Q2 2024 Results July 26, 2024

Q2 2024 Results Not for Product Promotional Use Forward Looking Statements and Non-GAAP Financial Information 2 This presentation contains statements about Bristol-Myers Squibb Company’s (the “Company”) future financial results, plans, business development strategy, anticipated clinical trials, results and regulatory approvals that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. All statements that are not statements of historical facts are, or may be deemed to be, forward-looking statements. Actual results may differ materially from those expressed in, or implied by, these statements as a result of various factors, including, but not limited to: (i) new laws and regulations, (ii) our ability to obtain, protect and maintain market exclusivity rights and enforce patents and other intellectual property rights, (iii) our ability to achieve expected clinical, regulatory and contractual milestones on expected timelines or at all, (iv) difficulties or delays in the development and commercialization of new products, (v) difficulties or delays in our clinical trials and the manufacturing, distribution and sale of our products, (vi) adverse outcomes in legal or regulatory proceedings, (vii) risks relating to acquisitions, divestitures, alliances, joint ventures and other portfolio actions and (viii) political and financial instability, including changes in general economic conditions. These and other important factors are discussed in the Company’s most recent annual report on Form 10-K and reports on Forms 10-Q and 8-K. These documents are available on the U.S. Securities and Exchange Commission’s website, on the Company’s website or from Bristol-Myers Squibb Investor Relations. No forward-looking statements can be guaranteed. In addition, any forward-looking statements and clinical data included herein are presented only as of the date hereof. Except as otherwise required by applicable law, the Company undertakes no obligation to publicly update any of the provided information, whether as a result of new information, future events, changed circumstances or otherwise. This presentation includes certain non-generally accepted accounting principles (“GAAP”) financial measures that we use to describe the Company’s performance. The non-GAAP financial measures are provided as supplemental information and are presented because management has evaluated the Company’s financial results both including and excluding the adjusted items or the effects of foreign currency translation, as applicable, and believes that the non-GAAP financial measures presented portray the results of the Company’s baseline performance, supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods. This presentation also provides certain revenues and expenses excluding the impact of foreign exchange (“Ex-FX”). We calculate foreign exchange impacts by converting our current-period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current-period results. Ex-FX financial measures are not accounted for according to GAAP because they remove the effects of currency movements from GAAP results. The non-GAAP information presented herein provides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. We encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. An explanation of these non-GAAP financial measures and a reconciliation to the most directly comparable financial measure are available on our website at www.bms.com/investors. Also note that a reconciliation of forward-looking non-GAAP measures, including non-GAAP earnings per share (EPS), to the most directly comparable GAAP measures is not provided because comparable GAAP measures for such measures are not reasonably accessible or reliable due to the inherent difficulty in forecasting and quantifying measures that would be necessary for such reconciliation. Namely, we are not, without unreasonable effort, able to reliably predict the impact of accelerated depreciation and impairment charges, legal and other settlements, gains and losses from equity investments and other adjustments. In addition, the Company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. These items are uncertain, depend on various factors and may have a material impact on our future GAAP results.

Chris Boerner, PhD Board Chair and Chief Executive Officer 3 Q2 2024 Results

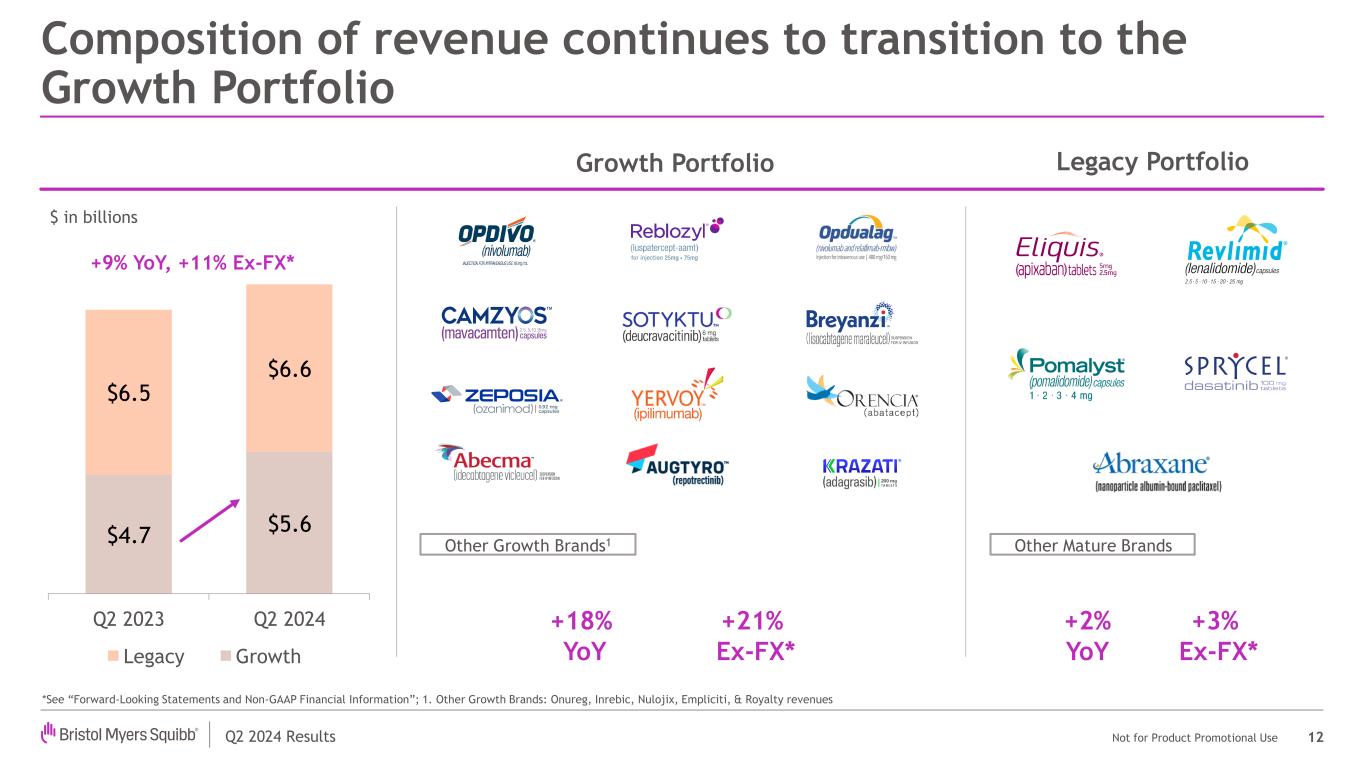

Q2 2024 Results Not for Product Promotional Use Research & Development Q2 2024 performance 4 Commercial • Subcutaneous nivolumab: potential to extend durability of IO business — U.S. FDA PDUFA date: December 29, 2024 — EU application under review *See “Forward-Looking Statements and Non-GAAP Financial Information” 1. Not an exhaustive list of assets, programs, or indications $4.7 $5.6 $6.5 $6.6 $11.2 $12.2 Q2 2023 Q2 2024 Legacy Growth $ in billions +82% Growth portfolio revenues: +18% or +21% Ex-FX* YoY >100% +53% >100% +53% Achieved multiple clinical & regulatory milestones1

Q2 2024 Results Not for Product Promotional Use 5 Focusing on transformational medicines where we have a competitive advantage Driving operational excellence throughout the organization Strategically allocating capital for long-term growth and returns Accelerating delivery of important medicines to more patients Reshaping BMS for sustained top-tier growth & value creation

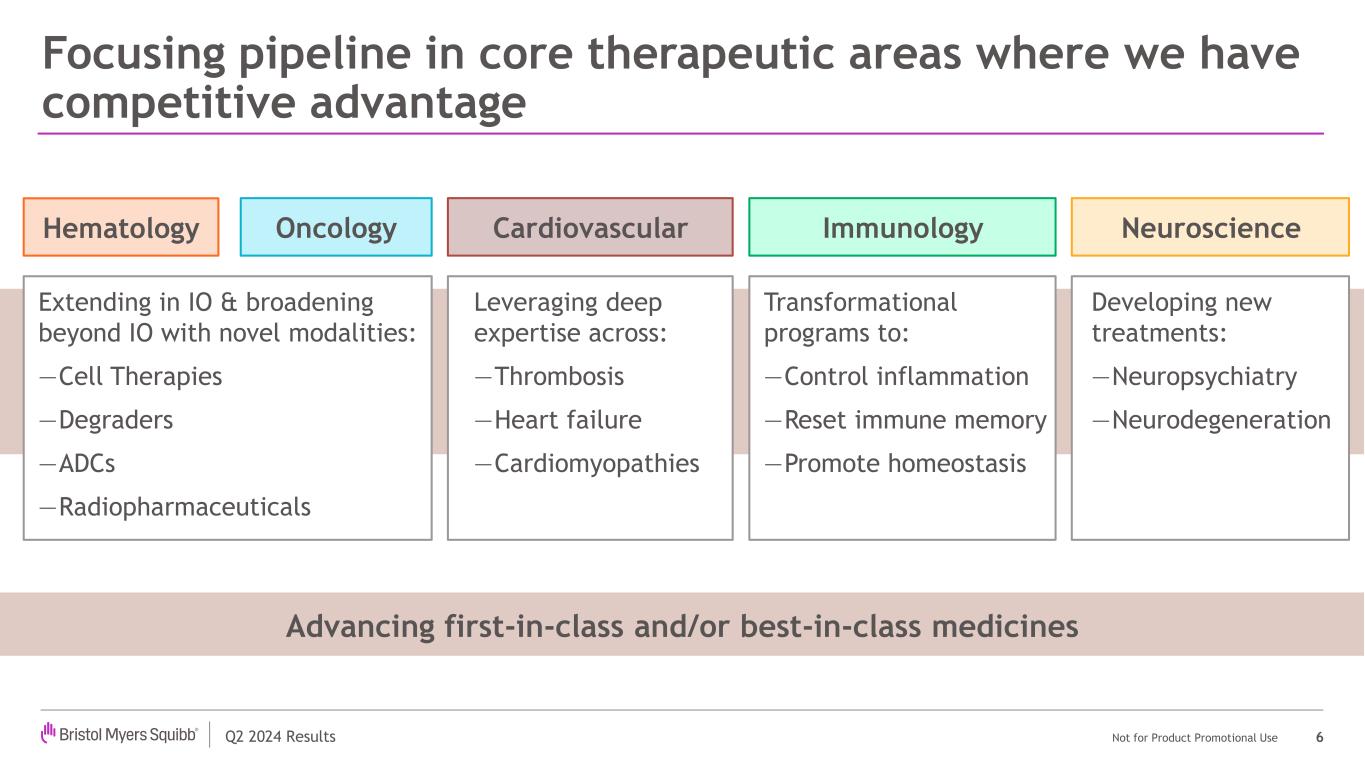

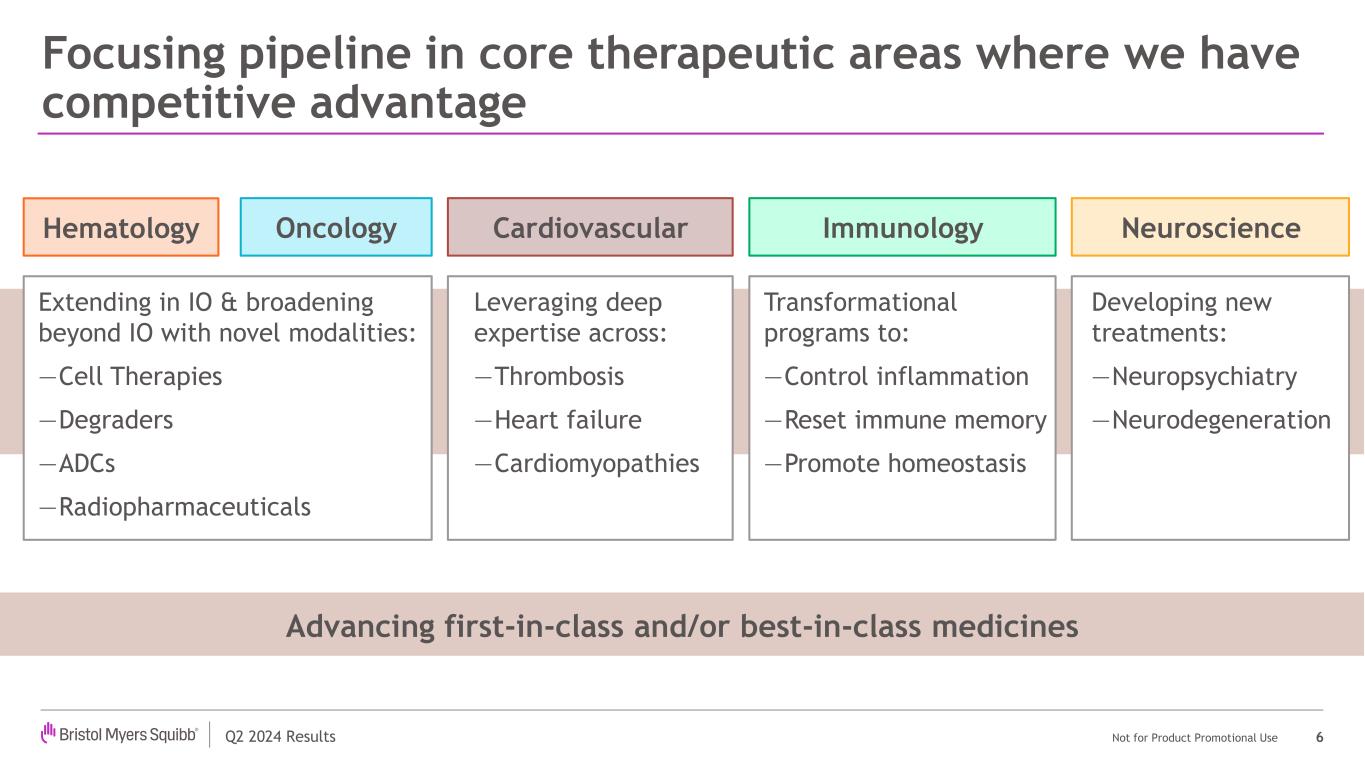

Q2 2024 Results Not for Product Promotional Use Focusing pipeline in core therapeutic areas where we have competitive advantage 6 ImmunologyHematology Neuroscience Transformational programs to: —Control inflammation —Reset immune memory —Promote homeostasis Developing new treatments: —Neuropsychiatry —Neurodegeneration Leveraging deep expertise across: —Thrombosis —Heart failure —Cardiomyopathies Advancing first-in-class and/or best-in-class medicines CardiovascularOncology Extending in IO & broadening beyond IO with novel modalities: —Cell Therapies —Degraders —ADCs —Radiopharmaceuticals

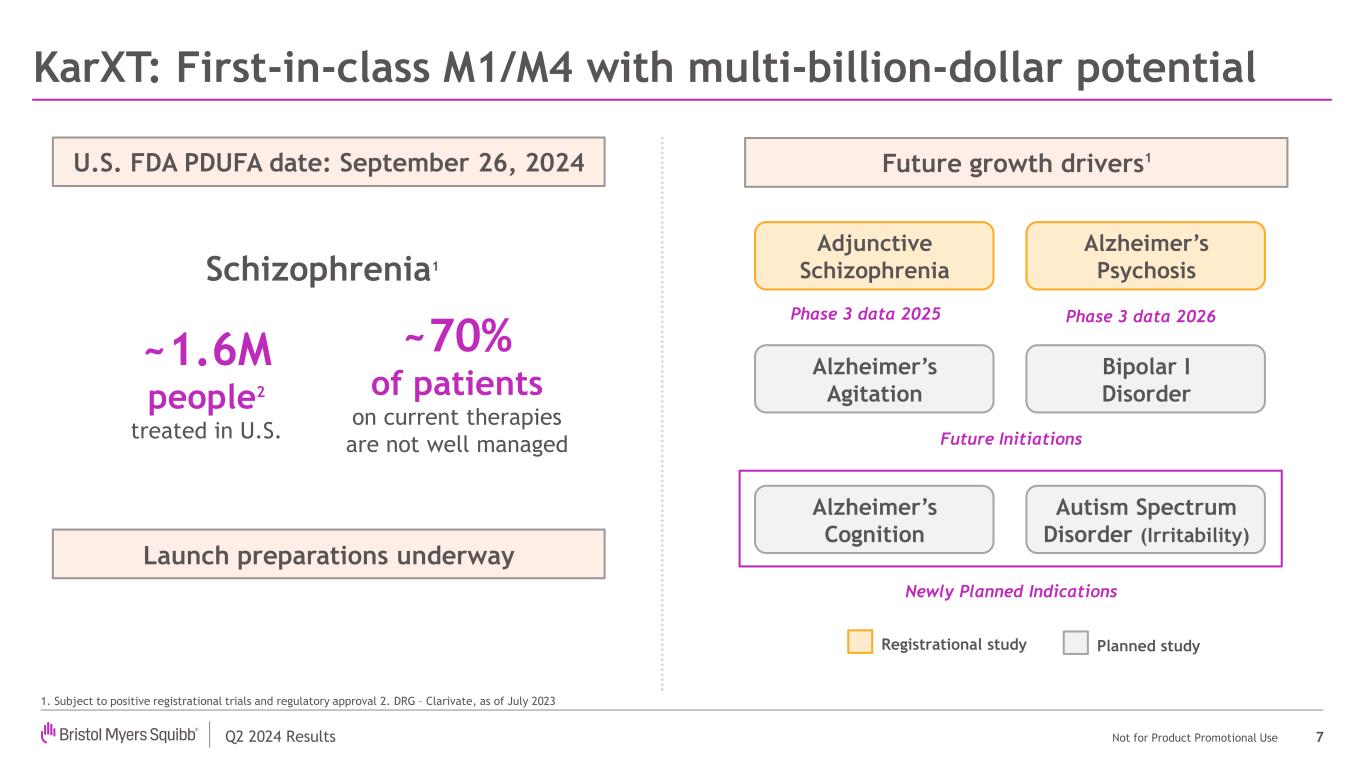

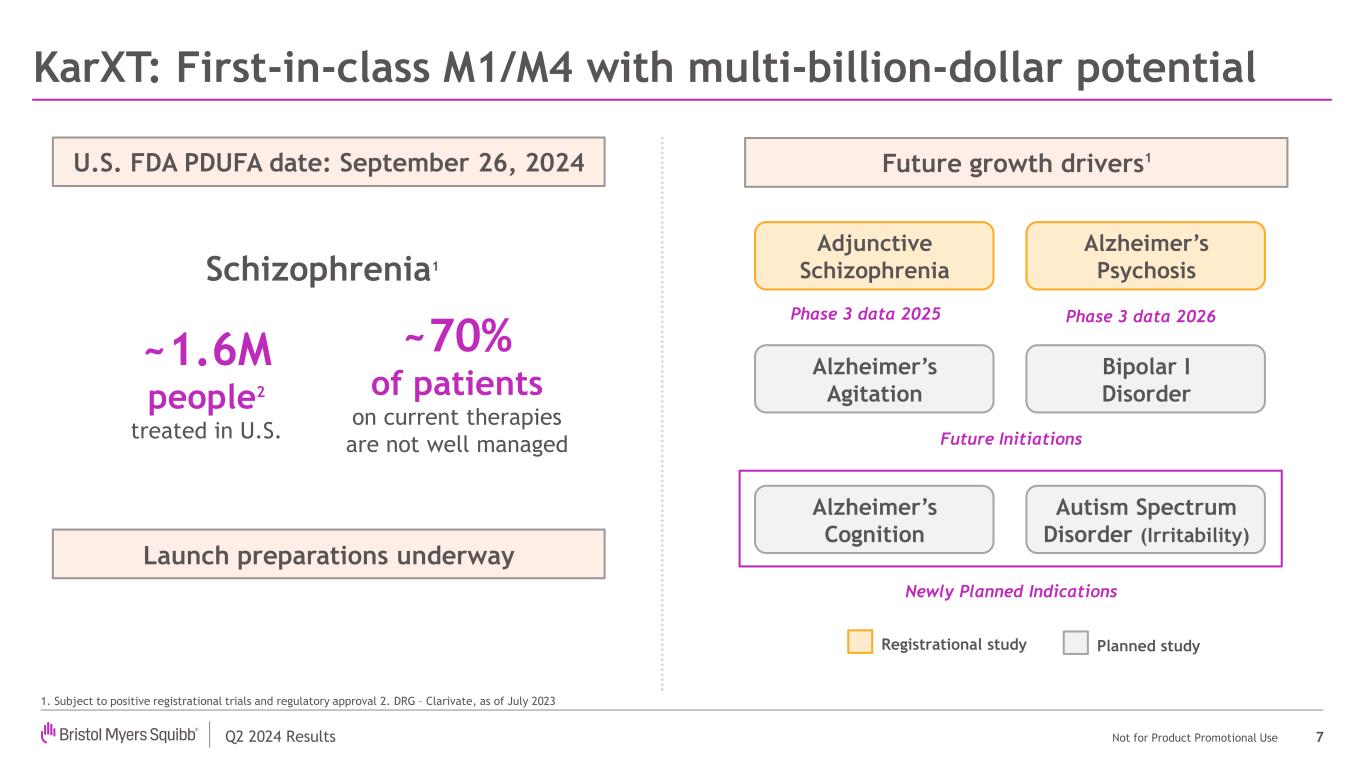

Q2 2024 Results Not for Product Promotional Use KarXT: First-in-class M1/M4 with multi-billion-dollar potential 7 Schizophrenia1 ~1.6M people2 treated in U.S. ~70% of patients on current therapies are not well managed 1. Subject to positive registrational trials and regulatory approval 2. DRG – Clarivate, as of July 2023 U.S. FDA PDUFA date: September 26, 2024 Adjunctive Schizophrenia Alzheimer’s Psychosis Alzheimer’s Agitation Bipolar I Disorder Alzheimer’s Cognition Autism Spectrum Disorder (Irritability) Registrational study Planned study Phase 3 data 2025 Phase 3 data 2026 Future Initiations Newly Planned Indications Future growth drivers1 Launch preparations underway

Q2 2024 Results Not for Product Promotional Use 8 Expanding in IO & diversifying beyond IO Accelerating return in Neuroscience Expanding in Immunology U.S. FDA PDUFA date: September 26th Phase 3 PsA data readout POETYK-PsA-I & II Strengthening pipeline momentum in the near term U.S. FDA PDUFA date: December 29th Present Phase 2 data & initiate Phase 3 trial in 1L NSCLC 2H 2024 key milestones*1 Phase 1 data readout in severe, refractory SLE PRMT5i Phase 1 data readout in advanced solid tumors *See “Forward-Looking Statements and Non-GAAP Financial Information” 1. Subject to positive registrational trials and regulatory approval KarXT SC Nivolumab CD19 NEX-T

Q2 2024 Results Not for Product Promotional Use Pipeline enters catalyst-rich period starting next year 9 • Reblozyl 1L TD MF associated anemia (INDEPENDENCE) • Opdualag Adjuvant Melanoma • Camzyos nHCM (ODYSSEY) • Sotyktu SLE (POETYK-SLE I & II) • KarXT Adjunctive Schizophrenia (ARISE) • KarXT Alzheimer’s Psychosis (ADEPT) • EGFR x HER3 ADC Advanced solid tumors • Krazati 1L NSCLC (TPS <50%) • RYZ101 ES-SCLC • Golcadomide 1L FL (GOLSEEK II) • MYK-224 HFpEF (AURORA) Growth Products indication expansion1 NME registrational data 2025–2026 key milestones* *See “Forward-Looking Statements and Non-GAAP Financial Information” 1. Subject to positive registrational trials and regulatory approval Key early-stage data • Milvexian LIBREXIA program • LPA1 IPF (ALOFT) • Iberdomide 2L+ MM (EXCALIBER-RRMM) • Mezigdomide 2L+ MM (SUCCESSOR I & II) • GPRC5D CAR T 4L+ MM (QUINTESSENTIAL) • RYZ101 2L+ GEP-NETs

Q2 2024 Results Not for Product Promotional Use 2024 Guidance Highlights*1 Total Revenues Reported Rates Upper end of low single-digit range Total Revenues Ex-FX Upper end of low single-digit range Non-GAAP EPS2 Increasing range to $0.60 - $0.90 Raising our 2024 outlook 10 *The Company does not reconcile forward-looking non-GAAP measures. See “Forward-Looking Statements and Non-GAAP Financial Information” 1. 2024 EPS Guidance excludes the impact of any potential future strategic acquisitions, divestitures, specified items, and the impact of future Acquired IPRD charges; 2. Includes the net impact of Acquired IPRD and licensing income through Q2 2024. Guidance excludes the impact of any potential future strategic acquisitions, divestitures, specified items, and the impact of future Acquired IPRD charges.

David Elkins Executive Vice President and Chief Financial Officer 11 Q2 2024 Results

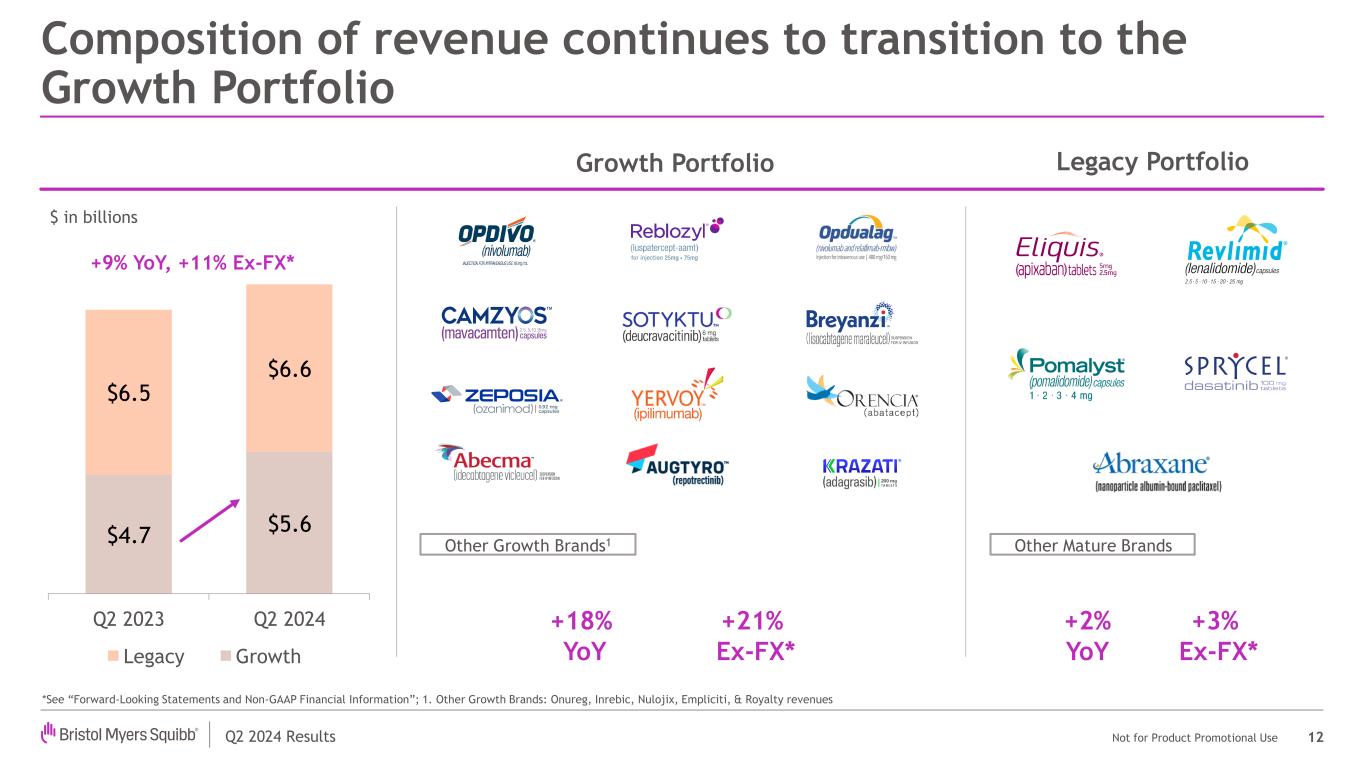

Q2 2024 Results Not for Product Promotional Use Composition of revenue continues to transition to the Growth Portfolio 12 $4.7 $5.6 $6.5 $6.6 Q2 2023 Q2 2024 Legacy Growth Growth Portfolio Other Growth Brands1 Legacy Portfolio Other Mature Brands *See “Forward-Looking Statements and Non-GAAP Financial Information”; 1. Other Growth Brands: Onureg, Inrebic, Nulojix, Empliciti, & Royalty revenues $ in billions +3% Ex-FX* +18% YoY +2% YoY +21% Ex-FX* +9% YoY, +11% Ex-FX*

Q2 2024 Results Not for Product Promotional Use Q2 2024 Oncology product summary 13 Opdivo: • U.S. sales growth vs. PY including favorable inventory dynamics • Ex-U.S. demand growth & expanded access Opdualag: • U.S. growth driven by strong demand; achieved ~25%-30% market share1 in 1L melanoma • Focused on driving share from PD-1 mono (<15%), dual IO, & BRAF/MEK settings Krazati: • Focused on increasing demand & new patient share in 2L+ NSCLC Global Net Sales *See “Forward-Looking Statements and Non-GAAP Financial Information” 1. BMS Internal Analysis $M YoY % Ex-FX* % $2,387 +11% +16% $630 +8% +10% $235 +53% +53% $231 (10%) (6%) $32 --- --- $7 --- ---

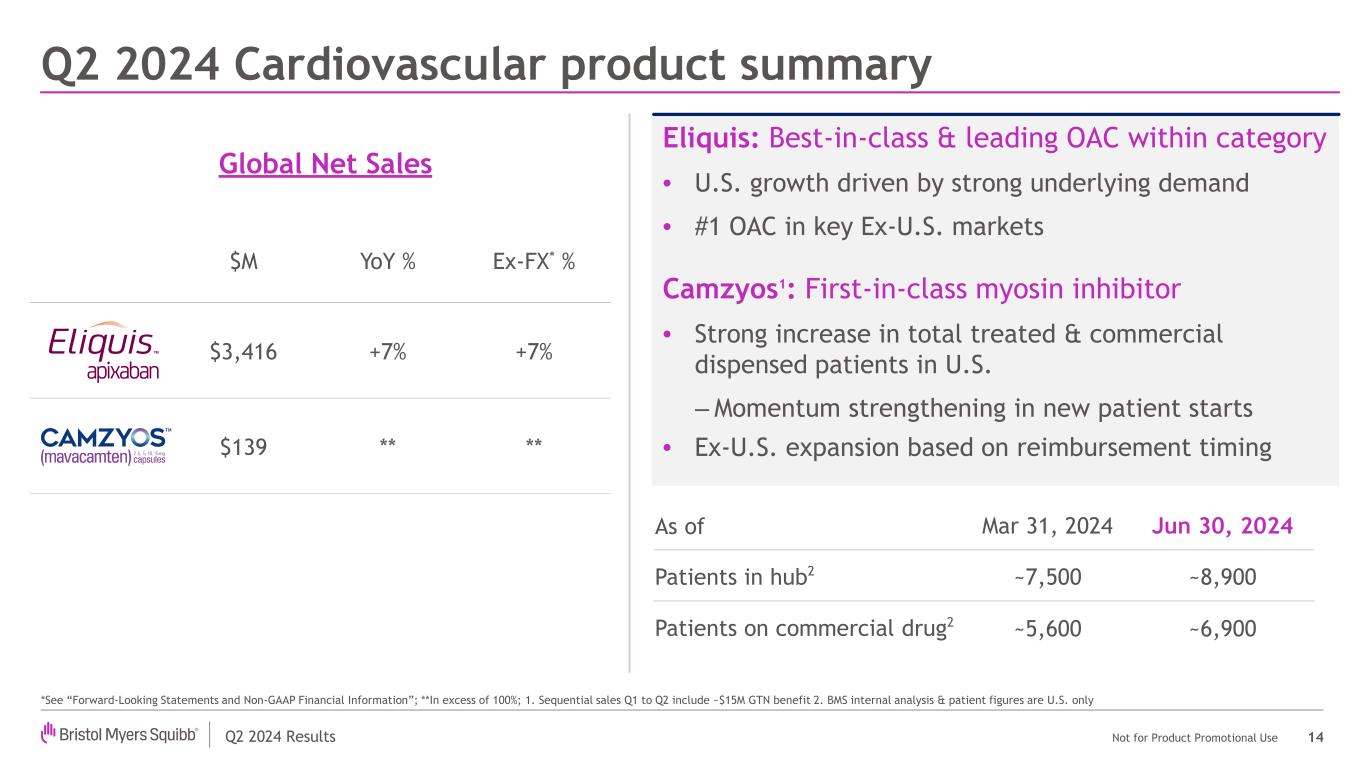

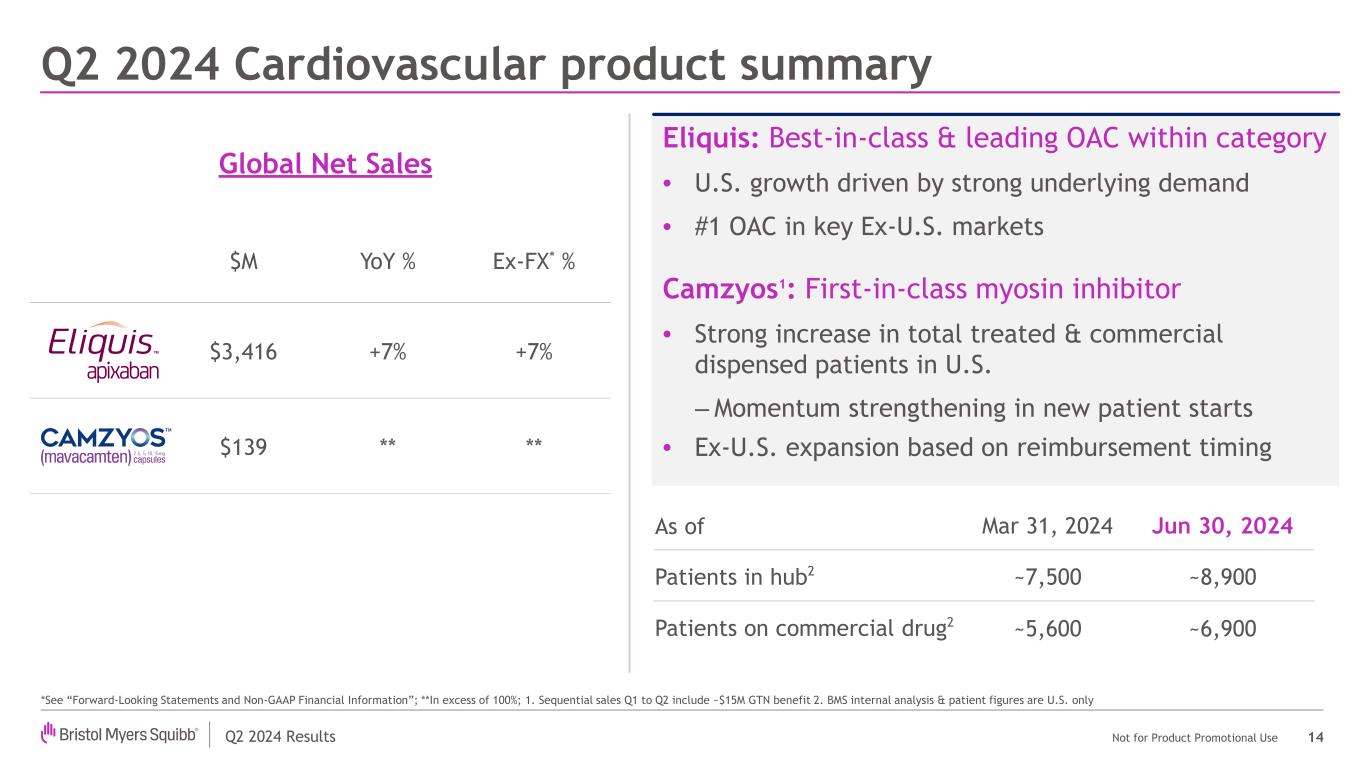

Q2 2024 Results Not for Product Promotional Use Q2 2024 Cardiovascular product summary 14 Eliquis: Best-in-class & leading OAC within category • U.S. growth driven by strong underlying demand • #1 OAC in key Ex-U.S. markets Camzyos1: First-in-class myosin inhibitor • Strong increase in total treated & commercial dispensed patients in U.S. ‒Momentum strengthening in new patient starts • Ex-U.S. expansion based on reimbursement timing Global Net Sales % $M YoY % Ex-FX* % $3,416 +7% +7% $139 ** ** As of Mar 31, 2024 Jun 30, 2024 Patients in hub2 ~7,500 ~8,900 Patients on commercial drug2 ~5,600 ~6,900 *See “Forward-Looking Statements and Non-GAAP Financial Information”; **In excess of 100%; 1. Sequential sales Q1 to Q2 include ~$15M GTN benefit 2. BMS internal analysis & patient figures are U.S. only

Q2 2024 Results Not for Product Promotional Use Q2 2024 Hematology product summary 15 Reblozyl: • Strong demand in 1L MDS-associated anemia • Increasing market share across both RS positive and RS negative populations • Securing reimbursement across Ex-U.S. markets Breyanzi: • Growth driven by expanded manufacturing capacity and increased demand across LBCL as well as recently approved expanded indications 1 $M YoY % Ex-FX* % $1,353 (8%) (7%) $959 +13% +14% $425 +82% +82% $424 (7%) (6%) $153 +53% +55% $95 (28%) (27%) Global Net Sales *See “Forward-Looking Statements and Non-GAAP Financial Information”

Q2 2024 Results Not for Product Promotional Use Q2 2024 Immunology product summary 16 Sotyktu1,2: First-in-class TYK2 inhibitor • Achieved 26% sequential growth in commercially paid scripts in the U.S. • Continued focus on demand growth and access improvements Global Net Sales *See “Forward-Looking Statements and Non-GAAP Financial Information”; **In excess of +100%; 1. Q1 & Q2 2024 sales include clinical trial sales of ~$2M & ~$5M, respectively; 2. Q2 sales include (~$10M) GTN impact including ($6M) adjustment from Q1; 3. Symphony Health, an ICON plc Company, Metys® U.S. TRx data Q3’23 Q4’23 Q1’24 Q2’24 ~6,500 ~8,700 ~9,800 ~12,300 Sotyktu Commercially Paid Scripts3 % $M YoY % Ex-FX* % $948 +2% +5% $151 +51% +51% $53 ** **

Q2 2024 Results Not for Product Promotional Use US GAAP Non-GAAP $ in billions, except EPS Q2 2024 Q2 2023 Q2 2024 Q2 2023 Total Revenues, net 12.2 11.2 12.2 11.2 Gross Margin % 73.2% 74.4% 75.6% 75.0% Operating Expenses1 4.8 4.2 4.2 4.2 Acquired IPR&D 0.1 0.2 0.1 0.2 Amortization of Acquired Intangibles 2.4 2.3 - - Effective Tax Rate (30.9%) (11.7%) 14.1% 16.9% Diluted EPS 0.83 0.99 2.07 1.75 Diluted Shares Outstanding (# in millions) 2,029 2,102 2,029 2,102 Q2 2024 Financial Performance 17 US P Non- P* Diluted EPS Impact from Acquired IPR&D2 (0.04) (0.05) (0.04) (0.05) *See “Forward-Looking Statements and Non-GAAP Financial Information”; 1. Operating Expenses = MS&A and R&D; 2. Represents the net impact from Acquired IPRD & Licensing income reported in Q2

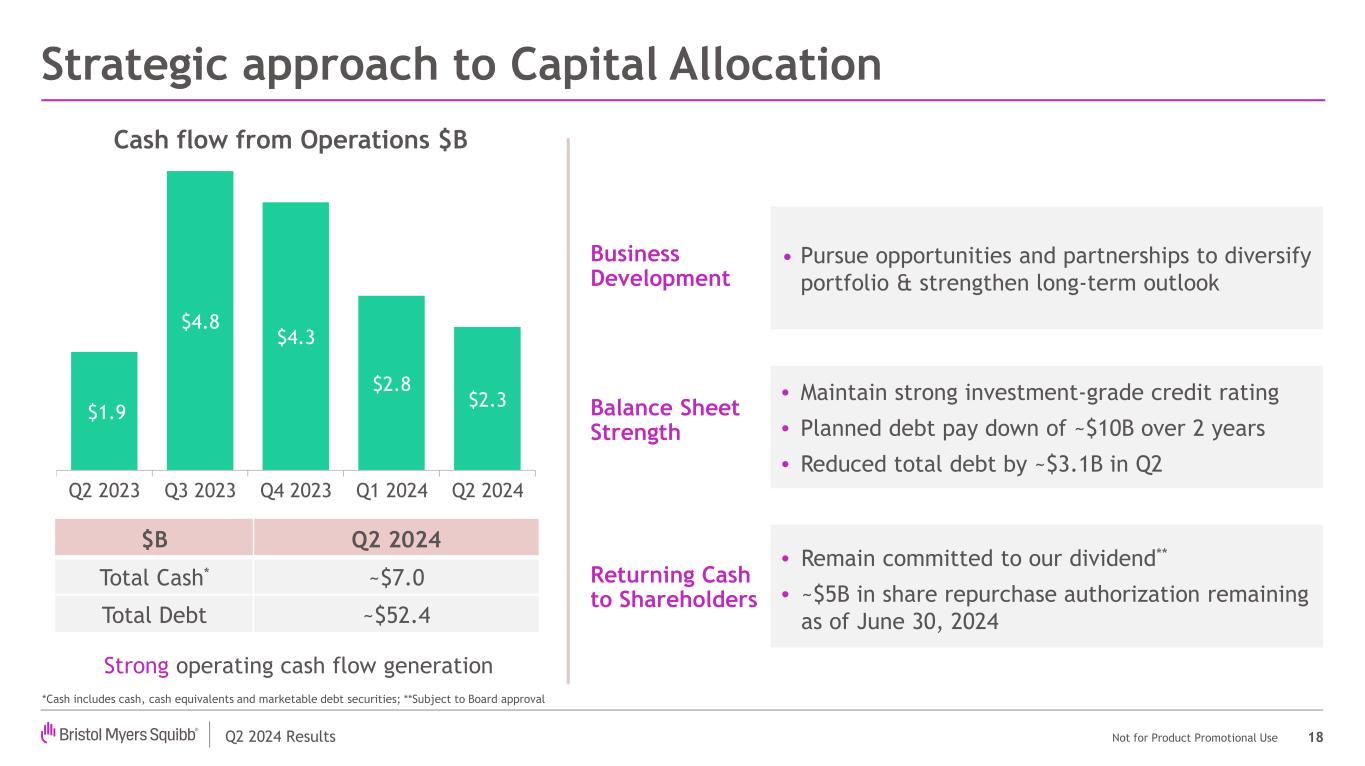

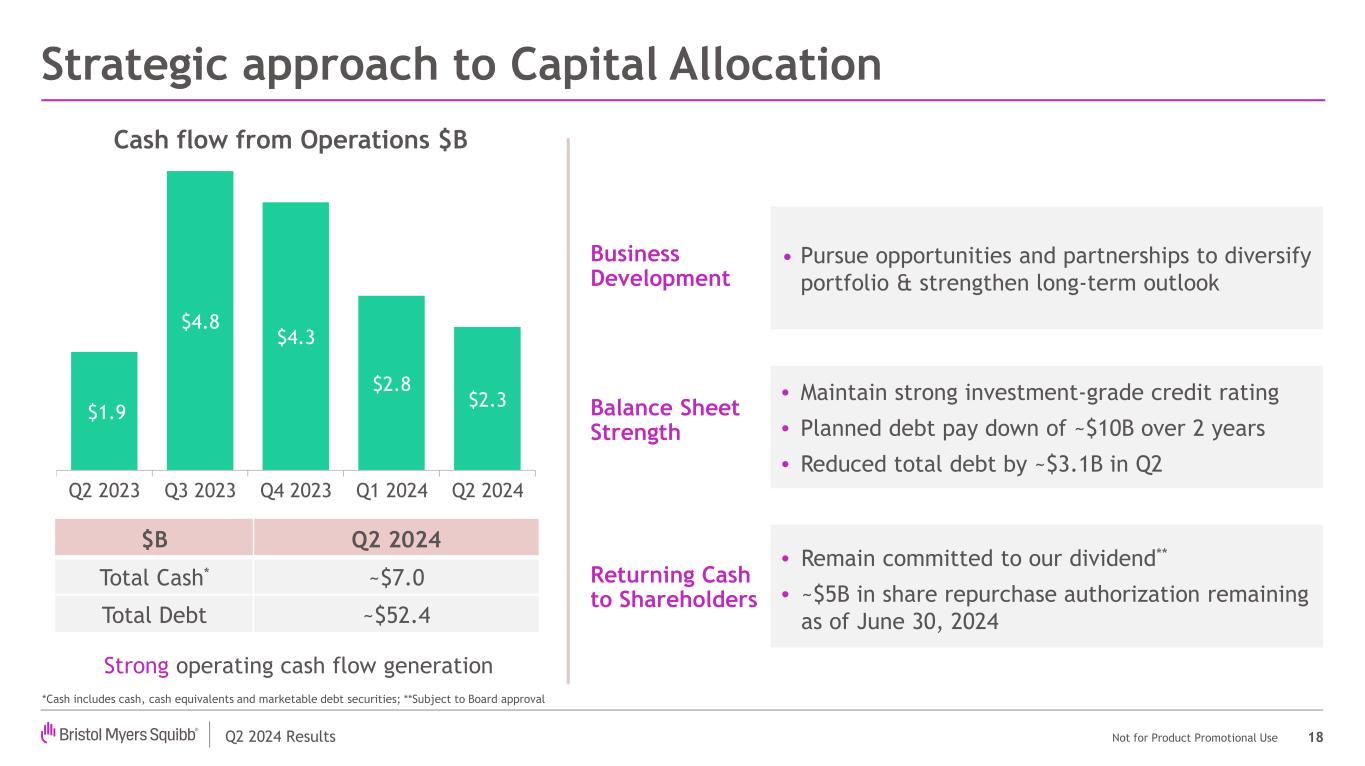

Q2 2024 Results Not for Product Promotional Use Strategic approach to Capital Allocation 18 *Cash includes cash, cash equivalents and marketable debt securities; **Subject to Board approval $B Q2 2024 Total Cash* ~$7.0 Total Debt ~$52.4 • Pursue opportunities and partnerships to diversify portfolio & strengthen long-term outlook • Maintain strong investment-grade credit rating • Planned debt pay down of ~$10B over 2 years • Reduced total debt by ~$3.1B in Q2 Business Development Balance Sheet Strength Returning Cash to Shareholders • Remain committed to our dividend** • ~$5B in share repurchase authorization remaining as of June 30, 2024 Strong operating cash flow generation $1.9 $4.8 $4.3 $2.8 $2.3 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Cash flow from Operations $B

Q2 2024 Results Not for Product Promotional Use April (Prior) July (Updated) Total Revenues Reported Rates Low single-digit increase Upper end of low single-digit range Total Revenues Ex-FX Low single-digit increase Upper end of low single-digit range Gross Margin % ~74% Between ~74% and ~75% Operating Expenses1 Low single-digit increase No change Other Income/ (Expense) ~($250M) ~($50M) Tax Rate2 ~69% ~66% Diluted EPS2 $0.40 - $0.70 $0.60 - $0.90 Revised 2024 Guidance 19 Non-GAAP* *The Company does not reconcile forward-looking non-GAAP measures. See "Forward-Looking Statements and Non-GAAP Financial Information”; 1. Operating Expenses = MS&A and R&D, excluding Acquired IPR&D and Amortization of acquired intangibles; 2. Includes the net impact of Acquired IPRD and licensing income through Q2 2024. Guidance excludes the impact of any potential future strategic acquisitions, divestitures, specified items, and the impact of future Acquired IPRD charges. Key Highlights • Total Revenues (reported & Ex-FX) are expected to be at the upper end of low-single digit range • Gross Margin updated due to sales mix • Operating Expenses are expected to be at upper end of low single-digit range • Other Income/(Expense) updated mainly due to royalties • Underlying Tax Rate excluding Acquired IPR&D: • Q2 at ~14.2% • FY’24 estimated at ~18%

Q2 2024 Results Not for Product Promotional Use Delivering on focused strategic execution in Q2 20 Return to Neuroscience Driving Sustainable Growth Q2 Performance • Multiple regulatory approvals & clinical development milestones achieved • Near-to-mid-term catalysts strengthen long-term outlook • Topline growth: +9% or +11% Ex-FX* • Growth portfolio: +18% or +21% Ex-FX* Advancing our Pipeline Raising FY 2024 Non-GAAP Guidance *See “Forward-Looking Statements and Non-GAAP Financial Information” • Focusing on Transformational Medicines • Driving Operational Excellence • Strategically Allocating Capital • KarXT: First-in-class medicine with multi-billion-dollar potential set to launch in schizophrenia • U.S. FDA PDUFA date: September 26, 2024

Chris Boerner, PhD Board Chair, Chief Executive Officer David Elkins Executive VP, Chief Financial Officer Samit Hirawat, MD Executive VP, Chief Medical Officer, Global Drug Development Adam Lenkowsky Executive VP, Chief Commercialization Officer 21 Q2 2024 Results Q&A