- TMX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Terminix Global (TMX) DEF 14ADefinitive proxy

Filed: 20 Apr 20, 8:36am

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| SERVICEMASTER GLOBAL HOLDINGS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

SERVICEMASTER GLOBAL HOLDINGS, INC.

150 Peabody Place

Memphis, TN 38103

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 26, 2020

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of ServiceMaster Global Holdings, Inc. will be held at ServiceMaster's corporate office, located at 150 Peabody Place, Memphis, TN 38103, on Tuesday, May 26, 2020, at 6:00 p.m., local time, for the following purposes:

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

Only stockholders of record at the close of business on April 9, 2020 are entitled to notice of, and to vote at, the Annual Meeting of Stockholders or any adjournment or postponement thereof. This notice and the accompanying proxy statement are first being mailed to stockholders on or about April 20, 2020. We currently intend to hold our Annual Meeting in person; however, we will continue to actively monitor issues related to COVID-19 and the impact of such on our Annual Meeting of Stockholders. We are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state and local governments may impose or recommend. In response to the COVID-19 crisis, it is possible that we may change the date, time or location of the Annual Meeting of Stockholders, or may conduct the Annual Meeting via the Internet or teleconference call if we determine it is not possible or advisable to hold an in-person meeting. We will notify stockholders of any such changes as promptly as practicable by issuing a press release that will be filed with the Securities and Exchange Commission and posted to our website.

By Order of the Board of Directors,

Michael C. Bisignano

Senior Vice President, General Counsel and Secretary

April 20, 2020

Whether or not you plan to attend the annual meeting, please vote by Internet or telephone at your earliest convenience or complete, sign, date and return the proxy card so that your shares will be represented at the meeting. You may choose to attend the meeting and personally cast your votes even if you vote by Internet or telephone or fill out and return a proxy card by mail. If you choose to attend the meeting in person, you may revoke your proxy and personally cast your votes at the meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 26, 2020:

The proxy statement, notice of annual meeting and the 2019 annual report are available, free of charge, at http://www.proxyvote.com.

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 26, 2020

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING | 1 | |||

THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | 7 | |||

EXECUTIVE OFFICERS | 20 | |||

EXECUTIVE COMPENSATION | 22 | |||

—COMPENSATION DISCUSSION AND ANALYSIS | 22 | |||

—COMPENSATION COMMITTEE REPORT | 37 | |||

—EXECUTIVE COMPENSATION TABLES | 38 | |||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 49 | |||

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 51 | |||

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 51 | |||

REPORT OF THE AUDIT COMMITTEE | 52 | |||

PROPOSAL 1: ELECTION OF DIRECTORS | 53 | |||

PROPOSAL 2: NON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | 53 | |||

PROPOSAL 3: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 54 | |||

OTHER BUSINESS | 57 |

i

SERVICEMASTER GLOBAL HOLDINGS, INC.

150 Peabody Place

Memphis, TN 38103

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING

What are the proxy materials?

The accompanying proxy is delivered and solicited on behalf of the board of directors of ServiceMaster Global Holdings, Inc., a Delaware corporation (referred to as "ServiceMaster," the "Company," "we," "us," or "our"), in connection with the 2020 Annual Meeting of Stockholders (the "Annual Meeting") to be held at ServiceMaster's corporate office, located at 150 Peabody Place, Memphis, TN 38103, on Tuesday, May 26, 2020, at 6:00 p.m., local time. We are first sending this proxy statement and the accompanying form of proxy to stockholders on or about April 20, 2020. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this proxy statement. This proxy statement includes information that we are required to provide to you under U.S. Securities and Exchange Commission ("SEC") rules and is designed to assist you in voting your shares. The proxy materials include our proxy statement for the Annual Meeting, our 2019 annual report to stockholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2019, and the proxy card or a voting instruction card for the Annual Meeting.

All stockholders and beneficial owners may access the proxy materials, free of charge, at www.proxyvote.com or on our website, at www.servicemaster.com. If you would like to receive a paper copy of our proxy materials, free of charge, please write to ServiceMaster Global Holdings, Inc., c/o Secretary, 150 Peabody Place, Memphis, TN 38103.

Could the Date, Time and Location of the Annual Meeting Change Due to COVID-19?

We currently intend to hold our Annual Meeting in person; however, we will continue to actively monitor issues related to COVID-19 and the impact of such on our Annual Meeting. We are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state and local governments may impose or recommend. In response to the COVID-19 crisis, it is possible that we may change the date, time or location of the Annual Meeting, or may conduct the Annual Meeting via the Internet or teleconference call (a "virtual meeting") if we determine it is not possible or advisable to hold an in-person meeting. We will notify stockholders of any such changes as promptly as practicable by issuing a press release that will be filed with the SEC and posted to our website.

If we elect to proceed with a virtual meeting, we will ensure that our stockholders will be able to participate in the virtual meeting by providing a toll-free telephone number whereby they can access the meeting, ensuring any presentations are available to access via the Internet, afford stockholders the opportunity to ask questions and be able to vote their shares, if necessary, in conjunction with the Annual Meeting. If we elect to hold a virtual meeting for the 2020 Annual Meeting, we would do so only as a precautionary measure in response to the COVID-19 situation; we would expect to revert to an in-person annual meeting in 2021 and future years.

If you plan to attend the Annual Meeting in person, please monitor our Investor Relations website at http://investors.servicemaster.com and check the website in advance of the Annual Meeting for any updates. Please also retain your Annual Meeting materials for access details you will need in the event

1

we decide to hold a virtual meeting, including the control number included on your proxy card or in the voting instructions that accompanied your proxy materials as you will need this number should we determine to switch to virtual meeting. A virtual meeting will have no impact on your ability to provide your proxy prior to the Annual Meeting by using the Internet or telephone or by completing, signing, dating and mailing your proxy card, as explained in this proxy statement.

What items of business will be voted on at the Annual Meeting?

The items of business scheduled to be voted on at the Annual Meeting are:

| • | Proposal 1: | The election of the three nominees named in this proxy statement as Class III directors for a term expiring at the 2023 Annual Meeting of Stockholders. | ||

• | Proposal 2: | A non-binding advisory vote approving executive compensation. | ||

• | Proposal 3: | The ratification of Deloitte & Touche LLP ("Deloitte") as the Company's independent registered public accounting firm for the year ending December 31, 2020. | ||

• | To transact such other business as may properly come before the Annual Meeting or any reconvened meeting following any adjournment or postponement thereof. | |||

How does the board of directors recommend I vote on these proposals?

| • | Proposal 1: | "FOR" each of the nominees named in this proxy statement as Class III directors for a term expiring at the 2023 Annual Meeting of Stockholders. | ||

• | Proposal 2: | "FOR" the non-binding advisory vote approving executive compensation. | ||

• | Proposal 3: | "FOR" the ratification of Deloitte as the Company's independent registered public accounting firm for the year ending December 31, 2020. | ||

• | At the discretion of the proxy holders, either FOR or AGAINST, any other matter or business that may properly come before the Annual Meeting. | |||

As of the date hereof, our board of directors is not aware of any other such matter or business to be transacted at our Annual Meeting. If other matters requiring a vote of the stockholders arise, the persons designated as proxies will vote the shares of common stock of the Company, par value $0.01 per share, represented by the proxies in accordance with their judgment on those matters.

Who is entitled to vote at the Annual Meeting?

The record date for stockholders entitled to notice of, and to vote at, the Annual Meeting is April 9, 2020. At the close of business on that date, we had 131,923,361 shares of common stock outstanding and entitled to be voted at the Annual Meeting held by two stockholders of record and approximately 34,000 beneficial stockholders. A quorum is required for our stockholders to conduct business at the Annual Meeting. The presence in person or by proxy of the holders of record of a majority of the shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Each outstanding share of common stock is entitled to one vote. Dissenters' rights are not applicable to any of the matters being voted upon at the Annual Meeting.

By granting a proxy, you authorize the persons named in the proxy to represent you and vote your shares at the Annual Meeting. Those persons will also be authorized to vote your shares to adjourn the Annual Meeting from time to time and to vote your shares at any adjournments or postponements of the Annual Meeting.

2

Registered Stockholders. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A. ("Computershare"), you are considered the stockholder of record with respect to those shares, and the proxy materials were provided to you directly by us. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card in one of the manners listed on the proxy card or to vote in person at the Annual Meeting.

Beneficial Stockholders. If your shares are held in a stock brokerage account or by a broker, bank, trustee or other nominee, you are considered the beneficial owner of shares held in "street name," and the proxy materials were forwarded to you by your broker, bank, trustee or other nominee, who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank, trustee or other nominee how to vote your shares using the methods prescribed by your broker, bank, trustee or other nominee on the voting instruction card you received with the proxy materials. Beneficial owners are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you follow your broker's, bank's, trustee's or other nominee's procedures for obtaining a legal proxy.

What votes are required to approve each of the proposals?

Proposal 1, the nominees for Class III director will be elected by a majority of the votes cast with respect to such director nominee's election. The "majority of votes cast" means that the number of shares voted "for" a director nominee must exceed the number of votes cast "against" that director nominee's election. In accordance with our amended and restated by-laws, stockholders do not have the right to cumulate their votes for the election of directors.

Proposal 2, the non-binding advisory vote approving executive compensation, will be determined by the affirmative vote of the holders of at least a majority of the outstanding shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote. As an advisory vote, this proposal is not binding. However, our board of directors and Compensation Committee will consider the outcome of the vote when making future compensation decisions for our executive officers.

Proposal 3, the ratification of the selection of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2020, will be determined by the affirmative vote of the holders of at least a majority of the outstanding shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote. The Audit Committee has sole and direct responsibility for the appointment, retention, termination, compensation, evaluation and oversight of the work of any independent registered public accounting firm engaged by the Company. The Audit Committee has already appointed Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2020. In the event of a negative vote on the ratification, the Audit Committee may reconsider its appointment of Deloitte for 2020 and will consider the outcome of the vote when making appointments of our independent registered public accounting firm in future years. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company's and the stockholders' best interests.

How are broker non-votes and abstentions counted?

The presence of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting, either in person or by proxy, will constitute a quorum. Shares of common stock represented by proxies at the meeting, including broker non-votes and those that are marked

3

"ABSTAIN" will be counted as shares present for purposes of establishing a quorum. Brokers or nominees holding shares for a beneficial owner may only vote on routine matters on behalf of a beneficial owner that does not provide voting instructions for their shares. A broker non-vote occurs when a broker or nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and, therefore, does not vote on a non-routine matter. Because broker non-votes are not voted affirmatively or negatively, they will have no effect on the approval of any of the proposals, except where brokers may exercise their discretion on routine matters. Abstention and broker non-votes shall not be counted as votes cast with respect to a director nominee's election in Proposal 1. As to Proposals 2 and 3, shares represented by proxies that are marked "ABSTAIN" will have the effect of a vote against the proposal, while a broker non-vote will not have an effect on the outcome of any proposal other than Proposal 3. Only the ratification of the selection of Deloitte as our independent registered public accounting firm in Proposal 3 is considered a routine matter. Your broker will therefore not have discretion to vote on the "non-routine" matters set forth in Proposals 1 and 2 absent direction from you. It is, therefore, important that you vote your shares.

What happens if a director nominee does not get a majority vote?

Following certification of the stockholder vote in an uncontested election, any incumbent director who did not receive a majority of the votes cast for his or her election shall promptly tender his or her resignation, contingent upon acceptance of such resignation by the board, to the Chairman of the board. The Chairman of the board shall inform the Nominating and Corporate Governance Committee of such tender of resignation, and the Nominating and Corporate Governance Committee shall consider such resignation and recommend to the board of directors whether to accept the tendered resignation or reject it or whether any other action should be taken. In deciding upon its recommendation, the Nominating and Corporate Governance Committee shall consider all relevant factors, including without limitation the qualifications of the director who has tendered his or her resignation and the director's contribution to the Company and the board. The board will act on the recommendation of the Nominating and Corporate Governance Committee no later than 90 days after the certification of the stockholder vote and disclose the decision by filing a Form 8-K with the SEC. The board shall consider the factors considered by the Nominating and Corporate Governance Committee and such additional information and factors that the board deems relevant.

Can I vote in person at the Annual Meeting?

For beneficial stockholders with shares registered in the name of a brokerage firm or bank or other similar organization, you will need to obtain a legal proxy from the broker, bank, trustee or other nominee that holds your shares before you can vote your shares in person at the Annual Meeting. For stockholders of record with shares registered directly in their names with Computershare, you may vote your shares in person at the Annual Meeting.

What do I need to do to attend the Annual Meeting in person?

Space for the Annual Meeting is limited and admission will be granted on a first-come, first-served basis. Stockholders should be prepared to present (1) valid government photo identification, such as a driver's license or passport; and (2) beneficial stockholders holding their shares through a broker, bank, trustee or other nominee will need to bring proof of beneficial ownership as of April 9, 2020, the record date, such as their most recent account statement reflecting their stock ownership prior to April 9, 2020, a copy of the voting instruction card provided by their broker, bank, trustee or other nominee or similar evidence of ownership.

4

Can I vote by telephone or Internet?

Stockholders of record with shares registered directly in their names with Computershare will be able to vote using the telephone and Internet. For beneficial stockholders with shares registered in the name of a broker, bank, trustee or other nominee, a number of brokerage firms and banks are participating in a program that offers telephone and Internet voting options. Stockholders should refer to the voting instruction card provided by their broker, bank, trustee or other nominee for instructions on the voting methods they offer. If your shares are held in an account at a broker, bank, trustee or other nominee participating in this program or registered directly in your name with Computershare, you may vote those shares by calling the telephone number specified on your proxy or accessing the Internet website address specified on your proxy instead of completing and signing the proxy itself. The giving of such a telephonic or Internet proxy will not affect your right to vote in person should you decide to attend the Annual Meeting. The telephone and Internet voting procedures are designed to authenticate stockholders' identities, to allow stockholders to give their voting instructions and to confirm that stockholders' instructions have been recorded properly. If you vote by telephone or by the Internet, you do not need to send in a proxy card or voting instruction form. The deadline for telephone and Internet voting will be 11:59 p.m., Eastern Time, on May 25, 2020.

How will my proxy be voted?

The proxy accompanying this proxy statement is solicited on behalf of our board of directors for use at the Annual Meeting. Stockholders who received a proxy by mail and choose to vote by mail are requested to complete, date and sign the accompanying proxy and promptly return it in the envelope provided. All signed, returned proxies that are not revoked will be voted in accordance with the instructions contained therein.

Proxies will be voted as specified by the stockholders. Unless contrary instructions are specified by the stockholder on the proxy card, if the accompanying proxy card is executed and returned (and not revoked) before the Annual Meeting, the shares of the common stock of the Company represented thereby will be voted "FOR" election of the nominees listed in this Proxy Statement as directors of the Company, "FOR" the proposal regarding advisory vote approving executive compensation and "FOR" the ratification of Deloitte as the Company's independent registered public accounting firm for the year ending December 31, 2020. A stockholder's submission of a signed proxy will not affect his or her right to attend and to vote in person at the Annual Meeting.

How do I change or revoke my proxy?

Any person signing a proxy in the form accompanying this proxy statement has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote pursuant to the proxy. A proxy may be revoked by a writing delivered to us stating that the proxy is revoked, by a subsequent proxy that is signed by the person who signed the earlier proxy and is delivered before or at the Annual Meeting, by voting again on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted) or by attendance at the Annual Meeting and voting in person. Please note, however, that if a stockholder's shares are held of record by a broker, bank, trustee or other nominee and that stockholder wishes to vote in person at the Annual Meeting, the stockholder must bring a legal proxy to the Annual Meeting.

5

Who will count and certify the votes?

Representatives of Broadridge Investor Communication Solutions, Inc. ("Broadridge") and the staff of our corporate secretary and investor relations offices will count the votes and certify the election results. The results will be publicly filed with the SEC on a Form 8-K within four business days after the Annual Meeting.

How can I make a proposal or make a nomination for director for next year's annual meeting?

You may present proposals for action at a future meeting or submit nominations for election of directors only if you comply with the requirements of the proxy rules established by the SEC and our amended and restated by-laws, as applicable. In order for a stockholder proposal or nomination for director to be considered for inclusion in our proxy statement and form of proxy relating to our annual meeting of stockholders to be held in 2021, the proposal or nomination must be received by us at our principal executive offices no later than December 21, 2020. Stockholders wishing to bring a proposal or nominate a director at the annual meeting to be held in 2021 (but not include it in our proxy materials) must provide written notice of such proposal to our Secretary at our principal executive offices between January 26, 2021 and February 25, 2021 and comply with the other provisions of our amended and restated by-laws.

Who pays for the cost of proxy preparation and solicitation?

The accompanying proxy is solicited by our board of directors. We have also retained the firm of Georgeson to aid in the solicitation of brokers, banks, institutional and other stockholders for a fee of approximately $10,000, plus reimbursement of expenses. Broadridge will also assist us in the distribution of proxy materials and provide voting and tabulation services for the Annual Meeting. All costs of the solicitation of proxies will be borne by us. We pay for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks, trusts or nominees for forwarding proxy materials to street name holders. We are soliciting proxies primarily by mail. In addition, our directors, officers and employees may solicit proxies by telephone or other means of communication personally. Our directors, officers and employees will receive no additional compensation for these services other than their regular compensation.

6

THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board Structure and Director Independence

Our board of directors is currently composed of seven directors. Our amended and restated certificate of incorporation provides for a classified board of directors, with members of each class serving staggered three-year terms. We currently have two directors in Classes I and II each and three directors in Class III. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The terms of directors in Classes I, II and III end at the annual meetings in 2020, 2021 and 2022, as indicated below.

Director | Class | |

|---|---|---|

| John B. Corness | Class I—Expiring 2021 Annual Meeting | |

| Stephen J. Sedita | Class I—Expiring 2021 Annual Meeting | |

| Laurie Ann Goldman | Class II—Expiring 2022 Annual Meeting | |

| Steven B. Hochhauser | Class II—Expiring 2022 Annual Meeting | |

| Deborah H. Caplan | Class III—Expiring 2020 Annual Meeting | |

| Naren K. Gursahaney* | Class III—Expiring 2020 Annual Meeting | |

| Mark E. Tomkins** | Class III—Expiring 2020 Annual Meeting |

* Chairman of the Board

** Lead Independent Director

At each annual meeting of stockholders, the successors of the directors whose term expires at that meeting are elected to hold office for a term expiring at the annual meeting of stockholders held in the third year following the year of their election. The board of directors is therefore asking you to elect the three nominees for director whose term expires at the Annual Meeting. Deborah H. Caplan, Naren K. Gursahaney and Mark E. Tomkins, our Class III directors, have been nominated for reelection at the Annual Meeting. See "Proposal 1—Election of Directors" below.

The number of members on our board of directors may be fixed by resolution adopted from time to time by the board of directors. Any vacancies or newly created directorships may be filled only by the affirmative vote of a majority of directors then in office, even if less than a quorum, or by a sole remaining director. Each director shall hold office until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation or removal. During 2019, Ms. Caplan was added as a new member of the board of directors. Effective as of January 21, 2020, Nikhil M. Varty resigned from his position as Chief Executive Officer and as a member of the board of directors.

Set forth below is biographical information as well as background information relating to each nominee's and continuing director's business experience, qualifications, attributes and skills and why the board of directors and Nominating and Corporate Governance Committee believe each individual is a valuable member of the board of directors. The persons who have been nominated for election and are to be voted upon at the Annual Meeting are listed first, with continuing directors following thereafter. The respective age of each individual below is as of April 20, 2020.

7

Nominees for Election to the Board of Directors in 2020

Class III—Directors Whose Term Expires in 2020

Name | Age | Principal Occupation and Other Information | |||

|---|---|---|---|---|---|

Deborah H. Caplan | 57 | Ms. Caplan has served as one of our directors since July 2019. Since April 2013, Ms. Caplan has served as executive vice president, human resources and corporate services for NextEra Energy, Inc. NextEra Energy is a leading clean energy company headquartered in Florida. Ms. Caplan previously served as NextEra Energy's vice president of integrated supply chain and vice president and chief operating officer of the subsidiary, Florida Power & Light Company. Prior to joining NextEra Energy, she worked for General Electric Company as the senior vice president of global operations for Vendor Financial Services. Ms. Caplan's extensive business experience, her leadership skills of building cultures founded on strong values and her corporate strategy skills qualify her to serve on our board of directors. | |||

Naren K. Gursahaney | 58 | Mr. Gursahaney has served our interim Chief Executive Officer since January 2020. He has served as one of our directors since December 2017 and as our Chairman of the Board since April 2019. He has been a private investor since 2016. From 2012 until 2016, he served as president and chief executive officer, and a member of the board of directors, of The ADT Corporation, a leading provider of security and automation solutions for homes and businesses in the United States and Canada. From 2003 until 2012, he served in various executive positions at Tyco International Ltd. He currently serves on the board of directors of NextEra Energy, Inc. Mr. Gursahaney's extensive experience in operations, strategic planning and with large, global residential and commercial services companies, along with his board experience, qualify him to serve on our board of directors. | |||

Mark E. Tomkins | 64 | Mr. Tomkins has served as one of our directors since June 2015 and has served as our lead independent director since January 2020. He previously served as our non-executive Chairman from May 2016 until April 2019. He has been a private investor since 2006. He currently serves on the boards of W. R. Grace & Co., a specialty chemical and specialty materials manufacturing and production company, and Trinseo S.A., a manufacturer of plastics, latex binders and synthetic rubber. From 2016 to 2019, he served on the board of Klockner Pentaplast Group, a privately held plastic film and packaging manufacturer and from 2007 until 2014, he served on the board of Elevance Renewable Sciences Inc., a privately held renewable polymer and energy company, and from 2007 to 2012, he served on the board of CVR Energy, Inc., a petroleum refining and nitrogen fertilizer manufacturing company. From 2005 until 2006, Mr. Tomkins served as senior vice president and chief financial officer of Innovene, a petrochemical and oil refining company controlled by BP p.l.c. that is now part of the INEOS Group. Prior to Innovene, he served as chief financial officer of Vulcan Materials Company and Great Lakes Chemical (now Lanxess), and was vice president of finance and business development for the polymer and electronic materials divisions of Allied Signal (now Honeywell) and held several finance positions with Monsanto. Mr. Tomkins is a certified public accountant. Mr. Tomkins' financial, accounting and management expertise, along with his experience on other public and private company boards, qualify him to serve on our board of directors. | |||

8

Continuing Members of the Board of Directors

Class I—Nominees Whose Term Expires in 2021

Name | Age | Principal Occupation and Other Information | |||

|---|---|---|---|---|---|

John B. Corness | 65 | Mr. Corness has served as one of our directors since July 2016. He has been a private investor and advisor since 2013. From 1999 until 2013, Mr. Corness was employed by Polaris Industries, Inc., a leading manufacturer of recreational and utility vehicles, where he held various positions including vice president of human resources. Previously, he served in various human resources positions at General Electric, Maple Leaf Foods Canada and TransAlta Resources. From 2013 until 2018 he owned Corness Associates, a consulting firm focused on succession planning, leadership development and HR strategy. His strength in identifying and creating strong leadership teams, and his knowledge of executive succession planning and compensation practices and plans for public company executive officers, qualify him to serve on our board of directors. | |||

Stephen J. Sedita | 68 | Mr. Sedita has served as one of our directors since December 2013. From 2008 until he retired in 2011, Mr. Sedita served as the chief financial officer and vice president of GE Home & Business Solutions, a business of General Electric Company. From 2007 until 2008, Mr. Sedita served as chief financial officer and vice president of GE Aviation. From 2005 until 2007, Mr. Sedita was vice president and chief financial officer of GE Industrial Sector, a portfolio of electrical product, systems and plastics businesses. Prior to GE Industrial Sector, he served as chief financial officer of GE Consumer & Industrial, GE Appliances and GE Plastics. From 1995 until 2016, he served on the board of Controladora Mabe, S.A. de C.V., and also served on the boards of Camco Inc. and Momentive Performance Materials Holdings Inc. Mr. Sedita's extensive business and financial background and his prior board service experience qualify him to serve on our board of directors. | |||

9

Continuing Members of the Board of Directors

Class II—Nominees Whose Term Expires in 2022

Name | Age | Principal Occupation and Other Information | |||

|---|---|---|---|---|---|

Laurie Ann Goldman | 57 | Ms. Goldman has served as one of our directors since December 2015. She was named chief executive officer of New Avon LLC, in January 2019 and served as such until August 2019. New Avon, LLC is a privately held company and is the leading social selling beauty company in North America, with independent sales representatives throughout the United States, Puerto Rico and Canada. Ms. Goldman is the founder and chief executive officer of LA Ventures, an investment and advisory firm for growth-oriented, consumer-facing businesses. From 2014 until 2019, she was a private investor and advisor. She serves on the boards of directors of Guess? Inc., a contemporary apparel and related consumer products retailer, and Joe & The Juice Holding A/S, a private company with a chain of juice bars and coffee shops in North America, Europe, Asia and Australia. Ms. Goldman previously served on the boards of directors of New Avon, LLC and Francesca's Holdings Corporation, a women's clothing retailer. From 2002 until 2014, Ms. Goldman served as chief executive officer of Spanx, Inc., a women's undergarment and apparel company. Ms. Goldman brings significant brand management and multi-channel product and marketing experience, and her prior executive management expertise, along with her experience on public and private company boards, qualify her to serve on our board of directors. | |||

Steven B. Hochhauser | 58 | Mr. Hochhauser has served as one of our directors since May 2018. Mr. Hochhauser, served as interim president of our American Home Shield business prior to its spin-off from March until May 2018. He has been a private investor since 2011. Since May 2019, he has served as chairman of A&R Logistics, a privately held company, and since 2016, he has served as chairman of Ascensus Specialties LLC, a privately held specialty chemicals company, and served as chief executive officer of Ascensus Specialties from 2016 until 2017. From 2012 until 2016 he was the lead director of Novolex, a privately held paper and plastic packaging company, and from 2013 until 2015, he was on the board of Argotec LLC, a privately held specialty plastic and films company. He is the former chairman and chief executive officer of Johns Manville. Mr. Hochhauser has held various executive positions at Ingersoll Rand, Honeywell and United Technologies. Mr. Hochhauser's knowledge of strategic planning and business operations, along with his leadership experience and prior board experience, qualify him to serve on our board of directors. | |||

Director Independence

Our board of directors has determined, after considering all of the relevant facts and circumstances, that Mses. Caplan and Goldman and Messrs. Corness, Hochhauser, Tomkins and Sedita are "independent" as defined under New York Stock Exchange ("NYSE") listing standards. In making its determination of director independence, our board of directors considers the NYSE listing standards and all relevant facts and circumstances, including ensuring that the following categories of relationships between a director and our Company are evaluated:

10

member of a 10 percent or greater equity interest in, another company or organization that made payments to, or received payments from, our Company or any of our subsidiaries for property or services in an amount which, in each of the last three fiscal years, did not exceed the greater of $1 million or two percent of such other company's consolidated gross revenues; and

No director qualifies as "independent" unless the board of directors affirmatively determines that the director has no material relationship with our Company or our subsidiaries (either directly or as a partner, stockholder or officer of an organization that has a relationship with our Company or any of our subsidiaries). Our board of directors assesses on a regular basis, and at least annually, the independence of directors and, based on the recommendation of the Nominating and Corporate Governance Committee, makes a determination as to which members are independent. To assist the board of directors in making its independence assessment, each year members of our board of directors complete responses to a questionnaire, which requires disclosure of each director's and his or her immediate family's relationships to the Company, as well as any potential conflicts of interest and other matters. In 2019, there were no related-party or conflicts of interest transactions between the Company and any of our independent directors that require disclosure under SEC rules.

On January 21, 2020, Naren K. Gursahaney, our Chairman of the Board, was appointed as the Company's interim CEO. Prior to his appointment, Mr. Gursahaney was deemed to be an independent director of the board. While he serves as interim CEO, he cannot be deemed an independent director; however, it is anticipated that once a permanent CEO is named, Mr. Gursahaney will be in a position to be re-evaluated and re-designated by the board of directors as an independent director pursuant to NYSE regulations.

Board Leadership Structure

Our board of directors is currently led by our Chairman, Mr. Gursahaney. As stated in our Corporate Governance Guidelines, the board has no policy with respect to the separation of the offices of Chairman of the Board and CEO. The board believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman and CEO in any way that is in the best interests of the company at a given point in time. The board believes this governance structure currently promotes a balance between the board's independent authority to oversee our business and the CEO and his management team who manage the business on a day-to-day basis. The board expects to periodically review its leadership structure to ensure that it continues to meet our needs.

In connection with Mr. Gursahaney's appointment as interim CEO, the board of directors amended the board's corporate governance guidelines to provide that if the Chairman of the Board is not an independent director, a lead independent director will be elected by and from among the independent directors of the board. The lead independent director is responsible for serving as liaison between the Chairman of the Board and the independent directors and will have authority to call meetings of the independent directors, and if requested by stockholders, ensure that he or she is available for consultation and direct communication with the stockholders. On January 21, 2020, the board of directors appointed Mr. Tomkins to serve as lead independent director.

Meetings of the Board of Directors and Attendance at the Annual Meeting

Our board of directors held 12 meetings during the fiscal year ended December 31, 2019. Each of our incumbent directors attended at least 75 percent of the total number of meetings of the board and

11

any committees of which he or she was a member in 2019. Directors are encouraged to attend our annual meetings. All of the directors serving on the board at the time attended the 2019 Annual Meeting.

Executive Sessions

Executive sessions, which are meetings of the independent directors, are regularly scheduled throughout the year. While serving as non-executive Chairman, Mr. Gursahaney, presided over the executive sessions. With Mr. Gursahaney's appointment as interim CEO, Mr. Tomkins, as lead independent director, will preside over the executive sessions of the independent directors. The committees of the board, as described more fully below, also meet regularly in executive session.

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines to address significant corporate governance issues. A copy of these guidelines is available without charge on our website atwww.servicemaster.com/company/about/corporate-governance. These guidelines provide a framework for our corporate governance initiatives and cover topics including, but not limited to, director qualification and responsibilities, board composition, director compensation and management and succession planning. The Nominating and Corporate Governance Committee is responsible for overseeing and reviewing the guidelines and reporting and recommending to our board of directors any changes to the guidelines.

Code of Conduct and Financial Code of Ethics

We have a Financial Code of Ethics that applies to the CEO, CFO and Controller, or persons performing similar functions, and other designated officers and employees, including the primary financial officer of each of our business units and the Treasurer. We also have a Code of Conduct that applies to all of our directors, officers and employees. The Financial Code of Ethics and Code of Conduct each address matters such as conflicts of interest, confidentiality, fair dealing and compliance with laws and regulations. The Financial Code of Ethics and the Code of Conduct is available without charge on our website atwww.servicemaster.com/company/about/corporate-governance.

We will promptly disclose any substantive changes in or waiver of, together with reasons for any waiver of, either of these codes granted to our executive officers, including our principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions, and our directors, by posting such information on our website atwww.servicemaster.com/company/about/corporate-governance.

Complaints Regarding Accounting, Internal Accounting Controls and Auditing Matters

In accordance with the Sarbanes-Oxley Act, our Audit Committee has adopted procedures for the receipt, retention and treatment of complaints regarding accounting controls or auditing matters and to allow for the confidential, anonymous submission by employees and others of concerns regarding questionable accounting or auditing matters.

Environmental, Social, Safety and Employee Matters

Three of our core commitments in our business are We Serve, We Care and We Deliver. Every day, our employees, service partners and franchise associates serve our customers, providing cleaner, healthier and safer environments wherever they are—at home, at work or at play. Our customers have come to trust us during some of the most important moments of their lives, whether protecting them from the effects of pests, helping them recover from the trauma of unexpected disasters or keeping their homes clean and businesses orderly, so they can live hassle-free lives. Our frontline serves our customers with passion because they care deeply about the work they do and the relationships they have built.

12

We Serve: We aspire to deliver an unparalleled customer experience, whether protecting our customers' health from the effects of harmful pests, returning them to a safe place to live or work by carefully restoring their lives or ensuring they breathe freely in an environment which we have kept meticulously clean. We believe through service and care, we have the power to impact and improve lives and drive growth in our businesses. This core belief is at the heart of how we are shaping our future, working with employees and franchise associates, and re-imagining our customer journeys to deliver memorable experiences to our customers at every touch point.

We Care: Listening to our employees in the field and instilling their learnings in our processes and systems allows us to remove obstacles from their paths, enabling them to deliver an unmatched customer experience. Enhancing benefits, optimizing work hours, improving pay-for-performance structures and creating career paths tailored to deserving employees' aspirations demonstrates our deep care for them in their quest to deliver outstanding service. We are creating a workplace that respects creativity, initiative, diversity of thought and cultural inclusion by recognizing talent and perseverance at every level. We have increased our community outreach because service and care are at the heart of our business.

We Deliver: Credibility is extremely important. We have significantly improved our ability to deliver on our commitments to our customers, employees, partners, stockholders and other stakeholders.

We have a Corporate Sustainability Report that discusses the values, goals and objectives we strive for each day and the impact we are making as we live the commitments ofWe Serve, We Care and We Deliver. The Corporate Sustainability Report is available without charge on our website atwww.servicemaster.com/company/about/corporate-governance.

Board Committees

Our board of directors maintains an Audit Committee, a Compensation Committee, an Environmental, Health and Safety Committee and a Nominating and Corporate Governance Committee. During 2019, each of these committees was comprised entirely of independent directors. Below is a brief description of our committees. The following table shows the committee members as of December 31, 2019, and the number of meetings held during 2019.

Director | Audit | Compensation | Nominating & Corporate Governance | Environmental, Health & Safety | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Deborah H. Caplan | X | X | X | X | |||||||||

John B. Corness | X | X* | X | X | |||||||||

Laurie Ann Goldman | X | X | X | X | |||||||||

Naren K. Gursahaney | X | X | X* | X | |||||||||

Steven B. Hochhauser | X | X | X | X | |||||||||

Stephen J. Sedita | X | X | X | X* | |||||||||

Mark E. Tomkins | X* | X | X | X | |||||||||

Number of Meetings in 2019 | 9 | 6 | 4 | 4 | |||||||||

X = Committee Member as of December 31, 2019; * = Chair

13

On January 21, 2020, in connection with Mr. Gursahaney's appointment as interim CEO, the board of directors reconstituted the membership of each of the committees as set forth below.

Director | Audit | Compensation | Nominating & Corporate Governance | Environmental, Health & Safety | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Deborah H. Caplan | X | X | |||||||||||

John B. Corness | X* | ||||||||||||

Laurie Ann Goldman | X | X* | |||||||||||

Naren K. Gursahaney | X | ||||||||||||

Steven B. Hochhauser | X | X | |||||||||||

Stephen J. Sedita | X | X* | |||||||||||

Mark E. Tomkins | X* | X | |||||||||||

X = Committee Member as of January 21, 2020; * = Chair

Audit Committee

Our Audit Committee is responsible, among its other duties and responsibilities, for overseeing our accounting and financial reporting processes, the audits of our financial statements, the qualifications and independence of our independent registered public accounting firm, the effectiveness of our internal control over financial reporting and the performance of our internal audit function and independent registered public accounting firm. Our Audit Committee reviews and assesses the qualitative aspects of our financial reporting, our processes to manage business and financial risks, and our compliance with significant applicable legal, ethical and regulatory requirements. Our Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The charter of our Audit Committee is available without charge on our website atwww.servicemaster.com/company/about/corporate-governance.

The current members of our Audit Committee are Messrs. Tomkins (Chair) and Sedita and Ms. Caplan. Our board of directors has designated each of Messrs. Tomkins and Sedita as "audit committee financial experts," and each member of the Audit Committee has been determined to be "financially literate" under the NYSE rules. Our board of directors has also determined that each member of the Audit Committee is "independent" as defined under NYSE and Exchange Act rules and regulations.

Compensation Committee

Our Compensation Committee is responsible, among its other duties and responsibilities, for reviewing and approving all forms of compensation to be provided to, and employment agreements with, the executive officers of our Company and its subsidiaries (including the CEO), establishing the general compensation policies of our company and its subsidiaries and reviewing, approving and overseeing the administration of the employee benefits plans of our company and its subsidiaries. Our Compensation Committee also periodically reviews management development and succession plans. The charter of our Compensation Committee is available without charge on our website atwww.servicemaster.com/company/about/corporate-governance.

The current members of our Compensation Committee are Messrs. Corness (Chair) and Hochhauser and Ms. Goldman. Our board of directors determined that each member of the Compensation Committee is "independent" as defined under NYSE listing standards. The Compensation Committee has the authority to retain compensation consultants, outside counsel and other advisers. During the first part of 2019, the committee engaged Semler Brossy Consulting Group, LLC ("Semler Brossy") to advise it on executive compensation program-design matters and to

14

prepare market studies of the competitiveness of components of the company's compensation program for its senior executive officers, including the named executive officers and non-employee directors. The Compensation Committee performed an assessment of Semler Brossy's independence to determine whether the consultant is independent, taking into account Semler Brossy's executive compensation consulting protocols to ensure consultant independence and other relevant factors. Based on that assessment, the Compensation Committee determined that the firm's work has not raised any conflict of interest and the firm is independent. During the second half of 2019, the Compensation Committee as part of good governance decided to rotate Compensation Committee consultants and opened a search for a new consulting firm. In November 2019, the Compensation Committee selected Pearl Meyer & Partners, LLC ("Pearl Meyer") as its new advisor on executive compensation matters. The Compensation Committee also performed an assessment of Pearl Meyer's and determined that the firm was independent.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible, among its other duties and responsibilities, for identifying and recommending candidates to the board of directors for election to our board of directors, reviewing the composition of the board of directors and its committees, developing and recommending to the board of directors corporate governance guidelines that are applicable to us and overseeing board of directors evaluations. In 2019, the board of directors elected to give responsibility for review and approval of director compensation to the Nominating and Corporate Governance Committee. The charter of our Nominating and Corporate Governance Committee is available without charge on our website atwww.servicemaster.com/company/about/corporate-governance.

The current members of our Nominating and Corporate Governance Committee are Ms. Goldman (Chair) and Messrs. Hochhauser and Tomkins. Our board of directors determined that each member of the Nominating and Corporate Governance Committee is "independent" as defined under NYSE listing standards.

Environmental, Health and Safety Committee

Our Environmental, Health and Safety Committee is responsible, among its other duties and responsibilities, for reviewing the status of the Company's policies and practices concerning environmental, health and safety matters, including processes to manage environmental, health and safety risk and ensure compliance with applicable laws and regulations; reviewing and monitoring the Company's environmental, health and safety risk assessments, performance, strategies, training and resources; and providing input to the Company on the management of current and emerging environmental, health and safety regulations and issues. The charter of our Environmental, Health and Safety Committee is available without charge on our website atwww.servicemaster.com/company/about/corporate-governance.

The current members of our Environmental, Health and Safety Committee are Messrs. Sedita (Chair) and Gursahaney and Ms. Caplan. Our board of directors determined that Mr. Sedita and Ms. Caplan are "independent" as defined under NYSE listing standards. While serving as interim CEO. Mr. Gursahaney is not an independent director; however, NYSE regulations do no prohibit Mr. Gursahaney from serving as a member of the Environmental, Health and Safety Committee.

Compensation Committee Interlocks and Insider Participation

Messrs. Corness, Gursahaney, Hochhauser, Sedita and Tomkins and Mses. Caplan and Goldman served on the Compensation Committee in 2019. During 2019, no member of the Compensation Committee was at any time an officer or employee of ServiceMaster or any of our subsidiaries nor was

15

any such person a former officer of ServiceMaster or any one of our subsidiaries. For 2019, there were no related-party or conflicts of interest transactions between the Company and any of our Compensation Committee members that require disclosure under SEC rules.

Selection of Nominees for Election to the Board

Our Corporate Governance Guidelines provide that the Nominating and Corporate Governance Committee will identify and select, or recommend that the board select, board candidates who the Nominating and Corporate Governance Committee believes are qualified and suitable to become members of the board consistent with the criteria for selection of new directors adopted from time to time by the board. The Nominating and Corporate Governance Committee considers the board's current composition, including expertise, diversity and balance of inside, outside and independent directors, and considers the general qualifications of the potential nominees, such as: integrity and honesty; the ability to exercise sound, mature and independent business judgment in the best interests of the stockholders as a whole; a background and experience with healthcare, operations, finance or marketing or other fields which will complement the talents of the other board members; factors that promote diversity of views and experience such as gender, race, national origin, age and sexual orientation; willingness and capability to take the time to actively participate in board and committee meetings and related activities; ability to work professionally and effectively with other board members and the Company's management; availability to remain on the board long enough to make an effective contribution; satisfaction of applicable independence standards; and absence of material relationships with competitors or other third parties that could present realistic possibilities of conflict of interest or legal issues.

In identifying candidates for election to the board of directors, the Nominating and Corporate Governance Committee considers nominees recommended by directors, stockholders and other sources. The Nominating and Corporate Governance Committee reviews each candidate's qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the board of directors. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate. Upon selection of a qualified candidate, the Nominating and Corporate Governance Committee would recommend the candidate for consideration by the full board of directors. The Nominating and Corporate Governance Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

The Nominating and Corporate Governance Committee will consider director candidates proposed by stockholders on the same basis as recommendations from other sources. Any stockholder who wishes to recommend a prospective candidate for the board of directors for consideration by the Nominating and Corporate Governance Committee may do so by submitting the name and qualifications of the prospective candidate in writing to the following address: ServiceMaster Global Holdings, Inc., c/o Secretary, 150 Peabody Place, Memphis, TN 38103. Any such submission should also describe the experience, qualifications, attributes and skills that make the prospective candidate a suitable nominee for the board of directors. Our amended and restated by-laws set forth the requirements for direct nomination by a stockholder of persons for election to the board of directors.

Stockholder Engagement

We expect all of our directors to attend our annual meetings of stockholders and be available to answer questions from stockholders at the meetings. Between meetings, we expect our interim CEO and our Senior Vice President and Chief Financial Officer, to engage with stockholders on a regular basis at industry and financial conferences, road shows and one-on-one meetings. Mr. Tomkins, our lead independent director, is also available to meet with stockholders on matters that they believe are better addressed by an independent director.

16

Communications with the Board

Any stockholder or interested party who wishes to communicate with our board of directors as a whole, the independent directors, our Chairman, our lead independent director or any individual member of the board or any committee of the board may write to or email the Company at: ServiceMaster Global Holdings, Inc., c/o Assistant Secretary, 150 Peabody Place, Memphis, TN 38103 or Board_of_Directors@servicemaster.com.

The board has designated the Company's Assistant Secretary as its agent to receive and review written communications addressed to the board, any of its committees, or any board member or group of members. The Assistant Secretary may communicate with the sender for any clarification. In addition, the Assistant Secretary will promptly forward to the chair of the Audit Committee and the Company's General Counsel any communication alleging legal, ethical or compliance issues by management or any other matter deemed by the Assistant Secretary to be potentially material to the Company. As an initial matter, the Assistant Secretary will determine whether the communication is a proper communication for the board. The Assistant Secretary will not forward to the board, any committee or any director communications of a personal nature or not related to the duties and responsibilities of the board, including, without limitation, junk mail and mass mailings, business solicitations, routine customer service complaints, new product or service suggestions, opinion survey polls or any other communications deemed by the Assistant Secretary to be immaterial to the Company.

Separately, the Audit Committee has established a whistleblower policy for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

Risk Oversight

Our board of directors as a whole has responsibility for overseeing our risk management. The board of directors exercises this oversight responsibility directly and through its committees. The oversight responsibility of the board of directors and its committees is informed by reports from our management team and from our internal audit department that are designed to provide visibility to the board of directors about the identification and assessment of key risks and our risk mitigation strategies. The full board of directors has primary responsibility for evaluating strategic and operational risk management and succession planning. Our Audit Committee has the responsibility for overseeing our major financial and accounting risk exposures and the steps our management has taken to monitor and control these exposures, including policies and procedures for assessing and managing risk, including oversight on compliance related to legal and regulatory exposure, and meets regularly with our chief legal and compliance officers. Our Compensation Committee evaluates risks arising from our compensation policies and practices, as more fully described below. The Audit Committee and Compensation Committee provide reports to the full board of directors regarding these and other matters.

Director Compensation

2019 Cash and Equity Retainers

Members of the board of directors who are not employed by us are entitled to receive an annual retainer of $200,000, of which $80,000 is payable in cash and the other $120,000 payable in stock. Effective as of March 22, 2018, the equity awards will consist of a grant of shares of common stock on the date of the Annual Meeting, or the date of the director's appointment to the board of directors if thereafter. Each director may elect to defer the receipt of the shares of common stock as Deferred Stock Equivalents ("DSEs") to a point in the future, including the time at which the individual is no

17

longer a member of the board, subject to the terms of the Amended and Restated ServiceMaster Global Holdings, Inc. 2014 Omnibus Incentive Plan (the "Omnibus Incentive Plan"). In addition to the amounts described above, the non-executive Chairman will receive an additional annual cash retainer of $50,000 and an extra $100,000 award of stock. The chairpersons of the Audit Committee and the Compensation Committee will each receive an additional annual cash retainer of $20,000, and the chairpersons of the Nominating and Corporate Governance Committee and the Environmental, Health and Safety Committee will each receive an additional annual cash retainer of $10,000; however, if our Chairman serves as a chairperson of a committee, the Chairman will not be entitled to the additional cash retainer for the committee chair role. All of our directors were reimbursed for reasonable expenses incurred in connection with attending board of directors meetings and committee meetings.

As part of its annual review of director compensation, the Nominating and Corporate Governance Committee asked our independent compensation consultant to review our pay practices relative to peers. We found that pay levels for our directors and non-executive Chairman are in-line with peer medians and we continue to believe that our compensation structure properly rewards our non-employee directors.

2019 Director Compensation Table

This table shows the compensation that each non-employee director received for his or her board and committee chair service in 2019. Amounts reflect partial year board service for Ms. Caplan.

Name of Director | Fees Earned or Paid in Cash(1) | Stock Awards(2) | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Deborah H. Caplan | $ | 34,565 | $ | 91,403 | $ | 125,968 | ||||

John B. Corness | $ | 100,000 | $ | 120,000 | $ | 220,000 | ||||

Naren K. Gursahaney | $ | 110,000 | $ | 220,000 | $ | 330,000 | ||||

Laurie Ann Goldman | $ | 80,000 | $ | 120,000 | $ | 200,000 | ||||

Steven B. Hochhauser | $ | 80,000 | $ | 120,000 | $ | 200,000 | ||||

Mark E. Tomkins | $ | 125,000 | $ | 120,000 | $ | 245,000 | ||||

Stephen J. Sedita | $ | 90,000 | $ | 120,000 | $ | 210,000 | ||||

18

2020 Director Compensation

While serving as interim CEO, Mr. Gursahaney will not receive any of the director compensation noted above. With Mr. Tomkins' appointment as lead independent director, he will receive an additional annual cash retainer of $50,000, but will not receive the additional fees for serving as chair of the Audit Committee.

Stock Ownership Guidelines for Directors

The board of directors has adopted stock ownership guidelines for members of the board of directors and for executive officers of the Company. The board believes that setting these ownership guidelines will enhance directors' and executive officers' alignment with other stockholders. The Nominating and Corporate Governance Committee reviews the director ownership levels and the Compensation Committee reviews the executive officer stock ownership levels on an annual basis. The guidelines for executive officers are discussed below in the Compensation Discussion and Analysis.

Members of the board of directors are expected to hold stock valued at five times the annual cash retainer. The annual cash retainer is $80,000, resulting in a current expectation to hold stock valued at $400,000. Directors will have a period of five years from February 2015 or their appointment to the board, whichever is later, to meet the ownership guidelines. Until a director meets his or her stock ownership guideline level, he or she cannot sell more than 50 percent of the shares such director owns. All directors subject to the stock ownership guidelines have either met, or are on track to meet, their stock ownership level within the five-year period.

Certain Securities Transactions

Short Selling

Our board of directors has adopted a policy that prohibits our directors, executive officers and all other employees from short sales and transactions in puts and calls of the Company's securities. Short sales of securities of the Company evidence an expectation on the part of the seller that such securities will decline in value and signal to the market an absence of confidence in the short-term prospects of the Company. Short sales may also reduce the seller's incentive to improve the performance of the Company.

Pledges and Hedges

In addition, the adopted policy prohibits any of our directors, executive officers and all other employees from engaging in pledging and hedging transactions in the Company's securities. Certain forms of hedging or monetization transactions (such as zero-cost collars and forward sale contracts) allow a person to lock in much of the value of his or her stock holdings, often in exchange for all or part of the potential appreciation in the stock. These transactions allow the person to continue to own the stock, but without the full risks and rewards of ownership. When that occurs, the person may no longer have the same objectives as the Company's other stockholders.

19

The following table sets forth information about our executive officers as of April 20, 2020.

Name | Age | Present Positions | First Became an Executive Officer | ||||||

|---|---|---|---|---|---|---|---|---|---|

Naren K. Gursahaney | 58 | Interim Chief Executive Officer & Chairman | 2020 | ||||||

Anthony D. DiLucente | 61 | Senior Vice President & Chief Financial Officer | 2017 | ||||||

Aster Angagaw | 56 | President, ServiceMaster Brands | 2019 | ||||||

Michael C. Bisignano | 48 | Senior Vice President, General Counsel & Secretary | 2018 | ||||||

David M. Dart | 50 | Senior Vice President, Human Resources | 2018 | ||||||

Pratip Dastidar | 57 | Senior Vice President & Chief Transformation Officer | 2018 | ||||||

Dion Persson | 59 | Senior Vice President, Business Development | 2018 | ||||||

Gregory L. Rutherford | 53 | President, Terminix Commercial | 2019 | ||||||

Kim Scott | 47 | President, Terminix Residential | 2019 | ||||||

Naren K. Gursahaney has served our interim Chief Executive Officer since January 2020. He has served as one of our directors since December 2017 and was appointed Chairman of the Board in April 2019. He has been a private investor since 2016. From 2012 until 2016, he served as president and chief executive officer, and a member of the board of directors, of The ADT Corporation, a leading provider of security and automation solutions for homes and businesses in the United States and Canada. From 2003 until 2012, he served in various executive positions at Tyco International Ltd. He currently serves on the board of directors of NextEra Energy, Inc. Mr. Gursahaney's extensive experience in operations, strategic planning and with large, global residential and commercial services companies, along with his board experience, qualify him to serve on our board of directors.

Anthony D. DiLucente has served as ServiceMaster's Senior Vice President and Chief Financial Officer since February 25, 2017. Mr. DiLucente joined ServiceMaster as Senior Vice President on January 17, 2017. From April 2011 until January 2017, he served as executive vice president and chief financial officer of HDT Global, a comprehensive provider of mobility solutions for military and government applications. He previously held financial leadership positions with Sun Capital Partners, Inc., Masonite Inc., Johns Manville and Honeywell International, Inc. Mr. DiLucente served as executive vice president and chief financial officer of Masonite Inc. when on March 16, 2009 Masonite Inc. filed a voluntary petition under Chapter 11 of the U.S. Bankruptcy Code and made a similar filing in Canada.

Aster Angagaw has served as President, ServiceMaster Brands since May 2019. From 2016 until 2019 she worked as chief executive officer of the North American Healthcare division of Sodexo S.A., a global integrated food and facilities management company. During her 18-year career with Sodexo, she also served as global head of sales and business development, and as group vice president of global transformation.

Michael C. Bisignano has served as Senior Vice President, General Counsel and Secretary since October 2018. From 2015 until 2018, Mr. Bisignano served as executive vice president, general counsel and secretary of CA Technologies, a leading global technology company. From 2010 until 2015, he served as senior vice president, general counsel and corporate secretary for Blackboard Inc., a multinational technology company. He previously held positions at Online Resources Corporation, Arbros Communications and with the law firm Milbank, Tweed, Hadley & McCoy.

20

David M. Dart has served as Senior Vice President, Human Resources since August 2018. From 2016 until 2018, he served as senior vice president and chief human resources officer of Veritas Technologies, a global enterprise software company. From 2014 until 2016 he served vice president of human resources for the specialty materials division of Celanese. Previously, he held positions at Ecolab, Bissell, ConAgra Foods and Amgen.

Pratip Dastidar has served as Senior Vice President and Chief Transformation Officer since December 2017. From 2015 until 2017, he led process innovation that helped operational scale-up at Salesforce.com. He previously held positions at HP, Amazon, Applied Materials, WABCO, United Technologies Carrier and Honeywell Aerospace.

Dion Persson has served as Senior Vice President, Business Development since September 2017. From 2011 until 2016 he served as vice president of strategy and analytics for Ingersoll Rand, a leading global provider of products, services and solutions. Mr. Persson has also held leadership roles at Johns Manville, a Berkshire Hathaway company, including senior vice president and general counsel, head of human resources and business leader for the company's global fiberglass business.

Gregory L. Rutherford has served as President, Terminix Commercial since May 2019. From 2006 until 2019, he served as division president, energy and environmental solutions at Republic Services, a leader in solid waste and recycling services. During his 13-year career at Republic Services, he held several leadership positions, including general manager, market vice president; area president and region vice president. Prior to Republic Services, he was at The Scooter Store, and served as a commercial airline pilot for United Airlines and Fighter Pilot in the U.S. Air Force.

Kim Scott has served as President, Terminix Residential since December 2019. From 2018 until 2019 she served as president of Rubicon Global Holdings LLC, a venture-backed technology company that provides waste, recycling and smart cities solutions to businesses and governments worldwide. Ms. Scott served on the board of directors of Rubicon Global from 2015 until 2018. Prior to Rubicon Global, from 2013 until 2017 she served as president of CHEP North America, a division of Brambles Limited, a supply chain logistics company. During her 11-year career with Brambles Limited, she held several leadership roles including, president CHEP USA; group vice president global acquisition integration; and vice president of operations. Ms. Scott began her career as an environmental engineer for the General Electric Company and U.S. Steel. She served on the board of directors of the U.S. Chamber of Commerce from 2013-2017.

21

Compensation Discussion and Analysis

This section describes the material elements of our 2019 executive compensation program and the principles underlying our executive compensation policies and decisions. In addition, in this section, we provide information regarding the compensation paid to each individual who served in the capacity as principal executive officer (CEO) or principal financial officer (CFO) during 2019 and the three most highly compensated executive officers (other than the CEO and CFO) who were serving as such as of the end of our most recent fiscal year, collectively referred to as our Named Executive Officers ("NEOs"). We have also included compensation data for two former executive officers, who, by virtue of their compensation, would have been designated as an NEO. For fiscal 2019, our NEOs are as follows:

2019 and Recent Highlights

Company Structure

Business Performance

22

year ended December 31, 2019 ("2019 Form 10-K"). Please see the narrative in the "Annual Incentive Plan" section below for more detailed information on this subject.

Metric | 2019 Target Performance | 2019 Actual Achievement | |||||

|---|---|---|---|---|---|---|---|

Revenue | $ | 2,105 million | $ | 2,077 million | |||

Adjusted EBITDA | $ | 443 million | $ | 417 million | |||

Management Structure

Compensation Decisions

In 2019, the Compensation Committee made the following compensation decisions:

23

Objectives of Our Compensation Program

Our compensation plans for executive officers (including the NEOs) are designed to:

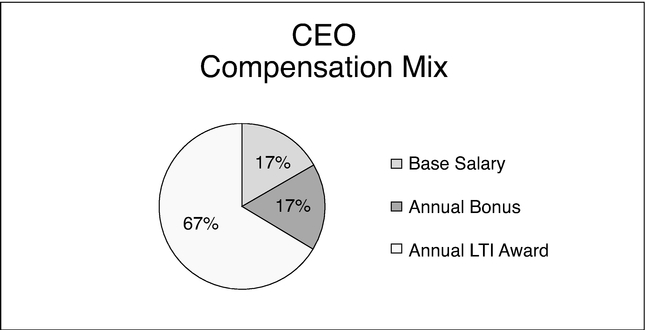

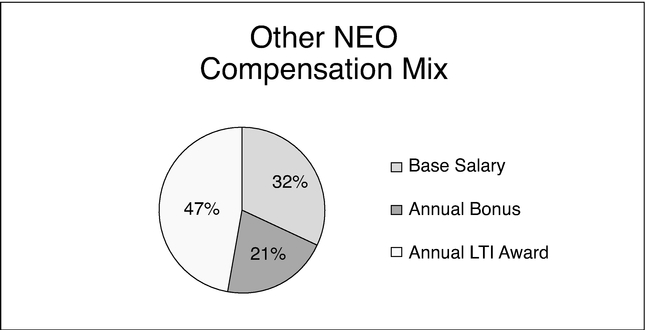

Elements of Executive Compensation, including for NEOs

To meet these objectives, our executive compensation program consists of the following: