Exhibit 99.3

Feldman Financial Advisors, Inc.

1001 Connecticut Avenue, NW · Suite 840

Washington, DC 20036

202-467-6862 · (Fax) 202-467-6963

Home Federal Bancorp, Inc. of Louisiana Shreveport, Louisiana Conversion Valuation Appraisal Report Valued as of February 25, 2008 Prepared By Feldman Financial Advisors, Inc. Washington, D.C. |

Feldman Financial Advisors, Inc.

1001 Connecticut Avenue, NW · Suite 840

Washington, DC 20036

202-467-6862 · (Fax) 202-467-6963

Board of Directors

Home Federal Bancorp, Inc. of Louisiana

624 Market Street

Shreveport, Louisiana 71101-3643

Members of the Board:

At your request, we have completed and hereby provide an independent appraisal (the “Appraisal”) of the estimated pro forma market value of the common stock to be issued (the “Stock Offering”) by Home Federal Bancorp, Inc. of Louisiana (“Home Federal Bancorp” or the “Company”), a new Louisiana corporation, headquartered in Shreveport, Louisiana, as of February 25, 2008, in connection with the mutual-to-stock conversion of Home Federal MHC of Louisiana (the “MHC”). Currently, the MHC’s principal activity is the ownership of the majority interest approximating 63.1% in Home Federal Bancorp, Inc. of Louisiana (“Bancorp”), a federal corporation, the current mid-tier holding company for Home Federal Savings and Loan Association (the “Bank”). The remainder of the Bancorp’s shares (36.9%) is owned by public stockholders. Home Federal Bancorp owns a 100% interest in the common stock of the Bank. At the conclusion of the conversion, the MHC and Bancorp will no longer exist. Home Federal Bancorp is offering for sale common stock representing the majority ownership interest in Bancorp in a subscription offering to Eligible Account Holders, Supplemental Eligible Account Holders and Other Members. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale in a community offering to current holders of Bancorp shares as of the Record Date, members of the local community and the public at large. At the conclusion of the conversion, existing public stockholders of Bancorp will receive new shares of common stock of the Company in exchange for their existing shares. Home Federal Bancorp will be renamed "First Louisiana Bancshares, Inc." after the conversion and offering have been completed and shares will be issued in that name.

In connection with the conversion, Home Federal Bancorp will acquire First Louisiana Bancshares, Inc. (“First Louisiana”). On December 12, 2007, Home Federal Bancorp entered into a definitive agreement to acquire First Louisiana. First Louisiana is the holding company of First Louisiana Bank, which is based in, Shreveport, Louisiana. Pursuant to the definitive agreement, shareholders of First Louisiana will be entitled to receive $28.00 in cash or a number of shares of Home Federal Bancorp common stock based on the IPO price, subject to a requirement that 60% of the total outstanding First Louisiana common stock be exchanged for stock. Assuming an IPO price of $10.00 per share, each share of First Louisiana being exchanged would receive 2.8 shares of the new holding company. As of December 31, 2007, First Louisiana had 788,524 shares of common stock issued and outstanding. The aggregate merger consideration is estimated to amount to $23.7 million.

Feldman Financial Advisors, Inc

Board of Directors

Home Federal Bancorp, Inc. of Louisiana

February 25, 2008

Page Two

This Appraisal has been prepared in accordance with the “Guidelines for Appraisal Reports for the Valuation of Savings and Loan Associations Converting from Mutual to Stock Form of Organization” of the OTS.

Feldman Financial Advisors, Inc. (“Feldman Financial”) is a financial consulting and economic research firm that specializes in financial valuations and analyses of business enterprises and securities in the thrift, banking, and mortgage industries. The background of Feldman Financial is presented in Exhibit I. In preparing the Appraisal, we conducted an analysis of the Company that included discussions with the Company’s management, the Company’s legal counsel, Elias, Matz, Tiernan & Herrick L.L.P., and the Company’s independent auditor, LaPorte Sehrt Romig Hand. In addition, where appropriate, we considered information based on other available published sources that we believe are reliable; however, we cannot guarantee the accuracy and completeness of such information.

We also reviewed, among other factors, the economy in the Company’s primary market area and compared the Company’s financial condition and operating performance with that of selected publicly traded thrift institutions. We reviewed conditions in the securities markets in general and in the market for thrift institution common stocks in particular.

The Appraisal is based on the Company’s representation that the information contained in the Prospectus and additional evidence furnished to us by the Company and its independent auditor are truthful, accurate, and complete. We did not independently verify the financial statements and other information provided by the Company and its independent auditor, nor did we independently value the assets or liabilities of the Company. The Appraisal considers the Company only as a going concern and should not be considered as an indication of the liquidation value of the Company.

It is our opinion that, as of February 25, 2008, the estimated pro forma market value of the Company on a fully converted basis was within a range (the “Valuation Range”) of $37,488,490 to $46,044,460 with a midpoint of $41,765,850. This value includes the 1,324,720 merger shares issued to First Louisiana Bancshares’ shareholders as part of the $23.7 million cash and stock acquisition of First Louisiana Bancshares. The Valuation Range was based upon a 15% decrease from the midpoint to determine the minimum and a 15% increase from the midpoint to establish the maximum. Assuming an additional 15% decrease below the minimum would result in an adjusted minimum valuation of $35,193,490 and a 15% increase above the maximum value would result in an adjusted maximum of $50,963,920.

Feldman Financial Advisors, Inc

Board of Directors

Home Federal Bancorp, Inc. of Louisiana

February 25, 2008

Page Three

Based on the foregoing valuation, the corresponding range of shares and market values based on a $10.00 per share price are as follows:

| | | Offering | | | Exchanged | | | Merger | | | Total | |

| | | Shares | | | Shares | | | Shares | | | Shares | |

| | | | | | | | | | | | | |

| Shares | | | | | | | | | | | | |

| Super maximum | | | 2,380,500 | | | | 1,391,172 | | | | 1,324,700 | | | | 5,096,392 | |

| Maximum | | | 2,070,000 | | | | 1,209,726 | | | | 1,324,700 | | | | 4,604,446 | |

| Midpoint | | | 1,800,000 | | | | 1,051,865 | | | | 1,324,700 | | | | 4,176,585 | |

| Minimum | | | 1,530,000 | | | | 894,129 | | | | 1,324,700 | | | | 3,748,849 | |

| Adjusted Minimum | | | 1,530,000 | | | | 894,129 | | | | 1,069,700 | | | | 3,519,349 | |

| | | | | | | | | | | | | | | | | |

| Market Value | | | | | | | | | | | | | | | | |

| Super maximum | | $ | 23,805,000 | | | $ | 13,911,720 | | | $ | 13,247,000 | | | $ | 50,963,920 | |

| Maximum | | $ | 20,700,000 | | | $ | 12,097,260 | | | $ | 13,247,000 | | | $ | 46,044,460 | |

| Midpoint | | $ | 18,000,000 | | | $ | 10,518,650 | | | $ | 13,247,000 | | | $ | 41,765,850 | |

| Minimum | | $ | 15,300,000 | | | $ | 8,841,290 | | | $ | 13,247,000 | | | $ | 37,488,490 | |

| Adjusted Minimum | | $ | 15,300,000 | | | $ | 8,941,290 | | | $ | 10,952,200 | | | $ | 35,193,490 | |

OTS regulations provide that in a conversion of a mutual holding company, the minority stockholders be entitled to exchange their current shares for newly issued shares of the fully converted Company. It is our understanding that the exchange ratio has been designed to preserve the current aggregate percentage ownership in Bancorp equal to 36.9%. The actual exchange ratio to be received by the existing minority shareholders of Bancorp will be determined at the end of the offering, based on the total number of shares sold in the subscription and community offerings. Based on this calculation, and the valuation offering range above, the Company’s exchange ratio would be 0.7165 shares, 0.8429 shares, 0.9694 shares and 1.1148 shares at the minimum (and adjusted minimum), midpoint, maximum and adjusted maximum of the offering range, respectively. Feldman Financial has no opinion on the proposed exchange ratio applied to the minority shares exchanged for newly issued shares of the Company.

Our Appraisal is not intended, and must not be construed, to be a recommendation of any kind as to the advisability of purchasing shares of common stock in the Stock Offering. Moreover, because the Appraisal is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of stock in the Stock Offering will thereafter be able to sell such shares at prices related to the foregoing estimate of the Company’s pro forma market value. Feldman Financial is not a seller of securities within the meaning of any federal or state securities laws and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

Feldman Financial Advisors, Inc

Board of Directors

Home Federal Bancorp, Inc. of Louisiana

February 25, 2008

Page Four

The valuation reported herein will be updated as appropriate. These updates will consider, among other factors, any developments or changes in the Company’s operating performance, financial condition, or management policies, and current conditions in the securities markets for thrift institution common stocks. Should any such new developments or changes be material, in our opinion, to the valuation of the Company, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in detail at that time.

| | Respectfully submitted, | |

| | | |

| | Feldman Financial Advisors, Inc. | |

| | | |

| | /s/ Trent R. Feldman | |

| | Trent R. Feldman | |

| | President | |

| | | |

| | /s/ Greg E. Izydorczyk | |

| | Greg E. Izydorczyk | |

| | Senior Vive President | |

Feldman Financial Advisors, Inc

TABLE OF CONTENTS

| TAB | | | PAGE |

| | | | |

| | | INTRODUCTION | 1 |

| | | | |

| I. | | Chapter One – BUSINESS OF HOME FEDERAL BANCORP AND FIRST | |

| | | LOUISIANA BANCSHARES | |

| | | General Overview | 4 |

| | | Financial Condition | 13 |

| | | Income and Expense Trends | 44 |

| | | Interest Rate Risk Management | 59 |

| | | Asset Quality | 62 |

| | | Market Area | 69 |

| | | Summary Outlook | 76 |

| | | | |

| II. | | Chapter Two – COMPARISONS WITH PUBLICLY HELD THRIFTS | |

| | | General Overview | 77 |

| | | Selection Criteria | 78 |

| | | Recent Financial Comparisons | 81 |

| | | | |

| III. | | Chapter Three – MARKET VALUE ADJUSTMENTS | |

| | | General Overview | 92 |

| | | Earnings Prospects | 93 |

| | | Financial Condition | 95 |

| | | Market Area | 97 |

| | | Management | 98 |

| | | Dividend Policy | 99 |

| | | Liquidity of the Issue | 100 |

| | | Subscription Interest | 100 |

| | | Stock Market Conditions | 101 |

| | | Recent Acquisition Activity | 102 |

| | | Marketability Discount | 104 |

| | | Adjustments Conclusion | 107 |

| | | Valuation Approach | 107 |

| | | Valuation Conclusion | 111 |

Feldman Financial Advisors, Inc

TABLE OF CONTENTS (Continued)

| TAB | | | | PAGE |

| | | | | | |

| | | | | | |

| IV. | | Appendix – EXHIBITS | |

| | | | | | |

| | | I | | Background of Feldman Financial Advisors, Inc. | I-1 |

| | | II-1 | | Consolidated Balance Sheet – Home Federal Bancorp | II-1 |

| | | II-2 | | Consolidated Income Statement – Home Federal Bancorp | II-2 |

| | | II-3 | | Consolidated Balance Sheet – First Louisiana Bancshares | II-3 |

| | | II-4 | | Consolidated Income Statement – First Louisiana Bancshares | II-4 |

| | | II-5 | | Loan Portfolio Composition – Home Federal Bancorp | II-5 |

| | | II-6 | | Loan Portfolio Composition – First Louisiana Bancshares | II-6 |

| | | II-7 | | Securities Portfolio – Home Federal Bancorp | II-7 |

| | | II-8 | | Securities Portfolio – First Louisiana Bancshares | II-8 |

| | | II-9 | | Deposit Portfolio – Home Federal Bancorp | II-9 |

| | | II-10 | | Deposit Portfolio – First Louisiana Bancshares | II-10 |

| | | III | | Financial and Market Data for All Public Thrifts | III-1 |

| | | IV-1 | | Pro Forma Assumptions for Fully Converted Valuation | IV-1 |

| | | IV-2 | | Pro Forma Fully-Converted Valuation Range – December 31, 2007 | IV-2 |

| | | IV-3 | | Pro Forma Fully-Converted Conversion Analysis at Midpoint | IV-3 |

| | | IV-4 | | Valuation Ratio Differential | IV-4 |

| | | IV-5 | | Pro Forma Fully-Converted Valuation Range – June 30, 2007 | IV-5 |

Feldman Financial Advisors, Inc

LIST OF TABLES

| TAB | | | | PAGE |

| | | | | |

| I. | Chapter One – BUSINESS OF HOME FEDERAL BANCORP | |

| | Table 1 | | Selected Financial Condition Data – Home Federal Bancorp | 13 |

| | Table 2 | | Selected Financial Condition Data – First Louisiana Bancshares | 14 |

| | Table 3 | | Pro Forma Balance Sheet as of December 31, 2007 | 19 |

| | Table 4 | | Pro Forma Balance Sheet as of June 30, 2007 | 20 |

| | Table 5 | | Loan Portfolio – Home Federal Bancorp | 23 |

| | Table 6 | | Loan Originations, Sales and Repayments – Home Federal Bancorp | 28 |

| | Table 7 | | Loan Portfolio – First Louisiana Bancshares | 29 |

| | Table 8 | | Securities Portfolio – Home Federal Bancorp | 33 |

| | Table 9 | | Securities Portfolio by Contractual Maturity – Home Federal Bancorp | 36 |

| | Table 10 | | Securities Portfolio – First Louisiana Bancshares | 37 |

| | Table 11 | | Deposit Portfolio – Home Federal Bancorp | 38 |

| | Table 12 | | Average Deposits and Yields – Home Federal Bancorp | 39 |

| | Table 13 | | Borrowings – Home Federal Bancorp | 41 |

| | Table 14 | | Deposit Portfolio – First Louisiana Bancshares | 42 |

| | Table 15 | | Summary Income Statement data – Home Federal Bancorp | 44 |

| | Table 16 | | Average Balances and Yields – Home Federal Bancorp | 45 |

| | Table 17 | | Average Balances and Yields – Home Federal Bancorp | 46 |

| | Table 18 | | Rate/Volume Analysis – Home Federal Bancorp | 47 |

| | Table 19 | | Average Balances and Yields – First Louisiana Bancshares | 54 |

| | Table 20 | | Rate/Volume Analysis – First Louisiana Bancshares | 55 |

| | Table 21 | | Pro Forma Income Statement - Six-Months Ended December 31, 2007 | 58 |

| | Table 22 | | Pro Forma Income Statement - Twelve-Months Ended June 30, 2007 | 58 |

| | Table 23 | | Interest Rate Risk Analysis – Home Federal Bancorp | 61 |

| | Table 24 | | Non-Performing Asset Summary – Home Federal Bancorp | 63 |

| | Table 25 | | Allowance for Loan Losses Summary – Home Federal Bancorp | 65 |

| | Table 26 | | Allocation of Allowance for Loan Losses – Home Federal Bancorp | 66 |

| | Table 27 | | Non-Performing Asset Summary – First Louisiana Bancshares | 67 |

| | Table 28 | | Allowance for Loan Losses Summary – First Louisiana Bancshares | 68 |

| | Table 29 | | Selected Demographic Data | 71 |

| | Table 30 | | Employment by Industry Shreveport-Bossier City MSA | 72 |

| | Table 31 | | Largest Employers in Caddo/Bossier City Parishes | 72 |

| | Table 32 | | Deposit Market Share – City of Shreveport | 74 |

| | Table 33 | | Deposit Market Share – City of Bossier | 74 |

| | Table 34 | | Deposit Market Share – Parish of Caddo | 75 |

| | Table 35 | | Deposit Market Share – Parish of Bossier City | 75 |

Feldman Financial Advisors, Inc

LIST OF TABLES (Continued)

| TAB | | | | PAGE |

| | | | | |

| | | | | |

| II. | Chapter Two – COMPARISONS WITH PUBLICLY HELD THRIFTS | |

| | Table 36 | | Comparative Group Operating Summary | 80 |

| | Table 37 | | Key Financial Comparisons | 83 |

| | Table 38 | | General Financial Performance Ratios | 87 |

| | Table 39 | | Income and Expense Analysis | 88 |

| | Table 40 | | Yield-Cost Structure and Growth Rates | 89 |

| | Table 41 | | Balance Sheet Composition | 90 |

| | Table 42 | | Regulatory Capital, Credit Risk, and Loan Composition | 91 |

| | | | | |

| III. | Chapter Three – MARKET VALUE ADJUSTMENTS | |

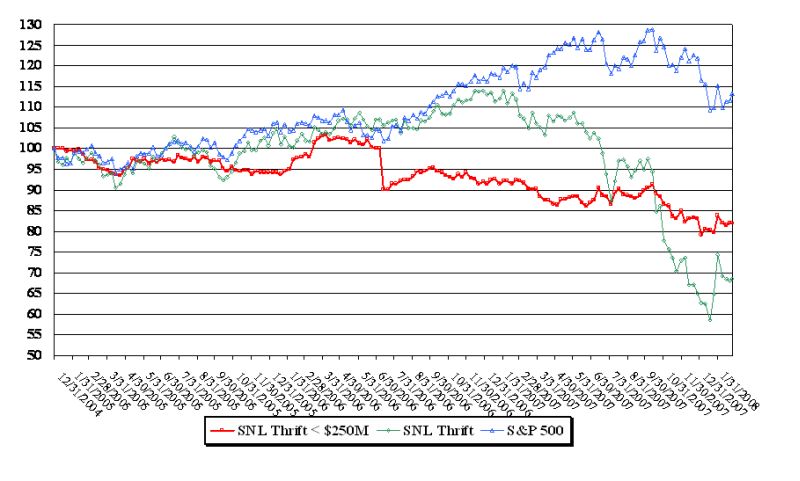

| | Table 43 | | Comparative Stock Index Performance | 103 |

| | Table 44 | | Summary of Recent Acquisition Activity | 105 |

| | Table 45 | | Summary of Recent Second-Step Stock Offerings | 106 |

| | Table 46 | | Pro Forma Comparative Market Valuation Analysis | 112 |

Feldman Financial Advisors, Inc

INTRODUCTION

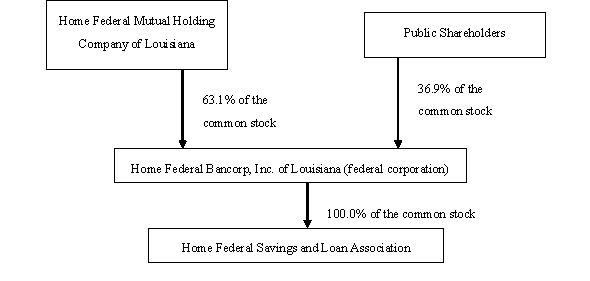

At your request, we have completed and hereby provide an independent appraisal (the “Appraisal”) of the estimated pro forma market value of the common stock to be issued (the “Stock Offering”) by Home Federal Bancorp, Inc. of Louisiana (“Home Federal” or the “Company”), a new Louisiana corporation, headquartered in Shreveport, Louisiana, as of February 25, 2008, in connection with the mutual-to-stock conversion of Home Federal Mutual Holding Company of Louisiana (the “MHC”). Currently, the MHC’s principal activity is the ownership of the majority interest approximating 63.1% in Home Federal Bancorp, Inc. of Louisiana (“Bancorp”), a federal corporation, the mid-tier holding company for Home Federal Savings and Loan Association (the “Bank”). Public stockholders own the remainder of the Bancorp’s shares (36.9%). Bancorp owns a 100% interest in the common stock of the Bank. At the conclusion of the conversion, the MHC and Bancorp will no longer exist.

As part of the conversion, the Company is offering for sale common stock representing the majority ownership interest in Bancorp that is currently held by Home Federal Mutual Holding Company of Louisiana in a subscription offering to Eligible Account Holders, Supplemental Eligible Account Holders and Other Members. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale in a community offering to current holders of Bancorp shares as of the Record Date, members of the local community and the public at large. At the conclusion of the conversion, existing public stockholders of Bancorp will receive new shares of common stock (adjusted for an exchange ratio) of the Company in exchange for their existing shares. This Appraisal has been prepared in accordance with the “Guidelines for Appraisal Reports for the Valuation of Savings and Loan Associations Converting from Mutual to Stock Form of Organization” of the Office of Thrift Supervision (“OTS”).

Feldman Financial Advisors, Inc

In the course of preparing the Appraisal, we reviewed and discussed with the Company’s management, the Company’s independent accountants, LaPorte Sehrt Romig Hand, the audited financial statements of the Company’s operations for the years ended June 30, 2006 and 2007, and the unaudited financial statements dated as of December 31, 2006 and 2007. We also reviewed and discussed with management other financial matters of the Bank and held discussions with Sandler O’Neill, the investment-banking firm engaged by the Company to market and sell the common stock.

Where appropriate, we considered information based upon other available public sources, which we believe to be reliable; however, we cannot guarantee the accuracy or completeness of such information. We visited the Company’s primary market area and examined the prevailing economic conditions. We also examined the competitive environment within which the Company operates and assessed the Company’s relative strengths and weaknesses.

We examined and compared the Company’s financial performance with selected segments of the thrift industry and selected publicly traded thrift institutions. We reviewed conditions in the securities markets in general and the market for thrift institution common stocks in particular. We included in our analysis an examination of the potential effects of the Stock Offering on the Company’s operating characteristics and financial performance as they relate to the estimated pro forma market value of the Company.

In preparing the Appraisal, we have relied upon and assumed the accuracy and completeness of financial and statistical information provided by the Company and its independent accountants. We did not independently verify the financial statements and other information provided by the Company and its independent accountants, nor did we independently value the assets or liabilities of the Company. The Appraisal considers the Company only as a going concern and should not be considered as an indication of the liquidation value of the Company.

Feldman Financial Advisors, Inc

Our Appraisal is not intended, and must not be construed, to be a recommendation of any kind as to the advisability of purchasing shares of common stock in the Stock Offering. Moreover, because such the Appraisal is necessarily based on estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of common stock in the Stock Offering will thereafter be able to sell such shares at prices related to the foregoing estimate of the Company’s pro forma market value. Feldman Financial is not a seller of securities within the meaning of any federal and state securities laws and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

The valuation reported herein will be updated as appropriate. Further updates will consider, among other factors, any developments or changes in the Company’s financial performance or management policies, and current conditions in the securities market for thrift institution common stocks. Should any such developments or changes be material, in our opinion, to the Stock Offering valuation of the Company, appropriate adjustments to the estimated pro forma market value may be made. The reasons for any such adjustments will be explained in detail at that time.

Feldman Financial Advisors, Inc

I. BUSINESS OF HOME FEDERAL BANCORP, INC. OF LOUISIANA AND FIRST LOUISIANA BANCSHARES

General Overview

Home Federal Bancorp

Home Federal Bancorp, Inc. of Louisiana is a new Louisiana chartered corporation, formed for the purpose of holding all of the capital stock of Home Federal Savings and Loan Association. To date, Home Federal Bancorp has only conducted organizational activities. Currently, Home Federal Bancorp, Inc. of Louisiana, a federally chartered corporation, the mid-tier stock holding company that was formed in 2005 owns all of the capital stock of the Bank. The mid-tier holding company is 63.1% owed by Home Federal Mutual Holding Company of Louisiana and 36.9% owned by public shareholders. After the conversion, Home Federal Mutual Holding Company of Louisiana and Home Federal Bancorp, Inc. of Louisiana, a federally chartered corporation, will no longer exist. In addition, as part of the conversion, existing public stockholders of Bancorp will receive new shares of common stock in Home Federal Bancorp in exchange for their existing shares of common stock of Bancorp. The Company’s principal executive offices are located at 624 Market Street, Shreveport, Louisiana. At December 31, 2007, the Company had total assets of $128.1 million, deposits of $81.0 million and equity capital of $30.4 million.

Home Federal Savings and Loan Association is a federally chartered stock-form savings association originally organized in 1924 and is subject to federal regulation by the Federal Deposit Insurance Corporation and the Office of Thrift Supervision. The association reorganized into the mutual holding company format in January 2005. After the conversion and offering and completion of the merger, Home Federal Savings and Loan will change its name to "First Louisiana Bank" and will continue to be regulated by the Office of Thrift Supervision as its primary Federal banking regulator.

Feldman Financial Advisors, Inc

Home Federal Savings and Loan's current headquarters and main office and two additional full service branch offices located in Shreveport, Louisiana, serve the Shreveport-Bossier City metropolitan area. The area served by Home Federal Savings and Loan is primarily the Shreveport-Bossier City metropolitan area; however, loan and deposit customers are found dispersed in a wider geographical area covering much of northwest Louisiana. Following the merger, the Company expects to use First Louisiana Bank's main office, which is newer and larger than Home Federal Bancorp’s current main office, as the main office for the combined company. In addition to the main office, the Company will operate six branch offices following the merger, five of which will be located in Shreveport and one in Bossier City.

Home Federal Savings and Loan's business primarily consists of attracting deposits from the general public and using those funds to originate loans and invest in securities. Home Federal Savings and Loan's market area is Caddo Parrish, Louisiana, which includes the city of Shreveport, and neighboring communities in Bossier Parish, Louisiana. At December 31, 2007, the Bank had total assets of $128.3 million, deposits of $83.9 million and equity capital of $27.8 million.

The Bank faces strong competition both in attracting deposits and in making loans. Its most direct competition for deposits has come historically from commercial banks, credit unions and other savings institutions located in the primary market area, including many large financial institutions, which have greater financial and marketing resources available to them. In addition, the Bank faces significant competition for investors' funds from short-term money market securities, mutual funds and other corporate and government securities. The Bank does not rely upon any individual group or entity for a material portion of its deposits. The Bank’s ability to attract and retain deposits depends on its ability to generally provide a rate of return, liquidity and risk comparable to that offered by competing investment opportunities.

Feldman Financial Advisors, Inc

Competition for real estate loans comes principally from mortgage banking companies, commercial banks, other savings institutions and credit unions. The Bank competes for loan originations primarily through the interest rates and loan fees charged, and the efficiency and quality of services provided borrowers. Factors, which affect competition, include general and local economic conditions, current interest rate levels and volatility in the mortgage markets. Competition may increase as a result of the continuing reduction of restrictions on the interstate operations of financial institutions.

The chart on the following page shows the Company’s current ownership structure, which is commonly referred to as the "two-tier" mutual holding company structure:

Feldman Financial Advisors, Inc

Following the conversion and offering and the merger, the new ownership structure will be as follows:

The conversion and offering are commonly referred to as a "second-step" conversion.

The Company has several business strategies that are designed to further improve long-term profitability and enhance the franchise. These strategies include:

| | · | Acquiring First Louisiana Bank, a commercial bank in-market competitor. Through the merger, the Company expects to: |

| | •• | Diversify its loan portfolio by adding more commercial real estate and commercial business loans, |

| | •• | Strengthen management by adding senior loan officers, including a commercial lender; and |

| | •• | Diversify the products and services offered for a larger customer base and an enhanced competitive position; |

| | · | Continuing geographic expansion of its market presence by opening additional de novo branches or through acquisitions; |

| | · | Improving the interest rate spread by acquiring First Louisiana Bank's lower costing transaction and savings accounts combined with higher yielding commercial real estate and business loans; and |

| | · | Maintaining high asset quality. |

Feldman Financial Advisors, Inc

The Company’s business strategy is focused on operating a growing and profitable community-oriented financial institution. The acquisition of First Louisiana Bancshares is an integral component of such strategy. As a result of the merger, the Company expects to:

| | · | Grow and Diversify the Loan Portfolio by, among other things, increasing the origination of commercial real estate and business loans. Home Federal Bancorp’s traditional lending activity has been concentrated on the origination of single-family residential loans and to a lesser degree, consumer loans. The acquisition of First Louisiana Bancshares will assist in the goal to develop a loan portfolio more consistent with that of a community bank. First Louisiana Bancshares’ primary lending activity is the origination of commercial real estate and business loans. At December 31, 2007, First Louisiana Bancshares’ commercial real estate loans amounted to $45.8 million, or 53.6% of its total loan portfolio, and its commercial business loans amounted to $26.7 million or 31.3% of its total loan portfolio.�� On a pro forma basis, as if the merger had been completed as of December 31, 2007, commercial real estate and business loans will account for 63.9% of the total loan portfolio. Commercial real estate, commercial business, construction and development and consumer loans all typically have higher yields and are more interest sensitive than long-term single-family residential mortgage loans. |

| | · | Strengthen the Management Team. As part of Home Federal Bancorp’s intent to transform itself to be more like a community bank, the acquisition of First Louisiana Bancshares presented Home Federal Bancorp with the opportunity to obtain the services of several experienced commercial lenders including Mr. Tom Glass, currently the chief lending officer of First Louisiana Bancshares, as well as two other experienced senior commercial lending officers. |

| | · | Diversify Products and Services. The acquisition of First Louisiana Bancshares also addresses the intent of Home Federal Bancorp to expand its products and services, particularly with respect to loan products. Home Federal Bancorp in the past has not been in a position to offer to its customers commercial real estate and business loans. As discussed above, the merger will result in Home Federal Bancorp obtaining the services of several experienced commercial lenders which will allow us to offer to customers and to the marketplace commercial loan products which it believe will materially improve its competitive position in the market area. The merger also results in the ability to expand involvement in construction and land lending. The merger with First Louisiana Bancshares also will provide Home Federal with a significant increase in non-interest bearing checking accounts due to the nature of First Louisiana Bancshares’ commercial lending activities. As a consequence, post-merger Home Federal Bancorp intends to emphasize increasing the amount of its checking accounts due to the ability to provide full-service banking relationships to commercial customers. |

Feldman Financial Advisors, Inc

| | · | Enhancing Core Earnings. The acquisition of First Louisiana Bancshares is expected to improve Home Federal Bancorp’s interest rate spread due to the infusion of the substantial amount of commercial real estate and business loans which generally bear interest rates higher than residential real estate loans as well as the typical investment securities invested in by Home Federal Bancorp, including mortgage-backed securities and U.S. Government and agency securities. |

| | · | Growing the franchise by expanding the franchise in the market area and contiguous communities. The Company intends to pursue opportunities to expand its market area by opening additional de novo banking offices and possibly, through acquisitions of other financial institutions and banking related businesses (although there are no current plans, understandings or agreements with respect to any specific acquisitions). The Company expects to focus on contiguous areas to the current locations in Caddo and Bossier Parishes. |

| | · | Strengthen Asset Quality. The Company expects to strengthen its asset quality. At December 31, 2007, non-performing assets totaled $52,000 or 0.4% of total assets. At the same date, First Louisiana Bancshares’ total non-performing assets totaled $2.6 million or 2.1% of total assets. A substantial majority of First Louisiana Bancshares’ non-performing assets consists of other real estate owned, [all] of which are commercial properties. The company intends to continue to aggressively address the resolution of non-performing assets. The Company also intends to continue to stress maintaining high asset quality after the reorganization and offering and the merger even as it continues to grow Home Federal Savings and Loan. The Company has no exposure to the sub-prime market for mortgage loans. |

In addition, the Stock Offering will afford the opportunity to bolster the Company’s stock-based compensation and benefit plans for management and employees, thereby improving the Company’s capacity to attract and retain qualified personnel.

First Louisiana Bancshares

First Louisiana Bancshares, Inc. is a Louisiana corporation and registered financial holding company under the Bank Holding Company Act of 1956, as amended, headquartered in Shreveport, Louisiana. First Louisiana Bancshares was organized on June 30, 1998 for the purpose of acquiring First Louisiana Bank and becoming a bank holding company under the Bank Holding Company Act and conducts business primarily through its banking subsidiary, First Louisiana Bank, a Louisiana state-chartered commercial bank, which commenced operations in September 1999. It also owns indirectly, First Louisiana Agency, Inc., a Louisiana corporation and state-licensed general insurance agency that is a subsidiary of the bank.

Feldman Financial Advisors, Inc

First Louisiana Bancshares currently conducts no significant operations other than providing managerial resources and strategic planning for First Louisiana Bank, and derives its revenues primarily from the operations of First Louisiana Bank. First Louisiana Bank is a full-service commercial bank, providing a wide variety of commercial banking services through three banking offices to small and middle-market businesses and individuals in its target marketplace, which is comprised primarily of the Shreveport-Bossier City metropolitan area and Caddo and Bossier Parishes, Louisiana. Although First Louisiana Bank has identified the Shreveport/Bossier City metropolitan area as its primary market area, it also has a number of customers located throughout Northwest Louisiana. First Louisiana Bank has actively pursued its target market for loans and deposits, particularly from small businesses, professionals and business owners.

The deposits of First Louisiana Bank are insured by the Deposit Insurance Fund of the Federal Deposit Insurance Corporation up to applicable limits. The operations of First Louisiana Bank are subject to the supervision and regulation of the FDIC and the Louisiana Office of Financial Institutions. First Louisiana Bancshares also owns 100% of the common stock of First Louisiana Statutory Trust I, a Delaware statutory trust that was formed for the purpose of issuing trust-preferred securities.

Feldman Financial Advisors, Inc

As of December 31, 2007, First Louisiana Bancshares had, on a consolidated basis, total assets of approximately $123.1 million, net loans receivable of approximately $84.5 million, total deposits of approximately $92.8 million, and shareholders’ equity of approximately $11.2 million. The revenues of First Louisiana Bank are primarily derived from interest and fees received in connection with commercial lending, interest and dividends from investment securities, and service charge income generated from demand deposits. The principal sources of funds for its lending activities are deposits, loan repayments and Federal Home Loan Bank advances. First Louisiana Bank’s principal expenses are interest paid on deposits and operating and administrative expenses.

The business strategy of First Louisiana Bancshares is to operate as a profitable, diversified financial services company, providing a variety of banking and other financial services, with an emphasis on small business lending, loans to professionals and business owners and residential mortgage loans. First Louisiana Bank offers a wide range of commercial and retail lending and financial services to businesses and individuals. To continue asset growth and profitability, First Louisiana Bancshares’ marketing strategy is targeted to:

| | • | Capitalize on its personal relationship approach that it believes differentiates the bank from its lager competitors; |

| | • | Provide customers with access to the bank’s executives who make key credit and other decisions; |

| | • | Pursue commercial lending opportunities with small to mid-sized businesses that are underserved by the larger competitors in the market; and |

| | • | Cross-sell products and services to the bank’s existing customers to leverage its relationships and enhance profitability. |

Feldman Financial Advisors, Inc

The remainder of Chapter I examines in more detail the trends addressed in this section, including the impact of changes in the Company’s economic and competitive environment, and recent management initiatives. The discussion is supplemented by the exhibits in the Appendix. Exhibit II-1 summarizes the Company’s consolidated balance sheets as of the years ended June 30, 2006 to 2007 and December 31, 2006 and 2007. Exhibit II-2 presents the Company’s consolidated income statements for the years ended June 30, 2006 to 2007 and for the six months ended December 31, 2006 and 2007. Exhibit II-3 summarizes First Louisiana’s consolidated balance sheets as of the years ended December 31, 2006 to 2007 and Exhibit II-4 presents First Louisiana’s consolidated income statements for the years ended December 31, 2006 to 2007.

Feldman Financial Advisors, Inc

Financial Condition

Table 1 presents selected data concerning the Company’s financial position as of June 30, 2003 to 2007 and December 31, 2007. The table also displays relative financial and performance ratios for the Company for the years ended June 30, 2003 through 2007 and for the six months ended December 31, 2006 and 2007.

Table 1

Selected Financial Condition Data – Home Federal Bancorp

As of June 30, 2003 through 2007 and December 31, 2007

| | | | | | At June 30, | |

| (Dollars in Thousands, except per share data) | | At December 31, 2007 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Selected Financial and Other Data: | | (unaudited) | | | | | | | | | | | | | | | | |

| Assets | | $ | 128,084 | | | $ | 118,785 | | | $ | 114,000 | | | $ | 111,331 | | | $ | 95,663 | | | $ | 100,759 | |

| Cash and cash equivalents | | | 14,958 | | | | 3,972 | | | | 4,930 | | | | 9,292 | | | | 4,342 | | | | 9,471 | |

| Securities available for sale | | | 81,163 | | | | 83,752 | | | | 83,694 | | | | 75,760 | | | | 64,254 | | | | 52,959 | |

| Securities held to maturity | | | 1,331 | | | | 1,408 | | | | 1,425 | | | | 1,613 | | | | 2,516 | | | | 4,068 | |

| Loans receivable, net | | | 28,751 | | | | 26,689 | | | | 20,866 | | | | 23,645 | | | | 22,786 | | | | 33,219 | |

| Deposits | | | 80,986 | | | | 77,710 | | | | 71,279 | | | | 69,995 | | | | 68,134 | | | | 71,390 | |

| FHLB advances | | | 15,933 | | | | 12,368 | | | | 13,417 | | | | 8,224 | | | | 9,748 | | | | 9,008 | |

| Total Stockholders' Equity | | | 30,441 | | | | 27,812 | | | | 28,539 | | | | 32,431 | | | | 17,309 | | | | 19,149 | |

| Full service offices | | | 3 | | | | 3 | | | | 3 | | | | 3 | | | | 3 | | | | 3 | |

| | | As of or For the Six Months | | | | | | | | | | | | | | | | |

| | | Ended December 31, | | | As of or For the Year Ended June 30, | |

| | | 2007 | | | 2006 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Selected Operating Data: | | (unaudited) | | | | | | | | | | | | | | | | |

| Total interest income | | $ | 3,506 | | | $ | 3,210 | | | $ | 6,590 | | | $ | 5,664 | | | $ | 5,064 | | | $ | 5,154 | | | $ | 6,115 | |

| Total interest expense | | | 1,967 | | | | 1,634 | | | | 3,448 | | | | 2,433 | | | | 2,030 | | | | 2,163 | | | | 2,710 | |

| Net interest income | | | 1,539 | | | | 1,576 | | | | 3,142 | | | | 3,231 | | | | 3,034 | | | | 2,991 | | | | 3,405 | |

| Provision for loan losses | | | - | | | | - | | | | 1 | | | | - | | | | - | | | | - | | | | (474 | ) |

| Net interest income after provision for loan losses | | | 1,539 | | | | 1,576 | | | | 3,141 | | | | 3,231 | | | | 3,034 | | | | 2,991 | | | | 3,879 | |

| Total non-interest income | | | 120 | | | | 151 | | | | 240 | | | | 144 | | | | 387 | | | | 321 | | | | 216 | |

| Total non-interest expense | | | 1,262 | | | | 1,224 | | | | 2,417 | | | | 2,414 | | | | 2,119 | | | | 2,080 | | | | 2,596 | |

| Income before income taxes | | | 397 | | | | 503 | | | | 964 | | | | 961 | | | | 1,302 | | | | 1,232 | | | | 1,499 | |

| Income taxes | | | 134 | | | | 171 | | | | 327 | | | | 327 | | | | 452 | | | | 411 | | | | 490 | |

| Net income | | $ | 263 | | | $ | 332 | | | $ | 637 | | | $ | 634 | | | $ | 850 | | | $ | 821 | | | $ | 1,009 | |

| Earnings per share of common stock: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Operating Ratios: | | | | | | | | | | | | | | | | | | | | | |

| Average yield on interest-earning assets | | | 5.81 | % | | | 5.62 | % | | | 5.69 | % | | | 5.35 | % | | | 5.09 | % | | | 5.33 | % | | | 6.09 | % |

| Average yield on interest-bearing liabilities | | | 4.15 | | | | 3.69 | | | | 3.84 | | | | 2.98 | | | | 2.62 | | | | 2.74 | | | | 3.29 | |

| Average interest rate spread | | | 1.66 | | | | 1.93 | | | | 1.85 | | | | 2.37 | | | | 2.47 | | | | 2.59 | | | | 2.80 | |

| Net interest margin | | | 2.55 | | | | 2.76 | | | | 2.71 | | | | 3.05 | | | | 3.05 | | | | 3.09 | | | | 3.39 | |

| Average interest-earning assets to interest-bearing liabilities | | | 127.44 | | | | 129.11 | | | | 128.93 | | | | 129.49 | | | | 128.6 | | | | 122.54 | | | | 121.86 | |

| Net interest income after provision for loan losses to non-interest expense | | | 121.95 | | | | 128.76 | | | | 129.95 | | | | 133.82 | | | | 143.18 | | | | 143.8 | | | | 149.42 | |

| Total non-interest expense to average assets | | | 1.98 | | | | 2.04 | | | | 2.00 | | | | 2.14 | | | | 2.02 | | | | 2.12 | | | | 2.55 | |

| Efficiency ratio | | | 76.07 | | | | 70.87 | | | | 71.49 | | | | 71.53 | | | | 61.94 | | | | 62.8 | | | | 63.39 | |

| Return on average assets | | | 0.41 | | | | 0.55 | | | | 0.53 | | | | 0.56 | | | | 0.81 | | | | 0.84 | | | | 0.99 | |

| Return on average equity | | | 1.67 | | | | 2.18 | | | | 2.13 | | | | 2.10 | | | | 3.17 | | | | 4.40 | | | | 5.48 | |

| Average equity to average assets | | | 24.75 | | | | 25.38 | | | | 24.82 | | | | 26.81 | | | | 25.57 | | | | 19.00 | | | | 18.08 | |

| Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | | |

| Non-performing loans as a percent of total loans receivable | | | 0.07 | % | | | -- | % | | | 0.46 | % | | | -- | % | | | -- | % | | | -- | % | | | 0.22 | |

| Non-performing assets as a percent of total assets | | | 0.04 | | | | -- | | | | 0.10 | | | | -- | | | | -- | | | | -- | | | | 0.07 | |

| Allowance for loan losses as a percent of total loans receivable | | | 0.85 | | | | 1.03 | | | | 0.92 | | | | 1.11 | | | | 0.98 | | | | 1.02 | | | | 0.68 | |

| Net charge-offs to average loans receivable | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | |

| Association Capital Ratios: | | | | | | | | | | | | | | | | | | | | | |

| Tangible capital ratio | | | 21.82 | % | | | 22.05 | % | | | 22.79 | % | | | 21.82 | % | | | 24.2 | % | | | 19.45 | % | | | 18.25 | |

| Core capital ratio | | | 21.82 | | | | 22.05 | | | | 22.79 | | | | 21.82 | | | | 24.2 | | | | 19.45 | | | | 18.25 | |

| Total capital ratio | | | 79.67 | | | | 83.74 | | | | 80.63 | | | | 79.67 | | | | 91.56 | | | | 71.21 | | | | 61.94 | |

Source: Home Federal Bancorp, Prospectus

Feldman Financial Advisors, Inc

Table 2 presents selected data concerning First Louisiana’s financial position as of December 31, 2003 to 2007 and December 31, 2007. The table also displays relative financial and performance ratios for the same period.

Table 2

Selected Financial Condition Data – First Louisiana Bancshares

As of December 31, 2003 Through 2007

| | | At December 31, | | |

| (Dollars in Thousands, except per share data) | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 |

| Selected Financial and Other Data: | | | | | | | | | | | | | | |

| Total assets | | $ | 123,092 | | | $ | 112,687 | | | $ | 109,951 | | | $ | 101,501 | | | $ | 90,001 | |

| Loans receivable, net | | $ | 84,539 | | | $ | 79,157 | | | $ | 73,243 | | | $ | 70,799 | | | $ | 62,616 | |

| Cash, federal funds sold and other interest-bearing deposits | | | 8,462 | | | | 5,035 | | | | 7,799 | | | | 7,550 | | | | 5,650 | |

| Investment securities | | | 16,577 | | | | 16,457 | | | | 17,101 | | | | 11,716 | | | | 12,538 | |

| Deposits | | | 92,811 | | | | 86,682 | | | | 85,020 | | | | 74,390 | | | | 63,116 | |

| Borrowings | | | 12,446 | | | | 9,087 | | | | 13,872 | | | | 17,823 | | | | 17,837 | |

| Subordinated debentures to First Louisiana Statutory Trust I | | | 4,124 | | | | 4,124 | | | | -- | | | | -- | | | | -- | |

| Stockholders' Equity | | | 11,237 | | | | 10,335 | | | | 9,158 | | | | 8,737 | | | | 8,700 | |

| Full service offices | | | 3 | | | | 3 | | | | 3 | | | | 3 | | | | 3 | |

| | | As of or For the Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Selected Operating Data: | | | | | | | | | | | | | | | |

| Interest income | | $ | 8,430 | | | $ | 7,587 | | | $ | 6,409 | | | $ | 5,172 | | | $ | 4,845 | |

| Interest expense | | | 3,101 | | | | 2,254 | | | | 1,715 | | | | 1,177 | | | | 1,216 | |

| Net interest income | | | 5,329 | | | | 5,333 | | | | 4,694 | | | | 3,995 | | | | 3,630 | |

| Provision for loan losses | | | 703 | | | | 983 | | | | 1,040 | | | | 1,270 | | | | 479 | |

| Net interest income after provision for loan losses | | | 4,626 | | | | 4,350 | | | | 3,653 | | | | 2,725 | | | | 3,151 | |

| Non-interest income | | | 1,104 | | | | 1,575 | | | | 944 | | | | 1,050 | | | | 1,049 | |

| Non-interest expense | | | 4,621 | | | | 4,380 | | | | 4,010 | | | | 3,704 | | | | 3,315 | |

| Income before income taxes | | | 1,109 | | | | 1,546 | | | | 587 | | | | 72 | | | | 885 | |

| Income taxes | | | 291 | | | | 488 | | | | 144 | | | | (45 | ) | | | 303 | |

| Net income | | | 818 | | | | 1,058 | | | | 443 | | | | 117 | | | | 582 | |

| Earnings per share of common stock: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 1.04 | | | | 1.35 | | | | 0.57 | | | | 0.15 | | | | 0.76 | |

| Diluted | | | 0.93 | | | | 1.22 | | | | 0.52 | | | | 0.14 | | | | 0.69 | |

| | | | | | | | | | | | | | | | |

| Selected Operating Ratios: | | | | | | | | | | | | | | | |

| Average yield on interest-earning assets | | | 7.73 | % | | | 7.45 | % | | | 6.76 | % | | | 6.27 | % | | | 6.62 | % |

| Average yield on interest-bearing liabilities | | | 3.50 | | | | 2.82 | | | | 2.27 | | | | 1.76 | | | | 2.09 | |

| Average interest rate spread | | | 4.23 | | | | 4.63 | | | | 4.49 | | | | 4.51 | | | | 4.53 | |

| Net interest margin | | | 5.01 | | | | 5.37 | | | | 5.01 | | | | 4.85 | | | | 4.95 | |

| Average interest-earning assets to interest-bearing liabilities | | | 156.11 | | | | 162.09 | | | | 160.72 | | | | 161.57 | | | | 162.09 | |

| Net interest income after provision for loan losses to non-interest expense | | | 100.11 | | | | 99.34 | | | | 91.12 | | | | 73.57 | | | | 95.05 | |

| Total non-interest expense to average assets | | | 3.96 | | | | 3.99 | | | | 3.91 | | | | 4.08 | | | | 4.1 | |

| Efficiency ratio | | | 71.83 | | | | 63.4 | | | | 71.12 | | | | 73.42 | | | | 70.85 | |

| Return on average assets | | | 0.7 | | | | 0.96 | | | | 0.43 | | | | 0.13 | | | | 0.72 | |

| Return on average equity | | | 7.51 | | | | 10.71 | | | | 4.95 | | | | 1.33 | | | | 6.93 | |

| Average equity to average assets | | | 9.33 | | | | 8.99 | | | | 8.73 | | | | 9.68 | | | | 10.37 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Asset Quality Ratios: | | | | | | | | | | | | | | | |

| Non-performing loans as a percent of total loans receivable | | | 0.37 | % | | | 2.67 | % | | | 1.68 | % | | | 1.10 | % | | | 4.37 | % |

| Non-performing assets as a percent of total assets | | | 2.13 | | | | 2.90 | | | | 1.62 | | | | 2.18 | | | | 3.46 | |

| Allowance for loan losses as a percent of total loans receivable | | | 1.04 | | | | 1.32 | | | | 1.41 | | | | 1.07 | | | | 1.17 | |

| Net charge-offs to average loans receivable | | | 1.02 | | | | 1.24 | | | | 1.04 | | | | 1.90 | | | | 0.52 | |

| | | | | | | | | | | | | | | | |

| Bank Capital Ratios: | | | | | | | | | | | | | | | |

| Tangible capital ratio | | | 10.88 | % | | | 11.02 | % | | | 10.44 | % | | | 10.29 | % | | | 11.48 | % |

| Core capital ratio | | | 10.88 | | | | 11.02 | | | | 10.44 | | | | 10.29 | | | | 11.48 | |

| Total capital ratio | | | 11.6 | | | | 11.96 | | | | 11.43 | | | | 11.08 | | | | 12.35 | |

Source: First Louisiana Bancshares, Prospectus

Feldman Financial Advisors, Inc

Balance Sheet Analysis

Home Federal Bancorp

The Company’s total assets experienced relatively steady growth since December 31, 2003, increasing by a compound annual rate of 5.5% from $100.8 million at June 30, 2003 to $128.1 million at December 31, 2007. The net asset expansion of $27.3 million over this period occurred primarily in the securities available for sale portfolio, which increased to $81.2 million at December 31, 2007 from $53.0 million at June 30, 2003. The loan portfolio decreased from $33.2 million at June 30, 2003 to $28.8 million at December 31, 2007, a decline of $4.5 million.

At December 31, 2007, total assets amounted to $128.1 million compared to $118.8 million at June 30, 2007, an increase of approximately $9.3 million, or 7.8%. This increase was primarily due to an increase in cash and cash equivalents of $11.0 million, or 276.6%, and an increase in loans receivable of $2.6 million, or 10.3%. These increases were partially offset by a decrease in the Company's deferred tax asset of $1.2 million, or 80.6%, and a decrease in investment securities of $2.7 million, or 3.1%.

The increase in cash and cash equivalents was due primarily to proceeds received through deposits, principal payments on securities and advances from the Federal Home Loan Bank of Dallas. The increase in loans receivable was primarily due to the purchase of first mortgage loans originated by another mortgage loan company. The purchased loans are from a mortgage loan originator in Arkansas and are secured by one-to-four-family residential properties. While the purchased loans are originated as fixed rate loans, Home Federal receives an adjustable rate of interest. Under the terms of the loan agreements, the seller repurchases any loan that becomes more than 90 days delinquent. At December 31, 2007, the balance of the purchased loans approximated $10.8 million. The decrease in investment securities was primarily due to sale of securities, partially offset by an increase in the market value of securities available for sale and the purchase of new securities.

Feldman Financial Advisors, Inc

Home Federal Bancorp's total assets increased $4.8 million, or 4.2%, to $118.8 million at June 30, 2007 compared to $114.0 million at June 30, 2006. This increase was primarily due to an increase in loans receivable and held-for-sale of $5.8 million and partially offset by a decrease in cash and cash equivalents of $958,000 compared to the prior year period.

Loans receivable, net increased $4.3 million, or 20.6%, from $20.9 million at June 30, 2006 to $25.2 million at June 30, 2007. The increase in loans receivable, net was attributable primarily to an increase in one-to-four family residential loans of $3.0 million, and an increase in home equity and second mortgage loans of $1.2 million.

Cash and cash equivalents decreased $958,000, or 18.3%, from $4.9 million at June 30, 2006 to $4.0 million at June 30, 2007. Securities available for sale remained stable from June 30, 2006 to June 30, 2007 at $83.7 million. During the past two years, the Company has experienced significant loan prepayments due to the heavy volume of loan refinancing. However, when interest rates were at their cyclical lows, management was reluctant to invest in long-term, fixed rate mortgage loans for portfolio and instead sold the majority of the long-term, fixed-rate mortgage loan production. The Company has attempted to strengthen its interest-rate risk position and favorably structure the balance sheet to take advantage of a rising rate environment by purchasing investment securities classified as available for sale.

The Company's total liabilities amounted to $97.6 million at December 31, 2007 an increase of approximately $6.6 million, or 7.3%, compared to total liabilities of $91.0 million at June 30, 2007. The primary reason for the increase in liabilities was due to the $3.3 million, or 4.2%, increase of customers' deposits due to normal deposits inflow, and a $3.5 million, 28.8%, increase in advances from the Federal Home Loan Bank.

Feldman Financial Advisors, Inc

Total liabilities increased $5.5 million, or 6.4%, from $85.5 million at June 30, 2006 to $91.0 million at June 30, 2007 due primarily to an increase in deposits of $6.4 million over the prior year period, partially offset by a decrease of $1.0 million, or 7.5%, in FHLB advances. The increase in deposits was attributable primarily to increases in certificates of deposit as well as increases in non-interest bearing and NOW accounts, partially offset by decreases in money market and passbook savings accounts. Certificates of deposit increased $6.0 million, or 10.5%, from $57.0 million at June 30, 2006 to $63.0 million at June 30, 2007.

Stockholders' equity increased $2.6 million, or 9.5%, to $30.4 million at December 31, 2007 compared to $27.8 million at June 30, 2007. This increase was primarily the result of the change in the Company's Accumulated Other Comprehensive Loss associated with securities available-for-sale of $2.3 million, or 82.2%, the recognition of net income of $263,000 for the six months ended December 31, 2007, and the distribution of shares associated with the Company's Recognition and Retention Plan of $156,000. These increases were offset by dividends of $147,000 paid during the six months ended December 31, 2007, and the acquisition of treasury shares of $38,000.

Stockholders' equity decreased $727,000, or 2.5%, to $27.8 million at June 30, 2007 from June 30, 2006 due primarily to treasury stock acquisitions for fiscal 2007 of $1.6 million, partially offset by accumulated comprehensive income of $275,000 and net income of $637,000. The change in accumulated other comprehensive income was primarily due to the change in net unrealized loss on securities available for sale due to recent minor declines in interest rates.

Feldman Financial Advisors, Inc

First Louisiana Bancshares

At December 31, 2007, total assets amounted to $123.1 million compared to $112.7 million at December 31, 2006, an increase of approximately $10.4 million, or 9.2%. This increase was primarily due to an increase in cash. Federal funds sold and other interest-bearing deposits of $3.4 million, or 68.1%, and an increase in loans receivable of $5.4 million, or 6.8%. The growth in loans receivable was driven by an increase in the commercial real estate portfolio. In addition, real estate owned increased by $1.2 million, or 105.0%

Deposits increased by $6.1 million, or 7.1%, from $86.7 million at December 31, 2006 to $92.8 million at December 31, 2007. This increase was primarily due to an increase in time deposit accounts. Time deposits increased from $30.4 million at December 31, 2006 to $38.3 million at December 31, 2007, an increase of $7.8 million or 25.8%. Borrowings from the Federal Home Loan Bank increased by $3.4 million, or 37.0%, from $9.1 million at December 31, 2006 to $12.4 million at December 31, 2007.

Stockholders’ equity increased by approximately $902,000, or 8.7%, from $10.3 million at December 31, 2006 to $11.2 million at December 31, 2007, which was primarily attributable to the increase in retained earnings of approximately $714,000.

Pro Forma Balance Sheet Impact of Acquisition of First Louisiana Bancshares

The pro forma balance sheet impact of the First Louisiana acquisition is shown in Table 3 as of December 31, 2007. This analysis does not take into consideration the proceeds from the Conversion. On the asset side of the balance sheet, the ratio of loans-to-assets will increase and the level of cash and investments comprising total assets will decline before factoring in the infusion of the net conversion proceeds. The decline in the pro forma level of cash and investments reflects the impact of funding the cash consideration and related acquisition cost, which have been estimated to total $9.9 million in the pro forma adjustments.

Feldman Financial Advisors, Inc

Table 3

Pro Forma Balance Sheet Data

As of December 31, 2007

| | | | | | | | | Pro | | | Home | |

| | | Home | | | First | | | Forma | | | Federal | |

| | | Federal | | | Louisiana | | | Merger | | | Bancorp | |

| | | Bancorp | | | Bancshares | | | Adjust- | | | Pro Forma | |

| | | Historical | | | Historical | | | ments | | | Consolidated | |

| Assets: | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 14,958 | | | $ | 8,462 | | | $ | (9,894 | ) | | $ | 13,526 | |

| Investment securities available for sale | | | 81,163 | | | | 15,449 | | | | - | | | | 96,612 | |

| Investment securities held to maturity | | | 1,331 | | | | 1,128 | | | | - | | | | 2,459 | |

| Loans receivable, net | | | 28,751 | | | | 84,539 | | | | (374 | ) | | | 112,916 | |

| Premises and equipment | | | 907 | | | | 6,252 | | | | 500 | | | | 7,659 | |

| Bank owned life insurance | | | - | | | | 3,039 | | | | - | | | | 3,039 | |

| Goodwill | | | - | | | | - | | | | 11,653 | | | | 11,653 | |

| Core deposit intangible | | | - | | | | - | | | | 1,660 | | | | 1,660 | |

| Other assets | | | 974 | | | | 4,223 | | | | (441 | ) | | | 4,756 | |

| Total assets | | $ | 128,084 | | | $ | 123,092 | | | $ | 3,104 | | | $ | 254,280 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Deposits | | $ | 80,986 | | | $ | 92,811 | | | $ | 103 | | | $ | 173,900 | |

| Borrowings | | | 15,933 | | | | 13,160 | | | | 148 | | | | 29,241 | |

| Other liabilities | | | 724 | | | | 1,760 | | | | - | | | | 2,484 | |

| Subordinated debentures | | | - | | | | 4,124 | | | | (480 | ) | | | 3,644 | |

| Total liabilities | | | 97,643 | | | | 111,855 | | | | (229 | ) | | | 209,269 | |

| | | | | | | | | | | | | | | | | |

| Stockholders' equity: | | | | | | | | | | | | | | | | |

| Preferred stock | | | - | | | | - | | | | - | | | | - | |

| Common stock | | | 14 | | | | 1,577 | | | | (1,564 | ) | | | 27 | |

| Additional paid-in capital | | | 13,541 | | | | 6,538 | | | | 8,018 | | | | 28,097 | |

| Retained earnings | | | 20,565 | | | | 3,073 | | | | (3,073 | ) | | | 20,565 | |

| Employee stock ownership plan | | | (969 | ) | | | - | | | | - | | | | (969 | ) |

| Recognition and retention plan | | | (395 | ) | | | - | | | | - | | | | (395 | ) |

| Accumulated other comprehensive (loss) income | | | (506 | ) | | | 49 | | | | (49 | ) | | | (506 | ) |

| Treasury stock, at cost | | | (1,809 | ) | | | - | | | | - | | | | (1,809 | ) |

| Total stockholders' equity | | | 30,441 | | | | 11,237 | | | | 3,333 | | | | 45,011 | |

| | | | | | | | | | | | | | | | | |

| Total liabilities and stockholders' equity | | $ | 128,084 | | | $ | 123,092 | | | $ | 3,104 | | | $ | 254,280 | |

Source: Home Federal Bancorp; First Louisiana Bancshares; preliminary prospectus.

Feldman Financial Advisors, Inc

Table 4 shows the pro forma balance sheet impact of the First Louisiana acquisition as of June 30, 2007.

Table 4

Pro Forma Balance Sheet Data

As of June 30, 2007

| | | | | | | | | Pro | | | Home | |

| | | Home | | | First | | | Forma | | | Federal | |

| | | Federal | | | Louisiana | | | Merger | | | Bancorp | |

| | | Bancorp | | | Bancshares | | | Adjust- | | | Pro Forma | |

| | | Historical | | | Historical | | | ments | | | Consolidated | |

| Assets: | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 3,972 | | | $ | 5,413 | | | $ | (9,894 | ) | | $ | (509 | ) |

| Investment securities available for sale | | | 83,752 | | | | 12,446 | | | | - | | | | 96,198 | |

| Investment securities held to maturity | | | 1,408 | | | | 1,109 | | | | - | | | | 2,517 | |

| Loans receivable, net | | | 26,689 | | | | 83,577 | | | | (374 | ) | | | 109,892 | |

| Premises and equipment | | | 923 | | | | 6,005 | | | | 500 | | | | 7,428 | |

| Bank owned life insurance | | | - | | | | 2,990 | | | | - | | | | 2,990 | |

| Goodwill | | | - | | | | - | | | | 12,131 | | | | 12,131 | |

| Core deposit intangible | | | - | | | | - | | | | 1,660 | | | | 1,660 | |

| Other assets | | | 2,041 | | | | 4,642 | | | | (441 | ) | | | 6,242 | |

| Total assets | | $ | 118,785 | | | $ | 116,182 | | | $ | 3,582 | | | $ | 238,549 | |

| | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Deposits | | $ | 77,710 | | | $ | 85,590 | | | $ | 103 | | | $ | 163,403 | |

| Borrowings | | | 12,368 | | | | 14,038 | | | | 148 | | | | 26,554 | |

| Other liabilities | | | 895 | | | | 1,671 | | | | - | | | | 2,566 | |

| Subordinated debentures | | | - | | | | 4,124 | | | | (480 | ) | | | 3,644 | |

| Total liabilities | | | 90,973 | | | | 105,423 | | | | (229 | ) | | | 196,167 | |

| | | | | | | | | | | | | | | | | |

| Stockholders' equity: | | | | | | | | | | | | | | | | |

| Preferred stock | | | - | | | | - | | | | - | | | | - | |

| Common stock | | | 14 | | | | 1,577 | | | | (1,564 | ) | | | 51 | |

| Additional paid-in capital | | | 13,509 | | | | 6,538 | | | | 8,018 | | | | 28,065 | |

| Retained earnings | | | 20,449 | | | | 2,745 | | | | (2,745 | ) | | | 20,449 | |

| Employee stock ownership plan | | | (997 | ) | | | - | | | | - | | | | (997 | ) |

| Recognition and retention plan | | | (551 | ) | | | - | | | | - | | | | (551 | ) |

| Accumulated other comprehensive (loss) income | | | (2,841 | ) | | | (101 | ) | | | 101 | | | | (2,841 | ) |

| Treasury stock, at cost | | | (1,771 | ) | | | - | | | | - | | | | (1,771 | ) |

| Total stockholders' equity | | | 27,812 | | | | 10,759 | | | | 3,811 | | | | 42,382 | |

| | | | | | | | | | | | | | | | | |

| Total liabilities and stockholders' equity | | $ | 118,785 | | | $ | 116,182 | | | $ | 3,582 | | | $ | 238,549 | |

Source: Home Federal Bancorp; First Louisiana Bancshares; preliminary prospectus.

Feldman Financial Advisors, Inc

As of December 31, 2007, the Company had no intangible assets, while on a pro forma combined basis goodwill and intangibles equaled 5.2% of assets. On the liability side of the balance sheet, the level of deposits and borrowings funding assets will increase, on a pro forma combined basis. Deposits increase to 68.4% of assets on a pro forma combined basis, while borrowings increase slightly from 12.4% of assets to 12.9% of assets on a pro forma combined basis. Before factoring in the impact of the net conversion proceeds, the Company’s equity-to-asset ratio decreases from 23.8% to 17.7% on a pro forma combined basis and the tangible equity-to-assets ratio decreases from 23.8% to 13.2%.

Lending Activities

Home Federal Bancorp

At December 31, 2007, Home Federal Bancorp's net loan portfolio amounted to $28.8 million, representing approximately 22.4% of total assets at that date. Historically, the Company’s principal lending activity has been the origination of one- to four-family residential loans. At December 31, 2007, one- to four-family residential loans totaled $19.0 million, or 67.6% of the total loan portfolio. As part of its desire to diversify the loan portfolio, the Company also offers consumer loans, which includes home equity loans, second mortgage loans and lines of credit and amounted to $5.5 million, or 19.5% of the total loan portfolio at December 31, 2007.

If the merger is completed, and the Company acquires First Louisiana Bancshares, the composition of the loan portfolio will change. First Louisiana Bancshares' primary lending activity is the origination of commercial real estate and commercial business loans. At December 31, 2007, First Louisiana Bancshares' commercial real estate loans amounted to $45.8 million, or 53.6% of the total loan portfolio and commercial business loans amounted to $26.7 million, or 31.3% of the total loan portfolio.

Feldman Financial Advisors, Inc

The types of loans that the Company may originate are subject to federal and state laws and regulations. Interest rates charged on loans are affected principally by the demand for such loans and the supply of money available for lending purposes and the rates offered by competitors. These factors are, in turn, affected by general and economic conditions, the monetary policy of the federal government, including the Federal Reserve Board, legislative and tax policies, and governmental budgetary matters.

A savings institution generally may not make loans to one borrower and related entities in an amount that exceeds 15% of its unimpaired capital and surplus. In addition, upon application the Office of Thrift Supervision permits a savings institution to lend up to an additional 15% of unimpaired capital and surplus to one borrower to develop domestic residential housing units.

At December 31, 2007, the regulatory limit on loans-to-one borrower was $4.2 million and the five largest loans or groups of loans-to-one borrower, including related entities, aggregated $3.1 million, $270,000, $355,000, $443,000 and $422,000. Each of the Company’s five largest loans or groups of loans was performing in accordance with its terms at December 31, 2007. The loan commitment described below is related to the largest loan to one borrower. The Company has applied to and received the approval of the Office of Thrift Supervision to utilize the higher lending limit for this loan relationship. Loans to or guaranteed by general obligations of a state or political subdivision are not subject to the foregoing lending limits

The board of directors has authorized a loan commitment of approximately $1.5 million to a limited partnership established by the Housing Authority of Bossier City, Louisiana, which is expected to be entered into in the third or fourth quarter of fiscal 2008. The loan will be secured by a first mortgage lien on real estate and low to moderate income rental units in Bossier City, Louisiana as well as a conditional assignment of rents. The commitment letter will include a condition that the Housing Authority of Bossier City, Louisiana executes takeout agreements with respect to the Company’s position in the event of default.

Feldman Financial Advisors, Inc

Table 5 and Exhibit II-5 analyze the composition of the loan portfolio by loan category at the dates indicated for Home Federal Bancorp.

Table 5

Loan Portfolio – Home Federal Bancorp

At June 30, 2003 to 2007 and at December 31, 2007

(Dollars in Thousands)

| | | | | | | | | June 30, | |

| | | December 31, 2007 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | Amount | | | % | | | Amount | | | % | | | Amount | | | % | | | Amount | | | % | | | Amount | | | % | | | Amount | | | % | |

| Real estate loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| One- to four-family residential | | $ | 19,016 | | | | 67.64 | | | $ | 16,669 | | | | 65.27 | | | $ | 13,721 | | | | 64.72 | | | $ | 19,301 | | | | 80.79 | | | $ | 20,903 | | | | 90.82 | | | $ | 30,341 | | | | 93.62 | |

| Other mortgage | | | 3,619 | | | | 12.87 | | | | 3,650 | | | | 14.29 | | | | 3,164 | | | | 14.92 | | | | 837 | | | | 3.50 | | | | 101 | | | | 0.44 | | | | 116 | | | | 0.36 | |

| Total real estate loans | | | 22,635 | | | | 80.51 | | | | 20,319 | | | | 79.56 | | | | 16,885 | | | | 79.64 | | | | 20,138 | | | | 84.29 | | | | 21,004 | | | | 91.26 | | | | 30,457 | | | | 93.98 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Home equity loans and second mortgage loans | | | 4,209 | | | | 14.97 | | | | 4,454 | | | | 17.44 | | | | 3,287 | | | | 15.50 | | | | 2,776 | | | | 11.62 | | | | 1,077 | | | | 4.68 | | | | 1,046 | | | | 3.23 | |

| Savings account | | | 490 | | | | 1.74 | | | | 283 | | | | 1.11 | | | | 613 | | | | 2.89 | | | | 470 | | | | 1.97 | | | | 590 | | | | 2.56 | | | | 714 | | | | 2.20 | |

| Equity lines of credit | | | 719 | | | | 2.56 | | | | 427 | | | | 1.67 | | | | 374 | | | | 1.76 | | | | 500 | | | | 2.09 | | | | 343 | | | | 1.49 | | | | 187 | | | | 0.58 | |

| Other | | | 60 | | | | 0.21 | | | | 57 | | | | 0.22 | | | | 43 | | | | 0.20 | | | | 6 | | | | 0.03 | | | | 1 | | | | 0.00 | | | | 5 | | | | 0.02 | |

| Total consumer loans | | | 5,478 | | | | 19.49 | | | | 5,221 | | | | 20.44 | | | | 4,317 | | | | 20.36 | | | | 3,752 | | | | 15.71 | | | | 2,011 | | | | 8.74 | | | | 1,952 | | | | 6.02 | |

| Total loans | | | 28,113 | | | | 100.00 | | | | 25,540 | | | | 100.00 | | | | 21,202 | | | | 100.00 | | | | 23,890 | | | | 100.00 | | | | 23,015 | | | | 100.00 | | | | 32,409 | | | | 100.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Less: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for loan losses | | | (235 | ) | | | | | | | (235 | ) | | | | | | | (235 | ) | | | | | | | (235 | ) | | | | | | | (235 | ) | | | | | | | (235 | ) | | | | |

| Deferred loan fees | | | (89 | ) | | | | | | | (94 | ) | | | | | | | (101 | ) | | | | | | | (80 | ) | | | | | | | (101 | ) | | | | | | | (183 | ) | | | | |

| Net Loans (1) | | $ | 27,789 | | | | | | | $ | 25,211 | | | | | | | $ | 20,866 | | | | | | | $ | 23,575 | | | | | | | $ | 22,679 | | | | | | | $ | 31,991 | | | | | |

______________________

| (1) | Does not include loans held for sale amounting to $961,644, $1,478,434, $0, $70,000, $108,000 and $1.2 million at December 31, 2007 2006, 2005, 2004 and 2003 respectively. |

Source: Home Federal Bancorp, Prospectus

One- to Four-Family Residential Real Estate Loans. The Company’s primary lending activity is the origination of loans secured by single-family residences. At December 31, 2007, $19.0 million, or 67.6%, of the total loan portfolio, before net items, consisted of one- to four-family residential loans. The loan-to-value ratio, maturity and other provisions of the loans made by us generally have reflected the policy of making less than the maximum loan permissible under applicable regulations, in accordance with sound lending practices, market conditions and underwriting standards established by us. The current lending policy on one- to four-family residential loans generally limits the maximum loan-to-value ratio to 80% or less of the appraised value of the property although the Company will lend up to a 95% loan-to-value ratio with private mortgage insurance. These loans are amortized on a monthly basis with principal and interest due each month and generally include "due-on-sale" clauses.

Feldman Financial Advisors, Inc

At December 31, 2007, $8.1 million, or 42.8%, of the one- to four-family residential mortgage loans were fixed-rate loans. Fixed-rate loans generally have maturities ranging from 15 to 30 years and are fully amortizing with monthly loan payments sufficient to repay the total amount of the loan with interest by the end of the loan term. Fixed-rate loans generally are originated under terms, conditions and documentation, which permit them to be sold to U.S. Government-sponsored agencies, such as the Federal Home Loan Mortgage Corporation, and other investors in the secondary mortgage market. Consistent with the asset/liability management, the Company has sold a significant portion of long-term, fixed rate loans over the past two years.

Although the Company offers adjustable rate loans, substantially all of the single-family loan originations over the last few years have consisted of fixed-rate loans due to the low interest rate environment. The adjustable-rate loans held in portfolio typically have interest rates, which adjust on an annual basis or semi-annual basis. These loans generally have an annual cap of 2% on any increase or decrease and a cap of 6% above or below the initial rate over the life of the loan. Such loans are underwritten based on the initial rate plus 2%.

Consumer Loans. The Company is authorized to make loans for a wide variety of personal or consumer purposes. The Company originates consumer loans in order to accommodate customers and because such loans generally have shorter terms and higher interest rates than residential mortgage loans. The consumer loans offered consist of home equity and second mortgage loans, loans secured by deposit accounts with us, equity lines of credit and automobile loans. However, the Company does not intend to materially expand its product offerings and instead intends to focus on increasing the volume of current products, primarily home equity and second mortgage loans. At December 31, 2007, $5.5 million, or 19.5% of the total loan portfolio consisted of consumer loans compared to $5.2 million, or 22.4% of the loan portfolio at December 31, 2006.

Feldman Financial Advisors, Inc

Of the $5.5 million of consumer loans held at December 31, 2007, $4.2 million consisted of home equity and second mortgage loans compared to $5.0 million of home equity and second mortgage loans at December 31, 2006. These loans are secured by the underlying equity in the borrower's residence. The Company does not require that it hold the first mortgage on the properties that secure the second mortgage loans. The amount of second mortgage loans generally cannot exceed a loan-to-value ratio of 80% after taking into consideration the first mortgage loan. These loans are typically three-to-five year balloon loans with fixed rates and contain an on-demand clause that allows for a call on the loan at any time.

The Company offers loans secured by deposit accounts held with the Company, which loans amounted to $490,000, or 1.7% of the total loan portfolio at December 31, 2007. Such loans are originated for up to 90% of the account balance, with a hold placed on the account restricting the withdrawal of the account balance. The interest rate on the loan is equal to the interest rate paid on the account plus 2%. These loans typically are payable on demand with a maturity date of one year.

The Company also offers lines of credit secured by a borrower's equity in real estate, which loans amounted to $719,000 or 2.6% of the total loan portfolio at December 31, 2007. The rates and terms of such lines of credit depend on the history and income of the borrower, purpose of the loan and collateral. Lines of credit will not exceed 90% of the value of the equity in the collateral.

Feldman Financial Advisors, Inc

Consumer loans generally have shorter terms and higher interest rates than residential mortgage loans, but generally entail greater credit risk than residential mortgage loans, particularly those loans secured by assets that depreciate rapidly, such as automobiles, boats and recreational vehicles. In such cases, repossessed collateral for a defaulted consumer loan may not provide an adequate source of repayment for the outstanding loan and the remaining deficiency often does not warrant further substantial collection efforts against the borrower. In particular, amounts realizable on the sale of repossessed automobiles may be significantly reduced based upon the condition of the automobiles and the fluctuating demand for used automobiles.