March 2, 2020

VIA SEDAR

British Columbia Securities Commission

Corporate Finance

P.O. Box 10142, Pacific Centre

701 West Georgia Street

Vancouver, BC V7Y 1L2

Dear Sirs and Mesdames:

Re: Filing by B2Gold Corp. (“B2Gold”) of a Technical Report not required by National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”)

B2Gold is re-filing the attached technical report entitled “Gramalote Project, Colombia, NI 43-101 Technical Report” dated effective December 31, 2019 (the “Report”) in respect of the Gramalote project, a joint venture between B2Gold and AngloGold Ashanti Limited, located in central Colombia (the “Gramalote Project”).

The Report is being re-filed to supersede and replace the version of the Report filed on February 28, 2020, to correct inadvertent errors in the “Environmental compensation” and “Exploration costs” portions of Table 22.2 “Cashflow Forecast on an Annualized Basis (2020-2036)”, insert a total for the AISC costs and provide a unit for those costs, and format the presentation of the royalties data to match the remainder of the table presentation. Apart from the corrections to Table 22.2, there were no other changes made to the Report, including to the cashflow totals in Table 22.2.

As B2Gold does not consider the Gramalote Project to be a material property for the purposes of NI 43-101, the Report is being filed on a voluntary basis as contemplated under section 4.2(12) of the Companion Policy to NI 43-101. The Report is being filed to provide additional information on the Updated Preliminary Economic Assessment for the Gramalote Ridge deposit at the Gramalote Project as announced by B2Gold on January 21, 2020, and not as a result of a requirement under NI 43-101.

Yours sincerely,

(Signed) “Tom Garagan”

Tom Garagan, P.Geo.

Senior Vice President, Exploration

cc. Alberta Securities Commission, Financial and Consumer Affairs Authority of Saskatchewan, Manitoba Securities Commission, Ontario Securities Commission, Autorite des marches financiers, Quebec, Nova Scotia Securities Commission, New Brunswick Securities Commission, Office of the Superintendent of Securities, Prince Edward Island, Office of the Superintendent of Securities, Newfoundland and Labrador

B2GOLD CORP.

Suite 3100, Three Bentall Centre, 595 Burrard Street, PO Box 49143, Vancouver, British Columbia, Canada V7X 1J1

T. 604.681.8371 F. 604.681.6209 www.b2gold.com

CERTIFICATE OF QUALIFIED PERSON

I, Tom Garagan, P.Geo, am employed as the Senior Vice President, Exploration with B2Gold Corp. ("B2Gold"), which has its head offices at 595 Burrard St #3100, Vancouver, BC V7X 1J1, Canada.

This certificate applies to the technical report titled "Gramalote Project, Colombia, NI 43-101 Technical Report", that has an effective date of 31 December, 2019 (the "technical report").

I am a member of the Association of Professional Engineers and Geoscientists of British Columbia, and of the Association of Professional Engineers, Geologists and Geophysicists of Alberta. I graduated from the University of Ottawa with a Bachelor of Science (Honours) degree in Geological Sciences in 1980.

I have practiced my profession for 40 years. In this time I have been directly involved in generating and managing exploration activities, and in the collection, supervision and review of geological, mineralization, exploration and drilling data; geological models; sampling, sample preparation, assaying and other resource-estimation related analyses; assessment of quality assurance-quality control data and databases; and supervision of mineral resource estimates.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101).

I visited the Gramalote Project from April 29-May 3, 2012.

I am responsible for, or co-responsible for, Sections 1.1 to 1.9, 1.11, 1.12, 1.22, 1.24; Section 2; Section 3; Section 4; Section 5; Section 6; Section 7; Section 8; Section 9; Section 10; Section 11; Section 12; Section 14; Section 23; Sections 25.1, 25.2, 25.3, 25.4, 25.6, 25.15; Section 26; and Section 27 of the technical report.

I am not independent of B2Gold as independence is described by Section 1.5 of NI 43-101.

I have been involved with the Gramalote Project since B2Gold acquired a project interest in 2006.

I have read NI 43-101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the technical report not misleading.

Dated: 28 February, 2020.

(Signed) "Tom Garagan"

Tom Garagan, P.Geo.

B2Gold Corp. 595 Burrard St #3100, Vancouver, BC V7X 1J1, Canada Tel: +1 604-681-8371 |

| www.b2gold.com |

CERTIFICATE OF QUALIFIED PERSON

I, Kevin Pemberton, P.E., am employed as the Chief Mine Planning Engineer with B2Gold Corp. ("B2Gold"), which has its head offices at 595 Burrard St #3100, Vancouver, BC V7X 1J1, Canada.

This certificate applies to the technical report titled "Gramalote Project, Colombia, NI 43-101 Technical Report", that has an effective date of 31 December, 2019 (the "technical report").

I am a registered Professional Mining Engineer in the state of Florida, USA (# PE 77013). I graduated in 1990 from the Montana College of Mineral Science and Technology with a Bachelor of Science in Mining Engineering degree. I have been employed in the mining industry for over 28 years. I have prepared, and supervised the preparation of, Mineral Reserve estimates, mining long-range plans, operations, surveying, ore control and construction management in predominantly open pit, but also underground, operations in North, Central, and South America, Russia and Kazakhstan.

I visited the B2Gold/Gramalote Colombia offices in Medellin from October 18-24, 2019, and inspected the Gramalote Project site during October 21-22, 2019.

I am responsible for, or co-responsible for, Sections 1.1, 1.2, 1.13, 1.15, 1.17 to 1.24; Sections 2.1 to 2.6; Section 3; Section 15; Section 16; Sections 18.1, 18.2, 18.5 to 18.9; Section 19; Sections 21.1, 21.2, 21.3.1, 21.3.2, 21.3.4 to 21.3.6; Section 22; Section 24; Sections 25.1, 25.7, 25.9, 25.11 to 25.16; Section 26 and Section 27 of the technical report.

I am not independent of B2Gold as independence is described by Section 1.5 of NI 43-101.

I have been involved with the Gramalote Project since October 2019.

I have read NI 43-101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the technical report not misleading.

Dated: 28 February, 2020

(Signed) "Kevin Pemberton"

Kevin Pemberton, P.E.

B2Gold Corp. 595 Burrard St #3100, Vancouver, BC V7X 1J1, Canada Tel: +1 604-681-8371 |

| www.b2gold.com |

CERTIFICATE OF QUALIFIED PERSON

I, John Rajala, P.E., am employed as the Vice President, Metallurgy with B2Gold Corp. ("B2Gold"), which has its head offices at 595 Burrard St #3100, Vancouver, BC V7X 1J1, Canada.

This certificate applies to the technical report titled "Gramalote Project, Colombia, NI 43-101 Technical Report", that has an effective date of 31 December, 2019 (the "technical report").

I am a registered professional engineer in the state of Washington (No. 43299) and have a B.S. and M.S in metallurgical engineering from Michigan Technological University (1976) and the University of Nevada - Mackay School of Mines (1981), respectively.

I have practiced my profession for 42 years, during which I have been directly involved in the operations and management of mineral processing plants for gold and base metals, and in process plant design and commissioning of projects located in Africa, Asia, North, Central and South America.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

I visited the Gramalote Project from 4-6 October, 2011.

I am responsible for, or co-responsible for, Sections 1.1, 1.2, 1.10, 1.14, 1.15, 1.18, 1.19, 1.22, 1.24; Sections 2.1 to 2.4, 2.6; Section 13; Section 17; Sections 18.3, 18.4; Sections 21.1, 21.2.1, 21.2.3, 21.2.6, 21.3.1, 21.3.3, 21.3.6; Sections 25.1, 25.5, 25.8, 25.15; Section 26 and Section 27 of the technical report.

I am not independent of B2Gold as independence is described by Section 1.5 of NI 43-101.

I have been involved with the Gramalote Project since 2011.

I have read NI 43-101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the technical report not misleading.

Dated: 28 February, 2020

(Signed) "John Rajala"

John Rajala, P.E.

B2Gold Corp. 595 Burrard St #3100, Vancouver, BC V7X 1J1, Canada Tel: +1 604-681-8371 |

| www.b2gold.com |

CERTIFICATE OF QUALIFIED PERSON

I, Ken Jones, P.E., am employed as the Environmental and Permitting Manager with B2Gold Corp. ("B2Gold"), which has its head offices at 595 Burrard St #3100, Vancouver, BC V7X 1J1, Canada.

This certificate applies to the technical report titled "Gramalote Project, Colombia, NI 43-101 Technical Report", that has an effective date of 31 December, 2019 (the "technical report").

I am a registered Professional Engineer (#42718, Colorado, USA). I graduated from the University of Iowa in 2001 with a B. Sc. in Chemical Engineering. I have practiced my profession for over 16 years. I have developed, conducted and/or directed environmental and social studies including baseline investigations; materials geochemical characterization; hydrologic, air and noise modeling; closure planning and costing; and environmental and social impact assessment for hard rock mining projects in over a dozen countries in North and South America, Africa and Asia. I have developed, implemented and maintained programs for engineering and administrative compliance regarding international environmental, health and safety regulations and best practices at gold projects in Nicaragua, Namibia, the Philippines and Mali.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101).

I visited the Gramalote Project from 19-20 August, 2019.

I am responsible for, or co-responsible for, Sections 1.1, 1.2, 1.16, 1.22, 1.24; Sections 2.1 to 2.4, 2.6; Section 20; Sections 25.1, 25.10, 25.15; Section 26; and Section 27 of the technical report.

I am not independent of B2Gold as independence is described by Section 1.5 of NI 43-101.

I have been involved with the Gramalote project since August, 2019.

I have read NI 43-101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the technical report not misleading.

Dated: 28 February, 2020

(Signed) "Ken Jones"

Ken Jones, P.E.

B2Gold Corp. 595 Burrard St #3100, Vancouver, BC V7X 1J1, Canada Tel: +1 604-681-8371 |

| www.b2gold.com |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This NI 43-101 Technical Report (the Report) contains "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation, including, but not limited to, B2Gold Corp.'s (B2Gold) objectives, strategies, intentions and expectations; projections; outlook; guidance; forecasts; estimates; and other statements regarding future or estimated financial and operational performance, gold production and sales, revenues and cash flows, and capital costs and operating costs, including projected cash operating costs, and budgets; statements regarding future or estimated mine life, metal price assumptions, estimated mineralized material grades, gold recovery rates, stripping ratios, throughput, processing; statements regarding anticipated exploration, drilling, development, construction, permitting and other activities or achievements of B2Gold; the results of and estimates in the 2020 PEA, including the production and life-of-mine estimates, capital cost and operating cost estimates, the financial projections, estimates and results, and other results of the economic analyses contained therein; the potential to convert existing Inferred Mineral Resources to the Indicated category; the timing to complete a feasibility study at Gramalote; the completion and results of a feasibility study at Gramalote; the potential to develop Gramalote as an open-pit gold mine and any decision from the joint venture in respect thereof; the anticipated effect of external factors on revenue, such as commodity prices, exchange rates and metal price assumptions, estimation of Mineral Resources, mine life projections, reclamation costs, economic outlook, government regulation of mining operations, receipt of additional required permits and authorizations, including with respect to surface rights; expectations regarding community relations and social licence to operate including with respect to resettlement of individuals due to project development and artisanal and small miners working in the Project area. All statements in this Technical Report that address events or developments that B2Gold expects to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of B2Gold's management as of the date such statements are made. All of the forward-looking statements in this Report are qualified by this cautionary note.

Forward-looking statements are not, and cannot be, a guarantee of future results or events. Forward-looking statements are based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable at the date the forward-looking statements is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking statements. The material factors or assumptions that B2Gold identified and were applied by B2Gold in drawing conclusions or making forecasts or projections set out in the forward-looking statements include, but are not limited to: the factors identified in Sections 1.12, 14.13 and 25.6 of this Report, which may affect the Mineral Resource estimate; the metallurgical recovery assumptions identified in Section 13 of this Report; the factors related to the 2020 PEA identified in Sections1.19, 1.20, 21.3 and 22.1 of this Report; the project risks and opportunities identified in Section 1.22 of this Report; dilution and mining recovery assumptions; the success of mining, processing, exploration and development activities; the accuracy of geological, mining and metallurgical estimates; geotechnical assumptions; assumptions used in the Mineral Resource estimate; anticipated commodity prices and the costs of production; no significant unanticipated operational or technical difficulties; the execution of B2Gold's business and growth strategies, including the success of B2Gold's strategic investments and initiatives; the availability of additional financing, if needed; the availability of personnel for exploration, development, and operational projects and ongoing employee relations; acquisition of any required surface rights; maintaining good relations with the communities surrounding the Project; no significant unanticipated events or changes relating to regulatory, environmental, resettlement and social licence matters, health and safety matters; no contests over title to B2Gold's properties; no significant unanticipated litigation; certain tax matters; and no significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices and foreign exchange rates).

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking statements may include, but are not limited to, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), uncertainties related to the continued development and operation of the Project, dependence on key personnel and employee relations; risks related to political or social unrest or change; operational risks and hazards, including unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks; failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated; the availability of electrical power, and the power rates used in the operating cost estimates and financial analysis; compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation; volatile financial markets that may affect B2Gold's ability to obtain additional financing on acceptable terms; the failure to obtain required approvals or clearances from government authorities on a timely basis; uncertainties related to the geology, continuity, grade and estimates of Mineral Resources, and the potential for variations in grade and recovery rates; uncertain costs of reclamation activities, and the final outcome thereof; changes to applicable laws or regulations, including with respect to interest rates and tax rates; tax refunds; hedging transactions; as well as other factors identified and as described in more detail under the heading "Risk Factors" in B2Gold's most recent Annual Information Form and B2Gold's other filings with Canadian securities regulators and the U.S. Securities and Exchange Commission, which may be viewed at www.sedar.com and www.sec.gov, respectively. The list is not exhaustive of the factors that may affect B2Gold's forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what benefits or liabilities B2Gold will derive therefrom. B2Gold's forward looking statements reflect current expectations regarding future events and operating performance and speak only as of the date hereof and B2Gold does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.

Gramalote Project |

Contents

| 1.0 SUMMARY | 1-1 |

| 1.1 Introduction | 1-1 |

| 1.2 Terms of Reference | 1-1 |

| 1.3 Project Setting | 1-1 |

| 1.4 Joint Venture | 1-2 |

| 1.5 Mineral Tenure, Surface Rights, Water Rights, Royalties and Agreements | 1-3 |

| 1.6 Geology and Mineralization | 1-3 |

| 1.7 History | 1-4 |

| 1.8 Drilling and Sampling | 1-5 |

| 1.9 Data Verification | 1-7 |

| 1.10 Metallurgical Test Work | 1-7 |

| 1.11 Mineral Resource Estimation | 1-8 |

| 1.12 Mineral Resource Statement | 1-9 |

| 1.13 Mining Methods | 1-10 |

| 1.14 Recovery Methods | 1-13 |

| 1.15 Project Infrastructure | 1-13 |

| 1.16 Environmental, Permitting and Social Considerations | 1-15 |

| 1.16.1 Environmental Considerations | 1-15 |

| 1.16.2 Closure and Reclamation Planning | 1-15 |

| 1.16.3 Permitting Considerations | 1-15 |

| 1.16.4 Social Considerations | 1-16 |

| 1.17 Markets and Contracts | 1-16 |

| 1.18 Capital Cost Estimates | 1-17 |

| 1.19 Operating Cost Estimates | 1-17 |

| 1.20 Economic Analysis | 1-18 |

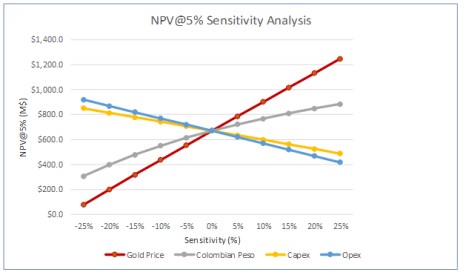

| 1.21 Sensitivity Analysis | 1-21 |

| 1.22 Risks and Opportunities | 1-21 |

| 1.23 Interpretation and Conclusions | 1-23 |

| 1.24 Recommendations | 1-24 |

| 2.0 INTRODUCTION | 2-1 |

| 2.1 Introduction | 2-1 |

| 2.2 Terms of Reference | 2-1 |

| 2.3 Qualified Persons | 2-1 |

| 2.4 Site Visits and Scope of Personal Inspection | 2-2 |

| 2.5 Effective Dates | 2-3 |

| 2.6 Information Sources and References | 2-3 |

| 2.7 Previous Technical Reports | 2-4 |

| ||

| TOC i | ||

| February 2020 |

Gramalote Project |

| 3.0 RELIANCE ON OTHER EXPERTS | 3-1 |

| 4.0 PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| 4.1 Introduction | 4-1 |

| 4.2 Property and Title in Colombia | 4-1 |

| 4.2.1 Mineral Title | 4-1 |

| 4.2.2 ANNA Minera | 4-2 |

| 4.2.3 Surface Rights | 4-2 |

| 4.2.4 Royalties | 4-2 |

| 4.2.5 Environmental | 4-2 |

| 4.2.6 Fraser Institute Survey | 4-3 |

| 4.3 Project Ownership | 4-4 |

| 4.4 Mineral Tenure | 4-5 |

| 4.5 Surface Rights | 4-8 |

| 4.6 Water Rights | 4-9 |

| 4.7 Royalties and Encumbrances | 4-9 |

| 4.7.1 Royalties | 4-9 |

| 4.7.2 Encumbrances | 4-9 |

| 4.8 Permitting Considerations | 4-9 |

| 4.9 Environmental Considerations | 4-10 |

| 4.10 Social License Considerations | 4-10 |

| 4.11 Comment on Property Description and Location | 4-10 |

| 5.0 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY | 5-1 |

| 5.1 Accessibility | 5-1 |

| 5.2 Climate | 5-1 |

| 5.3 Local Resources and Infrastructure | 5-1 |

| 5.4 Physiography | 5-2 |

| 5.5 Seismicity | 5-2 |

| 5.6 Sufficiency of Surface Rights | 5-2 |

| 6.0 HISTORY | 6-1 |

| 6.1 Exploration History | 6-1 |

| 6.2 Production | 6-1 |

| 7.0 GEOLOGICAL SETTING AND MINERALIZATION | 7-1 |

| 7.1 Regional Geology | 7-1 |

| 7.2 Project Geology | 7-1 |

| 7.2.1 Lithologies | 7-1 |

| 7.2.2 Structure | 7-6 |

| 7.3 Deposit Descriptions | 7-6 |

| 7.3.1 Gramalote Ridge | 7-6 |

Gramalote Project |

| 7.3.2 Trinidad | 7-9 |

| 7.4 Prospects/Exploration Targets | 7-10 |

| 7.5 Comments on Geological Setting and Mineralization | 7-10 |

| 8.0 DEPOSIT TYPES | 8-1 |

| 8.1 Deposit Model | 8-1 |

| 8.2 Comments on Deposit Types | 8-2 |

| 9.0 EXPLORATION | 9-1 |

| 9.1 Grids and Surveys | 9-1 |

| 9.2 Geochemistry | 9-1 |

| 9.3 Geophysics | 9-1 |

| 9.3.1 Airborne Geophysical Surveys | 9-1 |

| 9.3.2 Ground Geophysical Surveys | 9-2 |

| 9.4 Petrology, Mineralogy, and Research Studies | 9-2 |

| 9.5 Exploration Potential | 9-2 |

| 9.6 Comments on Exploration | 9-2 |

| 10.0 DRILLING | 10-1 |

| 10.1 Introduction | 10-1 |

| 10.2 Drill Methods | 10-1 |

| 10.3 Logging Procedures | 10-6 |

| 10.4 Recovery | 10-6 |

| 10.5 Collar Surveys | 10-6 |

| 10.6 Downhole Surveys | 10-7 |

| 10.7 Geotechnical and Hydrological Drilling | 10-7 |

| 10.8 Metallurgical Drilling | 10-7 |

| 10.9 Condemnation | 10-9 |

| 10.10 Sample Length/True Thickness | 10-9 |

| 10.11 Drilling Since the Mineral Resource Database Close-off | 10-9 |

| 10.12 Comments on Drilling | 10-10 |

| 11.0 SAMPLE PREPARATION, ANALYSES, AND SECURITY | 11-1 |

| 11.1 Sampling Methods | 11-1 |

| 11.1.1 RC | 11-1 |

| 11.1.2 Core | 11-1 |

| 11.2 Density Determinations | 11-1 |

| 11.3 Analytical and Test Laboratories | 11-2 |

| 11.4 Sample Preparation and Analysis | 11-2 |

| 11.4.1 Sample Preparation | 11-2 |

| 11.4.2 Analyses | 11-2 |

| 11.5 Quality Assurance and Quality Control | 11-3 |

| 11.6 Databases | 11-3 |

Gramalote Project |

| 11.7 Sample Security | 11-3 |

| 11.8 Sample Storage | 11-3 |

| 11.9 Comments on Sample Preparation, Analyses and Security | 11-4 |

| 12.0 DATA VERIFICATION | 12-1 |

| 12.1 Internal Data Verification | 12-1 |

| 12.2 External Data Verification | 12-1 |

| 12.2.1 Previous Technical Reports | 12-1 |

| 12.2.2 External Audits | 12-1 |

| 12.3 QP Verification | 12-1 |

| 12.4 Comments on Data Verification | 12-2 |

| 13.0 MINERAL PROCESSING AND METALLURGICAL TESTING | 13-1 |

| 13.1 Introduction | 13-1 |

| 13.2 Metallurgical Test Work | 13-1 |

| 13.2.1 Completed Test Work | 13-1 |

| 13.2.2 Sample Selection | 13-1 |

| 13.2.3 Mineralization Characterization | 13-3 |

| 13.2.4 Mineralogy | 13-4 |

| 13.2.5 Comminution | 13-4 |

| 13.2.6 Heap Leach | 13-5 |

| 13.2.7 Gravity Recovery | 13-5 |

| 13.2.8 Flotation | 13-5 |

| 13.2.9 Concentrate Leaching | 13-8 |

| 13.2.10 Thickening | 13-10 |

| 13.2.11 Cyanide Destruction | 13-10 |

| 13.2.12 Materials Handling | 13-11 |

| 13.2.13 Tailings Rheology | 13-11 |

| 13.2.14 Upgrading by Screening | 13-11 |

| 13.2.15 Recovery Variability Test Work | 13-11 |

| 13.2.16 Oxide Materials | 13-13 |

| 13.3 Recovery Estimates | 13-17 |

| 13.4 Metallurgical Variability | 13-17 |

| 13.5 Deleterious Elements | 13-18 |

| 13.6 Trade-off Studies | 13-19 |

| 14.0 MINERAL RESOURCE ESTIMATES | 14-1 |

| 14.1 Introduction | 14-1 |

| 14.2 Exploratory Data Analysis | 14-1 |

| 14.3 Geological Models | 14-1 |

| 14.3.1 Mineralization Zones | 14-1 |

| 14.3.2 Weathering Model | 14-2 |

Gramalote Project |

| 14.4 Density Assignment | 14-4 |

| 14.5 Grade Capping/Outlier Restrictions | 14-4 |

| 14.5.1 Gramalote Ridge | 14-4 |

| 14.5.2 Trinidad | 14-4 |

| 14.6 Composites | 14-4 |

| 14.7 Variography | 14-7 |

| 14.8 Estimation/Interpolation Methods | 14-7 |

| 14.9 Block Model Validation | 14-8 |

| 14.9.1 Gramalote Ridge | 14-9 |

| 14.9.2 Trinidad | 14-10 |

| 14.10 Classification of Mineral Resources | 14-11 |

| 14.11 Reasonable Prospects of Eventual Economic Extraction | 14-11 |

| 14.12 Mineral Resource Statement | 14-11 |

| 14.13 Factors That May Affect the Mineral Resource Estimate | 14-14 |

| 14.14 Comments on Section 14 | 14-14 |

| 15.0 MINERAL RESERVE ESTIMATES | 15-1 |

| 16.0 MINING METHODS | 16-1 |

| 16.1 Overview | 16-1 |

| 16.2 Geotechnical Considerations | 16-1 |

| 16.3 Hydrogeological Considerations | 16-1 |

| 16.4 Pit Optimization | 16-2 |

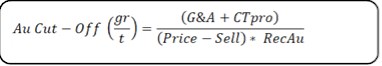

| 16.5 Cut-off Grade | 16-2 |

| 16.6 Open Pit Design | 16-4 |

| 16.7 Stockpiles | 16-7 |

| 16.8 Waste Storage Facilities | 16-7 |

| 16.9 Production Schedule | 16-7 |

| 16.10 Grade Control | 16-8 |

| 16.11 Mining Equipment | 16-8 |

| 17.0 RECOVERY METHODS | 17-1 |

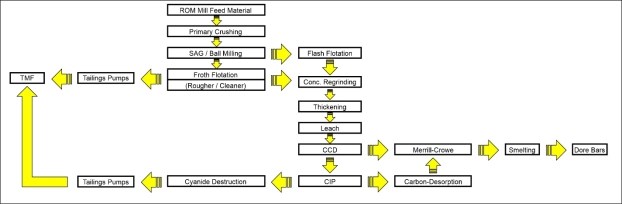

| 17.1 Process Flowsheet | 17-1 |

| 17.2 Plant Design | 17-1 |

| 17.2.1 Crushing | 17-1 |

| 17.2.2 Grinding | 17-1 |

| 17.2.3 Flotation, Regrind, and Thickening | 17-2 |

| 17.2.4 Leach and Counter Current Decantation | 17-3 |

| 17.2.5 Carbon-in-Pulp | 17-4 |

| 17.2.6 Cyanide Destruction | 17-5 |

| 17.2.7 Flotation Tailings Thickening | 17-5 |

| 17.2.8 Flotation and Leach Overland Tailings Pumping | 17-5 |

Gramalote Project |

| 17.3 Equipment Sizing | 17-5 |

| 17.4 Control Strategy | 17-6 |

| 17.5 Power and Consumables | 17-6 |

| 17.5.1 Plant Services | 17-6 |

| 17.5.2 Water | 17-8 |

| 17.5.3 Power | 17-8 |

| 17.6 Comments on Recovery Methods | 17-8 |

| 18.0 PROJECT INFRASTRUCTURE | 18-1 |

| 18.1 Introduction | 18-1 |

| 18.2 Road and Logistics | 18-1 |

| 18.3 Tailings Management Facilities | 18-4 |

| 18.4 Water Management | 18-4 |

| 18.5 Built Infrastructure | 18-5 |

| 18.6 Camps and Accommodation | 18-5 |

| 18.7 Power and Electrical | 18-6 |

| 18.8 Fuel | 18-6 |

| 18.9 Water Supply | 18-6 |

| 19.0 MARKET STUDIES AND CONTRACTS | 19-1 |

| 19.1 Market Studies | 19-1 |

| 19.2 Commodity Price Projections | 19-1 |

| 19.3 Contracts | 19-1 |

| 19.4 Comments on Section 19 | 19-1 |

| 20.0 ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT | 20-1 |

| 20.1 Introduction | 20-1 |

| 20.2 Baseline Studies | 20-1 |

| 20.3 Environmental Considerations/Monitoring Programs | 20-2 |

| 20.4 Closure Plan | 20-3 |

| 20.5 Permitting | 20-4 |

| 20.6 Considerations of Social and Community Impacts | 20-4 |

| 20.6.1 Resettlement | 20-6 |

| 20.6.2 Artisanal and Small-Scale Mining | 20-7 |

| 21.0 CAPITAL AND OPERATING COSTS | 21-1 |

| 21.1 Introduction | 21-1 |

| 21.2 Capital Cost Estimates | 21-1 |

| 21.2.1 Basis of Estimate | 21-1 |

| 21.2.2 Direct Cost Estimates | 21-2 |

| 21.2.3 Indirect Cost Estimates | 21-2 |

| 21.2.4 Owners' Cost Estimates | 21-3 |

Gramalote Project |

| 21.2.5 Contingency Estimate | 21-3 |

| 21.2.6 Capital Cost Estimate Summary | 21-3 |

| 21.3 Operating Cost Estimates | 21-3 |

| 21.3.1 Basis of Estimate | 21-3 |

| 21.3.2 Mining Cost Estimates | 21-4 |

| 21.3.3 Plant Cost Estimates | 21-4 |

| 21.3.4 Infrastructure Cost Estimates | 21-4 |

| 21.3.5 Overarching Services Cost Estimates | 21-5 |

| 21.3.6 Operating Cost Estimate Summary | 21-5 |

| 22.0 ECONOMIC ANALYSIS | 22-1 |

| 22.1 Caution Statement | 22-1 |

| 22.2 Methodology Used | 22-2 |

| 22.3 Financial Model Parameters | 22-3 |

| 22.3.1 Mineral Resource and Mine Life | 22-3 |

| 22.3.2 Metallurgical Recoveries | 22-3 |

| 22.3.3 Selling and Freight Costs | 22-3 |

| 22.3.4 Metal Prices and Exchange Rates | 22-3 |

| 22.3.5 Capital and Operating Costs | 22-3 |

| 22.3.6 Royalties | 22-3 |

| 22.3.7 Working Capital | 22-3 |

| 22.3.8 Taxes | 22-3 |

| 22.3.9 Closure Costs and Salvage Value | 22-4 |

| 22.3.10 Financing | 22-4 |

| 22.3.11 Inflation | 22-4 |

| 22.4 Economic Analysis | 22-5 |

| 22.5 Sensitivity Analysis | 22-5 |

| 23.0 ADJACENT PROPERTIES | 23-1 |

| 24.0 OTHER RELEVANT DATA AND INFORMATION | 24-1 |

| 25.0 INTERPRETATION AND CONCLUSIONS | 25-1 |

| 25.1 Introduction | 25-1 |

| 25.2 Mineral Tenure, Surface and Water Rights, Royalties and Agreements | 25-1 |

| 25.3 Geology and Mineralization | 25-2 |

| 25.4 Exploration, Drilling and Analytical Data Collection in Support of Mineral Resource Estimation | 25-2 |

| 25.5 Metallurgical Test Work | 25-3 |

| 25.6 Mineral Resource Estimates | 25-3 |

| 25.7 Mine Plan | 25-3 |

| 25.8 Recovery Plan | 25-4 |

| 25.9 Infrastructure | 25-4 |

Gramalote Project |

| 25.10 Environmental, Permitting and Social Considerations | 25-4 |

| 25.11 Markets and Contracts | 25-5 |

| 25.12 Capital Cost Estimates | 25-5 |

| 25.13 Operating Cost Estimates | 25-5 |

| 25.14 Economic Analysis | 25-6 |

| 25.15 Risks and Opportunities | 25-6 |

| 25.16 Conclusions | 25-7 |

| 26.0 RECOMMENDATIONS | 26-1 |

| 27.0 REFERENCES | 27-1 |

Tables

| Table 1-1: Indicated Mineral Resource Statement | 1-11 |

| Table 1-2: Inferred Mineral Resource Statement | 1-11 |

| Table 1-3: Capital Cost Estimate | 1-18 |

| Table 1-4: Operating Cost Summary | 1-19 |

| Table 1-5: Key Financial Metrics | 1-22 |

| Table 4-1: Mineral Tenure Table | 4-6 |

| Table 6-1: Exploration History | 6-2 |

| Table 7-1: Major Rock Types | 7-4 |

| Table 7-2: Vein Types | 7-9 |

| Table 9-1: Exploration Potential | 9-4 |

| Table 10-1: Project Drill Summary Table | 10-2 |

| Table 10-2: Gramalote Mineral Resource Drill Summary Table | 10-2 |

| Table 10-3: Trinidad Mineral Resource Drill Summary Table | 10-2 |

| Table 13-1: Metallurgical Test work Summary | 13-2 |

| Table 13-2: Recovery Projections | 13-19 |

| Table 14-1: Densities Assigned to the Block Model, Gramalote Ridge | 14-5 |

| Table 14-2: Densities Assigned to the Block Model, Trinidad | 14-5 |

| Table 14-3: Au and Ag Capping Levels, Gramalote Ridge | 14-5 |

| Table 14-4: Capping Levels, Trinidad | 14-6 |

| Table 14-5: Gold Grade Statistics, 6-m Composites, LG Domain, Gramalote Ridge | 14-6 |

| Table 14-6: Gold Grade Statistics, 4-m Composites Mineralized Domains, Trinidad | 14-7 |

| Table 14-7: Variogram Models, Gramalote Ridge | 14-8 |

| Table 14-8: Grade Estimation Plan | 14-9 |

| Table 14-9: Conceptual Pit Shell Parameters | 14-12 |

| Table 14-10:Indicated Mineral Resource Statement | 14-13 |

| Table 14-11:Inferred Mineral Resource Statement | 14-13 |

| Table 16-1:Pit Slope Design Assumptions | 16-2 |

| Table 16-2:Whittle Shell Inputs | 16-3 |

| Table 16-3:Royalty and Selling Cost Assumptions | 16-4 |

| Table 16-4:Subset of Mineral Resource Estimate within the 2020 PEA Mine Plan | 16-5 |

| Table 17-1:Anticipated Equipment List | 17-7 |

Gramalote Project |

| Table 20-1:Granted Environmental Permits | 20-5 |

| Table 21-1:Capital Cost Estimate Summary | 21-4 |

| Table 21-2:Operating Cost Estimate Summary | 21-6 |

| Table 22-1:Key Financial Metrics | 22-6 |

| Table 22-2:Cashflow Forecast on an Annualized Basis (2020-2036) | 22-7 |

| Table 22-3:Cashflow Forecast on an Annualized Basis (2037-2046) | 22-8 |

Figures

| Figure 1-1: Sensitivity Analysis | 1-23 |

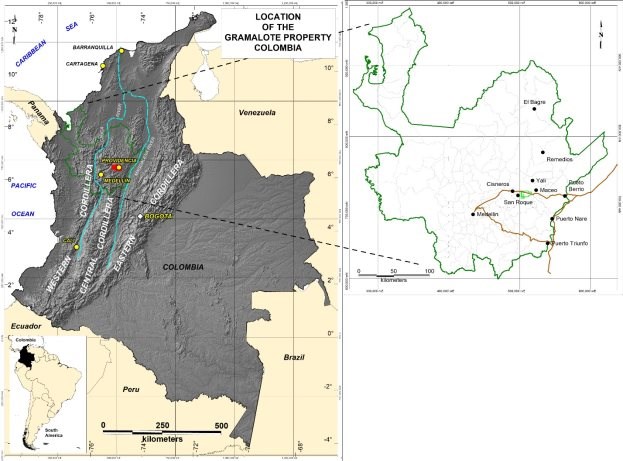

| Figure 2-1: Location Plan | 2-2 |

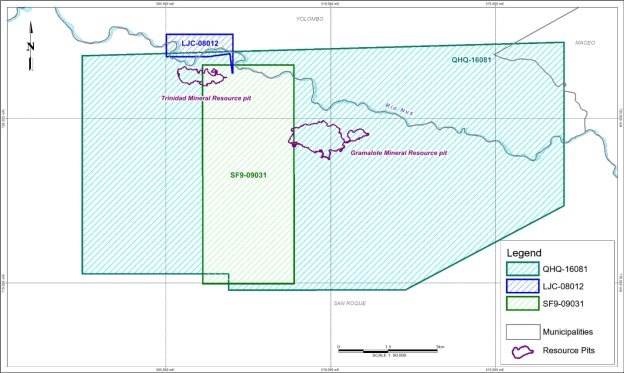

| Figure 4-1: Granted Mineral Tenure Location Plan | 4-7 |

| Figure 4-2: Mineral Tenure Under Application Location Plan | 4-8 |

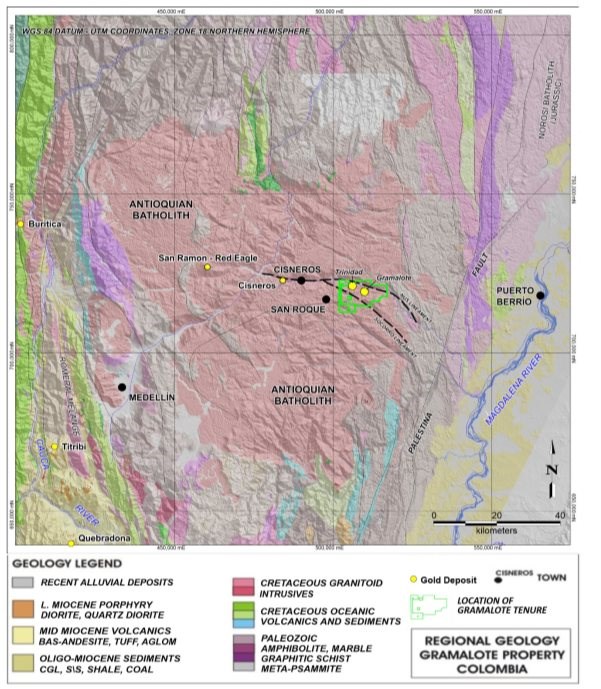

| Figure 7-1: Regional Geology | 7-2 |

| Figure 7-2: Regional Structural Setting | 7-3 |

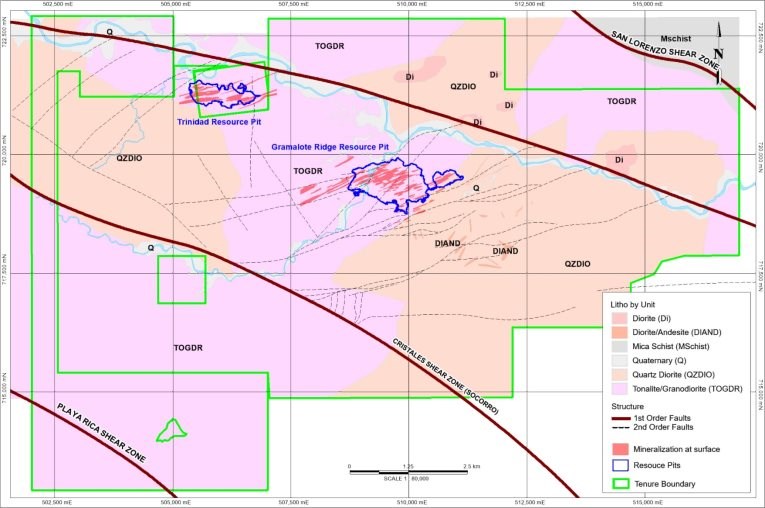

| Figure 7-3: Project Geology Map | 7-5 |

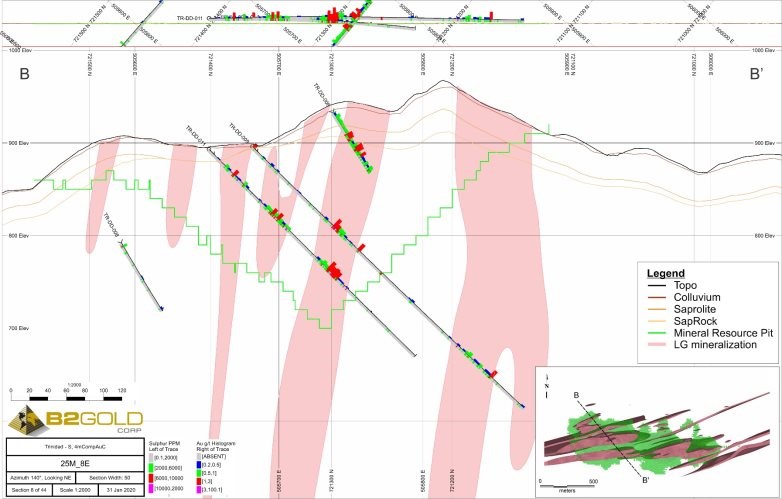

| Figure 7-4: Cross-Section, Gramalote Ridge Deposit | 7-8 |

| Figure 7-5: Cross-Section, Trinidad Deposit | 7-11 |

| Figure 9-1: Prospect Areas | 9-3 |

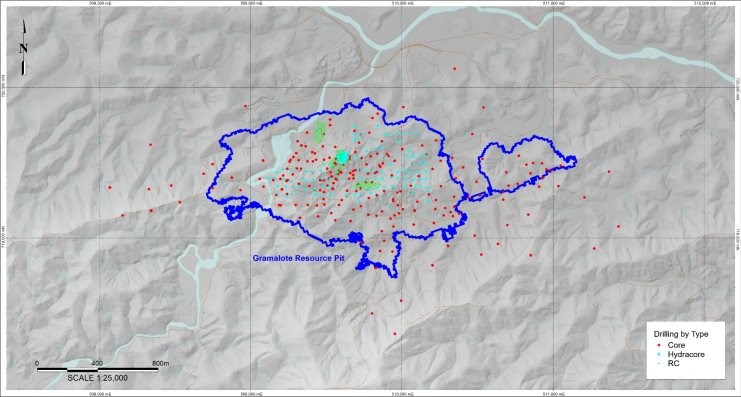

| Figure 10-1:Project Drill Collar Location Plan | 10-3 |

| Figure 10-2:Gramalote Mineral Resource Drill Collar Location Plan | 10-4 |

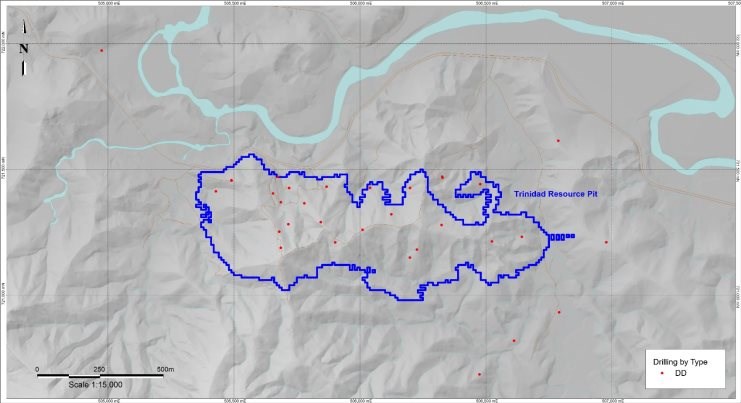

| Figure 10-3:Trinidad Mineral Resource Drill Collar Location Plan | 10-5 |

| Figure 10-4:Collar Location Plan, Geotechnical, Metallurgical and Condemnation Drill Holes | 10-8 |

| Figure 14-1:3D Perspective View of Gramalote Ridge Mineralized Zones | 14-3 |

| Figure 14-2:3D Perspective View of Mineralized Zones at Trinidad | 14-3 |

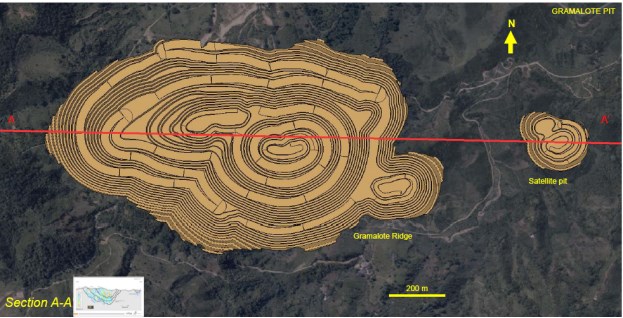

| Figure 16-1:Pit Phasing | 16-6 |

| Figure 16-2:Cross-Section through Phased Pits | 16-6 |

| Figure 17-1:Proposed Process Flowsheet | 17-2 |

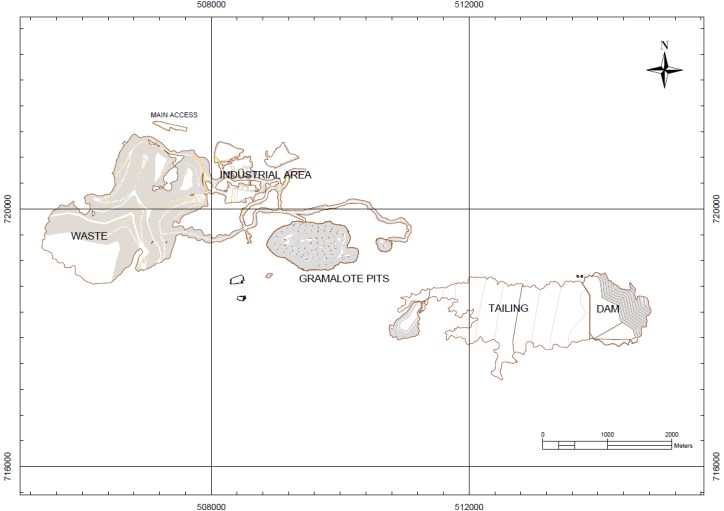

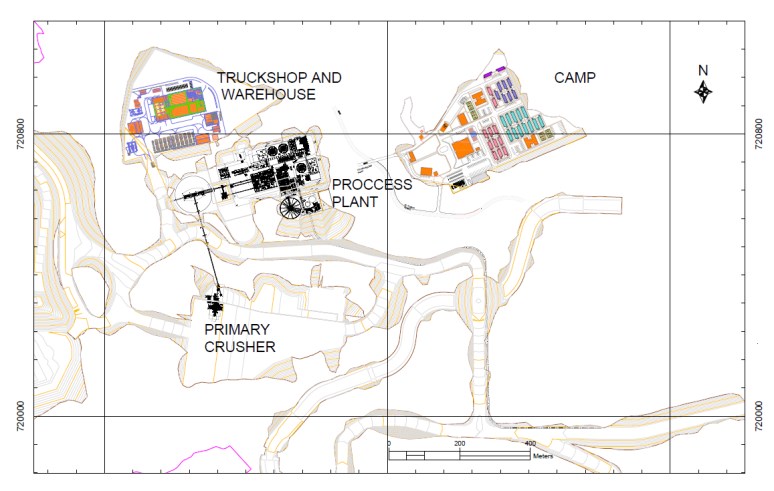

| Figure 18-1:Proposed Infrastructure Layout Overview Plan | 18-2 |

| Figure 18-2:Proposed Infrastructure Layout Plan, Industrial Area | 18-3 |

| Figure 22-1:Sensitivity Analysis | 22-9 |

Gramalote Project |

1.0 SUMMARY

1.1 Introduction

Mr Tom Garagan, P.Geo., Mr Kevin Pemberton, P.E., Mr John Rajala, P.E., and Mr Ken Jones, P.E., prepared a NI 43-101 Technical Report (the Report) on the Gramalote Gold Project (the Project) for B2Gold Corp. (B2Gold). The Project is located within the department of Antioquia in northwestern Colombia.

AngloGold Ashanti Limited (AngloGold) and B2Gold currently have a 51.7:48.3 interest respectively in the Project, which is operated as a joint venture (JV). During 2020, B2Gold will sole fund the first $13.9 M of expenditures which will cause the interest in the Project to become 50:50, and the Project will be funded on that basis going forward. As of 1 January 2020, B2Gold assumed the role of JV manager. The in-country operating entity is Gramalote Colombia Limited (Gramalote Colombia).

1.2 Terms of Reference

This voluntarily-filed Report provides updated information on the Gramalote Project, including an updated Mineral Resource estimate and the results of a preliminary economic assessment (2020 PEA).

Units used in the report are metric units unless otherwise noted. Monetary units are in United States dollars (US$) unless otherwise stated. The Report uses Canadian English.

Mineral Resources are reported in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014; the 2014 CIM Definition Standards). Mineral Resources are reported on a 100% basis. As at 1 January 2020, B2Gold had a 48.3% Project interest, and AngloGold held the remaining 51.7% Project interest.

1.3 Project Setting

The Project is located approximately 230 km northwest of the Colombian capital of Bogota and 120 km northeast of Medellin, the regional capital of the Department of Antioquia. It is situated in the Nus River valley, a transportation corridor of paved highways connecting the Colombian capital city of Bogota and the city of Medellin to the Magdalena River at Puerto Berrio. Access to the Project site is provided by well-maintained paved road surface from Medellin (2.5-4 hours driving time) and Bogota (8-10 hours driving time). The Project site is located 73 km by road from Puerto Berrio, from which direct water access is available to Barranquilla, a major ocean port on the Caribbean coast.

Gramalote Project |

An inactive freight/passenger railway line and active high-tension electricity lines pass within 1 km of the Gramalote Project area. A 2.3 MW hydroelectric plant is currently generating electricity at the Guacas Creek, within the Gramalote property. The nearest high voltage substation for a grid connection is approximately 30 km from the project site.

The climate in the vicinity of the Gramalote Project is mildly tropical. Future mining operations are planned to be conducted on a year-round basis. Topography along the Nus River valley is undulating with locally steep and incised areas. Elevations in the Gramalote Project area range from 800-1,500 masl, while elevations over the Antioquia plateau are generally between 2,300-2,500 masl.

1.4 Joint Venture

On May 15, 2008 B2Gold entered into an agreement with AngloGold, whereby AngloGold transferred to B2Gold a 2% interest in the Gramalote JV and assigned to B2Gold other rights relating to Gramalote Colombia, including AngloGold's right to acquire an additional 24% interest, so that B2Gold then held a 51% interest in the Gramalote JV (AngloGold retaining 49%) and accepted responsibility for management of exploration and development of the Gramalote Project. In addition, AngloGold transferred its interests in additional claims contiguous to the original Gramalote property to the Gramalote JV.

In 2010, AngloGold entered into an agreement with B2Gold to amend the Gramalote Shareholder's Agreement. Under the amended terms, AngloGold regained its 51% interest in the JV and became manager (operator) of the Project while B2Gold retained a 49% interest.

In 2017, Gramalote Colombia and AngloGold completed a detailed Project assessment. Based on marginal project economics reported to B2Gold by Gramalote Colombia and AngloGold, B2Gold elected to only fund $5.0 million of the 2018 Gramalote Project expenditures, resulting in B2Gold's interest in the Project reducing to 48.3%.

In late 2018 and early 2019, new resource interpretations and economic analysis indicated that the Project had the potential to become much more robust. As a result of this new information and B2Gold's own internal analysis, negotiations to modify the Shareholder's Agreement with AngloGold were initiated where the interests in the Project would become 50:50 and B2Gold would become the JV manager.

For the 2020 Gramalote budget, B2Gold agreed to fund the first $13.9 M of expenditures to increase its ownership from 48.3% to 50. An amended and restated Shareholders Agreement to ratify this change has been signed with a restatement date of January 1, 2020, at which date B2Gold assumed the role of Project manager.

Gramalote Project |

1.5 Mineral Tenure, Surface Rights, Water Rights, Royalties and Agreements

As of 9 January, 2020, Gramalote Colombia held 11,013.50 ha in two registered concession contracts:

- Integrated mining permit 14292, totalling 8,720.71 ha; informally referred to as the Gramalote permit;

- Concession title 4894, totalling 2,292.81 ha, informally referred to as the Trinidad permit.

There are also three applications for mineral title, LJC-0812, QHQ-16081, and SF9-09031, which collectively total 11,845.03 ha.

In November 2019, the National Mining Agency (NMA) launched a new mining cadastral system, the Mining Management Integral System (ANNA Minera), which will change the Colombian Mining Cadaster. The system uses grid cell references for all mining claims, and will eliminate the gaps, slivers, fractions, and errors in claim boundary locations ("corridors") that can appear between adjacent claims under the former system. Existing valid claims will be transferred to the new system.

Gramalote Colombia has commenced the acquisition of surface rights to support mining operations, with purchases having been completed on the majority of the area required.

Guacas Creek will provide the water for potable use. Gramalote Colombia currently holds a 40 L/s extraction permit. Water will be treated through a conventional 16 L/s water treatment plant. The project is located in a high rainfall area (approximately 2.4 m/a), and the water management system will deal with a positive water balance that will provide for all process water needs.

Once in production, State royalties on the gold and silver are 4% of the gross metal value at the plant site (as per Article 16 of Law 141 in 1994). Gross metal value is determined by using 80% of the London Metals Exchange spot prices for gold and silver, so the effective royalty rate is 3.2%. These State royalties are independent of national, departmental and municipal taxes.

1.6 Geology and Mineralization

The Gramalote Ridge and Trinidad deposits are considered to be examples of structurally-controlled, intrusive-related gold deposits.

The Project is located in the northern portion of Colombia's Central Cordillera. The terrane primarily comprises a metamorphic basement complex and the Antioquia Batholith. In the general Project area, the main compositional types within the Antioquia Batholith are tonalite and granodiorite, with subordinate monzonite and gabbro. Alaskitic, felsitic and andesitic dikes have intruded the complex.

Gramalote Project |

Gramalote Ridge is situated between two west-northwest-trending macro-scale curved lineaments that splay off the Palestina fault to the east, and transect the Antioquia Batholith, termed the Nus River and the El Socorro lineaments. Differential movement along the Nus and El Socorro lineaments is thought to have generated north-northwest, north-south and northeast-striking tensional dilation within the tonalite, reflected in the formation of stockwork style sheeted quartz and quartz carbonate veinlets.

The Gramalote Ridge deposit has dimensions of 1,300 by 1,500 by 700 m. The mineralization has been drill tested to a depth of about 600 m. Mineralization at Gramalote Ridge is hosted in uniform medium-grained tonalite with minor amounts of granodiorite and aplite dykes. Alteration is structurally-controlled and occurs as both broad zones and narrow selvedges around veins. Mineralized zones vary in width from 10-150 m in true width with vertical to sub-vertical dips to the south-southeast. The deposit remains open at depth and along strike. The primary mineralization consists of pyrite and chalcopyrite. Secondary minerals include rutile and a titaniferous mineral. Free gold occurs as argentiferous gold coeval with several tellurides and bismuth sulphosalt minerals.

The Trinidad deposit has dimensions of approximately 1,500 m by 500 m. Mineralization has been drill tested to a depth of about 300 m. The deposit remains open at depth and along strike, especially to the west. Mineralization is hosted in similar rock types to those that host the Gramalote Ridge deposit. Alteration is similar to that described for Gramalote Ridge. Mineralized zones at Trinidad are 10-80 m thick, and the zones periodically coalesce both along strike and down-dip. Mineralization is associated with stockwork veinlets and alteration along their margins.

A number of exploration targets have been identified that warrant additional exploration examination.

1.7 History

The Gramalote area has a long history of artisanal gold mining, likely dating from Pre-Colombian times to the present day. Historical production was dominated by hydraulic techniques, and by the early 1900s many operations were producing gold throughout the Nus River valley, including at Gramalote, Guacharacas, La Trinidad, Cisneros and El Limon. The miners worked residually-enriched colluvium and mineralized in situ saprolite in the surface oxide zone around Gramalote Ridge, as well as alluvial deposits.

Exploration prior to B2Gold's Project interest was conducted by Metallica Resources, Inc., Gridiron Exploration Ltd, Placer Dome Exploration Inc., Industrias Peñoles (a Grupo Nus affiliate), and Sociedad Kedahda S.A. (an AngloGold affiliate). These companies completed property reviews, and surficial sampling and mapping of the Gramalote Ridge area. AngloGold explored in the period 2003-2007, conducting stream sediment, soil, grab, chip, channel and panel sampling, geological and structural mapping of Gramalote Ridge, trial ground geophysical surveys, core drilling, metallurgical test work, and resource estimation.

Gramalote Project |

B2Gold obtained a project interest in 2008. Work completed under the Gramalote JV has include geological and structural mapping, core, Hydracore, and reverse circulation (RC) drilling, engineering investigations, resource estimation, and metallurgical test work.

1.8 Drilling and Sampling

Drilling completed on the project includes RC, core, and Hydracore drilling, totalling 942 drill holes (173,482.24 m). The resource drilling cut-off date for Gramalote Ridge and Trinidad was October 9, 2018. There are 556 drill holes (102,156.19 m) supporting the Mineral Resource estimate at Gramalote Ridge and 32 holes (11,249.36 m) supporting the Trinidad Mineral resource estimate. Drill holes completed for geotechnical, metallurgical and condemnation purposes are included in the resource drilling totals. These holes were not assayed but the logging provided input on weathering surface interpretations that are part of the resource model. A program of short core holes completed in 2015 (181 drill holes, approximately 800 m) at Gramalote Ridge to define near surface oxide mineralization is not included in the resource estimate drilling because these holes returned poor core recovery and did not extend into fresh rock.

Initial core logging was performed using A3-size log sheets with pre-set logging parameters to be collected, including lithology, alteration (dominant, subordinate and trace), types of veinlets, sulphide mineralization and comments. Current B2Gold drilling data is captured directly into MS Excel and is imported into a project-specific MS Access database. Geotechnical logging consists of determination of rock quality designation (RQD) on paper logging sheets at the drill site, prior to core being transported to the logging facility. In addition to RQD, routine geotechnical logging captures core recovery and rock strength. Digital core photographs were taken of all drill core.

Recoveries during the 2006-2007 AngloGold campaigns averaged 97%. Core recovery in 2008 varied between 94-99%, with an average of 96.48% for the duration of the drill program. Core recovery for the Gramalote Colombia drilling completed since 2008 averages 97.6%.

The 2006-2007 program drill hole collars were surveyed using a high-precision differential global positioning system (GPS) instrument. Since the 2007 program, drill hole collars are located on the drill pads by total station survey.

Depending on drill campaign, ground conditions, and the purpose of the drill hole, down-hole surveys could be taken at 3 m, 6 m, 7 m, 12 m, 30 m, and 100 m intervals. Instruments used included Pajari, Reflex Maxibor II, E-Z track, and Icefield tools.

Gramalote Project |

On average, the mineralization true width is about 75-80% of the downhole drilled length, but varies depending on local orientation of the mineralized zones and the drill hole.

In the opinion of the QP, the quantity and quality of the logged geological data, collar, and downhole survey data collected in the exploration and infill drill programs are sufficient to support Mineral Resource estimation and conceptual mine planning.

RC samples are taken from 2 m runs. Core sampling during the 2006-2007 AngloGold programs was undertaken on nominal 2 m intervals. B2Gold core holes from the 2008 program were sampled from top to bottom using variable core lengths observing breaks in alteration, mineralization intensities and lithology differences. The majority of the samples are 1.6 m or less, with an average of 1.1 m. Core sampling during the Gramalote Colombia programs was undertaken on nominal 2 m intervals.

A total of 2,924 density measurements have been taken from Gramalote Ridge core using water displacement methods. The average density was 2.64 t/m3. A total of 389 density measurements are recorded from Trinidad core, using water displacement methods. The average density was 2.64 t/m3. A total of 519 Gramalote Ridge samples were sent to ALS Chemex Bogota in order to check the values obtained. The average result was 2.66 t/m3.

All sample preparation has been completed by the following ALS laboratories: Bogota (prior to November 2012); Bucaramanga (December 2012); and Medellin (since January 2013). All routine analysis was completed at ALS Peru in Lima. ALS Peru was accredited under INDECOPI, the Peruvian consumer agency, prior to 2010, and has held ISO 170125 accreditations for selected analytical techniques since 2010. The ALS preparation facilities in Colombia are currently covered under the scope of accreditation issued to ALS Peru as of July 4, 2017. SGS (Medellin) was used as a check laboratory. The laboratory was not accredited at the time of use, but is currently in the process of obtaining ISO accreditation. All of the laboratories were independent of the Project operator at the time analytical work was performed.

The same sample preparation procedure that has been followed over time includes drying, crushing to 70% passing 2 mm (pre-2011); crushing to 85% passing 2 mm (post-2011), and pulverizing to >85% passing 75 µm. Gold analysis used the fire assay fusion method with an atomic absorption spectroscopy (AAS) finish on 50 g nominal sample weight, ALS code AU-AA24 (0.005 ppm detection limit), with gravimetric analysis (code AU-GRA22) for samples over 10 g/t Au. Analysis for copper and other elements was conducted using ALS method ME-MS61 (48 element), which comprises a four-acid digestion, followed by elemental determinations by inductively coupled plasma-mass spectrometry (ICP MS). A limited number of MS overlimits on Ag (>100 ppm) and Cu (>10000 ppm) were rerun with inductively coupled plasma-atomic emission spectroscopy (ICP AES).

Gramalote Project |

The quality assurance and quality control (QA/QC) program has included submission of certified reference materials (CRMs or standards), blanks, and coarse reject and pulp duplicate samples.

Sample security has not historically been monitored. Sample collection from drill point to laboratory relies upon the fact that samples are either always attended to, or stored in the locked on-site preparation facility, or stored in a secure area prior to laboratory shipment. Chain-of-custody procedures consist of sample submittal forms to be sent to the laboratory with sample shipments to ensure that all samples are received by the laboratory.

All rejects and pulps generated since the start of exploration drilling are retained in a storage facility in the Girardota municipality, located about 30 km north of Medellin. All core is stored at the Project site in three covered core storage buildings.

1.9 Data Verification

The data entry tool is the first stage of data validation through a set of scripts that displays any inconsistent data related with project logging rules. Picklists, look-ups and formulae within the Excel capture template help prevent missing or overlapping interval entries and entry of bad codes. Validation query sets within the database evaluate the completeness/integrity of the data set for any given hole within and between data tables.

The QP has personally verified data supporting the estimates. As a result of the data verification, the QP concludes that the Project data and database are acceptable for use in Mineral Resource estimation, and can be used to support conceptual mine planning.

1.10 Metallurgical Test Work

The 2020 PEA assumes that process operations will treat sulphide material by itself (no blending of oxide material). Oxide material (~3% of total plant feed) will be stockpiled and processed by itself at the very end of the project life.

Metallurgical test work facilities involved in the work included SGS Lakefield & SGS Santiago, FLSmidth, ALS Santiago & Perth, Jenike and Johanson, ADP Holdings, Julius Kruttschnitt Mineral Research Centre (JKMRC), and the Cooperative Research Centre for Optimising Resource Extraction (CRC-ORE).

Test work comprised mineralogy studies, comminution characterization testing, heap leach, gravity recoverable gold, flotation optimization, concentrate leach optimization, pilot grinding and flotation campaigns, thickening, cyanide destruction, tailings rheology, upgrading using screening, materials handling, and recovery variability tests.

Samples selected for metallurgical testing were representative of the various types and styles of mineralization within the Gramalote Ridge zones. Samples were selected from a range of locations within the deposit zones. Sufficient samples were taken so that tests were performed on sufficient sample mass. The variability test work for the Trinidad zone may not be fully representative of the mineralization to be mined, as much of the sample material came from an area to the north of the planned Trinidad pit, and the pit area mineralization is both thicker and higher-grade.

Gramalote Project |

Flotation and mass recovery models were fitted to each set of test results, and used to predict recovery at a series of flotation times. The relationship between flotation head grade and flotation tails grade was established. The projected recovery was calculated using the head-tail grade relationship and the planned plant feed grades. The recovery calculated using the relationship between tail and head grade is on average 0.5% higher than the actual recovery. The 2020 PEA assumes an overall average recovery of 94.3% for the Gramalote Ridge material, as follows: sulphide material recovery forecast: 94.8%; oxide material recovery forecast: 77.9%.

No deleterious elements are known from the processing perspective.

1.11 Mineral Resource Estimation

Mineral Resource models for Gramalote Ridge and Trinidad were built by B2Gold in 2019.

Low grade (LG) and high grade (HG) mineralization domains were interpreted for Gramalote Ridge. Both domains were used for gold grade capping, but only the LG (which includes the HG domain) was used in the final grade estimation. For Trinidad, 11 separate mineralized wireframes were created, with two, LG1 and LG2, representing more than 75% of the tonnage. Three weathering surfaces were created for each zone for each deposit: base of soil/colluvium, base of saprolite, and base of saprock.

Bulk densities were applied to the deposit models based on the mean of the domain and weathering state. Obvious outliers were excluded from the dataset prior to these calculations.

Capping levels were identified in each domain/sub-domain using distribution (probability) plots, deciles and spatial observation of high grades. Capping was done prior to compositing. Down-hole composites of 6 m length were created for Gramalote Ridge and 4 m length composites were created for Trinidad. Variograms were run on capped composites for Gramalote Ridge to evaluate spatial continuity and trends to gold mineralization and for use in gold grade estimation checks. Variograms were not run on Trinidad because of the widely-spaced data.

For Gramalote Ridge, gold and silver grades were estimated using inverse distance weighting to the third power (ID3), inverse distance weighting to the fourth power (ID4), ordinary kriging (OK) and nearest-neighbour (NN) interpolation into parent-sized blocks, with Mineral Resources reported from the ID3 estimate. For Trinidad, gold and silver grades were estimated using ID3, ID4 and nearest-neighbour (NN) interpolation into parent-sized blocks, with Mineral Resources reported from the ID3 estimate.

Gramalote Project |

The block model estimates were checked using comparison of different declustering (NN and cell declustering) methods; visual comparison of block grades to composites on cross sections and levels; comparison of global block statistics for different estimation techniques; swath plots to review potential local biases in the estimates; and change of support comparisons (Gramalote Ridge only). For Gramalote Ridge, the comparison of change-of-support results to various estimates, and the better representation of the ID3 model compared to the drill hole composites from the visual review on cross sections, supported the decision to use the ID3 model as the most appropriate estimate to use in Mineral Resource reporting. The checks completed on the Trinidad model support that the model can be used for classifying Inferred Mineral Resources.

Resource classification was implemented by manually wireframing contiguous areas of drilling.

Drill hole spacing for resource classification at Gramalote Ridge is as follows:

- Indicated: 50-60 m drill hole spacing;

- Inferred: 100-120 m drill hole spacing

Drill hole spacing for resource classification at Trinidad is as follows:

- No Measured or Indicated classified;

- Inferred: 100-120 m drill hole spacing or any block within 30 m of a drill hole.

Mineral Resources for Gramalote Ridge and Trinidad considered potentially amenable to open pit mining methods were constrained within conceptual Lerchs-Grossmann (L-G) pit shells. Based on these costs and assumptions, the break-even cut-off grades for Gramalote Ridge are 0.15 g/t Au for oxide and 0.19 g/t Au for sulphide. Calculated cut-off grades for Trinidad are 0.16 g/t Au for oxide and 0.20 g/t Au sulphide. Mineral Resources potentially amenable to open pit mining are stated above a cut-off of 0.15 g/t Au for oxide and above 0.20 g/t Au for sulphide.

1.12 Mineral Resource Statement

Mineral Resources are reported using the 2014 CIM Definition Standards. The Qualified Person for the estimates is Mr. Tom Garagan, P.Geo., B2Gold's Senior Vice President, Exploration. Mineral Resources have an effective date of 31 December, 2019. Indicated Mineral Resources are summarized in Table 1-1, and Inferred Mineral Resources in Table 1-2.

Factors that may affect the Mineral Resource estimate include: metal price and exchange rate assumptions; changes to the assumptions used to generate the gold grade cut-off grade; changes in local interpretations of mineralization geometry and continuity of mineralized zones; changes to geological and mineralization shape and geological and grade continuity assumptions; density and domain assignments; changes to geotechnical, mining and metallurgical recovery assumptions; changes to the input and design parameter assumptions that pertain to the conceptual pit constraining the estimates; and assumptions as to the continued ability to access the site, retain mineral and surface rights titles, maintain environment and other regulatory permits, and maintain the social license to operate.

Gramalote Project |

1.13 Mining Methods

The 2020 PEA is preliminary in nature, and is partly based on Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the 2020 PEA based on these Mineral Resources will be realized.

Approximately 47% of the Mineral Resources considered in the 2020 PEA mine plan are classified as Indicated. The remaining 53% are classified as Inferred.

The 2020 PEA is based on mining of the Gramalote Ridge deposit only. No mining is envisaged for the Trinidad deposit.

Geotechnical designs are based on information collected from surface mapping programs, geotechnical logging data, photo-logging observations, oriented core data, acoustic televiewer data, and results from laboratory testing to assess the intact rock strength. Pit slope assumptions used in pit optimization range from 59-67º (inter-ramp angles).

Gramalote Project |

Table 1-1: Indicated Mineral Resource Statement

Area | Tonnes (x 1,000) | Gold Grade (g/t Au) | Contained Gold Ounces (x 1,000) | Silver Grade (g/t Ag) | Contained Silver Ounces (x1,000) |

Gramalote Ridge Sulphide | 78,200 | 0.85 | 2,140 | 1.05 | 2,600 |

Total Indicated Mineral Resources | 78,200 | 0.85 | 2,140 | 1.05 | 2,600 |

Table 1-2: Inferred Mineral Resource Statement

Area | Tonnes (x 1,000) | Gold Grade (g/t Au) | Contained Gold Ounces | Silver Grade (g/t Ag) | Contained Silver Ounces (x 1,000) |

Gramalote Ridge Oxide | 6,000 | 0.61 | 120 | 1.65 | 300 |

Trinidad Oxide | 3,100 | 0.55 | 50 | 1.86 | 200 |

Subtotal Oxide Inferred | 9,100 | 0.59 | 170 | 1.72 | 500 |

Gramalote Ridge Sulphide | 105,600 | 0.70 | 2,370 | 0.95 | 3,200 |

Trinidad Sulphide | 14,400 | 0.62 | 290 | 1.00 | 500 |

Subtotal Sulphide Inferred | 120,100 | 0.69 | 2,660 | 0.96 | 3,700 |

Total Inferred Mineral Resources | 129,200 | 0.68 | 2,830 | 1.01 | 4,200 |

Notes to accompany Mineral Resource Tables:

1. Mineral Resources have been classified using the 2014 CIM Definition Standards.

2. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3. The Qualified Person for the resource estimate is Tom Garagan, P.Geo., B2Gold's Senior Vice President, Exploration.

4. Mineral Resources are reported on a 100% project basis. B2Gold holds a 48.3% interest; the remaining 51.7% interest is held by AngloGold Ashanti Limited. Mineral Resources have an effective date of 31 December, 2019.

5. Mineral Resources assume an open pit mining method and a gold price of US$1,500/oz.

6. Mineral Resources for Gramalote assume metallurgical recoveries of 83.9% for oxide and 95% for sulphide, and operating cost estimates of an average mining cost of US$2.13/t mined, processing cost of US$4.00/t processed for oxide and US$6.56/t processed for sulphide, general and administrative cost of US$1.89/t processed and selling cost of $50.52/oz produced.

7. Mineral Resources for Trinidad assume metallurgical recoveries of 81.7% for oxide and 90.9% for sulphide, and operating cost estimates of an average mining cost of US$1.82/t mined, processing cost of US$4.10/t processed for oxide and US$6.66/t processed for sulphide, general and administrative cost of US$1.89/t processed and selling cost of $50.52/oz produced.

8. Mineral Resources for Gramalote and Trinidad are reported at cut-offs of 0.15 g/t Au for oxide and 0.20 g/t Au for sulphide.

9. All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation differences between tonnes, grade, and contained metal content.

Gramalote Project |

A limited number of hydraulic field tests were completed to define the hydraulic characteristics of the various hydrogeological units across the project site. These included piezometer measurements, constant discharge tests, falling head tests, and Lugeon/packer hydraulic conductivity tests. Drawdown of groundwater elevations adjacent to the open pit will occur during mine operations. A proactive storm water management approach strategy to minimize water inflow to the pit and minimize environmental impact will be required from the start of mining activities.

Pit designs were evaluated using Whittle software. A cut-off grade was calculated for both oxide and sulphide material to identify the minimum grade that would generate a marginal benefit. The calculated cut-off grade for oxide material was 0.25 g/t Au, and for sulphide material, 0.29 g/t Au.

A conventional open pit truck and shovel operation is planned. A selective mining unit (SMU) size of 10 m x 10 m x 10 m was used for benchmarking the mineral resource model. No additional dilution factor or mining loss was applied to the grades in the mine plan. The Gramalote pit will have four phases, consisting of three phases in the main pit, and a small satellite pit that will have a single phase. The main ramps were designed to 30 m width for two-way access, and are assumed to have a 10% gradient. The lowest benches will have a 15 m wide ramp, and will be single-lane. Pit benches are assumed at 10 m intervals, with pre-split drilling at 20 m depths, drilling two benches at a time.

The mine planning strategy includes the use of stockpiles for oxide and sulphide materials. Three stockpiles are planned.

A waste rock storage facility (WRSF) is planned to be situated in the El Topacio and El Banco basins, towards the westernmost end of the project site. This facility will be developed in four construction stages, and will have capacity for about 320 Mm3 of material.

The mining plan considered a maximum sinking rate of eight benches per phase per year. Pre-stripping is estimated at 8.6 Mt for the period prior to first production. This is scheduled to be mined in a one-month period using the mining equipment. Any mill feed material mined during pre-stripping activities will be stockpiled. Waste moved during this period (5 Mt) will be used during the construction of the mine platforms and mine roads. The average mining rate will be between 45 and 52 Mt/a over the first seven years of mining and will then reduce during the final four years of mining, for an 11-year mine life. The strip ratio is forecast at 1.93:1.

Mining operations assume that lower-grade material will be stockpiled and treated at the end of the mine life, and high-value cut-backs will be mined early in the life-of-mine (LOM) to increase the plant feed grade during the early years of production. Year -1 and the first half of Year 1 will be restricted to pre-stripping activities. The second half of Year 1 will be the ramp up period for the process plant. From Year 2 and thereafter, the mine will be operating at approximate full capacity.

Gramalote Project |

Mining will be carried out with an Owner-operated fleet. Standard open pit mining equipment has been selected, with conventional drilling, blasting, loading and hauling envisaged. The equipment selection considered bulk excavation of mill feed material and waste using hydraulic shovel/excavators and front-end loaders.

1.14 Recovery Methods

The proposed process route uses conventional designs and equipment to produce gold doré. Process design is based on the metallurgical test work on sulphide mineralization at Gramalote Ridge.

The proposed plant will process ROM mill feed material at a rate of 11 Mt/a to produce doré bars, using conventional equipment and processes. The process plant will consist of primary crushing, two-stage grinding with flash flotation, conventional froth flotation, flotation tailings pumping, concentrate regrinding, concentrate leach, counter-current decant (CCD) thickening, carbon-in-pulp (CIP), carbon desorption, gold recovery by zinc precipitation (Merrill Crowe), and cyanide destruction of CIP tailings slurry before the tailings are pumped to the tailings management facility (TMF).

Equipment sizing was developed from the process design criteria, a process mass balance and third-party contractor Ausenco's experience with similar projects.

Reagents that are proposed to be used are conventional for gold operations. Water supply is assumed to be sourced from a camp water pond. The pond will contain a varying blend of TMF decant water and site run-off water that will be pumped via overland pipeline to the process plant.

1.15 Project Infrastructure

The project as envisaged in the 2020 PEA will include: two open pits, consisting of the main Gramalote Ridge pit, and a small Gramalote Ridge satellite pit; process plant; built infrastructure such as truckshop, tire shop, welding shop, wash and fuel bays, warehouses, plant maintenance shop, support facilities and offices, accommodations camp, core shed and logging area, magazine, explosives transference plant, concrete batch plant, and borrow pits; internal mine roads, including haul roads; WRSFs and stockpiles; and a TMF.

The 120 km road-trip from Medellin to the Gramalote site currently takes 2.5 hours. A portion of the access route is currently undergoing upgrades. The planned operations will require a combination of 30 m wide mine haul roads and 8 m wide operation and construction roads. Roads will be designed in a way that will connect all project facilities, including the truckshop, pits, crusher, WRSFs and stockpile areas.

Colombia has ports on both the Atlantic Ocean (Cartagena and Barranquilla) and Pacific Ocean (Buenaventura) that are equipped to receive large equipment. At a PEA-level of assessment, no significant issues affecting movement of normal or general cargo from the Atlantic or Pacific Ocean ports using road routes has been identified. Large pieces of equipment such as the grinding mills and mining fleet can be shipped by barge from the Atlantic ports by river to Puerto Berrio, approximately 73 km from the Project.

Gramalote Project |

The 2020 PEA TMF assumption is that the facility will store about 150 Mt of tailings. ANLA previously approved a TMF with a 220 Mt capacity in 2016, as part of the EIA. The flotation tailings and the leach circuit cyanide destruction tailing streams will be managed separately, and the proposed TMF will be a cross-valley impoundment with a single embankment across the Palestina Valley, approximately 500 m upstream of the confluence with the Nus River.

The water management concept was developed to maximize the reuse of process water and minimize the use of make-up water from fresh water sources. Water quality models currently indicate that water discharges will meet all Colombian regulatory and international standards. Water control reservoirs, seepage and sedimentation ponds will be located in different catchment areas to manage sediment discharges, storm events and contact water, including from the pits, the TMF and WRSF. The TMF water quality is predicted to meet discharge criteria requirements at all times and therefore under normal and wet conditions TMF water will be continuously discharged via the decant structure to the Camp Site Pond and from there to the Rio Nus. Water management ponds will be located downstream of each natural drainage basin containing mine installations. Sediments ponds will collect the runoff, entrained sediment, and the seepage captured by drains. The course of the Guacas Creek will need to be diverted, as it flows directly over what will be the western portion of the planned Gramalote Ridge pit.

A new camp for both construction and operations is assumed, and will accommodate approximately 3,000 persons.

Guacas Creek will provide the water for potable use. Process water will come from collection of surface water, specifically in the TMF area. No fresh water wells are envisaged for process use.

A single circuit 230 kV dedicated transmission line, 26 km long will be built to feed the project, extending from the existing Jaguas substation. The 230 kV supply will step down to 13.2 kV and be further reticulated to the entire facilities, i.e. processing plant, offices, cyclone station, reclaim water, accommodation facilities, via overhead transmission lines. In addition, the project assumes installation of 6 MVA of diesel-powered emergency backup power supply.

Gramalote Project |

1.16 Environmental, Permitting and Social Considerations

1.16.1 Environmental Considerations

Gramalote Colombia completed an Environmental Impact Assessment (EIA) and a Modification of the Environmental License (MEIA) that assessed the magnitude and likelihood of the potential project environmental and socio-economic impacts within the project's area of influence. The Ministry of Environment and Sustainable Development, National Authority for Environmental Licences (ANLA) subsequently granted an Environmental Licence for the Project through Resolutions 1514 (2015), 309 (2016), and 00782 (2019). The Environmental License presents the comprehensive conditions and requirements relating to the development, operation and closure of the Project.

The EIA and MEIA present the mitigation measures necessary to minimize potential project impacts to acceptable levels. Stand-alone Management Plans have been developed which describe the activities aimed to prevent, mitigate and correct significant impacts that could be generated on the environmental and social components derived from project development and to ensure that the project complies with its regulatory and permitting requirements and B2Gold's environmental and socio-economic standards. These Management Plans will be implemented across the life of the project; beginning during planning and continuing until the construction, closure and relinquishment phases of mining are accomplished.

1.16.2 Closure and Reclamation Planning

Gramalote Colombia has established a conceptual closure plan, approved under Resolution 1514 of 2015 and Resolution 0309 of 2016, that includes a strategy to effectively and progressively rehabilitate areas that could have been affected by project activities. The conceptual closure plan will be modified and updated periodically throughout the project life to reflect significant changes in the design, operation, project phase and etc. As part of project development, Gramalote Colombia has estimated the cost of the Project environmental reclamation and closure liabilities to be approximately US$45 M.

1.16.3 Permitting Considerations

Gramalote Colombia has been granted an Environmental Licence through Resolutions 1514 (2015), 309 (2016), and 00782 (2019). The License presents the comprehensive conditions and requirements relating to the development, operation and closure of the project.

Several additional permits and authorizations will be required for the Project, inclusive of:

Gramalote Project |

- Authorization for acquisition and use of explosives;

- Certificates for controlled chemical substances and products;

- Authorization for generation and transmission of electricity;

- Construction licenses.

1.16.4 Social Considerations

The development of the EIA and MEIA included the collection of comprehensive baseline data for the project area. The socio-economic baseline studies were used in support of the Project design and impact assessment to potentially impacted communities surrounding the proposed mine site. The EIA and MEIA then set out specific management requirements and activities aimed to prevent, mitigate and correct or compensate potential significant negative impacts and promote positive impacts to the communities in the Project area from development of the Gramalote Mine. Numerous socio-economic programs have been prepared with the participation of communities and considering the Colombian regulations and international best practices.

Two aspects that likely face potential significant negative impacts if not managed properly are the artisanal miners working in the project area and the resettlement of individuals due to project development. A final Resettlement Action Plan (RAP) will be developed in 2020 through a participatory approach with communities in alignment with international best practice (e.g., International Finance Corporation (IFC) Performance Standard 5 - Land Acquisition and Resettlement) and in compliance with Colombian legislation. The Environmental License includes an obligation for Gramalote Colombia to develop and implement an artisanal and small miner (ASM) Formalization Plan in accordance with Colombian legislative requirements. A pilot formalization project started in 2018 and is ongoing for an initial group of artisanal miners duly formalized in 18 Mining Production Units (MPU). Gramalote Colombia is also exploring new areas for new formalization processes with other ASM groups.

1.17 Markets and Contracts

No market studies have been completed. The doré that will be produced by the mine is readily marketable.