EXHIBIT 99.2

SUNSHINE FINANCIAL, INC. |

Stock Ownership Guide and Stock Order Form Instructions |

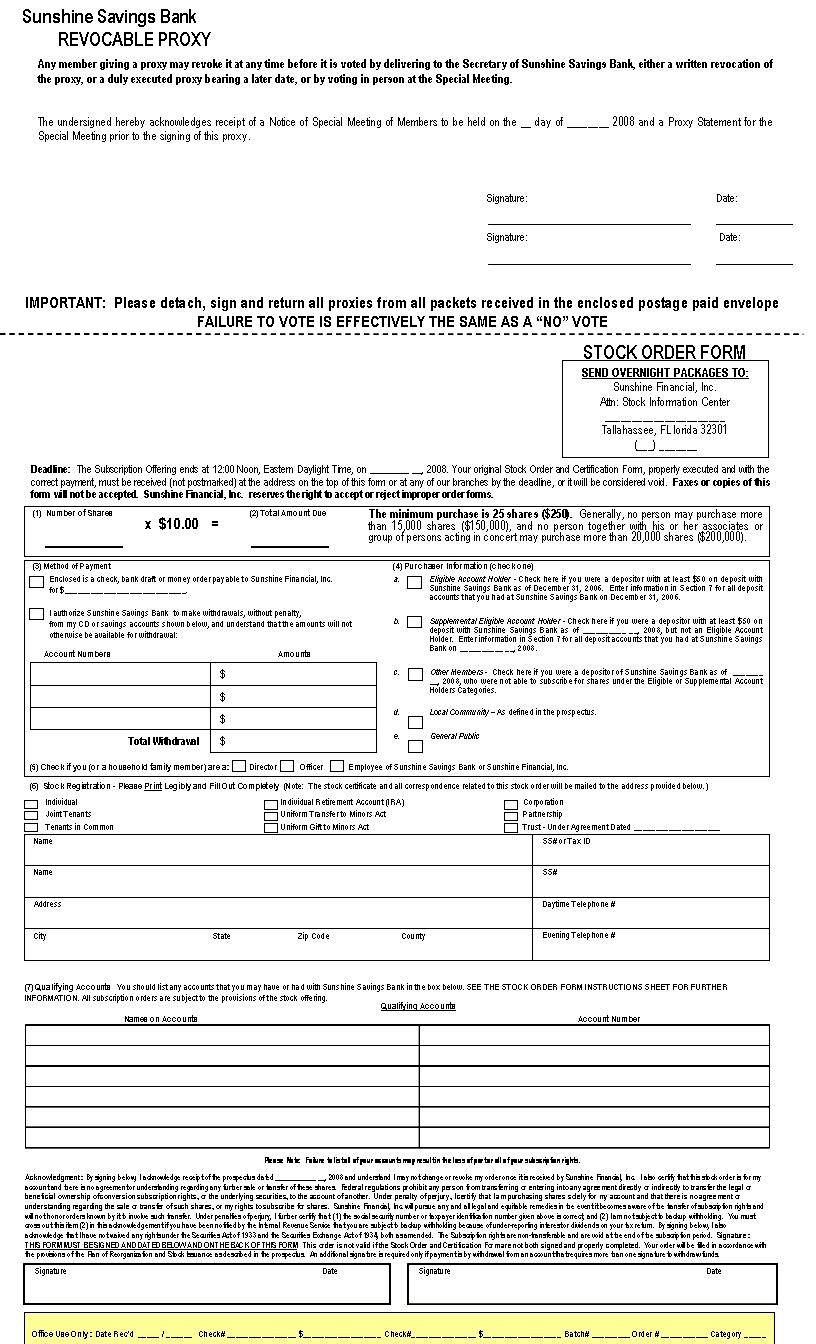

| Stock Order Form Instructions – All subscription orders are subject to the provisions of the stock offering. |

Item 1 and 2 - Fill in the number of shares that you wish to purchase and the total payment due. The amount due is determined by multiplying the number of shares ordered by the subscription price of $10.00 per share. The minimum purchase is 25 shares. Generally, the maximum purchase for any person is 15,000 shares (15,000 shares x $10.00 per share = $150,000). No person, together with associates, as defined in the prospectus, and persons acting in concert may purchase more than 20,000 shares (20,000 shares x $10.00 per share = $200,000) of the common stock offered in the stock offering. For additional information, see “THE REORGANIZATION AND STOCK OFFERING- Limitations on purchases of shares” in the prospectus.

Item 3 - Payment for shares may be made by check, bank draft or money order payable to Sunshine Financial, Inc. DO NOT MAIL CASH. Your funds will earn interest at the bank’s statement savings annual percentage yield until the stock offering is completed.

Payments for shares may also be made by authorizing a withdrawal from an account at Sunshine Savings Bank including certificates of deposit, designated on the Stock Order Form. To pay by withdrawal from a savings account or certificate at Sunshine Savings Bank insert the depositor number(s) and the amount(s) you wish to withdraw from each account. If more than one signature is required for a withdrawal, all signatories must sign in the signature box on the front of the Stock Order Form. To withdraw from an account with checking privileges, please write a check. Sunshine Savings Bank will waive any applicable penalties for early withdrawal from certificate accounts (CDs). A hold will be placed on the account(s) for the amount(s) you indicate to be withdrawn. Payments will remain in account(s) until the Stock Offering closes and earn their respective rate of interest.

Item 4 - Please check the appropriate box to tell us the earliest of the three dates that applies to you.

Item 5 - Please check one of these boxes if you are a director, officer or employee of Sunshine Savings Bank, or a member of such person’s household.

Item 6 - The stock transfer industry has developed a uniform system of shareholder registrations that we will use in the issuance of Sunshine Financial, Inc. common stock. Please complete this section as fully and accurately as possible, and be certain to supply your social security or Tax I.D. number(s) and your daytime and evening phone numbers. We will need to call you if we cannot execute your order as given. If you have any questions regarding the registration of your stock, please consult your legal advisor or contact the Stock Information Center at (___) ___-____. Subscription rights are not transferable. If you are an eligible or supplemental eligible account holder or other depositor, to protect your priority over other purchasers as described in the prospectus, you must take ownership in at least one of the account holder’s names.

Item 7 – You should list any qualifying accounts that you may have or had with Sunshine Savings Bank in the box located under the heading “Qualifying Accounts”. For example, if you are ordering stock in just your name, you should list all of your account numbers as of the earliest of the three dates that you were a depositor. Similarly, if you are ordering stock jointly with another depositor, you should list all account numbers under which either of you are owners, i.e. individual accounts, joint accounts, etc. If you are ordering stock in your minor child’s or grandchild’s name under the Uniform Transfers to Minors Act, the minor must have had an account number on one of the three dates and you should list only their account number(s). If you are ordering stock corporately, you need to list just that corporation’s account number, as your individual account number(s) do not qualify. Failure to list all of your qualifying depositor numbers may result in the loss of part or all of your subscription rights.

NOTE: The Stock Order Form is to be received (not postmarked) at _______________, Tallahassee, Florida 32301 or at Sunshine Savings Bank’s other branch offices by the end of the subscription offering on _________ __, 2008 at 12:00 Noon, Eastern Daylight Time.

(See Reverse Side for Stock Ownership Guide)

SUNSHINE FINANCIAL, INC. |

Stock Ownership Guide and Stock Order Form Instructions |

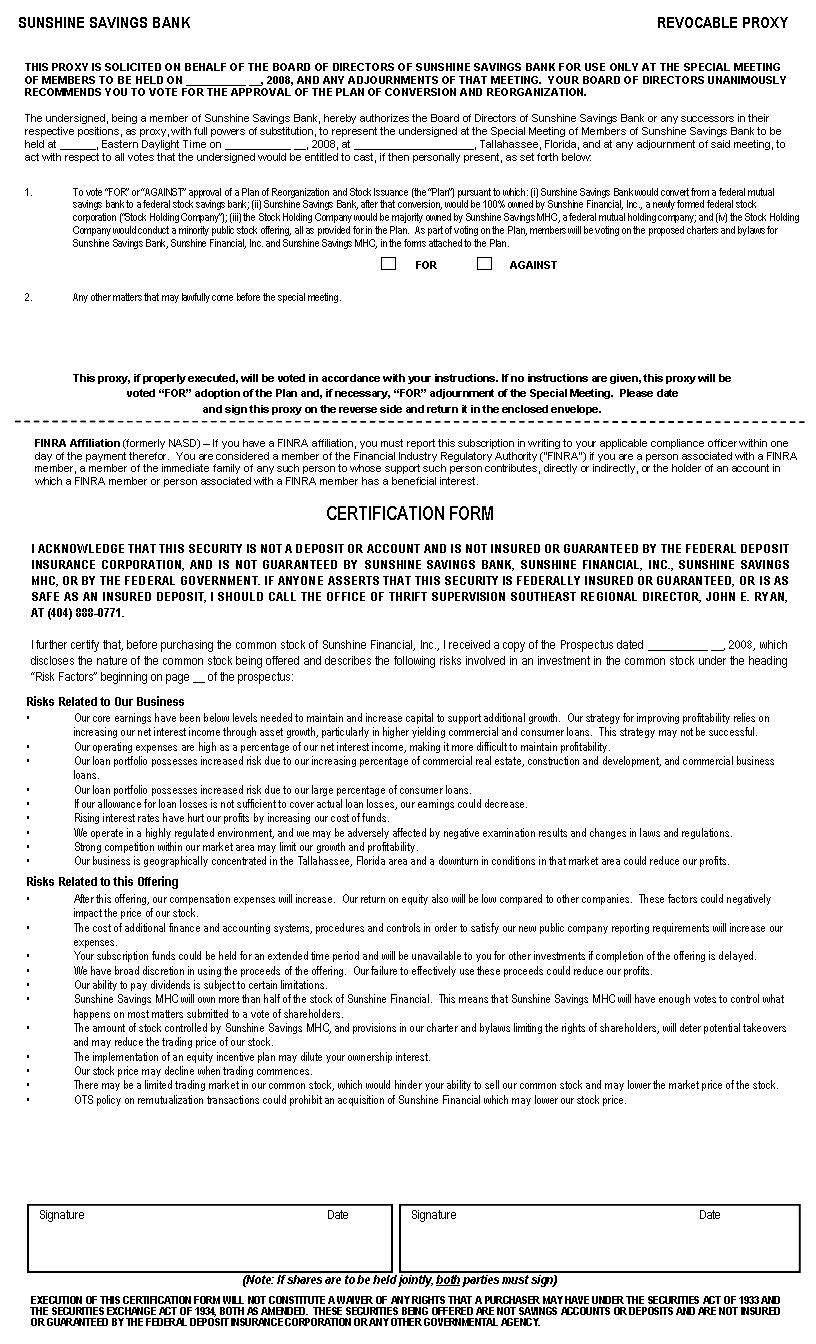

Individual - The stock is to be registered in an individual’s name only. You may not list beneficiaries for this ownership.

Joint Tenants - Joint tenants with rights of survivorship identifies two or more owners. When stock is held by joint tenants with rights of survivorship, ownership automatically passes to the surviving joint tenant(s) upon the death of any joint tenant. You may not list beneficiaries for this ownership.

Tenants in Common - Tenants in common may also identify two or more owners. When stock is to be held by tenants in common, upon the death of one co-tenant, ownership of the stock will be held by the surviving co-tenant(s) and by the heirs of the deceased co-tenant. All parties must agree to the transfer or sale of shares held by tenants in common. You may not list beneficiaries for this ownership.

Uniform Transfers To Minors Act - For residents of Florida and many states, stock may be held in the name of a custodian for the benefit of a minor under the Uniform Transfers to Minors Act. For residents in other states, stock may be held in a similar type of ownership under the Uniform Gifts to Minors Act of the individual state. For either ownership, the minor is the actual owner of the stock with the adult custodian being responsible for the investment until the child reaches legal age. Only one custodian and one minor may be designated.

Instructions: On the first name line, print the first name, middle initial and last name of the custodian, with the abbreviation “CUST” after the name. Print the first name, middle initial and last name of the minor on the second name line followed by the notation UTMA-FA or UGMA-Other State. List only the minor’s social security number.

Corporation/Partnership – Corporations/Partnerships may purchase stock. Please provide the Corporation/Partnership’s legal name and Tax I.D. To have depositor rights, the Corporation/Partnership must have an account in the legal name. Please contact the Stock Information Center to verify depositor rights and purchase limitations.

Individual Retirement Account - Individual Retirement Account (“IRA”) holders may potentially make stock purchases from their existing IRA if it is a self-directed IRA or through a prearranged “trustee-to-trustee” transfer if their IRA is currently at Sunshine Savings Bank. The stock cannot be held in your Sunshine Savings Bank account. Please contact your broker or self-directed IRA account provider as quickly as possible to explore this option, as it may take a number of days to complete a trustee-to-trustee transfer.

Registration for IRA’s: On Name Line 1 - list the name of the broker or trust department followed by CUST or TRUSTEE.

On Name Line 2 - FBO (for benefit of) YOUR NAME [IRA a/c #______].

Address will be that of the broker / trust department to where the stock certificate will be sent.

The Social Security / Tax I.D. number(s) will be either yours or your trustee’s, as the trustee directs.

Please list your phone numbers.

Fiduciary/Trust - Generally, fiduciary relationships (such as Trusts, Estates, Guardianships, etc.) are established under a form of trust agreement or pursuant to a court order. Without a legal document establishing a fiduciary relationship, your stock may not be registered in a fiduciary capacity.

Instructions: On the first name line, print the first name, middle initial and last name of the fiduciary if the fiduciary is an individual. If the fiduciary is a corporation, list the corporate title on the first name line. Following the name, print the fiduciary title, such as trustee, executor, personal representative, etc. On the second name line, print the name of the maker, donor or testator or the name of the beneficiary. Following the name, indicate the type of legal document establishing the fiduciary relationship (agreement, court order, etc.). In the blank after “Under Agreement Dated,” fill in the date of the document governing the relationship. The date of the document need not be provided for a trust created by a will.

(See Reverse Side for Stock Order Form Instructions)