JP Morgan healthcare conference JESPER HOEILAND, CEO JANUARY 14, 2020 Exhibit 99.2

Safe Harbor Any statements made in this presentation relating to future financial or business performance, guidance, conditions, plans, prospects, trends or strategies and other financial or business matters, including regarding the commercialization of TYMLOS® (abaloparatide) injection in the U.S., the development and potential commercialization of our product candidates, clinical trial results, regulatory actions and communications, potential collaborations, future revenues and operating expenses, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, when used in this presentation, the words “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predicts”, “targets” and similar expressions and their variants, as they relate to Radius Health, Inc. (“Radius”) or its management, may identify forward-looking statements. Radius cautions that these forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Important factors that may cause actual results to differ materially from the results discussed in the forward-looking statements or historical experience include risks and uncertainties, including the failure by Radius to secure and maintain relationships with collaborators; risks relating to clinical trials; risks relating to the commercialization of TYMLOS in the U.S., or potential commercialization of any of Radius’ proposed product candidates if approved, (such as marketing, regulatory, patent, product liability, supply, competition and other risks); dependence on the efforts of third parties; dependence on and challenges to our intellectual property rights; and risks that we may lack the financial resources and access to capital to fund our operations. Further information on the factors and risks that could affect Radius’ business, financial conditions and results of operations and could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation are contained under the caption “risk factors” in Radius’ Annual Report on Form 10-K for the period ended December 31, 2018, along with Radius’ other reports filed with the Securities and Exchange Commission. The forward-looking statements in this presentation represent Radius’ estimate as of the date of this presentation only, and Radius specifically disclaims any duty or obligation to update forward-looking statements. Within this presentation, in order to provide greater transparency regarding our performance, we refer to certain non-GAAP financial measures that involve adjustments to GAAP measures. Any non-GAAP financial measures presented should not be considered an alternative to measures required by GAAP and are unlikely to be comparable to non-GAAP information provided by other companies. A reconciliation between our non-GAAP financial measures and GAAP financial measures is included at the end of this presentation.

ENDOCRINE DISEASES Abaloparatide-PATCH TYMLOS Grow Portfolio through Selective Strategic Assets Targeted Endocrine Diseases Selective Investments to Complement Sales Offering Partner of Choice in the U.S. Expand Market Opportunity Increase Anabolic Use for OP1 via Novel Route of Administration Grow Market Leveraging HCP2 & Patient Demand Anabolic Market Leadership Strong Commercial Infrastructure Strong Market Access & Reach Increase Use by Sequential Treatment Strategy for growth and continued leadership Leverage TYMLOS Profitability and Financial Strength for Next Phase of Growth 1 Osteoporosis 2 Health Care Practitioner

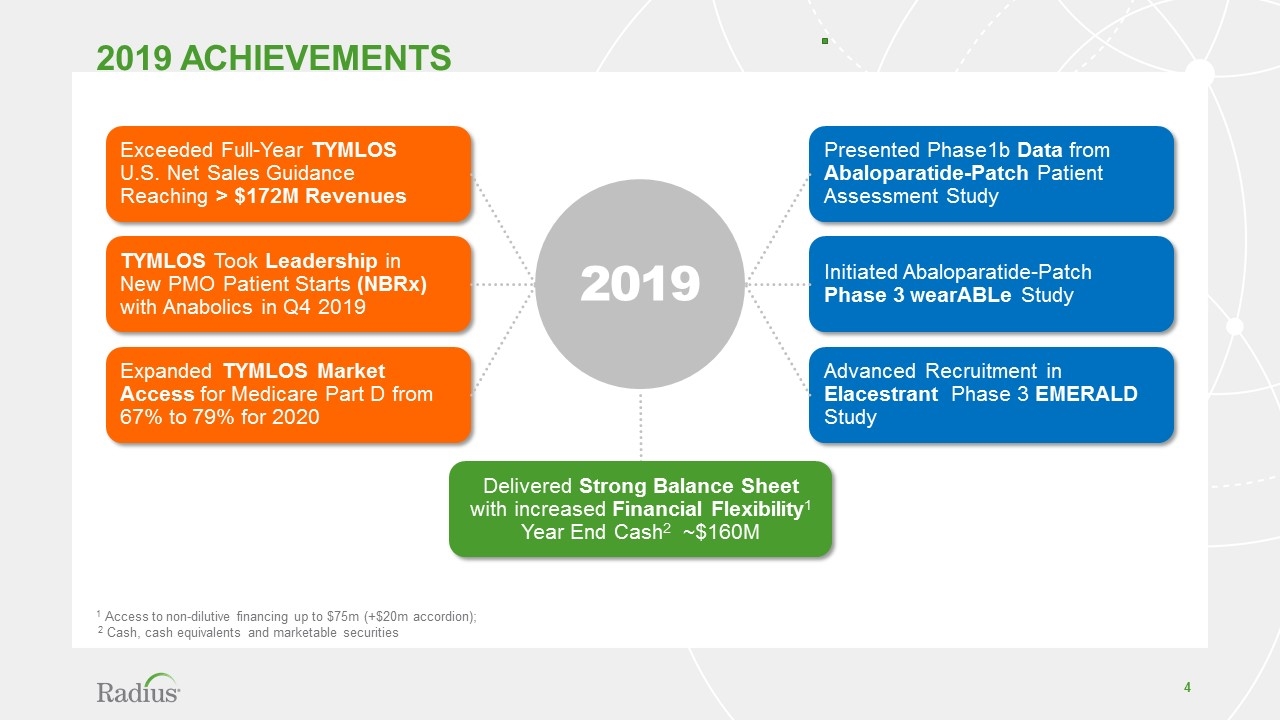

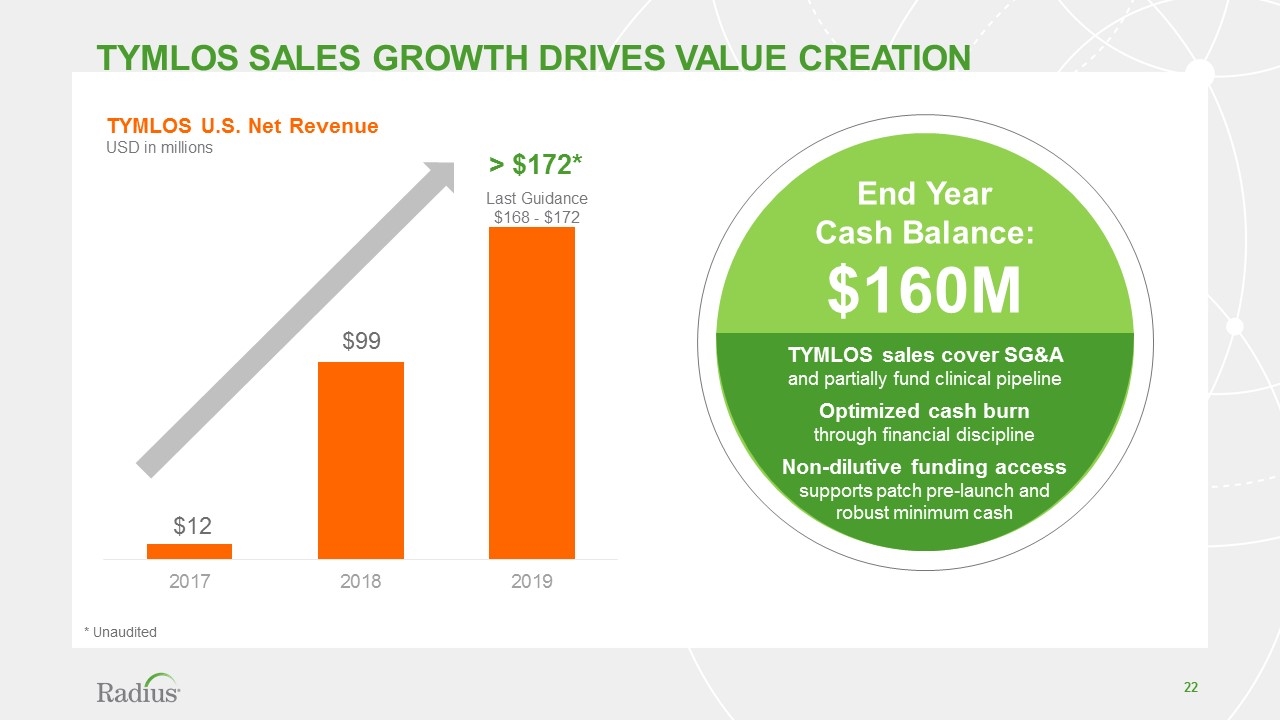

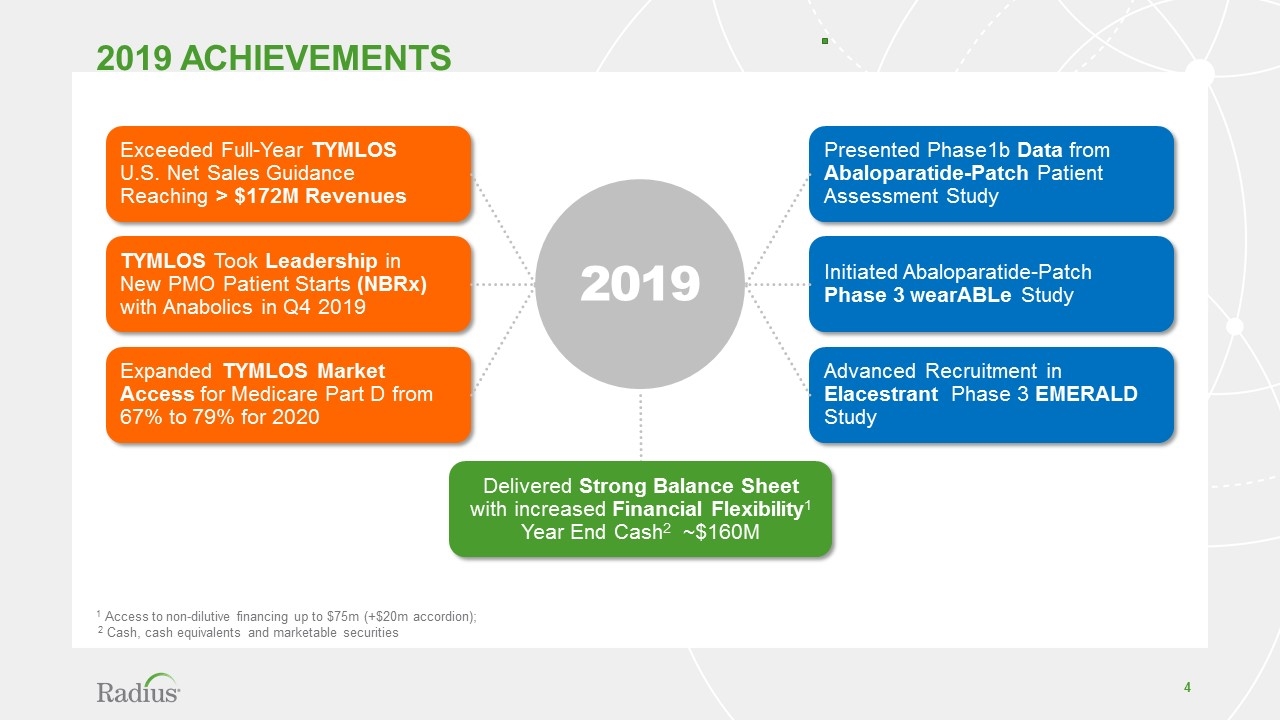

2019 achievements 1 Access to non-dilutive financing up to $75m (+$20m accordion); 2 Cash, cash equivalents and marketable securities Exceeded Full-Year TYMLOS U.S. Net Sales Guidance Reaching > $172M Revenues TYMLOS Took Leadership in New PMO Patient Starts (NBRx) with Anabolics in Q4 2019 Expanded TYMLOS Market Access for Medicare Part D from 67% to 79% for 2020 Presented Phase1b Data from Abaloparatide-Patch Patient Assessment Study Initiated Abaloparatide-Patch Phase 3 wearABLe Study Advanced Recruitment in Elacestrant Phase 3 EMERALD Study 2019 Delivered Strong Balance Sheet with increased Financial Flexibility1 Year End Cash2 ~$160M

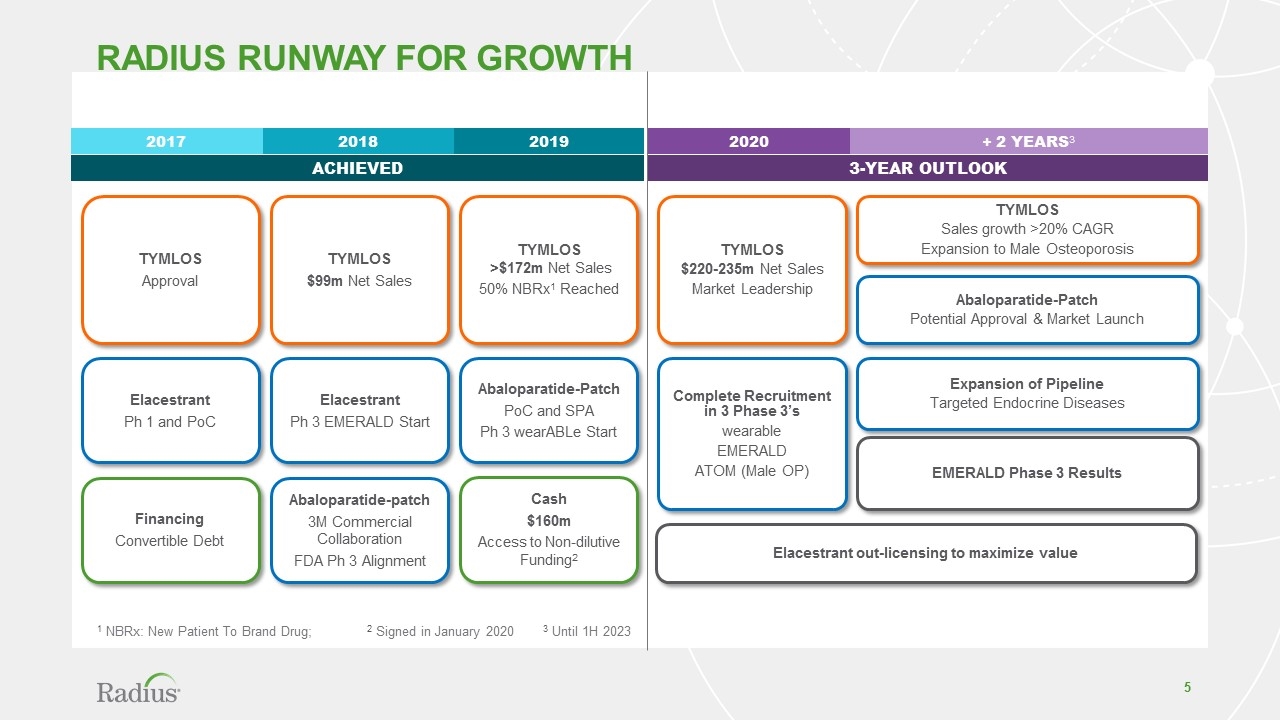

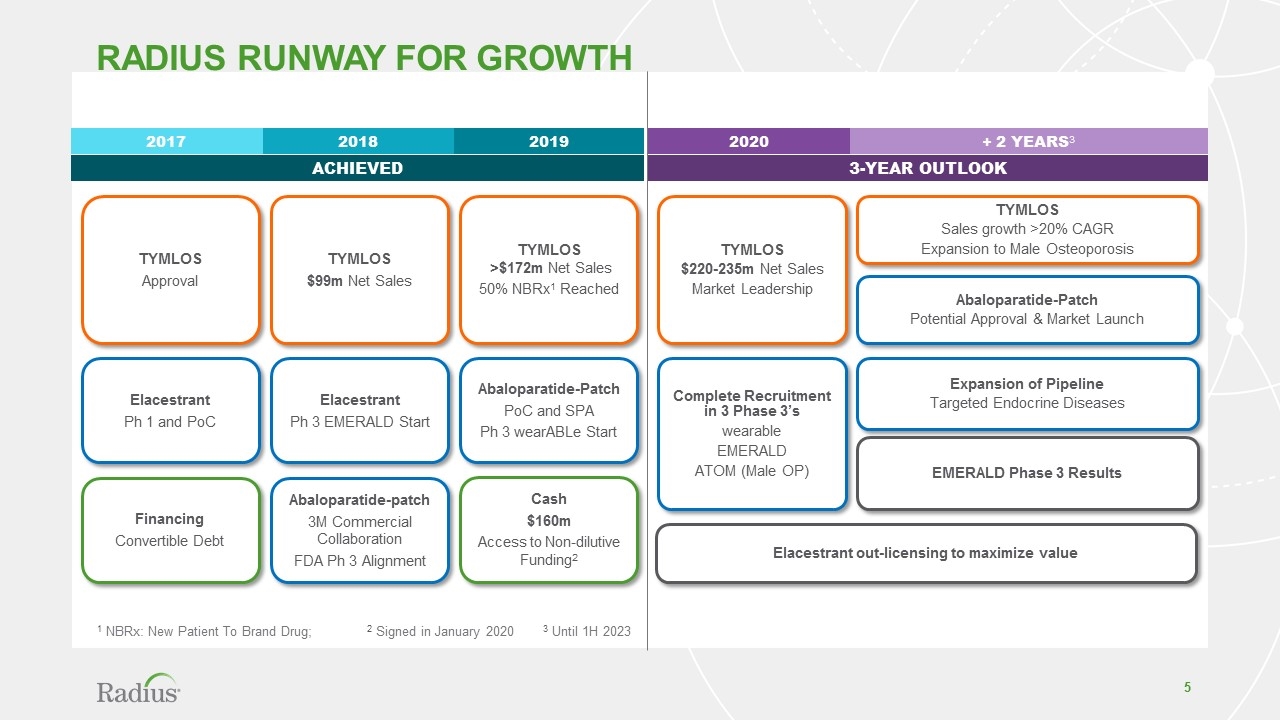

Radius RUNWAY FOR GROWTH 1 NBRx: New Patient To Brand Drug; 2 Signed in January 2020 3 Until 1H 2023 2017 2018 2019 ACHIEVED 2020 + 2 YEARS3 3-YEAR OUTLOOK TYMLOS $220-235m Net Sales Market Leadership Complete Recruitment in 3 Phase 3’s wearable EMERALD ATOM (Male OP) Elacestrant out-licensing to maximize value TYMLOS Approval Elacestrant Ph 1 and PoC Financing Convertible Debt TYMLOS $99m Net Sales Elacestrant Ph 3 EMERALD Start Abaloparatide-patch 3M Commercial Collaboration FDA Ph 3 Alignment TYMLOS >$172m Net Sales 50% NBRx1 Reached Cash $160m Access to Non-dilutive Funding2 Abaloparatide-Patch PoC and SPA Ph 3 wearABLe Start EMERALD Phase 3 Results Expansion of Pipeline Targeted Endocrine Diseases TYMLOS Sales growth >20% CAGR Expansion to Male Osteoporosis Abaloparatide-Patch Potential Approval & Market Launch

Pipeline Review

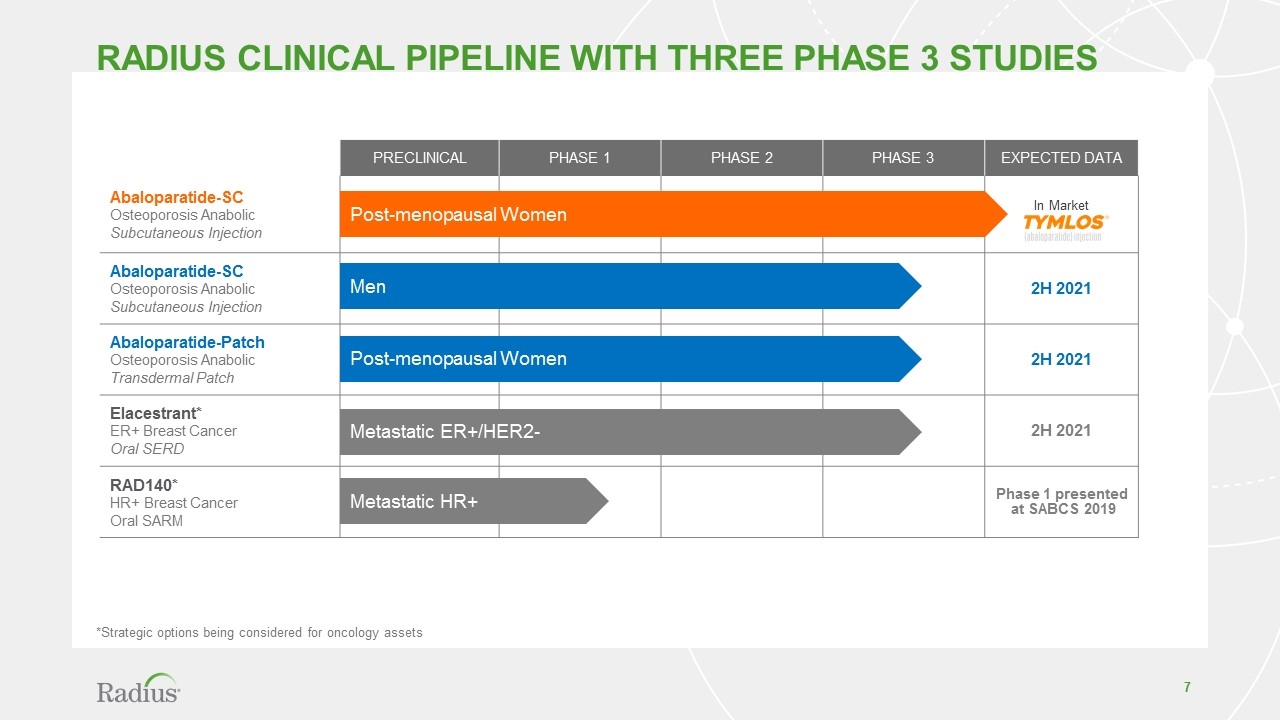

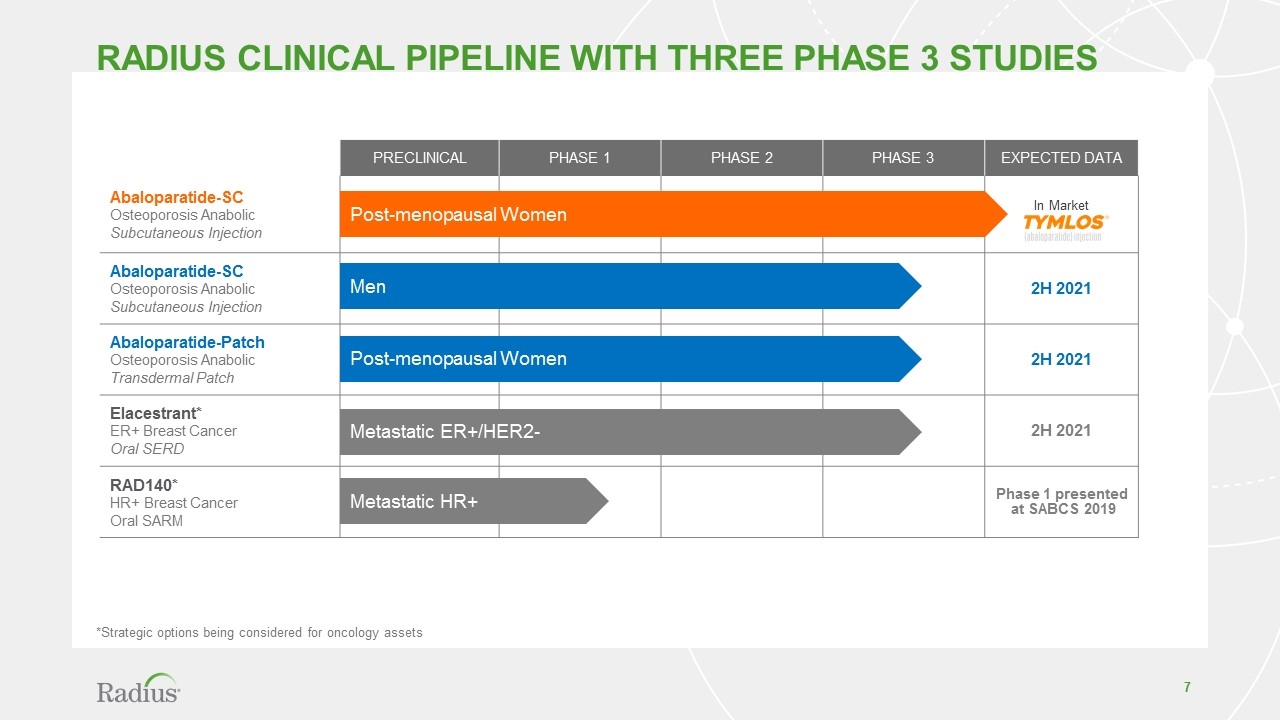

Radius CLINICAL PIPELINE WITH THREE Phase 3 studies PRECLINICAL PHASE 1 PHASE 2 PHASE 3 EXPECTED DATA Abaloparatide-SC Osteoporosis Anabolic Subcutaneous Injection In Market Abaloparatide-SC Osteoporosis Anabolic Subcutaneous Injection 2H 2021 Abaloparatide-Patch Osteoporosis Anabolic Transdermal Patch 2H 2021 Elacestrant* ER+ Breast Cancer Oral SERD 2H 2021 RAD140* HR+ Breast Cancer Oral SARM Phase 1 presented at SABCS 2019 Post-menopausal Women Metastatic HR+ Metastatic ER+/HER2- Men Post-menopausal Women *Strategic options being considered for oncology assets

Osteoporosis is a Large and Underserved Market 5.2M Patients 2.7M Patients 50k Patients US Prevalence of Women 50 yrs+ Diagnosed with Osteoporosis* Treated with Osteoporosis drugs** Treated with Anabolic Drugs** 1.8M high-risk 0.9M w/ fracture < 5% Penetration ~50% Diagnosis Rate Under-treatment of high-risk osteoporosis patients with bone building (anabolic) therapies *National US prevalence of women 50 yrs+ diagnosed with osteoporosis; Wright et al, JBMR 2014: 29(11): 2520-2526; Truven Health Analytics (IBM Watson Health); ~85% of OP cases postmenopausal; **Truven Health Analytics (IBM Watson Health) and IQVIA

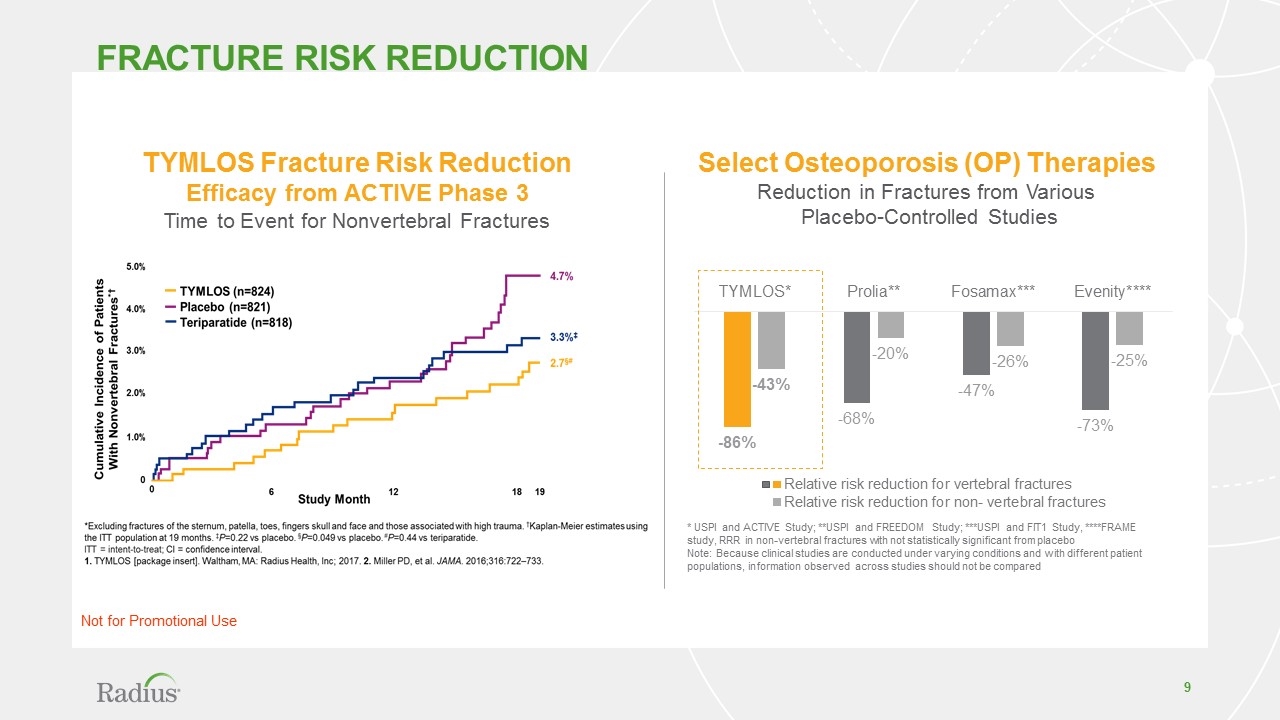

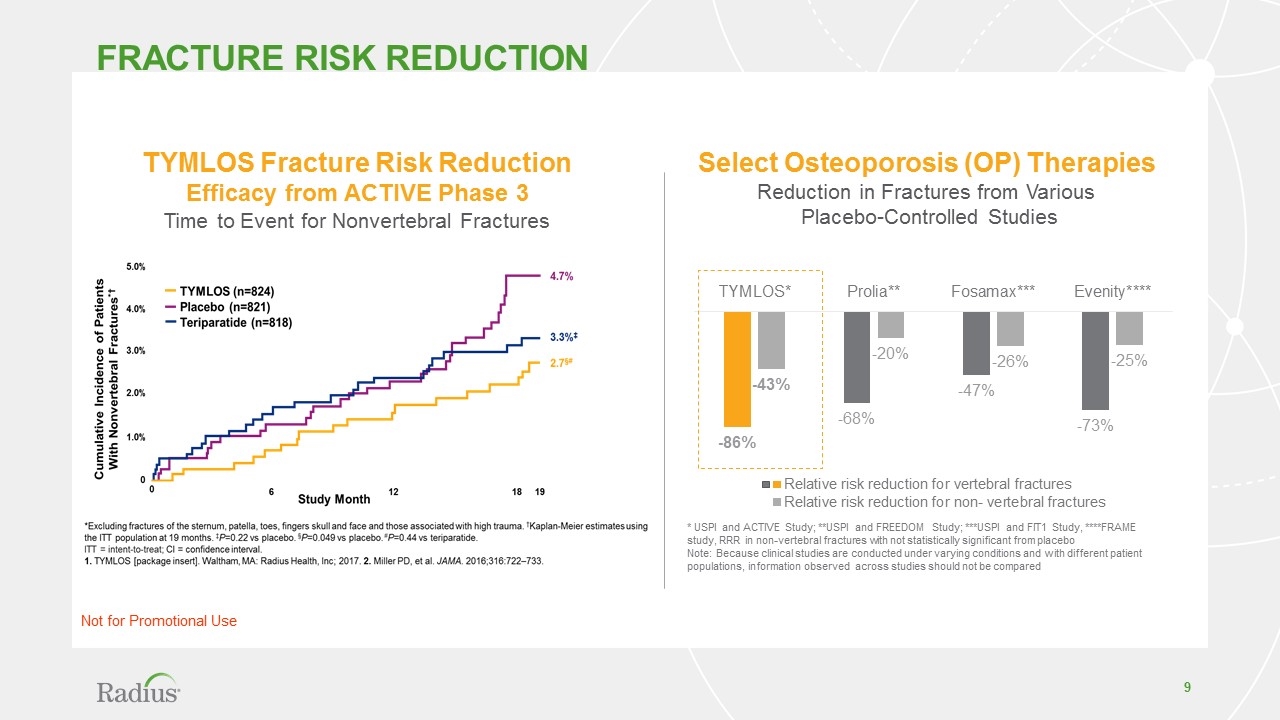

TYMLOS Fracture Risk Reduction Efficacy from ACTIVE Phase 3 Time to Event for Nonvertebral Fractures Select Osteoporosis (OP) Therapies Reduction in Fractures from Various Placebo-Controlled Studies * USPI and ACTIVE Study; **USPI and FREEDOM Study; ***USPI and FIT1 Study, ****FRAME study, RRR in non-vertebral fractures with not statistically significant from placebo Note: Because clinical studies are conducted under varying conditions and with different patient populations, information observed across studies should not be compared Fracture risk reduction Not for Promotional Use

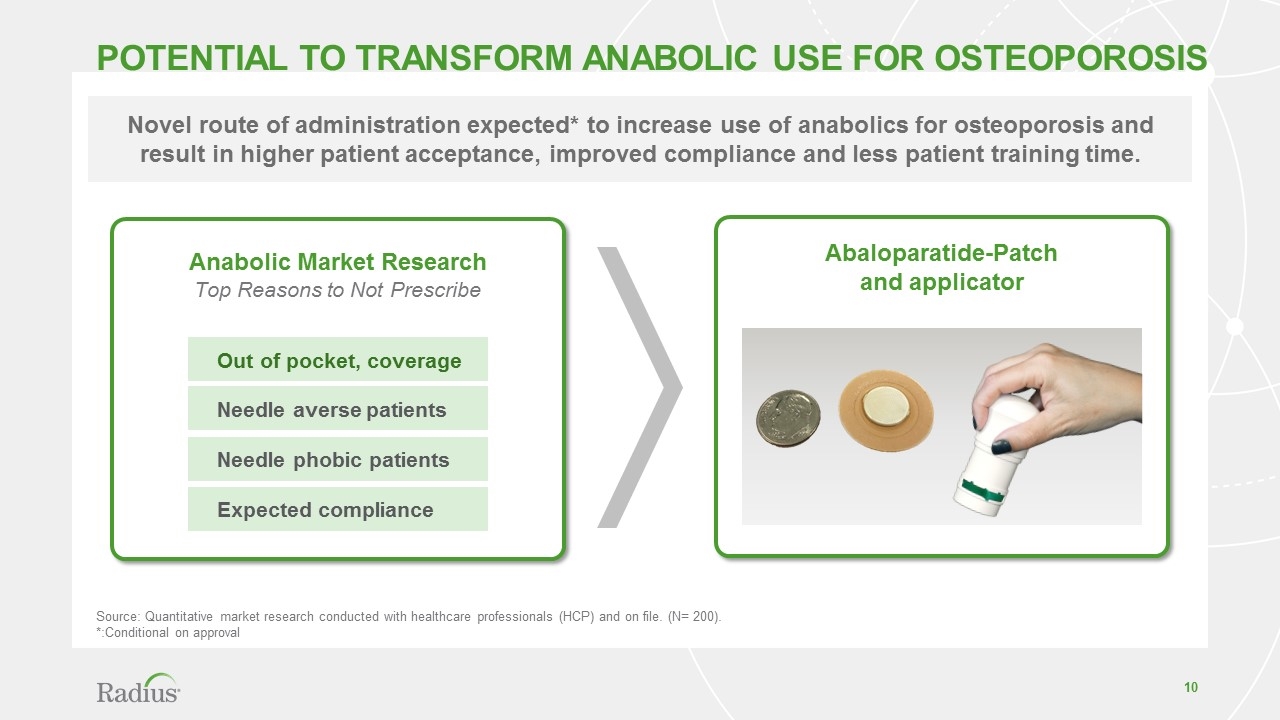

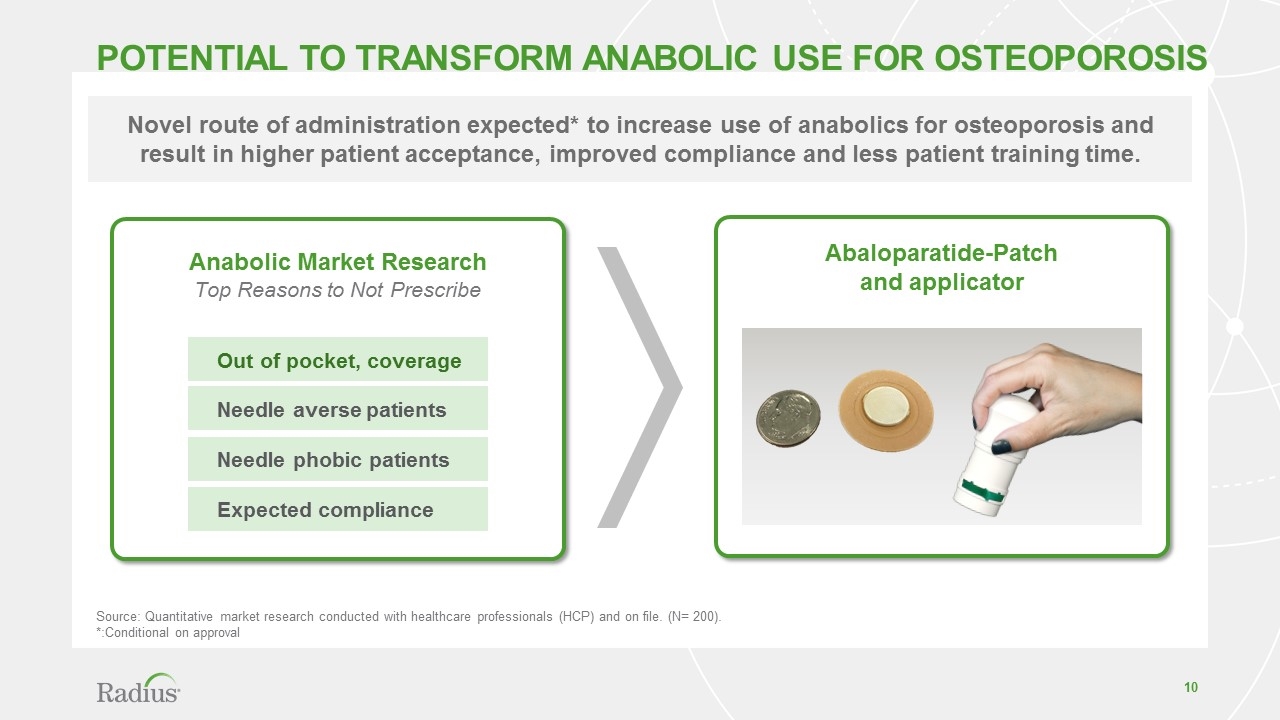

Potential TO Transform Anabolic Use for oSTEOPOROSIS Anabolic Market Research Top Reasons to Not Prescribe Out of pocket, coverage Needle averse patients Needle phobic patients Expected compliance Novel route of administration expected* to increase use of anabolics for osteoporosis and result in higher patient acceptance, improved compliance and less patient training time. Source: Quantitative market research conducted with healthcare professionals (HCP) and on file. (N= 200). *:Conditional on approval Abaloparatide-Patch and applicator

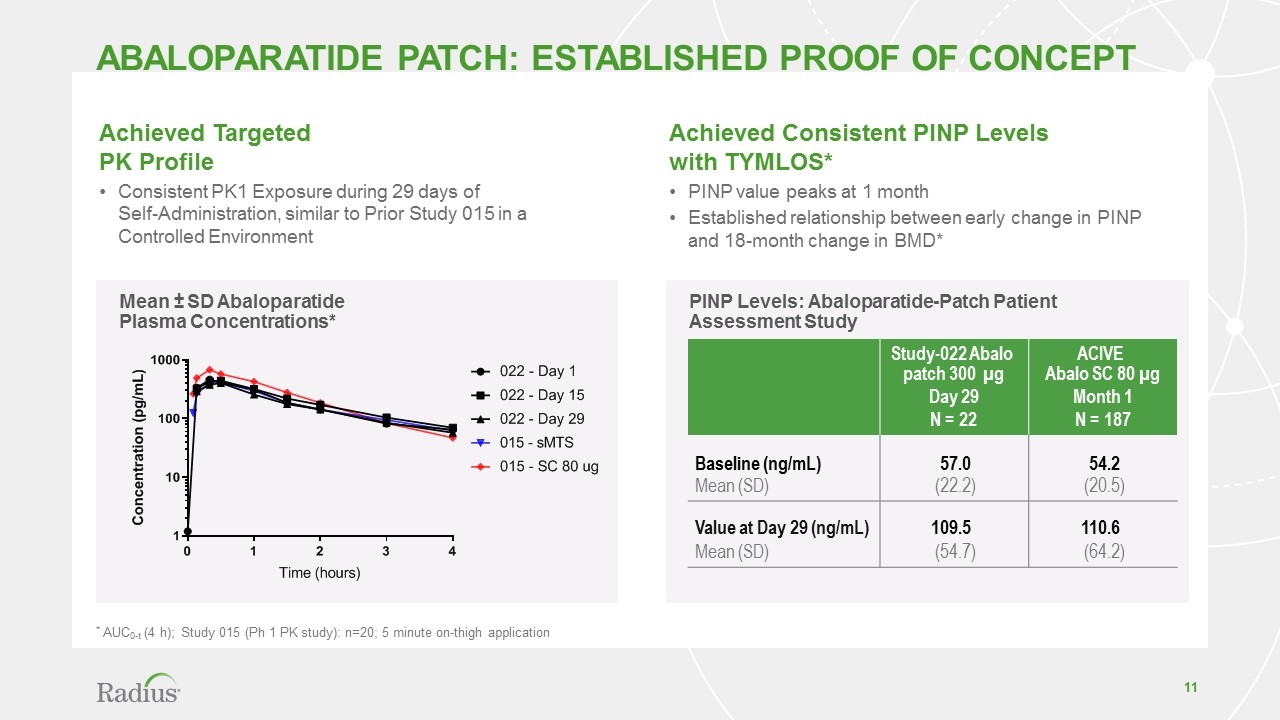

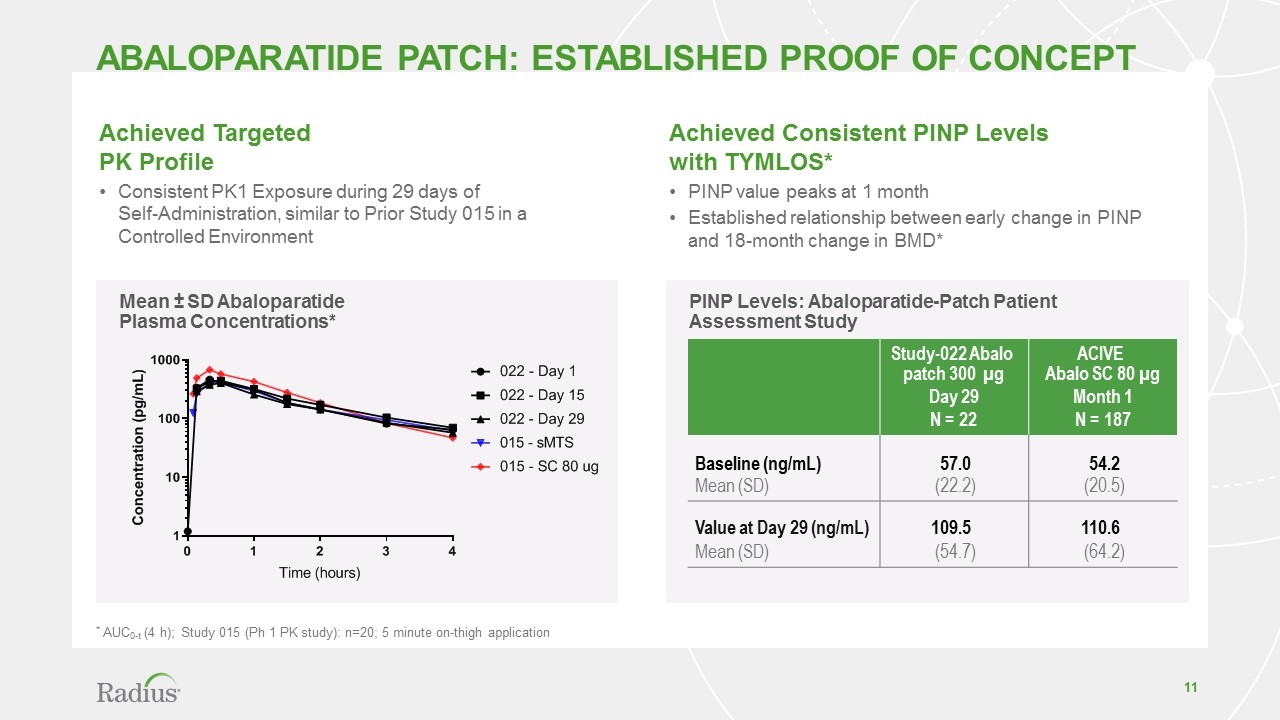

PINP Levels: Abaloparatide-Patch Patient Assessment Study abaloparatide patch: established Proof of concept Study-022 Abalo patch 300 µg Day 29 N = 22 ACIVE Abalo SC 80 µg Month 1 N = 187 Baseline (ng/mL) 57.0 54.2 Mean (SD) (22.2) (20.5) Value at Day 29 (ng/mL) 109.5 110.6 Mean (SD) (54.7) (64.2) Achieved Consistent PINP Levels with TYMLOS* PINP value peaks at 1 month Established relationship between early change in PINP and 18-month change in BMD* Achieved Targeted PK Profile Consistent PK1 Exposure during 29 days of Self-Administration, similar to Prior Study 015 in a Controlled Environment Mean ± SD Abaloparatide Plasma Concentrations* * AUC0-t (4 h); Study 015 (Ph 1 PK study): n=20; 5 minute on-thigh application

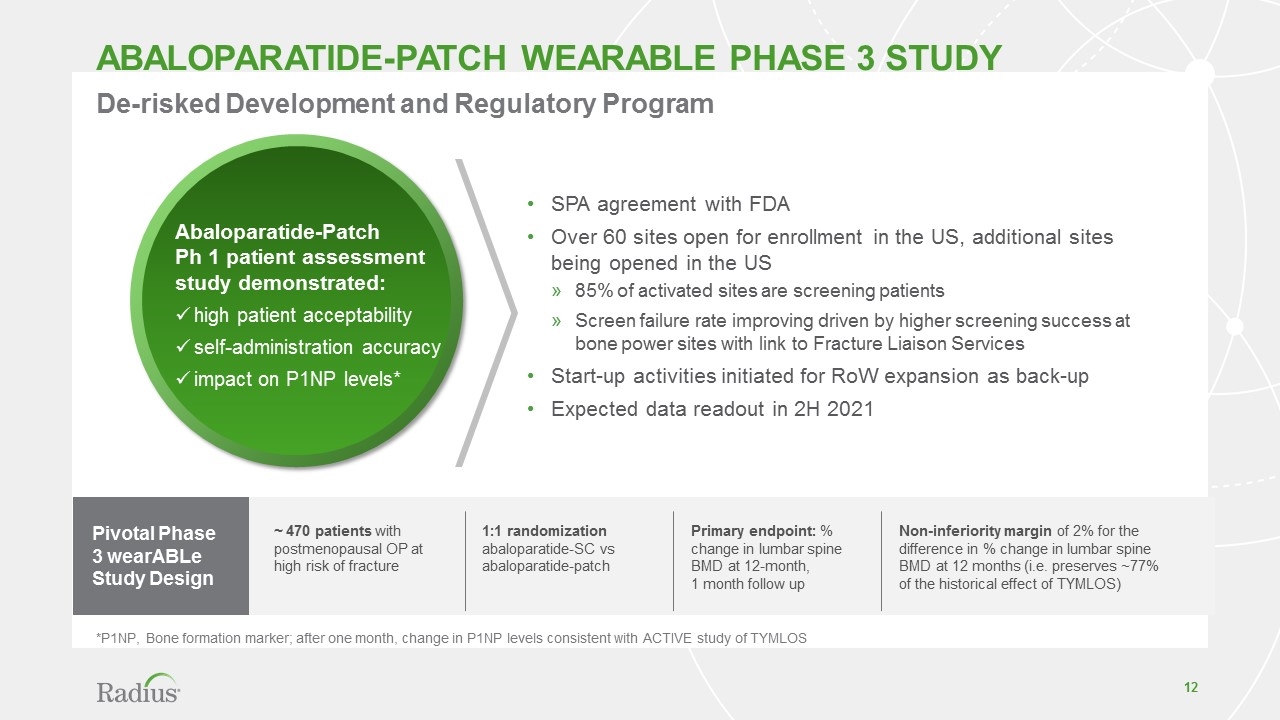

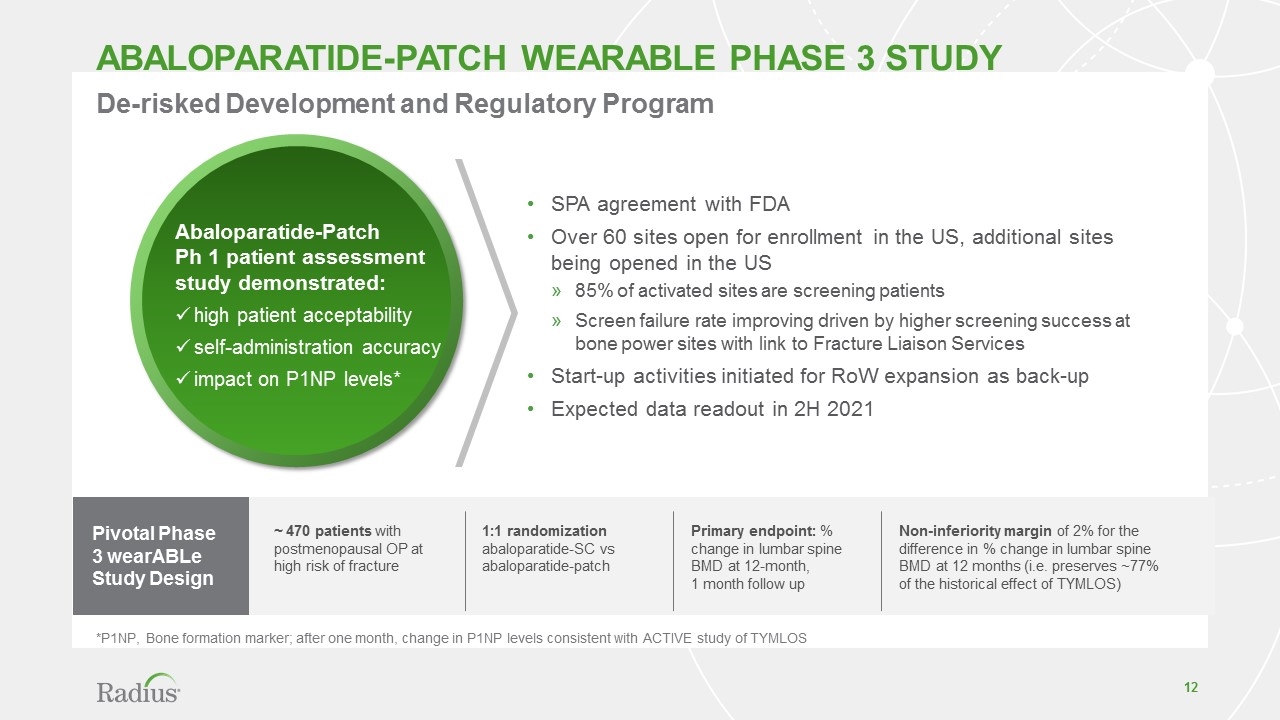

abaloparatide-patch WEARABLE PHASE 3 STUDY SPA agreement with FDA Over 60 sites open for enrollment in the US, additional sites being opened in the US 85% of activated sites are screening patients Screen failure rate improving driven by higher screening success at bone power sites with link to Fracture Liaison Services Start-up activities initiated for RoW expansion as back-up Expected data readout in 2H 2021 *P1NP, Bone formation marker; after one month, change in P1NP levels consistent with ACTIVE study of TYMLOS De-risked Development and Regulatory Program Abaloparatide-Patch Ph 1 patient assessment study demonstrated: high patient acceptability self-administration accuracy impact on P1NP levels* Pivotal Phase 3 wearABLe Study Design ~ 470 patients with postmenopausal OP at high risk of fracture Primary endpoint: % change in lumbar spine BMD at 12-month, 1 month follow up 1:1 randomization abaloparatide-SC vs abaloparatide-patch Non-inferiority margin of 2% for the difference in % change in lumbar spine BMD at 12 months (i.e. preserves ~77% of the historical effect of TYMLOS)

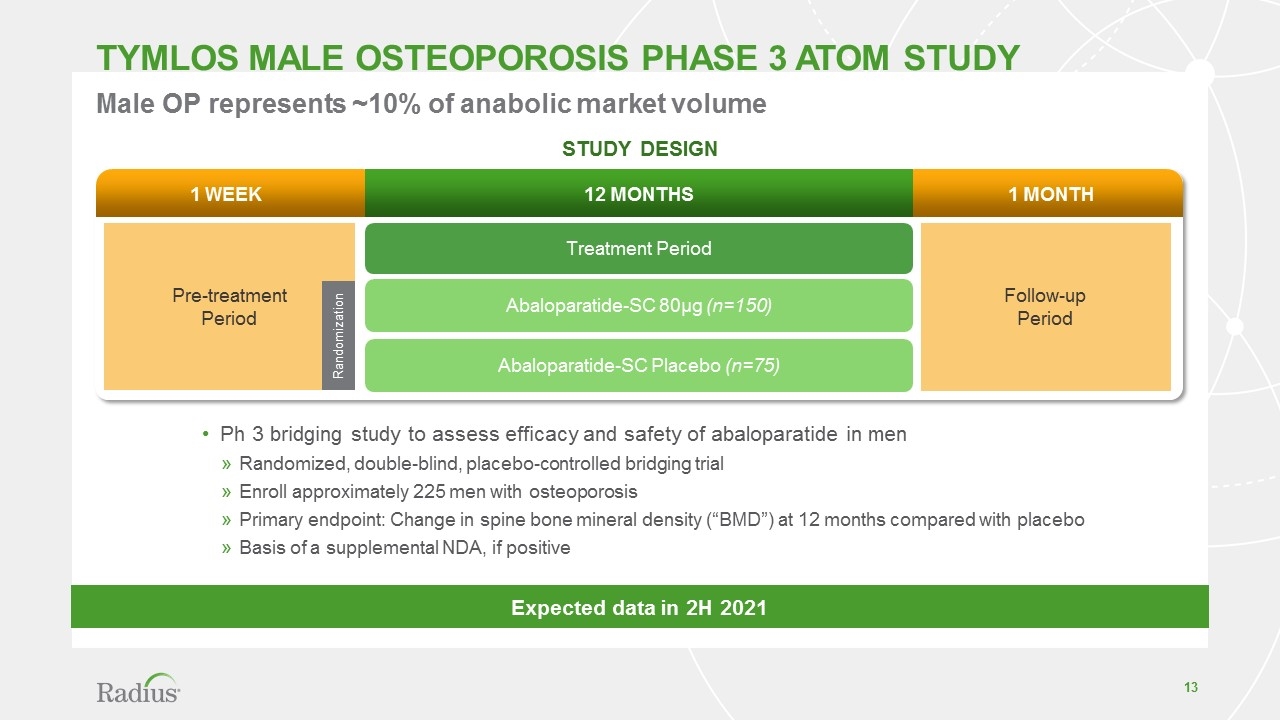

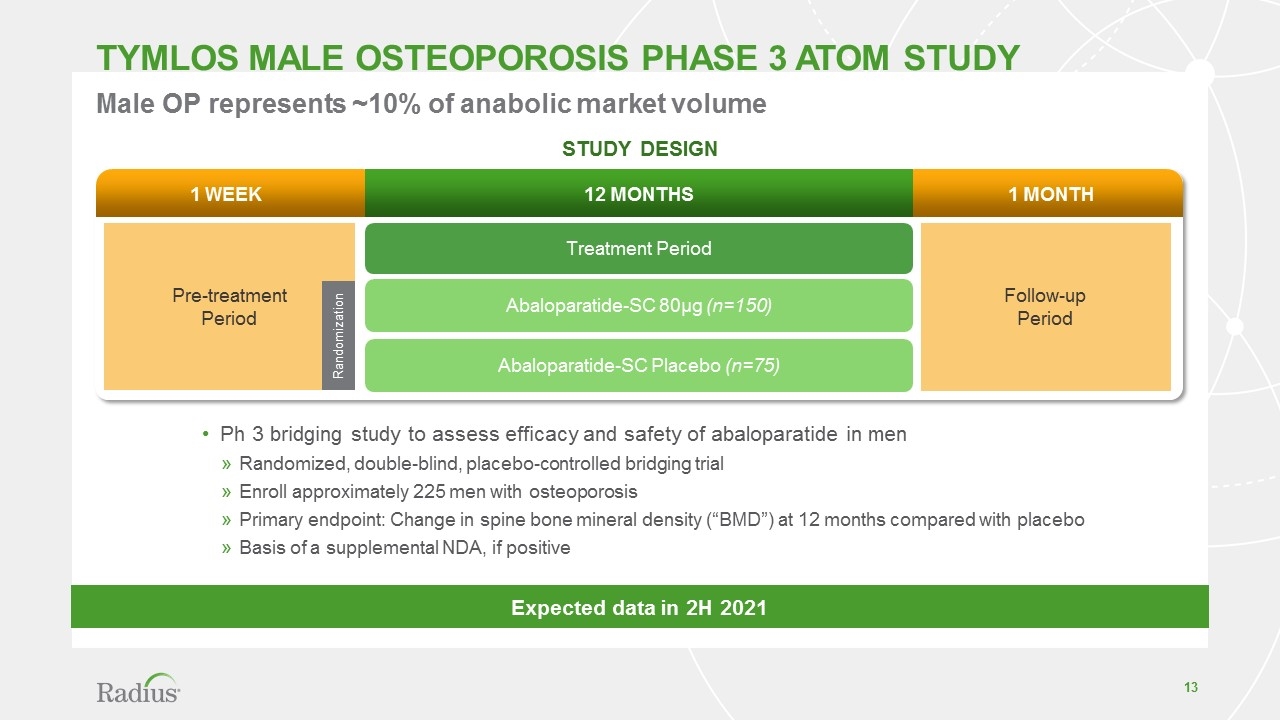

TYMLOS male osteoporosis phase 3 atom STUDY 1 week 1 month 12 months Pre-treatment Period Follow-up Period Treatment Period Abaloparatide-SC 80µg (n=150) Abaloparatide-SC Placebo (n=75) Randomization Ph 3 bridging study to assess efficacy and safety of abaloparatide in men Randomized, double-blind, placebo-controlled bridging trial Enroll approximately 225 men with osteoporosis Primary endpoint: Change in spine bone mineral density (“BMD”) at 12 months compared with placebo Basis of a supplemental NDA, if positive Male OP represents ~10% of anabolic market volume STUDY DESIGN Expected data in 2H 2021

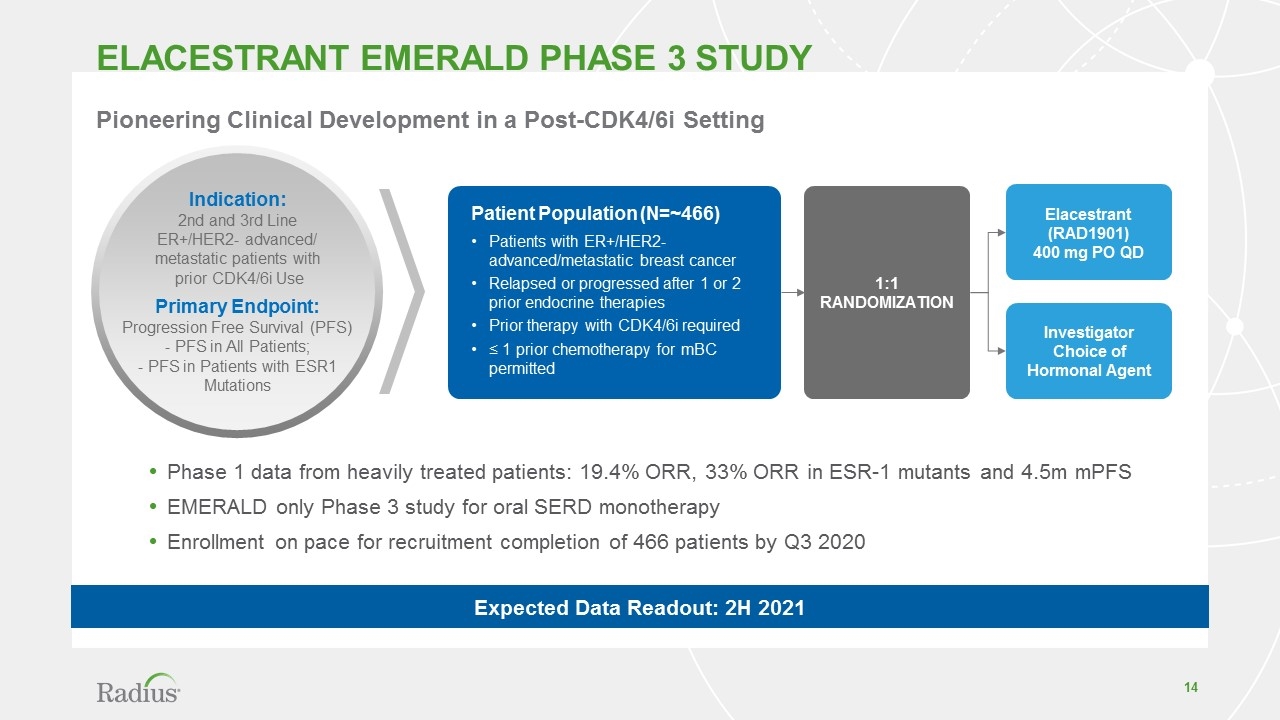

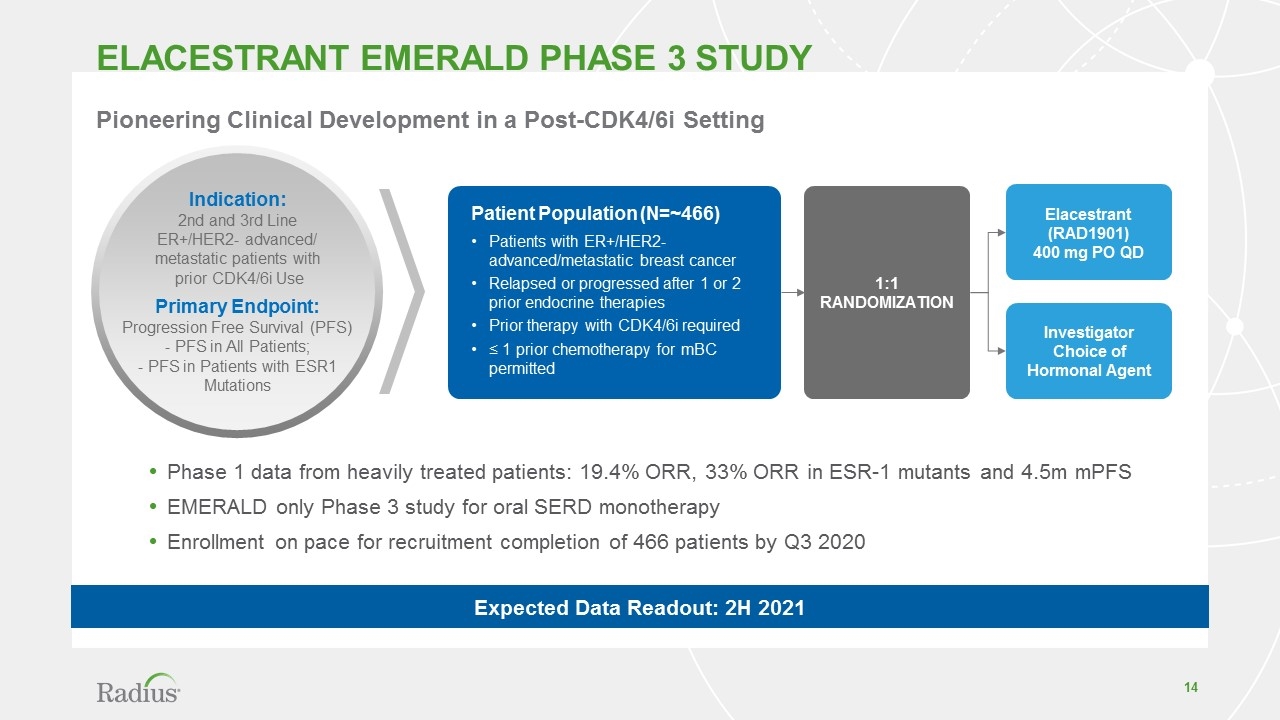

Elacestrant EMERALD Phase 3 STUDY Phase 1 data from heavily treated patients: 19.4% ORR, 33% ORR in ESR-1 mutants and 4.5m mPFS EMERALD only Phase 3 study for oral SERD monotherapy Enrollment on pace for recruitment completion of 466 patients by Q3 2020 Elacestrant (RAD1901) 400 mg PO QD Investigator Choice of Hormonal Agent Patient Population (N=~466) Patients with ER+/HER2- advanced/metastatic breast cancer Relapsed or progressed after 1 or 2 prior endocrine therapies Prior therapy with CDK4/6i required ≤ 1 prior chemotherapy for mBC permitted 1:1 Randomization Indication: 2nd and 3rd Line ER+/HER2- advanced/ metastatic patients with prior CDK4/6i Use Primary Endpoint: Progression Free Survival (PFS) - PFS in All Patients; - PFS in Patients with ESR1 Mutations Pioneering Clinical Development in a Post-CDK4/6i Setting Expected Data Readout: 2H 2021

Commercial Update Joe Kelly SVP SALES, MARKETING & operations

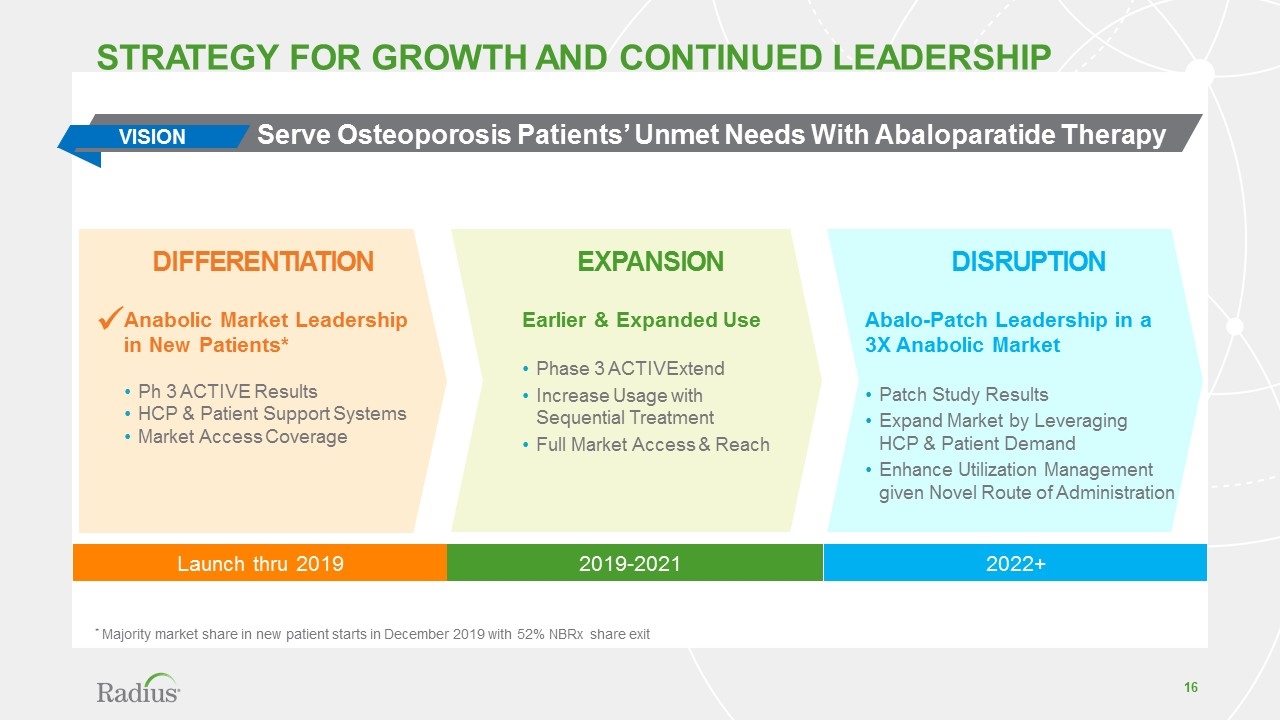

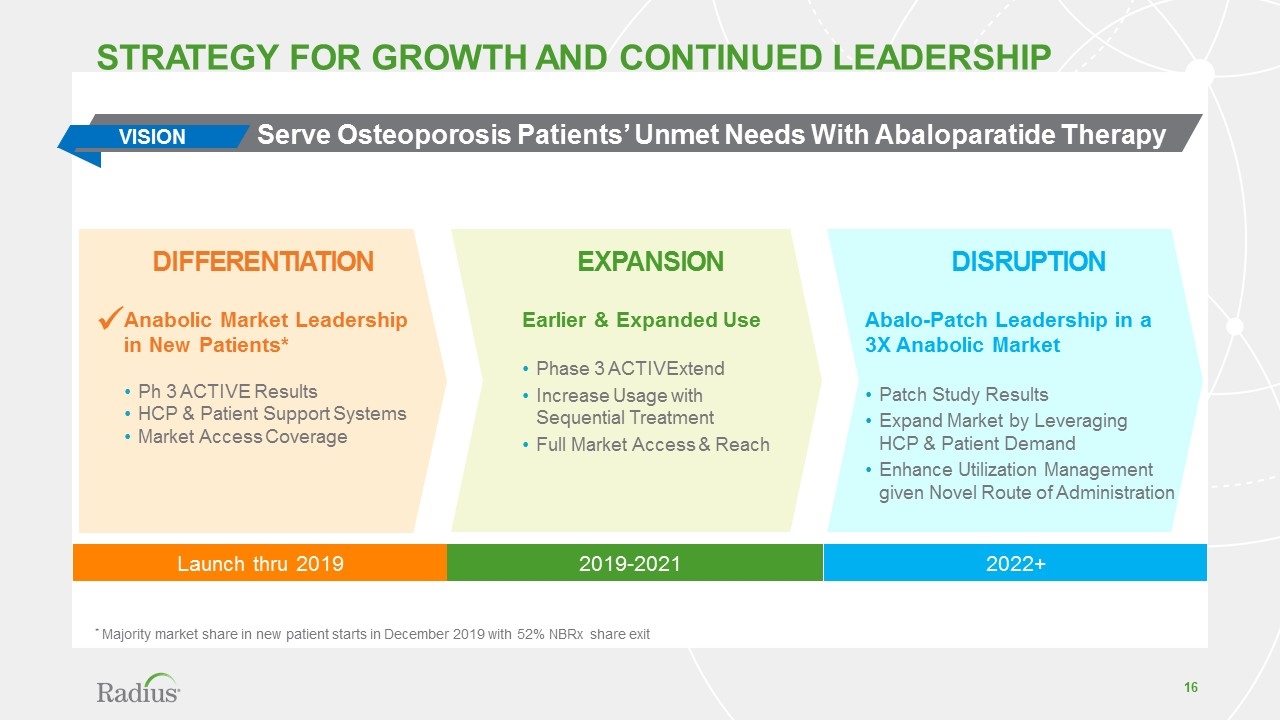

2019-2021 Disruption Expansion Differentiation Abalo-Patch Leadership in a 3X Anabolic Market Patch Study Results Expand Market by Leveraging HCP & Patient Demand Enhance Utilization Management given Novel Route of Administration Earlier & Expanded Use Phase 3 ACTIVExtend Increase Usage with Sequential Treatment Full Market Access & Reach Anabolic Market Leadership in New Patients* Ph 3 ACTIVE Results HCP & Patient Support Systems Market Access Coverage Strategy for growth and continued leadership VISION Launch thru 2019 2022+ Serve Osteoporosis Patients’ Unmet Needs With Abaloparatide Therapy ü * Majority market share in new patient starts in December 2019 with 52% NBRx share exit

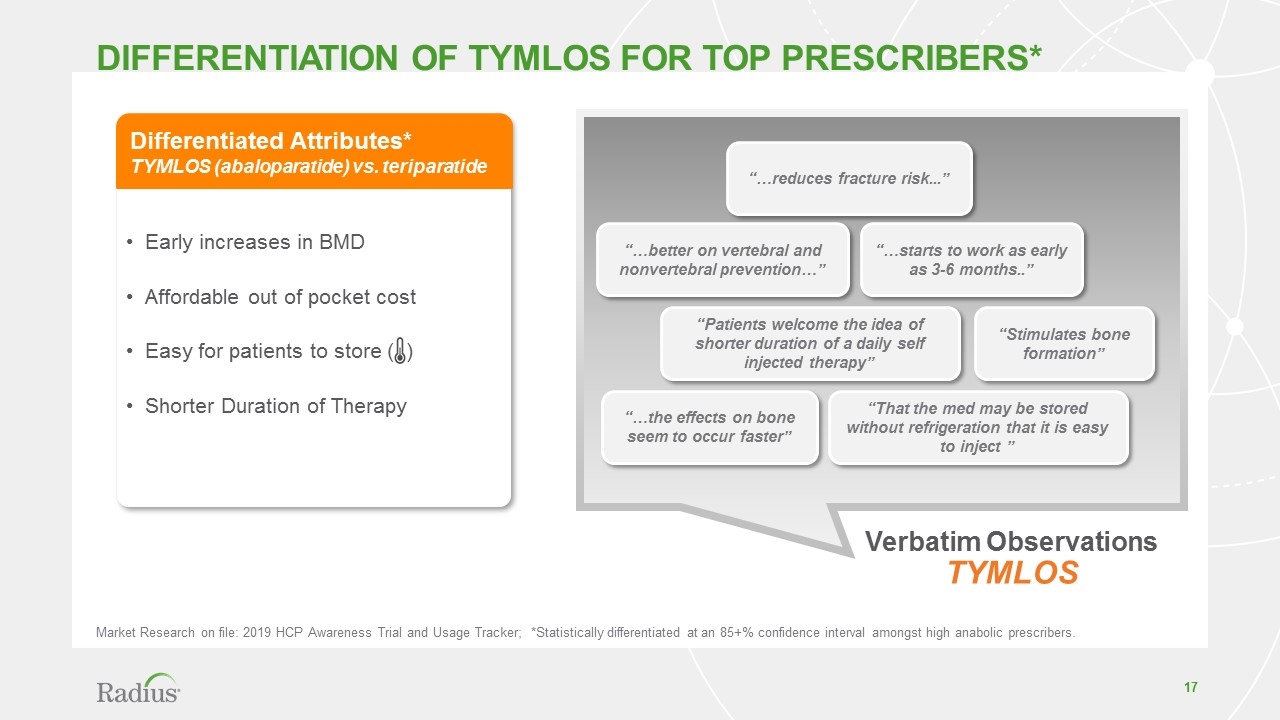

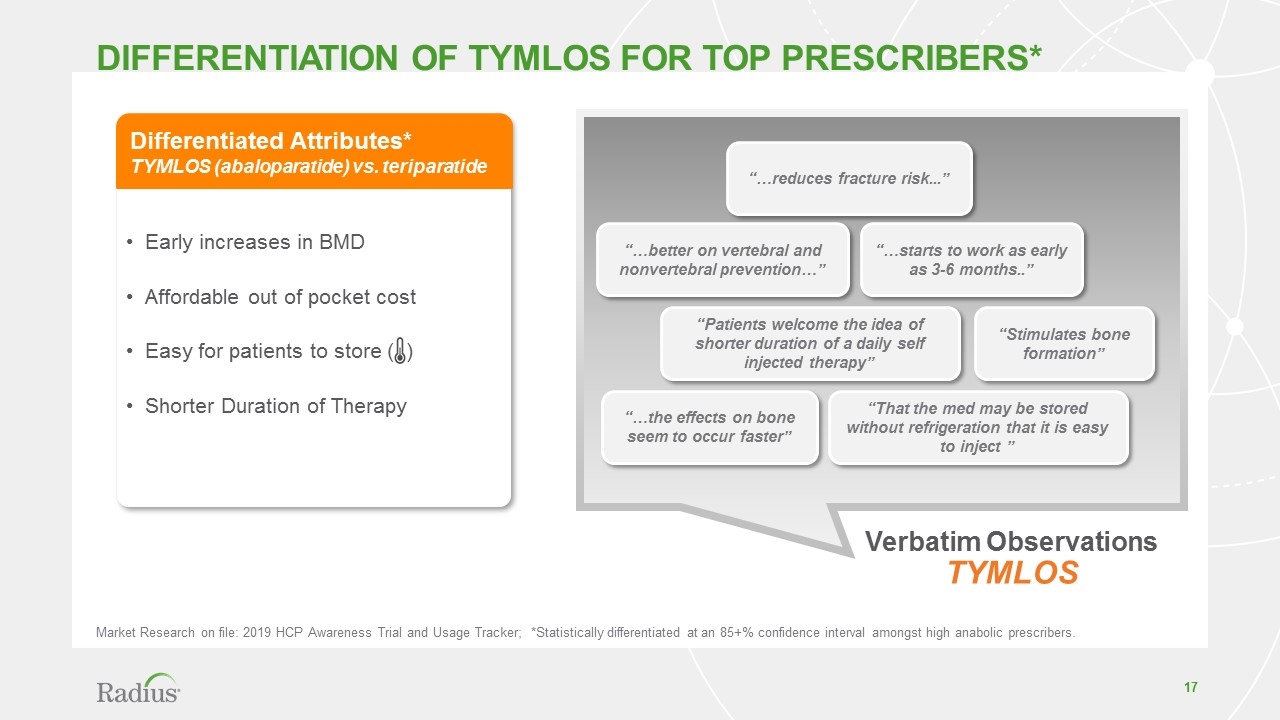

Verbatim Observations TYMLOS “…reduces fracture risk...” “…the effects on bone seem to occur faster” “That the med may be stored without refrigeration that it is easy to inject ” “Patients welcome the idea of shorter duration of a daily self injected therapy” “Stimulates bone formation” “…better on vertebral and nonvertebral prevention…” “…starts to work as early as 3-6 months..” Differentiation of tymlos for top prescribers* Differentiated Attributes* TYMLOS (abaloparatide) vs. teriparatide Early increases in BMD Affordable out of pocket cost Easy for patients to store ( ) Shorter Duration of Therapy Market Research on file: 2019 HCP Awareness Trial and Usage Tracker; *Statistically differentiated at an 85+% confidence interval amongst high anabolic prescribers.

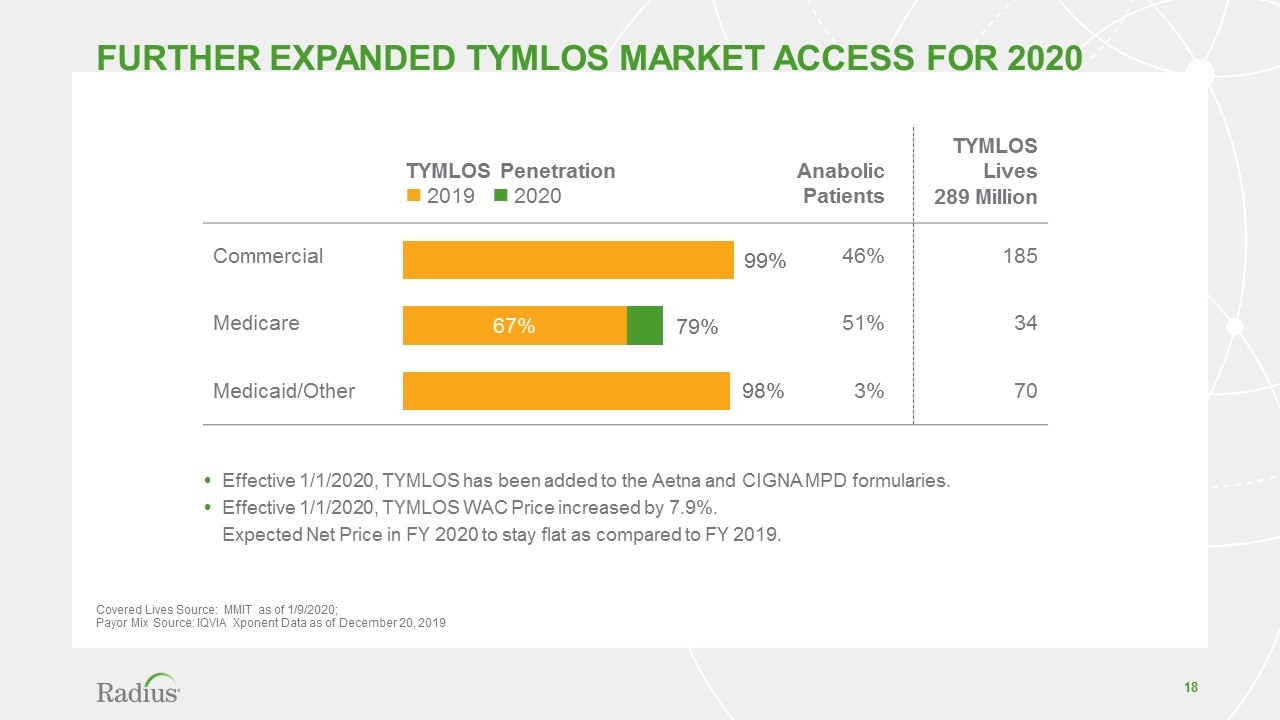

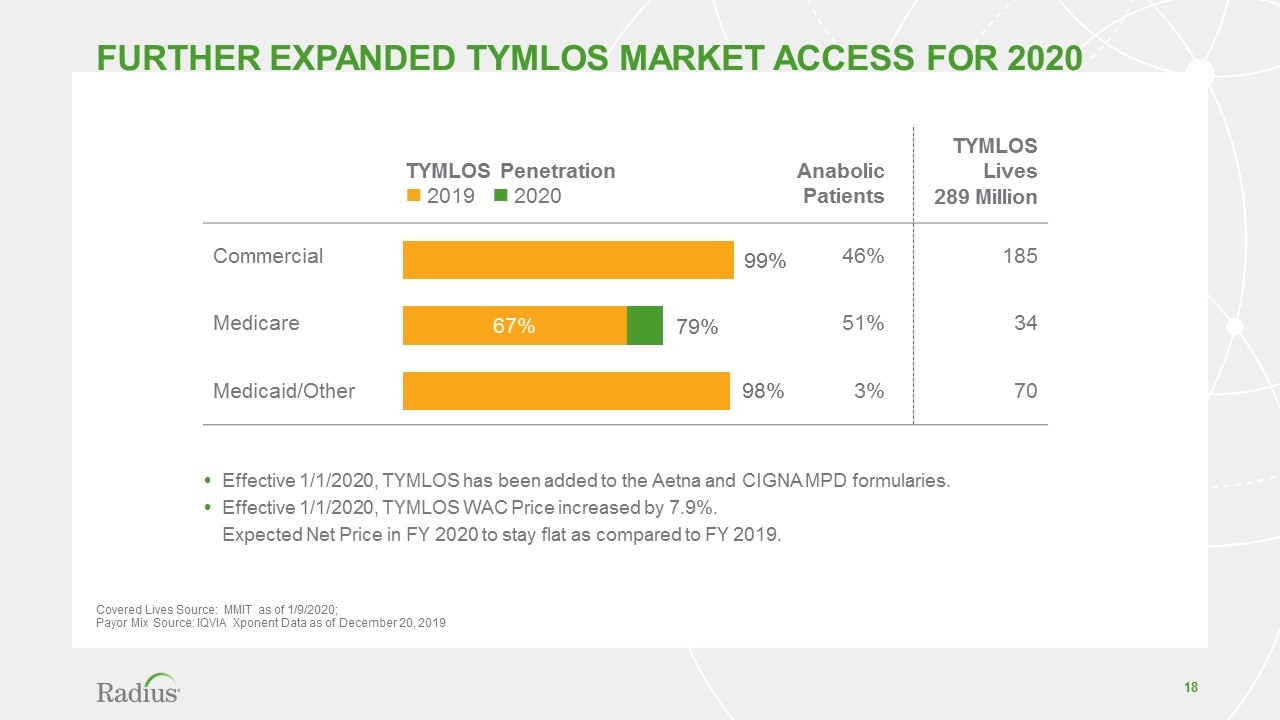

FURTHER expanded TYMLOS Market Access for 2020 Covered Lives Source: MMIT as of 1/9/2020; Payor Mix Source: IQVIA Xponent Data as of December 20, 2019 Effective 1/1/2020, TYMLOS has been added to the Aetna and CIGNA MPD formularies. Effective 1/1/2020, TYMLOS WAC Price increased by 7.9%. Expected Net Price in FY 2020 to stay flat as compared to FY 2019. TYMLOS Penetration n 2019 n 2020 Anabolic Patients TYMLOS Lives 289 Million Commercial 46% 185 Medicare 51% 34 Medicaid/Other 3% 70

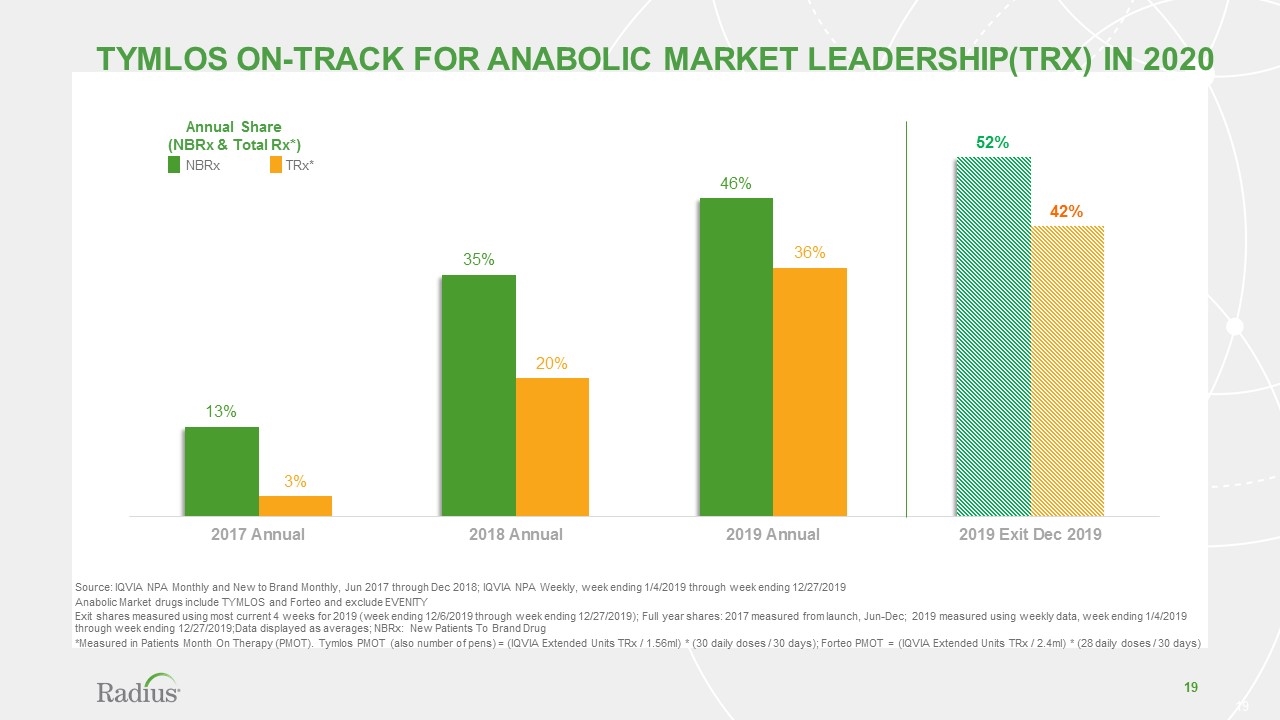

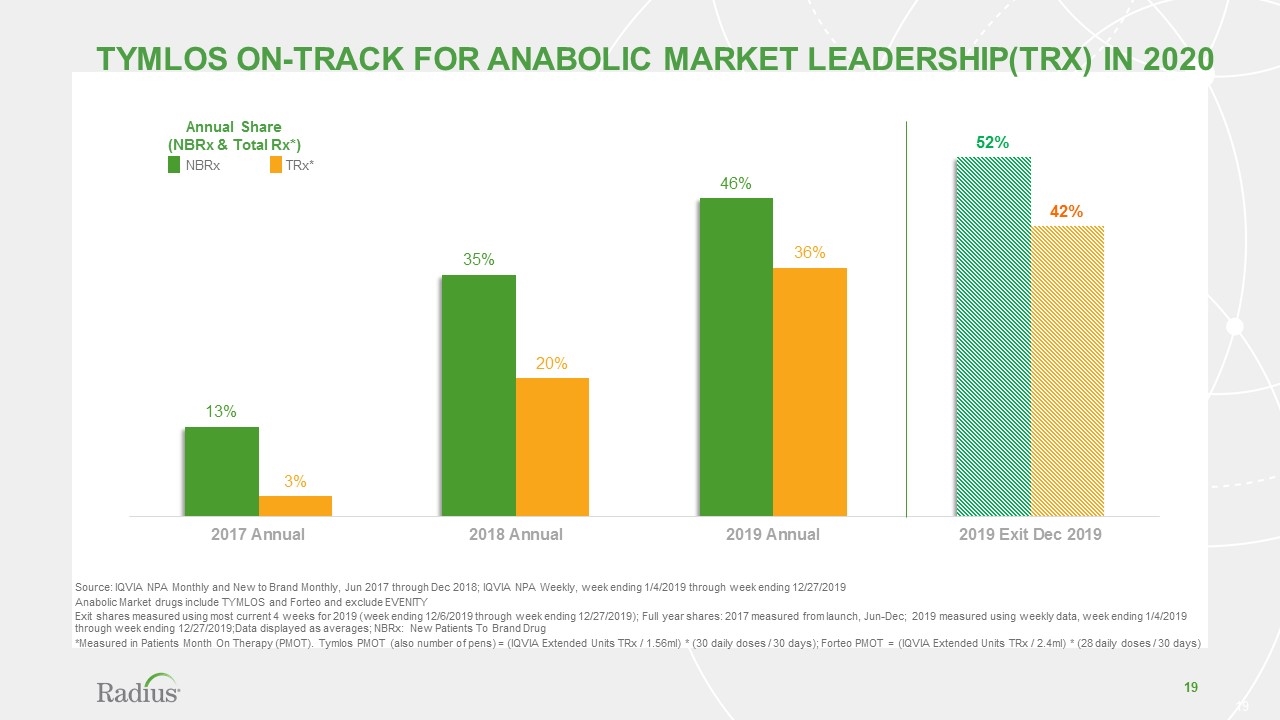

TYMLOS On-Track for Anabolic Market Leadership(TRx) in 2020 Annual Share (NBRx & Total Rx*) Source: IQVIA NPA Monthly and New to Brand Monthly, Jun 2017 through Dec 2018; IQVIA NPA Weekly, week ending 1/4/2019 through week ending 12/27/2019 Anabolic Market drugs include TYMLOS and Forteo and exclude EVENITY Exit shares measured using most current 4 weeks for 2019 (week ending 12/6/2019 through week ending 12/27/2019); Full year shares: 2017 measured from launch, Jun-Dec; 2019 measured using weekly data, week ending 1/4/2019 through week ending 12/27/2019;Data displayed as averages; NBRx: New Patients To Brand Drug *Measured in Patients Month On Therapy (PMOT). Tymlos PMOT (also number of pens) = (IQVIA Extended Units TRx / 1.56ml) * (30 daily doses / 30 days); Forteo PMOT = (IQVIA Extended Units TRx / 2.4ml) * (28 daily doses / 30 days) NBRx TRx*

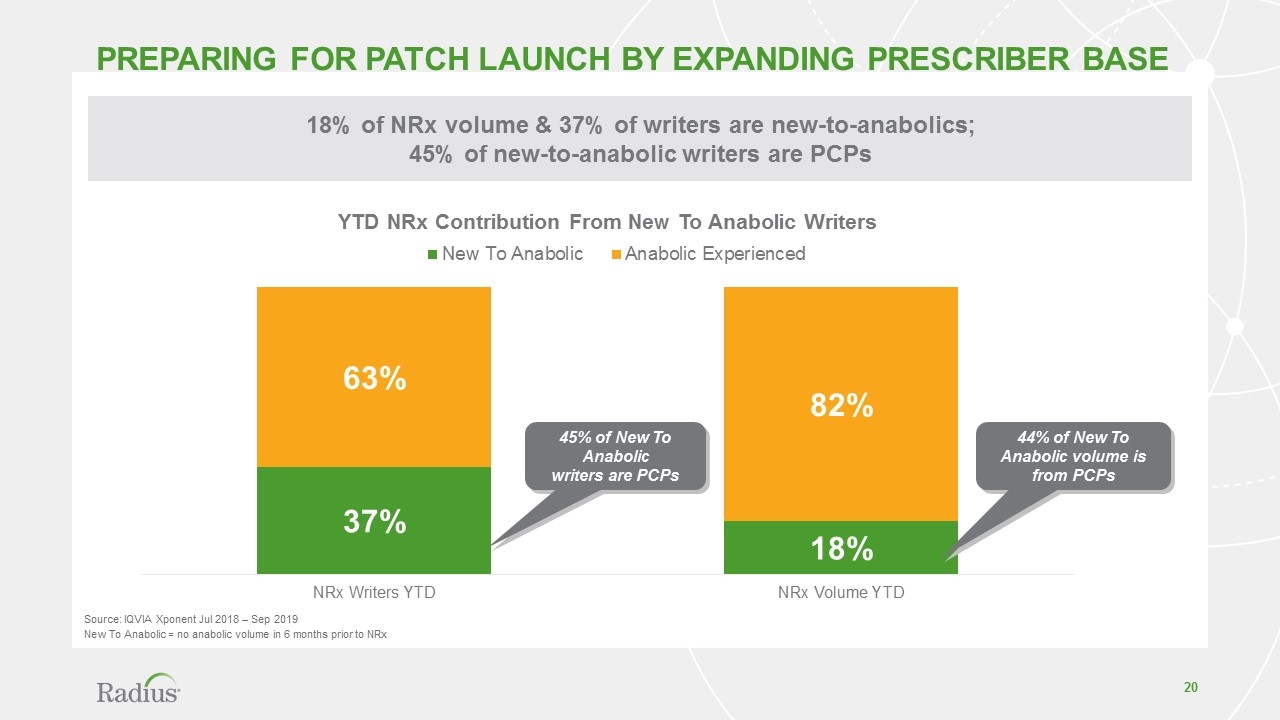

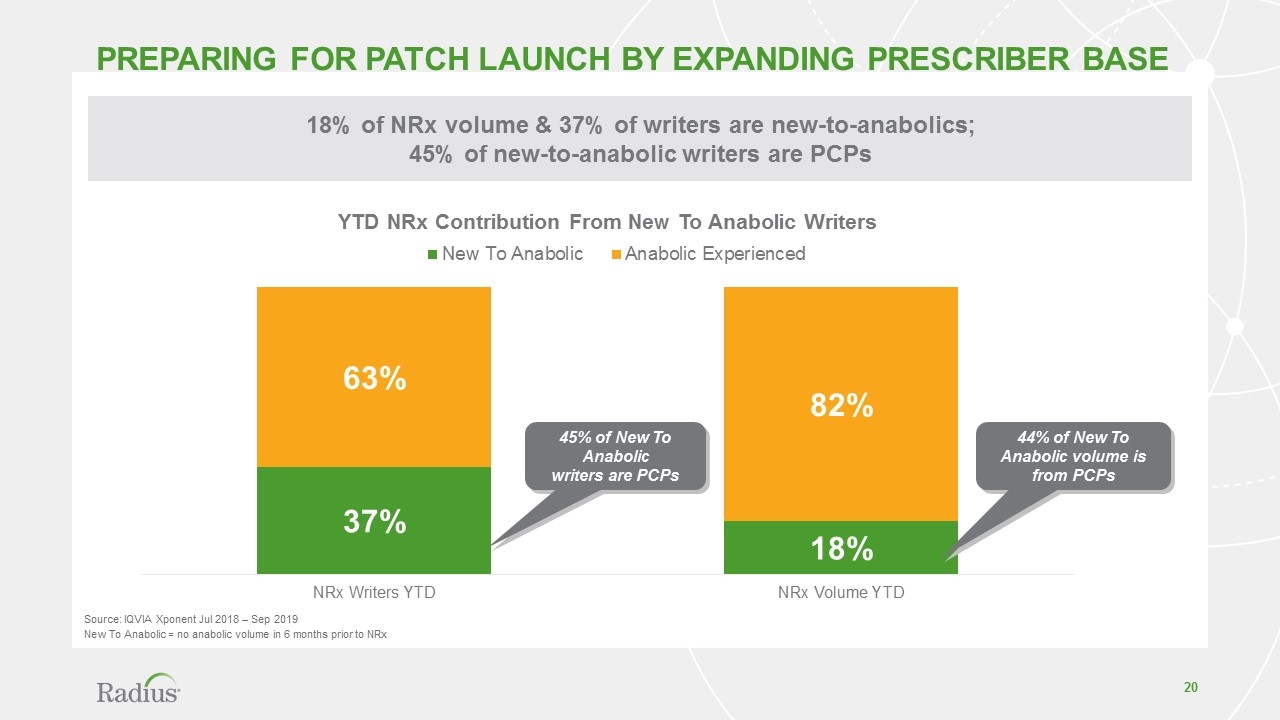

18% of NRx volume & 37% of writers are new-to-anabolics; 45% of new-to-anabolic writers are PCPs Preparing FOR Patch Launch by expanding prescriber base 45% of New To Anabolic writers are PCPs 44% of New To Anabolic volume is from PCPs Source: IQVIA Xponent Jul 2018 – Sep 2019 New To Anabolic = no anabolic volume in 6 months prior to NRx

Financial Review Pepe Carmona CHIEF financial OFFICER

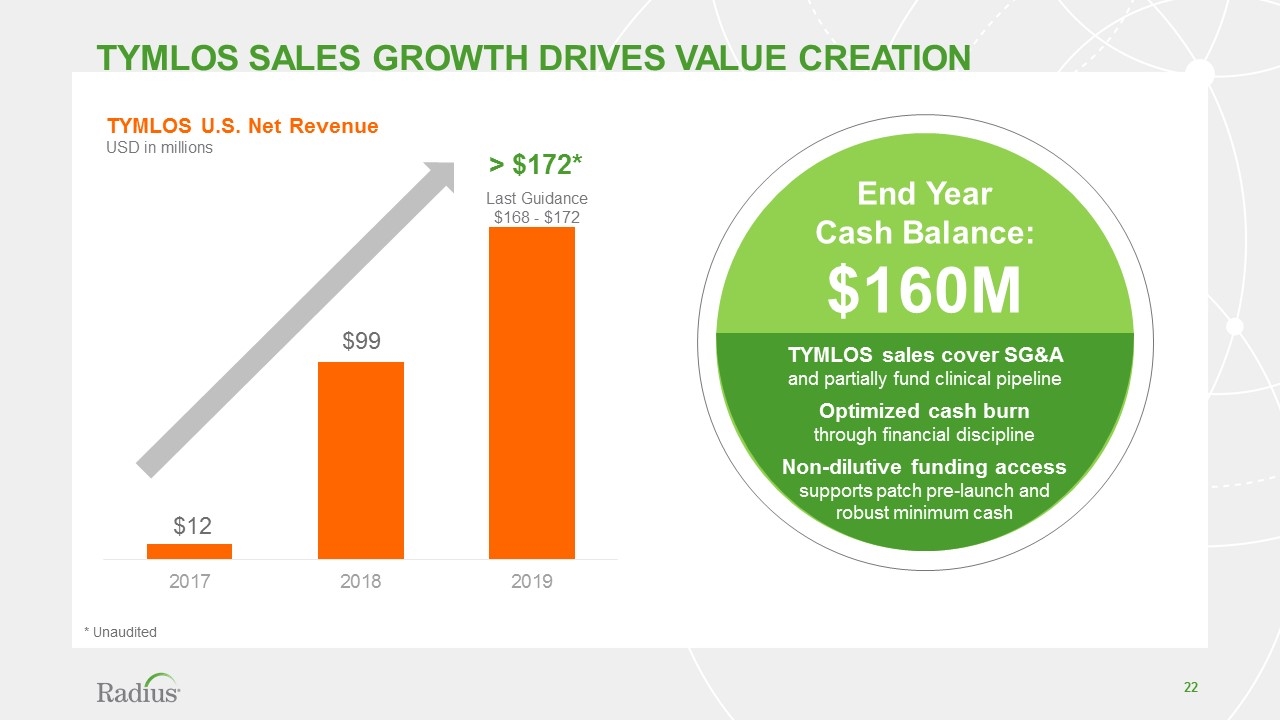

Tymlos sales growth drives value creation $12 $99 > $172* TYMLOS U.S. Net Revenue USD in millions TYMLOS sales cover SG&A and partially fund clinical pipeline Optimized cash burn through financial discipline Non-dilutive funding access supports patch pre-launch and robust minimum cash End Year Cash Balance: $160M Last Guidance $168 - $172 * Unaudited

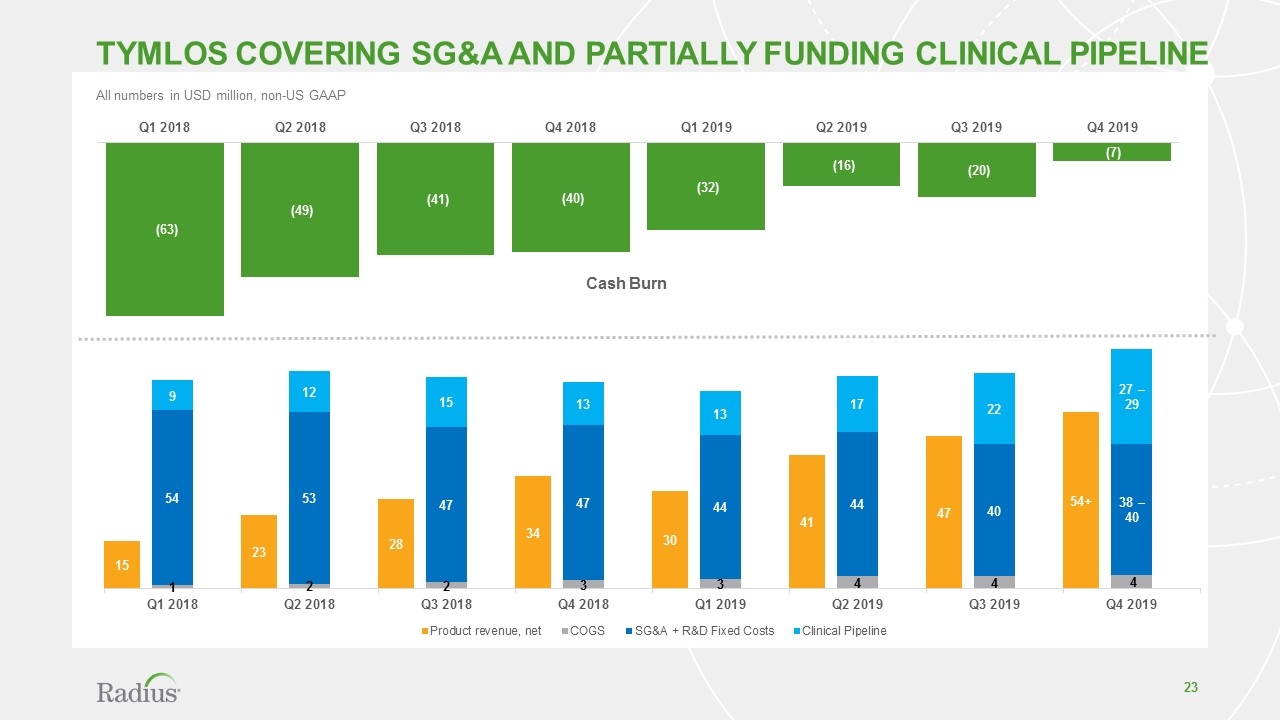

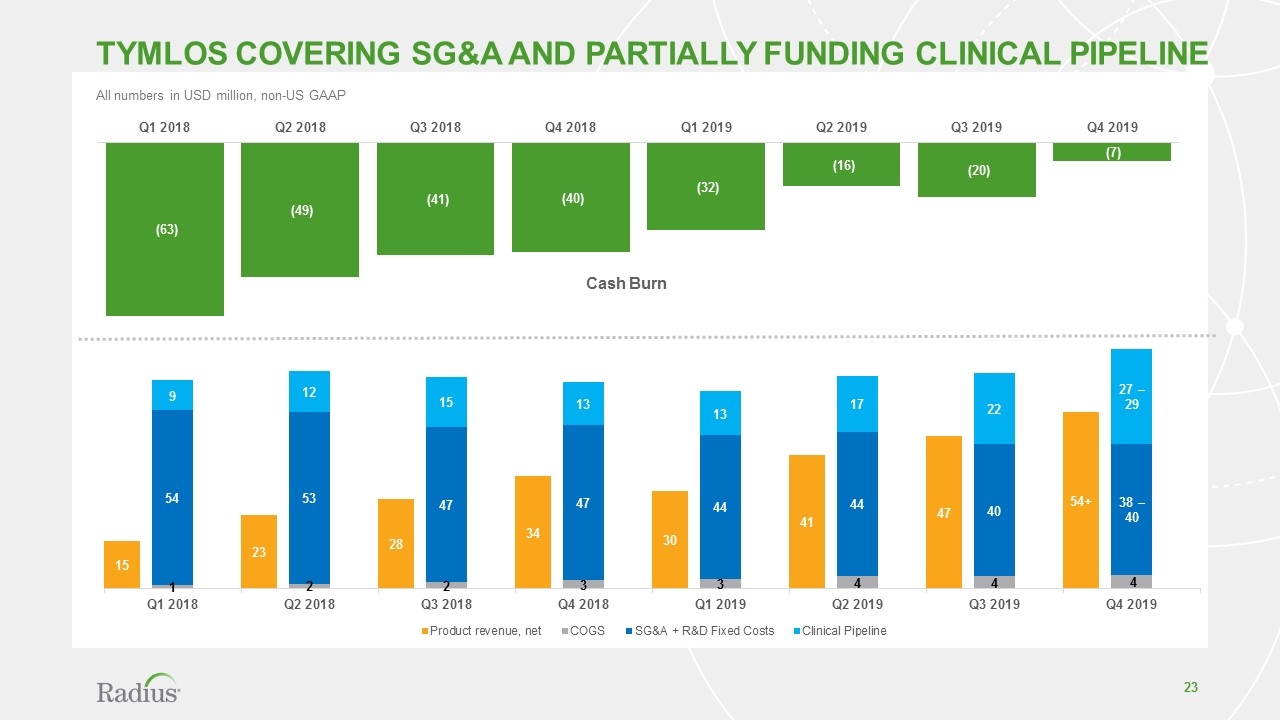

All numbers in USD million, non-US GAAP Cash Burn TYMLOS Covering SG&A and partially Funding Clinical Pipeline

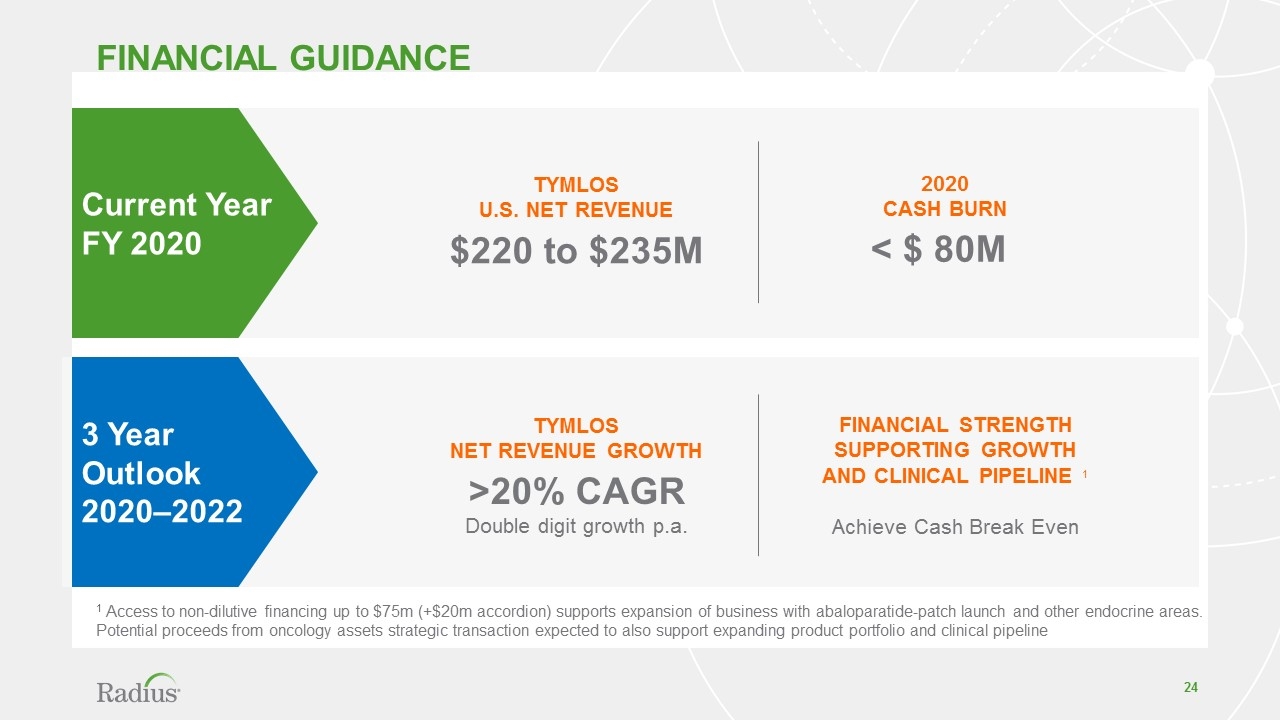

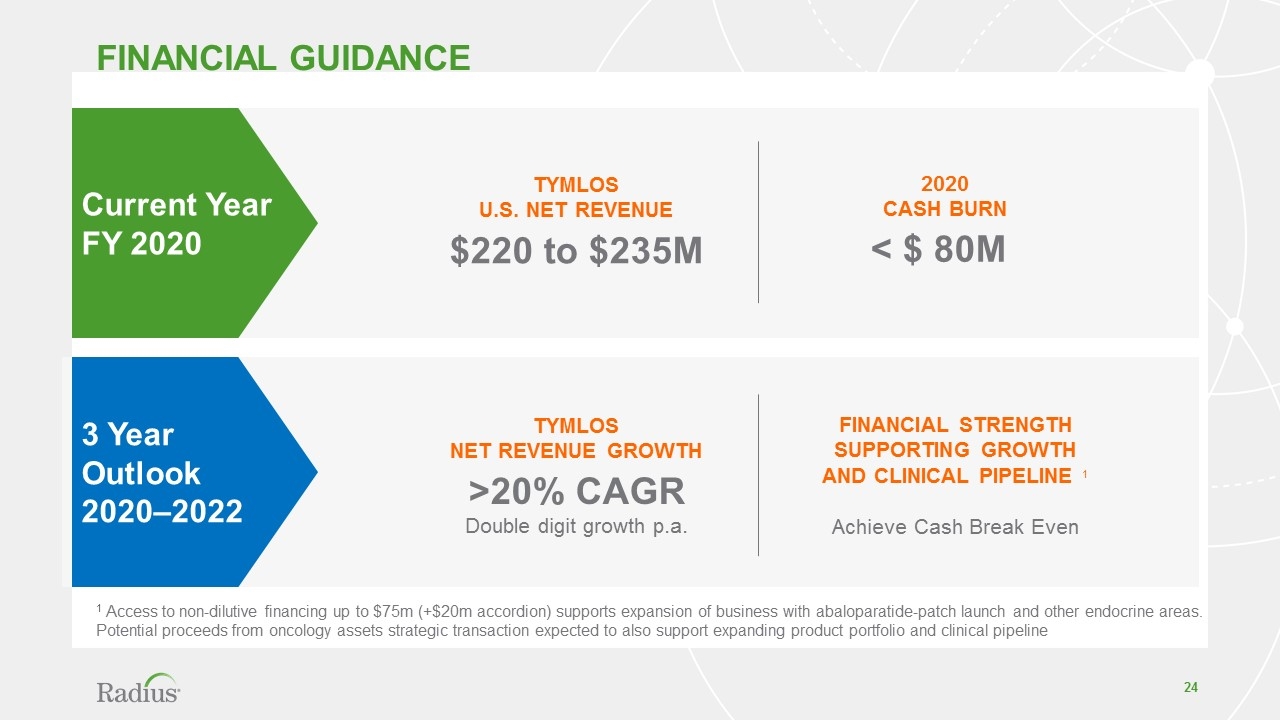

FINANCIAL GUIDANCE 1 Access to non-dilutive financing up to $75m (+$20m accordion) supports expansion of business with abaloparatide-patch launch and other endocrine areas. Potential proceeds from oncology assets strategic transaction expected to also support expanding product portfolio and clinical pipeline Current Year FY 2020 TYMLOS U.S. NET REVENUE $220 to $235M 2020 CASH BURN < $ 80M 3 Year Outlook 2020–2022 TYMLOS NET REVENUE GROWTH >20% CAGR Double digit growth p.a. FINANCIAL STRENGTH SUPPORTING GROWTH AND CLINICAL PIPELINE 1 Achieve Cash Break Even

Closing Remarks Jesper

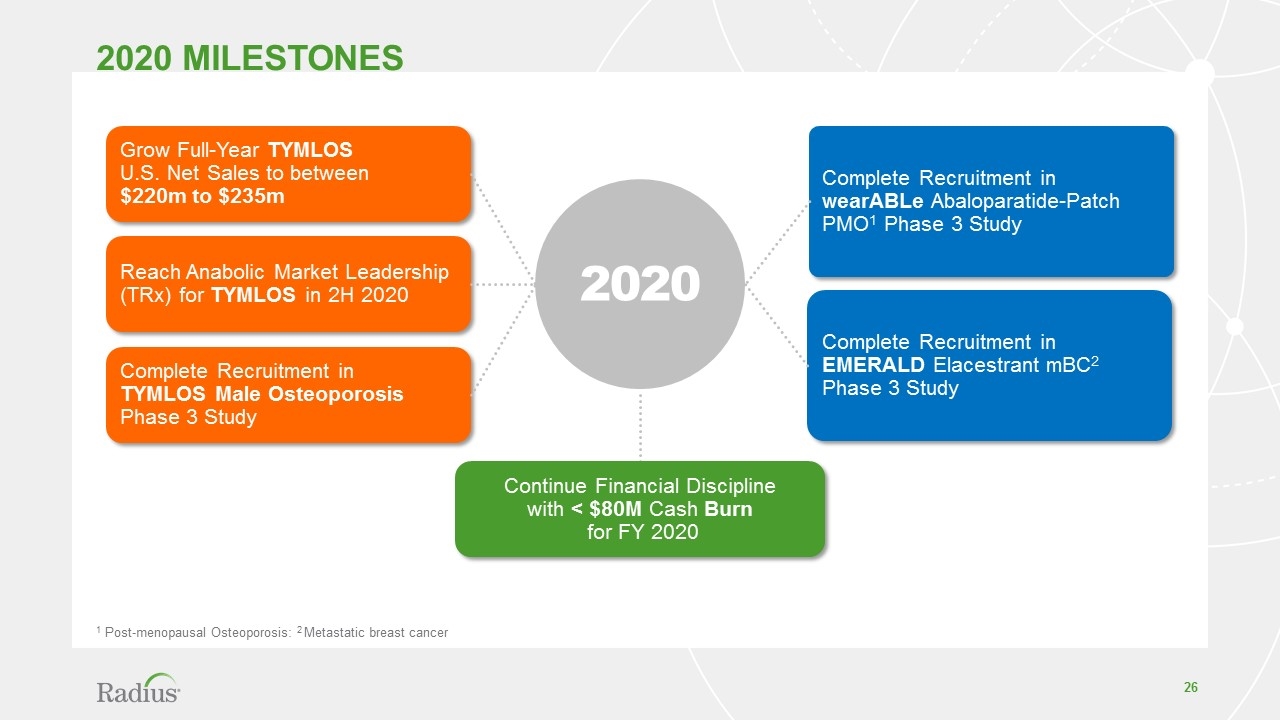

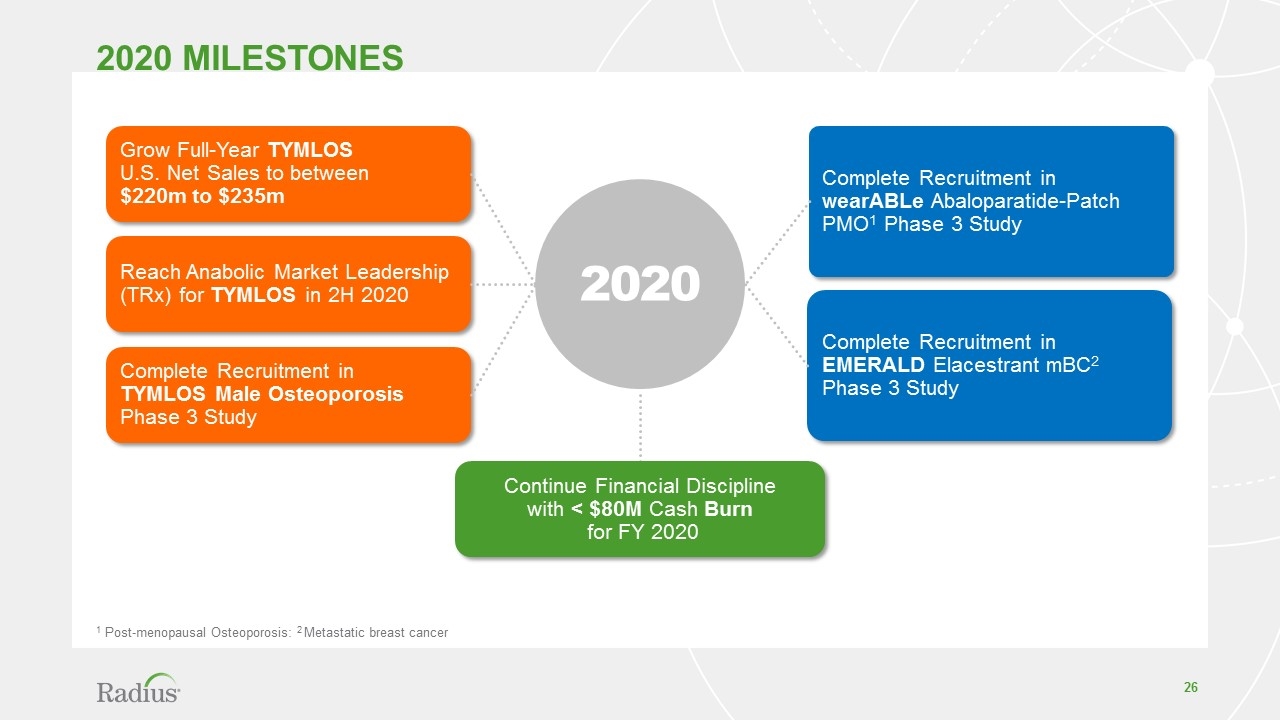

2020 Milestones 1 Post-menopausal Osteoporosis: 2 Metastatic breast cancer Grow Full-Year TYMLOS U.S. Net Sales to between $220m to $235m Reach Anabolic Market Leadership (TRx) for TYMLOS in 2H 2020 Complete Recruitment in TYMLOS Male Osteoporosis Phase 3 Study Complete Recruitment in wearABLe Abaloparatide-Patch PMO1 Phase 3 Study Complete Recruitment in EMERALD Elacestrant mBC2 Phase 3 Study 2020 Continue Financial Discipline with < $80M Cash Burn for FY 2020

Q&A

Appendix

Q4 2019 Q1 2020 Market Seasonality Market Share Price Seasonality All numbers in USD million 54+ (4) – (3) 3 – 6 (10) – (9) 45 - 48 * Higher patient abandonment rate early in the year ** Phasing of patients entering Medicare Part D Coverage Gap (70% manufacturer contribution) and support for commercial deductibles on new year patient plan, partially offset by price increase Anabolic Market Seasonality* (Q1’18: -6% and Q1’19: -8%) TRx 40% Q4’19 to 42-44% Q1’20 Initial phase deductibles** Q1 2020 sales to follow seasonality

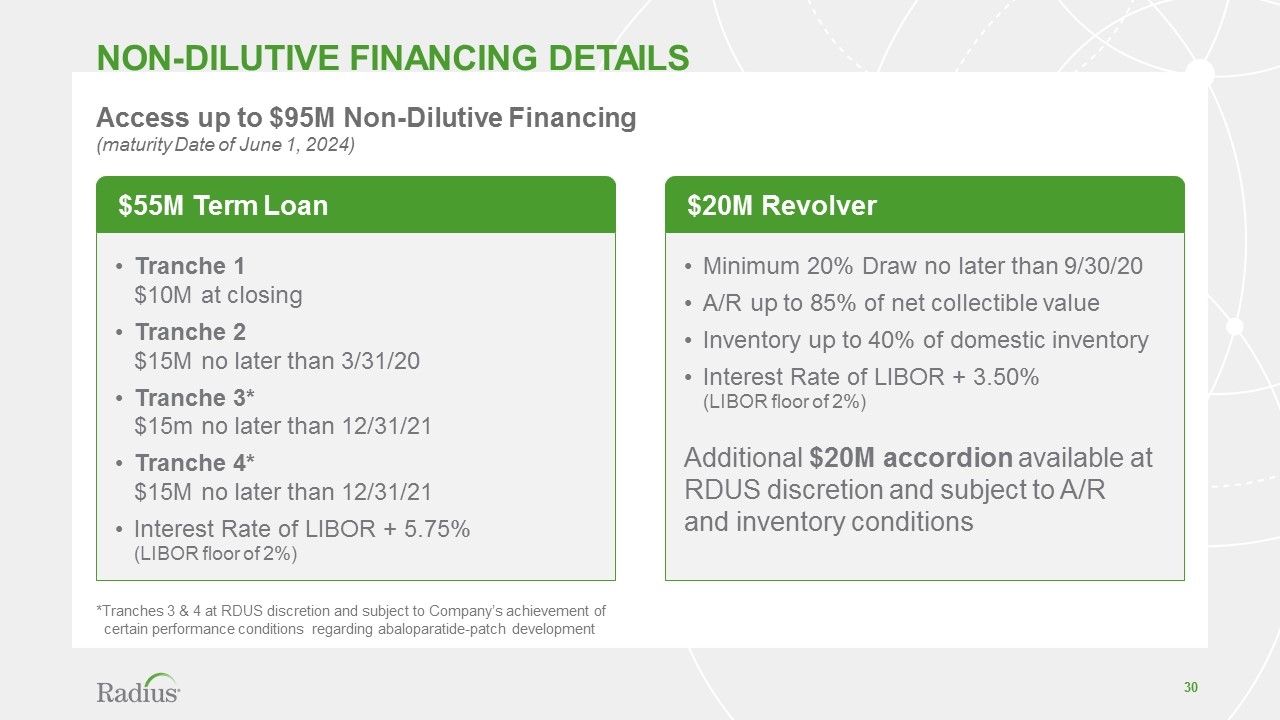

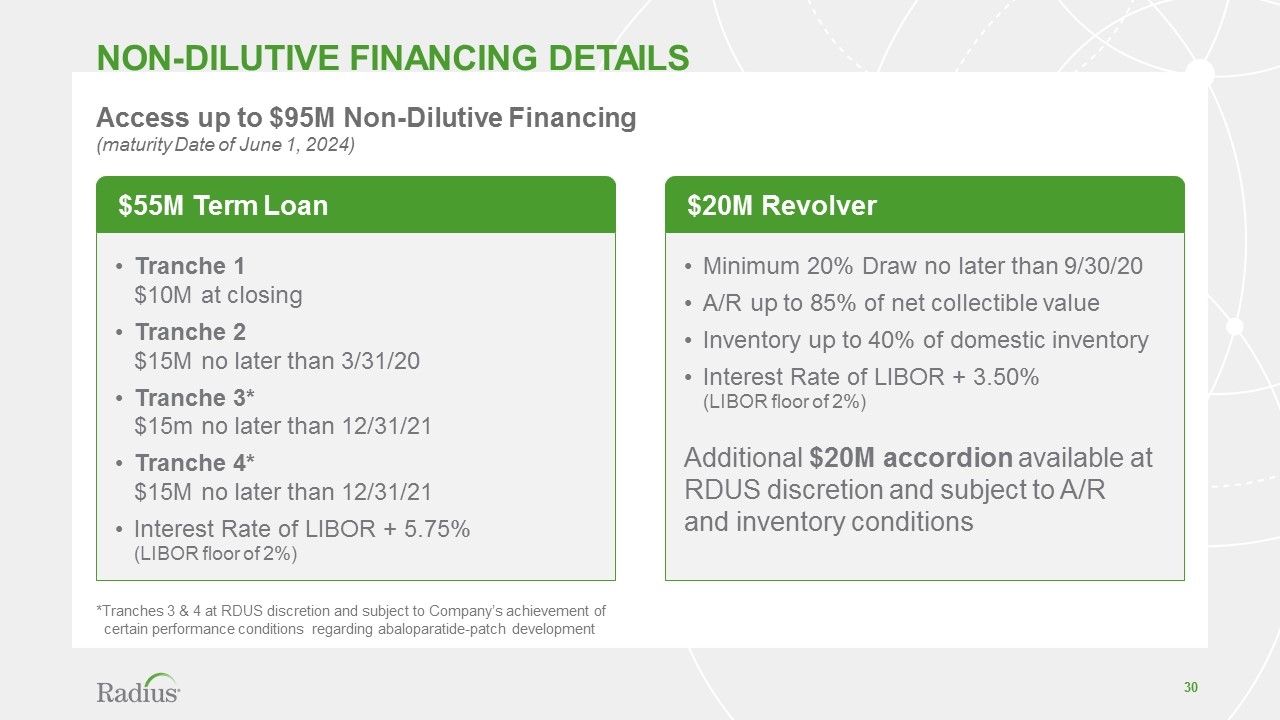

Tranche 1 $10M at closing Tranche 2 $15M no later than 3/31/20 Tranche 3* $15m no later than 12/31/21 Tranche 4* $15M no later than 12/31/21 Interest Rate of LIBOR + 5.75% (LIBOR floor of 2%) Non-dilutive financing DETAILS Access up to $95M Non-Dilutive Financing (maturity Date of June 1, 2024) $55M Term Loan Minimum 20% Draw no later than 9/30/20 A/R up to 85% of net collectible value Inventory up to 40% of domestic inventory Interest Rate of LIBOR + 3.50% (LIBOR floor of 2%) Additional $20M accordion available at RDUS discretion and subject to A/R and inventory conditions $20M Revolver *Tranches 3 & 4 at RDUS discretion and subject to Company’s achievement of certain performance conditions regarding abaloparatide-patch development

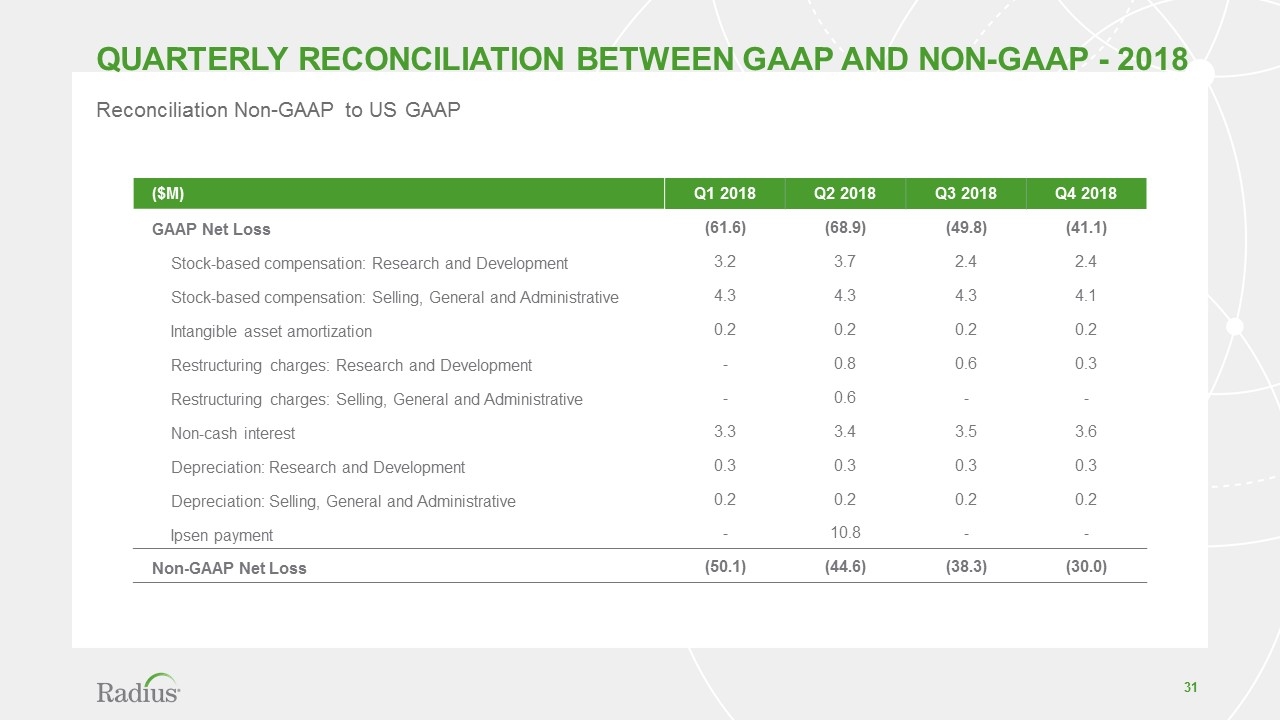

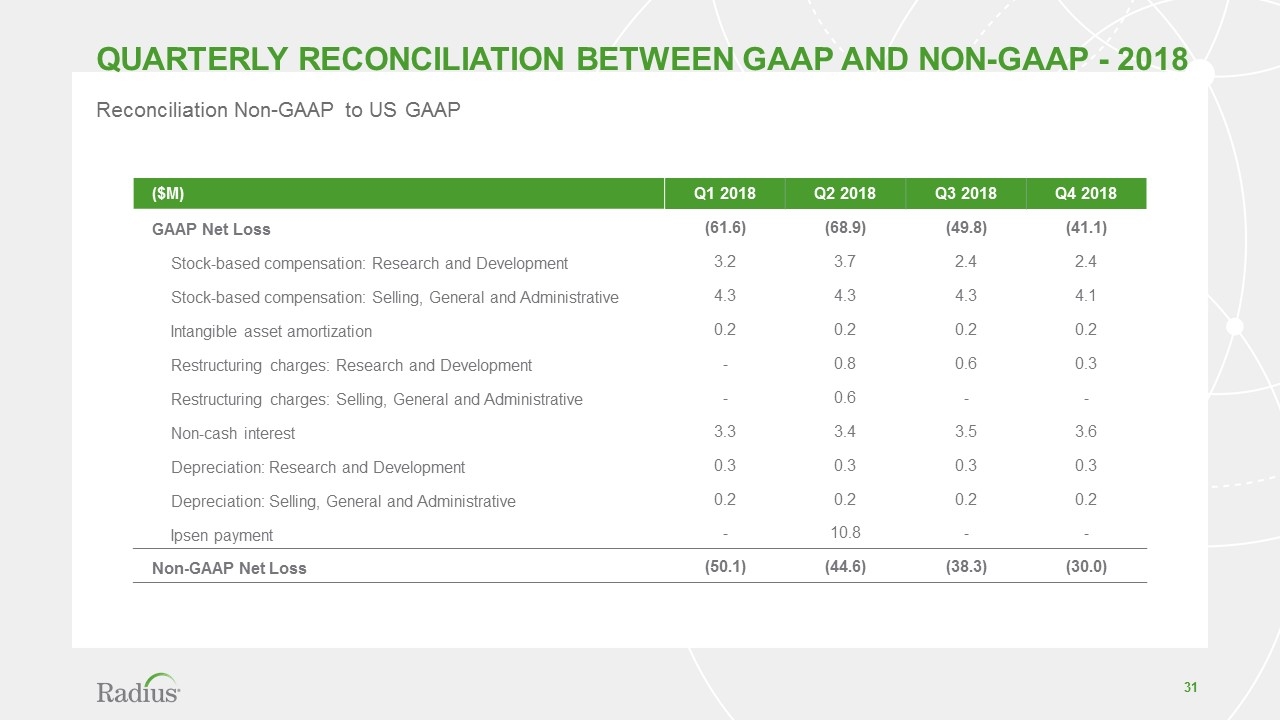

Reconciliation Non-GAAP to US GAAP ($M) Q1 2018 Q2 2018 Q3 2018 Q4 2018 GAAP Net Loss (61.6) (68.9) (49.8) (41.1) Stock-based compensation: Research and Development 3.2 3.7 2.4 2.4 Stock-based compensation: Selling, General and Administrative 4.3 4.3 4.3 4.1 Intangible asset amortization 0.2 0.2 0.2 0.2 Restructuring charges: Research and Development - 0.8 0.6 0.3 Restructuring charges: Selling, General and Administrative - 0.6 - - Non-cash interest 3.3 3.4 3.5 3.6 Depreciation: Research and Development 0.3 0.3 0.3 0.3 Depreciation: Selling, General and Administrative 0.2 0.2 0.2 0.2 Ipsen payment - 10.8 - - Non-GAAP Net Loss (50.1) (44.6) (38.3) (30.0) Quarterly Reconciliation between GAAP and Non-GAAP - 2018

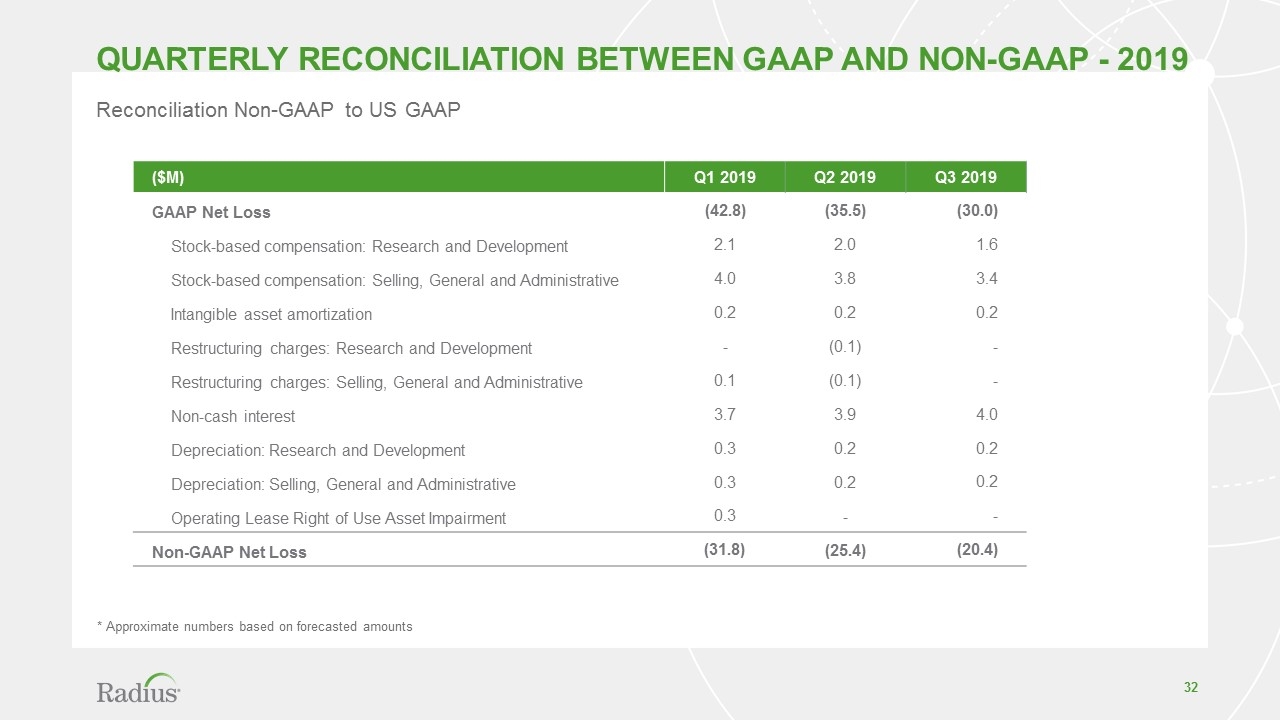

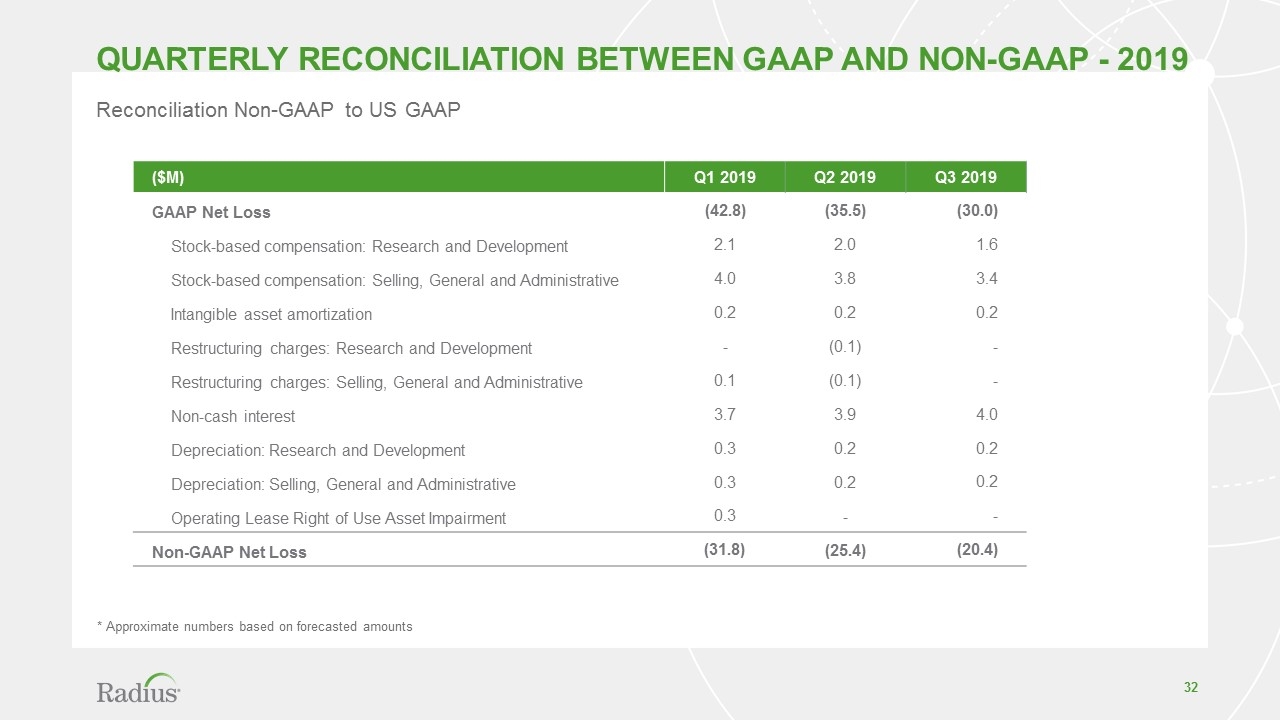

Reconciliation Non-GAAP to US GAAP ($M) Q1 2019 Q2 2019 Q3 2019 GAAP Net Loss (42.8) (35.5) (30.0) Stock-based compensation: Research and Development 2.1 2.0 1.6 Stock-based compensation: Selling, General and Administrative 4.0 3.8 3.4 Intangible asset amortization 0.2 0.2 0.2 Restructuring charges: Research and Development - (0.1) - Restructuring charges: Selling, General and Administrative 0.1 (0.1) - Non-cash interest 3.7 3.9 4.0 Depreciation: Research and Development 0.3 0.2 0.2 Depreciation: Selling, General and Administrative 0.3 0.2 0.2 Operating Lease Right of Use Asset Impairment 0.3 - - Non-GAAP Net Loss (31.8) (25.4) (20.4) * Approximate numbers based on forecasted amounts Quarterly Reconciliation between GAAP and Non-GAAP - 2019