incorporate that information into the ETM database. Using pricing, service and available capacity data derived from our carrier network, historical transaction information and external market sources, we are able to analyze the capabilities of our carrier network to recommend cost-effective shipping alternatives. We believe that the carriers with the most available capacity typically offer the most competitive rates.

Our clients communicate their transportation needs to us electronically through our EchoTrak web portal, other computer protocols, or by phone. ETM generates pricing and carrier information for our clients by accessing pre-negotiated rates with preferred carriers or using present or historical pricing and capacity information contained in our database. If a client enters its own shipment, ETM automatically alerts the appropriate account executive. ETM's pricing algorithms are checked for accuracy before the rates are made available to our account executives. If an error occurs and an inaccurate rate is conveyed to a client, we will honor the quoted rate and correct the defective algorithm to ensure that all quoted rates going forward are accurately

4

calculated. To date, any losses incurred as a result of an inaccurate quote have been negligible. After the carrier is selected, either by us or the client, our account executives use our ETM technology platform to manage all aspects of the shipping process.

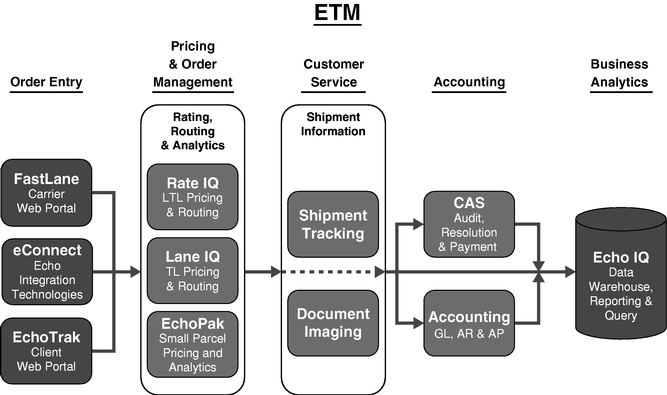

We have developed specialized software applications to provide our transportation and logistics services across all major modes of transportation. The software applications shown below reflect the key elements of our ETM technology platform:

The key elements of our ETM technology platform include:

FastLane is an Internet-based web portal that allows our carriers to view the status of all unpaid invoices, unbilled shipments, shipments in transit and other information used to quickly resolve any billing discrepancies.

eConnect is a set of tools that allows our clients and carriers to interact directly with ETM electronically through any of several computer protocols, including EDI, XML and FTP. The eConnect tools serve as an electronic bridge between the other elements of our ETM technology platform and our clients' enterprise resource planning (ERP), billing, accounts receivable, accounts payable, order management, back office and e-commerce systems. Through eConnect, our clients are able to request shipping services and receive financial and tracking data using their existing systems.

EchoTrak is an Internet-based web portal that connects and integrates our clients with ETM. By entering a username and password, our clients are able to display historical and active shipments in the ETM system using configurable data entry screens sorted by carrier, price, delivery date, destination and other relevant specifications. EchoTrak also generates automatic alerts to ensure that shipments are moving in accordance with the client specifications and timeline.

RateIQ is a pricing engine that manages LTL tariffs and generates rate quotes and transit times for LTL shipments. RateIQ also provides integrated tools to manage dispatch, communications, data collection and management functions relating to LTL shipments.

LaneIQ is a pricing engine that generates rate quotes for TL shipments. LaneIQ also provides integrated tools to manage dispatch, communications, headhaul and backhaul data collection and management functions relating to TL shipments.

EchoPak is a small parcel pricing and audit engine. For each small parcel shipped, EchoPak audits carrier compliance with on-time delivery requirements and pricing tariffs. In addition, EchoPak tracks information for each parcel and is able to aggregate and analyze that data for clients. For instance, clients are able to view shipments by date, business unit, product line

5

and location, and clients can access information regarding service levels and pricing.

Shipment Tracking stores shipment information en-route and after final delivery. The shipment data is typically acquired through our carrier EDI integration, allowing our clients to track the location and status of all shipments on one screen, regardless of mode or carrier. Final delivery information is permanently archived, allowing us to provide our clients with carrier performance reporting by comparing actual delivery times with the published transit time standards.

Document Imaging allows us to store digital images of all shipping documents, including bills of lading and delivery receipts. We index the images with the shipment data so users are able to view documents associated with an executed transaction. We use Document Imaging internally to store carrier qualification documents, including W-9, U.S. Department of Transportation authority and proof of insurance.

CAS (Cost Allocation System) automatically audits carrier invoices against our rating engine and accounts payable accrual system. If the amounts match, the invoice is automatically released for payment. If the amounts do not match, the invoice is sent to various administrative personnel for manual processing and resolution. CAS also integrates to our general ledger, accounts receivable and accounts payable systems.

Accounting includes our general ledger, accounts receivable and accounts payable functions. Accounting is integrated with CAS and EchoIQ, which gives us the ability to access both financial and operational data in our data warehouse and reporting systems.

EchoIQ stores internally and externally generated data to support our reporting and analytic functions and integrates all of our core applications with ETM.

ETM fully supports our logistics services, which we provide to our clients as part of our value proposition. Our ETM technology platform is able to track individual shipments and provide customized data and reports throughout the lifecycle of the shipment, allowing us to manage the entire shipping process for our clients. Our customized reports also provide our clients with greater visibility and control over their transportation expenditures, and our ability to benchmark the performance of their internal operations helps identify opportunities for additional cost savings.

We recently began to market Flex TMS. Flex TMS is a software-as-a-service TMS (Transportation Management System) with integrated managed services. This "a-la-carte" product provides shippers with a customized, cost effective solution for their logistics needs. It offers clients a standard solution which includes routing guide management, automated load entry, tendering and acceptance, load visibility with customized reporting and analytics complemented by industry experts to assist with freight management.

In 2008, 2009 and 2010 we spent approximately $3.0 million, $2.5 million and $5.1 million, respectively, on the development of ETM and related technologies.

Our IT infrastructure provides a high level of security for our proprietary software and database. The storage system for our proprietary data is designed to ensure that power and hardware failures do not result in the loss of critical data. The proprietary data is protected from unauthorized access through a combination of physical and logical security measures, including firewalls, encryption, antivirus software, anti-spy software, passwords and physical security, with access limited to authorized IT personnel. In addition to our security infrastructure, our system is backed up daily to prevent the loss of our proprietary data due to catastrophic failures or natural disasters.

Our Services

We are a non-asset-based provider of technology enabled transportation and logistics services, meaning we do not own the transportation equipment used to transport our clients' freight or warehouse our clients' inventory. We believe this allows us to be flexible and seek shipping alternatives that are tailored to the specific needs of our clients, rather than the deployment of particular assets. Through our carrier network, we provide transportation services using a variety of modes of transportation.

Transportation Services

Truckload (TL). We provide TL services across all TL segments, including dry vans, temperature-controlled units and flatbeds. Using our LaneIQ technology, we provide advanced dispatch, communication and data collection tools that enable our dedicated TL team to quickly disseminate critical pricing and capacity information to our clients on a real-time basis.

Less than Truckload (LTL). We provide LTL services involving the shipment of single or multiple pallets of freight. Using our RateIQ technology, we obtain real-time pricing and transit time information for every LTL shipment from our database of LTL carriers.

6

Small Parcel. We provide small parcel services for packages of all sizes. Using our EchoPak technology, we are often able to deliver cost saving opportunities to our clients that spend over $500,000 annually to ship with major small parcel carriers.

Inter-Modal. Inter-modal transportation is the shipping of freight by multiple modes, typically using a container that is transferred between ships, railcars or trucks. We offer inter-modal transportation services for our clients that utilize both trucks and rail. Using our ETM technology, our dedicated inter-modal team can select, on a timely basis, the most advantageous combination of trucks and rail to meet our clients' individual shipping demands and pricing expectations.

Domestic Air and Expedited Services. We provide domestic air and expedited shipment services for our clients when traditional LTL services do not meet delivery requirements. We use ETM track and trace tools to ensure that up to date information is available to our clients via EchoTrak.

International. We provide air and ocean transportation services for our clients, offering a comprehensive international delivery option to our clients. Using ETM, our dedicated teams can consolidate shipments, coordinate routing, local pick-up and delivery methods and prearrange customs clearance to minimize the time and economic burdens associated with international transportation.

Logistics Services

In addition to arranging for transportation, we provide logistics services, either on-site (in the case of some enterprise clients) or off-site, to manage the flow of those goods from origin to destination. Our core logistics services include:

| • | rate negotiation; |

| • | procurement of transportation, both contractually and in the spot market; |

| • | shipment execution and tracking; |

| • | carrier management, reporting and compliance; |

| • | executive dashboard presentations and detailed shipment reports; |

| • | freight bill audit and payment; |

| • | claims processing and service refund management; |

| • | design and management of inbound client freight programs; |

| • | individually configured web portals and self-service data warehouses; |

| • | ERP integration with transactional shipment data; |

| • | and integration of shipping applications into client e-commerce sites. |

We believe that direct access to our web-based applications, process expertise and analytical capabilities is a critical component of our offering, and we provide our logistics services to our clients as part of our value proposition.

Our Clients

We provide transportation and logistics services to corporate clients across a wide range of industries, such as manufacturing, construction, consumer products and retail. In 2010, we served over 22,700 clients using approximately 9,100 different carriers and, from January 2005 through December 31, 2010, we served over 37,000 clients using approximately 15,000 different carriers. Our clients fall into two categories: enterprise and transactional.

Enterprise Clients

We typically enter into multi-year contracts with our enterprise clients, generally with terms of one to three years, to provide some, or substantially all, of their transportation requirements. Each new enterprise client is assigned one or more dedicated account executives, who are able to work on-site or off-site, as required by the client. To foster a strategic relationship with these clients, we typically agree to a negotiated level of cost savings compared to the client's historical shipping expenditures over a fixed period of time. Cost savings are estimated periodically during the term of our agreement and if the negotiated amount is not achieved, our clients may have the right to terminate our agreement.

Our enterprise contracts are often on an exclusive basis for a certain transportation mode or point of origin and may apply

7

to a single mode, such as LTL, several modes or all transportation modes used by the client. These contractual exclusivity provisions help ensure, but do not guarantee, that we receive a significant portion of the amount that our enterprise clients spend on transportation in the applicable mode or modes or from the applicable point of origin. In our experience, compliance with such provisions varies from client to client and over time. Reasons compliance may vary include the widely-dispersed nature of transportation decision-making in some clients' organizations and the learning process involved in implementing our services. We work with and expect our enterprise clients to maintain and improve compliance with any applicable exclusivity provisions.

We recently began to market Flex TMS, which is a contractual agreement enabling our client to utilize our technology in exchange for transaction fees. Our transaction fees may be reduced to the extent that we manage a portion of the client's transportation. As of December 31, 2010, two of our enterprise clients were part of our Flex TMS programs.

We also provide small parcel consulting services to a limited number of our enterprise clients, which is included in our fee for service revenue. Under these arrangements, we review the client's small parcel shipping contracts and shipment data analyzing their volumes, distribution, rates and savings opportunities, prepare negotiation strategies and directly or indirectly participate in negotiations with carriers to improve the client's rates, charges, services and commitments.

Our annual revenue from individual enterprise clients typically ranges from $100,000 to $20.0 million. Our revenue from all enterprise clients increased in the last two years, from $87.4 million in 2008 to $109.1 million in 2009 and to $165.4 million in 2010. Our revenue from enterprise clients as a percentage of total revenue was 43% in 2008, 42% in 2009 and 39% in 2010.

Transactional Clients

We provide transportation and logistics services to our transactional clients on a shipment-by-shipment basis, which are typically priced to our carriers on a spot, or transactional, basis. Our annual revenue from individual transactional clients typically ranges from $1,000 to $50,000. Of our 50 largest transactional clients in 2009, 47 placed orders with us during 2010, which we believe demonstrates our ability to meet a variety of transportation requirements on a recurring basis.

Our Carrier Network

Our carrier network provides our clients with substantial breadth and depth of offerings within each mode. In 2010, we used approximately 8,300 TL carriers, 100 LTL carriers, 10 small parcel carriers, 94 inter-modal carriers, 10 domestic air carriers and 80 international carriers. Our ability to attract new carriers to our network and maintain good relationships with our current carriers is critical to the success of our business. We rely on our carriers to provide the physical transportation services for our clients, valuable pricing information for our proprietary database and tracking information throughout the shipping process from origin to destination. We believe we provide value to our carriers by enabling them to fill excess capacity on traditionally empty routes, repositioning their equipment and therefore offsetting their substantial overhead costs to generate incremental revenue. In addition, we introduce many of our clients to new carriers and broaden each carrier's market presence by expanding its sales channels to a larger client base.

We select carriers based on their ability to effectively serve our clients with respect to price, technology capabilities, geographic coverage and quality of service. In the small parcel mode, we use nationally recognized carriers, such as FedEx and UPS. In other transportation modes, we maintain the quality of our carrier network by obtaining documentation to ensure each carrier is properly licensed and insured, and has an adequate safety rating. In addition, we continuously collect information on the carriers in our network regarding capacity, pricing trends, reliability, quality control standards and overall customer service. We believe this quality control program helps to ensure that our clients receive high-quality service regardless of the carrier that is selected for an individual shipment. In 2010, we used approximately 8,500 of the over 24,000 carriers in our network to provide shipping services to our clients.

The carriers in our network are of all sizes, including large national trucking companies, mid-sized fleets, small fleets and owner-operators of single trucks. We are not dependent on any one carrier, and our largest carriers by TL, LTL and small parcel accounted for less than 0.7, 6.2% and 5.3%, respectively, of our total transportation costs across all modes in 2010. For international shipments, we currently rely on one forwarder to provide substantially all of our transportation. We consider our relationship with this carrier to be strong. In 2009 and 2010, international shipments accounted for 3% and 2% of our revenue, respectively.

Sales and Marketing

We market and sell our transportation and logistics services through our sales personnel located in four cities across the United States. As of December 31, 2010, our sales team consisted of 7 enterprise sales representatives, 375 transactional sales representatives and 199 sales agents. Our enterprise sales representatives typically have significant sales expertise and are

8

focused on building relationships with clients' senior management teams to execute enterprise contracts. Our transactional sales representatives, located at our headquarters in Chicago, as well as in our regional offices in Atlanta, Dallas, and Detroit, are focused on building new transactional client relationships and migrating transactional accounts to enterprise accounts. Our agents, located in regional shipping markets throughout the United States, are typically experienced industry sales professionals focused on building relationships with our clients' transportation managers. We support our sales team with account executives. These individuals are generally responsible for customer service, developing relationships with client personnel and managing the shipping process from origin to destination.

Our marketing efforts typically involve up to a six month selling cycle to secure a new enterprise client. Our efforts may begin in response to a perceived opportunity, a referral by an existing client, a request for proposal, a relationship between a member of our sales team and a potential client, new client prospects gained through acquisitions, an introduction by someone affiliated with our company, or otherwise. Our senior management team, sales representatives and agents are responsible for the sales process. An important aspect of this sales process is our analysis of a prospective client's historic transportation expenditures to demonstrate the potential savings that could be achieved by using our transportation and logistics services. Additionally, we demonstrate how our ETM system will add efficiency and information to our clients transportation management process. We also try to foster relationships between our senior management team and our clients' senior management, and many of our enterprise clients were secured by marketing our services to "C-level" management contacts. These relationships ensure that both parties are focused on seamless process integration and using our services to provide tangible cost savings.

As we become more knowledgeable about a client's business and processes, our ability to identify opportunities to create value for the client typically increases, and we focus on trying to expand the services we provide to our existing enterprise and transactional clients. As a relationship with a client grows, the time requirement to win an engagement for additional services typically declines and we are able to recognize revenue from our sales efforts more quickly. Historically, many of our clients have been more willing to turn over more of their transportation and logistics requirements to us as we demonstrate our capabilities.

Each new enterprise client is assigned one or more dedicated account executives, who are able to work on-site or off-site, as required by the client. Our dedicated account executives integrate the client's existing business processes with our proprietary technology platform to satisfy the client's transportation requirements, and assist our sales representatives and agents in targeting potential deficiencies in the client's operations that could lead to expanded service offerings. Because the account executives we hire generally have significant sales experience, they can also begin marketing our services after limited training on our model and systems. Our agreements with our account executives require them to market and sell our transportation and logistics services on an exclusive basis and contain non-compete and non-solicitation provisions that apply during and for a specified period after the term of their service.

Our transactional sales representatives, who focus on sales of our transportation and logistics services on a shipment-by-shipment basis, concentrate on building relationships with our transactional clients that could benefit from the competitive pricing and enhanced service associated with our services. Our ability to work with clients on a transactional basis provides us with an opportunity to demonstrate the cost savings associated with our technology-driven services before the client considers moving to a fully-outsourced enterprise engagement. Since January 2005, 80 transactional clients have migrated to an enterprise agreement.

Our sales team is critical to the success of our business and our ability to grow will depend on our ability to continue to attract, train and retain talented individuals. Candidates are recruited through search firms, Internet postings, advertisements in industry publications, industry event attendance, referrals and word-of-mouth networking. To attract these candidates, we will continue to offer attractive commission structures and highlight the advantages that our ETM technology platform provides in winning and maintaining new clients. We believe our business model provides us with a competitive advantage in recruiting sales representatives because it enables them to use our enhanced analytics technology and carrier network to market a broader range of services at competitive prices. Our services can be offered at no upfront cost and our clients are generally able to immediately realize tangible cost savings.

We had 24 sales representatives and agents as of December 31, 2005, and have grown to 581 as of December 31, 2010. We intend to continue to hire sales representatives and agents with established client relationships that we believe can be developed into new revenue opportunities. We also expect to augment our sales force through selective acquisitions of transportation and logistics service providers with experienced sales representatives and agents in strategic geographical locations.

Competition

The commercial freight transportation services and third-party logistics industries in which we operate are highly

9

competitive and fragmented. We have a number of competitors offering services similar to ours, which include:

| • | internal shipping departments at companies that have substantial transportation requirements, many of which represent potential sales opportunities; |

| • | non-asset-based logistics companies, such as C.H. Robinson Worldwide, Freightquote.com, Ozburn-Hessey Logistics, Total Quality Logistics and Transplace, with whom we compete most often; |

| • | asset-based logistics companies, such as Schneider, FedEx, JB Hunt and ABF; |

| • | carriers that offer logistics services, such as Conway and UPS, some of whom we frequently purchase transportation services from on behalf of our clients; |

| • | freight forwarders that dispatch shipments via asset-based carriers, typically arranging for shipments to or from international destinations, such as Expeditors International; and |

| • | smaller, niche service providers that provide services in a specific geographic market, industry segment or service area. |

We believe the principal elements of competition in transportation and logistics services are price, customer service and reliability. Some of our competitors, such as C.H. Robinson Worldwide, have larger client bases and significantly more resources than we do. In addition, some of our competitors may have more expertise in a single transportation mode that allows them to prepare and process documentation and perform related activities pertaining to that mode of transportation more efficiently than Echo. We compete against these entities by establishing ourselves as a leading technology enabled service provider with industry expertise in all major modes of transportation, which enables us to respond rapidly to the evolving needs of our clients related to outsourcing transportation.

Our clients may choose not to outsource their transportation business to us in the future by performing formerly outsourced services for themselves, either in-house or through offshore partnerships or other arrangements. We believe our key advantage over in-house business processes is that ETM gives us the ability to obtain favorable pricing and terms relative to in-house service departments. In addition, we believe we give companies the opportunity to focus on their core products and services while we focus on service, delivery and operational excellence.

We also face competition from some of the larger services companies, such as IBM or Accenture, because they offer transportation procurement and logistics services to their clients. Their well-established client relationships, industry knowledge, brand recognition, financial and marketing capabilities, technical resources and pricing flexibility may provide them with a competitive advantage over us. These companies may include service companies based in offshore locations, divisions of large IT service companies and global services companies located in the United States or offshore.

Intellectual Property

We rely primarily on a combination of copyright, trademark and trade secret laws, as well as license agreements and other contractual provisions, to protect our intellectual property rights and other proprietary rights. To date, we have not registered any patents nor trademarks. Some of our intellectual property rights relate to proprietary business process enhancements. It is our practice to enter into confidentiality and invention assignment agreements with all of our employees and independent contractors that:

| • | include a confidentiality undertaking by the employee or independent contractor; |

| • | ensure that all new intellectual property developed in the course of our relationship with employees or independent contractors is assigned to us; |

| • | and require the employee or independent contractor to cooperate with us to protect our intellectual property during and after his or her relationship with us. |

Government Regulation

Subject to applicable federal and state regulation, we may arrange for the transport of most types of freight to and from any point in the United States. Certain of our U.S. domestic ground transportation operations may be subject to regulation by the Federal Motor Carrier Safety Administration (the FMCSA), which is an agency of the U.S. Department of Transportation, and by various state agencies. The FMCSA has broad regulatory powers in areas such as safety and insurance relating to interstate motor carrier and broker operations. The ground transportation industry is also subject to possible regulatory and legislative changes (such as the possibility of more stringent environmental, safety or security regulations or limits on vehicle weight and

10

size) that could affect the economics of the industry by requiring changes in operating practices or the cost of providing transportation services.

Our international operations are impacted by a wide variety of U.S. government regulations. These include regulations of the U.S. Department of State, U.S. Department of Commerce and the U.S. Department of Treasury. Regulations cover matters such as what commodities may be shipped to what destination and to what end-user, unfair international trade practices and limitations on entities with whom we may conduct business.

Our air freight business in the United States is subject to regulation as an indirect air carrier by the Transportation Security Administration (the TSA) and the Department of Transportation. Our indirect air carrier security program has been approved by the TSA. Our officers also have completed the Security Threat Assessments required by TSA regulations. The airfreight industry is subject to regulatory and legislative changes that could affect the economics of the industry by requiring changes in operating practices or influencing the demand for, and the costs of providing, services to clients.

Our ocean transportation business in the United States is subject to regulation by the Federal Maritime Commission (the FMC). The FMC licenses persons acting as ocean transportation intermediaries, including ocean freight forwarders and non-vessel operating common carrier operators. Ocean freight forwarders are subject to surety bond requirements and required to retain a "qualified individual" as an officer of the company. Non-vessel operating common carriers are subject to FMC tariff publication requirements, and must submit for review and public notice certain shipping agreements reached with clients. Ocean freight forwarders are also subject to regulatory oversight, particularly those terms proscribing rebating practices. The FMC provides a forum for persons to challenge actions or practices of ocean transportation intermediaries through private actions.

Although Congress enacted legislation in 1994 that substantially preempts the authority of states to exercise economic regulation of motor carriers and brokers of freight, some intrastate shipments for which we arrange transportation may be subject to additional licensing registration, or permit requirements. We generally contractually require and/or rely on the carrier transporting the shipment to ensure compliance with these types of requirements. We, along with the contracted carriers that we rely upon, are also subject to a variety of federal and state safety and environmental regulations. Although compliance with the regulations governing licenses in these areas has not had a material adverse effect on our operations or financial condition in the past, there can be no assurance that such regulations or changes will not adversely impact our operations in the future. Violation of these regulations could also subject us to fines as well as increased claims liability.

Risk Management and Insurance

If a shipment is damaged during the delivery process, our client files a claim for the damaged shipment with us. In the cases where we have agreed (either contractually or otherwise) to pay for claims for damage to freight while in transit, we pursue reimbursement from the carrier for the claims. If we are unable to recover all or any portion of the claim amount from our carrier, we may bear the financial loss. We mitigate this risk by using our quality program to carefully select carriers with adequate insurance, quality control procedures and safety ratings. We also take steps to ensure that the coverage we provide to our clients for damaged shipments is substantially similar to the coverage that our carriers provide to us. In addition, we carry our own insurance to protect against client claims for damaged shipments, in cases where a carrier's coverage may have lapesed.

We extend credit to certain clients as part of our business model. These clients are subject to an approval process prior to any extension of credit or increase in their current credit limit. Our finance department reviews each credit request and considers, among other things, payment history, current billing status, recommendations by various rating agencies and capitalization. Clients that pass our credit request procedures may receive a line of credit or an increase in their existing credit amount. We believe this review and approval process helps mitigate the risk of client defaults on extensions of credit and the related bad debt expense.

We require all motor carriers we work with to carry at least $1.0 million in auto and general liability insurance and $100,000 in cargo insurance. We also maintain a broad cargo liability insurance policy to protect us against catastrophic losses that may not be recovered from the responsible carrier, and carry various liability insurance policies, including auto and general liability. Our collective insurance policies have a cap of $20.0 million.

Employees

As of December 31, 2010, we had 709 employees, consisting of 7 enterprise sales representatives, 375 transactional sales representatives, 187 account executives, 46 technology personnel and 94 administrative personnel. We also had 199 independent contractors working as sales agents, and a 30-person workforce based at our build, operate, transfer (BOT) facilities in Pune and Kolkata, India. We consider our employee relations to be good.

11

Our Website

Our website is http://www.echo.com. We make available, free of charge through our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, including exhibits and any amendments to those reports, filed with or furnished to the Securities and Exchange Commission. We make these reports available through our website as soon as reasonably practical after our electronic filing of such materials with, or the furnishing of them to, the Securities and Exchange Commission. The information contained on our website is not a part of this Annual Report on Form 10-K and shall not be deemed incorporated by reference into this Annual Report on Form 10-K or any other public filing made by us with the Securities and Exchange Commission.

Item 1A. Risk Factors

Set forth below are certain risk factors that could harm our business, results of operations and financial condition. You should carefully read the following risk factors, together with the financial statements, related notes and other information contained in this Annual Report on Form 10-K. Our business, financial condition and operating results may suffer if any of the following risks are realized. If any of these risks or uncertainties occur, the trading price of our common stock could decline and you might lose all or part of your investment. This Annual Report on Form 10-K contains forward-looking statements that contain risks and uncertainties. Please refer to the discussion of "Forward-Looking Statements" on page three of this Annual Report on Form 10-K in connection with your consideration of the risk factors and other important factors that may affect future results described below.

Risks Related to Our Business

If our carriers do not meet our needs or expectations, or those of our clients, our business could suffer.

The success of our business depends to a large extent on our relationships with clients and our reputation for providing high-quality technology enabled transportation and logistics services. We do not own or control the transportation assets that deliver our clients' freight, and we do not employ the people directly involved in delivering the freight. We rely on independent third-parties to provide TL, LTL, small parcel, inter-modal, domestic air, expedited and international services and to report certain information to us, including information relating to delivery status and freight claims. This reliance could cause delays in providing our clients with important service data and in the financial reporting of certain events, including recognizing revenue and recording claims. If we are unable to secure sufficient transportation services to meet our commitments to our clients, our operating results could be adversely affected, and our clients could switch to our competitors temporarily or permanently. Many of these risks are beyond our control and difficult to anticipate, including:

| • | changes in rates charged by transportation providers; |

| • | supply shortages in the transportation industry, particularly among truckload carriers; |

| • | interruptions in service or stoppages in transportation as a result of labor disputes; and |

| • | changes in regulations impacting transportation. |

If any of the third-parties we rely on do not meet our needs or expectations, or those of our clients, our professional reputation may be damaged and our business could be harmed.

Competition could substantially impair our business and our operating results.

Competition in the transportation services industry is intense. We compete against other non-asset-based logistics companies as well as asset-based logistics companies; freight forwarders that dispatch shipments via asset-based carriers; carriers offering logistics services; internal shipping departments at companies that have substantial transportation requirements; large business process outsourcing (BPO) service providers; and smaller, niche service providers that provide services in a specific geographic market, industry segment or service area. We also compete against carriers' internal sales forces and shippers' transportation departments. At times, we buy transportation services from our competitors. Historically, competition has created a downward pressure on freight rates, and continuation of this rate pressure may adversely affect the Company's revenue and income from operations.

In addition, a software platform and database similar to ETM could be created over time by a competitor with sufficient financial resources and comparable experience in the transportation services industry. If our competitors are able to offer comparable services, we could lose clients, and our market share and profit margin could decline. Our competitors may also establish cooperative relationships to increase their ability to address client needs. Increased competition may lead to revenue

12

reductions, reduced profit margins or a loss of market share, any one of which could harm our business.

A significant portion of our revenue is derived from a relatively limited number of large clients and any loss of, or decrease in sales to, these clients could harm our results of operations.

A significant portion of our revenue is derived from a relatively limited number of large clients. Revenue from our five largest clients, collectively, accounted for 15% of our revenue in 2010, and revenue from our 10 largest clients, collectively, accounted for 23% of our revenue in 2010. We are likely to continue to experience ongoing customer concentration, particularly if we are successful in attracting large enterprise clients. It is possible that revenue from these clients, either individually or as a group, may not reach or exceed historical levels in any future period. The loss or significant reduction of business from one or more of our major clients would adversely affect our results of operations.

If we are unable to expand the number of our sales representatives and agents, or if a significant number of our sales representatives and agents leaves us, our ability to increase our revenue could be negatively impacted.

Our ability to expand our business will depend, in part, on our ability to attract additional sales representatives and agents with established client relationships. Competition for qualified sales representatives and agents can be intense, and we may be unable to hire such persons. Any difficulties we experience in expanding the number of our sales representatives and agents could have a negative impact on our ability to expand our client base, increase our revenue and continue our growth.

In addition, we must retain our current sales representatives and agents and properly incentivize them to obtain new clients and maintain existing client relationships. If a significant number of our sales representatives and agents leave us, our revenue could be negatively impacted. We have entered into agreements with our sales representatives and agents that contain non-compete provisions to mitigate this risk, but we may need to litigate to enforce our rights under these agreements, which could be time-consuming, expensive and ineffective. A significant increase in the turnover rate among our current sales representatives and agents could also increase our recruiting costs and decrease our operating efficiency, which could lead to a decline in the demand for our services.

We may not be able to develop or implement new systems, procedures and controls that are required to support the anticipated growth in our operations.

Our revenue increased to $426.4 million in 2010 from $7.3 million in 2005, representing an annual revenue growth rate of 353% from 2005 to 2006, 188% from 2006 to 2007, 112% from 2007 to 2008 to 28% from 2008 to 2009 and 64% from 2009 to 2010. Between January 1, 2005 and December 31, 2010, the number of our employees, agents and independent contractors increased from 44 to 908. Continued growth could place a significant strain on our ability to:

| • | recruit, motivate and retain qualified sales representatives and agents, carrier representatives and management personnel; |

| • | develop and improve our internal administrative infrastructure and execution standards; and |

| • | expand and maintain the operation of our technology infrastructure in a manner that preserves a quality customer experience. |

To manage our growth, we must implement and maintain proper operational and financial controls and systems. Further, we will need to manage our relationships with various clients and carriers. We cannot give any assurance that we will be able to develop and implement, on a timely basis, the systems, procedures and controls required to support the growth in our operations or effectively manage our relationships with various clients and carriers. If we are unable to manage our growth, our business, operating results and financial condition could be adversely affected.

If we are unable to maintain ETM, our proprietary software, demand for our services and our revenue could decrease.

We rely heavily on ETM, our proprietary software, to track and store externally and internally generated market data, analyze the capabilities of our carrier network and recommend cost-effective carriers in the appropriate transportation mode. To keep pace with changing technologies and client demands, we must correctly interpret and address market trends and enhance the features and functionality of our proprietary technology platform in response to these trends, which may lead to significant ongoing research and development costs. We may be unable to accurately determine the needs of our clients and the trends in the transportation services industry or to design and implement the appropriate features and functionality of our technology platform in a timely and cost-effective manner, which could result in decreased demand for our services and a corresponding decrease in our revenue. Despite testing, we may be unable to detect defects in existing or new versions of our proprietary software, or errors may arise in our software. Any failure to identify and address such defects or errors could result in loss of revenue or market share, liability to clients or others, diversion of resources, injury to our reputation, and increased service and

13

maintenance costs. Correction of such errors could prove to be impossible or very costly, and responding to resulting claims or liability could similarly involve substantial cost.

We have not registered any patents nor trademarks to date, and our inability to protect our intellectual property rights may impair our competitive position.

Our failure to adequately protect our intellectual property and other proprietary rights could harm our competitive position. We rely on a combination of copyright, trademark, and trade secret laws, as well as license agreements and other contractual provisions to protect our intellectual property and other proprietary rights. In addition, we attempt to protect our intellectual property and proprietary information by requiring all of our employees and independent contractors to enter into confidentiality and invention assignment agreements. To date we have not pursued patent protection for our technology. We also have not registered trademarks to protect our brands. We cannot be certain that the steps we have taken to protect our intellectual property rights will be adequate or will prevent third-parties from infringing or misappropriating our rights; imitating or duplicating our technology, services or methodologies, including ETM; or using trademarks similar to ours. Should we need to resort to litigation to enforce our intellectual property rights or to determine the validity and scope of the rights of others, such litigation could be time-consuming and costly, and the result of any litigation is subject to uncertainty. In addition, ETM incorporates open source software components that are licensed to us under various public domain licenses. Although we believe that we have complied with our obligations under the various applicable licenses for the open source software that we use, there is little or no legal precedent governing the interpretation of many of the terms of these licenses, and the potential impact of such terms on our business is, therefore, difficult to predict.

We may be sued by third-parties for alleged infringement of their intellectual or proprietary rights.

Our use of ETM or other technologies could be challenged by claims that such use infringes, misappropriates or otherwise violates the intellectual property rights of third-parties. Any intellectual property claims, with or without merit, could be time-consuming and costly to resolve, could divert management's attention from our business and could require us to pay substantial monetary damages. Any settlement or adverse judgment resulting from such a claim could require us to enter into a licensing agreement to continue using the technology that is the subject of the claim, or could otherwise restrict or prohibit our use of such technology. There can be no assurance that we would be able to obtain a license on commercially reasonable terms, if at all, from the party asserting an infringement claim, or that we would be able to develop or license a suitable alternative technology to permit us to continue offering the affected services to our clients. Our insurance coverage for claims of infringement, misappropriation, or other violation of the intellectual property rights of third-parties may not continue to be available on reasonable terms or in sufficient amounts to cover one or more large claims against us, and our insurers may disclaim coverage as to any future claims. An uninsured or underinsured claim could result in unanticipated costs thereby reducing operating results.

We have a long selling cycle to secure a new enterprise contract and a long implementation cycle, which require significant investments of resources.

We typically face a long selling cycle to secure a new enterprise contract, which requires significant investment of resources and time by both our clients and us. Before committing to use our services, potential clients require us to spend time and resources educating them on the value of our services and assessing the feasibility of integrating our systems and processes with theirs. Our clients then evaluate our services before deciding whether to use them. Therefore, our enterprise selling cycle, which can take up to six months, is subject to many risks and delays over which we have little control, including our clients' decisions to choose alternatives to our services (such as other providers or in-house resources) and the timing of our clients' budget cycles and approval processes.

Implementing our enterprise services, which can take from one to six months, involves a significant commitment of resources over an extended period of time from both our clients and us. Depending on the scope and complexity of the processes being implemented, these time periods may be significantly longer. Our clients and future clients may not be willing or able to invest the time and resources necessary to implement our services, and we may fail to close sales with potential clients to which we have devoted significant time and resources, which could have a material adverse effect on our business, results of operations, financial condition and cash flows, as we do not recognize significant revenue until after we have completed the implementation phase.

Our clients may terminate their relationships with us on short notice with limited or no penalties, and our clients are not obligated to spend a minimum amount with us.

Our transactional clients, which accounted for approximately 58% and 61% of our revenue in 2009 and 2010, respectively, use our services on a shipment-by-shipment basis rather than under long-term contracts. These clients have no obligation to continue using our services and may stop using them at any time without penalty or with only limited penalties. Our contracts

14

with enterprise clients typically have terms of one to three years and are subject to termination provisions negotiated on a contract-by-contract basis. These termination provisions typically provide the client with the ability to terminate upon 30 or 60 days' advance written notice in the event of a material breach. Included as a material breach is the Company's failure to provide the negotiated level of cost savings. In some cases, the enterprise contracts may be terminated by providing written notice within 60 days of execution or may be terminated upon 60 to 90 days' advanced written notice for any reason. Enterprise contracts accounting for 9.3% and 17.1% of our revenue in 2010 are scheduled to expire (subject to possible renewal) in 2011 and 2012, respectively.

The volume and type of services we provide each client may vary from year to year and could be reduced if the client were to change its outsourcing or shipping strategy. Our enterprise clients generally are not obligated to spend any particular amount with us, although our enterprise contracts are typically exclusive with respect to point of origin or one or more modes of transportation, meaning that the client is obligated to use us if it ships from the point of origin or uses those modes. These contractual exclusivity provisions help ensure, but do not guarantee, that we receive a significant portion of the amount that our enterprise clients spend on transportation in the applicable mode or modes or from the applicable point of origin. In our experience, compliance with such provisions varies from client to client and over time. Failure to comply with these exclusivity provisions may adversely affect our revenue.

If a significant number of our transactional or enterprise clients elect to terminate or not to renew their engagements with us, or if the volume of their shipping orders decreases, our business, operating results and financial condition could suffer. If we are unable to renew our enterprise contracts at favorable rates, our revenue may decline.

If we are unable to deliver agreed upon cost savings to our enterprise clients, we could lose those clients and our results could suffer.

Our contracts with enterprise clients typically commit us to deliver a negotiated level of cost savings compared to our clients' historical shipping expenditures over a fixed period of time. We then estimate cost savings periodically during the term of our engagement and if the negotiated amount is not achieved, the client has the right to terminate the contract. Any number of factors, including a downturn in the economy, increases in costs, or decreases in the availability of transportation capacity, could impair our ability to provide the agreed cost savings. Even if our enterprise clients do not terminate their contracts with us as a result, our results of operations will suffer, and it may become more difficult to attract new enterprise clients.

The current uncertainty economic conditions of the global and domestic economy may have a material adverse affect on our business, results of operations and financial condition.

Our business, results of operations and financial condition are materially affected by the conditions in the global and domestic economy. The stress experienced by the global capital markets that began in the second half of 2007, substantially increased during the second half of 2008 and continued during 2009. The current economic environment continues to be uncertain. Concerns over unemployment, the availability and cost of credit, the U.S. mortgage market and a declining real estate market in the United States have contributed to increased volatility and diminished expectations for the economy and the financial markets going forward. These factors, combined with volatile oil prices and low business and consumer confidence, have precipitated a recession.

These events may have an adverse affect on us, our carriers and our clients. Carriers may charge higher prices to cover higher operating expenses such as higher fuel prices, costs associated with regulatory compliance and other factors beyond our control. Our gross profits and income from operations may decrease if we are unable to pass through to our clients the full amount of these higher transportation costs. In addition, our business, results of operations and financial condition may be negatively impacted by decreases in the volume of freight shipped by our clients due to decreases in their business volume or price increases by our carriers. If we are not able to timely and appropriately adapt to changes resulting from the difficult economic environment, our business, results of operations and financial condition may be materially and adversely affected.

High fuel prices may increase carrier prices and volatility in fuel prices may make it more difficult to pass through this cost to our clients, which may impair our operating results.

Fuel prices recently reached historically high levels in the past couple years and continue to be volatile and difficult to predict. In the event fuel prices rise, carriers can be expected to charge higher prices to cover higher operating expenses, and our gross profits and income from operations may decrease if we are unable to continue to pass through to our clients the full amount of these higher costs. Higher fuel costs could also cause material shifts in the percentage of our revenue by transportation mode, as our clients may elect to utilize alternative transportation modes, such as inter-modal. In addition, increased volatility in fuel prices may affect our gross profits and income from operations if we are not able to pass through to our clients any higher costs associated with such volatility. Any material shifts to transportation modes with respect to which we realize lower gross profit margins could impair our operating results.

15

A decrease in levels of excess capacity in the U.S. transportation services industry could have an adverse impact on our business.

We believe that, historically, the U.S. transportation services industry has experienced significant levels of excess capacity. Our business seeks to capitalize on imbalances between supply and demand in the transportation services industry by obtaining favorable pricing terms from carriers in our network through a competitive bid process. Reduced excess capacity in the transportation services industry generally, and in our carrier network specifically, could have an adverse impact on our ability to execute our business strategy and on our business results and growth prospects.

A decrease in the number of carriers participating in our network could adversely affect our business.

We use our proprietary technology platform to compile freight and logistics data from our network of over 24,000 carriers. In 2010, we used approximately 8,300 TL carriers, 100 LTL carriers, 10 small parcel carriers, 94 inter-modal carriers, 10 domestic air carriers and 80 international carriers. We expect to continue to rely on these carriers to fulfill our shipping orders in the future. However, these carriers are not contractually required to continue to accept orders from us. If shipping capacity at a significant number of these carriers becomes unavailable, we will be required to use fewer carriers, which could significantly limit our ability to serve our clients on competitive terms. The transportation industry has also experienced consolidation among carriers in recent years and further consolidations could result in a decrease in the number of carriers, which may impact our ability to serve our clients on competitive terms. In addition, we rely on price bids provided by our carriers to populate our database. If the number of our carriers decreases significantly, we may not be able to obtain sufficient pricing information for ETM, which could affect our ability to obtain favorable pricing for our clients.

Our obligation to pay our carriers is not contingent upon receipt of payment from our clients, and we extend credit to certain clients as part of our business model.

In most cases, we take full risk of credit loss for the transportation services we procure from carriers. Our obligation to pay our carriers is not contingent upon receipt of payment from our clients. In 2009 and 2010, our revenue was $259.6 million and $426.4 million, respectively, and our top 10 clients accounted for 27% and 23% of our revenue, respectively. If any of our key clients fail to pay for our services, our profitability would be negatively impacted.

We extend credit to certain clients in the ordinary course of business as part of our business model. By extending credit, we increase our exposure to uncollected receivables. The current economic conditions of the global and domestic economy have resulted in an increasing trend of business failures, downsizing and delinquencies, which may cause an increase in our credit risk. If we fail to monitor and manage effectively any increased credit risk, our immediate and long-term liquidity may be adversely affected. In addition, if one of our key clients defaults in paying us, our profitability would be negatively impacted.

A prolonged outage of our ETM database could result in reduced revenue and the loss of clients.

The success of our business depends upon our ability to deliver time-sensitive, up-to-date data and information. We rely on our Internet access, computer equipment, software applications, database storage facilities and other office equipment, which are mainly located in our Chicago headquarters. Our operations and those of our carriers and clients are vulnerable to interruption by fire, earthquake, power loss, telecommunications failure, terrorist attacks, wars, computer viruses, hacker attacks, equipment failure, physical break-ins and other events beyond our control, including disasters affecting Chicago. We attempt to mitigate these risks through various means, including system backup and security measures, but our precautions will not protect against all potential problems. We maintain fully redundant off-site backup facilities for our internet access, computer equipment, software applications, database storage and network equipment, but these facilities could be subject to the same interruptions that could affect our headquarters. If we suffer a database or network facility outage, our business could experience disruption, and we could suffer reduced revenue and the loss of clients.

Our ETM technology platform relies heavily on our telecommunication service providers, our electronic delivery systems and the Internet, which exposes us to a number of risks over which we have no control, including risks with respect to increased prices, termination, failures and disruptions of essential services.

Our ability to deliver our services depends upon the capacity, reliability and security of services provided to us by our telecommunication service providers, our electronic delivery systems and the Internet. We have no control over the operation, quality or maintenance of these services or whether the vendors will improve their services or continue to provide services that are essential to our business. In addition, our telecommunication service providers may increase their prices at which they provide services, which would increase our costs. If our telecommunication service providers were to cease to provide essential services or to significantly increase their prices, we could be required to find alternative vendors for these services. With a limited number of vendors, we could experience significant delays in obtaining new or replacement services, which could significantly harm our reputation and could cause us to lose clients and revenue. Moreover, our ability to deliver information

16

using the Internet may be impaired because of infrastructure failures, service outages at third-party Internet providers or increased government regulation. If disruptions, failures or slowdowns of our electronic delivery systems or the Internet occur, our ability to effectively provide technology enabled transportation and supply chain management services and to serve our clients may be impaired.

We are subject to claims arising from our transportation operations.

We use the services of thousands of transportation companies and their drivers in connection with our transportation operations. From time to time, these drivers are involved in accidents or goods carried by these drivers are lost or damaged and the carriers may not have adequate insurance coverage. Although these drivers are not our employees and all of these drivers are employees or independent contractors working for carriers or are owner-operators, from time to time, claims may be asserted against us for their actions, or for our actions in retaining them. Claims against us may exceed the amount of our insurance coverage, or may not be covered by insurance at all. If a shipment is lost or damaged during the delivery process, a client may file a claim for the damaged shipment with us and we will bear the risk of recovering the claim amount from the carrier. If we are unable to recover all or any portion of the claim amount from the carrier, and to the extent each claim exceeds the amount which may be recovered from the Company's own insurance, we may bear the financial loss. A material increase in the frequency or severity of accidents, claims for lost or damaged goods, liability claims or workers' compensation claims, or unfavorable resolutions of claims, could materially adversely affect our operating results. Significant increases in insurance costs or the inability to purchase insurance as a result of these claims could also reduce our profitability.

Our industry is subject to seasonal sales fluctuations. If our business experiences seasonality, it could have an adverse effect on our operating results and financial condition.