- TMX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Terminix Global (TMX) 425Business combination disclosure

Filed: 14 Dec 21, 5:02pm

Filed by Terminix Global Holdings, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Terminix Global Holdings, Inc.

(Commission File No. 001-36507)

Date: December 14, 2021

[The following is a presentation made available to employees of Terminix Global Holdings, Inc. on December 14, 2021]

CONFIDENTIAL AND PROPRIETARY. DO NOT DISTRIBUTE. Terminix and Rentokil Initial to Join Forces, Creating a Global Leader in Pest Control December 14, 2021

Additional Information About The Proposed Transaction And Where To Find It In connection with the proposed transaction between Rentokil Initial plc (“Rentokil”) and Terminix Global Holdings, Inc. (“Te rmi nix”), Rentokil will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F - 4, whi ch will include a proxy statement of Terminix that also constitutes a prospectus of Rentokil. Each of Rentokil and Terminix will also file other rele van t documents in connection with the proposed transaction. The definitive proxy statement/prospectus will be sent to the shareh old ers of Terminix. Rentokil will also file a shareholder proxy circular in connection with the proposed transaction with applicable securities regulators in the United Kingdom and the shareholder proxy circular will be sent to Rentokil’s shareholders. This communication is not a su bs titute for any registration statement, proxy statement/prospectus or other documents Rentokil and/or Terminix may file with the SEC in connection with th e p roposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS, INVESTORS, STOCKHOLDERS AND SHAREHOLDERS OF TERMINIX AND RENTOKIL ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT/PROSPECTUS AND SHAREHOLDER PRO XY CIRCULAR, AS APPLICABLE, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC OR APPLICABLE SECURITIES REGULATORS IN THE UNITED KINGDOM, AS WELL AS ANY AMENDMENTS OR SUPPLEMENT S T O THESE DOCUMENTS, IN CONNECTION WITH THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT TERMINIX, RENTOKIL, THE PROPOSED TRANSACTION AN D R ELATED MATTERS. The registration statement and proxy statement/prospectus and other documents filed by Rentokil and Terminix with the SEC, when filed, will be available free of charge at the SEC’s website at www.sec.gov. In a ddi tion, investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents fil ed with the SEC by Terminix online at investors.terminix.com, upon written request delivered to Terminix at 150 Peabody Pl., Memphis, TN 38103, USA , Attention: Corporate Secretary, or by calling Terminix’s Corporate Secretary’s Office by telephone at +1 901 - 597 - 1400 or by em ail at deidre.richardson@terminix.com, and will be able to obtain free copies of the registration statement, proxy statement/prospec tus , shareholder proxy circular and other documents which will be filed with the SEC and applicable securities regulators in the Un ited Kingdom by Rentokil online at https://www.rentokil - initial.com, upon written request delivered to Rentokil at Compass House, Manor Royal, C rawley, West Sussex, RH10 9PY, England, Attention: Katharine Rycroft, or by calling Rentokil by telephone at +44 (0) 7811 270734 or by email at katharine.rycroft@rentokil - initial.com . This communication is for informational purposes only and is not intended to, and shall not, constitute an offer to sell or b uy or the solicitation of an offer to sell or buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of any such jurisdiction. No off ering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securiti es Act of 1933, as amended. Participants in the Solicitation of Proxies This communication is not a solicitation of proxies in connection with the proposed transaction. However, under SEC rules, T erm inix, Rentokil, and certain of their respective directors, executive officers and other members of the management and employe es may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Terminix’s dir ect ors and executive officers may be found on its website at corporate.terminix.com/responsibility/corporate - governance and in its 2020 Annual Report on Form 10 - K filed with the SEC on February 26, 2021, available at investors.terminix.com and www.sec.gov. Information about Rento kil’s directors and executive officers may be found on its website at https://www.rentokil - initial.com and in its 2020 Annual Re port filed with applicable securities regulators in the United Kingdom on March 31, 2021, available on its website at https://www.rentokil - initi al.com. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the in terests of such potential participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy stateme nt/ prospectus and shareholder proxy circular and other relevant materials filed with the SEC and applicable securities regulator s i n the United Kingdom when they become available. Information Regarding Forward - Looking Statements This communication contains forward - looking statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act o f 1 995. Forward - looking statements can sometimes be identified by the use of forward - looking terms such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “potential,” “seeks,” “aims,” “projects,” “predicts,” “is optimistic,” “intends,” “plans ,” “estimates,” “targets,” “anticipates,” “continues” or other comparable terms or negatives of these terms, but not all forward - looking statements include such identifyi ng words. Forward - looking statements are based upon current plans, estimates and expectations that are subject to risks, uncert ainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward - looking statements. We can give no assur ance that such plans, estimates or expectations will be achieved and therefore, actual results may differ materially from any plans, estimates or e xpe ctations in such forward - looking statements. Important factors that could cause actual results to differ materially from such p lans, estimates or expectations include: a condition to the closing of the proposed transaction may not be satisfied; the occurrence of any even t t hat can give rise to termination of the proposed transaction; a regulatory approval that may be required for the proposed tra nsa ction is delayed, is not obtained or is obtained subject to conditions that are not anticipated; Rentokil is unable to achieve the synergies and value cr eation contemplated by the proposed transaction; Rentokil is unable to promptly and effectively integrate Terminix’s business es; management’s time and attention is diverted on transaction related issues; disruption from the proposed transaction makes it more difficult to main tai n business, contractual and operational relationships; the credit ratings of Rentokil declines following the proposed transac tio n; legal proceedings are instituted against Terminix or Rentokil; Terminix or Rentokil is unable to retain or hire key personnel; the announcement or the consummation of the proposed acquisition has a negative effect on the market price of the capital stock of Terminix or Rentok il or on Terminix’s or Rentokil’s operating results; evolving legal, regulatory and tax regimes; changes in economic, financial, political and regul ato ry conditions, in the United Kingdom, the United States and elsewhere, and other factors that contribute to uncertainty and v ola tility, natural and man - made disasters, civil unrest, pandemics (e.g., the coronavirus (COVID - 19) pandemic (the “COVID - 19 pandemic”)), geopolitical uncertain ty, and conditions that may result from legislative, regulatory, trade and policy changes associated with the current or subs equ ent U.S. or U.K. administration; the ability of Rentokil or Terminix to successfully recover from a disaster or other business continuity prob lem due to a hurricane, flood, earthquake, terrorist attack, war, pandemic, security breach, cyber - attack, power loss, telecommunic ations failure or other natural or man - made event, including the ability to function remotely during long - term disruptions such as the COVID - 19 pandemic ; the impact of public health crises, such as pandemics (including the COVID - 19 pandemic) and epidemics and any related company or governmental policies and actions to protect the health and safety of individuals or governmental policies or actions to main tai n the functioning of national or global economies and markets, including any quarantine, “shelter in place,” “stay at home,” wor kforce reduction, social distancing, shut down or similar actions and policies; actions by third parties, including government agencies; the risk that di sruptions from the proposed transaction will harm Rentokil’s or Terminix’s business, including current plans and operations; cer tain restrictions during the pendency of the acquisition that may impact Rentokil’s or Terminix’s ability to pursue certain business opportunities or stra teg ic transactions; Rentokil’s or Terminix’s ability to meet expectations regarding the accounting and tax treatments of the pro pos ed transaction; the risks and uncertainties discussed in the “Risks and Uncertainties” section in Rentokil’s reports available on the National Storage Mech ani sm at morningstar.co.uk/ uk /NSM and on its website at https://www.rentokil - initial.com; and the risks and uncertainties discussed in the “Risk Factors” and “Information Regarding Forward - Looking Statements” sections in Terminix’s reports filed with the SEC. These risks, as well a s other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus and sh are holder proxy circular. While the list of factors presented here is, and the list of factors to be presented in proxy statement/prospectus and shareh old er proxy circular will be, considered representative, no such list should be considered to be a complete statement of all pot ent ial risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward - looking statements. We caution you n ot to place undue reliance on any of these forward - looking statements as they are not guarantees of future performance or outcom es and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, an d the development of new markets or market segments in which we operate, may differ materially from those made in or suggeste d b y the forward - looking statements contained in this communication. Neither Rentokil nor Terminix assumes any obligation to update or revise the inf orm ation contained herein, which speaks only as of the date hereof. Important Information 2

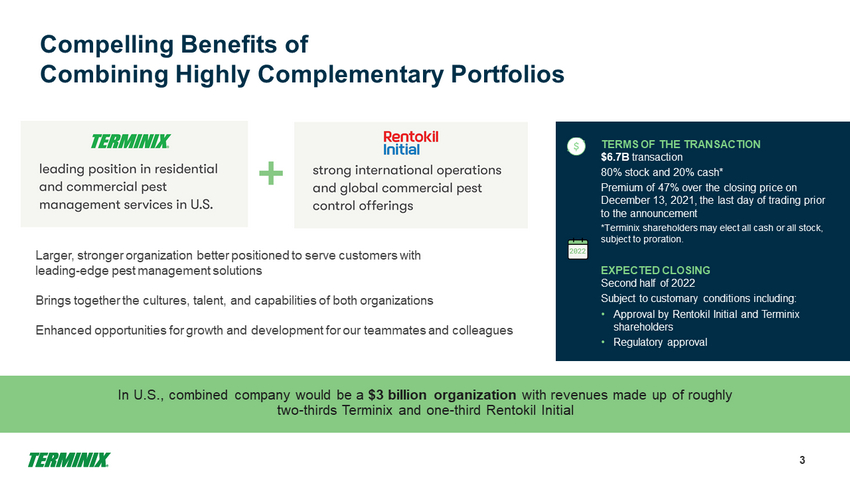

Compelling Benefits of Combining Highly Complementary Portfolios 3 Larger, stronger organization better positioned to serve customers with leading - edge pest management solutions Brings together the cultures, talent, and capabilities of both organizations Enhanced opportunities for growth and development for our teammates and colleagues In U.S., combined company would be a $3 billion organization with revenues made up of roughly two - thirds Terminix and one - third Rentokil Initial TERMS OF THE TRANSACTION $6.7B transaction 80% stock and 20% cash* Premium of 47% over the closing price on December 13, 2021, the last day of trading prior to the announcement *Terminix shareholders may elect all cash or all stock, subject to proration. EXPECTED CLOSING Second half of 2022 Subject to customary conditions including: • Approval by Rentokil Initial and Terminix shareholders • Regulatory approval

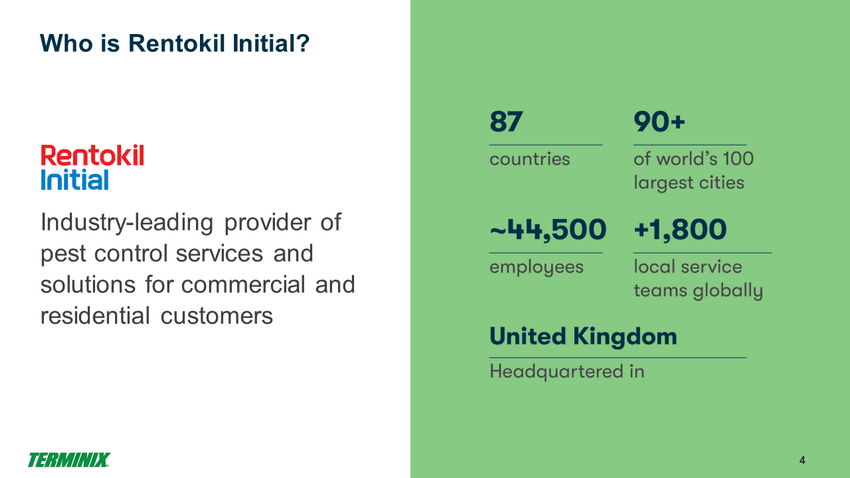

Who is Rentokil Initial? 4 Industry - leading provider of pest control services and solutions for commercial and residential customers

Next Step in Terminix’s Journey 5 Better positioned to serve large and loyal customer base More comprehensive service offerings across residential and commercial pest management – both domestically and around the world Creates strong growth platform Greater scale to drive growth and invest in innovation and technology Highly complementary businesses for strong operational and cultural fit Teammates will continue to be greatest asset Advances ongoing strategic initiatives Enables Terminix to accelerate our efforts on driving the Terminix Way and completing our CxP transformation Industry - leading ESG practices and profile Shared commitment to local communities Right leadership team Andy Ransom, CEO of Rentokil Initial, to be CEO of combined company; Brett Ponton to continue leading Terminix through closing, will continue with combined company Becoming a Leader in the Global Pest Control Industry

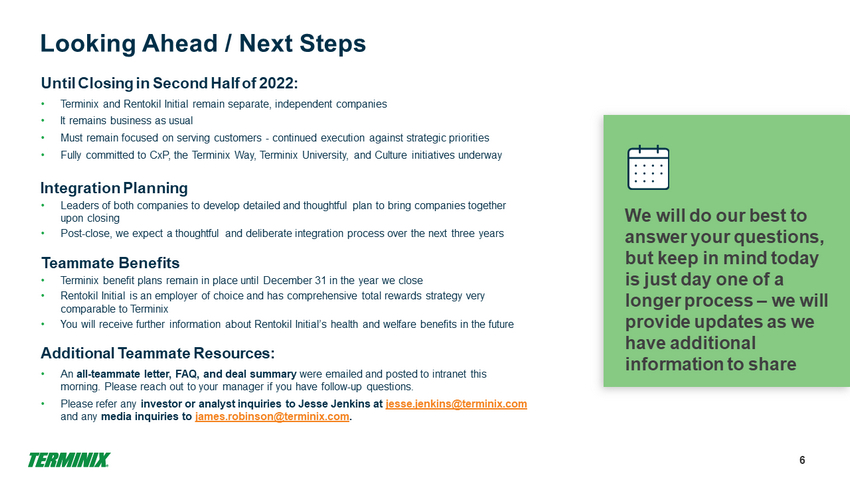

Looking Ahead / Next Steps 6 Until Closing in Second Half of 2022: • Terminix and Rentokil Initial remain separate, independent companies • It remains business as usual • Must remain focused on serving customers - continued execution against strategic priorities • Fully committed to CxP , the Terminix Way, Terminix University, and Culture initiatives underway Integration Planning • Leaders of both companies to develop detailed and thoughtful plan to bring companies together upon closing • Post - close, we expect a thoughtful and deliberate integration process over the next three years Teammate Benefits • Terminix benefit plans remain in place until December 31 in the year we close • Rentokil Initial is an employer of choice and has comprehensive total rewards strategy very comparable to Terminix • You will receive further information about Rentokil Initial’s health and welfare benefits in the future Additional Teammate Resources: • An all - teammate letter, FAQ, and deal summary were emailed and posted to intranet this morning. Please reach out to your manager if you have follow - up questions. • Please refer any investor or analyst inquiries to Jesse Jenkins at jesse.jenkins@terminix.com and any media inquiries to james.robinson@terminix.com . We will do our best to answer your questions, but keep in mind today is just day one of a longer process – we will provide updates as we have additional information to share

CONFIDENTIAL AND PROPRIETARY. DO NOT DISTRIBUTE. CONFIDENTIAL AND PROPRIETARY. DO NOT DISTRIBUTE.