Q3 2023 Results October 26, 2023 Exhibit 99.2

Q3 2023 Results Not for Product Promotional Use Forward Looking Statements and Non-GAAP Financial Information 2 This presentation contains statements about Bristol-Myers Squibb Company’s (the “Company”) future financial results, plans, business development strategy, anticipated clinical trials, results and regulatory approvals that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. All statements that are not statements of historical facts are, or may be deemed to be, forward-looking statements. Actual results may differ materially from those expressed in, or implied by, these statements as a result of various factors, including, but not limited to, (i) new laws and regulations, (ii) our ability to obtain, protect and maintain market exclusivity rights and enforce patents and other intellectual property rights, (iii) our ability to achieve expected clinical, regulatory and contractual milestones on expected timelines or at all, (iv) difficulties or delays in the development and commercialization of new products, (v) difficulties or delays in our clinical trials and the manufacturing, distribution and sale of our products, (vi) adverse outcomes in legal or regulatory proceedings, (vii) risks relating to acquisitions, divestitures, alliances, joint ventures and other portfolio actions, including our ability to complete the acquisition of Mirati Therapeutics, Inc. and (viii) political and financial instability, including changes in general economic conditions. These and other important factors are discussed in the Company’s most recent annual report on Form 10-K and reports on Forms 10-Q and 8-K. These documents are available on the U.S. Securities and Exchange Commission’s website, on the Company’s website or from Bristol-Myers Squibb Investor Relations. No forward-looking statements can be guaranteed. In addition, any forward-looking statements and clinical data included herein are presented only as of the date hereof. Except as otherwise required by applicable law, the Company undertakes no obligation to publicly update any of the provided information, whether as a result of new information, future events, changed circumstances or otherwise. This presentation includes certain non-generally accepted accounting principles (“GAAP”) financial measures that we use to describe the Company’s performance. The non-GAAP financial measures are provided as supplemental information and are presented because management has evaluated the Company’s financial results both including and excluding the adjusted items or the effects of foreign currency translation, as applicable, and believes that the non-GAAP financial measures presented portray the results of the Company’s baseline performance, supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods. This presentation also provides certain revenues and expenses excluding the impact of foreign exchange (“Ex-FX”). We calculate foreign exchange impacts by converting our current-period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current-period results. Ex-FX financial measures are not accounted for according to GAAP because they remove the effects of currency movements from GAAP results. The non-GAAP information presented herein provides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. We encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. An explanation of these non-GAAP financial measures and a reconciliation to the most directly comparable financial measure are available on our website at www.bms.com/investors. Also note that a reconciliation of forward-looking non-GAAP gross margin, non-GAAP operating margin, non-GAAP operating expenses and non-GAAP tax rate is not provided because a comparable GAAP measure for such measures are not reasonably accessible or reliable due to the inherent difficulty in forecasting and quantifying measures that would be necessary for such reconciliation. Namely, we are not, without unreasonable effort, able to reliably predict the impact of the unwind of inventory purchase price adjustments, accelerated depreciation and impairment of property, plant and equipment and intangible assets, and stock compensation resulting from acquisition-related equity awards, or currency exchange rates. In addition, the Company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. These items are uncertain, depend on various factors and may have a material impact on our future GAAP results.

Giovanni Caforio, MD Board Chair and Chief Executive Officer 3 Q3 2023 Results

Chris Boerner, PhD Chief Operating Officer Chief Executive Officer, effective November 1, 2023 4 Q3 2023 Results

Q3 2023 Results Not for Product Promotional Use Q3 2023 Performance 5 Financial Outlook Commercial & Financial Execution Pipeline Execution Business Development Q3 Global Net Sales In-Line Brands & New Product Portfolio • 11.0B; (2%) YoY; (3%) Ex-FX* • ~$9.3B; +8% YoY; +7% Ex-FX* *See “Forward-Looking Statements and Non-GAAP Financial Information” and “Bristol Myers Squibb Company Reconciliation of Certain GAAP Line Items to Certain Non-GAAP Line Items” • Entered into acquisition agreement with planned close by 1H 2024 • Strengthens & diversifies Oncology portfolio • GAAP $0.93, +24% YoY • Non-GAAP* $2.00, +1% YoY • Reblozyl: U.S. approval in 1L MDS associated anemia (COMMANDS) • Opdivo: U.S. & EU approval in Stage II adj. melanoma (CM-67K); positive Ph3 in SC nivolumab (CM-67T) & peri-adj. lung (CM-77T) • LPA1 antagonist: Established PoC in PPF Earnings per Share (EPS) Medium-Term Financial Targets* 1. 2020-2025 Financial Targets 2. At constant exchange rates on a risk-adjusted basis 3. Primarily I-O & Eliquis 4. Target through 2025 Reaffirms1: • Low-to-mid single digit revenue CAGR2 • Low double-digit revenue CAGR2 ex-Rev/Pom • $8–10B revenue growth from in-line brands3 Adjusts: • >$10B growth from new product portfolio in 2026 • Operating margin to >37%4

Q3 2023 Results Not for Product Promotional Use We are driven by our mission: Transforming patients’ lives through science Our Goal is to Deliver Sustainable Growth 6 Four Key Enablers Strong commercial execution to realize value of our marketed portfolio Evolve R&D for scientific leadership Execute strategic capital allocation to further strengthen our growth profile Foster a high- performance culture and attract & retain industry-leading talent

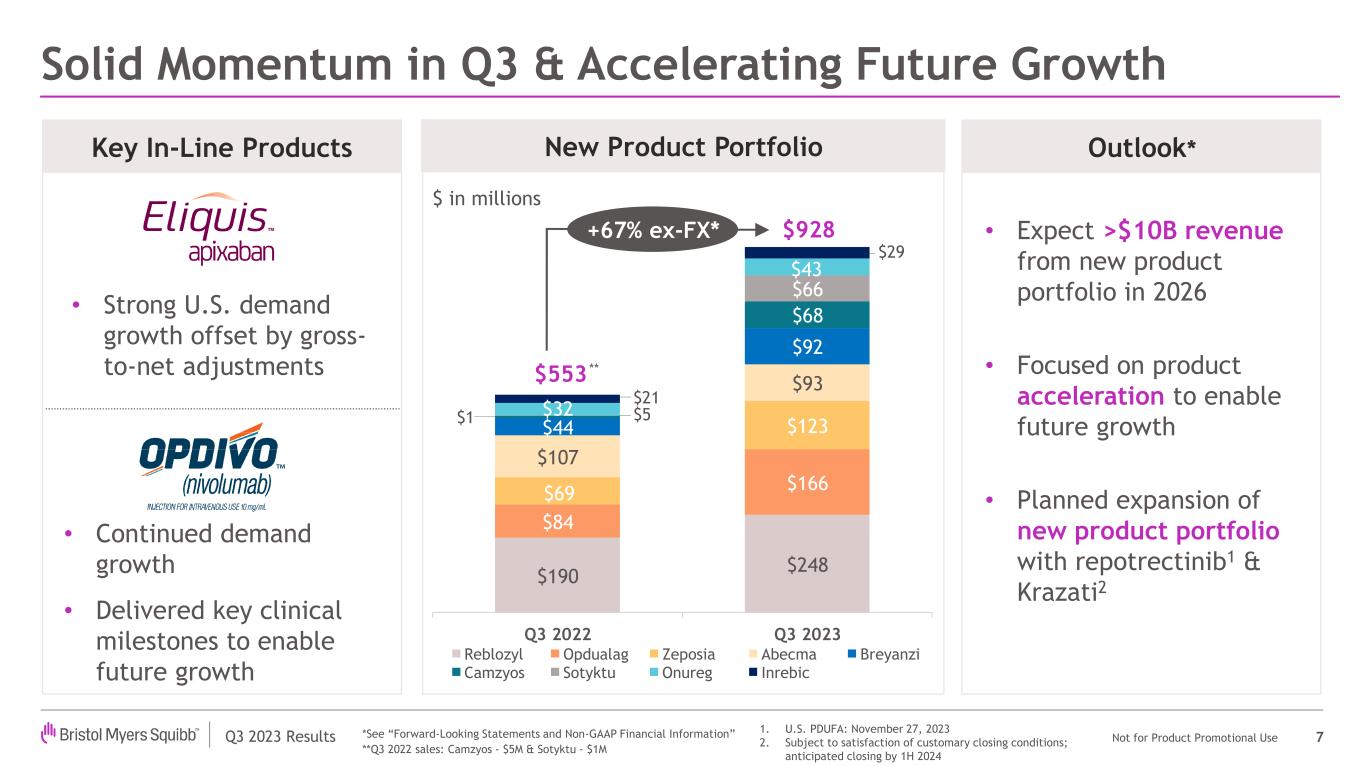

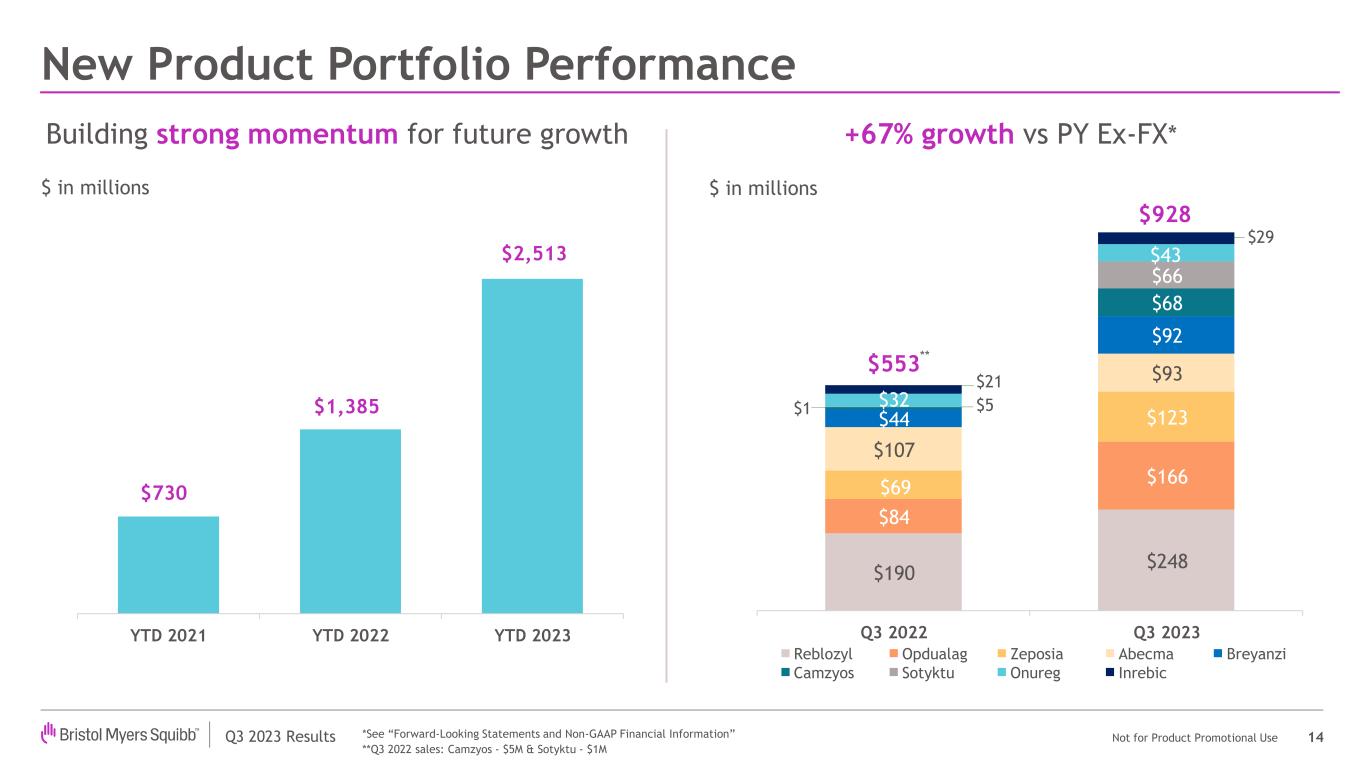

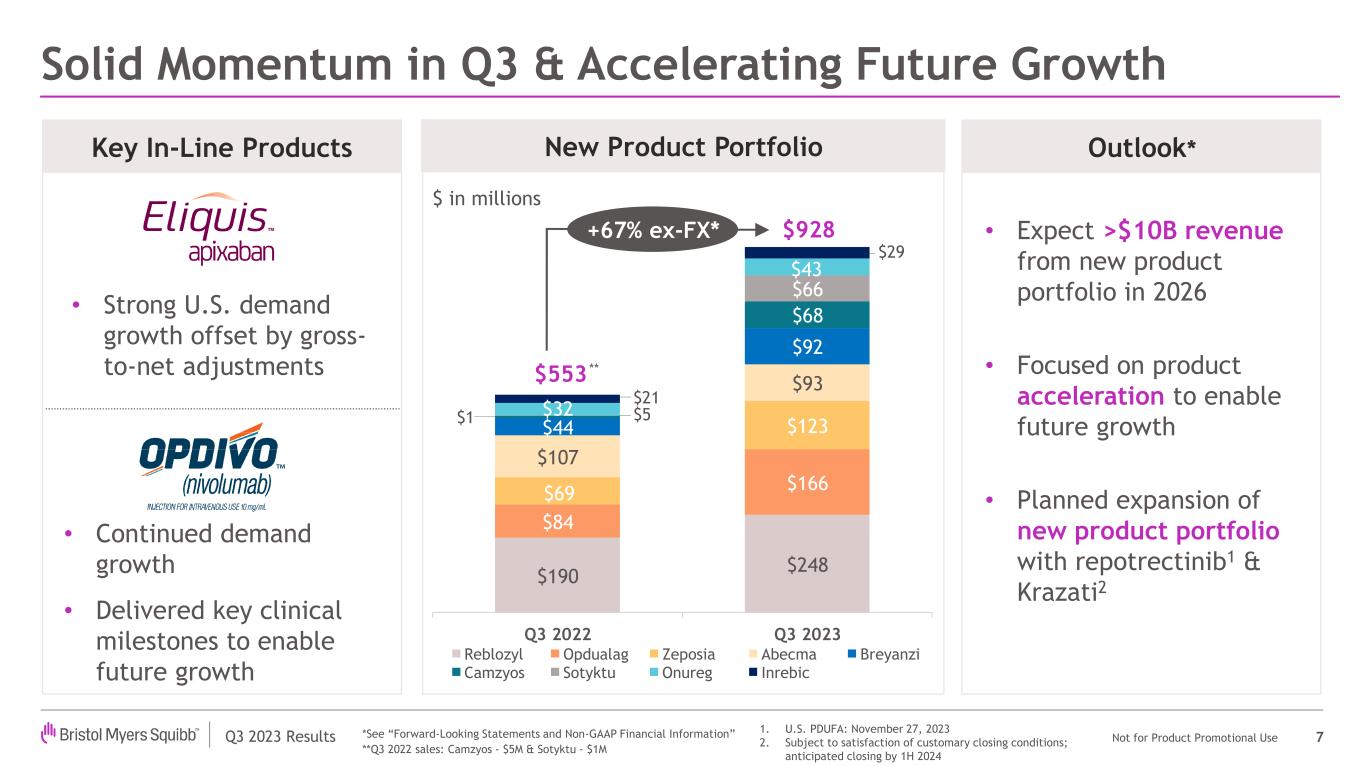

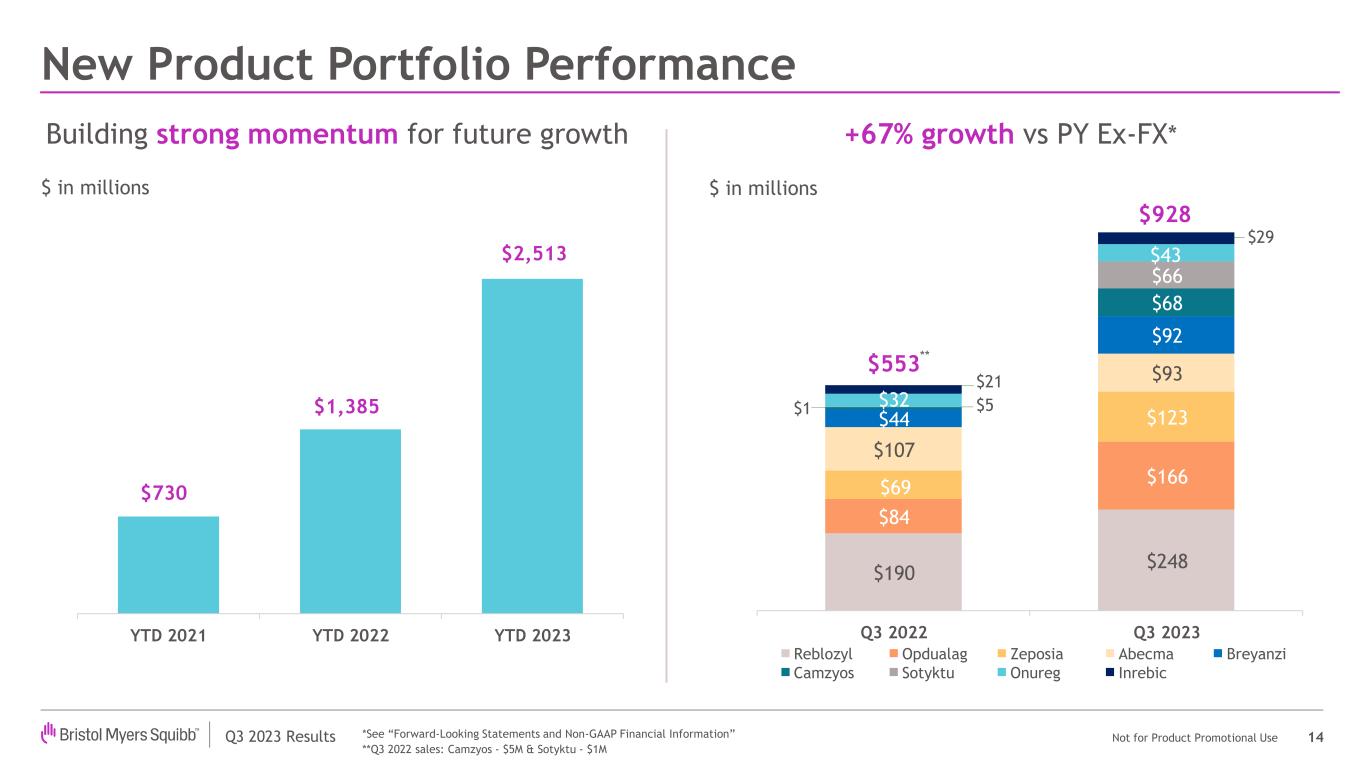

Q3 2023 Results Not for Product Promotional Use Solid Momentum in Q3 & Accelerating Future Growth 7 Key In-Line Products Outlook*New Product Portfolio • Strong U.S. demand growth offset by gross- to-net adjustments • Continued demand growth • Delivered key clinical milestones to enable future growth $190 $248 $84 $166 $69 $123 $107 $93 $44 $92 $68 $66 $32 $43 $553 $928 Q3 2022 Q3 2023 Reblozyl Opdualag Zeposia Abecma Breyanzi Camzyos Sotyktu Onureg Inrebic $ in millions $5 ** $1 $21 $29 **Q3 2022 sales: Camzyos - $5M & Sotyktu - $1M *See “Forward-Looking Statements and Non-GAAP Financial Information” +67% ex-FX* • Expect >$10B revenue from new product portfolio in 2026 • Focused on product acceleration to enable future growth • Planned expansion of new product portfolio with repotrectinib1 & Krazati2 1. U.S. PDUFA: November 27, 2023 2. Subject to satisfaction of customary closing conditions; anticipated closing by 1H 2024

Q3 2023 Results Not for Product Promotional Use Strong Delivery from our R&D Engine Since R&D Day 8 ImmunologyOncology Opdivo ‒ U.S. approval in Stage II adj. melanoma ‒ Peri-adj. lung & 1L MIUC presented at ESMO ‒ Met co-primary endpoints for SC nivolumab1 Krazati2 ‒ 1L lung TPS ≥ 50% encouraging Ph2 data at ESMO LPA1 antagonist ‒ Breakthrough Therapy Designation granted in PPF CD19 NEX T Cell Therapy ‒ Enrolling patients in Ph1 severe, refractory SLE trial ‒ Achieved FDA clearance to initiate MS trial Reblozyl ‒ U.S. approval in 1L MDS associated anemia with a broad label Other assets ‒ Data to be presented on key assets at ASH 2023 Hematology 1. Subcutaneous nivolumab could provide U.S. approval in indications representing 65-75% of Opdivo business & benefit patients into the early 2030s 2. Subject to satisfaction of customary closing conditions; anticipated closing by 1H 2024

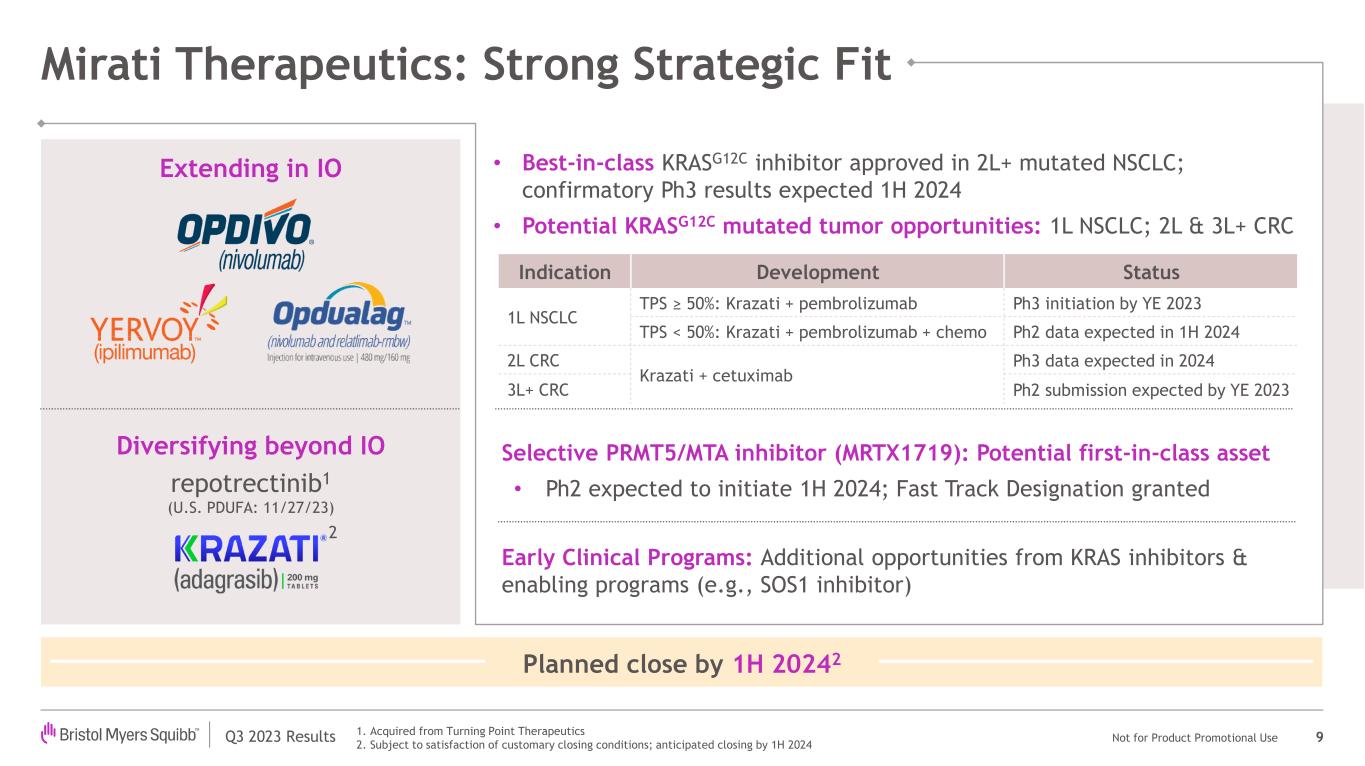

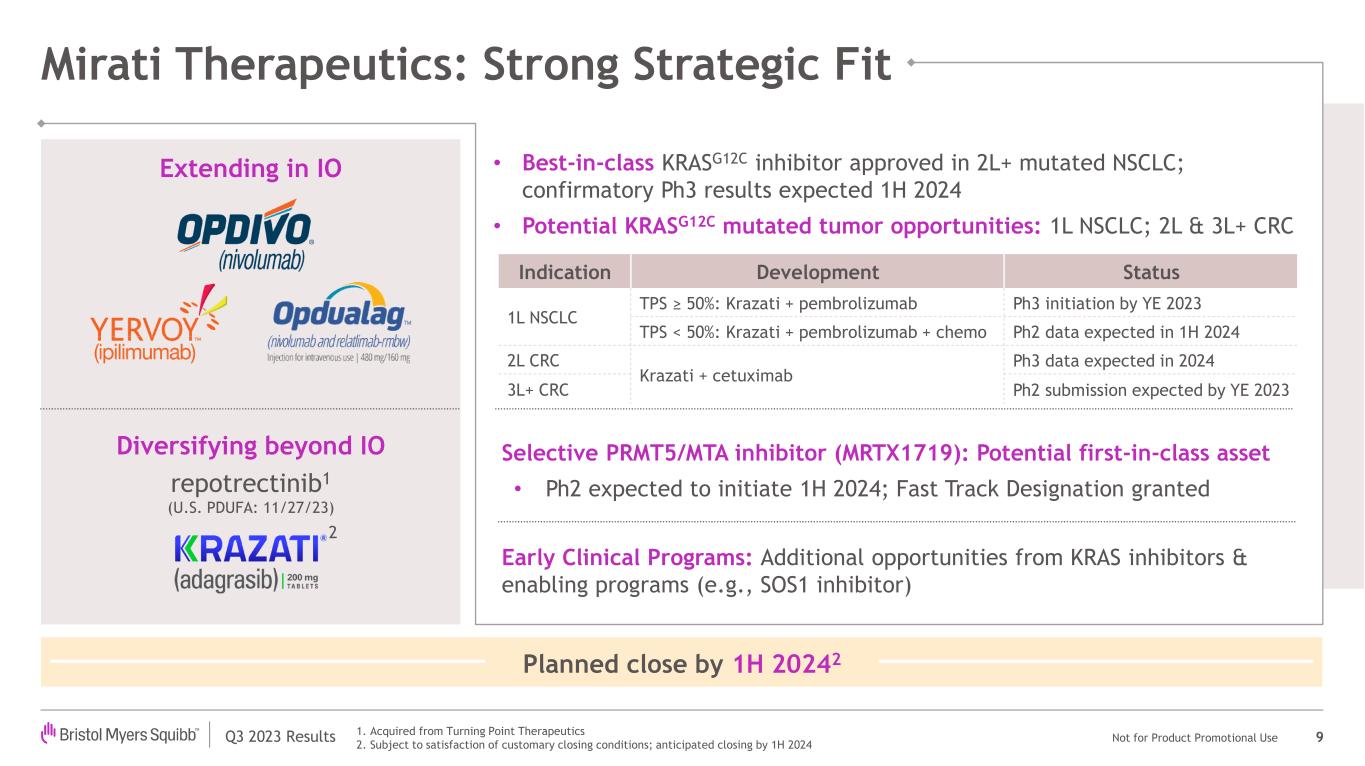

Q3 2023 Results Not for Product Promotional Use Mirati Therapeutics: Strong Strategic Fit 9 Extending in IO Diversifying beyond IO repotrectinib1 (U.S. PDUFA: 11/27/23) • Best-in-class KRASG12C inhibitor approved in 2L+ mutated NSCLC; confirmatory Ph3 results expected 1H 2024 • Potential KRASG12C mutated tumor opportunities: 1L NSCLC; 2L & 3L+ CRC Selective PRMT5/MTA inhibitor (MRTX1719): Potential first-in-class asset • Ph2 expected to initiate 1H 2024; Fast Track Designation granted Early Clinical Programs: Additional opportunities from KRAS inhibitors & enabling programs (e.g., SOS1 inhibitor) Planned close by 1H 20242 Indication Development Status 1L NSCLC TPS ≥ 50%: Krazati + pembrolizumab Ph3 initiation by YE 2023 TPS < 50%: Krazati + pembrolizumab + chemo Ph2 data expected in 1H 2024 2L CRC Krazati + cetuximab Ph3 data expected in 2024 3L+ CRC Ph2 submission expected by YE 2023 1. Acquired from Turning Point Therapeutics 2. Subject to satisfaction of customary closing conditions; anticipated closing by 1H 2024 2

Q3 2023 Results Not for Product Promotional Use Continued Strong Pipeline Execution 10 1. Data readout anticipated early 2024 2. ACS, SSP, AF trials conducted by Janssen 2023 Key Milestones Opdivo (+/- Yervoy) Early Stage: Neo-adjuvant NSCLC Ph3 (CM-816) approval in EU Metastatic: 1L mCRPC Ph3 (CM-7DX) Opdualag 1L NSCLC Ph21 repotrectinib ROS1+ NSCLC (TRIDENT-1) U.S. filing Abecma 3-5L MM Ph3 (KarMMa-3) filing Initiation NDMM Ph3 (KarMMa-9) Breyanzi 2L TE LBCL EU approval 3L+ CLL Ph1/2 (TRANSCEND-CLL) 3L+ FL Ph2 (TRANSCEND- FL) iberdomide Initiation of pivotal post-transplant maintenance H2H vs Revlimid Reblozyl 1L MDS (COMMANDS) U.S. filing Sotyktu Mod-to-severe PsO EU approval CD Ph2 (IM011-023) UC Ph2 (IM011-127) LPA1 Antagonist Initiation IPF Ph3 PPF Ph2 (IM027-040) Camzyos oHCM EU approval LIBREXIA (milvexian) Initiation Ph3 program2 2024/2025 Key Milestones Opdivo (+/- Yervoy) Metastatic: 1L HCC Ph3 (CM-9DW) 1L+ MSI High CRC Ph3 (CM-8HW) Early Stage: Peri-adj NSCLC Ph3 (CM-77T) Peri-adj MIBC Ph3 (CM-078) Adj HCC Ph3 (CM-9DX) Stage III Unresectable NSCLC Ph3 (CM-73L) Adj NSCLC Ph3 (ANVIL, co-op group) Opdualag 1L HCC Ph2 2L+ HCC Ph2 2L/3L+ MSS mCRC Ph3 alnuctamab BCMA TCE Initiation MM Ph3 Reblozyl 1L MF Ph3 (INDEPENDENCE) cendakimab EoE Ph3 Sotyktu PsA Ph3 Zeposia CD maintenance Ph3 (YELLOWSTONE) Milestones represent data readouts unless otherwise specified; subject to positive registrational trials and health authority approval

Q3 2023 Results Not for Product Promotional Use Numerous Levers to Drive Long-Term Growth 11 Extended durability of our IO business with subcutaneous nivolumab and Opdualag Increasingly de-risked the New Product Portfolio Number of registrational assets increasing from 6 to 12 over the next 18 months Developing medicines in rapidly growing markets with significant commercial opportunities Strategic optionality from Business Development Leading positions with differentiated platforms in Cell Therapy and Targeted Protein Degradation

David Elkins Executive Vice President and Chief Financial Officer 12 Q3 2023 Results

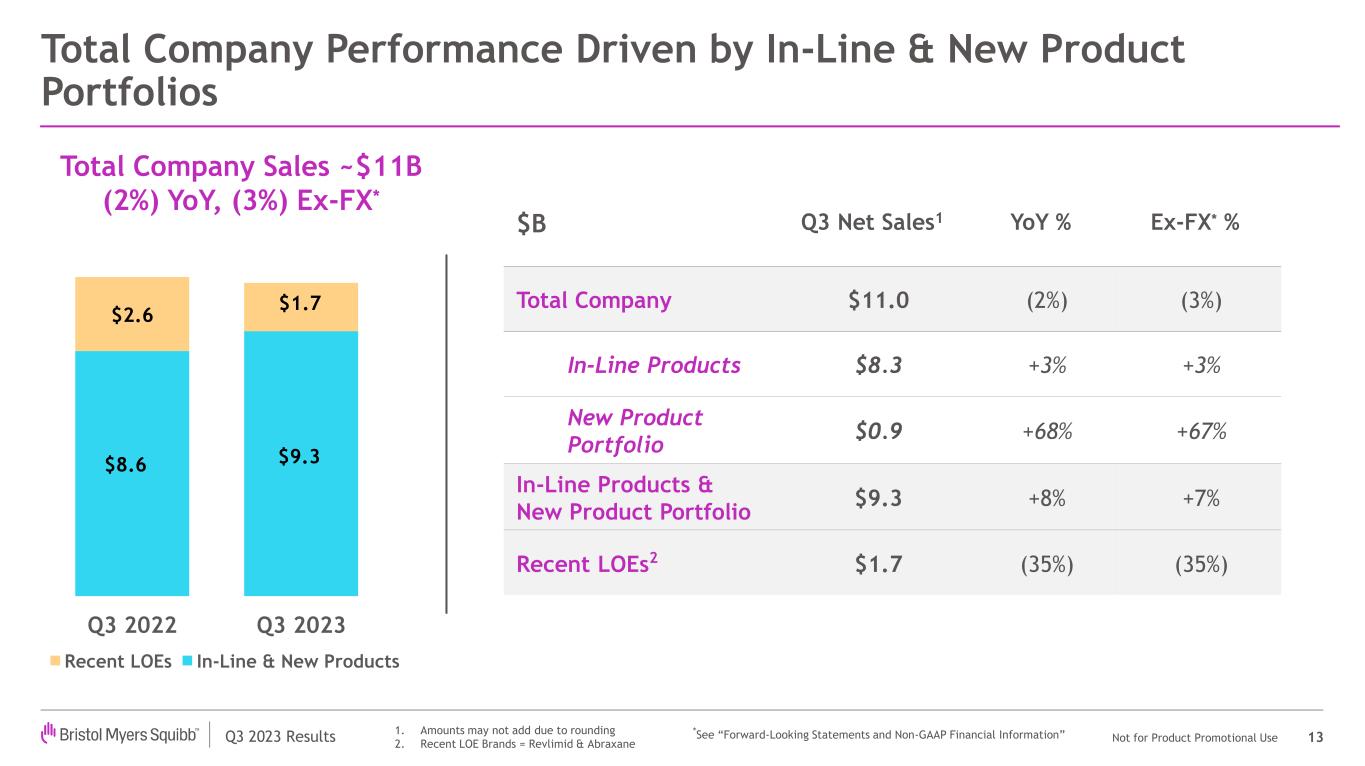

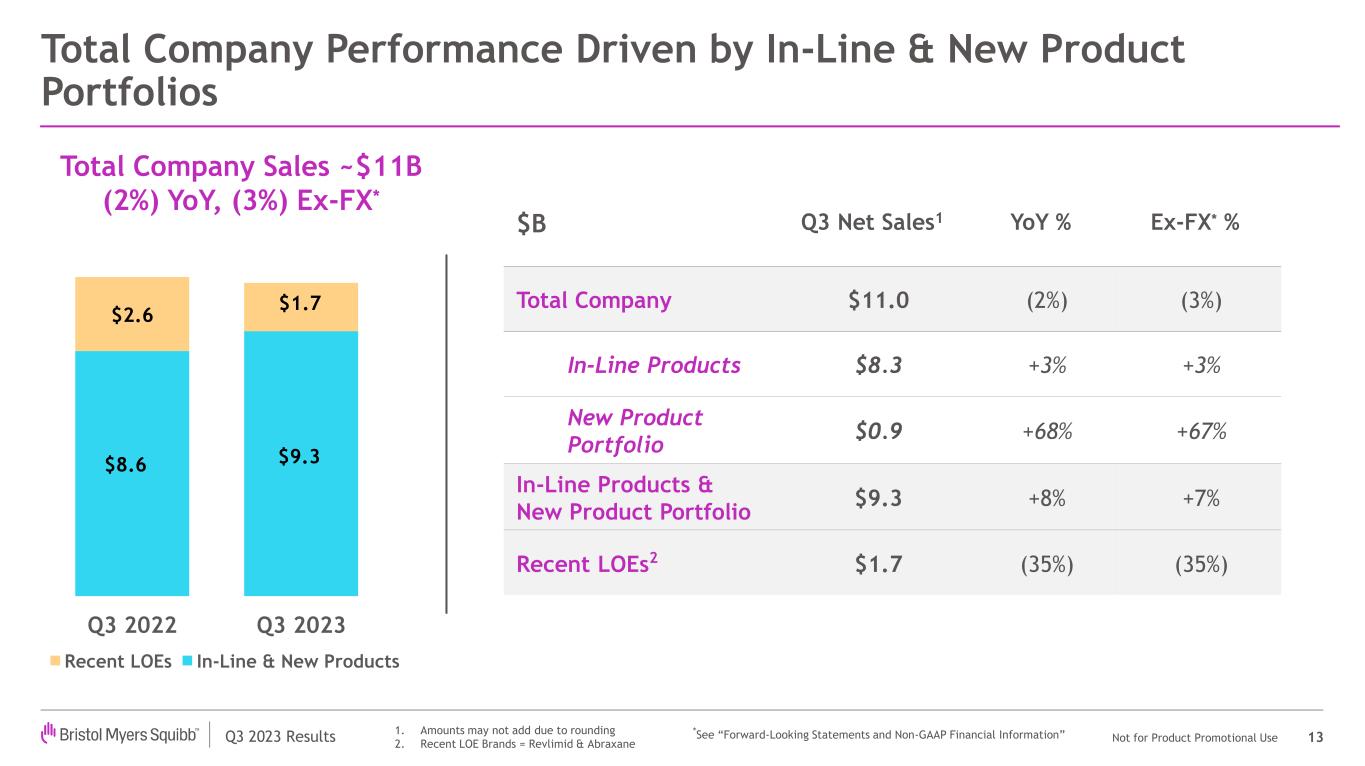

Q3 2023 Results Not for Product Promotional Use Total Company Performance Driven by In-Line & New Product Portfolios 13 Total Company Sales ~$11B (2%) YoY, (3%) Ex-FX* $B Q3 Net Sales1 YoY % Ex-FX* % Total Company $11.0 (2%) (3%) In-Line Products $8.3 +3% +3% New Product Portfolio $0.9 +68% +67% In-Line Products & New Product Portfolio $9.3 +8% +7% Recent LOEs2 $1.7 (35%) (35%) $8.6 $9.3 $2.6 $1.7 Q3 2022 Q3 2023 Recent LOEs In-Line & New Products 1. Amounts may not add due to rounding 2. Recent LOE Brands = Revlimid & Abraxane *See “Forward-Looking Statements and Non-GAAP Financial Information”

Q3 2023 Results Not for Product Promotional Use New Product Portfolio Performance 14 $190 $248 $84 $166 $69 $123 $107 $93 $44 $92 $68 $66 $32 $43 $553 $928 Q3 2022 Q3 2023 Reblozyl Opdualag Zeposia Abecma Breyanzi Camzyos Sotyktu Onureg Inrebic $ in millions +67% growth vs PY Ex-FX*Building strong momentum for future growth $ in millions **Q3 2022 sales: Camzyos - $5M & Sotyktu - $1M $5 ** $1 $21 $730 $1,385 $2,513 YTD 2021 YTD 2022 YTD 2023 *See “Forward-Looking Statements and Non-GAAP Financial Information” $29

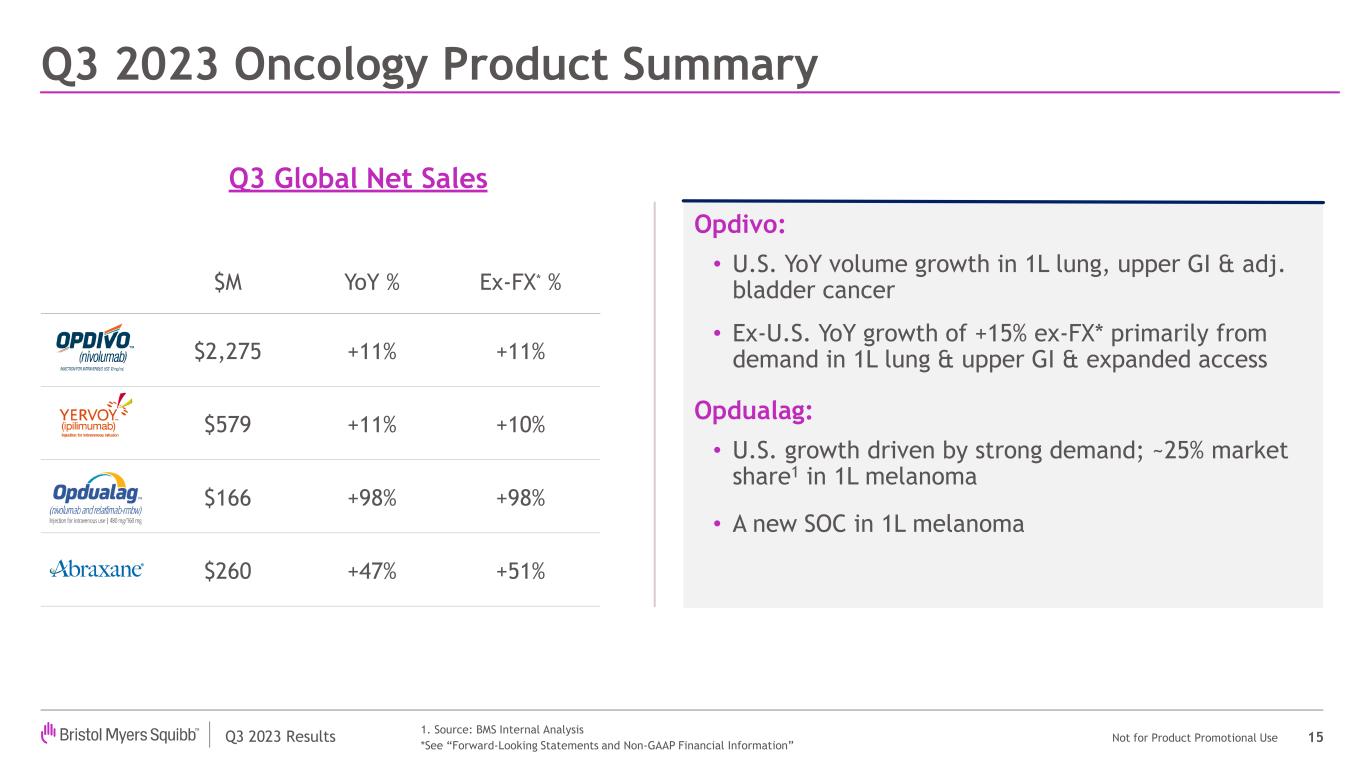

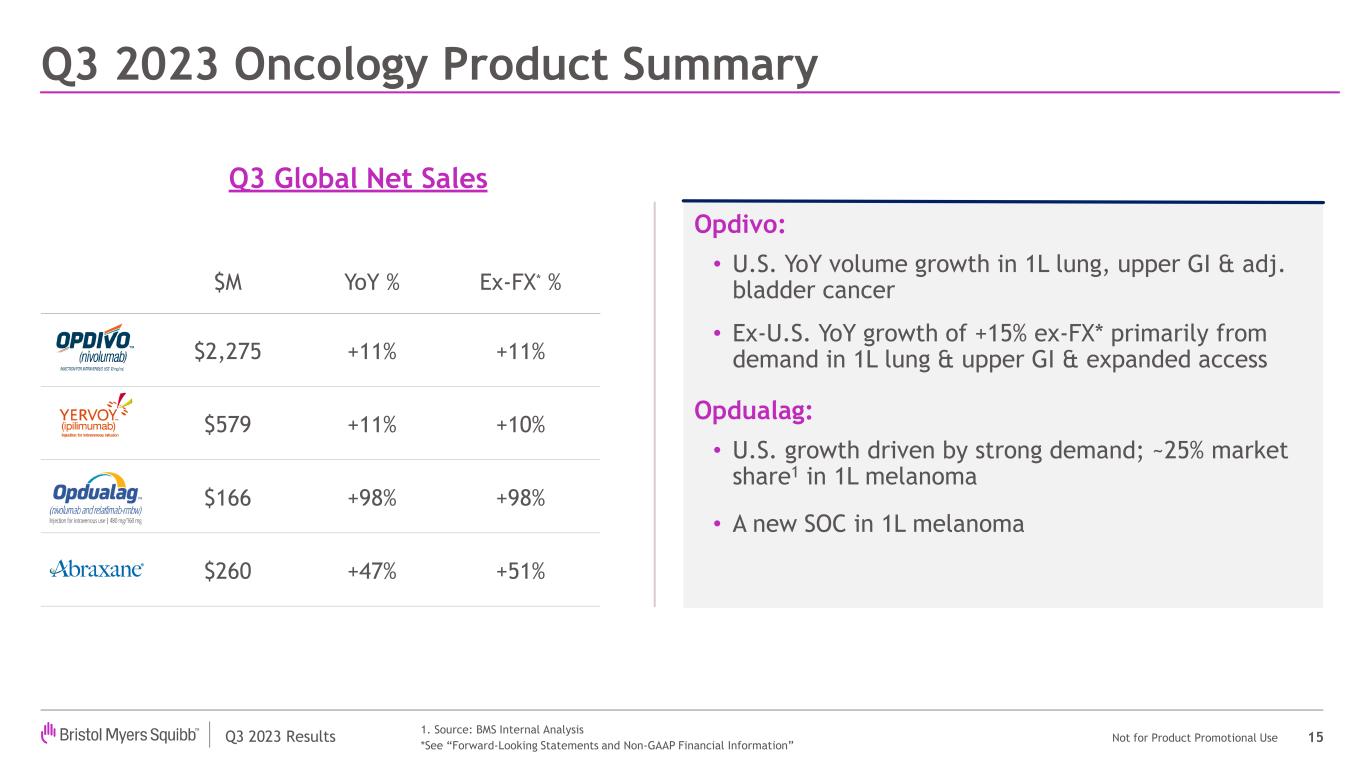

Q3 2023 Results Not for Product Promotional Use Q3 2023 Oncology Product Summary 15 Opdivo: • U.S. YoY volume growth in 1L lung, upper GI & adj. bladder cancer • Ex-U.S. YoY growth of +15% ex-FX* primarily from demand in 1L lung & upper GI & expanded access Opdualag: • U.S. growth driven by strong demand; ~25% market share1 in 1L melanoma • A new SOC in 1L melanoma $M YoY % Ex-FX* % $2,275 +11% +11% $579 +11% +10% $166 +98% +98% $260 +47% +51% Q3 Global Net Sales 1. Source: BMS Internal Analysis *See “Forward-Looking Statements and Non-GAAP Financial Information”

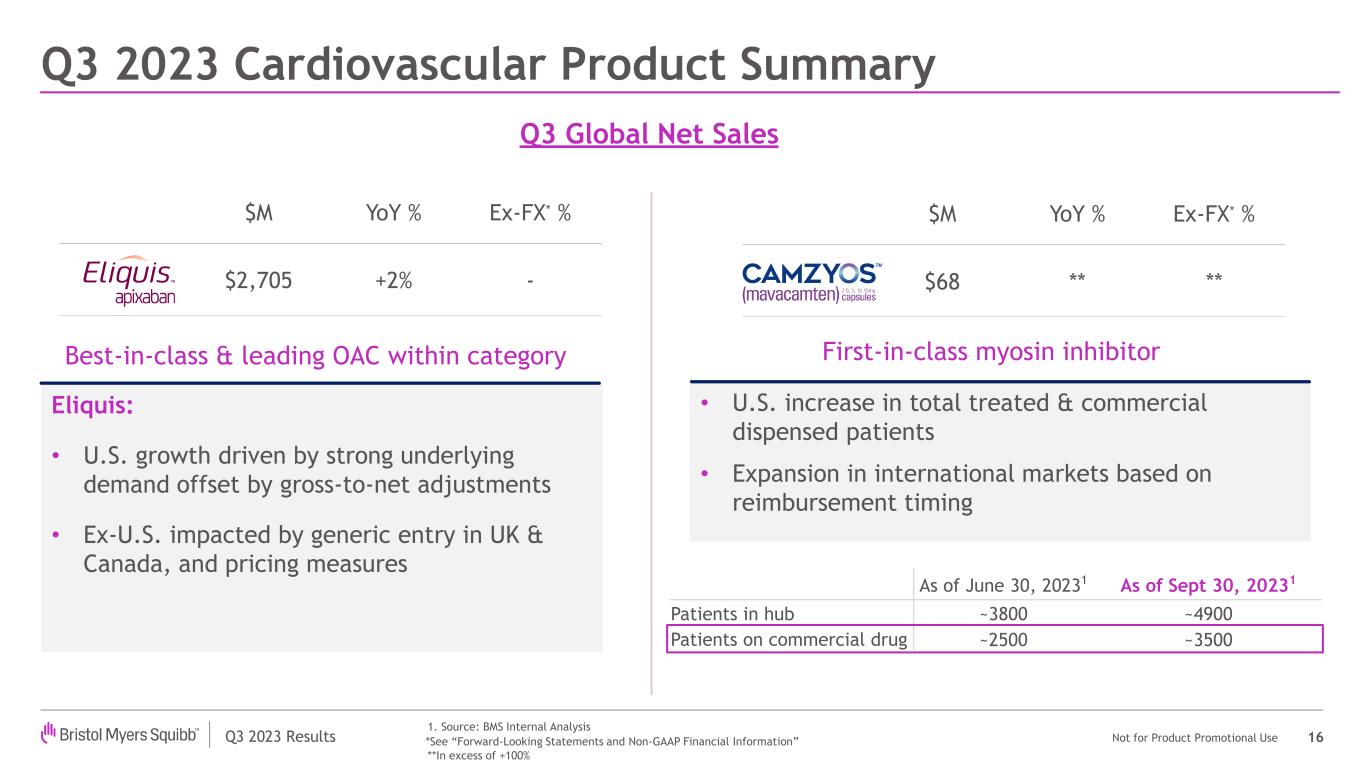

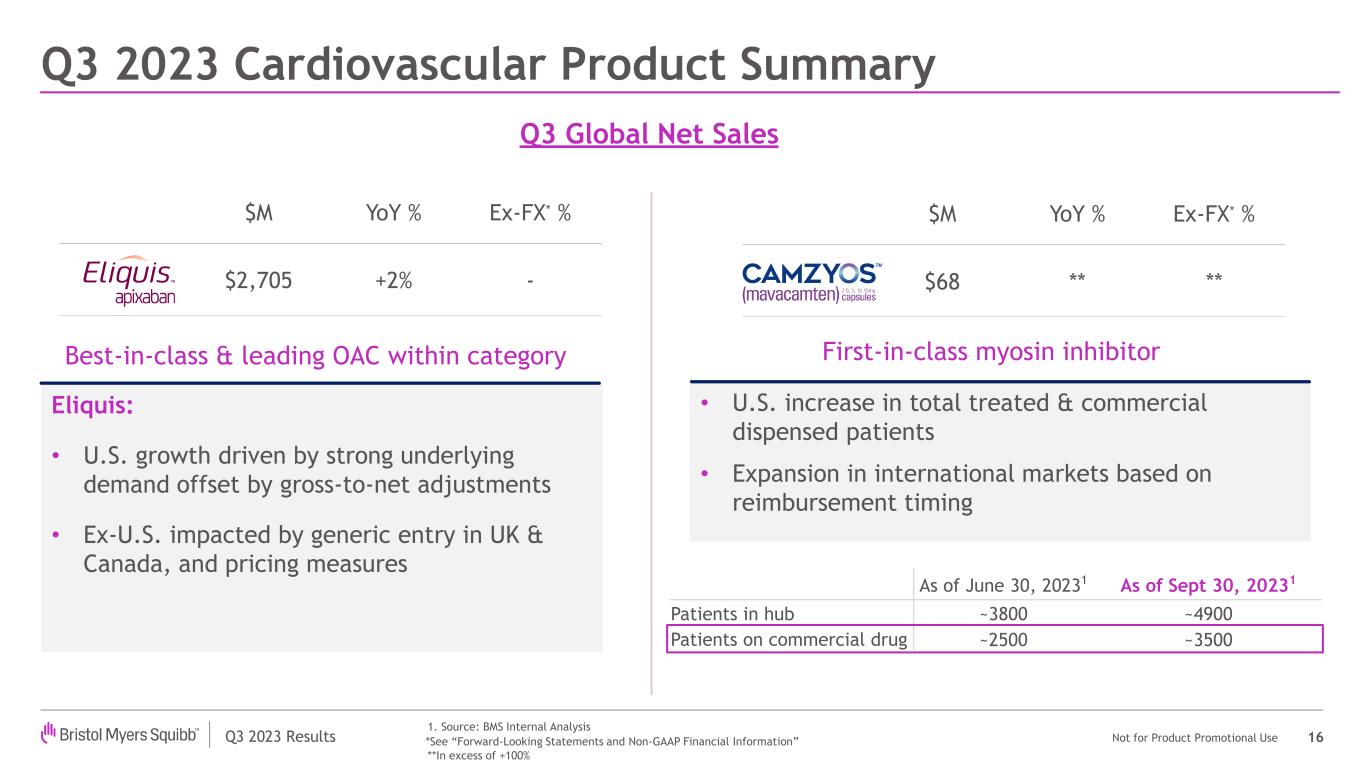

Q3 2023 Results Not for Product Promotional Use • U.S. increase in total treated & commercial dispensed patients • Expansion in international markets based on reimbursement timing Q3 2023 Cardiovascular Product Summary 16 Eliquis: • U.S. growth driven by strong underlying demand offset by gross-to-net adjustments • Ex-U.S. impacted by generic entry in UK & Canada, and pricing measures First-in-class myosin inhibitorBest-in-class & leading OAC within category Q3 Global Net Sales 1. Source: BMS Internal Analysis $M YoY % Ex-FX* % $2,705 +2% - $M YoY % Ex-FX* % $68 ** ** *See “Forward-Looking Statements and Non-GAAP Financial Information” **In excess of +100% As of June 30, 20231 As of Sept 30, 20231 Patients in hub ~3800 ~4900 Patients on commercial drug ~2500 ~3500

Q3 2023 Results Not for Product Promotional Use Q3 2023 Hematology Product Summary 17 Revlimid: FY 2023 revenue projection ~$6.0B Reblozyl: • U.S. FDA approval in August 2023 in 1L MDS-associated anemia with a broad label (COMMANDS) • U.S. strong YoY growth of +28% driven by demand from increased 1L use & 2L switches from ESAs as well as DoT Abecma: • Q3 impacted by manufacturing maintenance in June & increased availability of additional BCMA targeting agents Breyanzi: • Continued strong demand in 2L/3L+ LBCL • Q3 impacted by timing of infusions 1 $M YoY % Ex-FX* % $1,429 (41%) (41%) $872 (2%) (2%) $517 (8%) (8%) $248 +31% +29% $93 (13%) (14%) $92 ** ** $43 +34% +31% $29 +38% +33% Q3 Global Net Sales1 **In excess of +100% 1. Empliciti grouped in Mature & Other Brands *See “Forward-Looking Statements and Non-GAAP Financial Information”

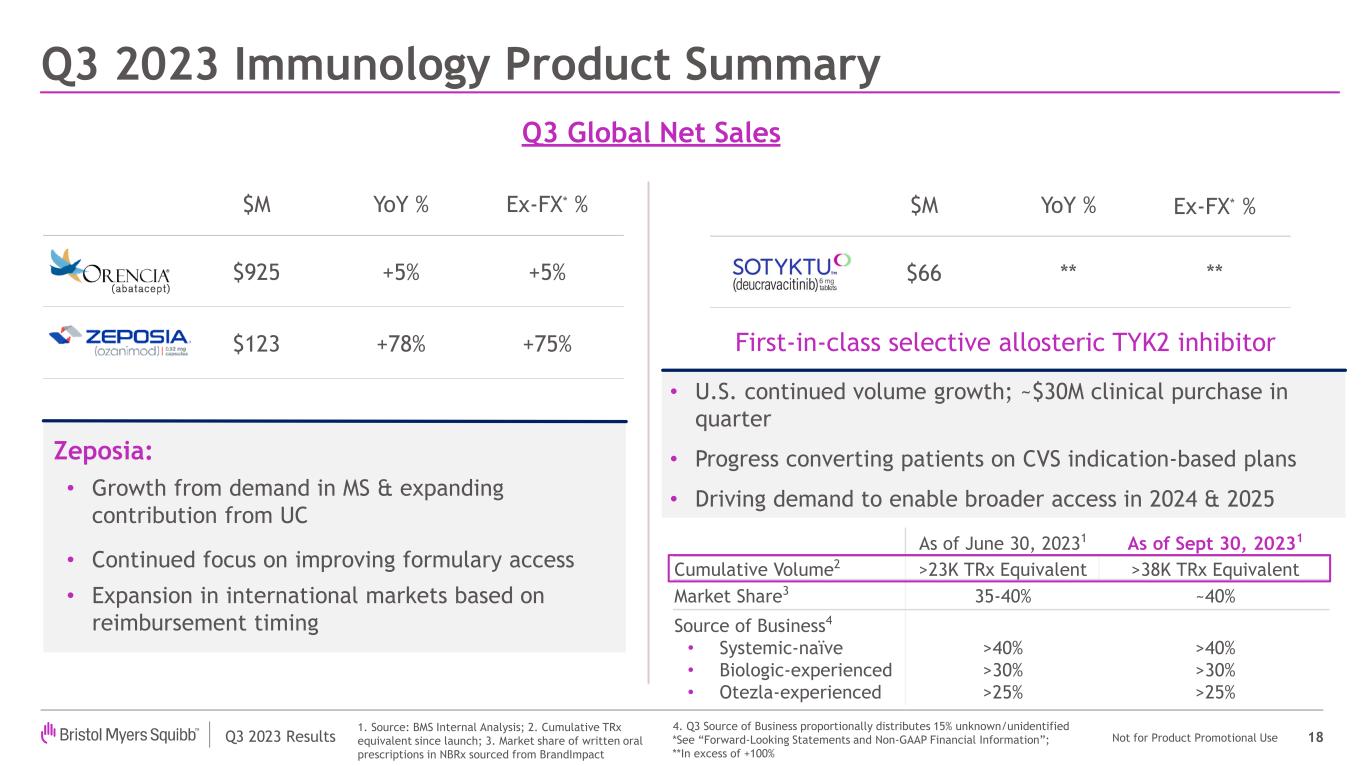

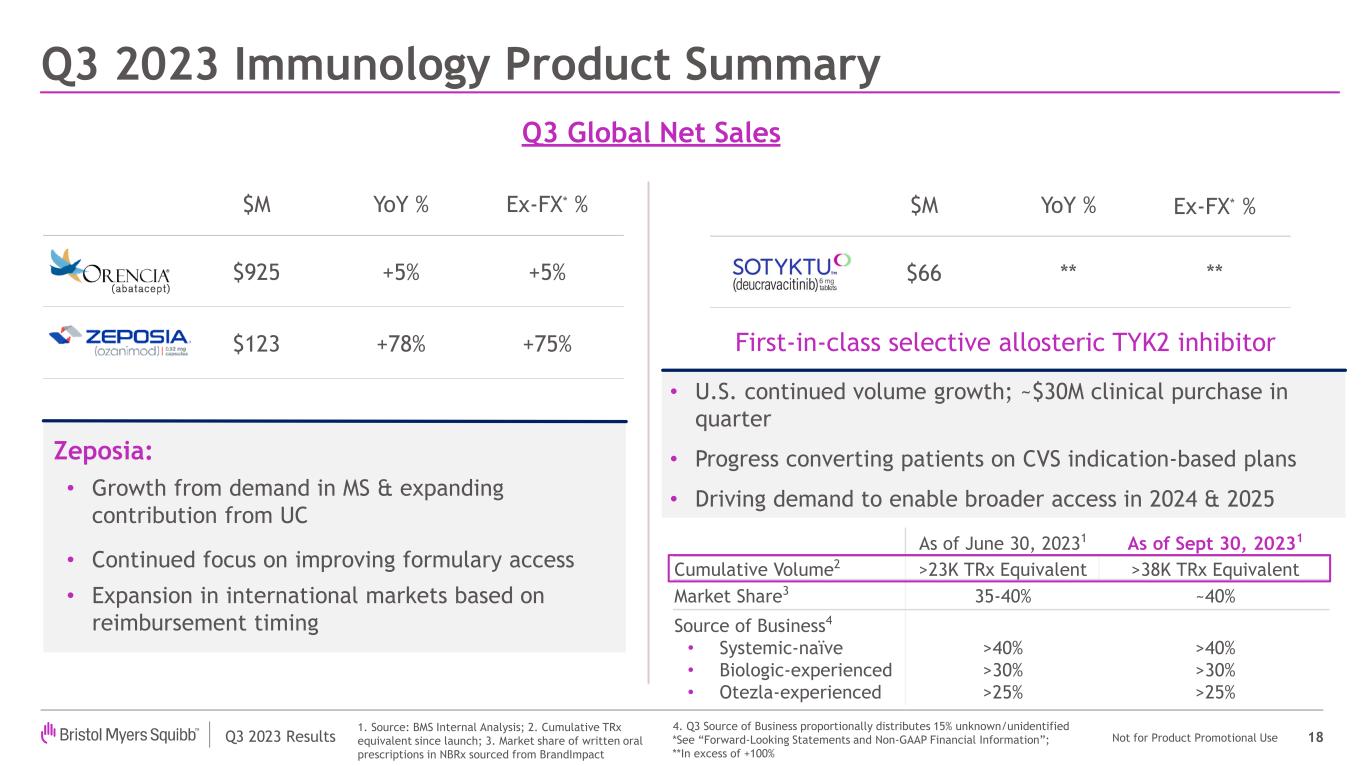

Q3 2023 Results Not for Product Promotional Use Q3 2023 Immunology Product Summary 18 Zeposia: • Growth from demand in MS & expanding contribution from UC • Continued focus on improving formulary access • Expansion in international markets based on reimbursement timing First-in-class selective allosteric TYK2 inhibitor Q3 Global Net Sales % $M YoY % Ex-FX* % $925 +5% +5% $123 +78% +75% % $M YoY % Ex-FX* % $66 ** ** As of June 30, 20231 As of Sept 30, 20231 Cumulative Volume2 >23K TRx Equivalent >38K TRx Equivalent Market Share3 35-40% ~40% Source of Business4 • Systemic-naïve • Biologic-experienced • Otezla-experienced >40% >30% >25% >40% >30% >25% 1. Source: BMS Internal Analysis; 2. Cumulative TRx equivalent since launch; 3. Market share of written oral prescriptions in NBRx sourced from BrandImpact *See “Forward-Looking Statements and Non-GAAP Financial Information”; **In excess of +100% 4. Q3 Source of Business proportionally distributes 15% unknown/unidentified • U.S. continued volume growth; ~$30M clinical purchase in quarter • Progress converting patients on CVS indication-based plans • Driving demand to enable broader access in 2024 & 2025

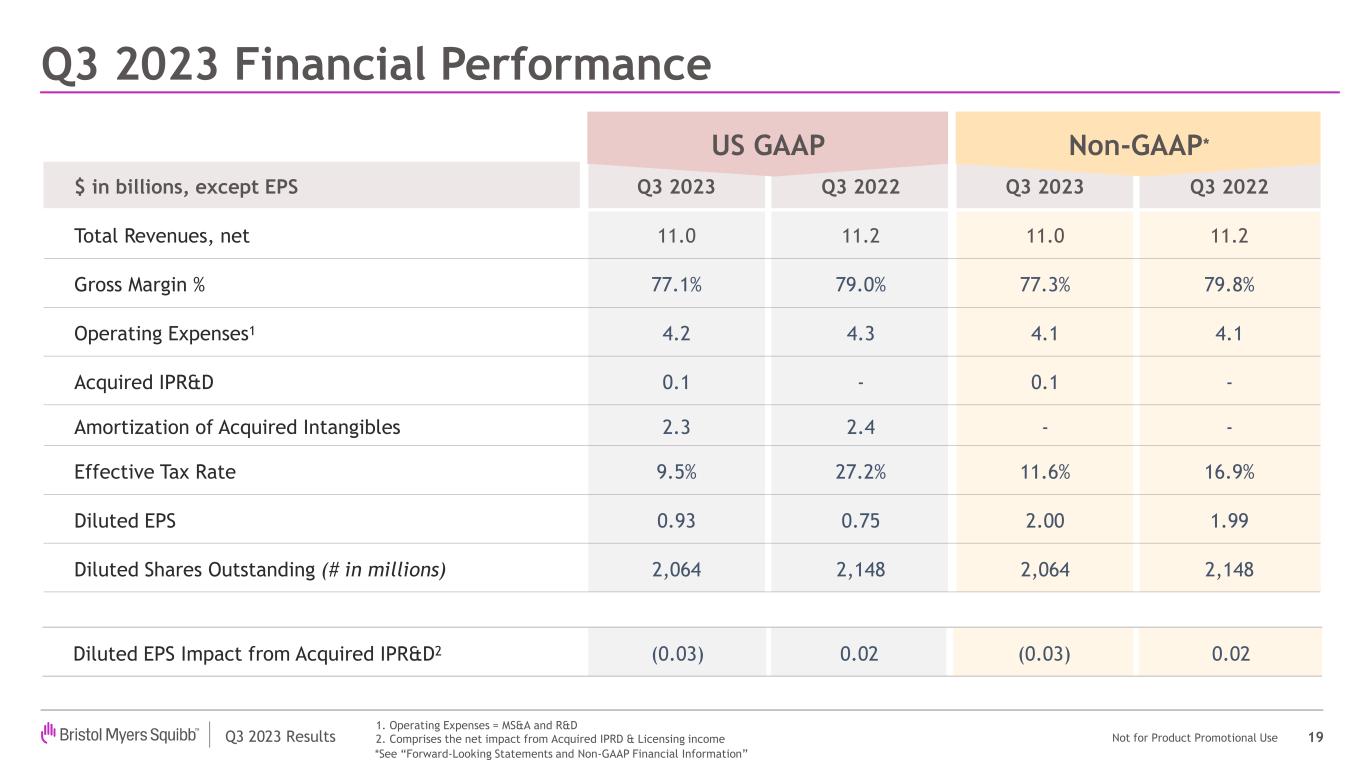

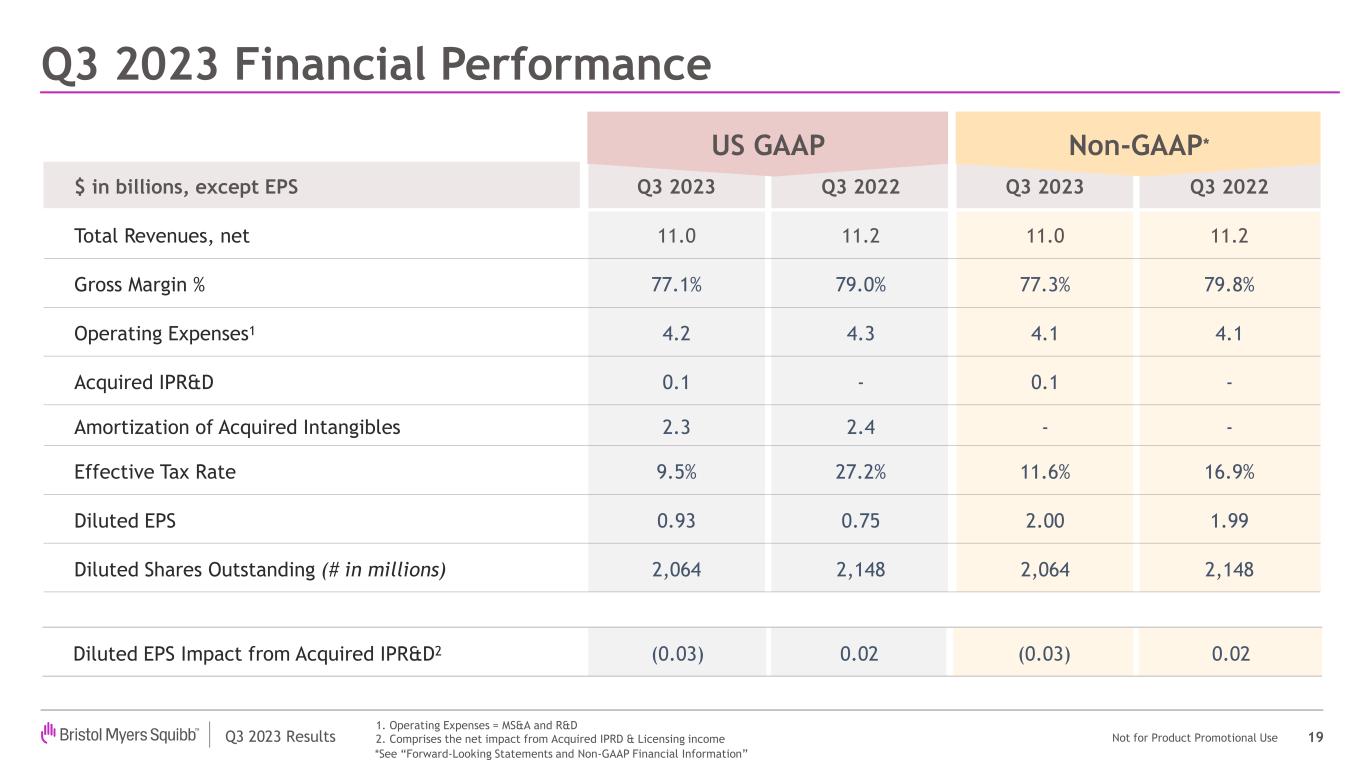

Q3 2023 Results Not for Product Promotional Use Q3 2023 Financial Performance 19 US GAAP Non-GAAP $ in billions, except EPS Q3 2023 Q3 2022 Q3 2023 Q3 2022 Total Revenues, net 11.0 11.2 11.0 11.2 Gross Margin % 77.1% 79.0% 77.3% 79.8% Operating Expenses1 4.2 4.3 4.1 4.1 Acquired IPR&D 0.1 - 0.1 - Amortization of Acquired Intangibles 2.3 2.4 - - Effective Tax Rate 9.5% 27.2% 11.6% 16.9% Diluted EPS 0.93 0.75 2.00 1.99 Diluted Shares Outstanding (# in millions) 2,064 2,148 2,064 2,148 US P Non- P* Diluted EPS Impact from Acquired IPR&D2 (0.03) 0.02 (0.03) 0.02 1. Operating Expenses = MS&A and R&D 2. Comprises the net impact from Acquired IPRD & Licensing income *See “Forward-Looking Statements and Non-GAAP Financial Information”

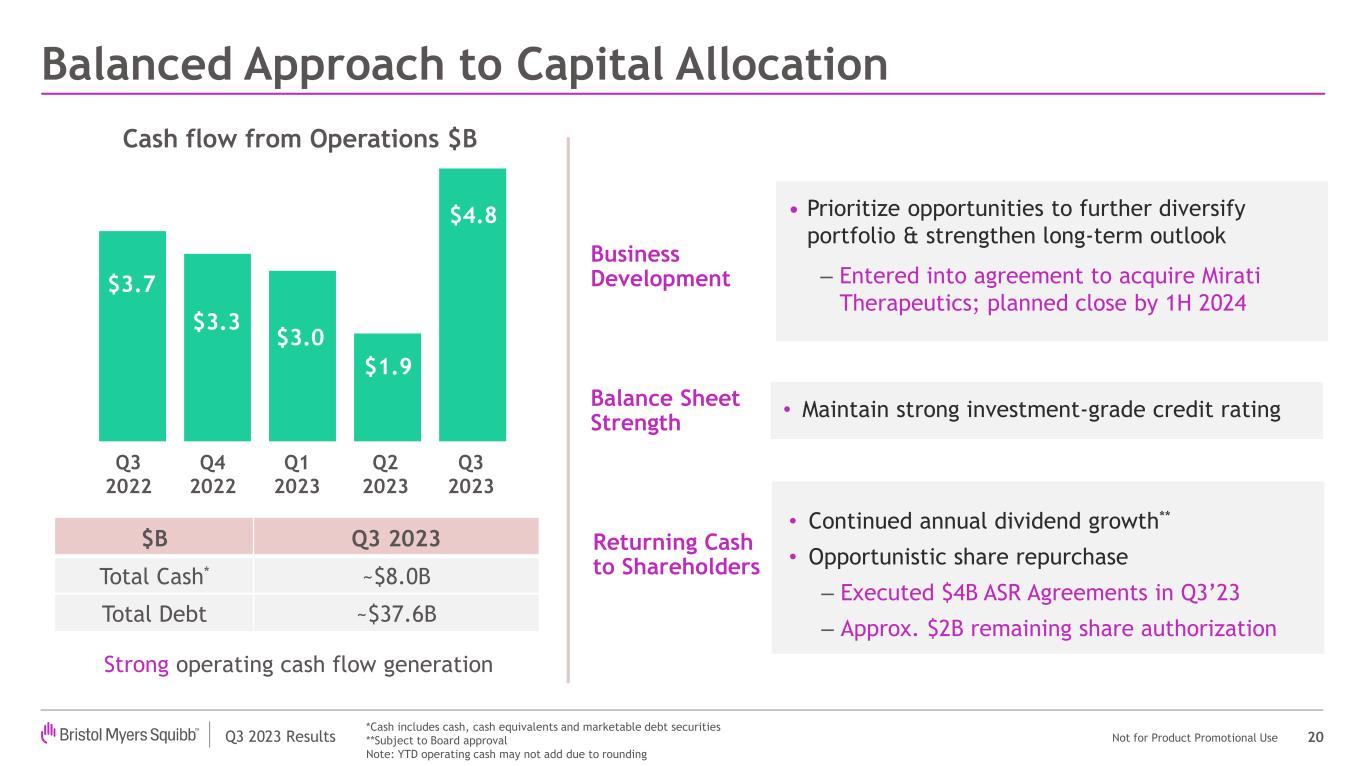

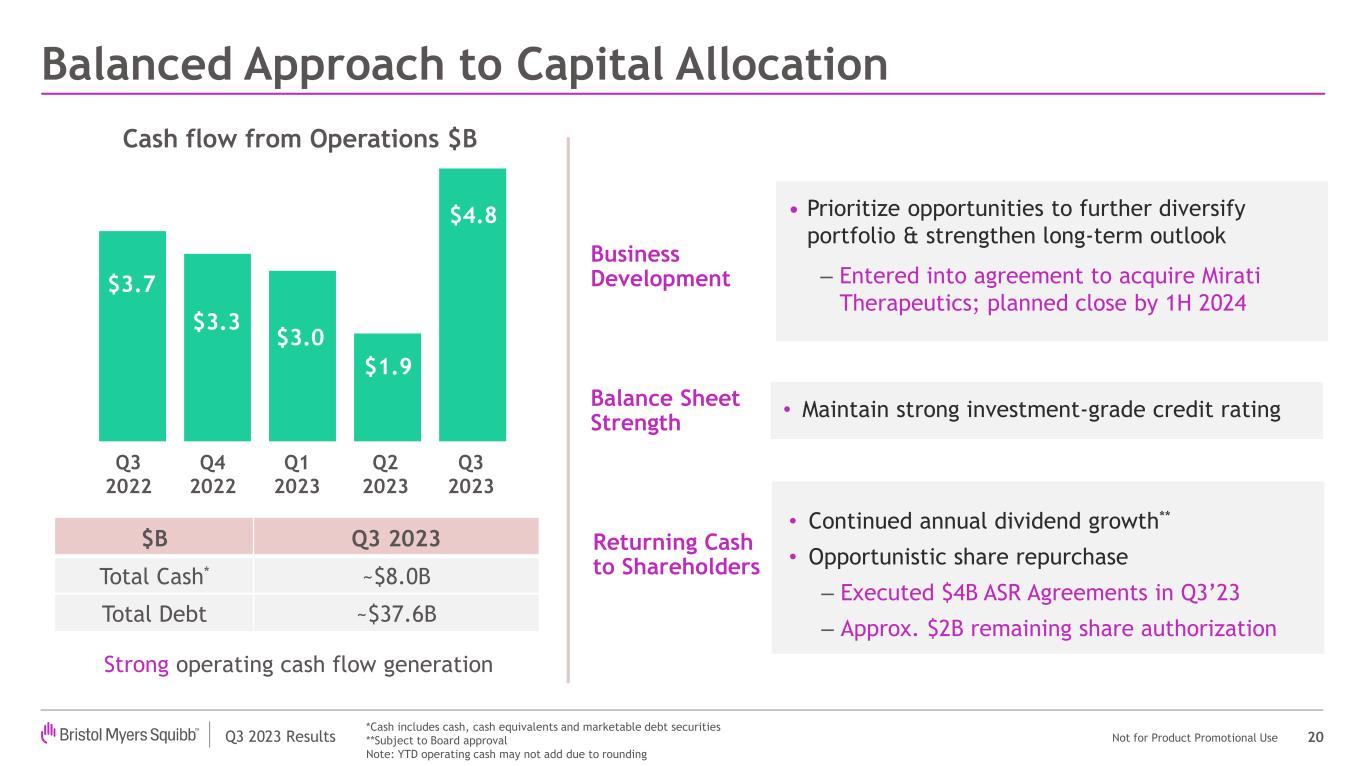

Q3 2023 Results Not for Product Promotional Use Balanced Approach to Capital Allocation 20 *Cash includes cash, cash equivalents and marketable debt securities **Subject to Board approval Note: YTD operating cash may not add due to rounding $B Q3 2023 Total Cash* ~$8.0B Total Debt ~$37.6B • Prioritize opportunities to further diversify portfolio & strengthen long-term outlook ‒ Entered into agreement to acquire Mirati Therapeutics; planned close by 1H 2024 • Maintain strong investment-grade credit rating Business Development Balance Sheet Strength Returning Cash to Shareholders • Continued annual dividend growth** • Opportunistic share repurchase ‒ Executed $4B ASR Agreements in Q3’23 ‒ Approx. $2B remaining share authorization Strong operating cash flow generation $3.7 $3.3 $3.0 $1.9 $4.8 Cash flow from Operations $B Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023

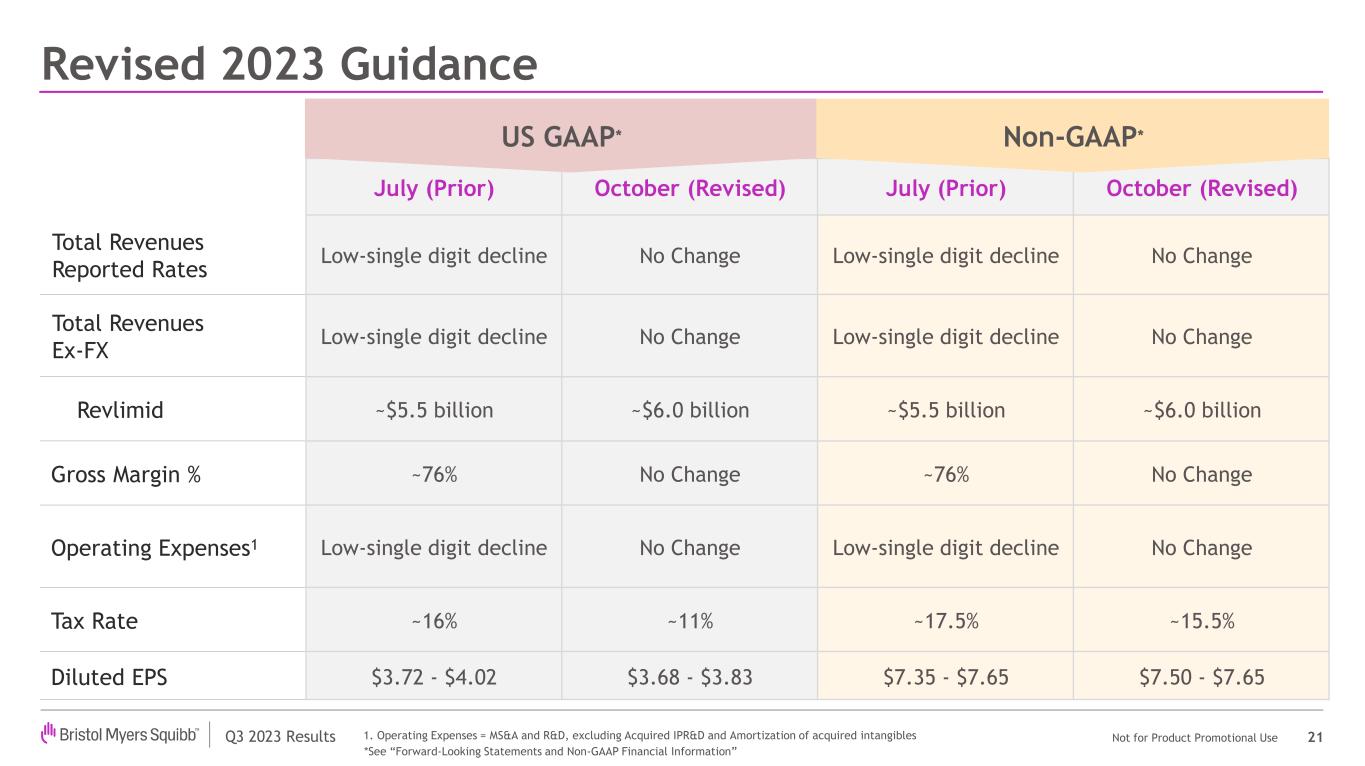

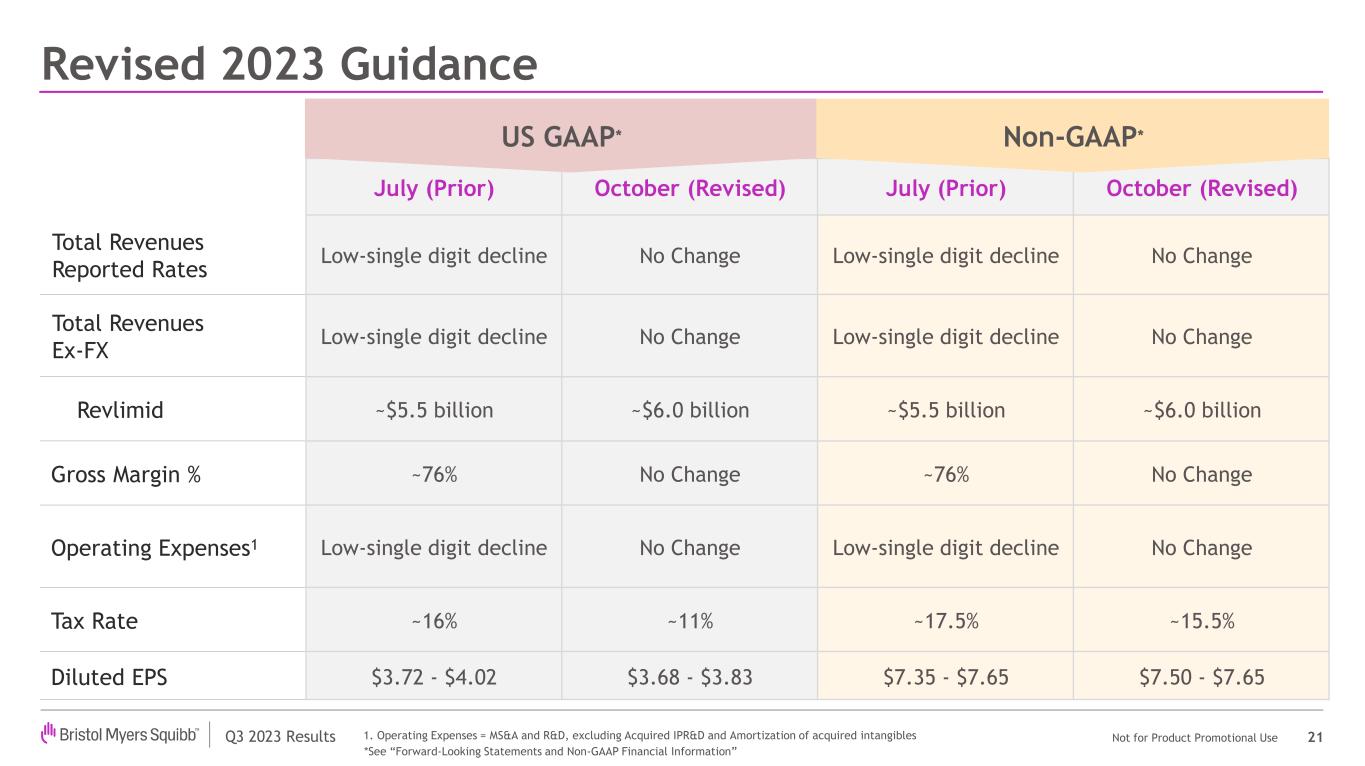

Q3 2023 Results Not for Product Promotional Use July (Prior) October (Revised) July (Prior) October (Revised) Total Revenues Reported Rates Low-single digit decline No Change Low-single digit decline No Change Total Revenues Ex-FX Low-single digit decline No Change Low-single digit decline No Change Revlimid ~$5.5 billion ~$6.0 billion ~$5.5 billion ~$6.0 billion Gross Margin % ~76% No Change ~76% No Change Operating Expenses1 Low-single digit decline No Change Low-single digit decline No Change Tax Rate ~16% ~11% ~17.5% ~15.5% Diluted EPS $3.72 - $4.02 $3.68 - $3.83 $7.35 - $7.65 $7.50 - $7.65 Revised 2023 Guidance 21 US GAAP* Non-GAAP* 1. Operating Expenses = MS&A and R&D, excluding Acquired IPR&D and Amortization of acquired intangibles *See “Forward-Looking Statements and Non-GAAP Financial Information”

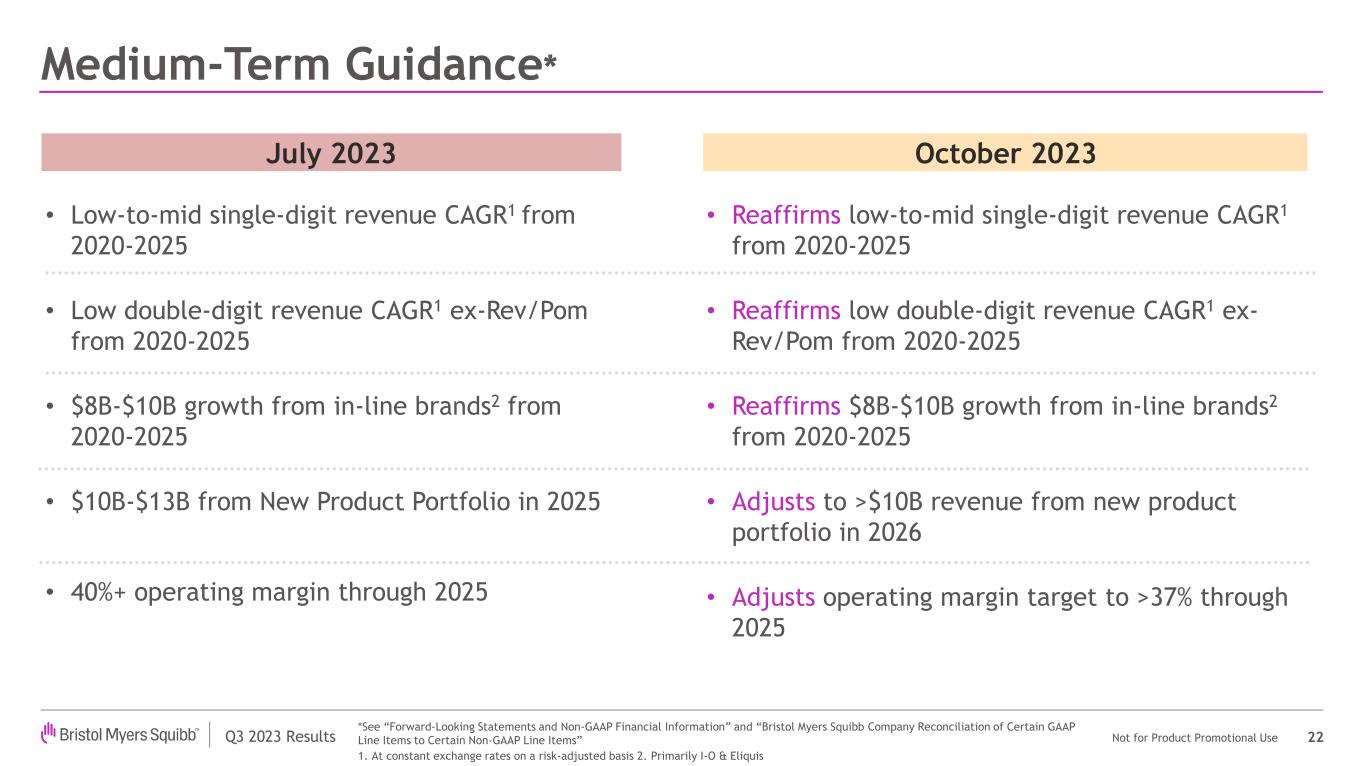

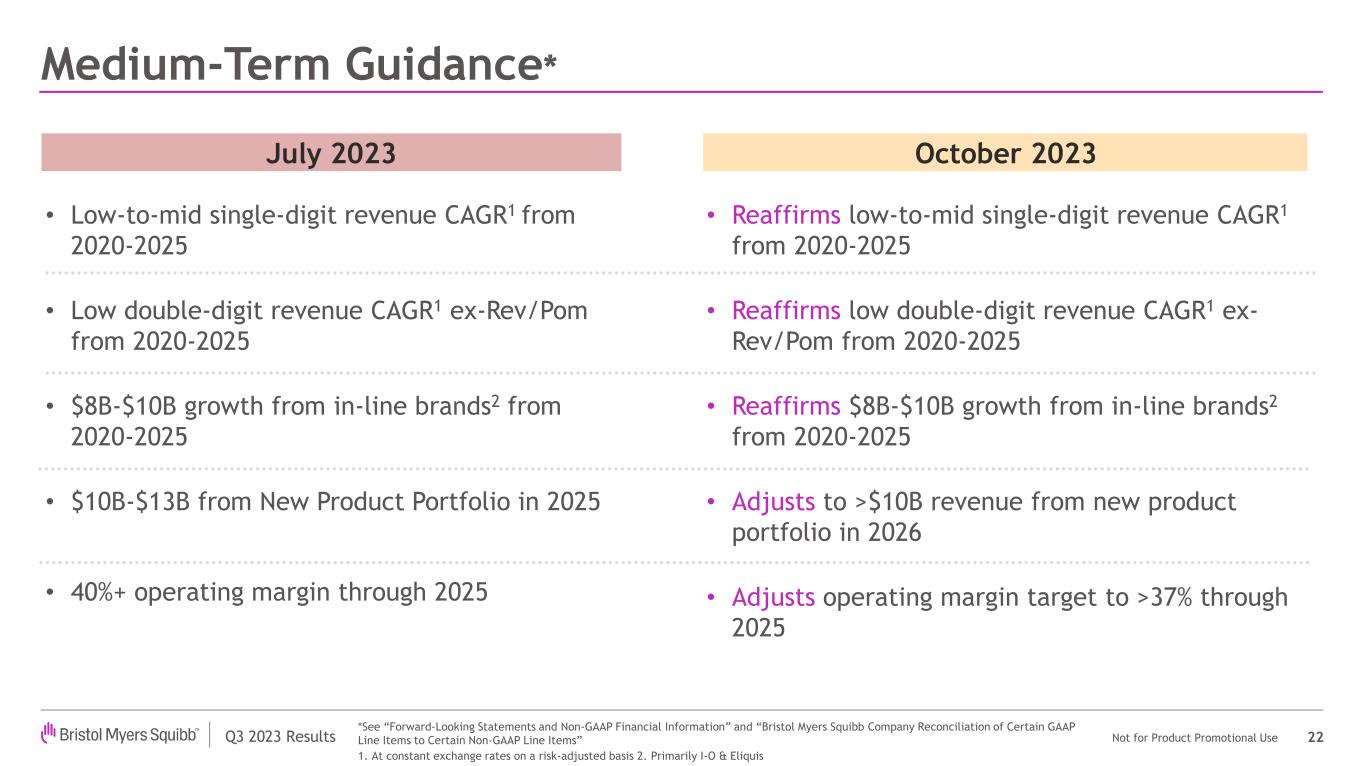

Q3 2023 Results Not for Product Promotional Use Medium-Term Guidance* 22 *See “Forward-Looking Statements and Non-GAAP Financial Information” and “Bristol Myers Squibb Company Reconciliation of Certain GAAP Line Items to Certain Non-GAAP Line Items” 1. At constant exchange rates on a risk-adjusted basis 2. Primarily I-O & Eliquis • Low-to-mid single-digit revenue CAGR1 from 2020-2025 • Low double-digit revenue CAGR1 ex-Rev/Pom from 2020-2025 • $8B-$10B growth from in-line brands2 from 2020-2025 • $10B-$13B from New Product Portfolio in 2025 • 40%+ operating margin through 2025 July 2023 • Reaffirms low-to-mid single-digit revenue CAGR1 from 2020-2025 • Reaffirms low double-digit revenue CAGR1 ex- Rev/Pom from 2020-2025 • Reaffirms $8B-$10B growth from in-line brands2 from 2020-2025 • Adjusts to >$10B revenue from new product portfolio in 2026 • Adjusts operating margin target to >37% through 2025 October 2023

Giovanni Caforio, MD Board Chair, Chief Executive Officer Chris Boerner, PhD Executive VP, Chief Operating Officer, CEO effective November 1, 2023 David Elkins Executive VP, Chief Financial Officer Samit Hirawat, MD Executive VP, Chief Medical Officer, Global Drug Development Adam Lenkowsky Executive VP, Chief Commercialization Officer 23 Q3 2023 Results Q&A

Q3 2023 Results Not for Product Promotional Use Year-Ended December 31 2020 2021 2022 Total Revenues $42,518 $46,385 $46,159 Gross Profit $30,745 $36,445 $36,022 Specified items (a) $3,300 $603 $356 Gross Profit excluding specified items $34,045 $37,048 $36,378 Marketing, Selling and Administrative $7,661 $7,690 $7,814 Specified items (a) ($279) ($3) ($79) Marketing, Selling and Administrative excluding specified items $7,382 $7,687 $7,735 Research and Development $10,048 $10,195 $9,509 Specified items (a) ($903) ($843) ($308) Research and Development excluding specified items $9,145 $9,352 $9,201 Operating margin 31% 40% 41% Specified items (a) 10% 3% 1% Operating margin excluding specified items (b) 41% 43% 42% Bristol Myers Squibb Company Reconciliation of Certain GAAP Line Items to Certain Non-GAAP Line Items 24 (a): An explanation of these non-GAAP financial measures and a reconciliation to the most directly comparable GAAP financial measure are available on our website at bms.com/investors. (b): Operating margin on Specified Items represents the difference between the GAAP and Non-GAAP operating margin (Unaudited, dollars in millions)