- CSAN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Cosan (CSAN) 6-KCurrent report (foreign)

Filed: 14 Aug 24, 6:29pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant To Rule 13a-16 Or 15d-16 of the

Securities Exchange Act of 1934

For the month of August 2024

Commission File Number: 333-251238

|

COSAN S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

|

Av. Brigadeiro Faria Lima, 4100, – 16th floor

São Paulo, SP 04538-132 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

CONTENT

| Tel.: 55 11 3848 5880 Fax: + 55 11 3045 7363 www.bdo.com.br | Rua Major Quedinho, 90 Consolacao - Sao Paulo, SP Brasil 01050-030 |

To the

Shareholders, Board Members and Management of

Cosan S.A.

São Paulo - SP

Introduction

We have reviewed the individual and consolidated interim financial information of Cosan S.A. (“Company”), included in the quarterly information, for the quarter ended June 30, 2024, which comprises the individual and consolidated interim statement of financial position as at June 30, 2024, and the respective individual and consolidated interim statements of profit or loss and comprehensive income for the three- and six-month periods then ended, and the of changes in equity and cash flows for the six-month period then ended, including the notes to the financial information.

The Company’s and its controlled companies’ Management is responsible for the preparation of this individual and consolidated interim financial information in accordance with NBC TG 21 (R4) and with International Accounting Standard (IAS) 34 - Interim Financial Reporting, issued by the International Accounting Standards Board (IASB), and for the presentation of this interim financial information in accordance with the standards issued by the Brazilian Securities and Exchange Commission (CVM) applicable to quarterly information. Our responsibility is to express a conclusion on the individual and consolidated interim financial information based on our review.

Scope of the review

We conducted our review in accordance with Brazilian and international standards on review engagements (NBC TR 2410 and ISRE 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity). A review of interim financial information consists principally of applying analytical and other review procedures and making enquiries of and having discussions with persons responsible for financial and accounting matters. An interim review is substantially less in scope than an audit conducted in accordance with auditing standards and does not provide assurance that we would become aware of any or all significant matters that might be identified in an audit. Accordingly, we do not express such an audit opinion.

Conclusion on the individual and consolidated interim financial information

Based on our review, we are not aware of any fact that would leads us to believe that the individual and consolidated interim financial information included in the accompanying Quarterly Information has not been prepared, in all material respects, in accordance with NBC TG 21 (R4) and IAS 34, applicable to the preparation of the Quarterly Information, and presented in accordance with the standards issued by CVM.

| Tel.: 55 11 3848 5880 Fax: + 55 11 3045 7363 www.bdo.com.br | Rua Major Quedinho, 90 Consolacão - São Paulo, SP Brasil 01050-030 |

Other matters

Individual and consolidated interim statements of value added – Supplementary information

The interim financial information referred to above includes the individual and consolidated statements of value added for the six-month period ended June 30, 2024, prepared under the responsibility of the Company's Management and presented as supplementary information for the purposes of IAS 34. These statements were submitted to review procedures executed with the review of the quarterly information, with the purpose of concluding whether they are reconciled with the interim financial information and accounting records, as applicable, and if its form and contents meet the criteria defined in NBC TG 09 – Statement of Value Added. Based on our review, we are not aware of any fact that would lead us to believe that these statements of value added were not prepared, in all material respects, in accordance with the criteria established in this standard and consistently with the individual and consolidated interim financial information taken as a whole.

Interim financial information for the previous quarter reviewed by another independent auditor

The corresponding amounts related to the individual and consolidated interim financial information for the quarter ended June 30, 2023, originally prepared before the reclassifications disclosed in Note 3.1, were reviewed by other independent auditors and their review report issued, without modification, in August 14, 2023. We also reviewed the reclassifications described in Note 3.1 that were carried out to change the corresponding values relating to the individual and consolidated interim financial information for the three and six-month period as of June 30, 2023. In our conclusion, such reclassifications are appropriate and were correctly carried out. We were not engaged to audit, review or apply any other procedures to the Company's individual and consolidated interim financial information for the corresponding three and six-month period ended June 30, 2023 and, therefore, we do not express an opinion or any form of assurance regarding this individual and consolidated interim financial information, taken as a whole.

The accompanying financial information has been translated into English for the convenience of readers outside Brazil.

São Paulo, August 14, 2024.

|

BDO RCS Auditores Independentes SS Ltda. CRC 2 SP 013846/O-1 |

|

|

Luiz Gustavo Pereira dos Santos |

Accountant CRC 1 SP 258849/O-9 |

(In thousands of Reais)

|

|

| Parent Company |

| Consolidated | ||||

| Note |

| 06/30/2024 |

| 12/31/2023 |

| 06/30/2024 |

| 12/31/2023 |

Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents | 5.2 |

| 1,800,369 |

| 1,769,976 |

| 17,230,061 |

| 14,658,481 |

Restricted cash | 5.3 |

| — |

| — |

| 8,435 |

| 7,860 |

Marketable securities | 5.3 |

| 598,482 |

| 705,777 |

| 3,861,784 |

| 3,407,955 |

Trade receivables | 5.7 |

| — |

| — |

| 4,159,171 |

| 3,330,488 |

Derivative financial instruments | 5.6 |

| 2,437 |

| 54,935 |

| 653,526 |

| 202,399 |

Inventories | 7 |

| — |

| — |

| 2,146,516 |

| 1,792,714 |

Receivables from related parties | 5.8 |

| 52,803 |

| 173,351 |

| 298,632 |

| 251,471 |

Income tax receivable |

|

| 415,141 |

| 508,268 |

| 882,389 |

| 888,942 |

Other recoverable taxes | 6 |

| 5,278 |

| 8,346 |

| 796,915 |

| 745,856 |

Dividend receivable | 17 |

| 179,478 |

| 319,135 |

| 299,249 |

| 255,777 |

Sectorial financial assets | 5.10 |

| — |

| — |

| 167,034 |

| 207,005 |

Other financial assets |

|

| — |

| — |

| 687 |

| 690 |

Other current assets |

|

| 75,293 |

| 177,001 |

| 680,692 |

| 722,386 |

|

|

| 3,129,281 |

| 3,716,789 |

| 31,185,091 |

| 26,472,024 |

Current assets held for sale | 8 |

| 5,045 |

| 2,998 |

| 2,374,980 |

| 2,138,165 |

Current assets |

|

| 3,134,326 |

| 3,719,787 |

| 33,560,071 |

| 28,610,189 |

|

|

|

|

|

|

|

|

|

|

Trade receivables | 5.7 |

| — |

| — |

| 62,755 |

| 114,148 |

Marketable securities | 5.3 |

| — |

| — |

| 111,554 |

| 96,006 |

Restricted cash | 5.3 |

| 41,679 |

| 81,621 |

| 160,299 |

| 195,392 |

Deferred tax assets | 15 |

| 3,448,139 |

| 2,478,911 |

| 6,673,747 |

| 5,609,030 |

Receivables from related parties | 5.8 |

| 262,910 |

| 174,745 |

| 67,004 |

| 88,620 |

Income tax receivable |

|

| — |

| — |

| 424,642 |

| 432,360 |

Other recoverable taxes | 6 |

| 34,414 |

| 33,639 |

| 1,224,932 |

| 1,132,703 |

Judicial deposits | 16 |

| 412,556 |

| 403,489 |

| 1,030,954 |

| 895,901 |

Derivative financial instruments | 5.6 |

| 776,014 |

| 102,881 |

| 2,004,133 |

| 2,344,400 |

Sectorial financial assets | 5.10 |

| — |

| — |

| 422,242 |

| 341,695 |

Other non-current assets |

|

| 101,752 |

| 71,250 |

| 279,335 |

| 216,694 |

Other financial assets |

|

| — |

| — |

| 3,507 |

| 2,423 |

Investments in subsidiaries and associates | 9.1 |

| 39,476,130 |

| 35,741,778 |

| 15,589,218 |

| 17,611,369 |

Investment in joint ventures | 10 |

| 1,328,530 |

| 1,320,592 |

| 11,749,804 |

| 11,742,442 |

Property, plant and equipment | 11.1 |

| 35,959 |

| 39,817 |

| 20,220,255 |

| 21,239,974 |

Intangible assets and goodwill | 11.2 |

| 8,422 |

| 6,863 |

| 23,096,019 |

| 22,650,287 |

Contract assets | 11.3 |

| — |

| — |

| 998,757 |

| 1,052,105 |

Right-of-use assets | 11.4 |

| 19,213 |

| 22,200 |

| 9,854,960 |

| 9,513,518 |

Investment property | 11.5 |

| — |

| — |

| 15,816,095 |

| 15,976,126 |

Non-current assets |

|

| 45,945,718 |

| 40,477,786 |

| 109,790,212 |

| 111,255,193 |

|

|

|

|

|

|

|

|

|

|

Total assets |

|

| 49,080,044 |

| 44,197,573 |

| 143,350,283 |

| 139,865,382 |

The accompanying notes are an integral part of these interim financial statements.

Statement of financial position

(In thousands of Reais)

|

|

| Parent Company |

| Consolidated | ||||

| Note |

| 06/30/2024 |

| 12/31/2023 |

| 06/30/2024 |

| 12/31/2023 |

Liabilities |

|

|

|

|

|

|

|

|

|

Loans, financing and debentures | 5.4 |

| 949,915 |

| 800,987 |

| 6,580,589 |

| 4,882,398 |

Leases | 5.5 |

| 8,939 |

| 8,959 |

| 941,763 |

| 733,063 |

Derivative financial instruments | 5.6 |

| 639,752 |

| 364,747 |

| 1,500,851 |

| 1,250,520 |

Trade payables | 5.9 |

| 1,957 |

| 2,431 |

| 4,438,849 |

| 3,920,273 |

Employee benefits payables |

|

| 28,285 |

| 61,926 |

| 650,405 |

| 829,329 |

Income tax payables |

|

| 1,641 |

| 2,716 |

| 545,882 |

| 445,934 |

Other taxes payable | 14 |

| 120,122 |

| 226,556 |

| 753,363 |

| 673,718 |

Dividends payable | 17 |

| 60,385 |

| 276,065 |

| 289,980 |

| 549,054 |

Concessions payable | 13 |

| — |

| — |

| 154,903 |

| 250,971 |

Related party payables | 5.8 |

| 178,049 |

| 198,899 |

| 497,673 |

| 322,160 |

Sectorial financial liabilities | 5.10 |

| — |

| — |

| 70,405 |

| 70,013 |

Other financial liabilities | 5 |

| — |

| — |

| 433,135 |

| 476,895 |

Other current liabilities |

|

| 631,362 |

| 593,643 |

| 1,654,239 |

| 1,516,084 |

Current liabilities |

|

| 2,620,407 |

| 2,536,929 |

| 18,512,037 |

| 15,920,412 |

Liabilities related to assets held for sale | 8 |

| — |

| — |

| 238,393 |

| 238,393 |

|

|

| 2,620,407 |

| 2,536,929 |

| 18,750,430 |

| 16,158,805 |

Loans, borrowings and debentures | 5.4 |

| 18,129,361 |

| 12,695,337 |

| 55,931,268 |

| 52,022,256 |

Leases | 5.5 |

| 17,441 |

| 20,584 |

| 5,239,241 |

| 4,542,731 |

Derivative financial instruments | 5.6 |

| 79,697 |

| 281,238 |

| 728,620 |

| 2,164,625 |

Trade payables | 5.9 |

| — |

| — |

| 57,506 |

| 264,252 |

Employee benefits payables |

|

| — |

| — |

| 33,263 |

| — |

Other taxes payable | 14 |

| 211,514 |

| 158,857 |

| 225,582 |

| 163,242 |

Provision for legal proceedings | 16 |

| 391,926 |

| 401,093 |

| 1,873,990 |

| 1,714,403 |

Concessions payable | 13 |

| — |

| — |

| 3,612,203 |

| 3,314,402 |

Investments with unsecured liabilities | 9.1 |

| 42,706 |

| 146,276 |

| — |

| — |

Related party payables | 5.8 |

| 7,282,284 |

| 6,449,968 |

| 1,078 |

| 1,078 |

Post-employment benefits | 23 |

| 291 |

| 313 |

| 631,048 |

| 617,647 |

Deferred tax liabilities | 15 |

| — |

| — |

| 5,249,301 |

| 5,225,433 |

Sectorial financial liabilities | 5.10 |

| — |

| — |

| 1,863,679 |

| 1,740,685 |

Deferred revenue |

|

| — |

| — |

| 17,859 |

| 19,129 |

Other non-current liabilities |

|

| 520,103 |

| 551,671 |

| 879,305 |

| 935,514 |

Non-current liabilities |

|

| 26,675,323 |

| 20,705,337 |

| 76,343,943 |

| 72,725,397 |

Total liabilities |

|

| 29,295,730 |

| 23,242,266 |

| 95,094,373 |

| 88,884,202 |

|

|

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

|

|

|

|

Share capital |

|

| 8,832,544 |

| 8,682,544 |

| 8,832,544 |

| 8,682,544 |

Treasury shares |

|

| (212,413) |

| (93,917) |

| (212,413) |

| (93,917) |

Additional paid-in capital |

|

| 2,475,403 |

| 2,561,964 |

| 2,475,403 |

| 2,561,964 |

Accumulated other comprehensive income |

|

| 334,072 |

| 314,325 |

| 334,072 |

| 314,325 |

Retained earnings |

|

| 8,773,990 |

| 9,490,391 |

| 8,773,990 |

| 9,490,391 |

Accumulated losses |

|

| (419,282) |

| — |

| (419,282) |

| — |

|

|

|

|

|

|

|

|

|

|

Equity attributable to: |

|

|

|

|

|

|

|

|

|

Owners of the Company |

|

| 19,784,314 |

| 20,955,307 |

| 19,784,314 |

| 20,955,307 |

Non-controlling interest | 9.2 |

| — |

| — |

| 28,471,596 |

| 30,025,873 |

Total shareholders' equity |

|

| 19,784,314 |

| 20,955,307 |

| 48,255,910 |

| 50,981,180 |

Total liabilities and shareholders' equity |

|

| 49,080,044 |

| 44,197,573 |

| 143,350,283 |

| 139,865,382 |

The accompanying notes are an integral part of these interim financial statements.

(In thousands of Reais, except earnings per share)

|

|

| Parent Company |

| Consolidated | ||||||||||||

| Note |

| 2Q24 |

| 2Q23 (Restated) (i) |

| 6M24 |

| 6M23 (Restated) (i) |

| 2Q24 |

| 2Q23 (Restated) (i) |

| 6M24 |

| 6M23 (Restated) (i) |

Net sales | 19 |

| — |

| — |

| — |

| — |

| 10,694,008 |

| 10,051,005 |

| 20,536,064 |

| 19,669,159 |

Cost of sales | 20 |

| — |

| — |

| — |

| — |

| (7,137,604) |

| (7,237,251) |

| (14,066,041) |

| (14,415,854) |

Gross profit |

|

| — |

| — |

| — |

| — |

| 3,556,404 |

| 2,813,754 |

| 6,470,023 |

| 5,253,305 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses | 20 |

| — |

| — |

| — |

| — |

| (376,497) |

| (341,507) |

| (737,901) |

| (681,240) |

General and administrative expenses | 20 |

| (111,518) |

| (94,699) |

| (215,201) |

| (181,341) |

| (611,413) |

| (532,690) |

| (1,194,668) |

| (1,023,213) |

Other operating incomes (expenses), net | 21 |

| 28,634 |

| (20,882) |

| 14,395 |

| (2,694) |

| (2,409,043) |

| (56,046) |

| (2,408,282) |

| 305,847 |

Operating expenses |

|

| (82,884) |

| (115,581) |

| (200,806) |

| (184,035) |

| (3,396,953) |

| (930,243) |

| (4,340,851) |

| (1,398,606) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before equity in earnings of investees finance results and income taxes |

|

| (82,884) |

| (115,581) |

| (200,806) |

| (184,035) |

| 159,451 |

| 1,883,511 |

| 2,129,172 |

| 3,854,699 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest in earnings of associates | 9.1 |

| 753,820 |

| (736,453) |

| 1,577,990 |

| (1,317,521) |

| 833,371 |

| 67,132 |

| 1,294,795 |

| 120,097 |

Interest in earnings of joint ventures | 10 |

| 50,927 |

| 29,870 |

| 5,052 |

| 158,256 |

| 450,974 |

| 263,003 |

| 47,066 |

| 1,393,417 |

Equity in earnings of investees |

|

| 804,747 |

| (706,583) |

| 1,583,042 |

| (1,159,265) |

| 1,284,345 |

| 330,135 |

| 1,341,861 |

| 1,513,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expense |

|

| (625,774) |

| (463,591) |

| (1,155,309) |

| (892,074) |

| (2,130,752) |

| (5,422,219) |

| (3,995,308) |

| (9,677,480) |

Financial income |

|

| 42,188 |

| 81,210 |

| 100,371 |

| 149,684 |

| 726,385 |

| 628,874 |

| 1,341,486 |

| 1,229,537 |

Foreign exchange, net |

|

| (1,514,581) |

| 467,485 |

| (1,852,577) |

| 710,628 |

| (2,442,818) |

| 1,550,338 |

| (2,974,036) |

| 2,135,679 |

Net effect of derivatives |

|

| 652,311 |

| (502,554) |

| 138,950 |

| (1,011,640) |

| 1,325,382 |

| 100,231 |

| 1,326,726 |

| 400,373 |

Financial results, net | 22 |

| (1,445,856) |

| (417,450) |

| (2,768,565) |

| (1,043,402) |

| (2,521,803) |

| (3,142,776) |

| (4,301,132) |

| (5,911,891) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

| (723,993) |

| (1,239,614) |

| (1,386,329) |

| (2,386,702) |

| (1,078,007) |

| (929,130) |

| (830,099) |

| (543,678) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes | 15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

|

| — |

| — |

| (3,849) |

| 30,562 |

| (543,520) |

| (481,640) |

| (827,916) |

| (1,672,822) |

Deferred |

|

| 496,885 |

| 191,430 |

| 970,896 |

| 403,826 |

| 652,042 |

| 948,122 |

| 952,076 |

| 1,335,119 |

|

|

| 496,885 |

| 191,430 |

| 967,047 |

| 434,388 |

| 108,522 |

| 466,482 |

| 124,160 |

| (337,703) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the period from continuing operations |

|

| (227,108) |

| (1,048,184) |

| (419,282) |

| (1,952,314) |

| (969,485) |

| (462,648) |

| (705,939) |

| (881,381) |

Profit for the period from discontinued operation, net of tax | 8 |

| — |

| 5,483 |

| — |

| 5,483 |

| — |

| 15,907 |

| — |

| 15,907 |

Loss for the period |

|

| (227,108) |

| (1,042,701) |

| (419,282) |

| (1,946,831) |

| (969,485) |

| (446,741) |

| (705,939) |

| (865,474) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the Company |

|

| (227,108) |

| (1,042,701) |

| (419,282) |

| (1,946,831) |

| (227,108) |

| (1,042,701) |

| (419,282) |

| (1,946,831) |

Non-controlling interest |

|

| — |

| — |

| — |

| — |

| (742,377) |

| 595,960 |

| (286,657) |

| 1,081,357 |

|

|

| (227,108) |

| (1,042,701) |

| (419,282) |

| (1,946,831) |

| (969,485) |

| (446,741) |

| (705,939) |

| (865,474) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share | 18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

| (R$0.1220) |

| (R$0.5615) |

| (R$0.2250) |

| (R$1.0459) |

Diluted |

|

|

|

|

|

|

|

|

|

| (R$0.1220) |

| (R$0.5647) |

| (R$0.2250) |

| (R$1.0517) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share | 18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

| — |

| R$0.0029 |

| — |

| R$0.0029 |

Diluted |

|

|

|

|

|

|

|

|

|

| — |

| R$0.0029 |

| — |

| R$0.0029 |

(i) For additional information see notes 3.1

The accompanying notes are an integral part of these interim financial statements.

(In thousands of Reais)

| Parent Company |

| Consolidated | ||||||||||||

| 2Q24 |

| 2Q23 (Restated) |

| 6M24 |

| 6M23 (Restated) |

| 2Q24 |

| 2Q23 (Restated) |

| 6M24 |

| 6M23 (Restated) |

Loss for the period | (227,108) |

| (1,042,701) |

| (419,282) |

| (1,946,831) |

| (969,485) |

| (446,741) |

| (705,939) |

| (865,474) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items that are or may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Foreign currency translation differences | 101,317 |

| (235,418) |

| 164,203 |

| (420,171) |

| 131,448 |

| (328,249) |

| 194,502 |

| (569,697) |

Gain (loss) on cash flow hedge | (127,372) |

| (1,078) |

| (159,756) |

| 129 |

| (167,146) |

| 775 |

| (209,710) |

| 2,360 |

| (26,055) |

| (236,496) |

| 4,447 |

| (420,042) |

| (35,698) |

| (327,474) |

| (15,208) |

| (567,337) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items that will not be reclassified to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actuarial gains (losses) with defined benefit plan, net of taxes | 892 |

| 18,394 |

| 15,300 |

| 18,515 |

| 1,278 |

| 38,740 |

| 25,564 |

| 41,935 |

Deferred taxes | — |

| — |

| — |

| — |

| (435) |

| (13,172) |

| (8,692) |

| (14,258) |

| 892 |

| 18,394 |

| 15,300 |

| 18,515 |

| 843 |

| 25,568 |

| 16,872 |

| 27,677 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income from continuing operations | (252,271) |

| (1,266,286) |

| (399,535) |

| (2,353,841) |

| (1,004,340) |

| (764,554) |

| (704,275) |

| (1,421,041) |

Comprehensive income from discontinuing operations | — |

| 5,483 |

| — |

| 5,483 |

| — |

| 15,907 |

| — |

| 15,907 |

Total comprehensive income for the period | (252,271) |

| (1,260,803) |

| (399,535) |

| (2,348,358) |

| (1,004,340) |

| (748,647) |

| (704,275) |

| (1,405,134) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Owners of the Company | (252,271) |

| (1,260,803) |

| (399,535) |

| (2,348,358) |

| (252,271) |

| (1,260,803) |

| (399,535) |

| (2,348,358) |

Non-controlling interest | — |

| — |

| — |

| — |

| (752,069) |

| 512,156 |

| (304,740) |

| 943,224 |

| (252,271) |

| (1,260,803) |

| (399,535) |

| (2,348,358) |

| (1,004,340) |

| (748,647) |

| (704,275) |

| (1,405,134) |

The accompanying notes are an integral part of these interim financial statements.

(In thousands of Reais)

|

|

|

|

| Capital reserve |

|

|

| Profit reserve |

|

|

|

|

|

|

| ||||||||

|

| Share capital |

| Treasury share |

| Corporate transactions - Law 6404 |

| Capital transactions |

| Accumulated other comprehensive income |

| Legal |

| Statutory reserve |

| Retained earnings |

| Accumulated loss |

| Equity attributable to controlling shareholders |

| Interest of non-controlling shareholders |

| Total equity |

At January 1, 2024 |

| 8,682,544 |

| (93,917) |

| 737 |

| 2,561,227 |

| 314,325 |

| 58,802 |

| 8,610,796 |

| 820,793 |

| — |

| 20,955,307 |

| 30,025,873 |

| 50,981,180 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the period |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| (419,282) |

| (419,282) |

| (286,657) |

| (705,939) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (note 17) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from cash flow hedge accounting |

| — |

| — |

| — |

| — |

| (159,756) |

| — |

| — |

| — |

| — |

| (159,756) |

| (49,954) |

| (209,710) |

Foreign currency translation differences |

| — |

| — |

| — |

| — |

| 164,203 |

| — |

| — |

| — |

| — |

| 164,203 |

| 30,299 |

| 194,502 |

Actuarial gain on defined benefit plan |

| — |

| — |

| — |

| — |

| 15,300 |

| — |

| — |

| — |

| — |

| 15,300 |

| 1,572 |

| 16,872 |

Total comprehensive income (loss) for the period |

| — |

| — |

| — |

| — |

| 19,747 |

| — |

| — |

| — |

| (419,282) |

| (399,535) |

| (304,740) |

| (704,275) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions and distributions to shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital increase (note 17(a)) |

| 150,000 |

| — |

| — |

| — |

| — |

| — |

| (150,000) |

| — |

| — |

| — |

| — |

| — |

Reduction of capital in subsidiary |

| — |

| — |

| — |

| — |

| — |

|

|

| — |

| — |

| — |

| — |

| (20,629) |

| (20,629) |

Own shares acquired |

| — |

| (162,174) |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| (162,174) |

| — |

| (162,174) |

Share based payments |

| — |

| 43,678 |

| — |

| (132,064) |

| — |

| — |

| — |

| — |

| — |

| (88,386) |

| 9,700 |

| (78,686) |

Loss in dividend distribution to non-controlling shareholders |

| — |

| — |

| — |

| (420) |

| — |

| — |

| — |

| — |

| — |

| (420) |

| 549 |

| 129 |

Dividends |

| — |

| — |

| — |

| — |

| — |

| — |

| (566,401) |

| — |

| — |

| (566,401) |

| (1,249,678) |

| (1,816,079) |

Employee compensation plan - value of employee services |

| — |

| — |

| — |

| 47,775 |

| — |

| — |

| — |

| — |

| — |

| 47,775 |

| 10,521 |

| 58,296 |

Total contributions and distributions |

| 150,000 |

| (118,496) |

| — |

| (84,709) |

| — |

| — |

| (716,401) |

| — |

| — |

| (769,606) |

| (1,249,537) |

| (2,019,143) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change of shareholding interest in subsidiary (note 9.1) |

| — |

| — |

| — |

| (1,852) |

| — |

| — |

| — |

| — |

| — |

| (1,852) |

| — |

| (1,852) |

Total transactions with shareholders |

| — |

| — |

| — |

| (1,852) |

| — |

| — |

| — |

| — |

| — |

| (1,852) |

| — |

| (1,852) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total contributions, distributions and transactions with the Company's shareholders |

| 150,000 |

| (118,496) |

| — |

| (86,561) |

| — |

| — |

| (716,401) |

| — |

| — |

| (771,458) |

| (1,249,537) |

| (2,020,995) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At June 30, 2024 |

| 8,832,544 |

| (212,413) |

| 737 |

| 2,474,666 |

| 334,072 |

| 58,802 |

| 7,894,395 |

| 820,793 |

| (419,282) |

| 19,784,314 |

| 28,471,596 |

| 48,255,910 |

The accompanying notes are an integral part of these interim financial statements.

Statement of changes in equity

(In thousands of Reais)

|

|

|

|

|

| Capital reserve |

|

|

| Profit reserve |

|

|

|

|

|

|

|

| |||||||||

|

| Share capital |

| Treasury share |

| Corporate transactions - Law 6404 |

| Capital transactions |

| Accumulated other comprehensive income |

| Legal |

| Statutory reserve |

| Profit to be realized |

| Retained earnings |

| Accumulated profits |

| Equity attributable to controlling shareholders |

| Non-controlling interest |

| Total equity | |

At January 1, 2023 |

| 8,402,544 |

| (107,140) |

| 737 |

| 2,319,191 |

| 567,546 |

| 58,802 |

| 9,240,466 |

| 171,021 |

| — |

| — |

| 20,653,167 |

| 27,516,232 |

| 48,169,399 | |

Loss for the period |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| (1,946,831) |

| (1,946,831) |

| 1,081,357 |

| (865,474) | |

Other comprehensive income (note 17) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gain from cash flow hedge accounting |

| — |

| — |

| — |

| — |

| 129 |

| — |

| — |

| — |

| — |

| — |

| 129 |

| 2,231 |

| 2,360 | |

Foreign currency translation differences |

| — |

| — |

| — |

| — |

| (420,171) |

| — |

| — |

| — |

| — |

| — |

| (420,171) |

| (149,526) |

| (569,697) | |

Actuarial gain on defined benefit plan |

| — |

| — |

| — |

| — |

| 18,515 |

| — |

| — |

| — |

| — |

| — |

| 18,515 |

| 9,162 |

| 27,677 | |

Total comprehensive income (loss) for the period |

| — |

| — |

| — |

| — |

| (401,527) |

| — |

| — |

| — |

| — |

| (1,946,831) |

| (2,348,358) |

| 943,224 |

| (1,405,134) | |

Transactions with owners of the Company contributions and distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Capital increase |

| 280,000 |

| — |

| — |

| — |

| — |

| — |

| (280,000) |

| — |

| — |

| — |

| — |

| — |

| — | |

Proceeds from capital increase in subsidiary |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| 9,709 |

| 9,709 | |

Gain on capital increase in a subsidiary |

| — |

| — |

| — |

| 55,495 |

| — |

| — |

| — |

| — |

| — |

| — |

| 55,495 |

| 20,110 |

| 75,605 | |

Share based payments |

| — |

| (114) |

| — |

| 1,891 |

| — |

| — |

| — |

| — |

| — |

| — |

| 1,777 |

| — |

| 1,777 | |

Write-off of stake in subsidiary |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| (22,280) |

| (22,280) | |

Dividends |

| — |

| — |

| — |

| — |

| — |

| — |

| (349,670) |

| (171,021) |

| — |

| — |

| (520,691) |

| (549,459) |

| (1,070,150) | |

Employee compensation plan - value of employee services |

| — |

| — |

| — |

| 55,326 |

| — |

| — |

| — |

| — |

| — |

| — |

| 55,326 |

| 7,832 |

| 63,158 | |

Total contributions and distributions |

| 280,000 |

| (114) |

| — |

| 112,712 |

| — |

| — |

| (629,670) |

| (171,021) |

| — |

| — |

| (408,093) |

| (534,088) |

| (942,181) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Changes in interest in subsidiaries: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gain on distribution of dividends in subsidiary |

| — |

| — |

| — |

| 33,456 |

| — |

| — |

| — |

| — |

| — |

| — |

| 33,456 |

| — |

| 33,456 | |

Change of shareholding interest in subsidiary |

| — |

| — |

| — |

| (866) |

| — |

| — |

| — |

| — |

| — |

| — |

| (866) |

| — |

| (866) | |

Total transactions with owners of the Company |

| — |

| — |

| — |

| 32,590 |

| — |

| — |

| — |

| — |

| — |

| — |

| 32,590 |

| — |

| 32,590 | |

Total transactions with owners of the Company |

| 280,000 |

| (114) |

| — |

| 145,302 |

| — |

| — |

| (629,670) |

| (171,021) |

| — |

| — |

| (375,503) |

| (534,088) |

| (909,591) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

At June 30, 2023 |

| 8,682,544 |

| (107,254) |

| 737 |

| 2,464,493 |

| 166,019 |

| 58,802 |

| 8,610,796 |

| — |

| — |

| (1,946,831) |

| 17,929,306 |

| 27,925,368 |

| 45,854,674 | |

The accompanying notes are an integral part of these interim financial statements.

(In thousands of Reais)

| Parent Company | Consolidated | ||||||||

| Note | 6M24 | 6M23 (Restated) (i) | 6M24 | 6M23 (Restated) (i) | |||||

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

| (1,386,329) |

| (2,386,702) |

| (830,099) |

| (543,678) |

Adjustments for: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization | 20 |

| 7,780 |

| 7,027 |

| 1,833,725 |

| 1,610,177 |

Impairment | 21 |

| — |

| — |

| 2,574,817 |

| — |

Interest in earnings of associates | 9.1 |

| (1,577,990) |

| 1,317,521 |

| (1,294,795) |

| (120,097) |

Interest in earnings of joint ventures | 10 |

| (5,052) |

| (158,256) |

| (47,066) |

| (1,393,417) |

Loss (gain) on disposed assets | 21 |

| 7 |

| (13,563) |

| 40,261 |

| 777 |

Share based payment | 24 |

| 32,836 |

| 43,515 |

| 81,258 |

| 83,179 |

Change in fair value of investment properties | 11.5 |

| — |

| — |

| — |

| (82,996) |

Legal proceedings provision | 21 |

| 3,877 |

| 43,524 |

| 149,301 |

| 78,624 |

Interest and foreign exchange, net |

|

| 2,786,747 |

| 1,046,845 |

| 4,994,791 |

| 6,616,525 |

Sectorial financial assets and liabilities, net | 5.10 |

| — |

| — |

| 28,016 |

| (3,526) |

Provisions for employee benefits |

|

| 19,459 |

| 22,215 |

| 190,575 |

| 142,452 |

Allowance for expected credit losses |

|

| — |

| — |

| 23,670 |

| 9,062 |

Profit on sale of investments | 21 |

| — |

| — |

| 383,205 |

| — |

Tax credit recovery |

|

| — |

| — |

| 4,207 |

| (4,225) |

Other |

|

| 611 |

| (49,525) |

| (171,476) |

| (278,598) |

|

|

| (118,054) |

| (127,399) |

| 7,960,390 |

| 6,114,259 |

Variation in: |

|

|

|

|

|

|

|

|

|

Trade receivable |

|

| — |

| — |

| (654,468) |

| 137,272 |

Inventories |

|

| — |

| — |

| (82,238) |

| 25,652 |

Other taxes, net |

|

| (7,974) |

| (10,082) |

| 33,447 |

| 149,741 |

Income tax |

|

| 69,003 |

| 57,760 |

| (697,352) |

| (500,693) |

Related parties, net |

|

| 384 |

| (100,409) |

| 109,994 |

| (152,409) |

Trade payables |

|

| 1,001 |

| (112,225) |

| 122,132 |

| (315,701) |

Employee benefits |

|

| (58,180) |

| (44,235) |

| (347,607) |

| (309,186) |

Provision for legal proceedings |

|

| 1,678 |

| (20,556) |

| (157,302) |

| (219,851) |

Financial instruments derivatives |

|

| — |

| — |

| (18,095) |

| 6,353 |

Other financial liabilities |

|

| — |

| — |

| (31,671) |

| (160,346) |

Judicial deposits |

|

| (3,026) |

| (1,942) |

| (127,925) |

| 22,965 |

Post-employment benefits obligation |

|

| — |

| — |

| (17,659) |

| (16,572) |

Other assets and liabilities, net |

|

| (19,255) |

| (20,129) |

| 22,213 |

| 142,892 |

|

|

| (16,369) |

| (251,818) |

| (1,846,531) |

| (1,189,883) |

|

|

|

|

|

|

|

|

| — |

Net cash (used in) generated from operating activities |

|

| (134,423) |

| (379,217) |

| 6,113,859 |

| 4,924,376 |

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

Capital contribution to associates | 9.1 |

| (4,173,198) |

| (4,000) |

| — |

| — |

Capital contribution in joint ventures | 10 |

| (8,337) |

| — |

| (8,337) |

| — |

Purchase of marketable securities |

|

| 123,223 |

| 209,386 |

| (242,724) |

| (838,963) |

Restricted cash |

|

| 43,048 |

| (2,277) |

| 40,779 |

| (24,131) |

Dividends received from associates | 17 |

| 1,787,186 |

| 618,758 |

| 644,631 |

| 96,301 |

Dividends received from joint venture | 17 |

| 228,342 |

| 46,103 |

| 293,912 |

| 405,926 |

Dividends received from finance investment |

|

| — |

| — |

| — |

| 457,450 |

Acquisition of instruments designated at fair value |

|

| — |

| — |

| (354) |

| (7,072) |

Reduction of capital in subsidiaries | 9.1 |

| 5,227 |

| — |

| — |

| — |

Acquisition of property, plant and equipment, intangible and contract assets |

|

| (2,489) |

| (2,657) |

| (3,207,373) |

| (2,781,817) |

Proceeds from the sale of investments |

|

| 16,847 |

| 15,000 |

| 2,096,475 |

| (5,926) |

Cost of acquiring new business |

|

| — |

| — |

| (17,047) |

| — |

Receipt of derivative financial instruments, except debt |

|

| — |

| 36,718 |

| 132 |

| 40,276 |

Payment of derivative financial instruments, except debt |

|

| (70,503) |

| (116,303) |

| (70,689) |

| (124,208) |

Net cash (used in) generated from investing activities |

|

| (2,050,654) |

| 800,728 |

| (470,595) |

| (2,782,164) |

Statement of cash flow

(In thousands of Reais)

| Parent Company | Consolidated | ||||||||

| Note | 6M24 | 6M23 (Restated) (i) | 6M24 | 6M23 (Restated) (i) | |||||

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from loans, borrowings and debentures | 5.4 |

| 4,421,447 |

| 1,989,748 |

| 10,799,808 |

| 6,109,999 |

Principal repayment of loans, borrowings and debentures | 5.4 |

| — |

| — |

| (7,772,439) |

| (1,099,528) |

Payment of interest on loans, borrowings and debentures | 5.4 |

| (680,726) |

| (388,427) |

| (2,252,731) |

| (1,594,296) |

Payment of derivative financial instruments |

|

| (355,848) |

| (307,650) |

| (2,111,172) |

| (1,005,403) |

Proceeds from derivative financial instruments |

|

| 14,199 |

| 7,962 |

| 959,656 |

| 94,670 |

Costs of banking operations with derivatives |

|

| — |

| — |

| (29,828) |

| (247,163) |

Principal repayment of leases | 5.5 |

| (3,169) |

| (2,594) |

| (248,175) |

| (239,375) |

Payment of interest on leases | 5.5 |

| (1,604) |

| (1,794) |

| (177,171) |

| (85,145) |

Proceeds from capital contributions by non-controlling shareholders |

|

| — |

| — |

| — |

| 9,709 |

Capital reduction |

|

| — |

| — |

| (20,520) |

| — |

Related parties |

|

| (249,499) |

| (345,367) |

| — |

| — |

Proceeds from the sale of treasury shares |

|

| (164,685) |

| — |

| (164,685) |

| — |

Dividends paid | 17 |

| (782,081) |

| (798,203) |

| (1,537,377) |

| (1,548,921) |

Dividends paid for preferred shares | 17 |

| — |

| — |

| (668,022) |

| — |

Payment of share-based compensation |

|

| — |

| — |

| — |

| (294) |

Net cash generated from (used in) financing activities |

|

| 2,198,034 |

| 153,675 |

| (3,222,656) |

| 394,253 |

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

| 12,957 |

| 575,186 |

| 2,420,608 |

| 2,536,465 |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period |

|

| 1,769,976 |

| 1,348,461 |

| 14,658,481 |

| 13,301,716 |

Effect of the foreign exchange rate changes |

|

| 17,436 |

| (12,198) |

| 150,972 |

| (98,891) |

Cash and cash equivalents at the end of the period |

|

| 1,800,369 |

| 1,911,449 |

| 17,230,061 |

| 15,739,290 |

|

|

|

|

|

|

|

|

|

|

Additional information |

|

|

|

|

|

|

|

|

|

Income taxes paid |

|

| — |

| — |

| 498,998 |

| 58,584 |

(i) For additional information see notes 3.1

The accompanying notes are an integral part of these interim financial statements.

Statement of cash flow

(In thousands of Reais)

Non-cash transactions:

The Company presents its statements of cash flows using the indirect method. During the period ended June, 2024, the Company carried out the following transactions that did not involve cash and, therefore, are not reflected in the parent company and consolidated statement of cash flows:

| (i) | Recognition of right-of-use as a counterpart to the lease liability in the amount of R$784,084 (R$100,014 on June 30, 2023), resulting from the application of inflation indexes and new contracts classified under the leasing rule (Note 11.4). |

| (ii) | Acquisition of property, plant and equipment and intangible assets with payment in installments R$759,766 (R$794,602 on June 30, 2023). |

Disclosure of interest and dividends:

Dividends and interest on shareholders' equity are classified as cash flow from investing activities by the Company. Dividends and interest received or paid are classified as cash flow from financing activities.

(In thousands of Reais)

| Parent Company |

| Consolidated | ||||

| 6M24 |

| 6M23 |

| 6M24 |

| 6M23 (Restated)(i) |

Revenue |

|

|

|

|

|

|

|

Net sales | — |

| — |

| 23,650,222 |

| 23,160,634 |

Other income (expense), net | 15,758 |

| (3,845) |

| 721,780 |

| 389,797 |

Impairment gain (loss) on trade receivables | — |

| — |

| 205 |

| (9,062) |

| 15,758 |

| (3,845) |

| 24,372,207 |

| 23,541,369 |

Inputs purchased from third parties |

|

|

|

|

|

|

|

Cost of goods sold and services rendered | — |

| — |

| 13,016,297 |

| 13,678,750 |

Materials, energy, third-party services and other | 66,448 |

| 44,063 |

| 1,107,676 |

| 889,718 |

| 66,448 |

| 44,063 |

| 14,123,973 |

| 14,568,468 |

|

|

|

|

|

|

|

|

Gross value added | (50,690) |

| (47,908) |

| 10,248,234 |

| 8,972,901 |

|

|

|

|

|

|

|

|

Retention |

|

|

|

|

|

|

|

Depreciation, amortization and impairment | 7,780 |

| 7,027 |

| 4,408,542 |

| 1,610,177 |

|

|

|

|

|

|

|

|

Net value added | (58,470) |

| (54,935) |

| 5,839,692 |

| 7,362,724 |

|

|

|

|

|

|

|

|

Value added transferred in |

|

|

|

|

|

|

|

Interest earnings in associates | 1,577,990 |

| (1,317,521) |

| 1,294,795 |

| 120,097 |

Interest earnings in joint ventures | 5,052 |

| 158,256 |

| 47,066 |

| 1,393,417 |

Profit for the period from discontinued operation, net of tax | — |

| 5,483 |

| — |

| 15,907 |

Finance revenue | 100,371 |

| 149,684 |

| 1,341,486 |

| 1,229,537 |

| 1,683,413 |

| (1,004,098) |

| 2,683,347 |

| 2,758,958 |

|

|

|

|

|

|

|

|

Value added to be distributed | 1,624,943 |

| (1,059,033) |

| 8,523,039 |

| 10,121,682 |

|

|

|

|

|

|

|

|

Distribution of value added |

|

|

|

|

|

|

|

Personnel and payroll charges | 111,018 |

| 117,596 |

| 1,289,541 |

| 1,253,719 |

Direct remuneration | 90,869 |

| 109,712 |

| 1,019,285 |

| 1,036,833 |

Benefits | 6,207 |

| 5,337 |

| 204,900 |

| 168,098 |

FGTS and other | 13,942 |

| 2,547 |

| 65,356 |

| 48,788 |

|

|

|

|

|

|

|

|

Taxes, fees and contributions | (935,727) |

| (422,886) |

| 2,231,848 |

| 2,520,254 |

Federal | (951,722) |

| (426,038) |

| 696,163 |

| 1,046,359 |

State | 1 |

| — |

| 1,438,565 |

| 1,390,401 |

Municipal | 15,994 |

| 3,152 |

| 97,120 |

| 83,494 |

|

|

|

|

|

|

|

|

Financial expenses and rents | 2,868,934 |

| 1,193,088 |

| 5,707,589 |

| 7,213,183 |

Interest and foreign exchange variation | 2,853,384 |

| 1,288,580 |

| 5,488,129 |

| 6,873,818 |

Rents | — |

| — |

| 72,019 |

| 83,034 |

Other | 15,550 |

| (95,492) |

| 147,441 |

| 256,331 |

|

|

|

|

|

|

|

|

Equity Remuneration | (419,282) |

| (1,946,831) |

| (705,939) |

| (865,474) |

Non-controlling interests | — |

| — |

| (286,657) |

| 1,081,357 |

Retained losses | (419,282) |

| (1,952,314) |

| (419,282) |

| (1,962,738) |

Profit for the period from discontinued operation, net of tax | — |

| 5,483 |

| — |

| 15,907 |

(i) For more details see notes 3.1.

The accompanying notes are an integral part of these interim financial statements.

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

Cosan S.A. (“Cosan” or “the Company”) is a publicly traded company at B3 S.A. - Brasil, Bolsa, Balcão (“B3”) in the special New Market (Novo Mercado) segment under the symbol “CSAN3”. The Company's American Depositary Shares (“ADSs”) are listed on the New York Stock Exchange, or “NYSE”, and are traded under the symbol “CSAN”. Cosan is a corporation (sociedade anônima) of indefinite term incorporated under the laws of Brazil, with its registered office in the city of São Paulo, state of São Paulo. Mr. Rubens Ometto Silveira Mello is the ultimate controlling shareholder of Cosan.

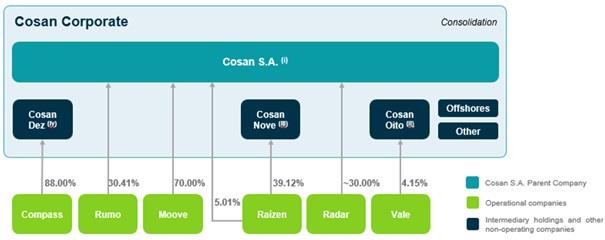

Corporate Cosan (Corporate segment) It is formed by the following entities:

| (i) | Parent company with direct or indirect equity interest in subsidiaries and joint venture. The main effects on its profit or loss are general and administrative expenses, contingencies, equity income and financial results attributed to loans. |

| (ii) | Cosan Oito is a subsidiary of Cosan S.A., which has a significant stake in Vale. |

| (iii) | Cosan Nove has a direct stake in Raízen of 39.12% and preferred shares with Itaú Unibanco S.A. (“Itaú”) which corresponds to an equity interest of 26.91%. |

| (iv) | Cosan Dez has a direct stake in Compass of 88,00% and preferred shares with Bradesco BBI S.A. (“Bradesco”) which corresponds to an equity interest of 23.20%. |

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

INTERNALIZATION OF SENIOR NOTES 2031

On February 16, 2024, the Company internalized the remaining resources arising from the 2031 senior notes, through the issuance of Loan 4131 by Cosan S.A., referenced in US dollars in the amount of equivalent to US$600,000 thousand, equivalent to R$2,982,600, with an annual coupon of 6.6% p.a. for the first four semesters and interest payment of 7.25% p.a. for the others. In return, Cosan Luxembourg contracted a Time Deposit (“TD”) with the same amount and counterparty in US dollars, with semi-annual payment frequency and annual remuneration of 7.25% p.a., which has as its underlying asset the issuance of Loan 4131. For more information see note 5.4 (e).

VALE'S DIVIDEND DISTRIBUTION

On February 22, 2024, Vale's Board of Directors approved the remuneration of shareholders in the amount of R$11,721,894. The amount declared corresponds entirely to dividends in the total amount of R$ 2.738548374 reais per share. The payment took place on March 19, 2024 and the amount received by the subsidiary Cosan Oito was R$577,469.

COMGÁS'S TENTH ISSUANCE OF DEBENTURES

On February 29, 2024, the Board of Directors of the indirect subsidiary Comgás approved the public offering of the 10th issuance of simple debentures, under a firm placement guarantee, non-convertible into shares, of the unsecured type, in a single series. The issuance was in the total amount of R$1,500,000, with semiannual interest at a rate equal to DI plus a spread of 0.80% p.a. and with maturity of the principal on March 15, 2029, with amortization on the maturity date. The net proceeds from the Issuance will be allocated to the ordinary management of the business of the indirect subsidiary Comgás.

RENEWAL OF THE SUDAM TAX BENEFIT

On December 20, 2023, indirect subsidiary Rumo Malha Norte S.A. filed with the Brazilian Federal Revenue Service (RFB) the constitutive report number 143/2023, issued by SUDAM on December 6, 2023, attesting to compliance with the legal conditions and requirements required for the renewal of the tax benefit, for another 10 years. In view of the above, the RFB, through the use of its powers, decided on March 13, 2024, through executive declaratory act number 024213308, to recognize the right to a 75% reduction in income tax and additional taxes referred to in article 1 of Provisional Measure No. 2,199-14, of August 24, 2001, calculated on the basis of the operating profit of the legal entity Rumo Malha Norte.

COMPASS'S THIRD ISSUANCE OF DEBENTURES

On March 15, 2024, the subsidiary Compass Gás e Energia S.A. raised its 3rd issuance of simple and non-convertible debentures, in the amount of R$1,500,000 with remuneration of CDI + 1.08% p.a., semiannual interest and principal maturing on March 15, 2029. The proceeds from the issuance will be used for general purposes and to strengthen working capital.

RESOLUTION OF COMPASS GAS AND ENERGY DIVIDENDS

On March 27, 2024, the Board of Directors of the indirect subsidiary Compass Gas and Energy approved the distribution of dividends in the amount of R$1,500,000. The payment took place on April 12, 2024 and the amount received by the subsidiary Cosan Dez was R$1,320,000.

COMPASS AND TRSP COMMERCIAL NOTES

On March 20, 2024, Compass and its subsidiary TRSP signed the 1st Issuance of Commercial Notes in the amount of R$200,000, with maturity in March 2026 and remuneration at 100% CDI + 1.7% p.a. The agreement was entered into through the depositary Laqus Depositária de Valores Mobiliários S.A. following the market conditions for the respective transaction.

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

COMPASS COMERCIALIZAÇÃO LOAN

On March 21, 2024, Compass and its subsidiary Compass Comercialização signed an "Uncommitted Term Loan Facility Agreement – Loan Agreement" with BNP Paribas S.A., for funding under the terms of Law No. 4,131. On March 22, 2024, the Company concluded the funding in the amount of EUR 78 million, equivalent to R$423,393, maturing in March 2025 and with an interest rate of 4.88% per year.

ISSUANCE OF DEBENTURES RUMO MALHA PAULISTA S.A.

On March 25, 2024, Rumo Malha Paulista raised R$1,200,000 with the 5th issuance of simple, non-convertible debentures, of the unsecured type, divided into two series, the first of which has an amount of R$532,243, with an IPCA rate + 5.7970% p.a., a term of 10 years, semiannual interest payments and bullet amortization, while the second is R$667,757 with an IPCA rate + 5.9284% p.a., a term of 15 years, semiannual interest payments and amortizations in the last three years.

On June 26, 2024, Rumo Malha Paulista raised R$704,000 with the 6th issue of simple debentures, not convertible into shares, of the unsecured type, divided into two series, the first of which has an amount of R$547,950, with a rate of IPCA + 6.42% p.a., term of 10 years, half-yearly interest payments and bullet amortization, while the second is for R$156,050 with a rate of IPCA + 6.5318% p.a., a term of 15 years, half-yearly interest payments and amortization in the last three years.

AGREEMENT FOR THE CONSTRUCTION OF A NEW PORT TERMINAL IN SANTOS

On March 25, 2024, Companhia Rumo S.A. and EMBRAPORT – Empresa Brasileira de Terminais Portuários S.A., signed a binding agreement for the implementation of a new port project (terminal) for grain and fertilizer lifts at the port of Santos. The estimated investment for the construction of the Terminal is R$2,500,000 and will be financed with loans, in addition to the possibility of potential strategic partnerships throughout the course of the Project's implementation. The start of construction is conditional on the fulfillment of customary conditions precedent for this type of operation, including licensing and legal and regulatory approvals. After the fulfillment of all conditions precedent, the period of 30 months for construction is estimated.

UNWIND VALE S.A. OPERATIONS

During the first months of 2024, as shown in the table, the Company anticipated the debts linked to Vale's operation, and in April 2024 the settlement of 100% of the debts was concluded, as well as the collar financing derivatives linked to the operation.

|

| Participation Cosan |

| Debt settlement Cashier Effect |

|

| ||||||

Base date |

| Direct |

| Collar-related |

| Total |

| Principal |

| Interest |

| Gain/Loss settlement Collar |

January, 2024 |

| 2.62% |

| 2.03% |

| 4.65% |

| (1,698,606) |

| (49,773) |

| 188,140 |

February, 2024 |

| 3.91% |

| 0.74% |

| 4.65% |

| (2,067,956) |

| (63,689) |

| 303,431 |

April 2024 (i) |

| 3.91% |

| — |

| 3.91% |

| (1,918,773) |

| (65,880) |

| 331,116 |

| (i) | On April 19, 2024, the Company concluded the sale of a further 33,524,185 shares equivalent to a 0.78% stake in Vale's voting share capital, together with the early settlement of the remaining debt. With this last advance payment, the Company settled 100% of the debts linked to the operation and collar derivatives, and now only holds a direct stake in Vale. |

In May 2024, the Company carried out the early settlement of the first tranche of the Call Spread derivative structure equivalent to 10,786 million shares or 0.24% of the total number of Vale S.A. shares, completely eliminating the maturities in 2024, reducing the economic stake from 1.58% to 1.34%.

|

| Cosan economic participation |

| Settlement gain/loss Call Spread | ||||

Base date |

| % Settled in advance |

| % Remaining |

| Cash effect |

| Result effect |

May, 2024 |

| 0.24% |

| 1.34% |

| 14,499 |

| (82,265) |

| 17 |

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

START OF OPERATIONS OF THE SÃO PAULO REGASIFICATION TERMINAL ("TRSP")

The second quarter of 2024 was marked by the start of operations of the São Paulo Regasification Terminal ("TRSP"), whose operating and service model includes strategic LNG infrastructure and logistics assets.

The start of operations is mainly due to the completion of the liquefied natural gas regasification terminal, located in Santos/SP. As shown in note 16, this asset was transferred from "work in progress" to the respective classes of assets.

The terminal has the capacity to regasify approximately 14 million m3 of LNG per day. And from April to June 2024, during the commissioning period, it regasified approximately 125 million m³ of LNG.

EXCLUSION OF ICMS FROM THE CALCULATION BASIS OF PIS AND COFINS

On April 10, 2024, the jointly controlled subsidiary Raízen S.A., through the indirect subsidiary Blueway, obtained approval from the Brazilian Federal Revenue Service for the request to qualify for a tax credit in the amount of R$1,824,019, determining the exclusion of ICMS from the PIS and COFINS calculation basis.

INCORPORATION OF ELEVAÇÕES PORTUÁRIAS S.A.

On April 30, 2024, CLI SUL S.A. ("CLI SUL") completed the process of incorporating Elevações Portuárias S.A. ("EPSA"), after obtaining the necessary regulatory approvals. As a result of this corporate reorganization, Rumo S.A. ("Rumo") received the amount of R$168,855 from CLI SUL on the same date. This amount refers to the additional acquisition price that CLI SUL undertook to pay to Rumo, under the terms of the share purchase agreement signed between the parties on July 15, 2022, and corresponds to 20% of the outstanding balance of the acquisition financing, plus accrued interest and other charges, less the cash held by CLI SUL.

After the merger, CLI SUL's shareholders became Corredor Logística e Infraestrutura S.A. ("CLI") and Rumo, with the shareholding split remaining at 80% for CLI and 20% for Rumo.

ADDENDUM TO THE RUMO MALHA PAULISTA CONCESSION CONTRACT

On May 28, 2024, the subsidiary Rumo entered into the 6th Amendment to the Concession Agreement of the indirect subsidiary Rumo Malha Paulista with the federal government through ANTT - Agência Nacional de Transportes Terrestres (National Land Transport Agency).

In order to update the Book of Obligations, the indirect subsidiary Malha Paulista will need to restore the economic and financial balance of the contract in an amount estimated at approximately R$1,170,000, of which R$500,000 will be converted into investments in its rail network and the rest will be paid in 4 annual installments of R$167,500. The amount of each annual installment will be adjusted by the accumulated variation of the IPCA between June 2023 and two months prior to the date of actual payment.

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

SALE OF SHARES IN TERMINAL XXXIX

On May 29, 2024, the subsidiary Rumo entered into a share purchase agreement, selling 50% (fifty percent) of its shareholding in Terminal XXXIX de Santos S.A. ("T-XXXIX") to a consortium formed between Bunge Alimentos S.A. and Zen-noh Grain Corporation, as disclosed in a material fact on the same date.

The sale of the stake in T-XXXIX represents a move towards financial discipline and capital recycling, strengthening the Company's cash position so that it can concentrate its efforts on projects that support the ongoing capacity increase program and strengthen the structural competitiveness of the rail modal.

The effectiveness of the operation depends on compliance with the binding conditions set out in the instrument, which has not yet occurred as of June 30, 2024.

MOOVE DIVIDEND RESOLUTION

On June 12, 2024, the Board of Directors of the subsidiary Moove Lubricants Holdings approved the distribution of dividends in the amount of US$116,903 thousand, equivalent to R$630,000. The payment took place on June 21, 2024.

RAISING LOANS FROM THE MOOVE SEGMENT

On June 14, 2024, Cosan Lubrificantes e Especialidades contracted two loans, one in the export prepayment modality and the other in the export credit note modality, with the banks Bank of America and Citibank, respectively, in the amounts of R$536,240 (corresponding to US$100,000 thousand) and R$268,120 (corresponding to US$50,000 thousand), respectively. The export prepayment loan has interest payments every six months and repayments will take place in June 2026 and June 2027, while the export credit loan has annual interest payments with the principal maturing in June 2027.

On June 14, 2024, Moove Lubrificants Limited contracted two loans with the banks Bank of America and Citibank, respectively, in the amounts of R$238,064 (corresponding to £35,000) and R$14,341 (corresponding to £2,500), respectively. For the first loan, interest payments are quarterly, and the principal is due in June 2026, while for the second loan, interest and principal payments are due in August 2024.

EARLY REDEMPTION OF RUMO MALHA PAULISTA S.A. DEBENTURES

On June 26, 2024, the subsidiary Rumo Malha Paulista made the optional early redemption of R$ 757,944, the total amount of the first series of the 2nd issue of simple debentures, not convertible into shares, of the unsecured type.

On the occasion of the optional early redemption, the holders of the debentures, on the date of the optional early redemption, were entitled to payment of: (a) the balance of the nominal unit value of the debentures of the first series; plus (b) the remuneration of the first series, calculated pro rata temporis, from the date of payment of the remuneration of the first series immediately preceding, on June 17, 2024, until the date of the optional early redemption; (c) plus a premium, apartment, levied on the amount of the early redemption, corresponding to 0.25% (twenty-five hundredths) percent multiplied by the remaining term of the debentures of the first series.

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

ISSUE OF DEBENTURES

On June 28, 2024, Cosan issued unsecured debentures, not convertible into shares, in the total amount of R$1,450,000, divided into two series. The first series bears interest at CDI plus 1.0% per year, matures in June 2029, pays interest every six months and amortizes the principal in June 2028 and June 2029. The second series bears interest at CDI plus 1.5% per year, maturing in June 2034, with half-yearly interest payments and principal repayments in June 2032, June 2033 and June 2034.

WRITE-OFF OF ASSETS AND IMPAIRMENT LOSS OF RUMO MALHA SUL

In the 2nd quarter of 2024, Rio Grande do Sul was impacted by extreme weather events. This force majeure event caused damage to the railway infrastructure of indirect subsidiary Rumo Malha Sul.

In this context, in the quarter ended June 30, 2024 and in accordance with Circular Letter No. 01/2024-CVM/SNC/SEP, Management identified the existence of indications that led to the anticipation of the recoverability test of the permanent assets (fixed assets, intangible assets and rights of use) of the cash generating unit of the subsidiary Rumo ("Rumo Malha Sul"), considering the event described above, including with regard to the term of use of the assets, the subsidiary Rumo provisioned the amount of R$2.392,776 as mentioned in note 11.1.

These individual and consolidated interim financial statements were prepared and are being presented in accordance with the technical pronouncement CPC 21 (R1) - Interim Statements and with the international standards IAS 34 - Interim Financial Reporting, issued by the International Accounting Standards Board (IASB), and also based on the provisions contained in the Brazilian Corporation Law, and presented in a manner consistent with the rules issued by the Securities and Exchange Commission, applicable to the preparation of quarterly information - ITR. Interim financial statements do not include all information necessary for a complete set of financial statements prepared in accordance with local standards and IFRS. However, specific explanatory notes are included to explain events and transactions that are significant to an understanding of changes in the Group's financial position and performance since the last annual financial statement.

The presentation of the Statements of Added Value (“DVA”), individual and consolidated, is required by Brazilian corporate legislation and by the accounting practices adopted in Brazil applicable to public companies CPC 09 – Statement of Added Value. IFRS standards do not require the presentation of this statement. As consequence, under IFRS, this statement is presented as supplementary information, without prejudice to the set of interim financial statements.

The information in the explanatory notes that did not undergo significant changes compared to the financial statements as of December 31, 2023, was not presented in full in this quarterly information.

These interim financial statements were prepared following the preparation basis and accounting policies consistent with those adopted in the preparation of the financial statements as of December 31, 2023. All balances have been rounded to the nearest thousand, unless otherwise indicated.

The significant judgments made by Management in applying the Company's accounting policies and the main sources of estimation uncertainty were the same as those described in the last annual financial statements, except for the revaluation of impairment in the indirect subsidiary Rumo Malha Sul.

The relevant information specific to the interim financial statements, and only them, are being disclosed and correspond to that used by Management in its management.

These interim financial statements were authorized for issuance by the Board of Directors on August 14, 2024.

Notes to the interim Financial Statements

(In thousands of Reais, except when otherwise indicated)

3.1. RECLASSIFICATION IN THE INCOME STATEMENT

ARSESP, through resolution 1,205 of August 18, 2021, NTF-044-2021, released a new Regulatory Accounting Manual and Chart of Accounts for the piped gas distribution sector for companies on its regulation with applicability as of fiscal year 2023.