Not for Product Promotional Use Q4 2024 Results February 6, 2025

Not for Product Promotional UseQ4 2024 Results Forward Looking Statements and Non-GAAP Financial Information 2 This presentation contains statements about Bristol-Myers Squibb Company’s (the “Company”) future financial results, plans, business development strategy, anticipated clinical trials, results and regulatory approvals that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. All statements that are not statements of historical facts are, or may be deemed to be, forward-looking statements. Actual results may differ materially from those expressed in, or implied by, these statements as a result of various factors, including, but not limited to: (i) new laws and regulations, including with respect to pricing controls and market access, (ii) our ability to obtain, protect and maintain market exclusivity rights and enforce patents and other intellectual property rights, (iii) our ability to achieve expected clinical, regulatory and contractual milestones on expected timelines or at all, (iv) difficulties or delays in the development and commercialization of new products, (v) difficulties or delays in our clinical trials and the manufacturing, distribution and sale of our products, (vi) adverse outcomes in legal or regulatory proceedings, (vii) risks relating to acquisitions, divestitures, alliances, joint ventures and other portfolio actions and (viii) political and financial instability, including changes in general economic conditions. These and other important factors are discussed in the Company’s most recent annual report on Form 10-K and reports on Forms 10-Q and 8-K. These documents are available on the U.S. Securities and Exchange Commission’s website, on the Company’s website or from Bristol- Myers Squibb Investor Relations. No forward-looking statements can be guaranteed. In addition, any forward-looking statements and clinical data included herein are presented only as of the date hereof. Except as otherwise required by applicable law, the Company undertakes no obligation to publicly update any of the provided information, whether as a result of new information, future events, changed circumstances or otherwise. This presentation includes certain non-generally accepted accounting principles (“GAAP”) financial measures that we use to describe the Company’s performance. The non-GAAP financial measures are provided as supplemental information and are presented because management has evaluated the Company’s financial results both including and excluding the adjusted items or the effects of foreign currency translation, as applicable, and believes that the non-GAAP financial measures presented portray the results of the Company’s baseline performance, supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods. This presentation also provides certain revenues and expenses excluding the impact of foreign exchange (“Ex- FX”). We calculate foreign exchange impacts by converting our current-period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current-period results. Ex-FX financial measures are not accounted for according to GAAP because they remove the effects of currency movements from GAAP results. The non-GAAP information presented herein provides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. We encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. An explanation of these non-GAAP financial measures and a reconciliation to the most directly comparable financial measure are available on our website at www.bms.com/investors. Also note that a reconciliation of forward-looking non-GAAP measures, including non-GAAP earnings per share (EPS), to the most directly comparable GAAP measures is not provided because comparable GAAP measures for such measures are not reasonably accessible or reliable due to the inherent difficulty in forecasting and quantifying measures that would be necessary for such reconciliation. Namely, we are not, without unreasonable effort, able to reliably predict the impact of accelerated depreciation and impairment charges, legal and other settlements, gains and losses from equity investments and other adjustments. In addition, the Company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. These items are uncertain, depend on various factors and may have a material impact on our future GAAP results. Certain information presented in the accompanying presentation may not add due to the use of rounded numbers.

Chris Boerner, PhD Board Chair and Chief Executive Officer 3 Q4 2024 Results

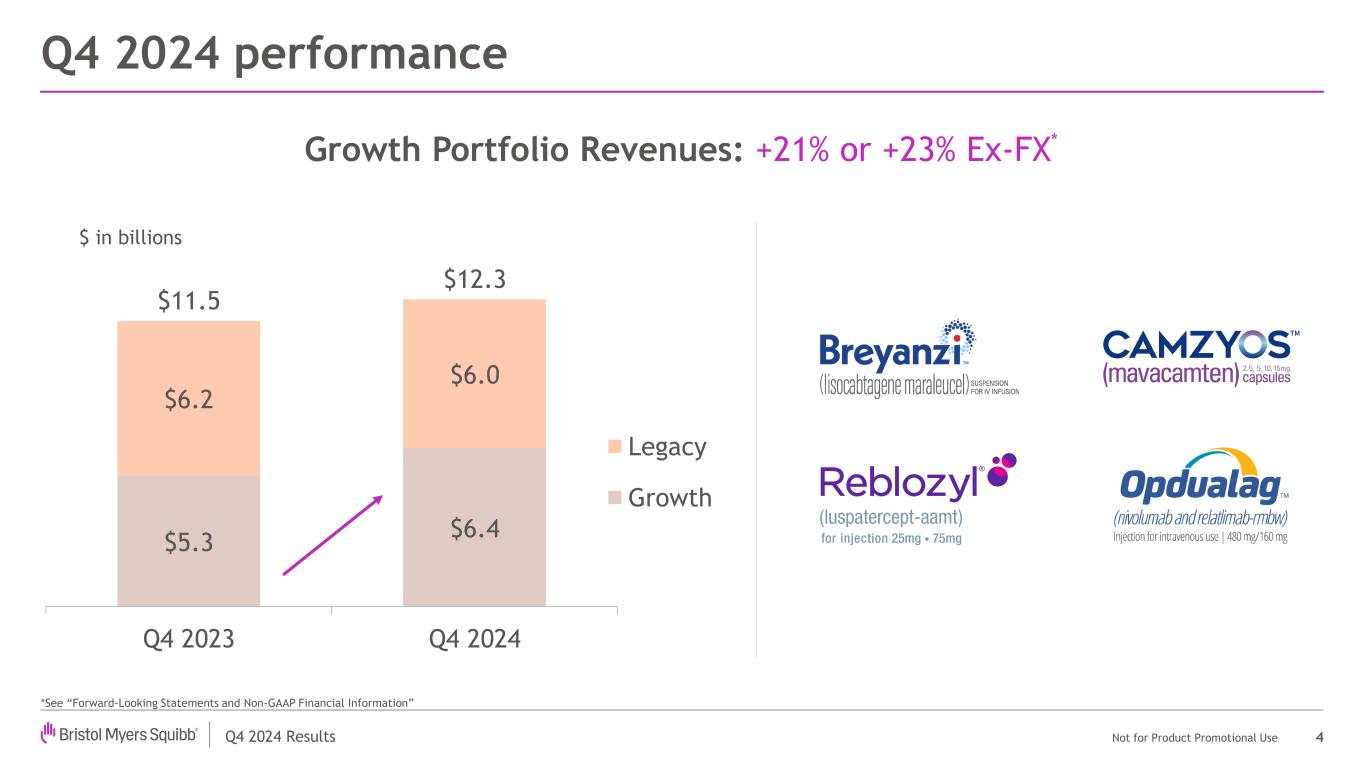

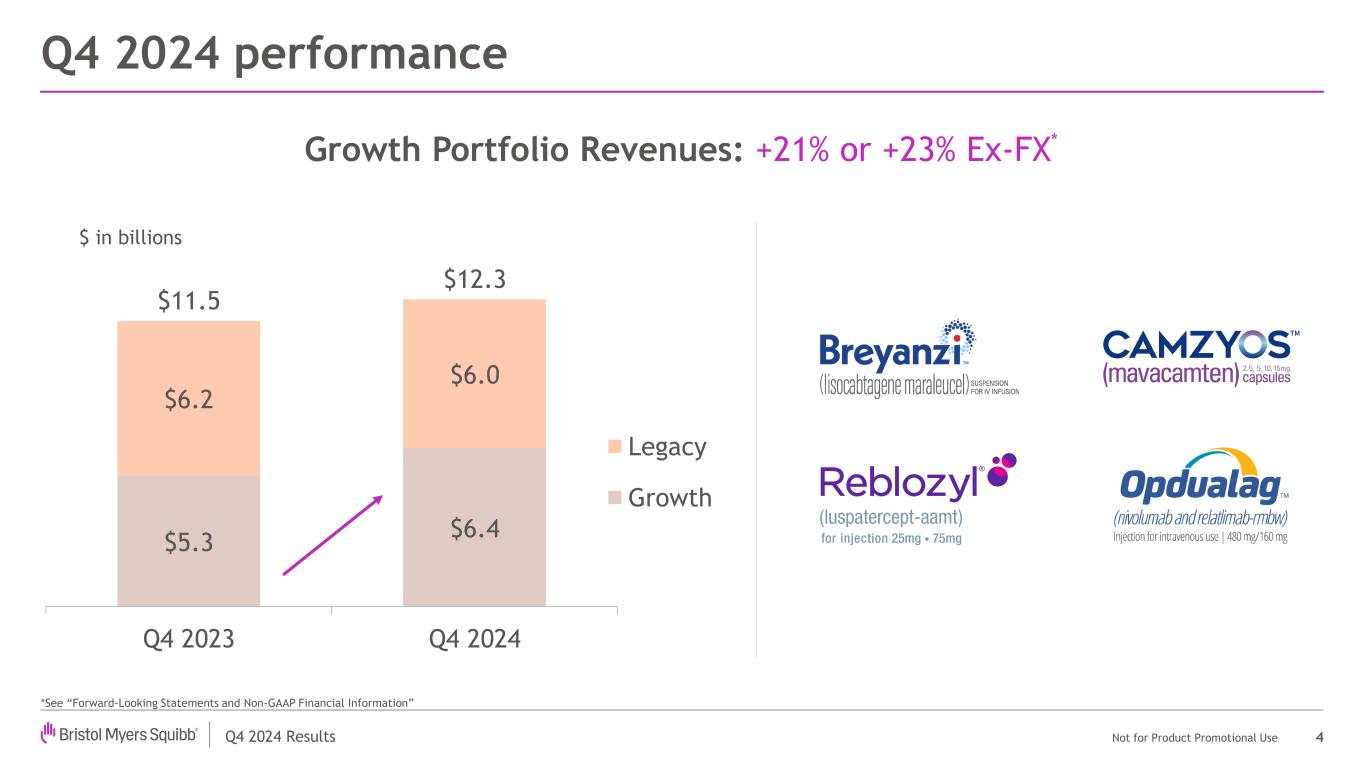

Q4 2024 Results Not for Product Promotional Use $5.3 $6.4 $6.2 $6.0 $11.5 $12.3 Q4 2023 Q4 2024 Legacy Growth Q4 2024 performance 4 *See “Forward-Looking Statements and Non-GAAP Financial Information” $ in billions Growth Portfolio Revenues: +21% or +23% Ex-FX*

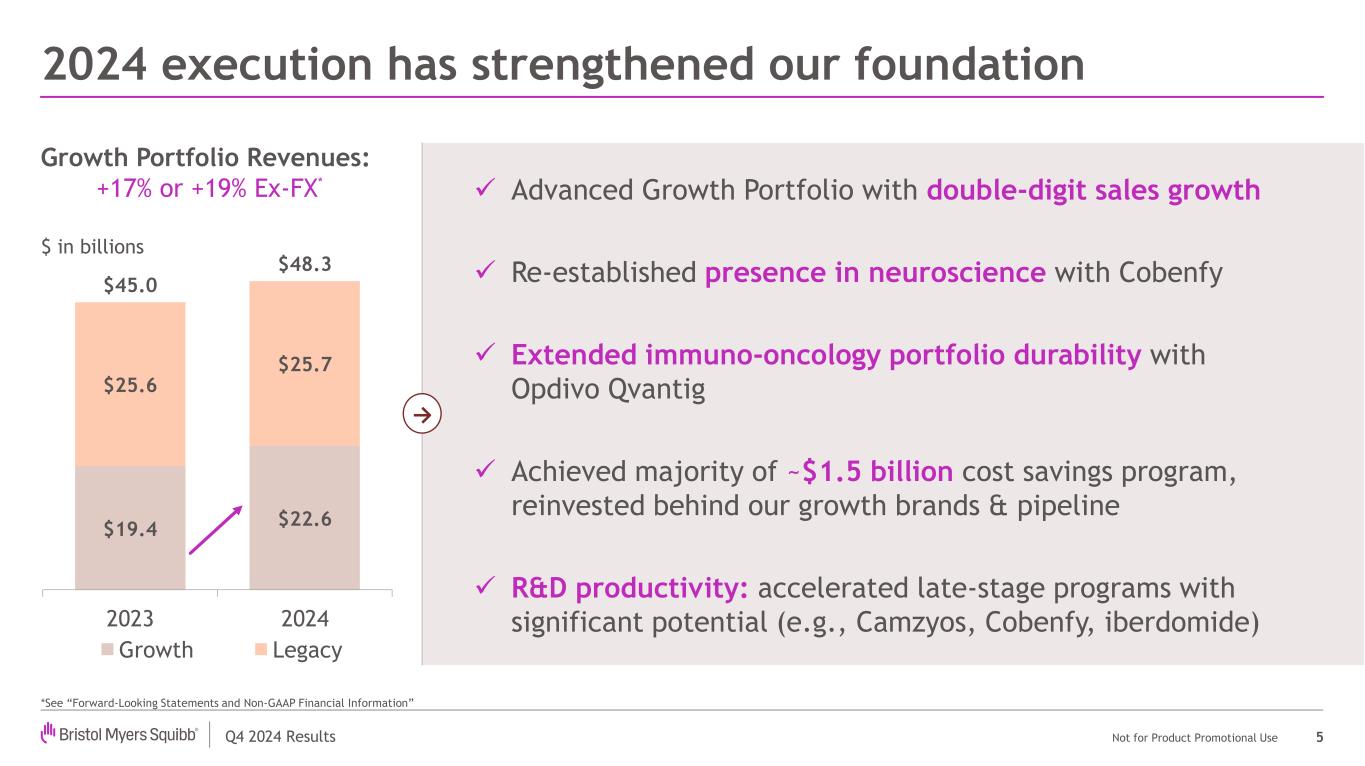

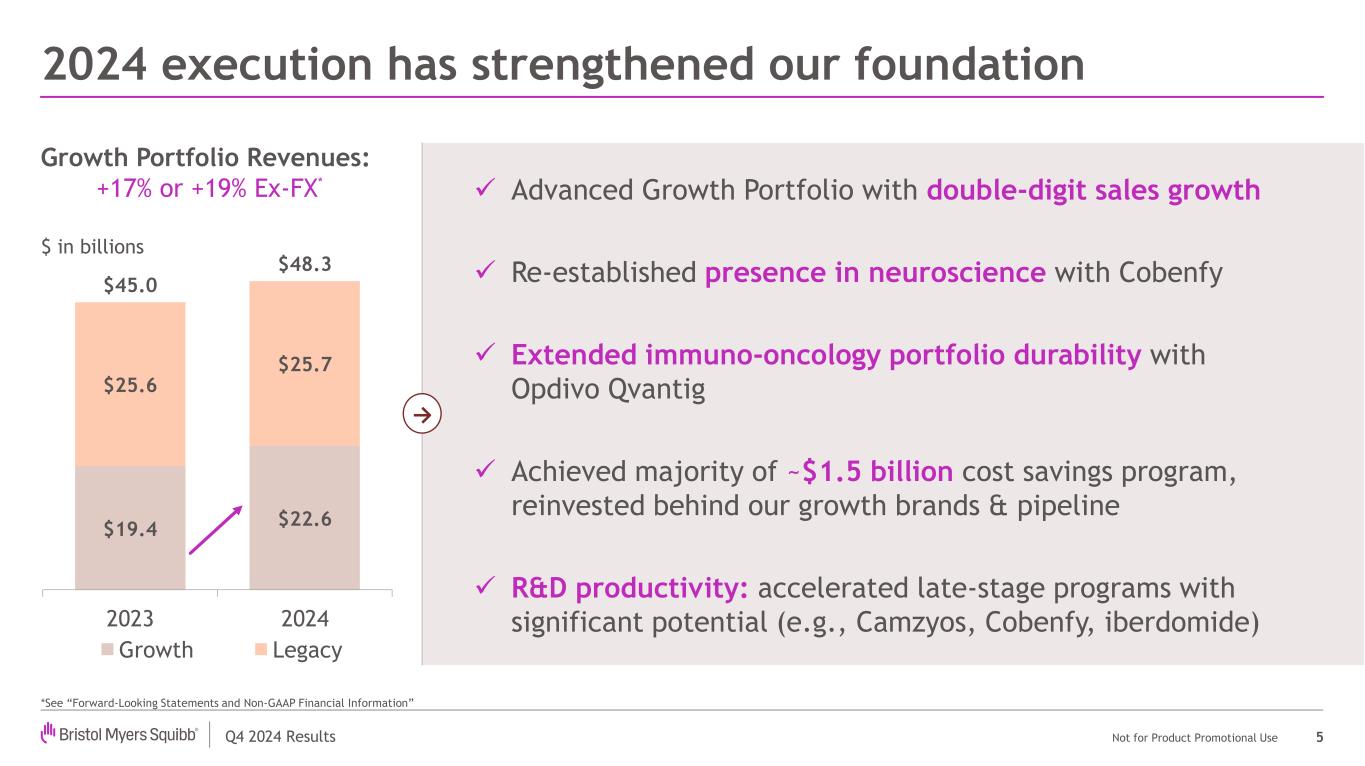

Q4 2024 Results Not for Product Promotional Use $19.4 $22.6 $25.6 $25.7 $45.0 $48.3 2023 2024 Growth Legacy 2024 execution has strengthened our foundation 5 Advanced Growth Portfolio with double-digit sales growth Re-established presence in neuroscience with Cobenfy Extended immuno-oncology portfolio durability with Opdivo Qvantig Achieved majority of ~$1.5 billion cost savings program, reinvested behind our growth brands & pipeline R&D productivity: accelerated late-stage programs with significant potential (e.g., Camzyos, Cobenfy, iberdomide) → $ in billions Growth Portfolio Revenues: +17% or +19% Ex-FX* *See “Forward-Looking Statements and Non-GAAP Financial Information”

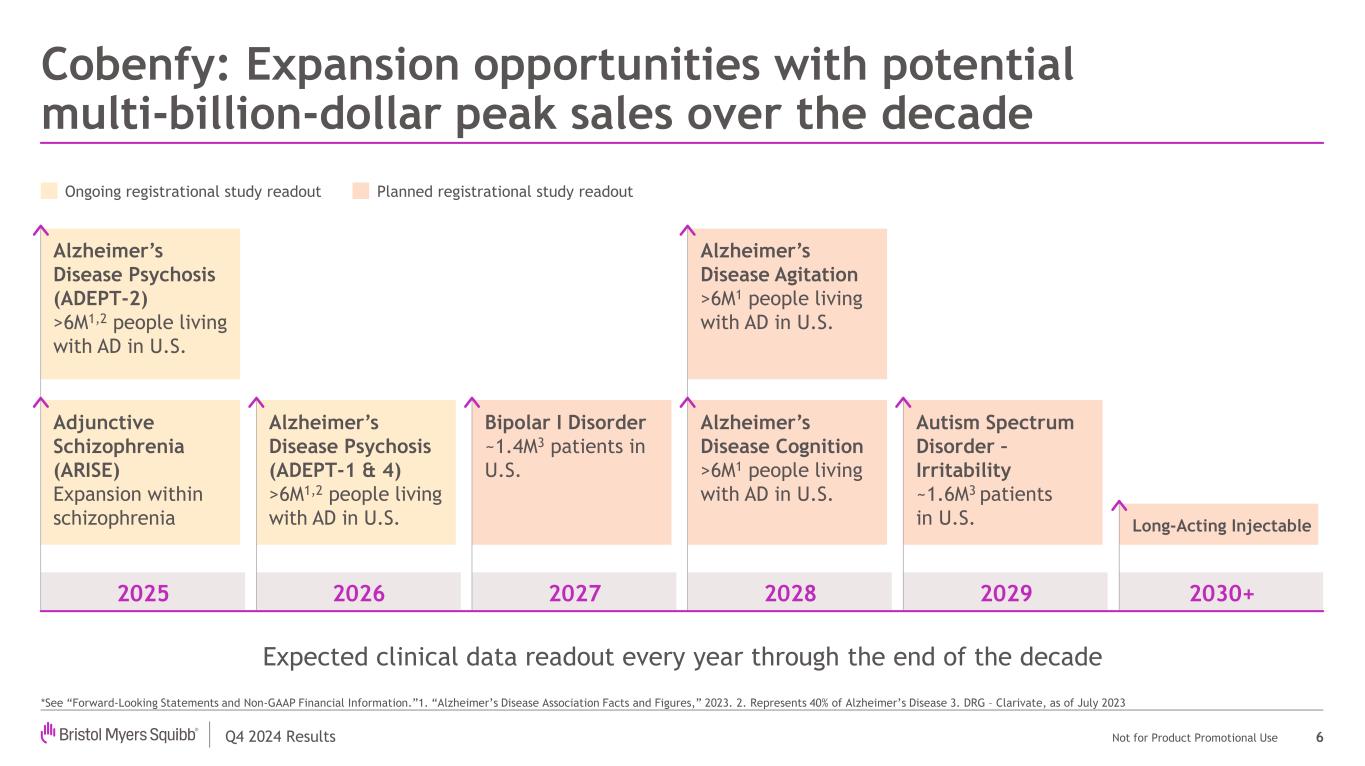

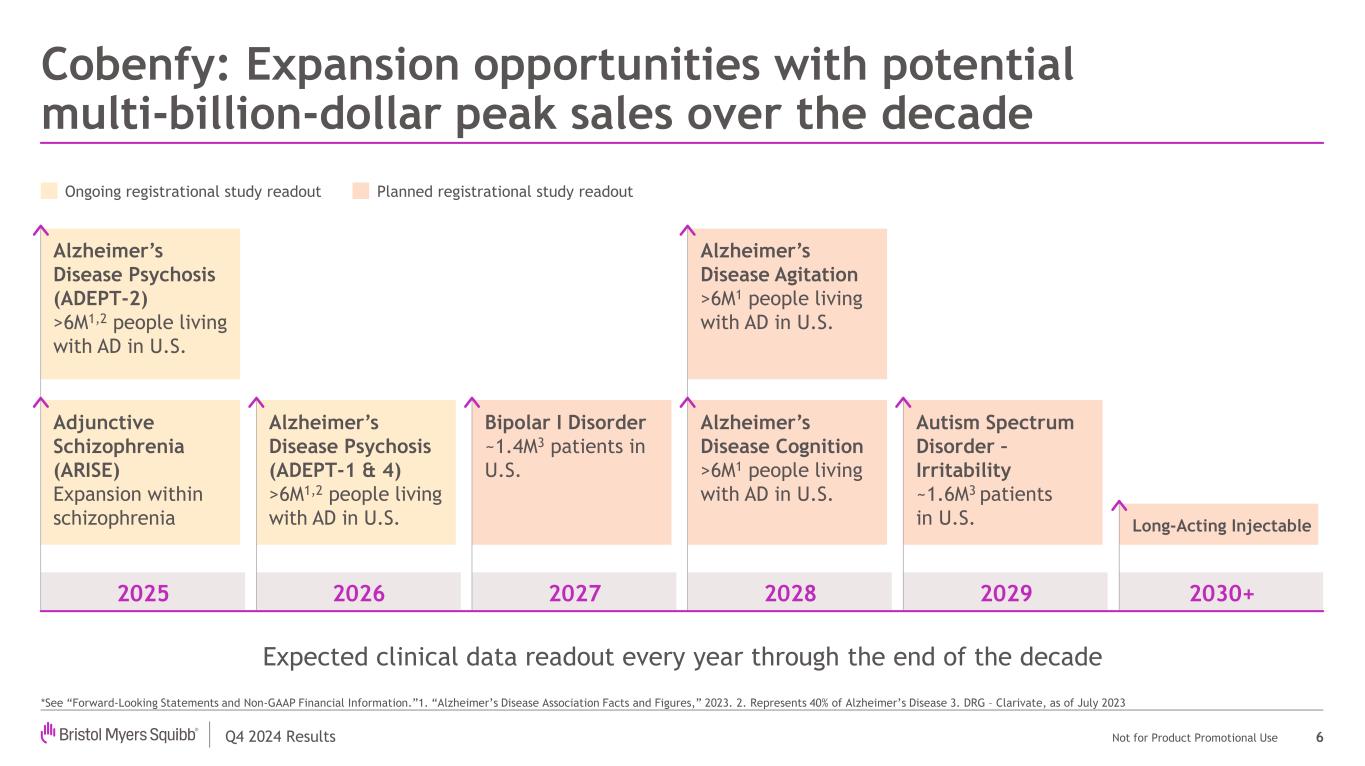

Q4 2024 Results Not for Product Promotional Use Cobenfy: Expansion opportunities with potential multi-billion-dollar peak sales over the decade 6 Expected clinical data readout every year through the end of the decade Ongoing registrational study readout Planned registrational study readout Alzheimer’s Disease Cognition >6M1 people living with AD in U.S. 2025 2026 2027 2028 2029 2030+ Alzheimer’s Disease Agitation >6M1 people living with AD in U.S. Bipolar I Disorder ~1.4M3 patients in U.S. Alzheimer’s Disease Psychosis (ADEPT-1 & 4) >6M1,2 people living with AD in U.S. Adjunctive Schizophrenia (ARISE) Expansion within schizophrenia Alzheimer’s Disease Psychosis (ADEPT-2) >6M1,2 people living with AD in U.S. Autism Spectrum Disorder – Irritability ~1.6M3 patients in U.S. Long-Acting Injectable *See “Forward-Looking Statements and Non-GAAP Financial Information.”1. “Alzheimer’s Disease Association Facts and Figures,” 2023. 2. Represents 40% of Alzheimer’s Disease 3. DRG – Clarivate, as of July 2023

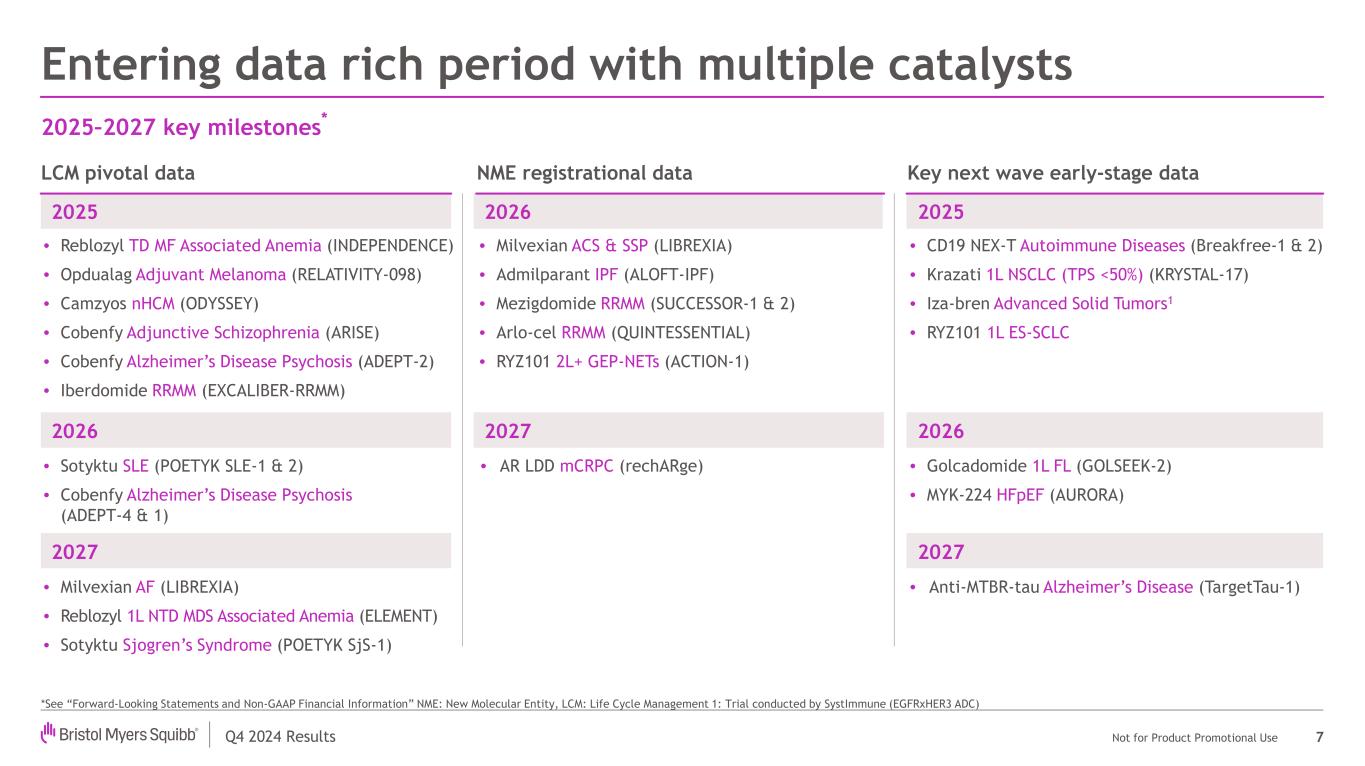

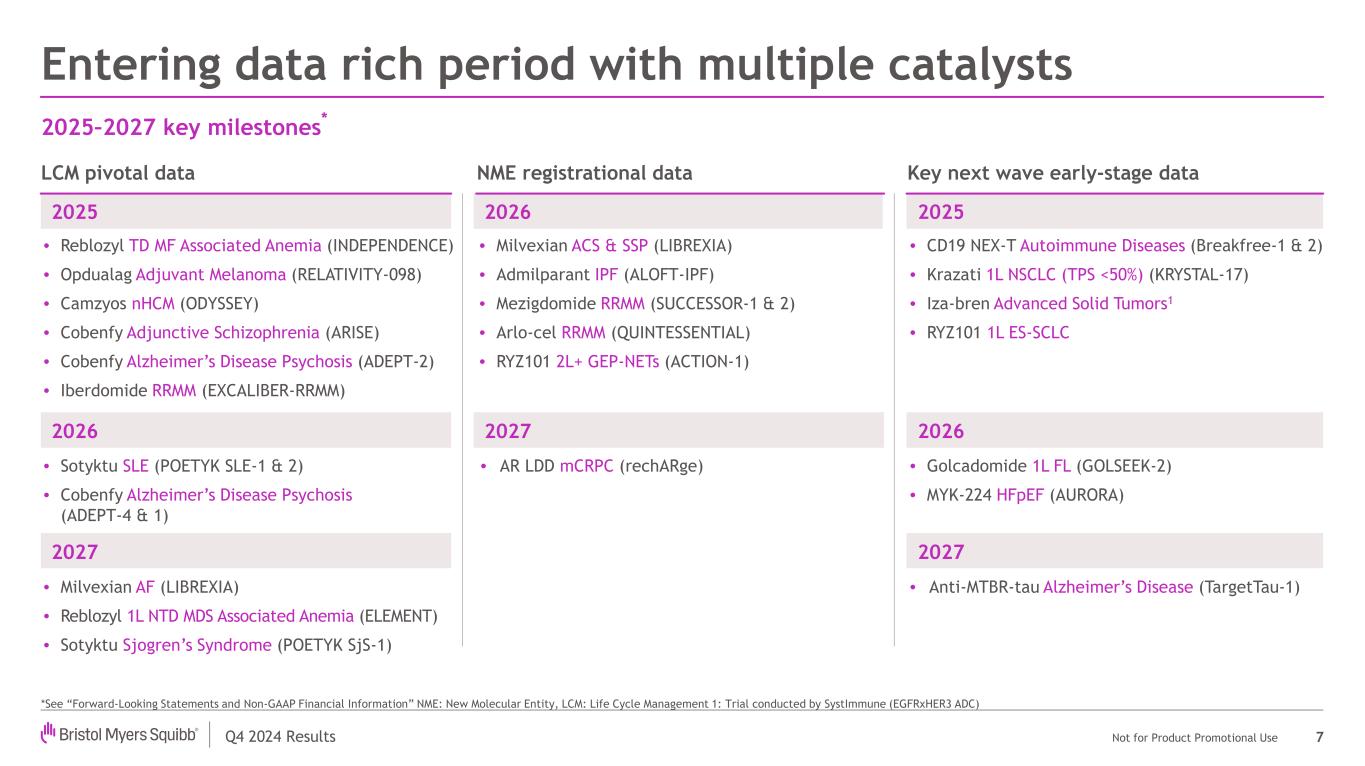

Q4 2024 Results Not for Product Promotional Use 20252025 Entering data rich period with multiple catalysts 7 2025–2027 key milestones * • Reblozyl TD MF Associated Anemia (INDEPENDENCE) • Opdualag Adjuvant Melanoma (RELATIVITY-098) • Camzyos nHCM (ODYSSEY) • Cobenfy Adjunctive Schizophrenia (ARISE) • Cobenfy Alzheimer’s Disease Psychosis (ADEPT-2) • Iberdomide RRMM (EXCALIBER-RRMM) • CD19 NEX-T Autoimmune Diseases (Breakfree-1 & 2) • Krazati 1L NSCLC (TPS <50%) (KRYSTAL-17) • Iza-bren Advanced Solid Tumors1 • RYZ101 1L ES-SCLC LCM pivotal data 2026 • Milvexian ACS & SSP (LIBREXIA) • Admilparant IPF (ALOFT-IPF) • Mezigdomide RRMM (SUCCESSOR-1 & 2) • Arlo-cel RRMM (QUINTESSENTIAL) • RYZ101 2L+ GEP-NETs (ACTION-1) NME registrational data Key next wave early-stage data 2026 • Sotyktu SLE (POETYK SLE-1 & 2) • Cobenfy Alzheimer’s Disease Psychosis (ADEPT-4 & 1) 2026 • Golcadomide 1L FL (GOLSEEK-2) • MYK-224 HFpEF (AURORA) 2027 • AR LDD mCRPC (rechARge) 2027 • Anti-MTBR-tau Alzheimer’s Disease (TargetTau-1) 2027 • Milvexian AF (LIBREXIA) • Reblozyl 1L NTD MDS Associated Anemia (ELEMENT) • Sotyktu Sjogren’s Syndrome (POETYK SjS-1) *See “Forward-Looking Statements and Non-GAAP Financial Information” NME: New Molecular Entity, LCM: Life Cycle Management 1: Trial conducted by SystImmune (EGFRxHER3 ADC)

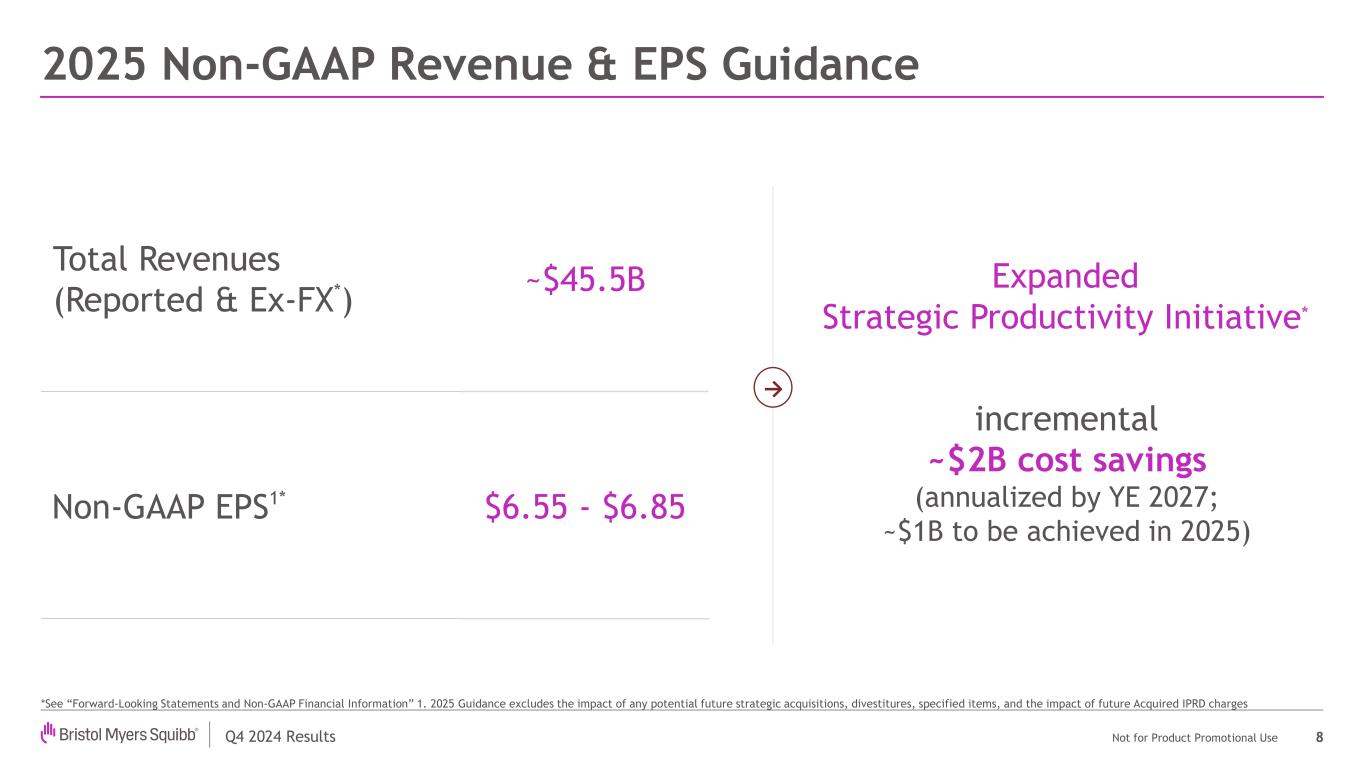

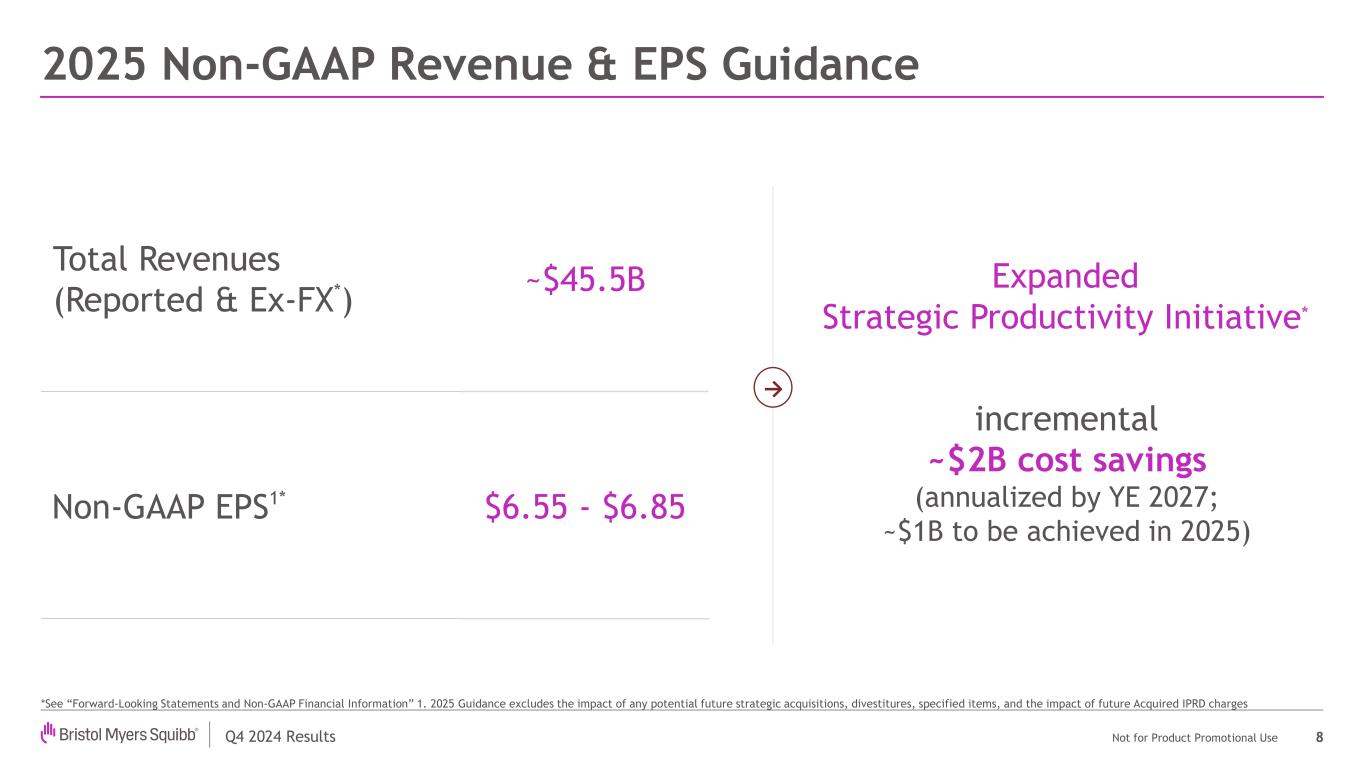

Q4 2024 Results Not for Product Promotional Use Total Revenues (Reported & Ex-FX*) ~$45.5B Non-GAAP EPS1* $6.55 - $6.85 2025 Non-GAAP Revenue & EPS Guidance 8 *See “Forward-Looking Statements and Non-GAAP Financial Information” 1. 2025 Guidance excludes the impact of any potential future strategic acquisitions, divestitures, specified items, and the impact of future Acquired IPRD charges Expanded Strategic Productivity Initiative* incremental ~$2B cost savings (annualized by YE 2027; ~$1B to be achieved in 2025) →

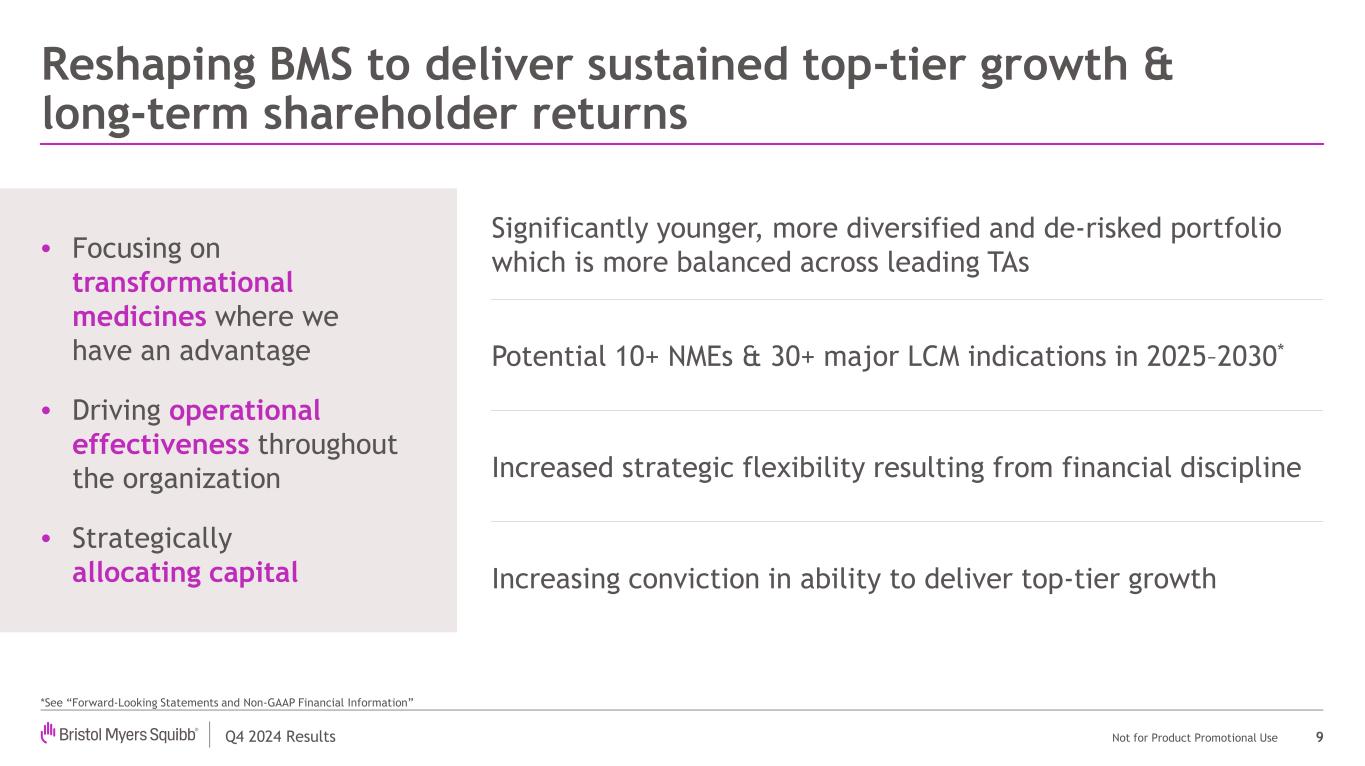

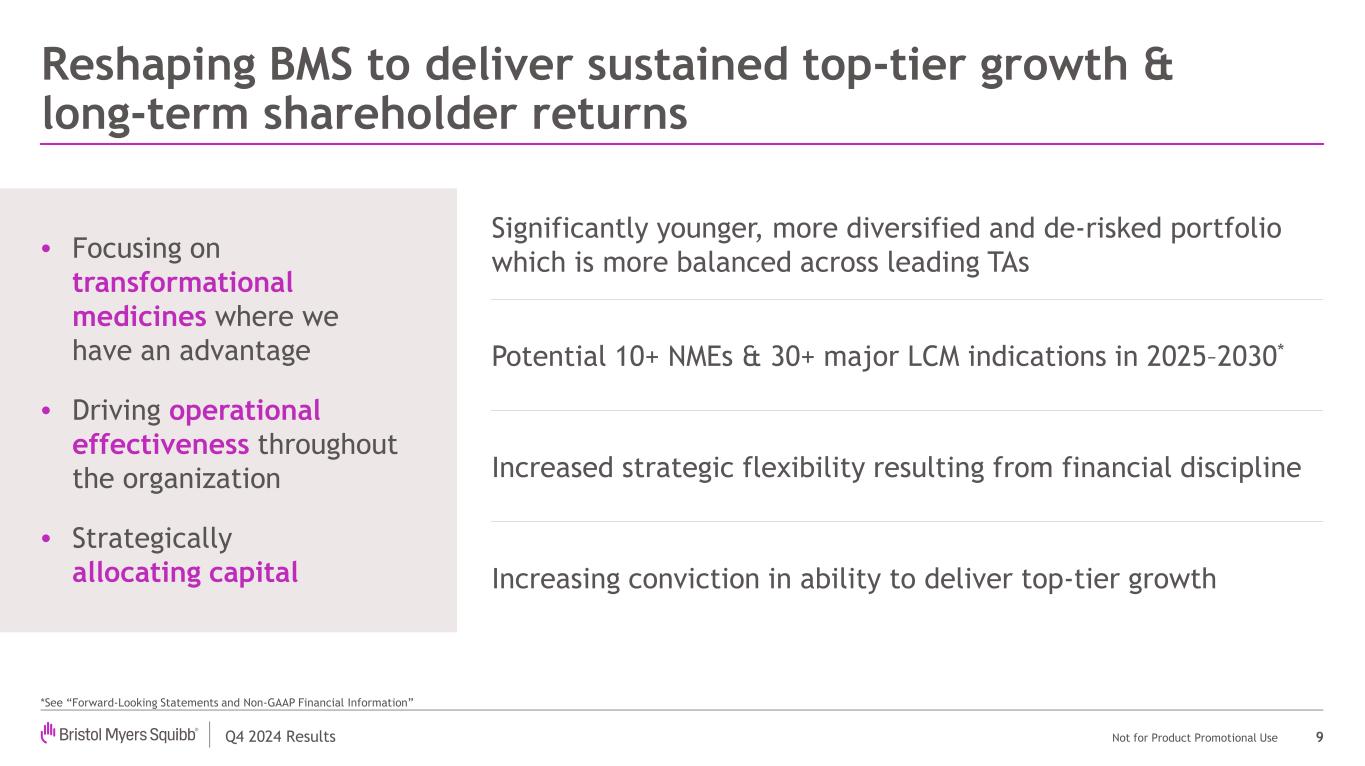

Q4 2024 Results Not for Product Promotional Use Reshaping BMS to deliver sustained top-tier growth & long-term shareholder returns 9 • Focusing on transformational medicines where we have an advantage • Driving operational effectiveness throughout the organization • Strategically allocating capital Significantly younger, more diversified and de-risked portfolio which is more balanced across leading TAs Potential 10+ NMEs & 30+ major LCM indications in 2025–2030* Increased strategic flexibility resulting from financial discipline Increasing conviction in ability to deliver top-tier growth *See “Forward-Looking Statements and Non-GAAP Financial Information”

David Elkins Executive Vice President and Chief Financial Officer 10 Q4 2024 Results

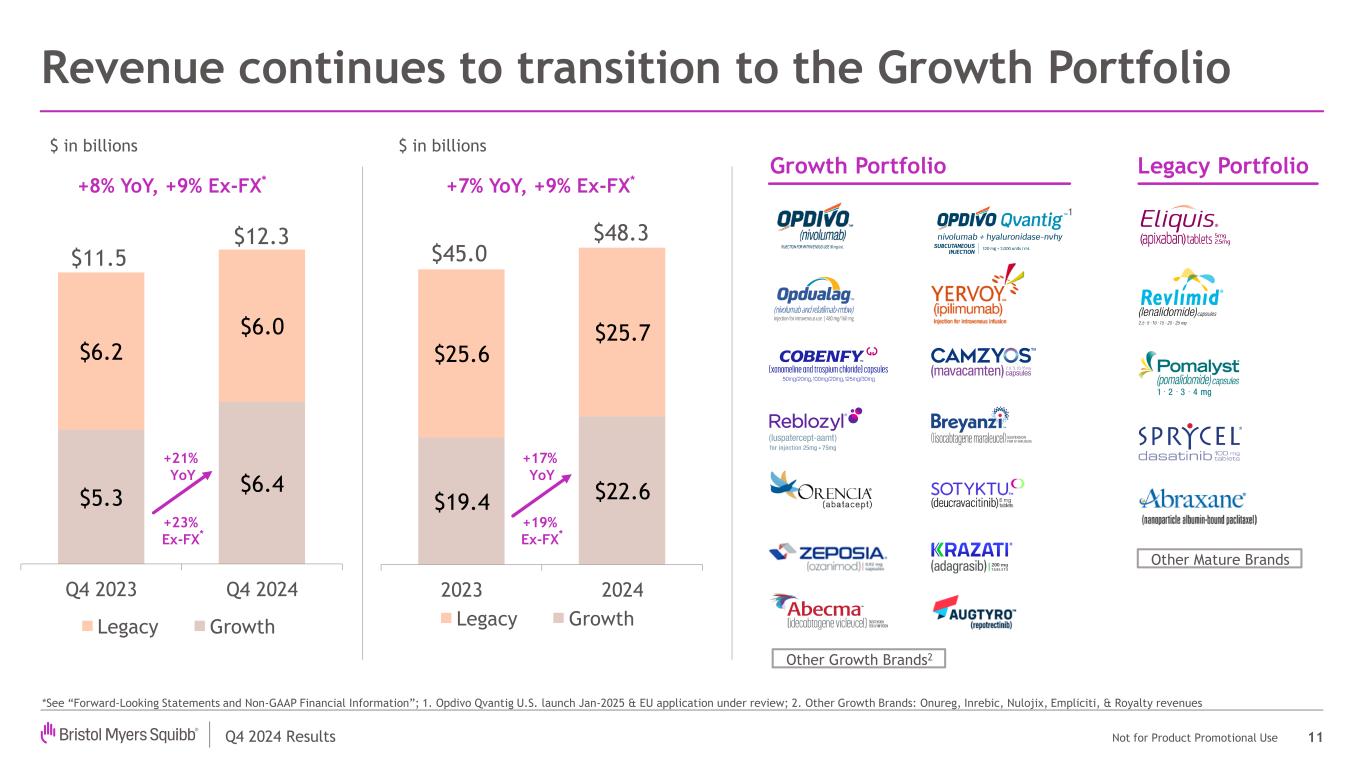

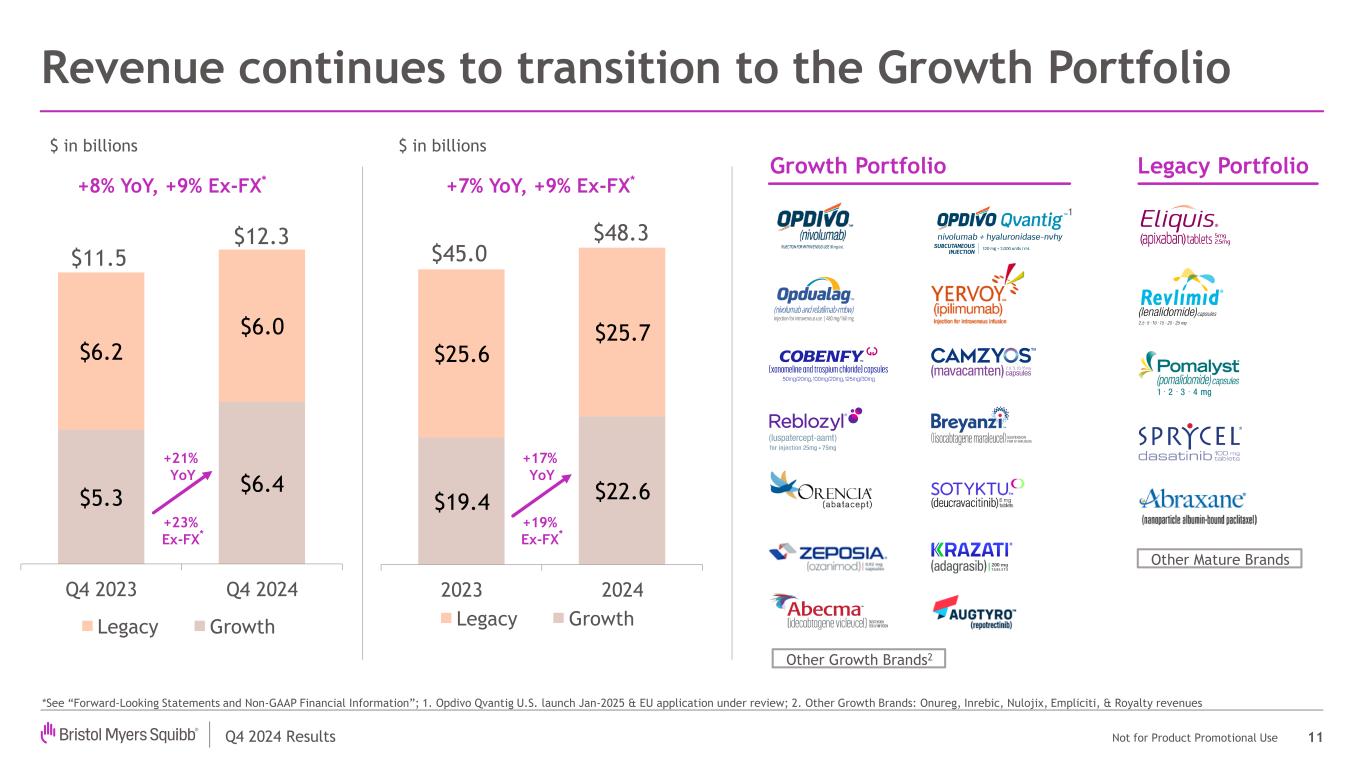

Q4 2024 Results Not for Product Promotional Use Revenue continues to transition to the Growth Portfolio 11 $5.3 $6.4 $6.2 $6.0 Q4 2023 Q4 2024 Legacy Growth *See “Forward-Looking Statements and Non-GAAP Financial Information”; 1. Opdivo Qvantig U.S. launch Jan-2025 & EU application under review; 2. Other Growth Brands: Onureg, Inrebic, Nulojix, Empliciti, & Royalty revenues $ in billions +21% YoY +23% Ex-FX * +8% YoY, +9% Ex-FX* $19.4 $22.6 $25.6 $25.7 2023 2024 Legacy Growth $ in billions +7% YoY, +9% Ex-FX* +17% YoY +19% Ex-FX * Growth Portfolio Legacy Portfolio Other Growth Brands2 Other Mature Brands 1 $11.5 $12.3 $45.0 $48.3

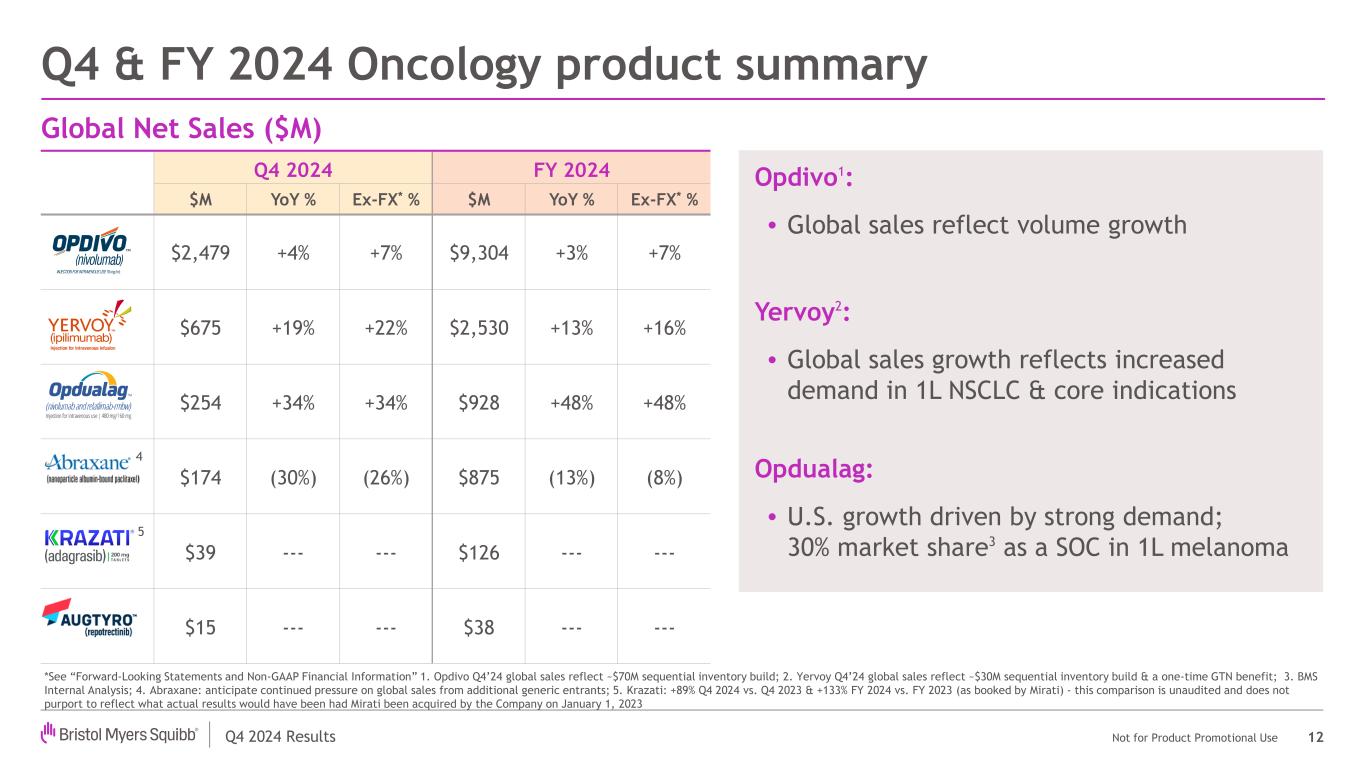

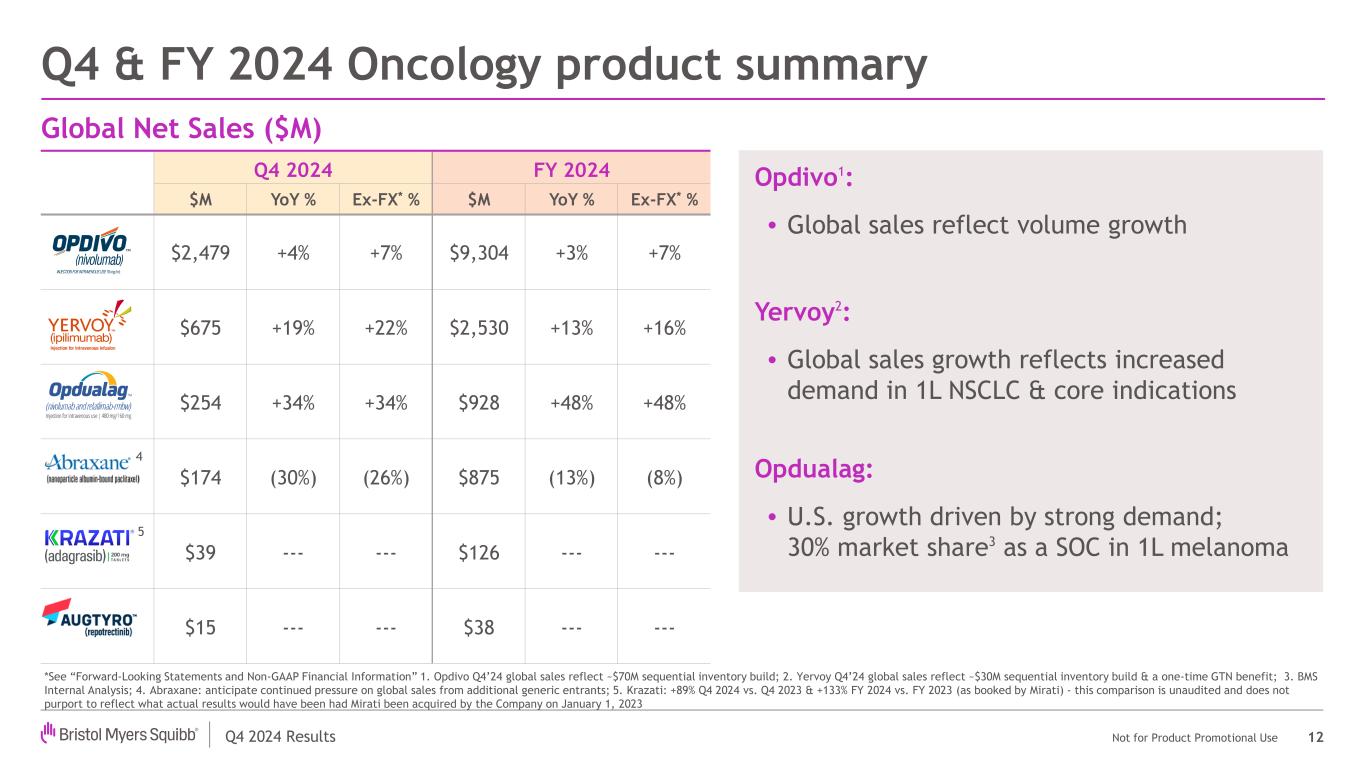

Q4 2024 Results Not for Product Promotional Use Q4 & FY 2024 Oncology product summary 12 Opdivo1: • Global sales reflect volume growth Yervoy2: • Global sales growth reflects increased demand in 1L NSCLC & core indications Opdualag: • U.S. growth driven by strong demand; 30% market share3 as a SOC in 1L melanoma Global Net Sales ($M) Q4 2024 FY 2024 $M YoY % Ex-FX* % $M YoY % Ex-FX* % $2,479 +4% +7% $9,304 +3% +7% $675 +19% +22% $2,530 +13% +16% $254 +34% +34% $928 +48% +48% $174 (30%) (26%) $875 (13%) (8%) $39 --- --- $126 --- --- $15 --- --- $38 --- --- *See “Forward-Looking Statements and Non-GAAP Financial Information” 1. Opdivo Q4’24 global sales reflect ~$70M sequential inventory build; 2. Yervoy Q4’24 global sales reflect ~$30M sequential inventory build & a one-time GTN benefit; 3. BMS Internal Analysis; 4. Abraxane: anticipate continued pressure on global sales from additional generic entrants; 5. Krazati: +89% Q4 2024 vs. Q4 2023 & +133% FY 2024 vs. FY 2023 (as booked by Mirati) - this comparison is unaudited and does not purport to reflect what actual results would have been had Mirati been acquired by the Company on January 1, 2023 5 4

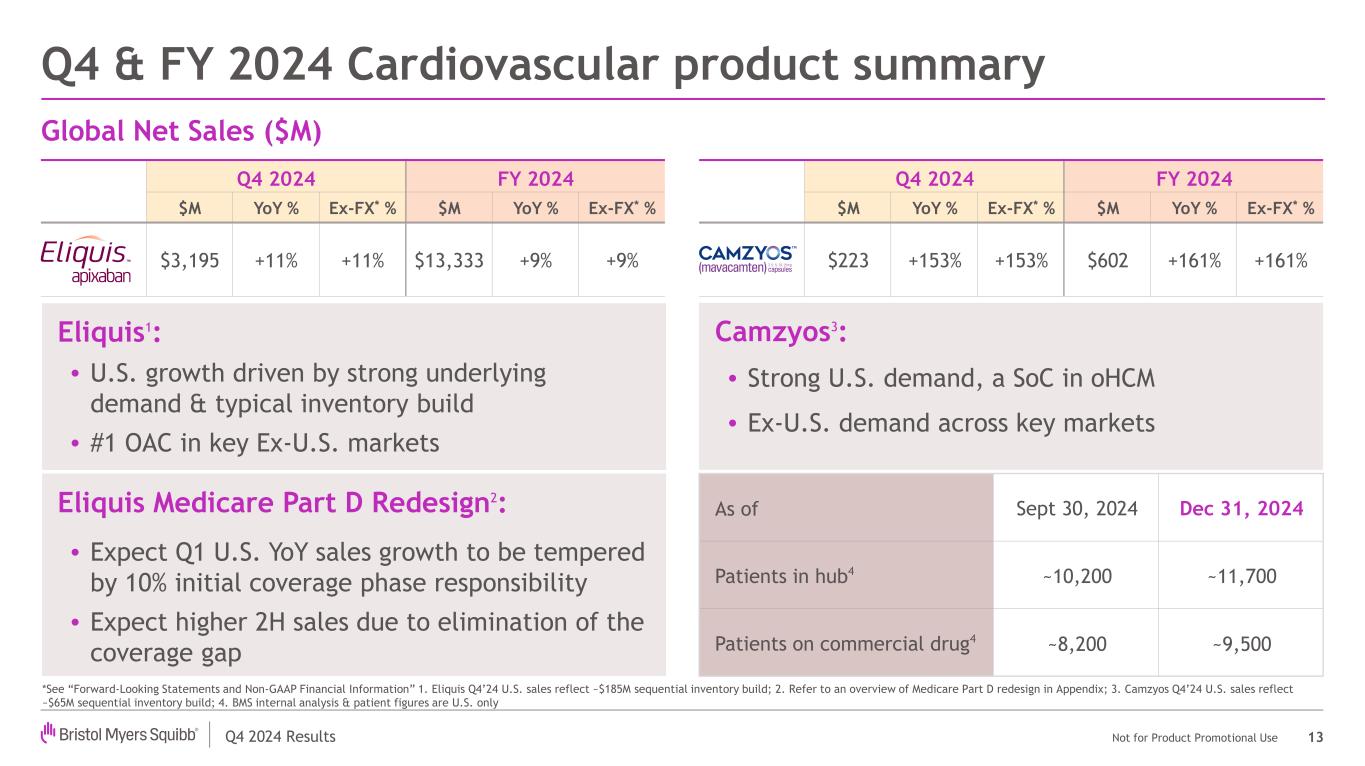

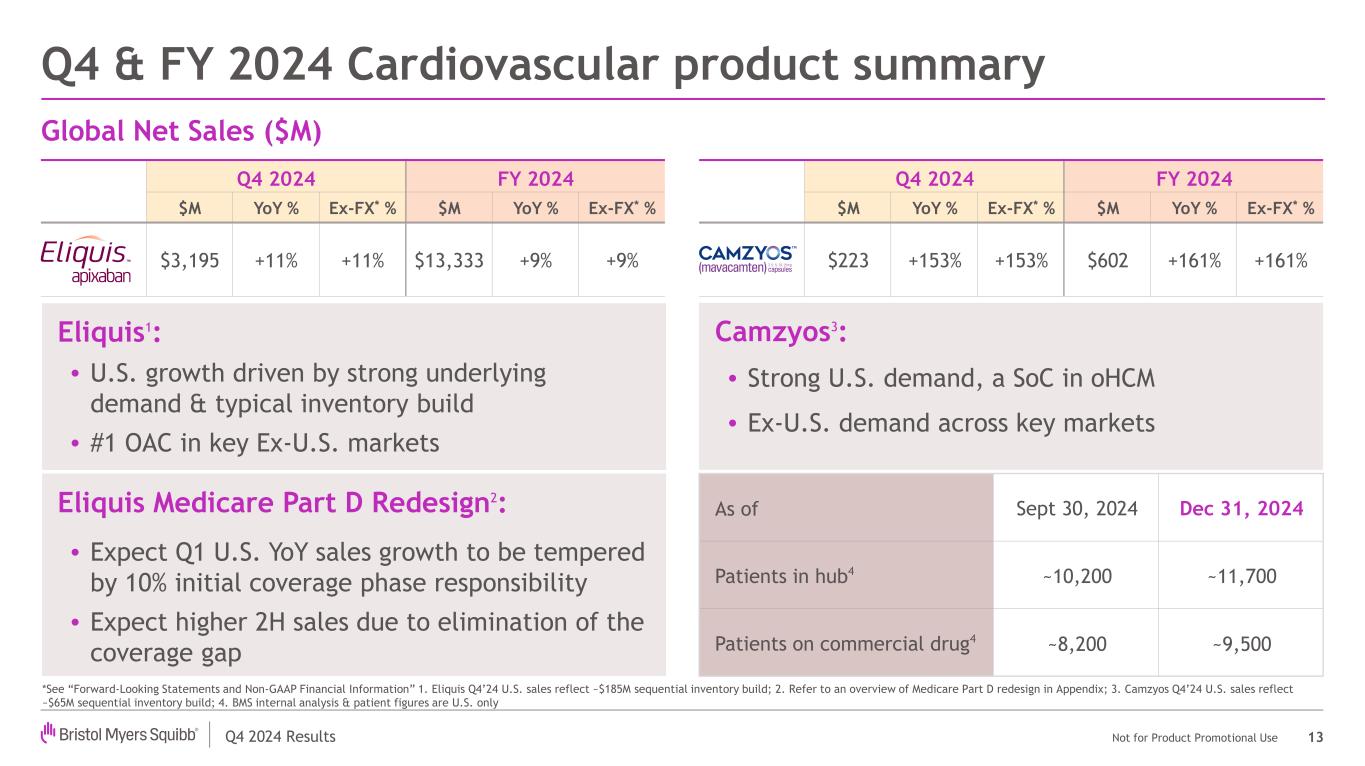

Q4 2024 Results Not for Product Promotional Use Q4 2024 FY 2024 $M YoY % Ex-FX* % $M YoY % Ex-FX* % $223 +153% +153% $602 +161% +161% Q4 2024 FY 2024 $M YoY % Ex-FX* % $M YoY % Ex-FX* % $3,195 +11% +11% $13,333 +9% +9% Camzyos3: • Strong U.S. demand, a SoC in oHCM • Ex-U.S. demand across key markets Q4 & FY 2024 Cardiovascular product summary 13 *See “Forward-Looking Statements and Non-GAAP Financial Information” 1. Eliquis Q4’24 U.S. sales reflect ~$185M sequential inventory build; 2. Refer to an overview of Medicare Part D redesign in Appendix; 3. Camzyos Q4’24 U.S. sales reflect ~$65M sequential inventory build; 4. BMS internal analysis & patient figures are U.S. only Global Net Sales ($M) Eliquis1: • U.S. growth driven by strong underlying demand & typical inventory build • #1 OAC in key Ex-U.S. markets As of Sept 30, 2024 Dec 31, 2024 Patients in hub4 ~10,200 ~11,700 Patients on commercial drug4 ~8,200 ~9,500 Eliquis Medicare Part D Redesign2: • Expect Q1 U.S. YoY sales growth to be tempered by 10% initial coverage phase responsibility • Expect higher 2H sales due to elimination of the coverage gap

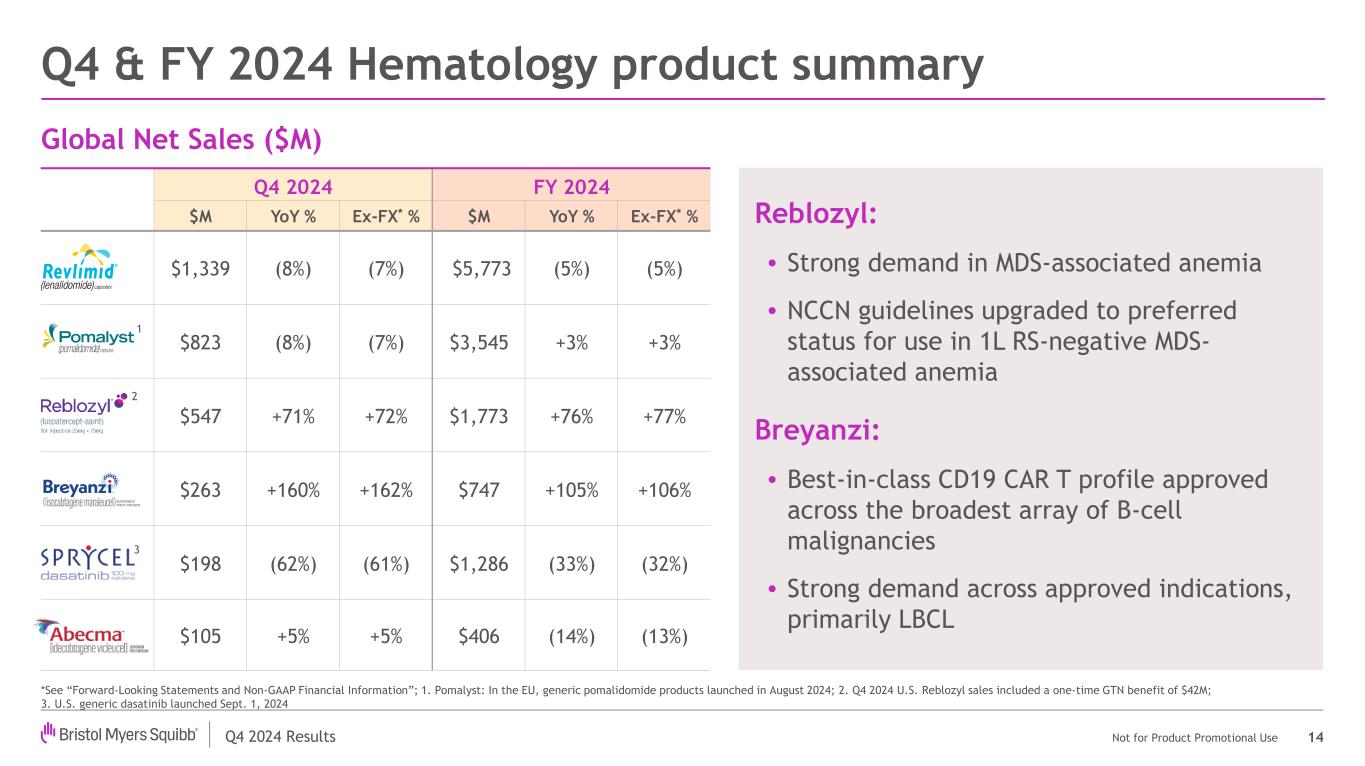

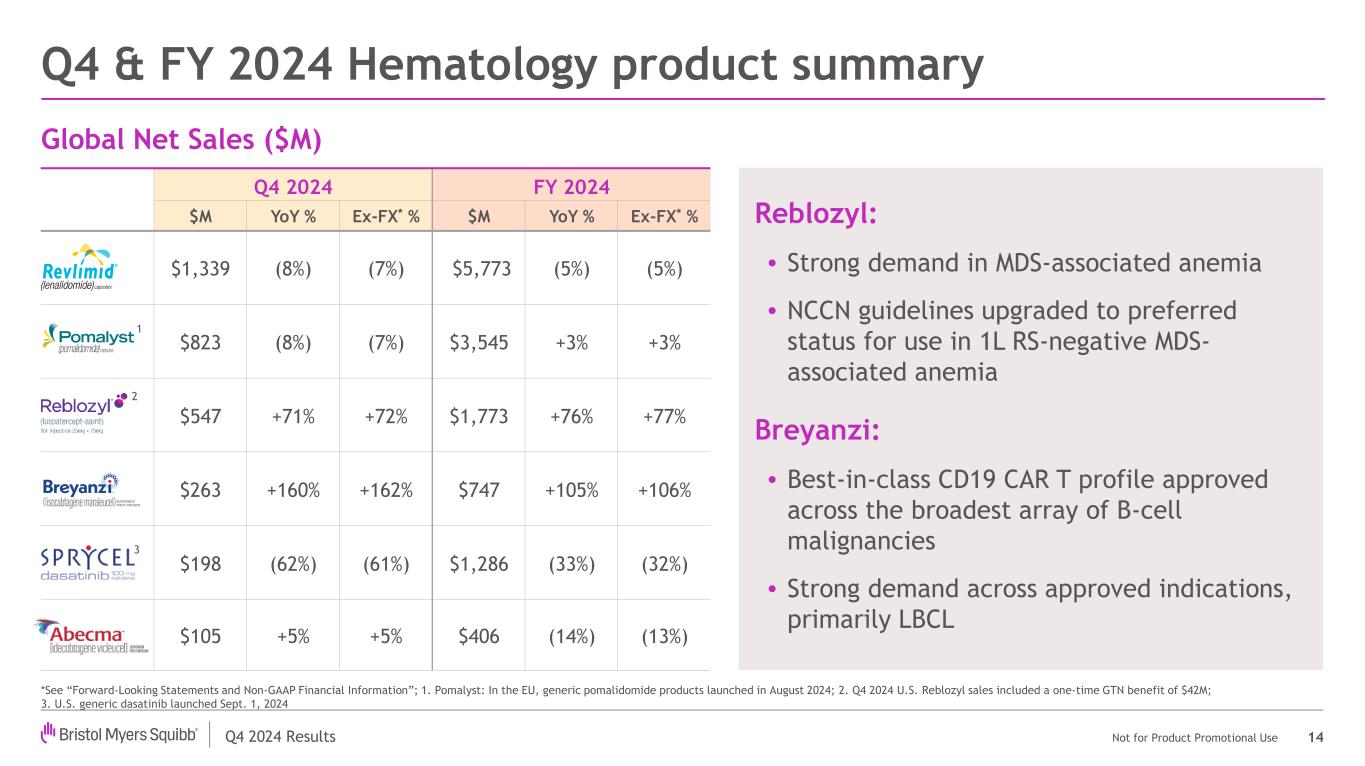

Q4 2024 Results Not for Product Promotional Use Q4 2024 FY 2024 $M YoY % Ex-FX* % $M YoY % Ex-FX* % $1,339 (8%) (7%) $5,773 (5%) (5%) $823 (8%) (7%) $3,545 +3% +3% $547 +71% +72% $1,773 +76% +77% $263 +160% +162% $747 +105% +106% $198 (62%) (61%) $1,286 (33%) (32%) $105 +5% +5% $406 (14%) (13%) Global Net Sales ($M) Q4 & FY 2024 Hematology product summary 14 *See “Forward-Looking Statements and Non-GAAP Financial Information”; 1. Pomalyst: In the EU, generic pomalidomide products launched in August 2024; 2. Q4 2024 U.S. Reblozyl sales included a one-time GTN benefit of $42M; 3. U.S. generic dasatinib launched Sept. 1, 2024 1 2 Reblozyl: • Strong demand in MDS-associated anemia • NCCN guidelines upgraded to preferred status for use in 1L RS-negative MDS- associated anemia Breyanzi: • Best-in-class CD19 CAR T profile approved across the broadest array of B-cell malignancies • Strong demand across approved indications, primarily LBCL 3

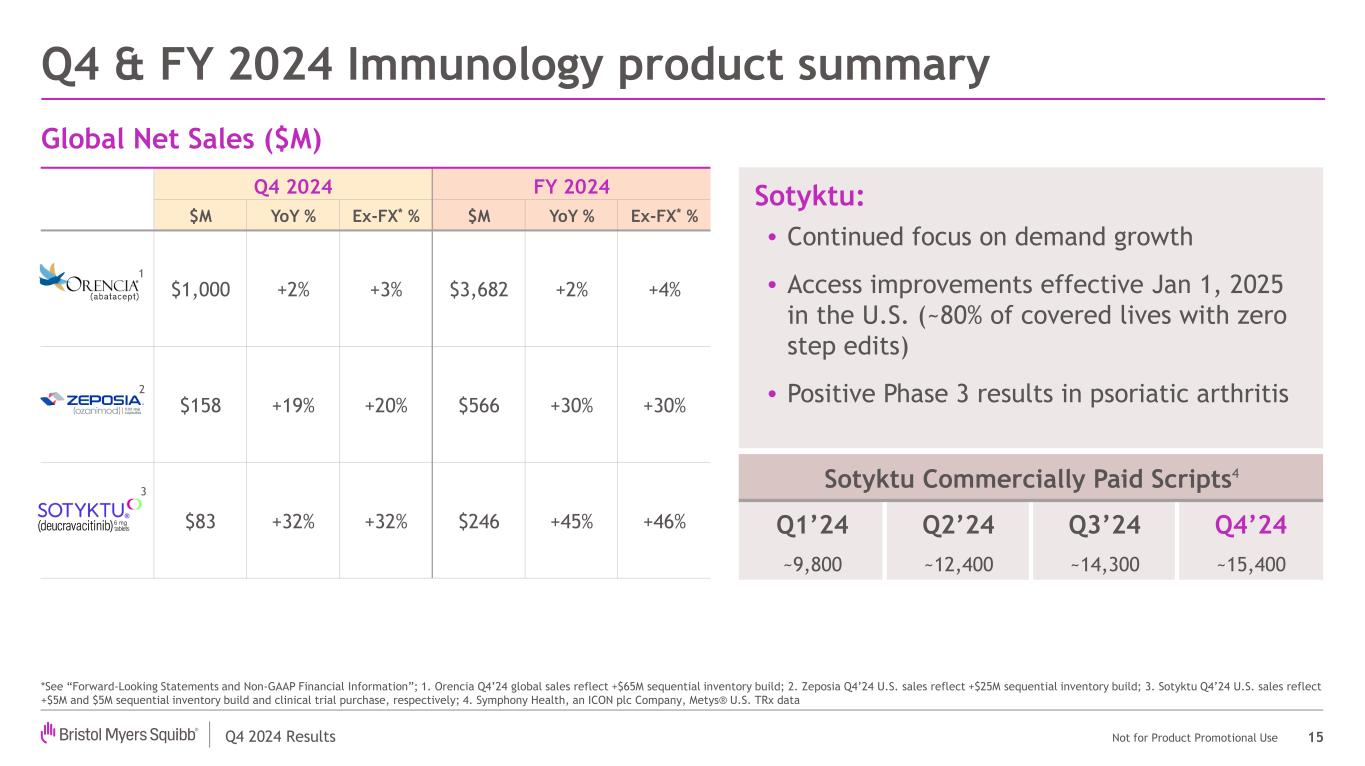

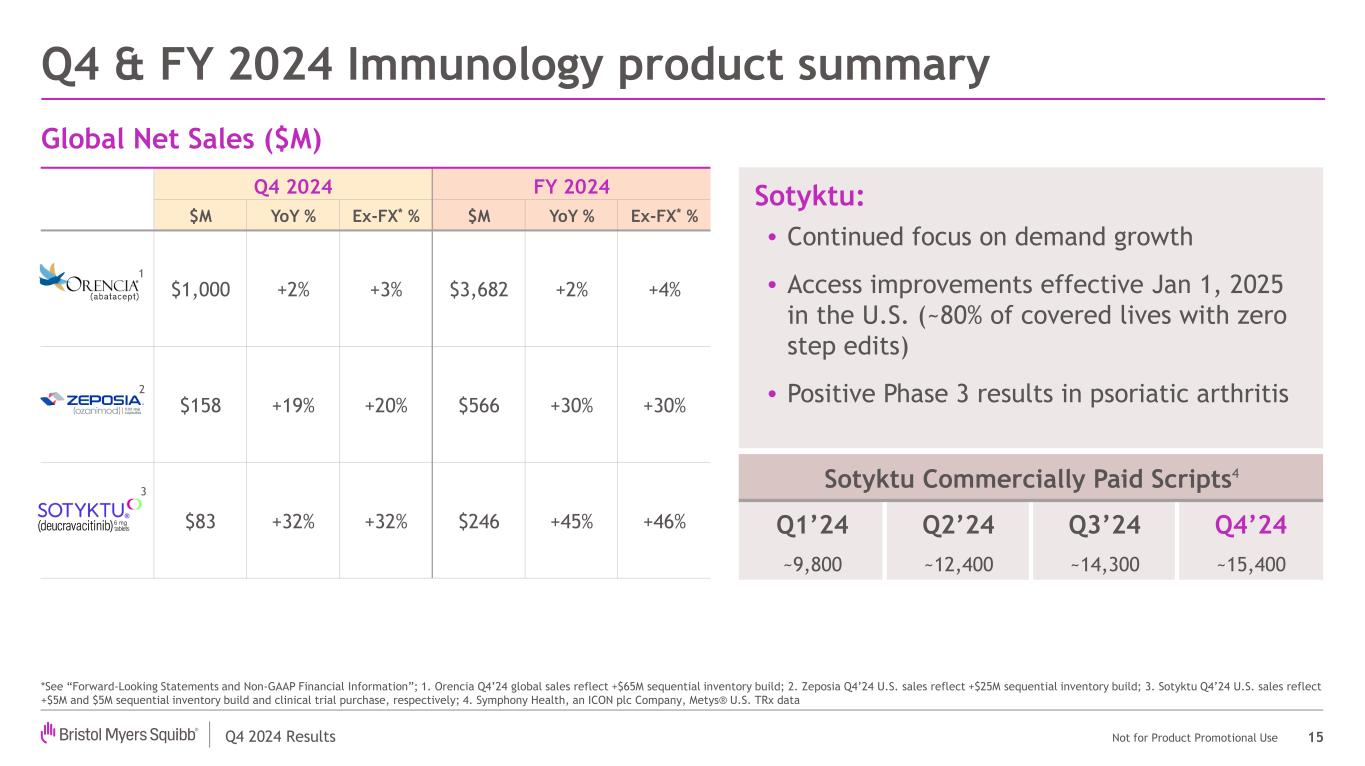

Q4 2024 Results Not for Product Promotional Use Sotyktu Commercially Paid Scripts4 Q4 2024 FY 2024 $M YoY % Ex-FX* % $M YoY % Ex-FX* % $1,000 +2% +3% $3,682 +2% +4% $158 +19% +20% $566 +30% +30% $83 +32% +32% $246 +45% +46% Sotyktu: • Continued focus on demand growth • Access improvements effective Jan 1, 2025 in the U.S. (~80% of covered lives with zero step edits) • Positive Phase 3 results in psoriatic arthritis Global Net Sales ($M) Q4 & FY 2024 Immunology product summary 15 Q1’24 Q2’24 Q3’24 Q4’24 ~9,800 ~12,400 ~14,300 ~15,400 *See “Forward-Looking Statements and Non-GAAP Financial Information”; 1. Orencia Q4’24 global sales reflect +$65M sequential inventory build; 2. Zeposia Q4’24 U.S. sales reflect +$25M sequential inventory build; 3. Sotyktu Q4’24 U.S. sales reflect +$5M and $5M sequential inventory build and clinical trial purchase, respectively; 4. Symphony Health, an ICON plc Company, Metys® U.S. TRx data 1 2 3

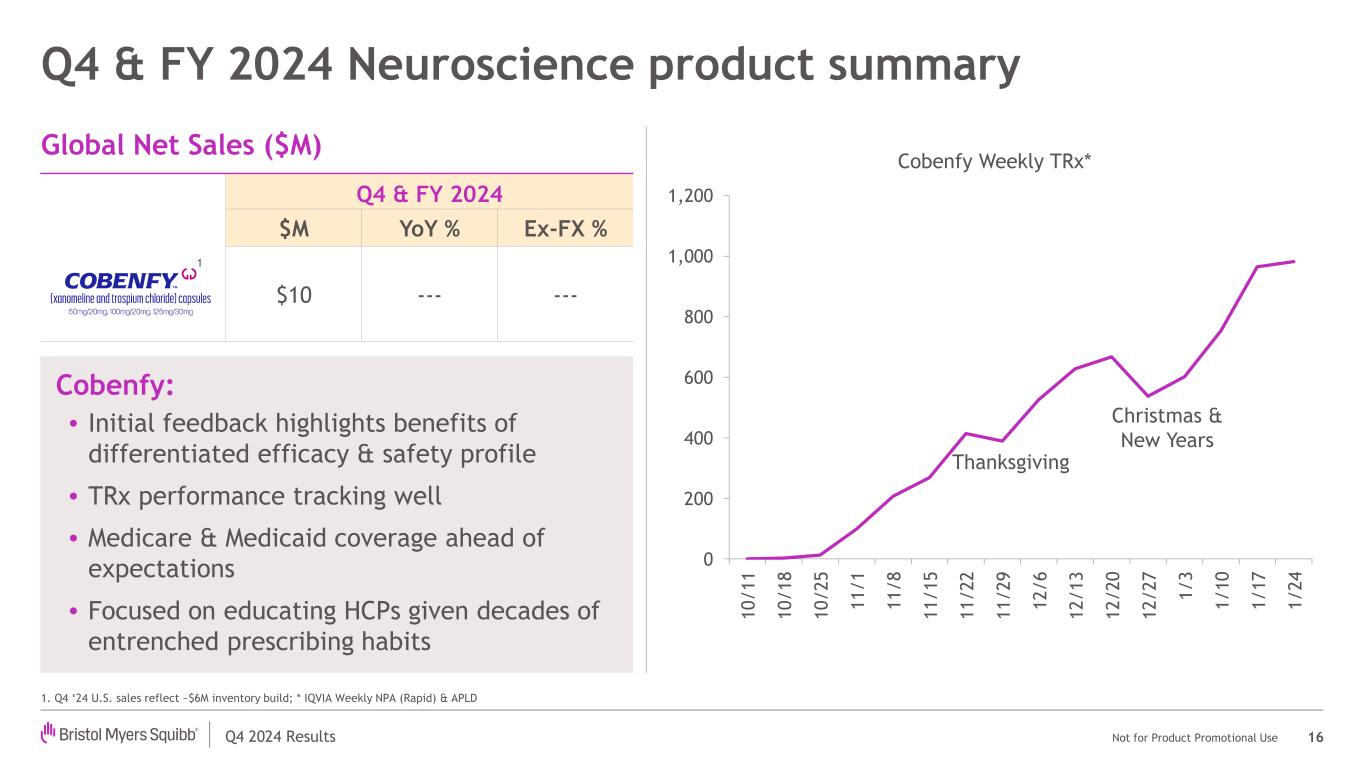

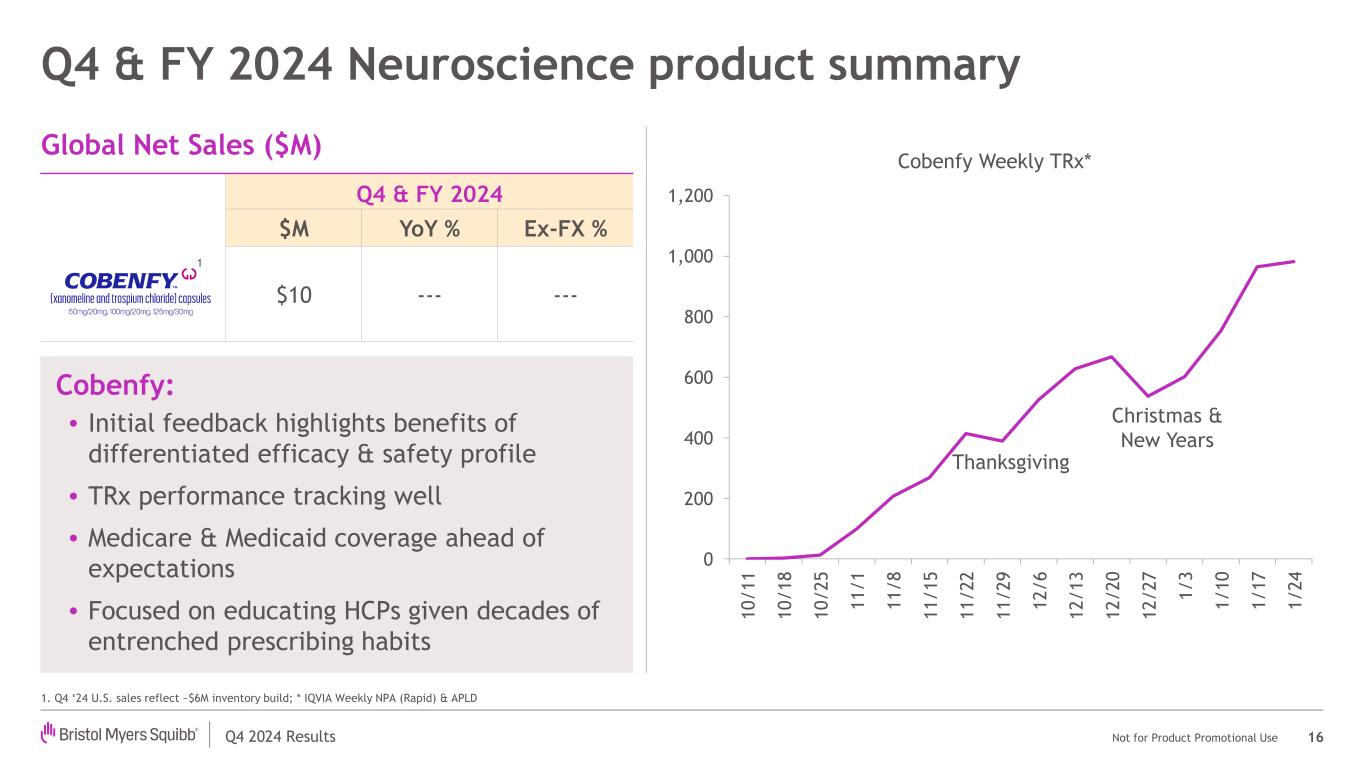

Q4 2024 Results Not for Product Promotional Use 0 200 400 600 800 1,000 1,200 1 0 / 1 1 1 0 / 1 8 1 0 / 2 5 1 1 / 1 1 1 / 8 1 1 / 1 5 1 1 / 2 2 1 1 / 2 9 1 2 / 6 1 2 / 1 3 1 2 / 2 0 1 2 / 2 7 1 / 3 1 / 1 0 1 / 1 7 1 / 2 4 Cobenfy Weekly TRx* Cobenfy: • Initial feedback highlights benefits of differentiated efficacy & safety profile • TRx performance tracking well • Medicare & Medicaid coverage ahead of expectations • Focused on educating HCPs given decades of entrenched prescribing habits Q4 & FY 2024 $M YoY % Ex-FX % $10 --- --- Q4 & FY 2024 Neuroscience product summary 16 Global Net Sales ($M) 1. Q4 ‘24 U.S. sales reflect ~$6M inventory build; * IQVIA Weekly NPA (Rapid) & APLD 1 Thanksgiving Christmas & New Years

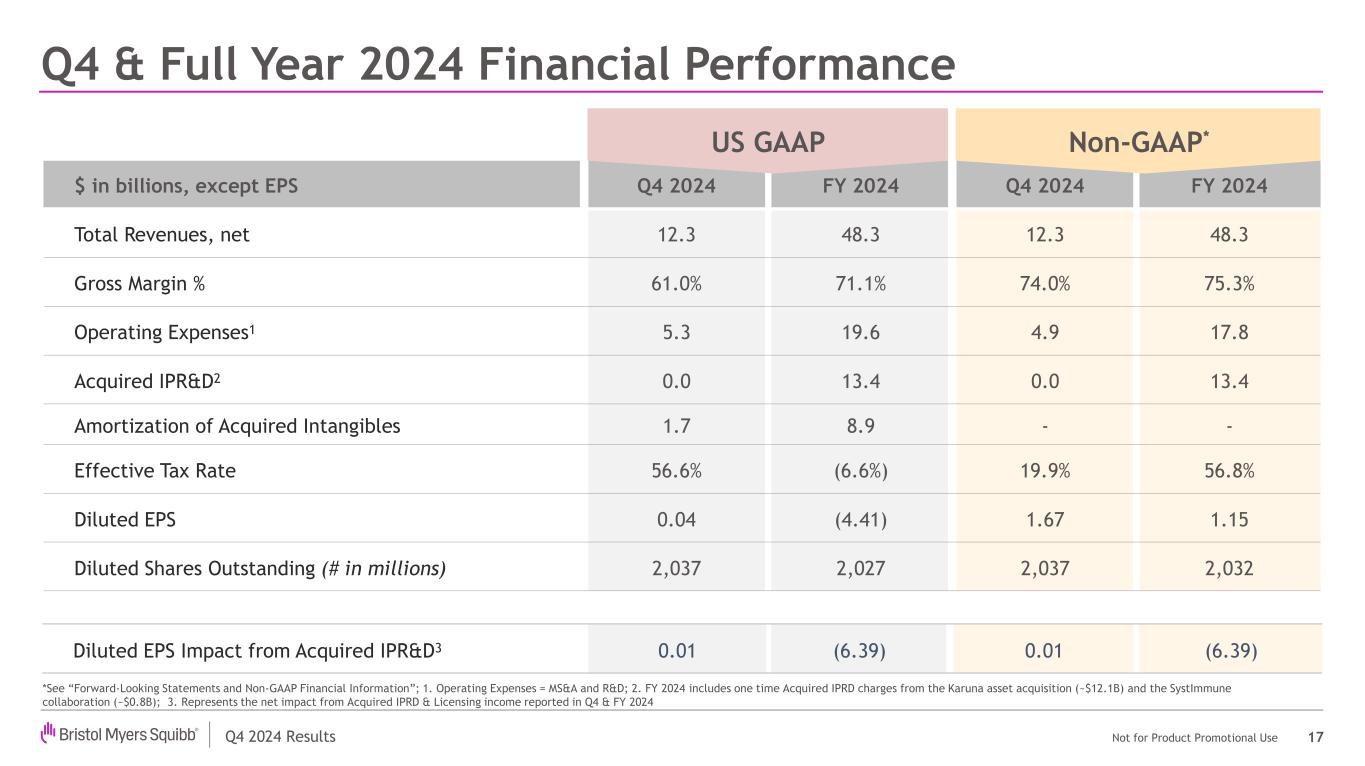

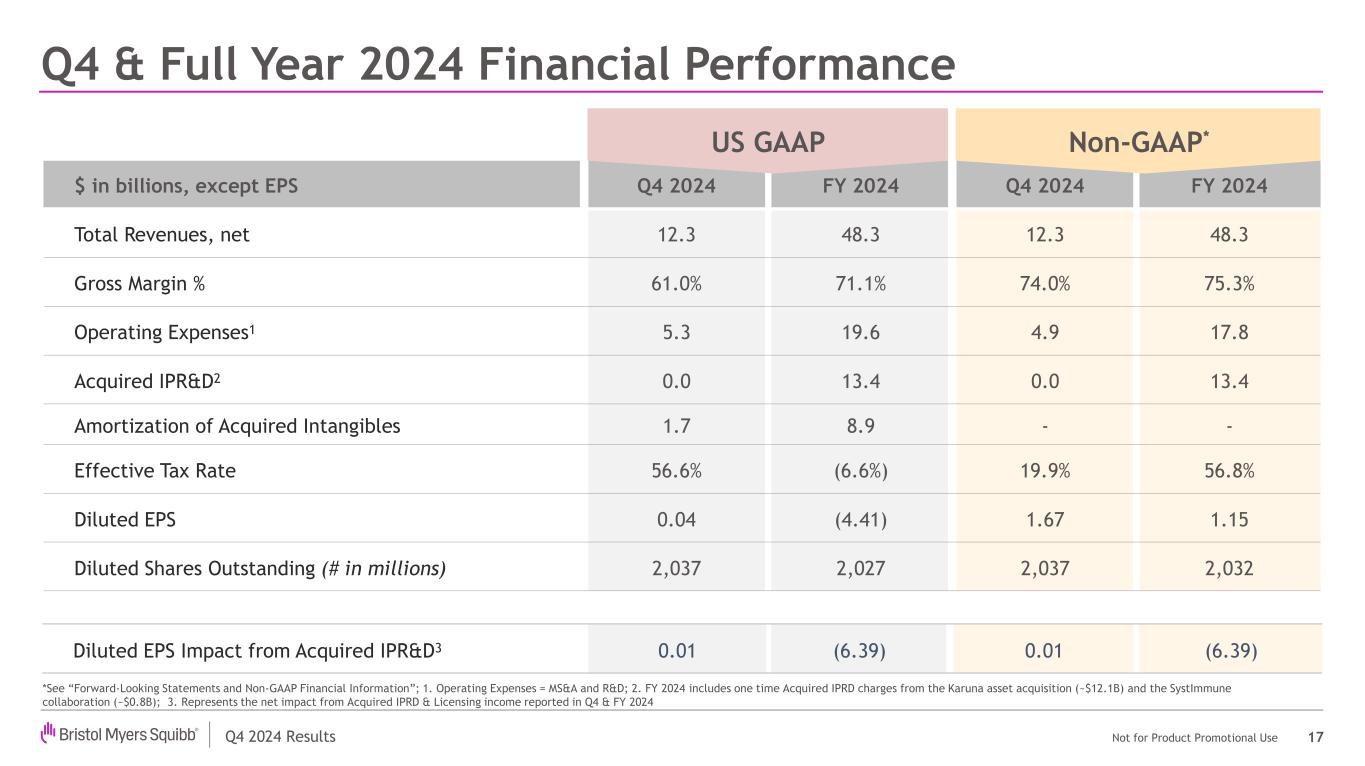

Q4 2024 Results Not for Product Promotional Use US GAAP Non-GAAP $ in billions, except EPS Q4 2024 FY 2024 Q4 2024 FY 2024 Total Revenues, net 12.3 48.3 12.3 48.3 Gross Margin % 61.0% 71.1% 74.0% 75.3% Operating Expenses1 5.3 19.6 4.9 17.8 Acquired IPR&D2 0.0 13.4 0.0 13.4 Amortization of Acquired Intangibles 1.7 8.9 - - Effective Tax Rate 56.6% (6.6%) 19.9% 56.8% Diluted EPS 0.04 (4.41) 1.67 1.15 Diluted Shares Outstanding (# in millions) 2,037 2,027 2,037 2,032 Q4 & Full Year 2024 Financial Performance US P Non- P* Diluted EPS Impact from Acquired IPR&D3 0.01 (6.39) 0.01 (6.39) *See “Forward-Looking Statements and Non-GAAP Financial Information”; 1. Operating Expenses = MS&A and R&D; 2. FY 2024 includes one time Acquired IPRD charges from the Karuna asset acquisition (~$12.1B) and the SystImmune collaboration (~$0.8B); 3. Represents the net impact from Acquired IPRD & Licensing income reported in Q4 & FY 2024 17

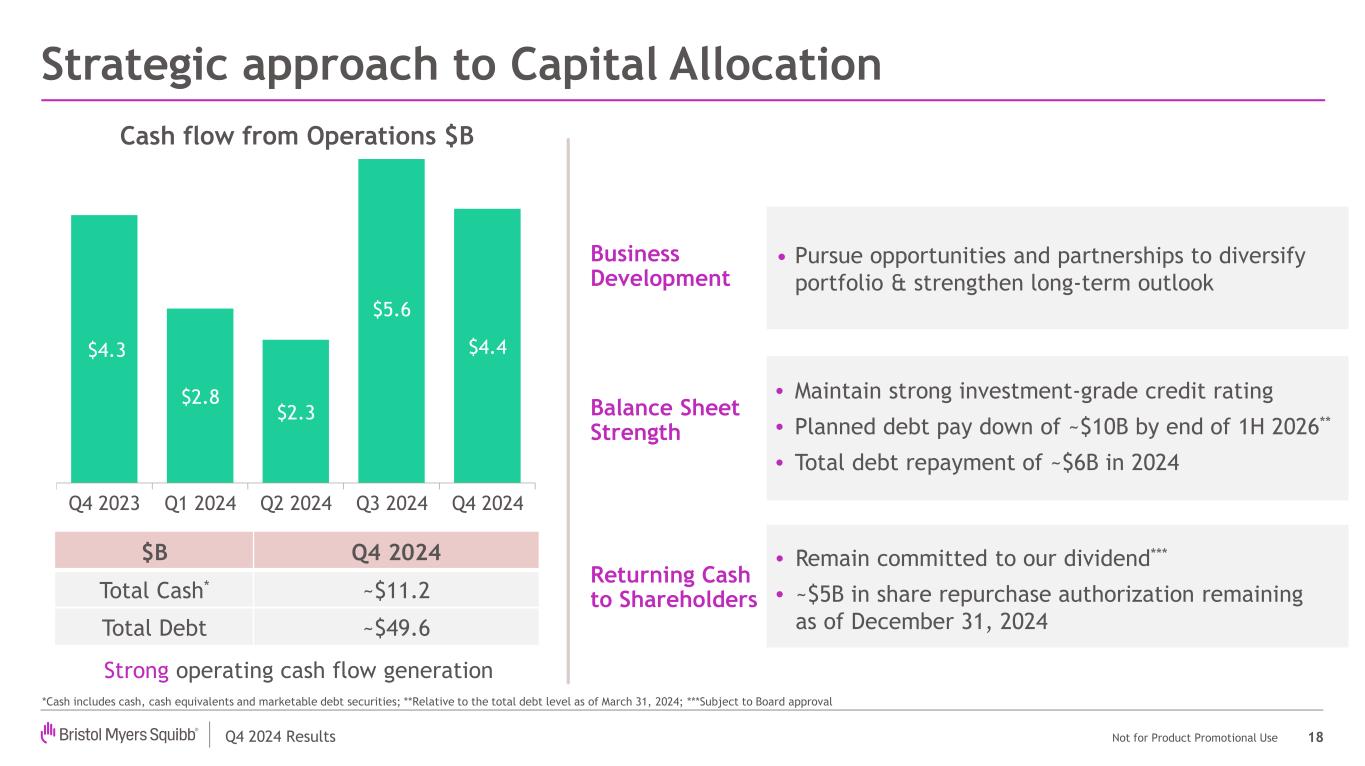

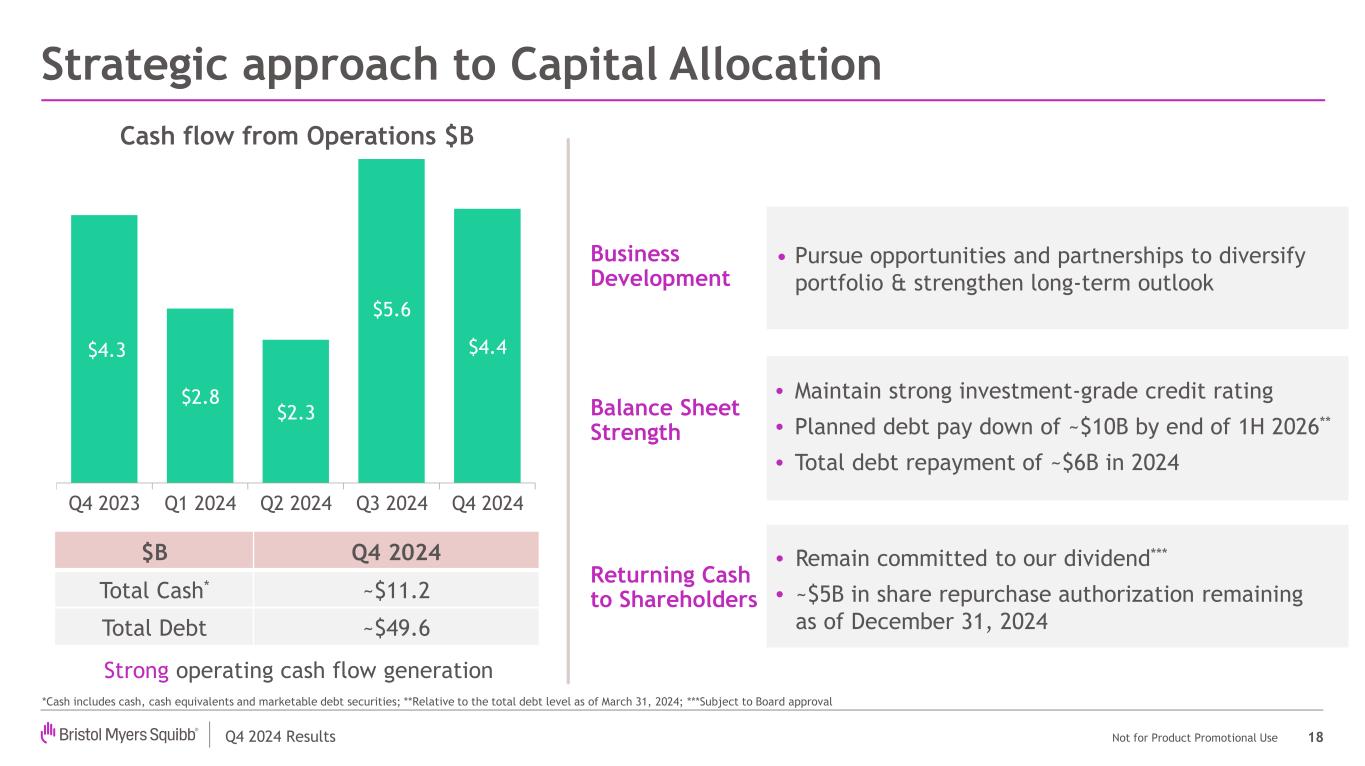

Q4 2024 Results Not for Product Promotional Use Strategic approach to Capital Allocation *Cash includes cash, cash equivalents and marketable debt securities; **Relative to the total debt level as of March 31, 2024; ***Subject to Board approval $B Q4 2024 Total Cash* ~$11.2 Total Debt ~$49.6 • Pursue opportunities and partnerships to diversify portfolio & strengthen long-term outlook • Maintain strong investment-grade credit rating • Planned debt pay down of ~$10B by end of 1H 2026** • Total debt repayment of ~$6B in 2024 Business Development Balance Sheet Strength Returning Cash to Shareholders • Remain committed to our dividend*** • ~$5B in share repurchase authorization remaining as of December 31, 2024 Strong operating cash flow generation $4.3 $2.8 $2.3 $5.6 $4.4 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Cash flow from Operations $B 18

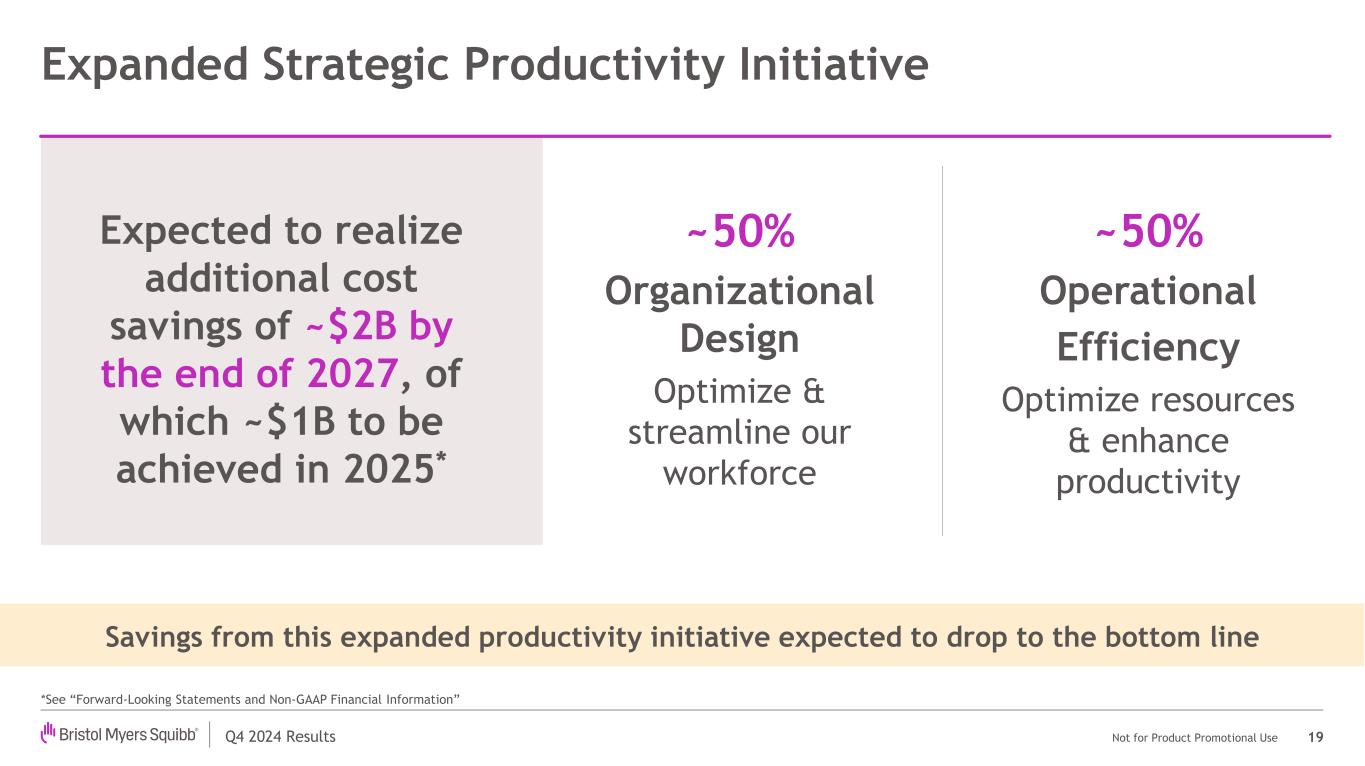

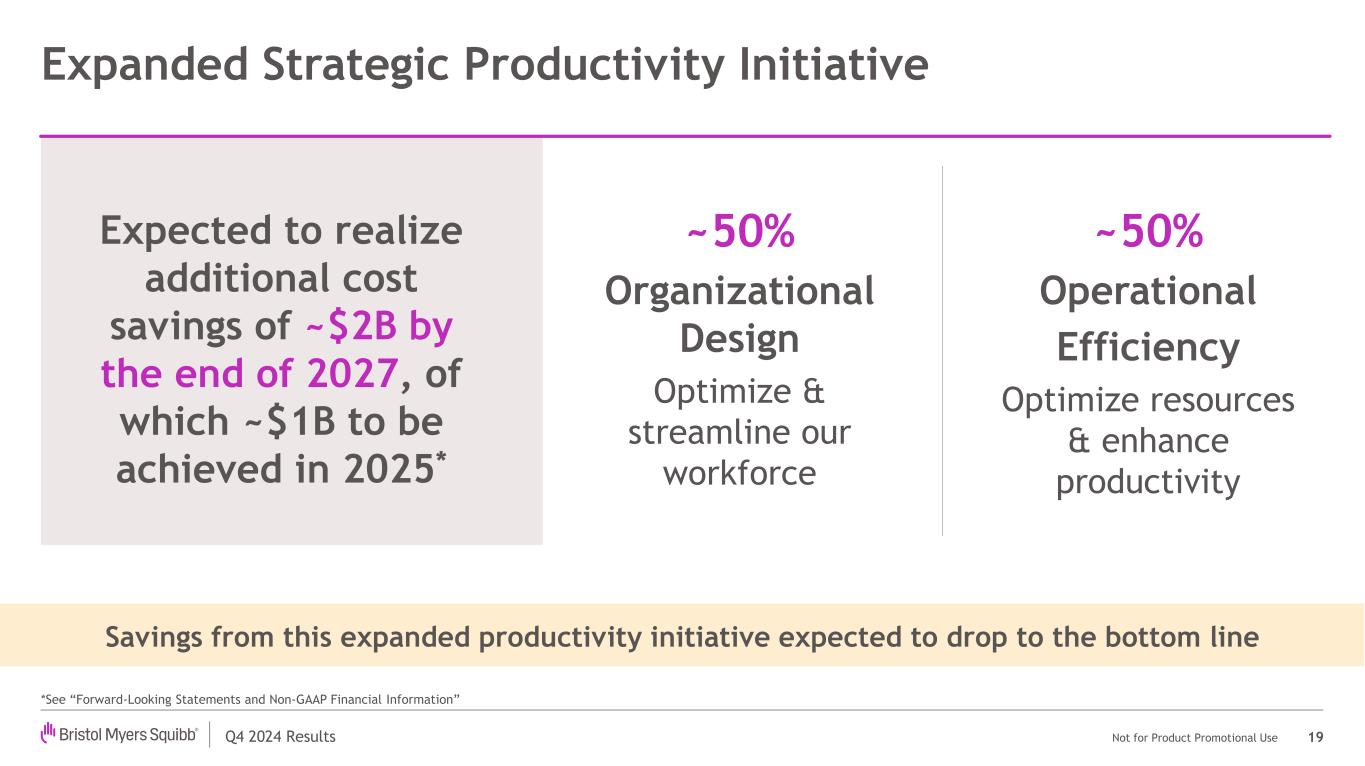

Q4 2024 Results Not for Product Promotional Use Expanded Strategic Productivity Initiative 19 Expected to realize additional cost savings of ~$2B by the end of 2027, of which ~$1B to be achieved in 2025* ~50% Organizational Design Optimize & streamline our workforce *See “Forward-Looking Statements and Non-GAAP Financial Information” ~50% Operational Efficiency Optimize resources & enhance productivity Savings from this expanded productivity initiative expected to drop to the bottom line

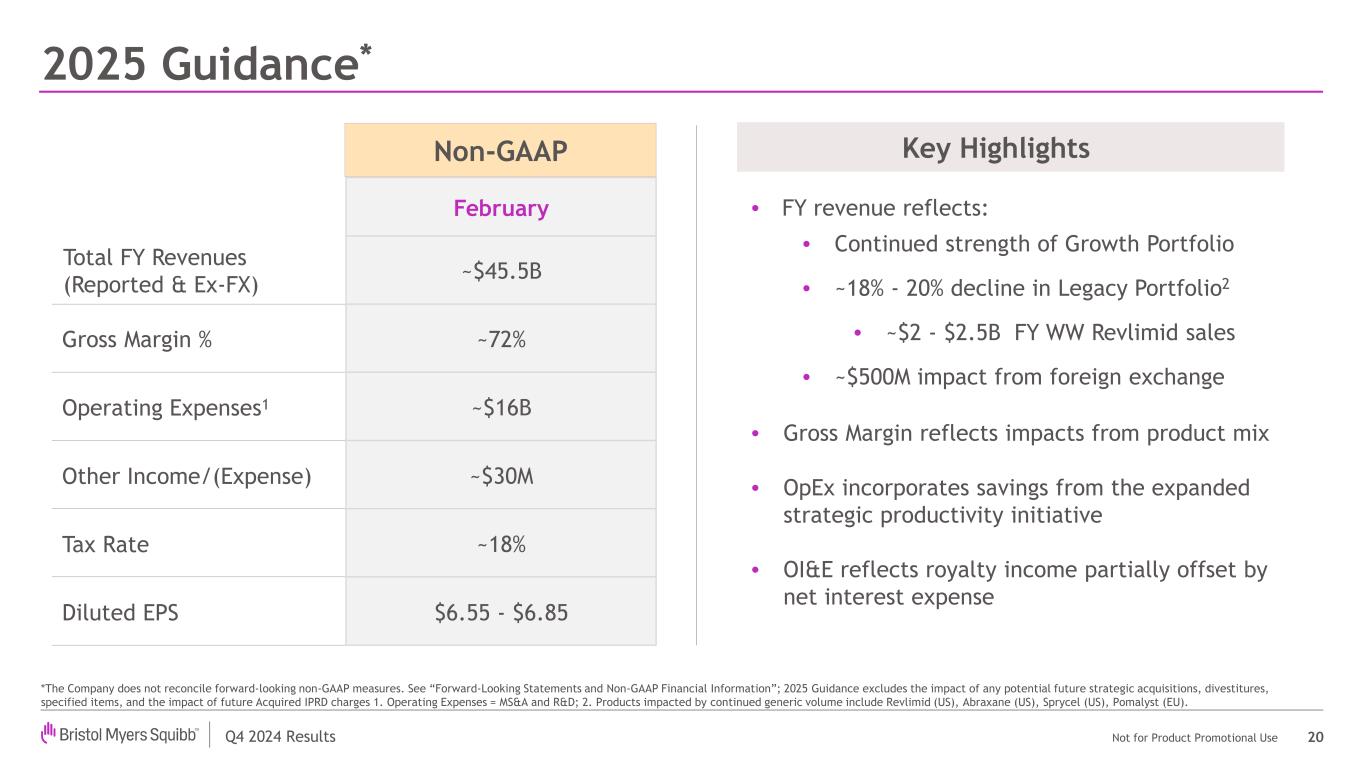

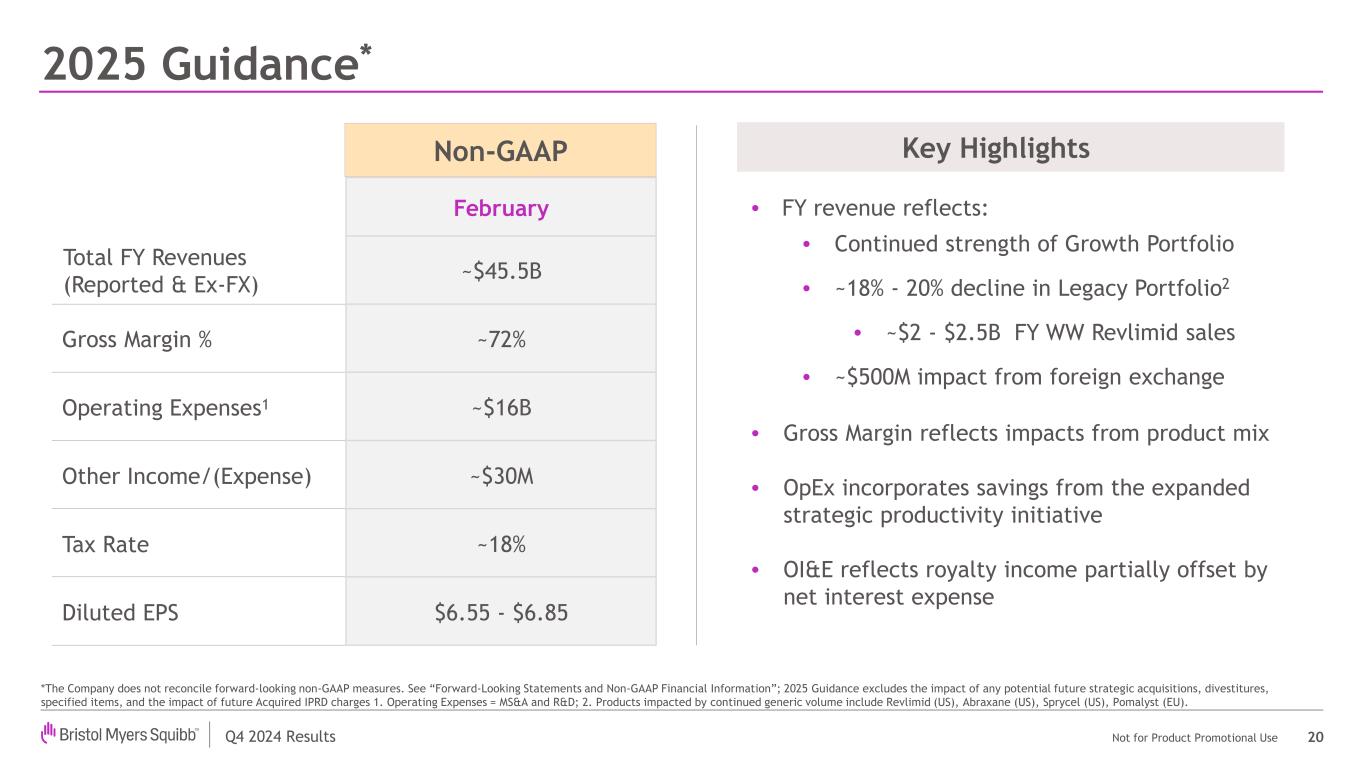

Q4 2024 Results Not for Product Promotional Use 2025 Guidance* 20 *The Company does not reconcile forward-looking non-GAAP measures. See “Forward-Looking Statements and Non-GAAP Financial Information”; 2025 Guidance excludes the impact of any potential future strategic acquisitions, divestitures, specified items, and the impact of future Acquired IPRD charges 1. Operating Expenses = MS&A and R&D; 2. Products impacted by continued generic volume include Revlimid (US), Abraxane (US), Sprycel (US), Pomalyst (EU). Key Highlights • FY revenue reflects: • Continued strength of Growth Portfolio • ~18% - 20% decline in Legacy Portfolio2 • ~$2 - $2.5B FY WW Revlimid sales • ~$500M impact from foreign exchange • Gross Margin reflects impacts from product mix • OpEx incorporates savings from the expanded strategic productivity initiative • OI&E reflects royalty income partially offset by net interest expense February Total FY Revenues (Reported & Ex-FX) ~$45.5B Gross Margin % ~72% Operating Expenses1 ~$16B Other Income/(Expense) ~$30M Tax Rate ~18% Diluted EPS $6.55 - $6.85 Non-GAAP

Chris Boerner, PhD Board Chair, Chief Executive Officer David Elkins Executive VP, Chief Financial Officer Samit Hirawat, MD Executive VP, Chief Medical Officer, Global Drug Development Adam Lenkowsky Executive VP, Chief Commercialization Officer 21 Q4 2024 Results Q&A