UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

RADIUS HEALTH, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Actions To Date: Alignment to Shareholders July 2022 1

Table of Contents Executive Summary S E C T I O N 1 Radius Health Business S E C T I O N 2 Transaction Resulting from Strategic Assessment & Process S E C T I O N 3 Board & Corporate Governance S E C T I O N 4 Velan and Repertoire’s Proxy Fight is Misguided and Does Not Offer a Realistic Path for the Company S E C T I O N 5 Concluding Remarks 2

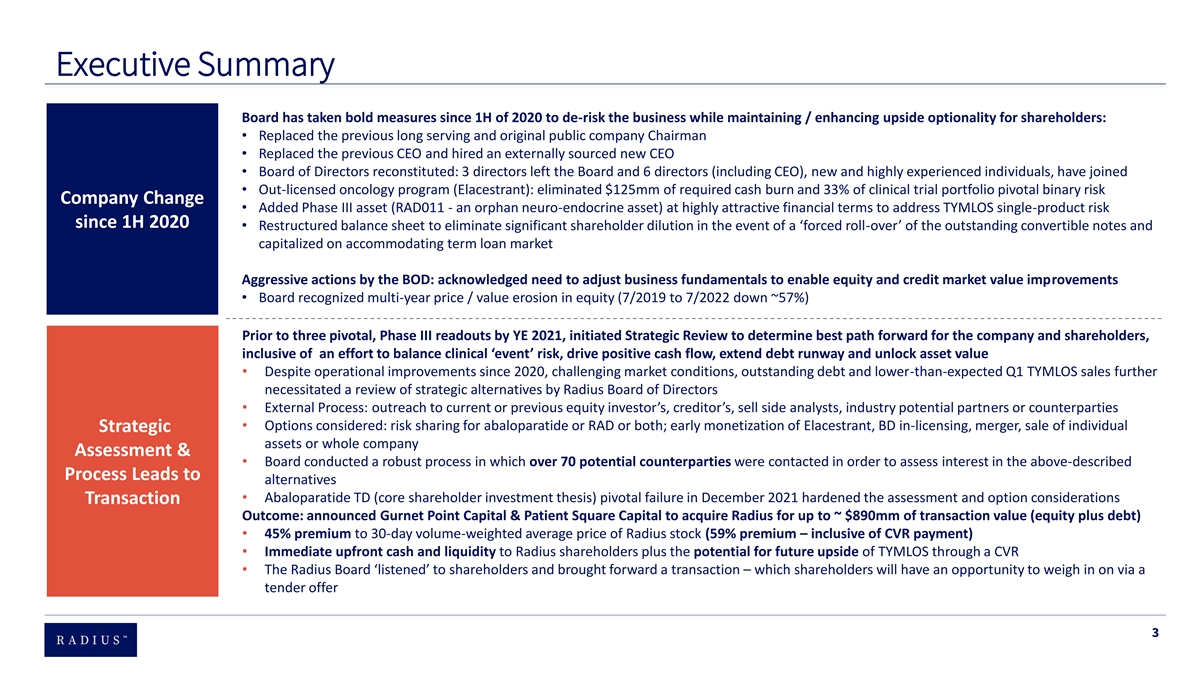

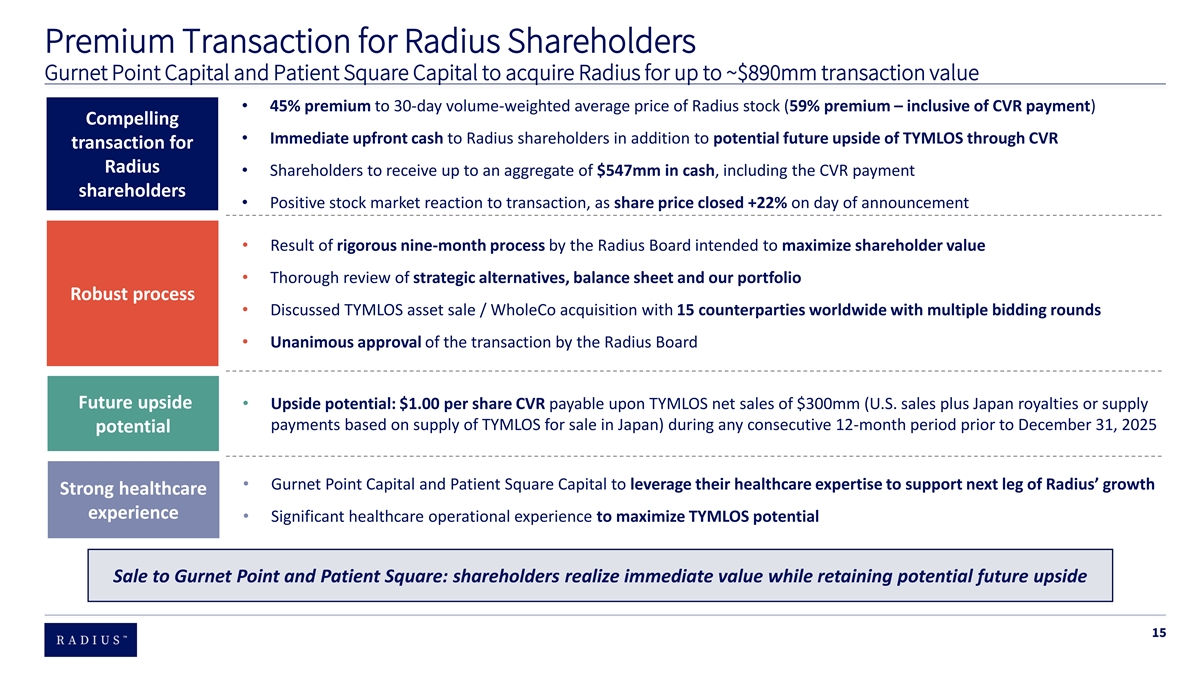

Executive Summary Board has taken bold measures since 1H of 2020 to de-risk the business while maintaining / enhancing upside optionality for shareholders: • Replaced the previous long serving and original public company Chairman • Replaced the previous CEO and hired an externally sourced new CEO • Board of Directors reconstituted: 3 directors left the Board and 6 directors (including CEO), new and highly experienced individuals, have joined • Out-licensed oncology program (Elacestrant): eliminated $125mm of required cash burn and 33% of clinical trial portfolio pivotal binary risk Company Change • Added Phase III asset (RAD011 - an orphan neuro-endocrine asset) at highly attractive financial terms to address TYMLOS single-product risk since 1H 2020 • Restructured balance sheet to eliminate significant shareholder dilution in the event of a ‘forced roll-over’ of the outstanding convertible notes and capitalized on accommodating term loan market Aggressive actions by the BOD: acknowledged need to adjust business fundamentals to enable equity and credit market value improvements • Board recognized multi-year price / value erosion in equity (7/2019 to 7/2022 down ~57%) Prior to three pivotal, Phase III readouts by YE 2021, initiated Strategic Review to determine best path forward for the company and shareholders, inclusive of an effort to balance clinical ‘event’ risk, drive positive cash flow, extend debt runway and unlock asset value • Despite operational improvements since 2020, challenging market conditions, outstanding debt and lower-than-expected Q1 TYMLOS sales further necessitated a review of strategic alternatives by Radius Board of Directors • External Process: outreach to current or previous equity investor’s, creditor’s, sell side analysts, industry potential partners or counterparties • Options considered: risk sharing for abaloparatide or RAD or both; early monetization of Elacestrant, BD in-licensing, merger, sale of individual Strategic assets or whole company Assessment & • Board conducted a robust process in which over 70 potential counterparties were contacted in order to assess interest in the above-described Process Leads to alternatives • Abaloparatide TD (core shareholder investment thesis) pivotal failure in December 2021 hardened the assessment and option considerations Transaction Outcome: announced Gurnet Point Capital & Patient Square Capital to acquire Radius for up to ~ $890mm of transaction value (equity plus debt) • 45% premium to 30-day volume-weighted average price of Radius stock (59% premium – inclusive of CVR payment) • Immediate upfront cash and liquidity to Radius shareholders plus the potential for future upside of TYMLOS through a CVR • The Radius Board ‘listened’ to shareholders and brought forward a transaction – which shareholders will have an opportunity to weigh in on via a tender offer 3

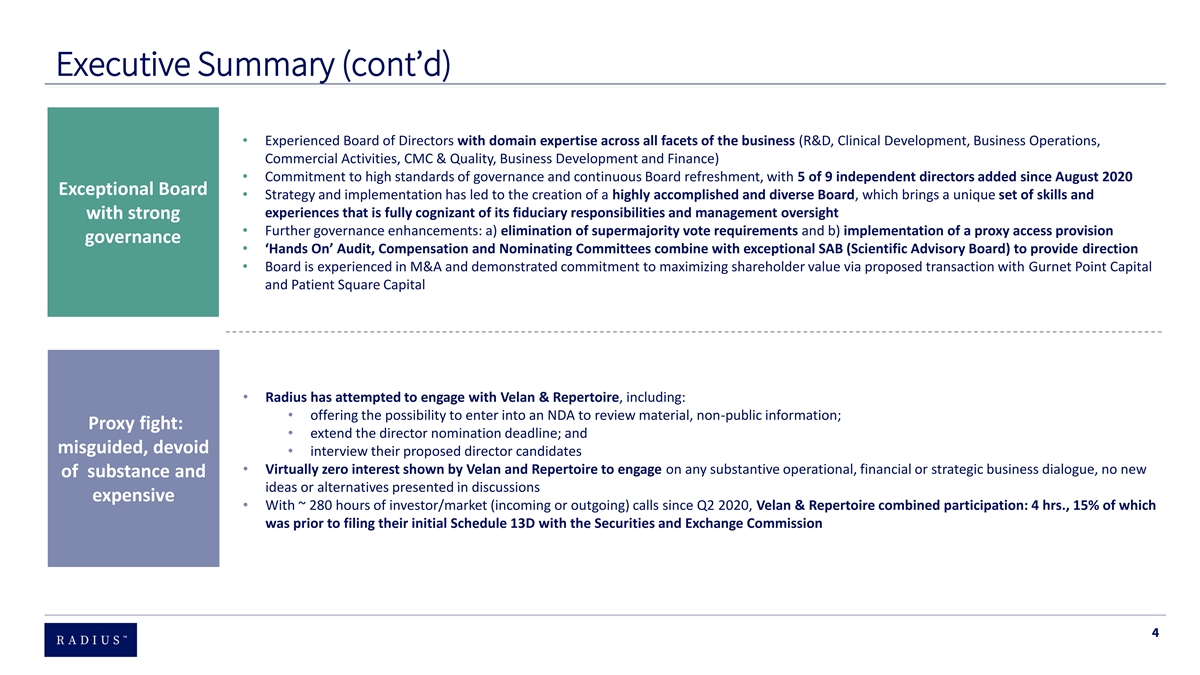

Executive Summary (cont’d) • Experienced Board of Directors with domain expertise across all facets of the business (R&D, Clinical Development, Business Operations, Commercial Activities, CMC & Quality, Business Development and Finance) • Commitment to high standards of governance and continuous Board refreshment, with 5 of 9 independent directors added since August 2020 Exceptional Board • Strategy and implementation has led to the creation of a highly accomplished and diverse Board, which brings a unique set of skills and experiences that is fully cognizant of its fiduciary responsibilities and management oversight with strong • Further governance enhancements: a) elimination of supermajority vote requirements and b) implementation of a proxy access provision governance • ‘Hands On’ Audit, Compensation and Nominating Committees combine with exceptional SAB (Scientific Advisory Board) to provide direction • Board is experienced in M&A and demonstrated commitment to maximizing shareholder value via proposed transaction with Gurnet Point Capital and Patient Square Capital • Radius has attempted to engage with Velan & Repertoire, including: • offering the possibility to enter into an NDA to review material, non-public information; Proxy fight: • extend the director nomination deadline; and misguided, devoid • interview their proposed director candidates • Virtually zero interest shown by Velan and Repertoire to engage on any substantive operational, financial or strategic business dialogue, no new of substance and ideas or alternatives presented in discussions expensive • With ~ 280 hours of investor/market (incoming or outgoing) calls since Q2 2020, Velan & Repertoire combined participation: 4 hrs., 15% of which was prior to filing their initial Schedule 13D with the Securities and Exchange Commission 4

S E C T I O N 1 Radius Health Business 5

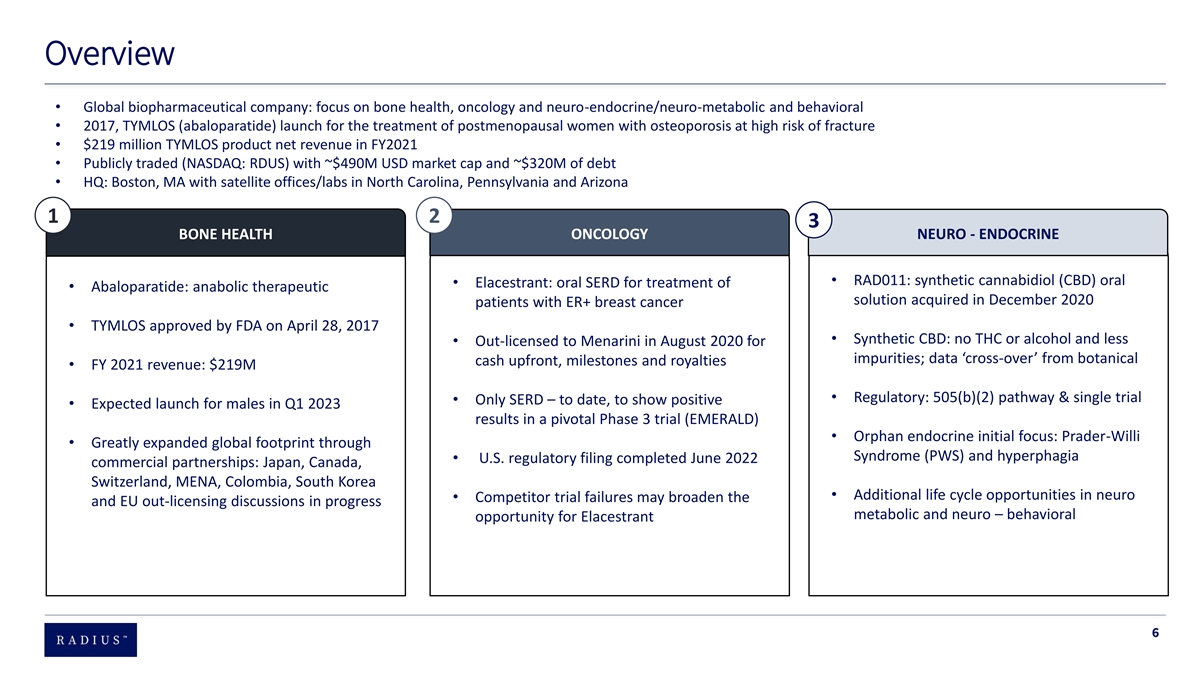

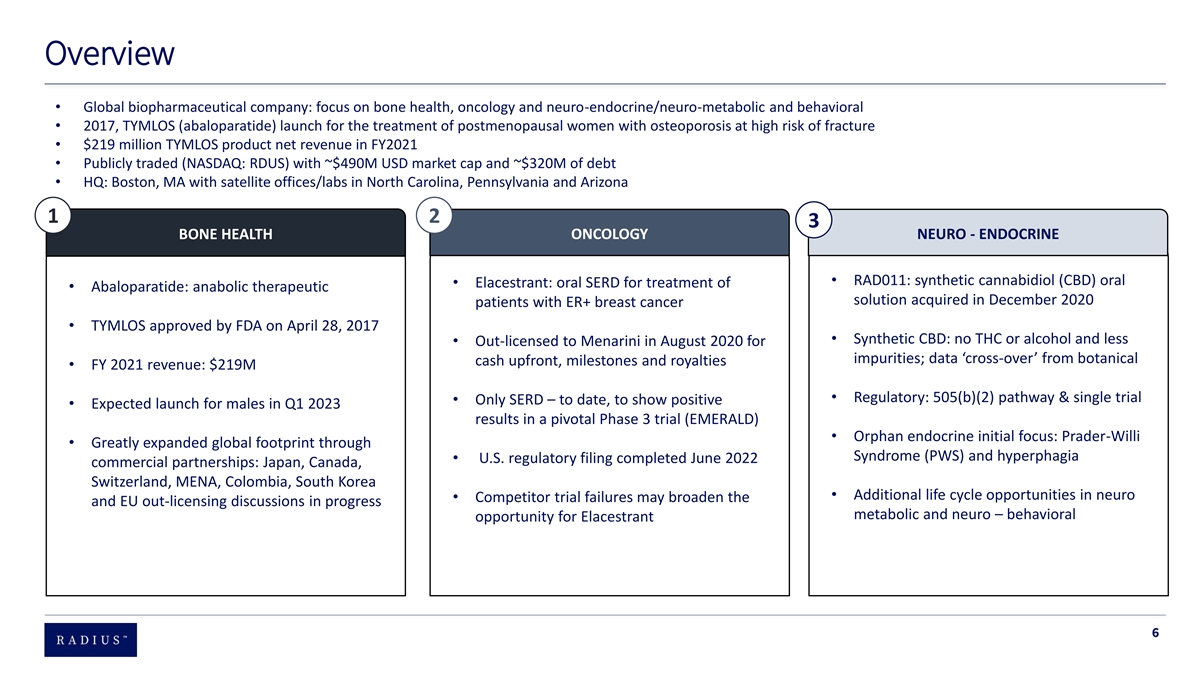

Overview • Global biopharmaceutical company: focus on bone health, oncology and neuro-endocrine/neuro-metabolic and behavioral • 2017, TYMLOS (abaloparatide) launch for the treatment of postmenopausal women with osteoporosis at high risk of fracture • $219 million TYMLOS product net revenue in FY2021 • Publicly traded (NASDAQ: RDUS) with ~$490M USD market cap and ~$320M of debt • HQ: Boston, MA with satellite offices/labs in North Carolina, Pennsylvania and Arizona 1 2 3 ONCOLOGY NEURO - ENDOCRINE BONE HEALTH T • RAD011: synthetic cannabidiol (CBD) oral • Elacestrant: oral SERD for treatment of • Abaloparatide: anabolic therapeutic solution acquired in December 2020 patients with ER+ breast cancer • TYMLOS approved by FDA on April 28, 2017 • Synthetic CBD: no THC or alcohol and less • Out-licensed to Menarini in August 2020 for impurities; data ‘cross-over’ from botanical cash upfront, milestones and royalties • FY 2021 revenue: $219M • Regulatory: 505(b)(2) pathway & single trial • Only SERD – to date, to show positive • Expected launch for males in Q1 2023 results in a pivotal Phase 3 trial (EMERALD) • Orphan endocrine initial focus: Prader-Willi • Greatly expanded global footprint through Syndrome (PWS) and hyperphagia • U.S. regulatory filing completed June 2022 commercial partnerships: Japan, Canada, Switzerland, MENA, Colombia, South Korea • Additional life cycle opportunities in neuro • Competitor trial failures may broaden the and EU out-licensing discussions in progress metabolic and neuro – behavioral opportunity for Elacestrant 6

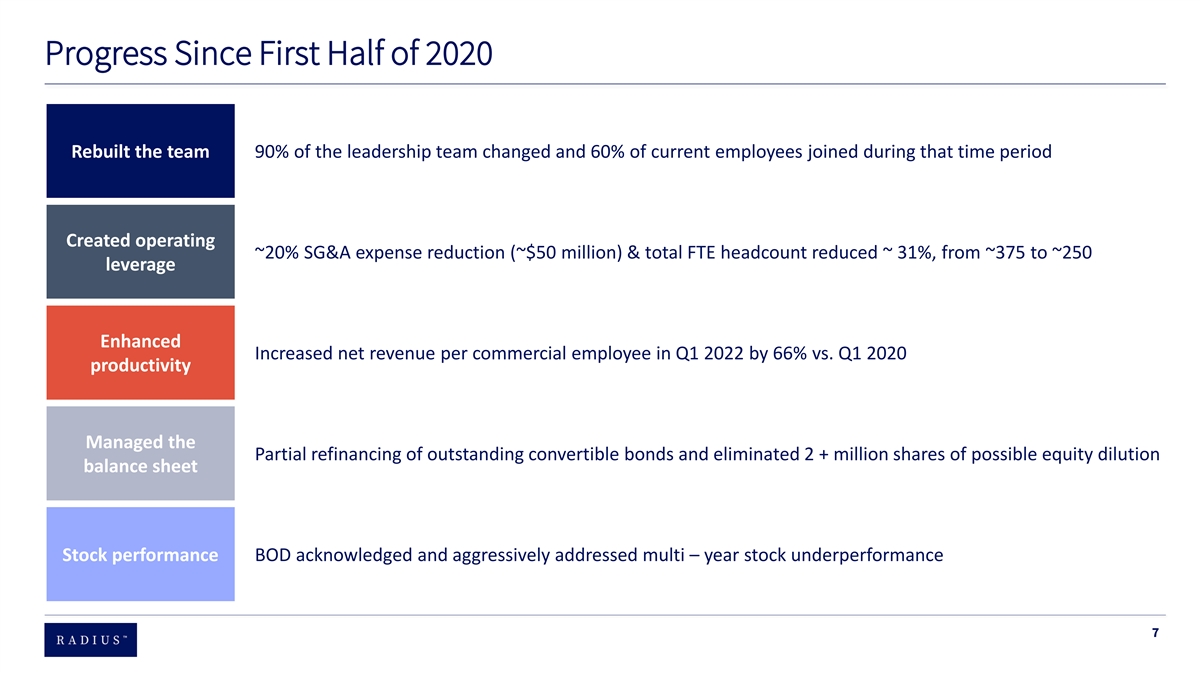

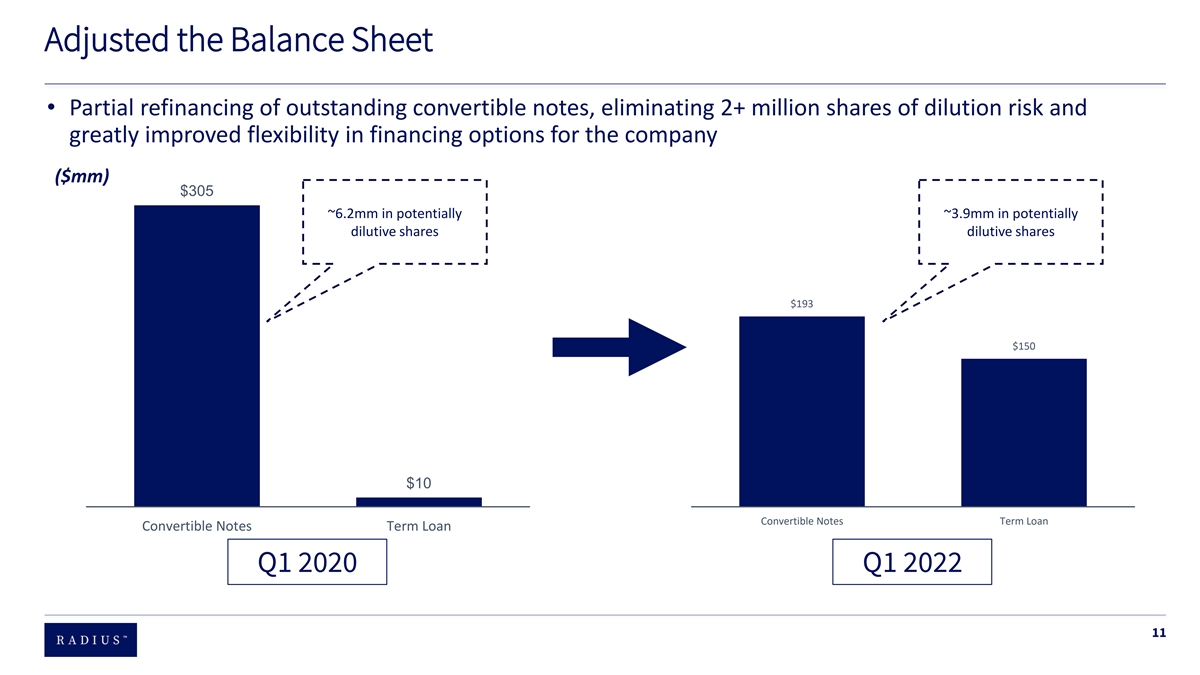

Progress Since First Half of 2020 Rebuilt the team 90% of the leadership team changed and 60% of current employees joined during that time period Created operating ~20% SG&A expense reduction (~$50 million) & total FTE headcount reduced ~ 31%, from ~375 to ~250 leverage Enhanced Increased net revenue per commercial employee in Q1 2022 by 66% vs. Q1 2020 productivity Managed the Partial refinancing of outstanding convertible bonds and eliminated 2 + million shares of possible equity dilution balance sheet Stock performance BOD acknowledged and aggressively addressed multi – year stock underperformance 7

Added Talent/Business Leaders JOINED IN APRIL 2020 JOINED IN MARCH 2022 Kelly Martin Mark Conley President and CEO Chief Financial Officer Kelly Martin is our President and Chief Executive Officer and joined the company in Mark serves as our Chief Financial Officer and joined the company in 2022. He is a Certified April 2020. He was the CEO of Elan Corporation plc, an Ireland-based pharmaceutical Public Accountant with over 30 years of experience in publicly listed companies. Prior to company. Prior to that he spent 21 years at Merrill Lynch & Co. Kelly currently serves joining Radius, Mark previously held senior leadership roles at Kaleido Biosciences, as Executive Chairman of two private companies: Wren Therapeutics Limited and Valeritas, Inc., as well as Thermo Fisher Scientific, Inc. Transition Bio, Inc. JOINED IN MARCH 2021 JOINED IN SEPTEMBER 2021 Elizabeth Messersmith, PhD Danielle Holtschlag SVP, Head of Neuroscience Group VP, U.S. Sales Channels Liz Messersmith leads the company’s neuroscience efforts and joined the company in Danielle Holtschlag serves as Head of U.S. Sales Channels and joined the company in March 2021. She has over 25 years of science translation and drug development September 2021. She has over two decades of sales leadership experience including experience advancing small molecules, biologics, and siRNAs in the therapeutic areas operations, training, and segment management. Prior to joining Radius, Danielle of CNS, dermatology, and a variety of orphan diseases. Liz previously held senior worked at PharmaEssentia and Genzyme. positions at Novan Inc., Quark Pharmaceuticals, Balance Therapeutics, Inc., and Elan Pharmaceuticals. JOINED IN JUNE 2021 JOINED IN MARCH 2021 Kim Clarke Bob Valentine General Counsel Business Intelligence & Digital - U.S. Commercial Kim serves as the company’s General Counsel and joined Radius in 2021. She brings Bob Valentine serves as head of business Intelligence & Digital for the U.S. Commercial two decades of experience to her role having worked in both corporate and private group and joined the company in March 2021. Prior to Radius, Bob was a consultant in practice focused on the biotech / pharmaceutical industry. Prior to joining Radius, Kim L.E.K. Consulting's Life Sciences practice, focused on growth strategy, M&A, and was Senior Counsel, US Pharma legal operations for GlaxoSmithKline. operations & planning. Bob has held various business roles at Shire, Regeneron, and Genzyme with experience in process engineering, business development, and operational execution. 90% of the leadership team changed and 60% of current employees have joined in last 24 months 8

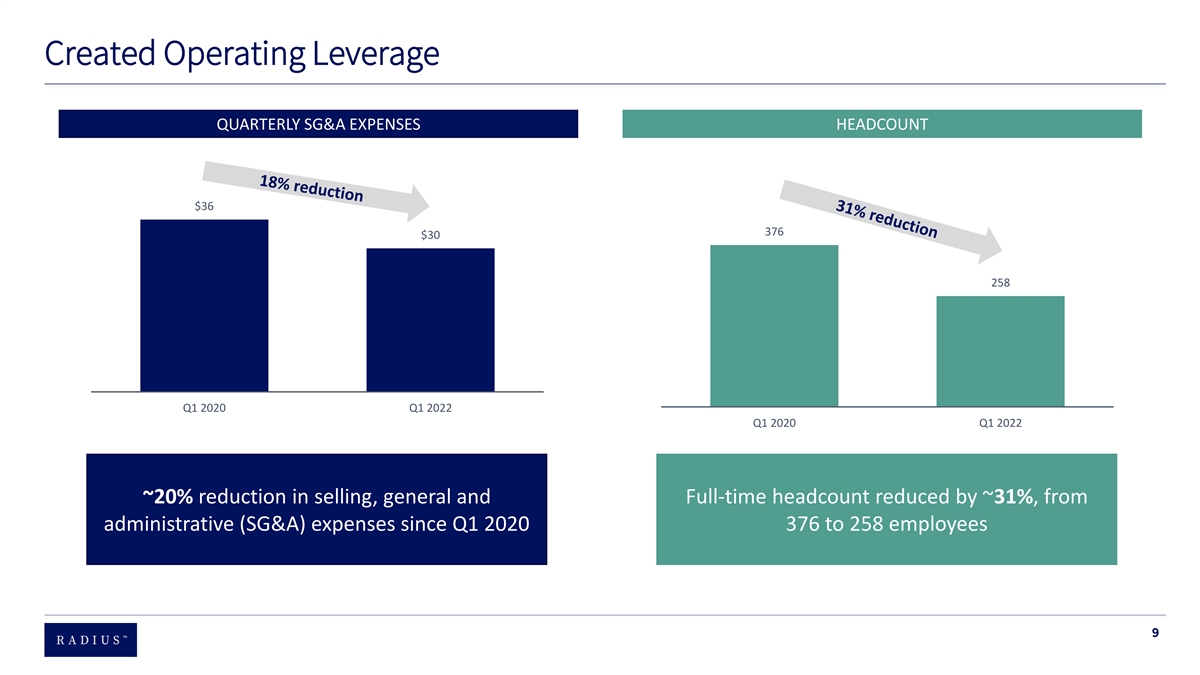

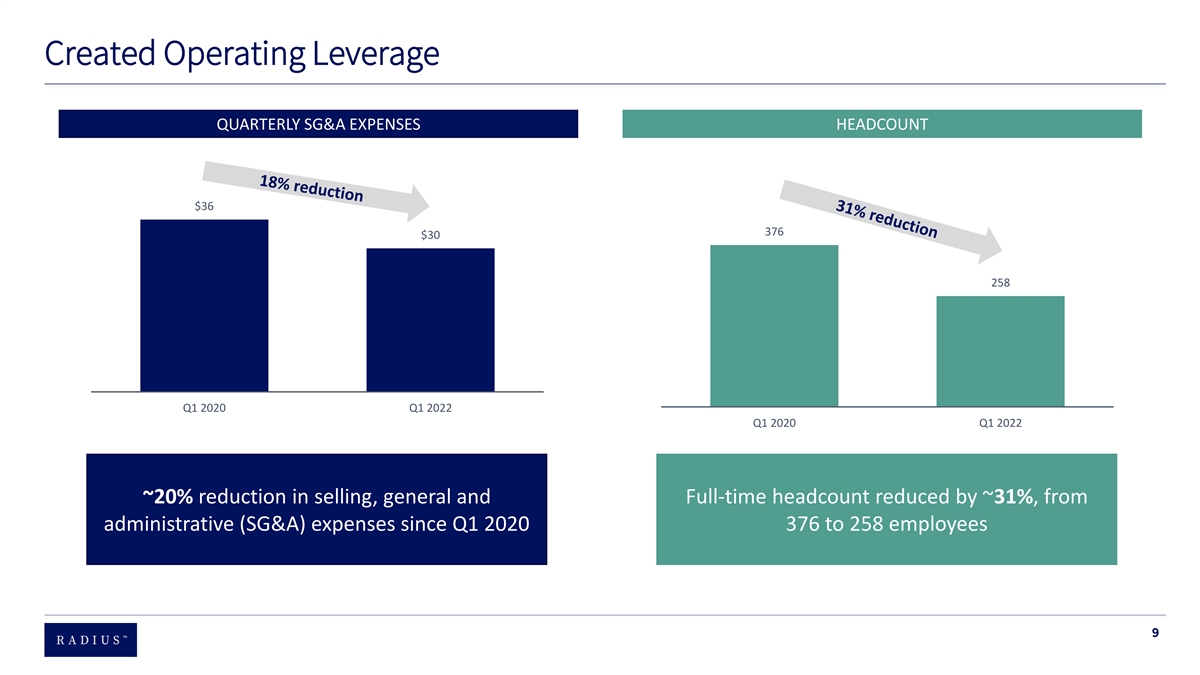

Created Operating Leverage QUARTERLY SG&A EXPENSES HEADCOUNT $36 376 $30 258 Q1 2020 Q1 2022 Q1 2020 Q1 2022 ~20% reduction in selling, general and Full-time headcount reduced by ~31%, from administrative (SG&A) expenses since Q1 2020 376 to 258 employees 9

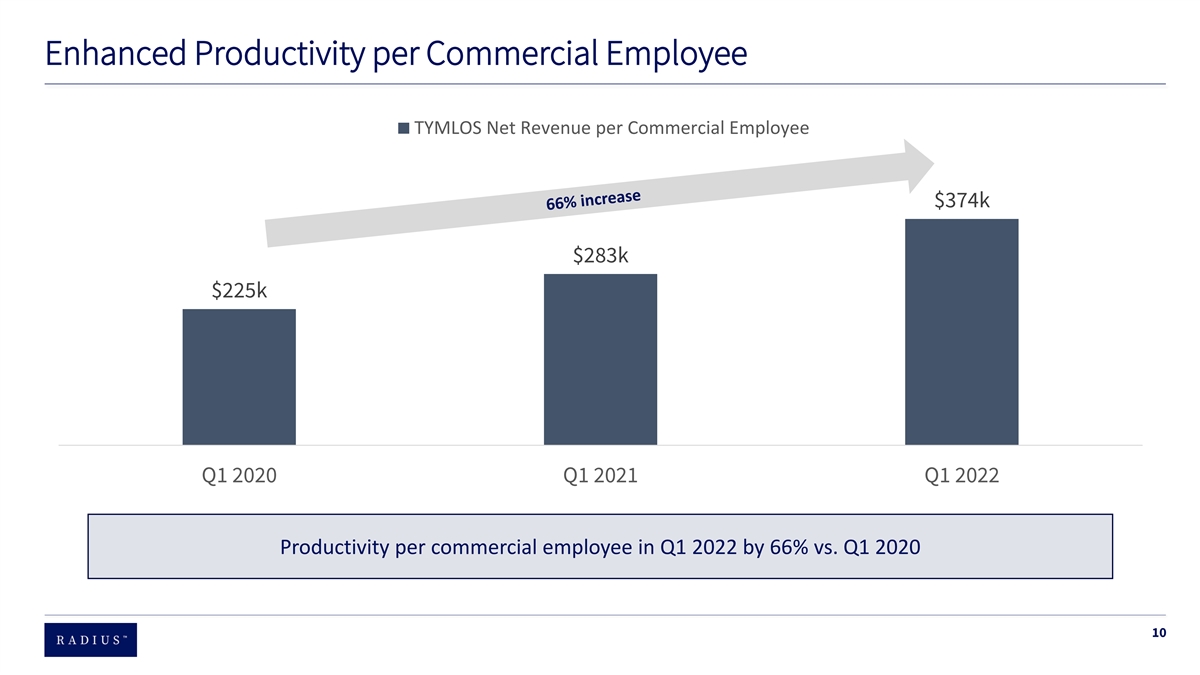

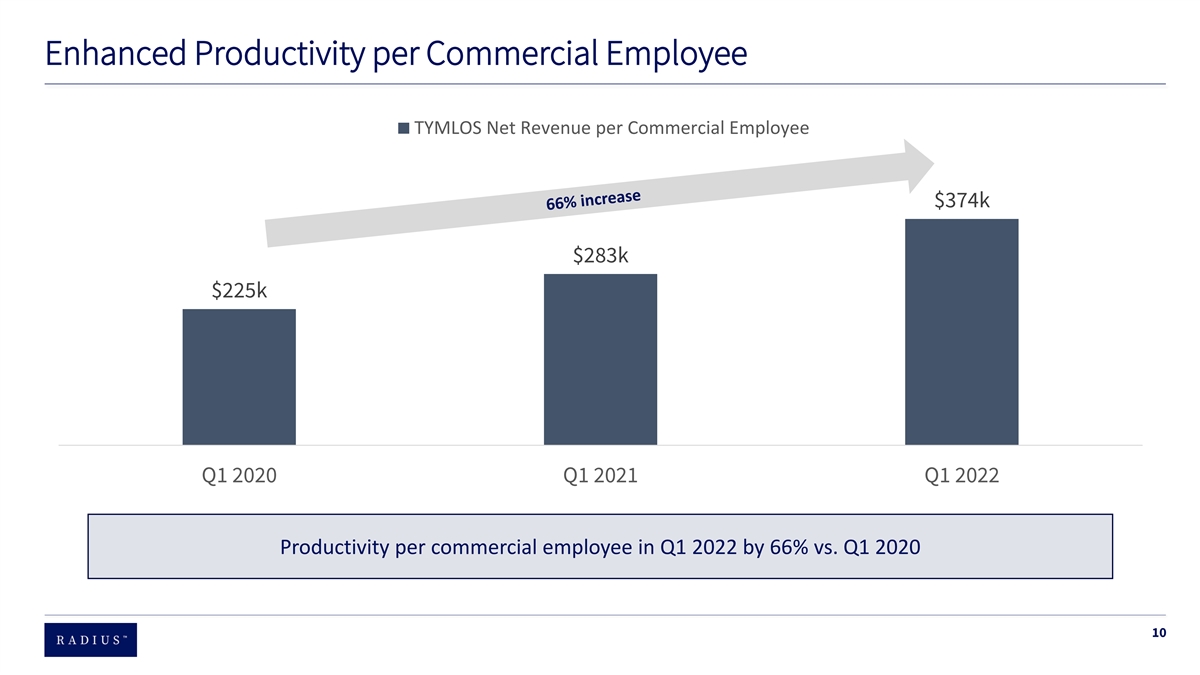

Enhanced Productivity per Commercial Employee TYMLOS Net Revenue per Commercial Employee $374k $283k $225k Q1 2020 Q1 2021 Q1 2022 Productivity per commercial employee in Q1 2022 by 66% vs. Q1 2020 10

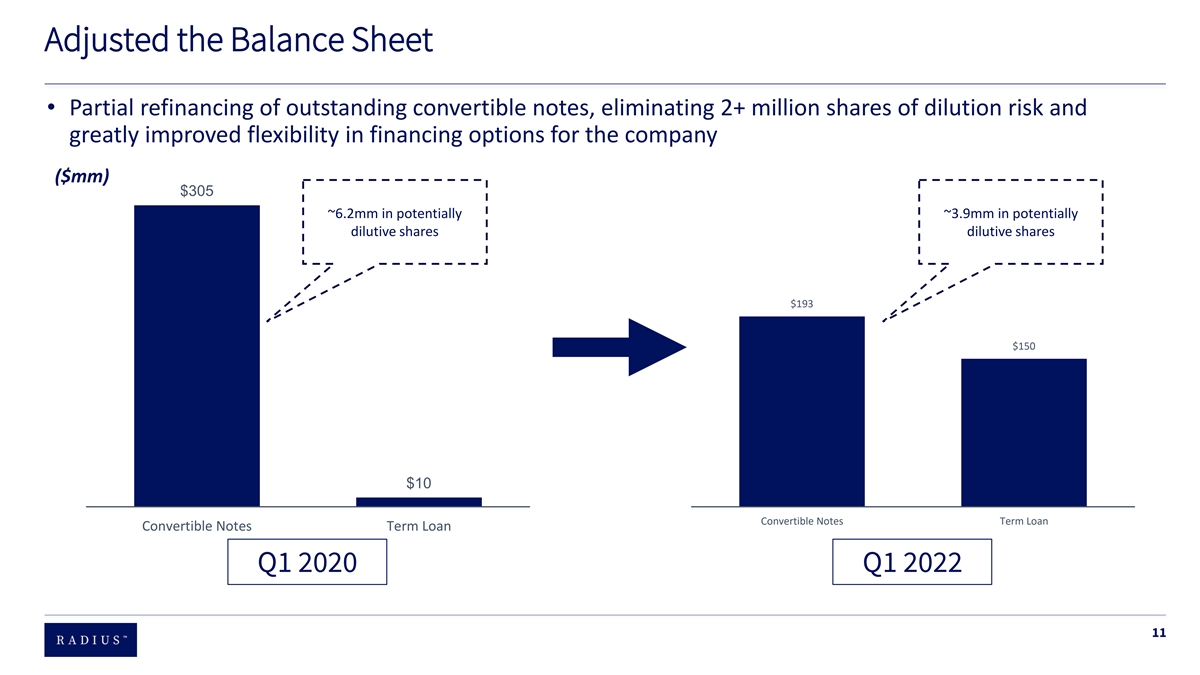

Adjusted the Balance Sheet • Partial refinancing of outstanding convertible notes, eliminating 2+ million shares of dilution risk and greatly improved flexibility in financing options for the company ($mm) $305 ~6.2mm in potentially ~3.9mm in potentially dilutive shares dilutive shares $193 $150 $10 Convertible Notes Term Loan Convertible Notes Term Loan Q1 2020 Q1 2022 11

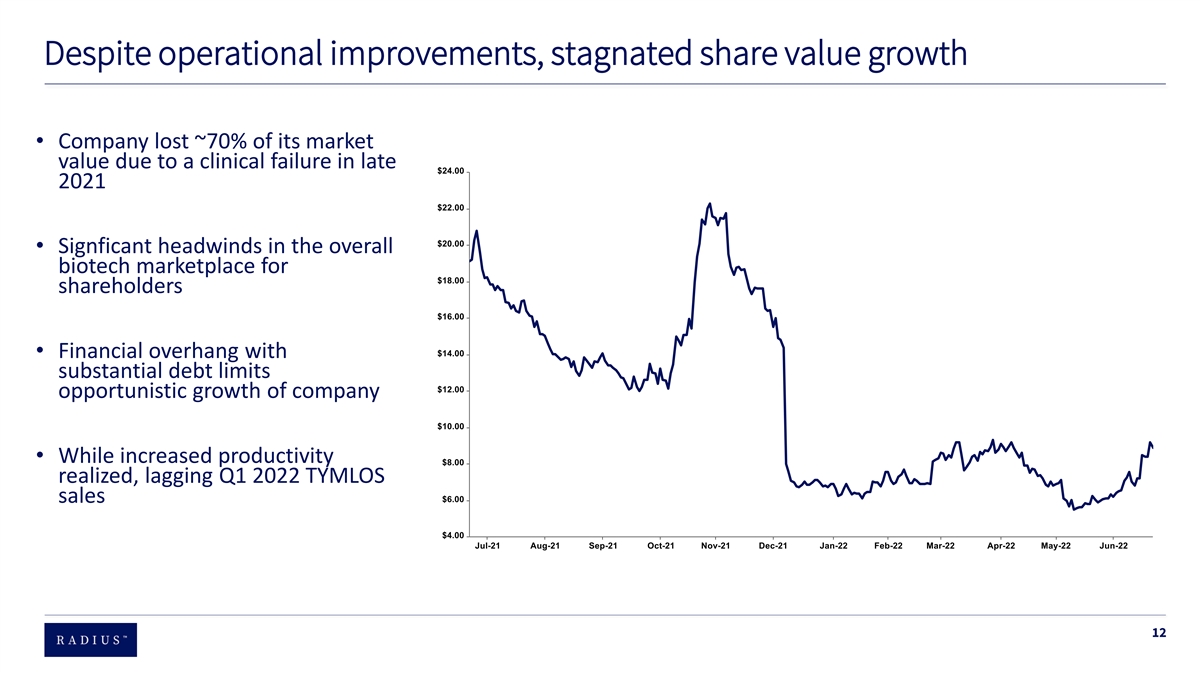

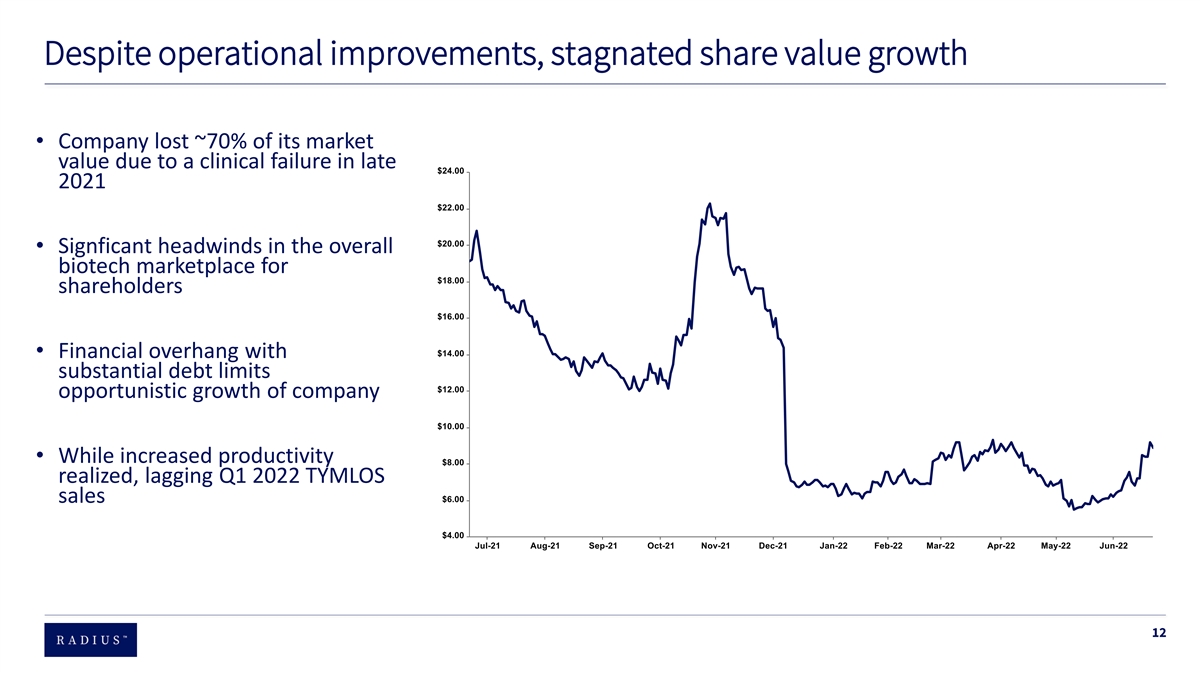

Despite operational improvements, stagnated share value growth • Company lost ~70% of its market value due to a clinical failure in late 2021 • Signficant headwinds in the overall biotech marketplace for shareholders • Financial overhang with substantial debt limits opportunistic growth of company • While increased productivity realized, lagging Q1 2022 TYMLOS sales 12

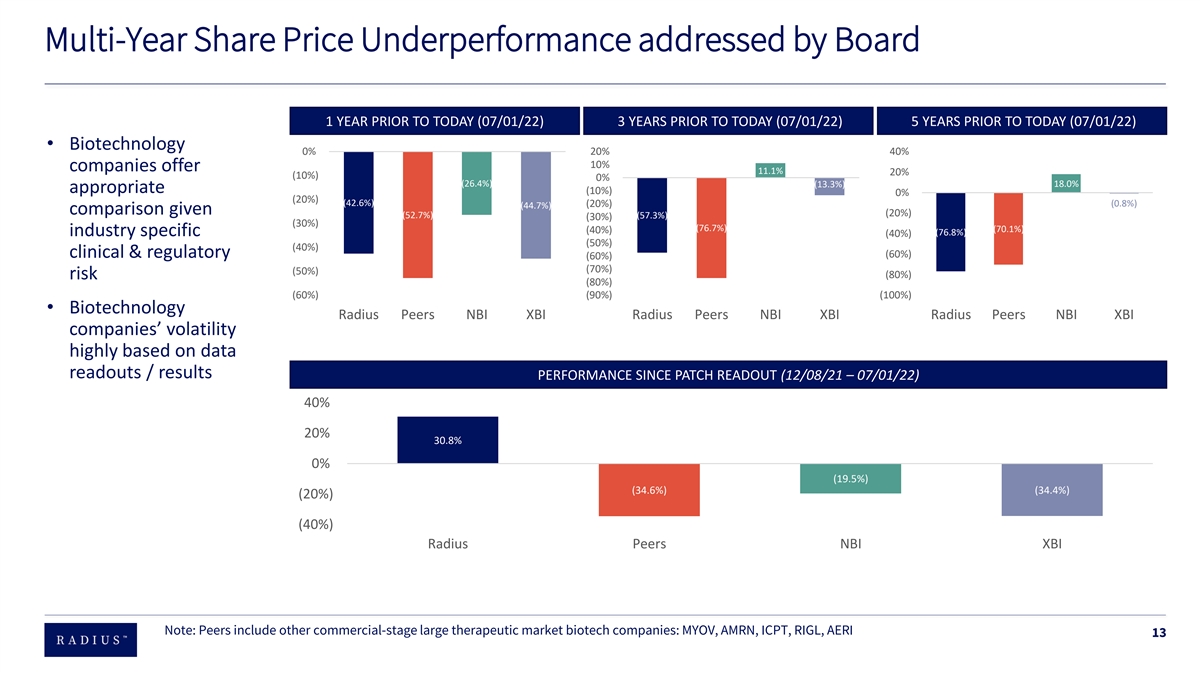

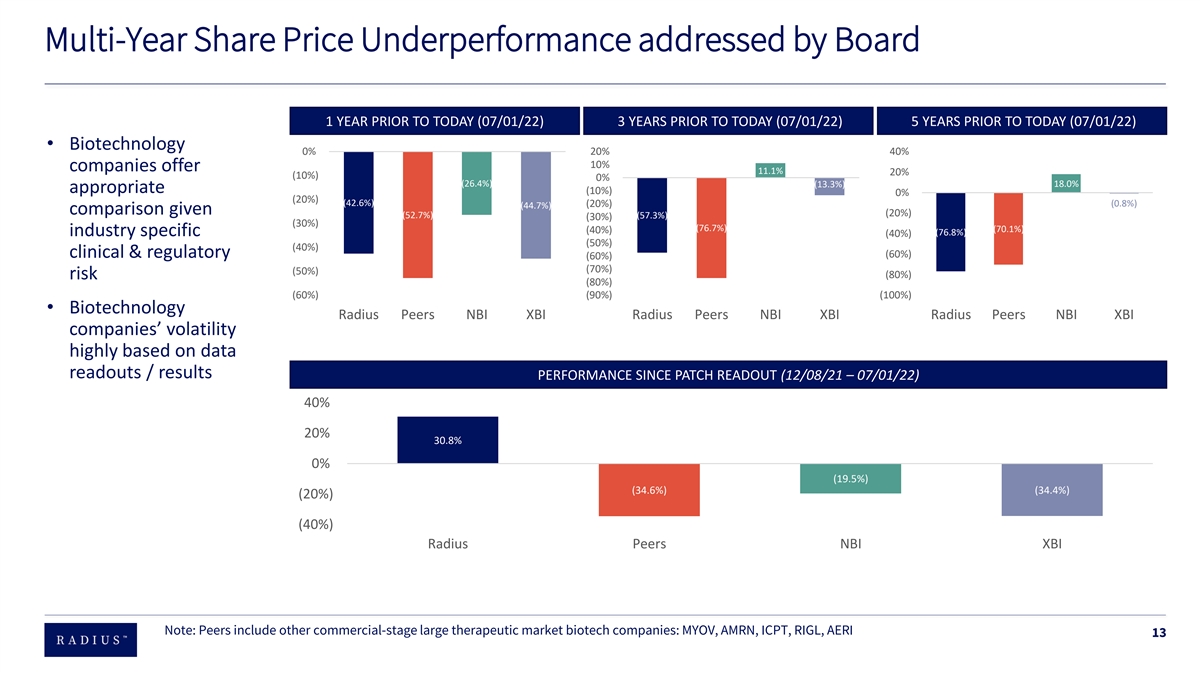

Multi-Year Share Price Underperformance addressed by Board 1 YEAR PRIOR TO TODAY (07/01/22) 3 YEARS PRIOR TO TODAY (07/01/22) 5 YEARS PRIOR TO TODAY (07/01/22) • Biotechnology 0% 20% 40% 10% companies offer 11.1% 20% (10%) 0% (26.4%) (13.3%) 18.0% appropriate (10%) 0% (20%) (42.6%) (0.8%) (20%) (44.7%) comparison given (20%) (52.7%) (57.3%) (30%) (30%) (76.7%) (70.1%) (40%) industry specific (76.8%) (40%) (50%) (40%) clinical & regulatory (60%) (60%) (70%) (50%) (80%) risk (80%) (60%) (90%) (100%) • Biotechnology Radius Peers NBI XBI Radius Peers NBI XBI Radius Peers NBI XBI companies’ volatility highly based on data readouts / results PERFORMANCE SINCE PATCH READOUT (12/08/21 – 07/01/22) 40% 20% 30.8% 0% (19.5%) (34.6%) (34.4%) (20%) (40%) Radius Peers NBI XBI Note: Peers include other commercial-stage large therapeutic market biotech companies: MYOV, AMRN, ICPT, RIGL, AERI 13

S E C T I O N 2 Transaction Resulting from Strategic Assessment & Process 14

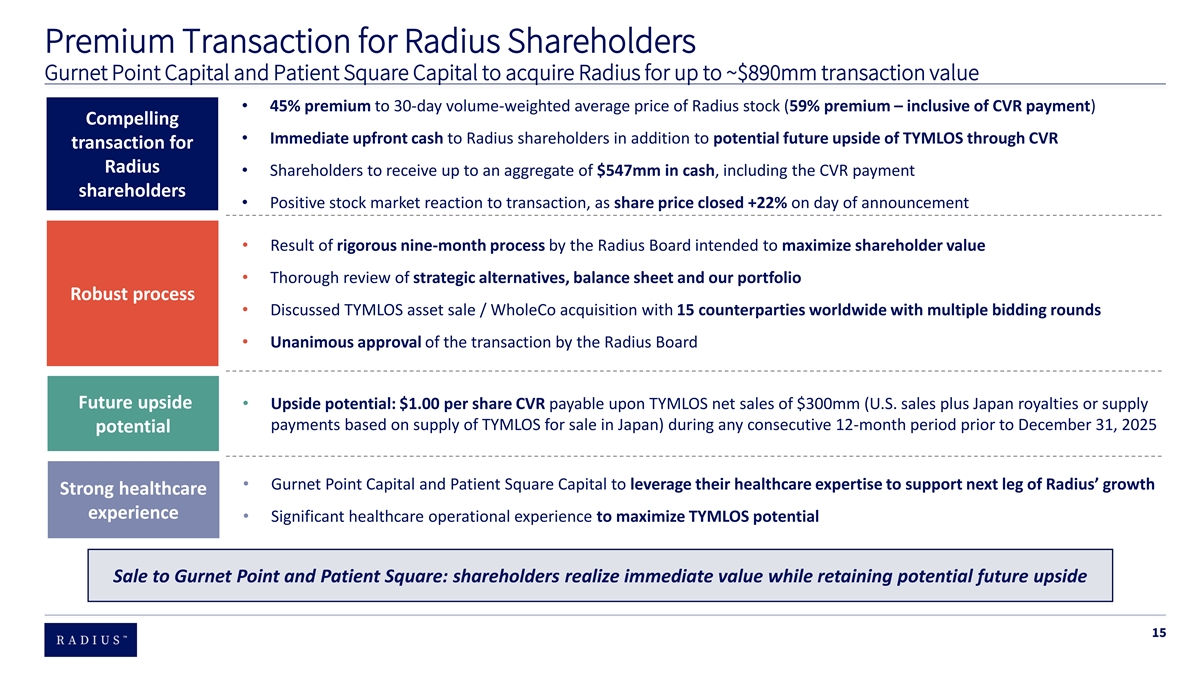

Premium Transaction for Radius Shareholders Gurnet Point Capital and Patient Square Capital to acquire Radius for up to ~$890mm transaction value • 45% premium to 30-day volume-weighted average price of Radius stock (59% premium – inclusive of CVR payment) Compelling • Immediate upfront cash to Radius shareholders in addition to potential future upside of TYMLOS through CVR transaction for Radius • Shareholders to receive up to an aggregate of $547mm in cash, including the CVR payment shareholders • Positive stock market reaction to transaction, as share price closed +22% on day of announcement • Result of rigorous nine-month process by the Radius Board intended to maximize shareholder value • Thorough review of strategic alternatives, balance sheet and our portfolio Robust process • Discussed TYMLOS asset sale / WholeCo acquisition with 15 counterparties worldwide with multiple bidding rounds • Unanimous approval of the transaction by the Radius Board Future upside • Upside potential: $1.00 per share CVR payable upon TYMLOS net sales of $300mm (U.S. sales plus Japan royalties or supply payments based on supply of TYMLOS for sale in Japan) during any consecutive 12-month period prior to December 31, 2025 potential • Gurnet Point Capital and Patient Square Capital to leverage their healthcare expertise to support next leg of Radius’ growth Strong healthcare experience • Significant healthcare operational experience to maximize TYMLOS potential Sale to Gurnet Point and Patient Square: shareholders realize immediate value while retaining potential future upside 15

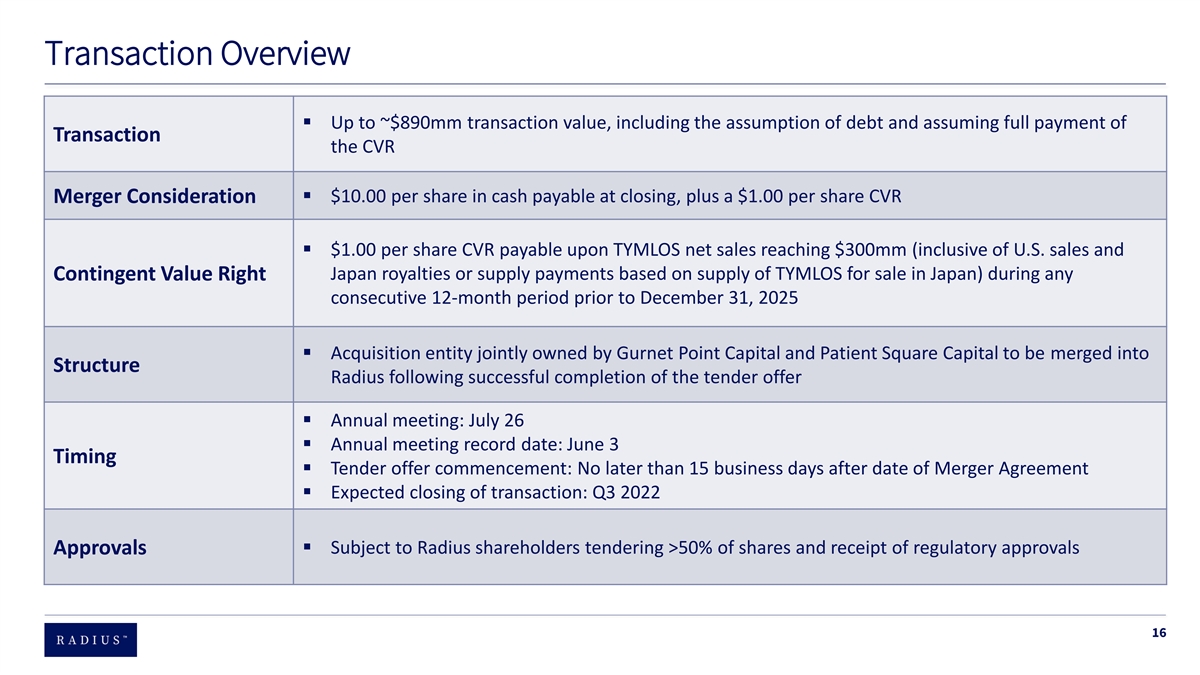

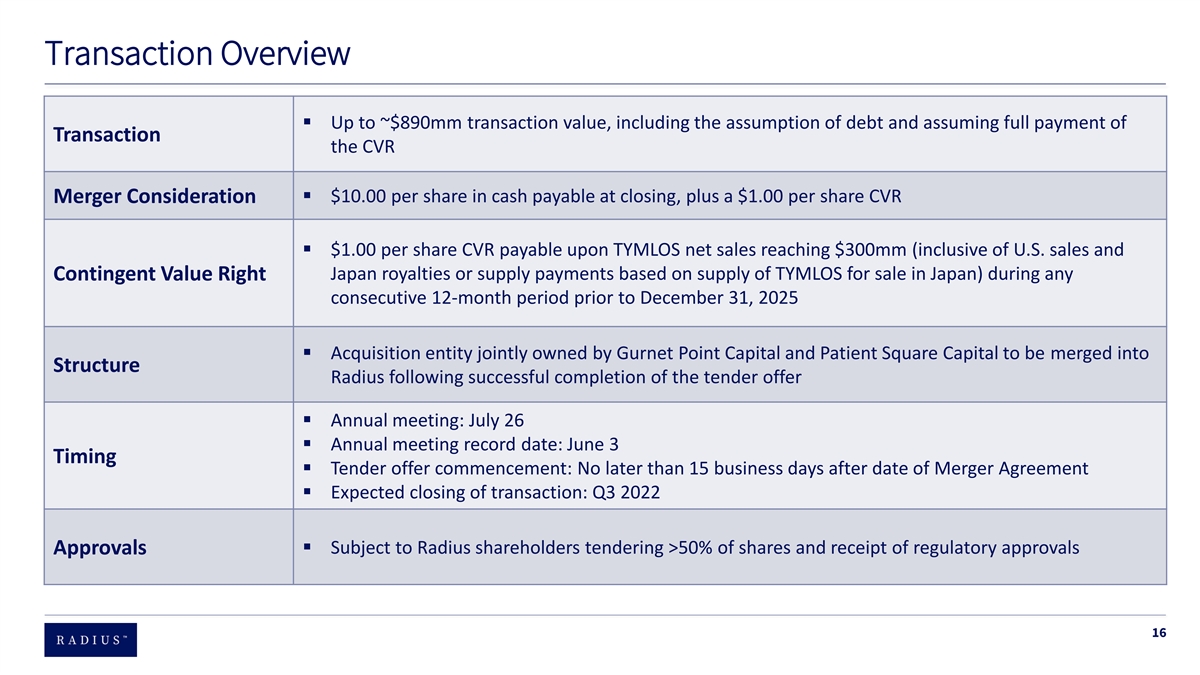

Transaction Overview ▪ Up to ~$890mm transaction value, including the assumption of debt and assuming full payment of Transaction the CVR ▪ $10.00 per share in cash payable at closing, plus a $1.00 per share CVR Merger Consideration ▪ $1.00 per share CVR payable upon TYMLOS net sales reaching $300mm (inclusive of U.S. sales and Japan royalties or supply payments based on supply of TYMLOS for sale in Japan) during any Contingent Value Right consecutive 12-month period prior to December 31, 2025 ▪ Acquisition entity jointly owned by Gurnet Point Capital and Patient Square Capital to be merged into Structure Radius following successful completion of the tender offer ▪ Annual meeting: July 26 ▪ Annual meeting record date: June 3 Timing ▪ Tender offer commencement: No later than 15 business days after date of Merger Agreement ▪ Expected closing of transaction: Q3 2022 ▪ Subject to Radius shareholders tendering >50% of shares and receipt of regulatory approvals Approvals 16

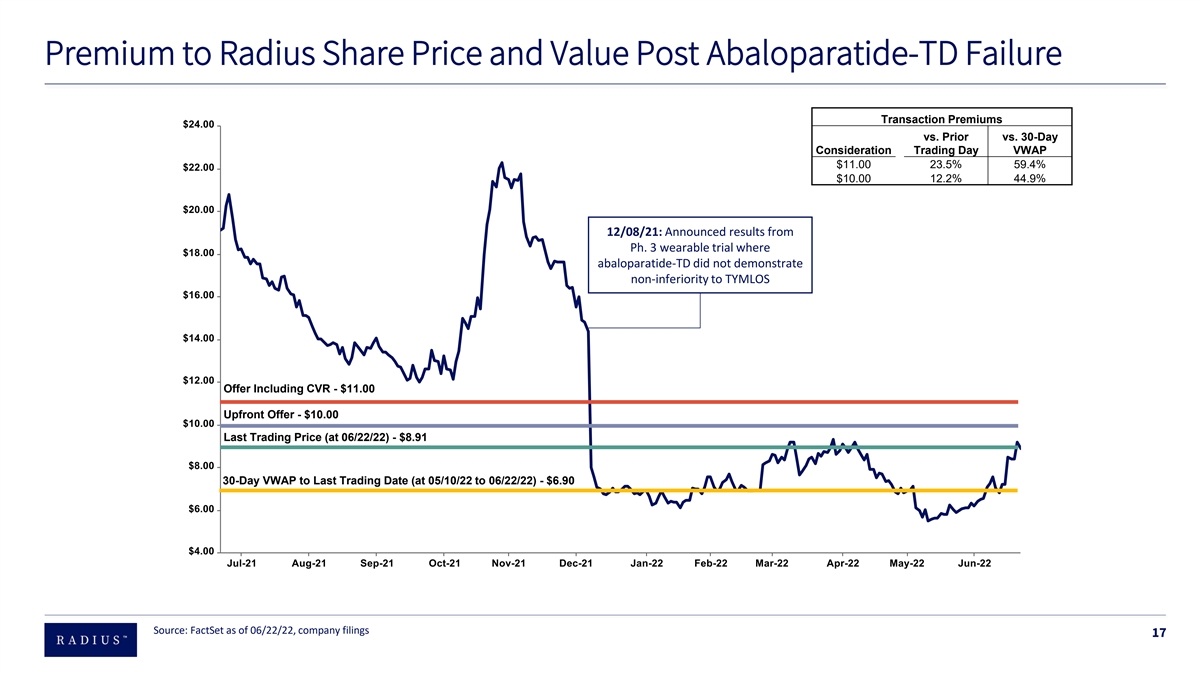

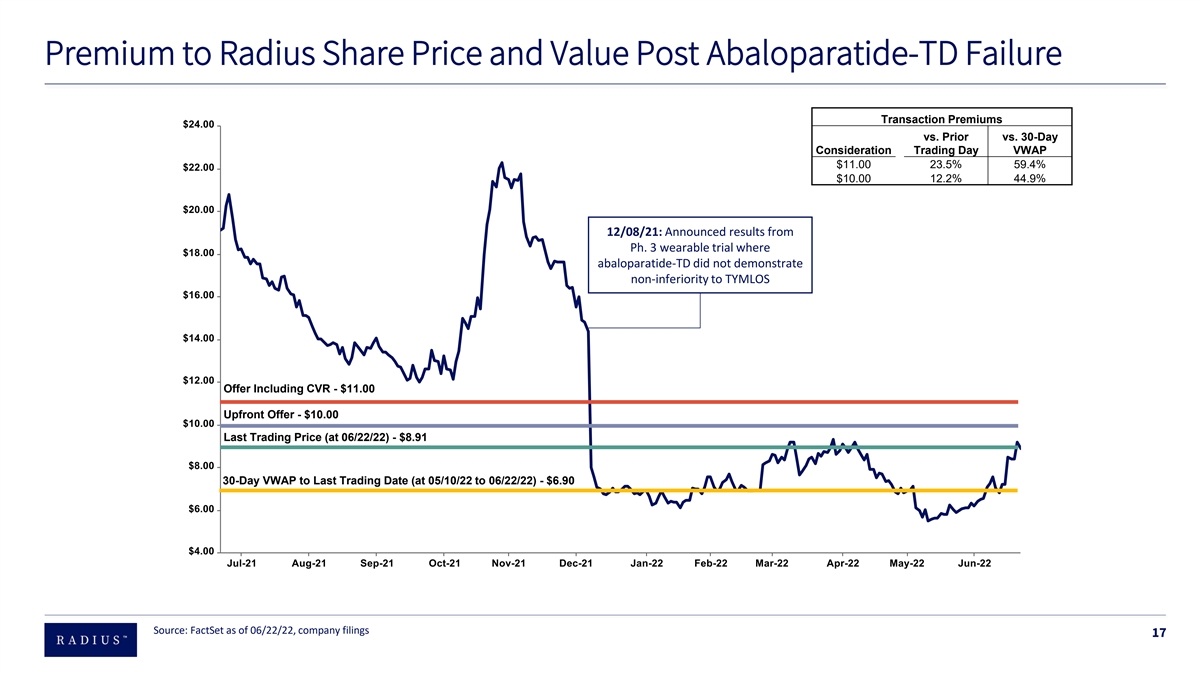

Premium to Radius Share Price and Value Post Abaloparatide-TD Failure Transaction Premiums vs. Prior vs. 30-Day Consideration Trading Day VWAP $11.00 23.5% 59.4% $10.00 12.2% 44.9% 12/08/21: Announced results from Ph. 3 wearable trial where abaloparatide-TD did not demonstrate non-inferiority to TYMLOS Offer Including CVR - $11.00 Upfront Offer - $10.00 Last Trading Price (at 06/22/22) - $8.91 30-Day VWAP to Last Trading Date (at 05/10/22 to 06/22/22) - $6.90 Source: FactSet as of 06/22/22, company filings 17

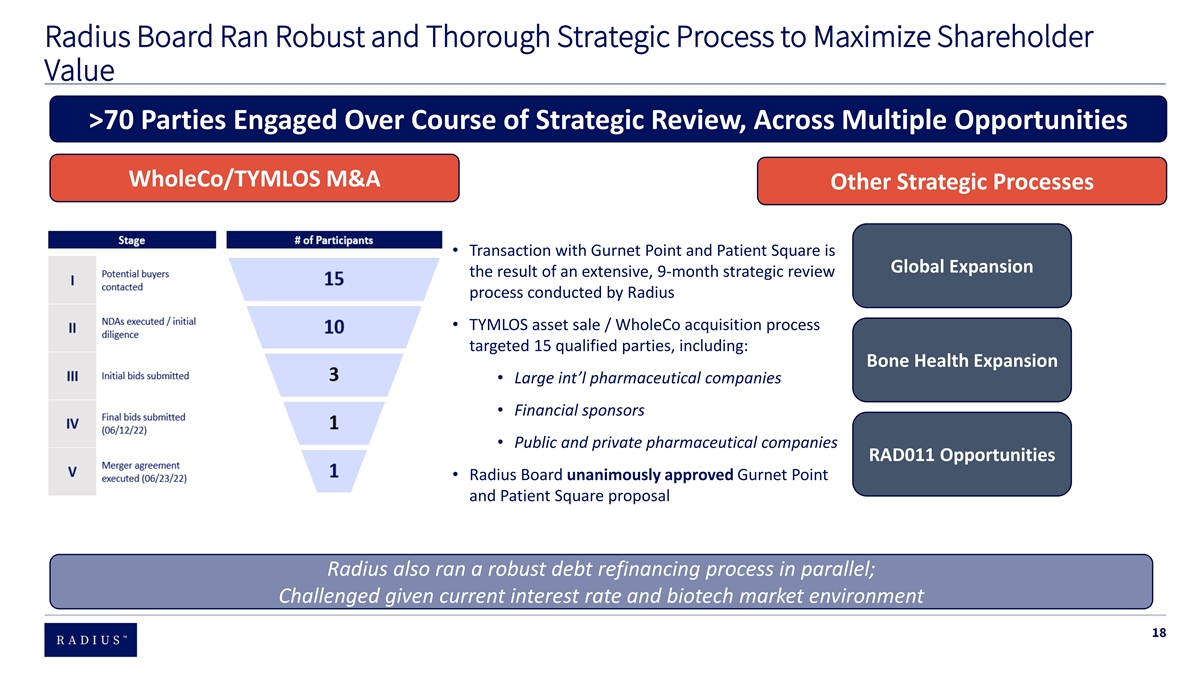

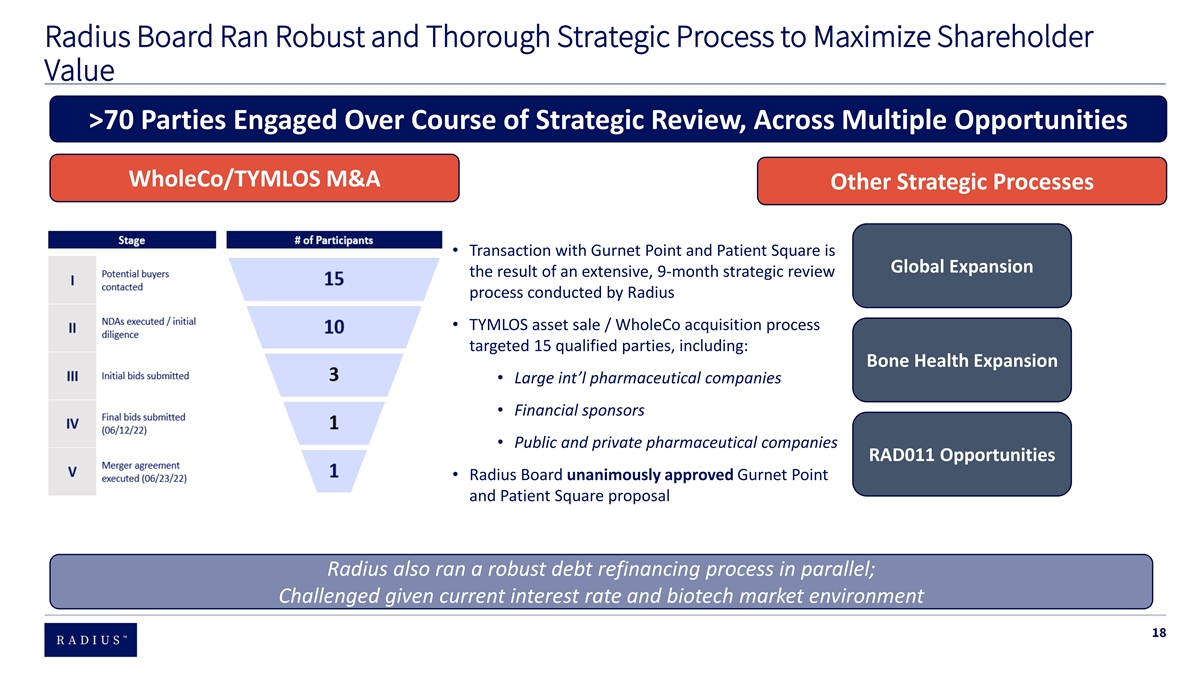

Radius Board Ran Robust and Thorough Strategic Process to Maximize Shareholder Value >70 Parties Engaged Over Course of Strategic Review, Across Multiple Opportunities WholeCo/TYMLOS M&A Other Strategic Processes • Transaction with Gurnet Point and Patient Square is Global Expansion the result of an extensive, 9-month strategic review process conducted by Radius • TYMLOS asset sale / WholeCo acquisition process targeted 15 qualified parties, including: Bone Health Expansion • Large int’l pharmaceutical companies • Financial sponsors • Public and private pharmaceutical companies RAD011 Opportunities • Radius Board unanimously approved Gurnet Point and Patient Square proposal Radius also ran a robust debt refinancing process in parallel; Challenged given current interest rate and biotech market environment 18

Comprehensive Strategic Review Initiated by Board in 2020 • Key Board of Directors considerations during strategic review process • Strengthening business • Enhancing shareholder value and reduce risk • Add to/diversify shareholder core value proposition of, predominantly abaloparatide-TD (“the patch”) • Refinancing outstanding indebtedness • Expanding global footprint (bone health expansion opportunities, licensing opportunities, potential sale of RAD011) • Potential sale of company and TYMLOS Additional strategic processes Debt refinancing process • Global Expansion:• May 2020: Radius began discussions with various financial institutions and holders of its convertible notes to evaluate opportunities to partially • January 2021 – December 2021: Radius met with 21 potential partners, leading to 4 draft term sheets and refinance its outstanding indebtedness to reduce dilution and refinancing contract negotiations advancing with a fifth party; 16 parties did not advance beyond initial conversations risk and to diversify the Company’s sources of debt capital • January 2022 – June 2022: Negotiations continued with 2 parties; Radius also met with another 15 • Q1 2021: Radius held formal discussions with eight prospective capital potential partners; 14 did not advance beyond initial conversations; on June 8, Radius announced licensing providers and informal discussions with an additional two prospective agreements with 3 parties (Labatec Pharma SA, Pharmbio Korea Inc. and Biosidus) capital providers and received 4 proposals • Bone Health Expansion: • March 2021: Radius completed refinancing transaction with MidCap • April 2021 – December 2021: Radius met with 5 prospective licensing partners and began preliminary Financial involving (1) secured term loan facility in an aggregate principal negotiations with 1 partner, which were placed on hold in August 2021 because Radius determined that amount of up to $150 million, with an additional $25 million term loan that there were insufficient data available with respect to the potential partner’s technology Radius could request within one year of the closing date of the initial term • RAD011: loan and (2) a secured revolving credit facility in an aggregate principal • September 2021 – February 2022: Radius explored potential RAD011 licensing opportunities with 7 amount of up to $25 million prospective licensing partners • January 2022: Radius launched second stage of refinancing process • Early 2022: Radius considered a potential reverse merger, spin off or carve out of RAD011 in parallel to in- intended to (1) repay the remainder of outstanding term loan and and out-licensing opportunities convertible notes, (2) provide operating flexibility and (3) optimize Radius’ ability to monetize the Elacestrant royalty stream and milestone cashflow • March 2022 – June 2022: Radius continued discussions with one of the partners with whom it had held prior discussions and met with 12 additional prospective partners; meetings were primarily informational • April 2022: Non-binding term sheet with a financial institution was signed and did not result in any substantive negotiations • Q2 2022: Refinancing placed on hold as potential sale of Radius gained momentum 19

S E C T I O N 3 Board & Corporate Governance 20

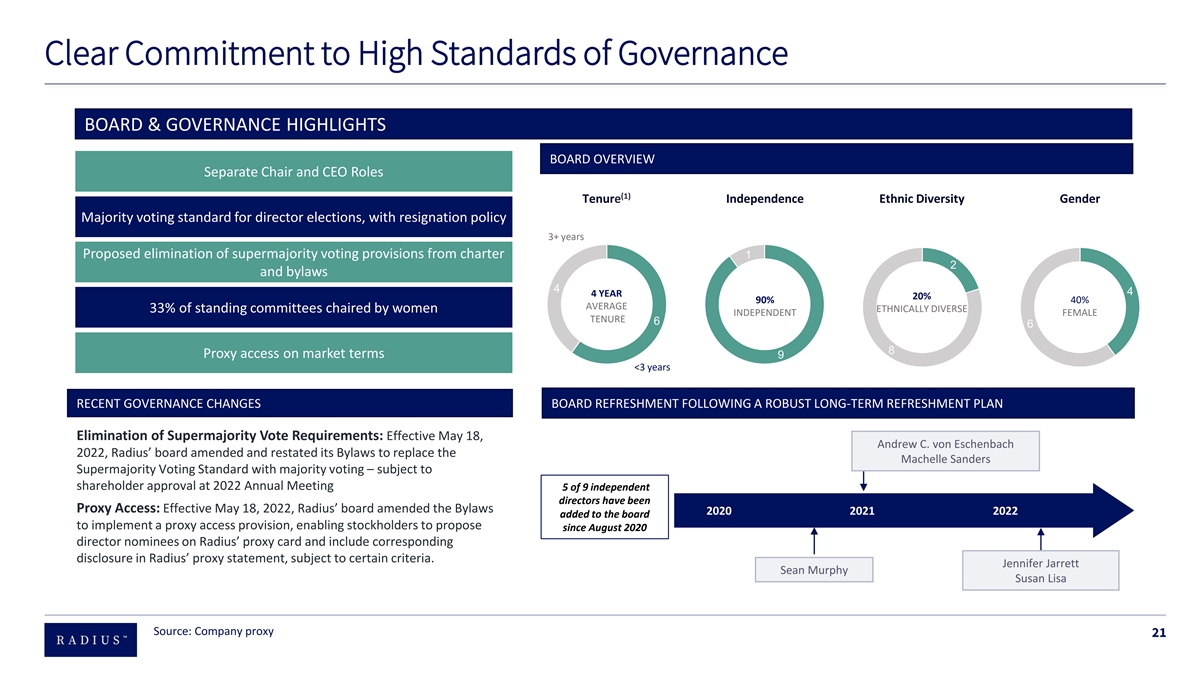

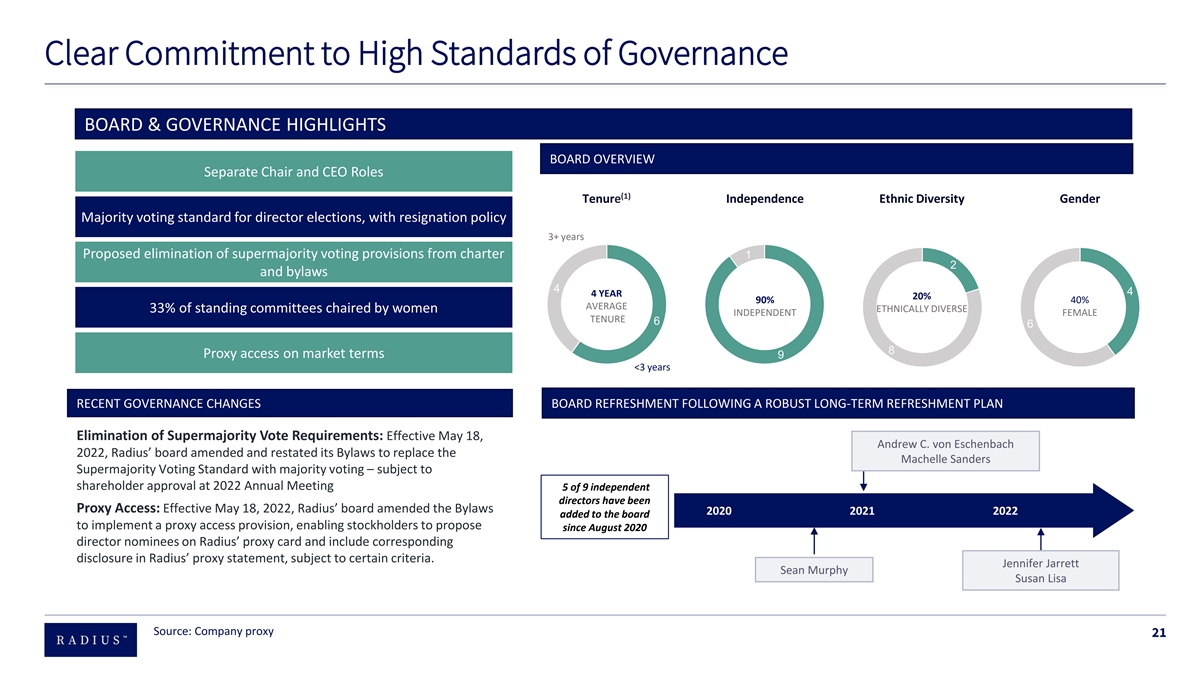

Clear Commitment to High Standards of Governance BOARD & GOVERNANCE HIGHLIGHTS BOARD OVERVIEW Separate Chair and CEO Roles (1) Tenure Independence Ethnic Diversity Gender Majority voting standard for director elections, with resignation policy 3+ years Proposed elimination of supermajority voting provisions from charter 1 2 and bylaws 4 4 4 YEAR 20% 90% 40% AVERAGE 33% of standing committees chaired by women ETHNICALLY DIVERSE INDEPENDENT FEMALE TENURE 6 6 8 Proxy access on market terms 9 <3 years RECENT GOVERNANCE CHANGES BOARD REFRESHMENT FOLLOWING A ROBUST LONG-TERM REFRESHMENT PLAN Recent Governance Changes Elimination of Supermajority Vote Requirements: Effective May 18, Andrew C. von Eschenbach 2022, Radius’ board amended and restated its Bylaws to replace the Machelle Sanders Supermajority Voting Standard with majority voting – subject to shareholder approval at 2022 Annual Meeting 5 of 9 independent directors have been Proxy Access: Effective May 18, 2022, Radius’ board amended the Bylaws 2020 2021 2022 added to the board to implement a proxy access provision, enabling stockholders to propose since August 2020 director nominees on Radius’ proxy card and include corresponding disclosure in Radius’ proxy statement, subject to certain criteria. Jennifer Jarrett Sean Murphy Susan Lisa Source: Company proxy 21

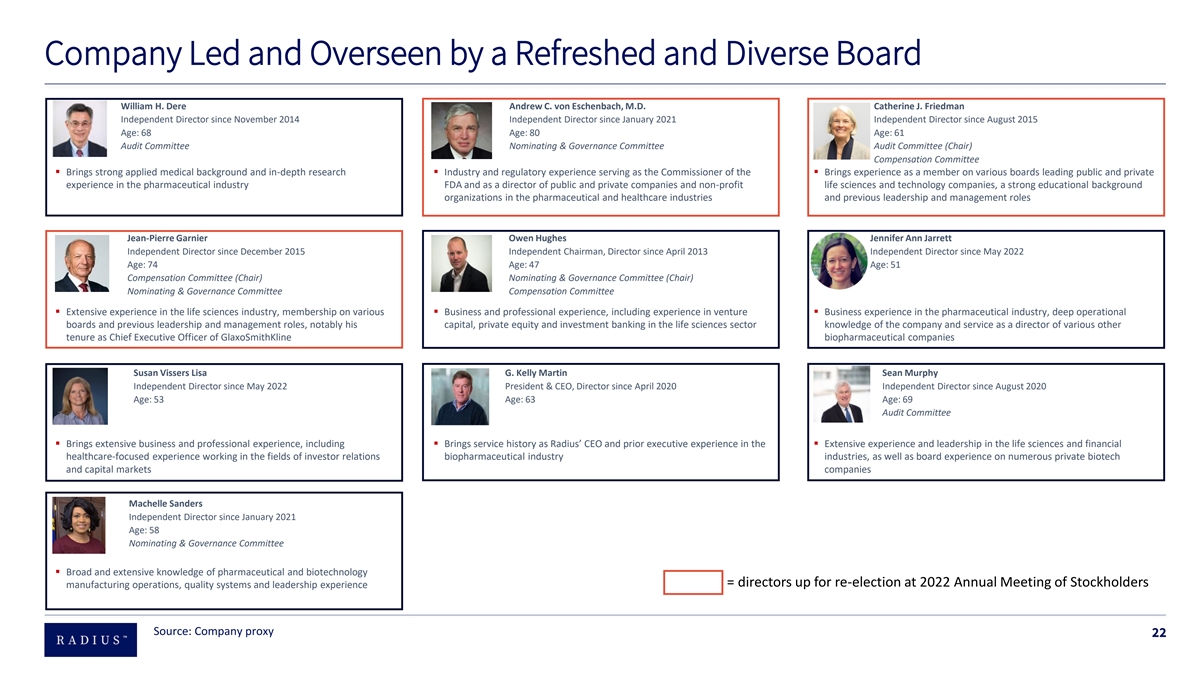

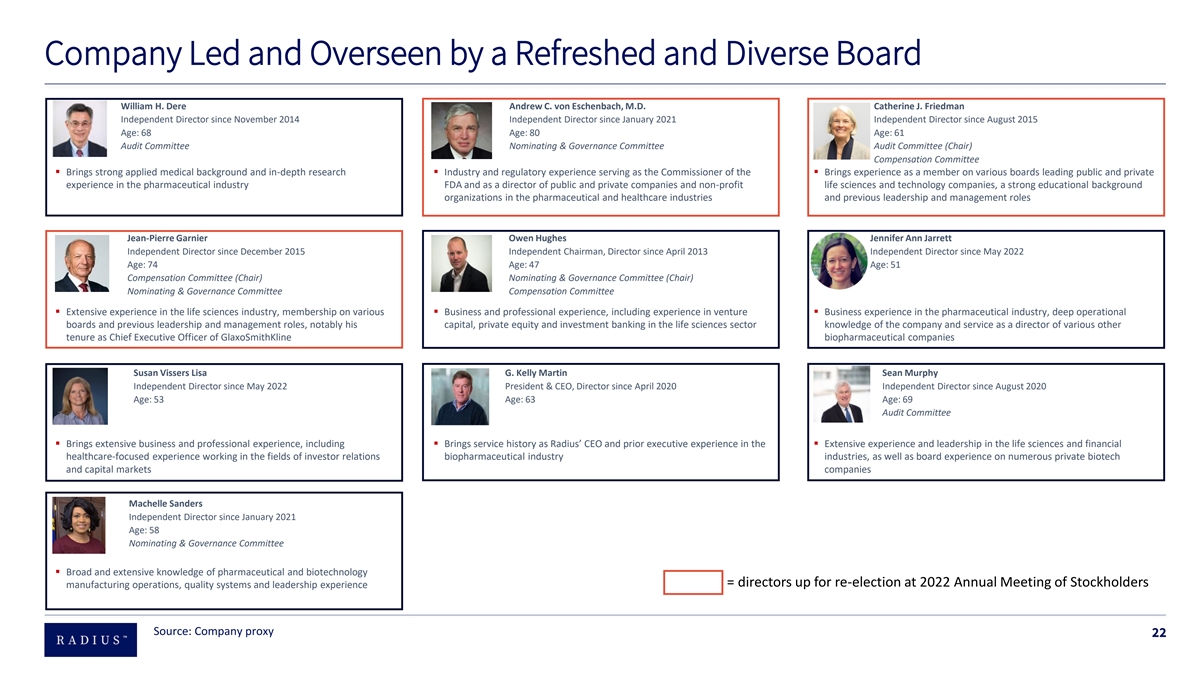

Company Led and Overseen by a Refreshed and Diverse Board William H. Dere Andrew C. von Eschenbach, M.D. Catherine J. Friedman Independent Director since November 2014 Independent Director since January 2021 Independent Director since August 2015 Age: 68 Age: 80 Age: 61 Audit Committee Nominating & Governance Committee Audit Committee (Chair) Compensation Committee ▪ Brings strong applied medical background and in-depth research ▪ Industry and regulatory experience serving as the Commissioner of the ▪ Brings experience as a member on various boards leading public and private experience in the pharmaceutical industry FDA and as a director of public and private companies and non-profit life sciences and technology companies, a strong educational background organizations in the pharmaceutical and healthcare industries and previous leadership and management roles Jean-Pierre Garnier Owen Hughes Jennifer Ann Jarrett Independent Director since December 2015 Independent Chairman, Director since April 2013 Independent Director since May 2022 Age: 74 Age: 47 Age: 51 Compensation Committee (Chair) Nominating & Governance Committee (Chair) Nominating & Governance Committee Compensation Committee ▪ Extensive experience in the life sciences industry, membership on various ▪ Business and professional experience, including experience in venture ▪ Business experience in the pharmaceutical industry, deep operational boards and previous leadership and management roles, notably his capital, private equity and investment banking in the life sciences sector knowledge of the company and service as a director of various other tenure as Chief Executive Officer of GlaxoSmithKline biopharmaceutical companies Susan Vissers Lisa G. Kelly Martin Sean Murphy Independent Director since May 2022 President & CEO, Director since April 2020 Independent Director since August 2020 Age: 53 Age: 63 Age: 69 Audit Committee ▪ Brings extensive business and professional experience, including ▪ Brings service history as Radius’ CEO and prior executive experience in the ▪ Extensive experience and leadership in the life sciences and financial healthcare-focused experience working in the fields of investor relations biopharmaceutical industry industries, as well as board experience on numerous private biotech and capital markets companies Machelle Sanders Independent Director since January 2021 Age: 58 Nominating & Governance Committee ▪ Broad and extensive knowledge of pharmaceutical and biotechnology = directors up for re-election at 2022 Annual Meeting of Stockholders manufacturing operations, quality systems and leadership experience Source: Company proxy 22

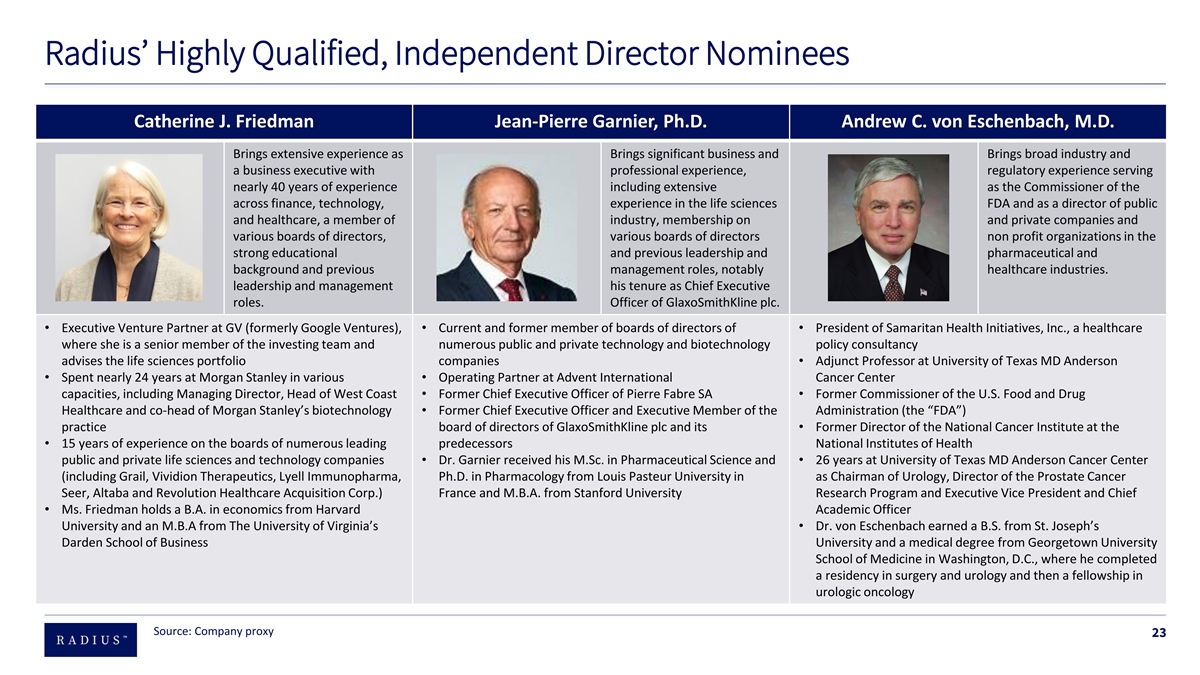

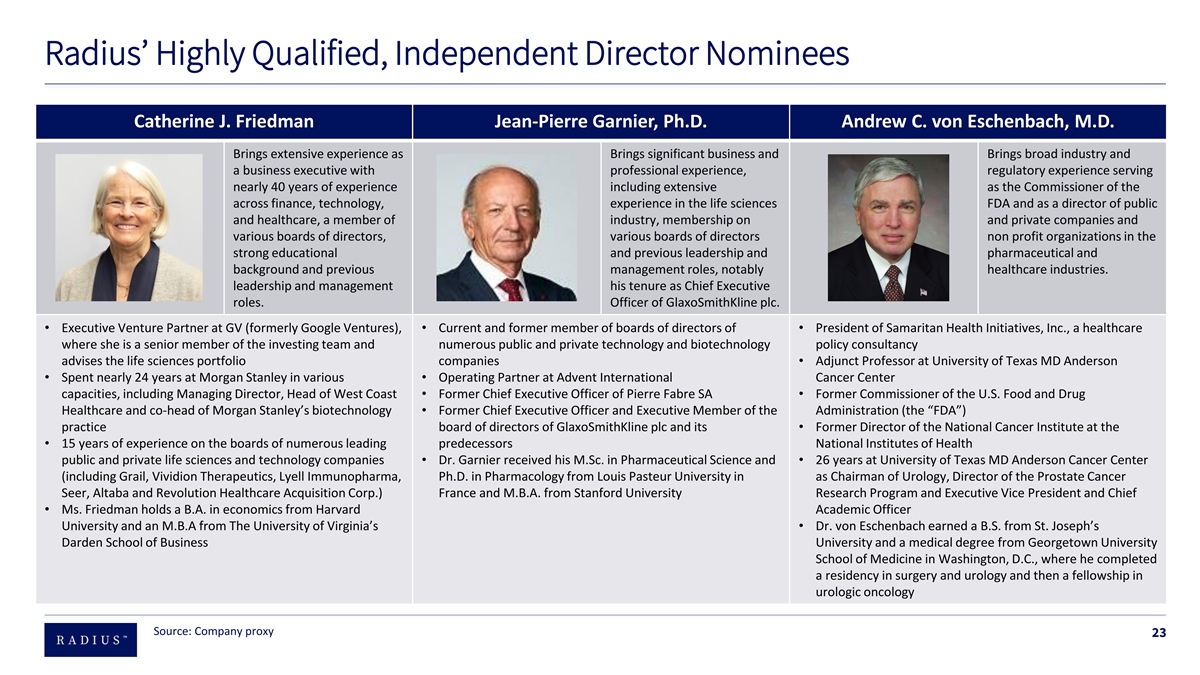

Radius’ Highly Qualified, Independent Director Nominees Catherine J. Friedman Jean-Pierre Garnier, Ph.D. Andrew C. von Eschenbach, M.D. Brings extensive experience as Brings significant business and Brings broad industry and a business executive with professional experience, regulatory experience serving nearly 40 years of experience including extensive as the Commissioner of the across finance, technology, experience in the life sciences FDA and as a director of public and healthcare, a member of industry, membership on and private companies and various boards of directors, various boards of directors non profit organizations in the strong educational and previous leadership and pharmaceutical and background and previous management roles, notably healthcare industries. leadership and management his tenure as Chief Executive roles. Officer of GlaxoSmithKline plc. • Executive Venture Partner at GV (formerly Google Ventures), • Current and former member of boards of directors of • President of Samaritan Health Initiatives, Inc., a healthcare where she is a senior member of the investing team and numerous public and private technology and biotechnology policy consultancy advises the life sciences portfolio companies• Adjunct Professor at University of Texas MD Anderson • Spent nearly 24 years at Morgan Stanley in various • Operating Partner at Advent International Cancer Center capacities, including Managing Director, Head of West Coast • Former Chief Executive Officer of Pierre Fabre SA• Former Commissioner of the U.S. Food and Drug Healthcare and co-head of Morgan Stanley’s biotechnology • Former Chief Executive Officer and Executive Member of the Administration (the “FDA”) practice board of directors of GlaxoSmithKline plc and its • Former Director of the National Cancer Institute at the • 15 years of experience on the boards of numerous leading predecessors National Institutes of Health public and private life sciences and technology companies • Dr. Garnier received his M.Sc. in Pharmaceutical Science and • 26 years at University of Texas MD Anderson Cancer Center (including Grail, Vividion Therapeutics, Lyell Immunopharma, Ph.D. in Pharmacology from Louis Pasteur University in as Chairman of Urology, Director of the Prostate Cancer Seer, Altaba and Revolution Healthcare Acquisition Corp.) France and M.B.A. from Stanford University Research Program and Executive Vice President and Chief • Ms. Friedman holds a B.A. in economics from Harvard Academic Officer University and an M.B.A from The University of Virginia’s • Dr. von Eschenbach earned a B.S. from St. Joseph’s Darden School of Business University and a medical degree from Georgetown University School of Medicine in Washington, D.C., where he completed a residency in surgery and urology and then a fellowship in urologic oncology Source: Company proxy 23

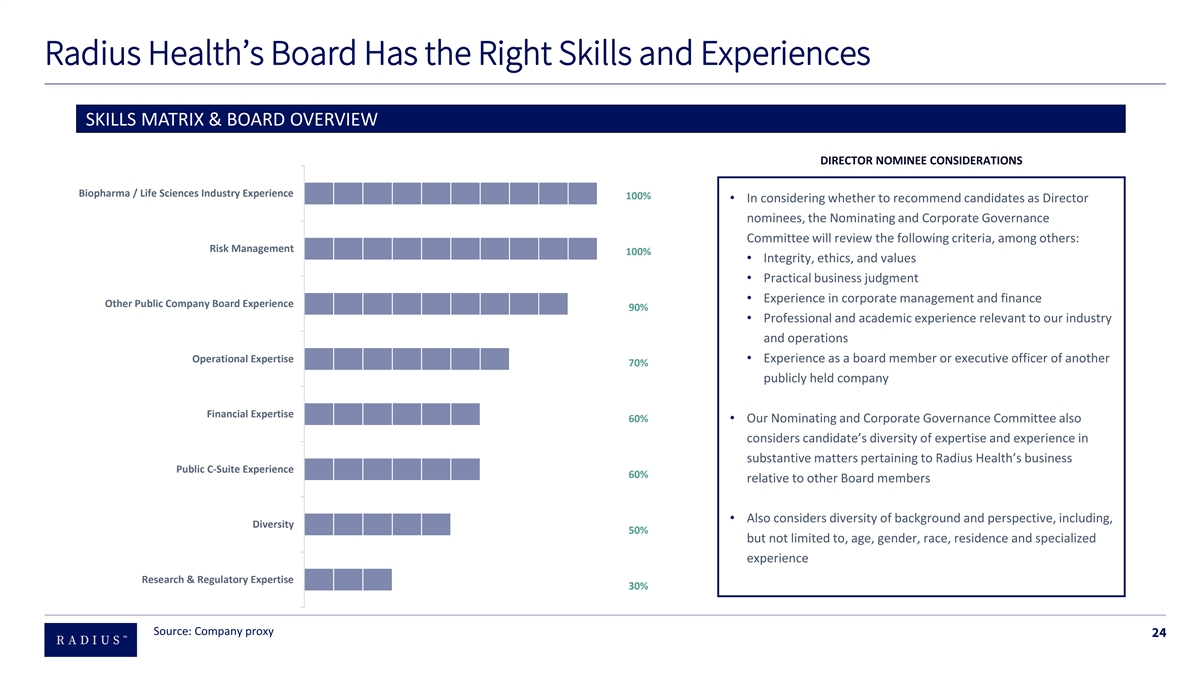

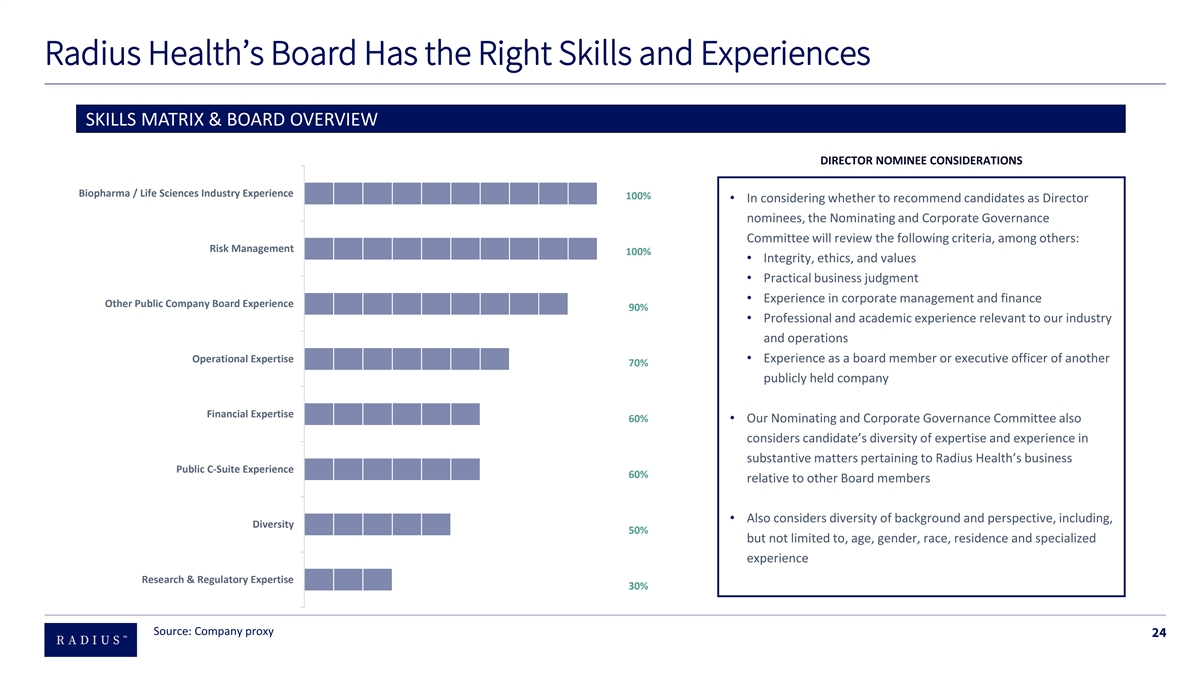

Radius Health’s Board Has the Right Skills and Experiences SKILLS MATRIX & BOARD OVERVIEW DIRECTOR NOMINEE CONSIDERATIONS Biopharma / Life Sciences Industry Experience 100% • In considering whether to recommend candidates as Director nominees, the Nominating and Corporate Governance Committee will review the following criteria, among others: Risk Management 100% • Integrity, ethics, and values • Practical business judgment • Experience in corporate management and finance Other Public Company Board Experience 90% • Professional and academic experience relevant to our industry and operations Operational Expertise• Experience as a board member or executive officer of another 70% publicly held company Financial Expertise 60%• Our Nominating and Corporate Governance Committee also considers candidate’s diversity of expertise and experience in substantive matters pertaining to Radius Health’s business Public C-Suite Experience 60% relative to other Board members • Also considers diversity of background and perspective, including, Diversity 50% but not limited to, age, gender, race, residence and specialized experience Research & Regulatory Expertise 30% Source: Company proxy 24

S E C T I O N 4 Velan and Repertoire’s Proxy Fight is Misguided and Does Not Offer a Realistic Path for the Company 25

Velan/Repertoire: Little Interest in Constructively Engaging with Radius Since the first engagement, and to date, Radius has attempted to constructively engage with Velan and Repertoire, including being open to their prior request to extending the director nomination deadline and interviewing their director candidates; however, there has been little interest by Velan and Repertoire in having a conversation of any depth March 7-10, 2022 Aug 2021 – Jan 2022 Following notice requesting an February 23, 2022 extension of the director After no discussions in ~5 Letter from Velan Mar 2020 – Aug 2021 nomination deadline, Velan and month period, Repertoire and Repertoire's Repertoire expressed to Radius that June 24, 2022 telephonically discussed legal counsel Multiple discussions about they had no concerns with the Velan and Repertoire express no Company “generally” with IR requesting the company “generally” composition of the Board; despite view on announced sale to Gurnet and Chief Commercial Officer questionnaire for (including around earnings, this, Radius later offered an Point and Patient Square Capital management changes and director extension of nomination deadline, nominations refinancing) but the offer was rejected Mar ‘20 Aug ‘21 Jan ‘22 Feb ‘22 Mar ‘22 Apr ‘22 May ‘22 Jun ‘22 March 25, 2022 Following Velan and Repertoire’s nomination of 4 director candidates, Company offered to interview nominees, but it was rejected on the condition that a settlement framework be agreed to prior to undertaking any interviews Velan/Repertoire have had zero engagement with the company post the strategic transaction announcement 26

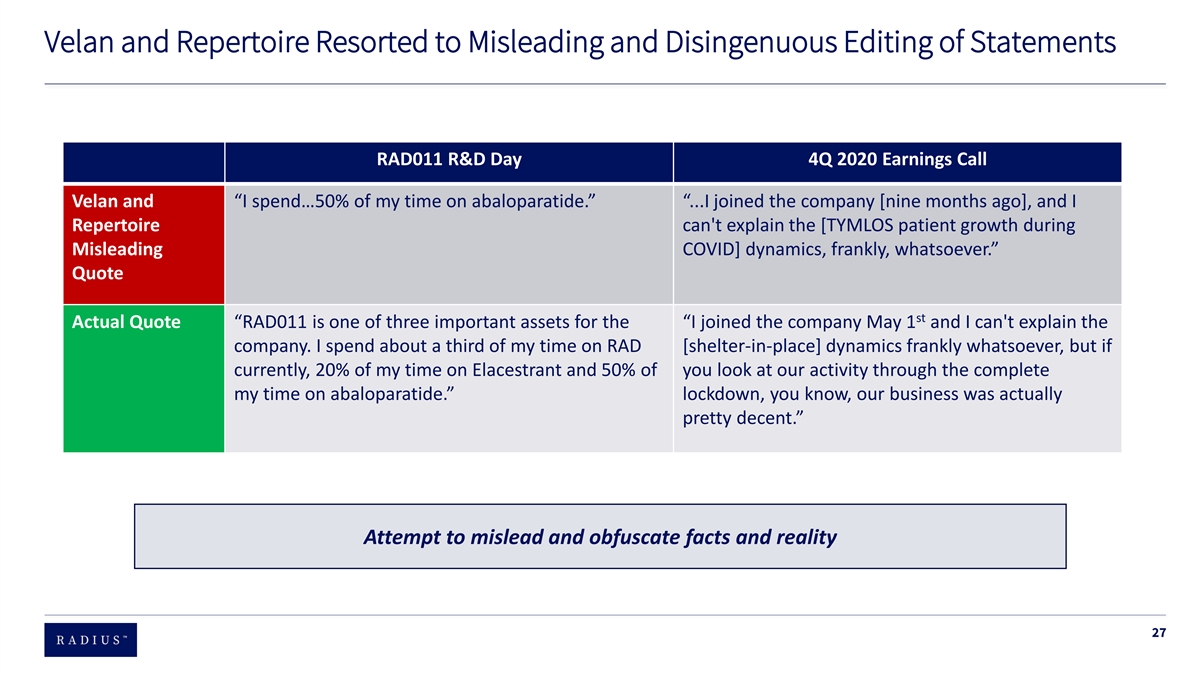

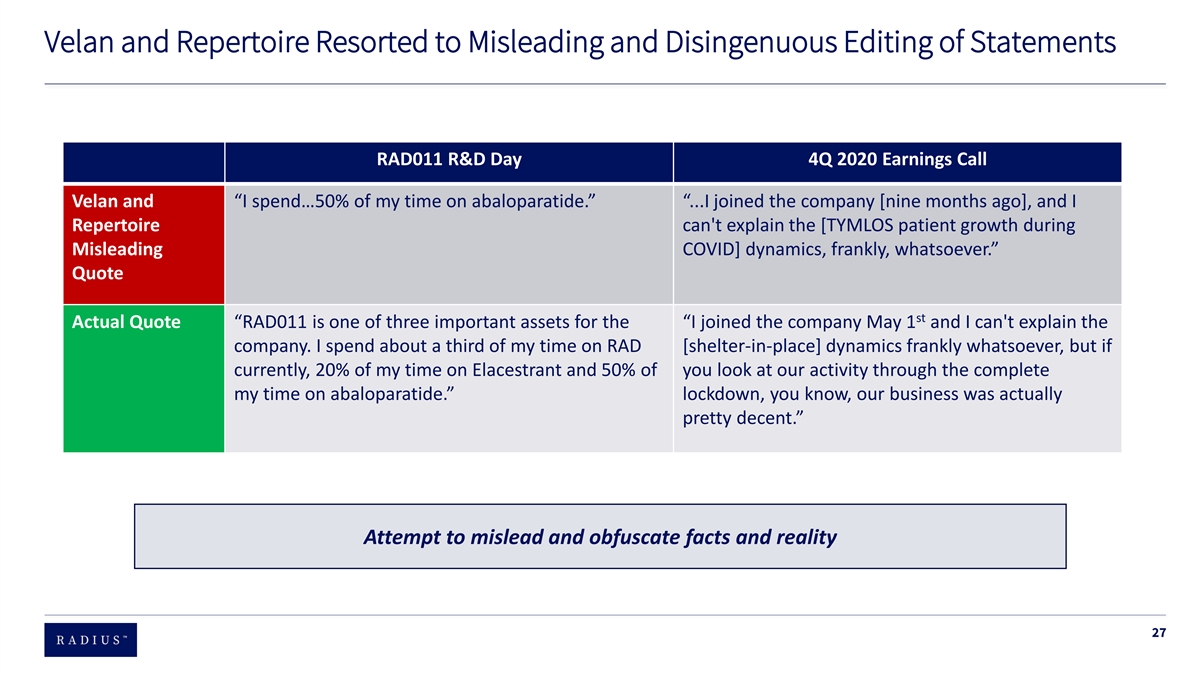

Velan and Repertoire Resorted to Misleading and Disingenuous Editing of Statements RAD011 R&D Day 4Q 2020 Earnings Call Velan and “I spend…50% of my time on abaloparatide.” “...I joined the company [nine months ago], and I Repertoire can't explain the [TYMLOS patient growth during Misleading COVID] dynamics, frankly, whatsoever.” Quote st Actual Quote “RAD011 is one of three important assets for the “I joined the company May 1 and I can't explain the company. I spend about a third of my time on RAD [shelter-in-place] dynamics frankly whatsoever, but if currently, 20% of my time on Elacestrant and 50% of you look at our activity through the complete my time on abaloparatide.” lockdown, you know, our business was actually pretty decent.” Attempt to mislead and obfuscate facts and reality 27

Velan and Repertoire Nominees are Not Additive Eric Ende Cynthia Flowers Ann MacDougall Current public boards: Current public boards: Current public boards: NeuBase Therapeutics, Avadel G1 Therapeutics, Opiant Pharmaceuticals Pharmaceuticals, Matinas Biopharma Caladrius Biosciences, Hikma Holdings Pharmaceuticals Primary Industry Experience: Primary Industry Experience: Primary Industry Experience: Legal counsel and not-for-profit Financial services Business management experience Eric Ende’s financial services and Ann MacDougall lacks critical Cynthia Flowers has a weak record of consulting credentials are not additive industry expertise and has a poor transforming companies to Radius’ Board record of company performance 28

S E C T I O N 5 Concluding Remarks 29

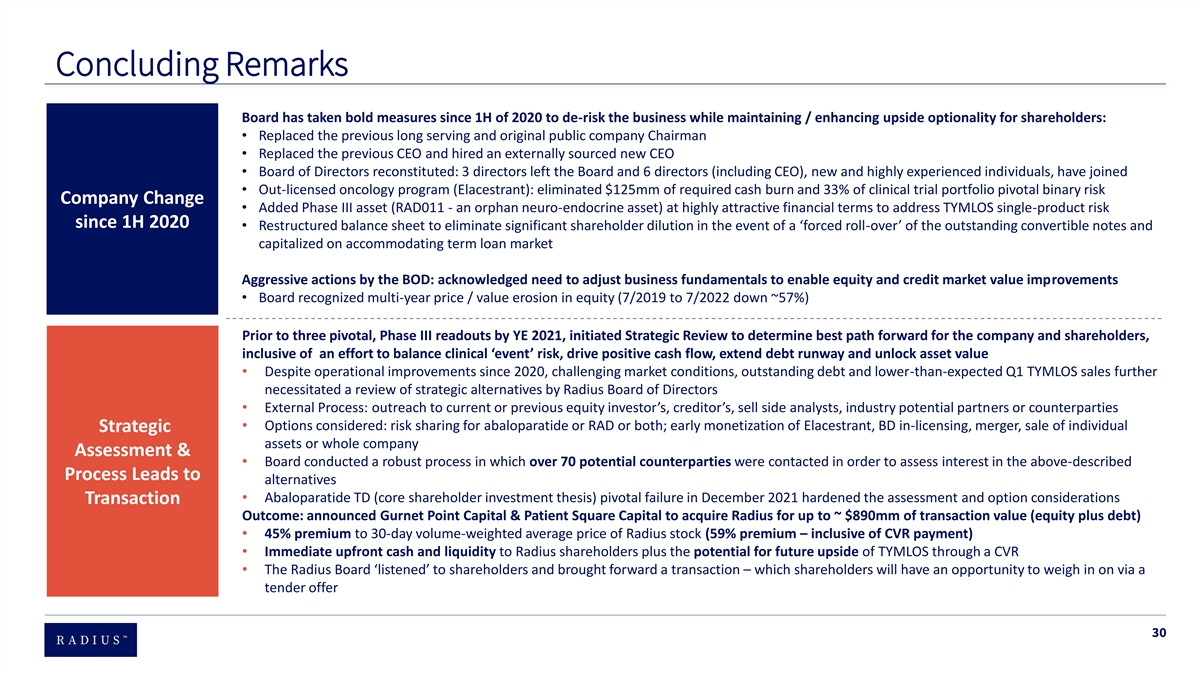

Concluding Remarks Board has taken bold measures since 1H of 2020 to de-risk the business while maintaining / enhancing upside optionality for shareholders: • Replaced the previous long serving and original public company Chairman • Replaced the previous CEO and hired an externally sourced new CEO • Board of Directors reconstituted: 3 directors left the Board and 6 directors (including CEO), new and highly experienced individuals, have joined • Out-licensed oncology program (Elacestrant): eliminated $125mm of required cash burn and 33% of clinical trial portfolio pivotal binary risk Company Change • Added Phase III asset (RAD011 - an orphan neuro-endocrine asset) at highly attractive financial terms to address TYMLOS single-product risk since 1H 2020 • Restructured balance sheet to eliminate significant shareholder dilution in the event of a ‘forced roll-over’ of the outstanding convertible notes and capitalized on accommodating term loan market Aggressive actions by the BOD: acknowledged need to adjust business fundamentals to enable equity and credit market value improvements • Board recognized multi-year price / value erosion in equity (7/2019 to 7/2022 down ~57%) Prior to three pivotal, Phase III readouts by YE 2021, initiated Strategic Review to determine best path forward for the company and shareholders, inclusive of an effort to balance clinical ‘event’ risk, drive positive cash flow, extend debt runway and unlock asset value • Despite operational improvements since 2020, challenging market conditions, outstanding debt and lower-than-expected Q1 TYMLOS sales further necessitated a review of strategic alternatives by Radius Board of Directors • External Process: outreach to current or previous equity investor’s, creditor’s, sell side analysts, industry potential partners or counterparties • Options considered: risk sharing for abaloparatide or RAD or both; early monetization of Elacestrant, BD in-licensing, merger, sale of individual Strategic assets or whole company Assessment & • Board conducted a robust process in which over 70 potential counterparties were contacted in order to assess interest in the above-described Process Leads to alternatives • Abaloparatide TD (core shareholder investment thesis) pivotal failure in December 2021 hardened the assessment and option considerations Transaction Outcome: announced Gurnet Point Capital & Patient Square Capital to acquire Radius for up to ~ $890mm of transaction value (equity plus debt) • 45% premium to 30-day volume-weighted average price of Radius stock (59% premium – inclusive of CVR payment) • Immediate upfront cash and liquidity to Radius shareholders plus the potential for future upside of TYMLOS through a CVR • The Radius Board ‘listened’ to shareholders and brought forward a transaction – which shareholders will have an opportunity to weigh in on via a tender offer 30

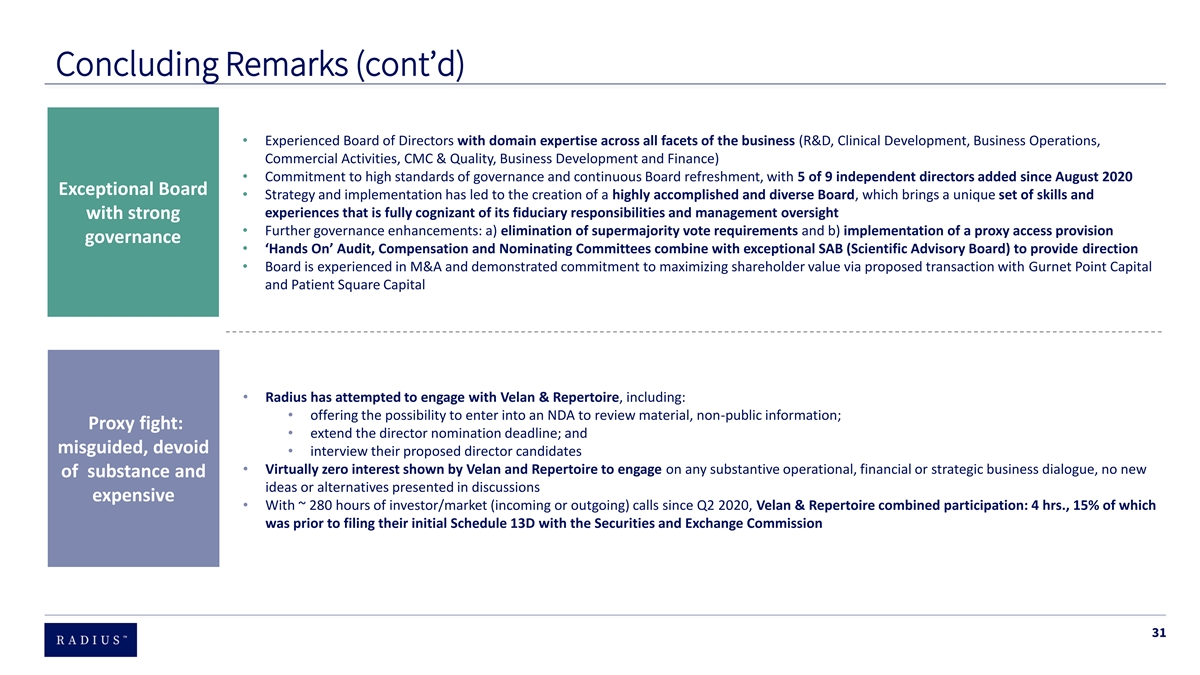

Concluding Remarks (cont’d) • Experienced Board of Directors with domain expertise across all facets of the business (R&D, Clinical Development, Business Operations, Commercial Activities, CMC & Quality, Business Development and Finance) • Commitment to high standards of governance and continuous Board refreshment, with 5 of 9 independent directors added since August 2020 Exceptional Board • Strategy and implementation has led to the creation of a highly accomplished and diverse Board, which brings a unique set of skills and experiences that is fully cognizant of its fiduciary responsibilities and management oversight with strong • Further governance enhancements: a) elimination of supermajority vote requirements and b) implementation of a proxy access provision governance • ‘Hands On’ Audit, Compensation and Nominating Committees combine with exceptional SAB (Scientific Advisory Board) to provide direction • Board is experienced in M&A and demonstrated commitment to maximizing shareholder value via proposed transaction with Gurnet Point Capital and Patient Square Capital • Radius has attempted to engage with Velan & Repertoire, including: • offering the possibility to enter into an NDA to review material, non-public information; Proxy fight: • extend the director nomination deadline; and misguided, devoid • interview their proposed director candidates • Virtually zero interest shown by Velan and Repertoire to engage on any substantive operational, financial or strategic business dialogue, no new of substance and ideas or alternatives presented in discussions expensive • With ~ 280 hours of investor/market (incoming or outgoing) calls since Q2 2020, Velan & Repertoire combined participation: 4 hrs., 15% of which was prior to filing their initial Schedule 13D with the Securities and Exchange Commission 31

Vote the BLUE Proxy Card Today The Radius Board of Directors unanimously recommends that you vote the BLUE proxy card “FOR ALL” of the Company’s highly qualified Board nominees 32

Safe Harbor Cautionary Statement Regarding Forward-Looking Statements This presentation includes forward-looking statements, including the ability of the parties to complete the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”) by and among Radius Health, Inc. (the “Company”), Ginger Acquisition, Inc., a Delaware corporation (“Parent”), a subsidiary jointly owned by Gurnet Point Capital, LLC and Patient Square Capital, and Ginger Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Parent (“Purchaser”), including the parties’ ability to satisfy the conditions to the consummation of the tender offer (the “Offer”) to purchase each issued and outstanding share (the “Shares”) of common stock, par value $0.0001 per share, of the Company contemplated thereby and the other conditions set forth in the Merger Agreement, statements about the expected timetable for completing the transactions and statements about potential benefits of the transactions for the Company. These statements are neither promises nor guarantees, and are subject to known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: uncertainties as to the timing of the offer and the subsequent merger of Purchaser with and into the Company (the “Merger”); uncertainties as to how many of the Shares will be tendered in the Offer; the possibility that various conditions to the consummation of the Offer and the Merger may not be satisfied or waived; the effects of disruption from the transactions contemplated by the Merger Agreement and the impact of the announcement and pendency of the transactions on the Company’s business; the risk that stockholder litigation in connection with the Offer or the Merger may result in significant costs of defense, indemnification and liability; the risks related to non-achievement of the contingent value right (“CVR”) milestone and that holders of the CVRs will not receive payments in respect of the CVRs; the adverse impact the ongoing COVID-19 pandemic is having and is expected to continue to have on the Company’s business, financial condition and results of operations, including our commercial operations and sales, clinical trials, preclinical studies, and employees; quarterly fluctuation in the Company’s financial results; the Company’s dependence on the success of TYMLOS, and the Company’s inability to ensure that TYMLOS will obtain regulatory approval outside the U.S. or be successfully commercialized in any market in which it is approved; risks related to manufacturing, supply and distribution; and the risk of litigation or other challenges regarding our intellectual property rights. These and other important risks and uncertainties discussed in the Company’s filings with the SEC, including under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ending December 31, 2021, and subsequent filings with the SEC, could cause actual results to differ materially from those indicated by the forward-looking statements made in this communication. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. The Company does not give any assurance that it will achieve its expectations. Additional Information and Where to Find It The Offer for the outstanding Shares referenced in this presentation has not yet commenced. This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell securities, nor is it a substitute for the tender offer materials that Parent and Purchaser will file with the SEC, upon the commencement of the Offer. At the time the Offer is commenced, Parent and its acquisition subsidiary will file a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, and thereafter the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the Offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A LETTER OF TRANSMITTAL AND RELATED DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE (AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF THE COMPANY’S SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. Holders of Shares can obtain these documents free of charge when they are filed from the SEC’s website at www.sec.gov or on the Company’s website at www.radiuspharm.com. 33