- TLPH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Talphera (TLPH) DEF 14ADefinitive proxy

Filed: 20 Jun 14, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |||

AcelRx Pharmaceuticals, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement if Other Than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box) | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| ||||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| ||||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| ||||

| 5. | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 6. | Amount Previously Paid:

| |||

| ||||

| 7. | Form, Schedule or Registration Statement No.:

| |||

| ||||

| 8. | Filing Party:

| |||

| ||||

| 9. | Date Filed:

| |||

| ||||

ACELRX PHARMACEUTICALS, INC.

351 Galveston Drive

Redwood City, CA 94063

650-216-3500

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On July 24, 2014

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders ofACELRX PHARMACEUTICALS, INC., a Delaware corporation (the “Company”). The meeting will be held on Thursday, July 24, 2014 at 12:00 p.m. local time at our principal office located at 351 Galveston Drive, Redwood City, California 94063 for the following purposes:

| 1. | To elect the Board’s two nominees for director, to hold office until the 2017 Annual Meeting of Stockholders. |

| 2. | To ratify the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2014. |

| 3. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is June 9, 2014. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on Thursday, July 24, 2014 at 12:00 p.m. local time at our principal office located at 351 Galveston Drive, Redwood City, California 94063.

The proxy statement and annual report to stockholders

are available athttps://materials.proxyvote.com/00444T.

| By Order of the Board of Directors |

/s/ Adrian Adams |

| Adrian Adams |

| Chairman |

Redwood City, California

June 20, 2014

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

| Page | ||||

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING | 1 | |||

| 6 | ||||

PROPOSAL NO. 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 9 | |||

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | 11 | |||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

Potential Payments Upon Termination or Change of Control for each Named Executive Officer | 32 | |||

| 33 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 35 | |||

| 37 | ||||

| 38 | ||||

| 39 | ||||

Policies and Procedures for Review of Related Party Transactions | 39 | |||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

ACELRX PHARMACEUTICALS, INC.

351 Galveston Drive

Redwood City, CA 94063

PROXY STATEMENT

FOR THE 2014 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors of AcelRx Pharmaceuticals, Inc. (sometimes referred to as the “Company” or “AcelRx”) is soliciting your proxy to vote at the 2014 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or through the internet.

We intend to mail these proxy materials on or about June 20, 2014 to all shareholders of record entitled to vote at the Annual Meeting.

How do I attend the Annual Meeting?

The meeting will be held on Thursday, July 24, 2014 at 12:00 p.m. local time at 351 Galveston Drive Redwood City, CA 94063. Directions to the Annual Meeting may be found atwww.acelrx.com. Information on how to vote in person at the Annual Meeting is discussed below.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on June 9, 2014 will be entitled to vote at the Annual Meeting. On this record date, there were 43,368,762 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on June 9, 2014 your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on June 9, 2014 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

1

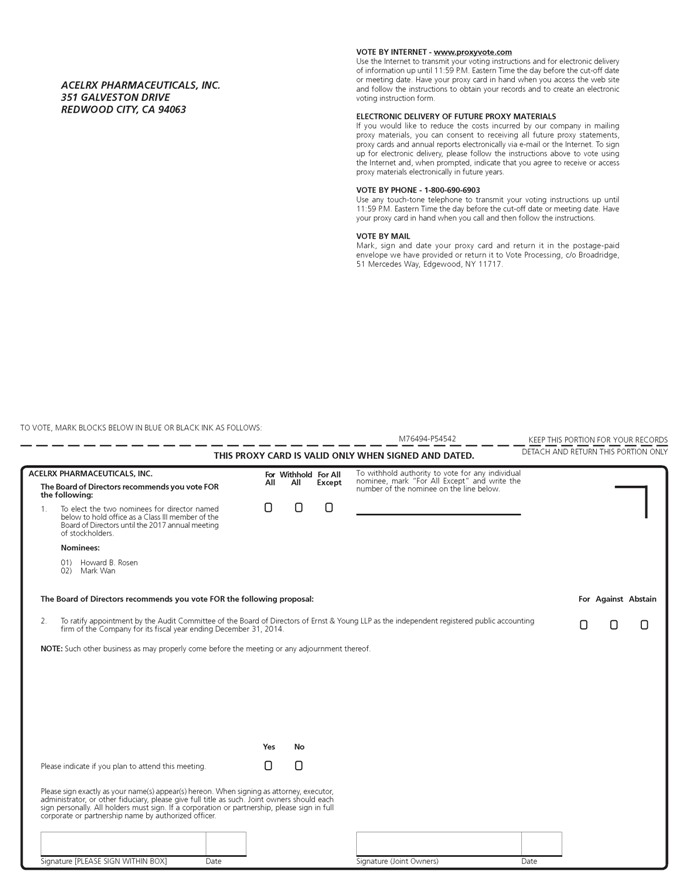

What am I voting on?

There are two matters scheduled for a vote:

| • | Election of two directors (Proposal 1); and |

| • | Ratification of selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as independent registered public accounting firm of the Company for its fiscal year ending December 31, 2014 (Proposal 2). |

What are the Board’s voting recommendations?

The Board of Directors recommends that you vote your shares:

| • | “For” each of the nominees named below for director to hold office until the 2017 annual meeting of stockholders (Proposal 1). |

| • | “For” the ratification of selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as independent registered public accounting firm of the Company for its fiscal year ending December 31, 2014 (Proposal 2). |

What if another matter is properly brought before the Annual Meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a shareholder of record, you may vote in person at the Annual Meeting or vote by proxy using the enclosed proxy card or vote by proxy over the telephone, or vote by proxy through the internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

| • | To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. |

| • | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

| • | To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m., Pacific Time on July 23, 2014 to be counted. |

| • | To vote through the internet, go to http://www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m., Pacific Time on July 23, 2014 to be counted. |

2

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a voting instruction form with these proxy materials from that organization rather than from AcelRx. Simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of June 9, 2014.

What if I return a proxy card or otherwise vote but do not make specific choices?

Shareholder of Record: Shares Registered in Your Name

If you are a stockholder of record and you indicate when voting on the internet or by telephone that you wish to vote as recommended by the board of directors, which recommendations are set forth under “What are the board’s voting recommendations?” above, or if you sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by the Board of Directors on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares held in “street name” and you do not provide the organization that holds your shares with specific instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform our inspector of elections that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” When our inspector of elections tabulates the votes for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not be counted toward the vote total for any proposal. We encourage you to provide voting instructions to the organization that holds your shares to ensure that your vote is counted on both proposals.

Which proposals are considered “routine” or “non-routine”?

The ratification of selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as independent registered public accounting firm of the Company for its fiscal year ending December 31, 2014 (Proposal 2) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected on Proposal 2.

The election of directors (Proposal 1) is considered a non-routine matter under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore we expect broker non-votes on Proposal 1.

3

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may grant a subsequent proxy by telephone or through the internet. |

| • | You may send a timely written notice that you are revoking your proxy to AcelRx’s Secretary at 351 Galveston Drive, Redwood City, CA 94063. |

| • | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes and, with respect to the other proposal, votes “For” and “Against” and abstentions. Broker non-votes have no effect and will not be counted towards the vote total for the proposal to elect directors.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange (“NYSE”), “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested) and executive compensation, including the

4

advisory stockholders vote on executive compensation. Of the two proposals, only Proposal No. 2, the ratification of the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent auditors of AcelRx for its fiscal year ending December 31, 2014, is a “routine” matter; the election of directors proposal is “non-routine.”

How many votes are needed to approve each proposal?

| • | Proposal No. 1: For the election of directors, the two nominees receiving the most “For” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” or “Withheld” will affect the outcome. |

| • | Proposal No. 2: Ratification of the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2014, must receive “For” votes from the holders of a majority of shares present in person or by proxy and entitled to vote. If you “Abstain” from voting, it will have the same effect as an “Against” vote. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 43,368,762 shares outstanding and entitled to vote. Thus, the holders of 21,684,381 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the internet?

The proxy statement, Form 10-K and annual report to stockholders are available athttps://materials.proxyvote.com/00444T.

5

ELECTION OF DIRECTORS

CLASSIFIED BOARD

Our Board of Directors is divided into three classes. Two classes consist of three directors and one class consists of two directors. Each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board of Directors presently has eight members. There are two directors in the class whose term of office expires in 2014. Each of the nominees listed below was previously elected by the stockholders. If elected at the Annual Meeting, each of these nominees would serve until the 2017 Annual Meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is the Company’s policy to encourage directors and nominees for director to attend the Annual Meeting.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. The two nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead will be voted for the election of a substitute nominee proposed by AcelRx. Each person nominated for election has agreed to serve if elected. The Company’s management has no reason to believe that any nominee will be unable to serve.

The following is a brief biography of each nominee and each director whose term will continue after the Annual Meeting. The biographies below also include a discussion of the specific experience, qualifications, attributes or skills of each nominee that led the Nominating and Corporate Governance Committee and the Board to conclude, as of the date of this proxy statement, that each nominee for Class III director should continue to serve as a director.

CLASS III NOMINEESFOR ELECTIONFORA THREE-YEAR TERM EXPIRINGATTHE 2017 ANNUAL MEETING

Howard B. Rosen, age 56, has served as our director since 2008. Since 2008, Mr. Rosen has served as a consultant to several companies in the biotechnology industry. He has also served as a lecturer at Stanford University in Chemical Engineering since 2008 and in Management since 2011. Mr. Rosen served as interim President and Chief Executive Officer of Pearl Therapeutics, Inc., a company focused on developing combination therapies for the treatment of highly prevalent chronic respiratory diseases, from June 2010 to March 2011. From 2004 to 2008, Mr. Rosen was Vice President of Commercial Strategy at Gilead Sciences, Inc., a biopharmaceutical company. Mr. Rosen was President of ALZA Corporation, a pharmaceutical and medical systems company that merged with Johnson & Johnson, a global healthcare company, in 2001, from 2003 until 2004. Prior to that, from 1994 until 2003, Mr. Rosen held various positions at ALZA Corporation. Mr. Rosen is a member of the board of directors of Alcobra, Ltd., a public pharmaceutical company. Mr. Rosen is also a member of the board of directors of a number of private biotechnology companies as follows: PaxVax, Inc., Entrega, Inc., Kala Pharmaceuticals, Inc. and ALDEA Pharmaceuticals. Mr. Rosen holds a B.S. in Chemical Engineering from Stanford University, an M.S. in Chemical Engineering from the Massachusetts Institute of Technology and an M.B.A. from the Stanford Graduate School of Business. Mr. Rosen’s experience in the biopharmaceutical industry, including his specific experience with commercialization of pharmaceutical products, provides him with the qualifications and skills to serve as a director.

Mark Wan, age 49, has served as our director since August 2006. Mr. Wan is a founding managing director of Causeway Media Partners, a private investment firm. He is also a founding general partner of Three Arch Partners, a venture capital firm. Prior to co-founding Three Arch Partners in 1993, Mr. Wan was a general

6

partner at Brentwood Associates, a private equity firm from 1987 until 1993. Mr. Wan currently serves on the board of directors of QT Vascular Ltd., a public Singapore-based medical device company. From 1999 until its acquisition by athenahealth, Inc., in March 2013, Mr. Wan served on the board of directors of Epocrates, Inc., a company focused on providing mobile drug reference tools. Mr. Wan also serves on the board of directors of numerous private companies. Mr. Wan holds a B.S. in Engineering from Yale University and an M.B.A. from the Stanford Graduate School of Business. Mr. Wan’s financial experience and extensive knowledge of our company provides him with the qualifications and skills to serve as a director.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

Set forth below is a brief biography of each continuing director composing the remainder of the Board with terms expiring as shown, including their ages, and information furnished by them as to principal occupations and public company directorships held by them. The biographies below also include a discussion of the specific experience, qualifications, attributes or skills of each continuing director that led the Nominating and Corporate Governance Committee and the Board to conclude, as of the date of this Proxy Statement, that the applicable director should continue to serve as a director.

CLASS I DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2015 ANNUAL MEETING

Adrian Adams, age 63, has served as our Chairman since February 2013. Mr. Adams has been Chief Executive Officer and President of Auxilium Pharmaceuticals Inc. since December 2011. Prior to joining Auxilium, from September 2011 until November 2011, Mr. Adams served as Chairman and Chief Executive Officer of Neurologix, a company focused on development of multiple innovative gene therapy development programs. Before Neurologix, Mr. Adams served as President and Chief Executive Officer of Inspire Pharmaceuticals, Inc., where he oversaw the commercialization and development of prescription pharmaceutical products and led the company through a strategic acquisition by global pharmaceutical leader Merck & Co., Inc. in May 2011. Prior to Inspire, Mr. Adams served as President and Chief Executive Officer of Sepracor Inc. from December 2006 until February 2010, when it was acquired by Dainippon Sumitomo Pharma Co. Prior to joining Sepracor, Mr. Adams was President and Chief Executive Officer of Kos Pharmaceuticals, Inc. from 2002 until the acquisition of the company by Abbott Laboratories in December 2006. Mr. Adams graduated from the Royal Institute of Chemistry at Salford University in the U.K. Mr. Adams has extensive national and international experience and has been instrumental in launching major global brands in addition to driving successful corporate development activities encapsulating financing, product and company acquisitions, in-licensing and company M&A activities, all of which provide him with the qualifications and skills to serve as a director.

Richard Afable, M.D., age 60, has served as our director since December 2013. Since February 2013, Dr. Afable has been the Chief Executive Officer of Covenant Health Network, based in Irvine, California, a non-profit healthcare delivery system formed through the affiliation of Hoag Memorial Hospital Presbyterian and St. Joseph Health System. Prior to Covenant Health Network, Dr. Afable served as the President and Chief Executive of Hoag Memorial Hospital Presbyterian from 2005 to 2013. Prior to Hoag Memorial Hospital Presbyterian, Dr. Afable served as the Chief Medical Officer of Catholic Health East from 1999 to 2005. He earned a B.S. in biology, an M.D. degree from Loyola University of Chicago, and a Masters in Public Health from the University of Illinois at Chicago. Dr. Afable’s scientific, financial and business expertise, including his experience as an executive officer in the health care industry, provides him with the qualifications and skills to serve as a director.

Mark G. Edwards,age 56, has served as our director since September 2011. Mr. Edwards is Managing Director of Bioscience Advisors Inc., a biopharmaceutical consulting firm he founded in 2011. From July 2008 until December 2010, he was Managing Director and a Principal of Deloitte Recap LLC, a wholly-owned subsidiary of Deloitte Touche Tohmatsu, an audit and financial consulting services firm. Mr. Edwards was previously the Managing Director and founder of Recombinant Capital, Inc. (Recap), a consulting and database firm based in

7

Walnut Creek, California, from 1988 until the sale of Recap to Deloitte in 2008. Prior to founding Recap in 1988, Mr. Edwards was Manager of Business Development at Chiron Corporation, a biotechnology company. He received his B.A. and M.B.A. degrees from Stanford University. Mr. Edwards’ financial and business expertise, including his background as a business advisor to pharmaceutical and biotechnology companies, provides him with the qualifications and skills to serve as a director.

CLASS II DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2016 ANNUAL MEETING

Stephen J. Hoffman, Ph.D., M.D., age 60, has served as our director since February 2010. Dr. Hoffman has been a Senior Advisor to PDL BioPharma, Inc. since February 2014. Prior to that he served as a managing director at Skyline Ventures, a venture capital firm, from May 2007 until February 2014. From January 2003 to March 2007, Dr. Hoffman was a general partner at TVM Capital, a venture capital firm. Prior to that, he served as President, Chief Executive Officer and a director of Allos Therapeutics, a biopharmaceutical company, from 1994 to 2002. From 1990 to 1994, Dr. Hoffman completed a fellowship in clinical oncology and a residency/fellowship in dermatology, both at the University of Colorado. Dr. Hoffman was the scientific founder of Somatogen Inc., a biotechnology company that was acquired by Baxter International, Inc., a global medical products and services company, in 1998, where he held the position of Vice President of Science and Technology from 1987 until 1990. He currently serves on the board of directors of Dicerna Pharmaceuticals, Inc. and Genocea Biosciences, Inc. Previously, Dr. Hoffman also served on the board of directors of Allos Therapeutics, Inc., a biopharmaceutical company that was acquired by Spectrum Pharmaceuticals, Inc. Dr. Hoffman holds a Ph.D. in bio-organic chemistry from Northwestern University and an M.D. from the University of Colorado School of Medicine. Dr. Hoffman’s scientific, financial and business expertise, including his diversified background as an executive officer and investor in public pharmaceutical companies, provides him with the qualifications and skills to serve as a director.

Richard A. King, age 49, has served as our director and President and Chief Executive Officer since May 2010. From April 2009 until May 2010, Mr. King acted as an independent consultant to a number of private and public biotechnology and venture capital companies. From October 2008 to April 2009, Mr. King served as President and General Manager of Tercica, Inc., a biotechnology company that was acquired by Ipsen, SA in 2008, and from February 2008 to October 2008, Mr. King served as President and Chief Operating Officer of Tercica, Inc., and from February 2007 until February 2008, he served as Chief Operating Officer of Tercica, Inc. From January 2002 to October 2006, Mr. King served as Executive Vice President of Commercial Operations of Kos Pharmaceuticals, Inc., a pharmaceutical company that was acquired by Abbott Laboratories, a global, broad-based health care company, in 2006. From January 2000 to January 2002, Mr. King served as Senior Vice President of Commercial Operations at Solvay Pharmaceuticals, a pharmaceutical company that was acquired by Abbott Laboratories in 2009. From April 1992 to January 2000, Mr. King held various marketing positions at SmithKline Beecham Pharmaceuticals, now known as GlaxoSmithKline, a global pharmaceutical company. Mr. King holds a B.Sc. in Chemical Engineering from University of Surrey and an M.B.A. from Manchester Business School. Mr. King’s extensive experience as an executive officer of public pharmaceutical companies and his knowledge of the day-to-day operations of our company provide him with the qualifications and skills to serve as a director.

Pamela P. Palmer, M.D., Ph.D., age 51, has served as our director and Chief Medical Officer since she co-founded the company in July 2005. Dr. Palmer has been on faculty at the University of California, San Francisco since 1996 and is currently a Clinical Professor of Anesthesia and Perioperative Care. Dr. Palmer was Director of UCSF PainCARE-Center for Advanced Research and Education from 2005 to 2009, and was Medical Director of the UCSF Pain Management Center from 1999 to 2005. Dr. Palmer has been a consultant of Omeros Corporation, a biopharmaceutical company, since she co-founded that company in 1994. Dr. Palmer holds an M.D. from Stanford University and a Ph.D. from the Stanford Department of Neuroscience. Dr. Palmer’s extensive clinical and scientific experience in the treatment of acute and chronic pain as well as historical knowledge of our company provides her with the qualifications and skills to serve as a director.

8

RATIFICATIONOF SELECTIONOF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014, and has further directed that management submit the selection of independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Ernst & Young LLP has audited the Company’s financial statements for fiscal 2011, 2012 and 2013. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of Ernst & Young LLP. Abstentions will be counted toward the tabulation of votes on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

PRINCIPAL ACCOUNTANT FEESAND SERVICES

The following table represents aggregate fees for the fiscal years ended December 31, 2013 and 2012 for professional services rendered by Ernst & Young LLP, our independent registered public accounting firm:

| Fiscal Year Ended | ||||||||

| 2013 | 2012 | |||||||

Audit Fees | $ | 843,875 | $ | 616,375 | ||||

Audit-Related Fees | — | — | ||||||

Tax Fees | — | — | ||||||

All Other Fees | — | — | ||||||

|

|

|

| |||||

Total Fees | $ | 843,875 | $ | 616,375 | ||||

Audit Fees:Consists of fees for professional services rendered for the audit of our financial statements and internal controls over financial reporting, review of interim financial statements and fees for assistance with registration statements filed with the SEC, comfort letters and services that are normally provided by Ernst & Young LLP in connection with statutory and regulatory filings or engagements. Fees for the 2013 audit and 2013 quarterly reviews of financial statements were $795,000. Fees for the 2012 audit and the 2012 quarterly reviews of financial statements were $435,000.

Pre-Approval Policies and Procedures

Our Audit Committee pre-approves all audit and permissible non-audit services provided by Ernst & Young LLP. These services may include audit services, audit-related services, tax services and other services. Pre-approval may be given as part of the Audit Committee’s approval of the scope of the engagement of the independent registered public accounting firm or on an individual explicit case-by-case basis.

9

In connection with the audit of our 2013 financial statements, we entered into an engagement agreement with Ernst & Young LLP which sets forth the terms by which Ernst & Young LLP will perform audit and interim services for us. That agreement is subject to alternative dispute resolution procedures and an exclusion of punitive damages.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

10

INFORMATION REGARDINGTHE BOARDOF DIRECTORSAND CORPORATE GOVERNANCE

INDEPENDENCEOF THE BOARDOF DIRECTORS

Under the rules of the NASDAQ Stock Market, LLC, or NASDAQ, “independent” directors must comprise a majority of a listed company’s board of directors within a specified period following that company’s listing date in conjunction with its initial public offering (“IPO”). In addition, applicable NASDAQ rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating committees be independent within the meaning of applicable NASDAQ rules. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act.

Our Board of Directors undertook a review of the independence of each director and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board of Directors determined that all of our directors, other than Mr. King, Dr. Palmer and Mr. Schreck, who resigned from the Board of Directors in February 2013, qualify as “independent” directors within the meaning of the NASDAQ rules. Accordingly, a majority of our directors are independent, as required under applicable NASDAQ rules. In making this determination, our Board of Directors considered Mr. Nohra’s affiliation with Alta Partners, one of our stockholders, (Mr. Nohra resigned from our Board of Directors on December 10, 2013), Dr. Hoffman’s affiliation through February 2014 with Skyline Ventures, one of our stockholders, and Mr. Wan’s affiliation with Three Arch Partners, also one of our stockholders. Our non-employee directors have been meeting, and we anticipate that they will continue to meet, in regularly scheduled executive sessions at which only non-employee directors are present.

Our Board of Directors has a Chairman, Mr. Adams since February 2013, and Mr. Schreck, who served in that role since 2005 until his resignation in February 2013, who has authority, among other things, to preside over Board meetings, including meetings of the independent directors. Accordingly, the Chairman has substantial ability to shape the work of our Board. The Company believes that separation of the roles of Chairman and Chief Executive Officer reinforces the independence of our Board in its oversight of the business and affairs of the Company. However, no single leadership model is right for all companies and at all times. Our Board recognizes that depending on the circumstances, other leadership models, such as combining the role of Chairman with the role of Chief Executive Officer, might be appropriate. Accordingly, the Board may periodically review its leadership structure.

ROLEOFTHE BOARDIN RISK OVERSIGHT

Our Board is generally responsible for the oversight of corporate risk in its review and deliberations relating to our activities and has determined that our principal source of risk falls into two categories, financial and product development. The Audit Committee oversees management of financial risks; our Board regularly reviews information regarding our cash position, liquidity and operations, as well as the risks associated with each. The Board regularly reviews plans, results and potential risks related to our lead therapeutic development programs and other preclinical programs as well as financial and strategic risk related to our operations.

In addition, our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines and policies and manages risks associated with the independence of the Board and potential conflicts of interest. Our Compensation Committee oversees risk management as it relates to our compensation plans, policies and practices for all employees including executives particularly whether our compensation programs may create incentives for our employees to take excessive or inappropriate risks which could have a material adverse effect on the Company. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks.

11

MEETINGSOF THE BOARDOF DIRECTORS

The Board of Directors met 13 times during the last fiscal year. All directors attended at least 75% of the aggregate number of meetings of the Board and of the committees on which they served held during the portion of the last fiscal year for which they were directors, with the exception of Mr. Nohra.

We do not have a formal policy regarding attendance by members of our Board at annual meetings of stockholders; however, directors are encouraged to attend all such meetings. In 2013, three of our eight directors attended the 2013 Annual Meeting of Stockholders.

INFORMATION REGARDING COMMITTEESOFTHE BOARDOF DIRECTORS

The Board has three committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which has the composition and responsibilities described below.

Audit Committee

The Audit Committee of the Board of Directors was established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several functions. The Audit Committee evaluates the performance of and assesses the qualifications of the independent auditors; determines and approves the engagement of the independent auditors; determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent auditors on the Company’s audit engagement team as required by law; reviews and approves or rejects transactions between the Company and any related persons; confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and meets to review the Company’s annual audited financial statements and quarterly financial statements with management and the independent auditor, including a review of the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The Audit Committee is composed of three directors: Messrs. Edwards and Rosen and Dr. Hoffman, each of whom in a non-employee member of our board of directors. The Audit Committee met five times during the fiscal year. The Audit Committee has adopted a written charter that is available to stockholders on the Company’s website atwww.acelrx.com.

The Board of Directors reviews the NASDAQ listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule 5605(c)(2)(A)(i) and (ii) of the NASDAQ listing standards).

In addition, our Board of Directors has determined that each of the directors serving on our audit committee meets the requirements for financial literacy under applicable rules and regulations of the SEC and NASDAQ. Our Board has also determined that Mr. Edwards qualifies as an “audit committee financial expert” within the meaning of SEC regulations. In making this determination, our Board considered the overall knowledge, experience and familiarity of Mr. Edwards with accounting matters, in analyzing and evaluating financial

12

statements and in managing private equity investments. Mr. Edwards serves as the Chairman of the Audit Committee. The composition of the audit committee satisfies the independence and other requirements of NASDAQ and the SEC.

Compensation Committee

The Compensation Committee was composed of two directors: Messrs. Nohra and Wan from January 1, 2013 through February 10, 2013. On February 11, 2013, Mr. Adams joined the Compensation Committee and it was then comprised of three directors. From January 1, 2013 until his resignation on December 11, 2013, Mr. Nohra served as Chairman of the Compensation Committee. Since December 11, 2013, the Compensation Committee has been comprised of three directors: Dr. Afable and Messrs. Wan and Adams, with Mr. Wan serving as Chairman of the Compensation Committee from December 11, 2013 through May 6, 2014 and Dr. Afable serving as the Chairman of the Compensation Committee since that time. All members of the Company’s Compensation Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ listing standards). The Compensation Committee met twice during the fiscal year. The Compensation Committee has adopted a written charter that is available to stockholders on the Company’s website atwww.acelrx.com.

The Compensation Committee of the Board of Directors acts on behalf of the Board to review, recommend for adoption and oversee the Company’s compensation strategy, policies, plans and programs, including:

| • | approving or recommending for approval to our Board of Directors the compensation and other terms of employment of our executive officers; |

| • | approving or recommending to our Board of Directors performance goals and objectives relevant to the compensation of our executive officers and assessing their performance against these goals and objectives; |

| • | evaluating and approving the equity incentive plans, compensation plans and similar programs, as well as modification or termination of existing plans and programs; |

| • | evaluating and recommending to our Board of Directors the type and amount of compensation to be paid or awarded to Board members; |

| • | administering our equity incentive plans; |

| • | establishing policies with respect to equity compensation arrangements; |

| • | recommending to our Board of Directors compensation-related proposals to be considered at our annual meetings, including the frequency of advisory votes on executive compensation; |

| • | reviewing and discussing with our management any conflicts of interest raised by the work of any compensation consultants; |

| • | reviewing the competitiveness of our executive compensation programs and evaluating the effectiveness of our compensation policy and strategy in achieving expected benefits to us; |

| • | approving or recommending to our Board of Directors the terms of any employment agreements, severance arrangements, change in control protections and any other compensatory arrangements for our executive officers; |

| • | reviewing with management our disclosures under the caption “Compensation Discussion and Analysis,” and recommending to the full Board its inclusion in our reports to be filed with the SEC; |

| • | preparing the Compensation Committee report, for our annual proxy statement; |

| • | reviewing the adequacy of our Compensation Committee charter on a periodic basis; and |

| • | reviewing and evaluating, at least annually, the performance of the Compensation Committee and its charter. |

13

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company (consistent with criteria approved by the Board), reviewing and evaluating incumbent directors, recommending to the Board for selection candidates for election to the Board of Directors, making recommendations to the Board regarding the membership of the committees of the Board, and assessing the performance of the Board.

The Nominating and Corporate Governance Committee was composed of three directors: Dr. Hoffman and Messrs. Schreck and Wan, from January 1, 2013 through February 11, 2013, when Mr. Adams joined the Nominating and Corporate Governance Committee. Since that time, the Nominating and Corporate Governance Committee has been comprised of three directors: Dr. Hoffman and Messrs. Wan and Adams. Mr. Wan serves as Chairman of the Nominating and Corporate Governance Committee. Our Board of Directors has determined that Dr. Hoffman and Messrs. Wan and Adams are independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ listing standards). The Nominating and Corporate Governance Committee met once and acted once by written consent during fiscal 2013. The Nominating and Corporate Governance Committee has adopted a written charter that is available to stockholders on the Company’s website andwww.acelrx.com.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, age, skills and such other factors as it deems appropriate given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for NASDAQ purposes, which determination is based upon applicable NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote.

The Nominating and Corporate Governance Committee of the board of directors, to date, has not adopted a formal policy with regard to the consideration of director candidates recommended by stockholders and will consider director candidates recommended by stockholders on a case-by-case basis, as appropriate. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. To date, the Nominating and Corporate Governance Committee has not received any such nominations nor has it rejected a director nominee from a stockholder or stockholders holding more than 5% of our voting stock. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by

14

delivering a written recommendation to our Secretary at the following address: 351 Galveston Drive, Redwood City, CA 94063, at least 120 days prior to the anniversary date of the mailing of the Company’s proxy statement for the last annual meeting of stockholders. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record holder of the Company’s stock and has been a holder for at least one year. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee currently consists of directors Afable, Wan and Adams. None of the members of our Compensation Committee during 2013 is currently or has been, at any time since our formation, one of our officers or employees. During 2013, no executive officer served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or our Compensation Committee. None of the members of our Compensation Committee during 2013 currently has or has had any relationship or transaction with a related person requiring disclosure pursuant to Item 404 of Regulation S-K.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Historically, the Company has not provided a formal process related to stockholder communications with the Board. Nevertheless, every effort has been made to ensure that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. The Company believes its responsiveness to stockholder communications to the Board has been excellent.

CODEOF BUSINESS CONDUCT AND ETHICS

The Company has adopted the AcelRx Pharmaceuticals, Inc. Code of Business Conduct and Ethics that applies to all officers, directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Business Conduct and Ethics is available on our website atwww.acelrx.com. Stockholders may request a free copy of the Code of Business Conduct and Ethics by submitting a written request to: AcelRx Pharmaceuticals, Inc., Attention: Investor Relations, 351 Galveston Drive, Redwood City, CA 94063. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the Code of Business Conduct and Ethics to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

15

REPORTOFTHE AUDIT COMMITTEEOFTHE BOARDOF DIRECTORS

The material in this report is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2013 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed pursuant to applicable auditing standards. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013.

Mark G. Edwards

Howard B. Rosen

Stephen J. Hoffman, Ph.D., M.D.

16

EXECUTIVE OFFICERSOFTHE REGISTRANT

The following table sets forth certain information concerning our executive officers as of June 9, 2014:

Name | Age | Position | ||||

Richard A. King | 49 | Director, President and Chief Executive Officer | ||||

Timothy E. Morris | 52 | Chief Financial Officer | ||||

Pamela P. Palmer, M.D., Ph.D. | 51 | Director, Chief Medical Officer and Co-Founder | ||||

Lawrence G. Hamel | 62 | Chief Development Officer | ||||

Badri Dasu | 51 | Chief Engineering Officer | ||||

Richard A. King.Mr. King’s biography is included above under the section titled “Proposal 1—Election of Directors— Class II Directors Continuing in Office Until the 2016 Annual Meeting.”

Timothy E. Morris has served as our Chief Financial Officer since March 25, 2014. Prior to joining the Company, from November 2004 to December 2013, Mr. Morris served as Senior Vice President Finance and Global Corporate Development, Chief Financial Officer of VIVUS, Inc. a biopharmaceutical company, overseeing finance, corporate development, IT, human resources, legal, and investor relations functions. Mr. Morris graduated cum laude with a B.S. in Business with an emphasis in Accounting from California State University, Chico, and is a Certified Public Accountant.

Pamela P. Palmer, M.D., Ph.D.Dr. Palmer’s biography is included above under the section titled “Proposal 1—Election of Directors—Class II Directors Continuing in Office Until the 2016 Annual Meeting.”

Lawrence G. Hamel has served as our Chief Development Officer since September 2006. From 1986 until September 2006, Mr. Hamel served as Product Development Manager, Director Project Management, Executive Director Oral Product Development, and Vice President Oral Products Development at ALZA Corporation. From 1977 until 1985, Mr. Hamel held a number of other positions at ALZA Corporation, including Senior Chemist, Research Scientist, and Senior Research Fellow. Mr. Hamel holds a B.S. in Biology from the University of Michigan.

Badri Dasu has served as our Chief Engineering Office since September 2007. From December 2005 until September 2007, Mr. Dasu served as Vice President of Medical Device Engineering at Anesiva, Inc., a biopharmaceutical company. From March 2002 until December 2005, Mr. Dasu served as Vice President for Manufacturing and Device Development at AlgoRx Pharmaceuticals, Inc., an emerging pain management company, which merged with Corgentech Inc., a biotechnology company, in December 2005. From January 2000 until March 2002, Mr. Dasu served as Vice President of Manufacturing and Process Development at PowderJect Pharmaceuticals, a vaccine, drug and diagnostics delivery company that was acquired by Chiron Corporation in 2003 and later acquired by Novartis AG, a global healthcare and pharmaceutical company, in 2006. Previously, Mr. Dasu served in various capacities in process development at Metrika, Inc., a company focused on the manufacture and marketing of disposable diabetes monitoring products that was acquired by Bayer HealthCare, LLC in 2006, and at Cygnus, Inc., a drug delivery and specialty pharmaceuticals company. Mr. Dasu holds a B.E. in Chemical Engineering from the University of Mangalore, India and a M.S. in Chemical Engineering from the University of Tulsa.

17

Compensation Discussion and Analysis

Our compensation discussion and analysis discusses the compensation of the five individuals who served as our executive officers during 2013, as set forth in the summary compensation table, subsequent tables and related disclosure in this proxy statement. Our compensation discussion and analysis describes our overall executive compensation philosophy, objectives and practices, as well as the Compensation Committee’s decisions and determinations regarding executive compensation for 2013. It also describes key decisions made by the Compensation Committee for 2014 prior to the filing of this proxy statement.

Compensation Philosophy

At AcelRx, we believe that our compensation philosophy and programs are focused on pay-for-performance principles, and that they are strongly aligned with our stockholders’ interests. Our Compensation Committee and our Board of Directors strive to achieve compensation policies and practices that will attract and retain talented and experienced executives to lead the company successfully in a competitive environment.

We believe that we provide an appropriate mix of fixed and performance-based compensation, and that the terms of our bonus plan and long-term incentives are designed to enable our company to attract and retain top talent, while at the same time creating a close relationship between performance and compensation. The Compensation Committee and the Board of Directors believes that the design of our programs, and therefore the compensation awarded to our executives, fulfills these objectives, while at the same time offering programs that are competitive with market practices and that demonstrate good governance practices. Based on this philosophy, our executive compensation policies are designed to:

| • | align executive compensation with our business objectives and corporate performance; |

| • | attract and retain executive officers who contribute to our company’s long-term success; |

| • | reward and motivate executive officers who contribute to our operating and financial performance; and |

| • | link executive officer compensation and stockholder interests through the grant of long-term equity incentives. |

Executive Summary and 2013 Highlights

For 2013, we achieved several of our corporate performance objectives and key milestones, including:

| • | in March, we reported top-line data demonstrating that Zalviso met its primary endpoint in a pivotal Phase 3 trial designed to compare the efficacy and safety of Zalviso to placebo in the management of acute post-operative pain after major open abdominal surgery; |

| • | In April, we reported top-line data showing that the primary endpoint was achieved in a placebo-controlled, dose-finding, Phase 2 clinical trial of ARX-04 for acute pain; |

| • | in May, we reported top-line data demonstrating that Zalviso met its primary endpoint in a pivotal Phase 3 trial designed to compare the efficacy and safety of Zalviso to placebo in the management of acute post-operative pain after major orthopedic surgery; |

| • | in July, we submitted the New Drug Application, or NDA, for Zalviso, to the U.S. Food and Drug Administration, or FDA; |

| • | in December, we announced a commercial collaboration with Grünenthal GmbH, covering the territory of the European Union, certain other European countries and Australia for Zalviso for potential use in the management of moderate-to-severe acute pain within a hospital, hospice, nursing home or other medically supervised setting; and |

18

| • | in July, we completed an underwritten public offering, in which we raised net proceeds of $47.9 million. In December, we entered into an amended loan and security with Hercules, which expanded the loan facility to $40 million, $15 million of which we drew down in December. These financing events have allowed us to continue commercial preparation activities for Zalviso and to allow for the continued advancement of our ARX-04 clinical development program. |

At our annual meeting in September of 2013, we conducted our first advisory vote on executive compensation, commonly referred to as a “say-on-pay” vote. At that time, approximately 99% of the votes affirmatively cast on the advisory say-on-pay proposal were voted in favor of the compensation of our named executive officers. The Compensation Committee understood this level of approval to indicate strong stockholder support for our executive compensation policies and programs generally, and as a result, our Compensation Committee has no plans to make any fundamental changes to our executive compensation programs in the near future. Our Compensation Committee and our Board of Directors remain committed to engaging with shareholders and being open to feedback, as described elsewhere in this proxy.

Also in 2013, we continued many of our key practices and programs that demonstrate good governance, including:

| • | An emphasis on pay for performance. A significant portion of our executive officers’ total compensation is variable and at risk and tied directly to measurable performance. The Compensation Committee believes that this structure continues to be appropriate, as it strongly aligns the interests of our executives with those of our stockholders. |

| • | Peer group positioning. Using a peer group selected with the assistance of an independent compensation consultant, the Compensation Committee continues to target alignment of the elements of our executives’ compensation to the 50th percentile of our peer group. |

| • | Equity as a key component to align the interests of our executives with those of our stockholders. Our Compensation Committee continues to believe that keeping executives interests aligned with those of our stockholders is critical to driving toward achievement of long-term goals of both our stockholders and the company. |

In 2013, we also continued program practices that demonstrate good governance and careful stewardship of corporate assets, including:

| • | Limited personal benefits. Our executive officers are eligible for the same benefits as our non-executive salaried employees, and they do not receive any additional perquisites. |

| • | No retirement benefits. We do not provide our executive officers with a traditional retirement plan, or with any supplemental deferred compensation or retirement benefits. |

| • | No tax gross-ups. We do not provide our executive officers with any tax gross-ups. |

| • | No single-trigger cash change in control benefits. We do not provide cash benefits to our executives upon a change in control, absent an actual termination of employment. |

Compensation Processes and Procedures

Our Compensation Committee generally meets at least once in the first quarter of the year, and again throughout the year, as needed. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with the Chief Executive Officer. From time to time, members of management and other employees as well as outside advisors or consultants are invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Compensation Committee also meets regularly in executive session.

19

Our Chief Executive Officer is not present, and does not participate in, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives.

The Compensation Committee and the Board of Directors have generally made most of the significant adjustments to annual compensation during the first quarter of the year. However, the Compensation Committee considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, at various meetings throughout the year.

Role of Compensation Committee’s Independent Compensation Consultant

The Compensation Committee did not retain an independent compensation consultant during 2013. However, the Compensation Committee had retained Towers Watson in 2012, and during that engagement, Towers Watson did significant work for the Compensation Committee, including selecting and recommending a peer group of companies for the Compensation Committee to use for comparison purposes in benchmarking our executive compensation policies and programs. Due to the significance of the work done in 2012, and the fact that the Compensation Committee did not believe that any material changes to our compensation programs were warranted for 2013, the Compensation Committee determined that it was a better use of resources not to retain an independent consultant during 2013. Instead, for 2013, the Compensation Committee requested management to update the peer group data based on both publicly available data, as well as survey data available through the Radford surveys.

Thus, in 2013, the Company’s management updated the benchmarking metrics and analyses based on publicly available data using the same peer group. The Compensation Committee used this updated data to make recommendations to the Board of Directors to approve changes to executive compensation.

In January 2014, the Compensation Committee engaged a new independent compensation consultant, Compensia, Inc., to provide the Committee with a competitive market assessment of the current compensation for the Company’s executive team. After review and consultation with Compensia, Inc. the Compensation Committee has determined that Compensia, Inc. is independent and there is no conflict of interest resulting from retaining Compensia, Inc. currently. In reaching these conclusions, the Compensation Committee considered the factors set forth in Rule 10C-1 of the Securities Exchange Act of 1934, as amended, and applicable NASDAQ listing standards.

Under its charter, the Compensation Committee has the sole discretion to retain or obtain the advice of compensation consultants, legal counsel and other compensation advisers, and it has direct responsibility for the appointment, compensation and oversight of the work of any compensation adviser. The Compensation Committee also has the right to receive from the Company appropriate funding for the payment of reasonable compensation to the compensation adviser it selects, as well as the responsibility to consider certain independence factors before selecting such compensation advisers. The compensation consultant reports directly and exclusively to the Compensation Committee with respect to executive and non-employee director compensation matters.

The result of Compensia’s work for the Compensation Committee will be reported in next year’s proxy, to the extent relevant and appropriate.

Role of our Management. In general, our CEO and finance department work together to prepare materials requested by and to be presented to the Compensation Committee, including analyses of financial data, peer data comparisons and other briefing materials. Our CEO typically presents these proposals, along with any background information, to the Compensation Committee for review and consideration. The Compensation Committee may approve, modify, or reject those proposals, or may request additional information from management on those matters.

20

For setting compensation levels for executives other than our CEO, the Compensation Committee will solicit and consider the recommendations of the CEO, including his review of the officer’s performance and contributions in the prior year, and his recommendations for the potential compensation levels that should be set for each executive officer for the coming year.

With respect to our CEO, the Compensation Committee generally prepares an evaluation of the CEO, which it then reviews with the independent members of the Board for their input and consideration. The Compensation Committee also submits to the independent Board members its recommendations for CEO compensation. The final compensation elements and levels for the CEO are then determined by the independent members of the Board.

No executive officer is present or participates directly in approving the amount of any component of his or her own compensation package.

Factors Considered in Setting Executive Compensation

The Compensation Committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. In determining compensation levels, Compensation Committee will generally consider the Company’s overall financial condition and performance, peer company data and other survey materials, reports on current market conditions, operational data, tax and accounting information, and tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios. The members of the Compensation Committee will also consider their own experiences with hiring and retaining executive officers at other companies.

In setting performance goals for the current year, the Compensation Committee will set goals for the clinical, regulatory, commercial, financial and corporate development areas of the Company.

Use of Peer Company Data

Our Peer Group. As discussed above, during 2012, our Compensation Committee engaged Towers Watson as its independent compensation consultant, and as part of this engagement, Towers Watson selected and recommended a group of ten companies to comprise our peer group for executive compensation comparison purposes. The companies were selected based on their similarity to us in terms of industry focus, stage of development, pharmaceutical assets, business strategy, and the geographical location of the talent pool with which we compete. The market data for the peer group was drawn from publically available documents.

For 2013, the Compensation Committee reviewed the list of companies in the peer group and determined that this group remained an appropriate group for comparison purposes for 2013. As a result, our peer group for 2013 remained unchanged from 2012, and consisted of the following companies:

Pacira Pharmaceuticals, Inc. | Cadence Pharmaceuticals, Inc. (acquired by Mallinckrodt plc in March 2014) | |

Zogenix, Inc. | Pozen, Inc. | |

NuPathe, Inc. (acquired by Teva Pharmaceutical Industries, Ltd. in February 2014) | Pain Therapeutics, Inc. | |

Anthera Pharmaceuticals, Inc. | Ardea Biosciences, Inc. (since June 2012, a wholly owned subsidiary of AstraZeneca PLC) | |