ARMOUR Residential REIT, Inc.

3001 Ocean Drive, Suite 201

Vero Beach, FL 32963

November 20, 2012

VIA EDGAR

Mr. Robert F. Telewicz Jr.

Senior Staff Accountant

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

Re: ARMOUR Residential REIT, Inc.

Form 10-K

Filed March 6, 2012

File No. 001-34766

Dear Mr. Telewicz:

ARMOUR Residential REIT, Inc. (the "Company") hereby responds to the Commission Staff's comment letter, dated October 23, 2012, regarding the Company's Form 10-K filed on March 6, 2012.

Please note that for the Staff's convenience, we have recited the Staff's comment in boldface type and provided the Company's response immediately thereafter.

Item 1. Business..page 3 Overview, page 3

| 1. | We note your disclosure that investments include Agency Securities, Agency Debt, U.S. Treasuries and money market instruments including reverse repurchase agreements. In future periodic filings, please provide a breakdown of the percentage of your current portfolio represented by each of these target asset types. |

Mr. Robert F. Telewicz, Jr.

Senior Staff Accountant

Division of Corporation Finance

United States Securities and Exchange Commission

November 20, 2012

Page 2

The Company has included in its Form 10-Q for the quarter ended September 30, 2012, a statement that as of the balance sheet date, Agency Securities accounted for 100% of its portfolio. The Company currently expects that substantially all of its portfolio will be allocated to Agency Securities for the foreseeable future and will include statements to that effect in future filings.

Item 7. Management's Discussion and Analysis..page 27

Contractual Obligations and Commitments, page 40

| 2. | In future periodic filings please update your tabular disclosure to include a column for contractual obligations greater than five years to comply with Regulation S-X Item 303. Include a footnote to the table, to the extent applicable, if there are no obligations exceeding five years. |

The Company will include in its Form 10-K for the fiscal year ending December 31, 2012 either a column of contractual obligations greater than five years or a footnote that no contractual obligations exceed five years.

Consolidated Statements of Operations..page F-6

| 3. | Please reconcile the difference between the amount of unrealized loss on derivatives as of December 31, 2011 as disclosed on your statement of operations with the amount disclosed on your statement of cash flows. |

The Company supplementally advises the Staff that the difference of $22,058,555 represents net accrued interest on swaps that was included in the "Realized" rather than "Unrealized" loss caption in the statement of operations. Footnote 1 on the face of the statement of operations discloses that interest expense on swaps is included in realized losses on derivatives.

Agency Securities, Available for Sale..page F-13

| 4. | We note your disclosure on pg. F-10 that financial instrument investments consist of Agency Securities, Agency Debt, U.S. Treasuries and money market instruments including reverse repurchase agreements as of December 31, 2011. In future periodic filings please revise your footnote to provide the required disclosures by each major security type described above. Discuss any significant changes in major security types from period to period in your Management's Discussion and Analysis as appropriate. |

Mr. Robert F. Telewicz, Jr.

Senior Staff Accountant

Division of Corporation Finance

United States Securities and Exchange Commission

Please see the Company's response to Comment No. 1 above. There have been no significant changes in major security type since December 31, 2011.

Repurchase Agreements..page F-21

| 5. | For those repurchase agreements accounted for as collateralized financings, please quantify the average quarterly balance for each of the quarters you have engaged in this type of financing. In addition, quantify the period end balance for each of those quarters and the maximum balance at any month-end. Explain the causes and business reasons for significant variances among these amounts. Please disclose this information in future periodic filings, and show us the disclosure you intend to provide. Additionally, when applicable, please show this information for each of the quarters in the past three years in your future period filings. |

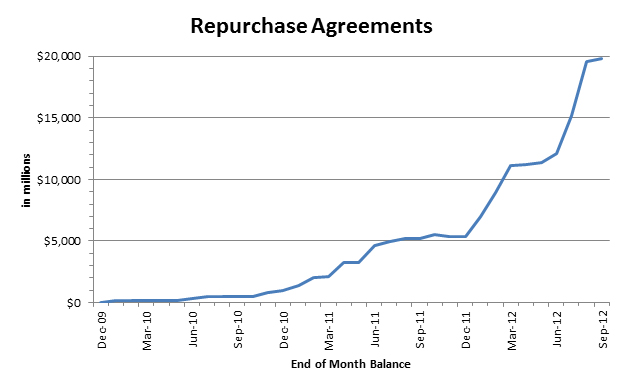

The Company undertakes to expand its disclosures about its repurchase agreements in Managements’ Discussion and Analysis by including a graphical chart in future filings that displays the outstanding balance of repurchase agreement financings as of the end of each month, commencing with the beginning of the earliest period presented. The Company believes that this presentation provides readers with more detail about its repurchase financing activities and makes trends or patterns easier to recognize as compared to a tabular presentation of only selected balances and averages. The Company will also describe the causes and business reasons for significant variations in these amounts. An example of such a chart and related disclosures appear below:

“Repurchase Facilities

The following graph represents the month-end outstanding balances of our repurchase agreements, which finance most of our Agency Securities. Over time, the level of our repurchase agreement financing has grown in conjunction with the growth in our portfolio of Agency Securities, which in turn has been the result of successful equity capital raising efforts. The balance of repurchase agreements outstanding will fluctuate within any given month based on changes in the market value of the particular Agency Securities pledged as collateral (including the effects of principal paydowns) and the level and timing of investment and reinvestment activity.

Mr. Robert F. Telewicz, Jr.

Senior Staff Accountant

Division of Corporation Finance

United States Securities and Exchange Commission

The following table represents the contractual repricing regarding our repurchase agreements as of . . . .”

* * * * *

In connection with responding to your comments, we acknowledge that:

| | · | the Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

| | · | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| | · | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities law of the United States. |

Mr. Robert F. Telewicz, Jr.

Senior Staff Accountant

Division of Corporation Finance

United States Securities and Exchange Commission

If you have any questions, please call me at (772) 617-4340.

Sincerely,

ARMOUR Residential REIT, Inc.

/s/ James R. Mountain

James R. Mountain, Chief Financial Officer