UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): January 26 , 2009

BioNeutral Group, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| Nevada | 333-149235 | 26-0745273 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | (COMMISSION FILE NO.) | (IRS EMPLOYEE IDENTIFICATION NO.) |

211 Warren Street

Newark, New Jersey 07103

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(973) 286-2899

(ISSUER TELEPHONE NUMBER)

MOONSHINE CREATIONS, INC.

160 Henry Martin Trail

Statesville, NC 28625

(704) 592-2622

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Form 8-K and other reports filed by Registrant from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, Registrant's management as well as estimates and assumptions made by Registrant's management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to Registrant or Registrant's management identify forward looking statements. Such statements reflect the current view of Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to Registrant's industry, Registrant's operations and results of operations and any businesses that may be acquired by Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although Registrant believes that the expectations reflected in the forward looking statements are reasonable, Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with Registrant's pro forma financial statements and the related notes that will be filed herein.

In this Form 8-K, references to “we,” “our,” “us,” “our company,” or the “Registrant” refer to Moonshine Creations, Inc., a Nevada corporation.

Item 1.01 Entry Into A Material Definitive Agreement

As more fully described in Item 2.01 below, on January 30, 2009, we entered into a share exchange agreement (the “Share Exchange Agreement”) by an among Moonshine Creations, Inc., a Nevada corporation, the shareholders of Moonshine, BioNeutral Laboratories Corporation USA, a Delaware company (“BioNeutral”) and the shareholders of BioNeutral (the “BioNeutral Shareholders”). The closing of the transaction (the “Closing”) took place on January 30, 2009 (the “Closing Date”).

As a condition to closing the Share Exchange Agreement, on December 22, 2008, pursuant to the majority consent of our board of directors and shareholders, we approved an amendment to our Articles of Incorporation changing our name to BioNeutral Group, Inc. Additionally, on December 22, 2008, our Board of Directors approved a 30-for-1 forward split of our common stock which was declared effective on January 20, 2009.

As a further condition to close, on the Closing Date, our corporate officers and directors who resigned also cancelled 150,000,000 shares of our common stock. We then issued 45,000,000 shares of our common stock to the BioNeutral Shareholders, in exchange for 100% shares of the issued and outstanding common stock of BioNeutral.

This transaction is more fully discussed in Item 2.01 of this Current Report. This brief discussion is qualified by reference to the provisions of the Share Exchange Agreement which is attached in full to this Current Report as Exhibit 2.1.

In connection with the Share Exchange, on January 30 , 2009, at a Special Meeting of Stockholders, our stockholders approved the 2009 Stock Incentive Plan which had been previously approved by the Compensation Committee of the Board of Directors, subject to stockholder approval. The Bioneutral 2009 Stock Incentive Plan allocates 5,000,000 shares to be issued to officers, employees or consultants to the Company at the discretion of the Board of Directors. The description of this plan is qualified in its entirety by reference to the full text of these plan, filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item 1.02 Termination of a Material Definitive Agreement

In December 2008 and January 2009, six (6) unaffiliated individuals extended a bridge loan to Bioneutral in the amount of $100,000, each. In consideration for the loan of $100,000 the Company issued to each lender a debenture (the “Debenture”) for the sum of $100,000 with an annual interest rate of 10%. The Debenture was payable within 90 days from the date of each Debenture. A copy of the form Debenture is attached hereto as Exhibit 4.1.

Pursuant to the terms of the Share Exchange and as mutually agreed to by each Debenture holder and Bioneutral, the Debentures were converted into common stock of Bioneutral Group, Inc. (formerly, Moonshine Creations, Inc.) at a conversion price of $1.00 per share (the “Conversion Agreement”). A copy of the form Conversion Agreement is attached hereto as Exhibit 4.2.

A further description of the shares issued pursuant to this Conversion Agreement is discussed in Item 3.02, below.

Item 2.01 Completion of Acquisition and Disposition of Assets

CLOSING OF SHARE EXCHANGE AGREEMENT

On December 22, 2008, pursuant to the majority written consent of our Board of Directors and shareholders, we effectuated a 30-for-1 forward stock split of our issued and outstanding common stock as of the date thereof. As of the same date, we filed an amendment to our Articles of Incorporation with the Secretary of the State of Nevada to increase our authorized shares of common stock to 200,000,000. Before the effectiveness of the forward stock split, we had 5,635,500 shares of common stock issued and outstanding, of which 5,000,000 shares were restricted and the remaining 635,500 shares were free trading. After the effectuation of the forward split, our outstanding common stock was increased to 169,065,000 shares, of which 150,000,000 shares were restricted and 19,065,000 were free trading.

On January 30, 2009, we entered into a Share Exchange Agreement with BioNeutral and the BioNeutral Shareholders. The Closing took place on January 30, 2009. Pursuant to the Share Exchange Agreement our sole corporate officer and director, Victoria Callanan, resigned from her positions and agreed to cancel her 150,000,000 shares of our common stock of the 169,065,000 shares outstanding. Further, as consideration for the exchange of 100% of the shares of BioNeutral Laboratories Corporation USA, we agreed to issue a total of 45,000,000 shares of our common stock to the shareholders of Bioneutral Laboratories Corporation USA. As of the Closing Date, we issued 42,649,500 shares to the shareholders of Bioneutral Laboratories Corporation USA. The remaining 2,350,500 shares shall be issued to the preferred shareholders of Bioneutral Laboratories Corporation USA within 30 days of the Closing Date pursuant to a mandatory conversion feature of the preferred shares. Additionally, at Closing, we issued 600,000 shares to six investors who purchased debentures in Bioneutral Laboratories Corporation USA and agreed to convert those Debentures into shares of common stock per the terms of the Share Exchange Agreement. Additionally, we issued 50,000 shares of common stock to Anslow & Jaclin, LLP as partial compensation for legal services. Accordingly, immediately following the Closing Date, there were 62,364,500 shares of common stock outstanding and within 30 days of the Closing Date and, consistent with the terms of the Share Exchange Agreement, there will be 64,715,000 shares issued and outstanding .

As a result of the closing of the share exchange, BioNeutral became our wholly-owned subsidiary. Our shareholders and directors approved the Share Exchange Agreement and the transactions contemplated under the Share Exchange Agreement.

BUSINESS

Overview

BioNeutral is a specialty chemical company, organized in 2003 in the State of Delaware to commercialize a novel combinational chemistry-based technology which can neutralize harmful environmental contaminants, toxins and dangerous micro-organisms including bacteria, viruses and spores.

The formulations, including Ygiene™ and Ogiene™, are eco-friendly and include natural and common ingredients which are found in baby products and in every day foods. We are able to combine these widely-used compounds in unique ways to create products that enhance our cleaning results. Our proprietary platform technology has been proven effective in surface, water and airborne applications. Our products include BioNeutralizers and ChemoNeutralizers. A brief description of our products is below.

Products

BioNeutral has two classes of formulations: (1) antimicrobials (Ygiene™); and (2) bioneutralizers (Ogiene™). The antimicrobials kill a broad spectrum of harmful microbes, including virulent gram and bacteria (which cause staph infections), viruses, yeast, mold, fungi, spores and certain bioterrorism agents such as anthrax. The bioneutralizers destroy a wide range of toxic and noxious agents, particulates and their associated odors. Of particular importance is the neutralization of hydrogen sulfide, carbon dioxide, sulfur dioxide, formaldehyde and ammonia that are known contributors to foul odors and/or greenhouse gases.

Ygiene™, the trade name for the Company’s antimicrobial products, targets and binds to specific surface proteins, penetrates the microbe’s cellular structure and alters the contents of the cell. Our studies have verified that the antimicrobial formulation possesses the effectiveness of chlorine bleach or caustic soda without the toxicity or danger of use. The formulations have been proven to kill over 200 microbes, including Methicillin resistant Staphylococus Aureus (MRSA), multi-drug resistant Pseudomonas Aeruginosa, and E. Coli. The antimicrobials have been shown to provide large Zones of Inhibition and tests have verified high potency across a wide spectrum of harmful microbes. Although full toxicity studies are to be completed early next year, the company believes that the products are relatively safe to use due to the nature of the components in the formulations. In addition, the companies antimicrobial formulations are “green” in nature and in fact are all environmentally friendly.

As a surface disinfectant, Ygiene™’s efficacy exceeded leading commercial brand antimicrobials. Its antimicrobial properties were more effective against Anthrax than chlorine dioxide and formaldehyde, and it has a proven ability to kill a variety of molds, including those associated with “sick building syndrome”.

Ygiene™ is peroxy based and can deliver more active ingredient than any currently available anti-microbial. It can kill health threatening spores on contact inclusive of Black Mold, Anthrax and C. diff.

There are three categories of Ygiene formulations that are intended to serve a broad range of markets:

| · | Military/first responders/hospital sterilant/specialty industrial: “kill on contact” for anthrax and all micro-organisms. |

| · | Hospital/health care/mold/industrial applications: high level disinfection for hospitals and other health care facilities, eradication of mold and industrial cleaning in food preparation and other demanding environments. It will kill organisms in less than 1 minute and will perform to a very high standard. |

| · | Consumer products/light industrial/health care: it can be used in general areas of the hospital, nursing home, physician or dental office. It is very mild yet sporacidal, bactericidal and viracidal, and can be used as a superior skin sanitizer. |

Ogiene™, the trade name for the Company’s bioneutralizers, eliminates odors of many chemicals, including hydrogen sulfide, formaldehyde and ammonia; and is effective against many greenhouse gases such as carbon dioxide and sulfur dioxide. It can be used for odor control in a variety of uses and we plan to market this product for hotels, restaurants, industrial manufacturing, controlled animal feeding operations (CAFOs) and homes. We believe that Ogiene™ will effectively neutralize gases that are poisonous and considered Weapons of Mass Destruction (WMDs).

Ogiene™ formulation interacts with the functional organic or inorganic groups of harmful gases removing them from the air. It can be used to remove industrial pollution, environmental contaminants, and protection against chemical weapons of mass destruction. Ogiene™ is rapidly acting and effective on a wide variety of gases. In addition, usually no or minimal clean up is required and Ogiene™ is non-toxic. Ogiene™ is effective in the gas phase – being applied as a fog, mist or spray – or in the liquid phase – being applied directly to liquid contaminates. The toxic gases and odors that Ogiene™ can eliminate include:

| · | Ammonia and carbon dioxide |

| · | Sulfur dioxide/ nitrogen oxide (green house gases) |

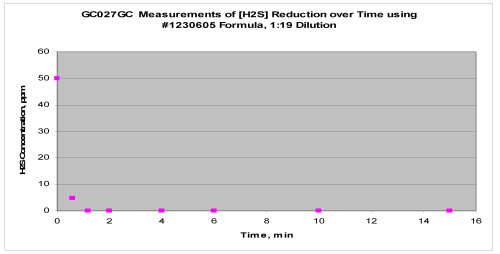

The following illustrates the effectiveness of Ogiene™ on some model gases:

| Gas | Threshold Smell | Levels in Test | % Reduced in 10 seconds | % Reduced in 1 minute |

| H2S | 2ppb | 20-50ppm | 50 | 95 |

| NH3 | 17ppm | 20-50ppm | 25 | 80 |

| SO2 | 3ppm | 50-150ppm | 99 | 100 |

| CO2 | na | 2000ppm | 10 | 25 |

| Formaldehyde | 0.8ppm | 17-41ppm | 80 | 99 |

| Acetic Acid | 0.4ppm | 17-25ppm | 20 | 60 |

The chart below demonstrates the rate of gas removal by Ogiene™:

The chart above demonstrates that the active ingredients of our product can rapidly treat a wide variety of gases. Our technology platform provides excellent delivery capabilities of active ingredients and is more than sufficiently robust to address the elimination of a broad range of gases. This is important since household, institutional and industrial odors and irritating gases can be the result of either a single odoriferous compound or the result of a multiplicity of odoriferous compounds or components. These odor causing components include various organic carboxylic acids, aldehydes, ketones, amines, mercaptans, sulfides, disulfides, esters, etc. In addition, various inorganic compounds such as ammonia, hydrogen sulfide, sulfur dioxide may add to the complexity of specific odors.

In general, the Ygiene™ and Ogiene™ formulations have the following interesting characteristics/capabilities:

| · | Family of “green” formulations which are lethal to spores, bacteria’s and viruses at room temperature; |

| · | Formulation can be manipulated, depending upon the needs of the market, to address requirements that can vary: |

| o | the kill time from seconds to minutes; |

| o | the breadth of kill, and the class of organisms up to the most difficult to eradicate sports. |

| · | The ingredients, when combined, have lower toxicity and far greater efficacy; |

| · | The formulations are stable, non corrosive, non flammable and water soluble. |

| · | The formulations can be applied as a liquid, wet wipe, spray, mist/fog or foam/froth and can be applied to air, surface and water. |

Our Customers

We will market and sell our products to consumers, commercial and military chemical firms. We have already been in contact with several potential customers, including:

| · | A leading international defense and technology company that provides products for the electronics, aerospace and shipbuilding industries to the government and commercial customers. This company would primarily be interested in BioNeutral’s Ygiene™ for its antimicrobial properties (such as anthrax remediation) and Ogiene™ to neutralize toxic gases. |

| · | A leading manufacturer of cleaners, including laundry and floor care products, where Ygiene™ could be used in detergents as an antibacterial and anti-mold agent. |

| · | A leading cleaning and maintenance products company where Ygiene™ could be used as an antibacterial in cleaners and water care products. |

| · | A major cleaning and cleaning products international firm where YgieneTM would be used as a major product extension for our targeted markets. |

Marketing

Our plan is to develop a small, highly capable, experienced business team to market, license, sell and distribute its products to major international companies in our target industries. These major customers will have the financial ability, marketing and distribution skills to successfully sell BioNeutral products efficiently. Current major markets include hotels, restaurants and hospitals. We anticipate that our major markets will include the military, power generation, CAFOs, mold remediation, surgical equipment sterilization and wastewater treatment facilities. Rapid and sustained revenue growth will require a combination of technical, marketing and specific application development.

We will provide for two marketing initiatives: (1) BioNeutral will engage a contract manufacturer to produce finished products and then resell them to BioNeutral’s distributors/customers; and (2) BioNeutral will use a contract manufacturer to produce the component which will be sold to a customer who will manufacture the finished products for mass distribution using the customer’s brand name. It is intended that all products will require the use of BioNeutral’s registered trademarks of Ogiene™ and Ygiene™. For narrowly defined applications, the Company intends to offer exclusive marketing arrangements in which BioNeutral will receive an upfront license fee, and the licensee will be responsible for agreed-upon sales requirements.

We plan to adjust pricing based upon the demand for each product and the value added for products. We will employ a public relations firm who will assist us in conveying the message about the unique properties of our products through specific industry trade journals.

As soon as the EPA certifies YgieneTM, the Company will commit most of its resources to application development, marketing and business development to accelerate commercialization as rapidly as possible.

Intellectual Properties

Intellectual property includes patent application for the formulations, the manufacturing process, and the trademarks of Ogiene™ and Ygiene™.

In March 2005, the Company filed a non-provisional patent application for the composition of matter of its formulations, the manufacturing process and a number of applications. BioNeutral filed a “Continuation in Part” in May 2006 relating to additional formulation technology and another “Continuation in Part” in May 2007 protecting the recent commercial formulations. A new additional patent was filed in May 2008 for Ogiene™FE to protect the Formaldehyde applications.

The Company believes its patent claims are unique within its chemical composition space. Prior lab and field tests have verified about 80 potential applications. As the Company continues to utilize its technology platform and complement its product offerings, it plans to aggressively protect its technology and products by filing patent applications.

Regulatory Approvals

Ogiene™ products do not rely upon antibiotic or pesticide activity, and therefore are not covered under the Federal Insecticide, Fungicide and Rodenticide Act (FIFRA). All of the ingredients in Ogiene™ have been approved by the EPA under the Toxic Substance Control Act (TSCA).

Ygiene™ is a pesticide under FIFRA and will require EPA registration for disinfectant claims and FDA registration for sterilant claims. The EPA process typically takes eight to nine months and costs about $100,000. The FDA sterilant process typically takes 13 to 18 months with an approximate cost of $400,000. The Company has completed raw material sourcing and manufacturing scale-up at the contract manufacturer. The formulation has passed initial EPA screening tests for hard surface disinfectant and mold use and three batches have been produced for the EPA certification process. Toxicity studies will be conducted after adequate financing is achieved with an expected completion by the second quarter of 2009. After these independent efficacy and toxicity tests are completed, the first application for certification will be submitted to the EPA. Approval is expected by October 2009.

DESCRIPTION OF PROPERTIES

We are located at New Jersey Institute of Technology, 211 Warren Street, Newark, NJ 07103.

DESCRIPTION OF LEGAL PROCEEDINGS

There is no pending litigation against us.

Risks Related to Our Business

We need to raise additional capital or take other measures in the next few months in order to continue our operations and the current credit and financial environment is very uncertain.

The Company’s cash flow projections presently indicate that our current assets and projected revenues will not be sufficient to fund operations over the coming twelve months. As such, the Company will need to raise additional financing or take other measures within the next few months in order to continue its operations. However, as a newly formed business, the Company’s ability to accurately project revenues and expenses can be significantly impacted by unforeseen events, developments and contingencies that cannot be anticipated. As such, there can be no assurance that management’s plans to raise additional financing will be successful or sufficient in order to sustain our operations over the coming twelve months.

Our business is subject to numerous risks as an early stage company.

Our operations are dependent upon us building a successful level of revenues to sustain our operations and with little history to draw on and limited experience in this business, our business faces numerous risks to potential success including but not limited to customer acceptance of our products, competition, having the human and financial resources to achieve our plans, etc. There is no assurance that our business will be successful.

We have limited operating history.

We have only recently commenced the marketing and sale of our bioneutralizers, odor controllers and antimicrobial applications. Prospective investors in our securities have limited operating history on which to base an evaluation of our future performance. Our prospects must be considered in light of the risks, expenses, and difficulties frequently encountered by companies in an early stage of development, particularly companies in new or rapidly evolving markets. Although we believe that we have developed a model that will be successful, there can be no assurance that we will be able to achieve or sustain profitability, or generate sufficient cash flow to meet our capital and operating expense obligations. As a result, you could lose your entire investment.

We are planning for rapid growth and intend to aggressively build our Company. The growth in the size and geographic range of our business will place significant demands on management and our operating systems. Our ability to manage our growth effectively will depend on our ability to attract additional management personnel; to develop and improve our operating systems; to hire, train, and manage an employee base; and to maintain adequate service capacity. Additionally, the proposed rapid roll-out of our products and operations may require hiring additional management personnel to oversee procurement and materials management duties. We will also be required to rapidly expand our operating systems and processes in order to support the projected increase in product applications and demand. There can be no assurance that we will be able to effectively manage growth and build the infrastructure necessary to achieve its rapid roll-out plan.

Our success depends on our ability to retain our key personnel.

Our present and future performance will depend on the continued service of our senior management personnel, key sales personnel, and consultants. Our key employees include Stephen Browand, our Chairman and Chief Executive Officer and Dr. Andy Kielbania, our Chief Scientist. The loss of the services of any of these individuals could have an adverse effect on us. We currently do not have employment agreements with our officers. We do not maintain any key man life insurance on any of our key personnel.

We may not be successful in protecting our intellectual property and proprietary rights and we may be required to expend significant amounts of money and time in attempting to protect our intellectual property and proprietary rights and if we are unable to protect our intellectual property and proprietary rights our competitive position in the market could suffer.

We have applied for patents to protect our proprietary technologies relating to our unique cleaning and odor-removing products. In addition, we currently hold two registered trademarks pertaining to our intellectual property rights. If we fail to successfully enforce our intellectual property rights, our competitive position could suffer, which could harm our operating results. Patents may not be issued for our patent applications that we may file in the future or for our patent applications we have filed to date, third parties may challenge, invalidate or circumvent any patent issued to us, unauthorized parties could obtain and use information that we regard as proprietary despite our efforts to protect our proprietary rights, rights granted under patents issued to us, if any, may not afford us any competitive advantage, others may independently develop similar technology and protection of our intellectual property rights may be limited in certain foreign countries. We may be required to expend significant resources to monitor and police our intellectual property rights. Any future infringement or other claims or prosecutions related to our intellectual property could have a material adverse effect on our business. Any such claims, with or without merit, could be time consuming to defend, result in costly litigation, divert management’s attention and resources, or require us to enter into royalty or licensing agreements. Such royalty or licensing agreements, if required, may not be available on terms acceptable to us, if at all. We may not be in a position to properly protect our position or stay ahead of competition in new research and the protecting of the resulting intellectual property.

Although we believe that our products do not and will not infringe upon the patents or violate the proprietary rights of others, it is possible such infringement or violation has occurred or may occur which could have a material adverse effect on our business.

In the event that products we sell are deemed to infringe upon the patents or other proprietary rights of third parties, we could be required to modify our products or obtain a license for the manufacture and/or sale of such products and services. In such event, we cannot assure you that we would be able to do so in a timely manner, upon acceptable terms and conditions, or at all, and the failure to do any of the foregoing could have a material adverse effect upon our business. Moreover, we cannot assure you that we will have the financial or other resources necessary to enforce or defend a patent infringement or proprietary rights violation action. In addition, if our products or proposed products are deemed to infringe or likely to infringe upon the patents or proprietary rights of others, we could be subject to injunctive relief and, under certain circumstances, become liable for damages, which could also have an adverse effect on our business.

We may not be able to timely fill orders for our products.

In order for us to successfully market our products, we must be able to timely fill orders for our product line. Our ability to timely meet our supply requirements will depend on numerous factors including our ability to successfully maintain an effective distribution network and to maintain adequate inventories and our ability of the Company’s sole supplier to adequately produce the Company’s products in volumes sufficient to meet demand. Failure of the Company to adequately supply its products to retailers or of the Company’s supplier to adequately produce products to meet demand could materially adversely impact the operations of the Company.

Unavailability of raw materials used to manufacture our products, increases in the price of the raw materials, or the necessity of finding alternative raw materials to use in our products could delay the introduction and market acceptance of our products.

Our failure to procure adequate supplies of raw materials could delay the commercial introduction or shipment and hinder market acceptance of our eco-friendly cleaning products.

We are dependent on third parties to transport our products, so their failure to transport our products could adversely affect our earnings, sales and geographic market.

We will use third parties for the vast majority of our shipping and transportation needs. If these parties fail to deliver our products in a timely fashion, including due to lack of available trucks or drivers, labor stoppages or if there is an increase in transportation costs, including due to increased fuel costs, it would have a material adverse effect on our earnings and could reduce our sales and geographic market.

Our Company is subject to regulation by the Federal Trade Commission with respect to our environmental marketing claims.

The Company advertises its products as eco-friendly and “green” cleaning products and must conform with the Federal Trade Commission’s Guides for the use of Environmental Marketing Claims (the “Guides”). In the event Federal Trade Commission (“FTC”) determined that our products are not in compliance with the Guides and applicable State law regulations, the FTC may bring enforcement actions against on the basis that our marketing claims are false or misleading. Such action could have a material adverse affect on our business operations.

Risks Related to Our Corporate Governance and Common Stock

We are subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to its customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our Common Stock, which in all likelihood would make it difficult for our stockholders to sell their securities.

Rule 3a51-1 of the Securities Exchange Act of 1934 establishes the definition of a "penny stock," for purposes relevant to us, as any equity security that has a minimum bid price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited number of exceptions which are not available to us. It is likely that our shares will be considered to be penny stocks for the immediately foreseeable future. This classification severely and adversely affects any market liquidity for our Common Stock.

For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker or dealer approve a person's account for transactions in penny stocks and the broker or dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and that that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth:

| | · | the basis on which the broker or dealer made the suitability determination, and |

| | · | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions.

Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because of these regulations, broker-dealers may not wish to engage in the above-referenced necessary paperwork and disclosures and/or may encounter difficulties in their attempt to sell shares of our common stock, which may affect the ability of selling shareholders or other holders to sell their shares in any secondary market and have the effect of reducing the level of trading activity in any secondary market. These additional sales practice and disclosure requirements could impede the sale of our common stock, if and when our common stock becomes publicly traded. In addition, the liquidity for our common stock may decrease, with a corresponding decrease in the price of our common stock. Our common stock are subject to such penny stock rules for the foreseeable future and our shareholders will, in all likelihood, find it difficult to sell their common stock.

The market for penny stock has experienced numerous frauds and abuses which could adversely impact subscribers of our stock.

We believe that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

| | · | control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

| | · | manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| | · | “boiler room" practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons; |

| | · | excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| | · | wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

We believe that many of these abuses have occurred with respect to the promotion of low price stock companies that lacked experienced management, adequate financial resources, an adequate business plan and/or marketable and successful business or product.

The Company is controlled by existing stockholders.

The Company’s officers, directors and principal stockholders and their affiliates own or control a majority of the Company’s outstanding common stock. As a result, these stockholders, if acting together, would be able to effectively control matters requiring approval by the stockholders of the Company, including the election of the Company’s Board of Directors.

Our certificate of incorporation limits the liability of our directors.

Our certificate of incorporation limits the personal liability of the director of our Company for monetary damages for breach of fiduciary duty as a director, subject to certain exceptions, to the fullest extent allowed by Nevada law. Accordingly, except in limited circumstances, our directors will not be liable to us or our stockholders for breach of their duties.

Provisions of our certificate of incorporation, bylaws and Nevada corporate law have anti-takeover effects.

Some provisions in our certificate of incorporation and bylaws could delay or prevent a change in control of our Company, even if that change might be beneficial to our stockholders. Our certificate of incorporation and bylaws contain provisions that might make acquiring control of us difficult, including provisions limiting rights to call special meetings of stockholders and regulating the ability of our stockholders to nominate directors for election at annual meetings of our stockholders. In addition, our board of directors has the authority, without further approval of our stockholders, to issue common stock having such rights, preferences and privileges as the board of directors may determine. Any such issuance of common stock could, under some circumstances, have the effect of delaying or preventing a change in control of our Company and might adversely affect the rights of holders of common stock.

In addition, we are subject to Nevada statutes regulating business combinations, takeovers and control share acquisitions, which might also hinder or delay a change in control of the Company. Anti-takeover provisions in our certificate of incorporation and bylaws, anti-takeover provisions that could be included in the common stock when issued and the Delaware statutes regulating business combinations, takeovers and control share acquisitions can depress the market price of our securities and can limit the stockholders’ ability to receive a premium on their shares by discouraging takeover and tender offer bids, even if such events could be viewed as beneficial by our stockholders.

Upon consummation of the Share Exchange, we became subject to the liabilities of BioNeutral, both known and unknown.

Upon consummation of the Share Exchange Agreement, we became subject to all liabilities, claims and obligations of BioNeutral, both known and unknown. It is possible that BioNeutral is subject to certain liabilities, claims and obligations unknown to us. If we are subject to any such liabilities or obligations, our business, financial condition and results of operations could be materially and adversely affected.

Our management team does not have extensive experience in public company matters, which could impair our ability to comply with legal and regulatory requirements.

We became a public company and subject to the applicable reporting requirements under the securities laws upon consummation of the Share Exchange Agreement. Our management team has had very limited public company management experience or responsibilities. This could impair our ability to comply with legal and regulatory requirements such as the Sarbanes-Oxley Act of 2002 and applicable federal securities laws including filing required reports and other information required on a timely basis. There can be no assurance that our management will be able to implement and affect programs and policies in an effective and timely manner that adequately respond to increased legal, regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Our internal financial reporting procedures are still being developed and we will need to allocate significant resources to meet applicable internal financial reporting standards.

As a public company we will be required to adopt disclosure controls and procedures that are designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure. We are taking steps to develop and adopt appropriate disclosure controls and procedures.

These efforts require significant time and resources. If we are unable to establish appropriate internal financial reporting controls and procedures, our reported financial information may be inaccurate and we will encounter difficulties in the audit or review of our financial statements by our independent auditors, which in turn may have material adverse effects on our ability to prepare financial statements in accordance with generally accepted accounting principles and to comply with our SEC reporting obligations.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes Oxley Act of 2002 could prevent us from producing reliable financial reports or identifying fraud. In addition, current and potential stockholders could lose confidence in our financial reporting, which could have an adverse effect on our stock price.

We became subject to Section 404 of the Sarbanes-Oxley Act of 2002 upon consummation of the Share Exchange Agreement. Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud, and a lack of effective controls could preclude us from accomplishing these critical functions. Commencing with our fiscal year ending March 31, 2009, we will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, in connection with, Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 5 (“AS 5”) which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments. Although we intend to augment our internal controls procedures and expand our accounting staff, there is no guarantee that this effort will be adequate.

During the course of our testing, we may identify deficiencies which we may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404 and AS5. In addition, if we fail to maintain the adequacy of our internal accounting controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. Failure to achieve and maintain effective internal controls could cause us to face regulatory action and also cause investors to lose confidence in our reported financial information, either of which could have an adverse effect on our stock price.

There are additional requirements and costs associated with becoming a public company which may prove to be burdensome, especially for a smaller public company.

As a result of the Share Exchange Agreement, we became subject to the information and reporting requirements of the U.S. Securities laws, including the Sarbanes-Oxley Act. The U.S. Securities laws require, among other things, review, audit and public reporting of our financial results, business activities, adequacy of controls and other matters. We cannot assure you that we will be able to comply with all of these requirements. Our cost of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC and furnishing audited reports to stockholders will cause our expenses to be higher than they would be if the Company had remained privately-held and the Share Exchange Agreement had not been consummated. Increased costs may be material and may include the hiring of additional employees and/or the retention of additional consultants and professionals. Our failure to comply with U.S. Securities laws could result in private or governmental legal action against us and/or our officers and directors, which could have a detrimental effect on our business and finances, the value of our securities and the ability of our stockholders to resell their securities.

We became public through the Share Exchange Agreement and we may not be able to attract the attention of major brokerage firms.

Additional risks are associated with our Company becoming public through the Share Exchange Agreement. For example, security analysts of major brokerage firms may not provide coverage of us since there is no incentive to brokerage firms to recommend the purchase of our common stock. In addition, even if we should so desire, we cannot assure you that brokerage firms will want to conduct any public offerings on our behalf in the future.

There will be a limited trading market for our common stock.

It is anticipated that there will be a limited trading market for the Company’s common stock on the OTC-BB. The lack of an active market may impair your ability to sell your shares at the time you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair market value of our

common stock. An inactive market may also impair our ability to raise capital by selling shares of capital stock and may impair our ability to acquire other companies or technologies by using common stock as consideration.

You may have difficulty trading and obtaining quotations for our common stock.

The Company’s common stock may not be actively traded, and the bid and asked prices for our common stock on the OTC-BB may fluctuate widely. As a result, investors may find it difficult to dispose of, or to obtain accurate quotations of the price of, our securities. This severely limits the liquidity of the common stock, and would likely reduce the market price of our common stock and hamper our ability to raise additional capital.

The market price of our common stock may, and is likely to continue to be, highly volatile and subject to wide fluctuations.

The market price of the Company’s common stock is likely to be highly volatile and could be subject to wide fluctuations in response to a number of factors that are beyond our control, including:

| • | | dilution caused by our issuance of additional shares of common stock and other forms of equity securities in connection with future capital financings to fund our operations and growth, to attract and retain valuable personnel and in connection with future strategic partnerships with other companies; |

| • | | announcements of new acquisitions or other business initiatives by our competitors; |

| • | | our ability to take advantage of new acquisitions or other business initiatives; |

| • | | fluctuations in revenue from our biodegradable plastics products; |

| • | | changes in the market for biodegradable plastics products and/or in the capital markets generally; |

| • | | changes in the demand for biodegradable plastics products, including changes resulting from the introduction or expansion of new biodegradable products; |

| • | | quarterly variations in our revenues and operating expenses; |

| • | | changes in the valuation of similarly situated companies, both in our industry and in other industries; |

| • | | changes in analysts’ estimates affecting our Company, our competitors and/or our industry; |

| • | | changes in the accounting methods used in or otherwise affecting our industry; |

| • | | additions and departures of key personnel; |

| • | | announcements of technological innovations or new products available to the our industry; |

| • | | announcements by relevant governments pertaining to incentives for biodegradable product development programs; |

| • | | fluctuations in interest rates and the availability of capital in the capital markets; and |

| • | | significant sales of our common stock, including sales by the investors following registration of the shares of common stock issued in the Offering and/or future investors in future offerings we expect to make to raise additional capital. |

These and other factors are largely beyond our control, and the impact of these risks, singly or in the aggregate, may result in material adverse changes to the market price of our common stock and/or our results of operations and financial condition.

Our operating results may fluctuate significantly, and these fluctuations may cause our stock price to decline.

Our operating results will likely vary in the future primarily as the result of fluctuations in our revenues and operating expenses, expenses that we incur, and other factors. If our results of operations do not meet the expectations of current or potential investors, the price of our common stock may decline.

We do not expect to pay dividends in the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, investors will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all. Investors cannot be assured of a positive return on investment or that they will not lose the entire amount of their investment in the common stock.

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

We make forward-looking statements in Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report based on the beliefs and assumptions of our management and on information currently available to us. Forward-looking statements include information about our possible or assumed future results of operations which follow under the headings “Business and Overview,” “Liquidity and Capital Resources,” and other statements throughout this report preceded by, followed by or that include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions.

Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those expressed in these forward-looking statements, including the risks and uncertainties described below and other factors we describe from time to time in our periodic filings with the U.S. Securities and Exchange Commission (the “SEC”). We therefore caution you not to rely unduly on any forward-looking statements. The forward-looking statements in this report speak only as of the date of this report, and we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Company Overview

BioNeutral is a specialty chemical company, organized in 2003 to commercialize a novel combinational chemistry-based technology which can neutralize harmful environmental contaminants, toxins and dangerous micro-organisms including bacteria, viruses and spores.

The formulations, including Ygiene™ and Ogiene™, are green and include natural and common ingredients which are found in baby products and in the foods we eat. We combine these widely used compounds in unique ways to create enhanced results. Our proprietary platform technology been proven effective in surface, water and airborne applications. Our products include BioNeutralizers and ChemoNeutralizers.

Plan of Business

We began operations in 2003 as a privately held company. Activities in recent years included securing debt and equity-based financing, development, design and marketing of our cleaning products: (i) the all-purpose cleaner; (ii) Ogiene – the toxic gas and odor eliminator; and (iii) Ygiene – an antimicrobial. The Company generated revenues of $2,041,000 in 2004 but has yet to generate consistent revenue growth or cash flows from operations.

Our multi-purpose cleaner does not contain any phosphates, abrasives, alkyl phenol ethoxylates, chlorine or caustic properties. It removes spots and stains (including, fruits and vegetables, permanent marker, ball point pen ink, animal fats, dirt and grime, etc.) from surfaces such as countertops, tables, floors, clothing and vinyl siding. Our Ogiene product is a chemical neutralizer that eliminates toxic gases and odors. It is water based and ph buffered to efficiently and effectively eliminate toxic gases. It is eliminates in eliminating industrial, institutional, household and animal odors. It is highly effective against hydrogen sulfide, ammonia, sulfur dioide and formaldehyde. In addition, Ogiene can reduce the odor from smoke, pet odors, cooking odors and bathroom odors. Our third product, Ygiene, is a bioneutralizer that fights against microbials. It is noncorrosive to ferrous metals and is easily customizable to specific applications. Ygiene can protect against bacteria such as E.coli, salmonella and anthrax by killing these microorganisms quicker than conventional antimicrobials. The Ygiene family of products can be used as sanitzers, disinfectants, cold sterilants, consumer grades, hospital grades, industrial grades and military grades.

During 2009, we intend to begin to produce and offer for resale our multi-purpose cleaners. Additionally, we expect to enter into contracts with certain governmental agencies to utilize our Ogiene product to eliminate odors and toxic gases in contaminated homes that were affected by Hurricane Katrina. We also intend to continue to develop and obtain regulatory approval on our Ygiene products.

We anticipate the sale and distribution of our initial product offering of our multi-purpose cleaner will begin during the fiscal year of 2009.

We intend to deliver brand building messages through several marketing and advertising vehicles, including television, radio, national print, online marketing and search engine optimization, and retail store promotions.

Results of Operations

The following table sets forth the results of the operations of BioNeutral for the two most recent fiscal years ended on December 31, 2007 and 2006, and the nine month periods ended Septemeber 30, 2008 and 2007, respectively.

Nine Months Ended September 30, 2008 and 2007

| | | September 30, 2008 | | | September 30, 2007 | | | Increase (Decrease) | | | Percentage Increase (Decrease) | |

| | | | | | | | | | | | | | |

| Revenues | | $ | - | | | $ | - | | | $ | - | | | | 0 | | % |

| Cost of Sales | | | - | | | | - | | | | - | | | | 0 | | % |

| Gross Profit | | | - | | | | - | | | | - | | | | 0 | | % |

| Operating Expenses | | | 5,232,828 | | | | 1,612,830 | | | | 3,619,998 | | | | 224 | | % |

| Other Income and Expenses | �� | | (9,942 | ) | | | 12,150 | | | | (22,092 | ) | | | (182 | ) | % |

| Net Loss | | | (5,242,770 | ) | | | (1,600,680 | ) | | | (3,642,090 | ) | | | 228 | | % |

| Other Comprehensive Income | | | 4,550 | | | | - | | | | 4,550 | | | | 100 | | % |

| Comprehensive Loss | | | (5,238,220 | ) | | | (1,600,680 | ) | | | (3,637,540 | ) | | | 227 | | % |

| | | | | | | | | | | | | | | | | | |

| Loss Per Common Share | | | | | | | | | | | | | | | | | |

| - Basic and Diluted | | $ | (0.26 | ) | | $ | (0.10 | ) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Weighted Average Common Shares Outstanding | | | | | | | | | | | | | | | | | |

| - Basic and Diluted | | | 19,965,941 | | | | 16,098,644 | | | | | | | | | | |

Revenues

The Company last generated revenues during the year ended December 31, 2004. The Company is in the process of planning its initial efforts to commercialize its technology and is currently awaiting finalized rulings on several of its core patents pending.

Cost of Sales

The Company had no sales and therefore had no cost of sales during the nine months ended September 30, 2008 and 2007, respectively.

Gross Profit

The Company did not generate any sales or gross profits during the nine months ended September 30, 2008 and 2007, respectively.

Operating Expenses

For the nine months ended September 30, 2008, the Company’s operating expenses increased 224% as compared to the nine months ended September 30, 2007. The Company has minimal operations in 2008 and 2007 and was focused solely on enhancing the Company's technology and ensuring the Company's patents pending were in process and were en route to approval in the nearest term possible. Operating expenses increased by approximately $3.6 million due almost entirely to stock based compensation. Stock based compensation was approximately $1.0 million in 2007 and increased to $4.6 million in 2008. The increase in stock based compensation in 2008 was as a result of management turnover whereby the Company's new management were compensated aggressively by the Board of Directors with the intention of motivating employees and producing results.

Other Income and Expenses

The Company incurred interest expense of $5,753 and $2,556 during the nine months ended September 30, 2008 and 2007, respectively. During 2008 and 2007, the Company continued to require short term financing by members of the Board of Directors, all of which carried interest at a 9% interest rate. Additionally, during the nine months ended September 30, 2008, the Company realized losses on sales of marketable securities of $5,252 as compared to gains on sales of marketable securities of $14,622 during the nine months ended September 30, 2007.

Net Loss

For the nine months ended September 30, 2008, the Company’s net loss increased $3,642,090 as compared to the loss generated for the nine months ended September 30, 2007. The Company issued common stock as compensation in 2008 and 2007. The stock based compensation in 2008 was approximately $3.6 million more than was issued in 2007.

For the Nine Months Ended September 30, 2008 and 2007

At September 30, 2008. we had cash and cash equivalents of $112,851 as compared to cash and cash equivalents of $6,800 as of December 31, 2007. Net cash used in operating activities for the nine months ended Septembe 30, 2008 was $(27,492) as compared to net cash used in operating activities of $(392,413) for the nine months ended September 30, 2007. The Company operated in 2008 and 2007 without a revenue generating business model. In 2008 and 2007, the Company struggled with cashflow limitations and was still working to successfully develop the Company's technology, know-how and trade secrets into commercialized products or applications. The Company raised funds in 2008 and 2007 through debt and equity transactions, which essentially paid for additional patent filings and maintenance of the Company's expanding intangible asset portfolio.

Years Ended December 31, 2007 and 2006

| | | December 31, 2007 | | | December 31, 2006 | | | Increase (Decrease) | | | Percentage Increase (Decrease) |

| | | | | | | | | | | | | | |

| Revenues | | $ | - | | | $ | - | | | $ | - | | | | 0 | | % |

| Cost of Sales | | | - | | | | - | | | | - | | | | 0 | | % |

| Gross Profit | | | - | | | | - | | | | - | | | | 0 | | % |

| Operating Expenses | | | 2,375,879 | | | | 38,570,889 | | | | (36,195,010 | ) | | | (94 | ) | % |

| Other Income and Expenses | | | (7,294 | ) | | | (10,471 | ) | | | 3,177 | | | | 30 | | % |

| Net Loss | | | (2,383,173 | ) | | | (38,581,360 | ) | | | 36,198,187 | | | | 94 | | % |

| Other Comprehensive Income (Loss) | | | 864 | | | | (41,441 | ) | | | 42,305 | | | | 102 | | % |

| Comprehensive Loss | | | (2,382,309 | ) | | | (38,622,801 | ) | | | 36,240,492 | | | | 94 | | % |

| | | | | | | | | | | | | | | | | | |

| Loss Per Common Share | | | | | | | | | | | | | | | | | |

| - Basic and Diluted | | $ | (0.15 | ) | | $ | (2.55 | ) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Weighted Average Common Shares Outstanding | | | | | | | | | | | | | | | | | |

| - Basic and Diluted | | | 16,353,286 | | | | 15,102,729 | | | | | | | | | | |

Revenues

The Company last generated revenues during the year ended December 31, 2004. The Company is in the process of planning its initial efforts to commercialize its technology and is currently awaiting finalized rulings on several of its core patents pending.

Cost of Sales

The Company had no sales and therefore had no cost of sales during the years ended December 31, 2007 and 2006, respectively.

Gross Profit

The Company did not generate any sales or gross profits during the years ended December 31, 2007 and 2006, respectively.

Operating Expenses

For the year ended December 31, 2007, the Company’s operating expenses decreased 94% as compared to the year ended December 31, 2006. As of December 31, 2006, the Company recorded a substantial impairment loss related to its intangible assets as the Company encountered difficulties with its independent testing process. The total impairment loss was $35,068,000, which represented an 82% loss in the value of the Company's sole significant asset, its patent costs. Independent testing of the Company’s technology, know-how and trade secrets were conducted throughout 2006. Certain testing and preparation procedures resulted in negative results which caused concern within the Company's investor base and management. At the end of 2006, a lack of liquidity and other factors forced the Company to raise capital at an approximate 82% discount to the value investors assigned to the Company's common stock througout 2005, 2004 and 2003, respectively.

The Company recorded $562,744 and $2,306,763 in depreciation and amortization expenses during the years ended December 31, 2007 and 2006, respectively. The cost basis used to amortize the Company's patent costs was greatly reduced on December 31, 2006 as a result of the impairment loss. Therefore, amortization expense for patent costs was $1,744,019 less in 2007 as compared to 2006.

Other Income and Expenses

The Company incurred interest expense of $4,546 and $16,796 during the years ended December 31, 2007 and 2006, respectively. During 2006, the Company incurred interest expense on two promissory notes totaling approximately $340,000. During 2007, the Company converted the promissory notes to equity and incurred significantly less in interest expense as a result. Additionally, during the year ended December 31, 2007, the Company realized losses on sales of marketable securities of $2,832 as compared to gains on sales of marketable securities of $5,711 during the year ended December 31, 2006.

Net Loss

For the year ended December 31, 2007, the Company’s net loss decreased $36,198,187 as compared to the loss generated for year ended December 31, 2006. The Company’s results of operations for 2007 consisted of reorganization activities which focused on preserving capital while management and the Company's Board of Directors focused on refining and proving the validity of the Company's technology, know-how and trade secrets.

Liquidity and Capital Resources

For the Years Ended December 31, 2007 and December 31, 2006

At December 31,2007 we had cash and cash equivalents of $6,800 as compared to cash and cash equivalents of $107,184 as of December 31, 2006. Net cash used in operating activities for the year ended December 31, 2007 was $(175,941) as compared to net cash used in operating activities of $(60,047) for the year ended December 31, 2006. The Company operated in 2007 and 2006 without a revenue generating business model. In 2007 and 2006, the Company struggled with cashflow limitations and was unable to develop the Company's technology, know-how and trade secrets into commercialized products or applications. The Company raised funds in 2007 and 2006 through debt and equity transactions, which essentially paid for additional patent filings and maintenance of the Company's expanding intagible asset portfolio.

OFF-BALANCE SHEET ARRANGEMENTS:

We do not have off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose entities” (SPEs).

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements and related notes requires us to make judgments, estimates, and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. An accounting policy is considered to be critical if it requires an accounting estimate to be made based on assumptions about matters that are highly uncertain at the time the estimate is made, and if different estimates that reasonably could have been used, or changes in the accounting estimates that are reasonably likely to occur periodically, could materially impact the financial statements.

A critical accounting policy is one that is both important to the presentation of our financial position and results of operations, and requires management's most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. We believe the following critical accounting policies affect the more significant judgments and estimates used in the preparation of our consolidated financial statements.

Valuation of intangible assets and long lived assets, review for impairment losses, amortization of intangible assets;

Valuation of stock based compensation and other equity instruments;

Revenue recognition;

Valuation of Long-Lived Assets

Long-lived tangible assets and definite-lived intangible assets are reviewed for possible impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. The Company uses an estimate of undiscounted future net cash flows of the assets over the remaining useful lives in determining whether the carrying value of the assets is recoverable. If the carrying values of the assets exceed the expected future cash flows of the assets, the Company recognizes an impairment loss equal to the difference between the carrying values of the assets and their estimated fair values. Impairment of long-lived assets is assessed at the lowest levels for which there are identifiable cash flows that are independent from other groups of assets. The evaluation of long-lived assets requires the Company to use estimates of future cash flows. However, actual cash flows may differ from the estimated future cash flows used in these impairment tests. As of December 31, 2007, management does not believe any of the Company’s assets were impaired. As of December 31, 2006, management determined that its patents were impaired and recorded an impairment loss of $35,068,000.

Revenue Recognition

The Company records revenues when the following fundamental criteria are met: (i) persuasive evidence of an arrangement exists, (ii) delivery has occurred or services have been rendered, (iii) the price to the customer is fixed or determinable and (iv) collection of the resulting receivable is reasonably assured. Revenues are recorded in accordance with Staff Accounting Bulletin ("SAB") No. 104, as issued by the United States Securities and Exchange Commission (“SAB 104”), the Company is still contemplating various business plans but anticipates recognizing revenues in 2009.

The Company negotiates contracts with its customers, which may include revenue arrangements with multiple deliverables, as outlined by Emerging Issues Task Force No. 00-21 ("EITF 00-21"). The Company’s accounting policies are defined such that each deliverable under a contract is accounted for separately. Historically, the Company has not entered into contracts with its customers that provided for multiple deliverables.

Stock-Based Compensation

The Company does not have a formal stock option plan. However, the Company offered some of our employees stock-based compensation in the form of stock warrants and shares of our common stock. Prior to July 1, 2005, we accounted for those stock-based compensation awards using the recognition and measurement principles of the intrinsic value method of Accounting Principles Board (“APB”) Opinion No. 25, Accounting for Stock Issued to Employees, and its related interpretations, and applied the disclosure-only provisions of SFAS No. 123, Accounting for Stock-Based Compensation. Under the intrinsic value method, we recognized compensation expense on the date of grant only if the current market price of the underlying stock on the grant date exceeded the exercise price of the stock-based award.

In December 2004, the FASB issued SFAS No. 123 (Revised 2004), Share-Based Payment (“SFAS 123(R)”), which revises SFAS 123 (R) and supersedes APB Opinion No. 25. SFAS No. 123(R) requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values beginning with the first interim or annual period after June 15, 2005. Subsequent to the effective date, the pro forma disclosures previously permitted under SFAS 123 (R) are no longer an alternative to financial statement recognition.

In March 2005, the Staff of the SEC issued SAB No. 107, Share-Based Payment. SAB No. 107 expresses the view of the SEC Staff regarding the interaction between SFAS 123 (R) and certain SEC rules and regulations and provides the SEC Staff’s views regarding the valuation of share-based payment arrangements for public companies. The SEC Staff believes the guidance in SAB No. 107 will assist public companies in their initial implementation of SFAS 123 (R) beginning with the first interim or annual period of the first fiscal year that begins after June 15, 2005.

Effective July 1, 2005, we adopted SFAS 123 (R) using the modified prospective method. Under this method, compensation cost recognized during 2006 includes: (1) compensation cost for the portions of all share-based payments granted prior to, but not yet vested as of July 1, 2005, based on the grant date fair value estimated in accordance with the original provisions of FASB Statement No. 123 amortized on a straight-line basis over the options’ remaining vesting period beginning July 1, 2005, and (2) compensation cost for all share-based payments granted subsequent to July 1, 2005, based on the grant-date fair value estimated in accordance with the provisions of SFAS 123 (R) amortized on a straight-line basis over the options’ requisite service period.

RECENT ACCOUNTING PRONOUNCEMENTS

In September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements", which clarifies the principle that fair value should be based on the assumptions that market participants would use when pricing an asset or liability. It also defines fair value and established a hierarchy that prioritizes the information used to develop assumptions. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007. SFAS No. 157 did not have a material impact on the Company’s financial position, resultsof operations or cash flows.

In February 2007, the FASB issued SFAS 159, "The Fair Value Option for Financial Assets and Financial Liabilities", which permits entities to choose to measure many financial instruments and certain other items at fair value. The unrealized gains and losses on items for which the fair value option has been elected should be reported in earnings. The decision to elect the fair value option is determined on an instrument-by-instrument basis, should be applied to an entire instrument and is irrevocable. Assets and liabilities measured at fair values pursuant to the fair value option should be reported separately in the balance sheet from those instruments measured using other measurement attributes. SFAS No. 159 is effective as of the beginning of the Company's 2008 fiscal year. The adoption of SFAS No. 159 did not have a material effect on the Company’s financial position, results of operations or cash flows.

In December 2007, the FASB issued SFAS No. 160, "Noncontrolling Interests in Consolidated Financial Statements, an amendment of Accounting Research Bulletin No 51" (SFAS 160). SFAS 160 establishes accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent, changes in a parent's ownership of a noncontrolling interest, calculation and disclosure of the consolidated net income attributable to the parent and the noncontrolling interest, changes in a parent's ownership interest while the parent retains its controlling financial interest and fair value measurement of any retained noncontrolling equity investment. SFAS 160 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Early adoption is prohibited. The adoption of SFAS No. 160 is not expected to have a material effect on its financial position, results of operations or cash flows.

In December 2007, the FASB issued SFAS 141R, "Business Combinations" ("SFAS 141R"), which replaces FASB SFAS 141, "Business Combinations". This Statement retains the fundamental requirements in SFAS 141 that the acquisition method of accounting be used for all business combinations and for an acquirer to be identified for each business combination. SFAS 141R defines the acquirer as the entity that obtains control of one or more businesses in the business combination and establishes the acquisition date as the date that the acquirer achieves control. SFAS 141R will require an entity to record separately from the business combination the direct costs, where previously these costs were included in the total allocated cost of the acquisition. SFAS 141R will require an entity to recognize the assets acquired, liabilities assumed, and any non-controlling interest in the acquired at the acquisition date, at their fair values as of that date. This compares to the cost allocation method previously required by SFAS No. 141. SFAS 141R will require an entity to recognize as an asset or liability at fair value for certain contingencies, either contractual or non-contractual, if certain criteria are met. Finally, SFAS 141R will require an entity to recognize contingent consideration at the date of acquisition, based on the fair value at that date. This Statement will be effective for business combinations completed on or after the first annual reporting period beginning on or after December 15, 2008. Early adoption of this standard is not permitted and the standards are to be applied prospectively only. Upon adoption of this standard, there would be no impact to the Company's results of operations and financial condition for acquisitions previously completed. The adoption of SFAS No. 141R is not expected to have a material effect on its financial position, results of operations or cash flows.

In January 2008, the SEC released SAB No. 110, which amends SAB No. 107 which provided a simplified approach for estimating the expected term of a "plain vanilla" option, which is required for application of the Black-Scholes option pricing model (and other models) for valuing share options. At the time, the Staff acknowledged that, for companies choosing not to rely on their own historical option exercise data (i.e. because such data did not provide a reasonable basis for estimating the term), information about exercise patterns with respect to plain vanilla options granted by other companies might not be available in the near term; accordingly, in SAB No. 107, the Staff permitted use of a simplified approach for estimating the term of plain vanilla options granted on or before December 31, 2007. The information concerning exercise behavior that the Staff contemplated would be available by such date has not materialized for many companies. Thus, in SAB No. 110, the Staff continues to allow use of the simplified rule for estimating the expected term of plain vanilla options until such time as the relevant data becomes widely available. The Company does not expect its adoption of SAB No. 110 to have a material impact on its financial position, results of operations or cash flows.

In March 2008, the FASB issued SFAS No. 161 "Disclosures about Derivative Instruments and Hedging Activities-An Amendment of FASB Statement No. 133." ("SFAS 161"). SFAS 161 establishes the disclosure requirements for derivative instruments and for hedging activities with the intent to provide financial statement users with an enhanced understanding of the entity's use of derivative instruments, the accounting of derivative instruments and related hedged items under Statement 133 and its related interpretations, and the effects of these instruments on the entity's financial position, financial performance, and cash flows. This statement is effective for financial statements issued for fiscal years beginning after November 15, 2008. The Company does not expect its adoption of SFAS 161 to have a material impact on its financial position, results of operations or cash flows.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Foreign Currency Risk

Currently, we have no exposure to foreign currency risk as all our sales transactions, assets and liabilities are denominated in the U.S. dollar.

Interest Rate Risk