Lender Processing Services Fourth Quarter 2011 Supplemental Materials Exhibit 99.2 |

Forward-Looking Statements 2 ONE SOURCE. POWERFUL SOLUTIONS. This presentation contains forward-looking statements that involve a number of risks and uncertainties. Those forward-looking statements include all statements that are not historical facts, including statements about our beliefs and expectations. Forward-looking statements are based on management's beliefs, as well as assumptions made by and information currently available to management. Because such statements are based on expectations as to future economic performance and are not statements of historical fact, actual results may differ materially from those projected. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to: our ability to adapt our services to changes in technology or the marketplace; the impact of adverse changes in the level of real estate activity (including among others, loan originations and foreclosures) on demand for certain of our services; our ability to maintain and grow our relationships with our customers; the effects of our substantial leverage on our ability to make acquisitions and invest in our business; the level of scrutiny being placed on participants in the foreclosure process; risks associated with federal and state enforcement actions, inquiries and examinations currently underway or that may be commenced in the future with respect to our default management operations, and with civil litigation related to these matters; changes to the laws, rules and regulations that regulate our businesses as a result of the current economic and financial environment; changes in general economic, business and political conditions, including changes in the financial markets; the impact of any potential defects, development delays, installation difficulties or system failures on our business and reputation; risks associated with protecting information security and privacy; and other risks and uncertainties detailed in the “Statement Regarding Forward- Looking Information,” “Risk Factors” and other sections of the Company’s Form 10-K, the Company’s subsequent reports on Form 10-Q and other filings with the Securities and Exchange Commission. |

3 ONE SOURCE. POWERFUL SOLUTIONS. Use of Non-GAAP Measures U.S. Generally Accepted Accounting Principles (GAAP) is the term used to refer to the standard framework of guidelines for financial accounting. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions, and in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, LPS reports several non-GAAP measures, including “EBITDA” (GAAP operating income plus depreciation and amortization); “EBITDA, as adjusted” (EBITDA adjusted for the impact of certain non-recurring adjustments, if applicable); “EBIT, as adjusted” or “adjusted operating income” (GAAP operating income adjusted for the impact of certain non-recurring adjustments, if applicable); “adjusted net earnings” (GAAP net earnings adjusted for the impact of certain non-recurring adjustments, if applicable, plus the after-tax purchase price amortization of intangible assets added through acquisitions); “adjusted net earnings per diluted share” or “adjusted EPS per diluted share” (adjusted net earnings divided by diluted weighted average shares); and “adjusted free cash flow” (net cash provided by operating activities less additions to property, equipment and computer software, as well as non-recurring adjustments, if applicable). LPS provides these measures because it believes that they are helpful to investors in comparing year-over-year performance in light of certain non-recurring charges, and to better understand our financial performance, competitive position and future prospects. Non-GAAP measures should be considered in conjunction with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP net earnings. A reconciliation of these non-GAAP measures to related GAAP measures is included in the attachments to this release. |

2011 Business Highlights 4 ONE SOURCE. POWERFUL SOLUTIONS. Strengthened leadership team Conducted strategic review of businesses Exited non-core businesses During cyclical downturn • Outperformed market metrics • Preserved strong margins through disciplined cost management Signed 7 new MSP and 15 new Desktop customers Continued to resolve outstanding litigation |

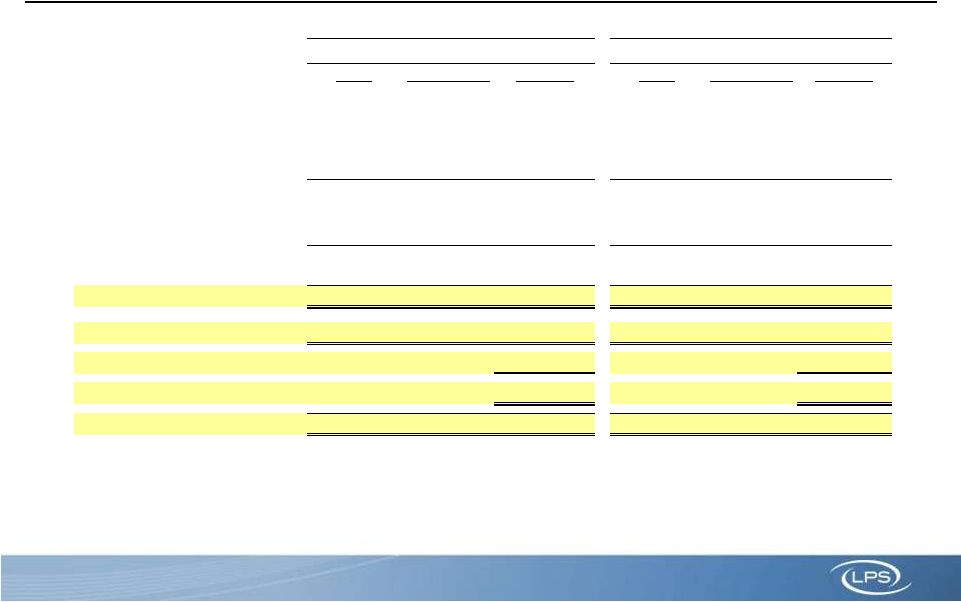

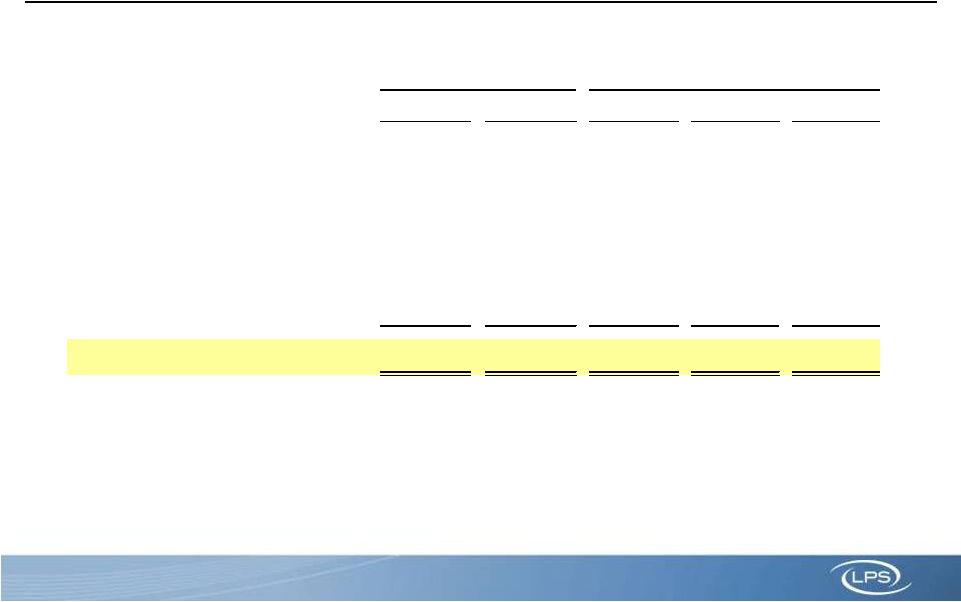

5 ONE SOURCE. POWERFUL SOLUTIONS. Condensed Income Statement GAAP to Adjusted ($ in millions) GAAP Adjustments Adjusted GAAP Adjustments Adjusted Revenue 533.8 $ - $ 533.8 $ 2,090.1 $ - $ 2,090.1 $ EBITDA 28.9 106.2 135.1 380.6 135.4 516.0 EBITDA % 5.4% 25.3% 18.2% 24.7% EBIT 4.9 106.2 111.1 290.2 135.4 425.6 Earnings (loss) before taxes (11.3) 106.2 94.9 223.9 143.4 367.2 Provision (benefit) for taxes (7.1) 42.7 35.6 81.1 56.8 137.8 Continuing operations, net of tax (4.2) 63.5 59.3 142.8 86.6 229.4 Discontinued operations, net of tax (17.0) 15.5 (1.5) (46.3) 34.8 (11.5) Net earnings (loss) (21.2) $ 79.0 $ 57.8 $ 96.5 $ 121.4 $ 218.0 $ Earnings (loss) per diluted share (0.25) $ 0.94 $ 0.69 $ 1.13 $ 1.42 $ 2.55 $ Purchase Amortization, net of tax 0.03 0.13 Adjusted earnings per diluted share 0.72 $ 2.68 $ Free cash flow 124.9 $ (3.3) $ 121.5 $ 373.0 $ 8.2 $ 381.2 $ Note: columns may not total due to rounding. Q4 2011 FY 2011 |

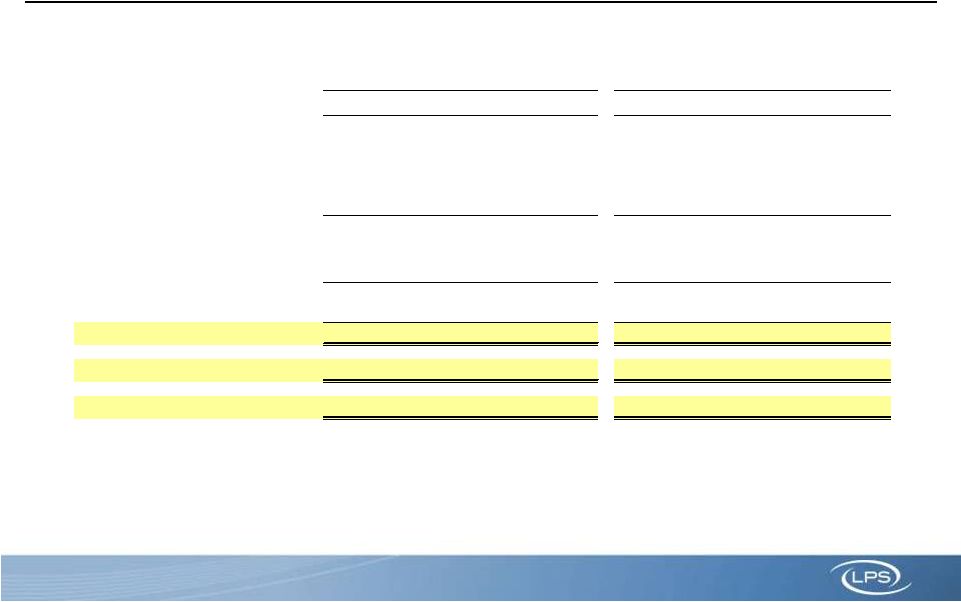

6 ONE SOURCE. POWERFUL SOLUTIONS. Condensed Income Statement Adjusted Results ($ in millions) Q4-11 Q4-10 % Var FY11 FY10 % Var Revenue 533.8 $ 618.2 $ -13.6% 2,090.1 $ 2,376.9 $ -12.1% EBITDA 135.1 172.7 -21.8% 516.0 683.2 -24.5% EBITDA % 25.3% 27.9% (264) 24.7% 28.7% (406) EBIT 111.1 148.8 -25.3% 425.6 594.2 -28.4% Earnings before taxes 94.9 132.5 -28.4% 367.2 524.2 -29.9% Provision for taxes 35.6 49.4 27.9% 137.8 199.2 30.8% Continuing operations, net of tax 59.3 83.1 -28.7% 229.4 325.0 -29.4% Discontinued operations, net of tax (1.5) (3.7) 59.7% (11.5) (13.9) 17.8% Net earnings 57.8 $ 79.4 $ -27.3% 218.0 $ 311.1 $ -29.9% Adjusted earnings per diluted share 0.72 $ 0.92 $ -21.7% 2.68 $ 3.50 $ -23.4% Adjusted free cash flow 121.5 $ 134.4 $ -9.5% 381.2 $ 342.0 $ 11.5% Note: columns may not total due to rounding. Quarterly Annual |

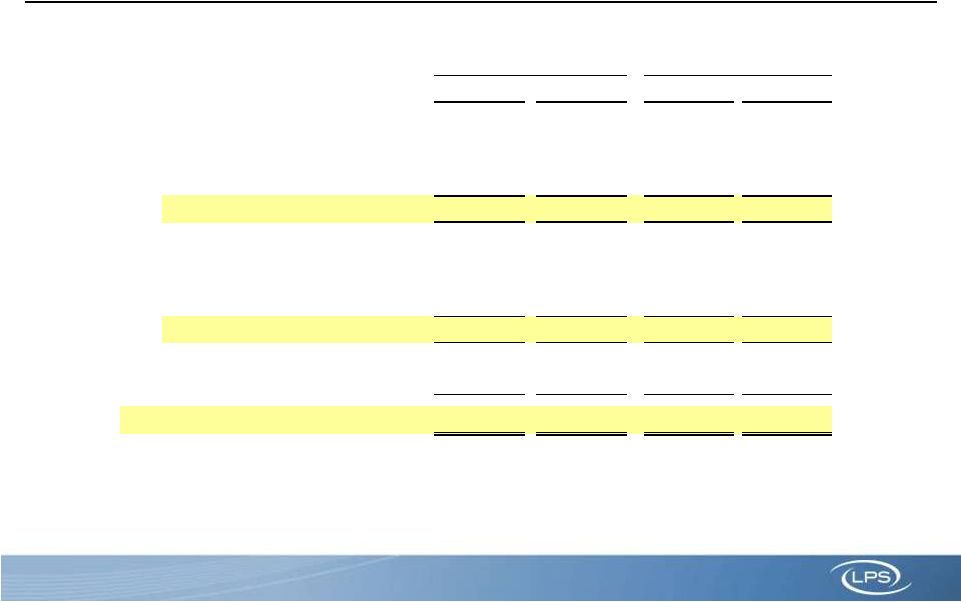

Summary of Adjustments 7 ONE SOURCE. POWERFUL SOLUTIONS. Q4-11 FY-11 GAAP EPS (0.25) $ 1.13 $ Adjustments: Legal and Regulatory Reserve 0.63 0.63 Exiting Non-Core Businesses 0.18 0.41 Other Non-Recurring 0.21 0.46 Income Tax Benefit (0.08) (0.08) Total Adjustments 0.94 1.42 Purchase Amortization, net 0.03 0.13 Adjusted EPS 0.72 $ 2.68 $ |

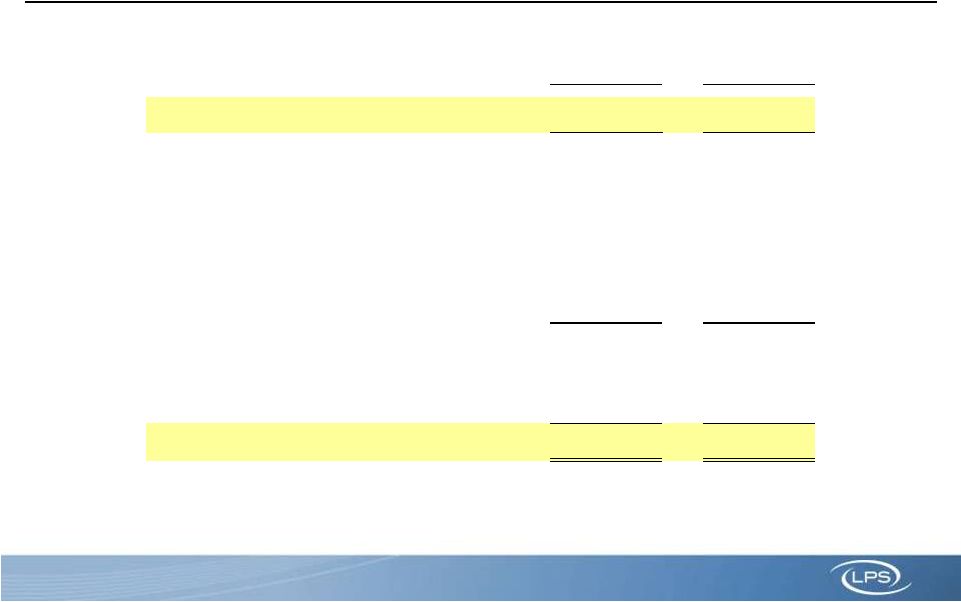

Segment Revenue 8 ONE SOURCE. POWERFUL SOLUTIONS. ($ in millions) Q4-11 Q4-10 vs PY vs PQ Technology, Data and Analytics: Mortgage Processing 106.1 $ 100.3 $ 5.8% -0.2% Other TD&A 86.0 83.1 3.5% 9.9% Total TD&A 192.1 183.5 4.7% 4.1% Loan Transaction Services: Loan Facilitation Services 156.4 185.3 -15.6% 13.3% Default Services 186.6 251.2 -25.7% -6.0% Total LTS 343.0 436.6 -21.4% 1.9% Corporate and Other (1.3) (1.9) nm nm Total Revenue 533.8 $ 618.2 $ -13.6% 2.8% Note: columns may not total due to rounding. Revenue $ % Growth |

Segment EBITDA Adjusted 9 ONE SOURCE. POWERFUL SOLUTIONS. ($ in millions) Q4-11 Q4-10 Q4-11 Q4-10 Q3-11 Technology, Data and Analytics 83.1 $ 79.6 $ 43.3% 43.4% 43.5% Loan Transaction Services 80.2 114.8 23.4% 26.3% 19.9% Corporate and Other (28.3) (21.7) nm mn nm Total EBITDA 135.1 $ 172.7 $ 25.3% 27.9% 22.1% Note: columns may not total due to rounding. EBITDA $ EBITDA Margin % |

Guidance – Q1 2012 Revenue $470 - $490 million EPS $0.50 - $0.55 10 ONE SOURCE. POWERFUL SOLUTIONS. |