EXHIBIT 99.1

Feldman Financial Advisors, Inc.

1001 Connecticut Avenue NW, Suite 840

; Washington, DC 20036

202-467-6862

(Fax) 202-467-6963

Sunshine Financial, Inc. Tallahassee, Florida Conversion Valuation Appraisal Report Valued as of June 16, 2008 Prepared By Feldman Financial Advisors, Inc. Washington, D.C. |

Feldman Financial Advisors, Inc.

1001 Connecticut Avenue, NW, Suite 840

; Washington, DC 20036

202-467-6862

(Fax) 202-467-6963

June 16, 2008

Board of Directors

Sunshine Financial, Inc.

1400 East Park Avenue

Tallahassee, FL 32301-2816

Members of the Board:

At your request, we have completed and hereby provide an independent appraisal (the “Appraisal”) of the estimated pro forma market value of Sunshine Financial, Inc. (the “Company”) on a fully converted basis, as of June 16, 2008, in conjunction with the offer for sale of a minority interest of the Company’s common stock (the “Stock Offering”). The Company is the mid-tier holding company of Sunshine Savings Bank (the “Bank”). The Company will offer 45% of its outstanding shares of common stock for sale in subscription and community offerings to eligible depositors, the employee stock ownership plan, directors, officers and employees of the Company and the Bank, and then to the general public. The remainder of Sunshine Financial, Inc.’s outstanding common stock upon completion of this offering will be held by Sunshine Savings MHC, its federally chartered mutual holding company parent. The Appraisal is furnished pursuant to the filing by the Company of the Application for Approval of a Minority Stock Issuance by a Holding Company Subsidiary of a Mutual Holding Company (the “Application”) with the Office of Thrift Supervision (“OTS”).

Feldman Financial Advisors, Inc. (“Feldman Financial”) is a financial consulting and economic research firm that specializes in financial valuations and analyses of business enterprises and securities in the thrift, banking, and mortgage industries. The background of Feldman Financial is presented in Exhibit I. In preparing the Appraisal, we conducted an analysis of the Company that included discussions with the Company’s management, the Company’s legal counsel, Silver, Freedman & Taff, L.L.P., and the Company’s independent auditor, Hacker, Johnson & Smith PA. In addition, where appropriate, we considered information based on other available published sources that we believe are reliable; however, we cannot guarantee the accuracy and completeness of such information.

Board of Directors

Sunshine Financial, Inc.

June 16, 2008

Page Two

We also reviewed, among other factors, the economy in the Company’s primary market area and compared the Company’s financial condition and operating performance with that of selected publicly traded thrift institutions. We reviewed conditions in the securities markets in general and in the market for thrift institution common stocks in particular.

The Appraisal is based on the Company’s representation that the information contained in the Application and additional evidence furnished to us by the Company and its independent auditor are truthful, accurate, and complete. We did not independently verify the financial statements and other information provided by the Company and its independent auditor, nor did we independently value the assets or liabilities of the Company. The Appraisal considers the Company only as a going concern and should not be considered as an indication of the liquidation value of the Company.

It is our opinion that, as of June 16, 2008, the estimated pro forma market value of the Company on a fully converted basis was within a range (the “Valuation Range”) of $15,300,000 to $20,700,000 with a midpoint of $18,000,000. The Valuation Range was based upon a 15% decrease from the midpoint to determine the minimum and a 15% increase from the midpoint to establish the maximum. Assuming an additional 15% increase above the maximum value would result in an adjusted maximum of $23,805,000. As part of the Stock Offering, the Company will offer common stock equal to 45% of the aggregate pro forma market value for sale in a subscription and community offering. Thus, assuming an offering price of $10.00 per share of common stock, the Company will offer a minimum of 688,500 shares, a midpoint of 810,000 shares, a maximum of 931,500 shares, and an adjusted maximum of 1,071,225 shares. The aggregate pro forma market value of the common stock sold in the Stock Offering will range from $6,885,000 at the minimum and $8,100,000 at the midpoint to $9,315,000 at the maximum and $10,712,250 at the adjusted maximum.

Our Appraisal is not intended, and must not be construed, to be a recommendation of any kind as to the advisability of purchasing shares of common stock in the Stock Offering. Moreover, because the Appraisal is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of stock in the Stock Offering will thereafter be able to sell such shares at prices related to the foregoing estimate of the Company’s pro forma market value. Feldman Financial is not a seller of securities within the meaning of any federal or state securities laws and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

Board of Directors

Sunshine Financial, Inc.

June 16, 2008

Page Three

The valuation reported herein will be updated as appropriate. These updates will consider, among other factors, any developments or changes in the Company’s operating performance, financial condition, or management policies, and current conditions in the securities markets for thrift institution common stocks. Should any such new developments or changes be material, in our opinion, to the valuation of the Company, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in detail at that time.

| | Respectfully submitted, | |

| | | |

| | | |

| | Feldman Financial Advisors, Inc | |

| | | |

| | | |

| | | |

| | Trent R. Feldman President | |

| | | |

| | | |

| | Greg Izydorczyk Senior Vice President | |

Feldman Financial Advisors, Inc.

TABLE OF CONTENTS

| TAB | | PAGE |

| | | |

| | INTRODUCTION | 1 |

| |

| I. | Chapter One – BUSINESS OF SUNSHINE SAVINGS BANK |

| | General Overview | 4 |

| | | |

| | Financial Condition | 8 |

| | Income and Expense Trends | 27 |

| | Interest Rate Risk Management | 38 |

| | Asset Quality | 42 |

| | Market Area | 47 |

| | Summary Outlook | 51 |

| |

| II. | Chapter Two – COMPARISONS WITH PUBLICLY HELD THRIFTS |

| | |

| | General Overview | 52 |

| | Selection Criteria | 53 |

| | Recent Financial Comparisons | 57 |

| |

| III. | Chapter Three – MARKET VALUE ADJUSTMENTS |

| | |

| | General Overview | 69 |

| | Earnings Prospects | 70 |

| | Financial Condition | 72 |

| | Market Area | 73 |

| | Management | 74 |

| | Dividend Policy | 74 |

| | Liquidity of the Issue | 75 |

| | Subscription Interest | 75 |

| | Stock Market Conditions | 77 |

| | Recent Acquisition Activity | 78 |

| | New Issue Discount | 79 |

| | Adjustments Conclusion | 83 |

| | Valuation Approach | 83 |

| | Valuation Conclusion | 86 |

| |

| IV. | Appendix – EXHIBITS |

| | |

| | I | Background of Feldman Financial Advisors, Inc. | I-1 |

| | II-1 | Statement of Financial Condition | II-1 |

| | II-2 | Statement of Operations | II-2 |

| | II-3 | Loan Portfolio Composition | II-3 |

| | II-4 | Deposit Account Distribution | II-4 |

| | III | Financial and Market Data for All Public Thrifts | III-1 |

| | IV-1 | Pro Forma Assumptions for Full Conversion Valuation | IV-1 |

| | IV-2 | Pro Forma Full Conversion Valuation Range | IV-2 |

| | IV-3 | Pro Forma Full Conversion Analysis at Maximum | IV-3 |

| | IV-4 | Comparative Discount and Premium Analysis | IV-4 |

| | V-1 | Pro Forma Assumptions for MHC Stock Offering | V-1 |

| | V-2 | Pro Forma MHC Stock Offering Range | V-2 |

Feldman Financial Advisors, Inc.

LIST OF TABLES

| TAB | | PAGE |

| | | |

| I. | Chapter One – BUSINESS OF SUNSHINE FINANCIAL, INC. |

| |

| | Table 1 | Selected Financial Condition and Performance Data | 8 |

| | Table 2 | Selected Financial and Performance Ratios | 9 |

| | Table 3 | Loan Portfolio | 13 |

| | Table 4 | Deposit Portfolio | 23 |

| | Table 5 | Certificates of Deposit by Interest Rate | 25 |

| | Table 6 | Borrowings | 26 |

| | Table 7 | Summary Income Statement Data | 27 |

| | Table 8 | Average Balances and Yields | 28 |

| | Table 9 | Rate/Volume Analysis | 29 |

| | Table 10 | Present Value Equity Analysis | 41 |

| | Table 11 | Non-performing Asset Summary | 43 |

| | Table 12 | Allowance for Loan Loss Summary | 44 |

| | Table 13 | Allocation of Allowance for Loan Losses | 45 |

| | Table 14 | Selected Demographic Data | 48 |

| | Table 15 | Largest Employers Leon County | 49 |

| | Table 16 | Deposit Market Share for Leon County | 50 |

| |

| II. | Chapter Two – COMPARISONS WITH PUBLICLY HELD THRIFTS |

| |

| | Table 17 | Comparative Group Operating Summary | 56 |

| | Table 18 | Key Financial Comparisons | 59 |

| | Table 19 | General Financial Performance Ratios | 64 |

| | Table 20 | Income and Expense Analysis | 65 |

| | Table 21 | Yield-Cost Structure and Growth Rates | 66 |

| | Table 22 | Balance Sheet Composition | 67 |

| | Table 23 | Regulatory Capital, Credit Risk, and Loan Composition | 68 |

| |

| III. | Chapter Three – MARKET VALUE ADJUSTMENTS |

| |

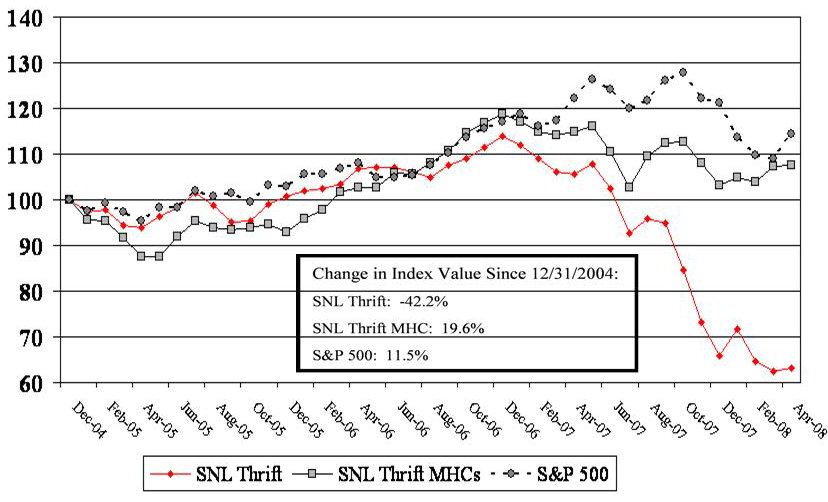

| | Table 24 | Comparative Stock Index Performance | 80 |

| | Table 25 | Summary of Recent Florida Acquisition Activity | 82 |

| | Table 26 | Summary of Recent First-Stage MHC Stock Offerings | 83 |

| | Table 27 | Fully Converted Market Valuation Analysis | 87 |

| | Table 28 | Comparative Fully Converted Market Valuation Analysis | 88 |

| | Table 29 | Pro Forma Comparative MHC Valuation Analysis | 89 |

Feldman Financial Advisors, Inc.

INTRODUCTION

As requested, Feldman Financial Advisors, Inc. (“Feldman Financial”) has prepared an independent appraisal (the “Appraisal”) of the estimated pro forma market value of Sunshine Financial, Inc. (“Sunshine Financial” or the “Company”) on a fully converted basis, as of June 16, 2008, in conjunction with the offer for sale of a minority interest of the Company’s common stock (the “Stock Offering”). The Company is the mid-tier holding company of Sunshine Savings Bank (the “Bank”). The Company will offer 45% of its outstanding shares of common stock for sale in subscription and community offerings to eligible depositors, the employee stock ownership plan, directors, officers and employees of the Company and the Bank, and then to the general public. The remainder of Sunshine Financial, Inc.’s outstanding common stock upon completion of this offering will be held by Sunshine Savings MHC, its federally chartered mutual holding company parent. The Appraisal is furnished pursuant to the filing by the Company of the Application for Approval of a Minority Stock Issuance by a Holding Company Subsidiary of a Mutual Holding Company (the “Application”) with the Office of Thrift Supervision (“OTS”).

In the course of preparing the Appraisal, we reviewed and discussed with the Company’s management and the Company’s independent accountants, Hacker, Johnson & Smith PA, the audited financial statements of the Company’s operations for the years ended December 31, 2006 and 2007 and the unaudited financial statements for the quarter ended March 31, 2007 and 2008. We also discussed with management other financial matters of the Bank.

Where appropriate, we considered information based upon other available public sources, which we believe to be reliable; however, we cannot guarantee the accuracy or completeness of such information. We visited the Company’s primary market area and examined the prevailing

Feldman Financial Advisors, Inc.

economic conditions. We also examined the competitive environment within which the Company operates and assessed the Company’s relative strengths and weaknesses.

We examined and compared the Company’s financial performance with selected segments of the thrift industry and selected publicly traded thrift institutions. We reviewed conditions in the securities markets in general and the market for thrift institution common stocks in particular. We included in our analysis an examination of the potential effects of the Stock Offering on the Company’s operating characteristics and financial performance as they relate to the estimated pro forma market value of the Company.

In preparing the Appraisal, we have relied upon and assumed the accuracy and completeness of financial and statistical information provided by the Company and its independent accountants. We did not independently verify the financial statements and other information provided by the Company and its independent accountants, nor did we independently value the assets or liabilities of the Company. The Appraisal considers the Company only as a going concern and should not be considered as an indication of the liquidation value of the Company.

Our Appraisal is not intended, and must not be construed, to be a recommendation of any kind as to the advisability of purchasing shares of common stock in the Stock Offering. Moreover, because such the Appraisal is necessarily based on estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of common stock in the Stock Offering will thereafter be able to sell such shares at prices related to the foregoing

Feldman Financial Advisors, Inc.

estimate of the Company’s pro forma market value. Feldman Financial is not a seller of securities within the meaning of any federal and state securities laws and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

The valuation reported herein will be updated as appropriate. These updates will consider, among other factors, any developments or changes in the Company’s financial performance or management policies, and current conditions in the securities market for thrift institution common stocks. Should any such developments or changes be material, in our opinion, to the Stock Offering valuation of the Company, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in detail at that time.

Feldman Financial Advisors, Inc.

I. BUSINESS OF SUNSHINE SAVINGS BANK

General Overview

Sunshine Savings Bank was originally chartered as a credit union in 1952 as Sunshine State Credit Union to serve employees of the State of Florida. The Bank expanded over the years to serve city, county, state and federal government employees as well as the employees of commercial and industrial companies, associations, contract employees serving these groups, and family members. This expansion resulted in the evolution toward a community financial institution with a growing focus trending more toward real estate lending than the traditional credit union products.

On July 1, 2007, the credit union converted to a federal mutual savings bank to expand available loan products and to access capital. The charter conversion also enabled the institution to offer loans to the general public, rather than solely to individuals who qualified for membership at the credit union. As part of that charter conversion, deposits are now insured by the FDIC and the Bank is regulated by the Office of Thrift Supervision. The new bank was named Sunshine Savings Bank to reflect its historical community roots and continued commitment to the local community in providing banking services and in community contributions and activities.

The Bank’s principal business consists of attracting retail deposits from the general public and investing those funds, along with borrowed funds, in loans secured by first and second mortgages on one- to four-family residences (including residential construction loans) and consumer loans. The Bank also offers a wide variety of secured and unsecured consumer loan products, including home equity, direct automobile loans, and credit card loans as well as a

Feldman Financial Advisors, Inc.

variety of deposit accounts having a wide range of interest rates and terms, including savings accounts, money market deposit and term certificate accounts and demand accounts. The primary sources of funds are deposits and payments on loans. As of March 31, 2008, Sunshine Savings Bank had total consolidated assets of $167.4 million, total deposits of $148.9 million and equity of $17.5 million.

The Bank operates four full service branch offices serving the Tallahassee, Florida metropolitan area and one full service branch office located in Pembroke Pines, Florida serving Broward County, Florida. Unless indicated otherwise, references to Sunshine Savings Bank prior to July 1, 2007 shall include Sunshine State Credit Union. Executive offices are located at 1400 East Park Drive, Tallahassee, Florida 32301.

Sunshine Financial will be the mid-tier holding company for Sunshine Savings Bank when the change in structure is complete. Sunshine Financial is not currently an operating company and has not engaged in any business to date. Sunshine Financial will be chartered under federal law and will own 100% of the stock of Sunshine Savings Bank. After completion of the reorganization, Sunshine Financial will direct Sunshine Savings Bank's business activities and may, in the future, acquire or organize other operating subsidiaries, including other financial institutions or other financial services companies, although it currently has no specific plans or agreements to do so.

Upon completion of the change in structure and the stock offering, Sunshine Savings MHC will own 55.0% of the outstanding shares of Sunshine Financial. Persons who had membership rights in Sunshine Savings Bank as of the date of the change in structure will have these rights automatically exchanged for identical rights in Sunshine Savings MHC after the

Feldman Financial Advisors, Inc.

change in structure. All depositors of Sunshine Savings Bank will be members of Sunshine Savings MHC after the reorganization. So long as Sunshine Savings MHC exists, it is required by the OTS regulations to own a majority of the voting stock of Sunshine Financial. As a result, Sunshine Savings MHC, through its board of directors, will be able to exercise voting control over most matters put to a vote of shareholders of Sunshine Financial. Sunshine Savings MHC is not expected to engage in any business activity other than holding more than half of the shares of Sunshine Financial and investing any funds retained by it.

The Bank faces strong competition in its market and faces substantial competition in attracting deposits and in originating loans. The Bank’s market area has a high concentration of financial institutions, many of which are branches of large money center and regional banks that have resulted from the consolidation of the banking industry in Florida and other eastern states and many of these institutions have greater resources than the Bank does and offers services that the Bank does not provide.

Competition in originating real estate loans comes primarily from other savings institutions, commercial banks, credit unions, life insurance companies and mortgage bankers. Other savings institutions, commercial banks, credit unions and finance companies provide vigorous competition in consumer lending. Commercial business competition is primarily from local commercial banks. The Bank competes by consistently delivering high quality, personal service to its customers that result in a high level of customer satisfaction.

The Bank attracts its deposits through its branch office system. Competition for those deposits is principally from other savings institutions, commercial banks and credit unions located in the same community, as well as mutual funds and other alternative investments. The

Feldman Financial Advisors, Inc.

Bank competes for these deposits by offering superior service and a variety of deposit accounts at competitive rates.

In order to facilitate its growth objectives and maintain appropriate capital levels, the Company plans to raise additional capital through the Stock Offering. The net proceeds from the Stock Offering may also be used to support increased lending activities, repay borrowings, or other general corporate purposes. In addition, the Stock Offering will afford the opportunity to implement stock-based compensation and benefit plans for management and employees, thereby improving the Company’s capacity to attract and retain qualified personnel. The Stock Offering also provides the occasion for the Company to strengthen its ties to the local community by allowing customers the opportunity to become equity owners of the Company and participate in possible stock price appreciation and cash dividends.

The remainder of Chapter I examines in more detail the trends addressed in this section, including the impact of changes in the Company’s economic and competitive environment, and recent management initiatives. The discussion is supplemented by the exhibits in the Appendix. Exhibit II-1 summarizes the Bank’s consolidated balance sheets as of the years ended December 31, 2006 and 2007 and for the quarter ended March 31, 2008. Exhibit II-2 presents the Bank’s consolidated income statements for the years ended December 31, 2006 and 2007 and for the quarters ended March 31, 2008 and 2007.

Feldman Financial Advisors, Inc.

Financial Condition

Table 1 presents selected data concerning the Bank’s financial position as of December 31, 2005 to 2007 and at March 31, 2008. Table 2 displays relative financial and performance ratios for the Bank for the fiscal years ended December 31, 2005 through 2007 and for the three months ended March 31, 2007 and 2008.

Table 1

Selected Financial Condition and Performance Data

As of or For the Years Ended December 31, 2005 to 2007

and the Three Months Ended March 31, 2007 and 2008

| | | At March 31, | | | At December 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Selected Financial Condition Data: | | (In thousands) | |

| Total assets | | $ | 167,447 | | | $ | 156,925 | | | $ | 136,562 | | | $ | 145,449 | |

| Loans receivable net | | | 126,284 | | | | 125,602 | | | | 118,021 | | | | 116,097 | |

| Securities held to maturity, at amortized cost: | | | 0 | | | | | | | | | | | | | |

| U.S. government and federal agency | | | 0 | | | | - | | | | - | | | | 3,995 | |

| Federal Home Loan Bank stock | | | 283 | | | | 246 | | | | 291 | | | | 341 | |

| Deposits | | | 148,860 | | | | 137,568 | | | | 118,077 | | | | 127,938 | |

| Other borrowings | | | 0 | | | | 500 | | | | - | | | | - | |

| Equity | | | 17,524 | | | | 17,785 | | | | 17,478 | | | | 16,557 | |

| | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended March 31, | | | For the Year Ended December 31, | |

| | | 2008 | | | 2007 | | | 2007 | | | 2006 | | | 2005 | |

| | | (In thousands) | |

| Total interest income | | $ | 2,232 | | | $ | 2,210 | | | $ | 9,019 | | | $ | 9,382 | | | $ | 9,917 | |

| Total interest expense | | | 1,052 | | | | 645 | | | | 3,227 | | | | 2,209 | | | | 1,885 | |

| Net interest income | | | 1,180 | | | | 1,565 | | | | 5,792 | | | | 7,173 | | | | 8,032 | |

| Provision for loan losses | | | 225 | | | | 225 | | | | 898 | | | | 897 | | | | 1,432 | |

| Net interest income after provision for loan losses | | | 955 | | | | 1,340 | | | | 4,894 | | | | 6,276 | | | | 6,600 | |

| Fees and service charges | | | 470 | | | | 527 | | | | 2,438 | | | | 2,584 | | | | 2,714 | |

| Other non-interest income | | | 54 | | | | 104 | | | | 9 | | | | (13 | ) | | | (4 | ) |

| Total non-interest income | | | 524 | | | | 631 | | | | 2,447 | | | | 2,571 | | | | 2,710 | |

| Total non-interest expense | | | 1,897 | | | | 1,846 | | | | 7,604 | | | | 7,926 | | | | 7,945 | |

| Income (loss) before income tax expense (benefit) | | | (418 | ) | | | 125 | | | | (263 | ) | | | 921 | | | | 1,365 | |

Income tax expense (benefit)(1) | | | (157 | ) | | | - | | | | (570 | ) | | | - | | | | - | |

Net income (loss)(1) | | $ | (261 | ) | | $ | 125 | | | $ | 307 | | | $ | 921 | | | $ | 1,365 | |

| | | | | | | | | | | | | | | | | | | | | |

| (1) | Until its conversion to a federally chartered mutual savings bank on July 1, 2007, Sunshine Savings Bank was a credit union, generally exempt from federal income taxes. As a result of the change in tax status on July 1, 2007, Sunshine Savings Bank recorded a deferred tax asset in the amount of $407,670, as well as a related tax benefit in the income statement of $407,670. The following table provides a reconciliation to pro forma net income for all periods presented, had Sunshine Savings Bank been subject to federal and state income taxes: |

Feldman Financial Advisors, Inc.

| | March 31, | | December 31, |

| | 2008 | | 2007 | | 2007 | | 2006 | | 2005 |

| | (In Thousands) |

| Historical net earnings | ($261) | | $125 | | $307 | | $921 | | $1,365 |

| Less: pro forma income tax | 157 | | 47 | | (100) | | 347 | | 514 |

| Less: tax benefit | 157 | | n/a | | 570 | | n/a | | n/a |

| Pro forma net earnings | ($261) | | $78 | | ($163) | | $574 | | $851 |

| | | | | | | | | | |

Source: Sunshine Savings Bank, preliminary prospectus.

Table 2

Selected Financial and Performance Ratios

As of or For the Years Ended December 31, 2005 to 2007

and the Three Months Ended March 31, 2007 and 2008

| | | | | | | |

| | | At or For the Three Months Ended March 31, | | | At or For the Year December 31, | |

| | | 2008 | | | 2007 | | | 2007 | | | 2006 | | | 2005 | |

Selected Financial Ratios and Other Data: | | | | | | | | | | | | | | | |

| Performance ratios: | | | | | | | | | | | | | | | |

| Return on assets (ratio of net income to | | | (0.67 | ) | | | 0.37 | % | | | 0.21 | % | | | 0.66 | % | | | 0.92 | % |

| average total assets) |

| Return on equity (ratio of net income to | | | (5.91 | ) | | | 2.86 | | | | 1.73 | | | | 5.36 | | | | 8.51 | |

| average equity) |

| Interest rate spread information: | | | | | | | | | | | | | | | | | | | | |

| Average during period | | | 2.55 | | | | 4.40 | | | | 3.69 | | | | 5.18 | | | | 5.47 | |

| End of period | | | 2.69 | | | | 4.41 | | | | 2.73 | | | | 4.67 | | | | 5.94 | |

Net interest margin(1) | | | 3.20 | | | | 5.01 | | | | 4.37 | | | | 5.67 | | | | 5.76 | |

| Noninterest income to operating revenue | | | 19.01 | | | | 22.21 | | | | 21.34 | | | | 21.51 | | | | 21.46 | |

| Operating expense to average total assets | | | 4.85 | | | | 5.53 | | | | 4.85 | | | | 5.89 | | | | 5.33 | |

| Average interest-earning assets to average | | | 122.54 | | | | 129.50 | | | | 127.99 | | | | 128.02 | | | | 121.56 | |

| interest-bearing liabilities |

Efficiency ratio(2) | | | 111.33 | | | | 84.06 | | | | 92.29 | | | | 81.34 | | | | 73.96 | |

| | | | | | | | | | | | | | | | | | | | | |

| Asset quality ratios: | | | | | | | | | | | | | | | | | | | | |

| Nonperforming assets to total assets at end of period | | | 1.00 | | | | 0.39 | | | | 1.05 | | | | 0.53 | | | | 0.52 | |

| Nonperforming loans to total loans | | | 1.20 | | | | 0.30 | | | | 1.10 | | | | 0.38 | | | | 0.18 | |

| Allowance for loan losses to non-performing loans | | | 94.47 | | | | 414.36 | | | | 101.64 | | | | 337.61 | | | | 766.67 | |

| Allowance for loan losses to loans receivable, net | | | 1.14 | | | | 1.25 | | | | 1.12 | | | | 1.28 | | | | 1.41 | |

| Net charge-offs to average loans outstanding | | | 0.63 | | | | 0.85 | | | | 0.82 | | | | 0.87 | | | | 1.35 | |

| | | | | | | | | | | | | | | | | | | | | |

| Capital Ratios: | | | | | | | | | | | | | | | | | | | | |

| Equity to total assets at end of period | | | 10.47 | | | | 12.21 | | | | 11.33 | | | | 12.80 | | | | 11.38 | |

| Average equity to average assets | | | 11.31 | | | | 13.12 | | | | 12.68 | | | | 12.73 | | | | 10.75 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other data: | | | | | | | | | | | | | | | | | | | | |

| Number of full service offices | | | 5 | | | | 4 | | | | 5 | | | | 4 | | | | 4 | |

| | | | | | | | | | | | | | | | | | | | | |

| (1) | Net interest income divided by average interest earning assets. |

| (2) | Total other operating expense, excluding real estate owned and repossessed property expense, as a percentage of net interest income and total other operating income, excluding net securities transactions. |

Source: Sunshine Savings Bank, preliminary prospectus.

Feldman Financial Advisors, Inc.

Balance Sheet Composition

Total assets increased by $30.9 million, or 22.6%, to $167.4 million at March 31, 2008 from $136.6 million at December 31, 2006. The increase in total assets was due primarily to increases in cash and cash equivalents and in the loan portfolio. Cash and cash equivalents increased to $34.2 million at March 31, 2008 from $10.7 million at December 31, 2006, while our loan portfolio increased $8.3 million, or 7.0%, since December 31, 2006. The increase in total assets was funded by an increase in deposits.

Loans. The loan portfolio had an increase of $0.7 million, to $126.3 million at March 31, 2008 from $125.6 million at December 31, 2007. One-to-four family real estate mortgage loans increased $1.8 million and other secured consumer loans increased $1.3 million. These increases were partially offset by a decrease in automobile loans of $1.5 million, and a decrease in unsecured loans of $0.8 million. The decrease in automobile and unsecured loans was primarily due to a combination of more stringent underwriting policies and a greater emphasis on providing mortgage lending to our customer base.

The loan portfolio had an increase of $7.6 million, or 6.4%, to $125.6 million at December 31, 2007 from $118.0 million at December 31, 2006. One-to-four family real estate mortgage loans increased $10.9 million or 16.6%, and home equity loans increased $3.5 million, or 22.4%. These increases were partially offset by a decrease in automobile loans of $4.7 million or 22.5%, and a decrease in unsecured loans of $1.8 million or 13.0%. The decrease in automobile and unsecured loans was primarily due to a combination of more stringent underwriting policies, a greater emphasis on providing mortgage lending to the customer base and competition.

Feldman Financial Advisors, Inc.

Allowance for Loan Losses. The allowance for loan losses at March 31, 2008 was $1.45 million or 1.15% of net loans receivable, compared to $1.4 million or 1.12% of net loans receivable at December 31, 2007. Non-performing loans increased to $1.5 million at March 31, 2008 from $1.4 million at December 31, 2007, primarily as a result of one non-performing first mortgage loan. Non-performing loans to total loans increased to 1.20% at March 31, 2008 from 1.10% at December 31, 2007.

The allowance for loan losses at December 31, 2007 was $1.4 million or 1.12% of net loans receivable, compared to $1.5 million or 1.28% of net loans receivable at December 31, 2006. The decline in the allowance for loan losses was due primarily to charge-offs of non-performing loans. Non-performing loans increased to $1.4 million at December 31, 2007 from $452,000 at December 31, 2006, primarily as a result of seven non-performing first mortgage loans. Non-performing loans to total loans increased to 1.10% at December 31, 2007 from 0.38% at December 31, 2006.

Deposits. Total deposits increased $11.3 million to $148.9 million at March 31, 2008 from $137.6 million at December 31, 2007. This increase was due primarily to a $9.2 million increase in certificate of deposit accounts. The increase in certificate accounts was the result of paying more competitive interest rates and the Bank’s recent access to the general public for deposits as the Bank no longer had field of membership limitation since the conversion to a bank charter.

Total deposits increased $19.5 million, or 16.5%, to $137.6 million at December 31, 2007 from $118.1 million at December 31, 2006. This increase was due primarily to a $28.3 million, or 72.1%, increase in certificate of deposit accounts.

Feldman Financial Advisors, Inc.

Equity. Total equity decreased $261,000 to $17.5 million at March 31, 2008 or 10.47% of total assets, from $17.8 million at December 31, 2007. This decrease was solely due to the net loss for the three months ended March 31, 2008.

Total equity increased $307,000 to $17.8 million at December 31, 2007 or 11.33% of total assets, from $17.5 million at December 31, 2006. This increase was solely due to the retention of net income.

Lending Operations

Table 3 and Exhibit II-3 presents information concerning the composition of the Bank’s loan portfolio in dollar amounts and in percentages (before deductions for loans in process, deferred fees and discounts and allowances for losses) at the dates indicated.

Loan Approval Procedures and Authority. The Bank’s lending policies and loan approval limits are recommended by senior management and approved by the Board of Directors. Unsecured loans of $50,000 and secured loans of $100,000 and below meeting underwriting guidelines can be approved by individual loan officers, although secured loans up to $750,000 may be approved by the Chief Executive Officer. The loan committee, consisting of the President and Chief Executive Officer, Executive Vice President and Chief Operating Officer, Chief Lending Officer, and the Senior Vice President and Chief Financial Officer, reviews all other loans and all loan modifications. Loan committee meetings require a quorum of three members of the committee. Loans submitted to the loan committee require approval of a majority of the members voting and approval of all members present if only three members are present. Loans exceeding $1.0 million must be approved by the board of directors. All closed loans are presented to the Board for ratification on a monthly basis.

Feldman Financial Advisors, Inc.

Table 3

Loan Portfolio

As of December 31, 2006 and 2007 and March 31, 2008

(Dollars in Thousands)

| | | March 31, | | | December 31, | |

| | | 2008 | | | 2007 | | | 2006 | |

| | | Amount | | | Percent | | | Amount | | | Percent | | | Amount | | | Percent | |

| Real estate loans: | | (Dollars in thousands) | |

| One- to four-family | | $ | 77,537 | | | | 60.76 | % | | | 75834 | | | | 59.68 | % | | | 65547 | | | | 54.88 | % |

| Construction or development | | | 708 | | | | 0.56 | | | | 592 | | | | 0.47 | | | | 0 | | | | 0 | |

| Total real estate loans | | | 78,245 | | | | 61.32 | | | | 76426 | | | | 60.15 | | | | 65547 | | | | 54.88 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer loans: | | | | | | | | | | | | | | | | | | | | | | | | |

| Home equity | | | 19,026 | | | | 14.91 | | | | 19,032 | | | | 14.99 | | | | 15,547 | | | | 13.02 | |

| Automobile | | | 14,723 | | | | 11.54 | | | | 16,236 | | | | 12.78 | | | | 20,936 | | | | 17.53 | |

| Credit cards and unsecured | | | 11,874 | | | | 9.3 | | | | 12,653 | | | | 9.96 | | | | 14,537 | | | | 12.17 | |

| Deposit account | | | 1,520 | | | | 1.19 | | | | 1,816 | | | | 1.42 | | | | 1,979 | | | | 1.66 | |

| Other | | | 2216 | | | | 1.74 | | | | 905 | | | | 0.7 | | | | 881 | | | | 0.74 | |

| Total consumer loans | | | 49,359 | | | | 38.68 | | | | 50,642 | | | | 39.85 | | | | 53,880 | | | | 45.12 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total loans | | $ | 127,604 | | | | 100.00 | % | | $ | 127,068 | | | | 100.00 | % | | $ | 119,427 | | | | 100.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less: | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans in process | | | (175 | ) | | | | | | | (7 | ) | | | | | | | (215 | ) | | | | |

| Deferred fees and discounts | | | 42 | | | | | | | | 50 | | | | | | | | 95 | | | | | |

| Allowance for losses | | | 1,453 | | | | | | | | 1,423 | | | | | | | | 1,526 | | | | | |

| Total loans, net | | $ | 126,284 | | | | | | | $ | 125,602 | | | | | | | $ | 118,021 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Sunshine Savings Bank, preliminary prospectus

One- to Four-Family Real Estate Lending. Sunshine Savings Bank originates loans secured by first mortgages on one- to four-family residences primarily in its market area. The Bank originates one- to four-family residential mortgage loans primarily through referrals from real estate agents, builders and from existing customers. Walk-in customers are also important sources of loan originations. Since converting from a credit union to a federal mutual savings bank in 2007, the Bank has expanded its target residential mortgage market to include individuals who are not members, with an emphasis on increasing residential real estate loan originations.

Feldman Financial Advisors, Inc.

Sunshine Savings Bank generally originates mortgage loans in amounts up to 80% of the lesser of the appraised value or purchase price of a mortgaged property, but will also permit loan-to-value ratios of up to 95%. For loans exceeding an 80% loan-to-value ratio, Sunshine Savings Bank generally requires the borrower to obtain private mortgage insurance covering the Bank for any loss on the amount of the loan in excess of 80% in the event of foreclosure. The majority of one- to four-family residential loans are originated with fixed rates and have terms of ten to 30 years. The Bank also originates adjustable-rate mortgage, or ARM, loans, which have interest rates that adjust annually to the yield on U.S. Treasury securities adjusted to a constant one-year maturity plus a margin. Most ARM loans are hybrid loans, which after an initial fixed rate period of five or seven years will convert to an adjustable interest rate for the remaining term of the loan. The pricing strategy for mortgage loans includes setting interest rates that are competitive with other local financial institutions and consistent with the Bank’s asset/liability management objectives. ARM loans have terms of up to 30 years with an initial fixed-rate period of one year according to the terms of the loan. ARM loans generally have a cap of two percentage points on rate adjustments during any one-year and six percentage points over the life of the loan. As a consequence of using caps, the interest rates on these loans may not be as rate sensitive as the Bank’s cost of funds. During the quarter ended March 31, 2008, the Bank originated $$4.6 million of one- to four-family fixed rate mortgage loans and no one- to four-family ARM loans. During the year ended December 31, 2007, the Bank originated $18.2 million of one- to four-family fixed rate mortgage loans and $153,000 one- to four-family ARM loans.

Feldman Financial Advisors, Inc.

ARM loans generally pose different credit risks than fixed-rate loans, primarily because as interest rates rise, the borrower’s payment rises, increasing the potential for default. The Bank has not experienced significant delinquencies in its one- to four-family loan portfolio, including ARM loans. However, the majority of these loans have been originated within the past several years, when rates were historically low. The Bank has offered some teaser rates for the initial loan rate on its ARM loans but not at significant discounts from prevailing rates.

Most of the loans are written using generally accepted underwriting guidelines, and are readily saleable to Freddie Mac, Fannie Mae, or other private investors. Real estate loans generally contain a “due on sale” clause allowing he Bank to declare the unpaid principal balance due and payable upon the sale of the security property.

Property appraisals on real estate securing the one- to four-family residential loans are made by state certified independent appraisers approved by the board of directors. Appraisals are performed in accordance with applicable regulations and policies. The Bank generally requires title insurance policies on all first mortgage real estate loans originated, but may also originate loans that will be retained for portfolio with an attorney’s opinion in lieu of title insurance. Homeowners, liability, fire and, if required, flood insurance policies are also required.

Residential Construction Lending. Sunshine Savings Bank originates construction loans for single-family houses to individuals for construction of their primary residence in its market areas. The Bank will generally originate construction loans in an amount up to 80% for a one- to four-family residential construction loan. Construction loans generally have terms up to 12 months and provide for monthly payments of interest only until maturity. The Bank typically

Feldman Financial Advisors, Inc.

converts construction loans to individuals to permanent loans on completion of construction but does not require take-out financing prior to origination.

Construction lending is generally considered to involve a higher degree of credit risk than long-term permanent financing of residential properties. If the estimate of construction cost proves to be inaccurate, the Bank may be compelled to advance additional funds to complete the construction with repayment dependent, in part, on the success of the ultimate project rather than the ability of a borrower or guarantor to repay the loan. If the Bank is forced to foreclose on a project prior to completion, there is no assurance that the Bank will be able to recover the entire unpaid portion of the loan. In addition, the Bank may be required to fund additional amounts to complete a project and may have to hold the property for an indeterminate period of time.

Consumer Lending. Sunshine Savings Bank offers a variety of secured consumer loans, including home equity, new and used automobile, boat and other recreational vehicle loans, and loans secured by savings deposits. The Bank also offer unsecured consumer loans including a credit card product. The Bank originates its consumer loans primarily in its market areas.

Home equity loans, consisting of fixed-rate loans and variable-rate lines of credit, have been increasing in amount and as a percentage of the total loan portfolio consistently over the past several years. At March 31, 2008, home equity lines of credit totaled $13.14 million and home equity loans totaled $5.96 million, or collectively 37.6% of the consumer loan portfolio and 14.98% of the gross loan portfolio. The lines of credit may be originated in amounts, together with the amount of the existing first mortgage, of up to 95% of the value of the property securing the loan (less any prior mortgage loans) provided that the borrower obtain private mortgage insurance covering the Bank for any loss on the amount of the loan in excess of 80% in

Feldman Financial Advisors, Inc.

the event of foreclosure. Home equity lines of credit are originated with an adjustable rate of interest, based on Treasury bill securities adjusted to a constant one-year maturity rate plus a margin. Home equity lines of credit generally have up to a ten-year draw period and amounts may be drawn upon again after payment at any time during the draw period. At March 31, 2008, unfunded commitments on these lines of credit totaled $3.6 million.

Fixed-rate home equity loans are originated in amounts, together with the amount of the existing first mortgage, of up to 100% of the appraised value of the subject property for home equity loans (less any prior mortgage loans) provided that the borrower obtain private mortgage insurance covering the Bank for any loss on the amount of the loan in excess of 80% in the event of foreclosure. These loans may have terms for up to 20 years and are fully amortizing.

Collateral value is determined through existing appraisals, new appraisals or evaluations by the loan department. On second mortgages, the Bank does not require title insurance but does require homeowner, liability, fire and, if required, flood insurance policies.

Sunshine Savings Bank makes loans on new and used automobiles. The Bank currently originates automobile loans only on a direct basis although the board recently approved a policy to originate up to $5.0 million of indirect automobile loans using the same underwriting guidelines as direct automobile loans. The automobile loan portfolio totaled $14.7 million at March 31, 2008, or 29.8% of the consumer loan portfolio and 11.5% of the gross loan portfolio.

Automobile loans may be written for a term of up to six years for new cars and five years for used cars and have fixed or adjustable rates of interest. Loan-to-value ratios are up to 100% of the lesser of the purchase price or the National Automobile Dealers Association value for auto

Feldman Financial Advisors, Inc.

loans, plus up to $1,500 for extended warranty insurance. The Bank follows its internal underwriting guidelines in evaluating automobile loans, including credit scoring.

Consumer loans also include loans secured by new and used boats and recreational vehicles, deposits and unsecured credit card and other consumer loans, all of which, at March 31, 2008, totaled $15.6 million, or 12.2% of the gross loan portfolio. Loans secured by boats and recreational vehicles typically have terms up to twenty years, and loan-to-value ratios up to 90%. They are made with fixed and adjustable rates. Although the Bank currently originates boat and recreational vehicle loans on a direct basis, the board recently adopted a policy to originate up to $10.0 million in boat loans and $5.0 million in recreational vehicle loans using the same underwriting guidelines as comparable direct loans. Unsecured consumer loans either have a fixed rate of interest generally for a maximum term of 60 months, or are revolving lines of credit of generally up to $50,000. At March 31, 2008, unfunded commitments on unsecured lines of credit totaled $13.2 million, and the average outstanding balance on these lines was approximately $5,700.

Consumer loans generally have shorter terms to maturity, which reduces exposure to changes in interest rates. In addition, management believes that offering consumer loan products helps to expand and create stronger ties to the existing customer base by increasing the number of customer relationships and providing cross-marketing opportunities.

Underwriting standards for consumer loans include a determination of the applicant’s credit history and an assessment of the applicant’s ability to meet existing obligations and payments on the proposed loan. The stability of the applicant’s monthly income may be

Feldman Financial Advisors, Inc.

determined by verification of gross monthly income from primary employment, and additionally from any verifiable secondary income.

Consumer and other loans generally entail greater risk than do one- to four-family residential mortgage loans, particularly in the case of consumer loans that are secured by rapidly depreciable assets, such as manufactured homes, automobiles, boats and other recreational vehicles. In these cases, any repossessed collateral for a defaulted loan may not provide an adequate source of repayment of the outstanding loan balance. As a result, consumer loan collections are dependent on the borrower’s continuing financial stability and, thus, are more likely to be adversely affected by job loss, divorce, illness or personal bankruptcy.

Subprime Lending. Prior to 2006, Sunshine Savings Bank made a significant amount of loans to borrowers that are considered “subprime” as defined by banking regulators. These loans are considered subprime typically because the borrowers have weakened credit histories that include payment delinquencies and possibly more severe problems such as charge-offs, judgments, and bankruptcies. These subprime loans may also display reduced repayment capacity as measured by the borrowers’ credit scores, debt-to-income ratios, or other criteria such as limited credit histories. In exchange for the additional lender risk associated with subprime loans, the Bank generally receives a higher interest rate on the loan, and depending on the severity of the credit history, a lower loan-to-value ratio may have been required as well, compared to that required for a borrower of a loan meeting conforming secondary market standards.

As of March 31, 2008, the Bank held in its subprime loan portfolio approximately $18.9 million in one-to four-family mortgage loans (of which $4.8 million were adjustable rate), $4.9

Feldman Financial Advisors, Inc.

million of automobile loans (of which $4.1 million were adjustable rate) and $7.6 million in other types of consumer loans (of which $4.9 million were adjustable rate). These subprime loans represent in the aggregate approximately 25% of the gross loan portfolio at March 31, 2008.

Loans originated prior to 2006 (the year in which the Bank changed its lending focus and implemented more stringent underwriting standards) were subject to $1.4 million in charge-offs, specific loss and valuation allowances and provisions for loan losses on foreclosed assets from January 1, 2006 through March 31, 2008. In comparison, the $64.8 million in loans originated after December 31, 2005 were subject to only $0.5 million in charge-offs, specific loss and valuation allowances and provisions for loan losses on foreclosed assets during this same time period. Of the $1.5 million in non-performing loans and $135,000 in foreclosed assets as of March 31, 2008, $1.7 million were originated prior to 2006, $300,000 were originated after December 31, 2005 and $1.6 million relate to subprime borrowers. There can be no assurance, however, that the level of delinquencies experienced with respect to subprime loans or loans originated after December 31, 2005 loans will not increase as this pool continues to age, particularly if the local economy weakens.

Loans to One Borrower. At March 31, 2008, the maximum amount under federal law that Sunshine Savings Bank could lend to any one borrower and the borrower’s related entities was approximately $2.8 million. The Bank’s largest lending relationship consists of a $680,000 loan secured by a principal residence. The next four largest were also secured by a principal residence and ranged in total from $413,000 to $554,000. All five loans were current as of March 31, 2008.

Feldman Financial Advisors, Inc.

Investment Portfolio

Sunshine Savings Bank’s investment portfolio has historically been a small portion of its assets as the Bank attempt to be fully invested in loans. The Bank does intend, however, to utilize its borrowing capacity at the Federal Home Loan Bank (“FHLB”) of Atlanta to purchase investment grade securities to leverage the balance sheet and increase net interest income. In addition, Sunshine Savings Bank expects its net proceeds initially will be used to invest in short-term liquid assets such as U.S. Government and federal agency securities of various maturities, mortgage-backed or other marketable securities, deposits in other financial institutions, or a combination thereof, until they can be deployed in an orderly fashion. The general objectives of the investment portfolio will be to provide liquidity when loan demand is high, to assist in maintaining earnings when loan demand is low and to maximize earnings while satisfactorily managing risk, including credit risk, reinvestment risk, liquidity risk and interest rate risk. Investment quality will emphasize safer investments with the yield on those investments secondary to not taking unnecessary risk with the available funds of Sunshine Savings Bank.

The Bank does not currently participate in hedging programs, interest rate caps, floors or swaps, or other activities involving the use of off-balance sheet derivative financial instruments. Further, it does not invest in securities which are not rated investment grade.

At March 31, 2008 and December 31, 2007 and 2006, the Bank did not have any investment securities. As a member of the FHLB, the Bank had $283,000 in stock of the Federal Home Loan Bank of Atlanta at March 31, 2008. The Bank also had $29.7 million of fed funds and $3.1 million of interest-bearing deposits as of March 31, 2008.

Feldman Financial Advisors, Inc.

Deposit Portfolio

Deposits are The Bank’s major source of funds for lending and other investment purposes. Exhibit II-4 and Table 4 presents a summary of the Company’s deposit composition as of March 31, 2008 and December 31, 2006 to 2007. Total deposits amounted to $148.9 million at March 31, 2008.

Current deposit products include checking, savings, money market, savings accounts, and certificates of deposit accounts ranging in terms from seven months to sixty months, and individual retirement accounts with terms starting at eighteen months. Deposit account terms vary, primarily as to the required minimum balance amount, the amount of time that the funds must remain on deposit and the applicable interest rate. The Bank solicits deposits primarily in its market areas. At March 31, 2008, the Bank had no brokered, Internet or wholesale deposits. Sunshine Savings Bank primarily relies on competitive pricing policies, marketing and customer service to attract and retain these deposits. As of March 31, 2008, core deposits, which are define as non-certificate or non-time deposit accounts, represented approximately 48.4% of total deposits.

Feldman Financial Advisors, Inc.

Table 4

Deposit Portfolio Distribution

As of December 31, 2006 to 2007 and March 31, 2008

(Dollars in Thousands)

| | | March 31, | | | December 31, | |

| | | 2008 | | | 2007 | | | 2006 | |

| | | Amount | | | Percent | | | Amount | | | Percent | | | Amount | | | Percent | |

| Real estate loans: | | (Dollars in thousands) | |

| One- to four-family | | $ | 77,537 | | | | 60.76 | % | | | 75834 | | | | 59.68 | % | | | 65547 | | | | 54.88 | % |

| Construction or development | | | 708 | | | | 0.56 | | | | 592 | | | | 0.47 | | | | 0 | | | | 0 | |

| Total real estate loans | | | 78,245 | | | | 61.32 | | | | 76426 | | | | 60.15 | | | | 65547 | | | | 54.88 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer loans: | | | | | | | | | | | | | | | | | | | | | | | | |

| Home equity | | | 19,026 | | | | 14.91 | | | | 19,032 | | | | 14.99 | | | | 15,547 | | | | 13.02 | |

| Automobile | | | 14,723 | | | | 11.54 | | | | 16,236 | | | | 12.78 | | | | 20,936 | | | | 17.53 | |

| Credit cards and unsecured | | | 11,874 | | | | 9.3 | | | | 12,653 | | | | 9.96 | | | | 14,537 | | | | 12.17 | |

| Deposit account | | | 1,520 | | | | 1.19 | | | | 1,816 | | | | 1.42 | | | | 1,979 | | | | 1.66 | |

| Other | | | 2216 | | | | 1.74 | | | | 905 | | | | 0.7 | | | | 881 | | | | 0.74 | |

| Total consumer loans | | | 49,359 | | | | 38.68 | | | | 50,642 | | | | 39.85 | | | | 53,880 | | | | 45.12 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total loans | | $ | 127,604 | | | | 100.00 | % | | $ | 127,068 | | | | 100.00 | % | | $ | 119,427 | | | | 100.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less: | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans in process | | | (175 | ) | | | | | | | (7 | ) | | | | | | | (215 | ) | | | | |

| Deferred fees and discounts | | | 42 | | | | | | | | 50 | | | | | | | | 95 | | | | | |

| Allowance for losses | | | 1,453 | | | | | | | | 1,423 | | | | | | | | 1,526 | | | | | |

| Total loans, net | | $ | 126,284 | | | | | | | $ | 125,602 | | | | | | | $ | 118,021 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Sunshine Savings Bank; preliminary prospectus.

The flow of deposits is influenced significantly by general economic conditions, changes in money market and prevailing interest rates and competition. The variety of deposit accounts we offer has allowed us to be competitive in obtaining funds and to respond with flexibility to changes in consumer demand. The Bank has become more susceptible to short-term fluctuations in deposit flows as customers have become more interest rate conscious. Sunshine Savings Bank tries to manage the pricing of deposits in keeping with the asset/liability management, liquidity and profitability objectives, subject to competitive factors. Based on experience, the Bank believe that its deposit portfolio is a relatively stable source of funds. Despite this stability, the ability to attract and maintain these deposits and the rates paid on them has been and will continue to be significantly affected by market conditions.

Feldman Financial Advisors, Inc.

A large percentage of deposits are in certificates of deposit. Liquidity could be reduced if a significant amount of certificates of deposit, maturing within a short period of time, were not renewed. Historically, a significant portion of the certificates of deposit remain after they mature and management believes that this will continue. However, the need to retain these time deposits could result in an increase in the cost of funds.

Table 5 sets forth certificates of deposit classified by interest rate as of the date indicated.

Borrowings

To supplement deposits as a source of funds for lending or investment, the Bank may borrow funds in the form of advances from the FHLB. The Bank has a credit agreement with the FHLB and this credit arrangement is subject to annual renewal and incurs no service charges. FHLB advances are typically secured by the FHLB stock and a portion of residential mortgage loans and by other assets, mainly securities which are obligations of or guaranteed by the U.S. government.

Feldman Financial Advisors, Inc.

Table 5

Certificates of Deposit by Interest Rate

At March 31, 2008

(Dollars in Thousands)

| | | | 2.00- | | | | 4.00- | | | | 6.00- | | | | | | Percent | |

| | | | 3.99% | | | | 5.99% | | | | 7.99% | | | Total | | | of Total | |

Certificate accounts maturing in quarter ending: | | (Dollars in Thousands) | |

| | | | | | | | | | | | | | | | | | | |

| June 30, 2008 | | $ | 1,055 | | | $ | 15,126 | | | $ | - | | | $ | 16,181 | | | | 21.06 | % |

| September 30, 2008 | | | 754 | | | | 13,297 | | | | - | | | | 14,051 | | | | 18.29 | |

| December 31, 2008 | | | 3,562 | | | | 12,953 | | | | - | | | | 16,515 | | | | 21.49 | |

| March 31, 2009 | | | 1,108 | | | | 9,410 | | | | 122 | | | | 10,640 | | | | 13.85 | |

| June 30, 2009 | | | 272 | | | | 14,883 | | | | - | | | | 15,155 | | | | 19.72 | |

| September 30, 2009 | | | 406 | | | | 675 | | | | - | | | | 1,081 | | | | 1.41 | |

| December 31, 2009 | | | 232 | | | | 544 | | | | - | | | | 776 | | | | 1.01 | |

| March 31, 2010 | | | 206 | | | | 199 | | | | - | | | | 405 | | | | 0.53 | |

| June 30, 2010 | | | 92 | | | | 100 | | | | - | | | | 192 | | | | 0.25 | |

| September 30, 2010 | | | 53 | | | | 171 | | | | - | | | | 224 | | | | 0.29 | |

| December 31, 2010 | | | 19 | | | | 39 | | | | - | | | | 58 | | | | 0.08 | |

| March 31, 2011 | | | 63 | | | | 99 | | | | - | | | | 162 | | | | 0.21 | |

| Thereafter | | | 103 | | | | 1,291 | | | | 0 | | | | 1,394 | | | | 1.81 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 7,925 | | | $ | 68,787 | | | $ | 122 | | | $ | 76,834 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Percent of total | | | 10.3 | % | | | 89.5 | % | | | 0.2 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Source: Sunshine Savings Bank; preliminary prospectus.

At March 31, 2008, the Bank had no FHLB advances outstanding. The Bank plans on relying, in part, on long-term FHLB advances to fund asset and loan growth. The Bank is required to own stock in the Federal Home Loan Bank of Atlanta based on the amount of advances. At March 31, 2008, the Bank had $283,000 in FHLB stock.

Table 6 sets forth the actual and maximum month-end balances and average balance of borrowings for the periods indicated.

Feldman Financial Advisors, Inc.

Table 6

Borrowings

Years Ended December 31, 2006 and 2007 and the Quarters Ended March 31, 2007 and 2008

(Dollars in Thousands)

| | | Three Months Ended March 31, | | | Year Ended December 31, | |

| | | 2008 | | | 2007 | | | 2007 | | | 2006 | |

| Maximum balance: | | (Dollars in thousands) | |

| Other borrowings | | $ | 500 | | | $ | 0 | | | $ | 500 | | | $ | 0 | |

| | | | | | | | | | | | | | | | | |

| Average balances and rates | | | | | | | | | | | | | | | | |

| Other borrowings | | | 250 | | | | 0 | | | | 17 | | | | 63 | |

| | | | | | | | | | | | | | | | | |

| Weighted average interest rate of | | | | | | | | | | | | | | | | |

| Other borrowings | | | 4.80 | % | | | 0.00 | % | | | 8.50 | % | | | 5.00 | % |

| | | | | | | | | | | | | | | | | |

| Period end balances: | | | | | | | | | | | | | | | | |

| Federal Home Loan Bank advances | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

| Other borrowings | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

| | | | | | | | | | | | | | | | | |

| Weighted average interest rate of | | | | | | | | | | | | | | | | |

| Other borrowings | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| | | | | | | | | | | | | | | | | |

Source: Sunshine Savings Bank, preliminary prospectus.

Equity Capital

At March 31, 2008, total equity was $17.5 million. The decrease from 2007 year-end reflected the net loss incurred during the quarter. As of March 31, 2008, the Bank exceeded all applicable regulatory capital requirements and was well capitalized. Total equity was $17.8 million at December 31, 2007 and $17.5 million at December 31, 2006. The increase during 2007 reflected net income of $307,000 for the year.

The Bank’s core capital amounted to $16.6 million or 9.94% of adjusted total assets at March 31, 2008. The Bank’s regulatory capital ratios of Tier 1 risk-based capital, and total risk-based capital were 15.54%, and 16.79%, respectively, as of March 31, 2008. In comparison, the minimum regulatory requirements were 3.00%, 4.00%, and 8.00%, and the threshold requirements for regulatory “well-capitalized” levels were 5.00%, 6.00%, and 10.00%, respectively.

Feldman Financial Advisors, Inc.

Income and Expense Trends

Table 7 displays the main components of the Company’s earnings performance over the quarters ended March 31, 2007 and 2008 and the fiscal years ended December 31, 2005 to 2007. Table 8 displays sets forth certain information relating yields and costs at and for the periods indicated. The average yields and costs are derived by dividing income or expense by the daily average balance of assets or liabilities, respectively, for the periods presented. Table 9 reflects the sensitivity of Sunshine Savings Bank’s interest income and interest expense to changes in volume and in prevailing interest rates during the periods indicated.

Table 7

Summary Income Statement Data

For Years Ended December 31, 2005 to 2007

And the Quarter Ended March 31, 2007 and 2008

| | | For the Three Months Ended March 31, | | | For the Year Ended December 31, | |

| | | 2008 | | | 2007 | | | 2007 | | | 2006 | | | 2005 | |

| | | (In thousands) | |

| Total interest income | | $ | 2,232 | | | $ | 2,210 | | | $ | 9,019 | | | $ | 9,382 | | | $ | 9,917 | |

| Total interest expense | | | 1,052 | | | | 645 | | | | 3,227 | | | | 2,209 | | | | 1,885 | |

| Net interest income | | | 1,180 | | | | 1,565 | | | | 5,792 | | | | 7,173 | | | | 8,032 | |

| Provision for loan losses | | | 225 | | | | 225 | | | | 898 | | | | 897 | | | | 1,432 | |

| Net interest income after provision for loan losses | | | 955 | | | | 1,340 | | | | 4,894 | | | | 6,276 | | | | 6,600 | |

| Fees and service charges | | | 470 | | | | 527 | | | | 2,438 | | | | 2,584 | | | | 2,714 | |

| Other non-interest income | | | 54 | | | | 104 | | | | 9 | | | | (13 | ) | | | (4 | ) |

| Total non-interest income | | | 524 | | | | 631 | | | | 2,447 | | | | 2,571 | | | | 2,710 | |

| Total non-interest expense | | | 1,897 | | | | 1,846 | | | | 7,604 | | | | 7,926 | | | | 7,945 | |

| Income (loss) before income tax expense (benefit) | | | (418 | ) | | | 125 | | | | (263 | ) | | | 921 | | | | 1,365 | |

Income tax expense (benefit)(1) | | | (157 | ) | | | - | | | | (570 | ) | | | - | | | | - | |

Net income (loss)(1) | | $ | (261 | ) | | $ | 125 | | | $ | 307 | | | $ | 921 | | | $ | 1,365 | |

| | | | | | | | | | | | | | | | | | | | | |

Source: Sunshine Savings Bank, preliminary prospectus.

Feldman Financial Advisors, Inc.

Table 8

Average Balances and Yields

For the Years Ended December 31, 2006 and 2007

and the Quarters Ended March 31, 2007 and 2006

| | At March 31, | | Three Months ended March 31, | | Year Ended December 31, |

| 2008 | | 2008 | | 2007 | | 2007 | | 2006 |

Yield/ Rate | | Average Outstanding Balance | Interest Earned/ Paid | Yield/ Rate | | Average Outstanding Balance | Interest Earned/ Paid | Yield/ Rate | | Average Outstanding Balance | Interest Earned/ Paid | Yield/ Rate | | Average Outstanding Balance | Interest Earned/ Paid | Yield/ Rate | |

| |

| |

| | (Dollars in thousands) | |

Interest-Earning Assets: | | | | | | | | | | | | | | | | | | |

Loans receivable(1) | 6.66 | % | $124,680 | $2,036 | 6.53 | % | $118,728 | $2,120 | 7.14 | % | $122,071 | $8,560 | 7.01 | % | $115,351 | $8,805 | 7.63 | % |

| Investments | | | -- | -- | -- | | -- | -- | -- | | -- | -- | -- | | 2,316 | 73 | 3.17 | |

| FHLB stock | 5.85 | | 248 | 4 | 5.96 | | 288 | 3 | 4.17 | | 257 | 15 | 5.85 | | 303 | 17 | 5.61 | |

| Other interest-earning assets | 4.12 | | 22,829 | 192 | 3.36 | | 5,780 | 86 | 6.02 | | 10,087 | 444 | 4.40 | | 8,004 | 487 | 6.08 | |

| | | | | | | | | | | | | | | | | | | |

Total interest-earning assets(1) | 6.22 | | 147,757 | 2,232 | 6.04 | | 124,796 | 2,209 | 7.08 | | 132,415 | 9,019 | 6.81 | | 125,974 | 9,382 | 7.45 | |

| | | | | | | | | | | | | | | | | | | |

Interest-Bearing Liabilities: | | | | | | | | | | | | | | | | | | |

| MMDA and savings | 1.33 | | 49,222 | 166 | 1.35 | | 54,598 | 184 | 1.35 | | 51,627 | 705 | 1.37 | | 59,373 | 724 | 1.22 | |

| Time deposits | 4.94 | | 71,109 | 882 | 4.96 | | 41,729 | 460 | 4.41 | | 51,812 | 2,521 | 4.87 | | 38,982 | 1,482 | 3.80 | |

| Notes payable | | | 250 | 3 | 4.80 | | 42 | 1 | 5.68 | | 17 | 1 | 5.91 | | 49 | 3 | 4.75 | |

| | | | | | | | | | | | | | | | | | | |

| Total interest-bearing liabilities | 3.53 | % | $120,581 | $1,051 | 3.49 | % | $96,369 | $645 | 2.68 | % | $103,456 | $3,227 | 3.12 | % | $98,404 | $2,209 | 2.24 | % |

| | | | | | | | | | | | | | | | | | | |

| Net interest income | | | | $1,181 | | | | $1,564 | | | | $5,792 | | | | $7,173 | | |

| Interest rate spread | 2.69 | % | | | 2.56 | % | | | 4.40 | % | | | 3.69 | % | | | 5.21 | % |

| Net earning assets | | | $27,176 | | | | $28,427 | | | | $28,959 | | | | $27,570 | | | |

Net interest margin(2) | 3.12 | % | | | 3.20 | % | | | 5.02 | % | | | 4.37 | % | | | 5.69 | % |

Ratio of average interest-earning assets to average interest-bearing liabilities | | | | | | | | | | | 127.99 | % | | | 128.02 | % | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1) Calculated net of deferred loan fees, loan discounts, loans in process and loss reserves. |

(2) Net interest margin represents net interest income as a percentage of average interest-bearing assets. |

Source: Sunshine Savings Bank, preliminary prospectus.

Feldman Financial Advisors, Inc.

Table 9

Rate/Volume Analysis

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Quarter Ended March 31, | | | Year Ended December 31, | |

| | | 2008 vs. 2007 | | | 2007 vs. 2006 | |

| | | Increase | | | Total | | | Increase | | | Total | |

| | (decrease) due to | | | increase | | | (decrease) due to | | | increase | |

| | | Volume | | | Rate | | | (decrease) | | | Volume | | | Rate | | | (decrease) | |

Interest-earning assets: | | (In thousands) | |

| Loans receivable | | $ | 106 | | | $ | (190 | ) | | $ | (84 | ) | | $ | 513 | | | $ | (758 | ) | | $ | (245 | ) |

| Investments | | | - | | | | - | | | | - | | | | (73 | ) | | | - | | | | (73 | ) |

| FHLB Stock | | | - | | | | 1 | | | | 1 | | | | (3 | ) | | | 1 | | | | (2 | ) |

| Other interest-earning assets | | | 254 | | | | (148 | ) | | | 106 | | | | 127 | | | | (170 | ) | | | (43 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-earning assets | | $ | 360 | | | $ | (337 | ) | | $ | 23 | | | $ | 564 | | | $ | (927 | ) | | $ | (363 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| NOW, DDA, savings | | $ | (18 | ) | | $ | 0 | | | $ | (18 | ) | | $ | (94 | ) | | $ | 75 | | | $ | (19 | ) |

| Time deposits | | | 324 | | | | 98 | | | | 422 | | | | 488 | | | | 551 | | | | 1,039 | |

| Notes Payable | | | 3 | | | | (1 | ) | | | 2 | | | | (2 | ) | | | - | | | | (2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-bearing liabilities | | $ | 309 | | | $ | 97 | | | $ | 406 | | | $ | 392 | | | $ | 626 | | | $ | 1,018 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 51 | | | $ | (434 | ) | | $ | (383 | ) | | $ | 172 | | | $ | (1,553 | ) | | $ | (1,381 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Sunshine Savings Bank, preliminary prospectus.

As noted in the tables above, earnings have deteriorated over the past few years. Net income declined from $1.4 million for the year ended December 31, 2005 to $307,000 for the year ended December 31, 2007. Removing the tax benefit that the Bank received when it converted from a credit union to a federally chartered mutual savings bank, the Bank would have reported a loss of $263,000 for the year ended December 31, 2007. For the three months ended March 31, 2008, the Bank reported a loss of $261,000 compared to net income of $125,000 for the same period in 2007.

Management believes the primary factor in the declining earnings has been the deterioration in its interest rate spread and margin as he Bank shifts its focus to mortgage lending. The interest rate spread, which is the difference between the average yield earned on

Feldman Financial Advisors, Inc.

interest-earning assets and the average rate paid on interest-bearing liabilities, declined steadily from 5.47% in fiscal 2005 to 3.69% in fiscal 2007 and then to 2.56% during the three months ended March 31, 2008. As such, the Bank has become even more reliant on non-interest income in order to generate net income. Management does not expect that there will be sufficient net interest income to absorb the projected growth in non-interest expenses arising from the Bank’s programmed expansion, repositioning and organizational restructuring. Management also expects that non-interest expenses will be higher for 2008 as a result of the accounting, legal and various other additional non-interest expenses usually associated with operating as a public company, particularly as a result of the requirements of the Sarbanes-Oxley Act of 2002. Additional annual employee compensation and benefit expenses stemming from the shares granted to employees, officers and directors under new benefit plans will also increase non-interest expenses.

Comparison of Operating Results for the Three Months Ended March 31, 2008 and 2007

Net income for the three months ended March 31, 2008 was a loss of $261,000 compared to net income of $125,000 for the three months ended March 31, 2007. The earnings represent a return on average assets for the period of (0.67)% for 2008 and 0.37% for 2007.

The decrease in net income was due primarily to a decrease in the interest rate spread. The average yield on assets decreased to 6.53% for the three months ended March 31, 2008 from 7.14% for the three months ended March 31, 2007. This decline was expected due to a change in emphasis from higher risk and higher rate consumer automobile and unsecured lending to lower risk and lower yielding single-family mortgage lending. In addition, the average cost of

Feldman Financial Advisors, Inc.

liabilities increased to 3.49% for the three months ended March 31, 2008 from 2.68% for the three months ended March 31, 2007, primarily due to the higher cost of certificate of deposit accounts.

Net Interest Income. Net interest income decreased $383,000, or 24.5%, to $1.2 million for the three months ended March 31, 2008 from $1.6 million for the same period in 2007 as the increase in the average balance of the loan portfolio was not enough to offset the lower rates earned on loans and the increased costs of deposits. The interest spread decreased to 2.56% for the three months ended March 31, 2008 from 4.40% for the same period in 2007, while the average net interest margin declined to 3.12% at March 31, 2008 from 5.01% at March 31, 2007. The ratio of average interest earning assets to average interest bearing liabilities decreased to 122.5% at March 31, 2008, from 129.5% as of March 31, 2007.

Interest Income. Interest income for the three months ended March 31, 2008 and March 31, 2007 was $2.2 million. While the total interest income remained stable, the yield on loans decreased to 6.53% for the three months ended March 31, 2008 from 7.14% for the three months ended March 31, 2007, primarily the result of emphasizing lower yielding and lower risk mortgage loan products. In addition, the overall yield on average earning assets decreased to 6.04% from 7.08% for the same period due to lower yielding loans and lower yielding federal funds sold.

Interest Expense. Interest expense for the three months ended March 31, 2008 was $1.0 million compared to $0.6 million for the same period in 2007, an increase of $0.4 million. The increase was primarily the result of an increase in both the average balance and average rate of certificate accounts. Average certificate accounts increased to $71.1 million for the three-month

Feldman Financial Advisors, Inc.

period ended March 31, 2008 from $41.7 million for the same period in 2007 and the average rate paid on certificates increased to 4.96% from 4.41%. It is noteworthy that the Bank has $46.7 million, or 61% of total certificates, that will mature from April 1, 2008 through December 31, 2008, which are costing an average rate of 5.08%. It is expected, but not certain, that these certificates would most likely be renegotiated at significantly lower rates, thus reducing the banks overall cost of funds and increasing its net interest margin.

Provision for Loan Losses. The Bank establishes an allowance for loan losses by charging amounts to the loan provision at a level required to reflect estimated credit losses in the loan portfolio. In evaluating the level of the allowance for loan losses, management considers, among other factors, historical loss experience, the types of loans and the amount of loans in the loan portfolio, adverse situations that may affect borrowers’ ability to repay, estimated value of any underlying collateral, prevailing economic conditions, and current factors.

Based on management’s evaluation of these factors, the provision for loan losses was $225,000 for the three months ended March 31, 2008 and 2007. Net charge-offs for the three months ended March 31, 2008 were $195,000 compared to $250,000 for the three month period ended March 31, 2007. For 2008, net charge-offs consisted of $85,000 for automobile loans, $94,000 for unsecured loans, and $16,000 for home equity loans. For the same period in 2007, net charge-offs consisted of $141,000 for automobile loans, and $109,000 for unsecured loans. Non-performing loans to total loans at March 31, 2008 were 1.20% compared to 0.30% at March 31, 2007. The allowance for loan losses to net loans receivable was 1.14% at March 31, 2008 compared to 1.25% at March 31, 2007.

Feldman Financial Advisors, Inc.

Non-interest Income. Non-interest income for the three months ended March 31, 2008 declined $107,000 to $524,000 compared to $631,000 for the same period in 2007. Loan fees and service charges on deposit accounts decreased by $39,000 and $57,000, respectively, for the three months ended March 31, 2008, compared to the three months ended March 31, 2007 due to a reduction in our fee schedule and the number of demand accounts.

Non-interest Expense. Non-interest expense for the three months ended March 31, 2008 was $1.9 million, compared to $1.8 million for the same period in 2007. The largest increase occurred in salaries and employee benefits, which was attributable to an increase in employees, normal merit pay increases as well as increased insurance costs. The number of full-time equivalent employees at March 31, 2008 was 81.