Exhibit 99.1

| CHILE MINING TECHNOLOGIES INC. |

| FORM 10-K DISCLOSURE |

| |

| Fiscal Year Ended March 31, 2010 |

| |

| TABLE OF CONTENTS |

| PART I |

| | | |

| Item 1. | Business | 2 |

| Item 1A. | Risk Factors | 14 |

| Item 1B. | Unresolved Staff Comments | 20 |

| Item 2. | Properties | 21 |

| Item 3. | Legal Proceedings | 27 |

| Item 4. | (Removed and Reserved) | 27 |

| | | |

| PART II |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity | |

| | Securities | 27 |

| Item 6. | Selected Financial Data | 28 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 28 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 36 |

| Item 8. | Financial Statements and Supplementary Data | 36 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 36 |

| Item 9A. | Controls and Procedures | 36 |

| Item 9B. | Other Information | 36 |

| | | |

| PART III |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 36 |

| Item 11. | Executive Compensation | 39 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 40 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 42 |

| Item 14. | Principal Accounting Fees and Services | 43 |

| | | |

| PART IV |

| | | |

| Item 15. | Exhibits, Financial Statement Schedules. | 44 |

Special Note Regarding Forward Looking Statements

Statements herein contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A, “Risk Factors” included herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Terms

Except as otherwise indicated by the context, references to:

the “Company,” “we,” “us,” or “our,” are to the combined business of CMT and its 99.9% owned subsidiary, Minera, but do not include the stockholders of CMT;

“CMT” are to Chile Mining Technologies Inc., a Nevada corporation;

“Minera” are to Sociedad Minera Licancabur, S.A., a Chilean company;

“Chile” and “Chilean” are to the Republic of Chile;

“Peso” are to the Chilean peso, the legal currency of Chile;

“U.S. dollar,” “$” and “US$” are to the legal currency of the United States;

“SEC” are to the Securities and Exchange Commission;

“Securities Act” are to the Securities Act of 1933, as amended, and “Exchange Act” are to the Securities Exchange Act of 1934, as amended;

“Exploration” means the process of locating commercially viable concentrations of minerals to mine; and

“Exploitation” means the act of extracting a mineral resource from source material.

1

PART I

Business Overview

We are a mineral extraction company based in the Republic of Chile, with copper as our principal “pay metal.” Our founders, Messrs. Jorge Osvaldo Orellana Orellana and Jorge Fernando Pizarro Arriagada, have refined the electrowin process in a way that permits the electrowin process to be used at a relatively small mine and/or tailings sites. Electrowinning is a process in which positive and negative electrodes are placed in an acidic solution containing copper ions, and an electric current passed through the solution causes the copper to be deposited on the negative electrodes so that it can be collected. We have obtained rights to conduct our mineral extraction operations at 7 different sites, and are in negotiations to obtain rights to one additional site, in and around the Coquimbo region, which is located in north-central Chile, approximately 400 kilometers north of Santiago. While these sites each have their own mineral deposits, we will procure the majority (approximately 88%) of our source material from non-traditional sources, including tailings, ore, or a combination thereof, by purchasing rights to such source material at smaller sites, where it is not economical for larger open-pit mining companies to operate, due largely to the transportation costs associated with moving source materials to fixed processing sites. By utilizing Minimum Intrusion Non-traditional Input, or MINI, plants, we are able to build scalable, less expensive plants closer to source material deposits, thereby resulting in significant processing savings. In addition, since smaller sites generally require higher copper prices, due to transportation costs, to operate profitably, these deposits can currently be purchased at a discount. By utilizing this strategy, we are able to reduce costs and operate profitably with smaller deposits.

The initial design capacity of each MINI plant is between approximately 1,400 and 2,000 metric tons of annual copper cathode output. Each MINI plant can be expanded on a modular basis in increments of 1,500 metric tons. We believe that the installed cost for a new 1,500 metric ton MINI plant, at the average location, is about $2,500,000 or $1,667 per metric ton of annual capacity. Expanding the capacity of an existing MINI plant will cost between $400 and $800 per metric ton, depending on the site. Once the available source material deposits at and around the site of an existing MINI plant have been depleted, we anticipate that we can recover up to 70% of the cost of constructing a new MINI plant by relocating the support structures and processing equipment from the original MINI plant.

By reducing unit costs and carefully managing the average source material grade, we estimate that the MINI plant technology will allow us to break even at copper prices as low as US$1.00 per pound or US$2,205 per metric ton. As of August 9, 2010, copper was trading at $7,425 per metric ton on the London Metals Exchange, or LME.

Since our inception on January 2, 2008, we have focused our activities on acquiring mineral rights and sites on which to construct our MINI plants. Since starting construction in the fall of 2008, we have successfully completed our first scalable MINI plant, designated as the Ana Maria plant, located about 30 kilometers northeast of the town of Illapel, in the mining district of Matancilla. We have been testing the production of copper cathodes at the Ana Maria plant since late April 2009. In July 2009, we produced our first commercial run of copper cathodes.

Initially, we plan to sell our copper cathodes to Madeco, the largest cable producer in Chile. Based on our discussions with Madeco, we expect that the selling price will be at a 3% discount from the price for copper, adjusted for purity, on the LME. We expect that sales will be made under purchase orders where cash will be paid upon delivery. We anticipate that this arrangement will provide us with immediate cash flow with which we will use to fund our current operations. In the future, as business volume grows, we may elect to sell our copper cathodes at the generally higher prices prevailing on the LME.

We are ramping up production at the Ana Maria plant and expect to be producing 275,625 pounds, or 125 metric tons, per month within our third fiscal quarter. The present annual capacity of the MINI plant is 3,307,500 pounds or 1,500 metric tons. We believe that the site can be progressively expanded to about 5,000 metric tons per annum on a modular basis in increments of 500 to 1,000 metric tons, subject to the market price for copper and the grade and quantity of source materials available to be processed. We are also further enhancing our electrowin-based recovery techniques to reduce costs and improve the yield of the copper out of the mineral spectrum, as well as refining our metallurgy to extract other pay metals, including gold, silver and molybdenum.

We have also begun preparatory work at some of the additional sites we have under our control, in anticipation of the construction of additional MINI plants over the next 18 to 24 months.

2

Corporate History and Structure

Background and History of CMT

CMT was incorporated in the State of Nevada on September 26, 2007, under the name “SMSA El Paso I Acquisition Corp.,” to effect the reincorporation of Senior Management Services of El Paso Sunset, Inc., a Texas corporation, or SMSA Texas, from Texas to Nevada (which was completed by a merger of SMSA Texas into CMT on October 1, 2007) as part of the implementation of a Chapter 11 reorganization plan of SMSA Texas and its affiliated companies, or the SMS Companies, which filed a petition for Chapter 11 reorganization on January 17, 2007. During the three years prior to filing the reorganization petition, the SMS Companies operated a chain of skilled nursing homes in Texas, which prior to the bankruptcy proceedings consisted of 14 nursing facilities, ranging in size from approximately 114 beds to 325 beds. In 2005, the SMS Companies obtained a secured credit facility from a financial institution, which eventually was comprised of an $8.3 million term loan and a revolving loan of up to $15 million. By late 2006, the SMS Companies were in an “overadvance” position, whereby the amount of funds by the lender exceeded the amount of collateral eligible to be borrowed under the credit facility.

Beginning in September 2006, the SMS Companies entered into the first of a series of forbearance agreements whereby the lender agreed to forebear from declaring the financing in default provided that the SMS Companies obtained a commitment from a new lender to refinance and restructure the credit facility. The SMS Companies were unsuccessful in obtaining a commitment from a new lender and, on January 5, 2007, the lender declared the SMS Companies in default and commenced foreclosure and collection proceedings. Subsequently, on January 17, 2007, the SMS Companies filed a petition for reorganization under Chapter 11 of the Bankruptcy Code.

The First Amended, Modified Chapter 11 Plan, or the Plan, as presented by the SMS Companies and their creditors was approved by the United States Bankruptcy Court, Northern District of Texas - Dallas Division, on August 1, 2007. The Plan provided that certain identified claimants as well as unsecured creditors, in accordance with the allocation provisions of the Plan, and our new controlling stockholder would receive “new” shares of our post-reorganization common stock, pursuant to Section 1145(a) of the Bankruptcy Code.

Halter Financial Group, Inc., or Halter Financial, participated with the SMS Companies and their creditors in structuring the Plan. As part of the Plan, Halter Financial provided $115,000 to be used to pay professional fees associated with the Plan confirmation process. Halter Financial was granted an option to be repaid through the issuance of equity securities in 23 of the SMS Companies, including CMT. Halter Financial exercised the option and as provided in the Plan 80% of our outstanding common stock, or 400,000 shares, was issued to Halter Financial in satisfaction of Halter Financial’s administrative claims. The remaining 20% of our outstanding common stock, or 100,016 shares, was issued to 455 holders of unsecured debt. The 500,016 shares were issued pursuant to Section 1145 of the Bankruptcy Code. Effective September 26, 2007, Halter Financial transferred its 400,000 shares to Halter Financial Investments, L.P., or HFI, a Texas limited partnership controlled by Timothy P. Halter. Mr. Halter also served as our president and sole director from our formation on September 26, 2007 until January 1, 2008, when he was replaced by Richard Crimmins.

We were subject to the jurisdiction of the bankruptcy court until we consummated the exchange transaction described below with LAV in November 2008. As we timely consummated a merger or acquisition with a qualifying entity, we filed a certificate of compliance with the bankruptcy court which stated that the requirements of the Plan had been met, resulting in the discharge to be deemed granted. Thereafter, the post discharge injunction provisions set forth in the Plan and the confirmation order became effective.

Exchange Transaction with LAV

On November 18, 2008, we entered into a share exchange agreement with Latin America Ventures, Inc., or LAV, a Nevada corporation, and the sole stockholder of LAV, Mr. Pierre Galoppi, pursuant to which Mr. Galoppi transferred 100% of the issued and outstanding shares of the capital stock of LAV to us in exchange for 1,500,000 newly issued shares of our common stock that constituted approximately 75% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of such exchange. As a result of this transaction, Mr. Galoppi became our controlling stockholder and LAV became our subsidiary. In connection with the Share Exchange Agreement, our sole director and officer, Richard Crimmins, resigned and was replaced by Mr. Galoppi as our sole director and officer.

3

LAV was organized on September 15, 2008 as a Nevada corporation and was formed to seek and identify a privately-held operating company located in Latin America desiring to become a publicly held company by combining through a reverse merger or acquisition transaction.

On December 15, 2008, we entered into an agreement and plan of merger with LAV pursuant to which LAV was merged with and into us, with CMT continuing as the surviving corporation. In connection with the merger, our name was changed to from “SMSA El Paso I Acquisition Corp.” to “Latin America Ventures, Inc.” The parent-subsidiary merger and name change became effective on December 30, 2008.

Reverse Acquisition of Minera

On May 12, 2010, we completed a reverse acquisition transaction through a share exchange with Minera and its shareholders whereby we acquired 99.9% of the issued and outstanding capital stock of Minera in exchange for 6,000,000 shares of our common stock, par value $0.001, which constituted 83.33% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Minera became our subsidiary and the former shareholders of Minera became our controlling stockholders.

Jorge Osvaldo Orellana Orellana, our Chairman and Chief Executive Officer, who is also one of the former shareholders of Minera, retained one share of Minera, constituting 0.1% of Minera’s issued and outstanding capital stock. We structured the acquisition of Minera to allow Mr. Orellana to retain one share of Minera in order to comply with Chilean legal requirements that a Sociedad Anónim, like Minera, have at least two record owners of its capital stock. Upon the closing of the reverse acquisition, Mr. Orellana entered into a nominee agreement with us pursuant to which he agreed to act as the record holder of such share, but agreed that all other rights to the share, including the right to receive distributions on the share, vote the share and be the beneficial owner of the share, rest in the Company.

In connection with our reverse acquisition of Minera, we also entered into a Cancellation Agreement with HFI and Mr. Pierre Galoppi, our controlling stockholders, whereby HFI and Mr. Galoppi agreed to the cancellation of an aggregate of 3,600,500 shares of our common stock owned by them.

Upon the closing of the reverse acquisition on May 12, 2010, Mr. Pierre Galoppi, our sole director and officer, submitted a resignation letter pursuant to which he resigned from all offices that he held effective immediately and from his position as our director that became effective on May 27, 2010, the tenth day following our mailing of an information statement complying with the requirements of Section 14f-1 of the Exchange Act, or the Information Statement, to our stockholders. On the same date, our board of directors increased its size from one to five members and appointed Messrs. Jorge Osvaldo Orellana Orellana, Jorge Fernando Pizarro Arriagada, Iván Orlando Vergara Huerta, J. Christopher McLean and Gerard Pascale, to fill the vacancies created by such increase and Mr. Galoppi’s resignation. Mr. Orellana’s appointment became effective upon the closing of the reverse acquisition on May 12, 2010, and the remaining appointments became effective on May 27, 2010. In addition, our executive officers were replaced by Minera’s executive officers upon the closing of the reverse acquisition as indicated in more detail below.

Minera was incorporated as a “sociedad anónima cerrada” under the laws of Chile on January 2, 2008. Under Chilean law a “sociedad anónima cerrada” is functionally the same as a corporation under U.S. law.

As a result of the reverse acquisition, we have assumed the business and operations of Minera. On June 16, 2010, we changed our name to “Chile Mining Technologies Inc.” to more accurately reflect our new business operations.

For accounting purposes, the share exchange transaction with Minera was treated as a reverse acquisition, with Minera as the acquirer and CMT as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Minera.

Private Placement Transaction

On May 12, 2010, we also completed a private placement in which we issued and sold to certain accredited investors an aggregate of 2,089,593 shares of our common stock for an aggregate purchase price of $5,809,000, or $2.78 per share, and warrants to purchase up to 1,044,803 shares of our common stock. The warrants have a term of four years, bear an exercise price of $3.61 per share (subject to customary adjustments), are exercisable on a net exercise or cashless basis and are exercisable by investors at any time after the closing date. This private placement occurred on the same day, but immediately after, the reverse acquisition transaction described above.

4

As a result of this private placement, we raised approximately $5.8 million in gross proceeds, which left us with approximately $4.5 million in net proceeds after the deduction of offering expenses in the amount of approximately $1.3 million. We are under a contractual obligation to register the shares of our common stock, including the shares of common stock underlying the warrants, within a pre-defined period.

In connection with the private placement, we also agreed to certain “make good” provisions. Under the “make good” provisions, we issued additional “make good” warrants to the investors to purchase up to an aggregate of 2,089,593 shares of our common stock, at an exercise price of $0.01 per share, which will only become exercisable if we do not meet certain financial performance targets in 2011 and 2012. The “make good” provisions established minimum net income thresholds of $14,382,102 and $15,179,687 for the 2011 and 2012 fiscal years, respectively. If, in a given fiscal year, 90% of the applicable minimum net income threshold is not met, such aggregate number of “make good” warrants will become exercisable equal to the amount by which our actual net income is less than the applicable financial target, divided by the financial target, and multiplied by 2,338,130.

Halter Financial Securities, Inc., or HFS, acted as placement agent in connection with this private placement. As compensation for its services, HFS and/or its designees received a cash fee of $522,805.86, representing 9% of the gross proceeds received from the private placement, and warrants to purchase up to 188,062 shares of our common stock, representing 9% of number of shares issued to the investors in the private placement. The warrants have a term of four years, bear an exercise price of $3.61 per share (subject to customary adjustments), are exercisable on a net exercise or cashless basis and are exercisable at any time after the closing date of the private placement.

Convertible Promissory Note and Make Good Warrant

Halter Financial Group, L.P., or HFG, provided certain advisory services to us in connection with the reverse acquisition of Minera and private placement transaction described above. Pursuant to an advisory agreement that Minera entered into with HFG on April 16, 2009, HFG agreed to (a) advise Minera with regard to its desire to effect a combination transaction with a U.S. domiciled public shell corporation, (b) help Minera identify suitable investment bank(s) to act as placement agent for its contemplated private placement transactions and (c) counsel management on matters related to the operating a U.S. domiciled public company. Under the terms of the advisory agreement, HFG was entitled to receive a cash payment of $450,000 at the closing of the reverse acquisition of Minera. In lieu of such cash payment, HFG agreed to accept a cash payment of $260,000 and a promissory note issued by us in the principal amount of $190,000 that accrues simple annual interest at a rate of 3%. The note is due and payable on the sooner of the closing of our next equity financing (including the receipt of additional funds by the Company from any subsequent closing of the May 12 private placement) or the 180th day following the date of its issuance. In addition, at any time that the note remains outstanding, it may be converted at HFG’s option into shares of our common stock at a conversion price of $2.78. At the closing, HFG was also issued a “make good” warrant, to purchase up to 985,104 shares of our common stock. The terms of the “make good” warrant issued to HFG are identical to the terms of the “make good” warrants issued to the investors in the private placement.

The four principals and sole beneficial equity holders of HFG, Timothy Halter, David Brigante, Marat Rosenberg and George Diamond, are also the sole equity holders of WLT Brothers Holdings, Inc., which is the sole owner of HFS. However, none of such equity holders is an employee, member of the board of directors or similar governing body, or member of the management team of HFS.

Standby Credit Facility

On May 6, 2010, Minera entered into a letter agreement that outlines the proposed terms of a standby facility of credit with AIBC International Corp.(SR), AIBC. Under the letter agreement we may, subject to the satisfaction of the conditions outlined below, from time to time upon 90 days notice, request an advance from AIBC up to an aggregate of $3.0 million.

Our ability to receive advances from AIBC under the letter agreement is subject to several conditions, including the following:

5

the reverse acquisition of Minera must be consummated (this occurred on May 12, 2010) and our common stock must continue to be quoted on the OTC Bulletin Board and/or a recognized North American securities exchange;

we must complete an equity financing resulting in gross proceeds of at least $5,845,000 on or prior to May 31, 2010;

AIBC must receive audited financial statements, or such other documentation as AIBC may deem necessary in its sole discretion, indicating that 75% of the free cash flow from the operations of our Company will be sufficient to enable us to make all payments agreed to in repayment of any advance, and that there are sufficient assets available with current provable values to collateralize the amount of any advance (including any other advances then outstanding);

we and AIBC must enter into a loan agreement reflecting the terms and conditions set forth in the letter agreement and such subsidiary and parent guarantees of our obligations as AIBC may require, all of which documentation must be in form and substance reasonably satisfactory to AIBC and to its counsel, to us and Minera. The loan documents will be consistent with the letter agreement and will provide for customary events of default and remedies thereupon;

AIBC must be satisfied that any debt outstanding to it, and any security granted in connection with that debt, ranks in priority to our other debt;

AIBC must have received customary legal opinions from our U.S. and other local counsels as to the validity and enforceability of the obligations created under the loan documents; and

the representations and warranties contained in the letter agreement must be true as of the date of the advance.

In connection with the execution of the letter agreement, we issued to AIBC 75,000 shares of our common stock a one-year warrant to purchase up to 360,000 shares of our common stock, at an exercise price of $2.78 per share.

In addition, we will pay to AIBC additional compensation upon the drawdown of any portion of the $3.0 million as follows:

upon the drawdown of the first $1,000,000, in the aggregate, a cash fee equal to 8% of such drawdown and one- year warrants to purchase such number of shares of our common stock equal to 8% of the drawdown, with a per share exercise price equal to the average trading price of our common stock for the 10-trading day period prior to the drawdown;

upon the drawdown of the second $1,000,000, in the aggregate, a cash fee equal to 12% of such drawdown and one-year warrants to purchase such number of shares of our common stock equal to 12% of the drawdown, with a per share exercise price equal to the average trading price of our common stock for the 10-trading day period prior to the drawdown; and

upon the drawdown of the third $1,000,000, in the aggregate, a cash fee equal to 18% of such drawdown and one- year warrants to purchase such number of shares of our common stock equal to 18% of the drawdown, with a per share exercise price equal to the average trading price of our common stock for the 10-trading day period prior to the drawdown.

Any amounts borrowed under the facility will accrue interest at a rate of 12.5% per annum, and must be re-paid within six months from the date of the drawdown.

AIBC may terminate the facility contemplated by the letter agreement if:

we breach any representations, warranties or covenants and fail to cure the breach;

there is a material adverse change in relation to the assets, property, business, or corporate capacity of our Company that impairs our ability to fulfill their obligations under the letter agreement;

we are sanctioned by any securities or regulatory authority or noted as a reporting issuer in default under any applicable securities legislation; or

any securities or stock exchange regulatory authority or other tribunal, court or other entity determines that the securities issuable to AIBC under the letter agreement cannot be issued, are void or subject to escrow or any other impairment on AIBC's ability to freely trade them.

6

AIBC is required during the term of the letter agreement to maintain sufficient capital so that it can satisfy its obligations under the letter agreement and the obligations that it will have under the loan documents following a request for advance by Minera.

Our Industry

Overview of the Global Copper Industry

Copper, in the form of copper cathode, is an internationally traded commodity, and its prices are determined by the major metals exchanges – the New York Mercantile Exchange, or COMEX, the LME, and the Shanghai Futures Exchange, or SHFE. Prices on these exchanges generally reflect the worldwide balance of copper supply and demand, but are also influenced significantly, from time to time, by speculative actions and currency exchange rates. Copper consumption is closely associated with industrial production and therefore tends to follow economic cycles. During an expansion, demand for copper tends to increase, thereby driving up the price. As a result, copper prices are volatile and cyclical.

According to data from the International Copper Study Group, or ICSG, an intergovernmental organization that serves to increase copper market transparency and promote international discussions and cooperation on issues related to copper, the refined copper market balance for 2010 is expected to show a surplus of approximately 580,000 metric tons. A decline in production will not be sufficient to overcome the weak demand for refined copper. A smaller surplus of around 240,000 metric tons is expected to develop in 2010 as increased economic activity is expected to boost demand in copper end-use markets.

World copper mine production in 2010 is expected to rise by 6.7%, or 1.1 million metric tons, to 16.8 metric tons. Capacity utilization rates are expected to improve to around 84% in 2010, up from 80% in 2009, which was the lowest level since 1989. World refined copper production for 2010 is projected to remain relatively stable, increasing by 0.6% in 2010, to around 18.5 million metric tons. In 2011, it is anticipated that production will increase by about 3% to 19.1 million metric tons. A shortage of concentrates in 2009 and 2010 based on projected production is expected to restrain the growth of refined production.

The recent global economic crisis has significantly reduced world refined copper usage. ICSG expects world refined usage to decline by 1.5% in 2010 to 17.9 million metric tons. An average increase of 6.9% in three major markets – the United States, the European Union, and Japan, is expected to be more than offset by a decline in apparent usage in China of about 13%. Industrial demand growth in China, however, which is based on semi manufacture production, is expected to grow by 7.5% and 5%, respectively in 2010 and 2011. ICSG expects world copper usage to recover in 2011, rising by about 5.8% to 18.9 million metric tons.

In 2011, the market is expected to be more closely balanced as an increase in economic activity is expected to lead to stronger end use markets and the growth in refined production is expected to moderate. The above information from ICSG is available on their website at www.icsg.org.

7

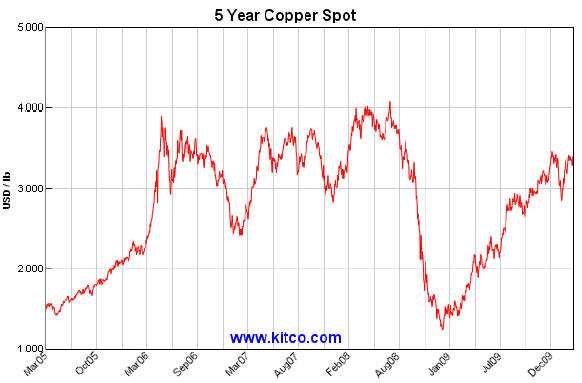

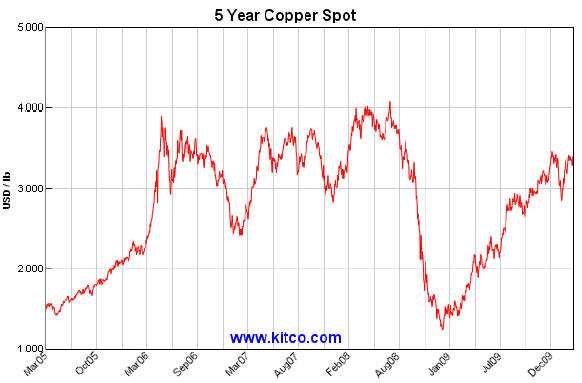

The graph below presents LME spot copper prices and reported stocks of copper at the LME and the COMEX from March 2005 through March 2010.

Copper Mining in Chile

Chile is the world’s largest producer of copper from a mining perspective, producing 5,330,000 metric tons in 2008, or approximately 35% of total worldwide production. At the average prevailing price of copper in 2008 of $3.15 per pound, or $6,949 per metric ton, total Chilean copper production was valued at $37.1 billion. Codelco, the Chilean state-owned copper producing entity, is projecting that, once such figures are available, total Chilean mine production will have increased by 3.7% in 2009 to 5,400,000 metric tons and by 6% in 2010 to approximately 5,830,000 metric tons. Our projected 7,500 metric tons of installed copper processing capacity will account for 0.0012% of total national output in 2010.

Copper has been mined and refined in Chile since pre-Columbian times. In the Spanish colonial period dating from 1535 to 1818, the year when independence from Spain was declared in Chile, several dozen small mines were worked by hand, producing around 125,000 metric tons of copper, according to the Chilean Copper Commission (Comisión Chilena del Cobre), or Cochilco. In the period following the establishment of the Republic of Chile until 1900, and as a result of significant British and U.S. investment in new mining technology, about 1,650,000 metric tons of copper was mined at several hundred sites, averaging about 33,000 metric tons per year between 1875 and 1900. Generally, only ore bearing more than 10% copper was mined in shallow pits or short underground mines. Many of our tailings in the Coquimbo region date from this period.

In the 20th century, Chile established itself as the world leader in copper production. In the early 1970s, Salvador Allende’s leftist government nationalized several of the larger foreign-owned copper mining and smelting operations into a state-owned entity known as Codelco. By 1975, the four Codelco properties produced 682,300 metric tons, representing 82% of Chilean copper output. Following the 1976 reorganization, Codelco alone produced 890,000 metric tons in 1977, with Chuquicamata generating 579,000 metric tons, or 65%, of the corporate total, and, another Codelco mine, El Teniente, reaching 276,000 metric tons. From 1983 to 1989, Codelco increased its production from 1,100,000 metric tons to 1,240,000 metric tons, reflecting a pattern of steady reinvestment in extraction, processing, and refining capacity. With the renovation of production capabilities, Codelco emerged as one of the lowest cost producers of copper in the global industry, allowing it to survive a long period in the late 1980s and early 1990s when metals prices were depressed. With the emergence of the Chinese and other Asian economies, Codelco’s output and profitability increased with the demand for copper causing higher prices.

In 1986, Augusto Pinochet’s government liberalized the mining law of Chile, limiting the Codelco mineral claims to those that it had already explored and staked, and permitting private enterprise, domestic and foreign, to reenter the mining business for copper and all other minerals in the country. In addition to several small, locally-owned mining companies, many major international mining companies such as Australia-based BHP-Billiton, Canada-based Aur Resources Inc., and South Africa-based Anglo-American plc, began to develop modern, high-capacity copper mining projects, most of which came on line in the late 1990s, increasing Chilean national copper output by over 400% from 1989, and global market share from about 17% to approximately 35% in 2010.

8

Our Competitive Strengths

We believe that the following competitive strengths enable us to compete effectively and to capitalize on the growth of the market for copper:

Use of MINI plant Design. Our overall strategy is to extract copper from source material for the lowest possible cost using MINI plant design. We believe that the MINI plant offers major advantages in (1) making smaller-sized ore deposits and tailings sites economically viable over the expected range of copper prices; (2) reducing electricity and water requirements in a country where the resources are scarce and relatively expensive; (3) increasing portability as the source material at a commercially feasible site depletes; and (4) increasing our proximity to smaller third-party mining operations.

First to Market. To our knowledge, we are the first company in Chile to utilize a scalable MINI plant concept to process relatively small deposits and tailings sites. Being an early entrant to the market provides us with know-how and experience that are essential to the profitable exploitation of these sites. Any new market entrants that might become our competitors in the future will require time to develop operational processes and experience and general know-how before they can effectively compete with us.

Low level of Competition. We currently have no competitors in Chile that extract copper from smaller or abandoned tailings sites utilizing MINI plants like we do. Although we can provide no assurances that other mining companies will not enter the market of extracting copper utilizing the MINI plant concept, we believe that we will have a competitive advantage over any new market entrant as a result of our ongoing operational experience.

Experienced Management Team. Each member of our management team has extensive experience in the mining industry in Chile. All members of our senior management team have advanced degrees, and include a geologist and a mechanical engineer. Our senior management team has worked together at our Chilean subsidiary, Minera, and on other projects before the inception of Minera for over fifteen years. This experience provides us with the ability to identify new mining opportunities, analyze such opportunities for profitability and develop processes to exploit any opportunities we identify.

Our Growth Strategy

We are committed to enhancing profitability and cash flows through the following strategies:

Opportunity to Expand Volume. Since starting construction in the fall of 2008, we have successfully completed the first MINI plant, designated as the Ana Maria plant, located about 30 kilometers northeast of the town of Illapel, in the mining district of Matancilla. We have also begun preparatory work at some of the additional sites we have under our control, in anticipation of the construction of additional MINI plants over the next 18 to 24 months. We have identified seven additional sites suitable for our MINI plants. We believe that the funds raised in connection with our recent private placement and our credit facility with AIBC will be sufficient to bring four of the sites on-line, with a planned capacity of at least 6,000 metric tons per year, bringing our total annual production capacity to about 7,500 metric tons by the end of 2010. The remaining three sites have the potential to expand output by 4,500 metric tons per year. Working with the eight sites we currently have under control, we believe that we could have the capacity to extract 12,000 metric tons of copper per year by the beginning of 2011, through expansion based entirely on future projected cash flows.

Exploration. Utilizing the operational platform that we have developed, we intend to create other sources of revenue within the Chilean mining industry. We plan to create a mineral exploration department and utilize our experienced management and operational teams to explore mining opportunities in Chile.

9

Our Products

Our main product is copper, in the form of copper cathode. Copper is the world’s third most widely used metal and an important component in the world’s infrastructure. Copper has unique chemical and physical properties, including high electrical conductivity and resistance to corrosion, as well as excellent malleability and ductility that has made it a superior material for use in the electrical energy, telecommunications, building construction, transportation and industrial machinery businesses. Copper is also an important metal in non-electrical applications such as plumbing, roofing and, when alloyed with zinc to form brass, in many industrial and consumer applications.

Initially, we plan to sell our copper cathodes to Madeco, the largest cable producer in Chile. Based on our discussions with Madeco, we expect that the selling price will be at a 3% discount from the price for copper, adjusted for purity, on the LME. We expect that sales will be made under purchase orders where cash will be paid upon delivery. We anticipate that this arrangement will provide us with immediate cash flow with which to fund our current operations. In the future, as business volume grows, we may elect to sell our copper cathodes at the generally higher prices prevailing on the LME.

Our Plants

Since starting construction in the fall of 2008, we have successfully completed our first scalable MINI plant, designated as the Ana Maria plant, located about 30 kilometers northeast of the town of Illapel, in the mining district of Matancilla. We have been testing the production of copper cathodes at the Ana Maria plant since late April 2009. In July 2009, we produced our first commercial run of copper cathodes.

We are ramping up production at the Ana Maria plant and expect to be producing 275,625 pounds, or 125 metric tons, per month within our third fiscal quarter. The present annual capacity of the MINI plant is 3,307,500 pounds or 1,500 metric tons. We believe that the site can be progressively expanded to about 5,000 metric tons per annum on a modular basis in increments of 500 to 1,000 metric tons, subject to the market price for copper and the grade and quantity of source materials available to be processed. We are also further enhancing our electrowin-based recovery techniques to reduce costs and improve the yield of the copper out of the mineral spectrum, as well as refining our metallurgy to extract other pay metals, including gold, silver and molybdenum.

We have also begun preparatory work at some of the additional sites we have under our control, in anticipation of the construction of additional MINI plants over the next 18 to 24 months. We have identified seven additional sites suitable for our MINI plants. We believe that the funds raised in connection with our recent private placement and our credit facility with AIBC will be sufficient to bring four of the sites on-line, with a planned output capacity of at least 6,000 metric tons of copper cathodes per year, bringing our total expected output capacity to about 7,500 metric tons by the end of 2010. The remaining three sites have the potential to expand output by an additional 4,500 metric tons per year in the aggregate. Working with the seven sites we currently have under our control, we believe that we could increase our total expected output capacity of copper cathodes to 12,000 metric tons per year by the beginning of 2011, through expansion based entirely on future projected cash flows.

The table below summarizes the capacity of each of our current and planned MINI plants.

| District | Plant | Initial Production | Initial Capacity/Year |

| PHASE 1 | | | |

| Matancilla | Ana Maria | Operating | 1,500 MT |

| Salamanca | Santa Filomena | 3rdQuarter 2010 | 1,500 MT |

| Combarbala | Gabriella | 3rdQuarter 2010 | 1,500 MT |

| Camisa | Camisa | 3rdQuarter 2010 | 1,500 MT |

| PHASE 2 | | | |

| Chincolco | Jakeline | 1stQuarter 2011 | 1,500 MT |

| Cerrado | Cerrado | 1stQuarter 2011 | 1,500 MT |

| Cabildo | Jaqueline | 1stQuarter 2011 | 1,500 MT |

| TOTAL | | | 12,000 MT |

Additionally, we are currently in negotiations to purchase property rights at a site in Panulcillo, and we anticipate that we will be able to commence construction of a MINI plant on this site in mid-2011.

10

Production

The following chart illustrates the process of extracting copper from source material:

As shown in the chart above, source material in the form of ore, identified as “run-of-mine,” is initially crushed and milled, with the larger fragments sent for leaching in either vats or in large mounds. The smaller fragments are blended with copper tailings and leached in tanks. Each leaching process, which differs chemically and operationally, involves the introduction of acids to the source material, which liquefies the copper contained in the source material, thereby separating it from the rock and other materials in the source material. The resulting acidic solution is then filtered and ultimately placed into tanks where the electrowin process is introduced. During the electrowinning process, positive and negative electrodes are placed in the acidic solution containing the copper ions, and an electric current passed through the solution causes the copper to be deposited on the negative electrodes for collection in the form of the copper cathodes.

The price of copper on the LME fluctuates daily, and, more significantly, by quarter of the year, with prices tending to be stronger in the April to September period, and weaker in the October to March period, subject to global supply and demand. Output from each MINI plant is also subject to a number of factors revolving around overall mechanical reliability of the processing equipment, the ore grade, and weather conditions.

The economic advantages of the MINI plant are driven by the ability to achieve profitable operation by reducing the cost of: (1) transportation of the source material to the plant site; (2) leaching agents; (3) electric power; (4) water; (5) total manpower; and (6) capital cost recovery of the installed plant. Most elements of the unit costs tend to increase as the world price of copper rises. In periods of price retreats, some elements such as leaching agents and feed stock have dropped below their peak period costs. Electric power and water costs tend to be relatively stable, but are generally quite high in Chile due to geography and the desert-like climate, which affects most regions where mines have been exploited.

The following table illustrates the costs associated with producing one pound of copper, based on our current budget estimates for the Ana Maria plant:

| Cost Element | | Unit Cost |

| Copper Ore – Average 2.65% grade | | 0.20 |

| Receiving, Scaling & Crushing | | 0.09 |

| Processing to Tank House | | 0.14 |

| Electrowin to Cathodes | | 0.29 |

| Labor & Fringe Benefits | | 0.15 |

| Plant Operating Overhead | | 0.05 |

| Depreciation of Plant & Equipment | | 0.08 |

| TOTAL COST PER POUND – US$ | | 1.00 |

11

Raw Materials

Source material, including tailings and ore, sulfuric acid and water are the principal raw materials used in our current operations. While the properties we have obtained rights to each have their own mineral deposits, we will procure the majority (approximately 88%) of our source material from third parties by purchasing rights to such source material at smaller sites, where it is not economical for larger open-pit mining companies to operate, due largely to the transportation costs associated with moving source materials to fixed processing sites.

While the process of extracting copper from tailings requires the use of sulfuric acid, we utilize a methodology which allows us to extract the sulfuric acid that is contained in the tailings which are either located at our MINI plant site or which are created through the use of our copper extraction process on ore, and then reuse the sulfuric acid to extract copper from future source material. This recycling process helps us minimize our costs of raw materials.

Our operations require significant quantities of water for mining, ore processing and related support facilities. Our operations are in areas where water is scarce and competition among users for continuing access to water is significant. Continuous production at our MINI plants is dependent on our ability to maintain our water rights and claims and defeat claims adverse to our current water uses in legal proceedings. At present our only MINI plant that is operational is our Matancilla facility. At this facility, we have obtained the right to collect water from the river that flows through the property to satisfy all of the operational needs of the facility.

Research and Development

We do not currently engage in any significant levels of research and development and do not have any employees who are solely dedicated to research and development. We do, however, continually monitor industry developments in the mining and processing industries and we regularly analyze our own procedures and methods to further refine and improve them.

Our Competition

We currently have no competitors in Chile that extract copper from exclusively from smaller producers or abandoned tailings sites utilizing MINI plants like we do. Although we can provide no assurances that other mining companies will not enter the market of extracting copper utilizing the MINI plant concept, we believe that we will have a competitive advantage over any new market entrant as a result of our ongoing operational experience.

There are, however, other companies in Chile producing copper from tailings. One such company, MVC, a wholly-owned subsidiary of a Canadian publicly traded company, Amerigo Resources Ltd., produces copper and molybdenum concentrates from tailings located in the world’s largest underground copper mine, Codelco’s El Teniente mine. MVC is currently treating all fresh tailings from El Teniente’s present production and has the right to treat the higher grade tailings from a 200 million tonin situ tailings impoundment located next to MVC’s plant. MVC, however, processes a different type of copper ore using a flotation process for copper concentrate, as opposed to our process which utilizes cathodes.

We do not believe that MVC represents significant competition for us for the following reasons:

The operations of MVC are in a separate geographic region from where we are currently operating or where we expect to expand our operations;

MVC conducts its operations through large capital expenditure at one production site, whereas our business model focuses on conducting operations at multiple production sites with small targeted capital investments to each site; and

MVC is focused and dependent on a single customer, whereas our business model combines self-provided source material combined with access to third-party source material.

Intellectual Property

We do not possess any material intellectual property.

12

Environmental Matters

Chile’s environmental regulations are administered by the Comisión Nacional del Medio Ambiente, or CONAMA. Typically, copper producers and other similar companies are required to prepare and submit environmental impact studies detailing the impact of the copper reclamation and production on the surrounding environment, and to adhere to other environmental regulations. We have obtained written confirmation from CONAMA that our operations fall outside the scope of these environmental regulations because our MINI plant facilities do not produce in excess of 5,000 metric tons of copper per year from ore source material.

Regulation

Our mineral reclamation activities are not regulated by any specific governmental agency, as our activities are not in the public domain. The general policies of the mining industry, however, are administered by the Chilean Ministry of Mining and its departments, and our activities are governed by the Chilean Mining Code, Decree of Mining Security and general labor, commercial, health and environmental regulations. We believe that we are in compliance with all laws and regulations that are applicable to our operations.

Our Employees

As of March 31, 2010, we employed 36 full-time employees. The following table sets forth the number of our full-time employees by function.

| Function | | Number of Employees |

| General and administration | | 2 |

| Executive Officers | | 4 |

| Marketing and Sales | | 1 |

| Research and Development | | 5 |

| Engineering/Technicians | | 7 |

| Operations | | 17 |

| TOTAL | | 36 |

Insurance

We maintain property insurance for our premises located in Santiago, Chile where our executive offices are located. We also maintain property insurance for our automobiles. We do not maintain business interruption insurance or key-man life insurance. We believe our insurance coverage is customary and standard of companies of comparable size in comparable industries in Chile.

We do not maintain property insurance for our MINI plants. Because of the modular nature of our MINI plant facilities and the fact that we do not erect any permanent structures at these facilities, we have determined that premiums payable for property insurance would be an inefficient use of our operating capital.

Seasonality

The price of copper on the LME fluctuates during the year, with prices tending to be stronger in the April to September period, and weaker in the October to March period, subject to global supply and demand.

13

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included herein, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We have limited operating history upon which to evaluate our potential for future success.

Our operating subsidiary, Minera, was initially formed as a closed capital corporation (sociedad anónima cerrada) on January 2, 2008 and first began processing copper from its first operational MINI plant in April, 2009. The likelihood of our success must be considered in light of the risks and uncertainties frequently encountered by early stage companies like ours in an evolving market, such as unforeseen capital requirements, failure of market acceptance, failure to establish business relationships, and competitive disadvantages as against larger and more established companies. If we are unsuccessful in addressing these risks and uncertainties, our business will be materially harmed.

If we fail to effectively manage our growth and expand our operations, our business, financial condition, results of operations and prospects could be adversely affected.

Our future success depends on our ability to expand our business. Since starting construction in the fall of 2008, we have successfully completed the first MINI plant, designated as the Ana Maria plant. Working from a former mine processing plant, we brought the updated MINI plant on-line within six months, securing permits and perfecting the technical aspects of the extraction operation. To date, we have invested US$3,008,338 in the Ana Maria plant. We have also begun preparatory work at some of the additional sites we have under our control, in anticipation of the construction of additional MINI plants over the next 18 to 24 months.

We have identified seven potential sites suitable for our MINI plants. We believe that the funds raised in connection with our recent private placement and our credit facility with AIBC described elsewhere herein will be sufficient to bring four of the sites on-line, with a planned capacity of at least 6,000 metric tons per year, bringing our total production capacity to about 7,500 metric tons by the end of 2010. The remaining three sites have the potential to expand output by 4,500 metric tons per year. Working with the eight sites we currently have under control, we believe that we could have the capacity to extract 12,000 metric tons of copper per year by the beginning of 2011, through expansion based entirely on future projected cash flows. However, our ability to establish this additional capacity and increase the volume of copper is subject to significant risks and uncertainties, including:

delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as problems with equipment vendors and manufacturing services provided by third-party manufacturers;

the inability to obtain, or delays in obtaining, required approvals by relevant government authorities;

diversion of significant management attention and other resources; and

failure to execute our expansion plan effectively.

To accommodate our growth, we will need to implement a variety of new and upgraded operational and financial systems, procedures, and controls, including improvements to our accounting and other internal management systems, by dedicating additional resources to our reporting and accounting function, and improvements to our record keeping systems. We will also need to recruit more personnel and train and manage our growing employee base. Furthermore, our management will be required to maintain and expand our relationships with our existing customer and find new customers for our products. There is no guarantee that our management can succeed in maintaining and expanding these relationships.

The expansion of our business may place significant strain on our personnel, management, financial systems, and operational infrastructure, and may impede our ability to meet any increased demand for our products. Our business growth also presents numerous risks and challenges, which are difficult to quantify but could be significant, including the costs associated with such growth.

If we encounter any of the risks described above, or if we are otherwise unable to establish or successfully operate additional capacity or increase our output, we may be unable to grow our business and revenues, reduce our operating costs, maintain our competitiveness or improve our profitability and, consequently, our business, financial condition, results of operations, and prospects will be adversely affected.

14

Extended declines in the market prices of copper could adversely affect our earnings and cash flows. Fluctuations in the market prices of copper can cause significant volatility in our financial performance and can adversely affect the trading prices of our common stock.

Our earnings and cash flows are affected significantly by the market prices of copper. The world market prices of copper have fluctuated historically and are affected by numerous factors beyond our control. Copper prices declined significantly during the latter part of 2008 from their recent historically high levels and, while prices have steadily recovered, exchange inventories remain at significantly higher levels than the first half of 2008. After averaging $3.61 per pound for the first nine months of 2008, the LME spot copper prices declined to a four-year low of $1.26 per pound in December 2008. The LME spot copper price closed at $3.37 per pound on August 9, 2010. An extended decline in the market price of copper could (1) adversely affect our earnings and cash flows, (2) adversely affect our ability to repay our debt and meet our other fixed obligations, and (3) depress the trading prices of our common stock.

In addition, substantially all of our copper cathode sales will be provisionally priced at the time of shipment, subject to final pricing at a specified future date based on the LME prices on that date. Accordingly, in times of falling copper prices, our revenues during a quarter are negatively affected by lower prices received for sales priced at current market rates and also from a decrease related to the final pricing of provisionally priced sales in prior periods.

If the market prices for the copper cathodes we produce fall below our production costs of $1.00 per pound for a sustained period of time, we may have to further revise our operating plans, including curtailing production, reducing operating costs and capital expenditures and discontinuing certain exploration and development programs. We may be unable to decrease our costs in an amount sufficient to offset reductions in revenues, and may incur losses.

World copper prices have historically fluctuated widely. During the three years ended December 31, 2008, the LME daily closing spot prices ranged from $1.26 to $4.08 per pound for copper. World copper prices are affected by numerous factors beyond our control, including:

the strength of the U.S. economy and the economies of other industrialized and developing nations, including China, which has become the largest consumer of refined copper in the world;

available supplies of copper from mine production and inventories;

sales by holders and producers of copper;

demand for industrial products containing copper;

investment activity, including speculation, in copper as a commodity;

the availability and cost of substitute materials; and

currency exchange fluctuations, including the relative strength or weakness of the U.S. dollar.

Disruptions in the capital and credit markets related to the current national and worldwide financial crisis, which may continue indefinitely or intensify, could adversely affect our results of operations, cash flows and financial condition, or those of our customers and suppliers.

The current disruptions in the capital and credit markets may continue indefinitely or intensify, and adversely impact our results of operations, cash flows and financial condition, or those of our customers and suppliers. Disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect our access to liquidity needed to conduct or expand our businesses or conduct acquisitions or make other discretionary investments, as well as our ability to effectively hedge our currency or interest rate. Such disruptions may also adversely impact the capital needs of our customers and suppliers, which, in turn, could adversely affect our results of operations, cash flows and financial condition.

We may require additional capital and we may not be able to obtain it on acceptable terms or at all.

We believe that our current cash and cash flow from operations will be sufficient to meet our present cash needs. We may, however, require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If these resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

15

investors’ perception of, and demand for, securities of Chilean-based companies involved in the mining sector;

conditions of the U.S. and other capital markets in which we may seek to raise funds;

our future results of operations, financial condition and cash flows; and

economic, political and other conditions in Chile.

Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could have a material adverse effect on our business, financial condition and results of operations.

Our business is subject to operational risks that are generally outside of our control and could adversely affect our business.

Mineral reclamation sites, like the sites where we will locate our MINI plants, by their nature are subject to many operational risks and factors that are generally outside of our control and could adversely affect our business, operating results and cash flows. These operational risks and factors include the following:

unanticipated ground and water conditions;

adverse claims to water rights and shortages of water to which we have rights;

adjacent land ownership that results in constraints on current or future operations;

geological problems, including earthquakes and other natural disasters;

metallurgical and other processing problems;

the occurrence of unusual weather or operating conditions and other force majeure events;

lower than expected ore grades or recovery rates;

accidents;

delays in the receipt of or failure to receive necessary government permits;

the results of litigation, including appeals of agency decisions;

uncertainty of exploration and development;

delays in transportation;

interruption of energy supply;

labor disputes;

inability to obtain satisfactory insurance coverage; and

the failure of equipment or processes to operate in accordance with specifications or expectations.

Continuation of our production is dependent on the availability of a sufficient water supply to support our operations.

Our operations require significant quantities of water for mineral reclamation, ore processing and related support facilities. Our operations are in areas where water is scarce and competition among users for continuing access to water is significant. Continuous production is dependent on our ability to maintain our water rights and claims and defeat claims adverse to our current water uses in legal proceedings.

Although each of our sites currently has sufficient water rights and claims to cover its operational demands, we cannot predict the potential outcome of pending or future legal proceedings on our water rights, claims and uses. The loss of some or all water rights for any of our sites, in whole or in part, or shortages of water to which we have rights could require us to curtail or shut down production and could prevent us from pursuing expansion opportunities. Additionally, we have not yet secured adequate water rights to support all of our potential expansion projects, and our inability to secure those rights could prevent us from pursuing some of those opportunities.

An interruption of energy supply could adversely affect our operations and increased production costs could reduce our profitability and cash flow.

Our operations and development projects require significant amounts of energy. Our principal energy source is electricity. We access electricity from the national power grid and through onsite backup generators that are diesel powered. A disruption in the transmission of energy, inadequate energy transmission infrastructure, or the termination of any of our energy supply contracts could interrupt our energy supply and adversely affect our operations.

16

Electricity represents a significant portion of our production costs. An inability to procure sufficient electricity at reasonable prices could adversely affect our profits, cash flow and growth opportunities. Our production costs are also affected by the prices of commodities we consume or use in our operations, such as sulfuric acid, steel, reagents, liners, explosives and diluents. The prices of such commodities are influenced by supply and demand trends affecting the mining industry in general and other factors outside our control and such prices are at times subject to volatile movements. Future increases in the cost of these commodities could make our operations less profitable. Increases in the costs of commodities that we consume or use may also significantly affect the capital costs of new projects.

We could incur substantial costs in order to comply with, or to address any violations under, environmental laws that could significantly increase our operating expenses and reduce our operating income.

We are subject to Chile’s comprehensive statutory and regulatory environmental requirements relating to, among others:

the protection of our employees’ health and safety;

the acceptance, storage, treatment, handling and disposal of hazardous waste;

the discharge of materials into the air;

the management and treatment of wastewater and storm water;

the remediation of soil and groundwater contamination; and

the restoration of natural resource damages.

We believe that we are currently in material compliance with applicable statutes and regulations governing the protection of human health and the environment, including employee health and safety. We can give you no assurance, however, that we will continue to be in material compliance or avoid fines, penalties and expenses associated with compliance issues in the future.

We are required to obtain, and must comply with, a specific resolution of the Chilean Ministry of Health issued to us in order to conduct our operations. Failure to comply with the resolution, or violations thereto if not remedied, could result in our incurring fines. Further, our operations are conducted primarily outdoors and as such, depending on the nature of the ground cover, could involve the risk of releases of wastes and other regulated materials to the soil during transportation and, possibly, to the groundwater.

In Chile, environmental statutes and regulations have changed rapidly in recent years by requiring greater and more expensive protective measures, and it is possible that we will be subject to more stringent environmental standards in the future. For these reasons and others, we cannot accurately predict future capital expenditures for pollution control equipment, remediation, or other initiatives that may be required. However, we expect that environmental standards will become increasingly more stringent and that the expenditures necessary to comply with those heightened standards will correspondingly increase.

In general, we do not carry environmental impairment liability insurance because we believe the cost of any premiums outweighs the benefit of coverage and that the current legal regime applicable to our operations protects us from any significant liability. If, however, we were to incur significant liability for environmental damage, such as a claim for soil or groundwater remediation, our results of operations and financial condition could be materially and adversely affected.

We depend heavily on key personnel and turnover of key employees and senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including Messrs. Jorge Osvaldo Orellana Orellana, our Chairman, Chief Executive Officer and President; Jose Luis Munoz Aviles, our Chief Financial Officer; and Alain Orellana Sejas, our Chief Operating Officer. They also depend in significant part upon our ability to attract and retain additional qualified management, technical, operational and support personnel for our operations. If we lose a key employee, if a key employee fails to perform in his or her current position, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantly deplete the institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing our business and could be harmed by turnover in the future.

17

Certain of our existing stockholders have substantial influence over our company, and their interests may not be aligned with the interests of our other stockholders.

Mr. Jorge Osvaldo Orellana Orellana, our Chairman, Chief Executive Officer and President, beneficially owns approximately 41.52% of our outstanding voting securities. As a result, he has significant influence over our business, including decisions regarding mergers, consolidations, the sale of all or substantially all of our assets, election of directors and other significant corporate actions. This concentration of ownership may also have the effect of discouraging, delaying or preventing a future change of control, which could deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our Company and might reduce the price of our shares.

We may be exposed to potential risks relating to our internal controls over financial reporting.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. We were not subject to these requirements for the fiscal year ended March 31, 2010, and accordingly we have not evaluated our internal control systems in order to allow our management to report on our internal controls as required by these requirements of SOX 404. Under current law, we will be subject to these requirements beginning with our annual report for the fiscal year ended March 31, 2011. We can provide no assurance that we will comply with all of the requirements imposed thereby. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner, investors and others may lose confidence in the reliability of our financial statements.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

We have a working capital deficit of $1,735,072 and have incurred a net loss of $1,842,036 for the cumulative period from January 24, 2008 (inception) to March 31, 2010, and have had no significant source of revenue. The future of our company is dependent upon future profitable operations from the production of copper and the development of our mineral properties. While our recent private placement generated enough capital to sustain our planned operations for the next 12 months, our management may need to seek additional financing in the future. These conditions raise substantial doubt about our company’s ability to continue as a going concern. Although there are no assurances that our plans will be realized, our management believes that we will be able to continue operations in the future.

RISKS RELATED TO DOING BUSINESS IN CHILE

Chilean political and economic conditions have a direct impact on our business.

All of our assets are located in Chile and all of our revenues are derived in Chile. Accordingly, our business, financial condition and results of operations depend to a considerable extent upon economic conditions in Chile. Future developments in the Chilean economy could adversely affect our financial condition or results of operations and may impair our ability to proceed with our strategic plan of business. In addition, such developments may impact the market price of our securities.

The Chilean government has exercised and continues to exercise a substantial influence over many aspects of the private sector and has changed monetary, fiscal, tax and other policies to influence the Chilean economy. We have no control over and cannot predict how governmental intervention and policies will affect the Chilean economy or, directly and indirectly, our operations and revenues. Our operations and financial condition, as well as the market price of our securities, may be adversely affected by changes in policies involving exchange controls, taxation, and other matters. In addition, our operations and financial condition, as well as the market price of our securities, may be adversely affected by factors such as:

fluctuations in currency exchange rates;

base interest rate fluctuations; and

other political, diplomatic, social and economic developments in or affecting Chile.

Additionally, in recent years the growth of the Chilean economy has slowed from the rates achieved in the 1990s. We cannot predict whether the Chilean economy will grow or decline in the future or if future developments in the Chilean economy will materially adversely affect our business, financial condition or results of operations.

18

Your ability to enforce civil remedies against our officers and directors in Chile may be limited.

Our operating subsidiary, Minera, is a closed capital corporation (sociedad anónima cerrada), organized under the laws of Chile. All of our directors and executive officers reside outside the United States in Chile, or in the case of Mr. McLean, Canada, and all of our assets and the assets of these persons are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States on, or bring actions or enforce foreign judgments against, us or these persons in U.S. courts.

In addition, we have been advised by our Chilean legal counsel, Guevara & Cia, that no treaty exists between the United States and Chile for the reciprocal enforcement of foreign judgments. There is also doubt as to the enforceability in Chilean courts of judgments of U.S. courts obtained in actions predicated upon the civil liability provisions of the U.S. federal securities laws. Chilean courts, however, have enforced judgments rendered in the United States by virtue of the legal principles of reciprocity and comity, subject to the review in Chile of the U.S. judgment in order to ascertain whether certain basic principles of due process and public policy have been respected, without reviewing the merits of the subject matter of the case. Lastly, we have been advised by our Chilean legal counsel that there is doubt as to the enforceability in original actions in Chilean courts of liabilities predicated solely upon U.S. federal securities laws.

RISKS RELATED TO THE MARKET FOR OUR STOCK

The market price of our common stock is volatile, leading to the possibility of its value being depressed at a time when you may want to sell your holdings.

The market price of our common stock can become volatile. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include:

our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors;

changes in financial estimates by us or by any securities analysts who might cover our stock;

speculation about our business in the press or the investment community;

significant developments relating to our relationships with our customers or suppliers;