| |

| Exhibit 99.1 |

August 4, 2021

Fellow Shareholders,

Roku delivered a strong second quarter, with record revenue growth that was driven by exceptional performance in platform monetization. Audiences, content, and advertisers continue their shift to TV streaming around the globe, and Roku is a key enabler of this long-term secular trend. We more than doubled monetized video ad impressions year-over-year, and leading media companies are increasingly turning to Roku’s tools to grow their DTC (direct to consumer) services. Looking ahead, our recent success at the Upfronts demonstrates the accelerating shift of advertisers from traditional TV to TV streaming. We closed commitments with all seven major agency holding companies, doubling dollar commitments year-over-year. We believe that our leading technology, platform scale, and the value we provide content providers, advertisers, and consumers all position us well for long-term growth.

Key Results

| • | Total net revenue grew 81% year-over-year (YoY) to $645 million |

| • | Platform revenue increased 117% YoY to $532 million |

| • | Gross profit was up 130% YoY to $338 million |

| • | Active Accounts reached 55.1 million, an increase of 1.5 million active accounts from Q1 2021 |

| • | Streaming hours were 17.4 billion hours, a decrease of 1.0 billion hours from Q1 2021 |

| • | Average Revenue Per User (ARPU) grew to $36.46 (trailing 12-month basis), up 46% YoY |

Key Operating Metrics | Q2 20 | | | Q3 20 | | | Q4 20 | | | Q1 21 | | | Q2 21 | | | YoY % | |

Active Accounts (millions) | | 43.0 | | | | 46.0 | | | | 51.2 | | | | 53.6 | | | | 55.1 | | | | 28 | % |

Streaming Hours (billions)* | | 14.6 | | | | 14.8 | | | | 17.0 | | | | 18.3 | | | | 17.4 | | | | 19 | % |

ARPU ($) | $ | 24.92 | | | $ | 27.00 | | | $ | 28.76 | | | $ | 32.14 | | | $ | 36.46 | | | | 46 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Summary Financials ($ in millions) | Q2 20 | | | Q3 20 | | | Q4 20 | | | Q1 21 | | | Q2 21 | | | YoY % | |

Platform revenue | $ | 244.8 | | | $ | 319.2 | | | $ | 471.2 | | | $ | 466.5 | | | $ | 532.3 | | | | 117 | % |

Player revenue | | 111.3 | | | | 132.4 | | | | 178.7 | | | | 107.7 | | | | 112.8 | | | | 1 | % |

Total net revenue | | 356.1 | | | | 451.7 | | | | 649.9 | | | | 574.2 | | | | 645.1 | | | | 81 | % |

Platform gross profit | | 138.5 | | | | 194.7 | | | | 300.8 | | | | 311.9 | | | | 345.0 | | | | 149 | % |

Player gross profit | | 8.4 | | | | 20.2 | | | | 4.6 | | | | 14.8 | | | | (6.7 | ) | | | -180 | % |

Total gross profit | | 146.8 | | | | 214.8 | | | | 305.5 | | | | 326.8 | | | | 338.3 | | | | 130 | % |

Platform gross margin % | | 56.6 | % | | | 61.0 | % | | | 63.8 | % | | | 66.9 | % | | | 64.8 | % | | | 820 | bps |

Player gross margin % | | 7.5 | % | | | 15.2 | % | | | 2.6 | % | | | 13.8 | % | | | -5.9 | % | | | -1350 | bps |

Total gross margin % | | 41.2 | % | | | 47.6 | % | | | 47.0 | % | | | 56.9 | % | | | 52.4 | % | | | 1120 | bps |

Research and development | | 84.4 | | | | 88.4 | | | | 94.7 | | | | 101.6 | | | | 113.3 | | | | 34 | % |

Sales and marketing | | 64.2 | | | | 71.0 | | | | 96.1 | | | | 88.9 | | | | 93.7 | | | | 46 | % |

General and administrative | | 40.5 | | | | 43.5 | | | | 49.5 | | | | 60.5 | | | | 62.2 | | | | 54 | % |

Total operating expenses | | 189.0 | | | | 202.9 | | | | 240.3 | | | | 251.0 | | | | 269.2 | | | | 42 | % |

Income (loss) from operations | | (42.2 | ) | | | 12.0 | | | | 65.2 | | | | 75.8 | | | | 69.1 | | | nm | |

Adjusted EBITDA 1 | | (3.4 | ) | | | 56.2 | | | | 113.5 | | | | 125.9 | | | | 122.4 | | | nm | |

Adjusted EBITDA margin % | | -1.0 | % | | | 12.4 | % | | | 17.5 | % | | | 21.9 | % | | | 19.0 | % | | nm | |

| | | | | | | | | | | | | | | | | | | | | | | |

Outlook ($ in millions) | Q3 2021E | | | | | | | | | | | | | | | | | | | |

Total net revenue | $675 - $685 | | | | | | | | | | | | | | | | | | | |

Total gross profit | $315 - $325 | | | | | | | | | | | | | | | | | | | |

Net income (loss) | ($3) - $7 | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA 2 | $60 - $70 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

1 Refer to the reconciliation of net income (loss) to adjusted EBITDA in the non-GAAP information in an appendix to this letter. | |

2 Q3 2021E reconciling items between net income (loss) and non-GAAP adjusted EBITDA consist of stock-based compensation of approximately $52 million, depreciation and amortization and other net adjustments of approximately $11 million. | |

___________________________

* Reported streaming hours data reflects previously disclosed adjustments to our streaming hours calculations for periods prior to Q4 2020.

| |

Roku Q2 2021 Shareholder Letter | 1 |

Account Growth

In Q2, we grew active accounts by 1.5 million, ending the quarter with 55.1 million, driven by sales of Roku TV™ models and streaming players. Q2 2021 net adds were higher than pre-covid levels in Q2 2019, but as expected, lower than the pandemic-related surge of Q2 2020. Player unit sales in Q2 2021 were relatively flat year-over-year, following the demand spike in Q2 2020. Tight component supply conditions and shipping constraints continued to increase costs faster than expected across all consumer electronics categories. In Q2, we insulated consumers from increased costs for Roku players, which resulted in Player gross margin turning negative in the quarter.

Consumers sought increased out-of-home entertainment activities (such as dining and travel) in Q2 as a result of pent-up demand and the loosening of COVID-19 restrictions, which led to a broader secular decline in overall TV viewing hours. On a year-over-year basis, Roku significantly outperformed the industry, with Roku’s streaming hours increasing nearly 19% globally, compared to a nearly 19% decline in traditional TV consumption and a nearly 2% decline in TV streaming across all platforms, for persons 2+ years of age in the U.S., according to Nielsen.

|

|

(* according to Nielsen for persons 2+ years of age in the U.S.) |

We believe that Roku continues to provide the best user experience in streaming. In June, the Roku Express 4k Plus earned the “best streamer overall” from CNET and Editor’s Choice award from TechHive. Tom’s Guide awarded the TCL QLED and Mini-LED Roku TV models “Best TV innovation.”

We continue to make good progress in our international markets. In the UK, we enhanced our product offering with the launch of TCL Roku TV models, which we expect will drive further platform adoption. And, we are excited to bring Roku to Germany, starting with players, later this year. We believe our business model will serve us well as we seek to grow in international markets by building scale with our affordable hardware and the Roku OS (the only OS purpose-built for TV), driving user engagement with a best-in-class user experience, and monetizing activities on the platform over time.

Platform Monetization

In Q2, Platform revenue exceeded half a billion dollars for the first time in the Platform segment’s history. Revenue of $532 million, up 117% year-over-year, was driven by significant contributions from both content distribution and advertising activities. ARPU was $36.46 (trailing 12-month basis), up 46% year-over-year.

| |

Roku Q2 2021 Shareholder Letter | 2 |

Content Distribution

DTC businesses are leaning into the Roku platform, leveraging key tools like Roku Pay and performance marketing to successfully build their streaming services — driving results that are exceeding expectations for both Roku and our partners. Media and Entertainment promotional spending (including what we traditionally termed our “audience development” business) grew significantly faster than the overall platform during Q2. We continue to innovate and launch new marketing tools, which are a highly efficient way for DTC services to acquire and engage viewers.

|

|

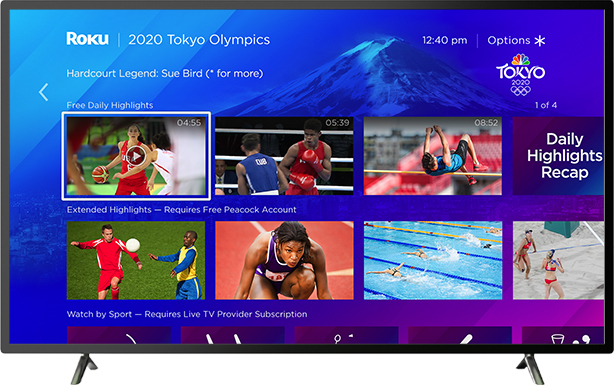

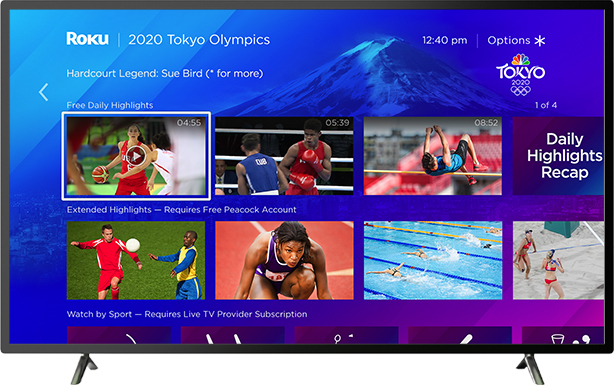

We partnered with NBCUniversal |

to bring an all-new, immersive Olympic experience to Roku viewers. |

As part of our ongoing efforts to recommend great content to our users and drive engagement across our platform, we partnered with NBCUniversal to create an immersive experience that enables users in the U.S. to find and stream NBC Olympics coverage directly from the Roku home screen. The great content selection on our platform is being further bolstered by the growing number of exclusive and day-and-date releases such as Cruella and Boss Baby: Family Business.

|

|

Boss Baby: Family Business |

| |

Roku Q2 2021 Shareholder Letter | 3 |

The Roku Channel Growth

In Q2, we continued to drive robust growth of The Roku Channel with streaming hours more than doubling year-over-year. Roku Originals, which consist of content we acquired in the Quibi acquisition, are off to a strong start. We premiered our first slate of Roku Originals programming with 30 titles available for free to The Roku Channel viewers, which drove deeper engagement in The Roku Channel. In the two weeks following launch, from May 20 to June 3:

| |

•A record number of unique accounts streamed The Roku Channel |

|

•The top ten watched programs on The Roku Channel were all Roku Originals |

•More than one in three users of The Roku Channel streamed a Roku Original |

Our expansion of content reinforces The Roku Channel flywheel and we plan to continue to pursue a diverse and cost-effective content strategy, with a primary focus on licensing and distribution through our more than 175 partners. As a reminder, in March we acquired This Old House and Ask This Old House, which were the two top-rated home improvement programs in the U.S. in 2020, according to Nielsen data. In May, Roku reached its first ever pay-one window rights deal with Saban Films. Under the agreement, a selection of Saban’s 2021 film slate will be available to users for free exclusively on The Roku Channel, in the U.S. and Canada, following theatrical and home entertainment release. With the success we've seen thus far with Roku Originals, we have greenlit additional seasons of certain shows, such as "Die Harter" with Kevin Hart.

|

|

Die Hart, Mapleworth Murders, and Reno 911! received eight Emmy nominations. |

This Old House won its 19th Emmy for “Outstanding Instructional and How-To Program.” |

Ad Business Strength

In Q2, advertisers continued to follow audiences and move budgets into TV streaming. Roku’s monetized video ad impressions more than doubled year-over-year. Our competitive advantages in first-party customer relationships, data, ad innovation, and ad technology helped drive this growth. We’re pleased with our progress increasing the number of small/medium sized businesses on our platform, as the number of advertisers outside the Ad Age 200 grew over 50% year-over-year.

| |

Roku Q2 2021 Shareholder Letter | 4 |

The OneView Ad Platform provides a single solution for advertisers to manage their entire campaign — across TV streaming, desktop, and mobile — using Roku’s scale, first-party data, and measurement tools. Apparel brand Smartwool used OneView to execute a combined TV streaming and digital display advertising campaign. As a result, consumers who saw a Smartwool ad on both TV streaming and on digital display were 72% more likely to visit the Smartwool website. As a result of our demonstrated return on investment, TV streaming spend in the OneView Ad Platform accelerated, with spend nearly tripling year-over-year.

We achieved strong results for Q2 and looking ahead, our ad business remains well positioned. Our success at this year’s Upfronts was driven by our ongoing ad innovation and competitive differentiators including The Roku Channel and the OneView Ad Platform. Furthermore, our results at the Upfronts underscore the accelerating shift of advertisers from traditional TV to TV streaming. Roku secured commitments with all seven major agency holding companies earlier than ever and earned double the dollar commitment compared to last year. Forty-two percent of all advertisers who committed to Roku during the Upfronts were new upfront commitments (did not participate last year).

Outlook

Our approach to outlook will be similar to last quarter, with formal outlook for Q3 and additional color looking further ahead.

Our Q3 outlook is for robust growth with total net revenue of $680 million at the midpoint (up 51% year-over-year) and total gross profit of $320 million at the midpoint (up 49% year-over-year). We anticipate quarterly sequential increases in operating expenses in the second half of 2021 from our investments in headcount, product development, and sales & marketing. As a result, we expect adjusted EBITDA to be $65 million at the midpoint in Q3.

In the near term, the varying rates of recovery from the pandemic around the world continue to present an uncertain operating environment. Within the Player segment, we expect global supply chain constraints and component cost increases to worsen in the second half of 2021, leading to increasing negative player gross margin. We believe these industry supply chain constraints and cost increases for streaming players and TV OEM partners will continue into 2022. Within the Platform segment, monetization remains strong, and while there will be a slowdown in year-over-year growth relative to last year’s pandemic-driven acceleration, we expect continued significant growth in the second half of the year.

Conclusion

We are pleased with our strong performance in the second quarter, and are excited about the road ahead. Roku remains very well positioned to benefit from the long-term secular trend of audiences, content, and advertisers shifting to TV streaming around the globe. Our success during the Upfronts this year, the clear value we offer partners seeking to build their own DTC streaming businesses, and the continued acceleration of The Roku Channel flywheel are evidence of the competitive advantages we have built.

Thank you for your support and Happy Streaming™!

Anthony Wood, Founder and CEO; and Steve Louden, CFO

| |

Roku Q2 2021 Shareholder Letter | 5 |

The Company will host a webcast of its conference call to discuss Q2 2021 results at 2 p.m. Pacific Time / 5 p.m. Eastern Time on August 4, 2021. Participants may access the live webcast in listen-only mode on the Roku investor relations website at roku.com/investor. An archived webcast of the conference call will also be available at roku.com/investor after the call.

About Roku, Inc.

Roku pioneered streaming to the TV. We connect users to the streaming content they love, enable content publishers to build and monetize large audiences, and provide advertisers with unique capabilities to engage consumers. Roku streaming players and TV-related audio devices are available in the U.S. and in select countries through direct retail sales and licensing arrangements with service operators. Roku TV™ models are available in the U.S. and in select countries through licensing arrangements with TV brands. Roku is headquartered in San Jose, Calif. U.S.A.

Roku, the Roku logo and other trade names, trademarks or service marks of Roku appearing in this shareholder letter are the property of Roku. Trade names, trademarks and service marks of other companies appearing in this shareholder letter are the property of their respective holders.

Investor Relations Conrad Grodd cgrodd@roku.com | Media Kim Sampson ksampson@roku.com |

Use of Non-GAAP Measures

In addition to financial information prepared in accordance with generally accepted accounting principles in the United States (GAAP), this shareholder letter includes certain non-GAAP financial measures. These non-GAAP measures include Adjusted EBITDA. In order for our investors to be better able to compare our current results with those of previous periods, we have included a reconciliation of GAAP to non-GAAP financial measures in the tables at the end of this letter. The Adjusted EBITDA reconciliation adjusts the related GAAP financial measures to exclude other income (expense), net, stock-based compensation expense, depreciation and amortization, and income tax (benefit)/expense where applicable. We believe these non-GAAP financial measures are useful as a supplement in evaluating our ongoing operational performance and enhancing an overall understanding of our past financial performance. However, these non-GAAP financial measures have limitations, and should not be considered in isolation or as a substitute for our GAAP financial information.

Forward-Looking Statements

This shareholder letter contains “forward-looking” statements that are based on our beliefs and assumptions and on information currently available to us. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “continue,” “could,” “design,” “estimate,” “expect,” “may,” “seek,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our beliefs and assumptions only as of the date of this letter. These statements include those related to the continuing shift of audiences, content, and advertisers to TV streaming; the benefits of our technology and platform to our long-term growth; the resolution of tight component supply conditions and shipping constraints; our user experience; our ability to innovate, build and launch new products and services, including direct to consumer marketing tools; our international expansion, including platform adoption in the UK and expansion into Germany; the performance, growth and monetization of, and content available on, The Roku Channel; advertisers moving their budgets to streaming; our sponsorship offering; the benefits of the Roku Brand Studio; the benefits and features of the OneView platform; advertising commitments we obtained at Upfronts; the content selection on our platform; the performance of Roku Originals; our competitive advantages; the impact of the COVID-19 pandemic and varying rates of recovery around the world on our business and the industries we operate in; our financial outlook for the third quarter of 2021 and our color provided for the second half of 2021 and into 2022; our investments; and our overall business trajectory. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Further information on factors that could cause actual results to differ materially from the results anticipated by our forward-looking statements is included in the reports we have filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. All information provided in this shareholder letter and in the attached tables is as of August 4, 2021, and we undertake no duty to update this information unless required by law.

| |

Roku Q2 2021 Shareholder Letter | 6 |

ROKU, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data)

(unaudited)

| | Three Months Ended | | | Six Months Ended | |

| | June 30, 2021 | | | June 30, 2020 | | | June 30, 2021 | | | June 30, 2020 | |

Net Revenue: | | | | | | | | | | | | | | | | |

Platform | | $ | 532,303 | | | $ | 244,777 | | | $ | 998,829 | | | $ | 477,334 | |

Player | | | 112,816 | | | | 111,296 | | | | 220,473 | | | | 199,505 | |

Total net revenue | | | 645,119 | | | | 356,073 | | | | 1,219,302 | | | | 676,839 | |

Cost of Revenue: | | | | | | | | | | | | | | | | |

Platform (1) | | | 187,328 | | | | 106,324 | | | | 341,918 | | | | 208,260 | |

Player (1) | | | 119,525 | | | | 102,913 | | | | 212,347 | | | | 180,642 | |

Total cost of revenue | | | 306,853 | | | | 209,237 | | | | 554,265 | | | | 388,902 | |

Gross Profit: | | | | | | | | | | | | | | | | |

Platform | | | 344,975 | | | | 138,453 | | | | 656,911 | | | | 269,074 | |

Player | | | (6,709 | ) | | | 8,383 | | | | 8,126 | | | | 18,863 | |

Total gross profit | | | 338,266 | | | | 146,836 | | | | 665,037 | | | | 287,937 | |

Operating Expenses: | | | | | | | | | | | | | | | | |

Research and development (1) | | | 113,276 | | | | 84,387 | | | | 214,857 | | | | 172,665 | |

Sales and marketing (1) | | | 93,678 | | | | 64,164 | | | | 182,551 | | | | 132,412 | |

General and administrative (1) | | | 62,228 | | | | 40,494 | | | | 122,739 | | | | 80,234 | |

Total operating expenses | | | 269,182 | | | | 189,045 | | | | 520,147 | | | | 385,311 | |

Income (Loss) from Operations | | | 69,084 | | | | (42,209 | ) | | | 144,890 | | | | (97,374 | ) |

Other Income (Expense), Net: | | | | | | | | | | | | | | | | |

Interest expense | | | (746 | ) | | | (1,034 | ) | | | (1,488 | ) | | | (1,897 | ) |

Other income (expense), net | | | 1,520 | | | | 557 | | | | 1,961 | | | | 1,818 | |

Total other income (expense), net | | | 774 | | | | (477 | ) | | | 473 | | | | (79 | ) |

Income (Loss) Before Income Taxes | | | 69,858 | | | | (42,686 | ) | | | 145,363 | | | | (97,453 | ) |

Income tax (benefit) expense | | | (3,609 | ) | | | 462 | | | | (4,400 | ) | | | 307 | |

Net Income (Loss) | | $ | 73,467 | | | $ | (43,148 | ) | | $ | 149,763 | | | $ | (97,760 | ) |

| | | | | | | | | | | | | | | | |

Net income (loss) per share — basic | | $ | 0.55 | | | $ | (0.35 | ) | | $ | 1.14 | | | $ | (0.81 | ) |

Net income (loss) per share — diluted | | $ | 0.52 | | | $ | (0.35 | ) | | $ | 1.06 | | | $ | (0.81 | ) |

| | | | | | | | | | | | | | | | |

Weighted-average common shares outstanding — basic | | | 132,705 | | | | 122,614 | | | | 131,198 | | | | 121,397 | |

Weighted-average common shares outstanding — diluted | | | 142,122 | | | | 122,614 | | | | 141,234 | | | | 121,397 | |

| | | | | | | | | | | | | | | | |

(1) Stock-based compensation was allocated as follows: | | | | | | | | | | | | | | | | |

Cost of platform revenue | | $ | 167 | | | $ | 232 | | | $ | 365 | | | $ | 443 | |

Cost of player revenue | | | 315 | | | | 310 | | | | 730 | | | | 648 | |

Research and development | | | 18,577 | | | | 13,348 | | | | 35,131 | | | | 26,603 | |

Sales and marketing | | | 14,275 | | | | 9,615 | | | | 27,638 | | | | 19,672 | |

General and administrative | | | 9,212 | | | | 6,531 | | | | 19,219 | | | | 13,075 | |

Total stock-based compensation | | $ | 42,546 | | | $ | 30,036 | | | $ | 83,083 | | | $ | 60,441 | |

| |

Roku Q2 2021 Shareholder Letter | 7 |

ROKU, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except par value data)

(unaudited)

| | As of | |

| | June 30, 2021 | | | December 31, 2020 | |

Assets | | | | | | | | |

Current Assets: | | | | | | | | |

Cash and cash equivalents | | $ | 2,083,273 | | | $ | 1,092,815 | |

Restricted cash, current | | | — | | | | 434 | |

Accounts receivable, net of allowances of $24,455 and $41,236 as of | | | 587,481 | | | | 523,852 | |

June 30, 2021 and December 31, 2020, respectively | | | | | | | | |

Inventories | | | 47,996 | | | | 53,895 | |

Prepaid expenses and other current assets | | | 80,482 | | | | 26,644 | |

Total current assets | | | 2,799,232 | | | | 1,697,640 | |

Property and equipment, net | | | 160,544 | | | | 155,197 | |

Operating lease right-of-use assets | | | 298,949 | | | | 266,197 | |

Intangible assets, net | | | 97,218 | | | | 62,181 | |

Goodwill | | | 146,784 | | | | 73,058 | |

Other non-current assets | | | 135,831 | | | | 16,269 | |

Total Assets | | $ | 3,638,558 | | | $ | 2,270,542 | |

Liabilities and Stockholders’ Equity | | | | | | | | |

Current Liabilities: | | | | | | | | |

Accounts payable | | $ | 132,483 | | | $ | 112,314 | |

Accrued liabilities | | | 423,253 | | | | 347,668 | |

Current portion of long-term debt | | | 7,377 | | | | 4,874 | |

Deferred revenue, current portion | | | 48,235 | | | | 55,465 | |

Total current liabilities | | | 611,348 | | | | 520,321 | |

Long-term debt, non-current portion | | | 84,928 | | | | 89,868 | |

Deferred revenue, non-current portion | | | 23,149 | | | | 21,283 | |

Operating lease liability, non-current portion | | | 336,948 | | | | 307,936 | |

Other long-term liabilities | | | 21,157 | | | | 3,119 | |

Total Liabilities | | | 1,077,530 | | | | 942,527 | |

Stockholders’ Equity: | | | | | | | | |

Common stock, $0.0001 par value | | | 13 | | | | 13 | |

Additional paid-in capital | | | 2,743,629 | | | | 1,660,379 | |

Accumulated other comprehensive income | | | 29 | | | | 29 | |

Accumulated deficit | | | (182,643 | ) | | | (332,406 | ) |

Total Stockholders’ Equity | | | 2,561,028 | | | | 1,328,015 | |

Total Liabilities and Stockholders’ Equity | | $ | 3,638,558 | | | $ | 2,270,542 | |

| |

Roku Q2 2021 Shareholder Letter | 8 |

ROKU, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands)

(unaudited)

| | Six Months Ended | |

| | June 30, 2021 | | | June 30, 2020 | |

Cash flows from operating activities: | | | | | | | | |

Net income (loss) | | $ | 149,763 | | | $ | (97,760 | ) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 20,412 | | | | 17,248 | |

Stock-based compensation expense | | | 83,083 | | | | 60,441 | |

Amortization of right-of-use assets | | | 13,979 | | | | 15,947 | |

Amortization of content assets | | | 28,093 | | | | 12,182 | |

Provision for (recoveries of) doubtful accounts | | | (1,099 | ) | | | 3,516 | |

Other items, net | | | (8 | ) | | | 290 | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | (56,661 | ) | | | 21,372 | |

Inventories | | | 5,899 | | | | 4,713 | |

Prepaid expenses and other current assets | | | (30,235 | ) | | | (5,222 | ) |

Other non-current assets | | | (72,195 | ) | | | 2,095 | |

Accounts payable | | | 16,433 | | | | 20,847 | |

Accrued liabilities | | | 16,543 | | | | 6,336 | |

Operating lease liabilities | | | (18,394 | ) | | | 12,695 | |

Other long-term liabilities | | | (527 | ) | | | (556 | ) |

Deferred revenue | | | (10,326 | ) | | | 5,952 | |

Net cash provided by operating activities | | | 144,760 | | | | 80,096 | |

Cash flows from investing activities: | | | | | | | | |

Purchases of property and equipment | | | (13,898 | ) | | | (64,109 | ) |

Acquisitions of businesses, net of cash acquired | | | (136,778 | ) | | | — | |

Proceeds from escrows associated with acquisition | | | — | | | | 1,058 | |

Net cash used in investing activities | | | (150,676 | ) | | | (63,051 | ) |

Cash flows from financing activities: | | | | | | | | |

Proceeds from equity issued under at-the-market offerings, net of issuance costs | | | 989,615 | | | | 349,609 | |

Proceeds from borrowings, net of issuance costs | | | — | | | | 69,325 | |

Repayments of borrowings | | | (2,500 | ) | | | (71,825 | ) |

Proceeds from equity issued under incentive plans | | | 10,285 | | | | 5,877 | |

Net cash provided by financing activities | | | 997,400 | | | | 352,986 | |

Net increase in cash, cash equivalents and restricted cash | | | 991,484 | | | | 370,031 | |

Cash, cash equivalents and restricted cash —beginning of period | | | 1,093,249 | | | | 517,333 | |

Cash, cash equivalents and restricted cash —end of period | | $ | 2,084,733 | | | $ | 887,364 | |

Cash, cash equivalents and restricted cash at end of period: | | | | | | | | |

Cash and cash equivalents | | | 2,083,273 | | | | 885,825 | |

Restricted cash, current | | | — | | | | 1,539 | |

Restricted cash, non-current | | | 1,460 | | | | — | |

Cash, cash equivalents and restricted cash —end of period | | $ | 2,084,733 | | | $ | 887,364 | |

| | | | | | | | |

Supplemental disclosures of cash flow information: | | | | | | | | |

Cash paid for interest | | $ | 1,290 | | | $ | 2,118 | |

Cash paid for income taxes | | $ | 487 | | | $ | 482 | |

Supplemental disclosures of noncash investing and financing activities: | | | | | | | | |

Non-cash consideration for business combination | | $ | 15,200 | | | $ | — | |

Services to be received as part of a business combination | | $ | 6,300 | | | $ | — | |

Unpaid portion of property and equipment purchases | | $ | 3,709 | | | $ | 5,218 | |

Unpaid portion of acquisition-related expenses | | $ | 271 | | | $ | — | |

Unpaid portion of purchased intangibles | | $ | — | | | $ | 400 | |

Unpaid portion of at-the-market issuance costs | | $ | — | | | $ | 150 | |

| |

Roku Q2 2021 Shareholder Letter | 9 |

NON-GAAP INFORMATION (in thousands)

(unaudited)

| | Three Months Ended | | | Six Months Ended | |

| | June 30, 2021 | | | June 30, 2020 | | | June 30, 2021 | | | June 30, 2020 | |

Reconciliation of Net Income (Loss) to Adjusted EBITDA: | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 73,467 | | | $ | (43,148 | ) | | $ | 149,763 | | | $ | (97,760 | ) |

Other income (expense), net | | | (774 | ) | | | 477 | | | | (473 | ) | | | 79 | |

Stock-based compensation | | | 42,546 | | | | 30,036 | | | | 83,083 | | | | 60,441 | |

Depreciation and amortization | | | 10,807 | | | | 8,800 | | | | 20,412 | | | | 17,248 | |

Income tax (benefit) expense | | | (3,609 | ) | | | 462 | | | | (4,400 | ) | | | 307 | |

Adjusted EBITDA | | $ | 122,437 | | | $ | (3,373 | ) | | $ | 248,385 | | | $ | (19,685 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Quarterly streaming hours published vs. revised streaming hours (billions) 0b 2b 4b 6b 8b 10b 12b 14b 2017 q1 2017 q2 2017 q3 2017 q4 2018 q1 2018 q2 2018 q3 2018 q4 2019 q1 2019 q2 2019 q3 2019 q4 2020 q1 published streaming hours revised streaming hours

| |

Roku Q2 2021 Shareholder Letter | 10 |